- View sidebar

Oracle Apps HRMS

How does the retro notification report and retropay (enhanced) work.

- Oracle Apps , payroll

- Leave a comment

The retrospective changes made will be recorded in pay_process_events with the following details:

- pay_process_events.effective_date as the effective date (back date) in the system on which the change/update was made

- pay_process_events.creation_date as the system date when the change/update was made.

When the Retro Notification report (RNR) is run, it will check for the date stored in pay_recorded_requests.recorded_date with attribute_category RETRONOT_ASG. This will tell RNR till which date the events are processed for an assignment. And will find the new events (i.e. events with creation_date after the recorded_date) and process them. It will create retro assignments (pay_retro_assignments) and retro entries (pay_retro_entries)

The Retropay(Enhanced) will process the assignments for which records were inserted into pay_retro_assignments by last RNR. It reprocesses all payroll actions (Quick Pay, Run, Balance Adjustments and Reversals) and creates retro entries where variances in balances are found.

If you do any further retrospective changes, the date stored in pay_process_events.creation_date would be greater than the pay_recorded_requests.recorded_date. Hence it would be processed in the next RNR run. This RNR would insert a new record in pay_retro_assignments and the same would be picked up by Retropay (Enhanced).

Doc ID 1213203.1

Share this:

Leave a comment cancel reply.

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

Payroll and OTL - EBS (MOSC)

Discussions

Retropay Enhanced is not Creating Retro Entry in the Current Unprocessed Payroll Period

Hello, We are running the Retropay (Enhanced) process and it seems to create entries in PAY_RETRO_ASSIGNMENTS, PAY_RETRO_ENTRIES but does not create the Retro Entries for the Element in the current Payroll Period which were shown in the Retro-Notifications Report. The retro changes are captured in the pay_process_events table, but are still not created by Retropay process.

Our Retro element is of same classification as of the base element and its Overtime element. We can see the Retro changes in the Retro Status screen as well. We are on 12.1.3 and we have Canada (CA) legislation.

- EBS_Payroll_CA

- EBS_Payroll_CorePayroll

Howdy, Stranger!

To view full details, sign in to My Oracle Support Community.

Don't have a My Oracle Support Community account? Click here to get started.

Instructions for posting

1. Select a discussion category from the picklist.

2. Enter a title that clearly identifies the subject of your question.

3. In the body, insert detailed information, including Oracle product and version.

Please abide by the Oracle Community guidelines and refrain from posting any customer or personally identifiable information (PI/CI).

Cloud / Fusion customers - Our Cloud community has moved! Please go to Cloud Customer Connect .

New to My Oracle Support Community? Visit our Welcome Center

Delivering Solutions

Oracle HRMS Pakistan

Functionality of retropay (enhanced), purpose of retropay processing.

Retro pay allows users to recalculate past payroll runs comparing the previous results with the new results. If any changes are detected they are applied to the current period

Run the RetroPay process to ensure that your payroll run for the current period reflects any backdated payments or deductions. Backdated adjustments can occur when:

- An employee receives a pay award that is backdated to a previous pay

- The payroll department makes a retrospective correction for an error that occurred in a previous pay period

For example, at the start of the current pay period, this employee has a pay award backdated to pay period 1. The employee has not yet received any payments for this award. In the current pay period the employee is entitled to payments that represent the backdated amounts for:

- Each of the preceding payroll periods (pay periods 1 to 4)

- The current pay period

You run your RetroPay process to ensure that the employee receives correct payment when you next run the payroll.

When backdated payments occur, the accuracy of your subsequent payroll processing depends on distinguishing between:

- The period in which the payment was earned

- The period in which the payment was made

The RetroPay Process Does Not Overwrite Your Historical Payment Records.

You never overwrite historical payroll data when you run RetroPay. Although you recalculate all periods that have retroactive changes whenever you run a RetroPay, you never modify the stored results for these periods. Instead, you create one or more RetroPay entries to receive the process results.

Think of the RetroPay process as a calculator holding results in memory so that it can process a final set of results. The RetroPay process uses your historical results to calculate the changes for the current period. The results for your current period change, but your historical records remain unchanged.

Why Enhanced?

Retro pay program is an automated process. It identifies the assignments that are eligible for retro calculation and pick only those assignments. This helps users from manually identifying the assignments for retro calculation.

Retro elements will be defined based on components and time period. Users can have different retro element for different scenarios

With Enhanced RetroPay, the concept of a retro assignment has now been introduced, providing an individual start date for each assignment. Unnecessary recalculation of periods prior to a change has now been eliminated.

Using Retro Status page, user can block, add new assignments for retro processing. This makes the process more enhanced and user controllable.

Functional User process of RetroPay (Enhanced)

Followings are the steps that User will follow

- Make the retrospective change(s) to an assignment as required

Run the ‘Retro-Notifications Report (Enhanced)’

- Navigate to the View RetroPay Status window and make sure that the retro assignments and corresponding entries are created properly

- Run the ‘RetroPay (Enhanced)’ process and verify the element entries are created

- Run the Payroll

For better understanding of RetroPay Process, We will consider following example.

There is a Permanent employee named Albert Sincere in your organization, Taking PKR 70,000 Monthly Salary. In the Month of September 2015, Company decides to Increase his Salary to PKR 85,000 per month which is retroactively applicable from the date of 01-Jul-2015. It means in the month of September Sincere will receive PKR 115,000 as a Gross Salary. Amount of 85000 is for the Month of Sep-15 and 15000 for each month Jul-15 and Aug-15.

Formula of Basic Salary is Negotiated Gross Salary X 100/175

Make the Retrospective Change.

Payroll and Payments have been made till the month of Aug-15. Then I retrospectively changed the Salary of ‘Albert Sincere’ from 70,000 to 85,000 with effective date 01-Jul-2015.

The Retro-Notification report identifies the assignments for retro calculation and will place it into the pay_retro_assignments and pay_retro_entries tables. Based on the event group (given by the user) and the last report run date for each assignment, the report will pick all the events present in pay_process_events table, validate those events, identify the eligible assignments for retro processing and add those assignments in pay_retro_assignments table. The process will also identify the element entry changes and add those in pay_retro_entries table. Element should have one default retro component. Elements that don’t have a retro component will not be included in pay_retro_entries table.

After Completion, Click on “View Output”

This report will show either an Employee has Retrospective change or not.

View RetroPay Status

Navigation: Global HRMS Manager > View > RetroPay Status

After Giving Employee detail you will see the Status of RetroPay. As you can see in below Screen shot, employee is in “Awaiting Process”

Run “RetroPay (Enhanced)” Request

Run Payroll

After completion of RetroPay (Enhanced) request, Run the Payroll of Current Period. As per our Example we will run Payroll for the Month of Sep-15

We can see in the “Run Result” that there are three lines for Negotiated Gross Salary.

Run Result Vales are as follow

We can see in Run Result that there are two lines for “Basic Salary Arrears”. This is the Element which calculated the Retrospective Amount of “Basic Salary” for the month of Jul-15 and Aug-15. One Line is for “Basic Salary” which reflects the Basic Salary of Current Month i.e. Sep-15.

This is complete document, For Setup of RetroPay (Enhanced) visit Setup Steps RetroPay (Enhanced)

Share this:

- Oracle Payroll

One thought on “ Functionality of RetroPay (Enhanced) ”

- Pingback: How to Setup Retro Pay (Enhanced) « Oracle HRMS Pakistan

Leave a comment Cancel reply

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

- Oracle Fusion Applications

- Oracle EBS R12

- Oracle Fusion Middleware

- Core Oracle Technology

- Oracle Banking & Billing Management

- Buy Certification Mock Exams

Fusion Blog

- Fusion Financials Latest Articles

- Oracle Fusion Applications Training Index

- Oracle Fusion HCM

- Fusion Procure To Pay

- Fusion PayRoll

- ADF Training

- APEX-Oracle Application Express

- Weblogic Server

- Oracle Data Integrator

- Oracle Identity and Access Management

- OFSAA - Oracle Financial Services Analytical Applications

- Common Apps Training Articles

- iProcurement

- Oracle Grants

- Financial Modules

- Supply Chain & Manufacturing

- R12 11i Differences

- Financials Documents

- AME and Self Service HRMS

- Financial Functional Documents

- Receivables

- General Ledger

- Oracle HRMS Payroll Migration

HRMS Miscellaneous

- Oracle Payroll

- Oracle HRMS Payroll Training Index

- Oracle Workflows Training Index

- Other R12 Articles

- OA Framework Training Index

- Oracle Scripts

- General Apps Topics

- Oracle Apps Interview Questions

- Virtual Machines

- BI Publisher - XMLP

- Mobile Supply Chain Application Framework

- Sunil Khatri

- Jayashree Prakash

- Ashish Harbhajanka

- Naveen Kumar

- Surinder Singh

- Krishnakumar Shanmugam

- Trending Authors

- Prasad Parmeswaran

- Kalimuthu Vellaichamy

- Kishore Ryali

- Sivakumar Ganesan

- Senthilkumar Shanmugam

- Prasad Bhogle

- Prabhakar Somanathan

- Ranu Srivastava

- Ahmad Bilal

- TheTechnoSpider

- Anshuman Ghosh

Oracle Gold Partners, our very popular training packages , training schedule is listed here Designed by Five Star Rated Oracle Press Authors & Oracle ACE's.

Search Courses

Oracle payroll tables, comments , add comment.

