Quantitative Market Research: A Guide + Examples

Quantitative market research is a numbers game.

It’s one of the four types of traditional market research; and a tried, trusted, and proven way to get answers to strategically important questions.

Whether you’re already familiar with quantitative research, looking for practical examples, or considering using it in your business, I will cover everything you need to know.

What is quantitative market research?

Quantitative market research collects numerical data to help answer a research question or objective. Popular forms of quantitative research include surveys, polls, questionnaires, and demographical data from primary and secondary sources. The data can be easily quantified, compared, and analyzed to establish patterns, trends, and insights that disprove or prove a research question. It’s used by large and small organizations, thanks to modern market research tools like Similarweb.

What questions can quantitative market research answer?

Quantitative data can help a company find answers to strategic questions. It can help organizations find patterns, spot trends, make predictions, and establish averages. Most questions that can be answered by quantitative research help determine the: how, when, what, and where. Some of these include:

- What is the market size ?

- How have the needs of a market changed?

- What is the number of people that make up your target audience?

- How many people are interested in buying your product?

- Is there a market for your products?

- Where does my target audience spend most of their time online?

- The frequency that people buy your product or service?

- How many people are aware of your brand, product, or service?

- What type of people are your best customers?

- How long do people spend on your website?

- What percentage of customers are happy with your product or service?

Read More: 98 Quantitative Market Research Questions & Examples

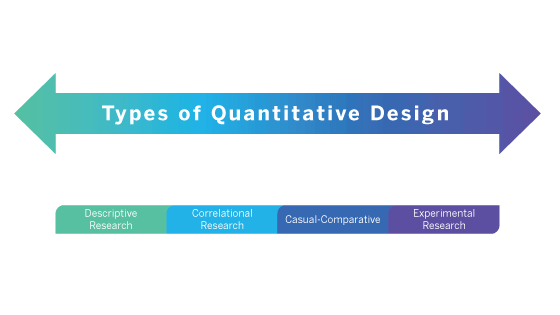

Types of quantitative market research design

Quantitative market research deals with secondary and primary data–as long as it’s presented in numerical form. There are five key techniques of quantitative research design to know.

Experimental research

Experimental research (AKA true experimental research) is a research technique that analyzes to prove a theory. In most cases, it will involve several theories yet to be proved or disproved.

This type of design creates a controlled environment where multiple variables are examined and observed to establish the cause and effect they each have. Various data types of manipulated in the process and each impact is assessed. The study aims to determine the precise conditions in which the different variables affect each other.

A few examples of experimental quantitative research design include

- The effect of Black Friday Marketing on the success of a business.

- Impact of service delivery issues on the perceived reliability of a brand.

- The effect of a gift with purchase on customer satisfaction levels.

Choosing a suitable quantitative research method is vital, as data collection can be utilized for different effects. For instance, statistics can be correlational (which helps infer conclusions about differences) or descriptive (which help to summarize data).

Descriptive research

This type of quantitative research is used to learn more about a specific topic, for instance:

Through observation, it measures different variables and investigates each in detail. It aims to describe characteristics– and is focused more on the ‘what’ of a research problem than the ‘why’ behind it. Aptly named, it describes a research subject without investigating why it happens.

A few examples of descriptive research include:

- A company’s Black Friday marketing campaign description.

- The description of service delivery issues a company or its customers face.

- An outline of what companies offer a gift with online purchases.

Quasi-experimental research

This is similar to experimental research (aka casual comparative research), which seeks to evaluate cause-and-effect relations among variables. However, in the case of quasi-experimental research, the key difference is that it’s an independent and dependent variable that is used.

This type of quantitative research design takes at least two types of data, analyzing each together to examine the differences–using a typical cause-and-effect methodology. Research is usually undertaken in a near-natural setting, with information being gathered from two groups.

- A naturally occurring group that’s closely matched with the original environment.

- A group that is not naturally present.

In doing this, causal links can be made. However, not all casual links will be correct due to other variables impacting results.

Examples of descriptive quantitative design include:

- The effect of the Black Friday campaign’s success on employee productivity.

- Service delivery issues effect on the public perception of a brand.

- The effect of free gifts on customer loyalty.

Stop Guessing, Start Analyzing

Get actionable insights for market research here

Correlational research

Correlational research is usually conducted to determine the relationship between two closely related entities. It looks at how each impacts the other and details the changes that occur.

This type of quantitative research design examines relationships between multiple data types. It will examine the extent to which they align with one another or where they differ. It will not delve into casual links any deeper than this.

Examples of quantitative correlational design include:

- The relationship between Black Friday campaign success and annual revenues.

- Correlations between delivery issues and brand reputation.

- The relationship between free gifts and their perceived loyalty.

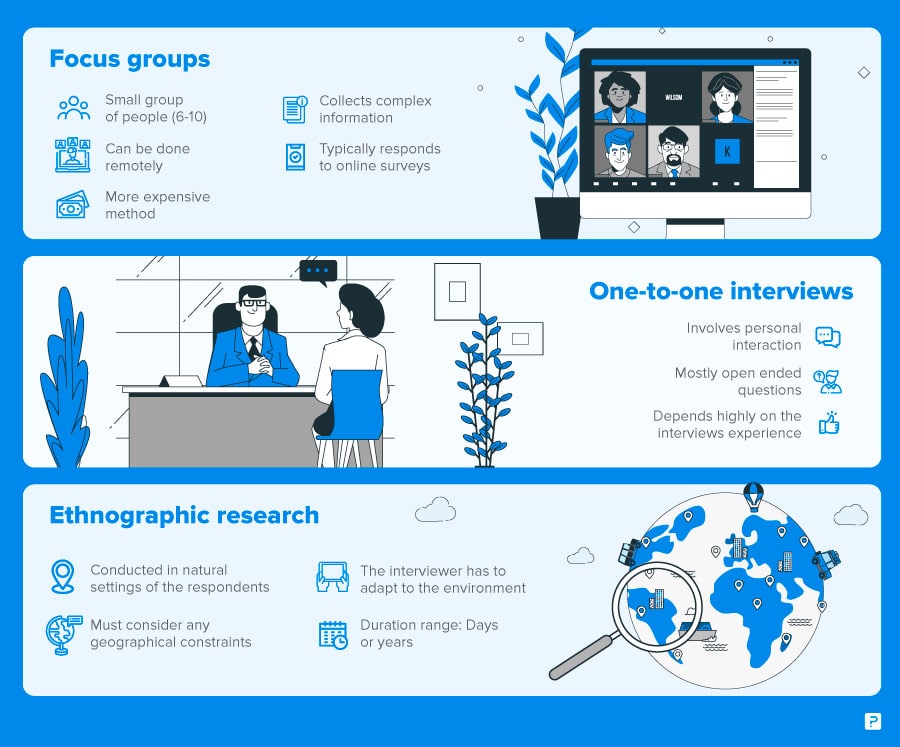

Quantitative market research data collection methods

You have a few options when considering which type of quantitative research is best. The first thing you’ll need to do is choose the data collection method. Below, I’ve summarized three of the most common quantitative research data collection methods.

