Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 7 Research Budget Templates with Samples and Examples

Tejas Prasanna

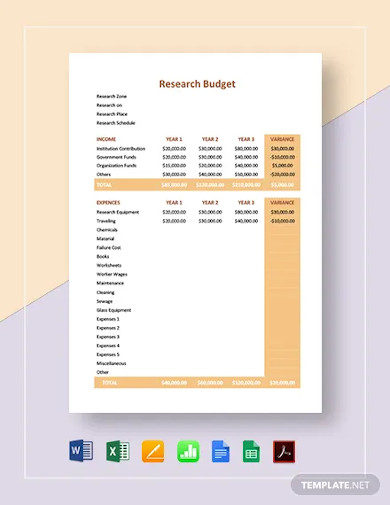

There is no magic formula for creating a research budget. Depending on the kind of research and the potential changes it can bring about, careful planning and allocation is necessary. Budgets can, thus, vary depending on the sponsors, besides other factors. However, every research budget has some essential guidelines.

Research budgets depend on the project deliverables, timelines, and milestones. The resources required also depend on the scope of the projects and sponsors.

Best Templates for Planning Your Research Budget

Designing a research budget is not easy. You will need to consider the resources required and categorize them according to guidelines to ensure funding is not a problem. The categories may include the project’s necessary supplies and equipment and the wages you must pay your assistants. Research budgets are allocated for a year, but you can also plan for a quarter, depending on the project.

At SlideTeam, we have taken care of all these pain points and designed content-ready presentation templates that address each of these points. You save the time, the resources, and the tedium in having to make these presentations from scratch.

What is even better is that each of the templates is 100% editable and customizable. The content-ready nature means you get a starting point and a structure to guide your presentation; the editability feature means you can customize the template to audience profile.

Let’s explore these templates now.

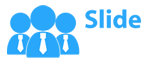

Template 1 - Impact matrix evaluation research solution budget

This PPT Template is the perfect solution for your research budgeting needs. The matrix suggests what solutions are essential with the help of relevant keys that assign priority levels. Priorities go from low to highest influence with increasing importance. They are color-coded, with white being the lowest and red being the highest influence. For instance, Maintain Awareness and Evaluation are red in many cases, as shown in the slide. So, that means that they bear a significant impact on the research budget. Similarly, Strategic and Budget Planning are color-coded white, which means they don't impact the research budget as much in some cases.

With the impact matrix and heatmap, mapping out your research budget will be a breeze.

Get it now!

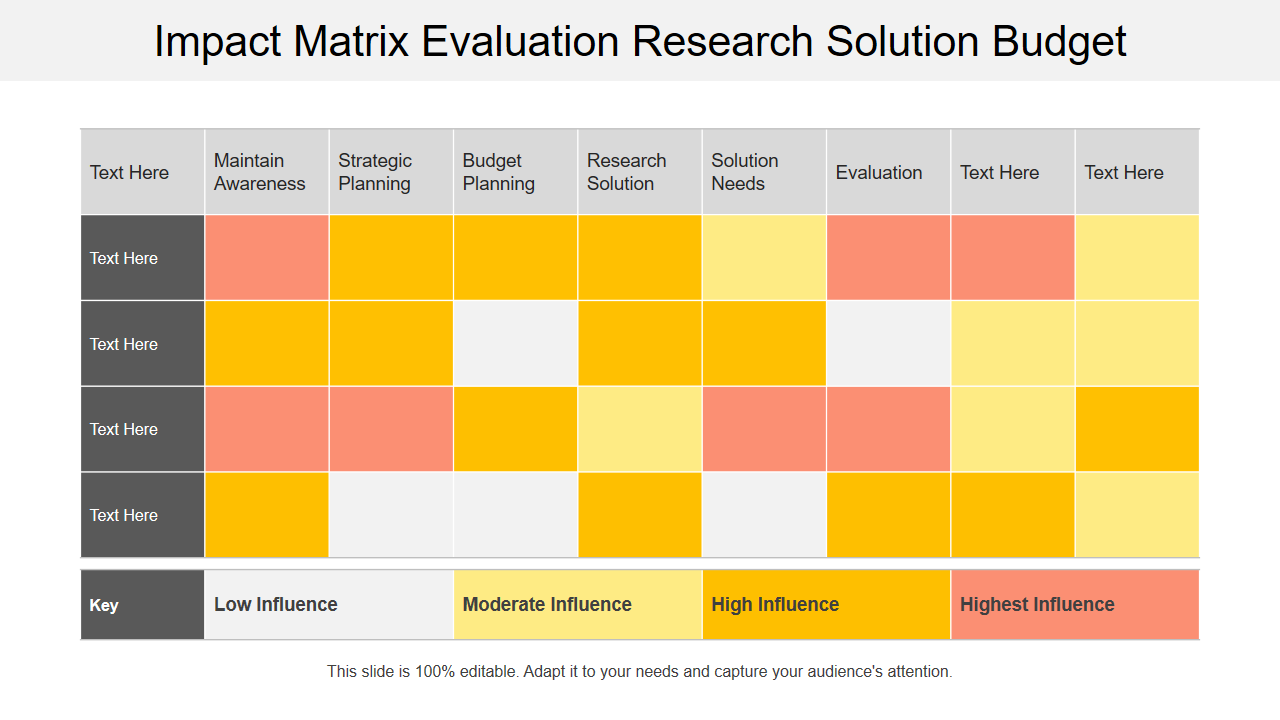

Template 2 Half-yearly research and development departmental budget

Research and Development departments can plan the budget required for projects for the two halves of the year using this PPT Template. The presentation template highlights areas for which you will need funding such as research and development, skills, innovation and patenting, and cooperation. You can also list your requirements for each area. For instance, under R&D and skills, you may need funding for medical research, chemical research, etc. Similarly, for innovation and patenting, you may need funding for product innovation and to cover patenting costs. Likewise, cooperation may involve setting up new laboratories and research centers. With this outlined, you can split the budget required for your research project for the two halves of the year.

Download now!

Template 3 - Budget Estimate for Research and Development Project

This presentation template for the budget estimate for your research and development project is apt for arriving at the calculation for the four quarters in a year. You can define and assign tasks as per the requirements of the project and allocate a set budget for each. The tasks may involve conducting market research and competitive analysis or be innovative or developmental. In either case, you can use this template to set a fixed budget for each task in the research project.

Get it today!

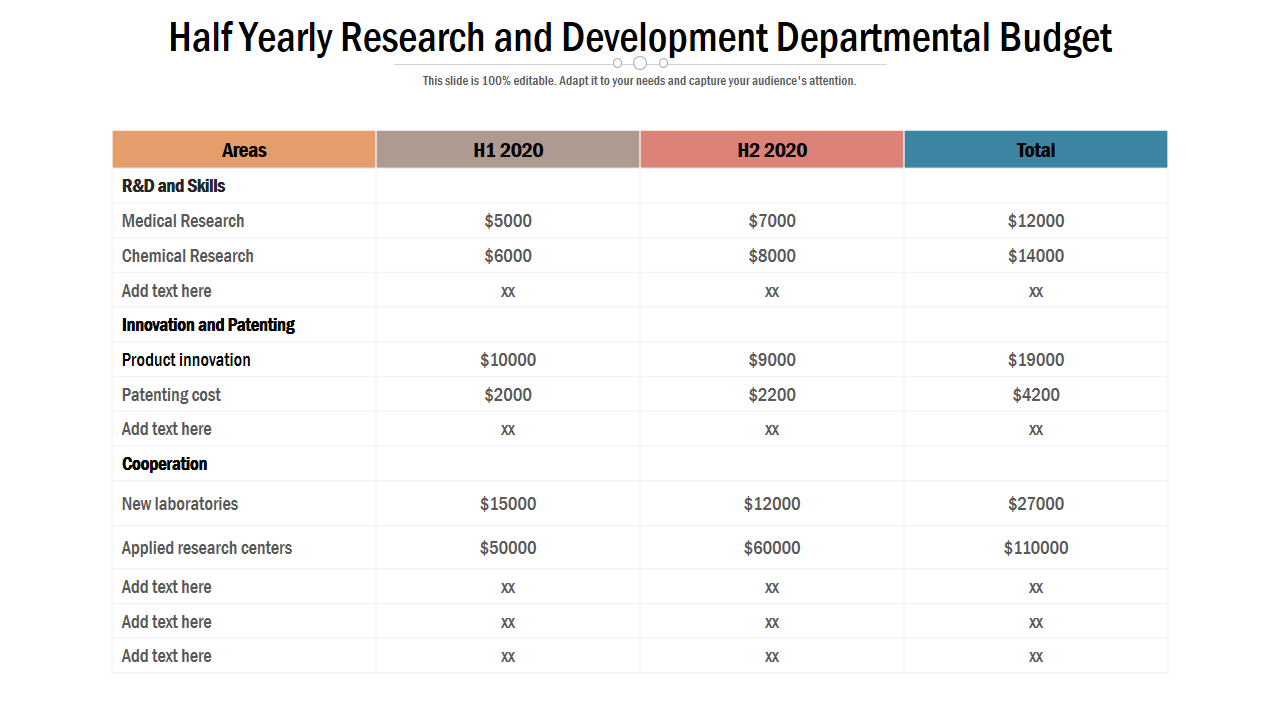

Template 4 Clinical Trial Phases with Communication and Budget Research Design for Clinical Trials

Clinical trials involve many phases, and you should let your research associates know about each step. For instance, you could post the information on the company website and provide relevant insights during the pre-trial phase. Similarly, you can offer the welcome letter and training materials during the trial start-up. During the trial, you can send newsletters to your associates, giving them relevant information and other valuable insights. All this requires funding, and you will need to allocate a budget. However, you don't need to worry, as this PPT Preset has you sorted, with dedicated sections for the pre-trial, trial start-up, during-trial, and trial-end phases. It also has communication, insights summary, and budget sections. You can use the budget section in the matrix to allot a budget for each trial phase and each section, including communication and insights.

