Sling is now Sling by Toast! Learn more

More Features

- Restaurants

- Get Started

Restaurant Business Plan: What To Include, Plus 8 Examples

- Business Growth & Management , Templates & Guides

Do you want to ensure the success of your new foodservice endeavor? Write a restaurant business plan.

In this article, the experts at Sling tell you why a business plan is vital for both new and existing businesses and give you tips on what to include.

Table Of Contents

What Is A Restaurant Business Plan?

Why is a restaurant business plan important, questions to ask first, what to include in an effective restaurant business plan, how to format a restaurant business plan, efficient workforce management is essential for success.

At its most basic, a restaurant business plan is a written document that describes your restaurant’s goals and the steps you will take to make those goals a reality.

This business plan also describes the nature of the business itself, financial projections, background information, and organizational strategies that govern the day-to-day activity of your restaurant.

A restaurant business plan is vital for the success of your endeavor because, without one, it is very difficult — sometimes even impossible — to obtain funding from an investor or a bank.

Without that all-important starting or operational capital, you may not be able to keep your doors open for long, if at all.

Even if funding isn’t a primary concern, a business plan provides you — the business owner or manager — with clear direction on how to translate general strategies into actionable plans for reaching your goals.

The plan can help solidify everything from the boots-on-the-ground functional strategy to the mid-level business strategy all the way up to the driving-force corporate strategy .

Think of this plan as a roadmap that guides your way when things are going smoothly and, more importantly, when they aren’t.

If you want to give your restaurant the best chance for success, start by writing a business plan.

Sitting down to write a restaurant business plan can be a daunting task.

As you’ll see in the What To Include In An Effective Restaurant Business Plan section below, you’ll need a lot of information and detail to ensure that the final document is both complete and effective.

Instead of starting with word one, it is hugely beneficial to answer a number of general questions first.

These questions will help you narrow down the information to include in your plan so the composition process feels less difficult.

The questions are:

- What problem does the business’s product or service solve?

- What niche will the business fill?

- What is the business’s solution to the problem?

- Who are the business’s customers?

- How will the business market and sell its products to them?

- What is the size of the market for this solution?

- What is the business model for the business?

- How will the business make money?

- Who are the competitors?

- How will the business maintain a competitive advantage?

- How does the business plan to manage growth?

- Who will run the business?

- What makes those individuals qualified to do so?

- What are the risks and threats confronting the business?

- What can you do to mitigate those risks and threats?

- What are the business’s capital and resource requirements?

- What are the business’s historical and projected financial statements?

Depending on your business, some of these questions may not apply or you may not have applicable answers.

Nevertheless, it helps to think about, and try to provide details for, the whole list so your finished restaurant business plan is as complete as possible.

Once you’ve answered the questions for your business, you can transfer a large portion of that information to the business plan itself.

We’ll discuss exactly what to include in the next section.

In this section, we’ll show you what to include in an effective restaurant business plan and provide a brief example of each component.

1) Executive Summary

You should always start any business plan with an executive summary. This gives the reader a brief introduction into common elements, such as:

- Mission statement

- Overhead costs

- Labor costs

- Return on investment (ROI)

This portion of your plan should pique the reader’s interest and make them want to read more.

Fanty & Mingo’s is a 50-seat fine-dining restaurant that will focus on Sweruvian (Swedish/Peruvian) fusion fare.

We will keep overhead and labor costs low thanks to simple but elegant decor , highly skilled food-prep staff, and well-trained servers.

Because of the location and surrounding booming economy, we estimate ROI at 20 percent per annum.

2) Mission Statement

A mission statement is a short description of what your business does for its customers, employees, and owners.

This is in contrast to your business’s vision statement which is a declaration of objectives that guide internal decision-making.

While the two are closely related and can be hard to distinguish, it often helps to think in terms of who, what, why, and where.

The vision statement is the where of your business — where you want your business to be and where you want your customers and community to be as a result.

The mission statement is the who , what , and why of your business — it’s an action plan that makes the vision statement a reality

Here’s an example of a mission statement for our fictional company:

Fanty and Mingo’s takes pride in making the best Sweruvian food, providing fast, friendly, and accurate service. It is our goal to be the employer of choice and offer team members opportunities for growth, advancement, and a rewarding career in a fun and safe working environment.

3) Company Description

In this section of your restaurant business plan, you fully introduce your company to the reader. Every business’s company description will be different and include its own pertinent information.

Useful details to include are:

- Owner’s details

- Brief description of their experience

- Legal standing

- Short-term goals

- Long-term goals

- Brief market study

- An understanding of the trends in your niche

- Why your business will succeed in these market conditions

Again, you don’t have to include all of this information in your company description. Choose the ones that are most relevant to your business and make the most sense to communicate to your readers.

Fanty & Mingo’s will start out as an LLC, owned and operated by founders Malcolm Reynolds and Zoe Washburne. Mr. Reynolds will serve as managing partner and Ms. Washburne as general manager.

We will combine atmosphere, friendly and knowledgeable staff, and menu variety to create a unique experience for our diners and to reach our goal of high value in the fusion food niche.

Our gross margin is higher than industry average, but we plan to spend more on payroll to attract the best team.

We estimate moderate growth for the first two years while word-of-mouth about our restaurant spreads through the area.

4) Market Analysis

A market analysis is a combination of three different views of the niche you want to enter:

- The industry as a whole

- The competition your restaurant will face

- The marketing you’ll execute to bring in customers

This section should be a brief introduction to these concepts. You can expand on them in other sections of your restaurant business plan.

The restaurant industry in our chosen location is wide open thanks in large part to the revitalization of the city’s center.

A few restaurants have already staked their claim there, but most are bars and non-family-friendly offerings.

Fanty & Mingo’s will focus on both tourist and local restaurant clientele. We want to bring in people that have a desire for delicious food and an exotic atmosphere.

We break down our market into five distinct categories:

- High-end singles

- Businessmen and businesswomen

We will target those markets to grow our restaurant by up to 17 percent per year.

Every restaurant needs a good menu, and this is the section within your restaurant business plan that you describe the food you’ll serve in as much detail as possible.

You may not have your menu design complete, but you’ll likely have at least a handful of dishes that serve as the foundation of your offerings.

It’s also essential to discuss pricing and how it reflects your overall goals and operating model. This will give potential investors and partners a better understanding of your business’s target price point and profit strategy.

We don’t have room to describe a sample menu in this article, but for more information on menu engineering, menu pricing, and even a menu template, check out these helpful articles from the Sling blog:

- Menu Engineering: What It Is And How It Can Increase Profits

- Restaurant Menu Pricing: 7 Tips To Maximize Profitability

- How To Design Your Menu | Free Restaurant Menu Template

6) Location

In this section, describe your potential location (or locations) so that you and your investors have a clear image of what the restaurant will look like.

Include plenty of information about the location — square footage, floor plan , design , demographics of the area, parking, etc. — to make it feel as real as possible.

We will locate Fanty & Mingo’s in the booming and rapidly expanding downtown sector of Fort Wayne, Indiana.

Ideally, we will secure at least 2,000 square feet of space with a large, open-plan dining room and rich color scheme near the newly built baseball stadium to capitalize on the pre- and post-game traffic and to appeal to the young urban professionals that live in the area.