This applies to telephone, video conference, or face-to-face interviews. While it’s an ideal way to connect with individuals to collect data, it’s a method that utilizes resources due to the time it takes to set up and conduct them.

A market research survey is a cost-effective way to collect quantitative data. Information can be obtained from large groups of people quickly, and the survey itself is relatively easy to set up. Your survey questions must be carefully considered for the results to provide meaningful data . When creating any form of survey for this type of market research , the questions should remain close-ended, giving participants a yes/no answer or one that requests a numerical result.

A few examples of quantitative market research survey questions include:

- Would you recommend Similarweb to a colleague?

2. On a scale of 1-10, with one being the lowest and ten being the highest, how would you rate your experience with the Similarweb customer support team today?

3. Could you find the information you were looking for on our site today?

4. On a scale of 1-10, with one being the lowest and ten being the highest, how easy could you find the information you were looking for on our site today?

5. Was your query resolved in full by our support representative?

While similar, a poll is a shorter survey version. It’s often used to give researchers a point-in-time perspective of a large group of people. Data can be collected in person, over the phone, or online. The costs for polls can vary, depending on whether you buy questions on an existing poll, such as YouGov, or if you opt for a more bespoke survey that you create from scratch.

Fun fact: The origins of polls date back to the 19th century. They were first used in America to predict the outcome of the presidential elections.

Quantitative market research advantages and disadvantages

As with all market research, there are pros and cons to consider. While there are many benefits of using quantitative market research, it’s important to weigh these up with the drawbacks to ensure you make the best choice for your project.

Benefits of quantitative market research

The information you obtain directly results from the questions asked and the audience you choose. Get these two factors right, and you’ll reap the rewards in your research. Here’s a quick summary of the advantages doing quantitative research offers.

- Collect a vast volume of data efficiently with a larger sample pool.

- Get a generalized view of a target audience and demographic.

- Results can be processed quickly as they are highly structured.

- Easy comparison of results from different groups of participants.

- Its objective–relying on solid numbers with fewer variables.

- Number-based research is ideal for analysis.

Disadvantages of quantitative market research

While all quantitative market research collection methods can generate insightful data showing a wider opinion, there are limitations to consider.

- If respondents are not representative of your target audience, this could potentially impact the accuracy of results–it’s also known as a sampling error.

- The wording of questions can impact the findings–consider this carefully when designing interviews, polls, or surveys.

- Quantitative research is close-ended, with no ability to receive data about the ‘why’ or ‘how’ behind the numbers. Findings can only provide a small part of the story without two-way dialogue.

- You’ll need a hypothesis and an appropriate model to avoid invalid results or bias to collect and analyze the data.

What strategies are used to ensure the accuracy of quantitative market research?

Researchers employ several strategies to ensure the accuracy of their quantitative market research. This includes using various data sources to ensure that no single source is unduly influencing the results. Additionally, researchers may use advanced statistical techniques such as regression analysis and factor analysis to ensure that their results are accurate and valid. Lastly, researchers may employ survey design principles such as random and stratified sampling to ensure that the results represent the studied population.

Using Similarweb for quantitative market research

For all the advantages that quantitative market research offers, it’s hard to ignore the limitations. Things like timeliness, bias, and the close-ended nature of this method all matter when you need to make important decisions and don’t have time to take on a lengthy research project.

That’s where we come in.

Depending on your market research questions, there’s usually a faster way to achieve your goals with insights gained from digital research intelligence software like Similarweb. Whether you want to learn more about a target audience, market, industry, or competitors, you can get up-to-date intel that’s on point, easy to understand, and accurate.

Consider your research question, and see what insights and information are available to you right now. With a world of data at your fingertips, you can harness Similarweb Digital Research Intelligence to uncover telling facts, that inform research and strengthen your position. Use it for:

Market Research

Benchmarking

Audience Insights

Company Research

Consumer Journey Tracking

Use it to uncover the insights you need to make decisions and develop strategies that help you win.

Wrapping up

With all types of market research, it’s important to take a balanced approach. Organizations that use quantitative market research to get numerical data must balance this with qualitative data to understand the sentiment behind the numbers. So, while quantitative research has its advantages, it must be done in tandem with other research types to provide a complete picture that tells you what, when, how, and why.

Similarweb’s suite of digital intelligence solutions offers unbiased, accurate, honest insights you can trust. Take it for a trial run today, and see how it can power up your research and save you time.

What are the four types of market research?

The four main types of market research include primary, secondary, quantitative, and qualitative. While there are subcategories, most research falls into one of these four key categories.

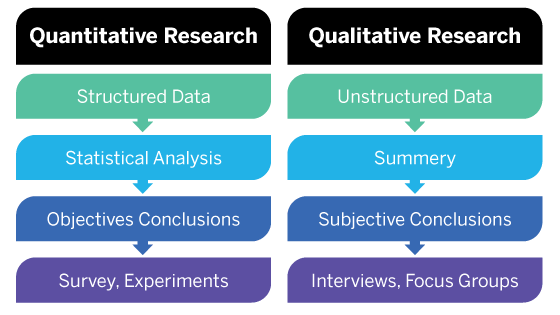

What is the difference between quantitative and qualitative market research?

Quantitative market research is focused on numbers. It collects numerical data to inform a research question or develop a theory. On the other hand, qualitative research is more about consumer sentiment, looking at how and why people feel a certain way about a product, service, or brand.

What are the benefits of quantitative market research?

As it deals with numerical data, quantitative research data can be analyzed quickly and consistently. Future replication is an easy and effective way to conduct a broad study across a large sample size. There are also fewer variables as data is close-ended. Both collection and analysis can be automated and costs less than qualitative research.

What types of questions can quantitative market research answer?

Quantitative research can help answer questions that explain what, how much, when, and where. It seeks to quantify attitudes, behaviors, and opinions but can also be used for establishing averages, making future predictions, and trendspotting.

Who is quantitative market research for?

Quantitative research data delivers information that can help shed light on a market or business. This makes it valuable to both established firms and start-ups of any size. Practically, it can help with market sizing, forecasting, market validation , and more.

What advancements have been made in quantitative market research?

In the past decade, technological advances have enabled quantitative market research to become even more precise and comprehensive. AI and machine learning have allowed researchers to collect and analyze large amounts of data faster and more accurately.

Related Posts

Demand Forecasting 101: How to Predict Future Demand For Your Products

US Financial Outlook: Top Trends to Watch in 2024

Top Economic Trends in Australia to Watch in 2024

What Is Data Management and Why Is It Important?

What is a Niche Market? And How to Find the Right One

The Future of UK Finance: Top Trends to Watch in 2024

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

- Pollfish School

- Market Research

- Survey Guides

- Get started

The Complete Guide to Quantitative Market Research

Quantitative research is a chief category in the research sphere, along with qualitative research. An encompassing aspect of market research , it can include both primary and secondary methods of extracting data.

Although used interchangeably with qualitative research, quantitative research is a distinct process that should not be confused with its counterpart. In fact, it is the opposite of qualitative research.

Let’s navigate through the waters of quantitative research in this complete guide.

What Defines & Makes Up Quantitative Research?

