Step-by-Step Guide to Writing a Simple Business Plan

By Joe Weller | October 11, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

A business plan is the cornerstone of any successful company, regardless of size or industry. This step-by-step guide provides information on writing a business plan for organizations at any stage, complete with free templates and expert advice.

Included on this page, you’ll find a step-by-step guide to writing a business plan and a chart to identify which type of business plan you should write . Plus, find information on how a business plan can help grow a business and expert tips on writing one .

What Is a Business Plan?

A business plan is a document that communicates a company’s goals and ambitions, along with the timeline, finances, and methods needed to achieve them. Additionally, it may include a mission statement and details about the specific products or services offered.

A business plan can highlight varying time periods, depending on the stage of your company and its goals. That said, a typical business plan will include the following benchmarks:

- Product goals and deadlines for each month

- Monthly financials for the first two years

- Profit and loss statements for the first three to five years

- Balance sheet projections for the first three to five years

Startups, entrepreneurs, and small businesses all create business plans to use as a guide as their new company progresses. Larger organizations may also create (and update) a business plan to keep high-level goals, financials, and timelines in check.

While you certainly need to have a formalized outline of your business’s goals and finances, creating a business plan can also help you determine a company’s viability, its profitability (including when it will first turn a profit), and how much money you will need from investors. In turn, a business plan has functional value as well: Not only does outlining goals help keep you accountable on a timeline, it can also attract investors in and of itself and, therefore, act as an effective strategy for growth.

For more information, visit our comprehensive guide to writing a strategic plan or download free strategic plan templates . This page focuses on for-profit business plans, but you can read our article with nonprofit business plan templates .

Business Plan Steps

The specific information in your business plan will vary, depending on the needs and goals of your venture, but a typical plan includes the following ordered elements:

- Executive summary

- Description of business

- Market analysis

- Competitive analysis

- Description of organizational management

- Description of product or services

- Marketing plan

- Sales strategy

- Funding details (or request for funding)

- Financial projections

If your plan is particularly long or complicated, consider adding a table of contents or an appendix for reference. For an in-depth description of each step listed above, read “ How to Write a Business Plan Step by Step ” below.

Broadly speaking, your audience includes anyone with a vested interest in your organization. They can include potential and existing investors, as well as customers, internal team members, suppliers, and vendors.

Do I Need a Simple or Detailed Plan?

Your business’s stage and intended audience dictates the level of detail your plan needs. Corporations require a thorough business plan — up to 100 pages. Small businesses or startups should have a concise plan focusing on financials and strategy.

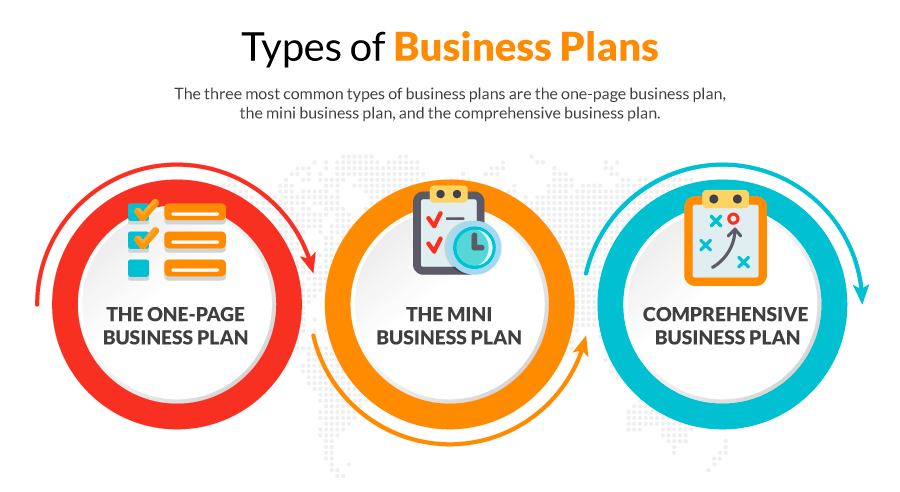

How to Choose the Right Plan for Your Business

In order to identify which type of business plan you need to create, ask: “What do we want the plan to do?” Identify function first, and form will follow.

Use the chart below as a guide for what type of business plan to create:

Is the Order of Your Business Plan Important?

There is no set order for a business plan, with the exception of the executive summary, which should always come first. Beyond that, simply ensure that you organize the plan in a way that makes sense and flows naturally.

The Difference Between Traditional and Lean Business Plans

A traditional business plan follows the standard structure — because these plans encourage detail, they tend to require more work upfront and can run dozens of pages. A Lean business plan is less common and focuses on summarizing critical points for each section. These plans take much less work and typically run one page in length.

In general, you should use a traditional model for a legacy company, a large company, or any business that does not adhere to Lean (or another Agile method ). Use Lean if you expect the company to pivot quickly or if you already employ a Lean strategy with other business operations. Additionally, a Lean business plan can suffice if the document is for internal use only. Stick to a traditional version for investors, as they may be more sensitive to sudden changes or a high degree of built-in flexibility in the plan.

How to Write a Business Plan Step by Step

Writing a strong business plan requires research and attention to detail for each section. Below, you’ll find a 10-step guide to researching and defining each element in the plan.

Step 1: Executive Summary

The executive summary will always be the first section of your business plan. The goal is to answer the following questions:

- What is the vision and mission of the company?

- What are the company’s short- and long-term goals?

See our roundup of executive summary examples and templates for samples. Read our executive summary guide to learn more about writing one.

Step 2: Description of Business

The goal of this section is to define the realm, scope, and intent of your venture. To do so, answer the following questions as clearly and concisely as possible:

- What business are we in?

- What does our business do?

Step 3: Market Analysis

In this section, provide evidence that you have surveyed and understand the current marketplace, and that your product or service satisfies a niche in the market. To do so, answer these questions:

- Who is our customer?

- What does that customer value?

Step 4: Competitive Analysis

In many cases, a business plan proposes not a brand-new (or even market-disrupting) venture, but a more competitive version — whether via features, pricing, integrations, etc. — than what is currently available. In this section, answer the following questions to show that your product or service stands to outpace competitors:

- Who is the competition?

- What do they do best?

- What is our unique value proposition?

Step 5: Description of Organizational Management

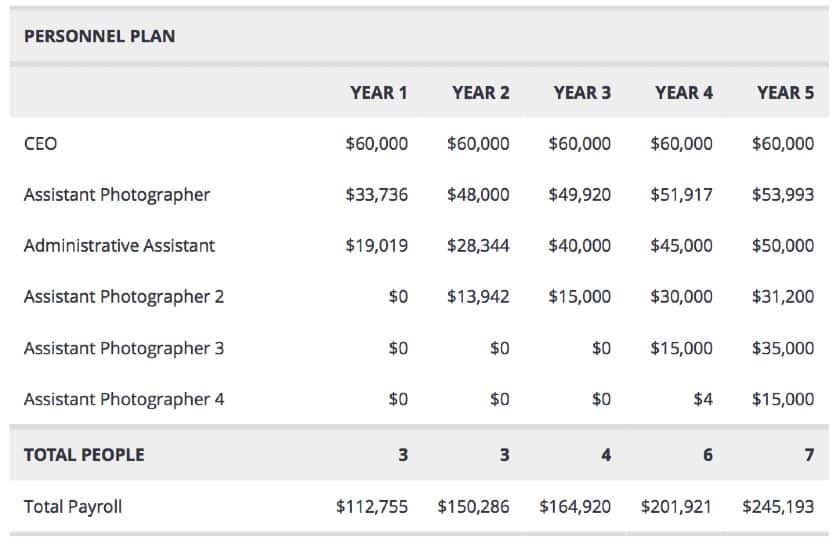

In this section, write an overview of the team members and other key personnel who are integral to success. List roles and responsibilities, and if possible, note the hierarchy or team structure.

Step 6: Description of Products or Services

In this section, clearly define your product or service, as well as all the effort and resources that go into producing it. The strength of your product largely defines the success of your business, so it’s imperative that you take time to test and refine the product before launching into marketing, sales, or funding details.

Questions to answer in this section are as follows:

- What is the product or service?

- How do we produce it, and what resources are necessary for production?

Step 7: Marketing Plan

In this section, define the marketing strategy for your product or service. This doesn’t need to be as fleshed out as a full marketing plan , but it should answer basic questions, such as the following:

- Who is the target market (if different from existing customer base)?

- What channels will you use to reach your target market?

- What resources does your marketing strategy require, and do you have access to them?

- If possible, do you have a rough estimate of timeline and budget?

- How will you measure success?

Step 8: Sales Plan

Write an overview of the sales strategy, including the priorities of each cycle, steps to achieve these goals, and metrics for success. For the purposes of a business plan, this section does not need to be a comprehensive, in-depth sales plan , but can simply outline the high-level objectives and strategies of your sales efforts.

Start by answering the following questions:

- What is the sales strategy?

- What are the tools and tactics you will use to achieve your goals?

- What are the potential obstacles, and how will you overcome them?

- What is the timeline for sales and turning a profit?

- What are the metrics of success?

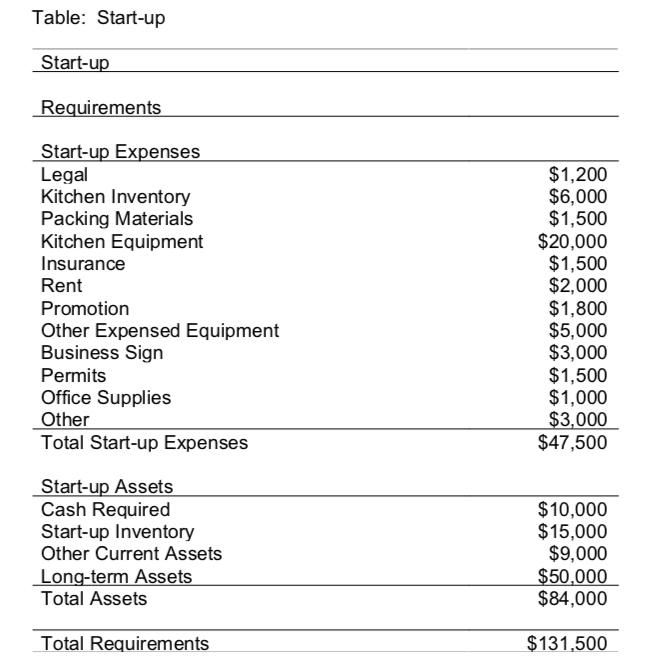

Step 9: Funding Details (or Request for Funding)

This section is one of the most critical parts of your business plan, particularly if you are sharing it with investors. You do not need to provide a full financial plan, but you should be able to answer the following questions:

- How much capital do you currently have? How much capital do you need?

- How will you grow the team (onboarding, team structure, training and development)?

- What are your physical needs and constraints (space, equipment, etc.)?

