Make A Payment

Disposition of installment obligations where income reported under installment method.

This article will be the final in a series of articles covering the installment method of reporting income. In our first article of the series, we discussed §453 and the basics of the installment method of income tax reporting. [1] As noted in the article, the installment method of reporting income can be a powerful tax deferral tool, and the taxpayer can elect out of installment sale treatment if desired, a choice that may be beneficial under the right set of circumstances. In our follow up article, we discussed §453A and the imposition of interest on large installment obligations, including how to calculate that interest. [2] In this final article of the series, we will discuss the disposition or transfer of an installment obligation and associated tax consequences.

General Rule: Gain of Loss to Be Recognized on Disposition

In general, under §453B(a), the transfer, distribution, sale, or other disposition of an installment obligation is a taxable event, meaning it triggers gain or loss. Just how much gain or loss is triggered depends on the type of disposition that takes place and of course, the basis in the obligation.

Where the obligation is satisfied at anything other than face value or sold or exchanged, the amount of the gain or loss is equal to the amount realized less the basis in the obligation. [3] For example, the holder of an obligation exchanges that obligation for a vehicle valued at $35K, the amount realized would be $35K, and the gain or loss would be $35K less the basis in the obligation.

Where the obligation is distributed or disposed of other than by sale or exchange, the amount of the gain or loss is equal to fair market value of the obligation at the time of its disposition, less the basis in the obligation. [4] To illustrate this, assume you have a promissory note with an outstanding principal balance of $20K, and there is no reason to think that balance will not be paid, thus making the fair market value of the note $20K. Now you gift that promissory note to your child. You’ve just created a taxable event with a gain or loss equal to $20K less the basis in the note.

For purposes of determining this gain or loss, the basis is equal to the excess of the face value of the obligation over an amount equal to the income which would be returnable if the obligation were paid in full [5] , which in plain English means you take the face value of the obligation and subtract out the unrecognized income associated with the obligation to arrive at the basis in the obligation.

Exceptions, Exceptions

Of course, we would not be writing this article if §453B were as simple as stated above. Although the exceptions are not overly complicated, there are quite a few and we will discuss some of those below.

Transfers on Death

The general rule of §453B(a) does not apply to a transfer that occurs at death [6] , though the rules of §691 do apply, commonly referred to as IRD, Income in Respect of a Decedent. In general, the recipient of an asset subject to IRD will recognize future income related to the asset as IRD in the future. This exception makes sense from a policy standpoint as the recipient of the obligation steps into the shoes of the decedent and will continue to recognize income under the installment method as payments on the obligation are received due to the application of the IRD rules of §691.

Distribution to Parent Corporation on Liquidation

In general, the transfer of assets from a subsidiary corporation to a parent corporation is not a taxable event under §337(a). §453B(d) piggybacks on this rule and allows an exception to the general rules for transfers of obligation that comply with §337(a). Thus, the transfer of an obligation from a subsidiary corporation to a parent corporation does not trigger tax under §453B as long as the transfer is governed by §337(a). Just as with the exception for transfers at death, this exception also makes sense from a policy standpoint. The parent corporation steps into the shoes of the subsidiary corporation and continues to recognize income on the obligation as payments are received.

Transfers Between Spouses or Incident to Divorce

Under §1041(a), a transfer is not a taxable event, that is, gain or loss is not recognized, if the transfer is made to a spouse [7] or to a former spouse incident to a divorce. [8] Just as with the exception for parent-subsidiary liquidations, §453B(g) piggybacks off an already existing exception and provides that a transfer that meets the requirements of either §1041(a)(1) or (a)(2) does not trigger gain or less recognition under §453B, and the transferee, that is the recipient of the obligation, steps into the shoes of the transferor for purposes of future tax treatment on the obligation. [9] Again, this makes sense from a policy standpoint since the spouse or former spouse recipient will continue to recognize income under the installment method as payments are received on the obligation.

Liquidation Distributions by S Corporation

If an S corporation distributes an installment obligation to a shareholder as part of a complete liquidation, and that distribution is not treated as payment for stock [10] , then no gain or loss is generally recognized by the distributing corporation. [11] As with the other exceptions discussed, this also makes sense as the shareholder recipient will continue to recognize gain on the obligation as payments are received.

Certain Nonrecognition Transactions

While a full discussion of nonrecognition transactions is beyond the scope of this article, Treas. Prop. Reg. §1.453B-1 provides that for purposes of the §453B, those transactions also do not trigger the recognition of gain or loss. Those nonrecognition transactions where an obligation is part of the transfer and which are excepted from the general rule of triggering gain or loss are transfers to a corporation solely in exchange for stock in a transaction that qualifies for §351 treatment (example is transferring assets to a corporation during its formation though it applies to many other scenarios), [12] distributions from a corporation under a reorganization which are not taxable under §361, [13] contributions to a partnership in exchange for partnership interests that satisfy the nonrecognition requirements of §721, [14] and distributions from a partnership to a partner that satisfy the nonrecognition requirements of §731. [15] However, the regulations do provide that these exceptions do not apply to a disposition that results in the satisfaction of the installment obligations, regardless of form, if such disposition is made in exchange for the receipt of stock in a corporation from the corporation in satisfaction of an installment obligation of the corporation [16] or the receipt of an interest in a partnership from the partnership in satisfaction of an installment obligation of the partnership. [17]

As noted at the onset of the article, the general rule is that the transfer or disposition of an installment obligation is a recognition event that triggers gain or loss. However, there are numerous exceptions to this rule, many of which are discussed herein. Taxpayers and their advisors should be aware of the many different exceptions so as to properly structure their affairs to take advantage of these exceptions, or if desired, avoid the exception and trigger gain.

As we approach the end of 2021, and the potential increase in the capital gains tax rate for those with income above a certain threshold (currently $1M is being discussed/proposed by the Biden administration), it may well make sense to intentionally use § 453B to trigger gain on an installment obligation and pay tax at the current 2021 rates rather than potential increased future rates. Knowing the rules and exceptions of §453B is key to properly structure this triggering of gain if so desired. On the flip side, taxpayers may also be able to use the installment method of income reporting in the opposite manner to avoid income that exceeds any such threshold that triggers an increased tax rate.

[1] Charles J. Allen, “Installment Method of Income Recognition – The Basics,” March 16, 2021, https://esapllc.com/installment-sale-basics-2021/ .

[2] Charles J. Allen, ” The Installment Method of Income Tax Reporting: Interest on Large Installment Obligations,” June 29, 2021, https://esapllc.com/453a-interest-on-large-installments-2021/ .

[3] §453B(a)(1).

[4] §453B(a)(2).

[5] §453B(b).

[6] §453B(c).

[7] §1041(a)(1).

[8] §1041(a)(2).

[9] §453B(g).

[10] See §453(h)(1), which is also discussed in our first article of the series: Charles J. Allen, “Installment Method of Income Recognition – The Basics,” March 16, 2021, https://esapllc.com/installment-sale-basics-2021/ .

[11] §453B(h).

[12] Treas. Prop. Reg. §1.453-1(c)(1)(i)(A).

[14] Treas. Prop. Reg. §1.453-1(c)(1)(i)(B).

[15] Treas. Prop. Reg. §1.453-1(c)(1)(i)(C).

[16] Treas. Prop. Reg. §1.453-1(c)(1)(ii)(A).

[17] Treas. Prop. Reg. §1.453-1(c)(1)(i)(B).

View Full Profile .

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

Transfers of installment obligations would trigger gain or loss under proposed rules

- Business Tax

- Partnership & LLC Taxation

The IRS issued proposed regulations relating to the nonrecognition of gain or loss on certain dispositions of an installment obligation. The regulations would require transferors that transfer installment obligations for equity interests in corporations or partnerships in nonrecognition transactions in satisfaction of those obligations to recognize gain or loss on the transfers ( REG-109187-11 ).