Name (required)

E-mail (required, but will not display)

Notify me of follow-up comments

More articles from this author

- Missing Roles in Fusion Applications R9 instance

- SLA's AAD in Fusion Accounting Hub

- Fusion Accounting Hub for Finance Transformation

- Changing FAADMIN Password in Fusion Applications

- Constructing Journal Lines in Fusion Accounting Hub using Rules

- Oracle some key products

- Oracle Golden Gate Training

- Oracle Hyperion Planning Training Concepts

- Sample chapter from BPEL BPMN Book

- Concurrent Program Logs in Fusion Applications

- iRecruitment Vacancy Segregation Solution

- Oracle SOA 12c is exciting

- Install SOA Suite Companion CDs

- Unrelated to Oracle but IMPORTANT: Muhammad Yunus article

- AME Part 4 - Customize AME For iRecruitment

- Oracle BPEL Training

- Self Service HRMS Setup Document sample

- Test workbench in AME - Testing SSHR AME - Part 8

- Fusion Applications Foundation Training for Functional and Technical Consultants

- Creating the AME Rule in Self Service HRMS - Part 7

Search Trainings

Fully verifiable testimonials, apps2fusion - event list, enquire for training.

Get Email Updates

Powered by Google FeedBurner

Latest Articles

- OIC Agent Installation Failed !!! Incorrect OIC Username / Password provided

- OM & AR Setups In EBS R12 Part 3

- OM & AR Setups In EBS R12 Part 2

- Fixed Asset Flexfields in Oracle Assets EBS R12

- OM & AR Setups In EBS R12 Part 1

- Join us on Facebook

- Self Paced Courses

- Custom home

- About Apps2Fusion

- Corporate Trainings

- Finance Transformation Experts

Popular Articles

- Subscribe to New Oracle Apps Articles on this Website by Email

- Basic Concepts - List of useful Oracle Apps Articles

- XML Publisher and Data Template - SQL Query to develop BI Publisher Reports

- OA Framework Tutorials Training

- Some Commonly Used Queries in Oracle HCM Cloud

Apps2Fusion are passionate about Fusion Cloud E-Learning and classroom trainings. Training is our core business and we have been doing this for many many years. We work hard to advise trainees with right career paths. We have published various five star rated Oracle Press Books each was best sellers in its category. We have helped many and could help you as well.

OUR COMPANY

eTRM uses javascript that opens and focuses a separate window to display reports. Your browser does not appear to support javascript. This should not prevent you from using eTRM but it does mean the window focus feature will not work. Please check the contents of other windows on your desktop if you click on a link that does not appear to do anything.

VIEW: HR.PAY_RETRO_ASSIGNMENTS#

View text - preformatted, view text - html formatted.

SELECT RETRO_ASSIGNMENT_ID RETRO_ASSIGNMENT_ID , ASSIGNMENT_ID ASSIGNMENT_ID , REPROCESS_DATE REPROCESS_DATE , START_DATE START_DATE , APPROVAL_STATUS APPROVAL_STATUS , SUPERSEDING_RETRO_ASG_ID SUPERSEDING_RETRO_ASG_ID , RETRO_ASSIGNMENT_ACTION_ID RETRO_ASSIGNMENT_ACTION_ID , CREATED_BY CREATED_BY , CREATION_DATE CREATION_DATE , LAST_UPDATED_BY LAST_UPDATED_BY , LAST_UPDATE_DATE LAST_UPDATE_DATE , LAST_UPDATE_LOGIN LAST_UPDATE_LOGIN FROM "HR"."PAY_RETRO_ASSIGNMENTS"

OraclePort.com

Oracle Techno Functional Portal, Technical and Functional Resource

- HR / Payroll Important Tables

One thought on “ HR / Payroll Important Tables ”

I WANT TO KNOW THAT IN WHICH TABLES THE DETAIL SALARY DIFFERENTLY LIKE TRANSPORT ,ALLOWANCE , BASIC AND NET_SALARY ALL WILL BE SHOWN SEPERATELY

Leave a Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- 1- Accounting Concepts

- 1- Oracle R12 Financial Setup

- 1.1 General Ledger Setup

- 1.1.1 User Creation and Assign Responsibility

- 1.1.2 Chart of Account and Segments Lists

- 1.1.3 Accounting Flexfield

- 1.1.4 Accounting Calendar

- 1.1.4 Define/Enable Currency

- 1.1.5 Accounting Flex Field Value Set

- 1.2 Payable Setup

- 1.2.1 Business Group/Calendar/Inv Org Creation

- Administrator n Concurrent

- Alerts and WorkFlows in Oracle Apps

- Concurrent Programs Related

- Configuring and Administrating Approval Transactions

- Defining HR Responsibility

- Enable Arabic for Reports

- Encumbrance : Accounting Concept Oracle

- Error Messages in Oracle Fusion

- Forms Personalizations

- Grade Key Flexfield Definition

- HR / Payroll Related Queries

- Important Tables

- Impratant Queries

- Installing GNU Make For EBS

- Manufacturing

- MO_Global.Set_Policy_Context

- News and Articals

- OAF Personalization

- OAFramework R12X Customization

- OPM Related Queries

- Oracle AME Setup

- Oracle Apps Basics

- Oracle Cloud

- Oracle EBS Documentation Library

- Oracle EBS Shut Down Script for Windows

- Oracle EBS Standard APIs and Interfaces

- Oracle Framework Personalization

- Oracle Fusion

- Oracle HR Fast Formual

- Oracle HRMS / Payroll

- Oracle HRMS / Payroll Setup

- Oracle HRMS Technical

- Oracle I-Recruitment

- Oracle Inventory User Practice

- Oracle OPM Accounting Cycle

- Oracle Purchasing User Practice

- Oracle R12 Form Customiztion

- Oracle R12 Installation on Windows

- Oracle Self-Service Human Resources

- Oracle Trainings

- Oracle XML / BI Publisher

- Report Customization Oracle EBS

- SCM Related Queries

- Self Service

- Setting Item Mandatory

- System Administration

- Tips & Tricks

- Toad Tricks and Tips

- Uncategorized

- Understanding and Using API User Hooks

- What are RICE Components

Recent Comments

- Arun on Oracle BI Publisher Tab issue in MS Word.

- Leo Caipei Chen on Report Customization Oracle R12

- Kavitha Shivaiah on Oracle BI Publisher Tab issue in MS Word.

- ZAFAR IMAM on Oracle SCM Techno Functional Training

- Zafar Imam on Oracle SCM Techno Functional Training

Recent Posts

- Oracle Cloud Support and Help Resources

- Oracle Fusion Error message Legal Entity doesn’t exit (PER-1531116)

- How to create Alerts or send Auto Email or Notification from Oracle Fusion.

- How to Edit Notification in Oracle Fusion.

- Enabling vacation rules and delegating approval responsibilities in Oracle Fusion.

Oracle Applications Knowledge Repository

Monday, january 19, 2015, api's to rollback enhanced retropay, update retropay assignment status, delete retro entries & delete retropay assignment.

- Enterprise 101

- Recruiter 101

- Pay/Bill 101

- HRCenter 101

- Beyond University

- Extra Credit

- Beyond Starter Pack

- Front Office

- Back Office

- Administration

- Beyond Troubleshooting

- Buzz Employee Engagement

- Buzz Time & Attendance

- On-Site Time Clock App

- Core Starter Pack

- Core for Recruiters

- Core for Sales

- Core for Pay and Bill Clerks

- Core for Administrators

- HRCenter & Core

- Enterprise Starter Pack

- Enterprise Troubleshooting

- United Kingdom

- Affordable Care Act

- Outlook Add-In

- Self-Hosted

- System Starter Pack

- HRCenter Admin Options

- Information Pages

- Organizing Workflows

- Translations (Localizations)

- Automated Voice & Text Integrations

- Background Check Integrations

- Candidate Management

- Employee Benefits

- E-Verify Integration

- Pay-card Provider Integrations

- Single Sign On (SSO)

- Skills & Assessment Integrations

- TimeClock Integrations

- Unemployment Management

- WOTC Integrations

- Affordable Care Act Reports

- Commission Module Reports

- Customer & Contact Reports

- Employee Info Reports

- Employee Reporting

- Financial Reports

- Forecast Reports

- Log Information Reporting

- Order & Assignment Reports

- Productivity Reports

- Sales & Invoicing Reports

- Task Reports

- Tax Administration Reports

- Time & Pay Reports

- User Security Setup

- Employee Portal

- Customer Portal

- Vendor Portal

- Administrator Portal

- 2024 Releases

- 2023 Releases

- 2022 Releases

- 2021 Releases

- 2020 Releases

- 2019 Releases

- 2018 Releases

- 2017 Releases

- 2016 Releases

- 2015 Releases

- Payroll, Tax, and Funding Services

- Standard Processes

- Funding and EOR Services

- Welcome to TempWorks University

- Full Enterprise 101 Course

- Enterprise Overview

- Hierarchy Training

- Before You Begin Recruiter 101 and Workbook

- Full Employee Record Course

- Employee Part 1: The Basics

- Employee Part 2: Searching

- *Employee Part 3: The Employee Details

- *The Resume Parser

- Full Customer and Order Record Course

- Customer Part 1: The Basics

- Orders Part 1: The Basics

- *Orders Part 2: Order Details

- Full Assignment Record Course

- Assignments Part 1: The Basics

- *Assignments Part 2: The Candidate Worksheet

- Assignments Part 3: How to Manage and Close Assignments

- Before You Begin Pay/Bill 101 Training and Workbook

- Full Employee Pay Setup and Customer Invoice Setup Course

- Payroll Part 1: The Basics of Employee Setup

- Payroll Part 2: Employee Adjustments

- Invoice Setup

- PO Setup

- Full Time Entry & Proofing Course

- Time Entry Part 1: The Basics

- Time Entry Part 2: The Details

- *Time Entry Part 3: One-Time Adjustments & Overrides

- Proofing

- Full Payroll and Invoicing Course

- The Payroll Wizard

- The Invoicing Wizard

- *Payroll Corrections

- *Invoice Corrections

- Before You Begin HRCenter 101 and Workbook

- The Job Board

- HRCenter Part 1: The Applicant Process

- HRCenter Part 2: The Service Rep Process

- Beyond University: HRCenter Minor Overview

- HRCenter 101: Beyond & the Job Board

- HRCenter 102: The Applicant Process

- HRCenter 201: Reviewing Applications in Beyond

- HRCenter 202: Searching for Applicants in Beyond

- HRCenter 203: Assigning New Workflows or Pages in Beyond

- HRCenter Admin: Form Builder

- HRCenter Admin: Surveys

- HRCenter Admin: Info Pages & Workflows

- Welcome to Beyond University!