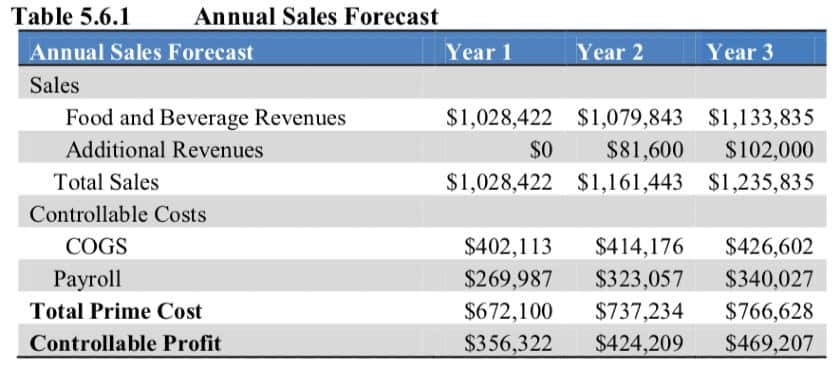

Step 10: Financial Projections

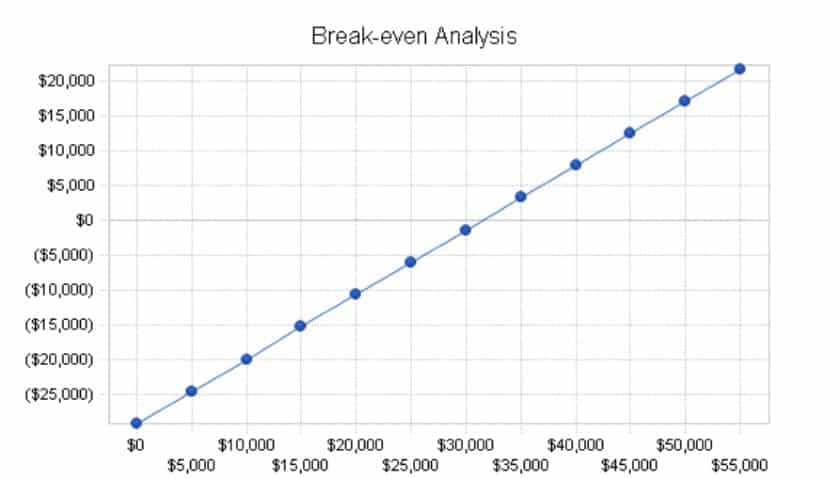

Apart from the fundraising analysis, investors like to see thought-out financial projections for the future. As discussed earlier, depending on the scope and stage of your business, this could be anywhere from one to five years.

While these projections won’t be exact — and will need to be somewhat flexible — you should be able to gauge the following:

- How and when will the company first generate a profit?

- How will the company maintain profit thereafter?

Business Plan Template

Download Business Plan Template

Microsoft Excel | Smartsheet

This basic business plan template has space for all the traditional elements: an executive summary, product or service details, target audience, marketing and sales strategies, etc. In the finances sections, input your baseline numbers, and the template will automatically calculate projections for sales forecasting, financial statements, and more.

For templates tailored to more specific needs, visit this business plan template roundup or download a fill-in-the-blank business plan template to make things easy.

If you are looking for a particular template by file type, visit our pages dedicated exclusively to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates.

How to Write a Simple Business Plan

A simple business plan is a streamlined, lightweight version of the large, traditional model. As opposed to a one-page business plan , which communicates high-level information for quick overviews (such as a stakeholder presentation), a simple business plan can exceed one page.

Below are the steps for creating a generic simple business plan, which are reflected in the template below .

- Write the Executive Summary This section is the same as in the traditional business plan — simply offer an overview of what’s in the business plan, the prospect or core offering, and the short- and long-term goals of the company.

- Add a Company Overview Document the larger company mission and vision.

- Provide the Problem and Solution In straightforward terms, define the problem you are attempting to solve with your product or service and how your company will attempt to do it. Think of this section as the gap in the market you are attempting to close.

- Identify the Target Market Who is your company (and its products or services) attempting to reach? If possible, briefly define your buyer personas .

- Write About the Competition In this section, demonstrate your knowledge of the market by listing the current competitors and outlining your competitive advantage.

- Describe Your Product or Service Offerings Get down to brass tacks and define your product or service. What exactly are you selling?

- Outline Your Marketing Tactics Without getting into too much detail, describe your planned marketing initiatives.

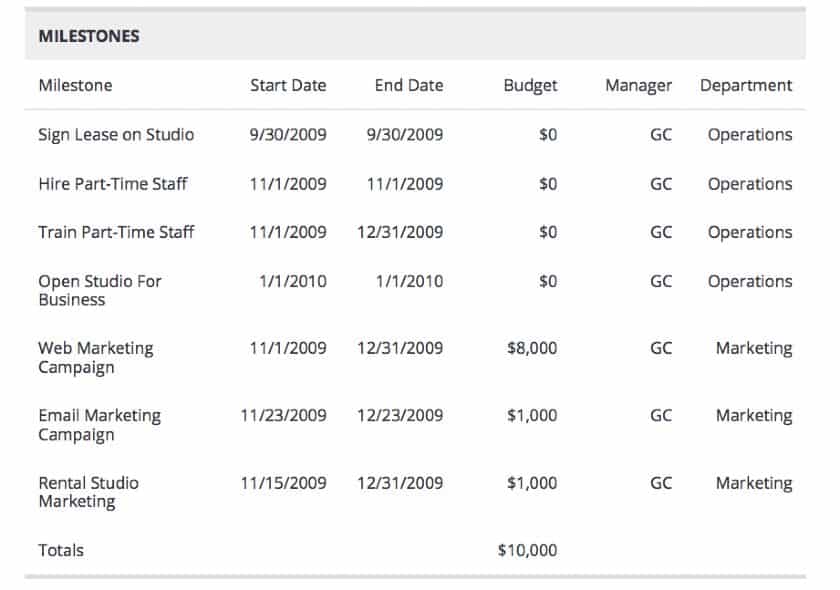

- Add a Timeline and the Metrics You Will Use to Measure Success Offer a rough timeline, including milestones and key performance indicators (KPIs) that you will use to measure your progress.

- Include Your Financial Forecasts Write an overview of your financial plan that demonstrates you have done your research and adequate modeling. You can also list key assumptions that go into this forecasting.

- Identify Your Financing Needs This section is where you will make your funding request. Based on everything in the business plan, list your proposed sources of funding, as well as how you will use it.

Simple Business Plan Template

Download Simple Business Plan Template

Microsoft Excel | Microsoft Word | Adobe PDF | Smartsheet

Use this simple business plan template to outline each aspect of your organization, including information about financing and opportunities to seek out further funding. This template is completely customizable to fit the needs of any business, whether it’s a startup or large company.

Read our article offering free simple business plan templates or free 30-60-90-day business plan templates to find more tailored options. You can also explore our collection of one page business templates .

How to Write a Business Plan for a Lean Startup

A Lean startup business plan is a more Agile approach to a traditional version. The plan focuses more on activities, processes, and relationships (and maintains flexibility in all aspects), rather than on concrete deliverables and timelines.

While there is some overlap between a traditional and a Lean business plan, you can write a Lean plan by following the steps below:

- Add Your Value Proposition Take a streamlined approach to describing your product or service. What is the unique value your startup aims to deliver to customers? Make sure the team is aligned on the core offering and that you can state it in clear, simple language.

- List Your Key Partners List any other businesses you will work with to realize your vision, including external vendors, suppliers, and partners. This section demonstrates that you have thoughtfully considered the resources you can provide internally, identified areas for external assistance, and conducted research to find alternatives.

- Note the Key Activities Describe the key activities of your business, including sourcing, production, marketing, distribution channels, and customer relationships.

