Call us today! 1300 171 534

If you’re in the early stages of putting together a business plan, having access to reliable, accurate and practical resources is essential. At the Business Plan Company, we want to inspire business owners to get their ideas off the ground. In our resources section, you’ll find a catalogue of helpful Australian business plan templates and examples you can use for your own business planning.

We have a number of free resources available to download, including a small business plan template, startup costs template and projections template. We also have a range of templates tailored to specific business models and industries, so you can achieve a more targeted approach to your business plan.

If you are having a go at putting together your own small business plan or startup business plan, have a look at our business plan examples and use our business plan template to help guide you through the process.

Make your mark in your industry with The Business Plan Company

Give yourself and your business the upper hand by partnering with The Business Plan Company. We have 17 years of experience crafting captivating and professional business plans that successfully convey your ideas, goals and ambitions. To learn more about our business plan services, contact us today.

Business Plans - Free Samples and Examples

Basic Business Plan - Cafe/Restaurant

Small Business Plan - Cafe/Restaurant

Business Plan

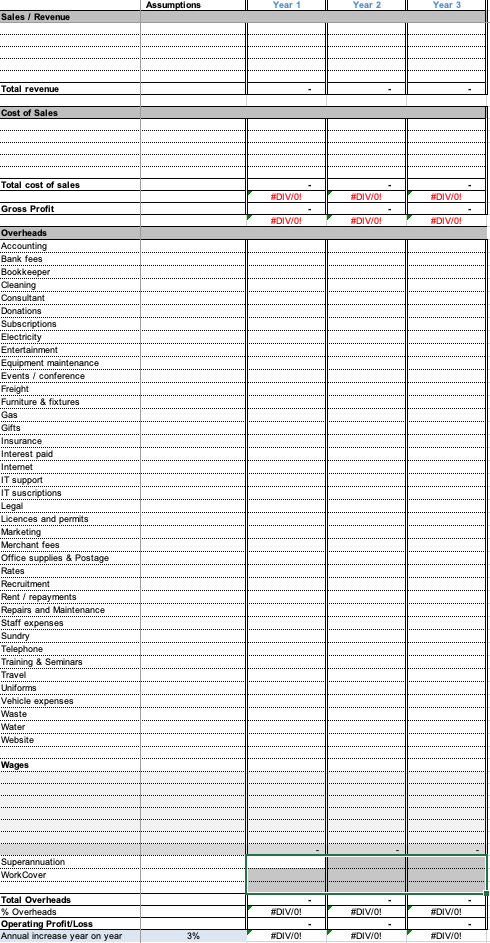

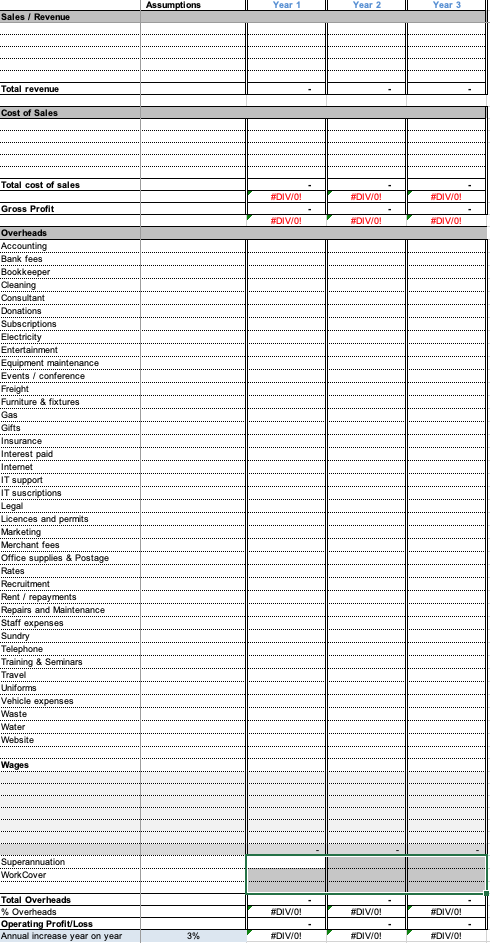

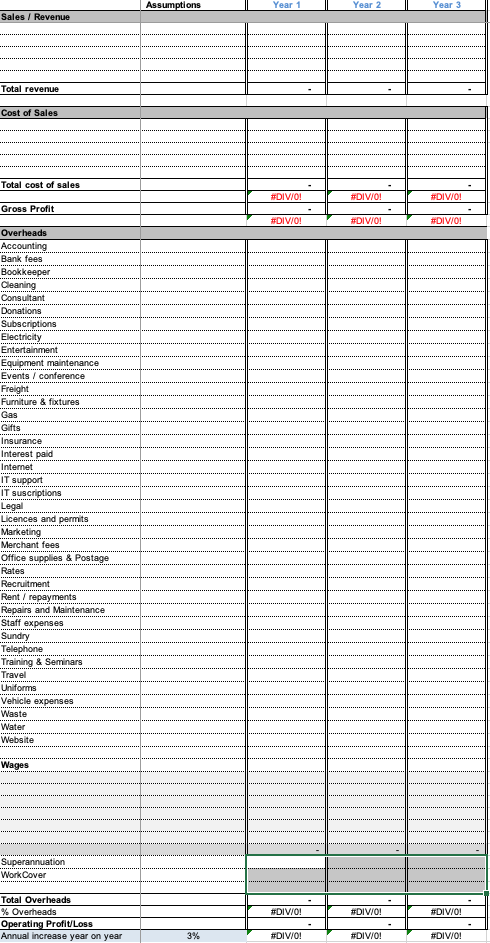

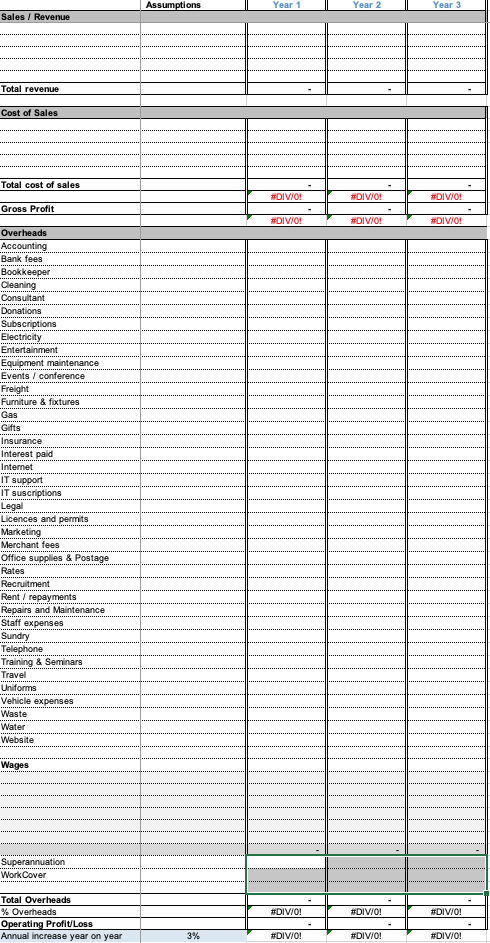

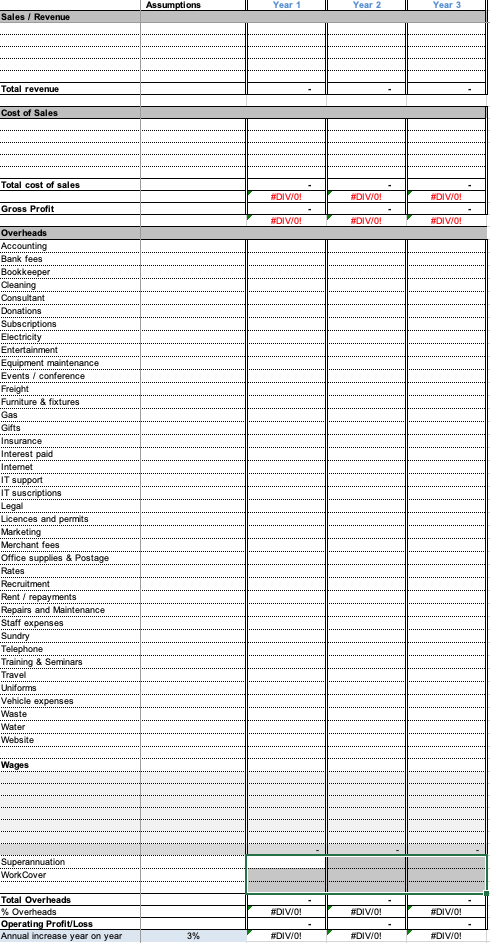

Financials, projections and startup costs templates.

Monthly Projections

Annual Projections

Monthly Projections - Salon

Monthly Projections - Restaurant

Startup Costs Estimate

At The Business Plan Company, we understand how challenging it can be to access accurate and industry-relevant resources when it comes to putting together an effective business plan. In our resources section, you’ll find a range of free Australian business plan templates, examples and a stack of financial, projections and start-up costs templates.

Whether you own a café, run a salon or an agency, you’ll find an Australian business plan template right for your business and its goals. We’ve also curated a series of YouTube videos that detail how to write a persuasive business plan.

Absolutely. We believe every business stands to walk away learning something new once they’ve gone through our catalogue of Australian business plan examples and templates. We also offer more laser-focused templates and resources for businesses across specific industries, including hospitality and service-based businesses, like salons.

However, if you would like more tailored business plan templates, get in touch with us, and we’ll work with you to find a more suitable solution.

No, business owners do not need any unique software to access our Australian business plan templates. Once you have found the template you would like to use, simply input your email address, and the document will appear as a PDF, which you can download to your desktop.

Yes, all our available-to-download Australian business plan examples under the Financials, Projections and Startup Costs Templates section can be used for your business’s financial forecasting and planning. Simply download the right template and start filling in the gaps.

Yes, while our Australian business plan templates are fairly generic and applicable to a range of businesses, we do offer more tailored templates for specific businesses such as cafés, restaurants, salons and start-ups. Our templates also vary in detail, as business owners can access basic and standard Australian business plan templates.

No, all our Australian business plan templates are completely free to download and use.

Putting together a business plan can be challenging, which is why The Business Plan Company is here to guide you through the process. Our team of business plan consultants can work with you to create a compelling and comprehensive business plan — simply get in touch with us to get started.

Please input your email address

Call us on 1300 171 534 to find out how we can help your business.