Parking will be available along side streets and in the 1,000-vehicle parking garage two blocks away.

7) Marketing

The marketing section of your restaurant business plan is where you should elaborate on the information you introduced in the Market Analysis section.

Go into detail about the plans you have to introduce your restaurant to the public and keep it at the top of their mind.

Fanty & Mingo’s will employ three distinct marketing tactics to increase and maintain customer awareness:

- Word-of-mouth/in-restaurant marketing

- Partnering with other local businesses

- Media exposure

We will direct each tactic at a different segment of our potential clientele in order to maximize coverage.

In the process of marketing to our target audience, we will endeavor to harness the reach of direct mail and broadcast media, the exclusivity of the VIP party, and the elegance of a highly trained sommelier and wait staff.

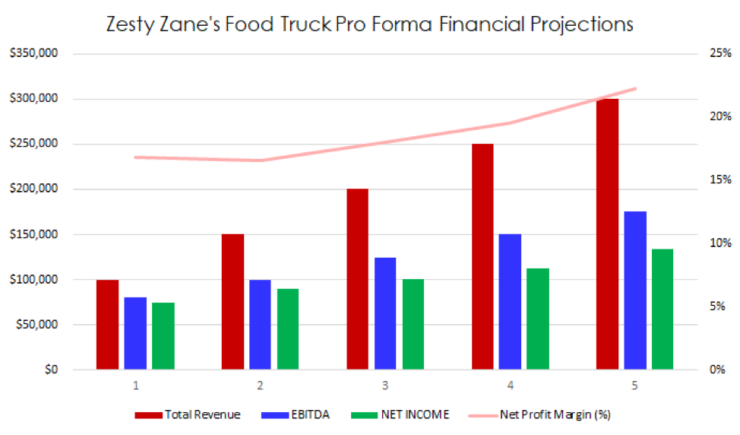

8) Financials

Even though the Financials section is further down in your restaurant business plan, it is one of the most important components for securing investors and bank funding.

We recommend hiring a trained accountant to help you prepare this section so that it will be as accurate and informative as possible.

Fanty & Mingo’s needs $250,000 of capital investment over the next year and a half for the following:

- Renovations to leased space

- Dining room furniture

- Kitchen and food-prep equipment

- Liquor license

Projected profit and loss won’t jump drastically in the first year, but, over time, Fanty & Mingo’s will develop its reputation and client base. This will lead to more rapid growth toward the third and fourth years of business.

Most entrepreneurs starting a new business find it valuable to have multiple formats of their business plan.

The information, data, and details remain the same, but the length and how you present them will change to fit a specific set of circumstances.

Below we discuss the four most common business plan formats to cover a multitude of potential situations.

Elevator Pitch

An elevator pitch is a short summary of your restaurant business plan’s executive summary.

Rather than being packed full of details, the elevator pitch is a quick teaser of sorts that you use on a short elevator ride (hence the name) to stimulate interest in potential customers, partners, and investors

As such, an effective elevator pitch is between 30 and 60 seconds and hits the high points of your restaurant business plan.

A pitch deck is a slide show and oral presentation that is designed to stimulate discussion and motivate interested parties to investigate deeper into your stakeholder plan (more on that below).

Most pitch decks are designed to cover the executive summary and include key graphs that illustrate market trends and benchmarks you used (and will use) to make decisions about your business.

Some entrepreneurs even include time and space in their pitch deck to demonstrate new products coming down the pipeline.

This won’t necessarily apply to a restaurant business plan, but, if logistics permit, you could distribute small samples of your current fare or tasting portions of new dishes you’re developing.

Stakeholder Plan (External)

A stakeholder plan is the standard written presentation that business owners use to describe the details of their business model to customers, partners, and potential investors.

The stakeholder plan can be as long as is necessary to communicate the current and future state of your business, but it must be well-written, well-formatted, and targeted at those looking at your business from the outside in.

Think of your stakeholder plan as a tool to convince others that they should get involved in making your business a reality. Write it in such a way that readers will want to partner with you to help your business grow.

Management Plan (Internal)

A management plan is a form of your restaurant business plan that describes the details that the owners and managers need to make the business run smoothly.

While the stakeholder plan is an external document, the management plan is an internal document.

Most of the details in the management plan will be of little or no interest to external stakeholders so you can write it with a higher degree of candor and informality.

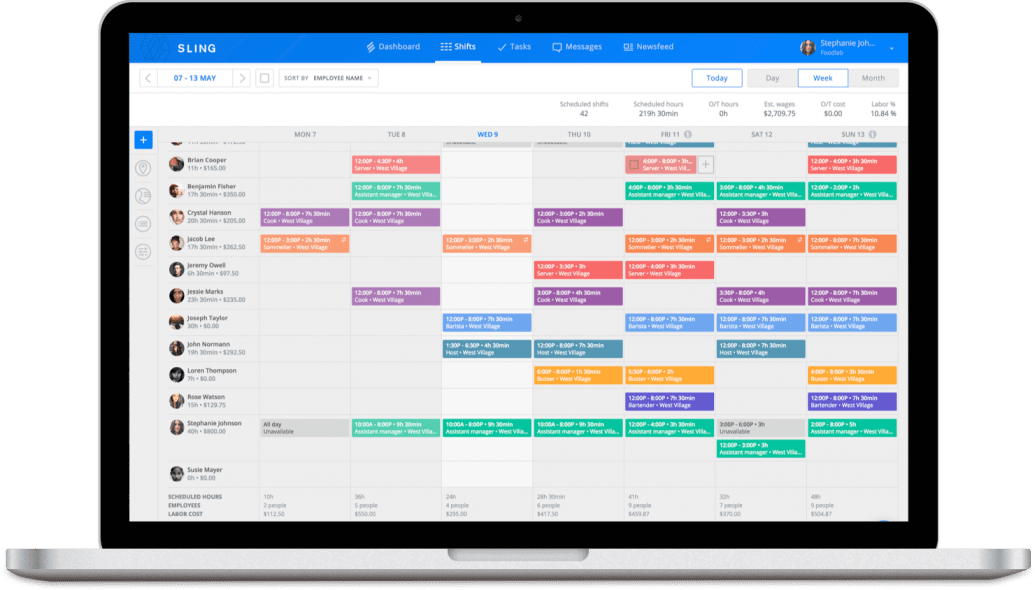

After you’ve created your restaurant business plan, it’s time to take steps to make it a reality.

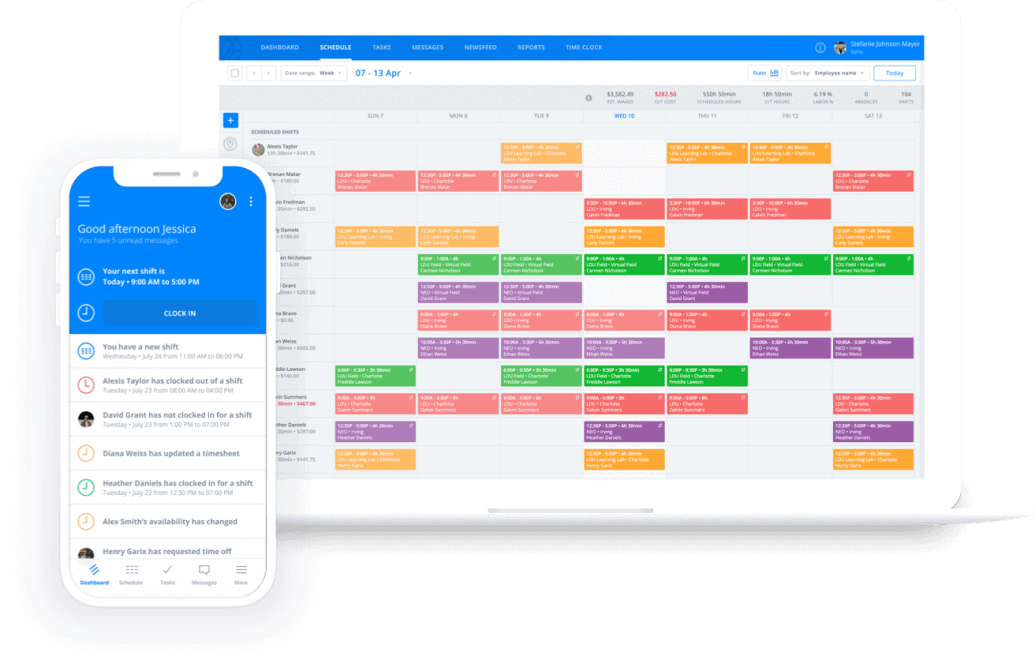

One of the biggest challenges in ensuring that your business runs smoothly and successfully is managing and optimizing your team. The Sling app can help.

Sling not only includes powerful and intuitive artificial-intelligence-based scheduling tools but also many other features to help make your workforce management more efficient, including:

- Time and attendance tracking

- Built-in time clock

- Labor cost optimization

- Data analysis and reporting

- Messaging and communication

- And much more…

With Sling, you can schedule faster, communicate better, and organize and manage your work from a single, integrated platform. And when you use Sling for all of your scheduling needs, you’ll have more time to focus on bringing your restaurant business plan to life.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Find the article useful? Share with others:

Related articles

How To Write Your Ideal Restaurant Mission Statement + 15 Inspiring Examples

Whether you run a one-person food cart, a small eatery with fewer than five empl...

12 Examples of Small Business Goals, Plus How to Achieve Your Own

Want to improve the way your business operates? Learn some of the more common bu...

55 Restaurant Marketing Tips To Win Your Market

Discover the best restaurant marketing tips and learn how you can harness onlin...

Get started today

Schedule faster, communicate better, get things done.

ZenBusinessPlans

100+ Sample Food Business Plans and Templates

Food generally is an essential consumable item. A lot of entrepreneurs these days are seriously on the lookout for profitable and trending food business ideas to start a new business. Choosing the right niche is the first and most important step for any business initiative.

Increasing population and desire to have easy access to food are the factors that create more opportunities in the food industry. Starting up a business is the best way to get out of the rat race and into being your own boss. But when it comes to the food industry, there are many things that can go wrong.

Even before the pandemic, restaurant owners were finding it difficult to fill chef spaces. But since COVID became a worldwide problem, this situation has become worse. The shutting down of social places meant that long-time workers in the food business have swapped to new job roles.

Don’t let this doom and gloom put you off, though, as we have some amazing ideas to help you get past these struggles and create a successful food business in 2023! If you keep your business small before you try reaching for the stars, you will be more likely to push through those barriers.

Sample Business Plans for Food Industry

1. charcuterie business plan.

Charcuterie is a display of prepared meats paired with cheeses and plain vegetables on a traditional board. Charcuterie is the culinary art of preparing meat products such as bacon, salami, ham, sausage, terrines, galantines, ballotines, pâtés, and confit professionally. Till today, this has remained a popular way to feed guests on a budget for small parties or wine tastings, and a person that prepares charcuterie is called a Charcutier.

2. Food Truck Business Plan

We said we would talk about food trucks, and here we are! A food truck is the best way to get your meals and hot snacks to festival-goers, but you can also use them like a classic restaurant. Some people set up shop in a location, clamp their truck to the floor and buy benches for their customers to sit on.

You still have that fun alfresco feeling without having to pay for top restaurant prices. We suggest using a food truck if your concepts aren’t time-consuming. If you have a dish that takes a long time to create, then your customers will be less likely to stick around for their meal.

This is because trucks are considered a fast food option. Instead of a normal fast food restaurant, though, many customers expect a more exciting menu from a truck in comparison.

The burgers are more than just a burger; they have 5 extra ingredients that make your mouth water from just smelling it. You can afford to be more creative in a food truck, as you won’t have to pay the same licenses or permits. This means you can use more ingredients and charge the same price as a normal burger.

3. Nano Brewery Business Plan

In simple terms, a nano brewery is a brewery (plant) that produces a small amount of beer per time; it is a small-scale brewery that can’t be compared to conventional brewery plants or microbrewery plants and it is usually owned independently. Any entrepreneur that has some cash and brewing technique can comfortably start his or her own nano brewery business.

4. Religious Coffee Shop Business Plan

According to reports, 7 in 10 Americans drink coffee every week; 62% drink coffee every day, making it second only to water. There are over 24,000 coffee shops in the United States, with an average sell rate of 230 cups per day.

Truth be told, coffee has become a crucial part of a cultural revolution, and owing to some amazing trends, it seems that growth will continue. Churches, ministries, and entrepreneurs in the United States are beginning to leverage coffee’s popularity and are gradually turning it into an opportunity for outreach and faith development.

5. Cocktail Bar Business Plan

A cocktail bar is a bar or small restaurant where cocktails are the main drinks available; a characteristic feature of many standard cocktail bars is a wide selection of assorted cocktail drinks available by the glass. A cocktail is a mixed drink typically made with a distilled beverage (such as gin, brandy, vodka, whiskey, tequila, cachaça, or rum) that is mixed with other ingredients. If beer is one of the ingredients, the drink is called a beer cocktail.

6. Fruit Juice Shop Business Plan

A fruit juice bar, or fruit juice shop is a small, informal restaurant where juice and in most cases, smoothies are made and served to customers. Fruit juice is ideally 100 percent pure juice made from the flesh of fresh fruit or from whole fruit, depending on the type used.

7. Cold Storage Business Plan

A cold storage business is a commercial facility for storing perishable products such as fruits, vegetables, meat, fish, furs, etc. under controlled conditions for longer periods. Based on the storage conditions, cold storage may be classified into three categories – short-term or temporary storage, long-term storage, and frozen storage.

Available data shows that the U.S. cold storage market size was estimated at USD 15.84 billion in 2019 and is expected to reach USD 16.43 billion in 2020.

8. Funnel Cake Business Plan

A funnel cake shop is a business that bakes and sells funnel cakes. Please note that the name “funnel cake” was derived from the method of squeezing batter through a funnel in a circular pattern into hot oil to achieve a dizzying pattern of crispy-fried dough.

The funnel cake business is a niche idea in the cake and bakery industry and available statistics have it that the global bakery product market size was estimated at USD 203.8 billion in 2018.

9. Fig and Coconut Jam Business Plan

A fig and coconut jam production company is a niche jam, jelly, and preserves business that produces and sells fig and coconut jam. Fig and coconut jam can be used like other jams as a fruit spread for toast, scones, cakes, and other baked goods, and it can also be used as a condiment for savory foods.

10. Cotton Candy Business Plan

A cotton candy business is a business that makes and sells cotton candies most especially at children’s parties, parks, stadiums et al. Cotton candy, which is also known as fairy floss and candy floss, is a spun-sugar confection that resembles cotton. The U.S. candy market is expected to reach a value of USD 19.6 billion by 2025, according to a new report by Grand View Research, Inc.

11. Hot Dog Vendor Business Plan

A hot dog vendor business is a business that sells different types of hot dogs and drinks from a shop, cart, or food truck. Hot dogs are prepared commercially by mixing the ingredients (meats, spices, binders, and fillers) in vats where rapidly moving blades grind and mix them all together. This mixture is forced through tubes for cooking.

The market size of the Hot Dog and Sausage Production industry is $19.2bn in 2023 and the industry is expected to increase by 3.6 percent going forward.

12. Crepe Restaurant Business Plan

A crepe restaurant is a niche restaurant that serves crepes (pancakes) as its main menu. A crepe is a French pancake that is made with a thin batter containing flour, eggs, melted butter, salt, milk, and water. Crepes can be filled with a variety of sweet or savory mixtures. Savory buckwheat crepes are always served for lunch and dinner in a crepe restaurant while sweet crepes are for dessert or snack.

13. Food Hub Business Plan

A food hub business as defined by the USDA is “a centrally located facility with a business management structure facilitating the aggregation, storage, processing, distribution, and/or marketing of locally/regionally produced food products.

Food hubs also fill gaps in food system infrastructures, such as transportation, product storage, and product processing. Available data shows that there are about 212 food hubs in the United States and industry data indicates that local food sales totaled at least $12 billion in 2014 and estimates that the market value could hit $20 billion.

Before Starting a Food Business, Test your idea

First off, you should be testing your ideas before putting a deposit on a business loan. Finding the problems early on will stop you from diving into a money pit. Use our advice like a checklist to guide you through this testing phase, and be ready to receive criticism. Remember, you cannot improve or create a strong foundation if you ignore everyone’s advice.

a. Feedback From 3rd Parties

The main reason why people think about creating a food business is because their friends or family say they should. They drool over your stews, make heart-eyes over your steaks, and lovingly long for another bite. Well, in reality, your friends and family are probably boosting your ego or sugar-coating their reaction.

We aren’t saying they are lying necessarily, but they might ignore some of your poorer meals because they know you are trying your best. Your customers won’t be so forgiving. To make sure your friends aren’t saying you are better than you are, you need a true third party to judge your food tasting sessions.

You could ask your co-workers to take the plate and make an anonymous comment. If they are mostly positive, that’s great; you can then adjust your recipes, packaging, service standards in accordance with all the positive and negative feedback.

You could also talk to local companies in the same area of business as you. Ask them if your packaging is appropriate, if they have advice for a new business owner, and anything else that you are worried about. Doing this beginner networking is a great way to start a community too. Local businesses are normally more friendly than chains and will be happy to help you on your journey.

b. Perfect “One Food” Business idea At A Time

You might feel as though you need a whole menu of amazing food, but in reality, you have to remember that you are starting at the bottom. Having one fantastic idea and putting a lot of effort into it would be a more successful business venture than spreading your ideas too thin.

When it comes to testing, your test group may become overwhelmed if they are given too many options. It wouldn’t be uncommon for the group to start comparing dishes to each other rather than their normal experiences.

In the testing group, you want these “customers” to tell you if your ideas will make it, if they are good enough to be sold and if there is a problem that can be fixed. If they have a lot to look at, they will simply tell you which one is the best. Once you find the best variation of that one food product, you can then start to work on another.

c. Look After The “Other” 20% Of Your Online Food Order Customers

There are normally 3 types of customers in the food industry; the ones who enjoy your food enough to try it again another time or simply not dismiss it; ones who will absolutely love your food and will keep coming back; and those who like to try new foods on a whim.

If the first type of person doesn’t like your food, they will simply not return. If the second type of person has a bad experience, they will try again. If this second visit redeems the food, they will remain loyal, but if it doesn’t save their experience, they will either drop into the first type or not come back.

Depending on how good your business is, you might have either a large percentage of lovers and a low percentage of “it’s fine” ers, or it can be the other way around. However, around 20% of your customers will likely be the third type.

Going to restaurants and vendors or trying new sweets on a whim is a growing hobby for many people. The third type wants to be the first ones to experience this unique and potentially viral adventure. These people will likely make a review on whatever social media network they use, and this can either boom or bury your business.

These people will not hesitate to share their lengthy and detailed opinions about your business. Of course, you should always take these opinions with a pinch of salt, as a negative review on a blog often gets more traction than a positive one; however, you should take note of what they are saying. Pleasing these reviewers will make your business look good online, and it can help you create a big fan base.

How To Write a Winning Food Business Plan + Template

Creating a business plan is essential for any business. Still, it can be beneficial for food businesses that want to improve their strategy or raise funding.

A well-crafted business plan not only outlines the vision for your company but also documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the key elements that every food business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Food Business Plan?

A food business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Food Business Plan?

A food business plan is required for banks and investors. The document is a clear and concise guide to your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Food Business Plan

The following are the key components of a successful food business plan:

Executive Summary

The executive summary of a food business plan is a one- to two-page overview of your entire business plan. It should summarize the main points, which you will present in full in the rest of your business plan.

- Start with a one-line description of your food company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your food business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your food firm, mention this.

Industry Analysis

The industry or market analysis is an important component of a food business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the food industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support your company’s success)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, a food business’ customers may include restaurants, grocery stores, caterers, and food trucks.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or food services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your food business may have:

- Unique menu items

- Strong industry reputation

- Proven track record of success

- Low-cost production

- Local sourcing

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or you may promote your food business via word-of-mouth marketing or by exhibiting at food trade shows.

Operations Plan

This part of your food business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a food business include reaching $X in sales. Other examples include expanding to a second location or launching a new product line.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific food industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Food Business

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Food Business

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

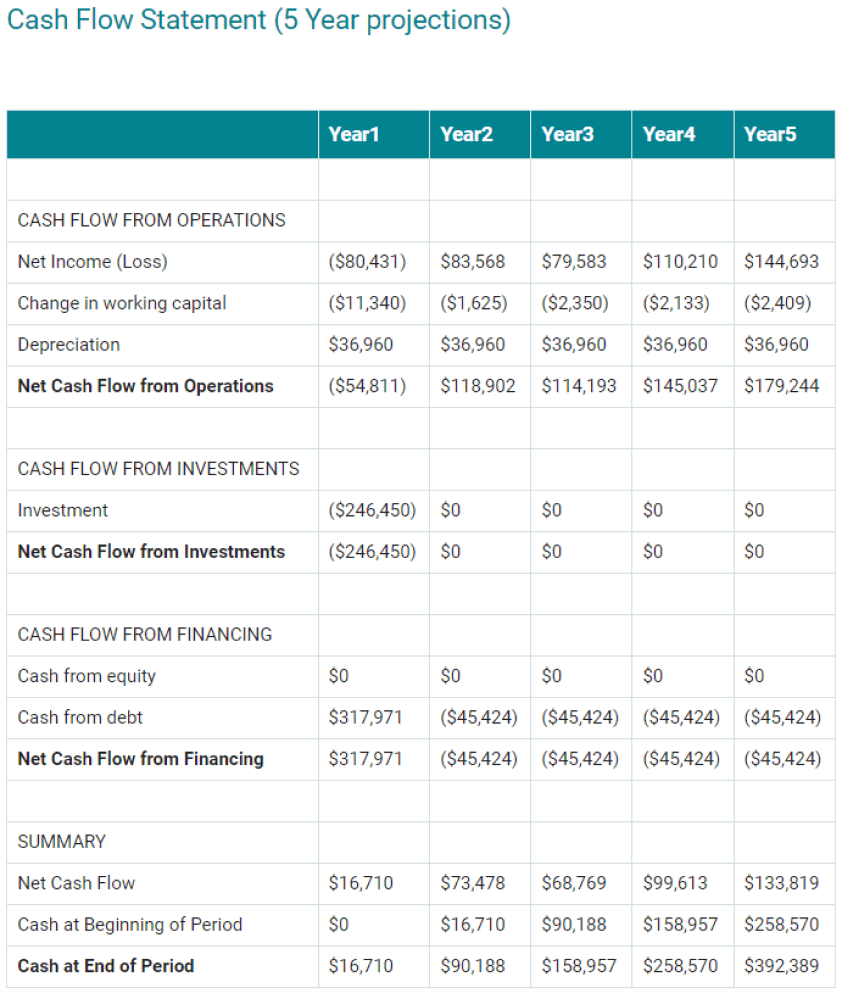

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup food business.

Sample Cash Flow Statement for a Startup Food Business

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

A well-written food business plan is a critical tool for any entrepreneur looking to start or grow their food company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

Finish Your Food Business Plan in 1 Day!

- Purchase History

Business Plan Template for a Food and Beverage Business

by I.J. Karam | Jan 12, 2023 | Business Plans

A business plan is an essential tool for any entrepreneur looking to start a food and beverage business. It outlines the goals and strategies for your company, and serves as a roadmap for success. In this guide, we will walk you through the process of creating a business plan for your food and beverage business, covering everything from market research and financial projections to marketing and operations. Whether you’re looking to open a restaurant, a food truck, or a catering business, this food and beverage business plan template guide will provide you with all the information you need to get started.

Before we start, we suggest you check our ready-made Food & Beverage business plan templates in Word with automatic financial plans in Excel. They will save you tons of time and efforts and will help you build a restaurant, food truck or any other type of F&B business plan in record time.

Now, let’s dive in and learn how to create a business plan for your food and beverage business.

Executive Summary for an F&B Business Plan

An executive summary is a brief overview of the main points of your business plan. It should be written last, after the rest of the plan has been completed, and should be no more than two pages long. In the executive summary for a food and beverage business, you should include the following key points:

- Business concept: Explain what your business is, what products or services you will offer, and what makes your business unique.

- Target market: Describe your target customers and the market you will be serving.

- Financial projections: Summarize your financial projections, including projected sales and profits.

- Management and ownership: Outline the management and ownership structure of your business, including key members of your team and their qualifications.

- Marketing and sales strategy: Explain how you plan to market and sell your products or services, including your pricing strategy and how you will reach your target market.

- Operations plan: Describe your operations plan, including how you will source ingredients, prepare and serve your products, and manage your inventory.

- Conclusion: Summarize the main points of your business plan and explain why you believe your business will be successful.

The executive summary serves as an introduction to your business plan, and should be written in clear, concise language that is easy for potential investors or lenders to understand.

Here is a sample executive summary for an F&B business:

Our business, [Business Name], is a new restaurant concept that specializes in serving locally sourced, organic, and sustainable cuisine. We will offer a range of dishes that cater to a variety of dietary restrictions and preferences, including vegetarian, vegan, and gluten-free options.

Our target market is health-conscious individuals and families in the [city/region] area who are looking for delicious and nutritious meal options. We have conducted extensive market research and have identified a strong demand for our type of food in the area.

We project sales of $500,000 in the first year, with a profit margin of 8%. Our restaurant will be owned and managed by [name], a seasoned restaurant professional with over 10 years of experience in the industry. Our team also includes a highly skilled head chef, a marketing expert, and a dedicated operations manager.

To reach our target market, we will launch an extensive marketing campaign that includes social media advertising, email marketing, and local collaborations. We will also offer a loyalty program and host events and promotions to attract customers.

Our restaurant will have a fully equipped kitchen, a dedicated prep area, and a stylish dining area that can accommodate up to 50 customers. We will source ingredients from local farmers and producers, and will have strict quality control measures in place to ensure that all dishes are prepared to the highest standards.

We are confident that our unique concept, experienced team, and comprehensive business plan will position us for success in the competitive food and beverage market. We are excited to bring our delicious and nutritious food to the community and become a go-to destination for healthy and sustainable dining options

The Problem Opportunity

In this section you need to cite the key problems encountered in the Food and Beverage (F&B) Industry and then show how your own business will solve in an effective manner.

As an example, key problems in the F&B industry can include:

- High competition in the market

- Rising food and labor costs

- Seasonal fluctuations in demand

- Limited access to funding

Here are potent solutions that your F&B business may want to offer to solve the above cited problems:

- Differentiate your business and offer a unique dining experience, conduct market research and tailor your offering to the needs of your target audience, and utilize effective marketing techniques to build brand awareness and reach new customers. Foster customer loyalty through loyalty programs or other incentives.

- Implement cost-saving measures and explore options for automating tasks or processes, increase efficiency by streamlining operations and implementing technology solutions, and offer value-priced menu items or promotions to attract cost-conscious customers.

- Explore options for offering products or services outside of traditional operating hours, utilize social media and other digital marketing techniques to reach new customers and increase visibility, and consider offering catering or delivery services to generate additional revenue.

- Research different funding options and create a compelling business plan, build relationships with potential investors or lenders and demonstrate the strength of your management team, and consider alternative forms of financing, such as crowdfunding or pre-sales.

Mission & Vision for a F&B Business

Mission: Our mission at [Your Company Name] is to provide our customers with a unique and enjoyable dining experience that combines high-quality food with exceptional customer service. We strive to create a warm and welcoming atmosphere that encourages customers to come back time and time again.

Vision: Our vision is to become the premier destination for [Your Cuisine] in [City/Region] and to establish ourselves as a leader in the F&B industry. We aim to achieve this through continuous innovation, the use of high-quality ingredients, and a commitment to excellence in every aspect of our business. We believe that by consistently exceeding our customers’ expectations, we can build a loyal following and achieve long-term success.

Products and Services

[Your Company Name] offers a wide range of high-quality food and beverage options to suit the tastes and preferences of our customers. Our menu features a variety of [Your Cuisine]-inspired dishes, including appetizers, entrees, and desserts. We offer a range of options to accommodate dietary preferences and restrictions, including vegetarian, vegan, and gluten-free options.

Our dishes are made with fresh, locally-sourced ingredients and prepared by our talented team of chefs. We take pride in the quality of our ingredients and the care that goes into preparing each dish. We are constantly innovating and experimenting with new flavors and techniques to keep our menu fresh and exciting.

In addition to our dining options, we also offer catering services for events of all sizes. Our catering team can create customized menus to suit the needs of your event and can provide all necessary equipment and staff to ensure a successful and stress-free event. We have experience catering a wide range of events, including weddings, corporate functions, and private parties.

We are dedicated to providing exceptional customer service and strive to create a memorable dining experience for every customer. Our team is trained to provide personalized service and to assist with any special requests or dietary needs. We have a variety of seating options available, including indoor and outdoor seating, and we offer a range of amenities to make our customers’ experience more enjoyable, such as free Wi-Fi and a selection of games and activities.

It is also a good idea to include your menu with pricing in this section:

Business Model Canvas for an F&B Business

Value Proposition:

- High-quality, delicious food made with fresh, locally-sourced ingredients.

- Exceptional customer service and a memorable dining experience.

- A wide range of menu options that cater to a variety of tastes and dietary preferences.

Customer Segments:

- Foodies: Customers who are passionate about food and are always seeking out new and exciting dining experiences.

- Health-conscious individuals: Customers who are looking for healthy and sustainable options when dining out.

- Time-poor individuals and families: Customers who are looking for convenient and quick dining options, including delivery and takeout.

- Social groups: Customers who are looking for a lively and welcoming atmosphere for group gatherings, such as birthdays, celebrations, or corporate events.

- Dine-in: Customers can visit the restaurant and enjoy their meals on-site.

- Takeout and delivery: Customers can order meals to be picked up or delivered to their homes or offices.

- Online ordering: Customers can place orders and make payments online.

- Social media: The business can use social media platforms to reach and communicate with customers.

Customer Relationships:

- Personalized service: The business will strive to create a memorable dining experience for every customer through personalized attention and care.

- Loyalty program: The business may offer a loyalty program to reward repeat customers and encourage customer retention.

- Online reviews and ratings: The business will monitor and respond to online reviews and ratings in order to maintain a positive reputation and to gather feedback from customers.

Revenue Streams:

- Sales of food and beverages: The primary source of revenue for the business will be the sale of food and beverages to customers.

- Catering services: The business may offer catering services for events such as corporate functions, parties, or weddings.

- Merchandise: The business may sell branded merchandise, such as t-shirts, hats, or tote bags.

Key Resources:

- Kitchen facilities and equipment: The business will need a fully-equipped kitchen and necessary cooking and food preparation equipment in order to prepare and serve meals.

- Staff: The business will need a team of chefs, servers, and other staff in order to operate.

- Marketing and branding materials: The business will need marketing and branding materials, such as menus, signage, and social media assets, in order to promote itself and its products and services.

Key Partners:

- Suppliers: The business will need to establish relationships with suppliers of fresh ingredients and other necessary supplies.

- Delivery partners: The business may work with third-party delivery partners in order to offer delivery services to customers.

- Event venues and organizers: The business may partner with event venues and organizers in order to provide catering services.

Key Activities:

- Menu development: The business will need to continuously develop and update its menu in order to keep it fresh and interesting.

- Food preparation and cooking: The business will need to prepare and cook meals to a high standard in order to deliver a superior product to customers.

- Customer service: The business will need to provide exceptional customer service in order to create a memorable dining experience for every customer.

- Marketing and promotion: The business will need to promote itself and its products and services in order to attract customers.

Key Expenses:

- Ingredient and supply costs: The business will incur costs for ingredients and other necessary supplies.

- Staff salaries and benefits: The business will need to pay salaries and benefits to its team of chefs, servers, and other staff.

- Rent and utilities: The business will need to pay rent and utilities for its kitchen and dining facilities.

- Marketing and promotional expenses: The business will incur costs for marketing and promotional activities.

SWOT Analysis for an F&B Business

- Strong brand recognition: Our business has a strong reputation and is well-known in the local community.

- Experienced team: Our team has a wealth of experience in the food and beverage industry and is able to provide high-quality products and services to our customers.

- High-quality ingredients: We use only the freshest and highest-quality ingredients in our dishes, which sets us apart from our competitors.

- Unique menu offerings: Our menu features a variety of unique and innovative dishes that are not offered by other restaurants in the area.

Weaknesses:

- Limited seating: Our premises have limited seating, which may limit our ability to accommodate larger groups or parties.

- Lack of online presence: We do not currently have a strong online presence, which may limit our ability to attract new customers through social media or online reviews.

- Limited catering experience: While we have experience in restaurant operations, we have limited experience in catering and events, which may be a weakness in terms of expanding into these areas.

Opportunities:

- Growing demand for healthy options: There is a growing demand for healthier options in the food and beverage industry, and we have the opportunity to capitalize on this trend by offering more plant-based and organic dishes on our menu.

- Expansion into catering and events: There is a strong demand for catering and event services in our area, and we have the opportunity to expand our business into these areas.

- Partnership opportunities: We have the opportunity to partner with other local businesses or organizations to offer special promotions or events.

- Competition: There is strong competition in the food and beverage industry, and we may face challenges from established competitors as well as new entrants to the market.

- Changes in consumer preferences: Consumer preferences may change over time, and we may need to adapt our offerings to meet the evolving needs and tastes of our customers.

- Economic downturns: Economic downturns or other external factors may impact consumer spending and could affect the demand for our products and services.

Market Trends

The food and beverage industry is a dynamic and rapidly-evolving sector, and it is important for businesses to stay up-to-date on the latest trends and developments. According to recent industry data, some of the current trends in the F&B industry include:

- Health and wellness: Consumers are increasingly seeking out healthy and sustainable options when dining out. This includes a demand for plant-based and vegetarian options, as well as a focus on locally-sourced and organic ingredients. In fact, a survey by the National Restaurant Association found that nearly 60% of consumers are more likely to visit a restaurant that offers healthy options.

- Convenience and delivery: With busy lifestyles, many consumers are looking for convenient dining options, including delivery and takeout. This trend has been accelerated by the COVID-19 pandemic, which has led to an increase in online ordering and contactless payment options. In fact, a report by the NPD Group found that off-premises dining, including delivery and takeout, now accounts for over half of all restaurant sales in the United States.

- Experiential dining: In addition to good food, many customers are seeking out dining experiences that are memorable and unique. This can include interactive or immersive elements, such as live music or interactive cooking demonstrations. A survey by Zagat found that 75% of consumers are willing to pay more for a unique dining experience.

- Plant-based options: The demand for plant-based options continues to grow, with many consumers looking for healthier and more sustainable options. This trend includes a wide range of plant-based alternatives, including vegetarian, vegan, and flexitarian options. A report by the Good Food Institute found that the market for plant-based meat alone is expected to reach $85 billion by 2030.

- The F&B industry is a large and growing sector, with the global food and beverage market projected to reach $31 trillion by 2024. The industry is highly competitive, with many players vying for a share of the market.

We believe that by adapting to the latest trends and offering a range of options that meet the needs and preferences of our customers, we can continue to grow and succeed in the competitive F&B industry.

Local Market Trends

Here is it a good idea to discuss how local market trends support your own F&B business idea. You can use local market report or the results of a survey you have done.

Target Customers

Our target customers are individuals and families who are seeking high-quality, delicious food and exceptional customer service. We aim to attract a diverse customer base and to appeal to a range of demographics, including:

- Foodies: Customers who are passionate about food and are always seeking out new and exciting dining experiences. These customers are typically willing to pay a premium for high-quality ingredients and innovative dishes.

- Health-conscious individuals: Customers who are looking for healthy and sustainable options when dining out. This includes a demand for plant-based, vegetarian, and vegan options, as well as a focus on locally-sourced and organic ingredients.

- Time-poor individuals and families: Customers who are looking for convenient and quick dining options, including delivery and takeout. These customers value efficiency and appreciate options that allow them to enjoy good food without spending a lot of time preparing it themselves.

- Social groups: Customers who are looking for a lively and welcoming atmosphere for group gatherings, such as birthdays, celebrations, or corporate events. These customers appreciate a range of seating options and amenities, such as outdoor seating or private dining rooms, and value personalized service.

We believe that by catering to these diverse groups and offering a range of options to meet their needs and preferences, we can establish ourselves as a premier destination for food and beverage in [City/Region].

Competitive Analysis in the local F&B Market

The food and beverage industry is highly competitive, with many players vying for a share of the market. It is important for businesses to understand the competitive landscape in order to effectively position themselves and to develop strategies for success.

Some of the key players in the [Your City/Region] market for [Your Cuisine] include:

- [Competitor 1]: This competitor is known for its wide range of menu options and convenient location. Its strengths include a diverse menu that caters to a variety of tastes and dietary preferences, as well as a central location that is easily accessible by public transportation. However, it has several weaknesses, including inconsistency in the quality of its food and a reputation for subpar customer service.

- [Competitor 2]: This competitor is known for its high-quality ingredients and innovative dishes. Its strengths include a focus on using fresh, locally-sourced ingredients and an emphasis on culinary creativity. However, it has a higher price point than some of its competitors, which may be a deterrent for some customers.

- [Competitor 3]: This competitor has a strong brand presence and a loyal customer base. Its strengths include a well-established reputation and a strong marketing campaign that has helped to build customer loyalty. However, it has limited menu options and may not appeal to customers who are looking for a wider range of choices.

Competitive Advantages

In order to differentiate ourselves from these competitors and establish a competitive advantage, we will focus on the following:

- Quality: We will use high-quality ingredients and prepare our dishes with care and attention to detail in order to deliver a superior product to our customers. This will help us to stand out from competitors who may have a reputation for inconsistency in the quality of their food.

- Service: We will provide exceptional customer service and strive to create a memorable dining experience for every customer. By focusing on personalized service and attention to detail, we can differentiate ourselves from competitors who may have a reputation for subpar customer service.

- Innovation: We will stay attuned to the latest trends and developments in the industry and will continuously innovate and experiment with new flavors and techniques in order to keep our menu fresh and exciting. This will help us to attract food-savvy customers who are always looking for new and exciting dining experiences.

- Price: While we will use high-quality ingredients and offer exceptional customer service, we will also be mindful of pricing in order to make our products and services accessible to a wider range of customers. By offering competitive pricing and value for money, we can appeal to price-sensitive customers while still delivering a high-quality product.

We believe that by focusing on these areas, we can differentiate ourselves from our competitors and establish a strong position in the market.

Operating Plan

- Menu: Our menu will feature a wide range of dishes made with fresh, locally-sourced ingredients. We will offer a mix of classic and contemporary dishes to appeal to a variety of tastes and dietary preferences, including vegetarian, vegan, and gluten-free options. We will regularly update and refresh our menu to keep it interesting and to reflect the latest trends and flavors.

- Kitchen and food preparation: Our kitchen will be fully equipped with the necessary cooking and food preparation equipment, including ovens, stoves, refrigerators, and storage facilities. We will maintain strict hygiene standards and follow all food safety regulations. Our chefs will be trained in the latest culinary techniques and will be responsible for preparing and cooking meals to a high standard.

- Service: Our service staff will be trained in the latest customer service techniques and will be responsible for providing exceptional service to our customers. They will be responsible for taking orders, serving meals, and handling payments, as well as for maintaining the cleanliness and appearance of the dining area.

- Hours of operation: Our restaurant will be open seven days a week, from [opening time] to [closing time]. We will also offer delivery and takeout services during these hours.

- Staffing: Our staff will include a team of chefs, servers, and other support personnel. We will maintain a schedule that ensures that we have sufficient staff on hand at all times to meet the needs of our customers.

- Facilities: Our restaurant will be located in a prime location, with convenient access for customers and sufficient seating and dining space to accommodate our expected volume of business. We will maintain the cleanliness and appearance of our facilities at all times.

- Suppliers: We will work with a network of trusted suppliers to source the freshest ingredients and other necessary supplies. We will maintain strong relationships with our suppliers and will work with them to ensure that we have a consistent supply of high-quality ingredients. We will also regularly review our supplier relationships to ensure that we are getting the best value for money.

- Financial management: We will use financial management software to track our income and expenses and to create financial reports. We will also maintain accurate and up-to-date records of all financial transactions.

- Legal and regulatory compliance: We will ensure that we are fully compliant with all relevant legal and regulatory requirements, including those related to food safety, employment, and business licensing. We will also carry the necessary insurance to protect our business and our customers.

- Risk management: We will identify and assess potential risks to our business and will implement measures to mitigate or prevent these risks. This may include having contingency plans in place for unexpected events or disruptions, such as natural disasters or equipment failures.

Marketing Plan for an F&B Business

Target Market:

Our target market is foodies, health-conscious individuals, time-poor individuals and families, and social groups. We will use market research to gather information about the preferences and behaviors of these customer segments and will tailor our marketing efforts to appeal to them. For example, we will use social media and email marketing to target foodies with promotions and updates about new menu items and events, and we will highlight the healthy and sustainable aspects of our ingredients and dishes to appeal to health-conscious individuals. We will also focus on the convenience and speed of our delivery and takeout services to attract time-poor individuals and families, and we will use social media and event sponsorship to promote our restaurant as a lively and welcoming place for group gatherings.

Marketing Mix:

- Product: Our products will include a wide range of dishes made with fresh, locally-sourced ingredients. We will offer a mix of classic and contemporary dishes to appeal to a variety of tastes and dietary preferences, including vegetarian, vegan, and gluten-free options. We will also offer catering services for events such as corporate functions, parties, and weddings. We will differentiate our products by highlighting their high quality and unique flavors, as well as by offering a wide range of options to cater to different tastes and preferences.

- Price: Our pricing will be competitive with other restaurants in the area, taking into account the quality of our ingredients and the level of service we provide. We will offer various pricing options, such as discounts for early bird diners and special deals for group bookings. We will also use upselling techniques to encourage customers to upgrade their meals or add extra items, such as appetizers or desserts.

- Place: Our restaurant will be located in a prime location, with convenient access for customers and sufficient seating and dining space to accommodate our expected volume of business. We will also offer delivery and takeout services to customers who prefer to dine at home. We will ensure that our restaurant is well-maintained and attractive, and that our online ordering and delivery systems are easy to use and reliable.

- Promotion: We will use a variety of marketing and promotional techniques to attract and retain customers. These may include traditional advertising methods, such as print and radio ads, as well as digital marketing techniques, such as social media and email marketing. We will also utilize word-of-mouth referrals and customer reviews to spread the word about our business. We will use social media to engage with customers and to promote our products and events, and we will use email marketing to send newsletters and special offers to our subscribers. We will also consider sponsoring local events or partnering with other businesses to reach new customers.

Marketing Budget:

Our marketing budget will be [amount] per year. This budget will be allocated to various marketing and promotional activities, such as advertising, social media marketing, email marketing, and event sponsorship. We will regularly review and adjust our marketing budget in order to ensure that we are getting the best return on investment. We will track the performance of our marketing efforts using metrics such as website traffic, social media engagement, and sales conversions, and we will use this data to optimize our campaigns and allocate our budget accordingly.

Hiring Plan

We will be hiring for the following positions:

- Chefs: We will be looking for chefs with a passion for food and a strong understanding of culinary techniques and trends. Candidates should have relevant culinary qualifications and experience, as well as strong organizational and time management skills.

- Servers: We will be looking for servers who are friendly, knowledgeable, and efficient, with a strong focus on customer service. Candidates should have experience in the hospitality industry, as well as excellent communication and interpersonal skills.

- Kitchen staff: We will be looking for kitchen staff with strong attention to detail and the ability to work well as part of a team. Candidates should have relevant food handling qualifications and experience, as well as good physical fitness and the ability to work under pressure.

Qualifications and experience: We will require all candidates to have relevant qualifications and experience for the positions they are applying for. For example, chefs will be required to have culinary qualifications and experience, while servers will be required to have experience in the hospitality industry.

Recruitment process: Our recruitment process will involve the following steps:

- Advertising: We will advertise the positions using a variety of methods, including job boards, social media, and local media.

- Resume screening: We will review resumes and cover letters to shortlist candidates who meet the minimum qualifications and experience requirements.

- Interviews: We will conduct interviews with shortlisted candidates to assess their fit for the positions and our company culture.

- Reference checks: We will contact the references provided by candidates to verify their qualifications and experience.

- Offer and acceptance: We will make job offers to successful candidates and will work with them to finalize the terms of their employment.

Selection criteria: In addition to qualifications and experience, we will also consider the following factors when making hiring decisions:

- Fit with our company culture: We will look for candidates who align with our values and who will thrive in our dynamic and collaborative work environment.

- Customer service skills: We will prioritize candidates who have strong customer service skills and who are able to create a positive and memorable dining experience for our customers.

- Teamwork and collaboration: We will look for candidates who are able to work well as part of a team and who are willing to contribute to the overall success of the business.

Financial Plan for an F&B Business

A financial plan for a food and beverage business outlines the financial projections and strategies for the business. It includes detailed information on projected income, expenses, and profits, as well as information on funding and investment.

The main components of a financial plan for an F&B business include:

- Sales forecast: A projection of the business’s expected sales over a certain period of time, usually 3-5 years. The forecast should be based on market research and should take into account the target market, competition, and pricing strategy.

- Expense budget: A detailed breakdown of the business’s expected expenses, including costs for ingredients, labor, rent, utilities, marketing, and other operational expenses.

- Profit and loss statement: A summary of the business’s projected income and expenses over a certain period of time, which helps to determine the profitability of the business.

- Break-even analysis: A calculation of the point at which the business will begin to turn a profit, taking into account fixed and variable costs.

- Cash flow statement: A projection of the business’s expected cash inflows and outflows over a certain period of time, which helps to determine the business’s liquidity.

- Funding and investment: Information on the business’s funding needs and sources, including information on loans, grants, and investments.

- Financial ratios: A set of calculations that help to evaluate the overall financial health of the business, such as profitability ratios, liquidity ratios, and solvency ratios.

- Assumptions: A list of the assumptions that have been made in the financial projections, such as projected sales growth, pricing strategy, and operating costs.

For a more detailed guide on how to build a detailed financial plan for your F&B business you might be interested to check our coffee shop financial plan guide , restaurant financial plan guide , food truck financial plan guide or bakery financial plan guide .

Sales Forecast

Let’s assume that [Your Restaurant] has a seating capacity of 100 and that the occupancy rate is 63.00% in Year 1, 70.58% in Year 2 and 78.90% in Year 3.

Also let’s assume that the average check is 25 USD.

This gives us the below revenue forecast for the next three years:

Year 1: 100 x 63.00% x 365 x 25 = 574,900 USD

Year 2: 100 x 70.58% x 365 x 25 = 644,000 USD

Year 3: 100 x 78.90% x 365 x 25 = 720,000 USD

The sales forecast is shown in the chart below:

Income Statement Forecast for an F&B Business

Below you can find the profit and loss statement forecast for the next three years:

| Less COGS | (101,775) | (114,000) | (127,500) |

| Less SG&A expenses | (347,500) | (362,600) | (388,700) |

| Less depreciation | (24,750) | (27,000) | (27,000) |

| Less interest expense | – | – | – |

| Pre-tax income | 100,875 | 140,400 | 176,800 |

| Less taxes | (30,263) | (42,120) | (53,040) |

Cash Flow Statement Forecast for an F&B Business

Below you can find the statement of cash flows forecast for the next three years:

| Net income | 70,613 | 98,280 | 123,760 |

| Plus depreciation | 24,750 | 27,000 | 27,000 |

| Less increase in inventory | (10,356) | (1,719) | (675) |

| Less increase in accounts receivable | – | – | – |

| Plus increase in accounts payable | 8,512 | 1,413 | 555 |

| Less investment | (270,000) | – | – |

| Plus net new equity capital raised | 292,182 | – | – |

| Less dividends paid | – | – | – |

| Plus net new long-term debt | – | – | – |

| Plus net new bank borrowings | – | – | – |

| Beginning cash balance | – | 115,700 | 240,674 |

| Ending cash balance | 115,700 | 240,674 | 391,314 |

Balance Sheet Forecast for an F&B Business

Below you can find the balance sheet forecast for the next three years:

| Cash | 115,700 | 240,674 | 391,314 |

| Inventory | 10,356.3 | 12,075.0 | 12,750.0 |

| Accounts receivable | – | – | – |

| – | – | – | |

| Gross property, plant & equipment | 270,000 | 270,000 | 270,000 |

| Less accumulated depreciation | (24,750) | (51,750) | (78,750) |

| – | – | – | |

| Accounts payable | 8,512 | 9,925 | 10,479 |

| Bank notes payable | – | – | – |

| Long-term debt | – | – | – |

| Shareholders equity | 362,795 | 461,075 | 584,835 |

Risk Management

We will take the following measures to manage financial risks:

- Diversification: We will diversify our revenue streams by offering a range of products and services, such as catering and events, in addition to our regular restaurant operations. This will help to reduce our dependence on any one particular source of income and will provide a buffer against any downturns in the market.

- Cost control: We will regularly review our expenses and will implement cost-saving measures where possible. This could include negotiating better rates with suppliers, reducing waste and spoilage, and streamlining our operations.

- Insurance: We will carry the necessary insurance to protect our business against financial losses due to events such as accidents, natural disasters, and equipment failures. This will help to ensure that we are able to recover from any unexpected setbacks and continue to operate smoothly.

Startup Capital

Our startup capital will come from the following sources:

- Investment: [amount] from [investor/s] – We will receive investment from [investor/s] in exchange for an ownership stake in our business.

- Loans: [amount] from [lender/s] – We will take out loans from [lender/s] to finance the start-up costs of our business, such as purchasing equipment and inventory.

Our startup capital will be used to cover the following costs: