Bitcoin Mining Business Plan Template

Written by Dave Lavinsky

Bitcoin Mining Business Plan

You’ve come to the right place to create your Bitcoin Mining business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Bitcoin Mining companies.

Below is a template to help you create each section of your Bitcoin Mining business plan.

Executive Summary

Business overview.

Pacific Blockchain is a new bitcoin mining business located in Seattle, Washington. It is run by Daniel Baker who has been mining bitcoin for six years. Throughout that time, he earned $250,000 worth of bitcoin from his efforts. To continue his success, he decided to pool his resources with other successful miners and create this company. Pacific Blockchain currently has ten mining rigs and three miners in the pool. In the future, the company will be open to bringing in more miners for a membership fee.

Product Offering

Pacific Blockchain’s only goal is to mine bitcoin. All miners in the pool will work towards this goal and all profits earned will be divided equally amongst pool members. Future miners who wish to join the pool will have to pay a membership fee.

Customer Focus

As a bitcoin mining company, Pacific Blockchain does not have a traditional customer base. The company only focuses on making sure the pool is mining enough bitcoin so everyone can make a profit. The pool currently has three miners but is open to bringing more on board.

Management Team

Pacific Blockchain is led by Daniel Baker who has been bitcoin mining since 2017. He has made $250,000 in profit through mining bitcoin and is eager to expand his business. He recently connected with two other local bitcoin miners and they all decided to pool their resources together to ensure a higher rate of success. Daniel also holds an MBA from University of Washington which has given him the education and expertise to run a business.

Success Factors

Pacific Blockchain will be able to achieve success by offering the following competitive advantages:

- Management: The management team has extensive bitcoin mining experience which will be attractive to new bitcoin miners.

- Track record of success: Daniel Baker’s success with bitcoin has led to $250,000 in profits thus far.

Financial Highlights

Pacific Blockchain is currently seeking $450,000 to launch. Funding will be dedicated towards three months of overhead costs to include payroll of the staff, rent, and marketing costs. Specifically, these funds will be used as follows:

- Location design/build: $50,000

- Equipment purchase upkeep: $250,000

- Three months of overhead expenses (payroll, rent, utilities): $100,000

- Marketing costs: $25,000

- Working capital: $25,000

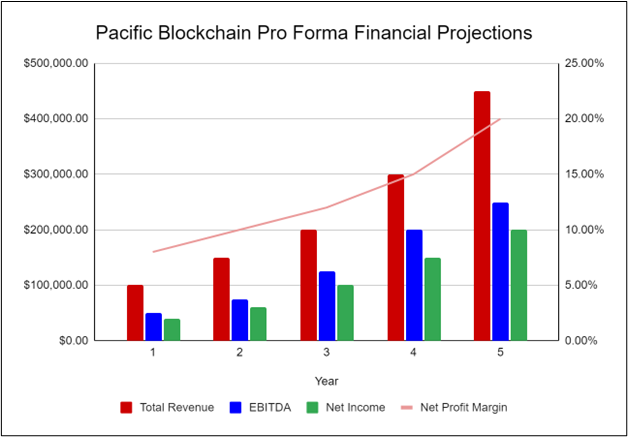

The following graph below outlines the pro forma financial projections for Pacific Blockchain.

Company Overview

Who is pacific blockchain, pacific blockchain history.

Daniel Baker incorporated Pacific Blockchain as an LLC. The business is currently being run out of Daniel’s home, but once the lease on Pacific Blockchain’s office location is finalized, all operations will be run from there.

Since incorporation, the company has achieved the following milestones:

- Found a business location and signed a Letter of Intent to lease it.

- Developed the company’s name, logo, and website.

- Determined equipment requirements

Pacific Blockchain Services

Industry analysis.

Cryptocurrency has completely transformed the finance industry and economy in a very short amount of time. Just a decade ago, few people understood cryptocurrency and even fewer establishments accepted it as a form of payment. Now there are millions of crypto-miners around the world and cryptocurrency is a widely accepted form of currency.

However, while a few years ago a home computer was enough to mine bitcoin and other cryptocurrencies, today the market is too competitive for normal computers to generate a meaningful profit. Therefore, there is increasing demand for more powerful equipment and for bitcoin mining farms and pools to form so miners can pool their resources together.

Cryptocurrency mining is a risky but highly rewarding revenue stream. This year, solving a block will earn a miner 6.25 BTC, which is roughly valued at $177K. A miner can earn a decent revenue from bitcoin, even if they only solve one or two blocks. However, due to the aforementioned competition, it is extremely difficult for any miner to earn substantial bitcoin. Therefore, it is important to collaborate with other miners and pool multiple rigs and other resources.

Despite what the critics say, bitcoin and other cryptocurrencies are here to stay. According to research the cryptocurrency industry was valued at $4.67 billion last year and is expected to expand at a compound annual growth rate (CAGR) of 12.5% over the next five years. This is a very high growth rate and shows that mining bitcoin is still a very profitable business.

Customer Analysis

Demographic profile of target market.

Pacific Blockchain will serve the miners that join its pool to mine bitcoin. Though the company is based in Seattle, Washington, we will open our pool to miners that live anywhere throughout the United States.

Customer Segmentation

The only customer segmentation that Pacific Blockchain will focus on is fellow bitcoin miners who are interested in joining the mining pool.

Competitive Analysis

Direct and indirect competitors.

Pacific Blockchain will face competition from other companies with similar business profiles. A description of each competitor company is below.

Riot Blockchain

Riot Blockchain is one of the top bitcoin mining companies in the world. Located in Rockdale, Texas, the company operates over 30,000 mining rigs and had a total of 4,884 BTC tokens in reserve at the end of 2021. In addition to running its own facilities, it also offers services and support to other large-scale mining businesses so they can take advantage of Riot’s proprietary infrastructure and establish their own farms.

Marathon Digital Holdings

Marathon Digital Holdings is another major competitor in the world of bitcoin. A former uranium and vanadium exploration business, this bitcoin mining company reportedly had reserves of 8,115 BTC at the end of 2021. Marathon has facilities located in South Dakota, Nebraska, Montana, and Texas and is committed to powering its facilities with renewable energy in the near future.

Cipher Mining

Cipher is the third major competitor of Pacific Blockchain. It is a fast-growing firm and has recently built its first facility in Alborz, Texas. It is expected to be a very successful firm, as it recently acquired 27,000 and 60,000 miners from Bitmain Technologies and SuperAcme Technologies respectively.

Competitive Advantage

Pacific Blockchain will be able to offer the following advantages over their competition:

- Community: Pacific Blockchain is a small bitcoin mining pool that offers community and support to new miners. This community is hard to find in larger firms that have thousands of miners.

Marketing Plan

Brand & value proposition.

Pacific Blockchain will offer the unique value proposition to its clientele:

- Extensive bitcoin experience

- A track record of success

- A welcoming community of fellow miners

Promotions Strategy

The promotions strategy for Pacific Blockchain is as follows:

Website/SEO

Pacific Blockchain will invest in developing a professional website that displays all of the features offered by the company. It will also invest in SEO so that the company’s website will appear at the top of search engine results.

Social Media

Daniel will create the company’s social media accounts and invest in ads on all social media platforms. The company will use targeted marketing to appeal to the target demographic.

Word of Mouth Marketing

Pacific Blockchain will encourage word-of-mouth marketing from loyal and satisfied miners.

All profits made through mining will be shared equally amongst the pool members. New miners who sign up with the pool will pay a 2% fee.

Operations Plan

The following will be the operations plan for Pacific Blockchain. Operation Functions:

- Daniel Baker is the owner of Pacific Blockchain. He will run the general operations and be the primary miner of bitcoin.

- Daniel is joined by Zachary Ertle and Walter Wright. Zachary and Walter are also seasoned miners who have earned substantial profit from bitcoin. They will contribute their equipment and resources and assist Daniel with bitcoin mining.

Milestones:

Pacific Blockchain will have the following milestones completed in the next six months.