Under Sec. 453B(a), gain or loss is recognized when an installment obligation is satisfied at other than its face value, or if it is distributed, transmitted, sold, or otherwise disposed of. Under Regs. Sec. 1.453-9(c)(2) (which was issued under the old installment sale rules that were replaced by Sec. 453B in 1980), if the Code has an exception to these rules for certain dispositions, then gain was not recognized. Those exceptions included transfers to corporations under Sec. 351 or 361, certain transfers to partnerships under Sec. 721, and distributions from partnerships to partners under Sec. 731.

However, under Rev. Rul. 73-423, the installment sale rules do not apply to the transfer of an installment obligation that results in a satisfaction of the obligation. Thus, the transfer of a corporation’s installment obligation to the issuing corporation in exchange for stock of the issuing corporation results in a satisfaction of the obligation. The transferor must recognize gain or loss on the transaction to the extent of the difference in the transferor’s basis in the obligation and the fair market value of the stock.

According to the IRS, these proposed regulations “republish” in Prop. Regs. Sec. 1.453B-1(c) the general rule of Regs. Sec. 1.453-9(c)(2) to the extent that it provides for nonrecognition of gain or loss in certain dispositions. The regulations also expand upon Rev. Rul. 73-423 by providing that a transferor recognizes gain or loss when it disposes of the installment obligation in a transaction that results in the satisfaction of the obligation, including when an installment obligation of a corporation or partnership is contributed to the corporation or partnership in exchange for an equity interest in the corporation or partnership.

The regulations would apply to transactions occurring after they are published as final in the Federal Register . Comments must be received by March 23.

— Sally P. Schreiber ( [email protected] ) is a JofA senior editor.

Where to find June’s flipbook issue

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

Manage the talent, hand off the HR headaches

Recruiting. Onboarding. Payroll administration. Compliance. Benefits management. These are just a few of the HR functions accounting firms must provide to stay competitive in the talent game.

FEATURED ARTICLE

2023 tax software survey

CPAs assess how their return preparation products performed.

Double Entry Bookkeeping

learn bookkeeping online for free

Home > Notes Payable > Installment Notes

Installment Notes

What are installment notes.

Installment notes are liabilities and represent amounts owed by a business to a third party, like notes payable , they are issued as a promissory note.

As each installment payment is made, the balance outstanding on the note is reduced and as a result the interest charge starts to fall. Since each installment payment is a fixed amount, the principal repaid increases with each payment.

Installment Payment Example

As the principal and interest are changing with each installment payment, when accounting for installment notes it is necessary to first calculate the amount of interest and principal repaid for a particular accounting period.

By way of illustration suppose a business borrows 40,000 at the start of an accounting period (January 1) by signing a 5% installment note that is to be repaid in 4 annual end of year payments of 11,280. As can be seen the first payment is due at the end of the accounting period (December 31).

Firstly calculate the interest and principal repayments for each accounting period by using an amortization table as shown below.

Installment Notes – Amortization Table

Furthermore the amortization table clearly shows how with each installment payment, the opening balance outstanding reduces, the interest expense reduces, and the principal repayment increases.

Following this the installment notes journal entries can now be generated as follows:

Issuing an Installment Note for Cash Journal

Firstly record the issue of the new borrowing.

As can be seen the debit is to cash as the installment note was issued in respect of new borrowings, and cash is received by the business. Furthermore the credit entry represents a liability of the business to repay the note in accordance with the terms agreed. In the balance sheet, the installments notes will either be current or long term liabilities depending on whether or not the amount outstanding is due within one year.

Installment Payment Journal Entry

Subsequently the journals at the end of each year record each installment payment split between interest and principal in accordance with the amortization table shown above.

As can be seen the debit to interest represents the interest expense for the year, the debit to installment notes is the repayment of the principal amount outstanding, and the credit to cash represents cash leaving the business to make the payment.

Finally at the end of year 4, the final payment reduces the principal balance of the installment notes to zero, and the liability is extinguished.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

AccountingLingo

Simplifying. Finance.

Installment Note: Definition, Understanding, Example

What is an Installment Note?

An installment note is an agreement between a borrower and a lender that outlines terms in which money is owed.

“To pay a certain amount of money to a named party, or to deposit money as such persons direct.” [1] Cornell Law School. " Promissory Note ." -Cornell Law School

Understanding

An installment note is a form of debt instrument also known as a promissory note. It is a liability for a borrower and an asset for the person or company loaning funds.

In most cases, installment notes are used between two people, a person and a company, or between two companies. Furthermore, they are often viewed as a substitute in lieu of bank financing and considered legal documents meant to protect borrower and lender interests.

Borrowers typically agree to repay loaned funds over a predetermined time at a set rate of interest. The repayment period could be days, weeks, months, or years; however long is necessary to fully repay the principal amount plus interest.

Both the borrower and lender mutually agree upon specifics of the transaction before the borrower signs an agreement outlining the terms.

In some jurisdictions, finance regulations may require specific verbiage be included within the document outlining a borrower’s intended purpose for the loaned funds such as purchase a home, car, or to finance business related property. The note may also include verbiage outlining options available to the lender should the borrower not make payments as agreed. In addition, the term “loan default” is commonly used to describe this situation.

With installment notes being considered legal documents, a lender may elect to pursue action via the local court system to collect outstanding funds should a loan default occur. This legal process varies based on jurisdiction.

A balloon loan or lump sum note are similar agreements however they commonly require repayment on a specific date. Furthermore, they don’t allow for a payment plan as would installment notes.

Installment notes are said to be “paid in full” once they no longer exist unless settled with the creditor under another form of debt extinguishment which may involve a negotiated settlement.

How an Installment Note is Reported in Business

An installment note would show within a business’s financial statements , more specifically under the liabilities section of the balance sheet. This type of obligation is commonly known as “notes payable” and is often a long-term debt.

From an accounting perspective, if a business owner took out a 10-year $200,000 installment note from a bank, they’d record the note as a debit to cash and a credit to notes payable. Each payment is often referred to as a partial payment of the total amount owed.

What May an Installment Note Include?

Installment notes typically include details such as how interest is applied when payments are made by the borrower. In addition, these details could identify the note including a fixed rate or a floating rate of interest. Installment notes commonly include the following as well:

- Date of agreement.

- Name of borrower.

- Name of lender.

- Amount of money loaned.

- Interest rate on the loan.

- Repayment period for the loan.

- Amount of each payment.

- Signature of borrower.

- Location in which transaction transpired.

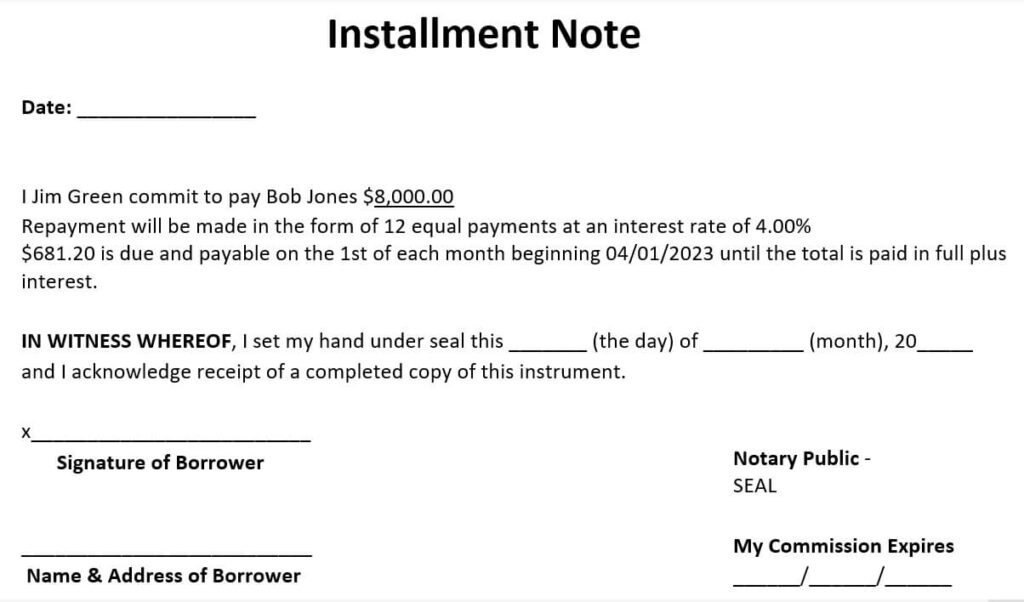

Bob Jones decides to sell his used car to the next-door neighbor Jim Green. They agree on a price of $10,000. Jim advises Bob he has $2,000 cash and asks Bob if he can pay the remaining $8,000 owed monthly over a 1-year period at a 4.00% fixed rate of interest. Bob agrees. They draft up an installment note covering the agreement which Jim signs.

