- Pollfish School

- Market Research

- Survey Guides

- Get started

How to Conduct Real Estate Market Research Like a Pro

Conducting real estate market research is a considerably different feat than conducting any other kind of market research . This is because this vertical, by its very nature, is packed with market intelligence that can be applied not simply to real estate companies, but to buyers and agents, along with those looking for a new property.

Therefore, as a business, you’ll find a lot of overlap between business-facing research and research that the target market can stand to study. However, even when you come across information that seems more suitable for consumers to review, it is of high value to your business as well.

Why? Because it is crucial to tap into the minds of your target market, to see exactly what they’re presented with. This intel will also grant you comparisons between your own offerings and those in the real estate market.

The Main Uses of Real Estate Market Research

Research for the real estate vertical can be used for a variety of purposes. The chief goal of market research for this industry is to discover if your business will be successful in a particular location.

Unlike other industries, real estate has an enormous focus on location and the brick and mortar aspect. It is self-explanatory as to why that is, nonetheless, getting a deep understanding of your target market is also essential.

Here are the key uses of market research for this sector:

- To understand changes and trends in the real estate market at large

- To understand the current housing/ space rental markets

- To compare prices of similar properties with yours

- To be informed on how much you can charge for rent (particularly for investment properties)

- To gauge your own prices as reasonable, too high or too low

- To be able to market your properties successfully (gain better reach, prospects and sales)

- To choose the proper investments

How to Conduct Real Estate Market Research

The following lists the necessary steps towards conducting a sufficient market research campaign within the real estate market. You’ll notice that this vertical demands doing an analysis on various elements. These remain constantly in existence in the sector, so it is critical to understand how to study each.

You’ll also notice that observing your target market doesn’t occur at a single step, rather it should be done in a variety of stages.

Step 1: Narrow down a region/neighborhood

Since real-estate is location-based, you must first settle on a region or a neighborhood you are interested in serving. If you are undecided, consider a few areas that you’d like to learn more about.

Identify the target market of your neighborhood. You can do so via secondary research, by finding the demographics of your intended neighborhood. There are several sources that fetch this data, including Neighborhood Scout , Census demographics data, for example for New York City and Movoto .

Aside from gleaning the target market, these tools gather other key info like crime, local schools and even real estate data.

Step 2: Study Your Competition

Once you have narrowed down a few neighborhoods to research, along with their respective target markets, it’s time to focus on the competition.

That means looking further into secondary sources. To do so, check for websites that provide real estate agent, vendor, supplier information in specific localities. BiggerPockets and Parkbench neighborhood marketing platform , for example, provide information on local real estate agents and vendors.

As for a neighborhood itself, look into The Federal Housing Finance Agency (FHFA) . This website provides data on recently sold properties in specified areas.

You can also check The FNC Residential Price Index . This platform features exhaustive and up-to-date data on the real estate market from public records and valuations. This index also shines a light on market trends.

Step 3: Observe Your Desired Neighborhoods

Aside from looking at your direct competitors in the particular neighborhoods you set your sights on, you should also look into each neighborhood’s supply. This refers to the number of properties currently on offer in the neighborhoods.

Then, you’ll need to find how in-demand a particular neighborhood is. To find this, you’ll have to survey your target market, or even the broader market of consumers seeking to find a residence or space to move into.

If you survey your target market, you can get their opinions about moving into a neighborhood. The more responders who prefer a neighborhood, the more expensive its properties become. In short, demand dictates the competition of a region.

