Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

- Finance & Investing

Insurance Company Business Plan

An insurance agency can become a profitable business if done right. After all, insurance companies as a business help people deal with uncertainties, and that is something all of us want.

And if you have good negotiation skills, are brilliant at planning, and have a thorough knowledge of how insurance works then you might have thought of having your insurance agency.

If yes, then what are you waiting for?

Get started because now is a time as good as any. All you need is a little industry information and an insurance company business plan to help you have a thriving business.

Industry Overview

The global insurance industry stands at a whopping value of 5.3 trillion US dollars in 2022 and is expected to grow at a rapid pace going forward too.

The major reason for the growth of the insurance sector comes from the increasing uncertainty of life, property, and everything else that concerns people.

The increase in disposable income amongst people has also contributed significantly to the growth of the sector.

But as everything good attracts competition, the insurance industry attracts a lot of competition too. And if you want to stand out amongst all of it, you’ll need to be brilliant at what you do. Proper steps to set up your business and planning can help you with that.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

Things to Consider Before Writing Your Insurance Company Business Plan

Know the industry.

The first step towards having a successful business is to research the industry and know what you are getting yourself into. It helps you understand the ins and outs of the business and what steps you should take to help your business succeed. It also helps you stay updated with the latest trends and use them to your advantage.

Get the necessary licenses and permits

As insurance companies are prone to lawsuits, fraud, and other such problems, having all the necessary documents can help you stay on the right side of the law. The licenses and permits act as an assurance for both your clients and your business that you’ll be able to deal with any legal hassle that comes your way. And as you don’t need to worry about the legalities you can focus on what really matters.

Know your audience

Knowing your target audience, their fears, motivations, and preferences can give you the required edge over your competitors. As you know your customers you’re able to serve them better. This eventually makes them return to you and build long-term and mutually beneficial relationships with your customers.

Promote your business

Promoting your business is foundational to success because for your business to work you need to let people know that your business exists. Hence, once you get to know your target audience, it is important to promote your business in a way that speaks to your target audience.

Chalking out Your Business Plan

If you are planning to start a new insurance company, the first thing you will need is a business plan. Use our sample insurance company business plan created using Upmetrics business plan software to start writing your business plan in no time.

Before you start writing your business plan for your new insurance business, spend as much time as you can reading through some examples of insurance-related business plans .

Reading sample business plans will give you a good idea of what you’re aiming for and also it will show you the different sections that different entrepreneurs include and the language they use to write about themselves and their business plans.

We have created this sample insurance company business plan for you to get a good idea about what a perfect insurance business plan should look like and what details you will need to include in your stunning business plan.

Insurance Company Business Plan Outline

This is the standard insurance company business plan outline which will cover all important sections that you should include in your business plan.

- Keys to Success

- 3 Year profit forecast

- Startup cost

- Funding Required

- Company Ownership

- Company Locations and Facilities

- Service Description

- Competitive Comparison

- Sales Literature

- Fulfillment

- Future Services

- Market Analysis

- Competition and Buying Patterns

- Business Participants

- Distributing a Service

- Cal Roberts, Patrick C. Johnson, Rob Champlain

- Agents (such as Co-operators)

- Mass Markets

- Group Plans – teachers, public employees

- Promotion Strategy

- Distribution Strategy

- Positioning Statement

- Pricing Strategy

- Sales Programs

- Sales Forecast

- Sales Yearly

- Strategic Alliances

- Service and Support

- Organizational Structure

- Startup Funding

- Important Assumptions

- Brake-even Analysis

- Profit Yearly

- Gross Margin Yearly

- Projected Cash Flow

- Projected Balance Sheet

- Business Ratios

After getting started with Upmetrics , you can copy this sample business plan into your business plan and modify the required information and download your insurance company business plan pdf or doc file. It’s the fastest and easiest way to start writing your business plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Download a sample insurance company business plan

Need help writing your business plan from scratch? Here you go; download our free insurance company plan pdf to start.

It’s a modern business plan template specifically designed for your insurance company business. Use the example business plan as a guide for writing your own.

Related Posts

Holding Company Business Plan

Insurance Agent Business Plan

Financial Plan for Startup Guide

Sample Business Plans Free Template

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How To Write an Insurance Company Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for insurance companies that want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every insurance company owner should include in their business plan.

Download the Ultimate Insurance Business Plan Template

What is an Insurance Company Business Plan?

An insurance company business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Insurance Company Business Plan?

An insurance company business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Insurance Company Business Plan

The following are the key components of a successful insurance company business plan:

Executive Summary

The executive summary of an insurance company business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your insurance company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your insurance company , you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your insurance company firm, mention this.

You will also include information about your chosen insurance company business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an insurance company business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the insurance industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an insurance company may include individuals, families, small businesses, and large corporations.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or insurance company services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your insurance company may have:

- Specialized industry knowledge

- Proven track record

- Strong customer relationships

- Robust product offerings

- Innovative solutions

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign.

- Or, you may promote your insurance company business via word of mouth.

Operations Plan

This part of your insurance company business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an insurance company include reaching $X in sales. Other examples include expanding to a new geographic market, launching a new product or service line, or signing on new major customers.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific insurance industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Insurance Company

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Insurance Company

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup insurance company business.

Sample Cash Flow Statement for a Startup Insurance Company

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your insurance company . It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it. All in all, a business plan is a key to the success of any business.

Finish Your Insurance Business Plan in 1 Day!

Other helpful articles.