As its name suggests, quantitative research is the process of aggregating quantitative, or numerical data for research purposes. This data is used for a number of applications. These include:

- Quantifying opinions, behaviors, attitudes and problems

- Making generalizations

- Forming predictions

- Discovering patterns

- Determining averages

- Testing relationships

Quantitative research generally relies on a larger sample size in order to quantify any issue or variable. In order to achieve this, this research method involves using mathematical and statistical means.

This type of research answers the “what” and the “how much” of a subject within a research endeavor. As it forms generalizations, this type of method involves surveying a larger population, using measurable data and processing all the data first and then analyzing it from a statistical standpoint.

The Four Main Types of Quantitative Research

There are four main ways to perform quantitative research. Aside from their methodology, these sub-categories also seek different types of answers and conclusions.

1. Descriptive Research

This is used to determine the state of variables. It describes the situation and environment surrounding a variable or topic. As such, it is used for arranging comparisons, outlining sample characteristics, overlooking emerging trends and confirming existing phenomena.

The data is collected by way of observation. Descriptive Research is used to form a hypothesis, but only after having aggregated all the necessary data.

2. Correlational Research

This research method is used to examine the relationships between different subjects and variables. Analyzing relationships is necessary to either test a hypothesis or a prediction. Because this research focuses on relationships between fixed variables, other outlying variables are not part of the investigation.

Correlational research is in direct opposition to experimental research, as none of the studied variables are manipulated. Correlations can be either positive or negative, with different degrees of the relationship’s strength.

3. Experimental Research

This method is used for finding whether there is a cause and effect relationship among variables. This kind of research relies on the scientific method. Unlike correlational research, experimental research involves manipulating variables.

Researchers would manipulate a variable to uncover its effect on another one. This method is frequently referred to as true experimentation, as no experimental undertaking leaves all variables unchanged; at least one must be influenced in some way.

This includes manipulating, randomizing or reverting back a variable. The variables are then measured, calculated and compared.

4. Survey Research

The final research method is crucial to understanding behavior. In market research, it is often used to acclimate a brand with its target market’s desires, needs, points of contention and behaviors.

Surveys allow researchers to ask pointed questions to either discover their target audience or get a granular sense of their opinions. As such, they can be conducted within one group or many, for the sake of comparison.

Instead of turning to survey panels , which are likely to have skewed or biased results, researchers should use a random sample of people. A non-panel-based survey will garner more respondents that aren’t motivated by professional compensation.

Surveys can be administered by mail, in-person, on the phone, or digitally. The latter has even more options: online surveys, third-party surveys, emails and in-app.

Examples of Questions for Quantitative Research

Survey research has a far larger scope of questions than do the other three types, as researchers can ask practically anything to conduct their studies. However, there are some best practices in survey questionnaires, such as focusing on your industry, your product and the desires of customers.

Learn more about asking insightful market research questions . Here are a few examples of quantitative research questions in the three other categories.

- Is working from home the best option to improve productivity for employees with long commutes? Variable: Working from home and in-office Demographic: Employees with long commutes Quantitative Research Type : Experimental

- How has the coronavirus changed employment for white-collar workers? Variable: Employment types and statuses Demographic: White-collar workers Quantitative Research Type : Experimental

- How often do working people travel for a holiday? Variable: Amount of times respondents travel during a holiday Demographic: working people Quantitative Research Type : Descriptive

- How much would you pay for a subscription to an entertainment magazine? Variable: payments for a magazine subscription Demographic: women aged 14-44, those interested in celebrities Quantitative Research Type : Descriptive

- What is the difference in smartphone usage between Millennials and senior citizens? Variable: Time spent on using a smartphone Demographic: Millennials and seniors Quantitative Research Type: Correlational

- Does the leadership style of car shop owners predict the job satisfaction of car salespeople? Variable: Leadership style and job satisfaction Demographic: Car shop employers and salespeople Quantitative Research Type: Correlational

When to Use Quantitative Research and How to Analyze It

The quantitative research method has specific use cases. You ought to consider which is best for your particular business, which includes your strategy, your marketing and other facets.

The core of quantitative research is to quantify a phenomenon (a problem, an inadequacy, and a slew of other occurrences) and understand its prevalence. Researchers do this by observing large portions of a population.

You should use this form of research whenever you need to be presented with the state of things at a higher level, or from a bird’s eye view. This Is because this type of research can identify links between various factors, look for correlations and discover cause and effect relationships.

Researchers can then use the results of their findings to form predictions. This is useful in market research when launching a new product, brainstorming product ideas or innovations or growing a customer base.

To analyze this research, it should first be made quantifiable and objective. Researchers should pin down the scales and units of measurements in their various studies. Then, they should organize them into easily interpretable formats.

For example, once you gather the numerical data, you can enter it into a spreadsheet. Thereafter, you can organize it by desegregating it into graphs, charts and tables. Finally, you should draw data-based conclusions from your study. You can also do further sleuthing via advanced analytics.

The Benefits and Drawbacks of Quantitative Research

Quantitative research has a bevy of benefits; it also has some hindrances. You should peruse both the positive and negative qualities of this research type before setting out on any major research project. The following may help you choose one form of research over the other, or use aspects of both.

- Larger sample pools: the larger the group of respondents, the more accurate are the results.

- Highly structured: Surveys, questionnaires, and other tools for recording numerical data

- Focused: The design of the study is determined before it begins

- Theory-based: Research tests a theory to provide support/proof

- Designed to Be Analyzed: Numbers/statistics exist as tables, charts, figures and other non-textual forms for easy analysis.

- Objective: Steering clear of bias as the research is separated from the data & only objective responses are sought.

- Direct comparisons of results: The study can be set in different cultural environments, times or different groups of participants with a statistical comparison of results.

- Focuses solely on numbers: This can be limiting as researchers may overlook other data and larger themes.

- Superficial Representations: It cannot adequately describe complex concepts (ex: feelings, opinions) it only shows the numbers behind them.

- Several factors can invalidate results: A hypothesis and a model for collecting/ analyzing data.is required; any mistake can lead to bias and inaccurate illustrations.

- Erred Structure: If any data is missing or if measurements are not clear, biases easily take precedence.

The Final Word on Quantitative Research

Market research is far too encompassing to fully complete, especially in a limited amount of time. To tackle market research, begin with a research method. Quantitative research is often a good starting point, as it shows you the existence of a problem by way of quantifying it.

Aside from confirming the existence, it can help confirm a hypothesis, find correlations and prove cause and effect relationships. A hard set of data can also help you make educated predictions.

While the three types of quantitative research methods are useful, they do have several disadvantages. The fourth one, ie, survey research helps fill in the gaps and inadequacies of numerical limitations. Interestingly enough, they too can be a source of hard data and numbers.

Either way, market research is sure to benefit from incorporating surveys as part of the processes.

Frequently asked questions

What is quantitative market research.

Quantitative market research utilizes the techniques of quantitative research in order to better understand the target market. In quantitative research, the information gathered from surveys and questionnaires is converted into numerical values so it can be easily analyzed.

What types of questions do quantitative research answer?