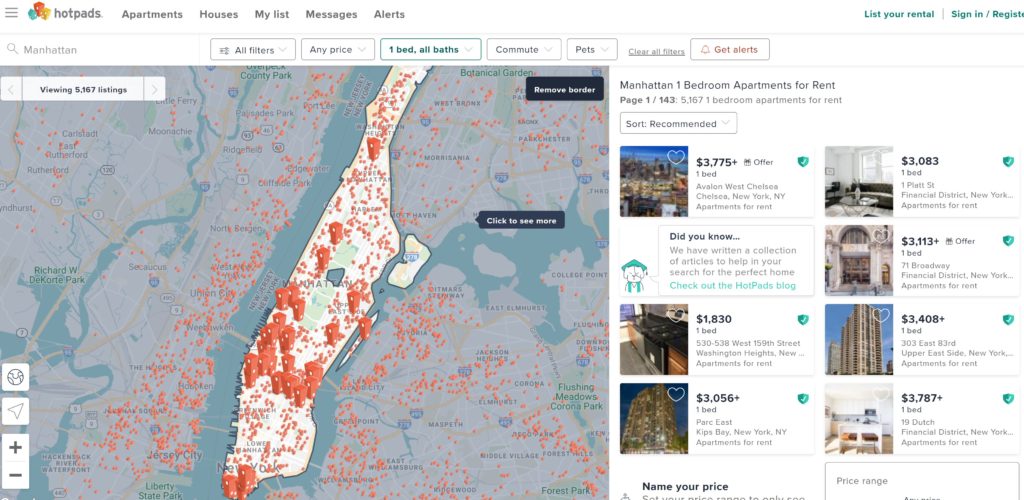

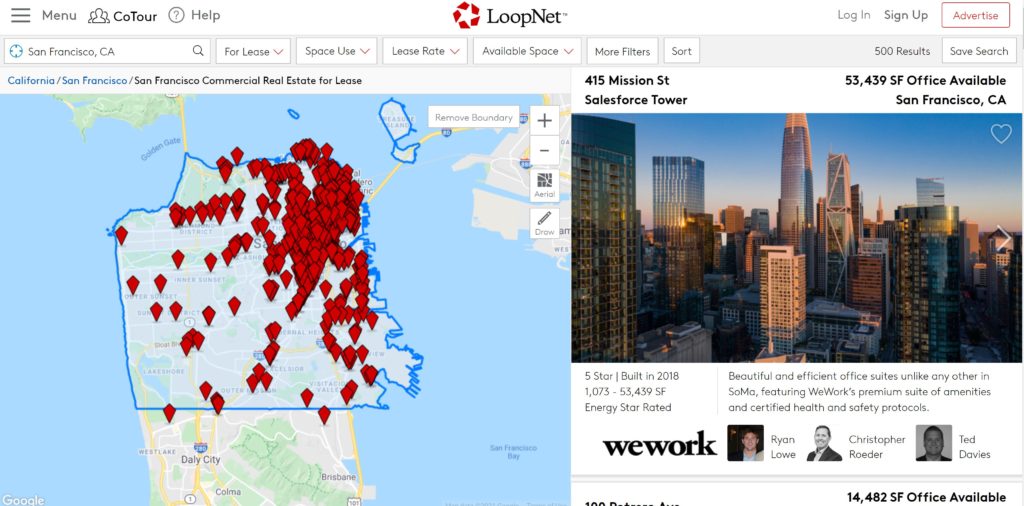

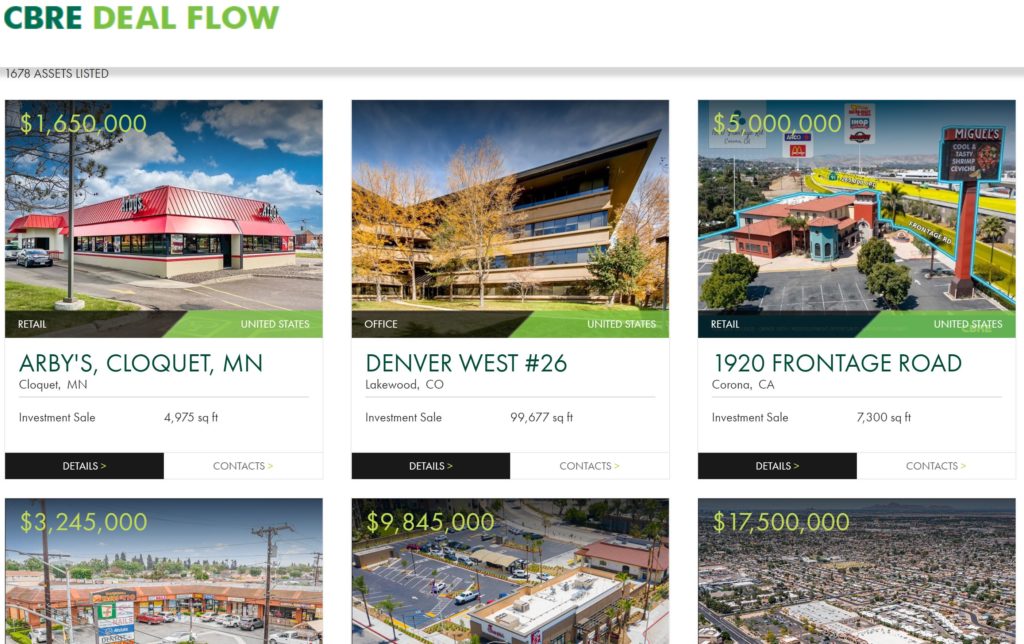

As part of your neighborhood observation, peruse several listings of the available properties, office space, apartments, or whichever real estate is most relevant to you. Pay attention to the prices in particular and compare them with your existing ones, or the ones you set out to charge.

This will give you a real-world view of pricing and pricing expectations of your target market.

Step 4: Analyze the physical elements of a neighborhood/property

Analyzing the properties of a neighborhood and the real estate you seek to sell requires not merely examining the physical properties of a home. Rather it also involves inspecting public utilities and services, along with general environmental aspects.

Here are the most pressing aspects to inspect that affect a property’s standing:

- Water resources

- Transportation in the area

- Regional climate

- Utilities offered and their functionality

Afterward, you will need to inspect the property itself.

- Size and square footage

- Number of rooms (bedrooms, bathrooms, other rooms)

- Age of properties (newer buildings tend to have a higher value)

- Amenities (decks, fireplaces, gardens, balconies, etc.)

- ANy recent or noteworthy improvements/ restorations

Step 5: Gauge how the neighborhood has been faring

After you examine the physical characteristics, you should get a deep read of how the neighborhood has been faring. This includes delving into the economics, construction and business performance of the region.

When developments are underway, they could impact a neighborhood’s properties. At times, they may incite new companies to arrive in the region. Some may impact the local economy positively, while others may worsen it.

An uptick in commercial real estate is usually a sign of a healthy local economy. This will stoke the interest of buyers and with more sales, the cost per property square foot will be on the rise.

Research the demographics of the neighborhood. This will allow you to be clued in to the target market as well as giving your buyers more insights. An elderly population, for example, is great to highlight to retirees and others within this age range.

But perhaps younger buyers are seeking a neighborhood with other young professionals.

Moreover, age and ethnicity are not enough to determine how a neighborhood will fare — and neither how your business will either. You’ll need to understand your target market at a deeper level.

That is where surveys rear their usefulness again. A survey with the right questions will give you all the answers you need to understand how to best appeal to your target market. It can also give you more insight as to the price and style of real estate your consumers are seeking.

A Wavering Market

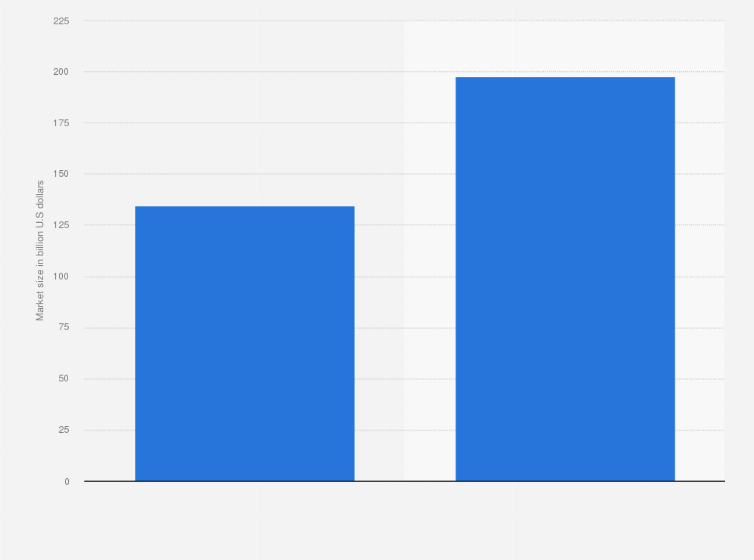

The real estate market is notorious for its rising costs, whether they concern rent or ownership. Unfortunately, this market has also been under the mercy of rocky times, such as the Great Recession and the Covid-19 pandemic. They have negatively affected sales and demand, especially for urban areas such as New York City .

Due to an exodus from Covid-19 hot spots, which were mostly urban, (at least early in the pandemic) suburban real estate has soared.

Frequently asked questions

What is market research.

Market research is the process of gathering information about target customers and markets in order to improve or introduce a product, feature, or service.

What is the goal of real estate market research?

The main goal of real estate market research is to understand if a real estate business will succeed in a specific location.

What factors should be considered while conducting real estate market research?

During a real estate market research project, you should seek to understand the following: changes in the market as a whole, current demand for and pricing of housing or commercial space, how your own prices compare to market averages, and current real estate marketing trends.

How can surveys be used during real estate marketing research?

A survey can provide real-time insight into market demands such as pricing, style, and how to appeal to your target audience.

How can demographics be used to plan marketing efforts?

By understanding the demographics of a target location, you can better understand the types of housing the population requires, their price points, and how to market to the various segments.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

- Coaching Team

- Investor Tools

- Student Success

- Real Estate Investing Strategies

Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

Real Estate Market Research: A How-To Guide

What is Market Research in Real Estate?

The Importance of Researching a Real Estate Market

How To Start Researching Your Real Estate Market

Tools and resources for in-depth research.

The real estate sector holds immense potential for long-term gains and financial security. However, one can’t emphasize enough the importance of thorough real estate market research. Without it, you’re essentially navigating without a compass. This guide is designed to lead you through the crucial steps of conducting comprehensive real estate market research that could make your venture well worth the work.

Before diving into the how-to’s, it’s essential to understand what market research in real estate actually involves. At its core, real estate market research is the systematic gathering, analysis, and interpretation of data related to property markets. This could encompass a wide range of factors like property values, rental rates, market trends, and consumer preferences. The goal is to obtain actionable insights that inform your real estate investment decisions, ensuring that you are making choices based on real data rather than just intuition or hearsay.

The Importance of Real Estate Market Research

Real estate market research is the cornerstone of any successful real estate venture . It’s akin to laying a strong foundation before you build a house. Neglect it, and you risk wasting both time and resources. According to data from the U.S. Bureau of Labor Statistics, approximately 20% of new businesses fail within the first two years, largely due to lack of proper research and planning. In real estate, these percentages can be even more daunting. Here’s why researching the real estate markets you plan to invest in can be so critical to your success:

Financial Benefits

Conducting diligent real estate market research can significantly improve your Return on Investment (ROI). Knowing where to invest, what type of property to invest in, and how much to invest are all answers derived from proper market research.

Risk Mitigation

The aim here is to reduce uncertainty. Investing without adequate research is akin to gambling your hard-earned money. Understanding market trends, property values, and neighborhood demographics can greatly mitigate your financial and strategic risks.

Embarking on real estate market research may seem like a daunting task, especially if you’re new to the industry. However, breaking it down into actionable steps can make the process more manageable and effective. Here’s a numbered guide on how to begin your research:

Define Your Objectives: The first step is to articulate what you aim to achieve with your real estate investment. Are you interested in residential properties for rental income, or are you leaning towards commercial real estate? Your investment goals will shape the kind of research you’ll need to conduct. Writing out a real estate business plan is a great way to define your goals.