Download here!

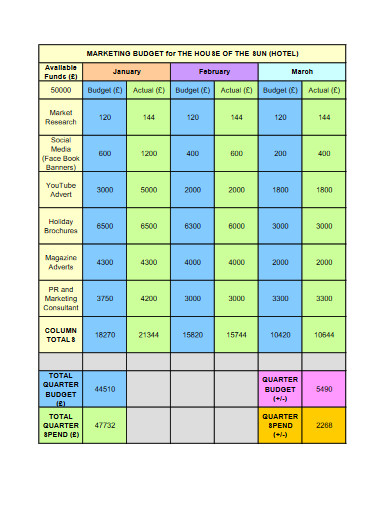

Template 5 Market research strategy with budget and area

The PPT Template has all the core elements required for your market research strategy, including the budget and area. This slide lets you list your clients, the items, and when to send them. You can also list background information related to your research, the aim and objectives of the project, the areas covered, and the budget.

The presentation template also provides a dedicated space to list your brands and products and a timeline for completing the research.

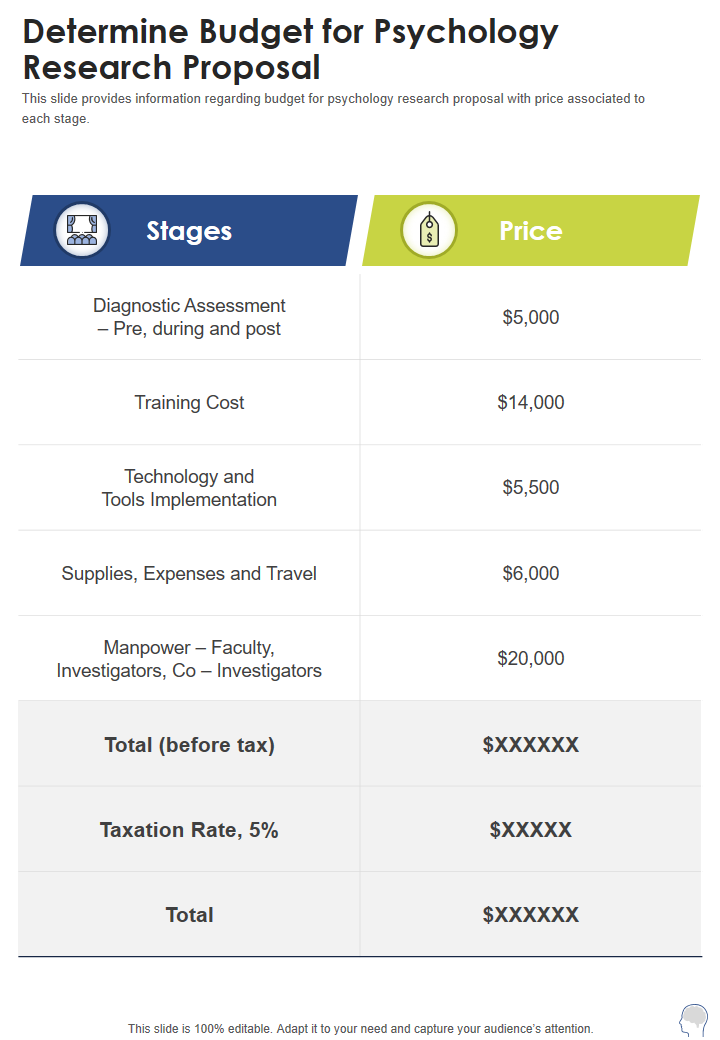

Template 6 - Determine Budget for Psychology Research Proposal One-Pager Sample Example Document

This presentation template is an easy-to-use tool for determining the budget required for psychology research. With this slide, you can allocate a budget for each area, including diagnostic assessment, training, technology and tools, supplies, travel, and workforce. It is a practical, hands-on template with information required to plan the budget for conducting psychological tests and evaluations. Please note that depending on your geography, taxes might or might not deserve a separate column.

Template 7 - Budgeting for Product Launch Market Research

Every company needs to conduct market research before launching a new product. The PowerPoint Presentation that you have here can help you plan the budget required for conducting such market research. It includes necessary information, including business and research objectives, priorities, methodologies, and forecasts. The presentation template also has the metrics required for the research, such as improving customer engagement, introducing new products, and increasing market share. For example, to improve customer engagement, you may be looking to improve marketing approaches and gather customer feedback. The methods you may use include conducting marketing mix studies and tests. Similarly, you may want to optimize your social media posts and profiles and conduct A/B tests when introducing new products. Improving your market share may involve analyzing the competition. You may even use this handy template for conducting market research, estimating, and forecasting budgets.

RESEARCH IS IMPORTANT BUSINESS

You can plan your research and the budget required using these templates. Remember that each new product launch has lots of research behind it. When going for a new launch, don’t just research the products and its uses, but also the markets – particularly, your target audience and how they will benefit from your brands. When allocating the budget for your research, don't forget to note your total resources and try to be as cost-effective as possible. You must consider the expected costs that you may incur and use these templates to work out a research budget that fits within your resources.

FAQs on Research Budget

What should be included in a research budget.

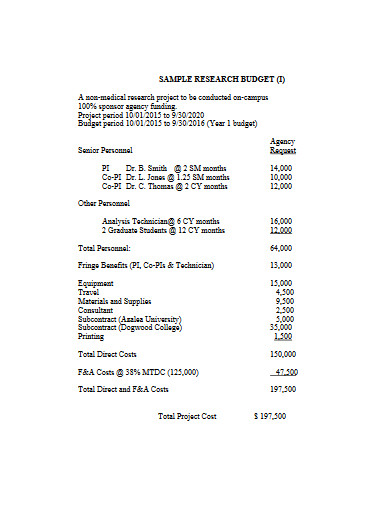

Research budgets should include all direct costs, and facilities and administrative costs (F&A). The facilities and administrative expenses are needed to achieve the primary objectives of the research. The project description should state the proposed budget and serve as a financial expression for the research. The idea is to ensure that the budget is comprehensive.

How do you create a research budget?

You can create a simple research budget by following these steps:

- List activities that will help you carry out the research.

- Check the rules for getting the funding required.

- Check all costs involved.

- Lay out the costs using a spreadsheet.

- Justify your budget by asking why and for what you need the money and where you got your figures.

What is the role of budget in research?

A budget can provide a detailed and clear picture of the structure of the research project, not to mention that it also lets you know how well it can be managed. The research project budget usually lets you see whether it will go according to plan and if it is feasible. So, it must be complete and reasonable.

What is the average budget for a research project?

The budget for a research project depends on the type of research and the proposed difference it could make to a field of study. For instance, the average budget for a market research project may vary between $20,000 and $50,000. Similarly, larger scientific research projects may cost millions or even billions of dollars, as in pharmaceuticals.

Related posts:

- Top 5 Startup Budget Templates with Samples and Examples

- Top 5 Construction Project Budget Templates With Examples And Samples

- Top 10 Cost Comparison Templates with Examples and Samples

- Top 5 Budget Planner Templates with Examples and Samples

Liked this blog? Please recommend us

Top 10 Purchasing Process Example Templates with Samples

Top 10 Banking Company Profile Templates for Crafting a Profile that Makes Money Talk!

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- J Ayurveda Integr Med

- v.10(2); Apr-Jun 2019

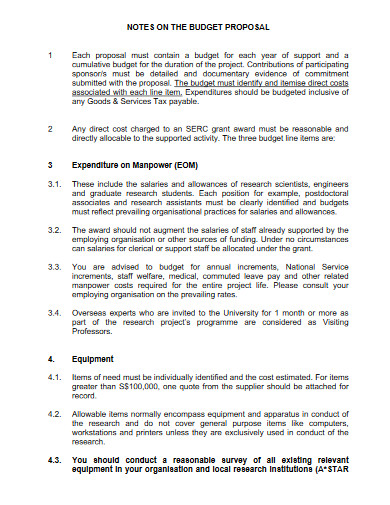

How to plan and write a budget for research grant proposal?

Medical research can have an enormous positive impact on human health. Health research improves the quality of human lives and society which plays a vital role in social and economic development of the nation. Financial support is crucial for research. However, winning a research grant is a difficult task. A successful grant-winning application requires two key elements: one is an innovative research problem with best probable idea/plan for tackling it and appropriate planning of budget. The aim of the present paper is to give an insight on funding agencies providing funding for health research including traditional Indian medicine (from an Indian perspective) and key points for planning and writing budget section of a grant application.

1. Introduction

Why health science research is important and why should it to be funded? Science and technology innovations and health research can have an enormous impact on human health. They improve public health, quality of human lives, longevity and have made society better [1] , [2] . Healthy humans with better quality of life are crucial for the social and economical development of the nation [3] . Medical research led to the expansion of knowledge about health problems/conditions and their mechanism, risk factors, outcomes of treatments or interventions, preventive measures and proper management. Clinical studies or trials provide important information about the safety and efficacy of a drug/intervention. Innovative basic science research had led to the discovery of new technology, efficient diagnostic and therapeutic devices. So, currently, an effort with multidisciplinary approach is a demand for better understanding of clinical conditions and providing safest health care to the community [2] , [4] .

