| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

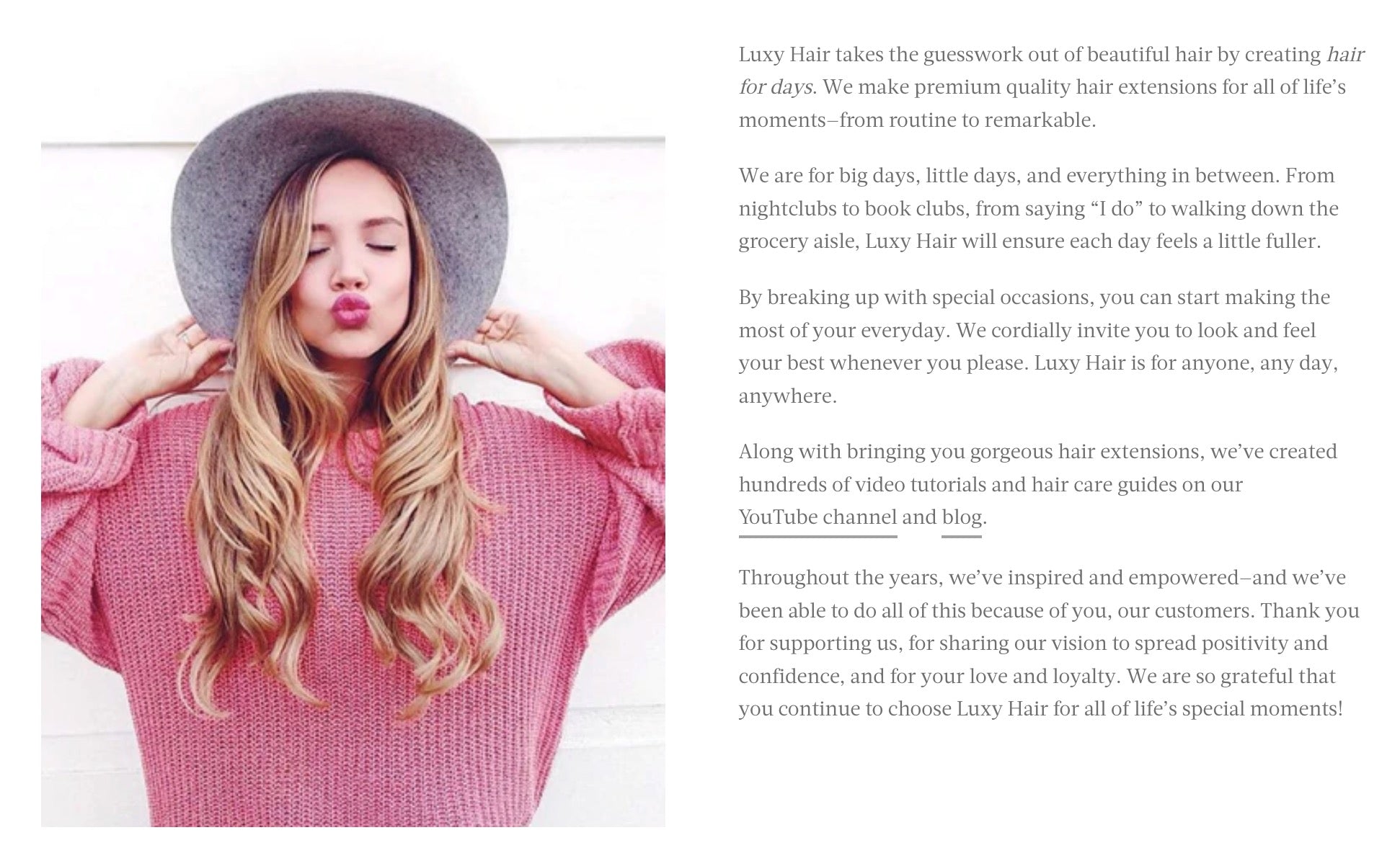

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

How To Start A Print On Demand Business In 2024

HR For Small Businesses: The Ultimate Guide

How One Company Is Using AI To Transform Manufacturing

Not-For-Profit Vs. Nonprofit: What’s The Difference?

How To Develop an SEO Strategy in 2024

How To Make Money On Social Media in 2024

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Additionally, she is a Columnist at Inc. Magazine.

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

How to Write a Business Plan in 9 Steps (+ Template and Examples)

Every successful business has one thing in common, a good and well-executed business plan. A business plan is more than a document, it is a complete guide that outlines the goals your business wants to achieve, including its financial goals . It helps you analyze results, make strategic decisions, show your business operations and growth.

If you want to start a business or already have one and need to pitch it to investors for funding, writing a good business plan improves your chances of attracting financiers. As a startup, if you want to secure loans from financial institutions, part of the requirements involve submitting your business plan.

Writing a business plan does not have to be a complicated or time-consuming process. In this article, you will learn the step-by-step process for writing a successful business plan.

You will also learn what you need a business plan for, tips and strategies for writing a convincing business plan, business plan examples and templates that will save you tons of time, and the alternatives to the traditional business plan.

Let’s get started.

What Do You Need A Business Plan For?

Businesses create business plans for different purposes such as to secure funds, monitor business growth, measure your marketing strategies, and measure your business success.

1. Secure Funds

One of the primary reasons for writing a business plan is to secure funds, either from financial institutions/agencies or investors.

For you to effectively acquire funds, your business plan must contain the key elements of your business plan . For example, your business plan should include your growth plans, goals you want to achieve, and milestones you have recorded.

A business plan can also attract new business partners that are willing to contribute financially and intellectually. If you are writing a business plan to a bank, your project must show your traction , that is, the proof that you can pay back any loan borrowed.

Also, if you are writing to an investor, your plan must contain evidence that you can effectively utilize the funds you want them to invest in your business. Here, you are using your business plan to persuade a group or an individual that your business is a source of a good investment.

2. Monitor Business Growth

A business plan can help you track cash flows in your business. It steers your business to greater heights. A business plan capable of tracking business growth should contain:

- The business goals

- Methods to achieve the goals

- Time-frame for attaining those goals

A good business plan should guide you through every step in achieving your goals. It can also track the allocation of assets to every aspect of the business. You can tell when you are spending more than you should on a project.

You can compare a business plan to a written GPS. It helps you manage your business and hints at the right time to expand your business.

3. Measure Business Success

A business plan can help you measure your business success rate. Some small-scale businesses are thriving better than more prominent companies because of their track record of success.

Right from the onset of your business operation, set goals and work towards them. Write a plan to guide you through your procedures. Use your plan to measure how much you have achieved and how much is left to attain.

You can also weigh your success by monitoring the position of your brand relative to competitors. On the other hand, a business plan can also show you why you have not achieved a goal. It can tell if you have elapsed the time frame you set to attain a goal.

4. Document Your Marketing Strategies

You can use a business plan to document your marketing plans. Every business should have an effective marketing plan.

Competition mandates every business owner to go the extraordinary mile to remain relevant in the market. Your business plan should contain your marketing strategies that work. You can measure the success rate of your marketing plans.

In your business plan, your marketing strategy must answer the questions:

- How do you want to reach your target audience?

- How do you plan to retain your customers?

- What is/are your pricing plans?

- What is your budget for marketing?

How to Write a Business Plan Step-by-Step

1. create your executive summary.

The executive summary is a snapshot of your business or a high-level overview of your business purposes and plans . Although the executive summary is the first section in your business plan, most people write it last. The length of the executive summary is not more than two pages.

Generally, there are nine sections in a business plan, the executive summary should condense essential ideas from the other eight sections.

A good executive summary should do the following:

- A Snapshot of Growth Potential. Briefly inform the reader about your company and why it will be successful)

- Contain your Mission Statement which explains what the main objective or focus of your business is.

- Product Description and Differentiation. Brief description of your products or services and why it is different from other solutions in the market.

- The Team. Basic information about your company’s leadership team and employees

- Business Concept. A solid description of what your business does.

- Target Market. The customers you plan to sell to.

- Marketing Strategy. Your plans on reaching and selling to your customers

- Current Financial State. Brief information about what revenue your business currently generates.

- Projected Financial State. Brief information about what you foresee your business revenue to be in the future.

The executive summary is the make-or-break section of your business plan. If your summary cannot in less than two pages cannot clearly describe how your business will solve a particular problem of your target audience and make a profit, your business plan is set on a faulty foundation.

Avoid using the executive summary to hype your business, instead, focus on helping the reader understand the what and how of your plan.

View the executive summary as an opportunity to introduce your vision for your company. You know your executive summary is powerful when it can answer these key questions:

- Who is your target audience?

- What sector or industry are you in?

- What are your products and services?

- What is the future of your industry?

- Is your company scaleable?

- Who are the owners and leaders of your company? What are their backgrounds and experience levels?

- What is the motivation for starting your company?

- What are the next steps?

Writing the executive summary last although it is the most important section of your business plan is an excellent idea. The reason why is because it is a high-level overview of your business plan. It is the section that determines whether potential investors and lenders will read further or not.