How To Write an Insurance Agency Business Plan + Template

Free Download

Insurance Company Business Plan Template

Download this free insurance company business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

Industry Business Planning Guides

How to Create a Business Plan Presentation

How to Write a Business Plan

Business Plan Template

Simple Business Plan Outline

How to Start a Business With No Money

How to Write a Business Plan for Investors

10 Qualities of a Good Business Plan

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

From template to plan in 30 minutes

- Step-by-step guidance

- Crystal clear financials

- Expert advice at your fingertips

- Funding & lender ready formats

- PLUS all the tools to manage & grow

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Insurance Company Strategic Plan Template

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

In the fast-paced world of insurance, having a solid strategic plan is essential for staying ahead of the competition. ClickUp's Insurance Company Strategic Plan Template is designed to help insurance companies like yours define their long-term goals, set objectives, and outline strategies for growth, risk management, customer acquisition and retention, product development, regulatory compliance, and financial performance.

With this template, you can:

- Map out your company's vision and mission

- Identify key performance indicators (KPIs) to track progress

- Set realistic targets and timelines for achieving your goals

- Collaborate with your team to ensure everyone is aligned and working towards the same objectives

Take your insurance company to new heights with ClickUp's Insurance Company Strategic Plan Template. Start planning for success today!

Benefits of Insurance Company Strategic Plan Template

Crafting an effective strategic plan is crucial for insurance companies striving for long-term success. With the Insurance Company Strategic Plan Template, you can:

- Define clear and actionable goals to guide your company's growth and development

- Strategically manage risks to protect your company and its clients

- Increase customer acquisition and retention through targeted marketing strategies

- Drive innovation and product development to stay ahead of the competition

- Ensure compliance with ever-changing regulations and industry standards

- Optimize financial performance to achieve sustainable profitability

Main Elements of Insurance Company Strategic Plan Template

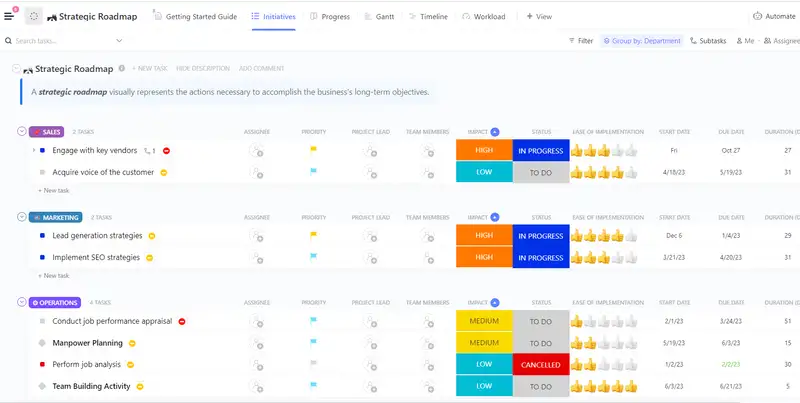

ClickUp's Insurance Company Strategic Plan template provides the essential tools to effectively manage and execute your company's strategic initiatives.

- Custom Statuses: Track the progress of each initiative with five different statuses, including Cancelled, Complete, In Progress, On Hold, and To Do.

- Custom Fields: Utilize eight custom fields such as Duration Days, Impact, Progress, and Team Members to capture important information about each initiative and easily track their development.

- Custom Views: Access six different views, including Progress, Gantt, Workload, Timeline, Initiatives, and Getting Started Guide, to gain a comprehensive overview of your strategic plan and monitor progress at a glance.

- Project Management: Leverage features like Gantt charts, workload management, and timelines to effectively plan and allocate resources, set realistic timelines, and ensure successful execution of your initiatives.

How to Use Strategic Plan for Insurance Company

If you're an insurance company looking to create a strategic plan, follow these six steps using the Insurance Company Strategic Plan Template in ClickUp:

1. Define your mission and vision

Start by clearly defining your insurance company's mission and vision. What is your ultimate purpose and what do you aspire to achieve? This will serve as the guiding principle for your strategic plan.

Use a Doc in ClickUp to outline and articulate your mission and vision statements.

2. Identify your target market

Determine your target market by analyzing demographics, customer needs, and market trends. Who are your ideal customers and what insurance products or services do they require? Understanding your target market will help you tailor your strategies to meet their specific needs.

Utilize custom fields in ClickUp to track and analyze data related to your target market.

3. Set strategic goals and objectives

Based on your mission, vision, and target market, establish strategic goals and objectives for your insurance company. What do you want to achieve in terms of market share, customer satisfaction, profitability, and growth? Make sure your goals are specific, measurable, attainable, relevant, and time-bound (SMART).

Create Goals in ClickUp to set and track your strategic objectives.

4. Develop action plans

Once you have your goals in place, develop action plans to outline the steps and initiatives needed to achieve them. Break down each goal into actionable tasks, assign responsibilities, and set deadlines. This will ensure that everyone on your team knows what needs to be done and when.

Utilize tasks and subtasks in ClickUp to create and assign action plans for each strategic goal.

5. Monitor progress and make adjustments

Regularly monitor the progress of your strategic plan and make adjustments as necessary. Track key performance indicators (KPIs) related to your goals, such as customer retention rate, premium growth, and claims ratio. If you're not on track to meet your objectives, identify areas for improvement and make necessary changes to your action plans.

Use Dashboards in ClickUp to visualize and monitor the progress of your strategic goals.

6. Communicate and engage your team

Ensure that your strategic plan is communicated to and understood by all members of your insurance company. Encourage open communication, collaboration, and engagement among your team members. Regularly update them on the progress of the plan and celebrate milestones and achievements along the way.

Utilize ClickUp's integrations, such as Email and AI-powered automations, to streamline communication and keep everyone informed.

By following these steps and utilizing ClickUp's features, you can create an effective and actionable strategic plan for your insurance company, setting you on the path to success.

Get Started with ClickUp’s Insurance Company Strategic Plan Template

Insurance companies can use this Insurance Company Strategic Plan Template to align their teams and ensure a clear roadmap for success in a competitive industry.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Make sure you designate which Space or location in your Workspace you’d like this template applied.