- 05/202X – Finalize lease agreement

- 06/202X – Finish design and build out of office

- 07/202X – Purchase rigs and other equipment

- 08/202X – Kickoff of promotional campaign

- 09/202X – Launch Pacific Blockchain

- 10/202X – Successfully mine bitcoin

Financial Plan

Key revenue & costs.

Pacific Blockchain will gain its revenues from mining bitcoin. Due to the nature of bitcoin, revenues are unpredictable. As of April 2023, every time we complete a block, we earn 6.25 BTC which is roughly valued around $177K. Even if we only solve a few blocks each year, Pacific Blockchain can be extremely profitable.

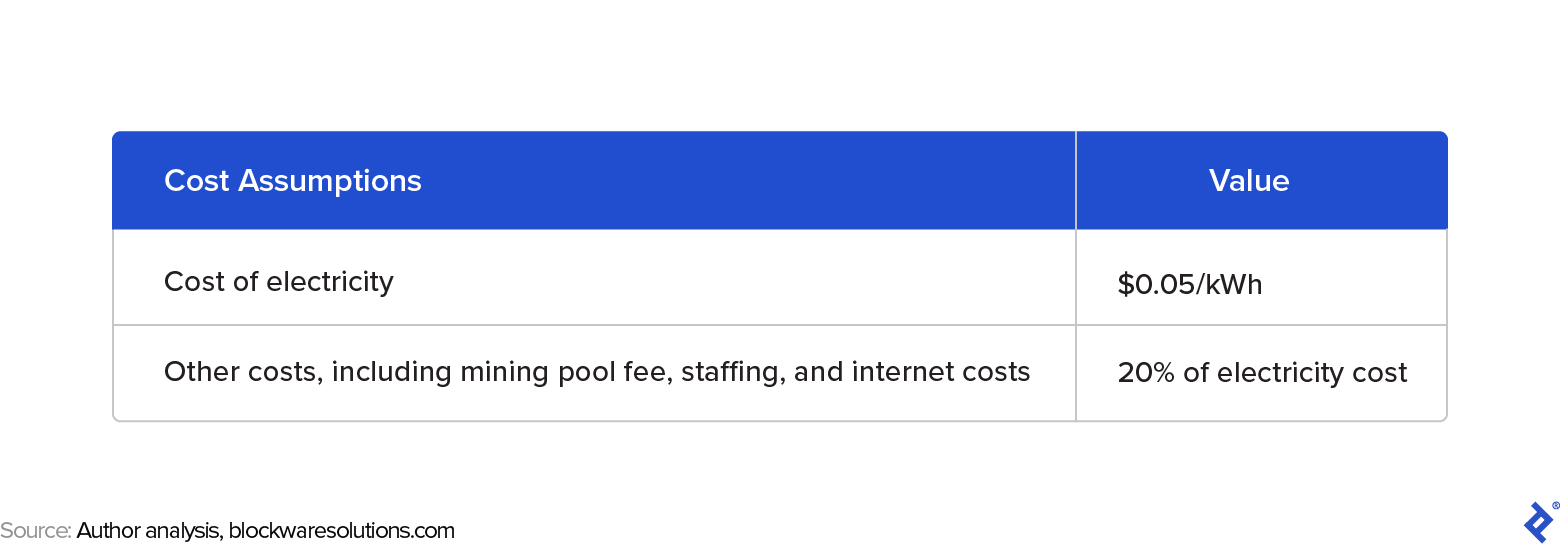

The primary cost drivers will include the cost of power consumption, the cost of equipment, employee salaries, and the lease.

Funding Requirements and Use of Funds

- Equipment purchase and upkeep: $250,000

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Average yearly bitcoin mined: 12.5 BTC

- Current value per BTC: $28,300

Financial Projections

Income statement, balance sheet, cash flow statement, bitcoin mining business plan faqs, what is a bitcoin mining business plan.

A Bitcoin mining business plan is a plan to start and/or grow your Bitcoin mining business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Bitcoin Mining business plan using our Bitcoin Mining Business Plan Template here .

What are the Main Types of Bitcoin Mining Businesses?

There are a number of different kinds of Bitcoin mining businesses , some examples include: Bitcoin mining validation, Bitcoin mining validation and minting, and Mining Pools.

How Do You Get Funding for Your Bitcoin Mining Business Plan?

Bitcoin Mining businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Bitcoin Mining Business?

Starting a Bitcoin mining business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Bitcoin Mining Business Plan - The first step in starting a business is to create a detailed Bitcoin mining business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your Bitcoin mining business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your Bitcoin mining business is in compliance with local laws.

3. Register Your Bitcoin Mining Business - Once you have chosen a legal structure, the next step is to register your Bitcoin mining business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your Bitcoin mining business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Bitcoin Mining Equipment & Supplies - In order to start your Bitcoin mining business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your Bitcoin mining business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Cryptocurrency Mining Business Plan: The Ultimate Guide To Writing Your Plan

Creating the perfect cryptocurrency mining business plan doesn’t take a genius.

But you do need to be careful, structured and creative in your approach.

You’ll need to keep a tight grip on your expenses, understand the mining hardware you’ll require and analyse your competitors.

This guide will teach you exactly how to write a cryptocurrency mining business plan that’s planned for success.

I’ve also included some useful templates, tips and a four stage process to getting started.

1. Why You Need A Cryptocurrency Mining Business Plan

Let’s be honest:

The world of cryptocurrency mining is competitive.

There are so many mining businesses competing against each other, it’s almost impossible to go at this alone.

Most of them are actually very small businesses !

And most don’t even have a business plan.

They’re not thinking ahead.

And that’s your opportunity to gain a headstart on your competitors.

Plus a cryptocurrency mining business plan will help you:

- Develop your profitability strategy

- Strategise the type of hardware you’ll require

- Keep a tight hold on the budgets (costs can quickly rack up)

- Analyse your competition and understand how you can beat them

- Understand your strengths, opportunities, weaknesses and threats

So let’s get into it.

2. A Cryptocurrency Mining Business Plan Will Evolve

It’s undeniable:

Your cryptocurrency mining business plan isn’t going to be an old document that gathers dust in the filing cabinet.

Far from it.

Just look at the way cryptocurrency mining has changed as an industry over the past few years.

A few years ago you could mine Bitcoin with a GPU:

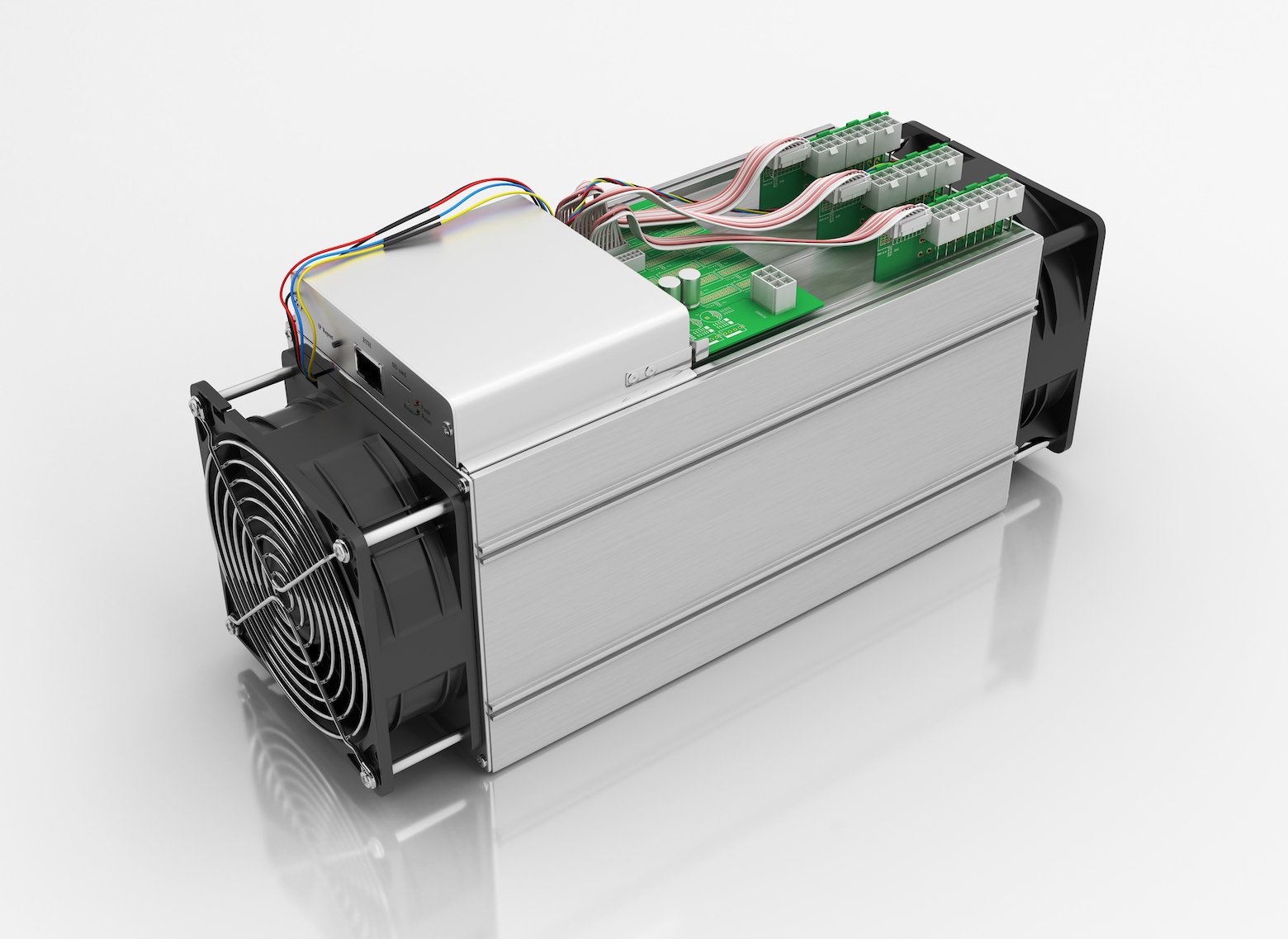

But now you need an expensive, powerful mining rig to be profitable.

And the thing is, cryptocurrency technology never stands still.

So that means you can’t afford to either.

If you want to stay one step ahead of your competitors, you have to keep adapting.

Plus you’ll need to keep your mining equipment , knowledge and operations well maintained.

You should keep tweaking your business as your operations grow.

You might need to add more cryptocurrencies into the mix, change your hardware or switch up your team’s skill sets.

This will also require more training and investment as the industry evolves.

So when I say your cryptocurrency mining business plan is going to change, I don’t mean you’ll have to rewrite it from scratch.

But you will have to carefully tweak it.

This is a living, breathing document that’s going to steer your business to success.

The best cryptocurrency mining business plan is the one that’s streamlined for maximum profitability in your industry.

3. Your Plan Will Steer Your Cryptocurrency Mining Business To Success

Your cryptocurrency mining business plan is like a compass:

Whilst it’s useful for mapping out the mining equipment, hardware and financial details of your business, it’s also ensuring you become accountable.

You will need to set goals, targets and objectives within the plan to ensure you stay on track.

This will also help you measure your progress too.

But also bear in mind that progress might not be linear – the world of cryptocurrency is volatile.

So your business might suffer some setbacks due to problems in the market, such as:

- Government regulations

- Changes in demand

- Total market capital

- New upgrades to the cryptocurrencies you’re mining

- Price manipulation

- Competitors

4. Free Cryptocurrency Mining Business Plan Templates

It’s always insightful to see how others are operating:

That way you can use these templates for inspiration.

Check out the free PDF documents below to find an example of cryptocurrency mining business plans.

Plus, if you’re a newbie to the crypto mining industry then you should compare your strategy with your competitors.

It’s important to note that with cryptocurrency, your strategy will change depending on the coin you’re going to mine.

You can download each of the free cryptocurrency mining business templates in PDF format below:

I’d recommend using one of these templates as the framework to your business plan:

That way you’re going to save time, whilst basing your project on an already successful mining strategy.

5. How To Write The Perfect Cryptocurrency Mining Business Plan

Part 1: executive summary.

Creating an executive summary is pretty easy.

But it’s also essential to your cryptocurrency mining business plan.

Here’s what you should summarise:

- Which cryptocurrencies you’re going to mine

- The conditions of the market you’re operating within

- The overall profit level and timelines you’re aiming to achieve

- Your market growth strategy

Some of this you won’t be able to write straight away.

So if you’re missing some details, wait until you’ve finalised your cryptocurrency mining business plan and then come back to it.

Part 2: Market Research

Now you need to research the market.

Because a solid cryptocurrency mining business plan relies on a strong analysis of current market conditions.

Let’s dive into the key considerations.

What Type Of Mining Will Your Business Do?

Not all cryptocurrencies are mined in the same way.

You can use different hardware to mine cryptocurrency – such as ASIC, GPU and CPU.

They all vary between:

- The amount of power they use

- How much they cost

- The type of cryptocurrencies they can mine

- The cost of maintaining them

- How much heat they let off (meaning you might need more cooling equipment)

Now let me explain each.

ASIC Mining

This is the most advanced type of cryptocurrency mining.

ASIC chips are expensive, but they’re also the most powerful.

Cryptocurrencies like Bitcoin can only be mined with an ASIC chip.

This also creates more complications to your cryptocurrency mining business plan because:

- You’ll need more expensive hardware

- You’ll need a powerful mining rig

- Some cryptocurrencies are ASIC resistant

- You need to have a lot of knowledge about how to optimise your ASIC hardware

- Competition in the ASIC mining world is the most heavily resourced

- ASIC mining generates a lot of heat

- ASIC mining rigs are large – so you’ll need to setup your mining business from a decent location

Overall, your cryptocurrency mining business needs a lot of resources, power and a large location to mine with ASIC Chip.

This is also known as a Graphic Processing Unit.

CPU cryptocurrency mining is probably the easiest of the lot.

But it’s also the least profitable.

You can CPU mine with very basic equipment – just a laptop and software will do.

Which Cryptocurrency Are You Going To Mine?

Make no mistake, picking your cryptocurrency of choice could make or break your business.

If you don’t factor in future cryptocurrency prices, you’re going to struggle.

For example, Bitcoin is almost unaffordable for most cryptocurrency mining businesses to mine right now.

Whereas Ethereum might be a better option.

Plus, some cryptocurrencies can only be mined with certain hardware:

E.g. Monero can be mined with CPU but not with ASIC (because it’s ASIC resistant).

Who Are Your Top Competitors?

Depending on the cryptocurrency you’re trying to mine, you could face a lot of competition .

After all, you’re trying to solve cryptographic algorithms on the blockchain before anyone else.

But your competition is going to vary depending on which industry you’re working within.

So when you’re creating your cryptocurrency mining business plan, you should analyse:

- The resources your competitors have

- Where they’re located

- If they’re a direct competitor or a substitute product – e.g. a mining pool vs individual cryptocurrency miners

- How successful they are

- Whether you can realistically compete with them

Future Predictions

Cryptocurrency mining is a fast paced world.

Because prices are volatile, it’s a 24/7 market and there’s very little barriers to entry.

So what does the mean for you?

Well, you need to estimate the state of the mining industry over the next 3-5 years.

This could save your business a lot of frustration and money along the way.

For example, if you’d mined Bitcoin last year, it could have cost you thousands of dollars .

If you’d sold in December 2018, you’d have been profitable.

If you sold in February 2018, you might not have.

So the value of your mining business is constantly fluctuating with market prices.

Another example is electricity prices:

Mining cryptocurrency requires a lot of energy – both from your hardware and keeping your hardware cool.

But the cost of electricity is rising substantially in the western world.

If your electricity bills are higher than the value of the cryptocurrency assets you’re mining, you’re not going to break even.

And that’s a major threat to your business.

SWOT Analysis Of The Mining Industry

A SWOT analysis plays a major role in the success of your cryptocurrency mining business plan.

So it’s crucial to be thorough here.