The executive summary can be a stand-alone document that covers everything in your business plan. It is not uncommon for investors to request only the executive summary when evaluating your business. If the information in the executive summary impresses them, they will ask for the complete business plan.

If you are writing your business plan for your planning purposes, you do not need to write the executive summary.

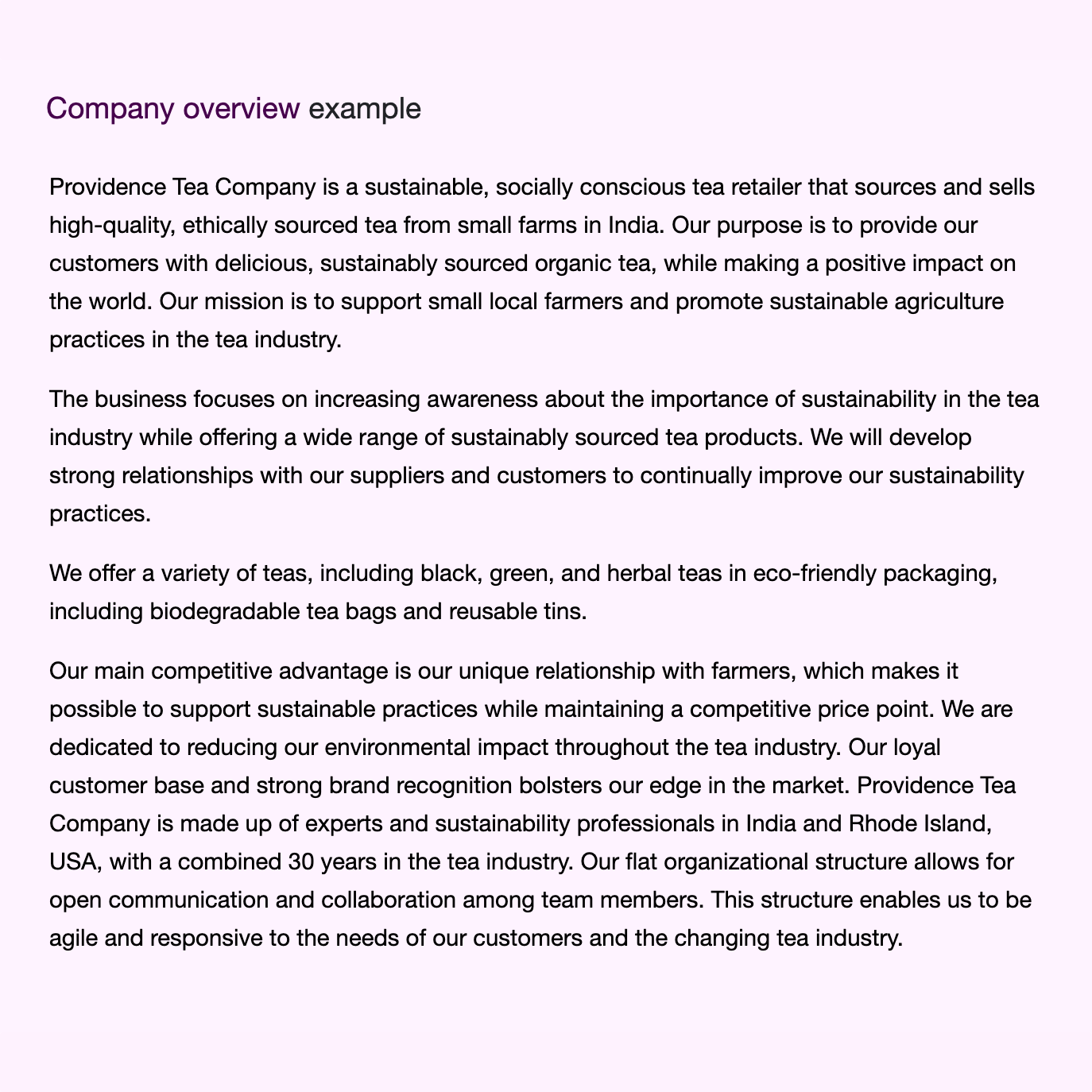

2. Add Your Company Overview

The company overview or description is the next section in your business plan after the executive summary. It describes what your business does.

Adding your company overview can be tricky especially when your business is still in the planning stages. Existing businesses can easily summarize their current operations but may encounter difficulties trying to explain what they plan to become.

Your company overview should contain the following:

- What products and services you will provide

- Geographical markets and locations your company have a presence

- What you need to run your business

- Who your target audience or customers are

- Who will service your customers

- Your company’s purpose, mission, and vision

- Information about your company’s founders

- Who the founders are

- Notable achievements of your company so far

When creating a company overview, you have to focus on three basics: identifying your industry, identifying your customer, and explaining the problem you solve.

If you are stuck when creating your company overview, try to answer some of these questions that pertain to you.

- Who are you targeting? (The answer is not everyone)

- What pain point does your product or service solve for your customers that they will be willing to spend money on resolving?

- How does your product or service overcome that pain point?

- Where is the location of your business?

- What products, equipment, and services do you need to run your business?

- How is your company’s product or service different from your competition in the eyes of your customers?

- How many employees do you need and what skills do you require them to have?

After answering some or all of these questions, you will get more than enough information you need to write your company overview or description section. When writing this section, describe what your company does for your customers.

The company description or overview section contains three elements: mission statement, history, and objectives.

- Mission Statement

The mission statement refers to the reason why your business or company is existing. It goes beyond what you do or sell, it is about the ‘why’. A good mission statement should be emotional and inspirational.

Your mission statement should follow the KISS rule (Keep It Simple, Stupid). For example, Shopify’s mission statement is “Make commerce better for everyone.”

When describing your company’s history, make it simple and avoid the temptation of tying it to a defensive narrative. Write it in the manner you would a profile. Your company’s history should include the following information:

- Founding Date

- Major Milestones

- Location(s)

- Flagship Products or Services

- Number of Employees

- Executive Leadership Roles

When you fill in this information, you use it to write one or two paragraphs about your company’s history.

Business Objectives

Your business objective must be SMART (specific, measurable, achievable, realistic, and time-bound.) Failure to clearly identify your business objectives does not inspire confidence and makes it hard for your team members to work towards a common purpose.

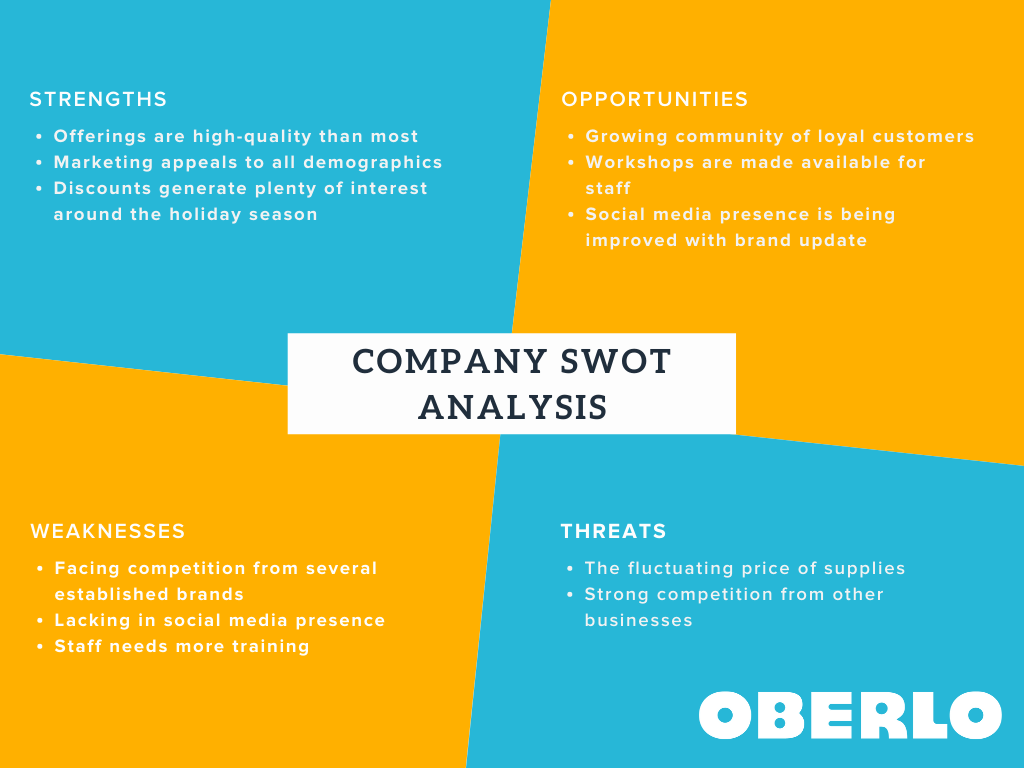

3. Perform Market and Competitive Analyses to Proof a Big Enough Business Opportunity

The third step in writing a business plan is the market and competitive analysis section. Every business, no matter the size, needs to perform comprehensive market and competitive analyses before it enters into a market.