Next, invite relevant members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a comprehensive strategic plan:

- Use the Progress View to track the progress of each strategic initiative and ensure alignment with company goals

- The Gantt View will help you visualize the timeline and dependencies of each initiative for effective project management

- Use the Workload View to balance resource allocation and ensure the team is not overwhelmed with tasks

- The Timeline View will provide a clear overview of milestones and deadlines for each strategic initiative

- The Initiatives View will help you track and manage individual initiatives and their progress

- Use the Getting Started Guide View to quickly get acquainted with the template and its features

- Organize initiatives into five different statuses: Cancelled, Complete, In Progress, On Hold, To Do, to keep track of progress

- Update statuses as you progress through initiatives to keep stakeholders informed of progress

- Monitor and analyze initiatives to ensure the strategic plan is effectively implemented and drives business growth.

Related Templates

- Patrol Officers Strategic Plan Template

- Refinery Operators Strategic Plan Template

- Interior Designers Strategic Plan Template

- Improving Productivity Strategic Plan Template

- Pr Professionals Strategic Plan Template

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Insurance business strategy

Take action today for immediate impact and sustained advantage in the insurance market.

The insurance industry is undergoing more upheaval than any other. Disruptors include changes in industry regulation, customer behavior, distribution channels, traditional and new competitors and core technologies of production and service.

- Can you quickly and decisively respond to important new challenges and opportunities?

- What will your markets look like, who will be your most important customers and competitors, and how are customer expectations likely to change?

- How can you get closer to customers and better understand their needs?

- Is your business nimble and innovative enough to compete with the mobile companies, internet providers and other new entrants that are making inroads into the market?

Next in insurance 2023 Scenarios for the next year and beyond

Because the trends affecting the insurance industry will continue to manifest longer than in just 2023, this year’s “Next in insurance” is looking beyond just the coming year to the rest of the decade. Change will remain constant and - as was the case with work and customer service models during the pandemic - sometimes be very sudden. But the factors spurring it will remain much the same as they are now:

- The ever-increasing growth of digital channels, wider distribution points via partnerships and embedded options, and enhanced analytics are integrating markets. Policy options will only grow and barriers to entry ease.

- Social responsibility and ESG remain critical. This is about more than maintaining a positive brand and extends to helping clients and society mitigate - even prevent - natural and human catastrophes, cybercrime and other loss incidents.

- Insurance companies can no longer be merely sellers of generic policies. They have to be technology-enabled - not just “digital” - in order to agilely assess and price risk and serve customers in the situations they need, learn about and purchase insurance.

{{filterContent.facetedTitle}}

Playback of this video is not currently available

{{item.publishDate}}

{{item.title}}

{{item.text}}

Download PDF - {{item.damSize}}

Accelerating insurance transformation and creating value

Business design.

- Define growth strategies to capture market share.

- Design operating models to reduce complexity and improve effectiveness.

- Create operational and technology strategies to improve market responsiveness.

Information advantage

- Enhance analytical capabilities and seek new insights to create an information advantage.

Mobilization and execution

- Transform core operations and platforms to improve operating leverage, market agility and operational effectiveness.

Customer impact

- Develop and improve direct distribution capabilities and integrated multi-channel strategies.

- Explore new capabilities that online strategies enable.

- Guide customer-driven innovations and product speed-to-market.

Insurance customer experience: Encouraging curiosity

PwC's Marie Carr and Bruce Brodie talk with PwC advisor Toby Alfred about how insurers can improve the customer experience and consequently their bottom line.

Insurance Leader, Consulting Solutions, PwC US

Consulting Principal, PwC US

Tom Kavanaugh

Insurance Advisory Principal, PwC US

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

- We're Hiring!

Crafting an Effective Insurance Agency Business Plan

If you're an independent insurance agent, you know that success doesn't happen by chance. It requires strategic planning and a clear roadmap for the future. That's where an insurance agency business plan comes into play.

In this guide, we'll explore what a business plan is, why it's essential, and how to create one tailored to your home insurance agency.

At a glance:

- Crafting a well-defined insurance agency business plan provides strategic direction and goal-setting for success.

- A comprehensive business plan allows for adaptability in an ever-evolving industry.

- Defining your brand, researching funding options, and staying compliant with regulations, are the ingredients that can transform your business plan into an effective tool for growth.

Benefits of having a business plan

Having a solid roadmap is like holding a compass in a dense forest. It not only guides you on how to become a successful insurance agency, but also ensures you stay on course.

Strategic direction

So let’s continue that analogy: you’re on a road trip without a map, compass, or GPS. You might eventually reach your destination, but it would be a long and uncertain journey. Similarly, running an insurance agency without a business plan is like traveling without a guide. A well-crafted plan provides a clear path and helps you stay focused on your goals.

Goal setting

Setting realistic and achievable goals is vital for any business. Your insurance agency business plan acts as a compass, allowing you to establish clear objectives. Whether you want to increase your client base, revenue, or expand your services, a business plan helps you chart the course.

Investor confidence

If you find yourself in a place to seek external funding, whether from investors or lenders, a comprehensive business plan is a must. It demonstrates that you've thought through your business strategy, increasing your chances of securing financial support.

Adaptability

The insurance industry is never stagnant, and as such adaptability is key. A business plan isn't set in stone; it's a living document that can be adjusted as circumstances change. If done correctly, it allows you to stay flexible and make informed decisions as market trends shift.

Key components of an insurance agency business plan

Your business plan is the document that transforms your vision into a tangible reality, ensuring your journey as an independent insurance agent is not only successful but prosperous too.

Let’s explore the key components of an effective business plan, including the executive summary, company overview and more.

