Business Plan Financial Projections

- Written By Dave Lavinsky

Financial projections are an important part of your business plan. The projections give investors and lenders an idea of how well your business is likely to do in the future. Financial projections include both income statements and balance sheets.

Financial projections are important for a number of reasons. First, they give investors and lenders an idea of how well your business is likely to do in the future. This can help you secure the funding you need to get your business off the ground. Financial projections also help you track your progress over time. You can use them to make sure your business is on track to meet its goals. Finally, financial projections can help you spot potential problems early on, so you can take corrective action.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

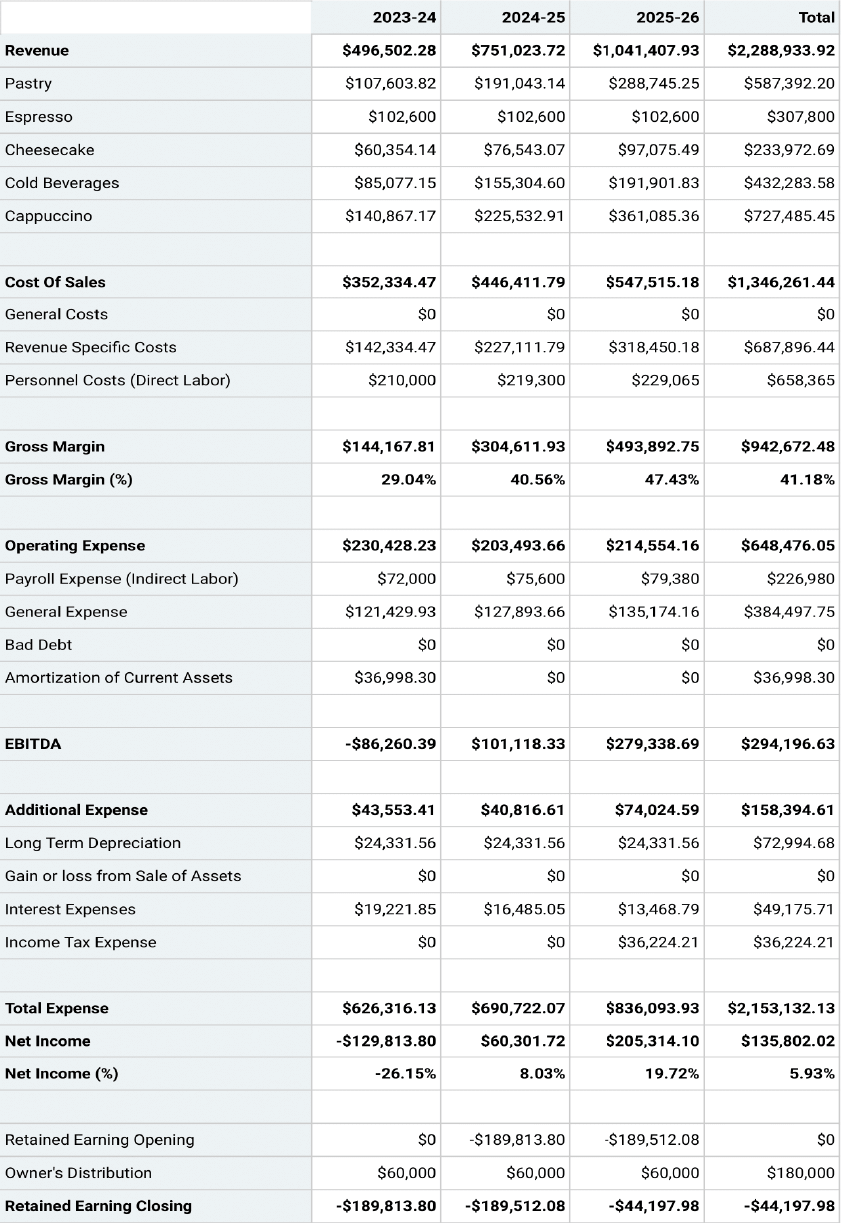

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