- Beyond University for Recruiters

- Beyond University for Sales

- Basics: How to Log In & Navigate in Beyond

- Basics: Introduction to Hierarchy in Beyond

- Basics: Searching for Records in Beyond

- Building Blocks: The Visifile in Beyond

- Building Blocks: Logging Messages in Beyond

- Building Blocks: Managing Documents in Beyond

- Building Blocks: Employee Advanced Searching

- Building Blocks - Near Me Search

- Beyond University: Creating Employee Records

- Beyond University: Employee Statuses

- Beyond University: Creating Customer Records

- Beyond University: Managing Customer Contacts

- Beyond University: Customer Defaults

- Beyond University: Creating Order Records

- Beyond University: Order & Assignment Searching

- Beyond University: How to Track Candidates

- Beyond University: Assigning Employees

- Beyond University: How To End Assignments

- Data Integrity Checks 101: Full Course

- Closing the Year 101: Full Course

- 1095-C & 1094-C: 101

- The Tempworks Tips and Tricks Series

- Coronavirus, FFCRA, & Paid Sick Leave

- Reaching Out to Employees

- COVID Reports Manual

- CARES Act PPP Loan Forgiveness Estimator

- COVID-19 Employee Retention Credits

- COVID-19 Required Documents

- Beyond - How to Log In

- Beyond - Dashboard

- Beyond - Default Insight Widgets

- Beyond - Email Setup

- Beyond - How to Email in Beyond

- Beyond - How to Import Email Templates from Enterprise

- Beyond - How to Create Email Templates

- Beyond - How to Utilize Email Templates

- Beyond - How to Manage Email Templates

- Beyond - Mass Mailer Account Setup

- Beyond - Hierarchy

- Beyond - Record Types

- Beyond - Charms Overview

- Beyond - Custom Data

- Beyond - Documents

- Beyond - Required Documents

- Message Logging

- Beyond - Quick View

- Beyond - Tasks

- Beyond - The Visifile

- Beyond - Advanced Searching

- Beyond - UI/UX Improvements Overview

- Beyond - Sales Pipeline Dashboard New

- Recruiter Manual

- Sales & Account Management Manual

- Beyond - Profile Reports

- Beyond - How to Create and Manage Hot Lists

- Beyond - Gross Profit Calculator

- Employee FAQs

- How to Create an Employee Record

- Beyond - Employee Profile Pictures

- Beyond - How to Upload Resumes in Bulk

- Beyond - Creating an Employee Resume

- How to Attach a Resume to an Employee Record

- Beyond Employee Story

- How to Deactivate and Reactivate Employee Records

- Managing Employee Interest Codes

- Managing Web User Account

- Washed Status

- Utilizing Recruiter First Workflows

- How to Assign a New HRCenter Workflow or Page

- Beyond - Employee Advanced Searching

- Beyond - Employee Required Documents

- Beyond - Interview Questionnaire

- Beyond - How to Merge Employee Records

- Beyond - How to Transfer an Employee to a Different Branch

- Beyond - Updating ACA Status for Employees

- Beyond - How to Reject HRCenter Pages

- Customer FAQ

- How to Create a Customer Record

- Customer Record Must-Haves

- Creating and Managing Departments

- Beyond - Creating Customer Worksites

- Customer Statuses

- Beyond - Customer Required Documents

- Filling out Customer Related Forms

- Managing Customer Defaults

- Managing Customer Interest Codes

- Managing Sales and Service

- Utilizing the Near Me search

- Beyond - NTO (Notice to Owner)

- Beyond - Customer Master View

- Beyond - How to Change a Parent Customer

- How to Create an Order

- How to Track Candidates on an Order

- Managing Order Interest Codes

- Searching for Orders

- Utilizing Order Contact Roles

- Beyond - Job Order Required Documents

- Beyond - How to Copy an Order

- Beyond - Utilizing Master Orders

- Beyond - How to Create and Manage Direct Hire Orders

- Beyond - How to Create and Utilize Rate Sheets

- Assignment FAQ

- How to Create an Assignment

- Assignment Details Overview

- Extending an Assignment

- How to End an Assignment

- How to Mass Update Assignments

- How to Mass Update Rates

- Understanding Assignment Restrictions

- Beyond - Creating a Contact Record

- Beyond - Managing Contact Interest Codes

- Deactivating Contact Records

- How to Create a Prospect Record

- Converting a Prospect to a Customer Record

- Vendors - Subcontractors in Beyond

- Vendors - 1099 Employees in Beyond

- AI Resume Matching & Sourcing

- Beyond - How to Add Employee Adjustments

- Beyond - Employee Pay Setup

- Beyond - Managing Employee Accruals

- Beyond - How to Manage Employee Taxes

- Beyond - Employee Pay History

- Beyond - Managing Accruals on the Customer, Worksite, and Assignment Records

- Beyond - Time Entry Overview

- Beyond - Late, Holiday, and Bonus

- Beyond - One-time Adjustments & Overrides

- Beyond - Retro Pay

- Beyond - Emailing Pay Notifications

- Beyond - Proof Payroll

- Beyond - How to Manage Billing Setup

- Beyond - How to Create & Manage Purchase Orders

- Beyond - Welcome to Administration

- Beyond - Session Expiration

- Beyond - Managing Your Service Representatives

- Beyond - Address Standardization

- Beyond - Creating & Managing Service Rep Teams

- Beyond - Insight Widget Access

- Beyond - Managing Security Groups

- Beyond - Product Instances

- Beyond - Personal Access Tokens

- Beyond - Status Change Workflows

- Beyond - Required Document Types

- Beyond - Creating Security Groups with Advanced Permissions

- Beyond - How to Create and Utilize Cards and Pages

- Beyond - How to Create Sales Teams

- Beyond - How to Create Job Titles

- Beyond - How to Create Interest Codes

- Basic Browser Troubleshooting

- Beyond - Insight Widget Troubleshooting

- Bridge Overview

- Support Tickets in Bridge

- Managing Users in Bridge

- Products & Community with Bridge

- Training, Knowledge Base, & Bridge

- Updating Job Board (Self-Hosted Clients Only)

- What is Buzz

- Buzz - Inviting Employees to Buzz

- Buzz - Welcome to Buzz Employee Engagement

- Buzz - Availability

- Buzz - Job Board

- Buzz - Job Offers

- Buzz - Live Chat

- Buzz - Setting Up Live Chat

- Employee: Buzz Overview

- Employee: Accepting & Declining Job Offers

- Employee: Chat with Your Rep

- Buzz - Time & Attendance

- Buzz - Timecard Entry Setup

- Employee: Entering Time in Buzz

- Buzz - Setting Up Mobile Time Punching

- Buzz - Setting up Facial Recognition

- Buzz - Setting Up Geolocation

- Employee: Buzz Facial Recognition Tips & Tricks

- Employee - Mobile Time Punching in Buzz

- WebCenter Vs. HRCenter Vs. Buzz

- Buzz Specific WebCenter Configurations

- On-Site Time Clock Overview

- How to Setup the On-Site Time Clock App

- On-Site Time Clock Configuration Options

- Employee: Using the On-Site Time Clock App

- Welcome to Core

- Core - How to Log In

- Core - Hierarchy

- Core - Home Page Overview

- Core - Security Role Overview

- Core - Bridge

- Core - Company & Employer Information

- Core - Logging Messages

- Welcome to Core for Recruiters

- Core - How to Add a New Employee

- Core - Employee Searching

- Core - Interest Codes

- Core - Employee Documents

- Core - Required Documents

- Core - Documenting Employee Education and Job History

- Core - Employee Interview Questionnaire

- Core - Order Searching

- Core - Assignment Restrictions

- Core - Creating Assignments

- Core - Merging Employees

- Core - Do Not Assign (DNA)

- Welcome to Core for Sales

- Core - How to Add a Customer Record

- Core - How to Add a Contact Record

- Core - Customer and Contact Searching

- Core - Departments Vs. Worksites

- Core - Order Defaults

- Core - Creating Orders

- Core - Tasks

- Core - Hot Lists

- Welcome to Core for Payroll & Billing Clerks

- Core - Payroll Overview

- Core - Time Entry

- Core - One Time Adjustments

- Core - Proofing

- Core - Employee Pay Setup

- Core - Employee Adjustments

- Core - Payroll Wizard

- Core - Customer Invoice Setup

- Core - Invoicing

- Welcome to Core for Admins

- Core - Assigning Security Roles & Hierarchy Permissions

- Core - Creating Accruals

- Core - Adding Adjustment Types

- Core- Creating Authorities

- Core - Adding Job Titles

- Core - Creating Message Action Codes

- Core - Adding Multiplier Codes

- Core - Creating Interest Codes

- Core - How to Create Interview Questionnaires

- Core - Creating Required Docs Options

- Core - Custom Data

- Core - Setting Up Worker Comp Codes

- Core - Managing Accrual Packages for an Employee

- Core - Adding a New Branch

- Core - HRCenter Application Overview

- Core - Managing Applications through HRCenter

- Core - Managing HRCenter Applicants

- How to Log into Enterprise

- Hosted Services Downloads

- How to Log in to Enterprise From a Mac

- System Requirements to Run Enterprise

- How to Add an Enterprise Shortcut to the Desktop

- Accessing Local Drives in Enterprise

- Two Factor Authentication (Two Tier Authentication)