Performing market and competitive analyses are critical for the success of your business. It helps you avoid entering the right market with the wrong product, or vice versa. Anyone reading your business plans, especially financiers and financial institutions will want to see proof that there is a big enough business opportunity you are targeting.

This section is where you describe the market and industry you want to operate in and show the big opportunities in the market that your business can leverage to make a profit. If you noticed any unique trends when doing your research, show them in this section.

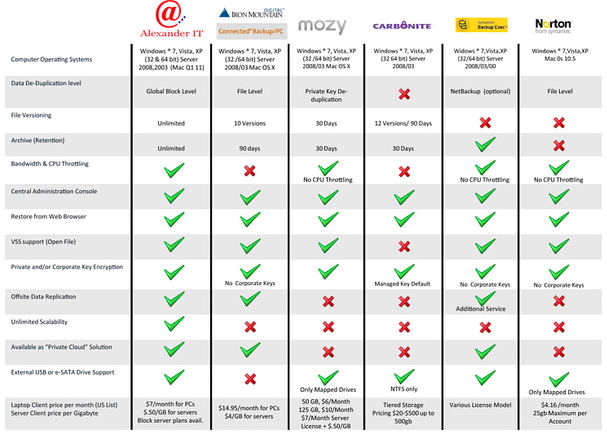

Market analysis alone is not enough, you have to add competitive analysis to strengthen this section. There are already businesses in the industry or market, how do you plan to take a share of the market from them?

You have to clearly illustrate the competitive landscape in your business plan. Are there areas your competitors are doing well? Are there areas where they are not doing so well? Show it.

Make it clear in this section why you are moving into the industry and what weaknesses are present there that you plan to explain. How are your competitors going to react to your market entry? How do you plan to get customers? Do you plan on taking your competitors' competitors, tap into other sources for customers, or both?

Illustrate the competitive landscape as well. What are your competitors doing well and not so well?

Answering these questions and thoughts will aid your market and competitive analysis of the opportunities in your space. Depending on how sophisticated your industry is, or the expectations of your financiers, you may need to carry out a more comprehensive market and competitive analysis to prove that big business opportunity.

Instead of looking at the market and competitive analyses as one entity, separating them will make the research even more comprehensive.

Market Analysis

Market analysis, boarding speaking, refers to research a business carried out on its industry, market, and competitors. It helps businesses gain a good understanding of their target market and the outlook of their industry. Before starting a company, it is vital to carry out market research to find out if the market is viable.

The market analysis section is a key part of the business plan. It is the section where you identify who your best clients or customers are. You cannot omit this section, without it your business plan is incomplete.

A good market analysis will tell your readers how you fit into the existing market and what makes you stand out. This section requires in-depth research, it will probably be the most time-consuming part of the business plan to write.

- Market Research

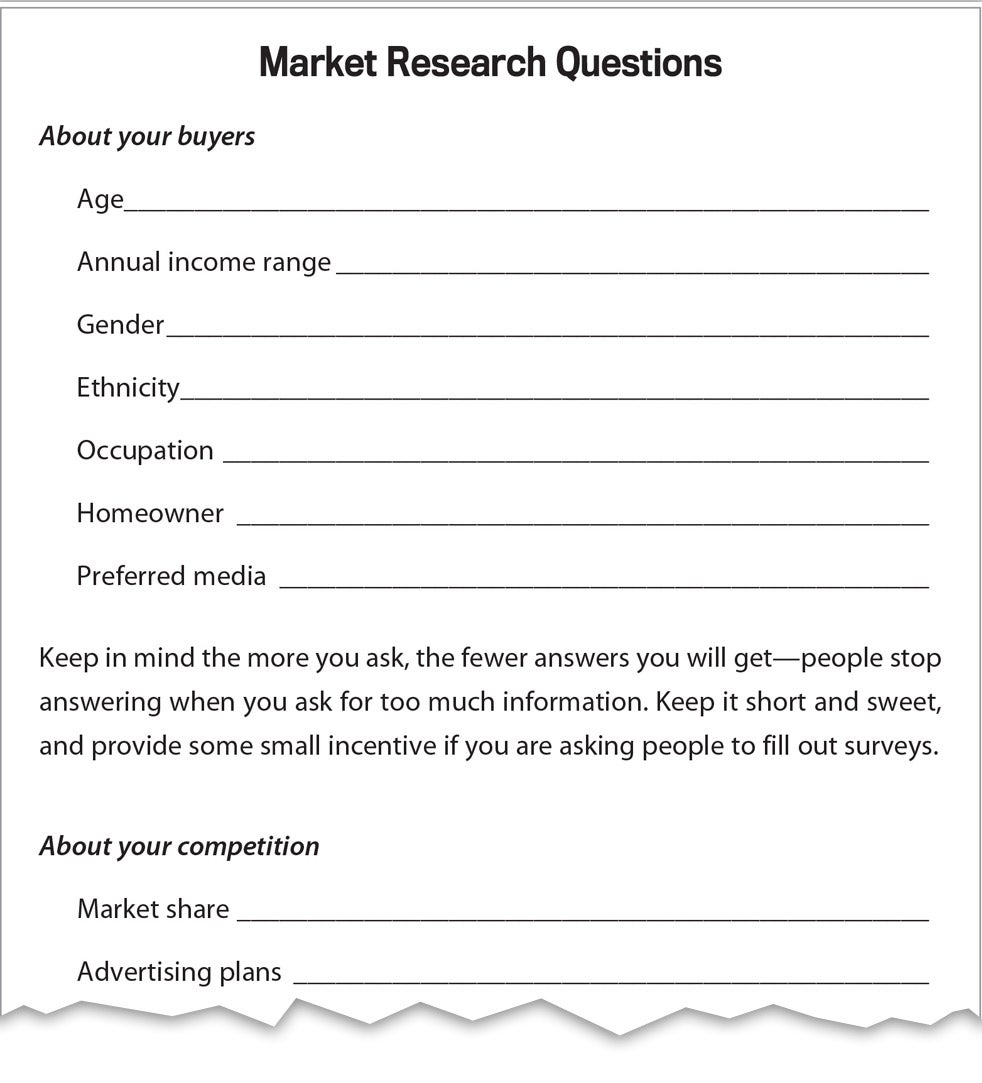

To create a compelling market analysis that will win over investors and financial institutions, you have to carry out thorough market research . Your market research should be targeted at your primary target market for your products or services. Here is what you want to find out about your target market.

- Your target market’s needs or pain points

- The existing solutions for their pain points

- Geographic Location

- Demographics

The purpose of carrying out a marketing analysis is to get all the information you need to show that you have a solid and thorough understanding of your target audience.

Only after you have fully understood the people you plan to sell your products or services to, can you evaluate correctly if your target market will be interested in your products or services.

You can easily convince interested parties to invest in your business if you can show them you thoroughly understand the market and show them that there is a market for your products or services.

How to Quantify Your Target Market

One of the goals of your marketing research is to understand who your ideal customers are and their purchasing power. To quantify your target market, you have to determine the following:

- Your Potential Customers: They are the people you plan to target. For example, if you sell accounting software for small businesses , then anyone who runs an enterprise or large business is unlikely to be your customers. Also, individuals who do not have a business will most likely not be interested in your product.

- Total Households: If you are selling household products such as heating and air conditioning systems, determining the number of total households is more important than finding out the total population in the area you want to sell to. The logic is simple, people buy the product but it is the household that uses it.

- Median Income: You need to know the median income of your target market. If you target a market that cannot afford to buy your products and services, your business will not last long.

- Income by Demographics: If your potential customers belong to a certain age group or gender, determining income levels by demographics is necessary. For example, if you sell men's clothes, your target audience is men.

What Does a Good Market Analysis Entail?

Your business does not exist on its own, it can only flourish within an industry and alongside competitors. Market analysis takes into consideration your industry, target market, and competitors. Understanding these three entities will drastically improve your company’s chances of success.

You can view your market analysis as an examination of the market you want to break into and an education on the emerging trends and themes in that market. Good market analyses include the following:

- Industry Description. You find out about the history of your industry, the current and future market size, and who the largest players/companies are in your industry.

- Overview of Target Market. You research your target market and its characteristics. Who are you targeting? Note, it cannot be everyone, it has to be a specific group. You also have to find out all information possible about your customers that can help you understand how and why they make buying decisions.

- Size of Target Market: You need to know the size of your target market, how frequently they buy, and the expected quantity they buy so you do not risk overproducing and having lots of bad inventory. Researching the size of your target market will help you determine if it is big enough for sustained business or not.

- Growth Potential: Before picking a target market, you want to be sure there are lots of potential for future growth. You want to avoid going for an industry that is declining slowly or rapidly with almost zero growth potential.

- Market Share Potential: Does your business stand a good chance of taking a good share of the market?

- Market Pricing and Promotional Strategies: Your market analysis should give you an idea of the price point you can expect to charge for your products and services. Researching your target market will also give you ideas of pricing strategies you can implement to break into the market or to enjoy maximum profits.

- Potential Barriers to Entry: One of the biggest benefits of conducting market analysis is that it shows you every potential barrier to entry your business will likely encounter. It is a good idea to discuss potential barriers to entry such as changing technology. It informs readers of your business plan that you understand the market.

- Research on Competitors: You need to know the strengths and weaknesses of your competitors and how you can exploit them for the benefit of your business. Find patterns and trends among your competitors that make them successful, discover what works and what doesn’t, and see what you can do better.

The market analysis section is not just for talking about your target market, industry, and competitors. You also have to explain how your company can fill the hole you have identified in the market.

Here are some questions you can answer that can help you position your product or service in a positive light to your readers.

- Is your product or service of superior quality?

- What additional features do you offer that your competitors do not offer?

- Are you targeting a ‘new’ market?

Basically, your market analysis should include an analysis of what already exists in the market and an explanation of how your company fits into the market.

Competitive Analysis

In the competitive analysis section, y ou have to understand who your direct and indirect competitions are, and how successful they are in the marketplace. It is the section where you assess the strengths and weaknesses of your competitors, the advantage(s) they possess in the market and show the unique features or qualities that make you different from your competitors.

Many businesses do market analysis and competitive analysis together. However, to fully understand what the competitive analysis entails, it is essential to separate it from the market analysis.

Competitive analysis for your business can also include analysis on how to overcome barriers to entry in your target market.

The primary goal of conducting a competitive analysis is to distinguish your business from your competitors. A strong competitive analysis is essential if you want to convince potential funding sources to invest in your business. You have to show potential investors and lenders that your business has what it takes to compete in the marketplace successfully.

Competitive analysis will s how you what the strengths of your competition are and what they are doing to maintain that advantage.

When doing your competitive research, you first have to identify your competitor and then get all the information you can about them. The idea of spending time to identify your competitor and learn everything about them may seem daunting but it is well worth it.

Find answers to the following questions after you have identified who your competitors are.

- What are your successful competitors doing?

- Why is what they are doing working?

- Can your business do it better?

- What are the weaknesses of your successful competitors?

- What are they not doing well?

- Can your business turn its weaknesses into strengths?

- How good is your competitors’ customer service?

- Where do your competitors invest in advertising?

- What sales and pricing strategies are they using?

- What marketing strategies are they using?

- What kind of press coverage do they get?

- What are their customers saying about your competitors (both the positive and negative)?

If your competitors have a website, it is a good idea to visit their websites for more competitors’ research. Check their “About Us” page for more information.

If you are presenting your business plan to investors, you need to clearly distinguish yourself from your competitors. Investors can easily tell when you have not properly researched your competitors.

Take time to think about what unique qualities or features set you apart from your competitors. If you do not have any direct competition offering your product to the market, it does not mean you leave out the competitor analysis section blank. Instead research on other companies that are providing a similar product, or whose product is solving the problem your product solves.

The next step is to create a table listing the top competitors you want to include in your business plan. Ensure you list your business as the last and on the right. What you just created is known as the competitor analysis table.

Direct vs Indirect Competition

You cannot know if your product or service will be a fit for your target market if you have not understood your business and the competitive landscape.

There is no market you want to target where you will not encounter competition, even if your product is innovative. Including competitive analysis in your business plan is essential.

If you are entering an established market, you need to explain how you plan to differentiate your products from the available options in the market. Also, include a list of few companies that you view as your direct competitors The competition you face in an established market is your direct competition.

In situations where you are entering a market with no direct competition, it does not mean there is no competition there. Consider your indirect competition that offers substitutes for the products or services you offer.

For example, if you sell an innovative SaaS product, let us say a project management software , a company offering time management software is your indirect competition.

There is an easy way to find out who your indirect competitors are in the absence of no direct competitors. You simply have to research how your potential customers are solving the problems that your product or service seeks to solve. That is your direct competition.

Factors that Differentiate Your Business from the Competition

There are three main factors that any business can use to differentiate itself from its competition. They are cost leadership, product differentiation, and market segmentation.

1. Cost Leadership

A strategy you can impose to maximize your profits and gain an edge over your competitors. It involves offering lower prices than what the majority of your competitors are offering.

A common practice among businesses looking to enter into a market where there are dominant players is to use free trials or pricing to attract as many customers as possible to their offer.

2. Product Differentiation

Your product or service should have a unique selling proposition (USP) that your competitors do not have or do not stress in their marketing.

Part of the marketing strategy should involve making your products unique and different from your competitors. It does not have to be different from your competitors, it can be the addition to a feature or benefit that your competitors do not currently have.

3. Market Segmentation

As a new business seeking to break into an industry, you will gain more success from focusing on a specific niche or target market, and not the whole industry.

If your competitors are focused on a general need or target market, you can differentiate yourself from them by having a small and hyper-targeted audience. For example, if your competitors are selling men’s clothes in their online stores , you can sell hoodies for men.

4. Define Your Business and Management Structure

The next step in your business plan is your business and management structure. It is the section where you describe the legal structure of your business and the team running it.

Your business is only as good as the management team that runs it, while the management team can only strive when there is a proper business and management structure in place.

If your company is a sole proprietor or a limited liability company (LLC), a general or limited partnership, or a C or an S corporation, state it clearly in this section.

Use an organizational chart to show the management structure in your business. Clearly show who is in charge of what area in your company. It is where you show how each key manager or team leader’s unique experience can contribute immensely to the success of your company. You can also opt to add the resumes and CVs of the key players in your company.

The business and management structure section should show who the owner is, and other owners of the businesses (if the business has other owners). For businesses or companies with multiple owners, include the percent ownership of the various owners and clearly show the extent of each others’ involvement in the company.

Investors want to know who is behind the company and the team running it to determine if it has the right management to achieve its set goals.

Management Team

The management team section is where you show that you have the right team in place to successfully execute the business operations and ideas. Take time to create the management structure for your business. Think about all the important roles and responsibilities that you need managers for to grow your business.

Include brief bios of each key team member and ensure you highlight only the relevant information that is needed. If your team members have background industry experience or have held top positions for other companies and achieved success while filling that role, highlight it in this section.

A common mistake that many startups make is assigning C-level titles such as (CMO and CEO) to everyone on their team. It is unrealistic for a small business to have those titles. While it may look good on paper for the ego of your team members, it can prevent investors from investing in your business.

Instead of building an unrealistic management structure that does not fit your business reality, it is best to allow business titles to grow as the business grows. Starting everyone at the top leaves no room for future change or growth, which is bad for productivity.

Your management team does not have to be complete before you start writing your business plan. You can have a complete business plan even when there are managerial positions that are empty and need filling.

If you have management gaps in your team, simply show the gaps and indicate you are searching for the right candidates for the role(s). Investors do not expect you to have a full management team when you are just starting your business.

Key Questions to Answer When Structuring Your Management Team

- Who are the key leaders?

- What experiences, skills, and educational backgrounds do you expect your key leaders to have?

- Do your key leaders have industry experience?

- What positions will they fill and what duties will they perform in those positions?

- What level of authority do the key leaders have and what are their responsibilities?

- What is the salary for the various management positions that will attract the ideal candidates?

Additional Tips for Writing the Management Structure Section

1. Avoid Adding ‘Ghost’ Names to Your Management Team

There is always that temptation to include a ‘ghost’ name to your management team to attract and influence investors to invest in your business. Although the presence of these celebrity management team members may attract the attention of investors, it can cause your business to lose any credibility if you get found out.

Seasoned investors will investigate further the members of your management team before committing fully to your business If they find out that the celebrity name used does not play any actual role in your business, they will not invest and may write you off as dishonest.

2. Focus on Credentials But Pay Extra Attention to the Roles

Investors want to know the experience that your key team members have to determine if they can successfully reach the company’s growth and financial goals.

While it is an excellent boost for your key management team to have the right credentials, you also want to pay extra attention to the roles they will play in your company.

Organizational Chart

Adding an organizational chart in this section of your business plan is not necessary, you can do it in your business plan’s appendix.

If you are exploring funding options, it is not uncommon to get asked for your organizational chart. The function of an organizational chart goes beyond raising money, you can also use it as a useful planning tool for your business.

An organizational chart can help you identify how best to structure your management team for maximum productivity and point you towards key roles you need to fill in the future.

You can use the organizational chart to show your company’s internal management structure such as the roles and responsibilities of your management team, and relationships that exist between them.

5. Describe Your Product and Service Offering

In your business plan, you have to describe what you sell or the service you plan to offer. It is the next step after defining your business and management structure. The products and services section is where you sell the benefits of your business.

Here you have to explain how your product or service will benefit your customers and describe your product lifecycle. It is also the section where you write down your plans for intellectual property like patent filings and copyrighting.

The research and development that you are undertaking for your product or service need to be explained in detail in this section. However, do not get too technical, sell the general idea and its benefits.

If you have any diagrams or intricate designs of your product or service, do not include them in the products and services section. Instead, leave them for the addendum page. Also, if you are leaving out diagrams or designs for the addendum, ensure you add this phrase “For more detail, visit the addendum Page #.”

Your product and service section in your business plan should include the following:

- A detailed explanation that clearly shows how your product or service works.

- The pricing model for your product or service.