- Include Your Key Resources List the critical resources — including personnel, equipment, space, and intellectual property — that will enable you to deliver your unique value.

- Identify Your Customer Relationships and Channels In this section, document how you will reach and build relationships with customers. Provide a high-level map of the customer experience from start to finish, including the spaces in which you will interact with the customer (online, retail, etc.).

- Detail Your Marketing Channels Describe the marketing methods and communication platforms you will use to identify and nurture your relationships with customers. These could be email, advertising, social media, etc.

- Explain the Cost Structure This section is especially necessary in the early stages of a business. Will you prioritize maximizing value or keeping costs low? List the foundational startup costs and how you will move toward profit over time.

- Share Your Revenue Streams Over time, how will the company make money? Include both the direct product or service purchase, as well as secondary sources of revenue, such as subscriptions, selling advertising space, fundraising, etc.

Lean Business Plan Template for Startups

Download Lean Business Plan Template for Startups

Microsoft Word | Adobe PDF

Startup leaders can use this Lean business plan template to relay the most critical information from a traditional plan. You’ll find all the sections listed above, including spaces for industry and product overviews, cost structure and sources of revenue, and key metrics, and a timeline. The template is completely customizable, so you can edit it to suit the objectives of your Lean startups.

See our wide variety of startup business plan templates for more options.

How to Write a Business Plan for a Loan

A business plan for a loan, often called a loan proposal , includes many of the same aspects of a traditional business plan, as well as additional financial documents, such as a credit history, a loan request, and a loan repayment plan.

In addition, you may be asked to include personal and business financial statements, a form of collateral, and equity investment information.

Download free financial templates to support your business plan.

Tips for Writing a Business Plan

Outside of including all the key details in your business plan, you have several options to elevate the document for the highest chance of winning funding and other resources. Follow these tips from experts:.

- Keep It Simple: Avner Brodsky , the Co-Founder and CEO of Lezgo Limited, an online marketing company, uses the acronym KISS (keep it short and simple) as a variation on this idea. “The business plan is not a college thesis,” he says. “Just focus on providing the essential information.”

- Do Adequate Research: Michael Dean, the Co-Founder of Pool Research , encourages business leaders to “invest time in research, both internal and external (market, finance, legal etc.). Avoid being overly ambitious or presumptive. Instead, keep everything objective, balanced, and accurate.” Your plan needs to stand on its own, and you must have the data to back up any claims or forecasting you make. As Brodsky explains, “Your business needs to be grounded on the realities of the market in your chosen location. Get the most recent data from authoritative sources so that the figures are vetted by experts and are reliable.”

- Set Clear Goals: Make sure your plan includes clear, time-based goals. “Short-term goals are key to momentum growth and are especially important to identify for new businesses,” advises Dean.

- Know (and Address) Your Weaknesses: “This awareness sets you up to overcome your weak points much quicker than waiting for them to arise,” shares Dean. Brodsky recommends performing a full SWOT analysis to identify your weaknesses, too. “Your business will fare better with self-knowledge, which will help you better define the mission of your business, as well as the strategies you will choose to achieve your objectives,” he adds.

- Seek Peer or Mentor Review: “Ask for feedback on your drafts and for areas to improve,” advises Brodsky. “When your mind is filled with dreams for your business, sometimes it is an outsider who can tell you what you’re missing and will save your business from being a product of whimsy.”

Outside of these more practical tips, the language you use is also important and may make or break your business plan.

Shaun Heng, VP of Operations at Coin Market Cap , gives the following advice on the writing, “Your business plan is your sales pitch to an investor. And as with any sales pitch, you need to strike the right tone and hit a few emotional chords. This is a little tricky in a business plan, because you also need to be formal and matter-of-fact. But you can still impress by weaving in descriptive language and saying things in a more elegant way.

“A great way to do this is by expanding your vocabulary, avoiding word repetition, and using business language. Instead of saying that something ‘will bring in as many customers as possible,’ try saying ‘will garner the largest possible market segment.’ Elevate your writing with precise descriptive words and you'll impress even the busiest investor.”

Additionally, Dean recommends that you “stay consistent and concise by keeping your tone and style steady throughout, and your language clear and precise. Include only what is 100 percent necessary.”

Resources for Writing a Business Plan

While a template provides a great outline of what to include in a business plan, a live document or more robust program can provide additional functionality, visibility, and real-time updates. The U.S. Small Business Association also curates resources for writing a business plan.

Additionally, you can use business plan software to house data, attach documentation, and share information with stakeholders. Popular options include LivePlan, Enloop, BizPlanner, PlanGuru, and iPlanner.

How a Business Plan Helps to Grow Your Business

A business plan — both the exercise of creating one and the document — can grow your business by helping you to refine your product, target audience, sales plan, identify opportunities, secure funding, and build new partnerships.

Outside of these immediate returns, writing a business plan is a useful exercise in that it forces you to research the market, which prompts you to forge your unique value proposition and identify ways to beat the competition. Doing so will also help you build (and keep you accountable to) attainable financial and product milestones. And down the line, it will serve as a welcome guide as hurdles inevitably arise.

Streamline Your Business Planning Activities with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

Small Business Trends

How to create a business plan: examples & free template.

This is the ultimate guide to creating a comprehensive and effective plan to start a business . In today’s dynamic business landscape, having a well-crafted business plan is an important first step to securing funding, attracting partners, and navigating the challenges of entrepreneurship.

This guide has been designed to help you create a winning plan that stands out in the ever-evolving marketplace. U sing real-world examples and a free downloadable template, it will walk you through each step of the process.

Whether you’re a seasoned entrepreneur or launching your very first startup, the guide will give you the insights, tools, and confidence you need to create a solid foundation for your business.

Table of Contents

How to Write a Business Plan

Embarking on the journey of creating a successful business requires a solid foundation, and a well-crafted business plan is the cornerstone. Here is the process of writing a comprehensive business plan and the main parts of a winning business plan . From setting objectives to conducting market research, this guide will have everything you need.

Executive Summary

The Executive Summary serves as the gateway to your business plan, offering a snapshot of your venture’s core aspects. This section should captivate and inform, succinctly summarizing the essence of your plan.

It’s crucial to include a clear mission statement, a brief description of your primary products or services, an overview of your target market, and key financial projections or achievements.