- Apps OnTempworks Migration

- Dashboard Widgets

- Enterprise Record Types

- How to Utilize Tasks

- Searching

- Tips for Navigating Through Enterprise

- Keyboard Shortcuts

- Tips and Tricks to Save Clicks

- Task Management

- The Tearaway Page

- Tips for Message Logging

- How to Customize Your Navigation Tree

- Calendar

- Record Favorites

- Full Reports Manual

- Enterprise Email Overview

- SMTP Email Setup

- Gmail Email Setup

- Mass Emailer SMTP Setup

- Email Functionality

- Sending Emails from a Message

- How to Set up and Utilize Email Templates in Enterprise

- SMS Email - Text Messages

- Commonly Asked Questions - Employees

- How to Add a New Employee Record

- Employee Searching

- Documenting an Interview

- How to Create Assignment Restrictions

- Enterprise - How to Document Employee Work History and Education

- How to Manage Required Documents

- How to Track Employee Availability

- Managing Employee Documents

- Managing Resumes

- Tracking Employee Availability

- Tracking WOTC Eligibility

- Utilizing the Washed Status

- Work Interests and Work Experience

- Manage Web User Account

- How to Transfer an Employee to a Different Branch

- How to Merge Employee Records

- How to Copy an Employee Record to a Contact Record

- How to Track Unemployment

- How to Create and Manage Hot Lists

- Commonly Asked Questions - Customer Record

- Creating Customer Records & Customer Record Avatars

- Enterprise - Customer Visifile and Snapshot

- Create & Manage Departments

- Create & Manage Worksites

- Default Customer Statuses

- Managing Sales & Service

- How to Change a Parent Customer

- How to Configure PEO Setup

- How to Create Purchase Orders

- How to Manage Interest Codes on the Customer

- How to Set up Customer Defaults

- How to Utilize the Sales Pipeline

- Notice to Owner

- Saving Customer Contracts

- How to Set Up Sales Tax on a Customer

- Enterprise - Gross Profit Calculator

- Commonly Asked Questions - Orders & Assignments

- How to Create and Manage Temporary Orders

- How to Create and Manage Direct Hire Orders

- Default Order Statuses

- How to Copy an Order

- How to Create and Manage the Candidate Worksheet

- How to Create and Utilize Rate Sheets

- How to Mass Update Assignment Rates

- How to Mass Update/End Assignments From the Order

- The Order Avatar & Icons

- Order Searching

- Order Types and Pay Periods

- Using Contact Roles with Orders

- Utilizing Master Orders

- How to Move an Order

- How to Assign an Employee

- The Assignment Status

- How to Document Employee Pay Raises

- How to End an Assignment

- How to Mass Assign and End Assignments

- How to Utilize the Assignment Replacement Option

- Assignment Calls

- How to Add a Contact

- Commonly Asked Questions- Contact

- How to Create Contact Groups

- Personal Call List

- Contact Record Must Haves

- Contact Avatar Area and Actions Menu

- Contact Statuses

- How to Deactivate a Contact

- How to Merge Contact Records

- How to Copy a Contact to an Employee Record

- How to Move a Contact to a Different Customer or Department

- How to Create a Worker Comp Claim

- Enterprise - Pay/Bill Overview

- Payroll Processor Manual

- Enterprise - Employee Pay History

- How to Enroll Employees in Direct Deposit

- How to Manage Arrears

- How to Manage Employee Taxes

- How to Set up Benefit Adjustments

- How to Set up Child Support Garnishments

- How to Set up Employee Adjustments

- How to Set up a Federal Levy

- How to Set up a Secondary Direct Deposit

- How to Set up 401K Adjustments

- Accrual Setup in Administration

- Employee, Customer, and Assignment Accruals

- Accruals - Break In Service

- Multiple Location-Based Accruals

- Enterprise - Department of Revenue Garnishments

- State Accruals Effective 1/1/2024

- How to Create Timecards

- Time Entry Tricks

- Timecard Icons and Their Meanings

- Fringe Benefits

- Gross Up Calculator

- How to Convert a Timecard to the Federal Format

- How to Duplicate Timecards

- How to Enter Late Time

- How to Import Timecards

- How to Pay Salaried Employees

- Pay Transactions on Separate Check

- How to Process Bi-Weekly Payroll

- How to Utilize Assignment Adjustments

- Unit Pay Transactions

- How to Refresh Timecards

- One-Time Adjustments and Overrides

- Timecard Linker

- Proofing Time Entry Sessions

- Marking Transactions as Not Payable or Not Billable

- Proofing Errors, Their Meanings, and How To Fix

- Commonly Asked Questions - Payroll

- Payroll Errors, Their Meanings, and How To Fix

- Enterprise - Flexible Payment Methods

- Change Adjustment Authorities After Payroll

- How to Complete Authority Check Runs

- How to Convert an Epay Transaction to a Live Check

- How to Correct Authority Checks

- How to Create ACH and Positive Pay Files

- How to Email Pay Stubs

- How to Reissue Checks

- How to Reprint a Paycheck or Payroll Run

- How to Undo Check Corrections

- How to Void and/or Reverse Checks

- Pulling the "Staged Check" Report

- Removing Transactions from Payroll Runs

- Voiding Check Date Validation

- Understanding Your Paycheck/Paystub

- Enterprise - Backdated Checks

- Paystub & Reporting Updates for Illinois Day and Temporary Labor Services Act

- Paystub & Reporting Updates for New Jersey Temporary Workers Bill of Rights

- Billing Clerk Manual

- How to Manage Billing Setup on a Customer

- Customer Adjustments and Invoice Processing

- How to Email Invoices

- Ignore Bill Cycle

- Commonly Asked Questions - Invoicing

- How to Process Bi-Weekly Invoicing

- How to Process Monthly Invoicing

- How to Process Weekly Invoices

- How to Create a Direct Hire Invoice

- How to Edit Invoices

- How to Find Processed Invoices

- How to Fix Issues During Invoice Processing

- Invoice Recipient Error

- How to Merge Invoices

- Enterprise - How to Recalculate Taxes & Surcharges on an Invoice

- How to Recast an Invoice

- How to Undo Invoice Corrections

- How to Void an Invoice

- Reverse Billing

- Invoice Payments Overview

- How to Quick Pay Invoices

- Uploading a Lockbox Feed

- How to Apply Overpayments to Invoices

- How to Create a Zero Dollar Invoice

- How to Pay Invoices with a Lump Sum Check

- How to Search and Filter Invoices in Accounts Receivable

- How to "Write Off" a Small Invoice Balance

- Closing the Week

- Admin Manual

- Creating Interest Codes

- How to Create Hotlist Tags

- How to Create Job Titles

- How to Create Message Action Codes

- How to Create Sales Teams

- How to Setup and Manage Business Codes

- How to Setup and Manage Custom Data

- How to Setup and Manage Required Docs

- How to Setup and Utilize Task Administration

- How to Setup Sales Pipeline Statuses

- How to Setup Web Evaluations

- Enterprise - Setting Up the Interview Questionnaire

- Creating Multiplier Codes

- How to Add Authorities

- Enterprise - How to Add Worker Comp Codes

- How to Setup Adjustments

- How to Setup Electronic Authority Payments

- How to Recalculate Worker Compensation

- Jurisdiction Setup

- GL Journal Entry Export Manual

- Adding GL Bank Accounts

- GL Journal Entry Export Setup Guide

- GL Journal Entry Export Report

- Enterprise - GL Map Type List

- Importing GL Journal Entry Into Quickbooks

- Managing Your Service Reps

- Managing Service Rep Web User Accounts

- Security Roles

- Security Group Administration

- Enterprise - Address Standardization

- How to Create Branches

- What Reports to Run and When to Run Them

- Vendors - Subcontractors in Enterprise

- Vendors - Distributing Orders to Subcontractors

- Vendors - Assigning Vendor Employees to an Order

- Vendors - Paying Subcontractors in Enterprise

- Vendors - 1099 Employees in Enterprise

- Vendors - Paying 1099 Employees

- Affordable Care Act Enhanced Module

- Attendance Module

- Commission Module Overview

- Setting up Burden Rates in the Commission Module

- Creating Commission Plans

- Allocating Assignments for Commission

- Calculating Commission and Pulling Reports

- Dispatcher Overview

- Creating and Managing Tickets in Dispatcher

- Checking-In Employee in Dispatcher

- Assign & Dispatch Tickets

- Paying Tickets in Dispatcher

- Close & Clear the Hall

- Education Module - School District Set Up in Enterprise

- Education Module - Teacher/Admin and Substitute Record Setup in Enterprise

- Education Module - WebCenter Setup Overview

- Education Module - WebCenter Substitute Request Setup & Overview

- Apps.OnTempWorks.com Requirements and Troubleshooting

- Troubleshooting Microsoft .NET

- Internet Speed/Quality Testing

- “Not Responding” lockup when using TempWorks Enterprise RemoteApp

- Poor Performance and Popup Windows Freeze or Do Not Appear in Enterprise Remote-App