Executive summary

The executive summary serves as the elevator pitch for your entire business plan. It's designed to capture the reader's attention and give them a quick, compelling overview of your insurance agency. You'll want to concisely highlight your agency's mission, vision, and goals. Think of it as distilling your agency's essence into a few powerful sentences. It's an invitation for the reader to learn more about your agency's journey.

Company overview

The company overview is your opportunity to introduce your insurance agency in detail. It's where you set the stage for the rest of your business plan. In this section, you’ll want to dive into the history of your agency, including its founding story, location(s), and size. You should also describe every type of insurance product you offer and provide a snapshot of what makes your agency unique.

Industry analysis

The industry analysis puts your industry knowledge to good use. It's all about understanding the broader insurance market, including its trends, challenges, and opportunities. In this section, you'll research and present data and insights into the insurance industry. Discuss market trends, regulatory changes, and any challenges that could impact your independent agency. Identifying opportunities within the industry allows you to position your agency effectively to take advantage of them.

Customer analysis

Understanding your target market is essential for tailoring your services and marketing efforts effectively. Create detailed buyer personas that encompass their needs, preferences, and pain points. This information is the foundation for developing products and services that resonate with your audience.

Competitive analysis

Knowing your competition is about gaining insights into their strengths and weaknesses. When performing your market analysis, or market research, be sure to look at factors like their market share, marketing strategy, pricing models, and customer service practices. Understanding how you stack up against the competition will help you develop a winning strategy that sets your agency apart.

Marketing plan

Your marketing plan is the strategic playbook for how you'll attract and retain clients. Specify your marketing channels, both online and offline; outline your budget and set measurable goals. Whether it's through digital advertising, content marketing, or print advertising, your marketing plan should maximize your independent insurance agency's reach and impact.

Operations plan

The operations plan is the behind-the-scenes blueprint for how your independent agency runs day-to-day. Detail your team structure, office setup, and technology requirements. It's about ensuring smooth workflow and efficient service delivery. This section gives a clear picture of how your agency operates on a daily basis.

Management team

Your management team is the engine that drives your agency. Introduce the key members of your management team and highlight their expertise. Explain how their skills and experiences contribute to the agency's success.

Financial plan

The financial plan is the heart of your business plan. It's where you demonstrate that your agency is not just a vision but a financially viable venture. For any enterprise, including insurance agencies, it’s important to provide detailed financial projections in your business plan, including income statements, balance sheets, and cash flow statements. Set clear financial goals and explain how you intend to achieve them.

Tips for creating an effective insurance agency business plan

Creating an insurance agency business plan is akin to crafting that roadmap we talked about earlier. But here's the twist—this isn't just any road; it's twisting and on an ever-changing landscape. To navigate it successfully, you need more than just directions; you need insider tips and tricks.

Define your brand

Your brand is more than just a logo; it's who you are. Define your brand identity, including your mission statement, core values, and unique selling proposition. A strong brand will set you apart in a crowded market.

Research funding options

If you need capital to start or expand your agency, explore different funding options, which could include personal savings, loans, or investors. Your business plan should outline your funding needs and how you intend to secure the necessary capital.

Apply for licenses

Ensure that you comply with all regulatory requirements in your area. This includes obtaining the necessary licenses and insurance policies to operate legally. Failing to do so could jeopardize your agency's success.

Set goals and establish metrics

Your business plan should include specific, measurable, and time-bound goals. Track key performance indicators to measure your progress and adjust your strategy accordingly. Regularly reviewing and updating your plan keeps you on the path to success.

A strategic roadmap for success

For an independent insurance agency, a well-crafted business plan is not simply a document; it's a dynamic tool that provides strategic direction, fosters adaptability, and instills investor confidence. By defining your brand, understanding your market, and detailing your operational and financial strategies, your insurance agency business plan becomes the compass guiding you through the complexities of the industry.

With clear goals, a solid management team, and a proactive approach to change, your agency can navigate the insurance industry effectively, ensuring not only agency survival but also sustainable growth

Request an Appointment with Openly

A partnership with Openly empowers you to deliver outstanding service with speed and ease while offering comprehensive coverage tailored to your clients' needs.

About the Author

Alyssa Little | Senior Content Strategist

Alyssa is the Senior Content Strategist at Openly, collaborating with industry thought leaders to provide insightful and informative content in the home insurance space. With over 15 years experience in content marketing strategy, copywriting, and editing, Alyssa has refined her expertise through her work at such companies as Gartner, Nike, and Trupanion. Alyssa holds a BA in History from the University of Puget Sound and an MA in Museum Studies from Newcastle University.

Related Blogs

May 18, 2023

December 21, 2023

May 15, 2023

Insurance Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Insurance Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Insurance Agency Business Plan

You’ve come to the right place to create your own business plan.

We have helped over 100,000 entrepreneurs and business owners create business plans and many have used them to start or grow their insurance companies.

Essential Components of a Business Plan For an Insurance Agency

Below we describe what should be included in each section of a business plan for a successful insurance agency and links to a sample of each section:

- Executive Summary – In the Executive Summary, you will provide a high-level overview of your business plan. It should include your agency’s mission statement, as well as information on the products or services you offer, your target market, and your insurance agency’s goals and objectives.

- Company Overview – This section provides an in-depth company description, including information on your insurance agency’s history, ownership structure, and management team.

- Industry Analysis – Also called the Market Analysis, in this section, you will provide an overview of the industry in which your insurance agency will operate. You will discuss trends affecting the insurance industry, as well as your target market’s needs and buying habits.

- Customer Analysis – In this section, you will describe your target market and explain how you intend to reach them. You will also provide information on your customers’ needs and buying habits.

- Competitive Analysis – This section will provide an overview of your competition, including their strengths and weaknesses. It will also discuss your competitive advantage and how you intend to differentiate your insurance agency from the competition.

- Marketing Plan – In this section, you will detail your marketing strategy, including your advertising and promotion plans. You will also discuss your pricing strategy and how you intend to position your insurance agency in the market.

- Operations Plan – This section will provide an overview of your agency’s operations, including your office location, hours of operation, and staff. You will also discuss your business processes and procedures.

- Management Team – In this section, you will provide information on your insurance agency’s management team, including their experience and qualifications.

- Financial Plan – This section will detail your insurance agency’s financial statements, including your profit and loss statement, balance sheet, and cash flow statement. It will also include information on your funding requirements and how you intend to use the funds.

Next Section: Executive Summary >

Insurance Agency Business Plan FAQs

What is an insurance agency business plan.

An insurance agency business plan is a plan to start and/or grow your insurance business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your insurance agency business plan using our Insurance Agency Business Plan Template here .

What Are the Main Types of Insurance Companies?

There are a few types of insurance agencies. Most companies provide life and health insurance for individuals and/or households. There are also agencies that specialize strictly in auto and home insurance. Other agencies focus strictly on businesses and provide a variety of liability insurance products to protect their operations.

What Are the Main Sources of Revenue and Expenses for an Insurance Agency Business?

The primary source of revenue for insurance agencies are the fees and commissions paid by the client for the insurance products they choose.

The key expenses for an insurance agency business are the cost of purchasing the insurance, licensing, permitting, and payroll for the office staff. Other expenses are the overhead expenses for the business office, utilities, website maintenance, and any marketing or advertising fees.

How Do You Get Funding for Your Insurance Agency Business Plan?

Insurance agency businesses are most likely to receive funding from banks. Typically you will find a local bank and present your business plan to them. Other options for funding are outside investors, angel investors, and crowdfunding sources. This is true for a business plan for insurance agent or an insurance company business plan.

What are the Steps To Start an Insurance Business?

Starting an insurance business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Insurance Business Plan - The first step in starting a business is to create a detailed insurance business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your insurance business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your insurance business is in compliance with local laws.

3. Register Your Insurance Business - Once you have chosen a legal structure, the next step is to register your insurance business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your insurance business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Insurance Equipment & Supplies - In order to start your insurance business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your insurance business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful insurance business:

- How to Start an Insurance Business

Where Can I Get an Insurance Business Plan PDF?

You can download our free insurance business plan template PDF here . This is a sample insurance business plan template you can use in PDF format.

Asking the better questions that unlock new answers to the working world's most complex issues.

Trending topics

AI insights

EY Center for Board Matters

EY podcasts

EY webcasts

Operations leaders

Technology leaders

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

EY.ai - A unifying platform

Strategy, transaction and transformation consulting

Technology transformation

Tax function operations

Climate change and sustainability services

EY Ecosystems

EY Nexus: business transformation platform

Discover how EY insights and services are helping to reframe the future of your industry.

Case studies

How Mojo Fertility is helping more men conceive

26-Sep-2023 Lisa Lindström

Strategy and Transactions

How a cosmetics giant’s transformation strategy is unlocking value

13-Sep-2023 Nobuko Kobayashi

How a global biopharma became a leader in ethical AI

15-Aug-2023 Catriona Campbell

We bring together extraordinary people, like you, to build a better working world.

Experienced professionals

EY-Parthenon careers

Student and entry level programs

Talent community

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

Press release

EY announces launch of artificial intelligence platform EY.ai following US$1.4b investment

13-Sep-2023 Rachel Lloyd

EY reports record global revenue results of just under US$50b

Doris Hsu from Taiwan named EY World Entrepreneur Of The Year™ 2023

09-Jun-2023 Lauren Mosery

No results have been found

Recent Searches

How do you steady the course of your IPO journey in a changing landscape?

EY Global IPO Trends Q1 2024 provides insights, facts and figures on the IPO market and implications for companies planning to go public. Learn more.

How can the moments that threaten your transformation define its success?

Leaders that put humans at the center to navigate turning points are 12 times more likely to significantly improve transformation performance. Learn More.

Artificial Intelligence

EY.ai - a unifying platform

Select your location

close expand_more

Five strategic themes defining the near future of insurance

EY Global Insurance Solutions Leader

Related topics

There are ample growth and transformation opportunities for insurers that take the right actions now..

- Purpose will be influential in shaping new value propositions, designing enhanced services and executing ESG strategies.

- New products, personalized experiences and empathetic communications can strengthen customer engagement.

- Carriers can tighten strategic focus, and simplify the business by engaging with private and alternative capital.

B y most accounts, the insurance industry has come through the COVID-19 pandemic in much better shape than many industry analysts believed possible in the immediate aftermath of the lockdown. Indeed, the attention of senior executives and boards is now focused on taking advantage of profoundly altered market conditions and new consumer needs.

Specifically, leaders are looking to spark growth and transform operations for a more digital and customer-centric future. The path forward will be defined largely by corporate purpose, with products designed to boost consumers’ financial well-being and protect against future shocks (including another pandemic). At the same time, the workforce will be refreshed with new skills and capabilities, leaner and more automated processes will become the norm, and capital will be deployed with more focus and creativity.

Purpose is also essential to shaping forward-looking strategies because of the disruptive societal trends – including climate change, geopolitical shifts and economic inequality – that are reshaping the insurance industry. As the EY CEO Imperative frames the current landscape, “Planning to rebound to an old normal is not an option. CEOs must reimagine their strategies for long-term value creation.”

This article highlights five key strategic priorities and supporting actions, covering the full breadth of the business, where insurers can achieve meaningful performance gains and substantial cost improvements in the months and quarters to come. It serves as a follow-up to a similar piece we published more than a year ago, as the industry was just coming to terms with the full economic implications of the pandemic. Today, these themes remain closely intertwined and will continue to evolve, even as insurers prioritize growth in this changed market landscape.

Bringing purpose to life

Purpose will guide the development of new products, management metrics and ESG strategies.

The pandemic’s massive financial impact on individuals, families and businesses sparked a great deal of conversation about the purpose of insurance. Many industry leaders saw an opportunity increase of the “mindshare” of insurance with consumers by finding ways to help contribute to global economic recovery and individual financial well-being.

The Environmental, Social and Governance (ESG) agenda has also shone a bright light on purpose relative to climate change, racial equality and other pressing societal issues. C-suites and boards must make sure the right ESG strategies are in place, as well as robust execution plans and appropriate metrics to track progress toward ESG goals. Metrics are particularly important to ensure inclusion into ESG funds and indexes that are capturing ever-larger shares of capital flows.

For many insurers, defining the right ESG strategy equates to finding the right balance between excluding high-volume carbon emitters and promoting the transition to a low-carbon economy. While some insurers have refused to underwrite policies for certain sectors and companies (e.g., oil and gas, mining), others are emphasizing investments in green energy, sustainable packaging and other businesses expected to grow in a greener economy.

We believe engaging with customers with new climate-related solutions can boost insurers’ growth. In commercial lines, such products would protect businesses against increased risk of flooding and promote adoption of carbon-reducing technologies. For consumers, future auto policies might include carbon offsets. The key is to embed purpose in underwriting processes, as well as in policies themselves.

Key actions for senior leaders and boards:

- Examine how your purpose aligns with changing customer needs and shifting market dynamics

- Define the right metrics to monitor the execution of ESG strategies and communicate progress to stakeholders

- Identify specific actions to embed purpose in operations and specific product features

Preparing the workforce with new skills and capabilities

Market conditions and the hybrid working world necessitate new employee experiences.

Remote working and hybrid working arrangements will permanently change how employees in insurance and every other industry do their jobs. Insurance leaders should seek to build on the digital collaboration capabilities that they instilled during the pandemic, even as they meet increased demand for flexibility regarding when and where employees work. Ongoing EY research clarifies what workers want and the importance of maintaining strong culture in the hybrid world.

What the insurance workforce does is also changing. The most important new capabilities are, to a large extent, the same as they were pre-COVID-19. Data science, beta underwriting and user experience design top the list. In general, however, insurers need people who think digitally and are comfortable working in agile fashion within multi-disciplinary teams.

The “Great Resignation” provides a clear opportunity for insurers to refresh their workforce. With so many people changing jobs, insurers that can provide interesting and meaningful work, within a flexible employee experience, will gain an edge in attracting and retaining new talent. A clearly articulated purpose – e.g., protecting individuals and society from its greatest threats – can boost engagement with workers and consumers alike.

Insurers that have had the most success to date in setting up a flexible workforce experience have taken a data-driven approach in defining their policies. Many have embraced parallel working structures, where specific teams of workers that would benefit from in-person interactions are in the office at the same time. Others are seeking access to scarce talent via collaboration with insurtechs, joint ventures and outsourcing relationships. Such strategic sourcing can help insurers both manage labor costs and compete in the war for talent.

The ultimate goal is talent liquidity – the ability to seamlessly move workers around the business as needs dictate. But the “work from anywhere” world presents new risks and requirements relative to tax policy, social security schemes, immigration status, and pay and compensation. As difficult as it will be to achieve, talent liquidity represents a huge upgrade from yesterday’s more rigid org charts. It’s also necessary for insurers to establish and benefit fully from new business models, such as ecosystems. In other words, talent liquidity will soon be a competitive imperative, rather than the aspiration it is today.

- Define the top skills the organization will need to meet key strategic objectives during the next 18-36 months

- Assess how alternative sourcing strategies can provide access to the most in-demand skills and specialist expertise

- Ensure that purpose statements are included in recruiting materials

Enhancing consumer engagement

Customer-centricity comes to life with simpler products and richer experiences.

Perhaps the biggest COVID-19-driven change in insurance was the rapid shift to nearly all-digital operations – an eye-opening experience for an industry once thought to be slow-moving and resistant to change. Sustaining both a strong digital orientation and a relentless focus on consumer needs will be key to making the most of the clear growth opportunity.

The pandemic’s severe economic impacts on consumers worldwide provide ample motivation to upgrade product portfolios and value propositions around financial well-being. EY research shows customers are most interested in products that cover short-term costs (e.g., mortgage payments, credit card bills, tuition fees) in the event of lost income. Compared to many current policies, these are simpler products with targeted protections and clear value propositions. Insurers that make them easy to find and purchase online have an opportunity to connect with a currently underserved segment.

Here again, purpose plays a role. That is, insurers that link their offerings to the outcomes and protections consumers want (e.g., financial well-being) stand to gain an edge in building long-term, even lifelong, relationships. Looking ahead, new products, with more flexible features, and stronger digital experiences are necessary to enable the business model transformations many insurers want to enact. Stronger ecosystem business models will also become the primary platform for customer engagement in the future.

- Develop affordable and accessible solutions to engage previously underserved segments (including younger consumers) with offerings to improve financial well-being

- Expand ecosystems to offer broader product options and richer, more personalized experiences for customers

- Ensure customer communications build trust through empathy and a warm, human tone

Digitizing for cost optimization and capital efficiency

Simpler, leaner and more operations promote scalability, agility and future innovation.

More digital operations also present opportunities to achieve badly needed cost efficiency. The ongoing pressure on costs, particularly in competitive and commoditized lines of business, shows no sign of letting up. A flexible and highly automated process environment that can easily scale up or down as demand fluctuates is essential to long-term financial success.

Capital management has become a critical capability for many insurers. Freeing funds to invest in digital transformation is a top priority, because both the front and back offices need optimizing. There is a virtuous circle effect to digitization efforts. While substantial investments are often necessary, they can deliver outstanding returns in the form of immediate-term cost savings (along with experience enhancements and process simplification). In turn, those savings can be invested in new product development and increased personalization that take advantage of the leaner and more automated processing environments. Innovation follows cost efficiency in this sense.

Given the upside, it’s no wonder that CEOs are focused on digitization. Nearly two-thirds, or 63%, of respondents in the global EY CEO Imperative survey, said that accelerating technology and digital innovation is having the greatest impact on their company.

Another important dimension of capital management is the divestment of non-core businesses. We have seen many high-profile divestments during the last few years, even by the most successful carriers and brands. The goal is usually to simplify the business and tighten the strategic focus, which helps reduce costs and improve capital efficiency.

- Build a business case for automation and digitization in the back office and define how much capital can be unleased for redeployment to other parts of the business

- Rigorously assess the product portfolio to identify the most likely candidates for divestment

- Review internal capabilities and functions to determine which are truly core and which can be best managed by third parties

Navigating through structural change and realignment

“Alternative” capital and macroeconomics are driving business simplification and strategic focus.

The current matrix of opportunities and risks is being shaped by large-scale structural change and realignment. The rise of alternative capital sources and the pronounced trend away from globalization are the most powerful underlying forces.

Alternative capital – a misnomer given that it has been mainstream for quite some time now – continues to flow into the industry. The rigor of such capital in returns-seeking is influencing board and senior management agendas across the industry, particularly relative to strategic focus and divesting non-core businesses. Geographic focus is one manifestation. The era of “flag planting” is well and truly over, as dominance in a few markets is clearly more beneficial than having a broader presence across global regions.

Insurers are engaging capital sources in more creative ways, too. Some carriers are adopting unique entity models. Others are seeking partners to fund digital transformation and launch new business models and even new brands. More consolidation and divestment are to be expected as the industry seeks to recover from a decade of slow growth and the pandemic’s impacts.

One can’t speak of capital flows without mentioning shifting regulatory regimes and accounting change. Even if the pandemic had never occurred, insurers were facing significant change in how they measure and report performance. Senior leaders also need to reconsider the narratives by which they communicate with investors. Within the next year, management must be ready to explain the meaning of new IFRS 17 and LDTI metrics in ways investors can understand and that provide context around insurers’ growth strategies.

- Conduct a full scan of the insurtech landscape to determine the most promising candidates for collaborations, joint ventures and/or acquisition

- Identify the optimal entity structures and capital strategies to achieve long-term strategic objectives

- Shape a clear narrative for capital markets so they understand performance under new metrics and reporting regimes

As subscription models become more common across industries, insurers must take stock of the opportunities and risks – from greater growth and stronger customer relationships, to the potential downside of new competitors. As with any transformation effort, developing the right data and technology capabilities is vital to effectively implementing such models.

About this article

How EY can help

Digital transformation in insurance

We collaborate with insurers on technology transformation programs and the deployment of digital tools. From concept to implementation, we work with you to develop strategies that optimize performance, drive efficiency and enhance quality.

Customer and growth solutions

EY helps insurers adopt the right tech and retool experiences for stronger relationships with customers and distributors from crisis to recovery and growth.

Related articles

Are your insurance solutions in tune with new consumer needs?

EY’s Global Insurance Consumer Survey reveals how insurers can support the needs of those impacted by the COVID-19 pandemic. Learn more.

How to put purpose into action: five critical actions for insurers

Boards and the C-Suite can take action to guide purpose-led programs that extend beyond the pandemic response to help drive societal wellbeing and growth.

- Connect with us

- Our locations

- Legal and privacy

- Open Facebook profile

- Open X profile

- Open LinkedIn profile

- Open Youtube profile

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Strategic Planning

Think MarshBerry. Think Forward.

Strategic Planning Services

Set the course that inspires commitment and enables success.

Strategic planning for insurance companies and wealth advisory firms is important to creating a shared vision for financial, operational, and staffing goals. What sets MarshBerry’s strategic planning process above others is it goes beyond simply creating the plan. It charts a course for where and how to get there with key objectives, short- and long-term action plans and implementation schedules that are focused, relevant, aligned and actionable.

The strategic planning advisors at MarshBerry will work with you to build a comprehensive roadmap for growth with specific expertise in the insurance brokerage and wealth and retirement plan advisory industries. Knowing the business dynamics, what will work for you and your business, along with the data to back up the advice, helps set the stage for your firms’ commitment to achieving results.

Whether it is outlining your strategic plan, providing board advisory or exploring strategic options, MarshBerry has proven experience in providing effective strategic business planning for insurance companies and wealth advisory firms.

Examples of Strategic Planning Components

- Revenue and Expense Inputs

- Benchmarking Statistics

- Growth Projections

- Financial Stability

- Service & Support Productivity

- Producer Performance

- Perpetuation

- Age of Staff

- Implementation Schedule

- Accountability Map

Strategic Planning Services for Insurance Brokerages & Wealth Management Firms

In the dynamic world of insurance, a well-defined strategic plan can make a significant difference. MarshBerry’s team of experienced professionals assists insurance brokerages in developing and executing strategic plans that align with long-term objectives and growth potential.

Our wealth management strategic planning services focus on the unique requirements of wealth management firms. Our experts guide you through market trends and financial complexities, delivering strategies that drive growth and enhance value.

Why Choose MarshBerry for Your Strategic Planning Needs?

Choosing MarshBerry means choosing a strategic partner dedicated to your success. Our team brings extensive industry experience and a deep understanding of insurance brokerages and wealth management firms, making us an unparalleled choice for strategic planning services.

Beyond the planning phase, we provide continuous support and guidance to ensure your firm’s sustained success. Partner with MarshBerry today and propel your strategic growth journey forward.

Contact MarshBerry today to learn how our strategic planning services for insurance brokerages and wealth management firms can elevate your business strategy.

Perpetuation Planning

Contact the advisory team.

MarshBerry’s team of advisors are thought leaders and experts in the insurance brokerage and financial services industries. As a client, your firm benefits from their combined hands-on experience and professional designations in finance, accounting and economics. No matter what your needs are, they have the understanding to craft a personalized solution.

Kim Kovalski joined MarshBerry in 2021 and is charged with providing strategic and operational consulting services to MarshBerry’s client base of independently-owned insurance agents & brokers, specialty distributors, wealth advisory industry, private equity firms, banks & credit unions and insurance carriers.

Brian is a Director at MarshBerry and a member of MarshBerry’s Financial Advisory team. He has extensive experience advising insurance brokers in mergers and acquisitions (M&A), capital raising, and other financial advisory services such as valuation, compensation consulting and perpetuation planning.

As a shareholder of the firm, and a Director in MarshBerry’s Financial Advisory Division, Tommy focuses his time on delivering valuable advice and counsel to his clients. In his 14+ year career, Tommy has built extensive knowledge in the insurance distribution space in areas involving merger and acquisition advisory, organic growth best practices, financial management, valuation, perpetuation and strategic planning.

Don Folino is part of MarshBerry's Growth Advisory division where he helps insurance agencies and brokerages build infrastructures that drive organic growth, as well as working with them through the continued development and execution of that process.

As Vice President of Growth Advisory, Eric's primary responsibility is to help firms create executional strategic plans to increase firm value, energize their recruiting efforts and increase sales velocity.

Christopher Darst joined MarshBerry in 1998 as a Financial Analyst responsible for the preparation of business valuation reports, perpetuation plans, and general consulting projects. In 2001, he moved to California to help launch the Dana Point office. With increased experience and responsibility, Chris expanded his responsibilities to include merger and acquisition ("M&A") work for various MarshBerry clients.

- Netherlands

- LinkedIn Twitter Facebook Instagram

Inside the strategy room: One CEO’s approach

In this episode of our Inside the Strategy Room podcast series, McKinsey’s Sean Brown introduces Deanna Mulligan, the president and CEO of Guardian Life Insurance, who spoke at a recent event introducing the book Strategy Beyond the Hockey Stick: People, Probabilities and Big Moves to Beat the Odds (John Wiley & Sons, February 2018). An edited transcript of her remarks follows. (Subscribe to the series on Apple Podcasts or GooglePlay .)

Podcast transcript

Sean Brown: Today we’ll hear from Deanna Mulligan. Deanna is the president and CEO of the Guardian Life Insurance Company of America, a role she’s held for the past eight years. Guardian Life is a Fortune 220 company based in New York, and one of the largest mutual-life-insurance companies in the United States.

Before joining Guardian Life, Deanna held senior positions at AXA Financial and New York Life, and she was also a partner at McKinsey. Deanna recently joined McKinsey senior partner Martin Hirt in New York at the launch of McKinsey’s book Strategy Beyond the Hockey Stick , which Hirt coauthored with Chris Bradley and Sven Smit.

Deanna reflected on how, along with her team, she’s applying the strategic levers in the book to develop a strategy for a company that’s starting with a strong endowment but that’s working in an industry facing headwinds. Here’s Deanna Mulligan.

Deanna Mulligan: Thank you very much. I’m honored that you invited me to come speak about our experiences with strategy here tonight. I think many of you probably know Guardian, of which I’m the CEO, but for those of you who don’t, we’re a Fortune 220 company, we’re based here in New York, and we are a mutual company. We’re owned by our policyholders, and therefore we don’t have some of the restrictions, some might say, that stock companies have. However, we do have policyholders, a board of directors, and rating agencies, and so we have some of the same pressures in terms of people wanting to understand how we’re doing quarter to quarter.

Subscribe to the Inside the Strategy Room podcast

I found this book very applicable to a situation that we’re going through right now, and we are going through a strategy process. I had an advanced copy of this book, and I gave it to one of my staff members, and the first thing he said was, “Wow, there’s some really funny cartoons in here. I didn’t know McKinsey could be funny.” He was very taken. He actually photocopied a couple of cartoons and handed them around in a meeting.

I wanted to make a comment on the few pieces of the book that struck me particularly. The first thing is that this is heavily data driven and quantitative—most strategy books aren’t. As an insurance company, we have a lot of people who are data nerds; we are just nerds. I thought, “Finally this is something I can give my team that they’re actually going to believe in.” It’s obvious that the data is tractable.

I’d also like to reflect on a few of the experiences that we’re going through now, that are relevant in the book, and give you a little context on where we stand with some of the ten levers. I came into the job I’m in with a good endowment for the type of company that we are. Unfortunately, being in the insurance industry, our trend is not terrific. We’re not in a fast-growing industry. It is, if anything, the opposite.

What my team and I are left with are the moves. I started thinking through each of the moves: what we’ve been doing, what we’ve been told by others, how we think about it, and then how this book is game changing on a few.

First, the M&A and divestments program. We have been on an M&A program for about five years, and we’ve made a lot of small acquisitions. Sometimes it’s hard to tell just one, two, or three years into the program what the impact is going to be, but I think we probably would have been a little bit bolder in some of the acquisitions if we’d had the data in this book.

In terms of resource allocation, I think this is where the social side of strategy really comes in. Those of you who have worked in big companies know that it’s hard to take resources away from powerful business-unit heads, even if you’re the CEO. Because there is a social component when you say to somebody, “Sorry, you’re either not getting enough return on the money we’ve allocated to you, or your business isn’t as important as we thought it was when we allocated it to you.” Thinking through how to deal with the people part of that is going to be important.

One of the conversations that we’re having as a team is about introducing the notion of corporate assets. We’re treating people as corporate assets. I have actually clawed back the career decisions about certain people and said that person is a corporate asset, because they’re either so talented, or they’re in a position that generates so much economic value for us, that we have to think of them as a corporate asset.