- Your business’ sales and distribution strategy.

- The ideal customers that want your product or service.

- The benefits of your products and services.

- Reason(s) why your product or service is a better alternative to what your competitors are currently offering in the market.

- Plans for filling the orders you receive

- If you have current or pending patents, copyrights, and trademarks for your product or service, you can also discuss them in this section.

What to Focus On When Describing the Benefits, Lifecycle, and Production Process of Your Products or Services

In the products and services section, you have to distill the benefits, lifecycle, and production process of your products and services.

When describing the benefits of your products or services, here are some key factors to focus on.

- Unique features

- Translating the unique features into benefits

- The emotional, psychological, and practical payoffs to attract customers

- Intellectual property rights or any patents

When describing the product life cycle of your products or services, here are some key factors to focus on.

- Upsells, cross-sells, and down-sells

- Time between purchases

- Plans for research and development.

When describing the production process for your products or services, you need to think about the following:

- The creation of new or existing products and services.

- The sources for the raw materials or components you need for production.

- Assembling the products

- Maintaining quality control

- Supply-chain logistics (receiving the raw materials and delivering the finished products)

- The day-to-day management of the production processes, bookkeeping, and inventory.

Tips for Writing the Products or Services Section of Your Business Plan

1. Avoid Technical Descriptions and Industry Buzzwords

The products and services section of your business plan should clearly describe the products and services that your company provides. However, it is not a section to include technical jargons that anyone outside your industry will not understand.

A good practice is to remove highly detailed or technical descriptions in favor of simple terms. Industry buzzwords are not necessary, if there are simpler terms you can use, then use them. If you plan to use your business plan to source funds, making the product or service section so technical will do you no favors.

2. Describe How Your Products or Services Differ from Your Competitors

When potential investors look at your business plan, they want to know how the products and services you are offering differ from that of your competition. Differentiating your products or services from your competition in a way that makes your solution more attractive is critical.

If you are going the innovative path and there is no market currently for your product or service, you need to describe in this section why the market needs your product or service.

For example, overnight delivery was a niche business that only a few companies were participating in. Federal Express (FedEx) had to show in its business plan that there was a large opportunity for that service and they justified why the market needed that service.

3. Long or Short Products or Services Section

Should your products or services section be short? Does the long products or services section attract more investors?

There are no straightforward answers to these questions. Whether your products or services section should be long or relatively short depends on the nature of your business.

If your business is product-focused, then automatically you need to use more space to describe the details of your products. However, if the product your business sells is a commodity item that relies on competitive pricing or other pricing strategies, you do not have to use up so much space to provide significant details about the product.

Likewise, if you are selling a commodity that is available in numerous outlets, then you do not have to spend time on writing a long products or services section.

The key to the success of your business is most likely the effectiveness of your marketing strategies compared to your competitors. Use more space to address that section.

If you are creating a new product or service that the market does not know about, your products or services section can be lengthy. The reason why is because you need to explain everything about the product or service such as the nature of the product, its use case, and values.

A short products or services section for an innovative product or service will not give the readers enough information to properly evaluate your business.

4. Describe Your Relationships with Vendors or Suppliers

Your business will rely on vendors or suppliers to supply raw materials or the components needed to make your products. In your products and services section, describe your relationships with your vendors and suppliers fully.

Avoid the mistake of relying on only one supplier or vendor. If that supplier or vendor fails to supply or goes out of business, you can easily face supply problems and struggle to meet your demands. Plan to set up multiple vendor or supplier relationships for better business stability.

5. Your Primary Goal Is to Convince Your Readers

The primary goal of your business plan is to convince your readers that your business is viable and to create a guide for your business to follow. It applies to the products and services section.

When drafting this section, think like the reader. See your reader as someone who has no idea about your products and services. You are using the products and services section to provide the needed information to help your reader understand your products and services. As a result, you have to be clear and to the point.

While you want to educate your readers about your products or services, you also do not want to bore them with lots of technical details. Show your products and services and not your fancy choice of words.

Your products and services section should provide the answer to the “what” question for your business. You and your management team may run the business, but it is your products and services that are the lifeblood of the business.

Key Questions to Answer When Writing your Products and Services Section

Answering these questions can help you write your products and services section quickly and in a way that will appeal to your readers.

- Are your products existing on the market or are they still in the development stage?

- What is your timeline for adding new products and services to the market?

- What are the positives that make your products and services different from your competitors?

- Do your products and services have any competitive advantage that your competitors’ products and services do not currently have?

- Do your products or services have any competitive disadvantages that you need to overcome to compete with your competitors? If your answer is yes, state how you plan to overcome them,

- How much does it cost to produce your products or services? How much do you plan to sell it for?

- What is the price for your products and services compared to your competitors? Is pricing an issue?

- What are your operating costs and will it be low enough for you to compete with your competitors and still take home a reasonable profit margin?

- What is your plan for acquiring your products? Are you involved in the production of your products or services?

- Are you the manufacturer and produce all the components you need to create your products? Do you assemble your products by using components supplied by other manufacturers? Do you purchase your products directly from suppliers or wholesalers?

- Do you have a steady supply of products that you need to start your business? (If your business is yet to kick-off)

- How do you plan to distribute your products or services to the market?

You can also hint at the marketing or promotion plans you have for your products or services such as how you plan to build awareness or retain customers. The next section is where you can go fully into details about your business’s marketing and sales plan.