- AWR- Agency Workers Regulations

- ACA Overview

- ACA Admin: Setting Up ACA Monthly Measurement Method

- ACA Admin: Setting Up ACA Look Back Method

- ACA Admin: ACA Permissions & Security

- Setting ACA Hire Dates for Employees

- ACA Overrides for Super Users

- ACA Admin: Setting Up ACA Adjustments in Administration

- Managing ACA Adjustments for Employees

- Auditing Employee Records with ACA Searches

- ACA Admin: Setting Up ACA Surcharges for Customers

- ACA Surcharge Overrides for Customers and Orders

- ACA Enhanced Module

- Affordable Care Manual

- Status of Current TempWorks Software Products

- Supported Platforms & System Requirements

- Daily Maintenance

- Monthly Maintenance

- How to Utilize Zoom

- Paying Your TempWorks Invoices Online

- Subscribing to the Knowledge Base

- Product and Technical Support Life Cycle Policy and Information

- Setting Up the Microsoft Outlook Add-in

- How to Use the Microsoft Outlook Add-in

- Clearing the Microsoft Outlook Add-in Cache

- TempWorks Database Server

- Report Server

- Enterprise Client Deployment Guide

- Miscellaneous Notes

- Microsoft Remote Desktop Server or Citrix Recommendations

- Self-Hosted Database Server Recommendations

- Self-Hosted Enterprise Client Deployment Guide

- Self-Hosted Environment Recommendations

- Hardware Questionnaire

- Self-Hosted API Server (v3) Deployment Guide

- WebCenter 6.5 Upgrade Instructions

- License Keys

- Performance Regression

- TempWorks Beyond Authentication Sequence

- Self-Hosted - Beyond Licensing

- HRCenter Overview

- HRCenter Applicant Process

- The Service Rep's Process

- Processing an I-9 in HRCenter

- Assigning HRCenter Workflows/pages from Enterprise

- Branding HRCenter

- Registration Page Setup

- How to Set up HRCenter Email Templates

- HRCenter Data Log Report

- Electronic Signatures

- E-Sign Legality

- How to Create Information Pages

- HRCenter Information Page Options

- How to Embed a Video in a HRCenter Application

- How to add a URL Link in Your HRC Application

- How to Create Surveys

- Uploading an Employee Handbook

- Prefilling and Postfilling Survey Answers

- When and When Not to Use the HRCenter Form Builder

- How to Create Form Pages

- HRCenter Form Builder

- Dependencies in the HRCenter Form Builder

- HRCenter Document Mapping

- Mobile Forms

- Utilizing the Dynamic State W4

- How to Mark Up Forms

- Default Federal I9 Optional Customizations

- How to Create & Edit Workflows

- How to Deactivate Workflows

- Recruiter First Workflows/Pages

- HRCenter - Creating Service Rep Only Workflows

- Web User Tenants

- Application Translations (for Spanish)

- Adding Translated Surveys

- Creating Translated Forms

- Optimizing Your Application for Spanish Language Users

- Integration Overview

- Sense Overview

- Beyond - Setting Up Sense

- Beyond - Using Sense Integration

- Beyond - Fields that Sync with Sense

- Text-Em-All Overview

- Enterprise - How to Utilize Call-Em-All

- Beyond - Setting Up Text-Em-All

- Beyond - Using Text-Em-All in Beyond

- Beyond - Setting Up TextUs

- Beyond - Using TextUs

- Asurint Background Screening Solutions Overview

- Crimcheck Overview

- First Advantage Overview

- AccuSourceHR Overview

- Universal Background Screening Overview

- Beyond - Background Check Providers and Setup

- How to Run a Background Check

- Reviewing Background Check Statuses

- Data Frenzy Integration

- Haley Marketing Integration

- Essential StaffCare Overview

- Essential StaffCare Integration

- Essential StaffCare Embedded On-Boarding Enrollment (EOE)

- BenefitElect Overview

- BenefitElect Integration

- E-Verify Overview

- Enterprise - Setting up E-Verify

- How to Process E-Verify Cases

- Enterprise - E-Verify Case Search

- Enterprise - How to Reset E-Verify Passwords

- Beyond - Setting up E-Verify

- Beyond - How to Process E-Verify Cases

- Beyond - E-Verify Case Search

- Beyond - Resetting E-Verify Passwords

- ADP Wisely Overview

- Enterprise - How to Utilize ADP Wisely

- Kittrell Paycards

- Rapid Paycards

- Rapid! PayCard Instant Funding

- Personal Access Tokens

- Single Sign On (SSO) Overview

- Single Sign On (SSO) Identity Providers

- Beyond - Single Sign On (SSO)

- Enterprise - SHL Assessment Integration

- Insight Worldwide Integration Overview

- Timerack Integration

- Experian Unemployment Claims Management

- Experian WOTC Overview

- How to Setup & Utilize Experian WOTC Integration

- ADP SmartCompliance WOTC Overview

- How to Setup & Utilize ADP WOTC Integration

- Clarus Solutions WOTC Overview

- How to Utilize the Clarus WOTC Integration

- HRCenter Equifax Integration

- MJA WOTC Integration

- CTI WOTC Integration

- Maximus WOTC Integration

- Job Board Posting Options & Configurations

- Job Board System Requirements

- Enterprise - Posting Jobs to Your TempWorks Job Board

- Posting Jobs to Your TempWorks Job Board

- Welcome to Reports

- Reports & Administrators

- Reports for Management

- Reports for Sales

- Reports for Payroll & Billing

- Affordable Care Act Reports Manual

- ACA Benefit Lookback List Ins Census Mail Export

- ACA Benefit Lookback List Insurance Census

- ACA Consecutive Assignment Worked

- ACA Employee Adjustments

- ACA Employee Cycles

- ACA Employee Details

- ACA Employee Details Communication Export

- ACA Exchange Notification List

- ACA Minimum Hours Ins Census Mail Export

- ACA Minimum Hours Insurance Census

- ACA Missing Check

- Affordable Care Act Benefit Lookback List

- Affordable Care Act Compliance Determination

- Affordable Care Act Financial Exposure

- Affordable Care Act Minimum Hours

- Contact Birthday List Report

- Contact Message Report

- Customer Address Labels 30up Report

- Customer List Report

- Customer Message Report

- Marketing Calls Report

- Active Employee Report

- Deactivated Employee Report

- Employee Address Labels 30up Report

- Employee Birthday List Report

- Employee Contact Info Report

- Employee List Report

- Employee Messages Report

- HRCenter Data Log Report

- Labor Hall Register Report

- New Employee Report

- Unemployment Claims Report

- Tax Administration Reports Manual

- New Hire Report

- EEO-1 Report

- CA Annual Pay Data

- CA Pay Transparency

- IL 941 Export

- Paid Family/Medical Leave Exports

- Expert Pay Export

- WebCenter Email Notifications Report

- Expenses Report

- Gross Profit Detail Report

- Gross Profit Summary Report

- Management Report

- Worker Comp Breakout Report

- Worker Comp List Report

- Worker Comp Summary Report

- Hours Forecast Report

- Assignment Change Log Report

- Current Timecard Change Log Report

- Customer Change Log Report

- Employee Adjustment Setup Change Log Report

- Employee Change Log Report

- Employee Electronic Pay Setup Change Log Report

- Employee Tax Setup Change Log Report

- Order Change Log Report

- User Login History Report

- Assignment Register Report

- Assignment Calendar Report

- Filled Assignments Report

- Order Register Report

- Message Productivity Report

- Messages Report

- Metrics Back Office Report

- Metrics Front Office Report

- Order Fill Ratio Report

- Order Interview Turnover Ratio Report

- Order Time To Fill Ratio Report

- Order Time To Hire Ratio Report

- Order Type - Job Title Metrics Report

- Rep Productivity Report

- Scorecard Report

- Turnover Detail Report

- AR Statement Summary Report

- Commission by Rep Report

- Commission By Sales Team Report

- Direct Hire Billing Fees Report

- Invoice Adjustment Register Report

- Invoice Aging Report

- Invoice Aging Summary Report

- Invoice Delivery Report

- Invoice Delivery Method Report

- Invoice Email Log Report

- Invoice Payments Report

- Invoice Register Report

- PO Number Summary Report

- PO Number Transaction Detail Report

- Quarterly Sales Report

- Sales Analysis Four Week Report

- Sales Analysis Four Week Comparison Report

- Sales Analysis Yearly Report

- Sales Summary Report

- Short Pay Invoices Report

- Top 25 Customers Report

- Yearly Sales Report

- Task Register Report

- Quarterly Reporting

- State - Local Tax Deposit

- Unemployment Summary Report

- Federal 941 Report

- Federal Tax Deposit Report

- Tax Deposit Report

- ACH Verification Report

- Adjustment Frequency Report

- Arrears Register Report

- Authority Check Detail Report

- Authority Garnishments Report

- Check Register Report

- Check Sign Off Report

- Current Timecards Report

- Direct Deposit Register Report

- Employee Accruals Report

- Employee Adjustments Report

- Employee Hours Report

- Payroll Summary Report

- Sending and Receipt of Web Evaluations

- General Ledger Report

- New Jersey Temporary Worker Bill of Rights (S511)