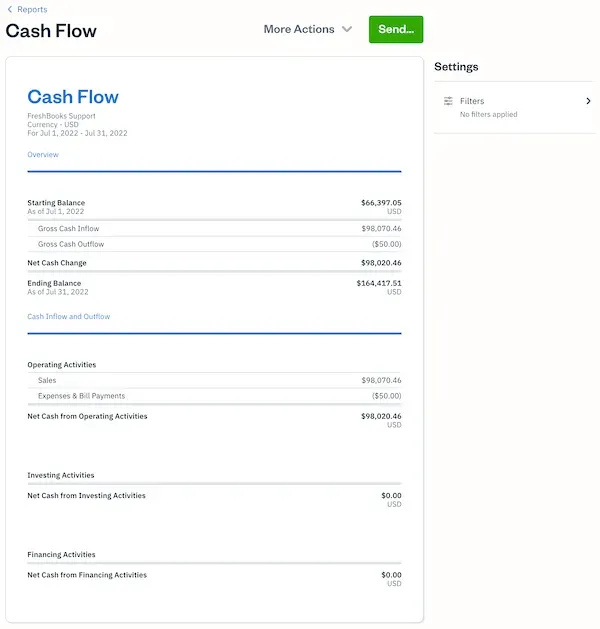

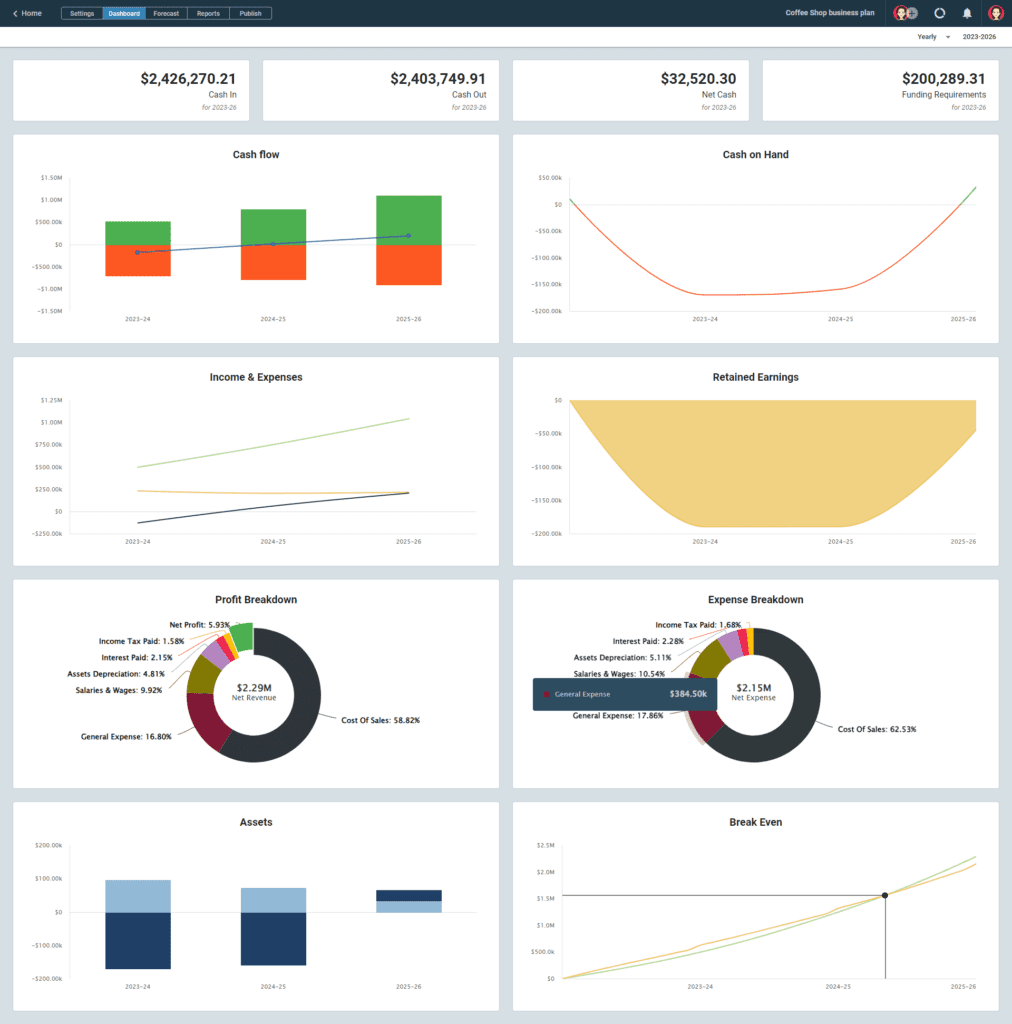

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

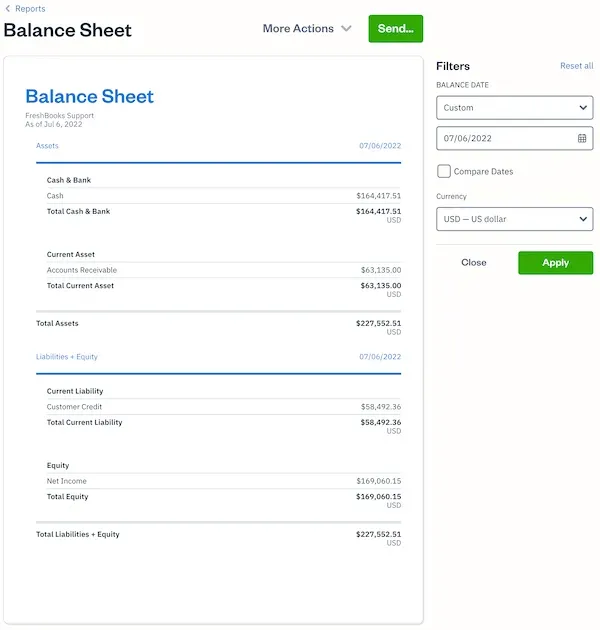

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

Recent Posts

How to Start A Car Rental Business

How to Start A Staffing Agency

Business Plan Outline and Example

Blog categories.

- Business Planning

- Venture Funding

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing a Business Plan—Financial Projections

Spell out your financial forecast in dollars and sense

Creating financial projections for your startup is both an art and a science. Although investors want to see cold, hard numbers, it can be difficult to predict your financial performance three years down the road, especially if you are still raising seed money. Regardless, short- and medium-term financial projections are a required part of your business plan if you want serious attention from investors.