Think of it as an elevator pitch in written form: it should be compelling enough to engage potential investors or stakeholders and provide them with a clear understanding of what your business is about, its goals, and why it’s a promising investment.

Example: EcoTech is a technology company specializing in eco-friendly and sustainable products designed to reduce energy consumption and minimize waste. Our mission is to create innovative solutions that contribute to a cleaner, greener environment.

Our target market includes environmentally conscious consumers and businesses seeking to reduce their carbon footprint. We project a 200% increase in revenue within the first three years of operation.

Overview and Business Objectives

In the Overview and Business Objectives section, outline your business’s core goals and the strategic approaches you plan to use to achieve them. This section should set forth clear, specific objectives that are attainable and time-bound, providing a roadmap for your business’s growth and success.

It’s important to detail how these objectives align with your company’s overall mission and vision. Discuss the milestones you aim to achieve and the timeframe you’ve set for these accomplishments.

This part of the plan demonstrates to investors and stakeholders your vision for growth and the practical steps you’ll take to get there.

Example: EcoTech’s primary objective is to become a market leader in sustainable technology products within the next five years. Our key objectives include:

- Introducing three new products within the first two years of operation.

- Achieving annual revenue growth of 30%.

- Expanding our customer base to over 10,000 clients by the end of the third year.

Company Description

The Company Description section is your opportunity to delve into the details of your business. Provide a comprehensive overview that includes your company’s history, its mission statement, and its vision for the future.

Highlight your unique selling proposition (USP) – what makes your business stand out in the market. Explain the problems your company solves and how it benefits your customers.

Include information about the company’s founders, their expertise, and why they are suited to lead the business to success. This section should paint a vivid picture of your business, its values, and its place in the industry.

Example: EcoTech is committed to developing cutting-edge sustainable technology products that benefit both the environment and our customers. Our unique combination of innovative solutions and eco-friendly design sets us apart from the competition. We envision a future where technology and sustainability go hand in hand, leading to a greener planet.

Define Your Target Market

Defining Your Target Market is critical for tailoring your business strategy effectively. This section should describe your ideal customer base in detail, including demographic information (such as age, gender, income level, and location) and psychographic data (like interests, values, and lifestyle).

Elucidate on the specific needs or pain points of your target audience and how your product or service addresses these. This information will help you know your target market and develop targeted marketing strategies.

Example: Our target market comprises environmentally conscious consumers and businesses looking for innovative solutions to reduce their carbon footprint. Our ideal customers are those who prioritize sustainability and are willing to invest in eco-friendly products.

Market Analysis

The Market Analysis section requires thorough research and a keen understanding of the industry. It involves examining the current trends within your industry, understanding the needs and preferences of your customers, and analyzing the strengths and weaknesses of your competitors.

This analysis will enable you to spot market opportunities and anticipate potential challenges. Include data and statistics to back up your claims, and use graphs or charts to illustrate market trends.

This section should demonstrate that you have a deep understanding of the market in which you operate and that your business is well-positioned to capitalize on its opportunities.

Example: The market for eco-friendly technology products has experienced significant growth in recent years, with an estimated annual growth rate of 10%. As consumers become increasingly aware of environmental issues, the demand for sustainable solutions continues to rise.

Our research indicates a gap in the market for high-quality, innovative eco-friendly technology products that cater to both individual and business clients.

SWOT Analysis

A SWOT analysis in your business plan offers a comprehensive examination of your company’s internal and external factors. By assessing Strengths, you showcase what your business does best and where your capabilities lie.

Weaknesses involve an honest introspection of areas where your business may be lacking or could improve. Opportunities can be external factors that your business could capitalize on, such as market gaps or emerging trends.

Threats include external challenges your business may face, like competition or market changes. This analysis is crucial for strategic planning, as it helps in recognizing and leveraging your strengths, addressing weaknesses, seizing opportunities, and preparing for potential threats.

Including a SWOT analysis demonstrates to stakeholders that you have a balanced and realistic understanding of your business in its operational context.

- Innovative and eco-friendly product offerings.

- Strong commitment to sustainability and environmental responsibility.

- Skilled and experienced team with expertise in technology and sustainability.

Weaknesses:

- Limited brand recognition compared to established competitors.

- Reliance on third-party manufacturers for product development.

Opportunities:

- Growing consumer interest in sustainable products.

- Partnerships with environmentally-focused organizations and influencers.

- Expansion into international markets.

- Intense competition from established technology companies.

- Regulatory changes could impact the sustainable technology market.

Competitive Analysis

In this section, you’ll analyze your competitors in-depth, examining their products, services, market positioning, and pricing strategies. Understanding your competition allows you to identify gaps in the market and tailor your offerings to outperform them.

By conducting a thorough competitive analysis, you can gain insights into your competitors’ strengths and weaknesses, enabling you to develop strategies to differentiate your business and gain a competitive advantage in the marketplace.

Example: Key competitors include:

GreenTech: A well-known brand offering eco-friendly technology products, but with a narrower focus on energy-saving devices.

EarthSolutions: A direct competitor specializing in sustainable technology, but with a limited product range and higher prices.

By offering a diverse product portfolio, competitive pricing, and continuous innovation, we believe we can capture a significant share of the growing sustainable technology market.

Organization and Management Team

Provide an overview of your company’s organizational structure, including key roles and responsibilities. Introduce your management team, highlighting their expertise and experience to demonstrate that your team is capable of executing the business plan successfully.

Showcasing your team’s background, skills, and accomplishments instills confidence in investors and other stakeholders, proving that your business has the leadership and talent necessary to achieve its objectives and manage growth effectively.

Example: EcoTech’s organizational structure comprises the following key roles: CEO, CTO, CFO, Sales Director, Marketing Director, and R&D Manager. Our management team has extensive experience in technology, sustainability, and business development, ensuring that we are well-equipped to execute our business plan successfully.

Products and Services Offered

Describe the products or services your business offers, focusing on their unique features and benefits. Explain how your offerings solve customer pain points and why they will choose your products or services over the competition.

This section should emphasize the value you provide to customers, demonstrating that your business has a deep understanding of customer needs and is well-positioned to deliver innovative solutions that address those needs and set your company apart from competitors.