- TimeClock Overview

- TimeClock Setup Guide - Enterprise

- TimeClock Authentication Options

- Employee: Interacting with the Tempworks Time Clock

- TimeClock Reports Manual

- Cost Center Setup for TempWorks TimeClocks

- Processing TimeClock Timecards

- TimeClock Troubleshooting

- Employee: Welcome to WebCenter

- Employee: The Home Tab

- Employee: The Assignment and Calendar Tabs

- Employee: The Timecards Tab

- Employee: The Pay History Tab

- Employee: The HRCenter Tab

- Employee: How to Reset Your Password

- Employee: WebCenter on Mobile Devices

- Employee: WebCenter Notifications

- WebCenter Admin: Employee Roles and Configs

- Customer: Welcome to WebCenter

- Customer: The Home Tab

- Customer: How to Create and Submit Orders

- Customer: Reviewing and Approving WebCenter Timecards

- Customer: Your Client's Web Timecard Preferences

- Customer: How to Enter Time

- Customer: Timeclock Punch Approval

- Customer: WebCenter Notifications

- Vendor: How to Add and Submit Employees

- Vendor: How to Review Orders

- Vendor: Management

- WebCenter Admin - Giving Vendors Access to the Web Portal

- WebCenter Admin - Additional Vendor Related Configurations

- WebCenter Admin - Vendor Reports Manual

- WebCenter - Intro to Administration

- WebCenter Admin - Setting up WebCenter Roles

- Administration: Intro to Configurations

- WebCenter Admin - Configuring WebCenter Order Requests

- WebCenter Admin - How to Add Documents to Portals

- WebCenter Branding Options

- WebCenter and Contact Roles

- WebCenter Admin - Setting Up Notifications

- WebCenter Admin - Web Evaluation Setup

- Setting up Timecards in WebCenter

- Configuring Timecard Templates

- ISO WebCenter Timecard Review

- Administration: How to Process WebCenter and Electronic Timecards in Enterprise

- Posting Messages to the WebCenter Home Page

- WebCenter Reports Manual

- Candidate Review Configurations in WebCenter

- WebCenter Admin - Unlocking an Employee Account

- Year End Checklist

- Year End Process / Closing the Year

- FFCRA W-2 Reporting

- 2020 W-4 Form

- How to Run Data Integrity Checks and Resolve Errors

- Adding Employer Benefits Not Tracked In TempWorks S125

- Utilizing Electronic W-2s

- W-2C Processing

- Beyond - Reprinting or Viewing Tax Documents

- Enterprise - Reprinting Tax Documents (Wage Summaries)

- 1094/1095 Process

- Ben Admin File Import

- 1094 - Accepted with Errors

- Troubleshooting Federal Tax Withholding

- Release Notes: 01/12/2024

- Release Notes: 01/26/2024

- Release Notes: 02/09/2024

- Release Notes: 02/23/2024

- Release Notes: 03/08/2024

- Release Notes: 03/22/2024

- Release Notes: 04/05/2024

- Release Notes: 04/19/2024

- Release Notes: 05/03/2024

- Release Notes: 05/17/2024 New

- Release Notes: 01/13/2023

- Release Notes: 01/27/2023

- Release Notes: 02/10/2023

- Release Notes: 02/24/2023

- Release Notes: 03/10/2023

- Release Notes: 03/24/2023

- Release Notes: 04/07/2023

- Release Notes: 04/21/2023

- Release Notes: 05/05/2023

- Release Notes: 05/19/2023

- Release Notes: 06/02/2023

- Release Notes: 06/16/2023

- Release Notes: 06/30/2023

- Release Notes: 07/14/2023

- Release Notes: 07/28/2023

- Release Notes: 08/25/2023

- Release Notes: 09/08/2023

- Off-Cycle Release Notes: 09/12/2023

- Release Notes: 09/22/2023

- Release Notes: 10/06/2023

- Release Notes: 10/20/2023

- Off-Cycle Release Notes: 10/24/2023

- Off-Cycle Release Notes: 10/25/2023

- Off-Cycle Release Notes: 10/27/2023

- Release Notes: 11/03/2023

- Off-Cycle Release Notes: 11/7/2023

- Off-Cycle Release Notes: 11/10/2023

- Release Notes: 11/17/2023

- Release Notes: 12/01/2023

- Release Notes: 12/15/2023

- Release Notes: 12/29/2023

- Off-Cycle Release Notes: 01/04/2022

- Off-Cycle Release Notes: 01/05/2022

- Off-Cycle Release Notes: 01/07/2022

- Release Notes: 01/14/2022

- Off-Cycle Release Notes: 01/18/2022

- Off-Cycle Release Notes: 01/19/2022

- Off-Cycle Release Notes: 01/20/2022

- Release Notes: 01/28/2022

- Off-Cycle Release Notes: 01/31/2022

- Off-Cycle Release Notes: 02/03/2022

- Off-Cycle Release Notes: 02/05/2022

- Release Notes: 02/11/2022

- Release Notes: 02/25/2022

- Off-Cycle Release Notes: 03/03/2022

- Release Notes: 03/11/2022

- Release Notes: 03/25/2022

- Release Notes: 04/08/2022

- Off-Cycle Release Notes: 04/09/2022

- Off-Cycle Release Notes: 04/14/2022

- Release Notes: 04/22/2022

- Release Notes: 05/06/2022

- Release Notes: 05/20/2022

- Release Notes: 06/03/2022

- Off-Cycle Release Notes: 06/07/2022

- Off-Cycle Release Notes: 06/08/2022

- Release Notes: 06/17/2022

- Release Notes: 07/01/2022

- Release Notes: 07/15/2022

- Off-Cycle Release Notes: 07/22/2022

- Release Notes: 07/29/2022

- Release Notes: 08/12/2022

- Release Notes: 08/26/2022

- Release Notes: 09/09/2022

- Release Notes: 09/23/2022

- Release Notes: 10/07/2022

- Release Notes: 10/21/2022

- Release Notes: 11/04/2022

- Release Notes: 11/18/2022

- Release Notes: 12/02/2022

- Release Notes: 12/16/2022

- Release Notes: 12/30/2022

- Release Notes: 01/01/2021

- Off-Cycle Release Notes: 01/08/2021

- Off-Cycle Release Notes: 01/11/2021

- Release Notes: 01/15/2021

- Release Notes: 01/29/2021

- Release Notes: 02/05/2021

- Release Notes: 02/12/2021

- Release Notes: 02/26/2021

- Release Notes: 03/12/2021

- Release Notes: 03/23/2021

- Release Notes: 03/26/2021

- Release Notes: 03/29/2021

- Release Notes: 04/09/2021

- Release Notes: 04/23/2021

- Release Notes: 05/07/2021

- Release Notes: 05/21/2021

- Release Notes: 06/04/2021

- Release Notes: 06/18/2021

- Release Notes: 06/28/2021

- Release Notes: 06/29/2021

- Release Notes: 07/02/2021

- Release Notes: 07/06/2021

- Release Notes: 07/16/2021

- Release Notes: 07/19/2021

- Release Notes: 07/30/2021

- Release Notes: 08/13/2021

- Release Notes: 08/27/2021

- Off-Cycle Release Notes: 08/27/2021

- Release Notes: 09/10/2021

- Release Notes: 09/24/2021

- Off-Cycle Release Notes: 09/24/2021

- Off-Cycle Release Notes: 10/01/2021

- Release Notes: 10/08/2021

- Release Notes: 10/22/2021

- Release Notes: 11/05/2021

- Release Notes: 11/19/2021

- Release Notes: 12/03/2021

- Release Notes: 12/17/2021

- Release Notes: 12/31/2021

- Release Notes: 12/4/2020

- Release Notes: 12/18/2020

- Off-Cycle Release Notes: 11/09/2020

- Release Notes: 11/20/2020

- Release Notes: 10/30/2020

- Release Notes: 10/16/2020

- Release Notes: 10/02/2020

- Release Notes: 9/20/2020

- Release Notes: 9/4/2020

- Release Notes: 8/21/2020

- Release Notes: 08/07/2020

- Off-Cycle Release Notes: 08/04/2020

- Release Notes: 07/24/2020

- Release Notes: 07/10/2020

- Release Notes: 06/26/2020

- Release Notes: 06/12/2020

- Release Notes: 05/29/2020

- Release Notes: 05/18/2020

- Release Notes: 5/01/2020

- Release Notes: 04/03/2020

- Release Notes: 04/17/2020

- Release Notes: 03/20/2020

- Release Notes: 03/06/2020

- Release Notes: 02/07/2020

- Release Notes: 01/24/2020

- Release Notes: 01/10/2020

- Release Notes: 12/20/2019

- Release Notes: 11/22/2019

- Release Notes: 11/01/2019

- Release Notes: 10/11/2019

- Release Notes: 09/20/19

- Release Notes: 08/09/2019

- Release Notes: 08/30/2019

- Release Notes: 07/19/2019

- Release Notes: 06/28/2019

- Release Notes: 06/06/2019

- Release Notes: 05/10/2019

- Release Notes: 04/18/2019

- Release Notes: 04/04/2019

- Release Notes: 03/22/2019

- Release Notes: 03/15/2019

- Release Notes: 02/22/2019

- Release Notes: 02/15/2019

- Release Notes: 01/25/2019

- Release Notes: 01/18/2019

- Release Notes: 12/28/2018

- Release Notes: 12/21/2018

- Release Notes: 11/30/2018

- Release Notes: 11/09/2018

- Release Notes: 10/26/2018

- Release Notes: 10/05/2018

- Release Notes: 09/21/2018

- Release Notes: 09/14/2018

- Release Notes: 09/07/2018

- Release Notes: 08/31/2018

- Release Notes: 08/24/2018

- Release Notes: 08/09/2018

- Release Notes: 07/27/2018

- Release Notes: 07/06/2018

- Release Notes: 06/22/2018

- Release Notes: 06/08/2018

- Release Notes: 06/01/2018

- Release Notes: 05/25/2018

- Release Notes: 05/11/2018

- Release Notes: 04/27/2018

- Release Notes: 04/20/2018

- Release Notes: 04/05/2018

- Release Notes: 03/23/2018

- Release Notes: 03/09/2018

- Release Notes: 03/02/2018

- Release Notes: 02/23/2018

- Release Notes: 02/16/2018

- Release Notes: 02/09/2018

- Release Notes: 02/02/2018

- Release Notes: 01/26/2018

- Release Notes: 01/19/2018

- Release Notes: 01/12/2018

- Release Notes: 01/05/2018

- Release Notes: 12/29/2017

- Release Notes: 12/15/2017

- Release Notes: 12/08/2017

- Release Notes: 12/01/2017

- Release Notes: 11/17/2017

- Release Notes: 11/10/2017

- Release Notes: 11/03/2017

- Release Notes: 10/27/2017

- Release Notes: 10/20/2017

- Release Notes: 10/13/2017

- Release Notes: 10/06/2017

- Release Notes: 09/29/2017

- Release Notes: 09/22/2017

- Release Notes: 09/15/2017

- Release Notes: 09/08/2017

- Release Notes: 09/01/2017

- Release Notes: 08/25/2017

- Release Notes: 08/18/2017

- Release Notes: 08/11/2017

- Release Notes: 08/04/2017

- Release Notes: 07/28/2017

- Release Notes: 07/21/2017

- Release Notes: 07/14/2017

- Release Notes: 07/07/2017

- Release Notes: 06/30/2017

- Release Notes: 06/23/2017

- Release Notes: 06/16/2017

- Release Notes: 06/09/2017

- Release Notes: 06/02/2017

- Release Notes: 05/26/2017

- Release Notes: 05/19/2017

- Release Notes: 05/12/2017

- Release Notes: 05/05/2017

- Release Notes: 04/28/2017

- Release Notes: 04/21/2017

- Release Notes: 04/14/2017

- Release Notes: 04/07/2017

- Release Notes: 03/31/2017

- Release Notes: 03/24/2017

- Release Notes: 03/17/2017

- Release Notes: 03/10/2017

- Release Notes: 03/03/2017

- Release Notes: 02/24/2017

- Release Notes: 02/17/2017

- Release Notes: 02/10/2017

- Release Notes: 02/03/2017

- Release Notes: 01/27/2017

- Release Notes: 01/20/2017

- Release Notes: 01/13/2017

- Release Notes: 01/06/2017

- Release Notes: 12/31/2016

- Release Notes: 12/16/16

- Release Notes: 12/09/2016

- Release Notes: 12/2/2016

- Release Notes: 11/18/2016

- Release Notes: 11/11/2016

- Release Notes: 11/4/2016

- Release Notes: 10/21/2016

- Release Notes: 10/14/2016

- Release Notes: 10/07/2016

- Release Notes: 09/30/2016

- Release Notes: 09/23/2016

- Release Notes: 09/16/2016

- Release Notes: 09/09/2016

- Release Notes: 08/26/2016

- Release Notes: 08/19/2016

- Release Notes: 08/12/2016

- Release Notes: 08/05/2016

- Release Notes: 07/29/2016

- Release Notes: 07/15/2016

- Release Notes: 07/08/16

- Release Notes: 07/01/2016

- Release Notes: 06/24/2016

- Release Notes: 06/03/16

- Release Notes: 05/27/16

- Release Notes: 05/20/16

- Release Notes: 05/13/16

- Release Notes: 05/06/16

- Release Notes: 04/29/16

- Release Notes: 04/22/16

- Release Notes: 04/15/16

- Release Notes: 04/08/16

- Release Notes: 04/01/16

- Release Notes: 03/25/16

- Release Notes: 03/18/16

- Release Notes: 03/04/16

- Release Notes: 02/25/16

- Release Notes: 02/18/16

- Release Notes: 02/11/16

- Release Notes: 02/04/16

- Release Notes: 01/28/16

- Release Notes: 01/21/16

- Release Notes: 01/14/16

- Release Notes: 01/07/16

- Release Notes: 12/31/15

- Release Notes: 12/24/15

- Release Notes: 12/10/15

- Release Notes: 12/03/15

- Release Notes: 11/19/15

- Release Notes: 11/12/15

- Release Notes: 11/05/15

- Release Notes: 10/29/15

- Release Notes: 10/22/15

- Release Notes: 10/15/15

- Release Notes: 10/08/15

- Release Notes: 10/01/15

- Tax Processing Services Overview

- Garnishment Setup Services

- What to Expect for Your Payroll Week

- Best Practices for a Successful Payroll Week

- Standard Payroll Deadlines

- Publishing W2's to WebCenter

- Reports for Filing Taxes Not Tracked in TempWorks

- Tax Collection Detail Report

- Wire Detail Reports

- Funding Clients: How to Manage Processing Fees

- TMS Worksite Evaluations for Customer Approval

- Paying Invoices Online

Enterprise - How to Process Retro Pay

What is retro pay.

Retro pay, retroactive pay, or back pay is defined as income from a previous weekend date being owed and paid to an employee. This may be utilized for a multitude of reasons including having an incorrect pay rate originally established and paid out to the employee, or a missed pay raise.

How to Document Retro Pay in Enterprise:

Step 1:

Make sure you have made the appropriate corrections to the related assignment. This could be simply updating the pay and bill rate information (if it was originally entered incorrectly) or completing a pay raise . This is important so that going forward, the employee is paid correctly and future errors are avoided.

Step 2:

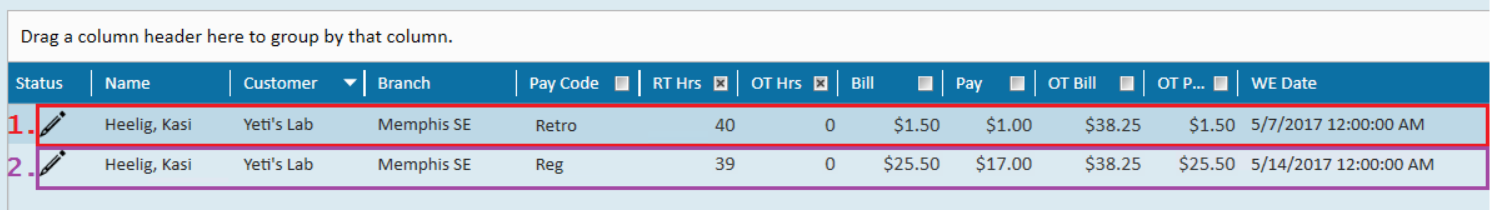

In time entry, enter the hours and rates as the difference owed. To do this, locate the employee's timecard in time entry and create a duplicate timesheet . In this example, let's say our employee was paid $16.00/hr last week for 40 hours worked when they should have been paid at a rate of $17.00/hr.

*Note* If the timecard was already created for this week at last week's incorrect pay/bill rate, you will need to refresh the timecard after making the appropriate updates to the related assignment record.

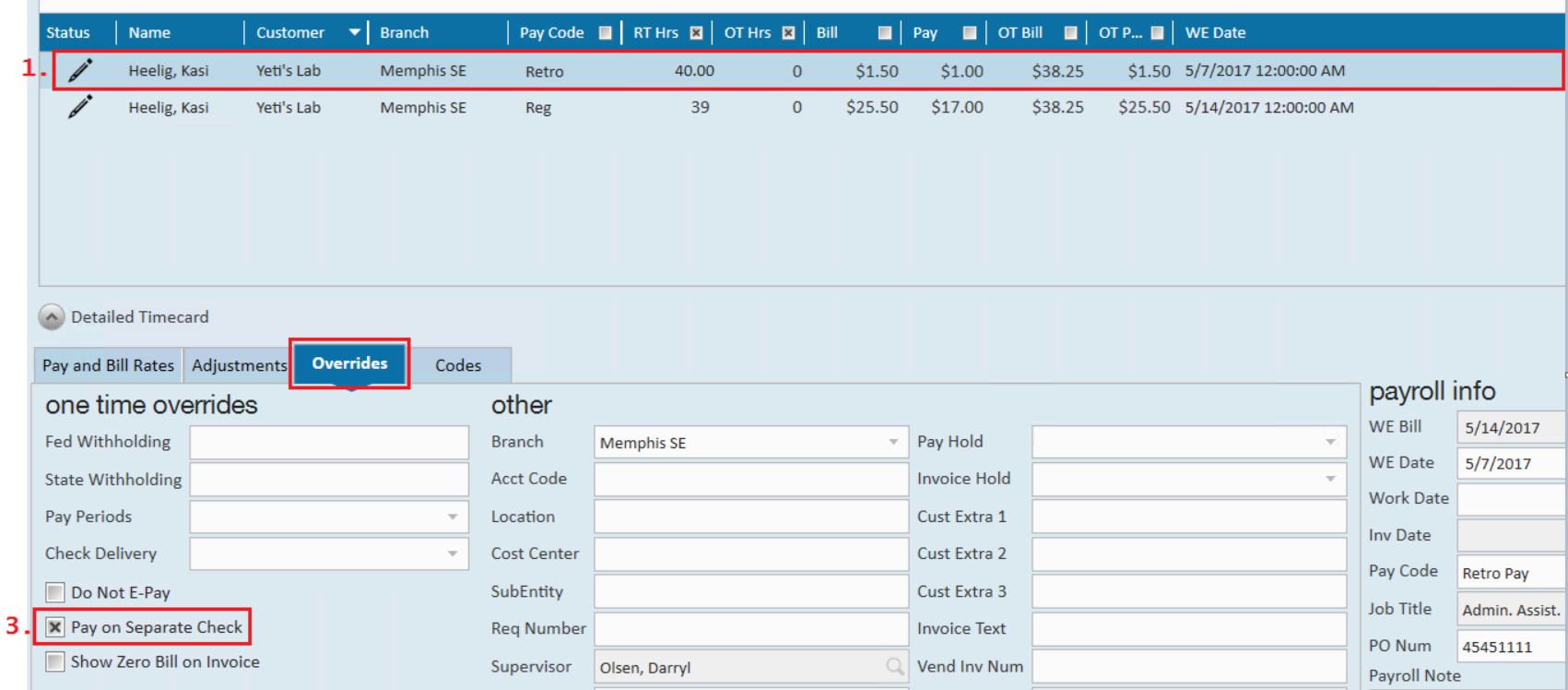

In timecard one, the pay code is updated to retro, the hours worked last week are entered, the pay rate and bill rate is entered as the difference owed, and the weekend date is set to the prior week.