The financial section of your business plan should include a sales forecast , expenses budget , cash flow statement , balance sheet , and a profit and loss statement . Be sure to follow the generally accepted accounting principles (GAAP) set forth by the Financial Accounting Standards Board , a private-sector organization responsible for setting financial accounting and reporting standards in the U.S. If financial reporting is new territory for you, have an accountant review your projections.

Sales Forecast

As a startup business, you do not have past results to review, which can make forecasting sales difficult. It can be done, though, if you have a good understanding of the market you are entering and industry trends as a whole. In fact, sales forecasts based on a solid understanding of industry and market trends will show potential investors that you've done your homework and your forecast is more than just guesswork.

In practical terms, your forecast should be broken down by monthly sales with entries showing which units are being sold, their price points, and how many you expect to sell. When getting into the second year of your business plan and beyond, it's acceptable to reduce the forecast to quarterly sales. In fact, that's the case for most items in your business plan.

Expenses Budget

What you're selling has to cost something, and this budget is where you need to show your expenses. These include the cost to your business of the units being sold in addition to overhead. It's a good idea to break down your expenses by fixed costs and variable costs. For example, certain expenses will be the same or close to the same every month, including rent, insurance, and others. Some costs likely will vary month by month such as advertising or seasonal sales help.

Cash Flow Statement

As with your sales forecast, cash flow statements for a startup require doing some homework since you do not have historical data to use as a reference. This statement, in short, breaks down how much cash is coming into your business on a monthly basis vs. how much is going out. By using your sales forecasts and your expenses budget, you can estimate your cash flow intelligently.

Keep in mind that revenue often will trail sales, depending on the type of business you are operating. For example, if you have contracts with clients, they may not be paying for items they purchase until the month following delivery. Some clients may carry balances 60 or 90 days beyond delivery. You need to account for this lag when calculating exactly when you expect to see your revenue.

Profit and Loss Statement

Your P&L statement should take the information from your sales projections, expenses budget, and cash flow statement to project how much you expect in profits or losses through the three years included in your business plan. You should have a figure for each individual year as well as a figure for the full three-year period.

Balance Sheet

You provide a breakdown of all of your assets and liabilities in the balances sheet. Many of these assets and liabilities are items that go beyond monthly sales and expenses. For example, any property, equipment, or unsold inventory you own is an asset with a value that can be assigned to it. The same goes for outstanding invoices owed to you that have not been paid. Even though you don't have the cash in hand, you can count those invoices as assets. The amount you owe on a business loan or the amount you owe others on invoices you've not paid would count as liabilities. The balance is the difference between the value of everything you own vs. the value of everything you owe.

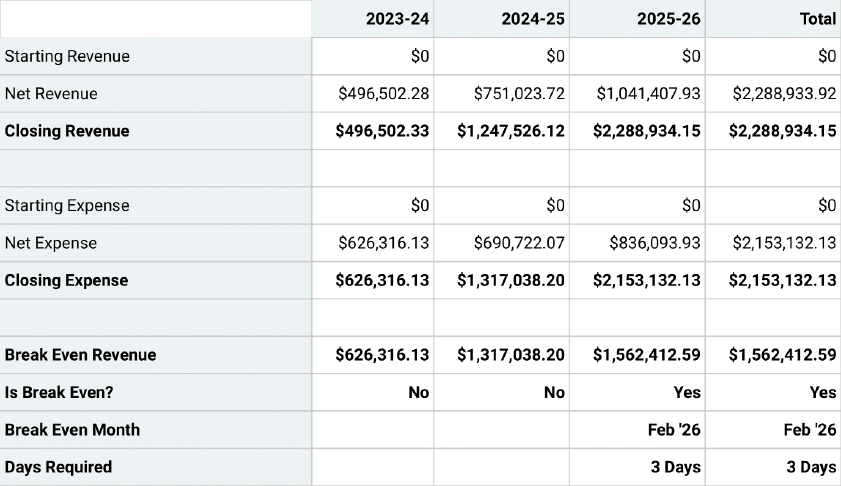

Break-Even Projection

If you've done a good job projecting your sales and expenses and inputting the numbers into a spreadsheet, you should be able to identify a date when your business breaks even—in other words, the date when you become profitable, with more money coming in than going out. As a startup business, this is not expected to happen overnight, but potential investors want to see that you have a date in mind and that you can support that projection with the numbers you've supplied in the financial section of your business plan.

Additional Tips

When putting together your financial projections, keep some general tips in mind:

- Get comfortable with spreadsheet software if you aren't already. It is the starting point for all financial projections and offers flexibility, allowing you to quickly change assumptions or weigh alternative scenarios. Microsoft Excel is the most common, and chances are you already have it on your computer. You can also buy special software packages to help with financial projections.

- Prepare a five-year projection . Don’t include this one in the business plan, since the further into the future you project, the harder it is to predict. However, have the projection available in case an investor asks for it.

- Offer two scenarios only . Investors will want to see a best-case and worst-case scenario, but don’t inundate your business plan with myriad medium-case scenarios. They likely will just cause confusion.