Example: EcoTech offers a range of eco-friendly technology products, including energy-efficient lighting solutions, solar chargers, and smart home devices that optimize energy usage. Our products are designed to help customers reduce energy consumption, minimize waste, and contribute to a cleaner environment.

Marketing and Sales Strategy

In this section, articulate your comprehensive strategy for reaching your target market and driving sales. Detail the specific marketing channels you plan to use, such as social media, email marketing, SEO, or traditional advertising.

Describe the nature of your advertising campaigns and promotional activities, explaining how they will capture the attention of your target audience and convey the value of your products or services. Outline your sales strategy, including your sales process, team structure, and sales targets.

Discuss how these marketing and sales efforts will work together to attract and retain customers, generate leads, and ultimately contribute to achieving your business’s revenue goals.

This section is critical to convey to investors and stakeholders that you have a well-thought-out approach to market your business effectively and drive sales growth.

Example: Our marketing strategy includes digital advertising, content marketing, social media promotion, and influencer partnerships. We will also attend trade shows and conferences to showcase our products and connect with potential clients. Our sales strategy involves both direct sales and partnerships with retail stores, as well as online sales through our website and e-commerce platforms.

Logistics and Operations Plan

The Logistics and Operations Plan is a critical component that outlines the inner workings of your business. It encompasses the management of your supply chain, detailing how you acquire raw materials and manage vendor relationships.

Inventory control is another crucial aspect, where you explain strategies for inventory management to ensure efficiency and reduce wastage. The section should also describe your production processes, emphasizing scalability and adaptability to meet changing market demands.

Quality control measures are essential to maintain product standards and customer satisfaction. This plan assures investors and stakeholders of your operational competency and readiness to meet business demands.

Highlighting your commitment to operational efficiency and customer satisfaction underlines your business’s capability to maintain smooth, effective operations even as it scales.

Example: EcoTech partners with reliable third-party manufacturers to produce our eco-friendly technology products. Our operations involve maintaining strong relationships with suppliers, ensuring quality control, and managing inventory.

We also prioritize efficient distribution through various channels, including online platforms and retail partners, to deliver products to our customers in a timely manner.

Financial Projections Plan

In the Financial Projections Plan, lay out a clear and realistic financial future for your business. This should include detailed projections for revenue, costs, and profitability over the next three to five years.

Ground these projections in solid assumptions based on your market analysis, industry benchmarks, and realistic growth scenarios. Break down revenue streams and include an analysis of the cost of goods sold, operating expenses, and potential investments.

This section should also discuss your break-even analysis, cash flow projections, and any assumptions about external funding requirements.

By presenting a thorough and data-backed financial forecast, you instill confidence in potential investors and lenders, showcasing your business’s potential for profitability and financial stability.

This forward-looking financial plan is crucial for demonstrating that you have a firm grasp of the financial nuances of your business and are prepared to manage its financial health effectively.

Example: Over the next three years, we expect to see significant growth in revenue, driven by new product launches and market expansion. Our financial projections include:

- Year 1: $1.5 million in revenue, with a net profit of $200,000.

- Year 2: $3 million in revenue, with a net profit of $500,000.

- Year 3: $4.5 million in revenue, with a net profit of $1 million.

These projections are based on realistic market analysis, growth rates, and product pricing.

Income Statement

The income statement , also known as the profit and loss statement, provides a summary of your company’s revenues and expenses over a specified period. It helps you track your business’s financial performance and identify trends, ensuring you stay on track to achieve your financial goals.

Regularly reviewing and analyzing your income statement allows you to monitor the health of your business, evaluate the effectiveness of your strategies, and make data-driven decisions to optimize profitability and growth.

Example: The income statement for EcoTech’s first year of operation is as follows:

- Revenue: $1,500,000

- Cost of Goods Sold: $800,000

- Gross Profit: $700,000

- Operating Expenses: $450,000

- Net Income: $250,000

This statement highlights our company’s profitability and overall financial health during the first year of operation.

Cash Flow Statement

A cash flow statement is a crucial part of a financial business plan that shows the inflows and outflows of cash within your business. It helps you monitor your company’s liquidity, ensuring you have enough cash on hand to cover operating expenses, pay debts, and invest in growth opportunities.

By including a cash flow statement in your business plan, you demonstrate your ability to manage your company’s finances effectively.

Example: The cash flow statement for EcoTech’s first year of operation is as follows:

Operating Activities:

- Depreciation: $10,000

- Changes in Working Capital: -$50,000

- Net Cash from Operating Activities: $210,000

Investing Activities:

- Capital Expenditures: -$100,000

- Net Cash from Investing Activities: -$100,000

Financing Activities:

- Proceeds from Loans: $150,000

- Loan Repayments: -$50,000

- Net Cash from Financing Activities: $100,000

- Net Increase in Cash: $210,000

This statement demonstrates EcoTech’s ability to generate positive cash flow from operations, maintain sufficient liquidity, and invest in growth opportunities.

Tips on Writing a Business Plan

1. Be clear and concise: Keep your language simple and straightforward. Avoid jargon and overly technical terms. A clear and concise business plan is easier for investors and stakeholders to understand and demonstrates your ability to communicate effectively.

2. Conduct thorough research: Before writing your business plan, gather as much information as possible about your industry, competitors, and target market. Use reliable sources and industry reports to inform your analysis and make data-driven decisions.

3. Set realistic goals: Your business plan should outline achievable objectives that are specific, measurable, attainable, relevant, and time-bound (SMART). Setting realistic goals demonstrates your understanding of the market and increases the likelihood of success.

4. Focus on your unique selling proposition (USP): Clearly articulate what sets your business apart from the competition. Emphasize your USP throughout your business plan to showcase your company’s value and potential for success.

5. Be flexible and adaptable: A business plan is a living document that should evolve as your business grows and changes. Be prepared to update and revise your plan as you gather new information and learn from your experiences.

6. Use visuals to enhance understanding: Include charts, graphs, and other visuals to help convey complex data and ideas. Visuals can make your business plan more engaging and easier to digest, especially for those who prefer visual learning.

7. Seek feedback from trusted sources: Share your business plan with mentors, industry experts, or colleagues and ask for their feedback. Their insights can help you identify areas for improvement and strengthen your plan before presenting it to potential investors or partners.

FREE Business Plan Template

To help you get started on your business plan, we have created a template that includes all the essential components discussed in the “How to Write a Business Plan” section. This easy-to-use template will guide you through each step of the process, ensuring you don’t miss any critical details.