Quantitative research seeks to define “what” and “how much.” It is used for identifying patterns, making predictions, establishing averages, and quantifying opinions, attitudes or behaviors.

What are the four main types of quantitative research?

The four main types of quantitative research are survey research, correlational research, descriptive research, and experimental research.

What type of surveys are used for quantitative research?

Quantitative surveys are best suited for quantitative research. In this type of survey, there are no open-ended questions, and all responses can be assigned a numerical value. In most cases, a quantitative survey is distributed to a large and random sample of individuals.

Why are large sample sizes important when conducting quantitative research?

A small sample size can lead to inaccurate results. The larger the sample size (i.e. the group of individuals who receive the survey), the more likely it is that the results will be statistically significant and accurate.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

Quantitative research: Understanding the approaches and key elements

Quantitative research has many benefits and challenges but understanding how to properly conduct it can lead to a successful marketing research project.

Choosing the right quantitative approach

Editor’s note: Allison Von Borstel is the associate director of creative analytics at The Sound. This is an edited version of an article that originally appeared under the title “ Understanding Quantitative Research Approaches .”

What is quantitative research?

The systematic approaches that ground quantitative research involve hundreds or thousands of data points for one research project. The wonder of quantitative research is that each data point, or row in a spreadsheet, is a person and has a human story to tell.

Quantitative research aggregates voices and distills them into numbers that uncover trends, illuminates relationships and correlations that inform decision-making with solid evidence and clarity.

The benefits of quantitative approach es

Why choose a quantitative approach? Because you want a very clear story grounded in statistical rigor as a guide to making smart, data-backed decisions.

Quantitative approaches shine because they:

Involve a lot of people

Large sample sizes (think hundreds or thousands) enable researchers to generalize findings because the sample is representative of the total population.

They are grounded in statistical rigor

Allowing for precise measurement and analysis of data, providing statistically significant results that bolster confidence in research.

Reduce bias

Structured data collection and analysis methods enhance the reliability of findings.

Boost efficiency

Quantitative methods often follow a qualitative phase, allowing researchers to validate findings by reporting the perspective of hundreds of people in a fraction of the time.

Widen the analysis’ scope

The copious data collected in just a 20-minute (max) survey positions researchers to evaluate a broad spectrum of variables within the data. This thorough comprehension is instrumental when dealing with complex questions that require in-depth analysis.

Quantitative approaches have hurdles, which include:

Limited flexibility

Once a survey is fielded, or data is gathered, there’s no opportunity to ask a live follow-up question. While it is possible to follow-up with the same people for two surveys, the likelihood of sufficient responses is small.

Battling bots

One of the biggest concerns in data quality is making sure data represents people and not bots.

Missing body language cues

Numbers, words and even images lack the cues that a researcher could pick up on during an interview. Unlike in a qualitative focus group, where one might deduce that a person is uncertain of an answer, in quantitative research, a static response is what the researcher works with.

Understanding quantitative research methods

Quantitative approaches approach research from the same starting point as qualitative approaches – grounded in business objectives with a specific group of people to study.

Once research has kicked off, the business objective thoroughly explored and the approach selected, research follows a general outline:

Consider what data is needed

Think about what type of information needs to be gathered, with an approach in mind. While most quantitative research involves numbers, words and images also count.

- Numbers: Yes, the stereotypical rows of numbers in spreadsheets. Rows that capture people’s opinions and attitudes and are coded to numbers for comparative analytics. Numerical analysis is used for everything from descriptive statistics to regression/predictive analysis.

- Words: Text analysis employs a machine learning model to identify sentiment, emotion and meaning of text. Often used for sentiment analysis or content classification, it can be applied to single-word responses, elaborate open-ends, reviews or even social media posts.

- Images: Image analysis extracts meaningful information from images. A computer vision model that takes images as inputs and outputs numerical information (e.g., having a sample upload their favorite bag of chips and yielding the top three brands).

Design a survey

Create a survey to capture the data needed to address the objective. During this process, different pathways could be written to get a dynamic data set (capturing opinions that derive from various lived experiences). Survey logic is also written to provide a smooth UX experience for respondents.

Prepare the data

The quality of quantitative research rests heavily on the quality of data. After data is collected (typically by fielding a survey or collecting already-existing data, more on that in a bit), it’s time to clean the data.

Begin the analysis process

Now that you have a robust database (including numbers, words or images), it’s time to listen to the story that the data tells. Depending on the research approach used, advanced analytics come into play to tease out insights and nuances for the business objective.

Tell the story

Strip the quantitative jargon and convey the insights from the research. Just because it’s quantitative research does not mean the results have to be told in a monotone drone with a monochrome chart. Answer business objectives dynamically, knowing that research is grounded in statistically sound information.

The two options: Primary vs. secondary research

The two methods that encompass quantitative approaches are primary (collecting data oneself) and secondary (relying on already existing data).

Primary research is primarily used

Most research involves primary data collection – where the researcher collects data directly. The main approach in primary research is survey data collection.

The types of survey questions

Span various measurement scales (nominal, ordinal, interval and ratio) using a mix of question types (single and multi-choice, scales, matrix or open-ends).

Analysis methods

Custom surveys yield great data for a variety of methods in market analysis. Here are a couple favorites:

- Crosstabulation : Used to uncover insights that might not be obvious at first glance. This analysis organizes data into categories, revealing trends or patterns between variables.

- Sentiment analysis: Used to sift through text to gauge emotions, opinions and attitudes. This method helps understand perception, fine-tune strategies and effectively respond to feedback.

- Market sizing: Used to map out the dimensions of a market. By calculating the total potential demand for a product or service in a specific market, this method reveals the scope of opportunities needed to make informed decisions about investment and growth strategies.

- Conjoint analysis : Used to uncover what people value most in products or services. It breaks down features into bits and pieces and asks people to choose their ideal combo. By analyzing these preferences, this analysis reveals the hidden recipe for customer satisfaction.

- Job-To-Be-Done : Used to understand the underlying human motivations that drive people to act. People are multifaceted and experience a myriad of situations each day – meaning that a brand’s competition isn’t limited to in-category.

- Segmentation: Used to identify specific cohorts within a greater population. It groups people with similar characteristics, behaviors or needs together. This method helps tailor products or services to specific groups, boosting satisfaction and sales.

Statistical rigor

Regardless of method, a quantitative approach then enables researchers to draw inferences and make predictions based upon the confidence in the data (looking at confidence intervals, margin of error, etc.)

Let’s not forget secondary research

By accessing a wide range of existing information, this research can be a cost-effective way to gain insights or can supplement primary research findings.

Here are popular options:

Government sources

Government sources can be extremely in-depth, can range across multiple industries and markets and reflect millions of people. This type of data is often instrumental for longitudinal or cultural trends analysis.

Educational institutions

Research universities conduct in-depth studies on a variety of topics, often aggregating government data, nonprofit data and primary data.

Client data

This includes any research that was conducted for or by companies before the present research project. Whether it’s data gathered from customer reviews or prior quantitative work, these secondary resources can help extend findings and detect trends by connecting past data to future data.