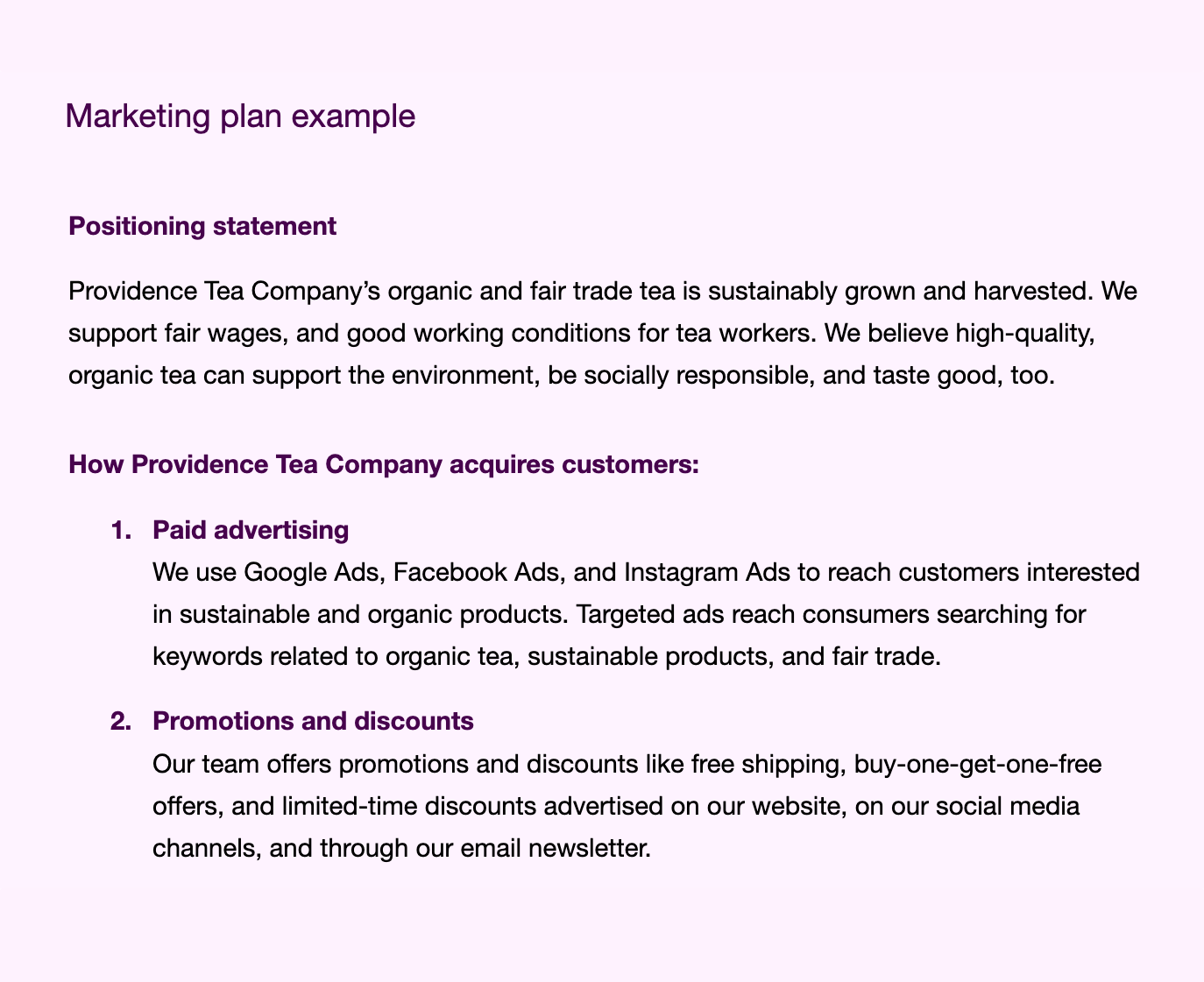

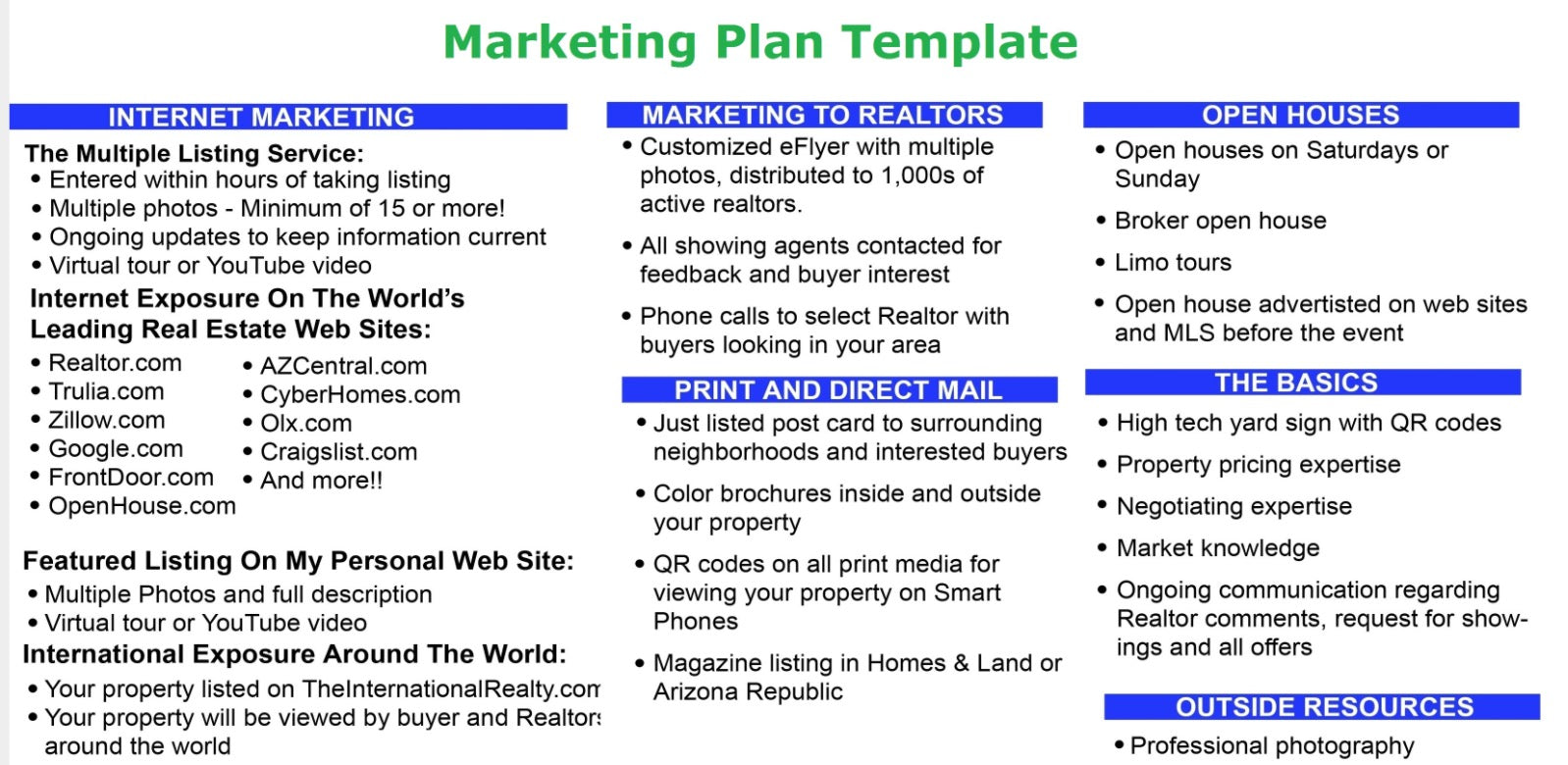

6. Show and Explain Your Marketing and Sales Plan

Providing great products and services is wonderful, but it means nothing if you do not have a marketing and sales plan to inform your customers about them. Your marketing and sales plan is critical to the success of your business.

The sales and marketing section is where you show and offer a detailed explanation of your marketing and sales plan and how you plan to execute it. It covers your pricing plan, proposed advertising and promotion activities, activities and partnerships you need to make your business a success, and the benefits of your products and services.

There are several ways you can approach your marketing and sales strategy. Ideally, your marketing and sales strategy has to fit the unique needs of your business.

In this section, you describe how the plans your business has for attracting and retaining customers, and the exact process for making a sale happen. It is essential to thoroughly describe your complete marketing and sales plans because you are still going to reference this section when you are making financial projections for your business.

Outline Your Business’ Unique Selling Proposition (USP)

The sales and marketing section is where you outline your business’s unique selling proposition (USP). When you are developing your unique selling proposition, think about the strongest reasons why people should buy from you over your competition. That reason(s) is most likely a good fit to serve as your unique selling proposition (USP).

Target Market and Target Audience

Plans on how to get your products or services to your target market and how to get your target audience to buy them go into this section. You also highlight the strengths of your business here, particularly what sets them apart from your competition.

Before you start writing your marketing and sales plan, you need to have properly defined your target audience and fleshed out your buyer persona. If you do not first understand the individual you are marketing to, your marketing and sales plan will lack any substance and easily fall.

Creating a Smart Marketing and Sales Plan

Marketing your products and services is an investment that requires you to spend money. Like any other investment, you have to generate a good return on investment (ROI) to justify using that marketing and sales plan. Good marketing and sales plans bring in high sales and profits to your company.

Avoid spending money on unproductive marketing channels. Do your research and find out the best marketing and sales plan that works best for your company.

Your marketing and sales plan can be broken into different parts: your positioning statement, pricing, promotion, packaging, advertising, public relations, content marketing, social media, and strategic alliances.

Your Positioning Statement

Your positioning statement is the first part of your marketing and sales plan. It refers to the way you present your company to your customers.

Are you the premium solution, the low-price solution, or are you the intermediary between the two extremes in the market? What do you offer that your competitors do not that can give you leverage in the market?

Before you start writing your positioning statement, you need to spend some time evaluating the current market conditions. Here are some questions that can help you to evaluate the market

- What are the unique features or benefits that you offer that your competitors lack?

- What are your customers’ primary needs and wants?

- Why should a customer choose you over your competition? How do you plan to differentiate yourself from the competition?

- How does your company’s solution compare with other solutions in the market?

After answering these questions, then you can start writing your positioning statement. Your positioning statement does not have to be in-depth or too long.

All you need to explain with your positioning statement are two focus areas. The first is the position of your company within the competitive landscape. The other focus area is the core value proposition that sets your company apart from other alternatives that your ideal customer might consider.

Here is a simple template you can use to develop a positioning statement.

For [description of target market] who [need of target market], [product or service] [how it meets the need]. Unlike [top competition], it [most essential distinguishing feature].

For example, let’s create the positioning statement for fictional accounting software and QuickBooks alternative , TBooks.

“For small business owners who need accounting services, TBooks is an accounting software that helps small businesses handle their small business bookkeeping basics quickly and easily. Unlike Wave, TBooks gives small businesses access to live sessions with top accountants.”

You can edit this positioning statement sample and fill it with your business details.

After writing your positioning statement, the next step is the pricing of your offerings. The overall positioning strategy you set in your positioning statement will often determine how you price your products or services.

Pricing is a powerful tool that sends a strong message to your customers. Failure to get your pricing strategy right can make or mar your business. If you are targeting a low-income audience, setting a premium price can result in low sales.

You can use pricing to communicate your positioning to your customers. For example, if you are offering a product at a premium price, you are sending a message to your customers that the product belongs to the premium category.

Basic Rules to Follow When Pricing Your Offering

Setting a price for your offering involves more than just putting a price tag on it. Deciding on the right pricing for your offering requires following some basic rules. They include covering your costs, primary and secondary profit center pricing, and matching the market rate.

- Covering Your Costs: The price you set for your products or service should be more than it costs you to produce and deliver them. Every business has the same goal, to make a profit. Depending on the strategy you want to use, there are exceptions to this rule. However, the vast majority of businesses follow this rule.

- Primary and Secondary Profit Center Pricing: When a company sets its price above the cost of production, it is making that product its primary profit center. A company can also decide not to make its initial price its primary profit center by selling below or at even with its production cost. It rather depends on the support product or even maintenance that is associated with the initial purchase to make its profit. The initial price thus became its secondary profit center.

- Matching the Market Rate: A good rule to follow when pricing your products or services is to match your pricing with consumer demand and expectations. If you price your products or services beyond the price your customer perceives as the ideal price range, you may end up with no customers. Pricing your products too low below what your customer perceives as the ideal price range may lead to them undervaluing your offering.

Pricing Strategy

Your pricing strategy influences the price of your offering. There are several pricing strategies available for you to choose from when examining the right pricing strategy for your business. They include cost-plus pricing, market-based pricing, value pricing, and more.