- Be reasonable and clear . As mentioned before, financial forecasting is as much art as science. You’ll have to assume certain things, such as your revenue growth, how your raw material and administrative costs will grow, and how effective you’ll be at collecting on accounts receivable. It’s best to be realistic in your projections as you try to recruit investors. If your industry is going through a contraction period and you’re projecting revenue growth of 20 percent a month, expect investors to see red flags.

How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

10 Min. Read

How to Set and Use Milestones in Your Business Plan

How to Write the Company Overview for a Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

What's Planergy?

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

Cristian Maradiaga

Download a free copy of "preparing your ap department for the future", to learn:.

- How to transition from paper and excel to eInvoicing.

- How AP can improve relationships with your key suppliers.

- How to capture early payment discounts and avoid late payment penalties.

- How better management in AP can give you better flexibility for cash flow management.

Business Plan Financial Projections: How To Create Accurate Targets

- Written by Keith Murphy

- 16 min read

Small businesses and startups have a lot riding on their ability to create effective and accurate financial projections as part of their business plan. Solid financials are a strong enticement for investors, after all, and can help new businesses chart a course that will take them beyond the legendendarily difficult first year and into a productive and profitable future.

But the need for business owners to look ahead in order to secure funding, increase profits, and make intelligent financial decisions doesn’t end when startups become full-fledged businesses—and business plan financial projections aren’t just for startups. Existing businesses can also put them to good use by harvesting insights from their existing financial statements and creating sales projections and other financial forecasts that guide and improve their ongoing business planning.

What Are Business Plan Financial Projections?

Successful companies plan ahead, looking as best they can into the near and distant future to chart a course to growth, innovation, and competitive strength. Financial projections, both as part of an initial business plan and as part of ongoing business planning, use a company’s financial statements to help business owners forecast their upcoming expenses and revenue in a strategically useful way.

Most businesses use two types of financial projections:

- Short-term projections are broken down by month and generally cover the coming 12 months. They provide a guide companies can use to monitor and adjust their financial activity to set and hit targets for the financial year. In the first year, short-term projections will be entirely estimated, but in subsequent years, historical data can be used to help fine-tune them for greater accuracy and strategic utility.

- Long-term projections are focused on the coming three to five years and are generally used to secure investment (both initial and ongoing), provide a strategic roadmap for the company’s growth, or both.

For startups, creating financial projections is part of their initial business plan. Providing financial forecasts banks and potential investors can use to determine the financial viability of a business is key to obtaining financing and investments needed to get the business off the ground.

For existing businesses—for whom an initial business plan has evolved into business planning—financial projections are useful in attracting investors who want to see clear estimates for upcoming revenue, expenses, and potential growth. They’re also helpful in securing loans and lines of credit from financial institutions for the same reason. And even if you’re not trying to get funding or investments, financial projections provide a useful framework for building budgets focused on growth and competitive advantage.

So whether you’re a small business owner, an aspiring tycoon starting a new business, or part of the financial team at a well-established corporation, what matters most is viewing financial projections as a living, breathing reference tool that can help you plan and budget for growth in a realistic way while still setting aspirational goals for your business.

Financial projections, both as part of an initial business plan and as part of ongoing business planning, use a company’s financial statements to help business owners forecast their upcoming expenses and revenue in a strategically useful way.

Financial Projections: Core Components

Whether you’re preparing them as part of your business plan or to enhance your business planning, you’ll need the same financial statements to prepare financial projections: an income statement, a cash-flow statement, and a balance sheet.

- Income statements , sometimes called profit and loss statements , provide detailed information on your company’s revenue and expenses for a given period (e.g., a quarter, year, or multi-year period).

- Cash flow statements provide a comprehensive view of cash flowing into and out of a business. They record all cash flow from operations, investment, and financing activities.

- Balance sheets are used to showcase a company’s assets, liabilities, and owner’s equity for a specific period.

How to Create Financial Projections

The process of creating financial projections is the same whether you’re drafting a business plan or creating forecasts for an existing business. The primary difference is whether you’ll draw on your own research and expertise (a new business or startup business) or use historical data (existing businesses).

Keep in mind that while you’ll create the necessary documents separately, you’ll most likely finish them by consulting each of them as needed. For example, your sales forecast might change once you prepare your cash-flow statement. The best approach is to view each document as both its own piece of the financial projection puzzle and a reference for the others; this will help ensure you can assemble comprehensive and clear financial projections.

1. Start with a Sales Projection

A sales forecast is the first step in creating your income statement. You can start with a one, three, or five-year projection, but keep in mind that, without historical financial data, accuracy may decrease over time. It’s best to start with monthly income statements until you reach your projected break-even , which is the point at which revenue exceeds total operating expenses and you show a profit. Once you hit the break-even, you can transition to annual income statements.

Also, keep in mind factors outside of sales; market conditions, global environmental, political, and health concerns, sourcing challenges (including pricing changes and increased variable costs) and other business disruptors can put the kibosh on your carefully constructed forecasts if you leave them out of your considerations.

Start with a reasonable estimate of the units sold for the forecast period, and multiply them by the price per unit. This value is your total sales for the period.

Next, estimate the total cost of producing these units (i.e., the cost of goods sold , or COGS; sometimes called cost of sales ) by multiplying the per-unit cost by the number of units produced.

Deducting your COGS from your estimated sales yields your gross profit margin.