Quantitative research enhances research projects

Quantitative research approaches are so much more than “how much” or “how many,” they reveal the why behind people’s actions, emotions and behaviors. By using standardized collection methods, like surveys, quant instills confidence and rigor in findings.

Canvs AI: Unlock critical insights from unstructured feedback Related Categories: Research Industry, Data Analysis, Quantitative Research Research Industry, Data Analysis, Quantitative Research, Artificial Intelligence / AI, Text Analytics

Segmentation in the pharma industry: How to create resilient strategies Related Categories: Research Industry, Sampling, Survey Research Research Industry, Sampling, Survey Research, Market Segmentation Studies, Segmentation Studies, Health Care (Healthcare), Health Care (Healthcare) Research, Patients , Questionnaire Analysis, Social Media Research

Leveraging AI to unlock qualitative research at scale Related Categories: Research Industry, Quantitative Research, Sampling, Hybrid Research (Qual/Quant) Research Industry, Quantitative Research, Sampling, Hybrid Research (Qual/Quant), Artificial Intelligence / AI, Qualitative Research, Attitude/Usage Studies, Consumer Research, Consumers, Data Visualization/Infographics

Situational choice experiments for marketing research Related Categories: Research Industry, Data Analysis, Survey Research Research Industry, Data Analysis, Survey Research, Conjoint Analysis/Trade-Off Analysis, Discrete Choice Modeling, Physicians, Software-Conjoint Analysis, Questionnaire Analysis

Root out friction in every digital experience, super-charge conversion rates, and optimise digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered straight to teams on the ground

Know exactly how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Meet the operating system for experience management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Ultimate Guide to Market Research

- Quantitative Research

Try Qualtrics for free

Your ultimate guide to quantitative research.

10 min read You may be already using quantitative research and want to check your understanding, or you may be starting from the beginning. Here’s an exploration of this research method and how you can best use it for maximum effect for your business.

You may be already using quantitative research and want to check your understanding, or you may be starting from the beginning. Here’s an exploration of this research method and how you can best use it for maximum effect for your business.

What is quantitative research?

Quantitative is the research method of collecting quantitative data – this is data that can be converted into numbers or numerical data, which can be easily quantified, compared, and analysed.

Quantitative research deals with primary and secondary sources where data is represented in numerical form. This can include closed-question poll results, statistics, and census information or demographic data .

Quantitative data tends to be used when researchers are interested in understanding a particular moment in time and examining data sets over time to find trends and patterns.

To collect numerical data, surveys are often employed as one of the main research methods to source first-hand information in primary research . Qualitative research can also come from third-party research studies .

Quantitative research is widely used in the realms of social sciences, such as psychology, economics, sociology, and marketing.

Research teams collect data that is significant to proving or disproving a hypothesis research question – known as the research objective. When they collect quantitative data, researchers will aim to use a sample size that is representative of the total population of the target market they’re interested in.

Then the data collected will be manually or automatically stored and compared for insights.

Learn how Qualtrics can enhance & simplify the quantitative research process

Qualitative vs quantitative research

While the quantitative research definition focuses on numerical data, qualitative research is defined as data that supplies non-numerical information.

Qualitative research focuses on the thoughts, feelings, and values of a participant, to understand why people act in the way they do. They result in data types like quotes, symbols, images, and written testimonials.

These data types tell researchers subjective information, which can help us assign people into categories, such as a participant’s religion, gender, social class, political alignment, likely favoured products to buy, or their preferred training learning style.

For this reason, qualitative research is often used in social research, as this gives a window into the behaviour and actions of people.

In general, if you’re interested in measuring something or testing a hypothesis, use quantitative methods. If you want to explore ideas, thoughts, and meanings, use qualitative methods.

However, quantitative and qualitative research methods are both recommended when you’re looking to understand a point in time, while also finding out the reason behind the facts.

Quantitative research data collection methods

Quantitative research methods can use structured research instruments like:

A survey is a simple-to-create and easy-to-distribute research method, which helps gather information from large groups of participants quickly. Traditionally, paper-based surveys can now be made online, so costs can stay quite low.

Quantitative questions tend to be closed questions that ask for a numerical result, based on a range of options, or a yes/no answer that can be tallied quickly.

Face-to-face or phone interviews

Interviews are a great way to connect with participants , though they require time from the research team to set up and conduct.

Researchers may also have issues connecting with participants in different geographical regions. The researcher uses a set of predefined close-ended questions, which ask for yes/no or numerical values.

Polls can be a shorter version of surveys, used to get a ‘flavour’ of what the current situation is with participants. Online polls can be shared easily, though polls are best used with simple questions that request a range or a yes/no answer.

Quantitative data is the opposite of qualitative research, another dominant framework for research in the social sciences, explored further below.

Quantitative data types

Quantitative research methods often deliver the following data types:

- Test Scores

- Per cent of training course completed

- Performance score out of 100

- Number of support calls active

- Customer Net Promoter Score (NPS)

When gathering numerical data, the emphasis is on how specific the data is, and whether they can provide an indication of what ‘is’ at the time of collection. Pre-existing statistical data can tell us what ‘was’ for the date and time range that it represented.

Quantitative research design methods (with examples)

Quantitative research has a number of quantitative research designs you can choose from:

Descriptive

This design type describes the state of a data type is telling researchers, in its native environment. There won’t normally be a clearly defined research question to start with. Instead, data analysis will suggest a conclusion, which can become the hypothesis to investigate further.

Examples of descriptive quantitative design include:

- A description of child’s Christmas gifts they received that year

- A description of what businesses sell the most of during Black Friday

- A description of a product issue being experienced by a customer

Correlational

This design type looks at two or more data types, the relationship between them, and the extent that they differ or align. This does not look at the causal links deeper – instead statistical analysis looks at the variables in a natural environment.

Examples of correlational quantitative design include:

- The relationship between a child’s Christmas gifts and their perceived happiness level

- The relationship between a business’ sales during Black Friday and the total revenue generated over the year

- The relationship between a customer’s product issue and the reputation of the product

Causal-Comparative/Quasi-Experimental

This design type looks at two or more data types and tries to explain any relationship and differences between them, using a cause-effect analysis. The research is carried out in a near-natural environment, where information is gathered from two groups – a naturally occurring group that matches the original natural environment, and one that is not naturally present.

This allows for causal links to be made, though they might not be correct, as other variables may have an impact on results.

Examples of causal-comparative/quasi-experimental quantitative design include:

- The effect of children’s Christmas gifts on happiness

- The effect of Black Friday sales figures on the productivity of company yearly sales

- The effect of product issues on the public perception of a product

Experimental Research

This design type looks to make a controlled environment in which two or more variables are observed to understand the exact cause and effect they have. This becomes a quantitative research study, where data types are manipulated to assess the effect they have. The participants are not naturally occurring groups, as the setting is no longer natural. A quantitative research study can help pinpoint the exact conditions in which variables impact one another.

Examples of experimental quantitative design include:

- The effect of children’s Christmas gifts on a child’s dopamine (happiness) levels

- The effect of Black Friday sales on the success of the company

- The effect of product issues on the perceived reliability of the product

Quantitative research methods need to be carefully considered, as your data collection of a data type can be used to different effects. For example, statistics can be descriptive or correlational (or inferential). Descriptive statistics help us to summarise our data, while inferential statistics help infer conclusions about significant differences.

Advantages of quantitative research

- Easy to do : Doing quantitative research is more straightforward, as the results come in numerical format, which can be more easily interpreted.

- Less interpretation : Due to the factual nature of the results, you will be able to accept or reject your hypothesis based on the numerical data collected.

- Less bias : There are higher levels of control that can be applied to the research, so bias can be reduced , making your data more reliable and precise.

Disadvantages of quantitative research

- Can’t understand reasons: Quantitative research doesn’t always tell you the full story, meaning you won’t understand the context – or the why, of the data you see, why do you see the results you have uncovered?

- Useful for simpler situations: Quantitative research on its own is not great when dealing with complex issues. In these cases, quantitative research may not be enough.

How to use quantitative research to your business’s advantage

Quantitative research methods may help in areas such as:

- Identifying which advert or landing page performs better

- Identifying how satisfied your customers are

- How many customers are likely to recommend you

- Tracking how your brand ranks in awareness and customer purchase intent

- Learn what consumers are likely to buy from your brand.

6 steps to conducting good quantitative research

Businesses can benefit from quantitative research by using it to evaluate the impact of data types. There are several steps to this:

- Define your problem or interest area : What do you observe is happening and is it frequent? Identify the data type/s you’re observing.

- Create a hypothesis : Ask yourself what could be the causes for the situation with those data types.

- Plan your quantitative research : Use structured research instruments like surveys or polls to ask questions that test your hypothesis.

- Data Collection : Collect quantitative data and understand what your data types are telling you. Using data collected on different types over long time periods can give you information on patterns.

- Data analysis : Does your information support your hypothesis? (You may need to redo the research with other variables to see if the results improve)

- Effectively present data : Communicate the results in a clear and concise way to help other people understand the findings.

Learn how Qualtrics can enhance & simplify the quantitative research process

Related resources

Market intelligence 9 min read, qualitative research questions 11 min read, ethnographic research 11 min read, business research methods 12 min read, qualitative research design 12 min read, business research 10 min read, qualitative research interviews 11 min read, request demo.

Ready to learn more about Qualtrics?

Quantitative Market Research: The Complete Guide

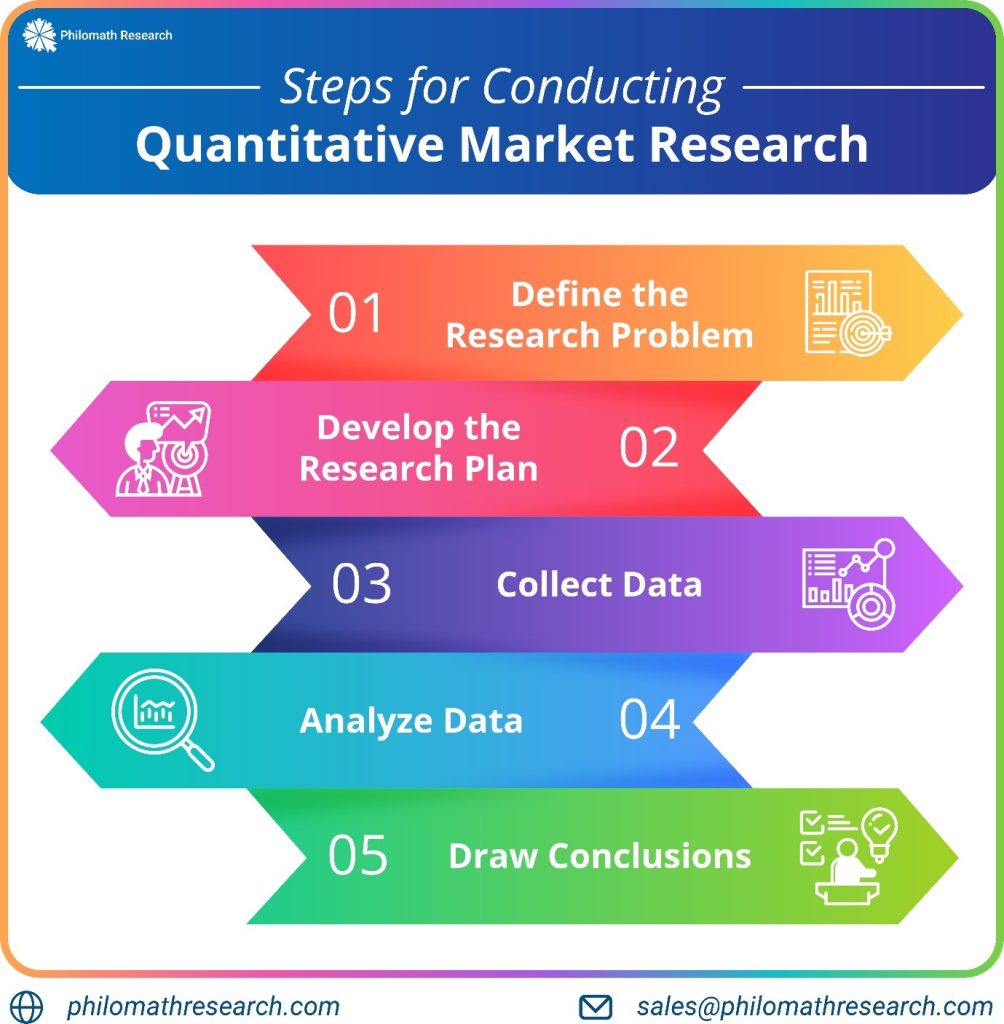

Quantitative market research is an essential tool for businesses looking to gain insights into their target market and make data-driven decisions. In this guide, we’ll provide an overview of quantitative market research and the steps involved in conducting it.

What is Quantitative Market Research? Quantitative market research involves the collection and analysis of numerical data to understand the preferences, behavior, and opinions of a target audience. The goal is to provide statistically significant data that can be used to make informed business decisions.

Step 1 : Define the Research Problem The first step in conducting quantitative market research is to clearly define the research problem. What are the key questions that you want to answer? What specific information are you trying to obtain? Defining the research problem is essential as it will guide the entire research process.

Step 2: Develop the Research Plan Once the research problem is defined, the next step is to develop a research plan. This includes determining the target audience, selecting the research methodology, and designing the research instrument. The research plan should be comprehensive and clearly outline the research objectives, sample size, data collection method, and analysis plan.

Step 3: Collect Data The next step is to collect the data. There are several methods of data collection including surveys, polls, online questionnaires, and phone interviews. It’s essential to ensure that the sample size is representative of the target audience and that the data is collected using a standardized approach.

Step 4: Analyze Data Once the data is collected, the next step is to analyze it. The data should be organized and summarized using statistical analysis techniques such as mean, mode, and standard deviation. The objective is to identify patterns and trends in the data that can be used to make informed business decisions.

Step 5: Draw Conclusions The final step is to draw conclusions based on the data analysis. The conclusions should be based on the data and provide insights into the target audience. It’s essential to ensure that the conclusions are supported by statistical evidence and that they can be used to make informed business decisions.