- Cost-plus Pricing: This strategy is one of the simplest and oldest pricing strategies. Here you consider the cost of producing a unit of your product and then add a profit to it to arrive at your market price. It is an effective pricing strategy for manufacturers because it helps them cover their initial costs. Another name for the cost-plus pricing strategy is the markup pricing strategy.

- Market-based Pricing: This pricing strategy analyses the market including competitors’ pricing and then sets a price based on what the market is expecting. With this pricing strategy, you can either set your price at the low-end or high-end of the market.

- Value Pricing: This pricing strategy involves setting a price based on the value you are providing to your customer. When adopting a value-based pricing strategy, you have to set a price that your customers are willing to pay. Service-based businesses such as small business insurance providers , luxury goods sellers, and the fashion industry use this pricing strategy.

After carefully sorting out your positioning statement and pricing, the next item to look at is your promotional strategy. Your promotional strategy explains how you plan on communicating with your customers and prospects.

As a business, you must measure all your costs, including the cost of your promotions. You also want to measure how much sales your promotions bring for your business to determine its usefulness. Promotional strategies or programs that do not lead to profit need to be removed.

There are different types of promotional strategies you can adopt for your business, they include advertising, public relations, and content marketing.

Advertising

Your business plan should include your advertising plan which can be found in the marketing and sales plan section. You need to include an overview of your advertising plans such as the areas you plan to spend money on to advertise your business and offers.

Ensure that you make it clear in this section if your business will be advertising online or using the more traditional offline media, or the combination of both online and offline media. You can also include the advertising medium you want to use to raise awareness about your business and offers.

Some common online advertising mediums you can use include social media ads, landing pages, sales pages, SEO, Pay-Per-Click, emails, Google Ads, and others. Some common traditional and offline advertising mediums include word of mouth, radios, direct mail, televisions, flyers, billboards, posters, and others.

A key component of your advertising strategy is how you plan to measure the effectiveness and success of your advertising campaign. There is no point in sticking with an advertising plan or medium that does not produce results for your business in the long run.

Public Relations

A great way to reach your customers is to get the media to cover your business or product. Publicity, especially good ones, should be a part of your marketing and sales plan. In this section, show your plans for getting prominent reviews of your product from reputable publications and sources.

Your business needs that exposure to grow. If public relations is a crucial part of your promotional strategy, provide details about your public relations plan here.

Content Marketing

Content marketing is a popular promotional strategy used by businesses to inform and attract their customers. It is about teaching and educating your prospects on various topics of interest in your niche, it does not just involve informing them about the benefits and features of the products and services you have,

Businesses publish content usually for free where they provide useful information, tips, and advice so that their target market can be made aware of the importance of their products and services. Content marketing strategies seek to nurture prospects into buyers over time by simply providing value.

Your company can create a blog where it will be publishing content for its target market. You will need to use the best website builder such as Wix and Squarespace and the best web hosting services such as Bluehost, Hostinger, and other Bluehost alternatives to create a functional blog or website.

If content marketing is a crucial part of your promotional strategy (as it should be), detail your plans under promotions.

Including high-quality images of the packaging of your product in your business plan is a lovely idea. You can add the images of the packaging of that product in the marketing and sales plan section. If you are not selling a product, then you do not need to include any worry about the physical packaging of your product.

When organizing the packaging section of your business plan, you can answer the following questions to make maximum use of this section.

- Is your choice of packaging consistent with your positioning strategy?

- What key value proposition does your packaging communicate? (It should reflect the key value proposition of your business)

- How does your packaging compare to that of your competitors?

Social Media

Your 21st-century business needs to have a good social media presence. Not having one is leaving out opportunities for growth and reaching out to your prospect.

You do not have to join the thousands of social media platforms out there. What you need to do is join the ones that your customers are active on and be active there.

Businesses use social media to provide information about their products such as promotions, discounts, the benefits of their products, and content on their blogs.

Social media is also a platform for engaging with your customers and getting feedback about your products or services. Make no mistake, more and more of your prospects are using social media channels to find more information about companies.

You need to consider the social media channels you want to prioritize your business (prioritize the ones your customers are active in) and your branding plans in this section.

Strategic Alliances

If your company plans to work closely with other companies as part of your sales and marketing plan, include it in this section. Prove details about those partnerships in your business plan if you have already established them.

Strategic alliances can be beneficial for all parties involved including your company. Working closely with another company in the form of a partnership can provide access to a different target market segment for your company.

The company you are partnering with may also gain access to your target market or simply offer a new product or service (that of your company) to its customers.

Mutually beneficial partnerships can cover the weaknesses of one company with the strength of another. You should consider strategic alliances with companies that sell complimentary products to yours. For example, if you provide printers, you can partner with a company that produces ink since the customers that buy printers from you will also need inks for printing.

Steps Involved in Creating a Marketing and Sales Plan

1. Focus on Your Target Market

Identify who your customers are, the market you want to target. Then determine the best ways to get your products or services to your potential customers.

2. Evaluate Your Competition

One of the goals of having a marketing plan is to distinguish yourself from your competition. You cannot stand out from them without first knowing them in and out.

You can know your competitors by gathering information about their products, pricing, service, and advertising campaigns.

These questions can help you know your competition.

- What makes your competition successful?

- What are their weaknesses?

- What are customers saying about your competition?

3. Consider Your Brand

Customers' perception of your brand has a strong impact on your sales. Your marketing and sales plan should seek to bolster the image of your brand. Before you start marketing your business, think about the message you want to pass across about your business and your products and services.

4. Focus on Benefits

The majority of your customers do not view your product in terms of features, what they want to know is the benefits and solutions your product offers. Think about the problems your product solves and the benefits it delivers, and use it to create the right sales and marketing message.

Your marketing plan should focus on what you want your customer to get instead of what you provide. Identify those benefits in your marketing and sales plan.

5. Focus on Differentiation

Your marketing and sales plan should look for a unique angle they can take that differentiates your business from the competition, even if the products offered are similar. Some good areas of differentiation you can use are your benefits, pricing, and features.

Key Questions to Answer When Writing Your Marketing and Sales Plan

- What is your company’s budget for sales and marketing campaigns?

- What key metrics will you use to determine if your marketing plans are successful?

- What are your alternatives if your initial marketing efforts do not succeed?

- Who are the sales representatives you need to promote your products or services?

- What are the marketing and sales channels you plan to use? How do you plan to get your products in front of your ideal customers?

- Where will you sell your products?

You may want to include samples of marketing materials you plan to use such as print ads, website descriptions, and social media ads. While it is not compulsory to include these samples, it can help you better communicate your marketing and sales plan and objectives.

The purpose of the marketing and sales section is to answer this question “How will you reach your customers?” If you cannot convincingly provide an answer to this question, you need to rework your marketing and sales section.

7. Clearly Show Your Funding Request

If you are writing your business plan to ask for funding from investors or financial institutions, the funding request section is where you will outline your funding requirements. The funding request section should answer the question ‘How much money will your business need in the near future (3 to 5 years)?’

A good funding request section will clearly outline and explain the amount of funding your business needs over the next five years. You need to know the amount of money your business needs to make an accurate funding request.

Also, when writing your funding request, provide details of how the funds will be used over the period. Specify if you want to use the funds to buy raw materials or machinery, pay salaries, pay for advertisements, and cover specific bills such as rent and electricity.

In addition to explaining what you want to use the funds requested for, you need to clearly state the projected return on investment (ROI) . Investors and creditors want to know if your business can generate profit for them if they put funds into it.

Ensure you do not inflate the figures and stay as realistic as possible. Investors and financial institutions you are seeking funds from will do their research before investing money in your business.

If you are not sure of an exact number to request from, you can use some range of numbers as rough estimates. Add a best-case scenario and a work-case scenario to your funding request. Also, include a description of your strategic future financial plans such as selling your business or paying off debts.

Funding Request: Debt or Equity?

When making your funding request, specify the type of funding you want. Do you want debt or equity? Draw out the terms that will be applicable for the funding, and the length of time the funding request will cover.

Case for Equity

If your new business has not yet started generating profits, you are most likely preparing to sell equity in your business to raise capital at the early stage. Equity here refers to ownership. In this case, you are selling a portion of your company to raise capital.

Although this method of raising capital for your business does not put your business in debt, keep in mind that an equity owner may expect to play a key role in company decisions even if he does not hold a major stake in the company.

Most equity sales for startups are usually private transactions . If you are making a funding request by offering equity in exchange for funding, let the investor know that they will be paid a dividend (a share of the company’s profit). Also, let the investor know the process for selling their equity in your business.

Case for Debt

You may decide not to offer equity in exchange for funds, instead, you make a funding request with the promise to pay back the money borrowed at the agreed time frame.

When making a funding request with an agreement to pay back, note that you will have to repay your creditors both the principal amount borrowed and the interest on it. Financial institutions offer this type of funding for businesses.

Large companies combine both equity and debt in their capital structure. When drafting your business plan, decide if you want to offer both or one over the other.