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

Free Business Plan Template for Small Businesses (2024)

Use this free business plan template to write your business plan quickly and efficiently.

A good business plan is essential to successfully starting your business — and the easiest way to simplify the work of writing a business plan is to start with a business plan template.

You’re already investing time and energy in refining your business model and planning your launch—there’s no need to reinvent the wheel when it comes to writing a business plan. Instead, to help build a complete and effective plan, lean on time-tested structures created by other entrepreneurs and startups.

Ahead, learn what it takes to create a solid business plan and download Shopify's free business plan template to get started on your dream today.

What this free business plan template includes

- Executive summary

- Company overview

- Products or services offered

- Market analysis

- Marketing plan

- Logistics and operations plan

- Financial plan

This business plan outline is designed to ensure you’re thinking through all of the important facets of starting a new business. It’s intended to help new business owners and entrepreneurs consider the full scope of running a business and identify functional areas they may not have considered or where they may need to level up their skills as they grow.

That said, it may not include the specific details or structure preferred by a potential investor or lender. If your goal with a business plan is to secure funding , check with your target organizations—typically banks or investors—to see if they have business plan templates you can follow to maximize your chances of success.

Our free business plan template includes seven key elements typically found in the traditional business plan format:

1. Executive summary

This is a one-page summary of your whole plan, typically written after the rest of the plan is completed. The description section of your executive summary will also cover your management team, business objectives and strategy, and other background information about the brand.

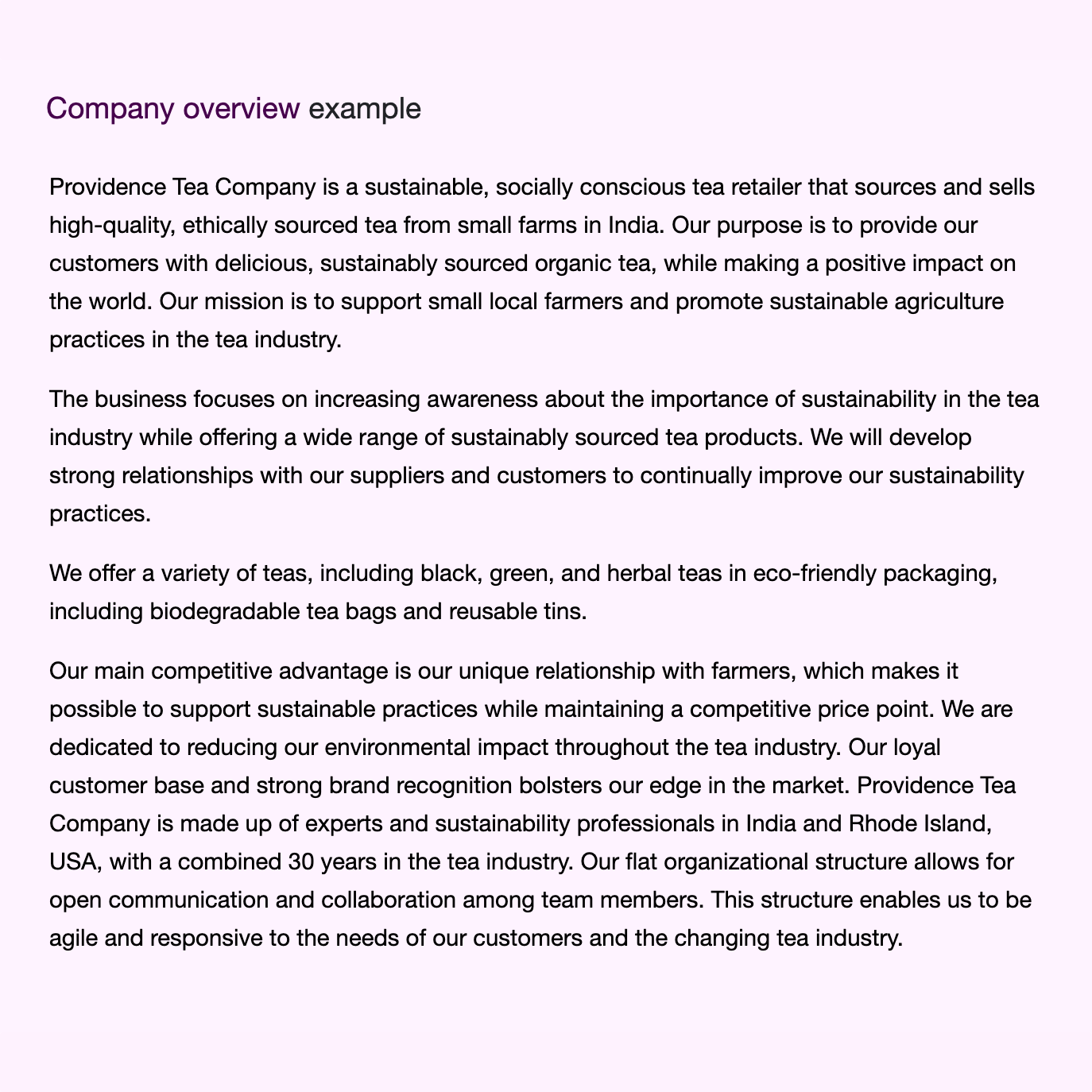

2. Company overview

This section of your business plan will answer two fundamental questions: “Who are you?” and “What do you plan to do?” Answering these questions clarifies why your company exists, what sets it apart from others, and why it’s a good investment opportunity. This section will detail the reasons for your business’s existence, its goals, and its guiding principles.

3. Products or services offered

What you sell and the most important features of your products or services. It also includes any plans for intellectual property, like patent filings or copyright. If you do market research for new product lines, it will show up in this section of your business plan.

4. Market analysis

This section includes everything from estimated market size to your target markets and competitive advantage. It’ll include a competitive analysis of your industry to address competitors’ strengths and weaknesses. Market research is an important part of ensuring you have a viable idea.

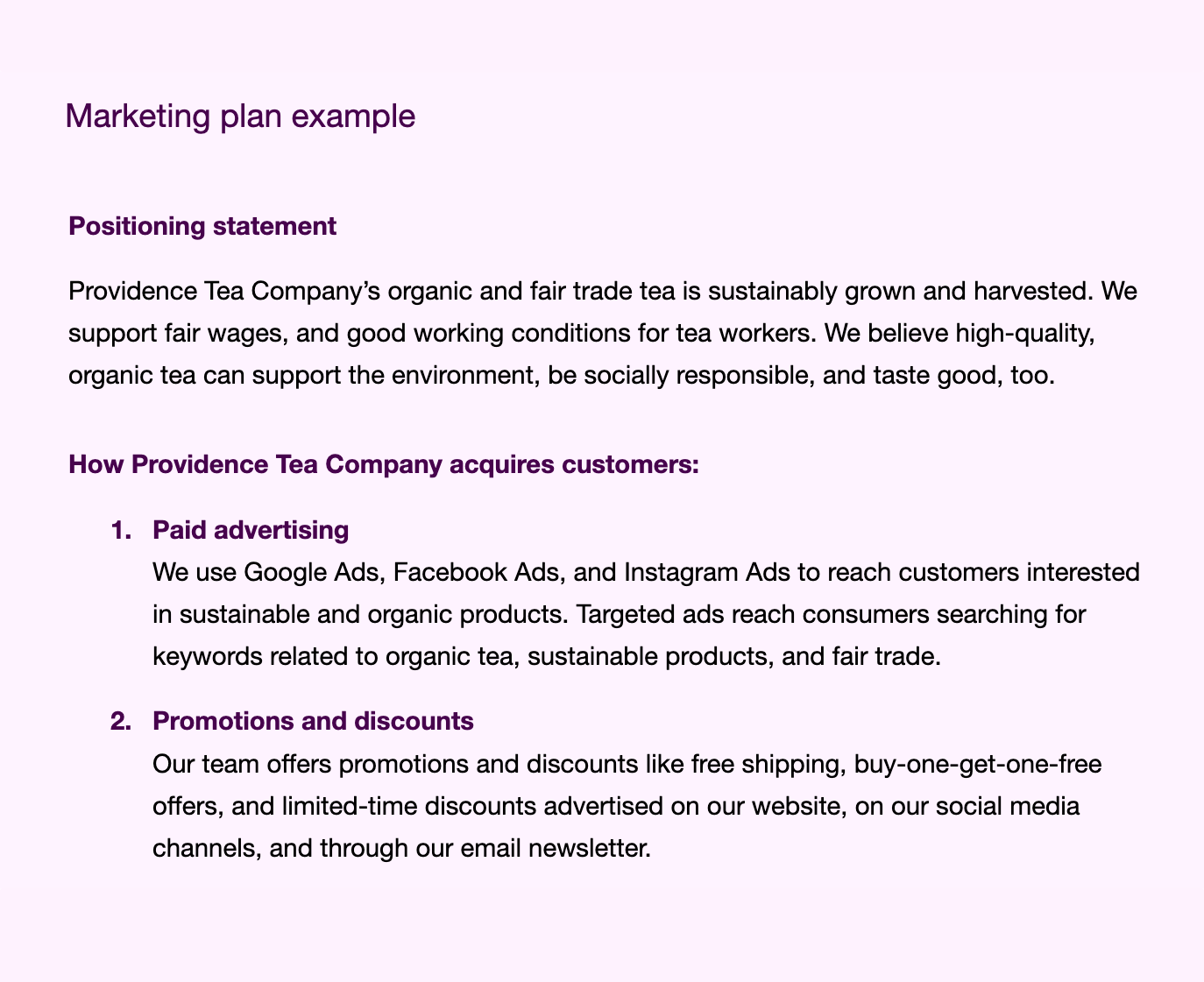

5. Marketing plan

How you intend to get the word out about your business, and what strategic decisions you’ve made about things like your pricing strategy. It also covers potential customers’ demographics, your sales plan, and your metrics and milestones for success.

6. Logistics and operations plan

Everything that needs to happen to turn your raw materials into products and get them into the hands of your customers.

7. Financial plan

It’s important to include a look at your financial projections, including both revenue and expense projections. This section includes templates for three key financial statements: an income statement, a balance sheet, and a cash-flow statement . You can also include whether or not you need a business loan and how much you’ll need.

Business plan examples

What do financial projections look like on paper? How do you write an executive summary? What should your company description include? Business plan examples can help answer some of these questions and transform your business idea into an actionable plan.

Professional business plan example

Inside our template, we’ve filled out a sample business plan featuring a fictional ecommerce business .