Quantitative market research is a research method that involves collecting numerical data that can be analyzed statistically. This method is widely used in market research to gather information about customer behavior, opinions, and preferences. Here are some of the benefits of quantitative market research:

1. Large Sample Size: One of the significant benefits of quantitative research is the ability to collect data from a large sample size. This provides a more accurate representation of the population and reduces the margin of error.

2. Objective Results: Quantitative research provides objective results, as the data collected is numerical and can be analyzed statistically. This minimizes the impact of personal bias and ensures that the results are reliable and valid.

3. Easy Data Analysis: The data collected through quantitative research can be analyzed using statistical software, making it easy to identify trends, patterns, and correlations. This allows researchers to draw conclusions and make data-driven decisions.

4. Cost-effective: Compared to other research methods, quantitative research is cost-effective. It requires fewer resources and can be conducted quickly and efficiently, making it an ideal method for businesses with limited budgets.

5. Easy to Replicate: Quantitative research is easy to replicate as it involves standard methods of data collection and analysis. This allows businesses to conduct similar research in different locations or with different groups of people, ensuring consistency in the results.

6. Measurable Results: The numerical data collected through quantitative research provides measurable results, making it easy to track progress over time. This is particularly useful in tracking customer satisfaction or changes in customer behavior.

In summary, quantitative market research is a reliable and cost-effective method for gathering data, providing objective results that can be easily analyzed and replicated. These benefits make it an essential tool for businesses looking to make data-driven decisions and stay competitive in the market.

Quantitative market research is a powerful tool for businesses looking to gain insights into their target audience. It’s essential to define the research problem, develop a research plan, collect and analyze the data, and draw conclusions based on the data analysis. By following these steps, businesses can make data-driven decisions that can help them succeed in the market. To know more about quantitative research reach us at www.philomathresearch.com

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

- What Is Qualitative Market Research and Its Types?

- Navigating the Essentials: Conducting Healthcare Market Research Like A Pro

- Discovering B2C Growth: Exploring the Best Market Research Tools

- Revolutionizing Market Research: How Businesses Are Shaping the Future of Consumer Insights

- Survey Programming Explained: Making Surveys Work for You

Recent Comments

- Privacy Policy

Home » Quantitative Research – Methods, Types and Analysis

Quantitative Research – Methods, Types and Analysis

Table of Contents

Quantitative Research

Quantitative research is a type of research that collects and analyzes numerical data to test hypotheses and answer research questions . This research typically involves a large sample size and uses statistical analysis to make inferences about a population based on the data collected. It often involves the use of surveys, experiments, or other structured data collection methods to gather quantitative data.

Quantitative Research Methods

Quantitative Research Methods are as follows:

Descriptive Research Design

Descriptive research design is used to describe the characteristics of a population or phenomenon being studied. This research method is used to answer the questions of what, where, when, and how. Descriptive research designs use a variety of methods such as observation, case studies, and surveys to collect data. The data is then analyzed using statistical tools to identify patterns and relationships.

Correlational Research Design

Correlational research design is used to investigate the relationship between two or more variables. Researchers use correlational research to determine whether a relationship exists between variables and to what extent they are related. This research method involves collecting data from a sample and analyzing it using statistical tools such as correlation coefficients.

Quasi-experimental Research Design

Quasi-experimental research design is used to investigate cause-and-effect relationships between variables. This research method is similar to experimental research design, but it lacks full control over the independent variable. Researchers use quasi-experimental research designs when it is not feasible or ethical to manipulate the independent variable.

Experimental Research Design

Experimental research design is used to investigate cause-and-effect relationships between variables. This research method involves manipulating the independent variable and observing the effects on the dependent variable. Researchers use experimental research designs to test hypotheses and establish cause-and-effect relationships.

Survey Research

Survey research involves collecting data from a sample of individuals using a standardized questionnaire. This research method is used to gather information on attitudes, beliefs, and behaviors of individuals. Researchers use survey research to collect data quickly and efficiently from a large sample size. Survey research can be conducted through various methods such as online, phone, mail, or in-person interviews.

Quantitative Research Analysis Methods

Here are some commonly used quantitative research analysis methods:

Statistical Analysis

Statistical analysis is the most common quantitative research analysis method. It involves using statistical tools and techniques to analyze the numerical data collected during the research process. Statistical analysis can be used to identify patterns, trends, and relationships between variables, and to test hypotheses and theories.

Regression Analysis

Regression analysis is a statistical technique used to analyze the relationship between one dependent variable and one or more independent variables. Researchers use regression analysis to identify and quantify the impact of independent variables on the dependent variable.

Factor Analysis

Factor analysis is a statistical technique used to identify underlying factors that explain the correlations among a set of variables. Researchers use factor analysis to reduce a large number of variables to a smaller set of factors that capture the most important information.

Structural Equation Modeling

Structural equation modeling is a statistical technique used to test complex relationships between variables. It involves specifying a model that includes both observed and unobserved variables, and then using statistical methods to test the fit of the model to the data.

Time Series Analysis

Time series analysis is a statistical technique used to analyze data that is collected over time. It involves identifying patterns and trends in the data, as well as any seasonal or cyclical variations.

Multilevel Modeling

Multilevel modeling is a statistical technique used to analyze data that is nested within multiple levels. For example, researchers might use multilevel modeling to analyze data that is collected from individuals who are nested within groups, such as students nested within schools.

Applications of Quantitative Research

Quantitative research has many applications across a wide range of fields. Here are some common examples:

- Market Research : Quantitative research is used extensively in market research to understand consumer behavior, preferences, and trends. Researchers use surveys, experiments, and other quantitative methods to collect data that can inform marketing strategies, product development, and pricing decisions.

- Health Research: Quantitative research is used in health research to study the effectiveness of medical treatments, identify risk factors for diseases, and track health outcomes over time. Researchers use statistical methods to analyze data from clinical trials, surveys, and other sources to inform medical practice and policy.

- Social Science Research: Quantitative research is used in social science research to study human behavior, attitudes, and social structures. Researchers use surveys, experiments, and other quantitative methods to collect data that can inform social policies, educational programs, and community interventions.

- Education Research: Quantitative research is used in education research to study the effectiveness of teaching methods, assess student learning outcomes, and identify factors that influence student success. Researchers use experimental and quasi-experimental designs, as well as surveys and other quantitative methods, to collect and analyze data.

- Environmental Research: Quantitative research is used in environmental research to study the impact of human activities on the environment, assess the effectiveness of conservation strategies, and identify ways to reduce environmental risks. Researchers use statistical methods to analyze data from field studies, experiments, and other sources.

Characteristics of Quantitative Research

Here are some key characteristics of quantitative research:

- Numerical data : Quantitative research involves collecting numerical data through standardized methods such as surveys, experiments, and observational studies. This data is analyzed using statistical methods to identify patterns and relationships.

- Large sample size: Quantitative research often involves collecting data from a large sample of individuals or groups in order to increase the reliability and generalizability of the findings.

- Objective approach: Quantitative research aims to be objective and impartial in its approach, focusing on the collection and analysis of data rather than personal beliefs, opinions, or experiences.

- Control over variables: Quantitative research often involves manipulating variables to test hypotheses and establish cause-and-effect relationships. Researchers aim to control for extraneous variables that may impact the results.

- Replicable : Quantitative research aims to be replicable, meaning that other researchers should be able to conduct similar studies and obtain similar results using the same methods.

- Statistical analysis: Quantitative research involves using statistical tools and techniques to analyze the numerical data collected during the research process. Statistical analysis allows researchers to identify patterns, trends, and relationships between variables, and to test hypotheses and theories.

- Generalizability: Quantitative research aims to produce findings that can be generalized to larger populations beyond the specific sample studied. This is achieved through the use of random sampling methods and statistical inference.

Examples of Quantitative Research

Here are some examples of quantitative research in different fields:

- Market Research: A company conducts a survey of 1000 consumers to determine their brand awareness and preferences. The data is analyzed using statistical methods to identify trends and patterns that can inform marketing strategies.

- Health Research : A researcher conducts a randomized controlled trial to test the effectiveness of a new drug for treating a particular medical condition. The study involves collecting data from a large sample of patients and analyzing the results using statistical methods.

- Social Science Research : A sociologist conducts a survey of 500 people to study attitudes toward immigration in a particular country. The data is analyzed using statistical methods to identify factors that influence these attitudes.

- Education Research: A researcher conducts an experiment to compare the effectiveness of two different teaching methods for improving student learning outcomes. The study involves randomly assigning students to different groups and collecting data on their performance on standardized tests.

- Environmental Research : A team of researchers conduct a study to investigate the impact of climate change on the distribution and abundance of a particular species of plant or animal. The study involves collecting data on environmental factors and population sizes over time and analyzing the results using statistical methods.

- Psychology : A researcher conducts a survey of 500 college students to investigate the relationship between social media use and mental health. The data is analyzed using statistical methods to identify correlations and potential causal relationships.

- Political Science: A team of researchers conducts a study to investigate voter behavior during an election. They use survey methods to collect data on voting patterns, demographics, and political attitudes, and analyze the results using statistical methods.

How to Conduct Quantitative Research

Here is a general overview of how to conduct quantitative research:

- Develop a research question: The first step in conducting quantitative research is to develop a clear and specific research question. This question should be based on a gap in existing knowledge, and should be answerable using quantitative methods.

- Develop a research design: Once you have a research question, you will need to develop a research design. This involves deciding on the appropriate methods to collect data, such as surveys, experiments, or observational studies. You will also need to determine the appropriate sample size, data collection instruments, and data analysis techniques.

- Collect data: The next step is to collect data. This may involve administering surveys or questionnaires, conducting experiments, or gathering data from existing sources. It is important to use standardized methods to ensure that the data is reliable and valid.

- Analyze data : Once the data has been collected, it is time to analyze it. This involves using statistical methods to identify patterns, trends, and relationships between variables. Common statistical techniques include correlation analysis, regression analysis, and hypothesis testing.

- Interpret results: After analyzing the data, you will need to interpret the results. This involves identifying the key findings, determining their significance, and drawing conclusions based on the data.

- Communicate findings: Finally, you will need to communicate your findings. This may involve writing a research report, presenting at a conference, or publishing in a peer-reviewed journal. It is important to clearly communicate the research question, methods, results, and conclusions to ensure that others can understand and replicate your research.

When to use Quantitative Research

Here are some situations when quantitative research can be appropriate:

- To test a hypothesis: Quantitative research is often used to test a hypothesis or a theory. It involves collecting numerical data and using statistical analysis to determine if the data supports or refutes the hypothesis.

- To generalize findings: If you want to generalize the findings of your study to a larger population, quantitative research can be useful. This is because it allows you to collect numerical data from a representative sample of the population and use statistical analysis to make inferences about the population as a whole.

- To measure relationships between variables: If you want to measure the relationship between two or more variables, such as the relationship between age and income, or between education level and job satisfaction, quantitative research can be useful. It allows you to collect numerical data on both variables and use statistical analysis to determine the strength and direction of the relationship.

- To identify patterns or trends: Quantitative research can be useful for identifying patterns or trends in data. For example, you can use quantitative research to identify trends in consumer behavior or to identify patterns in stock market data.

- To quantify attitudes or opinions : If you want to measure attitudes or opinions on a particular topic, quantitative research can be useful. It allows you to collect numerical data using surveys or questionnaires and analyze the data using statistical methods to determine the prevalence of certain attitudes or opinions.

Purpose of Quantitative Research

The purpose of quantitative research is to systematically investigate and measure the relationships between variables or phenomena using numerical data and statistical analysis. The main objectives of quantitative research include:

- Description : To provide a detailed and accurate description of a particular phenomenon or population.

- Explanation : To explain the reasons for the occurrence of a particular phenomenon, such as identifying the factors that influence a behavior or attitude.

- Prediction : To predict future trends or behaviors based on past patterns and relationships between variables.

- Control : To identify the best strategies for controlling or influencing a particular outcome or behavior.

Quantitative research is used in many different fields, including social sciences, business, engineering, and health sciences. It can be used to investigate a wide range of phenomena, from human behavior and attitudes to physical and biological processes. The purpose of quantitative research is to provide reliable and valid data that can be used to inform decision-making and improve understanding of the world around us.

Advantages of Quantitative Research

There are several advantages of quantitative research, including:

- Objectivity : Quantitative research is based on objective data and statistical analysis, which reduces the potential for bias or subjectivity in the research process.

- Reproducibility : Because quantitative research involves standardized methods and measurements, it is more likely to be reproducible and reliable.

- Generalizability : Quantitative research allows for generalizations to be made about a population based on a representative sample, which can inform decision-making and policy development.

- Precision : Quantitative research allows for precise measurement and analysis of data, which can provide a more accurate understanding of phenomena and relationships between variables.

- Efficiency : Quantitative research can be conducted relatively quickly and efficiently, especially when compared to qualitative research, which may involve lengthy data collection and analysis.

- Large sample sizes : Quantitative research can accommodate large sample sizes, which can increase the representativeness and generalizability of the results.

Limitations of Quantitative Research

There are several limitations of quantitative research, including:

- Limited understanding of context: Quantitative research typically focuses on numerical data and statistical analysis, which may not provide a comprehensive understanding of the context or underlying factors that influence a phenomenon.

- Simplification of complex phenomena: Quantitative research often involves simplifying complex phenomena into measurable variables, which may not capture the full complexity of the phenomenon being studied.

- Potential for researcher bias: Although quantitative research aims to be objective, there is still the potential for researcher bias in areas such as sampling, data collection, and data analysis.

- Limited ability to explore new ideas: Quantitative research is often based on pre-determined research questions and hypotheses, which may limit the ability to explore new ideas or unexpected findings.

- Limited ability to capture subjective experiences : Quantitative research is typically focused on objective data and may not capture the subjective experiences of individuals or groups being studied.

- Ethical concerns : Quantitative research may raise ethical concerns, such as invasion of privacy or the potential for harm to participants.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Questionnaire – Definition, Types, and Examples

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

Survey Research – Types, Methods, Examples

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research