Installment Note Example

Published by John Henry, MBA

Everything You Need to Know About an Installment Note: What It Is and How to Use It

An installment note is a legal document that outlines the terms of repayment of a loan. It is an agreement between a borrower and a lender, specifying the amount borrowed and how it will be paid back. For more information about installment notes and what they’re used for, keep reading

What Is an Installment Note?

An installment note is a loan agreement that allows a borrower to pay back a debt in regular payments, or installments, over a period of time. It usually involves a lender and a borrower, with the terms of repayment stated in writing.

The note is signed by both parties to confirm the loan agreement and its terms. It specifies the amount of money borrowed, the duration of the loan, the interest rate, and other important information, such as late payment fees and repayment schedules.

It also outlines the legal penalties for defaulting on the loan, including potential repossession of any collateral used to secure the loan.

The installment note is often used for loans that involve higher amounts and longer repayment periods, like mortgages or car loans.

It is a legally binding document that both parties must adhere to, and any changes should be notated and signed by both parties. By signing the note, both parties agree to all of its terms and conditions.

The installment note should also include any applicable fees, such as origination or document preparation fees.

Furthermore, it is important to read and understand the entire document before signing it to make sure that all of the terms are acceptable.

Always keep installment notes in a safe place, and both parties should keep copies for their records. This will provide proof of the loan agreement in case there are any disputes or misunderstandings.

What Should Be on an Installment Note?

An installment note should contain—at a minimum—the amount of the loan, the interest rate charged on the loan, the repayment schedule (including any prepayment penalties), and a detailed description of the collateral that secures the loan.

It is also advisable to include other important details in the note, such as the name(s) of the parties involved, the amount of each payment, and the date that each payment is due. If you are dealing with a large loan, you may want to include a co-signer or other type of guarantor.

If you are dealing with a personal loan for a family member or close friend, it is important to put everything in writing. This helps ensure everyone is on the same page and prevents misunderstandings.

How to Use an Installment Note?

Using an installment note is quite straightforward. First, you need to decide on the amount you need to borrow and the purpose of the loan. Next, you need to decide where to get the loan from. You can get a loan from a bank, an individual, or a peer-to-peer lending platform.

While you can get loans from multiple sources, it is important to negotiate different terms with each lender. It can be helpful to use an installment note as a template to negotiate the terms of each loan. If you are borrowing from a bank, you will likely have to use a commercial loan.

In some scenarios, banks will make personal loans in exchange for an installment note, but this isn’t common. Borrowing from an individual or peer-to-peer lender is generally easier, and you can usually negotiate a shorter repayment period.

Once you have the loan, you can start repaying it as soon as possible by using the installment note as a contract between you and the lender.

Benefits of Using an Installment Note

An installment note allows businesses to offer customers the convenience of paying for products or services over time. This arrangement can be beneficial in multiple ways:

1. Increased Cash Flow : Installment notes allow a business to receive payment for goods or services immediately rather than waiting until the full purchase amount is paid. This helps to free up cash flow, which can be used to reinvest in the business.

2. Improved Customer Relations : Installment notes give customers the option to pay over time, which can help businesses to build better relationships with their clients. Allowing customers to make payments in installments can result in more customer loyalty and repeat business.

3. Low Risk : Installment notes are a low-risk option because the customer is obligated to pay the full amount of the purchase price in order for them to keep using the product or service that was purchased. This helps protect the business from customers defaulting on their payments.

4. Easy to Use : Installment notes are relatively simple to use and can be easily customized to meet the needs of both the business and the customer. The payment amount, duration, and interest rate can all be adjusted according to the situation.

By offering installment notes, businesses can create an arrangement that works for both them and their customers.

How to Negotiate Installment Notes

Negotiating installment notes can be a tricky process. It is important to be respectful, go into the negotiation with a plan, and be prepared to walk away if you don’t get what you want.

1. Know What You Want : Before you start negotiating with a lender, you need to know what you want. What do you need the loan for? How much do you need? How long do you want to repay it? Knowing what you want before you start the process is critical for a successful negotiation.

2. Know What the Lender Wants : Before you start negotiating, you need to know what the lender wants. What can you provide as collateral? What would be the best repayment schedule for them? What is the lender’s biggest concern? You can usually find this information in the loan request form or on the lender’s website.

3. Be Respectful : It is important to maintain a respectful tone throughout the negotiation. This will help you build a positive relationship with the lender and maximize your chances of getting a favorable outcome.

4. Be Organized : You don’t want to start a negotiation without a plan. Before you start talking to the lender, you should have an idea of what you want, what you are willing to give, and what you are willing to walk away from.

Call Doane & Doane if You Need Assistance with an Installment Note Agreement

If you need help creating an installment note agreement, the experienced attorneys at Doane & Doane are here for you. We can provide legal advice and assistance with drafting and reviewing installment notes. We can also help to ensure that the agreement is legally binding and enforceable. Contact us today at (561) 656-0200 for more information.

The information in this blog post is for reference only and not legal advice. As such, you should not decide whether to contact a lawyer based on the information in this blog post. Moreover, there is no lawyer-client relationship resulting from this blog post, nor should any such relationship be implied. If you need legal counsel, please consult a lawyer licensed to practice in your jurisdiction.

Newer Post >

RECENT POSTS

Elder Law in Florida: Protecting the Rights and Interests of Seniors

What Is the Difference Between Medicare and Medicaid?

The Complete Guide to Estate Planning for Elderly Parents

How To Get Legal Guardianship Of A Child?

When Should I Hire an Elder Law Attorney? Understanding the Signs and Benefits

Get in touch.

Quick Links

Practice areas.

561-656-0200

888-403-3843

Palm Beach Gardens office:

2979 PGA Boulevard #201, Palm Beach Gardens, FL 33410

Working Hours

Mon to Fri: 9:00AM to 17:00PM

Social Media

All Rights Reserved.

This website is managed by Oamii .

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

5.8: Accounting for Leases and Installment Notes

- Last updated

- Save as PDF

- Page ID 51355

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Recognize that a business can borrow to purchase assets using an installment loan.

- Calculate the payment and account for that payment on an installment loan.

- Understand the similarities between finance leases and installment loans.

- Identify the criteria that determines whether a lease is accounted for using the finance lease or operating lease approach.

Question: Notes and bonds payable serve as the predominant source of reported noncurrent liabilities in the United States for large companies. Virtually all companies of any size raise significant sums of money by incurring debts of this type. However, smaller companies are more likely to borrow using installment loans . What is an installment loan or note and how is it accounted for?

Installment loans are most likely the form of borrowing that readers of this text are most familiar with. Home mortgages, student loans and car loans are common forms of installment loans used by individuals. Small and medium businesses acquire assets like buildings and equipment using installment loans or maybe leases. Both of these forms of borrowing, are referred to as installments because they require equal payments by the borrower – usually monthly but they could be on any other time schedule. Because they are annuities – equal payments and equal time periods in between – we can use the same tools (tables) given in the earlier section to develop the accounting. Each equal payment must be split into principal payment (amount to reduce the loan payable) and interest. The rule is that we always calculate the interest first.

Let’s see how this might work with a typical situation. Say Abilene, Inc. wants to purchase an airplane for use in its charter tour business. The airplane will cost $220,000 and Abilene will pay $20,000 in cash and borrow the remaining amount using an installment loan. The terms worked out with the bank are monthly payments for 5 years with an annual rate of interest of 10%. The journal entry for this purchase would look like this:

That does not seem too much different than our earlier discussion about recording liabilities. However, how do know the amount of the payment each month and how to account for that payment?

Knowing the interest rate and the number of equal payments on this loan, we can calculate the payment using the present value of an annuity table as given in the previous section. It is much easier to find the payments using an Excel spreadsheet. Using any version of Excel, you can find the PMT function and fill in the interest rate, number of payments and the amount borrowed to calculate the equal monthly payment.

Link to youtube video explaining how to use PMT function in Excel

Once the payment has been determined ($4,249) , the payment must be split into the interest and principal. Following the rule that interest is first we calculate interest for one month. The $200,000 balance multiplied by 10% = 20,000 then divide by 12 to convert the annual interest for just one month. $20,000 / 12 = 1,667 – this is the interest expense. The rest of the payment ($4,249 – $1,667) = $2,583 which is the amount of the principal paid on the loan. Thus the journal entry for the payment would look like this.

Interest expense goes on the income statement and increases expenses and reduces net income. Note payable debit reduces the balance in note payable from $200,000 to 197,418 (200,000 – 2,582). For the second month this is the new balance that will be used to calculate interest. Each payment will have less interest expense and more note payable even though the credit to cash will be the same each time (equal installments).

Check Yourself

Using the example of Abilene and their airplane given in the text above, what would be the debit to interest expense for the THIRD monthly payment on the installment loan?

A. $1,623

B. $1,645

C. $2,604

D. $1,667

The correct answer is A. For the second payment on the loan, the interest would be 197,418 x 10% / 12 = 1,645. That is subtracted from the payment of $4,249 to get the amount of principal paid – 2,604. The new balance on the loan is 197,418 – 2,604 = 194,814. This is used to calculate the interest for the third payment. 194,814 x .10 / 12 = 1,623.

Question: On Target’s balance sheet, besides notes payable, Target reports $2.6 billion in lease liabilities as of January 28, 2023. What is the differences between these liabilities and notes/loans payable?

Companies large and small use leasing arrangements to help them obtain control of assets such as buildings and equipment similar to what they would do with installment loans. Thus in some ways the accounting for them will be similar. After years of discussion and meetings, the FASB changed the accounting rules for leases such that almost all lease arrangements (both the liability and the related asset) are listed on the balance sheet. This is true even though from a legal standpoint, a lease does not transfer ownership to the lessee (renter). So an arrangement where Target leases space (lessee) in a mall and the lease is for 5 years, the amount of the control over that asset for 5 years is recorded as an asset while the payments (present value of them) is recorded as a liability. The mall retains legal ownership of the space even while it is in the control of Target. This focuses on control of the asset rather than ownership transfer.

The FASB did distinguish between two kinds of leases:

- Finance lease . Lessee gains substantially all the benefits and risks of ownership. The transaction is reported as a purchase with installment loan although the legal form is still that of a lease arrangement.

- Operating lease . Lessee does not obtain substantially all the benefits and risks of ownership. Lessee reports a right to use asset for the time they control the asset being leased.

In establishing reporting guidelines in this area, FASB created four specific criteria to serve as the line between the two types of leases. Such rules set a standard that all companies must follow. If any one of these criteria is met, the lease is automatically recorded by the lessee as a finance lease. Both the asset and liability are reported as if an actual purchase took place.

Note in each of these criteria the rationale for classifying the transaction as a finance lease.

- The lease contract specifies that title to the property will be conveyed to the lessee by the end of the lease term. If legal ownership is to be transferred from lessor to lessee , the entire series of payments is simply a method devised to purchase the asset. In substance, the agreement was never intended to be a rental. From the beginning, the property was being acquired.

- The lease contract allows the lessee to buy the property at a specified time at an amount sufficiently below its expected fair value so that purchase is reasonably assured. The availability of this bargain purchase option indicates, once again, that the true intention of the contract is the conveyance of ownership. The transaction is the equivalent of a purchase if the option price is so low that purchase by the lessee can be anticipated.

- The lease contract is for a term that is equal to most of the estimated life of the property. This criterion is different from the first two where the transaction was just a disguised purchased. Here, the lessee will never gain legal ownership. However, the lease is for such an extensive portion of the asset’s life that the lessee obtains a vast majority of its utility.

- The fourth criterion is too complicated to cover in an introductory textbook. The general idea is that the lessee is paying approximately the same amount as would have been charged just to buy the asset. Paying the equivalent of the purchase price (or close to it) indicates that no real difference exists between the nature of the lease transaction and an acquisition.

If none of the criteria are satisfied then the lease is an operating lease. For both the finance lease and operating lease, an asset and liability are recorded on the balance sheet. For both the amount of the asset and liability is the present value of all future payments. For a finance lease it is treated as a purchase and whatever the asset that is acquired is recorded as the debit and in subsequent periods the asset is depreciated using what we learned in chapter 4. For operating leases the asset is referred to as the right to use the asset for a specified time and is not depreciated. More in depth accounting for leases will be covered in intermediate accounting.

Which of the following is true with regard to the new FASB rules having to do with leases?

A. Finance leases use the present value to calculate the amount to be recorded but operating leases do not.

B. Companies that acquire control of assets using a finance lease will calculate depreciation on those assets.

C. Leases that transfer ownership automatically at the end of the lease are always accounted for as operating leases.

D. Control of assets is not as important as legal ownership transfer in accounting for leases.

The correct answer is B. The assets acquired with a lease that qualifies as a finance lease is treated just like any acquisition including depreciation. Both finance and operating leases use the present value to calculate the amount to be recorded. Those leases that automatically transfer ownership are finance leases and control of assets is more important than legal ownership.

Key Takeaway

Companies use installment loans to purchase buildings and equipment. The payment for any installment loan can be calculated using the PMT formula in an excel spreadsheet. Once the payment is calculated, each payment must be split into interest and principal. Unlike the amount of the payment, the interest does not need to be calculated using a formula or table. Finance leases are accounted for almost exactly like installment loans.

What is an Installment Note?

Home › Finance › Corporate Finance › What is an Installment Note?

Definition: An installment note is an obligation or liability that requires the borrower to repay the principal to the lender in a series of periodic payments. In contrast, a lump sum note or balloon loan requires that the borrower repay the entire note principal at a specific date. There is no payment plan.

- What Does Installment Note Mean?

An installment note, on the other hand, typically has a payment schedule where the borrower repays the lender in equal payments monthly, quarterly, semi-annually, or annually until the loan is fully repaid with interest. It works the same way a person mortgage works. There is a note term and a set payment amount that will be paid equally throughout the term.

These types of notes are common among franchises and businesses that require trade debts to float their inventory over several accounting periods.

Let’s look at an example.

Tim’s Brewery needs to finance its newest expansion and doesn’t want to use equity financing, so it takes out a loan with its local bank. Tim gets a 5-year $100,000 loan to add on to his factory records the note with a debit to cash and a credit notes payable.

The note terms include a 10 percent interest rate and monthly payments. Tim will make a monthly payment of $2,125. This payment amount includes the 10 percent interest charged every month.

Just like a personal mortgage, the installment note payments will first be made predominantly of interest payments. Toward the middle of the third year, a larger amount of the payments will go against the principal of the note.

At the first of each month, Tim will post a journal entry to record the loan payment by debiting the notes payable and interest expense account and crediting the cash account .

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Search 2,000+ accounting terms and topics.

- Basic Accounting Course

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Financial Statements

- Financial Ratio

- No videos yet! Click on "Watch later" to put videos here

- View all videos

- Don't miss new videos Sign in to see updates from your favourite channels Sign In

- You are not logged in! Login | Create new account

- Laura Anthony, Esq.

- Securities Law Blogs

Home » An Introduction to Promissory Notes

An Introduction to Promissory Notes

A promissory note is a written promise by a person, persons or entity to pay a specific amount of money (called “principal”) to another, usually to include a specified amount of interest on the unpaid principal amount. In addition, a promissory note will include the basic specifics of the debt, including full names of both debtor and creditor and an address for making payments. The specified time of payment may be written as: a) whenever there is a demand, b) on a specific date, c) in installments with or without the interest included in each installment, d) installments with a final larger amount (balloon payment). In the event that the written note does not include language specifying the time of payment, the law assumes it is payable on demand by the creditor.

Terms of Payment

A promissory note may contain other terms such as the right of the promisee to order payment be made to another person, security or collateral, conversion into stock or other equity, penalties for late payments, a provision for attorney’s fees and costs if there is a legal action to collect, the right to collect payment in full upon certain facts (such as the sale of collateral or a default in the note obligations.

There are legal limitations to the amount of interest which may be charged. When the amount due on the note, including interest and penalties (if any) is paid, the note must be cancelled and surrendered to the person(s) who signed it. The requirements of how a promissory note must be signed are governed by state law and vary from state to state. Some states require that a promissory note by witnessed, others require that it be notarized and some do not require witnessing or a notary. Notes often contain enforcement provisions, such as notice requirements, jurisdiction and venue.

The note is signed by the person borrowing the money. The note is then kept by the person lending the money as evidence of the loan and the repayment agreement (with a copy usually provided to the borrower). It is recommended that the debtor sign in blue ink so that there can be no confusion as to which document is the original (and thus enforceable) note.

Liens as Security

In some cases, a promissory note is used when a loan is made for the purchase of real property. When this type of loan is made, the person lending the money often takes a mortgage on the property. That is, the borrower agrees (through a written document that is recorded with the local recorder’s office) that the lender has an interest or lien on the property until such time as the loan is repaid in full. If the loan is not paid in full, the mortgage holder can file a lawsuit, usually called a foreclosure, seeking to have the property sold and the proceeds generated from that sale paid to the lender to satisfy or pay off the loan.

In cases where a loan is used for the purchase of specific personal property (i.e. property that is not land or real estate), a similar type of document can be used to secure the loan or to specify collateral for the repayment of the loan. A security interest can be obtained in the property that is purchased with the borrowed money – this is referred to as a purchase money security interest. If property other than the property purchased with the money is offered as collateral or security on the loan, this type of security is referred to as a non-purchase money security interest. The document that identifies these types of security interest is called a Security Agreement. This document sets forth the details on the type of collateral, location, and how the collateral is handled should the borrower not repay the loan as agreed.

Personal Guarantees

Some promissory notes provide for personal guarantees – if the person borrowing the money is a corporation or is an individual that does not appear to have a solid financial base, another individual will be required to sign the guarantee, thereby promising the lender to pay the loan if the borrower does not. These provisions are enforceable and will bind the person signing the guarantee in the same manner as the person who signed the note.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay. However, a promissory note is never assignable by the borrower, without the express written consent and approval of the lender. Moreover, convertible promissory notes are generally not assignable unless the third party meets specific criteria.

This is because a convertible promissory note is generally an investment decision (i.e. it can be converted into equity) and the exemption relied upon by the borrower may be limited to the lender meeting certain eligibility. For example, generally lenders in a convertible promissory note must be accredited and not be disqualified from participating in stock offerings, such as by having a penny stock bar.

Attorney Laura Anthony , Founding Partner, Legal & Compliance, LLC Securities, Reverse Mergers, Corporate Transactions

Securities attorney Laura Anthony provides ongoing corporate counsel to small and mid-size public Companies as well as private Companies intending to go public on the Over the Counter Bulletin Board (OTCBB), now known as the OTCQB. For more than a decade Ms. Anthony has dedicated her securities law practice towards being “the big firm alternative.” Clients receive fast and efficient cutting-edge legal service without the inherent delays and unnecessary expense of “partner-heavy” securities law firms.

Ms. Anthony’s focus includes but is not limited to compliance with the reporting requirements of the Securities Exchange Act of 1934, as amended, (“Exchange Act”) including Forms 10-Q, 10-K and 8-K and the proxy requirements of Section 14. In addition, Ms. Anthony prepares private placement memorandums, registration statements under both the Exchange Act and Securities Act of 1933, as amended (“Securities Act”). Moreover, Ms. Anthony represents both target and acquiring companies in reverse mergers and forward mergers, including preparation of deal documents such as Merger Agreements, Stock Purchase Agreements, Asset Purchase Agreements and Reorganization Agreements. Ms. Anthony prepares the necessary documentation and assists in completing the requirements of the Exchange Act, state law and FINRA for corporate changes such as name changes, reverse and forward splits and change of domicile.

Contact Legal & Compliance LLC for a free initial consultation or second opinion on an existing matter.

Recent Posts

Sec issues new mergers and acquisitions related c&di, regulation by enforcement, non-fungible tokens, disclosure considerations related to the conflict in the ukraine, sec proposes rules related to securities lending market, sec reopens comment period for pay versus performance, sec fall 2021 regulatory agenda, spac shareholder litigation – first fire.

B3-6-05, Monthly Debt Obligations (05/04/2022)

Alimony, child support, and separate maintenance payments, bridge / swing loans, business debt in borrower’s name, court-ordered assignment of debt, debts paid by others, non-applicant accounts, deferred installment debt, federal income tax installment agreements, garnishments, home equity lines of credit, installment debt, lease payments, rental housing payment, loans secured by financial assets, open 30–day charge accounts, other real estate owned—qualifying impact, revolving charge/lines of credit, student loans.

When the borrower is required to pay alimony, child support, or separate maintenance payments under a divorce decree, separation agreement, or any other written legal agreement—and those payments must continue to be made for more than ten months—the payments must be considered as part of the borrower’s recurring monthly debt obligations. However, voluntary payments do not need to be taken into consideration and an exception is allowed for alimony. A copy of the divorce decree, separation agreement, court order, or equivalent documentation confirming the amount of the obligation must be obtained and retained in the loan file.

For alimony and separate maintenance obligations, the lender has the option to reduce the qualifying income by the amount of the obligation in lieu of including it as a monthly payment in the calculation of the DTI ratio.

Note : For loan casefiles underwritten through DU, when using the option of reducing the borrower’s monthly qualifying income by the alimony or separate maintenance payment, the lender must enter the amount of the monthly obligation as a negative alimony or separate maintenance income amount. (If the borrower also receives alimony or separate maintenance income, the amounts should be combined and entered as a net amount.)

When a borrower obtains a bridge (or swing) loan, the funds from that loan can be used for closing on a new principal residence before the current residence is sold. This creates a contingent liability that must be considered part of the borrower’s recurring monthly debt obligations and included in the DTI ratio calculation.

Fannie Mae will waive this requirement and not require the debt to be included in the DTI ratio if the following documentation is provided:

a fully executed sales contract for the current residence, and

confirmation that any financing contingencies have been cleared.

When a self-employed borrower claims that a monthly obligation that appears on their personal credit report (such as a Small Business Administration loan) is being paid by the borrower’s business, the lender must confirm that it verified that the obligation was actually paid out of company funds and that this was considered in its cash flow analysis of the borrower’s business.

The account payment does not need to be considered as part of the borrower’s DTI ratio if:

the account in question does not have a history of delinquency,

the business provides acceptable evidence that the obligation was paid out of company funds (such as 12 months of canceled company checks), and

the lender’s cash flow analysis of the business took payment of the obligation into consideration.

The account payment must be considered as part of the borrower’s DTI ratio in any of the following situations:

If the business does not provide sufficient evidence that the obligation was paid out of company funds.

If the business provides acceptable evidence of its payment of the obligation, but the lender’s cash flow analysis of the business does not reflect any business expense related to the obligation (such as an interest expense—and taxes and insurance, if applicable—equal to or greater than the amount of interest that one would reasonably expect to see given the amount of financing shown on the credit report and the age of the loan). It is reasonable to assume that the obligation has not been accounted for in the cash flow analysis.

If the account in question has a history of delinquency. To ensure that the obligation is counted only once, the lender should adjust the net income of the business by the amount of interest, taxes, or insurance expense, if any, that relates to the account in question.

When a borrower has outstanding debt that was assigned to another party by court order (such as under a divorce decree or separation agreement) and the creditor does not release the borrower from liability, the borrower has a contingent liability. The lender is not required to count this contingent liability as part of the borrower’s recurring monthly debt obligations.

The lender is not required to evaluate the payment history for the assigned debt after the effective date of the assignment. The lender cannot disregard the borrower’s payment history for the debt before its assignment.

Certain debts can be excluded from the borrower’s recurring monthly obligations and the DTI ratio:

When a borrower is obligated on a non-mortgage debt - but is not the party who is actually repaying the debt - the lender may exclude the monthly payment from the borrower's recurring monthly obligations. This policy applies whether or not the other party is obligated on the debt, but is not applicable if the other party is an interested party to the subject transaction (such as the seller or real estate agent). Non-mortgage debts include installment loans, student loans, revolving accounts, lease payments, alimony, child support, and separate maintenance. See below for treatment of payments due under a federal income tax installment agreement.

When a borrower is obligated on a mortgage debt - but is not the party who is actually repaying the debt - the lender may exclude the full monthly housing expense (PITIA) from the borrower’s recurring monthly obligations if

the party making the payments is obligated on the mortgage debt,

there are no delinquencies in the most recent 12 months, and

the borrower is not using rental income from the applicable property to qualify.

In order to exclude non-mortgage or mortgage debts from the borrower’s DTI ratio, the lender must obtain the most recent 12 months' canceled checks (or bank statements) from the other party making the payments that document a 12-month payment history with no delinquent payments.

When a borrower is obligated on a mortgage debt, regardless of whether or not the other party is making the monthly mortgage payments, the referenced property must be included in the count of financed properties (if applicable per B2-2-03, Multiple Financed Properties for the Same Borrower B2-2-03, Multiple Financed Properties for the Same Borrower .

Credit reports may include accounts identified as possible non-applicant accounts (or with other similar notation). Non-applicant accounts may belong to the borrower, or they may truly belong to another individual.

Typical causes of non-applicant accounts include:

applicants who are Juniors or Seniors,

individuals who move frequently,

unrelated individuals who have identical names, and

debts the borrower applied for under a different Social Security number or under a different address. These may be indicative of potential fraud.

If the debts do not belong to the borrower, the lender may provide supporting documentation to validate this, and may exclude the non-applicant debts for the borrower’s DTI ratio. If the debts do belong to the borrower, they must be included as part of the borrower’s recurring monthly debt obligations.

Deferred installment debts must be included as part of the borrower’s recurring monthly debt obligations. For deferred installment debts other than student loans, if the borrower’s credit report does not indicate the monthly amount that will be payable at the end of the deferment period, the lender must obtain copies of the borrower’s payment letters or forbearance agreements so that a monthly payment amount can be determined and used in calculating the borrower’s total monthly obligations.

For information about deferred student loans, see Student Loans below.

When a borrower has entered into an installment agreement with the IRS to repay delinquent federal income taxes, the lender may include the monthly payment amount as part of the borrower’s monthly debt obligations (in lieu of requiring payment in full) if:

There is no indication that a Notice of Federal Tax Lien has been filed against the borrower in the county in which the subject property is located.

The lender obtains the following documentation:

an approved IRS installment agreement with the terms of repayment, including the monthly payment amount and total amount due; and

evidence the borrower is current on the payments associated with the tax installment plan. Acceptable evidence includes the most recent payment reminder from the IRS, reflecting the last payment amount and date and the next payment amount owed and due date. At least one payment must have been made prior to closing.

As a reminder, lenders remain responsible under the life-of-loan representations and warranties for clear title and first-lien enforceability in accordance with A2-2-07, Life-of-Loan Representations and Warranties A2-2-07, Life-of-Loan Representations and Warranties .

The payments on a federal income tax installment agreement can be excluded from the borrower’s DTI ratio if the agreement meets the terms in Debts Paid by Others or Installment Debt described above. If any of the above conditions are not met, the borrower must pay off the outstanding balance due under the installment agreement with the IRS in accordance with B3-6-07, Debts Paid Off At or Prior to Closing B3-6-07, Debts Paid Off At or Prior to Closing

All garnishments with more than ten months remaining must be included in the borrower’s recurring monthly debt obligations for qualifying purposes.

When the mortgage that will be delivered to Fannie Mae also has a home equity line of credit (HELOC) that provides for a monthly payment of principal and interest or interest only, the payment on the HELOC must be considered as part of the borrower’s recurring monthly debt obligations. If the HELOC does not require a payment, there is no recurring monthly debt obligation so the lender does not need to develop an equivalent payment amount.

All installment debt that is not secured by a financial asset—including student loans, automobile loans, personal loans, and timeshares—must be considered part of the borrower’s recurring monthly debt obligations if there are more than ten monthly payments remaining. However, an installment debt with fewer monthly payments remaining also should be considered as a recurring monthly debt obligation if it significantly affects the borrower’s ability to meet their credit obligations. See below for treatment of payments due under a federal income tax installment agreement.

Note: A timeshare account should be treated as an installment debt regardless of how it is reported on the credit report or other documentation (that is, even if reported as a mortgage loan).

Lease payments must be considered as recurring monthly debt obligations regardless of the number of months remaining on the lease. This is because the expiration of a lease agreement for rental housing or an automobile typically leads to either a new lease agreement, the buyout of the existing lease, or the purchase of a new vehicle or house.

The housing payment for each borrower’s principal residence must be considered when underwriting the loan. For the following scenarios, the borrower’s monthly rental housing payment must be evaluated (if the borrower does not otherwise have a mortgage payment or no housing expense):

for non-occupant borrowers, and

for second homes or investment properties.

The following list provides examples of acceptable documentation to verify the rental payment:

six months canceled checks or equivalent payment source;

six months bank statements reflecting a clear and consistent payment to an organization or individual;

direct verification of rent from a management company or individual landlord; or

a copy of a current, fully executed lease agreement and two months canceled checks (or equivalent payment source) supporting the rental payment amount.

Note: Refer to B3-5.4-03, Documentation and Assessment of a Nontraditional Credit History B3-5.4-03, Documentation and Assessment of a Nontraditional Credit History for rental payment history requirements when using non-traditional credit.

When a borrower uses their financial assets—life insurance policies, 401(k) accounts, individual retirement accounts, certificates of deposit, stocks, bonds, etc.—as security for a loan, the borrower has a contingent liability.

The lender is not required to include this contingent liability as part of the borrower’s recurring monthly debt obligations provided the lender obtains a copy of the applicable loan instrument that shows the borrower’s financial asset as collateral for the loan. If the borrower intends to use the same asset to satisfy financial reserve requirements, the lender must reduce the value of the asset (the account balance, in most cases) by the proceeds from the secured loan and any related fees to determine whether the borrower has sufficient reserves.

Note: Payment on any debt secured by virtual currency is an exception to the above policy and must be included when calculating the debt-to-income ratio.

Open 30–day charge accounts require the balance to be paid in full every month. Fannie Mae does not require open 30–day charge accounts to be included in the debt-to-income ratio.

See B3-6-07, Debts Paid Off At or Prior to Closing B3-6-07, Debts Paid Off At or Prior to Closing , for additional information on open 30–day charge accounts.

For details regarding the qualifying impact of other real estate owned, see B3-6-06, Qualifying Impact of Other Real Estate Owned B3-6-06, Qualifying Impact of Other Real Estate Owned .

Revolving charge accounts and unsecured lines of credit are open-ended and should be treated as long-term debts and must be considered part of the borrower's recurring monthly debt obligations. These tradelines include credit cards, department store charge cards, and personal lines of credit. Equity lines of credit secured by real estate should be included in the housing expense.

If the credit report does not show a required minimum payment amount and there is no supplemental documentation to support a payment of less than 5%, the lender must use 5% of the outstanding balance as the borrower's recurring monthly debt obligation.

For DU loan casefiles, if a revolving debt is provided on the loan application without a monthly payment amount, DU will use the greater of $10 or 5% of the outstanding balance as the monthly payment when calculating the total debt-to-income ratio.

If a monthly student loan payment is provided on the credit report, the lender may use that amount for qualifying purposes. If the credit report does not reflect the correct monthly payment, the lender may use the monthly payment that is on the student loan documentation (the most recent student loan statement) to qualify the borrower.

If the credit report does not provide a monthly payment for the student loan, or if the credit report shows $0 as the monthly payment, the lender must determine the qualifying monthly payment using one of the options below.

If the borrower is on an income-driven payment plan, the lender may obtain student loan documentation to verify the actual monthly payment is $0. The lender may then qualify the borrower with a $0 payment.

For deferred loans or loans in forbearance, the lender may calculate

a payment equal to 1% of the outstanding student loan balance (even if this amount is lower than the actual fully amortizing payment), or

a fully amortizing payment using the documented loan repayment terms.

The table below provides references to recently issued Announcements that are related to this topic.

Have questions?

Get answers to your policy and guide questions, straight from the source.

Work with Fannie Mae

- Customer Login

- Password Reset

- Not a customer? Get Started

Products & Solutions

- Mortgage Products & Options

- Technology Apps & Solutions

Support & Resources

- Customer Service

- News & Events

- Learning Center

- Guide Forms

Other Sites

- The Marketing Center

- Fannie Mae's Consumer Website

- Duty to Serve

Originating & Underwriting

Selling Guide

Download PDF Guide

(Published: May 01 2024)

Selling Questions? Ask Poli

Get answers to Guide & policy questions with Fannie Mae's AI-powered search tool.

Guide Resources

Forms, announcements, lender letters, legal documents, and more.

Browse the Guide

- Copyright and Preface

- A1-1-01, Application and Approval of Seller/Servicer

- A2-1-01, Contractual Obligations for Sellers/Servicers

- A2-1-02, Nature of Mortgage Transaction

- A2-1-03, Indemnification for Losses

- A2-2-01, Representations and Warranties Overview

- A2-2-02, Delivery Information and Delivery-Option Specific Representations and Warranties

- A2-2-03, Document Warranties

- A2-2-04, Limited Waiver and Enforcement Relief of Representations and Warranties

- A2-2-05, Invalidation of Limited Waiver of Representations and Warranties

- A2-2-06, Representations and Warranties on Property Value

- A2-2-07, Life-of-Loan Representations and Warranties

- A2-3.1-01, Lender Breach of Contract

- A2-3.1-02, Sanctions, Suspensions, and Terminations

- A2-3.2-01, Loan Repurchases and Make Whole Payments Requested by Fannie Mae

- A2-3.2-02, Enforcement Relief for Breaches of Certain Representations and Warranties Related to Underwriting and Eligibility

- A2-3.2-03, Remedies Framework

- A2-3.3-01, Compensatory Fees

- A2-4.1-01, Establishing Loan Files

- A2-4.1-02, Ownership and Retention of Loan Files and Records

- A2-4.1-03, Electronic Records, Signatures, and Transactions

- A2-4.1-04, Notarization Standards

- A2-5-01, Fannie Mae Trade Name and Trademarks

- A3-1-01, Fannie Mae’s Technology Products

- A3-2-01, Compliance With Laws

- A3-2-02, Responsible Lending Practices

- A3-3-01, Outsourcing of Mortgage Processing and Third-Party Originations

- A3-3-02, Concurrent Servicing Transfers

- A3-3-03, Other Servicing Arrangements

- A3-3-04, Document Custodians

- A3-3-05, Custody of Mortgage Documents

- A3-4-01, Confidentiality of Information

- A3-4-02, Data Quality and Integrity

- A3-4-03, Preventing, Detecting, and Reporting Mortgage Fraud

- A3-5-01, Fidelity Bond and Errors and Omissions Coverage Provisions

- A3-5-02, Fidelity Bond Policy Requirements

- A3-5-03, Errors and Omissions Policy Requirements

- A3-5-04, Reporting Fidelity Bond and Errors and Omissions Events

- A4-1-01, Maintaining Seller/Servicer Eligibility

- A4-1-02, Submission of Financial Statements and Reports

- A4-1-03, Report of Changes in the Seller/Servicer’s Organization

- A4-1-04, Submission of Irrevocable Limited Powers of Attorney

- B1-1-01, Contents of the Application Package

- B1-1-02, Blanket Authorization Form

- B1-1-03, Allowable Age of Credit Documents and Federal Income Tax Returns

- B2-1.1-01, Occupancy Types

- B2-1.2-01, Loan-to-Value (LTV) Ratios

- B2-1.2-02, Combined Loan-to-Value (CLTV) Ratios

- B2-1.2-03, Home Equity Combined Loan-to-Value (HCLTV) Ratios

- B2-1.2-04, Subordinate Financing

- B2-1.3-01, Purchase Transactions

- B2-1.3-02, Limited Cash-Out Refinance Transactions

- B2-1.3-03, Cash-Out Refinance Transactions

- B2-1.3-04, Prohibited Refinancing Practices

- B2-1.3-05, Payoff of Installment Land Contract Requirements

- B2-1.4-01, Fixed-Rate Loans

- B2-1.4-02, Adjustable-Rate Mortgages (ARMs)

- B2-1.4-03, Convertible ARMs

- B2-1.4-04, Temporary Interest Rate Buydowns

- B2-1.5-01, Loan Limits

- B2-1.5-02, Loan Eligibility

- B2-1.5-03, Legal Requirements

- B2-1.5-04, Escrow Accounts

- B2-1.5-05, Principal Curtailments

- B2-2-01, General Borrower Eligibility Requirements

- B2-2-02, Non–U.S. Citizen Borrower Eligibility Requirements

- B2-2-03, Multiple Financed Properties for the Same Borrower

- B2-2-04, Guarantors, Co-Signers, or Non-Occupant Borrowers on the Subject Transaction

- B2-2-05, Inter Vivos Revocable Trusts

- B2-2-06, Homeownership Education and Housing Counseling

- B2-2-07, First-Generation Homebuyer Loans

- B2-3-01, General Property Eligibility

- B2-3-02, Special Property Eligibility and Underwriting Considerations: Factory-Built Housing

- B2-3-03, Special Property Eligibility and Underwriting Considerations: Leasehold Estates

- B2-3-04, Special Property Eligibility Considerations

- B2-3-05, Properties Affected by a Disaster

- B3-1-01, Comprehensive Risk Assessment

- B3-2-01, General Information on DU

- B3-2-02, DU Validation Service

- B3-2-03, Risk Factors Evaluated by DU

- B3-2-04, DU Documentation Requirements

- B3-2-05, Approve/Eligible Recommendations

- B3-2-06, Approve/Ineligible Recommendations

- B3-2-07, Refer with Caution Recommendations

- B3-2-08, Out of Scope Recommendations

- B3-2-09, Erroneous Credit Report Data

- B3-2-10, Accuracy of DU Data, DU Tolerances, and Errors in the Credit Report

- B3-2-11, DU Underwriting Findings Report

- B3-3.1-01, General Income Information

- B3-3.1-02, Standards for Employment Documentation

- B3-3.1-03, Base Pay (Salary or Hourly), Bonus, and Overtime Income

- B3-3.1-04, Commission Income

- B3-3.1-05, Secondary Employment Income (Second Job and Multiple Jobs) and Seasonal Income

- B3-3.1-06, Requirements and Uses of IRS IVES Request for Transcript of Tax Return Form 4506-C

- B3-3.1-07, Verbal Verification of Employment

- B3-3.1-08, Rental Income

- B3-3.1-09, Other Sources of Income

- B3-3.1-10, Income Calculator

- B3-3.2-01, Underwriting Factors and Documentation for a Self-Employed Borrower

- B3-3.2-02, Business Structures

- B3-3.2-03, IRS Forms Quick Reference

- B3-3.3-01, General Information on Analyzing Individual Tax Returns

- B3-3.3-02, Income Reported on IRS Form 1040

- B3-3.3-03, Income or Loss Reported on IRS Form 1040, Schedule C

- B3-3.3-04, Income or Loss Reported on IRS Form 1040, Schedule D

- B3-3.3-05, Income or Loss Reported on IRS Form 1040, Schedule E

- B3-3.3-06, Income or Loss Reported on IRS Form 1040, Schedule F

- B3-3.3-07, Income or Loss Reported on IRS Form 1065 or IRS Form 1120S, Schedule K-1

- B3-3.4-01, Analyzing Partnership Returns for a Partnership or LLC

- B3-3.4-02, Analyzing Returns for an S Corporation

- B3-3.4-03, Analyzing Returns for a Corporation

- B3-3.4-04, Analyzing Profit and Loss Statements

- B3-3.5-01, Income and Employment Documentation for DU

- B3-3.5-02, Income from Rental Property in DU

- B3-4.1-01, Minimum Reserve Requirements

- B3-4.1-02, Interested Party Contributions (IPCs)

- B3-4.1-03, Types of Interested Party Contributions (IPCs)

- B3-4.1-04, Virtual Currency

- B3-4.2-01, Verification of Deposits and Assets

- B3-4.2-02, Depository Accounts

- B3-4.2-03, Individual Development Accounts

- B3-4.2-04, Pooled Savings (Community Savings Funds)

- B3-4.2-05, Foreign Assets

- B3-4.3-01, Stocks, Stock Options, Bonds, and Mutual Funds

- B3-4.3-02, Trust Accounts

- B3-4.3-03, Retirement Accounts

- B3-4.3-04, Personal Gifts

- B3-4.3-05, Gifts of Equity

- B3-4.3-06, Grants and Lender Contributions

- B3-4.3-07, Disaster Relief Grants or Loans

- B3-4.3-08, Employer Assistance

- B3-4.3-09, Earnest Money Deposit

- B3-4.3-10, Anticipated Sales Proceeds

- B3-4.3-11, Trade Equity

- B3-4.3-12, Rent Credit for Option to Purchase

- B3-4.3-13, Sweat Equity

- B3-4.3-14, Bridge/Swing Loans

- B3-4.3-15, Borrowed Funds Secured by an Asset

- B3-4.3-16, Credit Card Financing and Reward Points

- B3-4.3-17, Personal Unsecured Loans

- B3-4.3-18, Sale of Personal Assets

- B3-4.3-19, Cash Value of Life Insurance

- B3-4.3-20, Anticipated Savings and Cash-on-Hand

- B3-4.3-21, Borrower's Earned Real Estate Commission

- B3-4.4-01, DU Asset Verification

- B3-4.4-02, Requirements for Certain Assets in DU

- B3-5.1-01, General Requirements for Credit Scores

- B3-5.1-02, Determining the Credit Score for a Mortgage Loan

- B3-5.2-01, Requirements for Credit Reports

- B3-5.2-02, Types of Credit Reports

- B3-5.2-03, Accuracy of Credit Information in a Credit Report

- B3-5.3-01, Number and Age of Accounts

- B3-5.3-02, Payment History

- B3-5.3-03, Previous Mortgage Payment History

- B3-5.3-04, Inquiries: Recent Attempts to Obtain New Credit

- B3-5.3-05, Credit Utilization

- B3-5.3-06, Authorized Users of Credit

- B3-5.3-07, Significant Derogatory Credit Events — Waiting Periods and Re-establishing Credit

- B3-5.3-08, Extenuating Circumstances for Derogatory Credit

- B3-5.3-09, DU Credit Report Analysis

- B3-5.4-01, Eligibility Requirements for Loans with Nontraditional Credit

- B3-5.4-02, Number and Types of Nontraditional Credit References

- B3-5.4-03, Documentation and Assessment of a Nontraditional Credit History

- B3-6-01, General Information on Liabilities

- B3-6-02, Debt-to-Income Ratios

- B3-6-03, Monthly Housing Expense for the Subject Property

- B3-6-04, Qualifying Payment Requirements

- B3-6-05, Monthly Debt Obligations

- B3-6-06, Qualifying Impact of Other Real Estate Owned

- B3-6-07, Debts Paid Off At or Prior to Closing

- B3-6-08, DU: Requirements for Liability Assessment

- B4-1.1-01, Definition of Market Value

- B4-1.1-02, Lender Responsibilities

- B4-1.1-03, Appraiser Selection Criteria

- B4-1.1-04, Unacceptable Appraisal Practices

- B4-1.1-05, Disclosure of Information to Appraisers

- B4-1.1-06, Uniform Appraisal Dataset (UAD) and the Uniform Collateral Data Portal (UCDP)

- B4-1.2-01, Appraisal Report Forms and Exhibits

- B4-1.2-02, Desktop Appraisals

- B4-1.2-03, Hybrid Appraisals

- B4-1.2-04, Appraisal Age and Use Requirements

- B4-1.2-05, Requirements for Verifying Completion and Postponed Improvements

- B4-1.3-01, Review of the Appraisal Report

- B4-1.3-02, Subject and Contract Sections of the Appraisal Report

- B4-1.3-03, Neighborhood Section of the Appraisal Report

- B4-1.3-04, Site Section of the Appraisal Report

- B4-1.3-05, Improvements Section of the Appraisal Report

- B4-1.3-06, Property Condition and Quality of Construction of the Improvements

- B4-1.3-07, Sales Comparison Approach Section of the Appraisal Report

- B4-1.3-08, Comparable Sales

- B4-1.3-09, Adjustments to Comparable Sales

- B4-1.3-10, Cost and Income Approach to Value

- B4-1.3-11, Valuation Analysis and Reconciliation

- B4-1.3-12, Appraisal Quality Matters

- B4-1.4-01, Factory-Built Housing: Manufactured Housing

- B4-1.4-02, Factory-Built Housing: Modular, Prefabricated, Panelized, or Sectional Housing

- B4-1.4-03, Condo Appraisal Requirements

- B4-1.4-04, Co-op Appraisal Requirements

- B4-1.4-05, Leasehold Interests Appraisal Requirements

- B4-1.4-06, Community Land Trust Appraisal Requirements

- B4-1.4-07, Mixed-Use Property Appraisal Requirements

- B4-1.4-08, Environmental Hazards Appraisal Requirements

- B4-1.4-09, Special Assessment or Community Facilities Districts Appraisal Requirements

- B4-1.4-10, Value Acceptance (Appraisal Waiver)

- B4-1.4-11, Value Acceptance + Property Data

- B4-2.1-01, General Information on Project Standards

- B4-2.1-02, Waiver of Project Review

- B4-2.1-03, Ineligible Projects

- B4-2.1-04, Environmental Hazard Assessments

- B4-2.1-05, Unacceptable Environmental Hazards

- B4-2.1-06, Remedial Actions for Environmental Hazard Assessments Below Standards

- B4-2.2-01, Limited Review Process

- B4-2.2-02, Full Review Process

- B4-2.2-03, Full Review: Additional Eligibility Requirements for Units in New and Newly Converted Condo Projects

- B4-2.2-04, Geographic-Specific Condo Project Considerations

- B4-2.2-05, FHA-Approved Condo Review Eligibility

- B4-2.2-06, Project Eligibility Review Service (PERS)

- B4-2.2-07, Projects with Special Considerations and Project Eligibility Waivers

- B4-2.3-01, Eligibility Requirements for Units in PUD Projects

- B4-2.3-02, Co-op Project Eligibility

- B4-2.3-03, Legal Requirements for Co-op Projects

- B4-2.3-04, Loan Eligibility for Co-op Share Loans