The sample is set up to help you get a sense of each section and understand how they apply to the planning and evaluation stages of a business plan. If you’re looking for funding, this example won’t be a complete or formal look at business plans, but it will give you a great place to start and notes about where to expand.

Lean business plan example

A lean business plan format is a shortened version of your more detailed business plan. It’s helpful when modifying your plan for a specific audience, like investors or new hires.

Also known as a one-page business plan, it includes only the most important, need-to-know information, such as:

- Company description

- Key members of your team

- Customer segments

💡 Tip: For a step-by-step guide to creating a lean business plan (including a sample business plan), read our guide on how to create a lean business plan .

Benefits of writing a solid business plan

It’s tempting to dive right into execution when you’re excited about a new business or side project, but taking the time to write a thorough business plan and get your thoughts on paper allows you to do a number of beneficial things:

- Test the viability of your business idea. Whether you’ve got one business idea or many, business plans can make an idea more tangible, helping you see if it’s truly viable and ensure you’ve found a target market.

- Plan for your next phase. Whether your goal is to start a new business or scale an existing business to the next level, a business plan can help you understand what needs to happen and identify gaps to address.

- Clarify marketing strategy, goals, and tactics. Writing a business plan can show you the actionable next steps to take on a big, abstract idea. It can also help you narrow your strategy and identify clear-cut tactics that will support it.

- Scope the necessary work. Without a concrete plan, cost overruns and delays are all but certain. A business plan can help you see the full scope of work to be done and adjust your investment of time and money accordingly.

- Hire and build partnerships. When you need buy-in from potential employees and business partners, especially in the early stages of your business, a clearly written business plan is one of the best tools at your disposal. A business plan provides a refined look at your goals for the business, letting partners judge for themselves whether or not they agree with your vision.

- Secure funds. Seeking financing for your business—whether from venture capital, financial institutions, or Shopify Capital —is one of the most common reasons to create a business plan.

Why you should you use a template for a business plan

A business plan can be as informal or formal as your situation calls for, but even if you’re a fan of the back-of-the-napkin approach to planning, there are some key benefits to starting your plan from an existing outline or simple business plan template.

No blank-page paralysis

A blank page can be intimidating to even the most seasoned writers. Using an established business planning process and template can help you get past the inertia of starting your business plan, and it allows you to skip the work of building an outline from scratch. You can always adjust a template to suit your needs.

Guidance on what to include in each section

If you’ve never sat through a business class, you might never have created a SWOT analysis or financial projections. Templates that offer guidance—in plain language—about how to fill in each section can help you navigate sometimes-daunting business jargon and create a complete and effective plan.

Knowing you’ve considered every section

In some cases, you may not need to complete every section of a startup business plan template, but its initial structure shows you you’re choosing to omit a section as opposed to forgetting to include it in the first place.

Tips for creating a successful business plan

There are some high-level strategic guidelines beyond the advice included in this free business plan template that can help you write an effective, complete plan while minimizing busywork.

Understand the audience for your plan

If you’re writing a business plan for yourself in order to get clarity on your ideas and your industry as a whole, you may not need to include the same level of detail or polish you would with a business plan you want to send to potential investors. Knowing who will read your plan will help you decide how much time to spend on it.

Know your goals

Understanding the goals of your plan can help you set the right scope. If your goal is to use the plan as a roadmap for growth, you may invest more time in it than if your goal is to understand the competitive landscape of a new industry.

Take it step by step

Writing a 10- to 15-page document can feel daunting, so try to tackle one section at a time. Select a couple of sections you feel most confident writing and start there—you can start on the next few sections once those are complete. Jot down bullet-point notes in each section before you start writing to organize your thoughts and streamline the writing process.

Maximize your business planning efforts

Planning is key to the financial success of any type of business , whether you’re a startup, non-profit, or corporation.

To make sure your efforts are focused on the highest-value parts of your own business planning, like clarifying your goals, setting a strategy, and understanding the target market and competitive landscape, lean on a business plan outline to handle the structure and format for you. Even if you eventually omit sections, you’ll save yourself time and energy by starting with a framework already in place.

Business plan template FAQ

What is the purpose of a business plan.

The purpose of your business plan is to describe a new business opportunity or an existing one. It clarifies the business strategy, marketing plan, financial forecasts, potential providers, and more information about the company.

How do I write a simple business plan?

- Choose a business plan format, such as a traditional or a one-page business plan.

- Find a business plan template.

- Read through a business plan sample.

- Fill in the sections of your business plan.

What is the best business plan template?

If you need help writing a business plan, Shopify’s template is one of the most beginner-friendly options you’ll find. It’s comprehensive, well-written, and helps you fill out every section.

What are the 5 essential parts of a business plan?

The five essential parts of a traditional business plan include:

- Executive summary: This is a brief overview of the business plan, summarizing the key points and highlighting the main points of the plan.

- Business description: This section outlines the business concept and how it will be executed.

- Market analysis: This section provides an in-depth look at the target market and how the business will compete in the marketplace.

- Financial plan: This section details the financial projections for the business, including sales forecasts, capital requirements, and a break-even analysis.

- Management and organization: This section describes the management team and the organizational structure of the business.

Are there any free business plan templates?

There are several free templates for business plans for small business owners available online, including Shopify’s own version. Download a copy for your business.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The most intuitive, powerful

Shopify yet

Shopify Editions Summer ’24

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Latest from Shopify

3 July 2024

2 July 2024

1 July 2024

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

Free Small Business Plan Templates and Examples

By Kate Eby | April 27, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful collection of free small business plan templates for entrepreneurs, project managers, development teams, investors, and other stakeholders, as well as a list of useful tips for filling out a small business template.

Included on this page, you’ll find a simple small business template and a one-page small business plan template . You can also download a fill-in-the-blank small business plan template , and a sample small business plan template to get started.

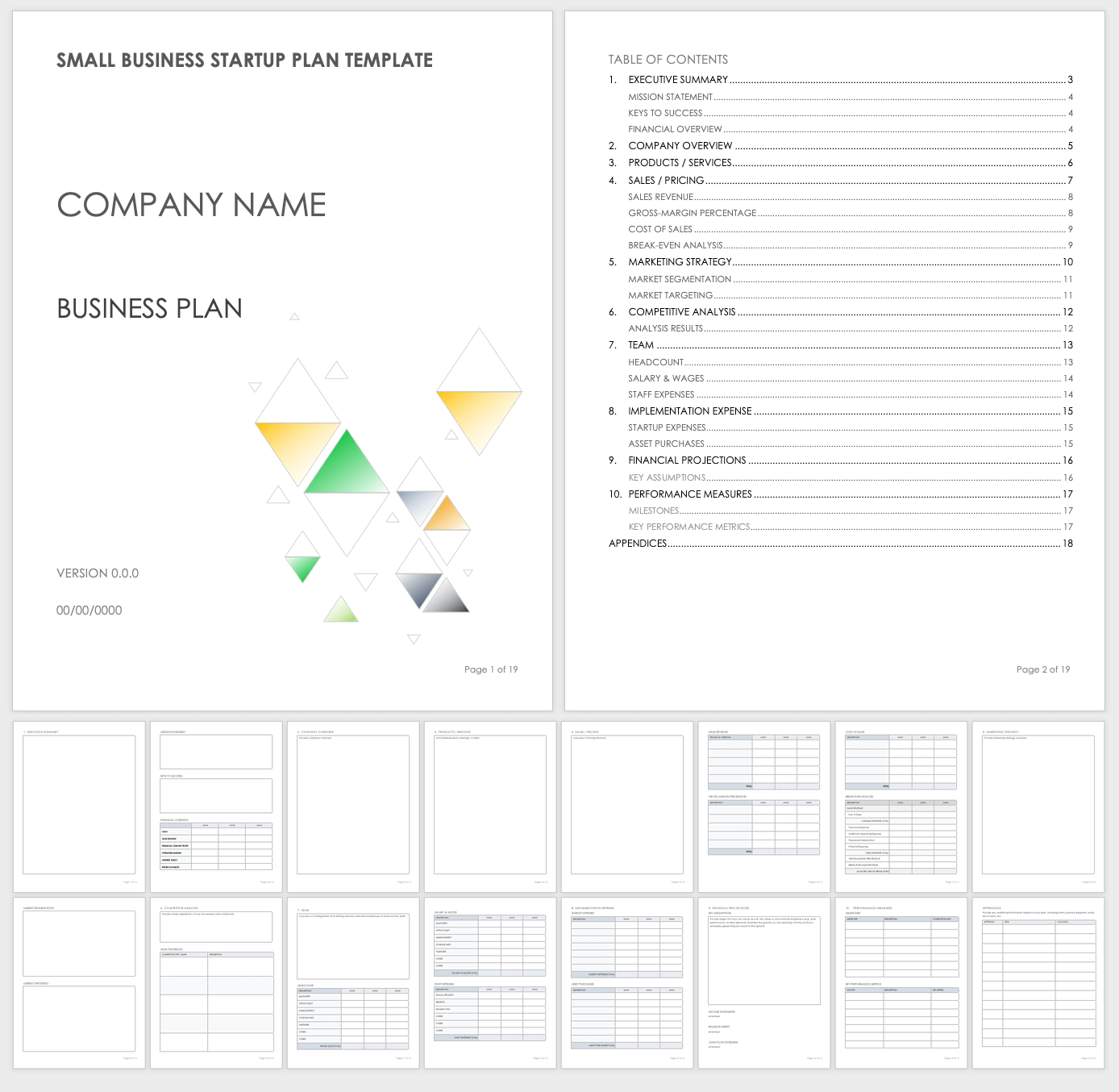

Small Business Plan Template

Download Small Business Plan Template Microsoft Word | Adobe PDF | Google Docs

Use this small business plan template to identify trends and demographics in the company overview. Highlight how your product or service uniquely benefits consumers in the offerings section, and note your proposed timeline, milestones, and the key performance metrics (KPIs) you will use to measure your success. This template has all the components of a standard business plan, from the executive summary through financing details.

Small Business Plan Sample Template

Download Small Business Plan Sample Microsoft Word | Adobe PDF | Google Docs

Use this small business plan sample template to draft the subsections and headings of the contents of your plan. This template provides editable sample text that shows you how to organize and create a ready-to-be-implemented business plan. This sample template helps remove the guesswork of what to include in a small business plan.