You have to understand:

- Strengths : What are the unique internal competitive advantages your business has? It could be your resources, technical knowledge or your team

- Weaknesses : What weaknesses could hurt your business? E.g. Your lack of experience

- Opportunities : These are the external factors that could help make your mining business become profitable. Opportunities include an inflation in cryptocurrency prices, where your crypto assets would rise in value.

- Threats : The factors you can’t control within the mining/cryptocurrency industry that may harm your business. This includes regulations, legislation and hackers.

Part 3: Growth Strategy And Scaling Up

Your growth strategy is a vital part of the cryptocurrency mining business plan.

Because you need to think about scaling up your operations, if you truly want to become profitable.

So will you have a huge mining farm?

Or just a small but efficient mining rig?

It’s all about economies of scale:

The more buying power you have, the better results you can get – meaning more profitability.

Let’s look at a few examples:

- If you use a mass amount of power, you might be able to get a discount on electricity rates

- Buying hardware in bulk is cheaper

- Pooling your resources together will help you earn mining rewards faster

Here’s some other key considerations.

Are You Going To Hire A Team?

If you want to scale up, are you going to hire a team to manage your mining company?

The other benefit of hiring a team is that they might have more experience and expertise than you.

So you can tap into their cryptocurrency mining knowledge.

And that’s a powerful competitive advantage.

How Many Cryptocurrencies Will Your Business Mine?

Some giant mining corporations mine millions of tokens, across dozens of cryptocurrencies.

But others will focus on mining just one coin.

This really depends on your financial resources and the size of the team you’ve hired.

Will You Use A Mining Pool?

Mining pools are where a huge network of cryptocurrency miners will pool together to share their hash power.

This means they can earn rewards faster, and then share those rewards across the pool.

But also, some mining pools are more reputable than others.

What Hardware Do You Need?

Will you buy individual equipment, or will you develop a huge mining rig instead.

And are you going to mine via ASIC, CPU or GPU equipment?

What’s The Best Location For Your Business?

Electricity prices vary by country.

For example, most Bitcoin miners are based in China.

Some countries have even banned cryptocurrency mining, which means less options when it comes to your location.

Cryptocurrency Regulations

You need to be legally compliant as a business.

So what legislation does your business need to comply with?

For example, is cryptocurrency legal in the country you’re operating within?

Part 4: The Financial Aspects of A Cryptocurrency Mining Business Plan

The financial elements of a cryptocurrency mining business plan are a little more complex than most businesses.

Just a tiny tweak can be a game-changer for your company’s profitability.

So what are the key things you need to consider?

What’s Your Budget?

First of all, you should have a clear idea of how much spending power you can tap into.

Because cashflow is the oxygen of any mining business.

E.g. If you can’t afford the electricity bills, you’re going to struggle.

So tied into your budget, you’re going to have expenses.

Mining cryptocurrency requires a lot of resources.

The main expenses for your business will be:

- Buying hardware

- Paying your electricity bills

- Renting a location

- Your staff’s salaries

- Transaction fees

- Maintenance of hardware

Break-Even Point

It’s going to take more resources and power to mine some cryptocurrencies than others.

I’d recommend looking at a cryptocurrency mining calculator.

Then you can plug in your key numbers and work out your break-even point.

Taxation rules normally are tricky enough.

But getting your head around cryptocurrency mining taxation is even harder.

This is going to vary location by location e.g. the US is really cracking down on taxing cryptocurrency miners and traders.

So it’s important to research tax legislation yourself, whilst also hiring an specialist crypto mining accountant.

You’ve worked out your expenses, your break even point and your budget so far.

Now it’s time to plot those numbers on a timeline.

Depending on your business goals, you could be planning ahead for 5+ years.

But also understand that this technology is evolving so much, your financial predictions could be way off.

This all comes down to the crypto market’s growth.

Essentially your cryptocurrency mining business plan should work by year:

- Your financial figures for each year

- In which year you’ll break even

- And when you’ll finally become profitable

More To Explore

The Ultimate Tax Solution with Crypto IRAs!

Over the past decade, crypto has shifted dramatically, growing from a unique investment to a significant player in the financial sector. The recent rise of

Your Guide To Overcoming Alcoholism and Transforming Your Life

Alcoholism is a condition that can stealthily take hold of one’s life, affecting not only the individual but also their loved ones. It’s a complex

How To Create a Digital Coin Mining Farm Business Plan: Checklist

By henry sheykin, resources on digital coin mining farm.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

In recent years, the digital coin mining industry has seen exponential growth, with an increasing number of individuals and businesses venturing into the world of cryptocurrencies. According to recent statistics, the global cryptocurrency market was valued at over $1.03 billion in 2020, and it is expected to reach a staggering $1.40 billion by 2027. This remarkable growth offers exciting opportunities for entrepreneurs looking to establish a digital coin mining farm.

Before diving into this lucrative industry, it is crucial to have a well-crafted business plan in place. This blog post will provide you with a comprehensive checklist of nine essential steps to help you write a business plan for your digital coin mining farm.

Step 1: Research the digital coin mining industry and market trends

Step 2: Define the target market and identify potential customers

Step 3: Conduct a competitive analysis

Step 4: Determine the legal and regulatory requirements

Step 5: Define the location and infrastructure requirements

Step 6: Estimate the initial investment cost

Step 7: Calculate the potential revenue and profitability

Step 8: Develop a marketing and sales strategy

Step 9: Create a team and identify key personnel

By following these nine steps, you will be well on your way to crafting a solid business plan that can guide your digital coin mining farm towards success. So, let's dive deeper into each of these steps and get started on your entrepreneurial journey in the world of digital coin mining!

Research The Digital Coin Mining Industry And Market Trends

Before starting a digital coin mining farm, it is crucial to thoroughly research the digital coin mining industry and stay up-to-date with the latest market trends. This research is vital to gaining a comprehensive understanding of the industry's dynamics and making informed decisions for your business. Here are some key areas to focus on:

- Blockchain technology and its impact on digital coin mining

- The evolution of digital coins and their market demand

- Mining algorithms and hardware requirements for different cryptocurrencies

- Current market conditions and projections for future growth

- Regulatory and legal developments in the cryptocurrency industry

- Emerging trends in mining techniques and software tools

Tips for researching the digital coin mining industry and market trends:

- Join industry forums and communities: Engage with experts, miners, and enthusiasts in digital coin mining forums to stay updated on the latest news, trends, and insights.

- Read reputable online publications: Regularly follow websites, blogs, and magazines focused on cryptocurrencies and blockchain technology for in-depth articles and analysis.

- Network with professionals: Attend conferences, seminars, and networking events to connect with industry professionals and learn from their experiences and expertise.

- Monitor social media: Follow influential figures and reputable organizations in the digital coin mining industry on social media platforms to receive real-time updates and insights.

By conducting thorough research on the digital coin mining industry and market trends, you will be equipped with the knowledge and insights necessary to make informed decisions and adapt to the ever-changing landscape of the cryptocurrency industry.

Define The Target Market And Identify Potential Customers

Identifying the target market is a crucial step in developing a successful business plan for a digital coin mining farm. By understanding the specific market segment you are targeting, you can tailor your strategies and offerings to meet their needs and preferences.

To define your target market , start by conducting thorough research on the cryptocurrency industry and its potential customer base. Consider factors such as demographics, psychographics, and behaviors of individuals and businesses involved in cryptocurrency investments and mining.

- Demographics: Identify the age, gender, income level, and geographical location of potential customers. This information will help you understand who your target audience is and how to position your mining farm accordingly.

- Psychographics: Dig deeper into the motivations, interests, and values of your target market. Understand their attitudes towards cryptocurrency, their risk appetite, and investment goals.

- Behaviors: Analyze the behaviors of potential customers in terms of their purchasing habits, online presence, and preferred platforms for cryptocurrency trading. This will help you determine the most effective channels to reach and engage with them.

Once you have defined your target market, it is important to identify specific customer segments within that market. These segments may include individual investors, businesses seeking cryptocurrency diversification, or organizations looking for consulting services.

- Consider conducting surveys or interviews with potential customers to gather insights directly from the target market.

- Use social media listening tools to track conversations and sentiments related to cryptocurrency investments and mining.

- Stay updated on industry news and trends to identify emerging customer segments or shifts in market demands.

- Collaborate with industry influencers or thought leaders to gain visibility and credibility within your target market.

Conduct a Competitive Analysis

Conducting a competitive analysis is crucial in understanding the digital coin mining industry and positioning your mining farm for success. By evaluating your competitors' strengths, weaknesses, and strategies, you can develop a unique selling proposition and gain a competitive edge.

In researching your competitors , examine their mining operations, hardware and software technologies, energy consumption, pricing strategies, and overall business models. This information will provide valuable insights into best practices and potential areas for improvement.

Once you have gathered data on your competitors, analyze and compare their offerings to pinpoint potential opportunities. Identify any gaps in the market that your mining farm can fill, whether it's providing enhanced security measures, more efficient mining processes, or offering specialized consulting services.

Tips for conducting a competitive analysis:

- Include both direct competitors (other mining farms) and indirect competitors (alternative investment options).

- Regularly monitor competitors' websites, social media channels, and industry publications for updates and announcements.

- Consider attending industry conferences and events to network with professionals and gain further insights into the market.

- Utilize online tools and resources to gather information on market share, customer reviews, and competitor pricing.

By conducting a comprehensive competitive analysis, you can identify gaps in the market, differentiate your mining farm, and develop strategic initiatives that will attract customers and drive profitability.

Determine The Legal And Regulatory Requirements

When establishing a digital coin mining farm, it is crucial to understand and comply with the legal and regulatory requirements governing the cryptocurrency industry. Failure to do so can lead to legal issues and financial penalties. Here are the steps to determine the legal and regulatory requirements for your mining farm:

- Research local laws and regulations: Start by researching the laws and regulations specific to your country or region. Cryptocurrency regulations can vary significantly across jurisdictions, so it is important to understand the legal framework that applies to your mining operations.

- Consult with legal professionals: To ensure compliance with the complex and evolving regulatory landscape of the cryptocurrency industry, it is advisable to consult with legal professionals experienced in this field. They can provide expert guidance and help you navigate any legal challenges that may arise.

- Obtain necessary licenses and permits: Depending on your location, you may be required to obtain certain licenses and permits to operate a digital coin mining farm legally. These licenses can include business licenses, permits for electricity usage, and any specific licenses required by local financial authorities.

- Comply with tax obligations: Cryptocurrency operations often have tax implications. Make sure to understand and fulfill your tax obligations, including reporting and paying applicable taxes on your mining activities and any profits generated. Consult with tax professionals who specialize in cryptocurrency taxation to ensure compliance.

Tips for Determining Legal and Regulatory Requirements:

- Stay updated on regulatory changes: The cryptocurrency industry is constantly evolving, and regulations can change rapidly. Stay informed about any updates or changes to legal requirements that may impact your mining operations.

- Engage in transparent and compliant practices: Building a solid reputation by operating transparently and adhering to regulatory requirements will help establish trust with customers, partners, and regulators.

- Consider the international landscape: If you plan to operate globally or serve international customers, it is crucial to consider the legal and regulatory requirements in those jurisdictions as well. This may involve understanding tax obligations, licensing requirements, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Define The Location And Infrastructure Requirements

When establishing a digital coin mining farm, finding the right location and ensuring the appropriate infrastructure is crucial for efficient and successful operations. Here are some key factors to consider:

- Electricity Supply: The availability of a stable and affordable electricity supply is essential, as mining operations consume significant amounts of power. Research and identify locations with reliable electricity infrastructure and consider the cost of electricity in the area.

- Cooling and Ventilation: Mining equipment generates a considerable amount of heat. Therefore, it is crucial to have a well-designed cooling and ventilation system to maintain optimal temperatures and prevent overheating. Consider locating the mining farm in an area with a climate suitable for cooling, or invest in advanced cooling solutions such as immersion cooling.

- Internet Connectivity: A stable and high-speed internet connection is essential for uninterrupted operations and efficient communication with mining pools and cryptocurrency exchanges. Ensure that the location has access to reliable broadband internet service providers.

- Physical Security: Given the high value of mining equipment, it is important to prioritize the physical security of the mining farm. Look for locations with appropriate security measures such as gated access, CCTV surveillance, and on-site security personnel.

- Space and Expansion: Consider the size of the location and whether it can accommodate the desired number of mining rigs. Additionally, assess the potential for future expansion to accommodate scalability and growth.

- Environmental Considerations: Depending on the location, there may be environmental factors to consider, such as local regulations on noise levels or emissions. Ensure compliance with any applicable environmental regulations.

- Consult with electrical engineers or experts to assess the electrical capacity and requirements for your mining farm.

- Consider the proximity of the location to mining equipment suppliers and maintenance services to facilitate easier equipment procurement and maintenance.

- Research local regulations and zoning laws to ensure compliance with any specific requirements for operating a mining farm in the chosen location.

By carefully considering the location and infrastructure requirements, you can establish a mining farm that maximizes efficiency, security, and profitability in the digital coin mining industry.

Estimate The Initial Investment Cost

Estimating the initial investment cost is crucial to determine the financial feasibility of your digital coin mining farm. It is important to consider various factors that will contribute to the overall cost and ensure that you have a realistic financial projection.

Here are some important points to consider when estimating the initial investment cost:

- Hardware and Equipment: Research and identify the mining hardware and equipment you will need to establish and operate your mining farm. Consider factors such as the number of mining rigs, ASIC miners, GPUs, cooling systems, power supply units, and networking equipment. Each of these components will contribute to the overall investment cost.

- Software and Technology: Determine the software and technology solutions that are essential for the smooth functioning of your mining farm. This may include mining software, network monitoring tools, security systems, and other software platforms that ensure efficient mining operations. Research and consider both the upfront and ongoing costs associated with these solutions.

- Infrastructure and Facility: Assess the infrastructure requirements for your mining farm, including the physical space, electrical setup, cooling systems, and internet connectivity. Estimate the cost associated with setting up and maintaining these facilities.

- Operating Expenses: Consider the ongoing expenses involved in running a digital coin mining farm. This may include electricity costs, maintenance and repairs, insurance, taxes, and other operational expenses. Calculate these expenses based on your estimations and market research.

- Consult with industry experts or experienced miners to get a realistic estimate of the hardware and equipment costs.

- Consider the scalability of your mining farm when estimating the initial investment. Plan for future expansion and potential upgrades.

- Keep track of the constantly evolving technology and market trends that may affect the cost of equipment and infrastructure.

- Factor in any legal and regulatory fees associated with operating a mining farm in your chosen location.

- Include a buffer for unforeseen costs or contingencies in your budget to ensure financial stability.

Estimating the initial investment cost for your digital coin mining farm requires thorough research, careful planning, and a realistic assessment of the various factors involved. By considering these important points and applying diligent financial analysis, you can develop a solid understanding of the financial requirements necessary to establish and operate your mining farm successfully.

Calculate The Potential Revenue And Profitability

When starting a digital coin mining farm, it is crucial to calculate the potential revenue and profitability to determine the feasibility of your business idea. This step involves analyzing various factors that contribute to the profitability of your mining operations.

1. Determine the mining efficiency: Assess the efficiency of the mining hardware and software you plan to utilize. Consider factors such as hash rate, power consumption, and maintenance costs. This information is crucial for estimating the amount of cryptocurrency you can mine and the associated costs.

- Research and choose mining hardware and software that offer high efficiency to maximize your mining output.

- Consider the ongoing costs of electricity and cooling when estimating profitability.

2. Determine the current market value: Keep track of the market value of the cryptocurrencies you plan to mine. The value of cryptocurrencies is highly volatile, so it is essential to stay informed about the current market trends. Research various platforms and exchanges to understand the potential selling price of your mined coins.

- Consider diversifying your mining operations by targeting multiple cryptocurrencies to reduce the risk associated with price fluctuations.

- Stay updated with industry news and events that may impact the market value of cryptocurrencies.

3. Calculate the revenue: Once you have determined the mining efficiency and market value, you can estimate the potential revenue. Multiply the estimated amount of cryptocurrency you can mine with the current market value to calculate the revenue per time period (e.g., per day, per week, or per month).

4. Consider the operating expenses: Running a digital coin mining farm incurs various costs, including electricity, cooling, maintenance, and operational overheads. Deduct these expenses from your estimated revenue to obtain the net revenue.

5. Assess the profitability: Compare the net revenue with your initial investment cost and ongoing expenses to determine the profitability of your mining farm. Factors such as equipment depreciation, cryptocurrency exchange fees, and market fluctuations should be taken into account when assessing profitability.

By diligently calculating the potential revenue and profitability, you can make informed decisions about the viability of your digital coin mining farm. It is essential to revisit these calculations periodically to adjust your strategy and ensure ongoing profitability.

Develop A Marketing And Sales Strategy

Developing a robust marketing and sales strategy is essential for the success of your digital coin mining farm. It will help you attract and retain customers, create brand awareness, and generate revenue. Here are some key steps to consider:

- Identify your target audience: Determine who your ideal customers are, whether they are individuals looking to invest in cryptocurrency or businesses seeking mining services.

- Understand their needs and preferences: Conduct market research to gain insights into what your target audience is looking for and their preferred methods of engagement.

- Build brand awareness: Utilize various marketing channels such as social media, content marketing, and search engine optimization to establish your brand and educate potential customers about the benefits of digital coin mining.

- Create a compelling value proposition: Clearly communicate the unique advantages of mining with your farm, such as advanced technology, high mining efficiency, and potential profitability.

- Develop a pricing strategy: Determine competitive and profitable pricing for your mining services, considering factors such as energy costs, mining hardware expenses, and market rates.

- Establish strategic partnerships: Collaborate with other businesses in the cryptocurrency industry, such as cryptocurrency exchanges or hardware manufacturers, to enhance your credibility and gain access to a wider customer base.

- Utilize targeted advertising: Invest in online advertising campaigns targeting individuals and businesses interested in cryptocurrency investments and mining. Consider platforms like Google Ads, social media ads, and cryptocurrency-related websites.

- Regularly monitor industry trends and adjust your marketing strategy accordingly.

- Offer incentives such as referral programs or discounts to attract and retain customers.

- Utilize email marketing to keep customers informed of updates, new services, and potential investment opportunities.

- Host webinars or workshops to educate potential customers about the benefits and process of digital coin mining.

By developing a comprehensive marketing and sales strategy, you can effectively promote your digital coin mining farm, attract customers, and position yourself as a reliable and profitable option in the cryptocurrency industry.

Create A Team And Identify Key Personnel

Building a team for your digital coin mining farm is crucial to ensure the smooth and successful operation of your business. Identifying and selecting key personnel who possess the necessary skills and expertise is essential for maximizing efficiency and productivity. Here are some key considerations when creating your team.

- Clearly define roles and responsibilities: Clearly define the roles and responsibilities of each team member to avoid any confusion or overlap of tasks. This will help create a structured and efficient work environment.

- Look for technical expertise: Look for individuals who have a strong background in digital coin mining, blockchain technology, and cryptocurrency. Their technical expertise will be invaluable in maintaining and optimizing your mining operations.

- Consider hiring IT professionals: Since digital coin mining heavily relies on advanced hardware and software, hiring IT professionals with experience in network security, data management, and system maintenance is crucial to ensure the security and stability of your mining farm.

- Utilize online platforms and communities: Reach out to online platforms and communities dedicated to digital coin mining to find potential team members who share your passion and expertise in the field.

- Consider partnerships and collaborations: Explore the possibility of partnering with other mining farms or technology companies to strengthen your team and pool resources to achieve greater success.

- Continuously invest in training and development: As the digital coin mining industry is ever-evolving, it is essential to invest in the professional development of your team members. This can be done through training programs, conferences, and workshops to keep them up-to-date with the latest trends and advancements in the field.

By creating a dedicated team and identifying key personnel with the necessary skills and expertise, you can build a strong foundation for your digital coin mining farm and position your business for long-term success in the cryptocurrency industry.

In conclusion, establishing a digital coin mining farm requires careful planning and consideration of various factors. By following the steps outlined in this checklist, entrepreneurs can develop a solid business plan that lays the foundation for success in the cryptocurrency industry.

$169.00 $99.00 Get Template

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

Home » Tips and tricks » Bitcoin Mining Business Plan: How to Make One

Bitcoin Mining Business Plan: How to Make One

Published: april 19, 2024 | last updated: march 23, 2024.

Fact Checked By Markos Koemtzopoulos

This post teaches you how to set up a Bitcoin mining business plan.

It is commonly said that if you don’t plan, then you’ve planned to fail. Every business needs a plan, Bitcoin mining operation is no exception.

Since the Bitcoin mining business has a very wide scope, I am not going to dwell on creating a business plan template for you but rather focus on what makes up such a template. With this knowledge, you will be able to create your own Bitcoin mining business plan that is customized to your specific needs. In case you decide to use a template, you will be able to know what to look for in a good template and how to customize it to your unique Bitcoin mining venture.

Before you move on make sure you understand what Bitcoin is and how it works .

Why have a Bitcoin mining business plan?

This is the most fundamental question that you must answer before anything else. The answer will determine a lot; including factors to consider, the key elements of the plan, and the format that the plan will take.

Whichever the reason, a Bitcoin mining business plan enables you to undertake careful planning of your Bitcoin mining operation. This way you will avoid costly mistakes and common pitfalls that cause most businesses to fail.

Factors to consider in coming up with a Bitcoin mining business plan

A successful crypto-mining business plan is guided by various factors. The following are some of the most significant factors that you need to consider:

1. The purpose

Who is your target audience? Why are you targeting that audience? What do you aim to achieve by that targeting? The answer to these questions will help you formulate the purpose of your Bitcoin mining business plan.

For example, a business plan targeting financiers will be slightly different from that targeting potential investors. Similarly, a business plan targeting business owners will differ from that targeting senior managers.

2. The business model

Any Business venture is based on a certain business model. The following are the main business models for a typical Bitcoin mining venture:

(a) The extraction model

The term ‘extraction’ is commonly used in the mining process to refer to the initial stages of getting the minerals (raw materials) off the ground.

In the Bitcoin mining process, this refers to the actual process of solving a given hash function using the SHA-256 hashing algorithm.

(b) The service provision model

Not all Bitcoin mining businesses engage in the extraction process. Some are engaged in services that support extraction such as purifying (proofing), transformation (tumbling), storage (wallets), advisory consultancy, software development, etc.

Some other services include hosting the rigs, managing the rigs, building the rigs, servicing the rigs, monitoring the extraction process, etc.

Thus, a business plan for a service provision model will materially differ from a business plan for the extraction model.

(c) Hybrid model

This is a combinational model. It encompasses both extraction and service provision. If your business enterprise is based on the hybrid model, then it will have a more complex business plan.

3. The legal model

What kind of legal entity is your Bitcoin mining venture? This is very important as it has financial implications, including tax costs and tax benefits. Your chosen legal model should give due consideration to the local laws and the regulatory compliance requirements.

The three main legal models are:

(a) Sole proprietorship

If you are planning to run your business as an individual, that is, without sharing ownership with someone else, then that will be a sole proprietorship. This model is adopted by solo miners.

The sole proprietorship has fewer legal considerations compared to the two other legal models. For example, in most jurisdictions, you don’t have to register your business venture since it will be carried out under your name. However, it does have significant financial implications since you are going to bear the financial risk and reward alone.

(b) Partnership

In case you want to run your business as a joint venture, that is, to share ownership with someone else, then that is a partnership. For a joint venture, it is a good idea for crypto miners to join a mining pool.

While a partnership has more legal considerations than a sole proprietorship, it does have far less legal considerations compared to a limited liability company. However, unlike the two, the potential risk of conflict negatively affecting the business is higher.

The financial risk is shared thus less burden on a single person.

(c) Limited liability company

If you are neither in favor of a sole proprietorship nor a partnership, you can form a limited liability company.

Traditionally, a limited liability company had two or more persons. However, in some jurisdictions, such as some States in the United States, a single person can form a limited liability company.

The primary distinction between a limited liability company and the rest is the legal requirements. For example, you don’t have to register a sole proprietorship or a partnership. However, you must register a limited liability company with the respective government agency. Thus, you have many legal considerations to make. The complexity of the requirements is such that you may need the professional services of a lawyer.

Key elements of a Bitcoin mining business plan

A Bitcoin mining business plan has the following key elements:

1. Executive Summary

This summary is intended to be consumed by key decision-makers who may not have time to go through the entire business plan.

The Executive Summary captures the key takeaways from each section of the business plan. In the case of Bitcoin mining operation, these key takeaways include the primary cost drivers such as energy costs, cost-saving opportunities such as tapping into cheap energy from renewable energy sources, the main potential risk factors such as financial risk due to legal issues, and revenue drivers such as the projected price of Bitcoin in comparison to its past performance, and Bitcoin reward trends, among others.

A quick overview of the financial projection for key investments, the operational costs projection, and the marketing strategy designed to achieve projected revenues are also important components of the Executive Summary.

2. Company Overview

This section introduces the Bitcoin mining company to key stakeholders. These stakeholders include business owners, potential investors, financiers, suppliers, and others.

A company overview is a summary of the company’s profile covering the company’s history, its progress over time, and key milestones achieved. It also covers the company’s vision, mission, goals, and core objectives.

The Company overview also offers a glimpse into the company’s future position and the underlying factors that are going to enable it to achieve that position (vision).

3. Background Analysis

This analysis is based on current and historical data. The primary objective is to provide an insight and understanding of the current state of affairs of the environment in which the Bitcoin mining company is being established or run.

(a) Industry analysis

This provides an analytical outlook of the entire industry to which the business venture belongs. In this case, the industry is the cryptocurrency mining industry.

This analysis covers both the qualitative and quantitative aspects. The qualitative aspects include industry regulators’ policy, government policy, perspectives from key players, legal issues, public sentiments, and the future outlook.

The quantitative aspects include key metrics such as market share, growth rate, economic impact in terms of contribution to GDP, employment statistics, customer numbers, trade volumes, etc.

(b) Market analysis

A business venture is market-driven. Thus, market analysis should be granted topmost priority. All plans and budgets should be based on the outcome of a proper market analysis.

Market analysis should enable you to determine your target market and derive an appropriate marketing strategy.

The following are the different components that form market analysis:

(i) Customer analysis

The purpose of customer analysis is to identify existing and potential customers. The following are important things to consider when carrying out customer analysis:

- Customers’ needs, wants, and preferences

- Consumer economics, including consumer behavior

- Changing trends in consumer behavior

- Impact of price changes on consumer demand

(ii) Product analysis

This analysis focuses on the position of the product in the target market. The important things to consider include:

- Product-market fit – this includes how the product meets the consumer demand

- Brand impact – this includes brand recognition, brand ranking in the market, and brand loyalty among others.

- Product development lifecycle – establishing the product lifecycle and defining the product attributes and characteristics at each stage in the cycle and the expected response from the target market at that particular stage.

(iii) Competitiveness analysis

This is a cross-sectional comparative analysis that involves various Bitcoin mining companies that are considered actual or potential competitors.

Competitive analysis is aimed at assessing how the Bitcoin mining company is positioned in the market compared to similar business establishments.

This competitiveness analysis reviews product mix, value proposition, pricing policy, market share, and profitability, among others.

4. Strategic plan

A strategic plan is a kind of plan that is geared towards actualizing your mining business goals and objectives.

The strategic plan is a combination of various plans. These include:

(a) Marketing plan

The first step in coming up with a strategic plan is to derive a marketing plan. This is because other components of a strategic plan such as operations plan, organizational plan, and financial plan depend on it. A marketing plan focuses on the means and ways of generating revenue. Beyond the initial investment and startup costs, the sustainability of a business venture requires financing from revenue generation. Thus, deriving a marketing plan is the most important consideration to make.

(b) Operations plan

This plan is geared towards ensuring that the Bitcoin mining operation not only runs smoothly but meets intended objectives.

(c) Organizational plan

This plan focuses on how to manage processes and resources in an efficient and effective way so that strategic goals and objectives are met.

(d) Financial plan

Financial projections are extremely important in establishing any business venture. These projects not only include the initial investment and startup costs but also the cost of sustaining the investment and running the Bitcoin mining operation.

The following are the key elements of a financial plan:

(i) Asset finance plan

The kind of assets that you will need depends on the scale of your Bitcoin mining operation. Large-scale mining operations such as those carried out on Bitcoin mining farms will require more asset financing than a small-scale mining operation.

Furthermore, the capacity and productivity of a given mining equipment will determine how much financing you will need.

When it comes to Bitcoin miners, ASIC miners are the most ideal. This is due to the extremely high mining difficulty factor on the Bitcoin network which makes the use of CPU and GPU miners unviable and unprofitable.

To get the best value for your money, the following are important things to look out for in your mining equipment:

Mining hardware cost and specifications

Generally, the higher the mining hardware specifications, the costlier the hardware. A high-performance mining rig will cost more. However, it is more likely to be cost-effective in terms of hash rate and computing power.

Mining software cost and specifications

While most crypto mining equipment comes with its own mining software, you may need other pieces of software for operational management purposes.

(ii) Capital finance plan

Financing your startup, investment, and operations is an important consideration in making sure that your business venture not only survives but also prospers.

The following are key elements of an effective capital finance plan:

Startup capital finance plan

This plan is aimed at financing startup costs.

Investment finance plan

The purpose of this plan is to finance investment costs. For Bitcoin mining, investing in renewable energy sources that provide low-cost electricity is an important consideration. This will not only drive down energy consumption but also have a low carbon footprint.

Operations finance plan

This plan aims to finance running costs. These are the operational costs incurred in running your Bitcoin mining venture. The following are some of the major running costs:

- Electricity costs – for a mining operation, electricity costs are by far the biggest running costs. Thus, a sound financial plan should incorporate measures required to incrementally reduce electricity consumption. This may include planning to acquire a high-performance mining rig that is more energy efficient, though capital intensive.

- Labor costs – Large-scale mining operations such as those carried out on Bitcoin mining farms are not only capital-intensive but also labor-intensive. While you may not need many employees like in a typical factory or mining industry, you nonetheless, need a highly-skilled workforce that will demand high wages. Thus, you need to plan how to finance this expensive labor cost.

- Repairs and maintenance costs – Tear and wear are common for any machine that runs 24/7 nonstop, such as the Bitcoin mining rigs. These costs can be high for large-scale Bitcoin mining farms.

- Management costs – Large-scale Bitcoin mining farms require highly skilled and experienced technical managers. Also, it may incur significant costs for monitoring and controlling such large-scale mining operations.

(iii) Liabilities plan

You can hardly finance a significant business venture by relying on your savings and revenues. Thus, you will need to finance some of your investments and operations using debt. An effective liabilities plan will ensure that you not only get the best value for your loan but also employ your loan in the most effective and impactful way.

8 Best Bitcoin Mining Hosting Solutions Compared

With so many hosting solutions available, it can be difficult to determine which one is the best fit for your mining operations. Which one do you trust and does it really make sense to outsource your machines to them or will they scam you? In this review, I will look at the top Bitcoin mining hosting providers. I will tell you the pros and cons of each so that you can make your own decision about which one best suits your needs. Continue reading .

Learn About a New Coin Every Week

Elemental crypto © copyright 2024, master crypto basics.

Join over 7,300 subscribers. It’s free.

- DigitalCoinPrice

How to Start a Crypto Mining Business?

By Vaibhav Borkar , Updated On January 31, 2022

16 mins read

Table of Content

The rise in cryptocurrency trading has led to the establishment of many crypto-mining companies in different parts of the world. Miners are a critical part of the crypto business because they verify data blocks on the blockchain. While crypto mining is costly and risky, it’s rewarding in the long run for investors who succeed and get rewarded with crypto tokens. As of August 2021, Bitcoin mining was one of the most profitable businesses globally. If you are looking to venture into this industry, here are some tips to guide you.

Tips to Start a Crypto Mining Business

Have a plan.

For your crypto mining company to be profitable, you need to have a plan. As of 2021, there were more than 4,000 digital currencies in circulation. Therefore, you need to decide which cryptocurrencies you’ll be mining. Draft a business plan and map out all the details and costs of running the crypto mining company. The plan should break down how you intend to make your business profitable. Also, write down whether you’ll start a sole proprietorship or a limited company.

Plan Your Finances

In previous years, crypto mining was not too complex; it could easily be done with a home computer. However, in recent times, the computations are performed using sophisticated hardware which is costly. Therefore, you need to create a budget to cover all the operating expenses.

Miners need a lot of capital to invest in processing power and electricity to handle and complete all calculations. You will need to use application-specific integrated circuits (ASICs) that are costly. If you can’t access a traditional bank loan, you can look up “ title loans online near me ” or “best title loans for new entrepreneurs”. These short-term loans are easier to access and more affordable.

Get Business Permits and Licenses

To prevent your business from getting shut down by the authorities, you need to obtain the necessary licenses and permits. While crypto mining happens in different countries, China has the most mining pools, about 60%, while the U.S. has about 10%. Crypto mining has a connection to global energy prices, so each country has different regulations regarding business permits and licenses. Before starting your business, check with the state and local authorities to know the exact permits you need.

Market Your Business

As with any other business, it’s important for your crypto mining company to attract investors. Some investors commit a lot of money to this venture, so you can acquire a significant amount of money if you market your business well. With more money, you can buy more equipment. If you have more equipment, you can qualify for reduced electric rates. Clearly present how profitable your business model is and you’ll appeal to more investors.

Crypto mining has been in existence for more than a decade. In earlier years, the process was less complex. These days, crypto miners require more sophisticated hardware. If you want to venture into the crypto mining industry, follow our tips and build a profitable business.

Bitcoin Mining Business Plan Template 2023

Did you know that the global cryptocurrency market, including btc, is projected to reach a staggering $5.19 billion by 2026? With the increasing popularity of mining bitcoin and the rise of pacific blockchain technology, the market is expected to continue growing rapidly. With the growing popularity of cryptocurrencies like Bitcoin, many entrepreneurs are looking to capitalize on the lucrative industry of cryptocurrency mining. Small businesses can generate significant profits from btc mining. If you’re considering starting a crypto mining business, having a well-defined business plan is crucial for businesses to maximize profits through effective marketing.

We’ll discuss the key components that should be included in your plan for future profit, such as market analysis, financial projections, operational strategies, and cost. We’ll highlight how a solid business plan, including a financial forecast, can attract investors and secure funding for your company. This guide will help you prepare for the future of your venture.

Whether you’re an experienced entrepreneur or new to the world of cryptocurrency, understanding the importance of a comprehensive financial forecast for your start-up pacific blockchain company is vital.

Table of Contents

- 1.1 Contribution to Creation and Security

- 1.2 Verifying Transactions and Maintaining Blockchain Network

- 1.3 Stability and Decentralization

- 1.4 Growing Significance with Increasing Adoption

- 2.1 Researching and Understanding the Current State of the Cryptocurrency Market

- 2.2 Selecting an Appropriate Mining Strategy Based on Factors like Hardware, Electricity Costs, and Location

- 2.3 Setting Up a Secure and Efficient Mining Operation with Proper Cooling Systems and Power Supply

- 2.4 Joining or Creating a Mining Pool to Increase Chances of Earning Consistent Rewards

- 3.1 Overview of Essential Hardware Components

- 3.2 Importance of Reliable Internet Connectivity

- 3.3 Considerations Regarding Energy Consumption

- 3.4 Need for Adequate Storage Solutions

- 4.1 Identifying Target Market Segments

- 4.2 Analyzing Competitors’ Strategies

- 4.3 Defining Clear Goals and Objectives

- 4.4 Outlining Marketing Strategies

- 5.1 Estimating Initial Investment Costs

- 5.2 Projected Revenue Streams

- 5.3 Assessing Potential Risks

- 5.4 Implementing Risk Management Strategies

- 6.1 Maximizing mining efficiency by selecting the most profitable cryptocurrencies to mine

- 6.2 Utilizing advanced mining software and algorithms to increase hash rates and overall productivity

- 6.3 Minimizing operational costs through energy-efficient hardware and strategic location selection

- 6.4 Regularly monitoring industry trends and adjusting mining strategies accordingly for optimal profitability

- 7.1.1 How much capital do I need to start a bitcoin mining business?

- 7.1.2 Is it still profitable to mine bitcoins?

- 7.1.3 What are some common risks associated with bitcoin mining?

- 7.1.4 Can I mine bitcoins from home?

- 7.1.5 How long does it take to recoup my initial investment in bitcoin mining?

Importance of Bitcoin Mining in the Cryptocurrency Industry

Bitcoin mining is essential for the creation and security of digital currencies in the pacific blockchain industry. It is a crucial process for both small businesses and companies, as it helps them generate profits by participating in the mining pool. Let’s delve into how mining impacts the stability, decentralization, and overall functioning of cryptocurrencies, specifically in relation to the Pacific Blockchain company and its pool.

Contribution to Creation and Security

Bitcoin mining is the process through which new bitcoins are created and added to circulation by crypto companies like Pacific Blockchain. This process involves pooling computational resources to solve complex mathematical problems and validate transactions on the blockchain network. Miners utilize powerful computers for cryptocurrency mining to solve complex mathematical problems, which validate transactions on the blockchain network. This is a crucial aspect of mining bitcoin and running a successful crypto mining business or mining operation. By mining bitcoin, miners ensure that each transaction in the cryptocurrency mining business is legitimate and prevent double-spending in their mining operation.

Verifying Transactions and Maintaining Blockchain Network

Miners act as auditors within the cryptocurrency ecosystem . In the crypto mining business, miners verify transactions by solving computational puzzles that require substantial computing power. This process, known as mining bitcoin, is crucial for the success of the Pacific Blockchain network. Miners often join forces by pooling their resources to increase their chances of solving these puzzles efficiently. Once a miner successfully solves a puzzle in their crypto mining business, they add the verified block of transactions to the blockchain network. In order to do this, the miner may join a pool or work independently. Regardless, the company needs to ensure that the transactions are securely added to the blockchain. This process ensures transparency and immutability within the pacific blockchain system. Additionally, it emphasizes the need for a pool in the cryptocurrency system.

Stability and Decentralization

The decentralized nature of cryptocurrencies like Bitcoin, particularly in the Pacific blockchain, is one of the most significant advantages. This enables individuals to participate in a pool of transactions without the need for intermediaries. Bitcoin mining, a process in the crypto world, contributes to the decentralization of power by distributing it among multiple participants in a pool instead of relying on a central authority. This is one of the key features of the Pacific Blockchain technology. The more miners there are in the crypto mining business, the more secure and resilient the Pacific blockchain network becomes against potential attacks or manipulation.

Growing Significance with Increasing Adoption

As adoption and demand for cryptocurrencies, specifically in the Pacific blockchain, increase worldwide, bitcoin mining in the Pacific blockchain continues to gain significance. The increasing number of miners in the Pacific blockchain strengthens the security of cryptocurrencies by making it harder for any single entity or group to control the network. This decentralized approach enhances trust in digital currencies while maintaining their integrity, making it ideal for the crypto mining business. Additionally, it aligns perfectly with the principles of Pacific blockchain.

Mining in the pacific blockchain also has economic implications as it provides an incentive for individuals or businesses to actively participate in securing the network. Miners in the crypto mining business receive rewards in newly minted bitcoins for their efforts, encouraging them to invest in specialized hardware and contribute resources towards maintaining a robust blockchain infrastructure.

Steps to Start a Profitable Bitcoin Mining Business

To start a profitable bitcoin mining business in the Pacific blockchain industry, there are several important steps you need to follow. These steps will help ensure that you have the necessary knowledge and resources to set up a successful crypto mining business operation. Let’s dive into each step in detail.

Researching and Understanding the Current State of the Cryptocurrency Market