The template is divided into the following sections:

- Mission statement

- Business Overview

- Key products or services

- Target market

- Financial highlights

- Company goals

- Strategies to achieve goals

- Measurable, time-bound objectives

- Company History

- Mission and vision

- Unique selling proposition

- Demographics

- Psychographics

- Pain points

- Industry trends

- Customer needs

- Competitor strengths and weaknesses

- Opportunities

- Competitor products and services

- Market positioning

- Pricing strategies

- Organizational structure

- Key roles and responsibilities

- Management team backgrounds

- Product or service features

- Competitive advantages

- Marketing channels

- Advertising campaigns

- Promotional activities

- Sales strategies

- Supply chain management

- Inventory control

- Production processes

- Quality control measures

- Projected revenue

- Assumptions

- Cash inflows

- Cash outflows

- Net cash flow

What is a Business Plan?

A business plan is a strategic document that outlines an organization’s goals, objectives, and the steps required to achieve them. It serves as a roadmap as you start a business , guiding the company’s direction and growth while identifying potential obstacles and opportunities.

Typically, a business plan covers areas such as market analysis, financial projections, marketing strategies, and organizational structure. It not only helps in securing funding from investors and lenders but also provides clarity and focus to the management team.

A well-crafted business plan is a very important part of your business startup checklist because it fosters informed decision-making and long-term success.

Why You Should Write a Business Plan

Understanding the importance of a business plan in today’s competitive environment is crucial for entrepreneurs and business owners. Here are five compelling reasons to write a business plan:

- Attract Investors and Secure Funding : A well-written business plan demonstrates your venture’s potential and profitability, making it easier to attract investors and secure the necessary funding for growth and development. It provides a detailed overview of your business model, target market, financial projections, and growth strategies, instilling confidence in potential investors and lenders that your company is a worthy investment.

- Clarify Business Objectives and Strategies : Crafting a business plan forces you to think critically about your goals and the strategies you’ll employ to achieve them, providing a clear roadmap for success. This process helps you refine your vision and prioritize the most critical objectives, ensuring that your efforts are focused on achieving the desired results.

- Identify Potential Risks and Opportunities : Analyzing the market, competition, and industry trends within your business plan helps identify potential risks and uncover untapped opportunities for growth and expansion. This insight enables you to develop proactive strategies to mitigate risks and capitalize on opportunities, positioning your business for long-term success.

- Improve Decision-Making : A business plan serves as a reference point so you can make informed decisions that align with your company’s overall objectives and long-term vision. By consistently referring to your plan and adjusting it as needed, you can ensure that your business remains on track and adapts to changes in the market, industry, or internal operations.

- Foster Team Alignment and Communication : A shared business plan helps ensure that all team members are on the same page, promoting clear communication, collaboration, and a unified approach to achieving the company’s goals. By involving your team in the planning process and regularly reviewing the plan together, you can foster a sense of ownership, commitment, and accountability that drives success.

What are the Different Types of Business Plans?

In today’s fast-paced business world, having a well-structured roadmap is more important than ever. A traditional business plan provides a comprehensive overview of your company’s goals and strategies, helping you make informed decisions and achieve long-term success. There are various types of business plans, each designed to suit different needs and purposes. Let’s explore the main types:

- Startup Business Plan: Tailored for new ventures, a startup business plan outlines the company’s mission, objectives, target market, competition, marketing strategies, and financial projections. It helps entrepreneurs clarify their vision, secure funding from investors, and create a roadmap for their business’s future. Additionally, this plan identifies potential challenges and opportunities, which are crucial for making informed decisions and adapting to changing market conditions.

- Internal Business Plan: This type of plan is intended for internal use, focusing on strategies, milestones, deadlines, and resource allocation. It serves as a management tool for guiding the company’s growth, evaluating its progress, and ensuring that all departments are aligned with the overall vision. The internal business plan also helps identify areas of improvement, fosters collaboration among team members, and provides a reference point for measuring performance.

- Strategic Business Plan: A strategic business plan outlines long-term goals and the steps to achieve them, providing a clear roadmap for the company’s direction. It typically includes a SWOT analysis, market research, and competitive analysis. This plan allows businesses to align their resources with their objectives, anticipate changes in the market, and develop contingency plans. By focusing on the big picture, a strategic business plan fosters long-term success and stability.

- Feasibility Business Plan: This plan is designed to assess the viability of a business idea, examining factors such as market demand, competition, and financial projections. It is often used to decide whether or not to pursue a particular venture. By conducting a thorough feasibility analysis, entrepreneurs can avoid investing time and resources into an unviable business concept. This plan also helps refine the business idea, identify potential obstacles, and determine the necessary resources for success.

- Growth Business Plan: Also known as an expansion plan, a growth business plan focuses on strategies for scaling up an existing business. It includes market analysis, new product or service offerings, and financial projections to support expansion plans. This type of plan is essential for businesses looking to enter new markets, increase their customer base, or launch new products or services. By outlining clear growth strategies, the plan helps ensure that expansion efforts are well-coordinated and sustainable.

- Operational Business Plan: This type of plan outlines the company’s day-to-day operations, detailing the processes, procedures, and organizational structure. It is an essential tool for managing resources, streamlining workflows, and ensuring smooth operations. The operational business plan also helps identify inefficiencies, implement best practices, and establish a strong foundation for future growth. By providing a clear understanding of daily operations, this plan enables businesses to optimize their resources and enhance productivity.

- Lean Business Plan: A lean business plan is a simplified, agile version of a traditional plan, focusing on key elements such as value proposition, customer segments, revenue streams, and cost structure. It is perfect for startups looking for a flexible, adaptable planning approach. The lean business plan allows for rapid iteration and continuous improvement, enabling businesses to pivot and adapt to changing market conditions. This streamlined approach is particularly beneficial for businesses in fast-paced or uncertain industries.

- One-Page Business Plan: As the name suggests, a one-page business plan is a concise summary of your company’s key objectives, strategies, and milestones. It serves as a quick reference guide and is ideal for pitching to potential investors or partners. This plan helps keep teams focused on essential goals and priorities, fosters clear communication, and provides a snapshot of the company’s progress. While not as comprehensive as other plans, a one-page business plan is an effective tool for maintaining clarity and direction.