In timecard two, the hours are entered as normal, but the updated/correct pay and bill rates are reflected.

Within the overrides tab of the detailed timecard for timecard one, it is recommended to opt to pay the retro pay on a separate check . This ensures that adjustments tied to the employee record will calculate correctly.

*Note* If there is a transaction for the employee in the same Weekend Bill as the Retro Pay transaction that has not been processed yet, you will need to process the non-Retro Pay transaction through a payroll run and post it first before you can process the Retro Pay transaction.

Related Articles

- Enterprise - How to Pay Transactions on a Separate Check

- *Time Entry Part 3: One-Time Adjustments & Overrides

- Enterprise - Time Entry Tricks

- Enterprise - Payroll Processor Manual

- Created: 05/22/2017 1:37 pm CDT

- Last updated: 07/08/2022 2:13 pm CDT

- Logging in to Enterprise Overview

- Enterprise - Recruiter Manual

- See more....

- New Release Notes: 05/17/2024

- New Beyond - Sales Pipeline Dashboard

- See more...

- How to Setup & Utilize ADP WOTC Integration

Subscribe for Updates

- BusinessPlus Payroll

Pay Assignments - HRPYPA

Use the Human Resource (HR) Pay Assignments (HRPYPA) page to set up employee pay assignments, including position and salary, which will be passed onto Payroll. The employee must have a record in HR Employee Master page.

Page Header

Entity : System-derived from the HR Employee Master, based upon the entered Employee ID. The Entity is used to identify security clearance. The field defaults to the entity associated with the logged in user on HRRQUS, if a record exists. Code values are defined in the HR Entity Codes (HRRQEN) page.

Type : System-derived from the HR Employee Master, based upon the entered Employee ID.

Employee ID : Indicates the employee identification number. Codes available for selection are defined on the HR Employee Master page.

Bargaining Unit : System-derived from the HR Employee Master, based upon the Employee ID entered.

Name : System-derived from the HR Employee Master, based upon the entered Employee ID.

HR Status : System-derived from the HR Employee Master, based upon the entered Employee ID.

Social Security # : System-derived from the HR Employee Master, based upon the entered Employee ID.

PY Status : System-derived from the HR Employee Master, based upon the entered Employee ID.

Pay Assignment Tab

Rec Tp : The record type is like an alias for the pay line that is created in payroll. All employees must have at least a PM - Primary Pay Line. Because a pay line is labeled with PM does not mean it is more or less important than an R0, S0, T0, or related entry. In Add Mode, if the system finds another record for the employee with the same entity and record type, and where the As of Date falls within the pay date range, it will paint the entire page (those appropriate fields) with information from that record. The new pay begin date will be set to one day after the old record pay end date. Manually adjust the dates to reflect the new assignment. When the new assignment is saved, the old record will be end-dated one day prior to the new record begin date. Other appropriate changes may be made as well. Code values are restricted to static system codes.

FY : The fiscal year for the assignment. Defaults to the fiscal year set up on HR System Set Up (HRRQSS) page.

Sequence : Some clients using contract accumulators attach a unique sequence number for each instance of a contract pay assignment (for example, when a step increase is given, the sequence would go from 1 to 2). The payroll system does not require a unique sequence number for each instance of a contract. If this functionality is selected, then it is because the client has an internal reason for it.

PCN : The position control number is the number used throughout the system for position control checking. Codes are defined in the HR PCN/Position Code Definitions (HRTBPC) page.

Position : Indicates the position number associated with the selected PCN. Codes are defined in the HR PCN/Position Definitions (HRTBPC) page.

Pay Class : The pay class is used by Payroll to perform hours and benefit patching and distribution. Code values are defined in the PY Pay Class Definitions (PYUPPY) page.

Pay Begin/End : Indicates the pay assignment's begin and end dates. The field is used to figure out the number of periods to pay, and it is passed to the PY Employee Pay Assignments (PYUPEP) page. These dates must be run within the fiscal year specified on the entry.

Calc Begin/End : The calculation dates, in association with the entered Calendar, are used to figure the actual days per year value. Calc Dates in HR are called Patch Dates in PY.

When a new record is created and its pay/calc date ranges overlap with an existing matching record type record, the existing records' end dates are updated to one day prior to the new records' begin date. This is so there are no date overlaps in the database for an employee’s records where the record type is the same. For example:

Existing record Pay Begin/End dates of 09/01/2022 - 08/31/2023 and Calc Begin/End dates of 08/24/2022 - 06/09/2023.

New record added has Pay Begin/End dates of 08/01/2023 - 07/31/2024 and Calc Begin/End dates of 08/24/2023 - 06/09/2024. Notice the overlap of the pay begin dates.

After saving the new record, the old/previously existing records' Pay Begin/End dates are: 09/01/2022 - 07/31/2023. The end date is one day prior to the new records' begin date. The Calc Begin/End dates are: 08/24/2022 to 08/23/2023. The calc end date was extended to one day prior to the new records' calc begin date.

Pay and Calc dates should always be evaluated and modified as needed when new overlapping pay assignment records are added.

Paid Begin/End : These optional dates are used primarily with contracts to show the effective dates of the salary. This is useful when a contract stops and the spread balance needs to be paid over the remaining part of the contract. If overlapping HR Pay Assignments are found with the same contract ID, a warning is displayed. This warning is required because we do not support the ability to have concurrently active pay assignment records with the same contract ID (effective with 7.9 release).

Assign St : Indicates an assignment status and can represent whatever a client wishes. Code values are defined in the HR Non-Entity Specific Codes (HRTBHR) page under the Code ID of ASSIGNMENT_STAT.

Reason : Indicates a reason code and can represent whatever a client wishes. A code of 00 requires a manual description be entered. Code values are defined in the HR Non-Entity Specific Codes (HRTBHR) page under the Code ID of REASON_CD.

Position Details

Prorate Salary : Indicates whether to prorate the salary by PCN FTE. If the field is selected, HR Pay Assignments will prorate the salary. If the field is blank, a PCN FTE will be assumed by the system and thus the salary amounts will not be prorated by the PCN FTE.

PCN FTE : Indicates the PCN/Position FTE value. By default, the actual amounts (daily, period, annual) are prorated by this value. To recalculate PCN FTE based on Actual hours to Default Hours:

Set the PCN FTE field to blank or zero.

Tab or click out of the field.

Tab or click back into the field and the recalculated amount displays.

Overriding calculate PCN FTE:

Set the PCN FTE field to the desired value.

Setting PCN FTE to zero:

Tab or click out of the field. Do not tab or click back into the field since the 0.00000 value will cause a recalculation.

Each time the value is recalculated by focusing back to the field it will need to be reset to zero.

Total FTE : Derived value from the HR Employee Master page. Represents the employee's total FTE for all PCN and Position assignments. For the system to function correctly, it must have the total FTE value before entering in position assignments on HR Pay Assignments. It is also needed to calculate the PCN Effort.

PCN Effort : Derived value, representing the amount of effort being put forth toward a position. If an employee is 1.00000 total FTE and they work one position, then all of their effort is going to that one position; therefore, a value of 1.00000 should be found in the PCN FTE field and the PCN Effort field. Likewise, if an employee is a part time person at .50000 Total FTE and they work one position, then all of their effort is going to that one position; therefore, a value of 1.00000 should be found in the PCN Effort field. If an employee is .75 Total FTE, and works two positions, then their effort could be .50000 on each position assignment.

APU/APU 2 : The calculation of Allocated Person Units is system-derived or manually entered depending on the entry in the APU Code fields on HR PCN/Position Code Definitions (HRTBPC) page. If a value is manually entered and, according to the coding on HR PCN/Position Code Definitions page, manual entry is not allowed, a warning is displayed and the value resets to its original value or calculates after leaving the Index Key field.

Spread Info : Indicates how the payroll pay assignment and benefit information is to be spread.

Budget Override : System-derived checkbox indicating if the budget is being overridden. To clear the checkbox, there needs to be an HRTBRG distribution record covering the current budget amount for a matching date range. If the HRTBPC PCN Budget Status code is to be changed after this field is showing a check mark, there needs to be ample budget established on the appropriate HRTBRG budget tab first. If there is, then the HRTBPC code can be changed.

Schedule Details

Calendar : Indicates the employee's assignment related payroll calendar. Each employee is Associated with a calendar but may use a different calendar for different positions. Code values are defined in the PY Calendar Definitions (PYUPCA) page.

Period Tp : Indicates the default Period Type code. This identifies how the employee is paid (M=Monthly, B=Bi-Weekly, S=Semi-Monthly). Code values are restricted to static system codes.

By default, the entire default line of values comes from the HR PCN/Position Code Definitions (HRTBPC) page for the PCN/Position combination. The Actual Hours/Day and Days/Week also come from that page. The Default line values can also be controlled using the HR System Set Up (HRRQSS), Addl Pay Info tab, Use Calendar to set Default Days/Hours field. There are two options on that page. One is to default the entire line and the other is to default only the Default Days/Year.