Choose Your Location: Picking the right location is crucial. Each market has its own set of characteristics—growth rate, property taxes, rental yields, and more. Make sure to choose a location that aligns with your objectives. For instance, if you’re looking for rental income, consider areas with high rental demand like cities with universities or growing job markets.

Gather Basic Data: Start by collecting fundamental data points like average property prices, market trends, and rental rates in your chosen location. Websites like Zillow or local real estate agencies can provide this information. This initial data serves as the groundwork for your subsequent, more detailed research.

Identify Market Indicators: Dive deeper by identifying key market indicators like vacancy rates, neighborhood development plans, and employment statistics. Data from the US Census Bureau can be particularly helpful here. These indicators will give you a more rounded view of the market’s health and potential.

Study The Competition: Understand who your competitors are. Are there a lot of new developments coming up? What are the average rental or selling prices in those? This will help you gauge market saturation and potential profitability.

Utilize Online Tools: Make good use of online tools and platforms specifically designed for real estate market research. Websites like Realtor.com and various real estate investment apps offer in-depth analysis and data sets that can aid in your research.

Consult with Professionals: Before finalizing your research, consult with industry professionals. A local real estate agent can offer valuable insights that are not available through online resources. Financial advisors can help evaluate the financial aspects of your prospective investment.

Assemble Your Findings: Finally, compile all the data and insights you’ve gathered into a cohesive report. This will serve as a roadmap for your real estate investment journey, helping you make informed decisions.

In today’s interconnected world, technology has made the task of conducting real estate market research considerably easier. With a wealth of online tools and resources, you can dive into data and trends more deeply than ever before, enriching your understanding and enhancing your investment strategy.

Online Portals

Websites like Zillow , Redfin , and Trulia serve as treasure troves of information. These platforms offer not just property listings, but also valuable insights into market trends, comparable home prices, neighborhood reviews, and historical sales data. You can filter your search according to various criteria, such as property type, price range, and geographic location, making these online portals incredibly user-friendly and tailored to your specific research needs.

Local Government Records

Don’t underestimate the value of local government records and databases. You can find detailed tax assessments, property ownership histories, public infrastructure plans, and even future zoning changes that could affect your investment. Most of this information is freely available to the public and can be accessed through county or city government websites. These records provide a ground-level view of the local market conditions and can offer data that are more current and specific than generalized online portals.

Real Estate Agents and Brokers

While digital tools are indispensable, human expertise adds a layer of depth to your real estate market research that shouldn’t be overlooked. Real estate agents and brokers who have been working in a particular area for years possess nuanced insights into local markets that you won’t find in any database. They can tell you about the less obvious aspects that might affect property value, such as neighborhood safety, community vibe, and even the reputation of local schools. So, consider hiring a local agent to complement your online research.

Financial Tools

Financial analysis is an integral part of real estate market research. For this, platforms like Microsoft Excel or specialized real estate investment software can be incredibly useful. These tools help you in creating various financial models to evaluate potential ROI, cash flow projections, and risk assessments. By inputting different variables, you can simulate numerous scenarios to see how each one would affect your investment outcome. This enables you to make more informed decisions, backed up by robust financial analysis.

Investing in real estate is not a decision to be taken lightly, and it starts with comprehensive real estate market research. This guide was designed to walk you through the critical steps of this crucial preparatory stage. The real estate market is rich with opportunities designed to help you succeed, but it’s up to you to take the first step. Real estate market research isn’t just an option; it’s a necessity. Make this investment of time and effort, and it could pay dividends for years to come.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

NAR Settlement: What It Means For Buyers And Sellers

What is the assessed value of a property, what is bright mls a guide for agents and investors, how to pass a 4 point home inspection, defeasance clause in real estate explained, what is the federal funds rate a guide for real estate investors.

Real Estate Market Research: A Comprehensive Guide

Welcome to our comprehensive guide on real estate market research. Whether you are a seasoned real estate investor or a first-time homebuyer, understanding the importance of market research is crucial for making informed decisions. In this blog post, we will take you through the steps involved in conducting effective real estate market research, explore the tools and techniques available, provide a case study of successful research, and highlight common mistakes to avoid. By the end of this guide, you will have a solid understanding of how to navigate the complex world of real estate market research and make informed decisions that can maximize your investment potential. So let's dive in and unlock the secrets of successful real estate market research!

Understanding the Importance of Real Estate Market Research

Real estate market research is the foundation for making informed decisions in the real estate industry. Whether you are a real estate investor, developer, or homebuyer, understanding the importance of conducting thorough market research is essential for success. In this section, we will explore the key reasons why real estate market research is crucial and how it can benefit you.

1.1. Identifying Market Trends and Opportunities

One of the primary reasons to conduct real estate market research is to identify current and emerging market trends. By analyzing data and market indicators, you can gain valuable insights into the direction of the real estate market in a specific area. This information allows you to identify opportunities for investment, whether it's in residential, commercial, or industrial properties.

1.2. Assessing Demand and Supply Dynamics

Market research enables you to assess the demand and supply dynamics in a particular real estate market. By understanding the demand for certain types of properties, you can identify areas where there is an undersupply or oversupply. This knowledge can guide your investment decisions, allowing you to focus on markets where there is a high demand and limited supply, maximizing your potential returns.

1.3. Evaluating Market Value and Pricing

Accurate valuation of real estate properties is crucial for making informed buying or selling decisions. Market research provides you with the necessary data to evaluate the market value of properties based on factors such as location, property type, amenities, and market conditions. Understanding the pricing trends in a specific market can help you negotiate better deals and avoid overpaying or underselling.

1.4. Mitigating Risks

Real estate market research helps mitigate risks associated with property investments. By analyzing market trends, you can identify potential risks such as market fluctuations, economic downturns, or oversaturated markets. This information allows you to make informed decisions and implement risk management strategies to protect your investments.

1.5. Supporting Decision-Making

Market research provides you with the necessary data and insights to make informed decisions in the real estate industry. Whether you are considering investment opportunities, evaluating potential development projects, or deciding on the purchase of a property, market research guides your decision-making process. It helps you weigh the pros and cons, assess the potential returns, and make strategic choices that align with your goals.

1.6. Gaining a Competitive Edge

In a competitive real estate market, having access to reliable market research gives you a competitive edge. By staying informed about market trends, demand and supply dynamics, and pricing patterns, you can make decisions faster and more confidently than your competitors. This allows you to seize opportunities before others, negotiate better deals, and position yourself as a knowledgeable and trustworthy player in the market.

Understanding the importance of real estate market research is the first step towards becoming a savvy investor or buyer. By harnessing the power of market research, you can make informed decisions, mitigate risks, and maximize your potential returns in the dynamic world of real estate. In the next section, we will delve into the step-by-step process of conducting real estate market research.

Steps to Conduct Real Estate Market Research

Conducting effective real estate market research involves a systematic approach that encompasses various steps. In this section, we will guide you through the essential steps to conduct comprehensive market research in the real estate industry. By following these steps, you will gather valuable insights and data to inform your investment decisions. Let's explore each step in detail:

1. Define the Purpose and Objectives

Before diving into market research, it's crucial to clearly define the purpose and objectives of your research. Ask yourself what specific information you are seeking and what decisions you need to make based on that information. Are you looking to identify investment opportunities, evaluate market trends, or assess the feasibility of a development project? Defining your purpose and objectives will help you focus your research efforts and gather the most relevant data.

2. Identify Target Market

Once you have defined your purpose, it's important to identify your target market. Determine the specific geographic area or property type that you want to focus on. For example, you may be interested in residential properties in a particular neighborhood or commercial properties in a specific city. By narrowing down your target market, you can gather more specific and accurate data.

3. Collecting and Analyzing Data

The next step is to collect and analyze data related to your target market. There are several sources of data you can utilize, such as government reports, real estate listings, local housing market reports, and demographic information. Collect data on factors such as property prices, rental rates, vacancy rates, population growth, employment rates, and infrastructure development. Use statistical analysis and data visualization techniques to gain insights from the collected data.

4. Interpreting the Results

Once you have gathered and analyzed the data, it's time to interpret the results. Look for patterns, trends, and correlations within the data to gain a deeper understanding of the market dynamics. Identify any key findings or insights that can inform your investment decisions. For example, you may discover a rising demand for rental properties in a specific neighborhood, indicating a potential investment opportunity.

5. Making Informed Decisions

Based on the insights gained from your research, it's time to make informed decisions. Evaluate the risks and rewards associated with potential investment opportunities. Consider factors such as market trends, demand and supply dynamics, pricing patterns, and potential risks. Use the collected data and analysis to assess the viability and profitability of your investment options. Make decisions that align with your goals and risk tolerance.

Conducting real estate market research is a systematic process that involves defining objectives, identifying the target market, collecting and analyzing data, interpreting the results, and making informed decisions. By following these steps, you can gather valuable insights and data to guide your real estate investment journey. In the next section, we will explore the tools and techniques available for conducting real estate market research.

Tools and Techniques for Real Estate Market Research

To conduct effective real estate market research, it is essential to utilize the right tools and techniques. In this section, we will explore various tools and techniques that can enhance your market research efforts and provide valuable insights. From real estate analytics tools to surveys and competitive analysis, let's delve into the tools and techniques available for conducting comprehensive real estate market research.

1. Real Estate Analytics Tools

Real estate analytics tools are powerful resources that provide in-depth data and analysis on the real estate market. These tools utilize algorithms and data mining techniques to gather and interpret large sets of real estate data. They can provide valuable information on property prices, market trends, rental rates, historical data, and more. Examples of popular real estate analytics tools include Zillow, Redfin, Realtor.com, and CoreLogic. By leveraging these tools, you can gain a deeper understanding of the market dynamics and make informed investment decisions.

2. Surveys and Interviews

Surveys and interviews are valuable techniques for collecting primary data and gaining insights directly from potential buyers, sellers, investors, and industry professionals. By developing well-designed questionnaires or conducting interviews, you can gather information on preferences, buying behavior, market perceptions, and more. Surveys and interviews can be conducted online, in person, or through telephone interviews. These methods allow you to gather qualitative and quantitative data that can supplement your market research efforts and provide a deeper understanding of market dynamics.

3. Competitive Analysis

Competitive analysis involves studying and evaluating your competitors in the real estate market. By analyzing their strategies, pricing, marketing efforts, and market share, you can gain insights into the competitive landscape and position yourself strategically. Look for information on competing properties, their features, amenities, pricing, and market positioning. This analysis helps you understand the strengths and weaknesses of your competitors and identify opportunities to differentiate yourself and gain a competitive advantage.

4. SWOT Analysis

SWOT analysis is a strategic planning technique that assesses the strengths, weaknesses, opportunities, and threats related to a specific real estate market. By conducting a SWOT analysis, you can identify the internal and external factors that impact the market and your investment decisions. Evaluate the strengths and weaknesses of the market, such as infrastructure, job growth, and property inventory. Identify opportunities for growth and potential threats, such as economic downturns or regulatory changes. This analysis provides a comprehensive overview of the market and helps you make informed decisions.

Utilizing the right tools and techniques is crucial for conducting comprehensive real estate market research. Real estate analytics tools, surveys, interviews, competitive analysis, and SWOT analysis are just a few examples of the tools and techniques available. By leveraging these resources, you can gather valuable insights, analyze market trends, and make informed decisions in the dynamic real estate market. In the next section, we will explore a case study of successful real estate market research to understand how these tools and techniques can be applied in practice.

Case Study: Successful Real Estate Market Research

In this section, we will examine a case study of successful real estate market research to understand how the tools and techniques discussed earlier can be applied in practice. By exploring a real-life example, we can gain insights into the process, methodology, findings, and outcomes of effective market research. Let's dive into the case study and learn from its success.

1. Identifying the Problem

In our case study, let's imagine a real estate development company, ABC Developers, looking to invest in a new residential project in the city of Sunshineville. The company wants to identify the most lucrative location and property type that will attract potential buyers and yield the highest return on investment. The problem is to determine the target market, demand-supply dynamics, and pricing trends in Sunshineville.

2. Research Methodology

To conduct the market research, ABC Developers employed a combination of tools and techniques. They started by utilizing real estate analytics tools like Zillow and local MLS listings to gather data on property prices, rental rates, and market trends in Sunshineville. They also conducted surveys and interviews with potential homebuyers to understand their preferences, needs, and buying behavior.

3. Findings and Recommendations

Based on the research, ABC Developers discovered several key findings. Firstly, they identified a growing demand for affordable housing options in Sunshineville due to an influx of young professionals and families. Secondly, they found that the demand was particularly high for townhouses and condominiums with modern amenities and proximity to public transportation. Additionally, ABC Developers observed a limited supply of such properties in the desired locations.

Based on these findings, ABC Developers recommended focusing on developing a townhouse project in a centrally located neighborhood with access to amenities and transportation. They also suggested pricing the units competitively to attract potential buyers and maximize profitability.

4. Outcome and Learnings

Following the research findings and recommendations, ABC Developers successfully acquired a plot of land in a prime location within Sunshineville and commenced the development of a townhouse project. The project received significant interest from potential buyers and was sold out within a short period. The units were priced competitively, and the amenities and location met the preferences of the target market.

The case study highlights the importance of conducting thorough market research before making investment decisions. By utilizing tools like real estate analytics, surveys, and interviews, ABC Developers gained valuable insights into the market dynamics and tailored their project to meet the demands of the target market. The successful outcome demonstrates the significance of data-driven decision-making and understanding the preferences and needs of potential buyers.

By studying this case study, we can learn how to apply the tools and techniques discussed earlier in real-life scenarios. It emphasizes the importance of gathering accurate data, analyzing market trends, and aligning your project with the demands of the target market. In the next section, we will discuss common mistakes in real estate market research and how to avoid them.

Common Mistakes in Real Estate Market Research and How to Avoid Them

In the world of real estate market research, there are some common mistakes that can hinder the accuracy and effectiveness of your research efforts. In this section, we will discuss these common mistakes and provide insights on how to avoid them. By being aware of these pitfalls, you can ensure that your market research is comprehensive, reliable, and insightful.

1. Inadequate Research Design

One common mistake is having an inadequate research design. This could include not clearly defining the research objectives, using biased sampling methods, or neglecting to include a diverse range of data sources. To avoid this mistake, it is crucial to clearly define your research objectives, ensure your sample is representative of the target market, and utilize various data sources to gather comprehensive information.

2. Ignoring Local Market Conditions

Failing to consider local market conditions is another common mistake. Real estate markets can vary significantly from one location to another, and what works in one area may not work in another. It is important to understand the unique characteristics of the local market, including factors such as demographics, economic conditions, and regulatory environment. By ignoring local market conditions, you risk making decisions based on inaccurate assumptions.

3. Reliance on Outdated Data

Using outdated data is a critical mistake that can lead to inaccurate analysis and decision-making. Real estate markets are dynamic, and trends can change rapidly. It is essential to ensure that the data you are using is current and up-to-date. Regularly update your research with the latest market data, trends, and indicators to ensure that your analysis is accurate and relevant.

4. Neglecting to Validate Results

Failing to validate the results of your research is a common oversight. It is important to verify the accuracy of your findings and conclusions through various means. This could include cross-referencing data from multiple sources, conducting follow-up surveys or interviews, or seeking expert opinions. Validating your results adds credibility to your research and enhances the reliability of your findings.

5. Overlooking Qualitative Factors

Market research is not solely about numbers and data; qualitative factors also play a significant role. Ignoring qualitative factors such as customer preferences, lifestyle trends, and community dynamics can lead to incomplete insights. Incorporate qualitative research methods like surveys, interviews, and focus groups to gather insights into the subjective aspects of the market. This holistic approach will provide a more comprehensive understanding of the market and inform your decision-making process.

By avoiding these common mistakes, you can enhance the accuracy and effectiveness of your real estate market research. Ensure your research design is robust, consider local market conditions, use up-to-date data, validate your results, and incorporate qualitative factors. By adopting these practices, you will make more informed decisions, minimize risks, and maximize the success of your real estate endeavors.

Congratulations! You have now reached the end of our comprehensive guide on real estate market research. We have explored the importance of market research, the steps involved, tools and techniques to utilize, a case study of successful research, and common mistakes to avoid. Armed with this knowledge, you are well-equipped to navigate the complex world of real estate market research and make informed decisions. Best of luck in your future real estate endeavors!

Drive smarter growth with the industry's most accurate, accessible, and up-to-date local market research platform.

Related Posts

Retail Analytics Use Cases

Guide to Commercial Real Estate Investing

A Comprehensive Guide to Investment Property Analysis

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Real estate market analysis: What it is & How to do it

A real estate market analysis is a tool that helps us to gather information to know, for example, if we should invest in a property or to determine the rental potential of a city or district. In fact, it would be crazy to buy a property without having information to support a purchase of this size.

Market research is the preliminary step that every investor must take before jumping into the market. The objective is to be sure that the project is viable and that it fits in the existing market.

Not all real estate investors are patient enough to competently conduct a real estate market analysis. If you want your real estate business to stand out from the competition, you need to do some research. So, what is a market study in real estate?

LEARN ABOUT: Purchasing Process

What is a real estate market analysis?

A real estate market analysis, also known as a comparative market analysis, is an analysis of current market values of properties, comparable to a property you are looking to buy or sell.

A real estate market analysis should always be done, whether buying or selling a property, as it will help to understand the current market, how much similar properties are worth, if it is an investment property, how much you can charge for rent, etc.

Real estate agents and brokers create reports to help sellers set list prices for their homes and, less frequently, to help buyers make competitive offers.

The information gathered through a real estate market survey helps the seller choose a listing price and helps buyers see if the asking price is too high, low or reasonable.

LEARN ABOUT: Real Estate Surveys

Why do a real estate market analysis?

There are several reasons to do this type of study, the main one is to have information that allows you to invest and buy safely. Other reasons also include:

- To know if you should invest in one city instead of another.

- To identify which elements hinder investment in certain places.

- To know demographic aspects to determine the evolution of the area where you want to invest.

- To have information about investment projects in certain areas and to know if in the future they will have a development that will increase the value of the properties.

By knowing the housing market prices, you will always have the opportunity to negotiate a lower price and avoid overpaying the market value of a property.

LEARN ABOUT: Data Analytics Projects

Tips for conducting an effective real estate market survey

Before starting to collect information, it is necessary to clearly define the market in which you are going to position yourself: type of products or services offered, type of market (individuals, companies, administrations, etc.), target geographic segmentation , etc.

A well-defined market is an essential starting point for conducting a relevant study.

- Property analysis: To conduct a real estate market analysis is to perform a property analysis. The area and neighborhood, lot size, construction time, services and amenities, etc. should be evaluated.

- Evaluate the original price: Once you have performed the property analysis, search online for the original listing, if possible. This will give you a good idea of the overall condition of the home. Review the photos and descriptions for any updates, remodeling or potential problems.

- Verify property value estimates: Use online resources to give you the estimated market value of the home. Since these are market value estimates, they may not be totally accurate, especially if changes have been made to the home. But this will provide a good starting number to continue your real estate market research.

- Comparisons: Make a comparison of the property with others in the same area, aspects such as size, price and other elements will help you determine the value.

- Decide the market value: According to all your research, you should have a price range for the value of your property. Take into account everything you have observed and analyzed and how it will affect the value.

To conduct a study you can choose between two solutions: do market research on your own with market research tools , or hire someone.

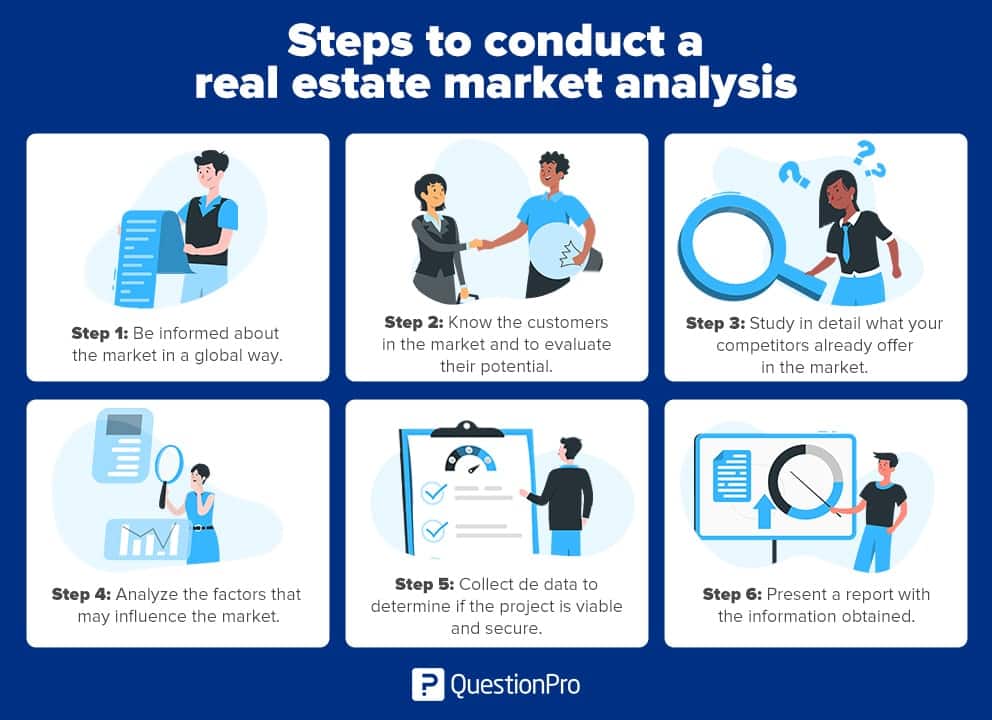

Steps to conduct a real estate market analysis

You need to take a structured and organized approach when conducting real estate market research. To do this, you can segment your analysis around these four axes: market, demand, supply and environment, and then you have to ask the right questions.

The objective is clear: to analyze the market potential and validate the commercial viability of your project.

Step 1: the study of the market and its evolution

As a first step, it is important to be informed about the market in a global way. The objective is to improve knowledge in this field: market volume, trends, likely evolution.

Here is an example of a list of questions to ask when studying the market and its likely evolution:

- What is the volume of the market? In particular, in terms of turnover, customers, quantity sold?

- How is the market doing now?

- What are its prospects for the coming years? A market may be growing or stagnating.

- What are the current market trends?

- What products or services are available in the market?

- Who are your direct or indirect competitors? What do they offer? What are the commonalities and differences between what the competition offers and your range of products/services?

- What are your terms and conditions of sale?

- Who are my potential suppliers and what terms and conditions can they offer me?

These questions will allow you to develop your knowledge of the market situation and the players involved.

We recommend you check this guide to conduct a market survey.

Step 2: Studying the demand

By studying the demand, the objective is to know the customers in the market and to evaluate if there is potential to be exploited. Here is an example of a list of questions to ask when considering demand in a real estate market survey:

- How many customers are there in this market? How is this number changing (increasing, decreasing, stagnant)?

- Who exactly are these real estate customers? Where are they located?

- What is the consumption rate of the customers? How do they behave?

- What are the consumer’s choice criteria? What is their budget? What are the important points to trigger a purchase?

Step 3: Studying of the offer

The analysis of the offer consists of studying in detail what your competitors already offer in the market. Here is an example of a list of questions to consider the offer:

- Who are the competitors in the market?

- Which companies have the largest market shares?

- What is the size of the main competitors? Where are they located and how do they choose their locations?

- How long have they been around and what is their financial health?

- What criteria do some competitors use to succeed better than others?

An in-depth study of your competitors’ offerings can help you identify opportunities to prepare your future offerings and gain competitive advantages.

Through a real estate market analysis you will have a better understanding of what works, the essential criteria for success, and also what has not worked.

Step 4: the environmental and legal study

The environmental analysis study consists of analyzing the factors that may influence the market, such as applicable regulations, technological developments or any other element that may have an influence.

Here is an example of a list of questions to ask when studying the environment:

- What innovations are affecting the market?

- What is the regulatory framework governing the market?

- Are there laws specific to this market?

- What are the trends in the evolution of legislation?

- Are there professional groups or other actors acting or influencing the market?

Step 5: Data collection process

The data collection process is one of the most important steps in conducting real estate market research, as it allows you to gather information that will help you determine if the project is viable and your investment is secure.

QuestionPro allows you to easily conduct your field research to get the data you need. It doesn’t matter if you don’t have Internet, our Offline App allows you to conduct surveys through mobile devices and download the information once you have a wifi connection.

Conduct real estate surveys and start getting the information you need to secure your investment in the real estate market.

Step 6: Reporting the results

Presenting a report with the information obtained will allow investors to perform an analysis and determine the best strategies to secure the investment.

Our survey software allows you to visualize the collected data in real time, which helps you to pre-analyze the information and prepare a report where you highlight what is relevant and stakeholders can visualize it and make better decisions.

Start standing out in the real estate industry by making the right decisions with the help of data!

If you are thinking of conducting real estate market research, we can help you.

LEARN ABOUT: 5 Ways Market Research

At QuestionPro we have the best tools and a team of professionals that will help you solve all your doubts about our platform, contact us!

MORE LIKE THIS

Techathon by QuestionPro: An Amazing Showcase of Tech Brilliance

Jul 3, 2024

Stakeholder Interviews: A Guide to Effective Engagement

Jul 2, 2024

Zero Correlation: Definition, Examples + How to Determine It

Jul 1, 2024

When You Have Something Important to Say, You want to Shout it From the Rooftops

Jun 28, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

- Explore Properties

- Agents & Brokers

- Sell Your Property

- Track with Stessa

- Screen with RentPrep

- Investor Services

- Investment Solutions

- News & Press

- Browse Properties

How to do a real estate market analysis like a pro

One of the most difficult things about buying a rental property investment is to avoid getting emotionally involved. In a hot real estate market , it’s easy to make the wrong decision when other home buyers are lined up ready to make an offer.

Successful real estate investors always say that money is made when the property is purchased, not when it’s sold. That’s because it’s much easier to add value to a rental property than to try to turn a profit on a house that was overpriced.

In this article we’ll discuss in detail how to do a real estate market analysis to buy a property that makes good business sense.

You don’t always need a real estate agent to understand the market

While asking a real estate agent to do a market analysis for you has some advantages, there are also some big drawbacks as well.

For example, the agent may not have the deep experience and specialized training needed to work with rental property investors. Or, the real estate agent may be so wrapped up in day-to-day market activities that they’re simply unable to see the big picture that real estate investors rely on for success.

Fortunately, there are several great ways to get the information you need to do a real estate analysis on your own.

Look at historical data first

Before you can understand where the market is going, it’s important to understand where it’s already been. Reviewing online real estate market performance reports from Zillow or the National Association of Realtors ( NAR ) make it easy to learn what’s been selling and for how much.

Dig deep into your target market and neighborhood

Once a specific strategy has been selected for each market, investors should immerse themselves in everything there is to know about the area.

A great resource for in-depth real estate market information are the Roofstock market summaries . You’ll find everything you need to know arranged in an easy-to-understand format, including:

- Market overview

- Data on population and job growth

- Major employers and workforce education levels

- Local housing market activity for the city and metro area

- Past, current, and future market trends for rental property

- Quality of life rankings to help predict future demand for real estate

Use multiple sources to gather unbiased data

By using the internet to gather transparent data from multiple sources, you’ll filter out the built-in bias that some people within that market might have.

Resources rental property investors use to gain a broad perspective of the local real estate market include:

- Local newspapers

- Community websites

- Social media

- Investment clubs

- Online investment portals

Understand how market factors affect investment strategy

The most successful rental property investors choose markets that best fit their investment strategy.

For example, investors focused on cash flowing rental property may find Birmingham or Pittsburgh an excellent match for a long-term buy-and-hold strategy. On the other hand, real estate investors looking for rapidly-rising home prices are opting to invest in markets such as Atlanta and nearly every city in Florida .

Some of the key factors to consider when analyzing a real estate market include:

- Property types with the greatest demand

- Most active agents and investors

- Who the local home wholesalers are

- Percentage of renter-occupied households

- Housing inventory stock

- Where the biggest employers are located

6 Key Steps to Real Estate Market Analysis

When doing a real estate market analysis, it’s best to use recent sales prices rather than asking prices for homes that are currently on the market. That’s because the listing price is what a seller hopes to get, while the final sales price is what the seller actually received.

The steps real estate investors follow when doing a market analysis are similar to what a professional appraiser does. When done properly, there shouldn’t be a significant difference between what you think a property is worth and the price the appraisal comes in at.

1. Research neighborhood quality and amenities

County assessor websites and Street View by Google Maps are excellent tools to use to research and narrow down potential property purchases without ever leaving your office. If the house backs to a garbage dump or major highway you can simply delete the property from your list and move on to the next one.

Other neighborhood qualities and amenities that affect property value include closeness to public transportation, proximity to shopping and schools, and nearby recreational amenities like parks and beaches.

If you have your eye on a particular single-family home, you can use the free rental property analyzer in this article to forecast the potential return of the property. Simply enter some information to view projected key return on investment (ROI) metrics, including cash flow, cash-on-cash return, net operating income, and cap rate.

2. Obtain property value estimates for the area

Calculating the average sale price per square foot for home sales in the area you’re considering is a good way to determine a “ballpark” property value estimate. Local real estate agents, property management companies, online listing databases, and the county assessor website are all good resources to use.

Keep in mind that these average calculations are just that. They don’t take into account unique aspects of the house or the neighborhood that may increase or decrease the value of your subject property.

3. Select comparables for your real estate market analysis

Begin your initial real estate market analysis by selecting six comparable properties. Three should be homes in the neighborhood that have sold within the last few months; then choose three more homes that are currently on the market.

When selecting comparables for your subject property look for:

- Homes with the same number of bedrooms and bathrooms.

- Houses having square footage within 10% to 20% of your intended purchase.

- Property with a similar lot size and shape.

- Select houses with a similar original construction date, elevation (also known as architectural design), and number of floors or stories.

- Homes with similar features such as free standing garage, outdoor swimming pool or patio deck, and scenic views.

- Choose homes in the same neighborhood and preferably on the same block.

- Select properties that are in the same school zone (because a low-quality school can have a significant negative impact on value).

4. Calculate average price of comparable listings

With this information in hand, the next step is to create a spreadsheet for all seven properties – your subject property (the one you’re thinking about buying), the three recent sales, and the three homes actively on the market for sale.

Your first column should list each house by address. Then, create individual columns for specific features and amenities:

- Selling or listing price

- Square feet

- Number of floors

- Age of house

- Kitchen upgrades

- Bathroom upgrades

- Recreation room or bonus areas

- Enclosed patio or sunroom

- Water heater and furnace condition

- Central air-conditioning and age

- Roof age, condition, and roofing materials

- Garage, carport, or on street parking

- Swimming pool

After you’ve filled out your spreadsheet, calculate the average price per square foot for each of the seven houses.

5. Fine-tune your market analysis with adjustments to your comparables

Every piece of real estate is unique, so the odds are that not every home on your list of comparables has the exact same features and amenities.

To make sure you’re comparing apples-to-apples, you’ll need to make adjustments to your comparables. An adjustment is something that adds or subtracts value from your subject property.

By using the spreadsheet format you’ll be able to see a pattern of how the specific features and amenities of each house affect the sales or listing price, and the price per square foot.

For example, because swimming pools and newer roofs can add value, the price per square foot may be higher. Homes with only 2 bedrooms will be worth less than 3 bedroom homes, and property with an old roof or outdated heating and cooling system will have less value than a house with recently updated equipment.

When you’re finished making adjustments to your comparables, recalculate the price per square foot. This will give you an accurate idea of the fair market value of your subject property.

6. Put your team to work

Now that you have a good idea of what the house is worth, your final step is to get the ball rolling and put your local market real estate team to work.

Have your local real estate agent or property manager visit the property. If you’re still building your team, check out Roofstock’s partner community .

Your boots-on-the-ground team should pay close attention to curb appeal, landscaping, neighboring houses, overall property condition, and the need for any immediate repairs or updating. Out-of-state investors can also use Google Maps or local companies that provide aerial drone video and photography services.

Also, compare the data on your market analysis to the actual features and amenities of the subject property and the information from your property inspection report. Mistakes can and do occur on listings and even county assessor websites.

Common FAQs about a real estate market analysis

Question: Can I find comparables without using the MLS?

Answer: Absolutely. Additional resources for finding recent sales and active listing information include public property records on the county assessor website, Zillow, and Roofstock’s marketplace of active listings.

Question: Should I look at expired listings when doing a real estate market analysis?

Answer: Many real estate investors review expired listings and ‘off market’ listings as a way to gauge what price the market will bear. Usually, homes that leave the market without being sold are overpriced relative to their true market value.

Question: Is a bigger house always a better value?

Answer: Generally, the best houses for real estate investors are the ones that match the median range in the neighborhood. For example, if most of the homes in an area have three bedrooms, smaller homes may be difficult to rent while bigger houses may generate less income per square foot compared to the market norm.

Question: What are the most important factors to consider when selecting comparable properties?

Answer: The 3 main factors to consider for choosing the best comparables are how recently the property sold, where the house is located in relation to the subject property, and unique characteristics of each comparable.

Put your real estate market analysis to work

Doing a good real estate market analysis helps you understand where you are in the real estate market cycle and whether it’s better to buy, sell, or hold.

Investors buying property use a market analysis to identify homes that are profitable and offer the best fit for their investment strategy. Sellers create a real estate market analysis to determine best sales price and marketing strategy.

The fact is that there’s money to be made in any real estate market. Investors use online listing platforms such as Roofstock to determine potential rental property returns and market values for rental property throughout the U.S.

Jeff has over 25 years of experience in all segments of the real estate industry including investing, brokerage, residential, commercial, and property management. While his real estate business runs on autopilot, he writes articles to help other investors grow and manage their real estate portfolios.

Roofstock makes it easy to get started in real estate investing.

Join 100,000+ Fellow Investors.

Subscribe to get our top real estate investing content., subscribe here, recommended articles.

How much is a rental property: The up-front & recurring costs

Roofstock vs. PeerStreet: A head-to-head comparison

Roofstock vs. RealtyShares: A head-to-head comparison

- Sell Properties

- Manage with Stessa

- Institutions

- General Inquiries

- (800) 466-4116

- [email protected]

- Get The Edge!

- 7 Day Challenge

- Property Development System

- One Minute Feaso

- Lead Developer+

- Real Estate Pro Forma

- Real estate market analysis in 13 easy steps

Steps to real estate market analysis

What is real estate market analysis?

Real estate market analysis, also known as comparative market analysis, is the process of evaluating and forecasting real estate markets to make sound investment decisions.

It is a key component of real estate investing , and there are a variety of methods that can be used to conduct a real estate market analysis.

The most important part of any comparative market analysis is data collection, so ensure you have accurate and up-to-date information on all aspects of the real estate market.

It includes site-specific and local factors, as well as current and emerging competition.

In simple words, you will be evaluating the current market value of properties that are similar to the one you are considering purchasing or selling.

You are missing out if you haven't yet subscribed to our YouTube Channel

What is included in a real estate market analysis?

1. Market study

- Local economies analysis - Examines the fundamental factors determining the demand for real estate in a specific market .

- Real Estate Market analysis - Examines the demand and supply of a specific property type in the market.

- Marketability analysis - Examines a specific development or property to determine its market competitiveness.

2. Studies based on individual decision

- Feasibility Study Analysis - Assesses whether a particular project is likely to be financially viable and appropriately implemented if pursued under a proposed programme. It's related to develop-ability, financial feasibility and investment analysis.

- Real Estate Investment Analysis - Also known as real estate proforma , which analyses a property to determine if it is a good investment. It includes modelling various timelines and or financing options to determine the best financial outcome under various assumptions.

Your real estate market Analysis should answer three key questions:

- Is there a demand for the type of product you are developing?

- What rent/price can you charge for your project, and how quickly will the market accept the project?

- How can the project be planned and marketed to increase its marketability?

- Property Development Feasibility Study 101

- Real Estate Development Proforma - Ultimate Guide

How to do real estate market analysis like a pro?

Step 1 - Choose an investment property

Start with location

The first step of your real estate market analysis should be finding a location of a particular property, whether residential, commercial or industrial, which will determine its value.

Location analysis is performed based on improvements, zoning and competition. It also considers the availability of similar properties.

Determining the property's market value

There are many theories and methods available. Some use inaccurate statistical bases; others use local trends or regional trends.

It is impossible to determine the market value of real estate purely based on visual inspections and other non-fundamental indicators. These selections should be made after a thorough comparative analysis of all real estate markets.

The following questions pose challenges for real estate investors performing market analysis:

- What are the factors that determine a fair market value of a property?

- What is the best way to compare properties of similar types?

- How much does an investment property cost?

Analyse the collective economic, demographic, and local factors that affect real estate values.

Step 2 - Collect decision making data

The data collection should be viewed as competitive intelligence. For all sorts of data, the analyst must consider bias.

Raw data, also known as primary, is unanalysed and collected by the analyst. This could include reading classified ads, new development announcements, legal notices and census data. Secondary data is data analysed by someone else, who then tells the analyst to conclude.

On the demand side, the analyst should consider the following factors:

- Household size

- Demographic features

- Purchasing power

- Affordability

- Employment statistics

- Commuting patterns

The following items are included in determining the supply side.

- Available space inventories.

- Vacancy rates and the existing property inventory's character.

- Recent space absorption, including the sorts of tenants or buyers.

- Projects that are now being built or are in the pipeline.

- The differences in market rents/sale prices by location and quality.

- Existing and projected projects' features, functions, and benefits.

- Concessions and terms.

The number of information sources available is also not limited. Newspapers, census and private databases, tax rolls, advertisements, and maps, etc. Any source that discloses something of interest—may be used by analysts.

The real estate market analyst may interview brokers, owners, planners, and local officials. The purpose of the interview is to gather as much information as possible about the market.

Step 3 - Understand local government requirements

The analyst must be familiar with the local government. The government is your largest partner in the real estate business.

If you want to conduct a project, you must first grasp how the political structure supports or inhibits your project. This includes understanding zoning laws, building codes, and other regulations that may impact the real estate market.

Almost everyone in the real estate industry conducts market research:

Analysis from private sources

- Appraisers / Property Valuers

- Real Estate and Financial Brokers

- Real Estate Developers

- Real Estate Investors

- Lenders and asset managers.

Analysis from public sources

- Urban & town planners

- Consultants in economic development

- Governmental organisations.

Market analysis is utilised in the private sector to increase profitability (and reduce losses by reducing market risks). On the other hand, the public sectors often include a framework of repercussions beyond economics or feasibility, such as density, traffic, or design.

Step 4 - Feasibility analysis and investment analysis

Feasibility study will help you determine if the investment property is a good fit for your investment goals. The feasibility study should include a detailed analysis of the costs and benefits of the investment.

The feasibility analysis process is designed to see if the numbers add up given current perceptions of how a project should go, how much it will cost, and who will buy or rent the property.

Investment analysis is a related technique that looks at the same financial questions from the investor's perspective.

Feasibility - often linked with developers and project management—is a component of market analysis for developers, whereas investment analysis explores the same concerns with a different set of options.

A developer may compare various projects, sites, and real estate markets; similarly, an investor may compare potential real estate investments against non real estate alternatives.

Funding factors will, of course, be reviewed by the investor as part of the research; nevertheless, financing is not limited to investors.

Lenders and potential lenders will conduct various investment analyses to assess risk and choose the best type of property development financing .

Market analysis is essential for a real estate project's first feasibility assessment , but it doesn't end there. Throughout the project's development and management phases, market research plays a significant role in creating the project.

Market experts are frequently contacted for repositioning measures after a project is up and going and the developer finds that absorption does not meet predictions.

There are as many different types of market analysis as there are different sorts of development initiatives, stages of development, and interests served.

- Property Development Finance: Guide To Property Development Funding

Market analysis includes:

- Determining the timing for demand.

- Analysing the direct relationship between demand and supply (which should consider the role of competition).

- Calculating investment rates of return

Market study vs Feasibility study

What is market study.

Market study focuses on three main areas of evaluation: the location, the demand for the product, and the supply of comparable items. Answering specific issues posed by lenders, equity partners, or investors should always be the crucial step in any market study.

Factors affecting the cost of market study

- Complexity of real estate market

- Data availability

- Methodology used

- Number of properties studied

- Size of real estate market

- Time frame of study

- Type of real estate market analysis

The difficulties of location and supply and demand analyses lead to a series of essential questions:

1. Is there sufficient demand for the existing or projected upgrades to ensure that vacancies are kept to a minimum? This should include demographic analysis, as well as income, employment, and growth projections.

Price segmentation and coordination with marketability may be additional market components beyond supply and demand analysis.

2. Is there a market for such advances, and if so, how easily can the development be sold? What effect would the proposed development have on present supply in the nearby area (local market) and the broader market (regional market)?

3. How will the development be funded, and where will the money come from?

Tenants, real estate acquisition/sale, and financing are three types of supply and demand that I recognise.

A real estate market analysis will also include the following questions, which are more concerned with marketability than with market conditions:

4. What are the current competitive developments, and how should this project be conceived, planned, and marketed to compete effectively? To put it another way, what is the unique development concept in terms of the site plan, architecture, design, and the target market (tenant, shopper, or user)?

5. What essential elements influence your market analysis?

The market study revolves around these five points, which include supply and demand issues.

A feasibility study concentrates on the financial implications of a proposed development or acquisition. Property Development Feasibility is based on three things:

- A location looking for a use

- Employ in site search

- An investor looking for a way to become involved.

Market analysis and feasibility study Should Include...

While the study paper has no defined format, a typical real estate market analysis will include the following items:

Cover page: It includes the type of study, property address, and team members.

Letter of transmittal: Major findings and conclusions.

Table of contents: A listing of all sections.

Nature of the project: Description of the project, techniques, strategies, approaches used, and the extent of services provided.

- How to calculate land value in 8 easy steps?

Economic context: Defines the market framework; first examines the more significant market areas (i.e., regions or cities) before moving on to the smaller market areas (i.e. neighbourhoods).

Analysts must consider all factors, including sociological, economic, governmental and political.

Property description and proposed development: It includes a separate description of the site and its improvements. This section outlines the proposed site's physical and economic strategy.

Competitive developments: While the economic backdrop part will give market statistics on the competitive supply, this section should include facts on the development's most significant competitors.

It should include rental rates and selling prices, vacancy rates, project sizes, and other data.

Market potential: In this section, the analyst determines how well the planned development will capture demand in light of the economic backdrop and comparison to competing developments.

This is where you may calculate the development's demand. Where does the demand for the suggested plan come from? What makes your plan unique or similar to the competition?

The conclusion of the marketability: This report should not include any new information. This section is devoted to pure analysis. So far in the report, everything has been considered regarding how the projected development would compete.

Addendum: Any supporting papers, such as site plans, maps, and information that supports other portions of the report, are placed in this section.

Exhibits: Include valuable additional items, such as a map identifying the location of the subject, competitive developments, and the market area.

It also includes photographs of the subject property, its block front, the block facing it, and competition schedules in specific sections or as an appendix.

The differences between the two types of research show a wide variety of needs for thorough real estate market analysis.

A key distinction to keep in mind is that a market study may remain most relevant for a long time. In contrast, a feasibility study is more likely to adapt as financial realities change, such as employment, building and land costs, and other economic data.

Property Development Feasibility Study Bundle

Download Free

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages) ✓ Real Estate Development ProForma - Ultimate Guide - (39 pages) ✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages) ✓ Preliminary Development Feasibility Assessment - (35 pages) ✓ How To Choose a Property Development Feasibility Template? - (50 pages)

Step 5 - Study the market area

Many real estate investors overlook the significance of market research and site evaluation. The most critical aspect of considering a real estate investment is to study the market area.

An overview of the real estate market area

A thorough real estate market analysis usually leads to market research, but what format does this report take?

An organised market study prepared logically is beneficial to the reader (whether approval-granting authorities, equity partners, or lenders). This way, the information gives a clear image of the market in all of its meanings, and one can discover meaningful information to make judgments quickly.

Your market area study report should emphasise and explain four critical areas of evaluation:

- The overall market area

- Location-specific factors

- Demand factors

- Supply of comparable properties

These four sections of the market study are meant to prompt crucial questions.

For example, if you can show that the market region, location, demand, and supply factors all favor advancing, it will make sense to others. Equally essential, if you can't build a convincing argument for the idea during the market analysis, why would anyone else want to go ahead with it?

Geographic information systems | Spatial analysis

A study of the market area is the starting point. It is the area where supply and demand are active.

Traditionally, market areas have been assessed by physically inspecting the land. New technology, on the other hand, has broadened the possibility of a market area analysis.

The emerging geographic information systems (GIS) technology, or electronic mapping, empowers real estate decision-makers from relying on arbitrary boundaries.

This new technology allows the analyst to examine geographic data from a genuinely global perspective. In many cases, artificial barriers do hide the actual market region.

A retail shopping mall, for example, would be constructed to service a specified population and geographical market region, allowing fair predictions about traffic volume and potential sales to be made.

However, a thorough examination of the market region may reveal that the outcomes are not always as evident as they appear at first glance.

- How To Sell A Commercial Property In Record Time?

Step 6 - Perform complex market study

You might want to figure out the regional facts that define the potential market. Geographic Information Systems ( GIS ) is the latest tool that you can use for more complex market area research.

These systems can include any database that can indicate a geographic location or spatial dimension for the variables.

GIS would almost certainly discover important insights for similar project studies in any modern market area investigation. Aside from the geographic location of a perceived market, additional market assessments may be required.

Here are some guidelines

- Determine the region not just in terms of geography but also in terms of where the market is located.

The market area for tenants can include both the immediate neighbourhood and adjacent areas. For example, this could be related to employment placement and access to transit lines in residential real estate projects .

- The study of any project should take into account how the new project may affect existing projects.