- Nonprofit Business Plan: Specifically designed for nonprofit organizations, this plan outlines the mission, goals, target audience, fundraising strategies, and budget allocation. It helps secure grants and donations while ensuring the organization stays on track with its objectives. The nonprofit business plan also helps attract volunteers, board members, and community support. By demonstrating the organization’s impact and plans for the future, this plan is essential for maintaining transparency, accountability, and long-term sustainability within the nonprofit sector.

- Franchise Business Plan: For entrepreneurs seeking to open a franchise, this type of plan focuses on the franchisor’s requirements, as well as the franchisee’s goals, strategies, and financial projections. It is crucial for securing a franchise agreement and ensuring the business’s success within the franchise system. This plan outlines the franchisee’s commitment to brand standards, marketing efforts, and operational procedures, while also addressing local market conditions and opportunities. By creating a solid franchise business plan, entrepreneurs can demonstrate their ability to effectively manage and grow their franchise, increasing the likelihood of a successful partnership with the franchisor.

Using Business Plan Software

Creating a comprehensive business plan can be intimidating, but business plan software can streamline the process and help you produce a professional document. These tools offer a number of benefits, including guided step-by-step instructions, financial projections, and industry-specific templates. Here are the top 5 business plan software options available to help you craft a great business plan.

1. LivePlan

LivePlan is a popular choice for its user-friendly interface and comprehensive features. It offers over 500 sample plans, financial forecasting tools, and the ability to track your progress against key performance indicators. With LivePlan, you can create visually appealing, professional business plans that will impress investors and stakeholders.

2. Upmetrics

Upmetrics provides a simple and intuitive platform for creating a well-structured business plan. It features customizable templates, financial forecasting tools, and collaboration capabilities, allowing you to work with team members and advisors. Upmetrics also offers a library of resources to guide you through the business planning process.

Bizplan is designed to simplify the business planning process with a drag-and-drop builder and modular sections. It offers financial forecasting tools, progress tracking, and a visually appealing interface. With Bizplan, you can create a business plan that is both easy to understand and visually engaging.

Enloop is a robust business plan software that automatically generates a tailored plan based on your inputs. It provides industry-specific templates, financial forecasting, and a unique performance score that updates as you make changes to your plan. Enloop also offers a free version, making it accessible for businesses on a budget.

5. Tarkenton GoSmallBiz

Developed by NFL Hall of Famer Fran Tarkenton, GoSmallBiz is tailored for small businesses and startups. It features a guided business plan builder, customizable templates, and financial projection tools. GoSmallBiz also offers additional resources, such as CRM tools and legal document templates, to support your business beyond the planning stage.

Business Plan FAQs

What is a good business plan.

A good business plan is a well-researched, clear, and concise document that outlines a company’s goals, strategies, target market, competitive advantages, and financial projections. It should be adaptable to change and provide a roadmap for achieving success.

What are the 3 main purposes of a business plan?

The three main purposes of a business plan are to guide the company’s strategy, attract investment, and evaluate performance against objectives. Here’s a closer look at each of these:

- It outlines the company’s purpose and core values to ensure that all activities align with its mission and vision.

- It provides an in-depth analysis of the market, including trends, customer needs, and competition, helping the company tailor its products and services to meet market demands.

- It defines the company’s marketing and sales strategies, guiding how the company will attract and retain customers.

- It describes the company’s organizational structure and management team, outlining roles and responsibilities to ensure effective operation and leadership.

- It sets measurable, time-bound objectives, allowing the company to plan its activities effectively and make strategic decisions to achieve these goals.

- It provides a comprehensive overview of the company and its business model, demonstrating its uniqueness and potential for success.

- It presents the company’s financial projections, showing its potential for profitability and return on investment.

- It demonstrates the company’s understanding of the market, including its target customers and competition, convincing investors that the company is capable of gaining a significant market share.

- It showcases the management team’s expertise and experience, instilling confidence in investors that the team is capable of executing the business plan successfully.

- It establishes clear, measurable objectives that serve as performance benchmarks.

- It provides a basis for regular performance reviews, allowing the company to monitor its progress and identify areas for improvement.

- It enables the company to assess the effectiveness of its strategies and make adjustments as needed to achieve its objectives.

- It helps the company identify potential risks and challenges, enabling it to develop contingency plans and manage risks effectively.

- It provides a mechanism for evaluating the company’s financial performance, including revenue, expenses, profitability, and cash flow.

Can I write a business plan by myself?

Yes, you can write a business plan by yourself, but it can be helpful to consult with mentors, colleagues, or industry experts to gather feedback and insights. There are also many creative business plan templates and business plan examples available online, including those above.

We also have examples for specific industries, including a using food truck business plan , salon business plan , farm business plan , daycare business plan , and restaurant business plan .

Is it possible to create a one-page business plan?

Yes, a one-page business plan is a condensed version that highlights the most essential elements, including the company’s mission, target market, unique selling proposition, and financial goals.

How long should a business plan be?

A typical business plan ranges from 20 to 50 pages, but the length may vary depending on the complexity and needs of the business.

What is a business plan outline?

A business plan outline is a structured framework that organizes the content of a business plan into sections, such as the executive summary, company description, market analysis, and financial projections.

What are the 5 most common business plan mistakes?

The five most common business plan mistakes include inadequate research, unrealistic financial projections, lack of focus on the unique selling proposition, poor organization and structure, and failure to update the plan as circumstances change.

What questions should be asked in a business plan?

A business plan should address questions such as: What problem does the business solve? Who is the specific target market ? What is the unique selling proposition? What are the company’s objectives? How will it achieve those objectives?

What’s the difference between a business plan and a strategic plan?

A business plan focuses on the overall vision, goals, and tactics of a company, while a strategic plan outlines the specific strategies, action steps, and performance measures necessary to achieve the company’s objectives.

How is business planning for a nonprofit different?

Nonprofit business planning focuses on the organization’s mission, social impact, and resource management, rather than profit generation. The financial section typically includes funding sources, expenses, and projected budgets for programs and operations.

Image: Envato Elements

Your email address will not be published. Required fields are marked *

© Copyright 2003 - 2024, Small Business Trends LLC. All rights reserved. "Small Business Trends" is a registered trademark.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25