What stage is your business at?

Tell us and we’ll match you with a special LivePlan discount:

New Business Idea

Startup Phase

Established Business

Enter your email address to unlock it.

Please enter a valid email address

We care about your privacy. See our Privacy Policy .

How To Write A Business Plan for A Bank Loan (3 Key Steps)

Wondering how to create a business plan that will wow your banker.

You're not alone.

Most entrepreneurs see writing a business plan as a gargantuan task – especially if they've never written one before.

Where do you start?

How do you calculate the financials?

How can you be sure you're not making a mistake?

And if you need a business plan for a bank loan, getting this document right is absolutely essential.

So here's what we recommend: simplify the planning process by breaking the work up into manageable, bite–sized steps. That way, you can focus on one section at a time to make sure it's accurate.

Here's a quick overview of the step–by–step process we guide entrepreneurs through when they sign up for LivePlan.

Step 1: Outline The Opportunity

This is the core of your business plan. It should give loan officers a clear understanding of:

- What problem you're solving

- How your product or service fits into the current market

- What sets your business apart from the competition

There are three key parts to this step:

The Problem & Solution

Detail exactly what problem you are solving for your customers. How do their lives improve after you solve that “pain point” for them?

We recommend actually going out and chatting with your target audience first. That way, you can validate that you're solving a real problem for your potential customers.

Be sure to describe your solution in vivid detail. For example, if the problem is that parking downtown is expensive and hard to find, your solution might be a bike rental service with designated pickup and dropoff locations.

Target Market

Who exactly are you selling to? And roughly how many of them are there?

This is crucial information for determining whether or not your business will succeed long–term. Never assume that your target market is “everyone.”

For example, it would be easy for a barber shop to target everyone who needs a haircut. But most likely, it will need to focus on a specific market segment to reach its full business potential. This might include catering to children and families, seniors or business professionals.

Competition

Who are your direct competitors? These are companies that provide similar solutions that aim to solve your customers' pain points.

Then outline what your competitive advantages are. Why should your target market choose you over the other products or services available?

Think you don't have any competition? Think again. Your customers are likely turning to an indirect competitor that is solving their problem with a different type of solution.

For example: A taco stand might compete directly with another taco stand, but indirectly with a nearby hot dog vendor.

Boost your chances of securing a loan

See how LivePlan can help you write a fundable business plan

Step 2: Show how you'll execute

This is where the action happens! Here you'll get into the details of how you'll take advantage of the opportunity you outlined in the previous section. This part demonstrates to banks that you have a strong plan to achieve success.

The three main components of this step include:

Marketing & Sales Plan

There can be a lot of moving parts to this one, depending on your business model.

But most importantly, you'll need to fully explain how you plan to reach your target market and convert those people into customers. A few example of what should be included:

- Positioning strategy. What makes your business both unique and highly desirable to your target market?

- Marketing activities. Will you advertise with billboards, online ads or something else entirely?

- Pricing. What you charge must reflect consumer demand. There are a few models to choose from, including ‘cost–plus pricing’ and ‘value pricing.’

This is the nuts and bolts of your business. It's especially important for brick–and–mortar companies that operate a storefront or have a warehouse.

You may want to explain why your location is important or detail how much space you have available. Plan to work at home? You can also cover your office space and any plans to move outside your house.

Any specialized software or equipment and tools should also be covered here.

Milestones & Metrics

Lenders and investors want to be confident that you know how to turn your business plans into financial success. That's where your milestones come in.

These are planned goals that help you progress your company. For example, if you're launching a new product your milestones may include completing prototypes and figuring out manufacturing.

Metrics are how you will gauge the success of your business. Do you want to generate a certain level of sales? Or keep costs at a certain level? Figuring out which metrics are most important and then tracking them is essential for growth.

Step 3: Detail your financial plan

This is the most crucial – and intimidating – part of any business plan for a bank loan. Your prospective lender will look especially close at this section to determine how likely your business is to succeed.

But the financial section doesn't have to be overwhelming, especially if you break the work into smaller pieces. Here are 3 items that your plan must have:

Simply put, this is your projections for your business finances. It gives you (and the bank) an idea of how much profit your company stands to make. Just a few items you'll need to include:

- Revenue. List all your products, services and any other ways your business will generate income.

- Direct costs. Or in other words, what are the costs to make what you sell?

- Personnel. Salaries and expenses related to what you pay yourself, employees and any contactors.

- Expenses. Things like rent, utilities, marketing costs and any other regular expenses.

Exactly how will you use any investments, loans or other financing to grow your business? This might include paying for capital expenses like equipment or hiring personnel.

Also detail where all your financing is coming from. Lines of credit, loans or personal savings should be listed here.

Bankers will be giving this section a lot of attention. Here's what you'll need:

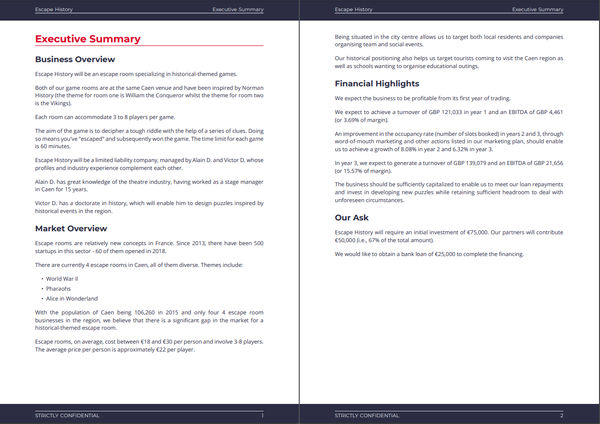

- Profit & Loss. This statement pulls in numbers from your sales forecast and other elements to show whether you're making or losing money.

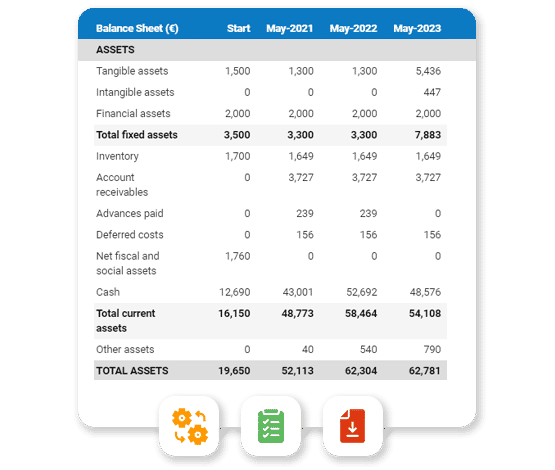

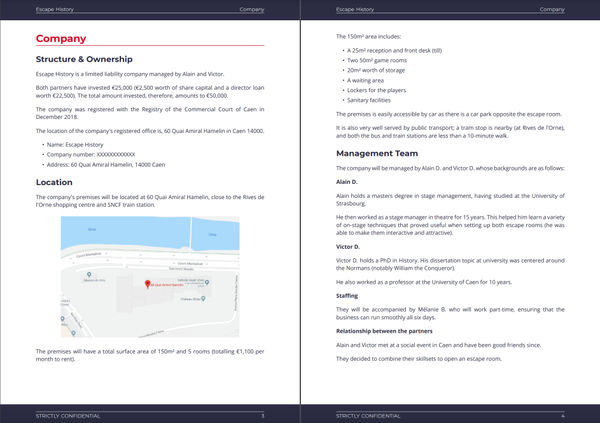

- Projected Balance Sheet. This is likely the first thing a loan officer will look at: it covers your liability, capital and assets. It provides an overview of how financially sound your business is.

- Projected Cash Flow. Essentially, this statement keeps track of how much money you have in the bank at any given point. Loan officers are likely to expect realistic monthly cash flow for the next 12 months.

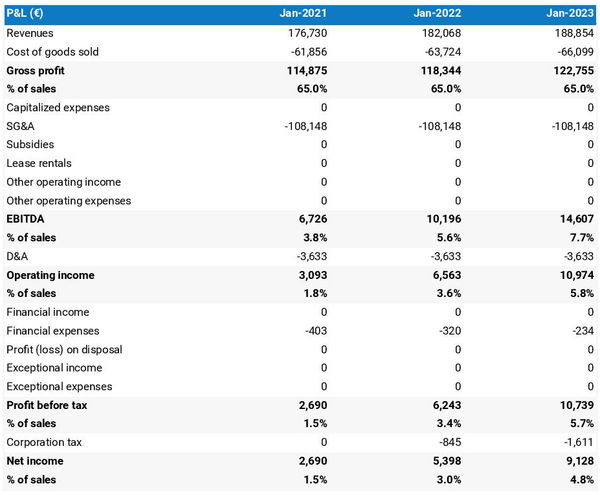

Don't forget the Executive Summary

The Executive Summary is the first section of your business plan, but we recommend you tackle it last.

It's basically an introduction to your company, summarizing the main points of your plan. Keep it to just one or two pages and be as clear and concise as possible.

Think of it as a quick read designed to get the lender excited about your business.

If you need help writing your plan

Not everyone feels confident writing a business plan themselves, especially if it's needed to secure a bank loan.

And although you don't need an MBA to write one, getting your business plan right often does require quite a bit of work. So if you need help writing your plan, here are two options to consider:

- Hire a professional business plan writer to do it for you. This is typically the most expensive route, but worth it if you're pursuing $100,000 or more in capital.

- Sign up for LivePlan. It's business planning software that walks you through a step–by–step process for writing any type of plan. It's an affordable option that also gives you an easy way to track your actuals against your business plan, so you can get the insights you need to grow faster.

LivePlan makes it easy to write a winning business plan

No risk – includes our 35-day money back guarantee.

- Search Search Please fill out this field.

Why Do I Need a Business Plan?

Sections of a business plan, the bottom line.

- Small Business

How to Write a Business Plan for a Loan

How to secure business financing

Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture.

:max_bytes(150000):strip_icc():format(webp)/smda1_crop-f0c167dd2b2144f68f352c63d17f7db5.jpg)

A business plan is a document that explains what a company’s objectives are and how it will achieve them. It contains a road map for the company from a marketing, financial, and operational standpoint. Some business plans are more detailed than others, but they are used by all types of businesses, from large, established companies to small startups.

If you are applying for a business loan , your lender may want to see your business plan. Your plan can prove that you understand your market and your business model and that you are realistic about your goals. Even if you don’t need a business plan to apply for a loan, writing one can improve your chances of securing finance.

Key Takeaways

- Many lenders will require you to write a business plan to support your loan application.

- Though every business plan is different, there are a number of sections that appear in every business plan.

- A good business plan will define your company’s strategic priorities for the coming years and explain how you will try to achieve growth.

- Lenders will assess your plan against the “five Cs”: character, capacity, capital, conditions, and collateral.

There are many reasons why all businesses should have a business plan . A business plan can improve the way that your company operates, but a well-written plan is also invaluable for attracting investment.

On an operational level, a well-written business plan has several advantages. A good plan will explain how a company is going to develop over time and will lay out the risks and contingencies that it may encounter along the way.

A business plan can act as a valuable strategic guide, reminding executives of their long-term goals amid the chaos of day-to-day business. It also allows businesses to measure their own success—without a plan, it can be difficult to determine whether a business is moving in the right direction.

A business plan is also valuable when it comes to dealing with external organizations. Indeed, banks and venture capital firms often require a viable business plan before considering whether they’ll provide capital to new businesses.

Even if a business is well-established, lenders may want to see a solid business plan before providing financing. Lenders want to reduce their risk, so they want to see that a business has a serious and realistic plan in place to generate income and repay the loan.

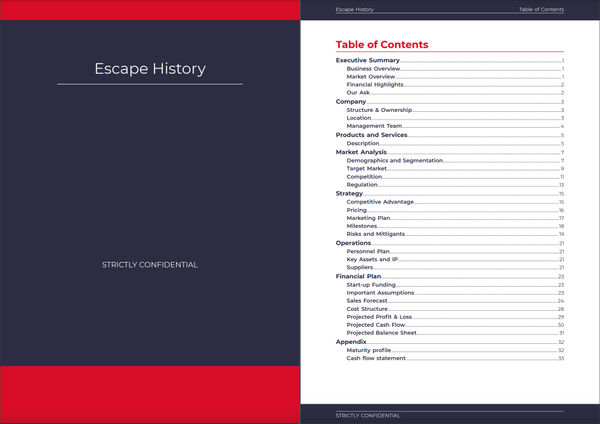

Every business is different, and so is every business plan. Nevertheless, most business plans contain a number of generic sections. Common sections are: executive summary, company overview, products and services, market analysis, marketing and sales plan, operational plan, and management team. If you are applying for a loan, you should also include a funding request and financial statements.

Let’s look at each section in more detail.

Executive Summary

The executive summary is a summary of the information in the rest of your business plan, but it’s also where you can create interest in your business.

You should include basic information about your business, including what you do, where you are based, your products, and how long you’ve been in business. You can also mention what inspired you to start your business, your key successes so far, and your growth plans.

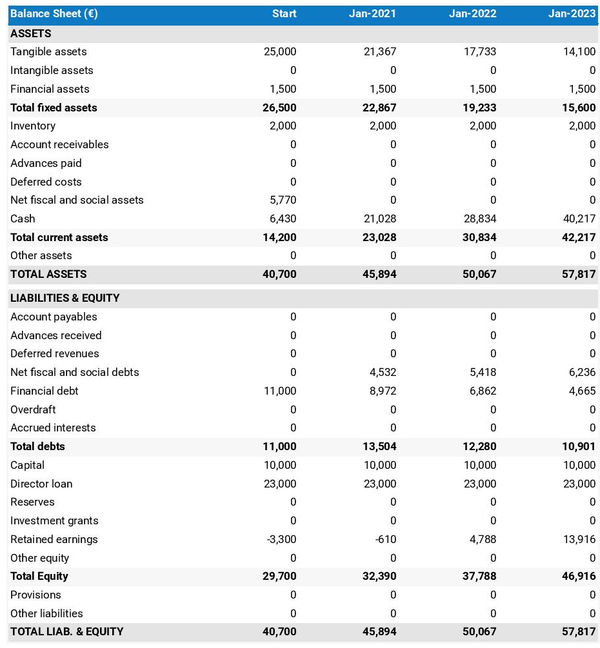

Company Overview

In this section, focus on the core strengths of your business, the problem you want to solve, and how you plan to address it.

Here, you should also mention any key advantages that your business has over your competitors, whether this is operating in a new market or a unique approach to an existing one. You should also include key statistics in this section, such as your annual turnover and number of employees.

Products and Services

In this section, provide some details of what you sell. A lender doesn’t need to know all the technical details of your products but will want to see that they are desirable.

You can also include information on how you make your products, or how you provide your services. This information will be useful to a lender if you are looking for financing to grow your business.

Market Analysis

A market analysis is a core section of your business plan. Here, you need to demonstrate that you understand the market you are operating in, and how you are different from your competitors. If you can find statistics on your market, and particularly on how it is projected to grow over the next few years, put them in this section.

Marketing and Sales Plan

Your marketing and sales plan gives details on what kind of new customers you are looking to attract, and how you are going to connect with them. This section should contain your sales goals and link these to marketing or advertising that you are planning.

If you are looking to expand into a new market, or to reach customers that you haven’t before, you should explain the risks and opportunities of doing so.

Operational Plan

This section explains the basic requirements of running your business on a day-to-day basis. Your exact requirements will vary depending on the type of business you run, but be as specific as possible.

If you need to rent office space, for example, you should include the cost in your operational plan. You should also include the cost of staff, equipment, and any raw materials required to run your business.

Management Team

The management team section is one of the most important sections in your business plan if you are applying for a loan. Your lender will want reassurance that you have a skilled, experienced, competent, and reliable senior management team in place.

Even if you have a small team, you should explain what makes each person qualified for their position. If you have a large team, you should include an organizational chart to explain how your team is structured.

Funding Request

If you are applying for a loan, you should add a funding request. This is where you explain how much money you are looking to borrow, and explain in detail how you are going to use it.

The most important part of the funding-request section is to explain how the loan you are asking for would improve the profitability of your business, and therefore allow you to repay your loan.

Financial Statements

Most lenders will also ask you to provide evidence of your business finances as part of your application. Graphs and charts are often a useful addition to this section, because they allow your lender to understand your finances at a glance.

The overall goal of providing financial statements is to show that your business is profitable and stable. Include three to five years of income statements, cash flow statements, and balance sheets. It can also be useful to provide further analysis, as well as projections of how your business will grow in the coming years.

What Do Lenders Look for in a Business Plan?

Lenders want to see that your business is stable, that you understand the market you are operating in, and that you have realistic plans for growth.

Your lender will base their decision on what are known as the “five Cs.” These are:

- Character : You can stress your good character in your executive summary, company overview, and your management team section.

- Capacity : This is, essentially, your ability to repay the loan. Your lender will look at your growth plans, your funding request, and your financial statements in order to assess this.

- Capital : This is the amount of money you already have in your business. The larger and more established your business is, the more likely you are to be approved for finance, so highlight your capital throughout your business plan.

- Conditions : Conditions refer to market conditions. In your market analysis, you should be able to prove that your business is well-positioned in relation to your target market and competitors.

- Collateral : Depending on your loan, you may be asked to provide collateral , so you should provide information on the assets you own in your operational plan.

How Long Does It Take to Write a Business Plan?

The length of time it takes to write a business plan depends on your business, but you should take your time to ensure it is thorough and correct. A business plan has advantages beyond applying for a loan, providing a strategic focus for your business.

What Should You Avoid When Writing a Business Plan?

The most common mistake that business owners make when writing a business plan is to be unrealistic about their growth potential. Your lender is likely to spot overly optimistic growth projections, so try to keep it reasonable.

Should I Hire Someone to Write a Business Plan for My Business?

You can hire someone to write a business plan for your business, but it can often be better to write it yourself. You are likely to understand your business better than an external consultant.

Writing a business plan can benefit your business, whether you are applying for a loan or not. A good business plan can help you develop strategic priorities and stick to them. It describes how you are going to grow your business, which can be valuable to lenders, who will want to see that you are able to repay a loan that you are applying for.

U.S. Small Business Administration. “ Write Your Business Plan .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

U.S. Small Business Administration. “ Fund Your Business .”

Navy Federal Credit Union. “ The 5 Cs of Credit .”

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for April 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How To Write a Business Plan for Bank Loan in 9 Steps: Checklist

By alex ryzhkov, resources on bank loan.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

Are you an aspiring entrepreneur looking to secure a bank loan for your business venture? Well, you're not alone. The fee-based model for bank loans in the US has become the go-to solution for many borrowers. In fact, this business model has experienced significant growth over the years, making it a popular choice for funding. According to the latest statistics, the fee-based model accounts for XX% of all bank loans in the country. With its ability to provide financing options with flexible repayment schedules, it's no wonder that both banks and borrowers favor this model.

Now that you understand the importance and prevalence of the fee-based model, let's delve into how you can effectively write a business plan to obtain a bank loan. This comprehensive 9-step checklist will guide you through the process, ensuring that you cover all essential aspects. So, roll up your sleeves and let's get started!

- Conduct market research

- Identify target customers

- Analyze competition

- Determine the amount of funding required

- Gather necessary financial documents

- Outline the purpose and goals of the loan

- Create a company profile

- Develop a marketing and sales strategy

- Identify potential risks and mitigation strategies

Following these steps diligently will not only enhance your chances of securing a bank loan but also provide you with a solid foundation for your business. So, let's dive right into the first step - conducting market research!

Conduct Market Research

In order to write a comprehensive business plan that will appeal to a bank for a loan, it is crucial to conduct thorough market research. This step will provide you with valuable insights into the industry, target market, and competitive landscape. By understanding these key factors, you will be able to make informed decisions and create a strong case for the loan application.

Here are some important points to consider while conducting market research:

- Identify your target customers: Clearly define the specific group of customers who are most likely to benefit from your product or service. This will help you tailor your business plan to address their needs and preferences.

- Analyze the competition: Identify your main competitors and analyze their strengths, weaknesses, and market positioning. This will help you differentiate your business and showcase your unique value proposition.

- Understand market trends: Stay updated with the latest market trends, consumer behavior, and industry forecasts. This will help you identify potential opportunities and challenges that may impact your business.

- Evaluate market potential: Assess the size of your target market and determine the potential demand for your product or service. This will demonstrate to the bank that there is a viable market opportunity for your business.

Tips for conducting market research:

- Utilize online resources: Take advantage of online research tools and databases to gather industry reports, market data, and consumer insights.

- Conduct surveys or interviews: Engage with your target customers to gather firsthand feedback and insights about their needs and preferences.

- Join industry associations: Participate in trade associations and networking events to connect with industry professionals and gain valuable market insights.

- Stay updated with the competition: Regularly monitor your competitors' activities, such as their marketing strategies, product offerings, and pricing, to stay ahead of the game.

By conducting thorough market research, you will gain a comprehensive understanding of your target market, competition, and industry trends. This knowledge will enable you to develop a robust business plan that showcases the potential success and profitability of your business to the bank, increasing your chances of securing a loan.

Identify Target Customers

Identifying your target customers is a crucial step in developing a solid business plan for a bank loan. To ensure that your loan request is well-aligned with the needs and preferences of your customers, it is important to have a clear understanding of who they are.

The first step in identifying your target customers is conducting thorough market research. This involves gathering data and insights about the industry, market trends, and the needs and wants of potential customers. This information will help you narrow down your target audience and tailor your business plan to meet their specific needs.

Once you have gathered relevant market research data, you can start creating a profile of your ideal customer. Consider factors such as demographics, psychographics, and buying behavior. Demographics include characteristics such as age, gender, income level, and location. Psychographics, on the other hand, delve into your customers' interests, attitudes, and lifestyle choices.

Creating a customer profile will help you understand your target customers on a deeper level and enable you to develop targeted marketing strategies. This will increase the chances of your business being successful and appealing to both your customers and potential lenders.

Tips for Identifying Target Customers:

- Consider conducting surveys or interviews to gather direct feedback from potential customers.

- Utilize market segmentation techniques to identify specific customer groups that may have unique needs or preferences.

- Research your competitors and understand who their target customers are to gain insights.

- Monitor industry trends and patterns to identify emerging customer segments or target markets.

Analyze Competition

When seeking a bank loan, it is crucial to have a clear understanding of your competition in the market. Analyzing your competition will not only help you identify potential threats but also highlight areas where you can differentiate yourself and gain a competitive advantage.

Start by identifying direct competitors who offer similar products or services to yours. Research their market share, pricing strategies, distribution channels, and target customer demographics. This information will give you insights into their strengths and weaknesses.

Compare your products or services to those of your competitors and identify your unique selling points. What sets you apart from the competition? Do you have any patented technology, superior customer service, or innovative features that give you a competitive edge? Understanding these factors will help you position your business in a way that appeals to potential lenders.

Tips for Analyzing Competition:

- Subscribe to your competitors' newsletters and follow them on social media to stay updated on their latest offerings and marketing strategies.

- Visit their websites and evaluate their online presence. Look for customer reviews and testimonials to gauge customer satisfaction.

- Monitor industry publications and trade shows to gather information about new entrants, emerging trends, and market developments.

- Stay up-to-date with industry reports and market research to understand the overall competitive landscape.

- Consider conducting a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to assess your business in relation to your competitors.

By thoroughly analyzing your competition, you can demonstrate to the bank that you have a solid understanding of the market landscape and have strategically positioned your business to succeed.

Determine The Amount Of Funding Required

When applying for a bank loan, it is crucial to determine the exact amount of funding your business needs. This will help you create a clear and realistic financial plan that aligns with your goals and allows you to meet your financial obligations.

Here are a few steps to help you determine the funding required:

- Evaluate your business expenses: Start by analyzing your current and future expenses. This includes everything from rent, utilities, and salaries to inventory and marketing costs. Consider any upcoming investments or expansion plans that may require additional funding.

- Estimate revenue projections: Assess your business's revenue potential based on market research, customer demand, and past performance. Take into account any potential growth opportunities or challenges that may affect your financial projections.

- Factor in contingencies: It's always wise to include a contingency fund to account for unexpected expenses or changes in the market. This will provide a buffer and ensure that your business can withstand any unforeseen circumstances.

- Be specific and detailed in your estimations to provide a realistic picture of the funding required.

- Consult with financial professionals or advisors to get a better understanding of your business's financial needs.

- Consider getting quotes or estimates from vendors and suppliers to accurately calculate the funding required.

- Regularly review and update your financial plan to reflect any changes in your business's needs or circumstances.

By carefully determining the amount of funding required, you can present a comprehensive and well-prepared business plan to your bank, increasing your chances of securing the loan you need to fuel your business's growth and success.

Gather Necessary Financial Documents

Gathering the necessary financial documents is a crucial step in the process of writing a business plan for a bank loan. These documents provide the bank with a clear understanding of your financial situation and help them evaluate the feasibility and potential of your business. Here are the essential financial documents you will need to gather:

- Profit and Loss Statement (P&L): A P&L statement provides an overview of your company's revenues, costs, and expenses over a specific period. It helps the lender assess your profitability and sustainability.

- Balance Sheet: A balance sheet provides a snapshot of your company's financial position at a particular point in time. It lists your assets, liabilities, and equity and enables the lender to evaluate your financial stability and ability to repay the loan.

- Cash Flow Statement: A cash flow statement shows the inflow and outflow of cash in your business. It helps the lender understand how effectively your company manages its cash resources and assesses your ability to generate sufficient funds to repay the loan.

- Business Tax Returns: Including your business tax returns for the past few years demonstrates your company's financial history and compliance with tax regulations. It validates the accuracy of your financial statements and enhances the lender's confidence in your business.

- Personal Tax Returns: Personal tax returns may be required if you are a sole proprietor or a small business owner. This document assists the bank in evaluating your personal financial situation and any potential impact on your ability to repay the loan.

- Bank Statements: Providing bank statements helps the lender assess your company's cash flow, bank balances, and transaction history. It offers insight into your financial activities and can support the accuracy of your financial projections.

- Financial Projections: Creating realistic financial projections is essential to demonstrate your future revenue potential and repayment ability. Ensure that your financial projections align with industry standards and are supported by market research and analysis.

- Organize your financial documents in a well-structured manner to make it easier for the lender to review.

- Ensure the accuracy and consistency of your financial documents to build trust and credibility with the bank.

- Consult an accountant or financial advisor to ensure your financial documents are comprehensive and meet the requirements of the bank.

- Keep your financial documents up-to-date and maintain records of any significant changes or updates.

- Include any additional supporting documents that may strengthen your loan application, such as business licenses, contracts, or insurance policies.

Outline The Purpose And Goals Of The Loan

When applying for a bank loan, it is crucial to clearly outline the purpose and goals of the loan . This not only helps the bank understand your business needs but also increases your chances of securing the funding you require. Here are some important points to consider:

- Specify the exact amount of funding you need and how it will be utilized. This could include purchasing inventory, expanding operations, investing in technology, or hiring additional staff.

- Identify the specific goal or objective of the loan. Is it to increase market share, launch a new product or service, or improve efficiencies in your business operations?

- Provide a timeline for achieving the goals outlined. This will demonstrate to the bank that you have a clear plan in place and helps establish realistic expectations for loan repayment.

- Outline the anticipated impact of the loan on your business. Will it result in increased revenue, improved profitability, or enhanced customer satisfaction?

- Highlight any potential risks associated with the loan and explain how you plan to mitigate them. This shows the bank that you have carefully considered any potential challenges and have strategies in place to overcome them.

- Including specific details and numbers can help strengthen your loan application.

- Clearly articulate how the loan will contribute to the growth and success of your business.

- Be realistic in setting goals and timelines to ensure feasibility.

- Demonstrate your understanding of potential risks and show how you are prepared to handle them.

Create A Company Profile

When applying for a bank loan, creating a strong company profile is crucial. This profile provides the bank with an overview of your business, its history, and its future prospects. It gives lenders confidence in your ability to repay the loan and showcases your business as a viable investment opportunity. Here are some important elements to include in your company profile:

- Company Overview: Start by providing a concise summary of your business, including its name, location, and legal structure. Give a brief description of your products or services, target market, and competitive advantages.

- Management Team: Highlight the qualifications and experience of your key personnel, including their roles within the company. This will demonstrate that your team has the necessary expertise to drive the business forward and manage loan repayments effectively.

- Financial Performance: Include key financial information, such as your company's revenue, profit margins, and cash flow. Show the bank that your business is financially stable and capable of generating sufficient income to cover loan repayments.

- Growth Potential: Outline your plans for growth and expansion. Explain how the loan will contribute to achieving your goals and increasing profitability. Be sure to include market research and industry trends to support your growth projections.

- Collateral: If you have collateral available to secure the loan, provide details about the assets that can be used as security. This could be real estate, inventory, equipment, or accounts receivable. Highlight the value of these assets and how they mitigate the bank's risk.

- Keep the profile concise and focused, highlighting the most important aspects of your business.

- Use clear and concise language to make the profile easy to understand.

- Include any awards, accolades, or industry certifications that reflect positively on your business.

- Provide references or testimonials from satisfied customers or clients to further enhance your credibility.

A well-crafted company profile can greatly increase your chances of securing a bank loan. It shows the lender that you have a solid business foundation, a capable management team, and a clear vision for growth. Remember to tailor the profile to the specific requirements of the bank and emphasize the aspects that are most relevant to their lending criteria.

Develop A Marketing And Sales Strategy

Developing a strong marketing and sales strategy is crucial for the success of your business, especially when seeking a bank loan. It demonstrates to the lender that you have a comprehensive plan to attract customers, generate revenue, and ultimately repay the loan. Here are some important steps to consider:

1. Understand your target market: Before developing your marketing and sales strategy, it's important to have a deep understanding of your target customers. Conduct market research to identify their needs, preferences, and behaviors. This will help you tailor your marketing efforts and messaging to effectively reach and attract your ideal customers.

2. Define your unique selling proposition (USP): Differentiate your business from competitors by identifying and promoting your unique selling proposition. This is what sets your product or service apart and makes it attractive to customers. Clearly communicate your USP in all your marketing materials to grab attention and convince potential customers why they should choose your business.

3. Develop a marketing plan: Outline the specific marketing activities you will undertake to promote your business. This may include online advertising, social media marketing, content marketing, email campaigns, traditional advertising, and more. Set realistic goals and allocate a budget for each marketing channel. Ensure your marketing plan aligns with your target market and USP.

4. Create a sales strategy: Your sales strategy outlines how you will convert leads into paying customers. Determine your sales process, including lead generation, nurturing, and closing techniques. Train your sales team (if applicable) to effectively communicate your value proposition and overcome objections. Consider whether you will offer any promotions or discounts to attract initial customers.

5. Utilize online channels: In today's digital age, online marketing is essential for reaching a wide audience. Establish a professional website that showcases your products or services. Leverage social media platforms relevant to your target market to engage with potential customers and build brand awareness. Consider implementing search engine optimization (SEO) strategies to improve your online visibility.

- Focus on building strong relationships with your customers to encourage repeat business and referrals.

- Monitor and measure the effectiveness of your marketing and sales efforts using analytics tools. This will help you identify what's working and what needs improvement.

- Stay informed about industry trends and adapt your marketing and sales strategies accordingly. Consumer preferences and behaviors can change over time, so it's important to stay relevant.

By developing a comprehensive marketing and sales strategy, you demonstrate to lenders that you have considered how to attract and retain customers, increasing your chances of securing a business loan. Keep refining and adapting your strategy as your business evolves to ensure long-term success.

Identify Potential Risks and Mitigation Strategies

Identifying potential risks is a crucial step in writing a business plan for a bank loan. Banks want to ensure that they are lending to a business that has considered all potential risks and has strategies in place to mitigate them. Here are some key risks to consider:

- Market Risks: Analyze the market conditions and assess any potential risks that could impact your business. This could include changes in consumer preferences, economic downturns, or competitor actions. Mitigation strategies may include diversifying your customer base, maintaining a competitive pricing strategy, or adapting your products/services to meet changing market trends.

- Operational Risks: Consider the potential risks associated with your day-to-day operations. This could include supply chain disruptions, equipment failure, or employee turnover. Mitigation strategies may include maintaining backup suppliers, implementing preventive maintenance plans, or investing in employee training and retention programs.

- Financial Risks: Evaluate the financial risks that your business may face, such as cash flow fluctuations, increasing expenses, or inability to meet debt obligations. Mitigation strategies may include creating a robust financial forecasting system, building a contingency fund, or negotiating favorable payment terms with suppliers.

- Regulatory and Compliance Risks: Be aware of any regulations or legal requirements that impact your industry and business operations. Non-compliance can lead to penalties, legal issues, and reputational damage. Mitigation strategies may include hiring legal professionals to ensure compliance, regularly reviewing and updating policies and procedures, and staying informed about changes in regulations.

- Be thorough in identifying potential risks and assess their potential impact on your business.

- Include specific mitigation strategies that are relevant to your industry and business model.

- Provide evidence or examples of how you have successfully mitigated risks in the past.

- Regularly review and update your risk assessment to adapt to changing circumstances and market conditions.

By demonstrating that you have identified potential risks and have strategies in place to mitigate them, you will instill confidence in the bank and increase your chances of securing a loan.

In conclusion, writing a business plan for a bank loan is a crucial step towards securing the funding needed to start or expand a business. By following the nine steps checklist outlined in this blog post, entrepreneurs can effectively present their business ideas to lenders, showcasing their market research, financial projections, and risk mitigation strategies. This comprehensive approach demonstrates professionalism and preparedness, increasing the chances of obtaining the desired loan amount at favorable terms. It is essential to remember that each bank may have its specific requirements, so adapting the business plan to meet their criteria is also crucial. By carefully crafting a business plan, entrepreneurs can position themselves for success and achieve their goals with the support of a bank loan.

$169.00 $99.00 Get Template

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

- Mar 30, 2023

The Ultimate Guide to Writing a Business Plan for a Loan: A Step-by-Step Walk-Through

The Ultimate Guide to Writing a Business Plan for a Loan: A Step-by-Step Walkthrough

As a business plan specialist and expert business planner, I'm here to guide you through the process of writing a comprehensive business plan for securing a loan. Whether you're a start-up or an established business looking to expand, a well-crafted business plan is essential for impressing potential lenders and securing the funding you need.

In this extensive, 5,000-word article, I'll cover everything you need to know about creating a top-notch business plan that will boost your chances of loan approval. We'll go through each section in detail, providing you with practical examples and tips to optimize your plan for success. So, let's get started!

Executive Summary

The executive summary is the first and most critical section of your business plan. It's a brief overview of your entire plan, highlighting the key points and giving readers an insight into your business.

Key elements to include in your executive summary:

Business concept: Briefly explain your business idea, the products or services you plan to offer, and the target market.

Company overview: Provide essential information about your company, including its legal structure, location, and mission statement.

Management team: Showcase the expertise and experience of your management team, emphasizing their ability to lead the business.

Market opportunity: Describe the market demand, trends, and target audience, highlighting the opportunity for your business to succeed.

Financial highlights: Summarize your financial projections, including sales, profits, and cash flow.

Loan purpose: Clearly state the purpose of the loan and the amount you're seeking.

Remember, the executive summary is often the first thing lenders read, so make it engaging and informative to grab their attention.

Company Description

The company description section is where you provide a more in-depth look at your business. It should give readers a clear understanding of your company's purpose, goals, and competitive advantages.

Key elements to include in your company description:

Business history: If your company has an existing history, briefly describe its origins and milestones achieved.

Mission statement: Articulate the purpose of your company and the value you aim to provide to customers.

Objectives: Outline the specific goals you want to achieve with your business, both short-term and long-term.

Products and services: Provide a detailed description of the products or services you plan to offer, emphasizing the benefits they provide to customers.

Target market: Identify your target audience, specifying their demographics, psychographics, and buying habits.

Competitive advantage: Explain what sets your business apart from the competition and how you plan to maintain this edge.

Market Analysis

The market analysis section demonstrates your understanding of the industry, market, and competition. It's crucial to show lenders that you've done your homework and have a comprehensive understanding of the market landscape.

Key elements to include in your market analysis:

Industry overview: Provide a high-level view of your industry, including its size, growth trends, and key players.

Market segmentation: Break down your target market into smaller segments, identifying their unique needs and preferences.

Target market characteristics: Describe the specific characteristics of your target market, such as demographics, psychographics, and geographic location.

Market demand: Present evidence of market demand, using data on customer needs, market trends, and buying behaviors.

Competitor analysis: Evaluate your main competitors, analyzing their strengths, weaknesses, and market share.

SWOT analysis: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) to assess your business's position in the market.

Marketing and Sales Strategy

In this section, outline your marketing and sales strategy to show lenders how you plan to attract and retain customers, as well as generate revenue. A well-defined marketing and sales strategy is crucial to demonstrate that you have a clear plan for growth and profitability.

Key elements to include in your marketing and sales strategy:

Marketing objectives: Define your marketing goals, such as brand awareness, lead generation, or customer retention.

Target audience: Reiterate your target market, emphasizing their needs and preferences.

Unique selling proposition (USP): Highlight your USP, the main reason customers should choose your products or services over the competition.

Marketing channels: Identify the marketing channels you plan to use, such as social media, email, content marketing, or paid advertising. Explain the rationale behind your choice of channels and how they align with your target audience.

Sales process: Describe your sales process, from lead generation to closing deals. Include details on your sales team structure, training, and compensation plans.

Key performance indicators (KPIs): List the KPIs you'll use to measure the success of your marketing and sales efforts, such as conversion rates, average deal size, or customer lifetime value.

Operations Plan

The operations plan section details the day-to-day activities required to run your business. It shows lenders that you have a clear understanding of the operational aspects of your company and the resources needed to support your growth.

Key elements to include in your operations plan:

Facilities: Describe your business's physical location, including its size, layout, and any equipment or machinery required.

Production process: If applicable, detail your production process, including the steps involved, quality control measures, and production capacity.

Supply chain: Outline your supply chain, identifying key suppliers, procurement processes, and inventory management practices.

Staffing: Explain your staffing requirements, including the roles, responsibilities, and qualifications of each team member.

Management structure: Provide an organizational chart, showcasing your company's management structure and reporting lines.

Legal and regulatory requirements: Identify any relevant legal or regulatory requirements, such as licenses, permits, or certifications needed to operate your business.

Financial Plan

The financial plan is arguably the most crucial section of your business plan when applying for a loan. It demonstrates your ability to manage finances, make informed decisions, and, ultimately, repay the loan.

Key elements to include in your financial plan:

Revenue projections: Estimate your future sales, breaking them down by product or service category and showing growth rates over time.

Expense projections: Forecast your expenses, including fixed costs (e.g., rent, utilities) and variable costs (e.g., marketing, salaries).

Cash flow statement: Provide a detailed cash flow statement, showing how cash will flow in and out of your business over a specified period (typically 12 months).

Profit and loss statement: Create a profit and loss statement that projects your business's profitability over time.

Balance sheet: Prepare a balance sheet that showcases your business's assets, liabilities, and equity.

Break-even analysis: Calculate the point at which your business will break even, meaning your revenues equal your expenses.

Loan repayment schedule: Detail your proposed loan repayment schedule, including the loan amount, interest rate, repayment terms, and projected date of full repayment.

The appendices section is where you can include any additional documents or supporting materials that are relevant to your business plan. These documents may provide further evidence of your company's viability and help strengthen your case for securing a loan.

Examples of items to include in the appendices:

Resumes of key team members

Product samples or prototypes

Market research data or surveys

Letters of intent or contracts with suppliers, partners, or customers

Intellectual property documentation, such as patents, trademarks, or copyrights

Relevant licenses, permits, or certifications

Writing a comprehensive business plan for a loan can seem like a daunting task, but with the right approach and guidance, it's an achievable goal. By following the step-by-step instructions outlined in this article, you can create a well-structured, persuasive business plan that will greatly improve your chances of securing the funding you need. Remember to:

Pay close attention to your executive summary, as it sets the tone for the entire plan.

Be thorough and detailed in your market analysis, showing a deep understanding of your industry and target audience.

Develop a solid marketing and sales strategy to demonstrate your ability to attract and retain customers.

Address the operational aspects of your business, including staffing, facilities, and supply chain management.

Present a robust financial plan, complete with projections and a loan repayment schedule.

By doing so, you'll showcase your expertise, commitment, and preparedness to potential lenders, significantly increasing the likelihood of obtaining the loan your business needs to grow and succeed.

In addition to following the steps outlined in this guide, consider seeking professional assistance from a business plan consultant or specialist to review and refine your plan. Their expertise can help you identify any areas that may need improvement and ensure that your business plan is optimized for success.

Finally, remember to continuously update your business plan as your business evolves. Regular updates will ensure that your plan remains relevant and accurate, providing you with a valuable roadmap for your business's future growth and development.

With dedication, persistence, and a well-crafted business plan, you can secure the funding you need to bring your business vision to life. Good luck, and here's to your success!

- Writing Your Business Plan

- Funding Your Business

Recent Posts

The Five Most Frequently Asked Questions About Business Loans

The Five Most Frequently Asked Questions About Startup Funding

The Ultimate Cheat Sheet: Business Plan Writing Tips & Tricks

How to write a business plan for a bank loan?

Whether you need a bank loan to start up a new business, grow an existing business or anything in between, writing a business plan can help make it a reality!

It involves outlining your goals and explaining how you plan to achieve them. A professional business plan is crucial to obtaining a bank loan and planning your outlook for both the short and long-term future.

Yet, most entrepreneurs view writing a business plan as a daunting task. But, it doesn't have to be!

In this guide, we explain what writing a business plan for a bank loan entails, why you need one, what tool you should use, and what content should be included.

Ready? Let's get started!

In this guide:

What is a business plan?

Do i need a business plan to secure a business loan, do banks actually look at business plans or is it just a box-ticking exercise, what do banks look for in a business plan, what tool should i use to write a business plan for a bank loan, what does a business plan for a bank loan look like, do i need a 3 or 5 year business plan for a bank, how long does a business plan for a bank loan need to be, key financial metrics and ratios banks look at when deciding on a loan application, examples and templates of business plans for a bank loan, pdf vs. powerpoint pitch: what format should you use to present your business plan to the bank, can i apply for multiple loans at the same time.

- Is it worth using a credit broker to apply to multiple lenders?

How long does the loan approval process usually take?

Key takeaways.

A business plan is a written document that contains two key parts:

- A written presentation that outlines what the company does, its medium term objectives and explains how it plans to achieve them.

- A financial plan that includes a cash flow statement, profit and loss statement and a balance sheet.

To get a business loan approved you need to convince the lender that your business will be able to repay it.

Regulated lenders also have legal obligations to demonstrate to their regulators that they are lending responsibly, meaning that your business can afford the loan.

Therefore, whilst a business plan is not strictly necessary to obtain a business loan, most banks will likely ask you to provide one, as it provides an objective way of assessing your borrowing capacity and to demonstrate affordability.

Imagine the following situation, a business borrows £100k from a regulated bank, and then goes bust. The regulator decides to investigate the bank. The bank can then provide the business plan to help demonstrate that the loan was affordable and that it behaved responsibly.

Need a solid financial forecast?

The Business Plan Shop does the maths for you. Simply enter your revenues, costs and investments. Click save and our online tool builds a three-way forecast for you instantly.

Most banks will look at your business plan when you hand in a loan application. How in-depth the bank looks at it though will depend on whether you are borrowing against assets or cash flow.

Asset-based lending

Borrowing against assets involves lending money to businesses whilst using their assets as collateral. These loans are also called secured loans.

Secured loans help reduce risks for lenders, they can seize the collateral if the borrower is unable to repay and sell the asset to recoup part of their losses. That's what happens with mortgages, for example.

Banks usually have pre-set loan-to-value ratios (LTVs) for the most common types of assets (property, equipment, vehicles etc.).

A loan-to-value assessment simply compares the appraised value of your asset against the value of the business loan.

For example, if you're buying a car worth £10,000 and the LTV ratio used by the bank is 70%, they can lend you up to £7,000 and will take the car as collateral.

The bank still needs to assess that you can afford the £7,000 business loan. They might ask you for a business plan, but might decide not to do so given that it's a small amount. They might simply look at your trading history or ask for a personal guarantee from the business owner instead.

BDC Bank - a Canadian bank - says that "financial institutions don’t use the same loan-to-value ratio for all asset types because of different asset liquidity levels".

In layman's terms, liquidity means how easy it is to sell the asset. If it's a delivery van, it's very easy as there is an established secondhand market (high liquidity), if it's a chemical plant it might take up to a year (low liquidity).

In a nutshell, the easier it is to sell the asset (if it needs to be seized), the higher the loan amount.

According to BDC Bank , likely LTV ratios for common asset types are:

- Marketable securities (high in liquidity): 90%

- Accounts receivables: 75%

- Commercial and industrial real estate: 65% to 100%

- Inventory (low in liquidity): 50%.

Capital Source Group - an alternate lender - says that some banks require a down payment of up to 20% of the market value of the equipment, referring to firms seeking finance to purchase key equipment, and mentions an indicative baseline LTV ratio of 50%.

Cash-flow-based lending

As we've seen above, asset-based lending is relatively straightforward, and lower risk as the asset is used as collateral. The decision making is more complicated if your business borrows against cash flows (for e.g. working capital purposes).

Cash-flow-based borrowing involves lending money to businesses based on their predicted cash flows. The bank has to assess how much you can borrow based on historical and projected financials.

Doing so requires to have a clear understanding of the future cash flows of the business, which can only be obtained through a business plan.

Most banks ask for business plans when you apply for a business loan because they need it to understand:

Who the borrower is

Whether or not there is collateral.

- If there is a trading history that supports the cash flow forecast

- What borrowing capacity and affordability can be inferred from the forecast

Firstly, the bank has to understand what entity or person it is lending money to. For example, if you take over a business, you could buy either its assets or shares.

If you were to buy their assets, a new company would likely be created but if you were to purchase their shares, you could do it directly or via a holding company (likelier option).

Depending on which option you choose, the bank has to decide whether it's lending to your current business, yourself or the holding company. The answer to this question then determines the level of risk the bank is undertaking.

Next, the bank has to decide whether or not there is sufficient collateral. Can it secure the loan against the business assets or does it need to request a personal warranty from the business owner(s)?

It will assess:

- Whether or not your current business has any assets that can be used as collateral

- If you, the business owner, have a house or cash in the bank or can offer a credible personal guarantee

- Whether or not the holding company will provide its shares as collateral or if it needs to ask its shareholders for a personal guarantee (or both)

Once the bank understands the value of the security, it can better estimate the borrowing capacity of the entity.

Does the trading history support the cash flow forecast

The bank will want to know if there is any trading history to support your cash flow forecast.

If there isn't, it becomes harder to judge and riskier from a lender's viewpoint.

Borrowing capacity and affordability: total indebtedness and credit metrics

Lastly, the bank will estimate your business credit score by taking into consideration: whether or not you have any outstanding debt, what your past repayments were like, and credit metrics such as fixed charge coverage ratio, net debt-to-equity ratio, and interest coverage ratio (we'll detail these 3 ratios later in this guide).

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

Writing a business plan can be both tedious and difficult if you start from scratch. Luckily for you, online business plan software can help you write a professional plan in no time.

There are several advantages to using specialised software like The Business Plan Shop:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you

- You get a professional document, formatted and ready to be sent to your bank

- You can easily compare your forecast against actuals from your accounting system to ensure you are on track to deliver your plan, and adjust your forecast to keep it up to date as time goes by

If you are interested in this type of solution, you can try our software for free by signing up to The Business Plan Shop today .

There are seven key sections that any business plan for a bank loan must include:

- Executive summary

- Company Overview

- Products and services

- Market analysis

- Financial projections

Let's have a look at each one in more detail.

1. Executive summary

Your executive summary should provide the bank with a quick snapshot of your business (who you are, what you sell, and what your financial projections look like). Remember that this is the first section of your business plan that they will look at - you need to keep them interested and do not need to go into depth.

You should also include details such as the loan amount sought and its purpose, providing the bank with a clear understanding of how the funds will be utilized to support your business's growth and operations.

For example, if you're a small manufacturing company seeking a loan to purchase new equipment, your executive summary would outline the specific amount needed for equipment acquisition and how it will contribute to increasing production capacity and efficiency.

Above is an example of how the "Our Ask" section which details the funding requirements might look like. This image was taken from one of our business plan templates .

Additionally, the executive summary may highlight any collateral or security offered to mitigate the lender's risk.

This could include assets such as real estate, equipment, inventory, or accounts receivable that you're willing to pledge as security for the loan.

By clearly outlining the collateral available to secure the loan, you demonstrate your commitment to fulfilling your financial obligations and provide assurance to the bank regarding the loan's repayment.

Moreover, the executive summary may touch upon the key terms and conditions your business is willing to accept, such as interest rates, repayment schedules, and loan covenants, to ensure the loan aligns with your business's financial objectives and capabilities.

For instance, if you're a small retail store seeking a loan to open a second store, you may try to negotiate a loan repayment holiday to defer the principal repayments until after the second store has started trading in order to improve cash flow.

2. Company overview

In this section, you should explain what structure your business takes up (sole trader, partnership or limited liability company). This way, the bank understands whether or not you are liable if your business defaults on its loan. If you are not they might ask you for a personal guarantee.

If you are a partnership or limited liability company, state who your partners are and what percentage of the business they own. Also, outline any skills and experience they have that make them suitable for their role.

Finally, you should state where your business(es) are located and why that particular location was chosen (for example, it could be because of the parking slots available or transport links, making it very accessible for potential customers).

3. Products and services

You should include a detailed list of the products or services that you sell. Whilst you don't have to specify every single item or service, you should aim to include all of the key ones.

For example, for a hair salon, this might be hair care, washing, stylish haircuts, combing, hair colouring, waving, and hair straightening.

4. Market analysis

The market analysis section of your business plan for a bank loan is where you bring together your local and national market research. Using charts and graphs along with text makes it easier to illustrate your points clearly.

You should also state who you plan to target and the competitors in your local market. For example, if you were a coffee shop business, you could target people seeking a takeaway coffee, those looking for a lunch or snack or people looking for a place to work.

Finally, you should state the regulation in effect in the local market and whether there are any plans to make changes in the future (by the council for example).

5. Strategy

Your strategy section helps explain how you plan to make your business a success. Both marketing and pricing strategies feature in this section.

Explain how you've determined your prices and whether or not they differ from your competitors. Remember that this will depend on your overall pricing strategy (cost-plus pricing, competitive, price skimming, etc.).

Your marketing plan should explain how you plan to attract and retain customers. For example, you could have an attractive storefront with your logo to encourage potential customers to visit inside. You might also offer loyalty cards (for example, buy 3 burgers, get the fourth one free).

Finally, key milestones must also be outlined so that both parties are aware of what needs to be achieved within an agreed-upon timeframe along with measures taken against any foreseeable risks and mitigants related thereto.

6. Operations

The operations section of your business plan for a bank loan should include information about your staffing team. List any current and future recruitment plans, employee skills, experience and what roles they are going to take up.

Plus, you should state what suppliers you chose and why. For example, you might have chosen a particular supplier thanks to their eco-friendly stance or brand reputation.

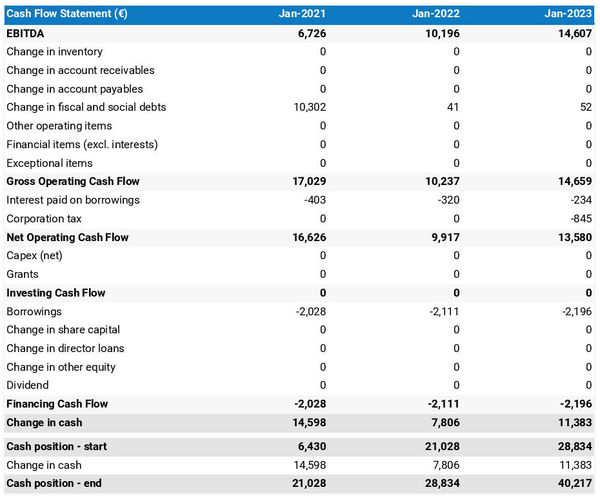

7. Financial projections

Arguably the most important section in your business plan for a bank, your financial projections help the bank decide whether or not they should lend to your company.

This section includes your balance sheet, profit and loss statement and cash flow forecast. Figures from these three statements are used to compute key ratios (see the section below).

Profit and loss statement

A projected P&L statement shows how much money the company might make and how much it will grow in the future.

It helps stakeholders understand how successful the company could be.

Balance sheet

A balance sheet shows what your business owns (assets), what it owes (liabilities), and what has been invested by the owners (equity).

Looking at a balance sheet enables investors, lenders, and business owners to assess the capital structure of the business.

One key aspect of this analysis is achieved by calculating key liquidity (short-term) and solvability (long-term) ratios to understand if the company can pay its debts as they fall due.

Cash flow statement

A projected cash flow statement is a document used to plan out how much cash your business will generate (inflows) and spend over a certain period (outflows).

This document shows the expected cash flows from the operations, investments and other financial activities.

Having this information can help you decide how much money your business needs to save for future expenses or investments, as well as anticipate potential cash shortfalls.

When seeking a bank loan, one common question that arises is the duration of the business plan required.

Understanding whether you need a 3-year plan or a more detailed 5-year money lending business plan can impact your credit application process.

For startups, and most small businesses, a 3-year business plan strikes the right balance between providing a clear vision of the future and not overwhelming with excessive detail.

This shorter timeframe is also often preferred by banks as it allows for a focused projection of your business's trajectory without straying too far into the unknown.

For these reasons, three-years is the de facto standard business plan duration for a loan application.

That being said, it might make sense for businesses to use a 5-year business plan in certain situations. For example when there are delayed cash flows because of a longer development or sales cycle or when the loan is used to fund significant capital investments.

Consider a manufacturing company investing in a new factory to increase production capacity. A 5-year plan would detail the initial investment and leave enough time to show the expected returns and the long-term impact on revenue, costs, and market position.

This longer-term view offers a more comprehensive picture of your business's growth potential and can demonstrate to the bank that you have a clear strategy for sustained success.

In summary, whether you opt for a 3 or 5-year business plan depends on the nature of your business, its growth trajectory, and the level of detail required to support your loan application.

Like most business plans, there's no specific number of pages that yours must have. A good rule of thumb, however, is to keep it between 15 and 35 pages.

As long as you've covered all of the key sections, ranging from the executive summary to the financial projections, your business plan for a bank loan should be good to go.

Remember, quality is more important than quantity.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

It's worth noting that ratio targets set by lenders are industry dependent.

There are usually three key financial ratios that banks calculate before lending money:

1. Fixed charged coverage ratio

This solvency ratio assesses how much headroom a business has over its upcoming debt repayments.

It is calculated by dividing the Cash flow available for debt service (or CFADS), which measures how much cash flow is available to pay off debt obligations, by the amount to be paid to service the debt (interest plus principal repayments).

It is one of the main ratios used by lenders to assess the borrowing capacity and the financial risk of a given business.

For businesses utilising bank debt, lenders usually expect the fixed charge coverage ratio to be above 2.0x, which implies that the business is expected to generate twice as much cash as is needed to service the debt, leaving a healthy buffer.

In any case, the ratio should be above 1.0x, below 1.0x the business is not generating enough cash to service its debt which puts lenders at risk.

For example, if your business records a CFADS of £500,000 and total debt service amounting to £250,000 (£50,000 of interest payments, and £200,000 of principal repayments), it will have a fixed charge coverage ratio of 2.0x.

2. Debt-to-EBITDA

This solvency ratio is used to assess the level of debt and borrowing capacity of the business. It compares the level of debt to the firm’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), used as a proxy for the operating cash flow.

For example, if your company has debt worth £20m and an EBITDA of £5M, your debt to EBITDA ratio would be £20m/£5m = 4.0x.

In simple terms, a company with a debt-to-EBITDA ratio of 4.0x would need at least 4 years to repay its debt. Whether or not this is too high will depend on the sector and the risk appetite of the lender.

3. Interest coverage ratio

This solvency ratio is commonly used by lenders to measure a business's ability to pay interest on its debt. It compares the firm’s EBITDA, used as a proxy for the operating cash flow, with the amount of interest expense due in a financial year.

Let's assume that you are writing a restaurant business plan for bank loan. Your business has an EBITDA of £500,000 and interest expenses amounting to £50,000, meaning it will have an interest coverage ratio of 10.0x.

The rationale behind this ratio is that, if the company was to default on its debt, lenders could potentially agree to delay the principal repayments as long as the company remains able to at least pay the interest. In that scenario, their capital would remain at risk but lenders would still be able to earn a return.

The higher the interest coverage ratio the better. Targets set by lenders are industry dependent. An interest coverage ratio higher than 4.0x is generally a good starting point.

Most of the business plan templates offered by The Business Plan Shop are examples of companies seeking bank loans and so can be used to structure your own plan.

We have templates to fit various industries including hospitality, retail, services, construction, industrials and more.

When preparing to present your business plan to a bank, one crucial decision is choosing the right format.

Should you go with a traditional PDF document or opt for a more dynamic PowerPoint pitch?

Using a PDF format is usually recommended to present a money-lending business plan. What matters to the bank is the content of your document, and the PDF format offers a comprehensive and structured way to present your business's details, financial projections, and strategies.

This format allows you to include detailed written explanations, charts, and graphs, providing a thorough overview of your business to the bank.

PDFs are particularly suitable for conveying complex information in a clear and organized manner, making it easier for bank officials to review and assess your loan application.

Does it mean that PowerPoint should be avoided at all costs?

Not necessarily, a PowerPoint pitch offers a visual and concise way to present the main takeaways from your business plan to the bank, and could therefore be used to complement your PDF document.

This format allows you to highlight key points, trends, and projections using engaging visuals, bullet points, and diagrams.

PowerPoint presentations could be effective for capturing the attention of bank officials during meetings or presentations, enabling you to convey your business's essence and potential compellingly.

In conclusion, a business plan in PDF is expected when presenting a business plan to the bank, but a PowerPoint can also be provided alongside.

As a small business owner seeking financing, you may wonder if it's possible to cast a wider net by applying for multiple loans simultaneously.

While it may seem like a strategic approach to increase your chances of securing funding, there are important factors to consider before pursuing this avenue.

Impact on your credit score

The first factor you need to consider is the potential implications for your credit score, financial stability, and relationship with lenders.

Applying for multiple loans within a short timeframe can result in multiple hard inquiries on your credit report, which may lower your credit score and raise red flags for lenders.

What happens if your business loan request is denied?