Before you sell equity in exchange for funding in your business, consider if you are willing to accept not being in total control of your business. Also, before you seek loans in your funding request section, ensure that the terms of repayment are favorable.

You should set a clear timeline in your funding request so that potential investors and creditors can know what you are expecting. Some investors and creditors may agree to your funding request and then delay payment for longer than 30 days, meanwhile, your business needs an immediate cash injection to operate efficiently.

Additional Tips for Writing the Funding Request Section of your Business Plan

The funding request section is not necessary for every business, it is only needed by businesses who plan to use their business plan to secure funding.

If you are adding the funding request section to your business plan, provide an itemized summary of how you plan to use the funds requested. Hiring a lawyer, accountant, or other professionals may be necessary for the proper development of this section.

You should also gather and use financial statements that add credibility and support to your funding requests. Ensure that the financial statements you use should include your projected financial data such as projected cash flows, forecast statements, and expenditure budgets.

If you are an existing business, include all historical financial statements such as cash flow statements, balance sheets and income statements .

Provide monthly and quarterly financial statements for a year. If your business has records that date back beyond the one-year mark, add the yearly statements of those years. These documents are for the appendix section of your business plan.

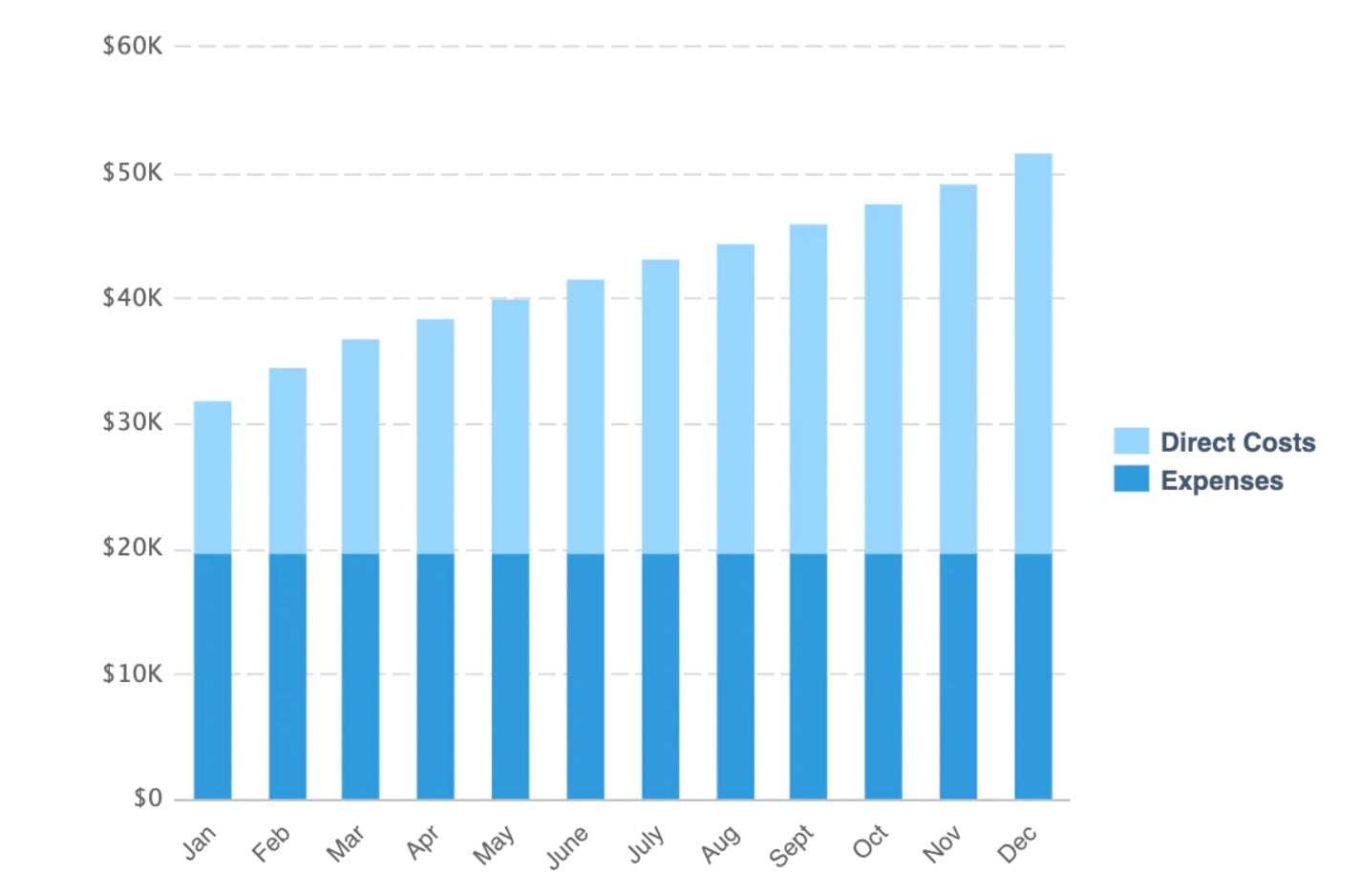

8. Detail Your Financial Plan, Metrics, and Projections

If you used the funding request section in your business plan, supplement it with a financial plan, metrics, and projections. This section paints a picture of the past performance of your business and then goes ahead to make an informed projection about its future.

The goal of this section is to convince readers that your business is going to be a financial success. It outlines your business plan to generate enough profit to repay the loan (with interest if applicable) and to generate a decent return on investment for investors.

If you have an existing business already in operation, use this section to demonstrate stability through finance. This section should include your cash flow statements, balance sheets, and income statements covering the last three to five years. If your business has some acceptable collateral that you can use to acquire loans, list it in the financial plan, metrics, and projection section.

Apart from current financial statements, this section should also contain a prospective financial outlook that spans the next five years. Include forecasted income statements, cash flow statements, balance sheets, and capital expenditure budget.

If your business is new and is not yet generating profit, use clear and realistic projections to show the potentials of your business.

When drafting this section, research industry norms and the performance of comparable businesses. Your financial projections should cover at least five years. State the logic behind your financial projections. Remember you can always make adjustments to this section as the variables change.

The financial plan, metrics, and projection section create a baseline which your business can either exceed or fail to reach. If your business fails to reach your projections in this section, you need to understand why it failed.

Investors and loan managers spend a lot of time going through the financial plan, metrics, and projection section compared to other parts of the business plan. Ensure you spend time creating credible financial analyses for your business in this section.

Many entrepreneurs find this section daunting to write. You do not need a business degree to create a solid financial forecast for your business. Business finances, especially for startups, are not as complicated as they seem. There are several online tools and templates that make writing this section so much easier.

Use Graphs and Charts

The financial plan, metrics, and projection section is a great place to use graphs and charts to tell the financial story of your business. Charts and images make it easier to communicate your finances.

Accuracy in this section is key, ensure you carefully analyze your past financial statements properly before making financial projects.

Address the Risk Factors and Show Realistic Financial Projections

Keep your financial plan, metrics, and projection realistic. It is okay to be optimistic in your financial projection, however, you have to justify it.

You should also address the various risk factors associated with your business in this section. Investors want to know the potential risks involved, show them. You should also show your plans for mitigating those risks.

What You Should In The Financial Plan, Metrics, and Projection Section of Your Business Plan

The financial plan, metrics, and projection section of your business plan should have monthly sales and revenue forecasts for the first year. It should also include annual projections that cover 3 to 5 years.

A three-year projection is a basic requirement to have in your business plan. However, some investors may request a five-year forecast.

Your business plan should include the following financial statements: sales forecast, personnel plan, income statement, income statement, cash flow statement, balance sheet, and an exit strategy.

1. Sales Forecast

Sales forecast refers to your projections about the number of sales your business is going to record over the next few years. It is typically broken into several rows, with each row assigned to a core product or service that your business is offering.

One common mistake people make in their business plan is to break down the sales forecast section into long details. A sales forecast should forecast the high-level details.

For example, if you are forecasting sales for a payroll software provider, you could break down your forecast into target market segments or subscription categories.

Your sales forecast section should also have a corresponding row for each sales row to cover the direct cost or Cost of Goods Sold (COGS). The objective of these rows is to show the expenses that your business incurs in making and delivering your product or service.

Note that your Cost of Goods Sold (COGS) should only cover those direct costs incurred when making your products. Other indirect expenses such as insurance, salaries, payroll tax, and rent should not be included.

For example, the Cost of Goods Sold (COGS) for a restaurant is the cost of ingredients while for a consulting company it will be the cost of paper and other presentation materials.

2. Personnel Plan

The personnel plan section is where you provide details about the payment plan for your employees. For a small business, you can easily list every position in your company and how much you plan to pay in the personnel plan.

However, for larger businesses, you have to break the personnel plan into functional groups such as sales and marketing.

The personnel plan will also include the cost of an employee beyond salary, commonly referred to as the employee burden. These costs include insurance, payroll taxes , and other essential costs incurred monthly as a result of having employees on your payroll.

3. Income Statement