From the gross margin, subtract expenses such as wages, marketing costs, rent, and other operating expenses. The result is your projected operating income , or net income .

Using these figures, you can create an income statement:

2. Cash Flow Statement

Tracking your estimated cash inflows and outflows from investment and financing, combined with the cash generated by business operations, is the purpose of a cash flow projection .

Investment activities might include, for example, purchasing real estate or investing in research and development outside of daily operations.

Financing activities include cash inflows from investor funding or business loans, as well as cash outflows to repay debts or pay dividends to shareholders.

A reliable and accurate cash flow projection is essential to managing your working capital effectively and ensuring you have all the cash you need to cover your ongoing obligations while still having enough left to invest in growth and innovation or cover emergencies.

Drawing from our income statement, we can create a basic cash flow statement:

3. The Balance Sheet

Providing a “snapshot” of your businesses’ financial performance for a given period of time, the balance sheet contains your company’s assets, liabilities, and owner’s equity.

Assets include inventory, real estate, and capital, while liabilities represent financial obligations and include accounts payable, bank loans, and other debt.

Owner’s equity represents the amount remaining once liabilities have been paid.

Ideally, over time your company’s balance sheet will reflect your growth through a reduction of liabilities and an increase in owner’s equity.

We can complete our triumvirate of financial statements with a basic balance sheet:

Best Practices for Effective Financial Projections

Like a lot of other business processes, financial planning can be complex, time-consuming, and even frustrating if you’re still using manual workflows and paper documents or basic spreadsheet-style applications such as Microsoft Excel. You can get free templates for basic financial projections from the Service Corps of Retired Executives (SCORE), but even templates can only take you so far.

Without a doubt, the best advantage you can give yourself in creating effective and accurate financial projections—whether they’re for the financial section of your business plan or simply part of your ongoing business planning—is to invest in comprehensive procure-to-pay (P2P) software such as Planergy.

In addition to helpful templates, best-in-class P2P software also provides a rich array of real-time data analysis, reporting, and forecasting tools that make it easy to transform historical data (or market research) into accurate forecasts. In addition, artificial intelligence and process automation make it easy to collect, organize, manage and share your data with all internal stakeholders, so everyone has the information they need to create the most useful and complete forecasts and projections possible.

Beyond investing in P2P software, you can also improve the quality and accuracy of your financial projections by:

- Doing your homework. Invest in financial statement analysis and ratio analysis, with a focus not just on your own company, but your industry and the market in general. Learn the current ratios used for liquidity analysis, profitability, and debt and compare them to your own to get a more nuanced and useful understanding of how your company performs internally and within the context of the marketplace.

- Keeping it real. It can be all too easy to get carried away with pie-in-the-sky optimism when forecasting the future of your business. Rose-colored glasses aren’t exclusive to startups and small businesses; over-inflated estimates can hobble even veteran organizations if they don’t practice good data discipline and temper their hopes with practical considerations. Focus on creating realistic, but positive, projections, and you won’t have to worry about investors or lenders glancing askance at your hard work.

- Hoping for the best, but planning for the worst. Run two scenarios when performing your financial projections: the best-case scenario where everything goes perfectly to plan, and a worse-case scenario where Murphy’s Law holds sway. While actual performance will undoubtedly fall somewhere in between the two, having an upper and lower boundary appeals to investors and lenders who are assessing your company’s financial viability.

Financial Projections Help You Reach Your Goals for Growth

From startups to global corporations, every business needs reliable tools for financial forecasting. Take the time to create well-researched, data-driven financial projections, and you’ll be well-equipped to attract investors, secure funding, and chart a course for greater profits, growth, and performance in today’s competitive marketplace.

What’s your goal today?

1. use planergy to manage purchasing and accounts payable.

- Read our case studies, client success stories, and testimonials.

- Visit our “Solutions” page to see the areas of your business we can help improve to see if we’re a good fit for each other.

- Learn about us, and our long history of helping companies just like yours.

2. Download our guide “Preparing Your AP Department For The Future”

3. learn best practices for purchasing, finance, and more.

Browse hundreds of articles , containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.

Related Posts

The Future of FP&A: How The Role Is Evolving With The Use Of Real-Time Data

- 17 min read

Days Sales Outstanding: What Is It and How To Calculate It

- 19 min read

Budgeting In UK Schools: MAT, Academy Budgeting Challenges and Best Practices

Procurement.

- Purchasing Software

- Purchase Order Software

- Procurement Solutions

- Procure-to-Pay Software

- E-Procurement Software

- PO System For Small Business

- Spend Analysis Software

- Vendor Management Software

- Inventory Management Software

AP & FINANCE

- Accounts Payable Software

- AP Automation Software

- Compliance Management Software

- Business Budgeting Software

- Workflow Automation Software

- Integrations

- Reseller Partner Program

Business is Our Business

Stay up-to-date with news sent straight to your inbox

Sign up with your email to receive updates from our blog

This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Read our privacy statement here .

Be Stress Free and Tax Ready 🙌 70% Off for 4 Months. BUY NOW & SAVE

70% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make financial projections for business.

Writing a solid business plan should be the first step for any business owner looking to create a successful business.

As a small business owner, you will want to get the attention of investors, partners, or potential highly skilled employees. It is, therefore, important to have a realistic financial forecast incorporated into your business plan.

We’ll break down a financial projection and how to utilize it to give your business the best start possible.

Key Takeaways

Accurate financial projections are essential for businesses to succeed. In this article, we’ll explain everything you need to know about creating financial projections for your business. Here’s what you need to know about financial projections:

- A financial projection is a group of financial statements that are used to forecast future performance

- Creating financial projections can break down into 5 simple steps: sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections

- Financial projections can offer huge benefits to your business, including helping with forecasting future performance, ensuring steady cash flow, and planning key moves around the growth of the business

Here’s What We’ll Cover:

What Is a Financial Projection?

How to Create a Financial Projection

What goes into a financial projection, what are financial projections used for.

Financial Projections Advantages

Frequently Asked Questions

What Is Financial Projection?

A financial projection is essentially a set of financial statements . These statements will forecast future revenues and expenses.

Any projection includes your cash inflows and outlays, your general income, and your balance sheet.

They are perfect for showing bankers and investors how you plan to repay business loans. They also show what you intend to do with your money and how you expect your business to grow.

Most projections are for the first 3-5 years of business, but some include a 10-year forecast too.

Either way, you will need to develop a short and mid-term projection broken down month by month.

As you are just starting out with your business, you won’t be expected to provide exact details. Most financial projections are rough guesses. But they should also be educated guesses based on market trends, research, and looking at similar businesses.

It’s incredibly important for financial statements to be realistic. Most investors will be able to spot a fanciful projection from a mile away.

In general, most people would prefer to be given realistic projections, even if they’re not as impressive.

Financial projections are created to help business owners gain insight into the future of their company’s financials.

The question is, how to create financial projections? For business plan purposes, it’s important that you follow the best practices of financial projection closely. This will ensure you get accurate insight, which is vital for existing businesses and new business startups alike.

Here are the steps for creating accurate financial projections for your business.

1. Start With A Sales Projection

For starters, you’ll need to project how much your business will make in sales. If you’re creating a sales forecast for an existing business, you’ll have past performance records to project your next period. Past data can provide useful information for your financial projection, such as if your sales do better in one season than another.

Be sure also to consider external factors, such as the economy at large, the potential for added tariffs and taxes in the future, supply chain issues, or industry downturns.

The process is almost the same for new businesses, only without past data to refer to. Business startups will need to do more research on their industry to gain insight into potential future sales.

2. Create Your Expense Projection

Next, create an expense projection for your business. In a sense, this is an easier task than a sales projection since it seems simpler to predict your own behaviors than your customers. However, it’s vital that you expect the unexpected.

Optimism is great, but the worst-case scenario must be considered and accounted for in your expense projection. From accidents in the workplace to natural disasters, rising trade prices, to unexpected supply disruptions, you need to consider these large expenses in your projection.

Something always comes up, so we suggest you add a 10-15% margin on your expense projection.

3. Create Your Balance Sheet Projection

A balance sheet projection is used to get a clear look at your business’s financial position related to assets, liabilities , and equity, giving you a more holistic view of the company’s overall financial health.

For startup businesses, this can prove to be a lot of work since you won’t have existing records of past performance to pull from. This will need to be factored into your industry research to create an accurate financial projection.

For existing businesses, it will be more straightforward. Use your past and current balance sheets to predict your business’s position in the next 1-3 years. If you use a cloud-based, online accounting software with the feature to generate balance sheets, such as the one offered by FreshBooks, you’ll be able to quickly create balance sheets for your financial projection within the app.

Click here to learn more about the features of FreshBooks accounting software.

4. Make Your Income Statement Projection

Next up, create an income statement projection. An income statement is used to declare the net income of a business after all expenses have been made. In other words, it states the profits of a business.

For currently operating businesses, you can use your past income statements and the changes between them to create accurate predictions for the next 1-3 years. You can also use accounting software to generate your income statements automatically.

You’ll need to work on rough estimates for new businesses or those still in the planning phase. It’s vital that you stay realistic and do your utmost to create an accurate, good-faith projection of future income.

5. Finally, Create Your Cash Flow Projection

Last but not least is to generate your projected cash flow statement. A cash flow projection forecasts the movement of all money to and from your business. It’s intertwined with a business’s balance sheet and income statement, which is no different when creating projections.

If your business has been operating for six months or more, you can create a fairly accurate cash flow projection with your past cash flow financial statements. For new businesses, you’ll need to factor in this step of creating a financial forecast when doing your industry research.

It needs to include five elements to ensure an accurate, useful financial forecast for your business. These financial statements come together to provide greater insight into the projected future of a business’s financial health. These include:

Income Statement

A standard income statement summarizes your company’s revenues and expenses over a period. This is normally done either quarterly or annually.

The income statement is where you will do the bulk of your forecasting.

On any income statement, you’re likely to find the following:

- Revenue: Your revenue earned through sales.

- Expenses: The amount you’ve spent, including your product costs and your overheads.

- Pre-Tax Earnings: This is your income before you’ve paid tax.

- Net Income: The total revenues minus your total expenses.

Net income is the most important number. If the number is positive, then you’re earning a profit, if it’s negative, it means your expenses outweigh your revenue and you’re making a loss.

Cash Flow Statement

Your cash flow statement will show any potential investor whether you are a good credit risk. It also shows them if you can successfully repay any loans you are granted.

You can break a cash flow statement into three parts:

- Cash Revenues: An overview of your calculated cash sales for a given time period.

- Cash Disbursements: You list all the cash expenditures you expect to pay.

- Net Cash Revenue: Take the cash revenues minus your cash disbursements.

Balance Sheet

Your balance sheet will show your business’s net worth at a given time.

A balance sheet is split up into three different sections:

- Assets: An asset is a tangible object of value that your company owns. It could be things like stock or property such as warehouses or offices.

- Liabilities: These are any debts your business owes.

- Equity: Your equity is the summary of your assets minus your liabilities.

Looking for an easy-to-use yet capable online accounting software? FreshBooks accounting software is a cloud-based solution that makes financial projections simple. With countless financial reporting features and detailed guides on creating accurate financial forecasts, FreshBooks can help you gain the insight you need to let your business thrive. Click here to give FreshBooks a try for free.

Financial projections have many uses for current business owners and startup entrepreneurs. Provided your financial forecasting follows the best practices for an accurate projection, your data will be used for:

- Internal planning and budgeting – Your finances will be the main factor in whether or not you’ll be able to execute your business plan to completion. Financial projections allow you to make it happen.

- Attracting investors and securing funding – Whether you’re receiving financing from bank loans, investors, or both, an accurate projection will be essential in receiving the funds you need.

- Evaluating business performance and identifying areas for improvement – Financial projections help you keep track of your business’s financial health, allowing you to plan ahead and avoid unwelcome surprises.

- Making strategic business decisions – Timing is important in business, especially when it comes to major expenditures (new product rollouts, large-scale marketing, expansion, etc.). Financial projections allow you to make an informed strategy for these big decisions.

Financial Projections Advantages

Creating clear financial projections for your business startup or existing company has countless benefits. Focusing on creating (and maintaining) good financial forecasting for your business will:

- Help you make vital financial decisions for the business in the future

- Help you plan and strategize for growth and expansion

- Demonstrate to bankers how you will repay your loans

- Demonstrate to investors how you will repay financing

- Identify your most essential financing needs in the future

- Assist in fine-tuning your pricing

- Be helpful when strategizing your production plan

- Be a useful tool for planning your major expenditures strategically

- Help you keep an eye on your cash flow for the future

Your financial forecast is an essential part of your business plan, whether you’re still in the early startup phases or already running an established business. However, it’s vital that you follow the best practices laid out above to ensure you receive the full benefits of comprehensive financial forecasting.

If you’re looking for a useful tool to save time on the administrative tasks of financial forecasting, FreshBooks can help. With the ability to instantly generate the reports you need and get a birds-eye-view of your business’s past performance and overall financial help, it will be easier to create useful financial projections that provide insight into your financial future.

FAQs on Financial Projections

More questions about financial forecasting, projections, and how these processes fit into your business plan? Here are some frequently asked questions by business owners.

Why are financial projections important?

Financial projections allow you to gain insight into your business’s economic trajectory. This helps business owners make financial decisions, secure funding, and more. Additionally, financial projections provide early warning of roadblocks and challenges that may lay ahead for the company, making it easier to plan for a clear course of action.

What is an example of a financial projection?

A projection is an overall look at a business’s forecasted performance. It’s made up of several different statements and reports, such as a cash flow statement, income statement, profit and loss statement, and sales statement. You can find free templates and examples of many of these reports via FreshBooks. Click here to view our selection of accounting templates.

Are financial forecasts and financial projections the same?

Technically, there is a difference between forecasting and projections, though many use the terms interchangeably. Financial forecasting often refers to shorter-term (<1 year) predictions of financial performance, while financial projections usually focus on a larger time scale (2-3 years).

What is the most widely used method for financial forecasting?

The most common method of accurate forecasting is the straight-line forecasting method. It’s most often used for projecting the growth of a business’s revenue growth over a set period. If you notice that your records indicate a 4% growth of revenue per year for five years running, it would be reasonable to assume that this will continue year-over-year.

What is the purpose of a financial projection?

Projection aims to get deeper, more nuanced insight into a business’s financial health and viability. It allows business owners to anticipate expenses and profit growth, giving them the tools to secure funding and loans and strategize major business decisions. It’s an essential accounting process that all business owners should prioritize in their business plans.

Michelle Alexander, CPA

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Does your business plan need a push?

Writting a business plan can be a springboard exercise for your business, and it's not as difficult as people think. All it takes is a bit of method, and some efficient tools. The good news our free articles and paid course have you covered!

Resources on Business Plan Writing :

An article of the Accelerated MBA written by:

Antoine Martin (Ph.D) | Business coach

Is this article relevant? Share it & help someone!

In this article:

Financial projections: how to write the financial plan in business plan.

So, you’ve decided to write a business plan? Good for you! It’s an important document that will help you outline your business goals, strategies, and tactics.

But it’s not just a document for you, as the business owner in charge of everything – it’s also important for potential investors and lenders.

In particular, one of the most important sections of your business plan should be your financial plan or, in other words, your overall financial projections for the next few years – understand, three to five years – distilled in a specific and highly codified format.

Why? Because the financial projections in a business plan are the numbers’ version of your pitch – if something doesn’t add-up, that’s where you see it.

Now, we know that numbers can be impressive (not to say daunting), so in this post, we’ll explain to you how to write a financial plan in your business plan.

We’ll also explain the logic you are supposed to follow to do things right (because financiers expect you to follow a very specific logic).

And we’ll explain what your business plan absolutely needs to include from a financial standpoint.

If that makes sense to you, then let’s get going!

By the way…

Before we dig into the financial projections’ discussion, let us give you a tiny bit of background!

We are professional business coaches, and our job is to push entrepreneurs and business owners to their next steps.

Business planning and business plans are part of that, obviously, therefore we have written a series of free articles on how to write a business plan – of which this page is a part.

We are on a mission to make entrepreneurship fun and accessible, so we provide about 80 percent of our content for free – including a free business plan template to be downloaded down this page.

Still, in case that’s not sufficient, we’ve also created our Business Plan Builder Module , which has been designed to make your life super easy.

Shameless plug: it gives you access to:

- a complete and solid business plan writing work-frame tool

- automated financial tables that take the hassle away (yayyy!)

- two designer-made templates (comprehensive + pitch deck)

- and two hours of tutorial videos recorded with a business coach to explain all the logic you’ll need to master if you plan on writing a business plan that converts.

There’s simply no way to make things easier!

Now, having said that, let’s get going.

As a reminder, what is a business plan about?

To start the discussion, remember that a business plan is about much more than just numbers. As we’ve explained in our article What are Business Plans For? , the role of such a document is to show that beyond a nice business plan pdf nobody really cares about, you have a real business and a plan to get it somewhere.

First, a business plan’s purpose is to help you explain what your project is about. In that sense, the document you need to write should be written as a storytelling instrument, designed, and formulated to tell people a story they will want to read AND remember.

Second, it should give you a way to showcase your main business objectives for the next few years, as well as the strategy you will put into place to get there and deliver on your promises.

Third, your business plan should also provide a market analysis, and a description of your main target segment. That gives the reader a better understanding of your ecosystem’s potential, but more importantly the exercise forces you to look around, open your eyes and do some meaningful research.

You wouldn’t want to drive blindfolded, would you?

Of course, your document should also have a financial component – which is the topic of this article – and there the challenge is to ensure that your financial projections make sense, that they are clear, accurate and easy to follow.

Long things short, investors and bankers expect you to match a very specific business plan outline and format (there’s a code!) and you don’t have much wiggle room there – so be careful in your approach!

What is a Financial Plan & what should it include?

Now, let’s get into the core of this article: financial plans and financial projections. What are they, why are they important – there is a lot to explore.

First things first, what is a financial plan? How important is it in a business plan? And what type of elements is it made of? What are the projected financial statements you need to provide? Oh, and what do we mean by ‘financial projections’ in the first place, by the way?

What is the role of a financial plan in business plan?

A financial plan is the financial part of your business plan. Its purpose is simple: explain to the reader what should be the ins and outs of your project from a financial perspective, and help them see if their own business projections are aligned with yours.

On the one hand, the idea is to put numbers on your project, to make it tangible and show that your vision includes the end and the means.

On the other, it is also to show that you are capable of defending your big idea as well as the projected financials that need to come with it – something that many wannabe entrepreneurs are actually unable to do…

As a side note, and as silly as that might sound, this means that your business plan should include a lot more than just a financial plan and a smart cash flow projection!

That point brings us back to the one we made earlier when we said that a business plan should follow a specific structure (go read that article!), but we mention it again because we want things to be very clear: your business plan should be a matter of storytelling, not just a matter of financial projections!

Typically, we often see accountants work on business plans, and what they produce is rarely enough because they only deliver financial estimates that make no real sense to non-accountants (even less to the entrepreneurs at stake) and leave aside the rest of the topics – particularly the storytelling!

Said differently? The numbers are one aspect of the story, but you still have to come up with the pitch – which is where the rest of the business plan comes in handy.

Make sure to deliver an easy-to-read mix!

Your financial plan must provide your financial projections

To get into the technical part of the discussion, the financial plan in your business plan should include your financial projections, organized in a very formal format.

That makes two distinct points to consider!

On the one hand, you should be able to show with clear numbers what money should come in and when (that’s the income forecasts), for this year but also for the next, the ones after that for three to five years.

On the other, you should also be able to show what money needs to go out to make the business roll. What are the production costs, the fixed and variable expenses, the salaries, and of course the various marketing expenses needed to generate the development you are planning on getting to.

On that point, remember that your cost of client acquisition should also be part of the formalized projections – otherwise your numbers will be flawed (and doomed).

Ultimately, you need to be very clear as to when your new business (or existing business) should break even, as to when should profits be expected, as to when lenders and investors will get their money back, so forth and so on.

It must include specific financial documents people will expect to see

From a very formal perspective, you shouldn’t be trying to make one single projection sheet. Nope! Your readers will expect to see three important financial documents in the financial section of the business plan you will introduce to them.

- A profit and loss statement – also known as your P&L statement, or as an income statement

- A cash flow statement

- And a balance sheet.