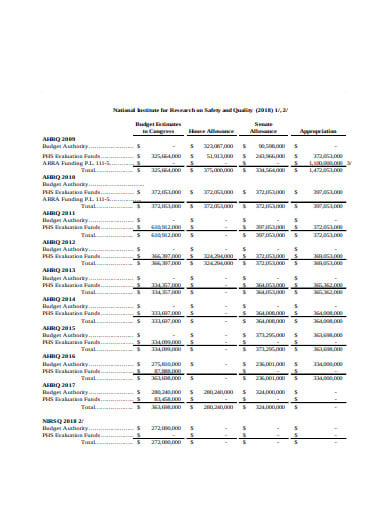

Whether it is basic or applied, clinical or non-clinical, all research needs financial support. Considering the importance of research in economic growth of a nation, many countries are increasing their budget for research and development in science. A study on impact of GDP (Gross Domestic Product) on research and development in science among Asian countries has found that one who spends more on research has more research outcomes in the form of total number of research documents, citations per documents and h-index [5] . About 95% of the NIH (National Institutes of Health, USA), budget goes directly to research awards, programs, and centers; training programs; and research and development contracts [6] . Total expenditure carried out for research in India is too less than USA and China. Percentage of GDP for research and development in India is 0.88%, while South Korea, USA and China have 4.292%, 2.742 and 2.1% respectively [7] .

Owing to the increasing competition among the researchers, especially the young ones, for their academic growth, preparing and planning a winning research proposal becomes very essential. A successful grant-winning application requires two key elements: (1) innovative research problem with best probable idea/plan for tackling it and (2) appropriate planning of budget. The aim of the present paper is to give an insight on funding agencies (from an Indian perspective) and key points for planning and writing budget section of a grant application.

2. What is the purpose of the budget plan in a grant application?

A budget is the quantitative expression of a financial plan for future expenses on the project in a given period of time [8] . Budget plan is a key element of a grant application. It demonstrates the required cost for the proposed project. It is a prediction of expenses and serves a plan for funders on how the organization will operate the project, spend the money in a given set of period and where their money will go. It shows the funders exactly what they can support and also helps the institution and investigating team in management of the project. Moreover, budget plan requires for accountability [9] .

3. Which are the funding agencies that sponsor health research in India?

Various national and international sponsoring agencies have identified health problems of priority for funding a research. Some of the leading funding agencies providing grant for health research including alternative systems of medicine in India are given in Table 1 . State Universities/deemed Universities also have a provision of funding for medical research.

Table 1

List of funding agencies those promote health research.

4. What constitutes a research project budget?

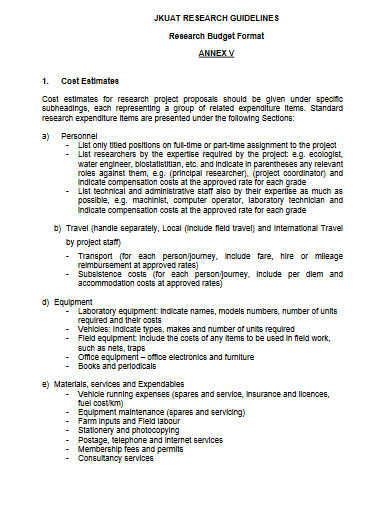

Proforma of the research grant applications and presentation of budget section may vary among the sponsoring agencies. However, major parts of budget plan in the applications of the above mentioned funding agencies are quite similar. The budget section is broadly divided into two categories: direct and indirect costs.

4.1. Direct costs:

These are the costs incurred specifically to carry out a project [10] . Direct costs include expenses towards personnel, materials, equipments, consumables and travel. These particulars are further categorized into recurring and non-recurring expenses on the basis of their occurrence during the study period. A brief description of the sub-sections under direct cost is given below:

4.1.1. Personnel:

Budget for personnel can be mentioned in this section in case human resources are required for the study and as per funding agency guidelines. Salaries with allowances can be budgeted for human resources such as site manager, research assistant, junior research fellow (JRF), senior research fellow (SRF), research associate, technician, data entry operator and attender. Most of the Indian funding agencies do not have a provision for salaries for the principal investigator (PI) and co-investigators (Co-PI). Ministry of AYUSH [11] and Rajiv Gandhi University of Health Science (RGUHS), Karnataka [12] provide one-time minimal fees for investigators and supporting staff respectively. There is a provision for salaries of investigators in Wellcome trust-DBT India alliance grants [13] .

4.1.2. Recurring expenses:

Recurring expenses are those which are variable and which keep on occurring throughout the entire project duration. Particulars categorized in this category are consumables, chemicals, glasswares, laboratory test charges, diagnostic kits, stationery, prints, photocopies, communication, postage, telephone charges, survey tools, questionnaires, publication charges, reprints, binding etc. Other expenses could be allowances for patients/participants, food charges and physician fees.

4.1.3. Non-recurring expenses:

Non-recurring expenses are those which are one-time in nature or which do not recur at regular intervals. Particulars included in this category are equipments or instruments with its accessories, software's, computer, printer, electrical and electronic items and accessories of the existing instrument in your lab. Percentage of budget allocated for equipment varies among the funding agencies from 25% to 90% of the entire budget. Some of the agencies do not have provision for equipment in budget. Vision Group on Science and Technology allocated their maximum grant (up to 90%) for development of infrastructure of laboratories [14] .

4.1.4. Traveling expenses:

Budget allocated for traveling can be used for attending meetings, conferences, workshops and training programs. Foreign travel is not allowed by any Indian funding agency. Traveling expenses for collection of data, survey and visit to other centers in multicentric study can be budgeted in this sub-section.

4.2. Indirect costs:

These are the costs which cannot be directly attributed to specific expenses of a project, but are required to run a project. It is also termed as overhead charges. Laboratory, electricity, water, library and other facilities are provided by the institution to run a proposed research project. Therefore, a fixed cost (usually) of about 5–15% of the total budget is provisioned as institutional overhead charges which goes to the institution directly. The range may, however, be flexible on the basis of the type of funding agency.

5. Budget justification

Most of the funding agencies require submission of a budget justification with all the items described above. Sometimes it is also called as budget narrative. Explanation of need for each line item in the budget with item-wise and year-wise breakdown has to be provided. Quantification of total costs of each line-item and document cost calculation should be done. When writing a budget justification, it is important to follow the same order as that in an itemized budget. For example, if equipment such as color doppler is required, then justify the need of a device with respect to the proposed methodology of the study. Similarly, for non-recurring expenses, breakdown the consumables item-wise and year-wise with its cost and calculation according to the protocol of the study and justify accordingly.

6. Budget summary

An item-wise and year wise summary of the total budget is usually required in most of the applications. Budget summary outlines the proposed grant and often (most of the format) appears at the beginning of the proposal. It should always be prepared at the end, after the grant proposal has been completely developed. A sample budget summary (as an example) for a proposed study for the duration of three years is shown in Table 2 . In the personnel section, a research fellow salary with allowances is budgeted year-wise. The salary of the research fellow for the first and second year is Rs. 2,30,000 per year (JRF) with an enhancement to Rs 2, 59,000 for the third year (SRF) as per the guidelines of the funding agency. As non-recurring expenses are one time in nature, a budget for equipment was budgeted only for the first year. Under the section of recurring expenses, more budgets are allocated in the second year for consumables because recruitment of subjects in large number will be done during the second year of the proposed study. Similarly, expenses toward travel, investigator fee and other miscellaneous costs year-wise have been budgeted. The emoluments and guidelines on service conditions for research personnel employed in research project by ICMR has been given in reference section [15] , [16] .

Table 2

Sample budget summary (year wise).

7. How to plan a simple research budget?

Planning of the research budget begins with an innovative research question, objectives and design of the study. Before starting to write a budget plan, it is essential to understand the expectations of funding agencies, University/Institute and the team of researchers. It is imperative to keep in mind that the research proposal will be reviewed by both scientific and financial (non-scientific) experts. Hence, the proposal should be prepared in such a way that it can be easily understood by even non-scientific experts.

Firstly, a list of what is essential and would add value for research such as focus of research, primary and secondary outcomes of the study, the source of the sample, study setting, sample design and sample size, techniques used to collect data, method of data analysis and available resources should be made [17] .

Secondly, the instructions, format of the application and rules of the funding agency should be read thoroughly. Budget specifications, limitations of recurring and non-recurring costs, and necessity of budget justification with cost breakdown should be checked. Note that one should not deviate or modify the proforma of the funding agency.

Thirdly, a list of items should be made and categorized into recurring and non-recurring expenses. Breakdown of the budget into item-wise and year-wise with cost calculation should be done. It should be ensured that costs are reasonable, allowable and related to the research proposal, so that the budget appears realistic. Travel expenses should be calculated as per the rules of the funding agency.

Fourthly, item-wise and year-wise justification of the requirement in a same sequence of format should be provided. A well-justified budget can enhance the evaluation of the research proposal by reviewers and funding body.

The last most important part is to review the budget and verify the costs and calculation. It is better, if other research team members can review the budget plan and re-calculate the costs thoroughly. Remember, too high budget and too low budget with respect to the research proposal are suspicious and chances of receiving a grant are less.

Sources of funding

Conflict of interest.

Peer review under responsibility of Transdisciplinary University, Bangalore.

The Research Whisperer

Just like the thesis whisperer – but with more money, how to make a simple research budget.

Every research project needs a budget*.

If you are applying for funding, you must say what you are planning to spend that funding on. More than that, you need to show how spending that money will help you to answer your research question .

So, developing the budget is the perfect time to plan your project clearly . A good budget shows the assessors that you have thought about your research in detail and, if it is done well, it can serve as a great, convincing overview of the project.

Here are five steps to create a simple budget for your research project.

1. List your activities

Make a list of everything that you plan to do in the project, and who is going to do it.

Take your methodology and turn it into a step-by-step plan. Have you said that you will interview 50 people? Write it on your list.

Are you performing statistical analysis on your sample? Write it down.

Think through the implications of what you are going to do. Do you need to use a Thingatron? Note down that you will need to buy it, install it, and commission it.

What about travel? Write down each trip separately. Be specific. You can’t just go to ‘South East Asia’ to do fieldwork. You need to go to Kuala Lumpur to interview X number of people over Y weeks, then the same again for Singapore and Jakarta.

Your budget list might look like this:

- I’m going to do 10 interviews in Kuala Lumpur; 10 interviews in Singapore; 10 interviews in Jakarta by me.

- I’ll need teaching release for three months for fieldwork.

- I’ll need Flights to KL, Singapore, Jakarta and back to Melbourne.

- I’ll need Accommodation for a month in each place, plus per diem.

- The transcription service will transcribe the 30 interviews.

- I’ll analysis the transcribed results. (No teaching release required – I’ll do it in my meagre research time allowance.)

- I’ll need a Thingatron X32C to do the trials.

- Thing Inc will need to install the Thingatron. (I wonder how long that will take.)

- The research assistant will do three trials a month with the Thingatron.

- I’ll need to hire a research assistant (1 day per week for a year at Level B1.)

- The research assistant will do the statistical analysis of the Thingatron results.

- I’ll do the writing up in my research allowance time.

By the end, you should feel like you have thought through the entire project in detail. You should be able to walk someone else through the project, so grab a critical friend and read the list to them. If they ask questions, write down the answers.

This will help you to get to the level of specificity you need for the next step.

2. Check the rules again

You’ve already read the funding rules, right? If not, go and read them now – I’ll wait right here until you get back.

Once you’ve listed everything you want to do, go back and read the specific rules for budgets again. What is and isn’t allowed? The funding scheme won’t pay for equipment – you’ll need to fund your Thingatron from somewhere else. Cross it off.

Some schemes won’t fund people. Others won’t fund travel. It is important to know what you need for your project. It is just as important to know what you can include in the application that you are writing right now.

Most funding schemes won’t fund infrastructure (like building costs) and other things that aren’t directly related to the project. Some will, though. If they do, you should include overheads (i.e. the general costs that your organisation needs to keep running). This includes the cost of basics like power and lighting; desks and chairs; and cleaners and security staff. It also includes service areas like the university library. Ask your finance officer for help with this. Often, it is a percentage of the overall cost of the project.

If you are hiring people, don’t forget to use the right salary rate and include salary on-costs. These are the extra costs that an organisation has to pay for an employee, but that doesn’t appear in their pay check. This might include things like superannuation, leave loading, insurance, and payroll tax. Once again, your finance officer can help with this.

Your budget list might now look like this:

- 10 interviews in Kuala Lumpur; 10 interviews in Singapore; 10 interviews in Jakarta by me.

- Teaching release for three months for fieldwork.

- Flights to KL, Singapore, Jakarta and back to Melbourne.

- Accommodation for a month in each place, plus per diem, plus travel insurance (rule 3F).

- Transcription of 30 interviews, by the transcription service.

- Analysis of transcribed results, by me. No teaching release required.

- Purchase and install Thingatron X32C, by Thing Inc . Not allowed by rule 3C . Organise access to Thingatron via partner organistion – this is an in-kind contribution to the project.

- Three trials a month with Thingatron, by research assistant.

- Statistical analysis of Thingatron results, by research assistant.

- Research assistant: 1 day per week for a year at Level B1, plus 25.91% salary on-costs.

- Overheads at 125% of total cash request, as per rule 3H.

3. Cost each item

For each item on your list, find a reasonable cost for it . Are you going to interview the fifty people and do the statistical analysis yourself? If so, do you need time release from teaching? How much time? What is your salary for that period of time, or how much will it cost to hire a replacement? Don’t forget any hidden costs, like salary on-costs.

If you aren’t going to do the work yourself, work out how long you need a research assistant for. Be realistic. Work out what level you want to employ them at, and find out how much that costs.

How much is your Thingatron going to cost? Sometimes, you can just look that stuff up on the web. Other times, you’ll need to ring a supplier, particularly if there are delivery and installation costs.

Jump on a travel website and find reasonable costs for travel to Kuala Lumpur and the other places. Find accommodation costs for the period that you are planning to stay, and work out living expenses. Your university, or your government, may have per diem rates for travel like this.

Make a note of where you got each of your estimates from. This will be handy later, when you write the budget justification.

- 10 interviews in Kuala Lumpur; 10 interviews in Singapore; 10 interviews in Jakarta by me (see below for travel costs).

- Teaching release for three months for fieldwork = $25,342 – advice from finance officer.

- Flights to KL ($775), Singapore ($564), Jakarta ($726), Melbourne ($535) – Blue Sky airlines, return economy.

- Accommodation for a month in each place (KL: $3,500; Sing: $4,245; Jak: $2,750 – long stay, three star accommodation as per TripAdviser).

- Per diem for three months (60 days x $125 per day – University travel rules).

- Travel insurance (rule 3F): $145 – University travel insurance calculator .

- Transcription of 30 interviews, by the transcription service: 30 interviews x 60 minutes per interview x $2.75 per minute – Quote from transcription service, accented voices rate.

- Analysis of transcribed results, by me. No teaching release required. (In-kind contribution of university worth $2,112 for one week of my time – advice from finance officer ).

- Purchase and install Thingatron X32C, by Thing Inc . Not allowed by rule 3C. Organise access to Thingatron via partner organistion – this is an in-kind contribution to the project. ($2,435 in-kind – quote from partner organisation, at ‘favoured client’ rate.)

- Research assistant: 1 day per week for a year at Level B1, plus 25.91% salary on-costs. $12,456 – advice from finance officer.

Things are getting messy, but the next step will tidy it up.

4. Put it in a spreadsheet

Some people work naturally in spreadsheets (like Excel). Others don’t. If you don’t like Excel, tough. You are going to be doing research budgets for the rest of your research life.

When you are working with budgets, a spreadsheet is the right tool for the job, so learn to use it! Learn enough to construct a simple budget – adding things up and multiplying things together will get you through most of it. Go and do a course if you have to.

For a start, your spreadsheet will multiply things like 7 days in Kuala Lumpur at $89.52 per day, and it will also add up all of your sub-totals for you.

If your budget doesn’t add up properly (because, for example, you constructed it as a table in Word), two things will happen. First, you will look foolish. Secondly, and more importantly, people will lose confidence in all your other numbers, too. If your total is wrong, they will start to question the validity of the rest of your budget. You don’t want that.

If you are shy of maths, then Excel is your friend. It will do most of the heavy lifting for you.

For this exercise, the trick is to put each number on a new line. Here is how it might look.

5. Justify it

Accompanying every budget is a budget justification. For each item in your budget, you need to answer two questions:

- Why do you need this money?

- Where did you get your figures from?

The budget justification links your budget to your project plan and back again. Everything item in your budget should be listed in your budget justification, so take the list from your budget and paste it into your budget justification.

For each item, give a short paragraph that says why you need it. Refer back to the project plan and expand on what is there. For example, if you have listed a research assistant in your application, this is a perfect opportunity to say what the research assistant will be doing.

Also, for each item, show where you got your figures from. For a research assistant, this might mean talking about the level of responsibility required, so people can understand why you chose the salary level. For a flight, it might be as easy as saying: “Blue Sky airlines economy return flight.”

Here is an example for just one aspect of the budget:

Fieldwork: Kuala Lumpur

Past experience has shown that one month allows enough time to refine and localise interview questions with research partners at University of Malaya, test interview instrument, recruit participants, conduct ten x one-hour interviews with field notes. In addition, the novel methodology will be presented at CONF2015, to be held in Malaysia in February 2015.

Melbourne – Kuala Lumpur economy airfare is based on current Blue Sky Airlines rates. Note that airfares have been kept to a minimum by travelling from country to country, rather than returning to Australia.

1 month accommodation is based on three star, long stay accommodation rates provided by TripAdvisor.

30 days per diem rate is based on standard university rates for South-East Asia.

Pro tip: Use the same nomenclature everywhere. If you list a Thingatron X32C in your budget, then call it a Thingatron X32C in your budget justification and project plan. In an ideal world, someone should be able to flip from the project plan, to the budget and to the budget justification and back again and always know exactly where they are.

- Project plan: “Doing fieldwork in Malaysia? Whereabouts?” Flips to budget.

- Budget: “A month in Kuala Lumpur – OK. Why a month?” Flips to budget justification.

- Budget justification: “Ah, the field work happens at the same time as the conference. Now I get it. So, what are they presenting at the conference?” Flips back to the project description…

So, there you have it: Make a list; check the rules; cost everything; spreadsheet it; and then justify it. Budget done. Good job, team!

This article builds on several previous articles. I have shamelessly stolen from them.

- Constructing your budget – Jonathan O’Donnell.

- What makes a winning budget ? – Jonathan O’Donnell.

- How NOT to pad your budget – Tseen Khoo.

- Conquer the budget, conquer the project – Tseen Khoo.

- Research on a shoestring – Emily Kothe.

- How to make a simple Gantt chart – Jonathan O’Donnell.

* Actually, there are some grant schemes that give you a fixed amount of money, which I think is a really great idea . However, you will still need to work out what you are going to spend the money on, so you will still need a budget at some stage, even if you don’t need it for the application.

Also in the ‘simple grant’ series:

- How to write a simple research methods section .

- How to make a simple Gantt chart .

Share this:

28 comments.

This has saved my day!

Happy to help, Malba.

Like Liked by 1 person

[…] you be putting in a bid for funding? Are there costs involved, such as travel or equipment costs? Research Whisperer’s post on research budgets may help you […]

I’ve posted a link to this article of Jonathan’s in the Australasian Research Management Society LinkedIn group as well, as I’m sure lots of other people will want to share this.

Thanks, Miriam.

This is great! Humorous way to talk explain a serious subject and could be helpful in designing budgets for outreach grants, as well. Thanks!

Thanks, Jackie

If you are interested, I have another one on how to do a timeline: https://theresearchwhisperer.wordpress.com/2011/09/13/gantt-chart/

[…] really useful information regarding budget development can be found on the Research Whisperer Blog here. Any other thoughts and suggestions are welcome – what are your tips to developing a good […]

[…] it gets you to the level of specificity that you need for a detailed methods section. Similarly, working out a budget for your workshops will force you to be specific about how many people will be attending (venue […]

A friend of mine recently commented by e-mail:

I was interested in your blog “How to make a simple research budget”, particularly the statement: “Think through the implications of what you are going to do. Do you need to use a Thingatron? Note down that you will need to buy it, install it, and commission it.”

From my limited experience so far, I’d think you could add:

“Who else is nearby who might share the costs of the Thingatron? If it’s a big capital outlay, and you’re only going to use it to 34% of it’s capacity, sharing can make the new purchase much easier to justify. But how will this fit into your grant? And then it’s got to be maintained – the little old chap who used to just do all that odd mix of electrickery and persuasion to every machine in the lab got retrenched in the last round. You can run it into the ground. But that means you won’t have a reliable, stable Thingatron all ready to run when you apply for the follow-on grant in two years.”

[…] (For more on this process, take a look at How to Write a Simple Project Budget.) […]

[…] Source: How to make a simple research budget […]

This is such a big help! Thank You!

No worries, Claudine. Happy to help.

Would you like to share the link of the article which was wrote about funding rules? I can’t find it. Many thanks!

Hello there – do you mean this post? https://theresearchwhisperer.wordpress.com/2012/02/14/reading-guidelines

Thank @tseen khoo, very useful tips. I also want to understand more about 3C 3F 3H. What do they stand for? Can you help me find out which posts talk about that. Thank again.

[…] mount up rapidly, even if you are in a remote and developing part of the world. Putting together a half decent budget early on and being aware of funding opportunities can help to avoid financial disaster half way […]

This is so amazing, it really helpful and educative. Happy unread this last week before my proposal was drafted.

Happy to help, Babayomi. Glad you liked it.

really useful! thanks kate

[…] “How to Make a Simple Research Budget,” by Jonathan O’Donnell on The Research Whisperer […]

[…] offering services that ran pretty expensive. until I found this one. It guided me through making a simple budget. The information feels sort of like a university graduate research paper but having analysed […]

[…] Advice on writing research proposals for industry […]

[…] research serves as the bedrock of informed budgeting. Explore the average costs of accommodation, transportation, meals, and activities in your chosen […]

Leave a comment Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

- Starting the research process

- How to Write a Research Proposal | Examples & Templates

How to Write a Research Proposal | Examples & Templates

Published on October 12, 2022 by Shona McCombes and Tegan George. Revised on November 21, 2023.

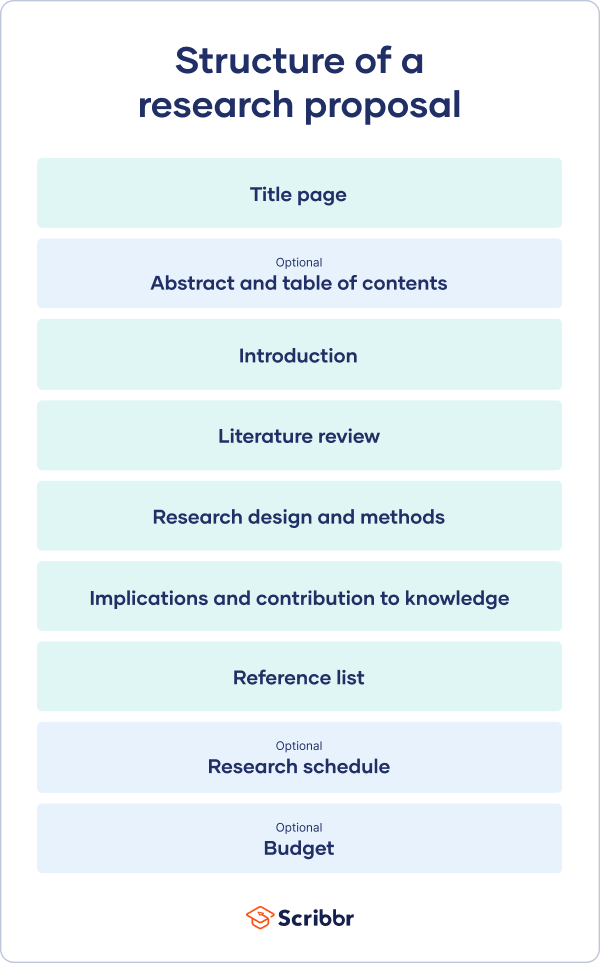

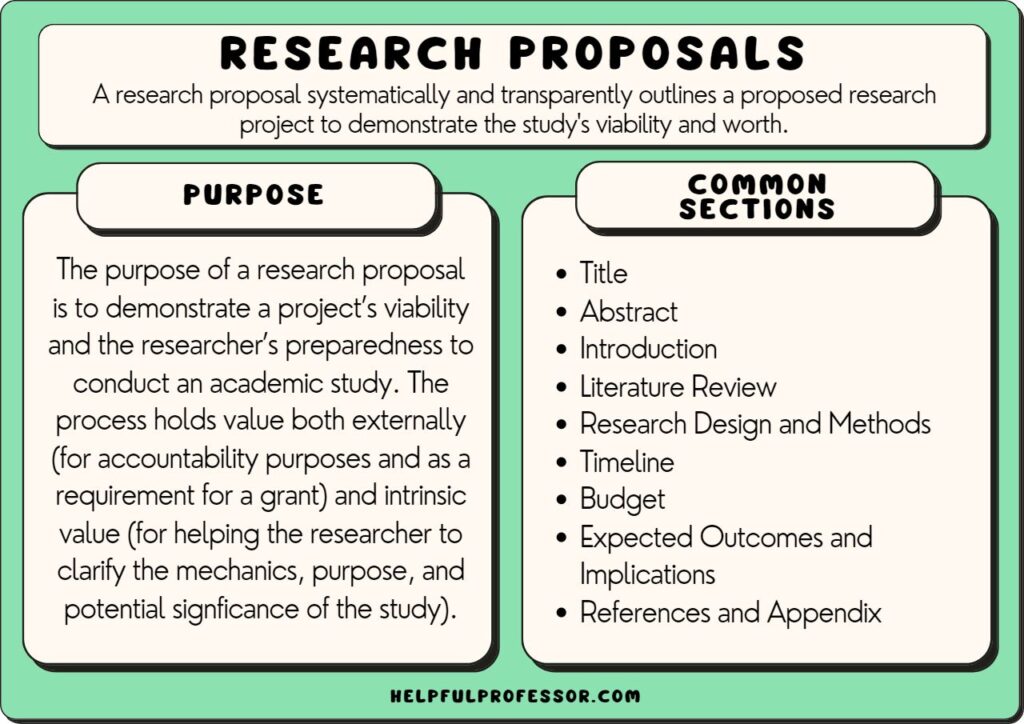

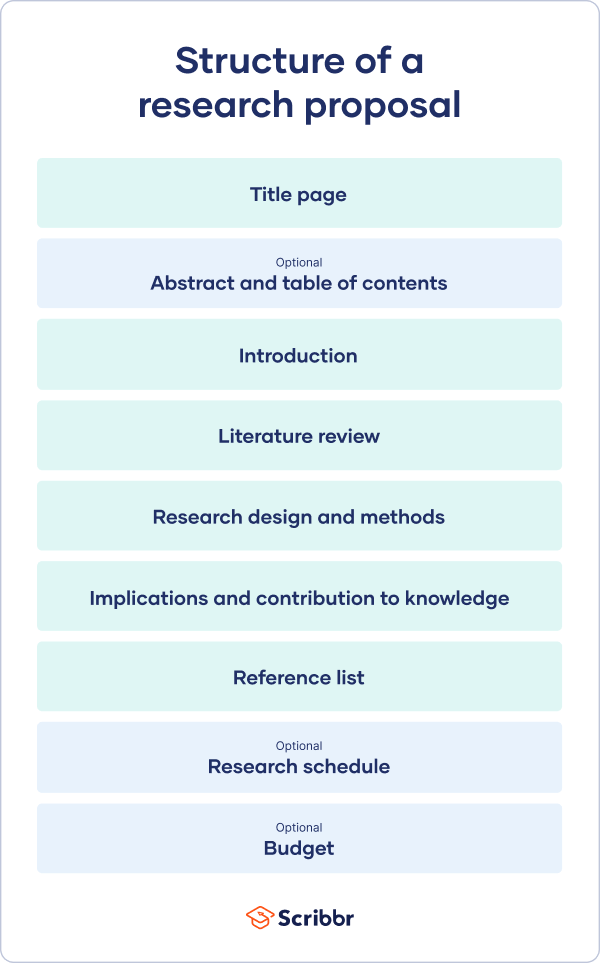

A research proposal describes what you will investigate, why it’s important, and how you will conduct your research.

The format of a research proposal varies between fields, but most proposals will contain at least these elements:

Introduction

Literature review.

- Research design

Reference list

While the sections may vary, the overall objective is always the same. A research proposal serves as a blueprint and guide for your research plan, helping you get organized and feel confident in the path forward you choose to take.

Table of contents

Research proposal purpose, research proposal examples, research design and methods, contribution to knowledge, research schedule, other interesting articles, frequently asked questions about research proposals.

Academics often have to write research proposals to get funding for their projects. As a student, you might have to write a research proposal as part of a grad school application , or prior to starting your thesis or dissertation .

In addition to helping you figure out what your research can look like, a proposal can also serve to demonstrate why your project is worth pursuing to a funder, educational institution, or supervisor.

Research proposal length

The length of a research proposal can vary quite a bit. A bachelor’s or master’s thesis proposal can be just a few pages, while proposals for PhD dissertations or research funding are usually much longer and more detailed. Your supervisor can help you determine the best length for your work.

One trick to get started is to think of your proposal’s structure as a shorter version of your thesis or dissertation , only without the results , conclusion and discussion sections.

Download our research proposal template

Here's why students love Scribbr's proofreading services

Discover proofreading & editing

Writing a research proposal can be quite challenging, but a good starting point could be to look at some examples. We’ve included a few for you below.

- Example research proposal #1: “A Conceptual Framework for Scheduling Constraint Management”

- Example research proposal #2: “Medical Students as Mediators of Change in Tobacco Use”

Like your dissertation or thesis, the proposal will usually have a title page that includes:

- The proposed title of your project

- Your supervisor’s name

- Your institution and department

The first part of your proposal is the initial pitch for your project. Make sure it succinctly explains what you want to do and why.

Your introduction should:

- Introduce your topic

- Give necessary background and context

- Outline your problem statement and research questions

To guide your introduction , include information about:

- Who could have an interest in the topic (e.g., scientists, policymakers)

- How much is already known about the topic

- What is missing from this current knowledge

- What new insights your research will contribute

- Why you believe this research is worth doing

As you get started, it’s important to demonstrate that you’re familiar with the most important research on your topic. A strong literature review shows your reader that your project has a solid foundation in existing knowledge or theory. It also shows that you’re not simply repeating what other people have already done or said, but rather using existing research as a jumping-off point for your own.

In this section, share exactly how your project will contribute to ongoing conversations in the field by:

- Comparing and contrasting the main theories, methods, and debates

- Examining the strengths and weaknesses of different approaches

- Explaining how will you build on, challenge, or synthesize prior scholarship

Following the literature review, restate your main objectives . This brings the focus back to your own project. Next, your research design or methodology section will describe your overall approach, and the practical steps you will take to answer your research questions.

To finish your proposal on a strong note, explore the potential implications of your research for your field. Emphasize again what you aim to contribute and why it matters.

For example, your results might have implications for:

- Improving best practices

- Informing policymaking decisions

- Strengthening a theory or model

- Challenging popular or scientific beliefs

- Creating a basis for future research

Last but not least, your research proposal must include correct citations for every source you have used, compiled in a reference list . To create citations quickly and easily, you can use our free APA citation generator .

Some institutions or funders require a detailed timeline of the project, asking you to forecast what you will do at each stage and how long it may take. While not always required, be sure to check the requirements of your project.

Here’s an example schedule to help you get started. You can also download a template at the button below.

Download our research schedule template

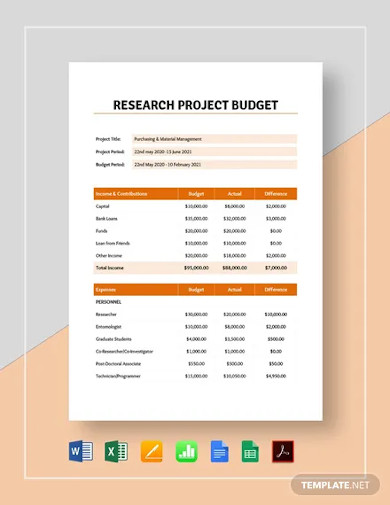

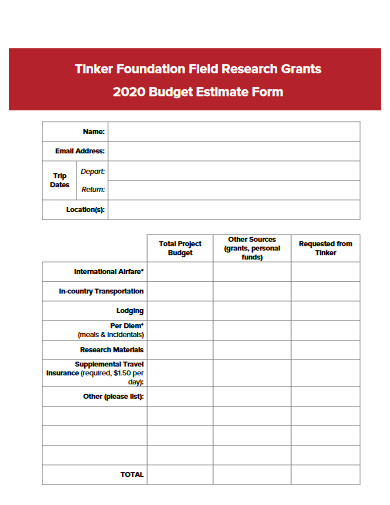

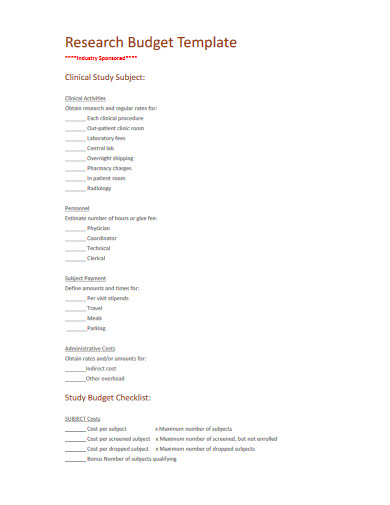

If you are applying for research funding, chances are you will have to include a detailed budget. This shows your estimates of how much each part of your project will cost.

Make sure to check what type of costs the funding body will agree to cover. For each item, include:

- Cost : exactly how much money do you need?

- Justification : why is this cost necessary to complete the research?

- Source : how did you calculate the amount?

To determine your budget, think about:

- Travel costs : do you need to go somewhere to collect your data? How will you get there, and how much time will you need? What will you do there (e.g., interviews, archival research)?

- Materials : do you need access to any tools or technologies?

- Help : do you need to hire any research assistants for the project? What will they do, and how much will you pay them?

If you want to know more about the research process , methodology , research bias , or statistics , make sure to check out some of our other articles with explanations and examples.

Methodology

- Sampling methods

- Simple random sampling

- Stratified sampling

- Cluster sampling

- Likert scales

- Reproducibility

Statistics

- Null hypothesis

- Statistical power

- Probability distribution

- Effect size

- Poisson distribution

Research bias

- Optimism bias

- Cognitive bias

- Implicit bias

- Hawthorne effect

- Anchoring bias

- Explicit bias

Once you’ve decided on your research objectives , you need to explain them in your paper, at the end of your problem statement .

Keep your research objectives clear and concise, and use appropriate verbs to accurately convey the work that you will carry out for each one.

I will compare …

A research aim is a broad statement indicating the general purpose of your research project. It should appear in your introduction at the end of your problem statement , before your research objectives.

Research objectives are more specific than your research aim. They indicate the specific ways you’ll address the overarching aim.

A PhD, which is short for philosophiae doctor (doctor of philosophy in Latin), is the highest university degree that can be obtained. In a PhD, students spend 3–5 years writing a dissertation , which aims to make a significant, original contribution to current knowledge.

A PhD is intended to prepare students for a career as a researcher, whether that be in academia, the public sector, or the private sector.

A master’s is a 1- or 2-year graduate degree that can prepare you for a variety of careers.

All master’s involve graduate-level coursework. Some are research-intensive and intend to prepare students for further study in a PhD; these usually require their students to write a master’s thesis . Others focus on professional training for a specific career.

Critical thinking refers to the ability to evaluate information and to be aware of biases or assumptions, including your own.

Like information literacy , it involves evaluating arguments, identifying and solving problems in an objective and systematic way, and clearly communicating your ideas.

The best way to remember the difference between a research plan and a research proposal is that they have fundamentally different audiences. A research plan helps you, the researcher, organize your thoughts. On the other hand, a dissertation proposal or research proposal aims to convince others (e.g., a supervisor, a funding body, or a dissertation committee) that your research topic is relevant and worthy of being conducted.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

McCombes, S. & George, T. (2023, November 21). How to Write a Research Proposal | Examples & Templates. Scribbr. Retrieved March 23, 2024, from https://www.scribbr.com/research-process/research-proposal/

Is this article helpful?

Shona McCombes

Other students also liked, how to write a problem statement | guide & examples, writing strong research questions | criteria & examples, how to write a literature review | guide, examples, & templates, unlimited academic ai-proofreading.

✔ Document error-free in 5minutes ✔ Unlimited document corrections ✔ Specialized in correcting academic texts

Let your curiosity lead the way:

Apply Today

- Arts & Sciences

- Graduate Studies in A&S

Creating a Budget

In general, while your research proposal outlines the academic significance of your study, the budget and budget narrative show that you have an understanding of what it will cost for you to be able to perform this research. Your proposed budget should identify all the expenses that are necessary and reasonable for the success of your project—no more and no less. The Office of Undergraduate Research understands that estimates, by definition, are imprecise, yet we encourage students applying for funding to research all aspects of their budgets with honest diligence.

If your research requires you to be in the field or in another city, state, or country, travel expenses may include transportation (airline, train, taxi, etc.), passport and visa fees, as well as fees for any vaccinations you may need to travel. Be sure to include anticipated major incidental expenses, such as printing, copying, fees for accessing archives, etc.

Please note that our funding restrictions prevent us from providing support for lab materials, equipment, software, hardware, etc.

Keep in mind these tips:

Convert all foreign currency figures to U.S. dollars.

Round all figures to whole dollars.

Make sure your budget and your proposal are consistent.

Identify areas where you are making efforts to save money!

Browse through these sample budgets for a better idea of how to outline your expenses and contact us if you have questions!

Sample Budget 1

Sample Budget 2

Sample Budget 3

Sample Budget 4

- Develop a research budget

- Research Expertise Engine

- Precursors to research

- Funding & award opportunities

- Grants vs contracts

- Sample Applications Library

- Factors to consider

- Internal Approval (formerly SFU Signature Sheet)

- Develop a research proposal

- Institutional support

- Review & submission

- Award & approval

- Award management

- Contracts & agreements

- Inventions & commercialization

- Ethics - human research

- Ethics - animal research

- Research safety

- Mobilizing Research

- Prizes & awards

- Training & events

- Forms & documents

On this page:

Basic components of a research budget

Two models of budget development, other factors affecting your budget.

- Additional Resources

Budgets should provide the sponsor with an accurate assessment of all cost items and cost amounts that are deemed necessary and reasonable to carry out your project. They should be based upon your description or the statement of work. Budget justification provides more in-depth detail and reason for each cost and is often considered by reviewers as a good indicator of the feasibility of the research.

A research budget contains both direct costs and indirect costs (overhead), but the level of detail varies from sponsor to sponsor. The first step in developing a budget is to carefully read the guidelines of the funding opportunity being pursued.

There is no magic formula available for developing a budget but there are some basic steps to follow in order to develop an accurate budget:

- Define project tasks, timelines and milestones and determine the actual resources and costs required to complete these. Consider whether contingencies are needed (and confirm they are eligible expenses).

- Determine the eligible expense categories and maximum amount allowed by the sponsor. Adjust scope of the project to make sure proposed activities fit within the allowance.

- Categorize these costs (e.g., salaries, supplies, equipment…) per year, in some cases by quarter.

- Ensure that project scope and budget match. Include indirect costs of research as permitted by sponsor and the University policy.

The examples below developed by the University of British Columbia demonstrate two ways to include indirect costs in your budget.

- Price model: Indirect cost is built into each budget line item.

- Cost model: Indirect cost of research is presented as a separate line item.

Unless the sponsor specifies in writing that they require the indirect costs of research to be presented as a separate line item (Cost Model), the indirect cost should be built into each budget line item (Price Model). Indirect costs are normally included in the price of goods and services worldwide.

For example, you are developing a budget for a funding opportunity with an indirect cost rate of 25%. Your direct costs are $201,000 broken down by expense categories shown in the second column of the table below. The third and fourth colums present the two ways you can include the 25% overhead in your budget using the Price Model or the Cost Model, respectively:

In-kind and cash contributions, like other costs to the sponsored project, must be eligible and must be treated in a consistent and uniform manner in proposal preparation and in financial reporting.

Cash contributions

Cash contributions are actual cash transactions that can be documented in the accounting system. Examples of cash contributions include:

- allocation of compensated faculty and staff time to projects, or

- the purchasing of equipment by the university or other eligible sponsor for the benefit of the project.

In-kind contributions

In-kind contributions are both non-monetary or cash equivalent resources that can be given a cash value, such as goods and/or services in support of a research project or proposal. It is challenging to report on in-kind contribution, please make sure the numbers you use are well supported, consistent and easy to quantitate.

Examples of an in-kind contribution may include:

- Access to unique database or information

- Professional, analytical, and other donated services

- Employee salaries including benefits for time allocated to the project

- Study materials, technologies, or components

- Patents and licenses for use

- Use of facilities (e.g., lab or meeting spaces)

- Partner organization time spent participating in the project

- Eligible infrastructure items

Matching on sponsored projects

Some sponsored projects require the university and/or a third party to contribute a portion of the project costs–this contribution is known as matching.

Matching requirements may be in the form of an actual cash expenditure of funds or may be an “in-kind” match. For example:

- A 1:1 match would require $100 of a third-party matching for every $100 received from an agency.

- A 30% match would mean that of a total budget of $100, the agency would provide $70 and a third party would need to match $30.

Examples of agency programs that include some form of matching from a third party are:

- NSERC Collaborative Research and Development Grants

- NSERC Idea to Innovation Grants

- SSHRC Partnership Grants

- CIHR Industry Partnered Collaborative Research Program, and

- CIHR Proof of Principle Grants

Additional resources

- Current salary and benefit rates for graduate students and postdocs/research associates

- SFU Business and Travel Expense Policy

- Animal care services

Potential U.S. Federal Government Shutdown: Research Continuity Guidance

- Find My GCO

- IACUC applications (Cayuse Animal Management System)

- IBC Applications (eMUA)

- IRB Applications (RASS-IRB) External

- Institutional Profile & DUNS

- Rates and budgets

- Report external interests (COI)

- Join List Servs

- Ask EHS External

- Research Development Services

- Cornell Data Services External

- Find Your Next Funding Opportunity

- Travel Registry External

- RASS (Formerly Form 10 and NFA) External

- International research activities External

- Register for Federal and Non-Federal Systems

- Disclose Foreign Collaborations and Support

- Web Financials (WebFin2) External

- PI Dashboard External

- Research metrics & executive dashboards

- Research Financials (formerly RA Dashboard) External

- Subawards in a Proposal

- Proposal Development, Review, and Submission

- Planning for Animals, Human Participants, r/sNA, Hazardous Materials, Radiation

- Budgets, Costs, and Rates

- Collaborate with Weill Cornell Medicine

- Award Negotiation and Finalization

- Travel and International Activities

- Project Finances

- Project Modifications

- Research Project Staffing

- Get Confidential Info, Data, Equipment, or Materials

- Managing Subawards

- Animals, Human Participants, r/sNA, Hazardous Materials, Radiation

- Project Closeout Financials

- Project Closeout

- End a Project Early

- Protecting an Invention, Creation, Discovery

- Entrepreneurial and Startup Company Resources

- Gateway to Partnership Program

- Engaging with Industry

- Responsible Conduct of Research (RCR)

- Export Controls

- Research with Human Participants

- Research Security

- Work with Live Vertebrate Animals

- Research Safety

- Regulated Biological Materials in Research

- Financial Management

- Conflicts of Interest

- Search

Appendix C: Sample Budget Justification

Costs for project budgets - appendix c.

The budget justification is one of the most important non-technical sections of the proposal, and it is often required by the sponsor. In this section, the Principal Investigator (PI) provides additional detail for expenses within each budget category and articulates the need for the items/expenses listed. The information provided in the budget justification may be the definitive criteria used by sponsor review panels and administrative officials when determining the amount of funding to be awarded.

The following format is a sample only; not all components will apply to every proposal. Many sponsors prefer that budget justifications follow their own format. In all cases, however, it is best to present the justification for each budget category in the same order as that provided in the budget itself.

Salaries and Wages:

Note: The quantification of unfunded effort (e.g., "The PI will donate 5% effort...") in the proposal narrative, budget, or budget justification is considered Voluntary Committed Cost Sharing. This is a legal commitment which must be documented in the University's accounting system. Consider quantifying effort only for the requested salary support. See http://www.dfa.cornell.edu/treasurer/policyoffice/policies/volumes/academic/costsharing.cfm for additional information.

- Principal Investigator: This proposal requests salary support for _______% of effort during the academic year and 100% of effort for _______months during the summer.

- Other Professional Support: List title and level of effort to be proposed to be funded. Other personnel categories (Research Associates, Postdoctoral Associates, Technicians) may be included here.

- Administrative and Clerical: List the circumstances for requiring direct charging of these services, which must be readily and specifically identifiable to the project with a high degree of accuracy. Provide a brief description of actual job responsibilities, the proposed title, and the level of effort. (See note at the end of this Appendix regarding direct charging costs that are normally considered indirect.)

- Graduate Students: List number and a brief description of project role. Include stipend, GRA allowance (tuition), and health insurance.

- Undergraduate Students: List number and a brief description of project role.

- Employee Benefits have been proposed at a rate of ______% for all non-student compensation as approved by the Department of Health and Human Services. See https://www.dfa.cornell.edu/capitalassets/cost/employee .

Capital Equipment: The following equipment will be necessary for the completion of the project: Include item description(s), estimated cost of each item, and total cost. Provide a brief statement on necessity and suitability.

Travel: For each trip, list destination, duration, purpose, relationship to the project, and total cost. Indicate any plans for foreign travel.

Technical Supplies and Materials: Include type of supplies, per unit price, quantity, and cost. When the cost is substantial, provide a brief statement justifying the necessity.

Publications: Page charges (number of pages multiplied by the per-page charge).

Services: Include type of services, cost per type, and total cost.

Consultants : Include the consultant's name, rate, number of days, total cost per consultant, and total consultant cost. Provide a brief statement outlining each individual's expertise and justifying the anticipated need for consultant services. Note: Justifying a specific consultant in the proposal may avoid the need to competitively bid consulting services.

Subcontracts: Include the subcontractor's name, amount, and total cost. Provide a brief description of the work to be performed and the basis for selection of the subcontractor. A separate budget and corresponding budget justification should be completed by the subcontractor, and is required by many agencies. Note: Justifying a specific subcontractor in the proposal may avoid the need to competitively bid subcontracted services. Post-award changes to subcontracts (additions, deletions, scope or budget modification) may require sponsor approval.

Other Expenses: May include conferences and seminars (see Appendix D ), Repair and Maintenance, Academic and User Fees.

Facilities and Administrative Costs (F&A) : F&A costs have been proposed at a rate of _____% of Modified Total Direct Cost (MTDC) as approved in Cornell's rate agreement with the Department of Health and Human Services. A copy of this agreement may be found at https://www.dfa.cornell.edu/capitalassets/cost/facilities . MTDC exclusions include Capital Equipment, GRA Allowance and Health Insurance, and Subcontract costs in excess of $25,000 per subcontract.

Annual escalations are proposed in accordance with University policy as outlined HERE .

Special information for direct charging costs that are normally considered indirect. Many costs such as administrative and clerical salaries, office supplies, monthly telephone and network charges, general purpose equipment, and postage are not typically considered direct costs. These may be proposed as direct costs where "unlike and different" circumstances exist. In such cases a budget justification detailing the request must be submitted to OSP for review and approval. Please read the University policy at https://www.dfa.cornell.edu/sites/default/files/policy/vol3_14.pdf or contact your Grant and Contract Officer for additional assistance.

Overview of Costs for Project Budgets (Budget and Costing Guide)

Appendix a: sample budget format showing major categories, appendix b: facilities and administrative (f&a) cost calculation detail, appendix d: sample budget for conferences and seminars, appendix e: cost sharing allowability matrix.

Sample budgets

Justification.

Bumblebee colonies will be obtained from Koppert Biological Systems (MI, USA) and shipped overnight to Nevada. An emerging standard for publication is the utilization of three to five colonies for testing so as to minimize individual colony biases and to acquire a sufficient data set. In order to maintain the colonies I will need pollen to feed them on a daily basis. Additionally I will use the chemical octopamine hydrochloride to explore neuroendocrine relationships between gustatory responsiveness, learning, and octopamine.

I estimated shipping costs to the best of my knowledge.

* Costs are estimated based on average costs of the material; final cost may be slightly different.

Sample Budget Justifications

Sponsor requirements differ, and sample budget justifications should be seen only as a starting point. Guidelines for sponsor requirements are in the annotated budget justifications. Read the solicitation and the sponsor’s proposal preparation guidelines for each proposal's requirements.

For Research Sponsors

- Sample Budget Justification for Non-Federal Research [DOCX] - April 6, 2023

- Annotated Budget Justification - Non-Federal Research

- Sample Budget Justification for Federal Research [DOCX] - April 6, 2023

- Annotated Budget Justification - Federal Research

For Non-Research Sponsors:

- Sample Budget Justification for Non-Federal Non-Research [DOCX] - July 29, 2022

- Annotated Budget Justification - Non-Federal Non-Research

- Sample Budget Justification for Federal Non-Research [DOCX] - July 29, 2022

- Annotated Budget Justification - Federal Non-Research

- Uniform Guidance Fixed Rate Requirements

- F&A Methodology

- F&A Components

- MIT Use of a de minimis Rate

- Fund Account Overhead Rates

- Allocation Rates

- Determination of On-Campus and Off-Campus Rates

- Employee Benefits (EB) Rates

- Vacation Accrual Rates

- Graduate Research Assistant Tuition Subsidy

- Historical RA Salary Levels

- MIT Facts and Profile Information

- Classification of Sponsored Projects

- Types of Sponsored Awards

- How Are Sponsored Projects Generated?

- Unallowables

- Types of Costs

- EHS Role in MIT Grant Writing Process

- Pre-Proposals / Letters of Intent

- MIT Investigator Status

- Components of a Proposal

- Special Reviews

- Applying Through Workspace

- Proposal Preparation Checklist

- Proposals and Confidential Information

- Personnel Costs

- Subcontracts and Consultants

- Kuali Coeus Approval Mapping

- Roles and Responsibilities

- Submission of Revised Budgets

- Standard Contract Terms and Conditions

- Contractual Obligations and Problematic Terms and Conditions

- Review and Negotiation of Federal Contract and Grant Terms and Conditions

- Industrial Collaboration

- International Activities

- MIT Export Control - Export Policies

- Nondisclosure and Confidentiality Agreements

- Negative Confirmation On Award Notices

- Routing and Acceptance of the Award Notice

- COI and Special Review Hold Notice Definitions

- Limiting Long-Term WBS Account Structures

- SAP Project WBS Element Conditions

- Kuali Coeus Electronic Document Storage (EDS)

- Billing Agreements

- PI Absence from Project

- Cost Principles and Allowable Expenses

- Cost Transfers

- Equipment Threshold

- Uniform Guidance and the FAR

- MIT Standard Terms and Policies

- Guidelines for Charging Faculty Summer Salary

- Key Personnel

- Limitations on Funds - Federal Contracts

- Managing Salary Costs

- Monitoring Project Budgets

- Monthly Reconciliation and Review

- No-Cost Extensions

- Reporting Requirements

- Return of Unexpended Funds to Foundations

- Determining the Sponsor Approved Budget (SAB)

- Working With the Sponsor Approved Budget (SAB)

- Sponsor Approved Budget (SAB) and Child Account Budgets

- Sponsor Approved Budget (SAB) and Prior Approvals

- Submitting an SAB Change Request

- When a PI Leaves MIT

- Research Performance Progress Reports

- Closing Out Fixed Price Awards

- Closeout of Subawards

- Record Retention

- Early Termination

- Reporting FAQs

- Using SciENcv

- AFOSR No-Cost Extension Process

- Terms and Conditions

- New ONR Account Set Ups

- Department of Defense Disclosure Guidance

- Department of Energy / Office of Science Disclosure Guidance

- Introduction to Industrial Sponsors

- General Considerations for Industrial Proposals

- SRC Guidance to Faculty Considering Applying for SRC Funding

- Find Specific RFP Information

- Industrial Proposal Checklist

- Proposal Formats

- Special Requirements

- Deadline Cycles

- Model Proposals

- Non-Competitive Industrial Proposals

- Master and Alliance Agreements With Non-Standard Proposal Processes

- Template Agreements

- New Consortium Agreements

- Competitive Industrial Proposals

- Collaborative (No-cost) Research Agreements

- National Aeronautics and Space Administration Disclosure Guidance

- NASA Graduate Research Fellowship Programs

- NASA PI Status and Definitions

- NIH Checklists and Preparation Guides

- National Institutes of Health Disclosure Guidance

- Human Subjects and NIH Proposals

- NIH Data Management and Sharing

- NIH Research Performance Progress Reports

- Grant Opportunities for Academic Liaison with Industry (GOALI) proposals

- MIT Guidance Regarding the NSF CAREER Program

- Research Experiences for Undergraduates (REU) Supplements

- National Science Foundation Disclosure Guidance

- NSF Proposals: Administrative Review Stage

- NSF Collaborations

- NSF Pre-Award and Post-Award Actions

- NSF Reporting

- NSF Frequently Asked Questions

- NSF Safe and Inclusive Working Environment

- Research Terms and Conditions Prior Approval and Other Requirements Matrix

- Process, Roles and Responsibilities

- What Is Allowable/Eligible Cost Sharing?

- MIT’s Preferred Cost Sharing Funds

- Third-Party Cost Sharing

- Showing Cost Sharing in a Proposal Budget

- Sponsor Specific Instructions Regarding Location in the Proposal

- Funding F&A Costs as Cost Sharing

- Using Faculty Effort for Cost Sharing

- Information about Completing the Cost Sharing Template

- NSF Cost Sharing Policy

- Tracking/Reporting Cost Sharing

- Special Cost Sharing Topics

- International Activities Examples

- Rubicon Fellowships

- Marie Skłodowska-Curie Fellowships

- Criteria for Subrecipients

- Subawards at Proposal

- Requesting New Subawards

- Managing Subawards

- RAS Subaward Team Contacts

- Funding and Approval

- Proposal Phase

- Award Set-up

- Monitoring Research During Project Period

- Closeout Phase

- Voluntary Cost Sharing

- Sponsor-Specific Guidance

- Audits and Auditors

- Upcoming Trainings and Events

- Research Administration Practices (RAP)

- NCURA Virtual Workshops and Webinars

- Guide to RA Resources and Training

- Career Paths

- Newsletters

- Tools and Systems

- Award Closeout & Audits

- Award Setup

- Cost Sharing

- Export Control

- Financial Conflict of Interest

- Kuali Coeus

- Project Monitoring

- Proposal Preparation & Submission

- Research Sub Awards

- Research Administration Email Lists

- RAS Operations

- VPR Research Administration Organization Chart

- By department

- By administrator

- Research Administrator Day

- News & Announcements

- Onsite searching on the VPR public websites

- UBC Research + Innovation

- Support for Researchers

- Attracting Funding

- Budgeting and Indirect Costs

Budget Templates

All funded research grants, contracts and agreements are required to include indirect cost recovery.

The required indirect cost recovery for research projects is:

- 25% on all non-industry funding (governemnt and non-profits)

- 40% of all direct costs on industry funding (any projects initiated before May 1, 2015 may continue to charge the previous rate of 25%)

The only exceptions to these rates are funds from any of the Tri-Council funding agencies (UBC recovers indirect costs for Tri-Council funds through the Federal Research Support Fund formerly the Indirect Costs Program. The only exception is the SSHRC-administered Tri-Agency New Frontiers in Research Fund. Applicants to this fund should contact ORS about building indirect cost recovery into their application.) and funds through grant applications which specify an alternate rate.

Many of the verified exceptions to the standard UBC rate of recovery are listed in the Indirect Costs of Research Verified Rates Table .

Since May 1, 2015, all discretionary powers for the recovery rate of indirect costs (for projects not covered by the standard or published verified rates) has rested with the Deans of the Faculties and not with the Vice-President, Research & Innovation Office.

Below is a sample budget development process.

A researcher creates a proposal for a research project with a government or non-profit partner with the following direct costs:

Direct Costs

The following models below demonstrate how to present to the sponsor a budget for this project utilizing the 25% recovery rate for government and non-profit projects.

Unless the sponsor specifies in writing that they require the indirect costs of research to be presented as a separate line item, the indirect cost should be built into each budget line item, as is customary for budgets.

Preferred “Price” Model

(25% Indirect Cost Built Into Pricing)

Alternative “Cost” Model

(only if required by Sponsor) (25% Indirect Cost Separated)

Tri-Council Matching or Partnered Grants

For Tri-Council grants requiring funding from one or more funding partners, the Tri-Council agency matches only the direct costs of the partners. Examples of these programs include, NSERC Collaborative Research and Development Grants, NSERC Idea to Innovation Grants, SSHRC Partnership Grants, CIHR Industry Partnered Collaborative Research Program, CIHR Proof of Principle Grants. In these cases, the agency may require that direct and indirect costs be shown separately in the budget submitted to the Tri-council agency. In all cases, an indirect cost recovery rate of 25% (for projects initiated after May 1, 2015, this rate will be 40% for industry partners) must be applied to the matching funds provided by the partner. Indirect costs should not be applied to the funds requested from the Tri-council agency. The only exception is the SSHRC-administered Tri-Agency New Frontiers in Research Fund. Applicants to this fund should contact ORS about building indirect cost recovery into their application

Departmental, Unit and Faculty-Specific Fees

Some departments or units require that an “administrative fee” be charged to each project. It’s expected that consistent recovery of indirect costs of research will alleviate the need for these additional fees. If these additional fees are required, however, indirect cost recovery must still be applied at the standard rate to all direct costs, including the administrative fee.

Sub-Awards to UBC