Simple Small Business Plan Template

Download Simple Small Business Plan Template Microsoft Word | Adobe PDF

Use this streamlined, customizable, simple small business plan template to chart revenue, expenses, and net profit or loss forecasts with sample graphics. Order your small business plan with numbered subsections and list them in a table of contents. Supplement the plan with additional information in the appendix for a complete business plan that you can present to investors.

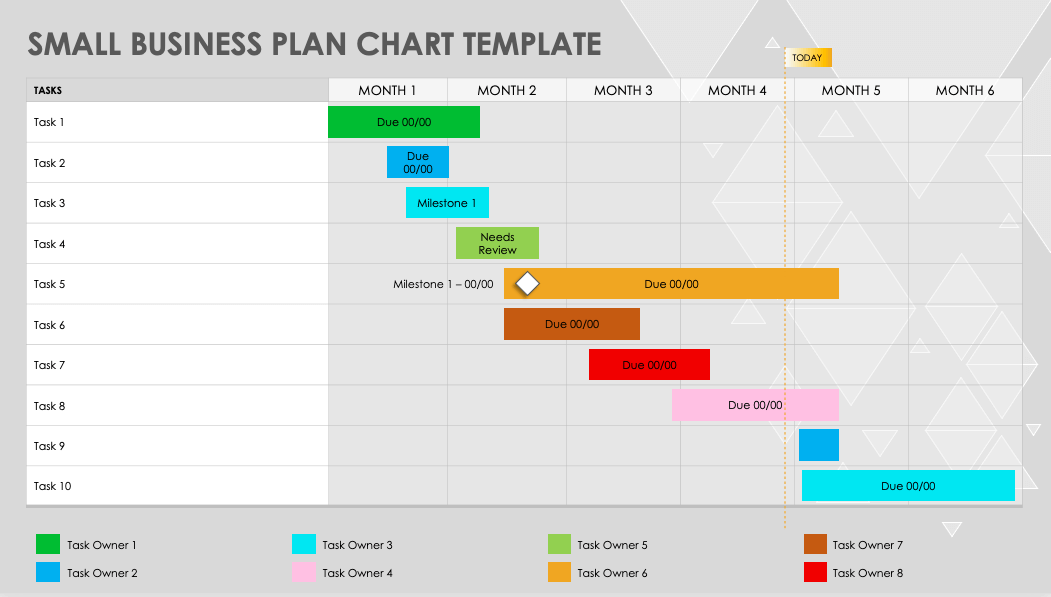

Small Business Plan Chart Template

Download Small Business Plan Chart Template Microsoft PowerPoint | Google Slides

Use this small business plan chart template to plan and track month-by-month and annual business planning. The flexible color-coded bar chart simplifies tracking and allows you to customize the plan to meet your needs. Add tasks, track owner status, and adjust the timeline to chart your progress with this dynamic, visually rich small business planning tool.

Small Business Plan Outline Template

Download Small Business Plan Outline Template Microsoft Word | Adobe PDF | Google Docs

Use this small business plan outline template to jumpstart a plan for your small business. This template includes the nine essential elements of a traditional business plan, plus a title page, a table of contents, and an appendix to ensure that your document is complete, comprehensive, and in order. Easily simplify or expand the outline to meet your company’s needs.

Printable Small Business Plan Template

Download Printable Small Business Plan Template Microsoft Word | Adobe PDF | Google Docs

This print-friendly small business plan template is ideal for presentations to investors and stakeholders. The customizable template includes all the standard, critical business plan elements, and serves as a guide for writing a complete and comprehensive plan. Easily edit and add content to this printable template, so you can focus on executing the small business plan.

Small Business Startup Plan Template

Download Small Business Startup Plan Template Microsoft Word | Adobe PDF | Google Docs

Use this small business startup plan template to draft your mission statement and list your keys to business success, in order to persuade investors and inform stakeholders. Customize your startup plan with fillable tables for sales revenue, gross profit margin, and cost of sales projections to secure your business's pricing structure.

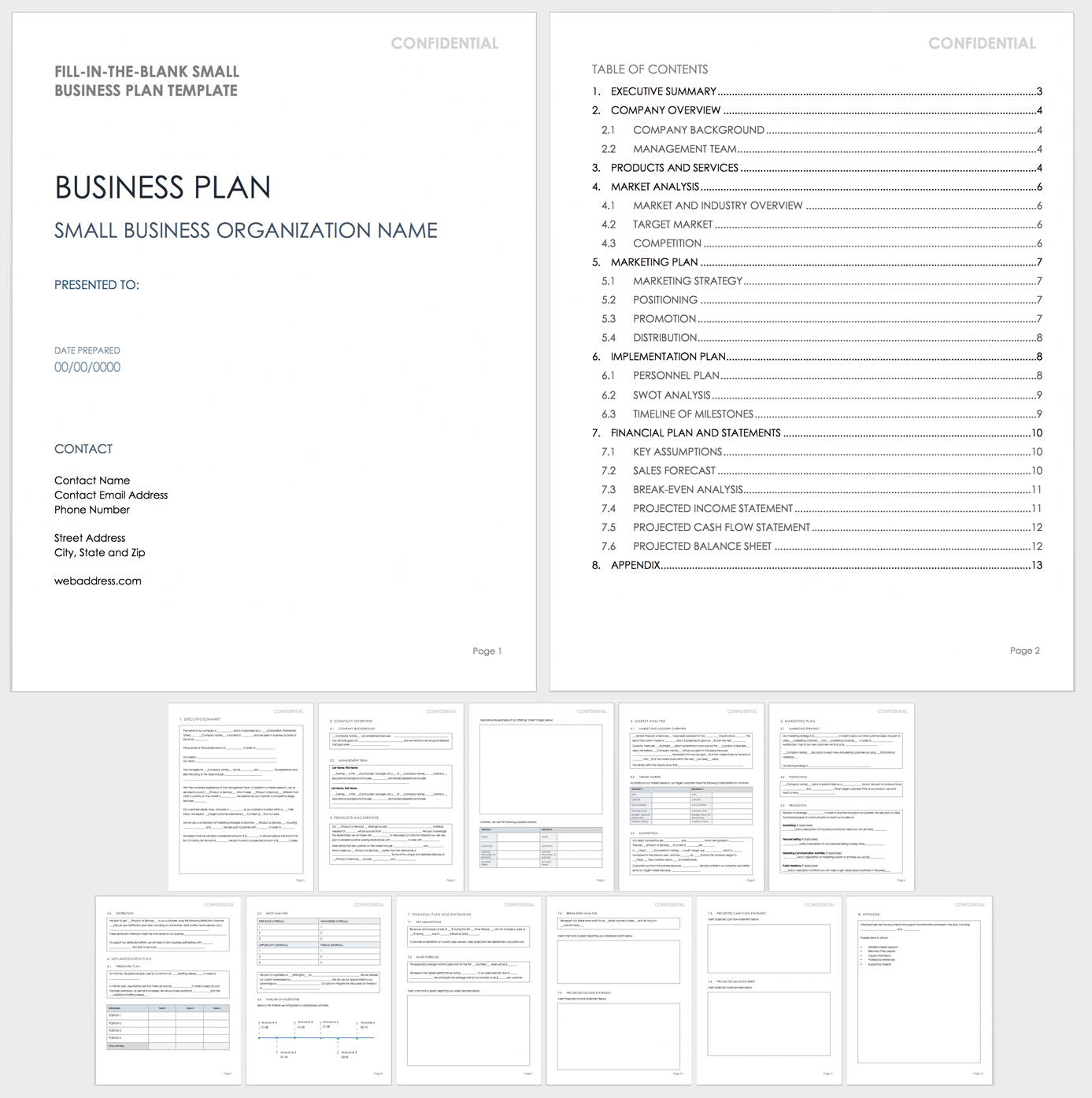

Fill-in-the-Blank Small Business Plan Template

Download Fill-in-the-Blank Small Business Plan Template Microsoft Word | Adobe PDF

This small business plan template simplifies the process to help you create a comprehensive, organized business plan. Simply enter original content for the executive summary, company overview, and other sections to customize the plan. This fill-in-the-blank small business plan template helps you to maintain organization and removes the guesswork in order to ensure success.

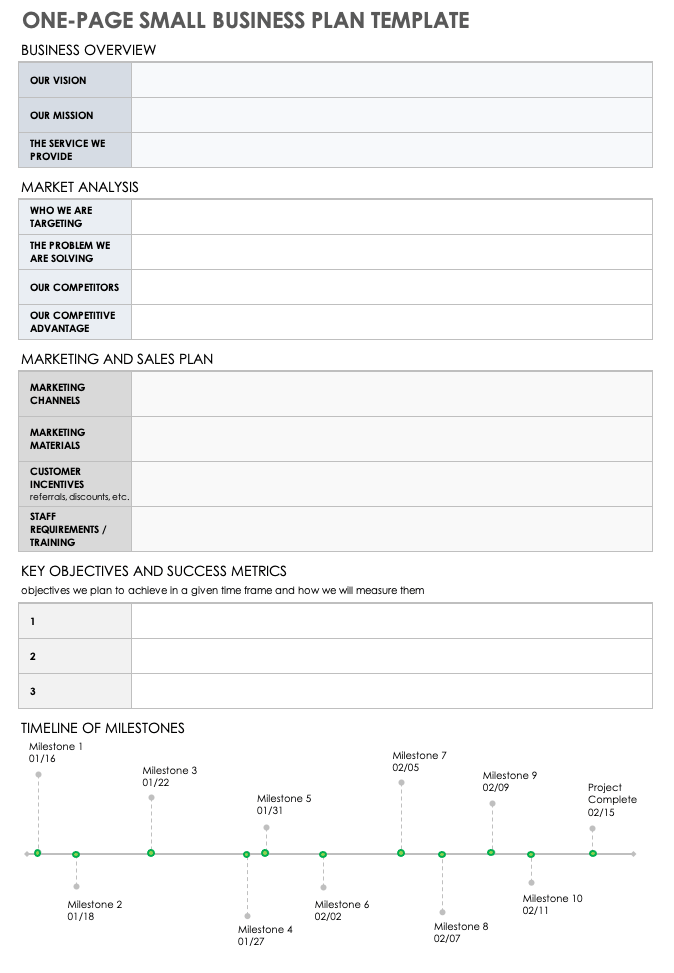

One Page Small Business Plan Template

Download One Page Small Business Plan Template Microsoft Excel | Microsoft Word | Adobe PDF

This one page small business plan template is ideal for quick, simple presentations. Use this template to summarize your business overview, market analysis, marketing, and sales plan, key objectives and success metrics, and milestones timeline. Complete the fillable sections to educate investors and inform stakeholders.

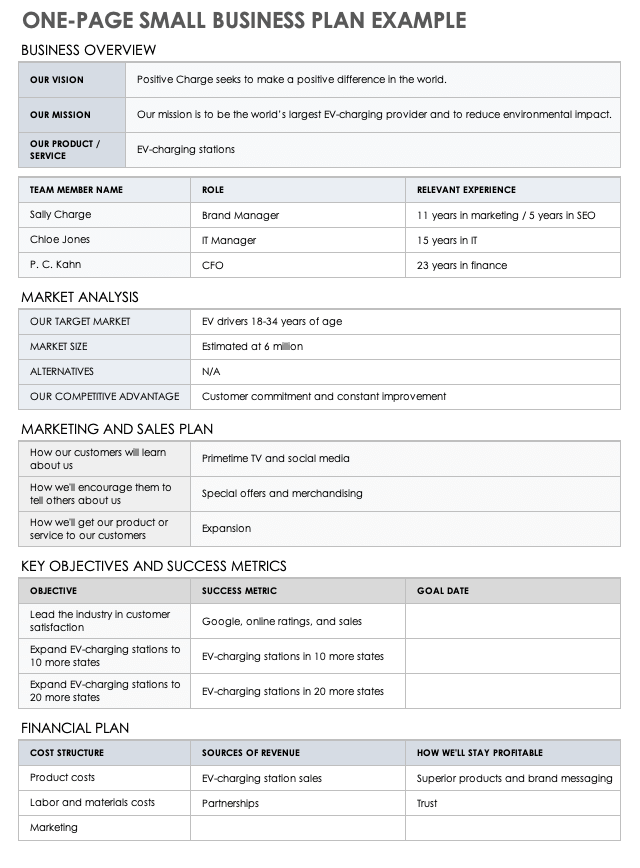

One Page Small Business Plan Example

Download One Page Business Plan Example Microsoft Excel | Microsoft Word | Adobe PDF

This one page small business plan example prompts you to list your vision, mission, product or service, team member names, roles, and relevant experience to promote your small business. Use the market analysis, marketing, sales plan sections to detail how you aim to sell your product or service. This small business plan features fillable tables for key objectives and success metrics. Plus, you’ll find space for your financial cost structure and revenue sources to show how your business will remain profitable.

What Is a Small Business Plan Template?

A small business plan template is a roadmap for defining your business objectives and detailing the operational, financial, and marketing resources required for success. Use a small business plan template to strategize growth, forecast financial needs, and promote investment.

A small business plan template organizes and outlines the content needed to achieve goals for growth and profit, including marketing and sales tactics. As opposed to starting from scratch, using a template makes it easy to organize the information and customize the plan to meet your needs.

A small business plan template includes standard business plan sections, as well as the following sections:

- Executive Summary: Summarize the key points in your small business plan in two pages or less to hold your reader's attention and promote buy-in. Write this section last to capitalize on your understanding of the small business plan.

- Company Overview: Describe the nature of your small business, the industry landscape and trends, demographics, and economic and governmental influences. List your location, product or service, and goals to show what makes your small business unique.

- Problem and Solution: Identify and explain the problem your product or service will solve and its costs. Propose and describe your solution and its benefits. Conclude this section with a summary of the problem and solution.

- Target Market: Identify your small business's target market by researching your product and service to determine the most likely demographic. Explain your target market's motivations for buying your product or service.

- Competition: Note the other competitor product or service offerings, pricing, and company revenues to understand how to outperform your competitors. Detail your small business's competitive advantages, based on research.

- Product or Service Offerings: Describe your product or service, how it benefits your target market, and what makes it unique. Highlight how your product or service will outsell competitors.

- Marketing: Detail your marketing plan with objectives and strategy, including goals, costs, and an action plan. A successful marketing plan reduces costs and boosts your product or service sales.

- Timeline and Metrics: Break down your small business plan into smaller activities. Describe these activities (and the performance metrics you intend to use to track them) and list a completion date for each.

- Financial Forecasts: Explain how your organization uses past performance and market research to inform your business's economic forecasts. Estimate growth and profits based on your informed assumptions.

- Financing: List your funding sources and how you intend to use the funds to keep your company on track as it grows. Smart financing at the planning stage prepares your organization for unexpected challenges and helps to mitigate risk.

A small business plan template enables you to complete your business plan quickly and comprehensively, so you can achieve your goals and turn your product or service idea into a profitable reality.

Optimize Your Business Plan with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Start or grow a business in NSW

Use this guide to check the transactions you may need to complete when you open a new business in NSW, grow or expand your business, or have to adapt your business.

Visit Service NSW Business Bureau to access resources and support for setting up your business, licences, grants and financial assistance.

For personalised support, book a call with a Service NSW Business Concierge or call us on 13 77 88 .

Planning a business

Before you invest time and money into setting up your business by registering and applying for the right business licences , make sure you put together a business plan and carefully consider how viable your business is. Many businesses fail when these things aren't considered.

Service NSW Business Bureau offers free, tailored business advice and guidance to help you start and grow your business. Book a call with a Service NSW Business Concierge or call us on 13 77 88 .

Choosing a business structure

It's important you choose the best structure for your business type. The most commonly used business structures are sole trader, company, partnership, and trust.

Set up as a sole trader Operating as a sole trader is the simplest and cheapest business structure you can set up. You control and manage the business, and although you 'trade' on your own, you can still employ people to work for you.

Register a company If you've decided a company structure is best for your business, you'll need to register your company with the Australian Government.

Register a limited partnership If you’ve decided a limited partnership structure is best for your business, you’ll need to register the limited partnership with NSW Fair Trading’s Registry Services.

Set up a trust business structure A trust is an obligation imposed on one person or entity – the trustee, to hold property for the benefit of another – the beneficiary. The trustee can be an individual or a company, the latter providing some asset protection.

Register a co-operative If you've decided a co-operative is best for your business, you'll need to register the co-operative with NSW Fair Trading's Registry Services.

Starting a business

Register an Australian Business Number (ABN) You don't have to register for an ABN, but an ABN will let you claim Goods and Services Tax credits, energy grants credits, register an Australian domain name, plus more.

Register a business name You'll need to register a business name, unless you're a sole trader or partnership and your business name is exactly the same as your first and last name or you and your partner's first and last names. You'll need an ABN or ABN application number to register your business name.

Business licences Stay compliant by registering for the required business licences for your industry before you open your doors.

Register your business for Goods and Services Tax (GST) You must register your business for GST if your GST turnover is $75,000 or more.

Apply for a business Tax File Number If you've decided a company, trust, or partnership structure is best for your business, you'll need to apply for a business Tax File Number.

Apply for an individual Tax File Number If you’ve decided a sole trader structure is best for your business, you’ll need to apply for an individual Tax File Number.

Register for PAYG withholding You'll need to register for PAYG withholding if you need to withhold tax (on behalf of the Australian Tax Office) from payments you make to employees, contractors, or other businesses that haven't supplied you an ABN.

Check the Personal Property Securities Register (PPSR) Before you buy or lease vehicles, equipment, stock or goods for your business, search the PPSR to avoid property that is stolen, unable to be insured, or subject to a debt or security interest.

Get liability insurance for your business You can choose to take out public liability, professional indemnity, or product liability insurance. Public liability insurance protects you and your business against the risks of damage or injury to people or property. While it's not mandatory, it's essential for a business.

Register for fuel tax credits You may be eligible to register for fuel tax credits for the fuel used by your business.

Developing your premises

Help with leasing business premises You can find out about commercial leasing on the Office of the NSW Small Business Commissioner website.

Apply for a development application (DA) or a complying development certificate (CDC) If your proposed development is located within certain local government areas, you can create an account on the NSW Planning Portal and submit your DA online or CDC online.

Apply to install a street awning or a business sign Before you install any street awnings or business signs at your premises, you may need to apply for permission from your local council.

Apply for a zoning certificate To find out about any controls, requirements and restrictions on a property, apply to your local council for a zoning certificate (Section 149 planning certificate).

Apply to make changes to a heritage listed place If you want to make changes to a heritage listed place, you may need to seek approval from your local council or the Heritage Council of NSW.

Apply for a construction certificate Before you start any building work, you need to apply for a Construction Certificate from your local council. This certificate confirms the construction plans are consistent with the development consent and other requirements.

Appoint a principal certifying authority After being issued with development consent or a Construction Certificate, and before you start any approved construction, you need to appoint a Principal Certifying Authority to oversee the building work.

Apply for a fire safety certificate You’ll need to have a final Fire Safety Certificate from your local council before a final Occupation Certificate can be issued for a new building or an existing building that’s changed use.

Apply for an occupation certificate Before moving in to your premises, you’ll need an Occupation Certificate from your local council to occupy or use a new building, or change the use of an existing building.

You can find your local council online to get the information relevant to your situation.

Before you start trading

Register a regulated water system You need to register a regulated water system, like a water cooling or warm water system, with your local council.

Waste management for businesses

- You may need approval from your water provider to discharge commercial trade wastewater into a public sewer.

- You’ll need approval from your local council if you want to place commercial waste from your business in a public place for collection.

Apply for a licence to play music at your business If you want to play music at your business, you'll need a OneMusic licence to cover copyright issues.

Selling goods

Comply with Australian competition and consumer laws It's important you understand and comply with competition and consumer laws that govern how all businesses in Australia, including online retailers and those with a shopfront, must deal with their competitors, suppliers and customers.

Meet requirements for displaying or advertising prices You must comply with pricing regulations, and display prices accurately and clearly.

Apply for an exemption from restricted trading days If you wish to open your business on a restricted trading day, such as Good Friday, Easter Sunday, ANZAC Day (prior to 1pm), or Christmas Day, you may need to apply for an exemption.

Check guidelines for importing and buying goods from overseas You don't need a licence to buy or import goods from overseas, but you may need to get permits to clear some goods from customs control. Check you understand and comply with any customs legislation and procedures before you order goods from overseas.

Setting up workers

Comply with Fair Work requirements If you’re employing staff you must comply with Fair Work requirements like minimum pay and conditions.

Comply with long service leave requirements If you're employing staff you must comply with NSW Industrial Relations requirement to pay long service leave.

Paying employees at, or above, award rates You must make sure you're providing at least minimum wages and conditions for your employees. These conditions are covered in the awards.

Register for the superannuation clearing house If you have 19 or fewer employees or have an aggregated turnover below $2 million, you can register for the small business superannuation clearing house to pay super contributions to your employees in a single online location.

Comply with work health and safety laws You must comply with work health and safety (WHS) laws so that your workers, and people who come into contact with your business (customers, contractors or visitors) are kept healthy and safe. As part of WHS laws, you'll also need to manage the risks to health and safety for hazardous manual tasks, hazardous chemicals and noise at work.

Apply for a workers insurance policy If you're going to pay more than $7,500 a year in wages, you'll need to have a workers compensation insurance policy.

Managing contractors and employees You have different responsibilities if you engage contractors rather than permanent employees. It's important for you to learn about the differences.

Other things to consider

Register a trade mark A trade mark (sometimes called a brand) is the way you show your customers and the public who you are.

Register a domain name for your business With an ABN, you can register a website name that ends with '.au'.

Comply with Australian standards Australian standards set out specifications and design procedures to ensure products and services consistently perform safely, reliably, and the way they're intended to.

Comply with NSW environmental legislation It's important to make sure you comply with all environmental laws covering water, land, air, noise pollution and waste management .

Apply to register a design You can protect your design, provided it is both new and distinctive, by registering it with IP Australia.

Apply for a patent If you've developed a new device, substance, method, or process, you can apply for a patent to give you rights over your invention in Australia.

Apply for a trade promotion gaming authority If you want to run a single free-entry competition, such as a sweep, giveaway or contest to promote your business, you'll need to apply for a permit online.

Register to be a NSW Seniors Card program participating business If you'd like to provide discounts to Seniors Card holders at your business and be listed in the NSW Seniors Card Directory, you can register to become a NSW Seniors Card program participating business.

Apply to be a Companion Card affiliate If your business charges an admission or participation fee and you'd like to issue a companion ticket at no charge to companion cardholders, you can apply to become a Companion Card affiliate.

Calculators

Use this list of calculator tools to help make starting and operating your small business easier.

Tax withheld calculator If you want to work out the tax you need to withhold from payments you make to employees or other workers, you can use the tax withheld calculator. The calculator applies to payments made in the current tax year.

Superannuation Guarantee Contributions Calculator Use the calculator to check the super contributions you need to pay your employees.

Leave calculator You can find out how much annual leave, annual leave loading, and sick and carer's leave you need to pay your employees, using the online leave calculator.

Notice and redundancy calculator This tool shows you how much notice and redundancy pay is required under awards, or under the National Employment Standards (NES)

The Service NSW Business Bureau provides free, ongoing and personalised support for every stage of your business. You can:

- talk to a Business Concierge for one-on-one guidance over the phone, in person or online

- get independent advice from a Business Connect advisor and access a range of events, webinars and online resources

- create a Business Profile to make it easier to manage your government transactions and business licences.

Rate the information on the page

Latest offers

Update your browser..

This website doesn't support your browser and may impact your experience.

NAB Mobile Banking app

Business plan template

Create a comprehensive business plan with this easy to use business plan template.

Businesses need a strong plan that outlines what you aim to achieve and gives you a roadmap to get there. Creating your own business plan doesn’t have to be difficult, simply set aside some time to work through the various elements.

What to consider when writing a business plan

The template walks you through each stage of a business plan. It will help ensure that nothing gets missed, including essential elements such as:

- your profile

- your marketing strategy

- your business structure.

When you’re writing your business plan , it’s important to:

- avoid long words or sentences

- use clear and concise language and avoid jargon

- identify your audience and keep them in mind when writing

- show why you care and let your passion for the business shine through

- highlight your unique value proposition

- include a realistic detailed financial plan

- think carefully through every step of your business start-up

- pinpoint weaknesses, identify your strengths and spot opportunities.

Why you should use a business plan template

A business plan template is an essential tool to help you create a clear, concise and comprehensive business plan. It can help you:

- secure funding and attract investors

- set goals and prioritise

- better control your business

- helps you seek finance.

Writing a plan can be enjoyable. It will help you highlight the ideas and activities at the core of your business, and force you to get your priorities in order too. It could also show you what success will look like, so you can begin measuring it. Each section of the template comes with brief instructions, so that you get the structure right.

When you’re finished, one of our small business bankers will be happy to go over the plan and provide advice and guidance. You can request a call back online to discuss this further.

Download our business plan template (DOC, 158KB) , opens in new window and read our detailed article on writing your business plan to get started.

Use our business plan template to guide you through writing your business plan.

Other business moments

Find out if you’re suited to running a business

Use our checklist to help you determine if you have what it takes.

How to write a business plan

Follow our helpful guide to writing a comprehensive plan.

What are business drivers and how do I identify them?

Boost profitability by identifying your key business drivers.

Related products and services

Online business banking.

Make your life easier with NAB's online business banking facilities. Find the product that suits your needs.

Loans and finance

Starting a business or looking to expand? Our range of business loans, overdrafts, equipment and trade finance options can help you achieve your goals.

Business calculators

NAB has a range of business calculators and tools, along with a national network of business bankers to help you.

Get in touch

Visit our business banking contact page for how-to-guides and FAQs, as well as contact numbers.

Visit a NAB branch

Our business bankers are located all around Australia.

Important information

This section contains Important Information relevant to the page you are viewing, but you can't see it because you have JavaScript disabled on your browser. Please enable JavaScript and come back so you can see the complete page. It's important that you read the Important Information in this section before acting on any information on this page.

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

The information contained in this article is correct as of July 2018 and is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, financial, and taxation advice before acting on any information in this article.

- MyServiceNSW

- Manage account

- Logout of MyServiceNSW

Charter for Small Business Action Plan

This action plan explains how we will deliver the 6 principles of the Charter, including the most important steps the NSW Government is taking to support small business.

It includes measures allowing small business to inform government policies and programs, help small businesses win NSW Government contracts and strengthen our response to unproductive red-tape and other pain points.

1. Clear and strong focal point to support small business to start, grow and thrive

- Establish the Service NSW Business Bureau.

- Support small businesses who are interested or ready to sell their goods and services to customers overseas.

The Service NSW Business Bureau provides guidance on government programs and topics such as business planning, marketing and cash flow.

The Business Bureau also connects small businesses to programs that can build readiness to export and overseas opportunities.

2. Stronger engagement on new policy and regulation

- Promote greater and more consistent sector consultation and engagement.

- Publish government agency statements on delivering the Charter principles.

- Examine and report on further steps to manage major infrastructure project impacts on small business.

The Service NSW Business Bureau is working across government agencies to improve how we engage with small business on policies and projects. This will help us design approaches that better meet the needs of small businesses in NSW.

3. Listen and respond to red-tape and other pain points

Improve coordination and response to red-tape and other pain points.

Remove legacy red tape requirements through legislative reform.

Provide financial support to help ease the cost of doing business.

Deliver faster payments to small businesses.

Government agencies are taking steps to make it easier to do business in NSW, including through streamlining regulation and providing targeted financial support. We are also strengthening processes to improve the way we respond to pain points raised by the sector.

4. Boost NSW Government procurement from small businesses

We will:

Promote awareness of NSW Government contracts, tendering tools and resources.

Make it easier for small businesses to supply goods and services to NSW Government agencies.

Increase tender weightings for small business, local content, jobs creation, and ethical supply chains.

We are creating more opportunities for small businesses to supply goods and services to NSW Government agencies. This includes building small business capability to submit tenders, and making procurement processes easier for small businesses, such as simplifying insurance requirements.

5. Introduce and report on metrics and identify opportunities for supporting small business policy, regulatory and economic settings

Develop and apply performance metrics to NSW Government agencies.

We are developing new ways to track progress against the Charter and action plan. This will include bringing data together to look at how various programs and measures are supporting small business.

6. Deliver key actions and commitments to timeline

- Report regularly against progress on the Charter and action plan.

The commitments in the Charter will be supported by new reporting that shows how NSW Government agencies are taking action to assist small businesses. This will provide important feedback to the sector on how we are tracking.

For free, ongoing and personalised support for your business call 13 77 88 or go to the Service NSW Business Bureau website.

Download or print

Request accessible format of this publication.

Tools, templates and more

Here you will find further information, services and support to help your business.

Use our feedback form to tell us what you think about this toolkit.

Advice and resources

A library of free resources for your business. Here you can find codes of practice, safety alerts, fact sheets and guides. You can also attend a webinar or join our mentor program.

All templates and tools

Find practical templates and tools to help improve your workplace health and safety.

Financial help

Apply for a $1000 rebate to help you install eligible safety items in your business.

Free on-site support

Ask for a visit to your workplace for tailored advice.

A list of useful terms is on our website.

Licences and registrations

Apply for a licence. Register your machinery and equipment.

Mental health at work

Mental health, just like physical health, is an important part of work health and safety. To find out how to create a mentally healthy workplace visit our Mental Health at Work website.

Access research, data and reports, to help you improve health and safety in your business.

SafeWork awards

Enter the annual SafeWork NSW Awards.

Other agencies

Fair trading nsw.

Provides information to consumers and traders on their rights and responsibilities when buying and selling products and services, housing and property. They also regulate associations and co-operatives.

NSW Small Business Commissioner

The Office of the NSW Small Business Commissioner (OSBC) advocates on behalf of small businesses in NSW, provides mediation and dispute resolution services, and speaks up for small business in government.

Service NSW

Your single point for many government agencies, where you can apply for a licence, get a permit, register a birth, pay most fines and more.

Regulates motor accidents CTP insurance, workers compensation insurance and the home building compensation scheme in NSW.

What you can do next

- Small and Medium Enterprise and Regional Procurement Policy

- View update history

- Contact owner

1. Introduction

1.1 introduction.

The NSW Government recognises that government procurement presents opportunities for small and medium businesses (SMEs) to provide a diverse range of goods and services, while supporting local jobs and building skills, and remains committed to improving access to government business opportunities.

This document supersedes the earlier version of the SME and Regional Procurement Policy document dated 20 August 2020 and reflects recommendations made as a result of the SME and Regional Procurement Policy Review PDF, 2225.81 KB .

1.2 Policy objectives

The SME and Regional Procurement Policy aims to increase SME participation in procurement opportunities within the NSW Government and improve economic, ethical, environmental and social outcomes through a range of initiatives.

By 2023 expected outcomes are:

- more contracts awarded to SMEs

- more participation of SMEs on large contracts

- increased spend with SMEs, overall and as a proportion of total government procurement expenditure

- improved capability of SMEs and regional businesses.

1.3 Application

The policy applies to the procurement of all goods and services (excluding construction), by a NSW Government agency, within the meaning of section 162 of the Public Works and Procurement Act 1912 (collectively referred to as ‘clusters’ or ‘agencies’ in this policy).

State-owned corporations, the Parliament of NSW and local councils are not covered by this policy. State-owned corporations are encouraged to adopt aspects of the SME and Regional Procurement Policy that are consistent with their corporate intent.

NSW Government agencies must apply the policy to all goods and services procurement activities commencing from 1 July 2021.

In NSW, each government agency is responsible for their own procurement.

So while the NSW Government Procurement Policy Framework sets out the policy and operating framework for the whole sector, agencies often have their own policies and procedures which must also be adhered to.

This policy must be read in conjunction with PBD 2023-03 Procurement Opportunities for Small (and medium) Enterprises which works in parallel with the SME and regional supplier exemption under the SME and Regional Procurement Policy. The SME and regional supplier exemption allows agencies to negotiate directly with and engage an SME or regional supplier to provide goods or services (excluding construction) valued up to $150,000. This will continue to support regional businesses while increasing the threshold for direct procurement with small (and medium) businesses from $150,000 to $250,000.

1.4 Definitions

- a local business has the same definition as an SME

- a small business is defined as an enterprise with 1-19 FTEs including sole traders and start-ups

- a medium business is defined as an enterprise with 20-199 FTEs.

- Regional NSW includes all areas within NSW outside the Newcastle, Sydney and Wollongong metropolitan areas. Here is a list of regional local government areas XLSX, 12.41 KB (LGAs).

- A SME may include, but are not limited to, local businesses, Aboriginal-owned businesses, social enterprise and disability employment organisations.

We may exclude large multinational companies with smaller subsidiaries from showing as SMEs in spend data.

1.5 Actions to date

Since 2019, the NSW Government has:

- Created a single platform buy.nsw – a gateway to NSW Government procurement resources and services for buyers and suppliers.

- Created the NSW Supplier Hub, integrated to buy.nsw, which makes it easier for businesses to register to sell to the NSW Government and easier for buyers to find suppliers.

- Committed to creating SimpleQuote to be integrated to buy.nsw for low-risk, low-value procurement.

- Updated the NSW Government’s Faster Payment Terms Policy so that all registered small businesses must be paid within 5 business days for goods and services worth up to $1 million, through a correctly rendered invoice.

- Introduced the Small Business Shorter Payment Terms Policy that requires large businesses who contract with NSW Government agencies for goods and services contracts valued at or above $7.5 million to pay small business subcontractors within 20 business days.

- Committed to the NSW Small Business Commission Tendering Support Program to provide small businesses with information, guidance and training to assist them with successfully finding and tendering for opportunities to sell to NSW Government.

- Extended the Business Connect program, a dedicated and personalised service that provides practical advice and training to support NSW small businesses to start, run, adapt or grow.

- Continued the Industry Capability Network NSW (ICN NSW) to deliver free-of-charge procurement advice and business matching to NSW project owners and suppliers on major projects.

- Continued SME targeted procurement support by providing focused advice via the NSW Procurement Service Centre.

- Created the Business Concierge Service, which provides a suite of assistance for starting or expanding a small business in NSW.

- Implemented e-invoicing to reduce errors and speed up the payment process for businesses.

2. Requirements and permissions

2.1 sme and regional supplier exemption.

NSW Government agencies may negotiate directly with and engage an SME or regional supplier, for goods and services up to $150,000, including where there is a whole-of-government arrangement in place.

Direct negotiate with SMEs and regional suppliers up to $150,000

This exemption continues the government’s support for local business, small business, sole traders and start-ups, regional businesses and growing SMEs.

You can directly negotiate with a supplier in one of these categories if your procurement is valued at up to $150,000. It cannot be applied to flow-on procurements though.

Direct negotiate with small and medium suppliers up to $250,000

Under PBD 2023-03 Procurement Opportunities for Small (and medium) Enterprises, agencies may negotiate directly with and engage small (and medium) businesses when procuring goods or services, excluding construction, valued up to and including $250,000, including where there are mandated procurement arrangements in place. This does not apply to regional suppliers.

Other exemptions may apply

Some SMEs fall into other supplier categories, so other exemptions may also apply. For example:

- Agencies may negotiate directly with an Aboriginal business for all procurements up to $250,000 , even if a mandated scheme or panel is in place (as per the Aboriginal Procurement Policy).

- Agencies may buy from an approved disability employment organisation goods and services of any value via a single written quote (as per Public Works and Procurement Regulation 2019).

- Agencies may buy directly from an SME for ICT procurements up to $250,000 , even if they are not on a whole-of-government contract (please refer to the ICT SME Procurement Commitments for more information).

You're not exempted from achieving value for money

When applying the SME and regional supplier exemption, agencies must still achieve value for money. Agencies must ensure their procurement meets quality, price, fitness for purpose, capability and other requirements.

Agencies must also apply the usual procurement rules – including your own agency's rules – to ensure probity and fairness.

Read more about probity and fairness in our buyer guidance.

Find SMEs and regional suppliers on Supplier Hub

Agencies should be satisfied of the status of SME and regional suppliers.

Supplier Hub has a searchable list of suppliers registered with NSW Government. You can filter suppliers by category, company type, size and location.

Example 1. Catering by local businesses under $4,000

An agency requires event catering and has a budget of $4,000.

A local bakery with 10 full-time employees (FTEs) is engaged to provide baked goods to a value of $2,500.

A local independent fruit supplier with 20 FTEs is engaged to provide fresh produce to a value of $1,500.

The agency can buy directly from both businesses as they are SMEs.

The exemption is a permission which supports local small businesses, particularly when buying fresh produce from local primary producers.

Example 2. Direct engagement for training services under $40,000

An agency requires whole-of-agency training and the estimated cost is $40,000.

A local training company with 12 FTEs is directly engaged to provide the training.

The agency can directly engage the training company because it is an SME. Importantly, it also offers a competitive price and can deliver the training onsite within the required timeframe.

The company is also a social enterprise, which supports government’s broader objectives of social outcomes through procurement.

Example 3. Local campaign by regional supplier valued under $150,000

An agency needs to develop a large-scale local communications campaign in a regional area, including traditional and social media. The agency’s pre-tender estimate was $120,000.

There is a whole-of-government scheme for advertising and digital communications services. However, a known potential supplier from the regional area is not on this scheme.

The agency believes the regional supplier is best placed to develop the campaign because they know the unique community needs and intricacies.

Given the estimate was below $150,000, the agency asked the regional supplier for a quote. The supplier quoted a competitive price and non-price criteria determined that they should be awarded the contract.

The agency can engage the regional supplier, regardless of the size of the business. The exemption is a permission which allows regional businesses to be supported.

If the regional supplier’s price was over $150,000, the agency would have had to go to market.

Example 4. Workflow management tool valued under $150,000

An agency requires a new workflow management tool. The agency’s pre-tender estimate is $140,000. The agency determines this is a low-risk ICT procurement.

In this case, the agency can buy directly from an SME because:

- the policy allows the agency to engage an SME or regional supplier up to $150,000

- the ICT Digital SME Procurement Commitments allow the agency to buy directly from an SME up to $250,000, even if they aren’t on a whole-of-government contract.

The agency identified an SME supplier with 150 FTEs with a unique solution to the agency’s needs. Although they’re not in the ICT Services Scheme, the agency requested the supplier for a quote. The supplier quoted a competitive price and an assessment determined that they should be awarded the contract.

The agency was able to buy from the SME supplier, regardless of whole-of-government arrangements, using Core& contracts ( see ICT risk guidelines ). Both permissions allow for SMEs to be supported through low-value ICT procurement.

Example 5. Direct engagement for services under $250,000

An agency requires whole-of-agency service and the estimated cost is $200,000.

A local company with 12 FTEs is directly engaged to provide the service.

The agency can directly engage the company under PBD 2023-03 Procurement opportunities for small (and medium) businesses because it is an small enterprise. Importantly, it also offers a competitive price.

2.2 SME first

NSW Government agencies must first consider purchasing from an SME, for procurements up to $3 million, where the agency is permitted to directly purchase goods and/or services from a supplier, including from prequalification schemes and panels.

'SME first' applies when buying directly

The SME first requirement must be applied where agencies can buy directly from a supplier.

To determine whether you can buy directly, check the rules of the procurement arrangement you're using.

NSW Government schemes, contracts and panels each have their own rules. The rules set out the conditions and thresholds that determine how to buy from it. Depending on the value of your procurement, you may need to seek one or more quotes, run a tender or buy directly from a supplier.

Agencies are not required to record how the SME first requirement has been applied.

There are some exceptions to SME first

You don't need to give first consideration to an SME where:

- direct engagement is not practical

- the engagement may not deliver value for money, or

- there is no suitable SME able to deliver the goods or services.

In this case, you can consider other suppliers on the scheme or contract.

SME first and the Aboriginal Procurement Policy (APP)

SMEs may include Aboriginal-owned businesses, regional businesses, social enterprises and disability employment organisations.

The Aboriginal Procurement Policy requires that you give first consideration to Aboriginal-owned businesses for procurements up to $250,000 where possible. The SME and Regional Procurement Policy extends the threshold to $3 million.

The policies overlap when the procurement value is up to $250,000. When deciding which policy to apply in these cases, consider:

- NSW Government targets associated with direct spend with Aboriginal businesses

- the market and agency requirements.

Example 1. Buying auditing services under $120,000

An agency needs to procure auditing services estimated at $120,000. They are using the Performance and Management Services Scheme, which their agency mandates.

The scheme rules do allow direct engagements for this procurement. They state that 'an engagement can be made directly from the scheme by inviting one written quotation from a supplier prequalified under the scheme up to $150,000.'

As well as the SME first requirement, the Aboriginal Procurement Policy (APP) requires giving first consideration to Aboriginal-owned businesses up to $250,000.

So the agency buyer uses their best endeavours to engage an SME or Aboriginal-owned business on the scheme that can fulfil the requirement.

If the buyer determines there is no suitable SME or Aboriginal-owned business, they may then consider other suppliers on the scheme.

Example 2. Consultancy engagement valued $450,000

An agency needs to engage an external consultant to prepare a strategic business case.

The procurement is estimated to be valued at $450,000. They're using the Performance and Management Services Scheme.

The scheme rules do not allow direct engagements in this case. They state that 'for procurements over $250,000 (excl. GST), an engagement can be made from the scheme by inviting a minimum of 3 suppliers, prequalified under the scheme, to submit written quotations. Open invitations to tender are not required.'

In this case, the agency is not required to apply the SME first requirement.

2.3 SME and sustainability criteria

For goods and services contracts valued at $3 million or more, a NSW Government agency must include in the non-price evaluation criteria as a minimum:

- 10% allocated to SME participation, and

- 10% allocated to support for the NSW Government’s economic, ethical, environmental and social priorities.

Where no weightings are used, SME participation and support for the NSW Government’s economic, ethical, environmental and social priorities should be given appropriate qualitative consideration.

Creating a new scheme

When establishing a new prequalification scheme, agencies are exempt from applying the SME and sustainability criteria.

Buying from an existing scheme or panel

When buying from an existing scheme, agencies must apply the SME and sustainability criteria if the value of the procurement is more than $3 million over the life of the contract.

Creating a new standing offer arrangement

When establishing a new standing offer arrangement, whether the SME and sustainability criteria will apply depends on the estimated spend with each supplier on the arrangement.

If the spend with every supplier is estimated to be over $3 million over the term of the contract, the agency must apply the criteria.

If the spend with every supplier is estimated to be under $3 million or cannot be estimated, the agency is exempt from applying the criteria.

View an illustration of this process in a decision tree PDF, 102.09 KB .

Seek CPO approval if you can't apply the policy

If you're unable to apply the SME and sustainability criteria or request a participation plan, you must seek approval from your agency's chief procurement officer (CPO) and include the reasons in the procurement plan.

See an example of how you can reference the policy in your tender documents:

'The SME and Regional Procurement Policy applies to this contract. Respondents are required to:

- Submit an SME and Local Participation Plan. This should contain achievable commitments as the Plan will be contractually binding on the successful Respondent.

- number of SME subcontractors, value of goods and services procured from SMEs, percentage of contract spend with SMEs

- number of FTEs in NSW, value of goods and services procured in NSW, value of capital expenditure in NSW.'

Table 1 lists the minimum percentages of non-price criteria you must apply to your tender evaluation for procurements valued at $3 million and over.

Once you determine the breakdown of price and non-price criteria you're applying (first column), check the minimum percentage you must use for SME participation (second column) and for sustainability commitment (third column).

For example, if your evaluation criteria breakdown is 40% price and 60% non-price, you must use at least 6% of your non-price criteria for SME participation and 6% of your non-price criteria for sustainability commitment.

| Price and non-price breakdown | SME participation | Sustainability commitment | Other non-price |

|---|---|---|---|

| 90% and 10% | 1% | 1% | 8% |

| 80% and 20% | 2% | 2% | 16% |

| 70% and 30% | 3% | 3% | 24% |

| 60% and 40% | 4% | 4% | 32% |

| 50% and 50% | 5% | 5% | 40% |

| 40% and 60% | 6% | 6% | 48% |

| 30% and 70% | 7% | 7% | 56% |

| 20% and 80% | 8% | 8% | 64% |

| 10% and 90% | 9% | 9% | 72% |

Ensure all weighted criteria is clear in your tender documents and applied consistently to all potential suppliers.

Your tender evaluation plan shouldn't contravene Australia’s obligations under International Procurement Agreements. Read more about enforceable procurement provisions .

Use the participation plan to evaluate tender responses

The SME and local participation plan is mandatory for procurements over $3 million ( section 2.4 ).

The plan may be used to assess the SME participation and sustainability commitment criteria.

Evaluate SME participation criteria

Some factors agencies can consider when evaluating SME participation include:

- whether the respondent is an SME

- whether the respondent is a consortium of SMEs

- whether the respondent is a large business that will subcontract to SMEs

- the number of SMEs that will benefit from subcontracting opportunities

- the value of goods and services which will directly support SMEs

- the value of goods or services that SMEs will benefit from subcontracting opportunities.

Evaluate sustainability commitment criteria

Sustainability commitments support NSW Government’s economic, ethical, environmental and social priorities.

Some factors you can consider when evaluating sustainability include:

- creation of jobs in NSW where possible

- developing and sustaining NSW industry capabilities, including supporting people to gain in-demand skills, providing skills and training opportunities, employing trainees or apprentices in NSW

- supporting remote and regional communities, such as employment opportunities, upskilling and training

- industry development, including sharing knowledge, skills and technology

- productivity benefits, including the creation of innovative practices, products and supply chains

- Aboriginal participation, for example Aboriginal-owned businesses in the supply chain or employment opportunities for Aboriginal people

- supplier commitments to prevent or minimise the risk of modern slavery in their supply chain

- capital investment

- initiatives to increase resource efficiency or reduce waste

- participation of social enterprises or disability employment organisations in the supply chain

- leasing of green-star rated real estate

- use of goods and services from disability employment organisations that employ persons with disability.

Evaluate local participation

Local participation commitments show how the supplier will support NSW Government’s economic priorities through the NSW economy.

In the best practice participation plan template, we define local content as ‘goods produced, services provided, and labour supplied by the NSW industry’.

Keep in mind that when evaluating local content, you shouldn't discriminate against suppliers on the basis of their size, location or ownership.

2.4 SME and local participation plan and reporting

For contracts valued at $3 million or more, suppliers are required to submit an SME and local participation plan, referencing SME and NSW specific content, consistent with International Procurement Agreement (IPA) obligations, and report on these commitments quarterly.

SME and local participation plans help agencies understand how the procurement will benefit SMEs and NSW Government’s economic, ethical, environmental and social priorities.

Agencies consider these benefits when determining the value for money of the tender responses received.

Procurements over $3 million must have a participation plan

Tender documents must include an SME and local participation plan.

The evaluation panel may use the plans to assess the SME participation and sustainability commitment criteria of tender responses.

Download the best practice participation plan template DOCX, 80.53 KB

Agencies can create their own participation plan template

Agencies can create their own or make changes to the best practice participation plan template DOCX, 80.53 KB .

When creating a new plan, keep in mind that the plans shouldn't create excessive red tape or cost for tenderers. The type and amount of information in the plans should be appropriate for the scale, scope and risk of the procurement.

Generally, an SME and local participation plan should cover 3 elements:

- SME participation, assessed under the SME criteria

- sustainability commitments, assessed under the sustainability criteria

- local participation, assessed under the sustainability criteria.

Keep in mind that when evaluating local content, you must not discriminate against suppliers based on their size, location or ownership.

For the SME and local participation plan, we define local content as ‘goods produced, services provided, and labour supplied in NSW’.

Include the final participation plan in the contract

Include the final SME and local participation plan in the contract requirements with the successful supplier(s).

The contract requirements should also state that the supplier must report on progress quarterly.

Report on progress quarterly

Once the contract is awarded, the supplier must report on progress on the agreed SME and local participation plan quarterly.

Reporting is required to be submitted quarterly through the reporting.buy.nsw portal .

Monitor progress

The contract manager is responsible for monitoring progress and ensuring the suppliers are working towards the commitments they have made in the SME and local participation plan.

The contract manager is also responsible for following up with the supplier if the plan is not being met.

Submit a final report at conclusion of the contract

When completing the contract, the supplier must submit a final report confirming compliance with the commitments made in the SME and local participation plan.

If the supplier can't confirm compliance with all measures they've committed to, they must explain why in reasonable detail in the final report.

View a diagram showing how the sustainability criteria, SME and local participation plan and reporting requirements are connected PDF, 70.31 KB .

The following examples and case studies are provided to assist agencies when evaluating SME participation and sustainability including local content. They are not intended to prescribe a specific process.

Agencies should ensure that considerations reflect the scale, scope and risk of the procurement.

Example 1. New panel for training services over $3 million

A NSW Government agency is establishing a panel for training services. The value is expected to be more than $3 million with each supplier. Therefore, they must include the SME and sustainability criteria. Tender respondents must submit a SME and local participation plan.

In evaluating tender responses, the agency could consider:

- competitive pricing

- employing staff and contractors located in NSW

- taxes paid to the Australian Government on associated profits

- using SMEs in delivering goods and services, such as a subcontractor or a supplier

- using Aboriginal-owned businesses in delivering the product

- sharing knowledge, skills and technology with SMEs or Aboriginal-owned businesses

- using goods and services from a business that provides services of people with disability

- using goods and services from a social enterprise.

The agency received 4 responses:

SME employing 30 workers across 2 offices in NSW. Supplier 1 has:

- proposed SME participation

- proposed local content (employment in NSW).

Provides training services across NSW, lease real estate in a number of states and cities which are green-star rated, and use a number of SMEs as subcontractors across Australia (including in NSW). Supplier 2 has:

- proposed local content (lease real estate, subcontractors across NSW)

- proposed sustainable benefit (green-star rating).

Uses goods and services from a business that provides services of people with disability, which is also an SME. The tenderer also noted further economic benefits given these employees, previously on welfare, are buying additional goods and services. Supplier 3 has:

- proposed social benefit.

The flow-on benefits of buying additional goods and services because the employees are no longer on welfare cannot be considered, as this is a second-round economic benefit, not a direct economic benefit of the procurement to the Australian economy.

No plan addressing the SME participation or the NSW Government’s economic, ethical, environmental, and social priorities including NSW-specific content was provided. Supplier 4 did not address mandatory requirements.

In this example, the evaluation relates only to the SME and sustainability criteria and the SME participation plan. The evaluation should encompass all evaluation criteria, consistent with the evaluation plan.

Example 2. New panel for laundry equipment over $3 million

A NSW Government agency is looking to establish a panel of prequalified suppliers of industrial laundry equipment via a standing offer agreement. The value is expected to be over $3 million with each supplier. Therefore, they must include the SME and sustainability criteria and consider the SME and local participation plan.

- ensuring that supply chains for essential goods and services are competitive and diverse, including by providing opportunities for SMEs and Aboriginal-owned businesses

- developing and sustaining NSW industry capabilities, including by supporting people to gain in-demand or relevant skills, providing skills and training opportunities and employing trainees or apprentices in NSW

- supporting remote and regional communities, such as through employment opportunities, upskilling and training

- sharing knowledge, skills and technology with SMEs

- providing environmental, social and economic benefits to Australian communities

- promoting the development of industry capabilities, including in supporting critical industrial capabilities.

Large business that will subcontract installation, maintenance and technical support to numerous SMEs, creating 8 additional jobs in NSW with 2 identified for Aboriginal employees. Supplier 1 has: