Next FREE Webinar w/ Live Q&A:

What Nonprofits Need to Know About Fiscal Sponsorships

July 25, 2024 • 11am PT

Register Now

- Against the Current

- Board Management

- Community and Culture

- Environmental, Social, & Governance (ESG)

- Fundraising

- HR and Employment Issues

- Leadership and Management

- Marketing and Communications

- Political Issues

- Risk Management

- Sample Policies & Templates

Trending Posts

Your Nonprofit’s Budget: A Window to Finding Your Priorities

Five Lessons for Creating an Effective (and Accountable) Nonprofit Board

A Board Member “Contract”

The Best Route to Approaching Donors: Hand-Head-Heart

Five Internal Controls for the Very Small Nonprofit

Your IRS Form 990 Questions Answered

Blue Avocado

Nonprofits Helping Nonprofits Succeed

Cyber Incident Response Plans for Nonprofits

October 5, 2023 • 11am PT

Brought to you by

It’s Not as Scary as You Think: 10 Easy Steps to Launch a Planned Giving Program for Your Nonprofit

Planned giving scares many who work in nonprofits. We think it’s too technical and takes too much time. Here are 10 easy steps to follow to get started with creating a planned giving program at your nonprofit.

The fundraising term planned giving scares many of us who work in nonprofits. We think it’s too technical and takes too much time.

In reality, planned giving simply means building relationships with your donors and their professional advisors. Instead of taking up too much time, planned giving can actually offer time to ramp up donors’ desires to give major gifts as well as ensure your nonprofit is in the position to receive them. But planned giving also doesn’t have to be time-consuming; I believe a nonprofit can accomplish these tasks in an extra 1-2 hours a month.

So, what are planned gifts?

Planned gifts are donations that can occur during a donor’s lifetime—referred to as major—and/or via their estate—referred to as testamentary. Their name probably comes from the fact that it is very rare for a donor to give a major gift via their ready cash. Unlike small, one-time donations, major gifts come from assets that need time to process on the donor end—this is probably where the planning comes in.

Download: Donor Directions for Gifts of Stock Codicial Template

This brings us to our next question: why are planned gifts so important?

According to the Giving USA 2022, [1] $484.85 billion was given by donors to charities in 2021, an increase of 4% from 2020. Of that nearly $485 billion, corporations only gave 4% and foundations only disbursed 19%. So maybe slow down on your race to apply for those grants—you and everyone else are trying to get them, and they actually constitute a comparably small portion of the pie, as it were.

In contrast, (living) individuals contributed a whopping 67% of last year’s gifts. Bequests (gifts via estates) alone made up 9% of the donations—twice what corporations gave. This is why you need a planned giving program in your nonprofit, and, more specifically, why you should work to build rapport with both donors AND their professional advisors. At its most basic level, planned giving is all about building relationships with donors, including their professional advisors.

For the most part, we nonprofits are really good at communicating with donors (or at least we should be). Similarly, donors are usually really good at talking with their professional advisors. However, a breakdown occurs between nonprofits and professional advisors. As nonprofit professionals, we need to fix this. After all, it is the professional advisors (attorneys, accountants, wealth managers) who set up the trusts, annuities, IRAs, etc., that you find in planned giving. And if the professional advisors don’t understand how your nonprofit works, these advisors can even talk your donors out of their charitable gift ideas.

But never fear! These 10 steps will help you to figure out how to best communicate with both your donors and their professional advisors.

10 steps to best communicate with donors and their advisors

Step #1: know your nonprofit’s ein and legal name..

Yes, this sounds super elementary, but it is purely to eliminate confusion. Consider how many other nonprofits may have a name similar to yours, whether locally or nationally. For example, how many nonprofits have the words care, hope , help , or hospice in their name?

Make sure all professional advisors know your EIN and legal name so they can incorporate them into any documents they may prepare for your donors. Remember, your donors’ professional advisors might be—and probably are—doing this work without your knowledge. So, make sure that they can easily find your organization’s legal name and EIN by adding it to your email signature line, newsletter, and website.

Step #2: Mention planned giving whenever possible.

Consider adding a phrase that references planned giving to your email signature line, website, and social media posts. Examples of this might read: “Please consider a gift to us in your estate plan” or “Do you know that ABC Charity accepts gifts of stock? Ask us how!”

Make sure you mix it up with different phrases—you never know which one is going to strike a chord. Again, make sure your leadership (and the rest of your nonprofit) knows what you are doing. You might even consider asking staff and board members to use these phrases in their communications as well.

Step #3: Create a template codicil.

A codicil is something that donors can complete and submit to their attorney to file along with their will. You provide it to donors who then take it to their attorney, which may or may not trigger a re-writing of the will. The codicil should include phrasing along the lines of:

We the donors (name) leave ____% of our estate to ABC Charity, EIN #_______.

Having this template on hand will complete the circle of communications between your organization, the donor, and their attorney.

Step #4: Adopt a gift acceptance policy.

A gift acceptance policy can be as simple as the following:

ABC Charity will accept unrestricted gifts of cash and stock at any time in any amount. All gifts of stock shall be liquidated immediately. The Executive Director has the authority to accept these gifts. All other asset gifts shall be reviewed by the _____ Committee before being accepted.

However, make sure you edit the policy as donations come in and your organization decides whether to accept certain assets. You might be surprised what people give—land, art, jewelry, vehicles—but you should make sure to take into account whether the donation is worth the work.

Step #5: Open a brokerage account.

Since we nonprofits are not licensed to buy and sell stock, you need a brokerage account to accept those gifts of stock on your behalf.

As you shop for a brokerage firm, ask whether a) your organization needs to keep a minimum amount in the account to keep it open and b) whether you need to have a certain number of transactions per year to keep it open. Some brokerage firms close accounts due to lack of activity, and you don’t want this to happen when a donor gives you stock. Hopefully you can find a brokerage firm that is amenable to maintaining a low-activity account at first as you work toward more gifts of stock.

Once you have this account, create a “Donor Instructions for Donated Stock” form where the donor (or really their broker) fills in the blanks of stock name, ticker symbol, number of shares, and donor name. Make sure you list your broker’s name, contact information, DTC #, and your organization’s account number.

Step #6: Plan for unexpected gifts.

Many planned gifts will arrive to you out of the blue—you had no idea that they were in the pipeline, which might drive you nuts! So, make sure your organization has a plan for how you will use major gifts (without donor restrictions) that arrive unexpectedly.

Use time at a board meeting to imagine that your nonprofit just won the lottery. Will you hire staff, replace the roof, launch a new program, or start an endowment?

And since these surprise gifts come in varying amounts, develop a wish list of items ranging from low to high cost. You can even publish this Wish List to encourage donors to give for specific items!

Step #7: Incorporate planned giving into your marketing.

Incorporate planned giving items into your usual marketing, whether this marketing usually appears on your website, in your newsletter, or via social media.

Snoop the websites and social media of bigger nonprofits (including universities) to see what they post about planned giving. Consider adopting these tools for your own use.

You might also try to message to both donors and their professional advisors. Your goal is two-fold: you want to get donors excited to give big as well as to convince professional advisors that your nonprofit is worthy of major gifts—whether during a donor’s lifetime or via their estate.

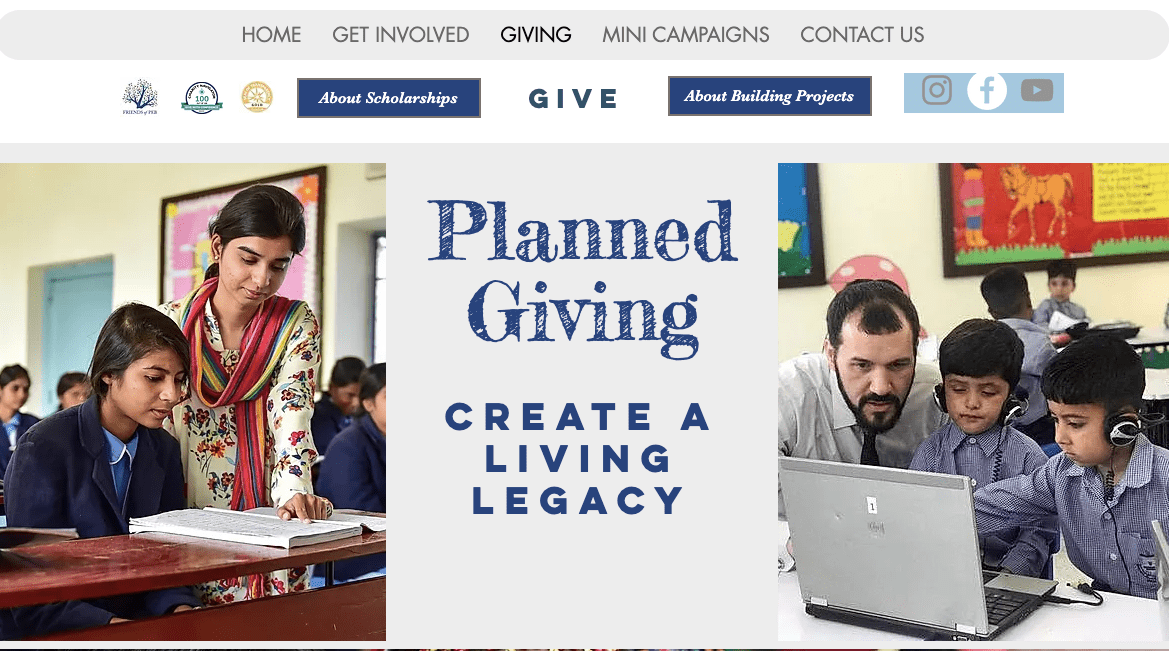

Step #8: Devote a website page to planned giving.

Create an obvious page on your website to house planned giving messaging and forms. Again, so much planned giving is done without your knowledge; you want to make it as easy as possible for donors and professional advisors to access what they need when they need it.

On this website page, you would house your legal name and EIN, mailing address, 990, Gift Acceptance Policy, and other formal documents. For example, if you follow steps 3 and 5, you might also place either the template codicil or the donated stock instructions here as well.

However, this webpage shouldn’t just be a bunch of downloadable templates. Make sure you link this page to other pages on your website where you tell stories of the great work that your nonprofit is doing and how you are improving the quality of life in your community. Donors are more likely to give to nonprofits they view as doing important work, and, after all, the work is what your nonprofit is about!

You might also use this page to invite donors and/or their advisors to meet with you. Meetings like this will help you all get to know one another better as well as ensure that donor gifts can be tailored to benefit both the donor and your organization’s needs. However, some donors will want to remain anonymous, and that’s okay.

Step #9: Keep a list of professional advisors.

Create a database or spreadsheet of professional advisors in your community. This should include attorneys, accountants, wealth managers, insurance agents, and bank trust officers.

Start networking with them, whether by newsletter, mail, or chamber functions, so that they get to know you and your organization’s capacity to accept major gifts. You want to partner with them on the technicalities, but you also want them to be a cheerleader for you when they are advising their clients—who sometimes don’t have a specific organization they’d like to donate to in mind.

Step #10: Get to know your local community foundation.

This is a good idea for a variety of reasons. Mainly, your local community foundation has the technical expertise to accept major, complex gifts that smaller nonprofits might not know how to deal with. The community foundation will then deposit these gifts into a Designated Fund or Agency Endowment specifically for your organization.

In addition, partnering with a community foundation might also serve as the credentials that convince a donor and/or professional advisor to structure a planned gift for your organization. The bigger your network is, the more points of access you have to the slice of pie that is planned giving.

It’s All about Relationships

Of course, there are a lot of nuances in planned giving—the technical definitions of and differences between charitable lead trusts, charitable remainder trusts, charitable gift annuities, IRA charitable rollovers, and gifts of business interests, for example. However, it is my hope that these ten steps should help you get started. Remember, while your first task is to ensure that your organization is prepared to accept major gifts, you also need to inspire community trust that you will use those major gifts wisely to do great things. Don’t be afraid to build that trust and those relationships—the big money will follow.

[1] You can see an paywall-free overview of this report at Resilia ’s “Highlights from the Giving USA Foundation 2022 Report”

About the Author

Julianne Buck

Julianne Buck is the Executive Director of the Community Foundation of Grundy County, Illinois, and is the founder of Nonprofit Brains and Brawn, LLC. She is a Chartered Advisor in Philanthropy® and serves on the board of directors of the Chicago Council on Planned Giving.

Articles on Blue Avocado do not provide legal representation or legal advice and should not be used as a substitute for advice or legal counsel. Blue Avocado provides space for the nonprofit sector to express new ideas. Views represented in Blue Avocado do not necessarily express the opinion of the publication or its publisher.

One thought on “ It’s Not as Scary as You Think: 10 Easy Steps to Launch a Planned Giving Program for Your Nonprofit ”

My name is Lynell….I have owned my small business for 20 years and we are hosting a celebration party and with it a silent auction where all proceeds will be donated to our local food bank. I am not a “non-profit” business and I have been trying to gather direction as to what to do for the people who are donating the items to be auctioned off. Would you be willing to email me any advice on the matter?

Thank you in advance for your time.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Related Posts

Nonprofit Fundraising: Are You Choosing the Right Grants?

9 Principles to Make Your Nonprofit Fundraising Effective — and Fun!

Rethinking Perpetuity: Resetting Endowment Expectations After the Pandemic

Table of Contents

Planned Giving: The Complete Guide (+5 Tips to Get Started)

Similar to major gifts, planned giving is the accumulation of long, engaging relationships between donors and nonprofits. A thoughtful and considerate planned giving program opens your nonprofit up to a significant source of funding and provides donors the chance to continue supporting a cause they believe in. Establishing a planned giving program requires organizational forethought, strong donor relationships, and a willingness to create long-term investments. Your nonprofit may already be knowledgeable about how to manage its donors , but planned giving necessitates taking additional steps in researching, connecting with, and instilling loyalty in donors.

To help your nonprofit start creating its planned giving program, this guide will provide an overview of core components of planned giving before discussing actionable best practices your nonprofit can use to begin building a successful planned giving program. Let’s start with the basics: What is planned giving?

What is Planned Giving?

Planned giving is formally planning to donate at a later time. Planned gifts can be given at any time but are most commonly willed after the donor passes away.

Planned giving, also known as legacy giving, and is sometimes confused with memorial funds. Memorial funds are nonprofit donations made on behalf of an individual after their passing on by their family, while planned gifts are arranged with the donor during their lifetime.

The Importance of Planned Giving

Nonprofits often devote extensive resources to courting major gifts as the foundation of their fundraising strategy. However, planned gifts on average have a return on investment that is more than $20 higher than the return on investment for major gifts.

Planned gifts are often large as donors can bequeath money without fear of how it will affect their future finances. Additionally, planned gifts usually have lower investment costs as your nonprofit should be working to build relationships with donors as part of your routine stewardship efforts. Rather than hosting large events and other donor cultivation activities in the hope that donors will part with their funding at the current moment, you can leverage your long-term relationships and encourage supporters to pledge their gifts for later.

Confirming a planned gift also provides nonprofits insight into their future financial situation. Unlike other fundraising sources, planned gifts don’t decrease during times of economic hardship. Individuals investing in their legacy aren’t impacted by fluctuating markets or changes in donation regulations.

Planned giving isn’t restricted to just your wealthiest donors, either. Fundraising often begins by creating a model that assesses your donors' ability to give. While models are still relevant to planned giving, your pool of potential donors is often larger than your nonprofit might first assume. More moderate supporters are capable of bequeathing planned gifts to their favorite nonprofits, meaning you don’t just have to ask your largest donors for these contributions.

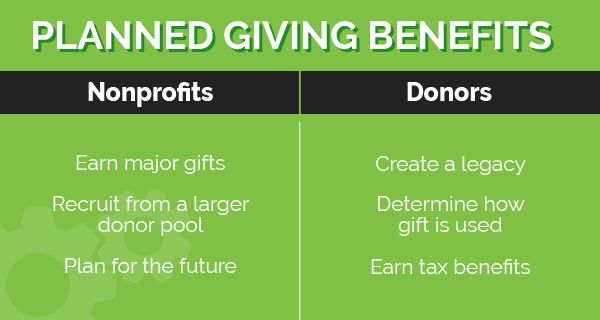

Planned Giving Benefits

Planned giving can seem difficult to talk about, but it’s ultimately beneficial for everyone involved to power through these challenging conversations. Relationship building is key to planned giving programs because planned gifts emerge from mutual respect, loyalty, and transparency between nonprofits and donors.

Benefits for Nonprofits

While your nonprofit obviously benefits from all donations, the specific positives of planned giving are more impactful than many organizations might first assume.

Planned giving requires long-term investment as your nonprofit builds relationships with donors over the course of their lifetime. This may lead to the assumption that planned giving has a low return on investment, when in actuality, planned giving has one of the highest return rates of any donation type.

To understand why this is, here are a few key benefits your nonprofit can gain through its planned giving program:

- Receive substantial gifts. Major gifts are the bedrock of many nonprofit’s fundraising strategies due to a few individuals often providing the bulk of your funding. What counts as a major gift depends on your nonprofit’s average donation size. No matter your nonprofit’s size, planned gifts are usually on par with (if not larger than) major gifts.

- Scout larger pool of donors. Wealthy donors are obviously awesome candidates for both major giving and planned giving. However, because planned giving allows individuals to contribute more in one gift than their budget would normally allow, moderate donors are also able to contribute sizable planned gifts. With a more expansive list of potential donors, every relationship your nonprofit builds becomes even more important to maintain.

- Plan for the future. Once a planned gift is secured, your nonprofit can count on receiving the agreed upon amount of funding, independent of how successful other fundraisers are. The delayed nature of planned giving also requires your nonprofit to consistently think about its future in order to show donors that your nonprofit will still be around when they are ready to bequeath their planned gift.

Benefits for Donors

Planned giving donors weigh different pros and cons when considering a donation than your regular donors do. However, the benefits do exist and are compelling enough that with proper marketing and a well-designed planned giving programs, planned gifts can form the basis of your nonprofit’s incoming revenue.

To help you understand motivations for your potential planned donors, here are a few of the most commonly discussed benefits of planned giving:

- Creating a legacy. As mentioned, planned giving is often referred to as legacy giving, and for good reason! Whether their gift is large or small, planned donors can continue to be remembered and celebrated as your nonprofit honors their contribution. Many nonprofits recognize planned donors who have passed away in speeches, at events, or through program names.

- Determining how their gift is used. While donations to specific campaigns go to particular programs, donors have little control over exactly how their money is spent. Similar to major (and sometimes also mid-tier donations), funds given through wills often come with stipulations and rules that nonprofits need to follow in order to receive the planned gift. This allows donors to decide exactly how they want their gift to be used.

- Earning tax breaks for their family. As with other donations, planned gifts can be deducted from your donor’s taxes, creating a financial incentive for long-term supporters to consider giving to your nonprofit in their will. The exact tax benefits are dependent on your donors’ estate, state, and other factors, which determine the method of giving that is most advantageous.

By building relationships with your donors, you will have the opportunity to iron out details regarding how they want to be remembered, how their money is used, and what tax breaks they qualify for. For example, some donors who want to specific how their gift is used might be curious about what parts of your nonprofit need the most help. By talking it out with them ahead of time, you can provide help that will lead to a win-win situation.

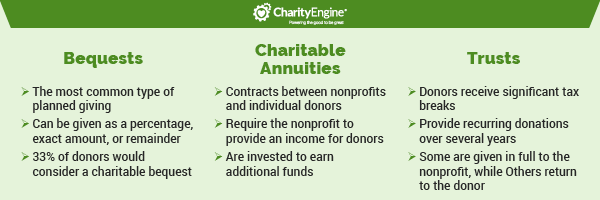

Types of Planned Giving

There are multiple ways for planned gift donors to contribute to your nonprofit. Most nonprofits are given money, but some receive land or other assets. The exact method of donating a planned gift also varies, giving donors a variety of options for what terms they want to give their contribution on.

To understand which planned giving method works best for your nonprofit and your donors, discuss your options openly to come to a choice everyone agrees with. Keep in mind that some forms of planned giving can quickly become complicated, so be sure to track every step of your planned giving process in your nonprofit CRM to stay organized

You should also be sure to thoroughly research each type of planned gift before entering into conversation with a donor about their prospective gift. Build out your planned giving program with the types of gifts that will be most advantageous to your organization and easiest for supporters to contribute. To help your nonprofit get started, here are three common types of planned giving:

With 90% of planned gifts being bequests , this is by far the most popular type of planned giving. This is likely because bequests are the most straightforward planned giving option. Bequests also give donors several options for how they want their money to be given, which generally fall into three groups:

- Exact amount. As the name implies, exact amount bequests are a specific amount of money that the donor agrees to give to your organization.

- Percentage. The nonprofit receives a percentage of the donor’s wealth. This option is often useful for donors with large estates that are only broken up or distributed after their passing.

- Remainder. Your donors likely have wealth they want to give to their loved ones and even other organizations. Remainder bequests grant your nonprofit whatever is left over after all other bequests have been given.

When marketing your planned giving program, let donors know they have multiple options, but consider centering bequests as the preferred giving method. This isn’t just because bequests are easiest for your nonprofit to handle. It’s straightforward, easy to explain, and 33% of Americans have stated they would consider giving a charitable bequest.

Charitable Annuities

Charitable annuities are contracts between nonprofits and individuals where the donor makes a significant contribution (usually monetary but sometimes including other assets such as land or property). In exchange, the nonprofit provides the donor a fixed income for the rest of their life.

Charitable annuity funds are invested by the nonprofit to earn capital gains, and after the pay period ends (or in the event of the donor’s death), the remainder of the gift is then donated to the nonprofit. While smaller nonprofits can create charitable annuity plans, usually only large nonprofit organizations such as universities actively encourage charitable annuities due to the complicated nature of this investment process.

There are two major types of charitable trusts: charitable lead trusts and charitable remainder trusts. Both are trusts that provide significant tax benefits to the founder of the trust in exchange for contributing an annual portion of the money to a nonprofit. The difference lies in how the funds donated are calculated and what tax breaks are given to the founder. Here is a more detailed breakdown of their differences:

- Charitable lead trusts are determined for a set period of time, usually ten years at a minimum. The trust gives the selected nonprofits annual payments over the course of the trust. When the trust ends, the rest of the money returns to the donor and their beneficiaries.

- Charitable remainder trusts give annual funds to a specific individual over a period of time. When that period of time is over (or if the founder of the trust passes away), the remainder of the trust is donated to a nonprofit organization.

Trusts are usually established by exceptionally wealthy individuals seeking tax breaks. While your nonprofit may encounter a donor interested in establishing a trust, they are uncommon when compared to bequests.

Marketing Your Planned Giving Program

Planned giving is deeply personal and often emotional, so once you have identified potential candidates, promote the opportunity to them with customized, personal appeals. Keep in mind who your audience is as you craft your message to inspire a deeper connection without inadvertently coming off as rude or scaring them away altogether.

However, while you should adjust your marketing strategy to accommodate planned giving’s specific requirements, you can still leverage tried-and-true marketing techniques such as multi-channel outreach . Your nonprofit should have several avenues of communication at its disposal, and you can use a variety of these channels to inform donors about your planned giving program.

- Your website. Your website is your main hub for information about your donation programs, including your planned giving program. When donors receive marketing materials related to your planned giving program, include a URL to your planned giving page so they can conduct research on their own without the pressure of responding immediately.

- Brochures. It’s difficult to address a wide audience when advertising your planned giving program. However, you can create a tasteful brochure that offers general information about the benefits of planned giving. Unlike fliers, social media posts, emails, or other marketing strategies, brochures communicate a sense of formality that can inspire donors to consider the option on more neutral grounds than if they were asked directly.

- Personal letters. Traditional mail appeals still carry a lot of weight, and a personally written letter lets donors know that your nonprofit is serious about your long-term connection with them. You can make use of templates and other automation tools to speed up the letter writing process, but be sure to take additional time preparing these letters due to their increased personal nature.

When making a direct ask, you can also reach out to donors directly through a phone call or in-person meetings. Make sure donors have privacy and the ability to think about the decision before making a direct ask so as not to pressure them into making a sensitive decision too quickly.

Communicating the benefits to your donors through marketing materials can be effective at getting the word out to a broad section of your audience. However, while some donors may approach your nonprofit to begin the planned giving process, many do need to be asked, making personal appeals a necessity.

5 Tips to Get Started With Your Planned Giving Program

While every fundraising effort your nonprofit launches requires extensive planning beforehand, planned giving is an exceptionally delicate topic that is accompanied by unique legal and ethical considerations. Ensure every member of your team is on the same page about how to approach donors and planned giving candidates, so as to create a sensitive but effective strategy for acquiring planned gifts.

To help give your team a sense of direction regarding how to approach donors, here are five key tips on how to start, build, and maintain relationships with your donors that can lead to planned giving:

1. Focus your energy on retaining existing donors.

Donors develop loyalty to your nonprofit over time. This means that the supporters who are most likely to consider becoming planned gift donors need to have been in contact with your nonprofit for several years (usually at least a decade). In turn, this means you’ll need to retain those donors for years in order to create the opportunity to ask them to consider planned giving options.

Retaining your current donors is ultimately more cost-effective than acquiring new donors, meaning this strategy is key for both your planned giving and other sustainable fundraising strategies . While you can (and should) implement strategies to attract new donors, you should never neglect your existing donor base.

You can show appreciation for your donors by continually providing opportunities for them to participate in your nonprofit through events, meet-ups, and other opportunities that are about more than just donating money. One of the key ways to continually engage donors over time is by showing them that they are part of a community and not just an ATM.

2. Design your planned giving program opportunities.

Many nonprofits create planned giving or legacy societies, creating a sense of community among your planned giving donors. These supporters can join to receive recognition, interact with other donors, and participate in entertaining stewardship activities.

What exactly goes into a planned giving society? Ultimately, these societies create a sense of community and help build the connection between your nonprofit and your planned giving donors. While every nonprofit approaches this in their unique way, a few key strategies to create a well-designed society include:

- Giving it a meaningful name. Branding plays a major role in how donors think about your nonprofit, and a name that evokes emotion or suggests greater importance can make members of your planned giving society feel proud of their inclusion with the group. A strong name can also draw curiosity from potential candidates who may be interested in joining after learning more.

- Collecting donor stories. Anecdotes from your donors about what your nonprofit has done for them or why your cause is meaningful can go a long way in making your donors feel heard. You can then share these stories (with permission) on your website’s planned giving page or bundle them into a collection to share with other members of your planned giving society.

- Creating exclusive events. While few people become a planned giving donor to attend more parties, additional events and opportunities exclusive to your planned giving society can build a stronger sense of community. Not to mention providing a few extra perks like this increases donor loyalty and gives your supporters something to look forward to even after their planned gift agreement is confirmed.

These events and opportunities shouldn’t solely be focused on converting more donors. Give your planned giving donors real, engaging, meaningful activities that will capture their attention and show your appreciation for their involvement with your mission.

3. Create marketing materials for your planned giving program.

Before creating your marketing materials, consider what is important to potential planned giving candidates. While some people are inspired to invest in planned giving due to the tax benefits, the overwhelming majority do it out of genuine personal investment in your cause. In general, technical and statistical information does very little to convince donors when compared to emotional appeals. However, a healthy mix of both is ultimately ideal.

With this in mind, create materials that use stories and images to invoke sentimentality and other feelings that lead naturally towards considering becoming a planned giving donor.

Your brochures and planned giving page will be staples to get the word out about your program details and informing supporters about their options. Therefore, address these materials first, ensuring you have all of the facts on the table for supporters to conduct research before you start reaching out on a personal level.

4. Locate prospective donors.

Donors need to know your planned giving program exists in order to participate. However, due to the sensitive nature of planned giving, you should avoid posting about it on social media like you would an event or crowdfunding campaign.

Consider your planned giving program’s primary audience. While the pool of potential planned giving donors is larger than that of major gifts, candidates still need to meet their own set of specific requirements:

- A long-term relationship with your nonprofit. Planned giving comes as a last step in a series of relationship-building interactions between donors and your nonprofit. Even if they fit the other two requirements, donors who don’t know your nonprofit well likely won’t be comfortable entrusting you with a planned gift. Avoid asking donors too early in your relationship by tracking previous interactions and only marketing your program after supporters have been with your nonprofit for at least 10-20 years.

- Large to moderate net worth. There are more candidates for planned giving than major giving. However, you can still use wealth prospecting tools to identify potential donors from your current base. Identify those who make regular donations to your nonprofit, how much those donations are, and if they have increased over time. Then compare their giving behavior to the results of your wealth screening to find individuals who are both generous and have enough set aside that they might consider making a planned gift in the future.

- Middle aged to late retirement. Approximately 53% of donors decide whether or not to contribute a planned gift when they first write their will. This means that donors who are ready to make planned gifts are likely to be middle-aged to older individuals, usually between the ages of 40-50 . While it is alright to let all of your donors know about your planned giving programs, the only ones who will consider enrolling in it are candidates who have already had the time to accumulate a fair bit of wealth over the course of their lives.

Identifying these candidates takes time as donors get to know your nonprofit and you get to know your donors. Monitor each donor’s engagement history so you can understand where they are on their donor journey to ensure you only ask appropriate candidates to consider planned giving. Once they fit these requirements and your nonprofit has built loyalty with them, you might be ready to make the first approach.

5. Steward and acknowledge your donors.

Thanking and acknowledging your donors’ contributions is an ongoing process. Personal and direct communication lets specific donors feel seen, which encourages them to continue supporting your nonprofit into the future. It might seem repetitive to thank your supporters over and over again, but deliberate and meaningful thank you messages are an integral part of any fundraising campaign c ycle for a reason.

There are more ways to recognize your donors than automatic follow-up messages after a successful donation. Sit down and consider all of the ways your donors can participate in your organization, and then thank them when they do so. A few methods you can use to show appreciation outside of email are:

- Phone calls. If a donor made a contribution (especially a mid-tier or larger donation) to your latest campaign, be sure to follow up with them with a phone call within 48 hours. While your call doesn’t have to be long, a brief chat with a member of your team will show donors that your nonprofit is made up of people who see and appreciate every contribution.

- Spotlighting donors. Between your website’s newspage, your social media profiles, and your newsletter, your nonprofit has several ways you can draw attention to donors. Always ask your donors permission before spotlighting them to the public. While some appreciate the attention, others may prefer to donate quietly.

- Personal letters. Sending a handwritten letter or card will let your donors know that your nonprofit took the time to sit down and specifically acknowledge their contribution. Your volunteers can help by writing the cards, which are then signed by your board members or other leadership at your nonprofit.

- Donor walls. For major gifts, sometimes a more permanent way to show appreciation is through public recognition. Donor walls are physical monuments to your donors’ contributions that your nonprofit can place in their office, in a common area, or even in public spaces (with permission) so visitors can come and read their names. Donor walls can be expensive, but remember that they are also an investment in your future fundraising programs.

In your thank you messages, be sure to express how grateful you are for donations, and also relay the gift’s impact. Use statistics and anecdotes from your programs to help donors get a better sense of what exactly your nonprofit is doing and why their donations matter.

Repeated acknowledgment and expressions of gratitude are fundamental building blocks of cultivating positive donor relationships. These opportunities can influence how long donors support your nonprofit and how receptive they will be to future donation requests such as asking for a planned gift.

How CharityEngine Can Power Planned Giving

Donors participate in planned giving programs for nonprofits to which they feel a strong sense of loyalty. Building these relationships doesn’t happen by coincidence. These connections develop over the course of multiple interactions between your donors and your nonprofit.

To track, plan, and solidify these relationship-building opportunities, your nonprofit will need a dedicated software solution to manage the journey of your planned giving donors.

CharityEngine’s comprehensive CRM can equip your nonprofit with key tools to set your planned giving program up for success. Along with being an all-in-one solution for fundraising, marketing, and data organization, CharityEngine allows your nonprofit to:

- Retain donors and build relationships. CharityEngine’s CRM allows nonprofits to gain an in-depth understanding of their donors’ motivations and interactions with comprehensive donor profiles. Additionally, CharityEngine’s status as an all-in-one software keeps your planned giving timelines organized by coordinating all of your relationship-building efforts in one place.

- Locate prospects. Before you receive a planned gift, you’ll need to identify potential planned gift donors. With the help of a planned giving prospecting tool, CharityEngine’s donor database can help your nonprofit analyze every aspect of your supporters’ journeys and record insights from additional prospect research to find donors who may be interested in your planned giving program.

- Track planned gift conversations and opportunities. Planned gifts require careful organization to discover opportunities to build strong relationships and start the conversation about planned giving. You’ll only ever receive a planned gift if you ask your donors, and knowing when it’s appropriate to ask requires careful analysis of your donors’ relationship with your nonprofit. CharityEngine’s focus on donors’ journeys can help create an engagement history timeline. These timelines help your nonprofit understand where your donors currently are on your planned gift timeline and find key opportunities to move them further along towards asking for a donation.

Implementing new technology can be a challenge, and can lead to an initial slow down productivity as staff learn the best practices for their new software. However, in the long-run, an upgrade in your software can lead to a major boost in fundraising options. During your nonprofit’s transition, remember that investing in new technology is an investment in your nonprofit’s future success. Don’t be afraid to reach out to your software provider for additional support getting your team up to speed.

Wrapping Up

Setting up a successful planned giving program is dependent on your ability to craft long-term loyalty and relationships with your donors. Your nonprofit can accomplish this taking the time to listen to donors, engage them further in your organization, and showing how they impact your mission.

This means that before getting started with your planned giving program, you’ll need to conduct extensive research on outreach, donor relations, and giving trends. Here are a few resources your nonprofit can use to begin its journey towards a planned giving program that’s beneficial for both you and your donors:

- Nonprofit CRM | How to Pick the Best Software Solution . Your CRM stores your donors’ information, and the best solution will allow you to organize and use that information to maintain and build relationships. Learn what features to look for to discover the software that meets your specific needs!

- Year-End Giving: Strategies and Statistics for Nonprofits . Do you know when your donors are most likely to give? Understand why the end of the year is such a popular time for giving and what your nonprofit can do to make the most of it.

- Multi-Channel Fundraising: What Your Nonprofit Needs to Know . Converting donors requires reaching out to them—usually multiple times. Get started researching multiple platforms to expand your communication strategy across channels.

Don't forget to share this post:

Related posts.

A Three-Step Checklist for GivingTuesday

It’s go-time. Pedal to the metal. Step on it. It’s almost GivingTuesday, and we’ve got three ...

6 Key Tips for a Successful Monthly Giving Program

At the heart of every nonprofit executive lies a gnawing worry: how will I raise more money? And ...

Getting Ready for Giving Tuesday with Matching Gifts: Top 3 Best Practices

Giving Tuesday is right around the corner, and it’s no secret that fundraising feels a little ...

Unlocking the Power of Planned Giving Events

Jun. 4, 2024

For every non-profit, the quest for sustainable financial support is ongoing. There are several proven tactics to gain one-time donations, which of course are valuable, and other events support and cultivate lasting relationships with donors that can provide a steady stream of support.

When planning events for your non-profit, it's essential to consider the specific goals you want to achieve. Donor appreciation events are an excellent way to recognize and thank your existing supporters for their generosity and loyalty. These events can range from intimate gatherings to larger celebrations, depending on your budget and resources.

Another type of event to consider is aimed at growing your donor pool. These events focus on engaging with potential new donors and introducing them to your organization's mission and impact. They can take various forms, such as networking mixers, open houses, or informational sessions. By effectively communicating your mission and highlighting your work, you can inspire attendees to become future supporters.

Additionally, informing new people about your mission is crucial for raising awareness and building community support. Consider hosting educational events, such as panel discussions, workshops, or guest speaker presentations, to share your organization's story and highlight the issues you're addressing. These events provide opportunities for dialogue and learning, fostering connections with individuals who may be passionate about your cause.

And, more specifically, a growing trend for non-profits is hosting planned giving events. A planned giving event is a specialized fundraising event organized by non-profit organizations to educate, engage, and inspire donors to make long-term commitments to support the organization's mission through planned gifts. Planned giving events are designed to highlight the benefits of legacy giving and provide donors with information and resources to include the organization in their estate plans or make other types of planned gifts.

With different events serving different purposes, your organization will likely continue to host a variety of events to support your mission both in the short- and long-term. Let’s continue to discuss event best practices and why a planned giving event should be part of your events plan.

An Event Is More Than Just One Day

The success of an event isn't determined by what happens on the day of. Promotion and follow-up are key contributors.

It’s essential to promote your event to reach your target audience effectively. Utilize a mix of marketing channels, including email newsletters, social media, and targeted advertising, to ensure maximum visibility. Moreover, getting engagement from your board members can significantly enhance the success of your event. Board members can leverage their networks, lend their expertise, and serve as ambassadors for the organization, helping to attract attendees and build credibility.

It's also crucial to have a robust follow-up strategy in place to maintain momentum and deepen relationships with attendees. This can include personalized thank-you notes, follow-up emails with event highlights, and opportunities for further engagement. Additionally, data collection is key to understanding your audience to nurture them to become a donor. Asking for feedback by utilizing surveys, registration forms, and other tools to gather valuable insights can be meaningful touchpoints in the follow-up process.

Looking at the Big Picture: Cultivating Donors Through the Planned Giving Cycle

The cultivating of donors involves several key stages, beginning with identification. This stage entails identifying potential donors who may be interested in making planned gifts to your organization. This can involve analyzing your donor database (which you help grow through events), conducting prospect research, and leveraging relationships with existing supporters to identify potential prospects.

Once potential donors have been identified, the cultivation stage begins. During this phase, it's essential to engage with donors and build relationships with them over time. This may involve personalized communications, one-on-one meetings, and opportunities for donors to learn more about planned giving options and the impact of their contributions.

Understanding the pool of donors who are interested and capable of giving in this way is crucial for effective planned giving. By segmenting your donor base and tailoring your cultivation efforts accordingly, you can maximize your success in securing planned gifts. Remember, planned giving is about creating a legacy, so it's essential to nurture relationships with donors and provide them with the support and information they need to make informed decisions about their charitable giving.

5 Benefits of Hosting a Planned Giving Event

By incorporating a planned giving campaign into your toolkit, your organization is on its way to ensuring the longevity and effectiveness of its mission. Planned giving events offer a unique platform to engage donors on a deeper level, leaving a lasting impact on both the organization and the community it serves.

1. Fostering Personal Connections

Planned giving events create an environment for non-profits to connect with donors on a personal level. Whether it's through intimate dining events or special presentations, these events offer opportunities for donors to interact with the organization's leadership, staff, and beneficiaries. Building these personal connections fosters trust and loyalty, encouraging donors to consider long-term commitments to the cause.

2. Educating Donors About Legacy Giving

Many donors are unaware of the benefits of legacy giving or how to include charitable donations in their estate plans. Planned giving events serve as educational platforms, providing donors with valuable information about legacy giving options such as bequests, charitable trusts, and gift annuities. By demystifying the process and highlighting real-life examples of the impact of planned gifts, non-profits can inspire donors to leave a legacy that extends far beyond their lifetimes.

3. Cultivating a Culture of Philanthropy

Planned giving events play a crucial role in cultivating a culture of philanthropy within the donor community. By highlighting the importance of planned giving and recognizing donors who have made legacy commitments, non-profits can inspire others to follow suit. These events create a ripple effect, encouraging donors to think strategically about their charitable giving and empowering them to make a meaningful difference for generations to come.

4. Ensuring Financial Stability

One of the most significant benefits of planned giving events is the potential for long-term financial stability. Unlike traditional fundraising efforts that rely on periodic campaigns and appeals, planned giving provides a steady and predictable source of revenue. By securing commitments from donors to include the organization in their estate plans, non-profits can build a sustainable financial foundation that enables them to weather economic uncertainties and continue their vital work for years to come.

5. Honoring Donors and Celebrating Impact

Planned giving events offer non-profits an opportunity to honor donors and celebrate the impact of their generosity. Whether through donor recognition ceremonies, legacy society memberships, or commemorative plaques, these events acknowledge the contributions of those who have made a lasting commitment to the organization's mission. By publicly expressing gratitude and sharing success stories, non-profits can inspire others to follow them and join the legacy of giving.

At the end of the day, events, including planned giving presentations, are a powerful tool for non-profits seeking to secure sustainable support for their mission.

We can help with a planned giving event for your donors

If you're not sure where to start, need support taking your planned giving event across the finish line, or are looking for a guest speaker, we can help. Our experts can speak to your donors about planned giving, educate them on their options for leaving a legacy, and help everyone walk away feeling empowered to make a lasting impact for a cause they care about. Contact us today to get support for your event!

The information in this paper is not intended as legal or tax advice. Consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation.

Want regular insights into financial planning and investing-related topics?

3 Considerations to Grow Your Endowment

How to Run Your Non-Profit Like a Business

4 Expectations for Your Investment Manager

Our team would be happy to answer any questions you may have. If you would like to connect, simply contact us or schedule a call .

Connect with Us

Please fill out the form below and we’ll contact you. We look forward to speaking with you about how we can help meet your needs.

Subscribe to our Insights

You can update your email preferences at any time.

Sign up to receive the latest financial planning and investment tips and news.

How to Make a Compelling Presentation at a Donor Meeting

You got the appointment with a potential donor. Now what? It’s presentation time. Here are six helpful tips on how to make a compelling presentation at a donor meeting.

1. Believe in what you are doing

Why are you doing what you are doing? Don’t undersell yourself. A lot of times I’ve seen people walk into a meeting timid, unenthusiastic, and unconfident. They don’t believe that what they are doing is worth people’s time and resources. If you don’t believe in yourself or your organization, why should your donor? Walk into that meeting knowing that what you are asking for is important. You can do it!

2. Do your research, know your audience, and understand what’s important to them

Who are you presenting to? Is it a business person, a teacher, alumni? Find out what’s important to them. Don’t just walk in with a pre-set script that you say to everyone—tailor it to the specific type of person.

I used to work for a non-profit called InterVarsity on college campuses. In my own fundraising efforts, I spoke with many different types of potential donors. When I met with business people, I knew they were used to talking about money, so I talked to them about the numbers in my organization and directly how their money would make an impact. Whenever I met with a parent, I’d talk about how what I’m doing impacts students’ lives. If I met up with alumni, I’d ask them to share their favorite moments while they were involved in InterVarsity. The better you know your audience, the better the presentation you’ll have.

3. Share about you

Sometimes people jump quickly to the organization they are working for and how people can give to that . Instead, try connecting with them through your personal story first. Tell them about yourself and why you are passionate about what you are doing. Share the story about how you got involved in the organization and why it matters to you. Then , share more about the organization. 😀

4. Show how and why their giving will be meaningful, have an impact, and be a good return on their investment

Your donor has the opportunity to give and invest in many things—why should they invest in you? Share a meaningful and compelling story about how you and your organization has made an impact. Give them some numbers. Be specific. People like details:

- “We have the opportunity to reach 1,000 people like this.”

- “This isn’t just one story, but one of many of the 100s of teens we interact with.”

- “This past year, we’ve seen 500 people impacted by this organization.”

- “Through your $100 gift, we were able to feed 100 people.”

- “This story all happened by a $30/month donation.”

Give numbers and show them concrete examples of how their donation will have an impact on people’s lives.

5. Share your big, compelling vision and invite them to imagine

Donors give to big, concrete visions. What’s your vision? So many times, I’ve had people share a small and vague vision—“Our vision is that we will build a strong community with each other.” So what? What does that mean? Give me a big vision with clear, concrete points.

- “Our vision is to see 100% of the homeless youth find community in this city.”

- “Our vision is to end hunger in all of Downtown Los Angeles.”

- “Our vision is to reach 100 campuses in ten years.”

Give me a concrete and visible dream that I can imagine and see. Give me numbers, so I know when you’ve reached your vision. “Imagine the impact of ending hunger in Los Angeles.” That’s compelling!

6. Make an ask

Now you’ve shared your compelling vision and presentation—don’t forget to make an ask. Give your donor clear next steps on how to get involved and put the ball in your court to follow-up—something like “can I follow-up with you next week?”

Best of luck and happy fundraising!

About the Author

Brian chung.

Brian is a former staff worker with InterVarsity Christian Fellowship at the University of Southern California and co-founder of Alabaster Co. He enjoys walking with his dog, Levi, and drinking kale smoothies.

Why You Should Add Planned Giving to Your Fundraising Strategy

Many nonprofits have added planned giving to their fundraising strategy. You may ask why and find it difficult to understand how waiting around for a gift could benefit your organization. But there are some facts that will blow your mind. In 2020, despite the onset of the pandemic, over $41 billion was given through planned…

Many nonprofits have added planned giving to their fundraising strategy. You may ask why and find it difficult to understand how waiting around for a gift could benefit your organization. But there are some facts that will blow your mind. In 2020, despite the onset of the pandemic, over $41 billion was given through planned giving. Another report shows that an average planned gift amount is almost 200 times a donor’s largest annual gift amount. These figures are self-explanatory as to why nonprofits these days choose to rely on these gifts alongside other donation methods.

This article will explain what planned giving entails, why it’s important, and how to include it in your fundraising plans.

What is Planned Giving?

Why are planned gifts important, what are the different types of planned gifts, 10 best practices for your planned giving program.

Planned giving is also known as legacy giving or legacy gift planning, and these gifts are major gifts for a nonprofit organization. It is hugely driven by the donor’s intention to make a major gift to a charity, which otherwise might be difficult with their current income. Donors plan for these gifts as a part of their overall financial or estate planning. These may include life insurance, personal property, cash, real estate, donor’s retirement plan, and gifts of equity. Annual donations and membership payments are not a part of planned giving.

Many major donors are concerned about taxes limiting the amount they can leave to their heirs. Whereas nonprofits are increasingly looking for ways to encourage major donations . Creating a planned gift or legacy gift program gives both sides the chance to benefit from the gift.

1. For donors

There are several reasons why an individual will include a planned gift in their will. These reasons range from supporting an organization’s mission to tax breaks. Below is a list of why donors may want to leave a planned gift:

- Donors get a chance to leave significant amounts to their favorite charities and causes.

- Planned gifts offer tax breaks for the donor’s heirs.

- Donors can add requirements to their donations and have more power over how their gift is used.

- Donors leave a legacy and are honored for their support.

2. For nonprofits

Nonprofits can benefit in many ways from a planned giving program. Here are a few reasons an organization will want to include it in their fundraising plans:

- Planned gifts offer a level of security and ensure the organization’s future.

- Planned giving provides an excellent return on investment. The cost of securing a legacy gift is much less than the amount received.

- Studies have found that after arranging such a giving program with the donor, there was an average increase of $3,171 in their annual gifts.

- Donors willing to leave a planned gift have a stronger attachment to the organization. By creating a legacy gifts program, nonprofits have a chance to strengthen relationships with these donors.

While most planned gifts do not benefit your nonprofit right away, some can. Regardless of the type of planned gift program, nonprofits must have a plan to receive the gift and use it to fulfill the organization’s mission.

1. Real estate

Donors may want to give a nonprofit real estate to benefit from the large tax break they can receive. Nonprofits can either use the real estate for their own needs or sell it at fair market value. For this gift type, donors leave this gift in their estate plan, wanting to support an organization of their choice at some time in the future.

When receiving property through an estate plan, your organization must know about any liens, environmental hazards, other landowners, insurance requirements, and maintenance needed before accepting the donation.

2. Charitable lead trusts

A common way nonprofits receive revenue right away from a planned gift program is with a charitable lead trust. The charity gets payments from the trust during the donor’s lifetime and other non-charity individuals, most often the donor’s heirs, receive the remaining income at the end of the trust.

3. Appreciated securities

Appreciated securities are not cash gifts. These gifts are stocks and are an excellent way to get the largest tax break for a donation . The donor can claim the total amount the stock was sold for on their taxes even if they purchased it at a lower price.

4. Retirement plans

When individuals reach 70 ½ years old, the IRS requires them to withdraw a certain percentage from their IRA (Individual Retirement Account) or 401K every year. Each withdrawal is taxed. In 2018, a new tax law was passed that allows people to give up to $15,000 as an individual or $30,000 as a couple without paying taxes. Owners of a retirement plan can either provide this amount to their heirs or a charity.

5. Bequests

Bequests are the most popular type of planned gift. Donors leave a specified amount to a charity in their will, and charities will receive the full amount in the event of their death. It is not rare for nonprofits to be unaware of this gift until they’ve received one.

6. Life insurance

Life insurance is a must-have for your family, but something people may not think about is the tax-free cash payout when the owner dies. Most individuals purchase a life insurance policy for the sake of their family, but donors can also leave this policy or part of this policy to their favorite charity.

7. Charitable remainder trusts

Split interest gifts, like a charitable remainder trust, can be complicated and require financial and legal professionals to help your organization and donor finalize the details. These gifts provide nonprofits a donation in the future and regular investment payments for the donor during their retirement. The benefit of this type of planned gift is obvious and provides a fantastic retirement income for the donor.

By creating a program that lays out ways donors can contribute significant amounts to your organization, you simplify the process. When promoting your planned giving or legacy gifts program, there are several steps your organization can take to encourage more donors to give.

1. Involve your board

Board members may be unaware of this donation opportunity and the tax breaks they can get in exchange for these donations. By informing them of the reasons and benefits that come from this type of gift, you may luck out and find a few board members interested in scheduling planned gifts for themselves. It is also the best way to get your board excited and willing to promote the program to the community. Many board members have connections with people who want to make this type of donation.

Pro tip: You should build a committee or advisory board of legal and financial experts willing to provide necessary information to your donors. Look for a financial advisor, attorney, and board member with previous experience with this type of donation. This committee will be in charge of developing a planned giving guide that includes in-depth information on the same.

2. Develop a planned giving case statement

Along with your planned giving guide, your nonprofit must have a case statement to hand out to individuals that may be interested. When creating a case statement, there are several things to include, but the most essential are your organization’s mission, vision, values, programs, financial status, impact on the community, and details about this giving program.

3. Create policies for acceptance and refusal of planned gifts

As we said earlier, there may be times when it is not in the best interest of your nonprofit to accept all planned gifts. In this case, you must have a policy in place that details how and when to deny these gifts. Keep your mission front of mind when creating these policies, so when specific gifts like property come up, you can make the right decision for your organization.

At first, your planned gift committee will want to keep these policies simple. As you receive more gifts and issues come up, you can add details more specific to your nonprofit.

4. Create a planned giving society

Planned gifts or legacies are a wonderful opportunity for nonprofits to recognize donors. Individuals that support your organization and leave a significant donation in their will should be honored. Creating a society and donor wall to highlight these gifts is an excellent way to promote the program and thank those who have given.

5. Create a planned giving brochure

The committee can work with your nonprofit’s development or fundraising department to create a brochure. This marketing piece should give a simple explanation of how donors can designate your nonprofit as a beneficiary in their will and why it benefits them and the organization.

Pro tip: Promote planned giving to all donors regardless of their annual income and make them aware of what it is. These gifts are one such section of major gifts that you get to acquire from all kinds of donors irrespective of their current wealth status.

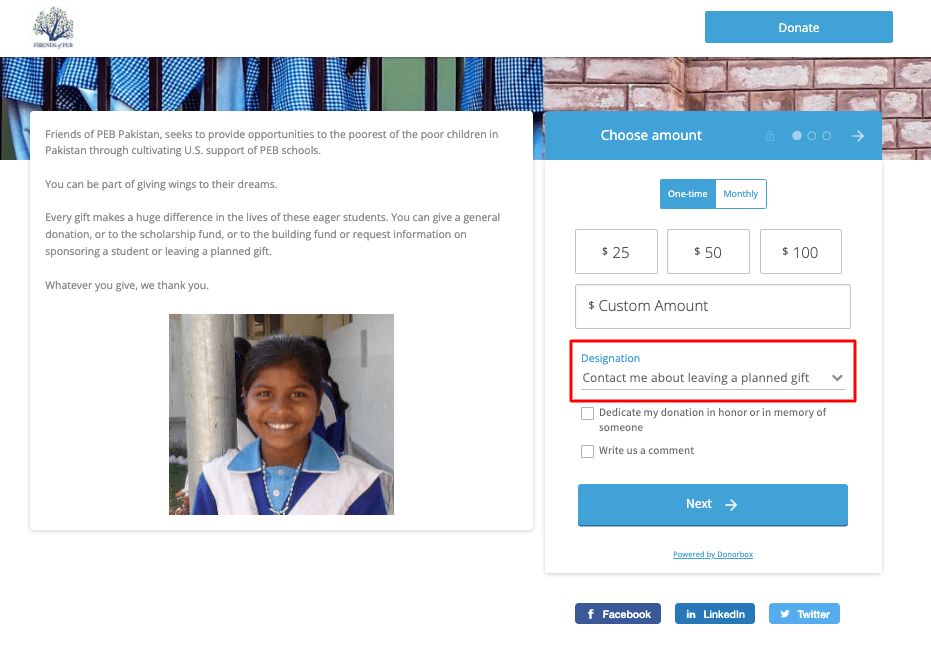

6. Add a planned giving page to your website

Marketing a planned giving program should not stop with a brochure. Adding your legacy society and information on this giving program to your website makes it easy for donors to learn more. You should check out the below planned giving page on Friends of PEB ’s website for an excellent reference.

7. Include the planned giving link on donation forms/gift acknowledgments

Since planned giving is not an immediate concern for most, it is crucial that your nonprofit reminds donors of such opportunities whenever possible. An easy way to do this is by adding a link to your online donation form or a check box on all gift acknowledgments for people to learn more. The below image shows a simple online donation page that lets donors select the option of being contacted for planned gifts right from the donation form.

8. Add a statement about planned gifts with your email signature

A great way to subtly promote the program is to add a planned giving message to your email signature . Most donors will ignore the message, but you may find a few donors interested in learning more and even could end up with a gift. Add the link to your respective page on your website, maybe also a line about which different gifts you’re open to receiving.

9. Offer a planned giving presentation for donors

An informational meeting is one of the best ways to educate your donors. Most of your donors do not have their own financial advisor and will appreciate the chance to learn more about planned giving and how it can benefit them, their families, and your nonprofit.

Pro tip: It is best to use experts that serve on your committee or ask outside professionals to lead the meeting. The focus should be on education, especially the fact that planned giving has nothing to do with their current wealth status and can, in fact, benefit them too.

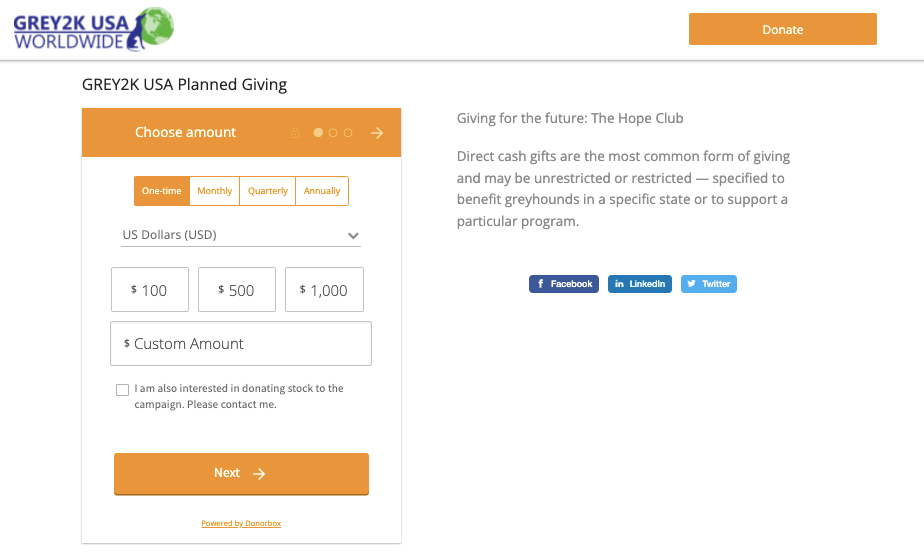

10. Create a separate planned giving campaign

Your nonprofits should have a planned giving campaign every year for the best donor response. These campaigns can cost next to nothing when done online, so you do not have to worry about tracking your return on investment right away. You can also add such giving options to other fundraising campaigns like your year-end holiday campaign.

The below campaign is simple and can work as a great reference for building your own planned giving campaign page. Apart from donations, they have also added a checkbox for donors who want to donate stock to the campaign. This way a nonprofit can encourage different options.

Pro tip: An excellent time for a planned giving campaign is when people have it on their minds during tax season. By bringing up the tax benefits for donors, you can entice supporters to learn more and potentially set up a planned gift this year with their accountant.

Planned giving should be an essential part of your fundraising strategy. Even if you do not see a return on your investment right away, you are investing in the future and attracting major gifts to your organization.

Donorbox helps you create intuitive and effective online campaigns for your nonprofit. It is an affordable online fundraising tool with advanced features like crowdfunding, peer-to-peer fundraising, text-to-give, membership campaigns, and more. Visit our website for more info.

Get fundraising tips, resources, and nonprofit management insights on our blog and sign up for our newsletter to fuel your fundraising efforts.

Kristine Ensor

Kristine Ensor is a freelance writer with over a decade of experience working with local and international nonprofits. As a nonprofit professional she has specialized in fundraising, marketing, event planning, volunteer management, and board development.

Join the fundraising movement!

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.

Giving Tips

Understanding legacy giving in 2024: planned giving basics, gift types, benefits and more.

Finding a way to give back to your community or to an organization that aligns with your values provides purpose and meaning. While we often take a ‘what can we do now’ approach to charitable giving, the truth is planned giving is a great way to maximize charitable impact after your lifetime.

Planned gifts are often larger than standard donations and help drive major philanthropic dollars into the nonprofit sector.

In 2021 alone, charitable bequests (the most common type of planned gift) accounted for 9% of all donations , totaling $46.01 billion. It’s a significant amount – more than doubling donations from corporations ($21.08 billion) – and underscores the importance for nonprofit organizations.

What is Planned Giving?

Planned giving , also referred to as gift planning or legacy giving, is a donor’s intention to contribute a planned gift to an organization beyond their lifetime. This is often a continuation of the donations an individual or couple has made while living, but on a much larger scale.

Unlike an annual gift, a planned gift is scheduled for the future – often as part of financial or estate plans. Typically donated through a will or trust, planned gifts are realized after a donor passes away. Typically, planned gifts are coordinated with professional advisors , attorneys and nonprofit organizations.

It’s important to note that planned giving is not limited by your current wealth.

Planned gifts are typically larger than lifetime donations because they can come from a variety of traditional and non-traditional assets at times not eligible for gifting during one’s lifetime, including life insurance policies, retirement assets, equity, or real estate holdings, rather than standard income.

This means even if you consistently contribute small gifts, your planned gift can be of a much greater value and impact.

Download: Guide to Building Your Charitable Legacy

Why Make a Planned Gift: Benefits of Planned Giving

Why is planned giving important?

“Not only does planned giving represent the opportunity to provide long-term support to an organization, but it also gives donors a chance to establish a legacy,” explained an article in Trust & Will.

Other benefits include:

- Planned giving provides an opportunity to leave a major gift that may not have been possible in a donor’s lifetime due to financial commitments.

- Charitable gifts are often exempt from estate tax, allowing more of the gift to go directly to the organization.

- Donors can avoid capital gains taxes when they transfer assets as part of a planned gift, maximizing the charitable contribution.

Perhaps the biggest benefit is that planned giving preserves a donor’s legacy.

Typically, a donor begins thinking about planned giving as they near retirement age but could start the process as early as their 40s. Since a planned gift usually aligns with a donor’s values and beliefs, the gift can be a personal one that represents a cause or nonprofit close to their heart, thus solidifying an impactful and lasting legacy for the donor.

Legacy Giving vs. Planned Giving

Planned giving is often referred to as legacy giving. The terms are generally interchangeable.

Planned gifts – or legacy gifts – can be used to support nonprofit organizations or establish legacy funds at community foundations . Legacy funds often fall into one of four categories:

- Advised Fund: Grants from a donor-advised fund are recommended by a fund advisor of your choosing. This type of fund is best when you want to designate a specific person to make grants from the fund on your behalf, typically a child or other close relative, after your lifetime.

- Broad-Purpose Fund: Broad-purpose funds support a chosen cause – for instance, protecting the environment. This type of fund is best if you are passionate about specific impact areas but you do not want to choose specific organizations to support.

- Designated Fund: Designated funds support specific organizations that you choose during your lifetime. This type of fund is best when you know the exact organization(s) you want to support, each of which receives a set percentage adding up to 100% of your total gift.

- Scholarship Fund: Scholarship funds support students’ academic pursuits and are tailored to match your interests. You set scholarship award criteria. Community foundation staff and volunteers review applications and award scholarship recipients on your behalf.

Opening an endowment, or permanent legacy fund, with a planned gift is a flexible, efficient, tax-effective way to ensure the causes you care about will benefit from your generosity forever.

Legacy gifts are usually given upon a donor’s death – but not always.

According to an article by Nonprofit Hub, legacy giving can take several forms, “including recurring donations that begin while the donor is alive and continue after they’re deceased. And legacy gifts don’t have to be monetary, either. They can include material goods, property, stocks—anything that’s of value to the beneficiary.”

Types of Planned Gifts

The planned gift definition is any charitable donation that funds a legacy fund.

Planned gifts come in several forms, each distinct and beneficial in their own unique way.

Some planned gifts provide lifelong income to families while others use estate and tax planning to provide for charity and heirs in ways that maximize gifts or the impact on an estate.

What is a planned gift example?

Some of the more common types of planned gifts San Diego Foundation stewards are:

- Donor-Advised Fund : A donor-advised fund (DAF) can be used to give now , give later or both. A DAF succession plan engages family members within the philanthropic goals set by the donor. DAFs are the most popular philanthropic option at San Diego Foundation.

- Bequest by Will or Living Trust : Naming a charity in your will or living trust enables you to support your community and retain complete control over the assets during your lifetime while earning a full charitable deduction on estate taxes. This type of gift – called a charitable bequest – can be a specific dollar amount, a percentage or all of your estate, or what remains after other bequests are made.

- Charitable Gift Annuity: A Charitable Annuity is essentially a contract between you and a charity of your choosing that involves transferring cash or property to the charity in exchange for a partial tax deduction and a lifetime stream of annual income.

- Charitable Remainder Trust: A Charitable Remainder Trust is a qualified trust that pays income to beneficiaries. After all income payments have been completed, the remainder is distributed to qualified charities. With this trust you’re able to bypass capital gains tax, increasing income, and receiving a charitable income tax deduction.

- Charitable Lead Trust: Through a Charitable Lead Trust, you and your legal or financial advisor select assets to fund a lead trust: the charity receives a fixed annual payout from the trust, and the remainder goes to your beneficiaries at the end of the charity’s payout term.

- Charitable Endowment: With a Charitable Endowment, you can leave property or money in an endowment so that the charity does not spend the principal. Instead, the nonprofit grants the endowment income per your instructions.

- Life Insurance: Gifting a life insurance policy allows you to make a significant legacy gift to the nonprofit community with tax benefits that you can enjoy during your lifetime. Through a relatively small annual cost of the premium, you can give a gift to your favorite charity that is larger than otherwise would be possible.

- IRA, 401(k) or Other Retirement Assets: A retirement plan can be a tax-efficient and simple way of including your favorite charity in your estate plan. A charity that is named as the beneficiary does not pay income or estate taxes on the distribution.

- Custom Estate Plan for Business, Investments or Special Needs Child: If you own a family business, substantial real estate holdings or a large estate, then a custom plan that considers your special property goals can be created. A custom plan option is also useful if you have a child with special needs. A child with special needs may be provided for through a “special needs trust.”

Maximizing Planned Gifts with Community Foundations

SDF can help determine which planned giving option is best for you and your family.

Our Giving Team is available to answer questions and assist with planning to ensure that your values and interests live on. By creating a charitable legacy, you can provide lasting benefits for you, your family, and your community.