Get the Reddit app

A place to focus primarily on all things related to Charles Schwab. This is a community, full of seasoned investors and newbies, focusing around the idea that investing is not as scary as some people make it.

What happens when your option gets assigned on Schwab?

I’m thinking of doing “poor man’s” covered calls with MSFT which I already own 10 shares of. If I get assigned on my short call, how do I fulfill my end of the contract? Will my 10 existing shares be sold, or will it be covered purely by my long call?

- Open an Account

Stock options: NQSOs and ISOs

With stock options, you have the opportunity—but not the obligation—to buy company stock at a fixed price (known as the "award price"). Stock options are subject to a vesting schedule. The vesting schedule establishes the length of time you will need to be employed at your company before the ownership of the stock options shifts to you. Once vested, stock options will have value only if the current stock price is higher than the award price.

Upbeat music plays throughout.

Grey text appears on a white background.

Onscreen text: Stock options: What are they?

An animated scene inside an airport terminal. Outside, visible through a window, an airplane taxies in from the right while a woman walks into the scene from the left, rolling her suitcase.

Female narrator: Investing is a journey. And stock options can be an important part of that journey that can help you get where you want to be.

The woman continues walking through the airport terminal, passing other travelers who are looking out a window at the plane rolling by.

Narrator: They're a way to share in your company's success. Because when the company does well, so do your stock options.

The woman steps onto an escalator going up, passing posters on the wall along the way.

Narrator: It's important to know that stock options aren't actually stock.

Onscreen text on the first poster: WHAT ARE STOCK OPTIONS? The option to buy shares of your company's stock at a specified price—called the award price

Narrator: They're the option to buy shares of your company's stock at a specified price—called the award price.

The woman studies the next poster and rests her chin in her hand, considering what she has just read.

Onscreen text on the second poster: AWARD PRICE The fixed price you'll pay for your shares

Narrator: No matter how much the stock price in the market might increase, you can still buy shares at your award price.

You earn your stock options over time, through a process called vesting.

Onscreen text on the third poster: VESTING This means earning your stock options over time.

Narrator: Once your options are vested, you have choices to make about when and how to exercise them.

As the woman passes the VESTING poster, she nods as if in agreement.

Onscreen text on the final poster: EXERCISING OPTIONS Purchasing your options of company stock—before they expire

The woman studies this final poster. She arrives at the top of the escalator and continues walking through the terminal.

Narrator: Exercising options means purchasing shares of your company stock. And you'll really want a plan for what you'll do with them before you exercise.

The woman passes others in the terminal. Then she pauses and moves her hand to her chin as if in thought. Three circles representing thought bubbles pop up above her head. The one on the left is navy with a bar graph; the one in the center is light blue with a calendar icon; and the one on the right is red with three dollar bills. The three circles then animate and merge together under the red circle featuring the money. The word "HOLD" appears on a monitor mounted near the windows.

Onscreen text: HOLD

Narrator: When making that decision, it's important to consider the value of the stock price, when your options expire, and your personal or financial tax situation.

The red circle animates to show an icon of a certificate, and the woman starts walking again.

Narrator: It also helps to think about what you want out of your exercise after it settles. Do you want cash to spend? Or would you rather have company stock?

There are three common ways to exercise: hold, sell, and sell-to-cover.

The woman resumes walking, and next to the monitor saying "HOLD," two other monitors come into view. The two new monitors say "SELL" and "SELL-TO-COVER," respectively. The woman stops and looks up at the monitors.

The frame zooms in on the monitor that says "HOLD."

Narrator: "Hold" means buying your shares and keeping all of them.

The word "HOLD" fades away and is replaced by a blue screen that has an icon of a stock certificated on the left.

Onscreen text: EXERCISE AND HOLD If the market price dips below your award price, your shares will lose value.

Narrator: This gives your shares time to potentially gain value. But it can also be risky because there's no guarantee you'll make a profit. If, for example, the market price of the stock dips below your award price, your shares will lose value.

A dollar bill icon in a circle emerges from the stock certificate icon and moves up and down across the screen, mimicking the rise and fall of stock values.

The frame moves to the monitor containing the word "SELL" and zooms in.

Onscreen text: EXERCISE AND SELL Money from sale of stock – Taxes = Your profit

A circle appears on the screen and a total of five dollar bills appear in it, one at a time.

Narrator: "Sell" means you exercise your options and immediately sell the purchased shares for cash. The money from the sale is yours after taxes, and you could use it to pay for a short-term financial goal or reinvest it, amongst other things.

The frame moves to the sign that says "Sell-to-cover" and zooms in. A circle appears that fills with three stock certificate icons.

Onscreen text: SELL-TO-COVER (Partial Sell) Exercise stop options [then] Sell just enough shares to cover price and taxes [then] Own shares without spending cash

Narrator: "Sell-to-cover" means you exercise your stock options, then immediately sell just enough of the shares you just bought to cover the price and taxes. In the end, you're left with shares you own that you didn't have to dip into your savings to buy.

Zooms out to show the woman looking up at all three monitors. In the background, an airplane takes off from the left [Rumble of the jet engines] and ascends to the right.

Narrator: And before you make any exercise decisions, think about your financial goals and how your stock options can help you reach them.

The screen split into two frames. On the left, the woman resumes walking through the terminal. On the right, a beach scene appears, featuring a white Adirondack chair and a tropical drink under a sunny sky.

Narrator: Do you need to build up a retirement savings fund?

The woman continues walking in the left screen, while the right screen transitions to a laptop computer surrounded by a lamp, coffee mug, pencil holder and eyeglasses. On the computer screen is a circle graph divided into sections of various colors and with a dollar sign in the center.

Narrator: Diversify your investments to potentially grow wealth?

The right side of the screen then transitions to a young girl and a dog standing in front a house with a "For Sale" sign in the yard. The woman walks from the airport terminal in the left screen into the yard and joins the girl and the dog. The left screen disappears as a "Sold" sign covers the "For Sale" sign and the woman puts her arm around the girl. The dog wags its tail and barks.

Narrator: Or save for a home?

When you're ready to make your move, log in to the Equity Award Center to exercise your options.

A white screen fills and gray text appears.

Onscreen text: Still have questions? Call a Schwab Stock Plan Specialist at 800-654-2593. International Participants, call +1-602-355-3408.

Narrator: Still have questions? Give us a call.

Upbeat music stops.

Schwab logo and "Own your tomorrow®" tagline animate in, and a disclosure appears.

Brand music plays.

Onscreen text: INVESTING INVOLVES RISK, INCLUDING LOSS OF PRINCIPAL. Schwab Stock Plan Services provides equity plan services and other financial services to corporations and employees through Charles Schwab & Co., Inc. ("Schwab"). Schwab, a registered broker-dealer, offers brokerage and custody services to its customers.

©2023 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC7077878 (0123-2HAB)

We'll cover:

Understanding your grant agreement

- How to exercise options

- How stock options are taxed: NQSOs vs. ISOs

Cost basis and tax forms

Common questions about stock options.

The grant agreement you receive from your employer covers important details about your stock options, including:

- Your grant date. The grant date is when you've officially been granted your options. This is important as it sets your vesting schedule and exercise periods (see below).

- The number of stock options and the type you have been granted. There are two main types of stock options: non-qualified stock options (NQSOs) and incentive stock options (ISOs).

- The award price for the grant. The award price is the fixed amount you'll pay for each share of stock (regardless of the stock price on the open market). An award price can also be referred to as a strike price, exercise price, option price, or grant price.

- The vesting schedule. A vesting schedule establishes the time frame in which stock options become available for you to purchase (which is called "exercising").

- The exercise period. This is the amount of time you have to exercise your options once they vest. In most cases, you'll have 10 years from the date of grant before your options expire.

Make sure to read and understand your full grant agreement. There are additional details about transferability, taxation, and more.

How to exercise your options

Exercising means using your options to buy shares of company stock at the award price. Let's say you have 2,000 options with an award price of $40 and the current stock market price is $50. The value lies in the difference between the award price and market price (known as the spread). Your potential profit is $20,000 (the $10 spread times 2,000 options)—and you commonly have three choices for what to do next:

- Exercise and hold: You buy the stock and hold it. The entire amount is subject to changes in market value.

- Exercise and sell: You buy the stock and immediately sell it. This is known as a cashless exercise, as no money is required out of pocket.

- Sell to cover: You buy the stock and sell just enough to cover the cost of the purchase price, plus applicable taxes and transaction costs. In other words, instead of getting a profit in cash, you get it in stock.

Prior to exercising or selling any shares, you'll want to carefully consider any applicable fees and the tax consequences. For advice, consult a tax advisor or a financial consultant.

Taxation at exercise

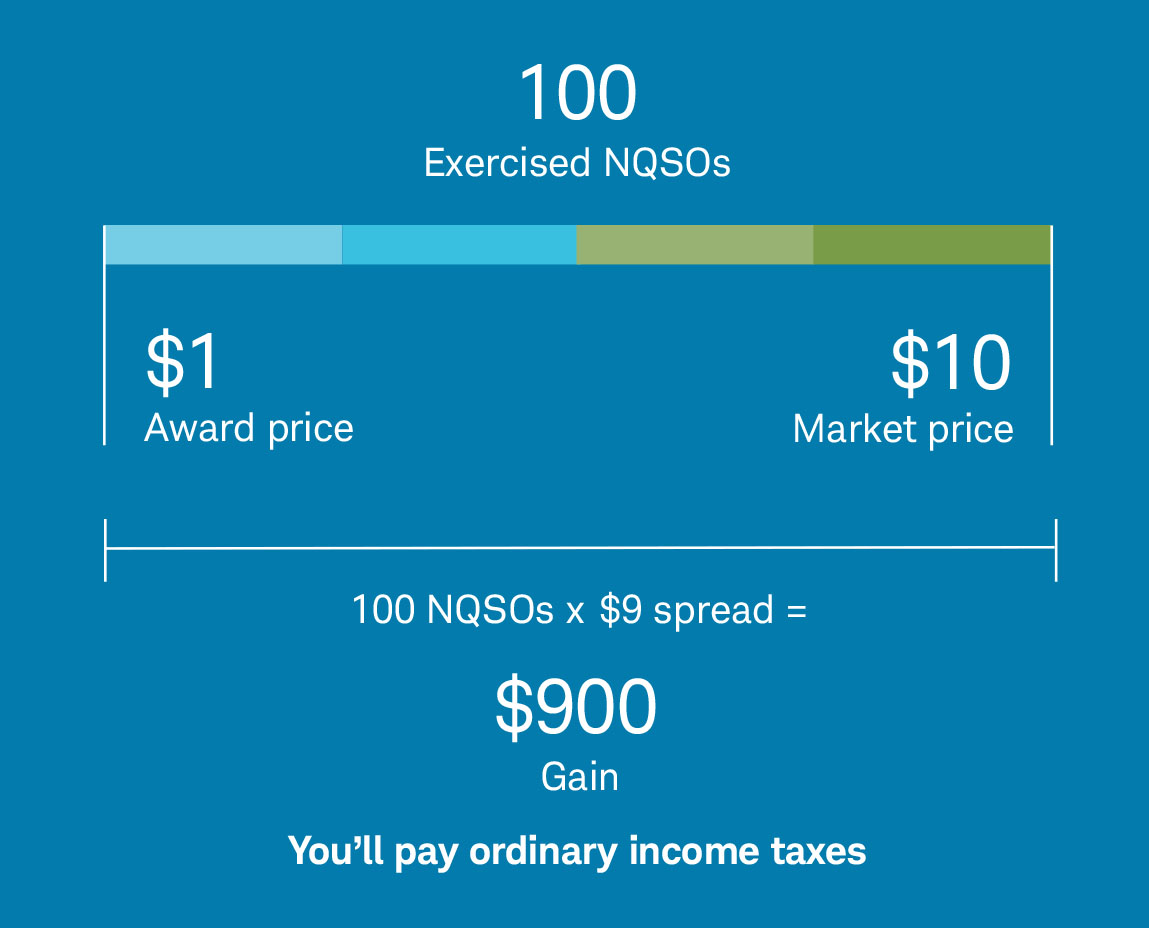

With nonqualified stock options (NQSOs), taxes typically come into play twice—when you exercise the options and when you sell them. The price you pay when you exercise your options is called the "award price." The "spread" is the difference between the award price and the market price on the day you exercise. If you exercise your NQSOs and sell the stock in a single transaction, your spread is taxed as ordinary income, and your company will usually withhold taxes. You're subject to ordinary income taxes on the spread when you exercise, regardless of whether you also sell at the same time. For example, if you exercise 100 vested NQSOs at an award price of $1 per share and you sell at a market price of $10 per share, you’ll pay ordinary income tax on the $900 gain at exercise. We recommend consulting with a tax professional on your individual situation.

Taxation at sale

With NQSOs, you're taxed on any increase in value you realize when you sell.

For example, if the market price is $15 per share at the time you exercise and then has risen to $20 per share when you sell, that $5-per-share increase would be subject to ordinary income tax or capital gains tax. The amount you will pay in taxes depends on how long you hold the shares after the grant and exercise dates.

If you sell your shares within a year of exercising, you'll likely pay ordinary income tax on the short-term capital gains profit you make.

If you hold your shares for at least a year (plus one day) before selling them, you'll likely pay long-term capital gains taxes, which typically have a lower rate than short-term capital gains, on the profit you make selling your shares.

If the market price falls and you sell at that lower price, that's a capital loss, and you won't owe any taxes.

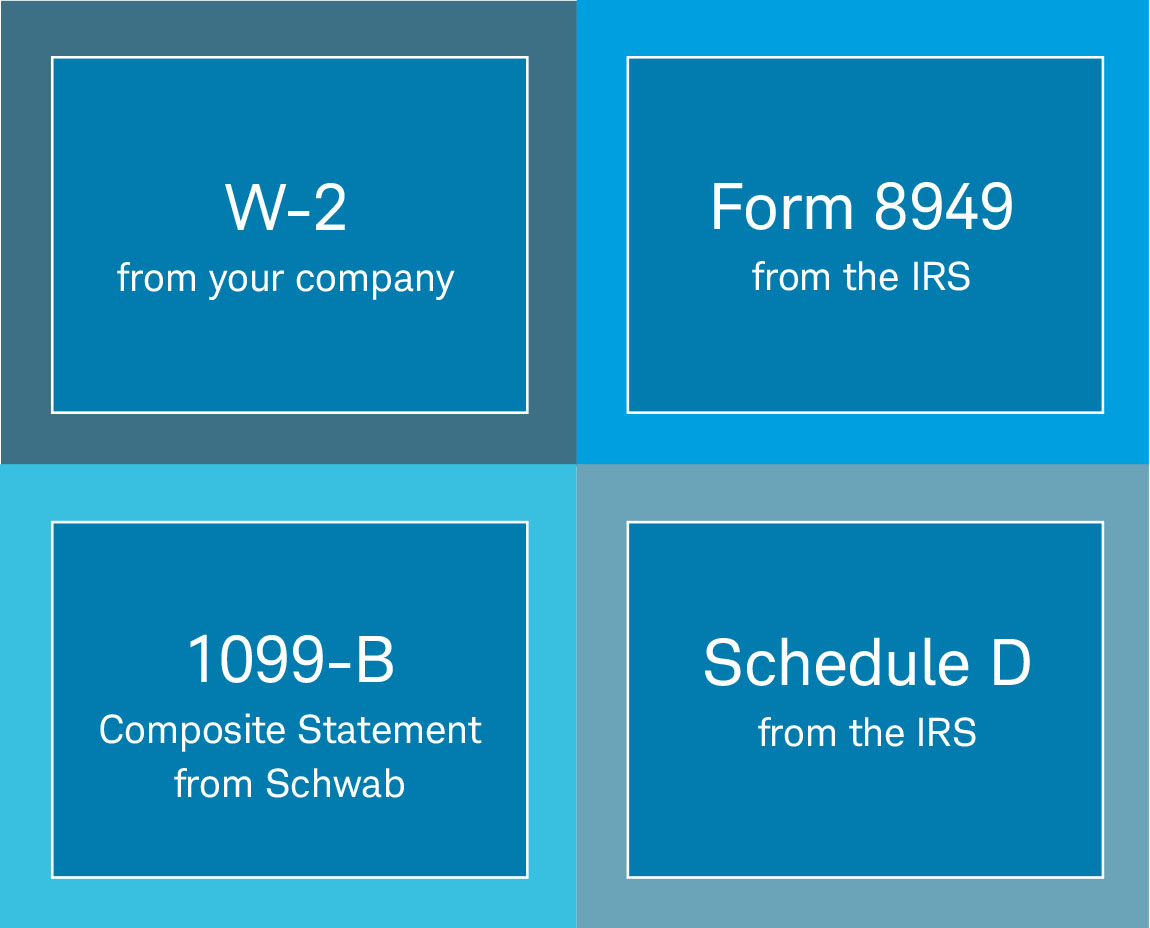

Forms you'll need

The following forms apply to U.S. taxation. If you're an international tax filer, you'll have different obligations—and may need different forms—based on the country you live in.

Log in to your Schwab brokerage account. From the Accounts page, select Statements to access yours.

These forms are completed for you:

- W2 from your company that reports ordinary income and taxes paid on your behalf

- 1099-B Composite Statement from Schwab that reports shares you've sold in your Schwab brokerage account

These forms you need to complete yourself:

- Form 8949 from the IRS that reports ordinary income received and taxes paid on your behalf

- Schedule D from the IRS that reports the totals from Form 8949

We recommend consulting with a tax professional on your individual situation.

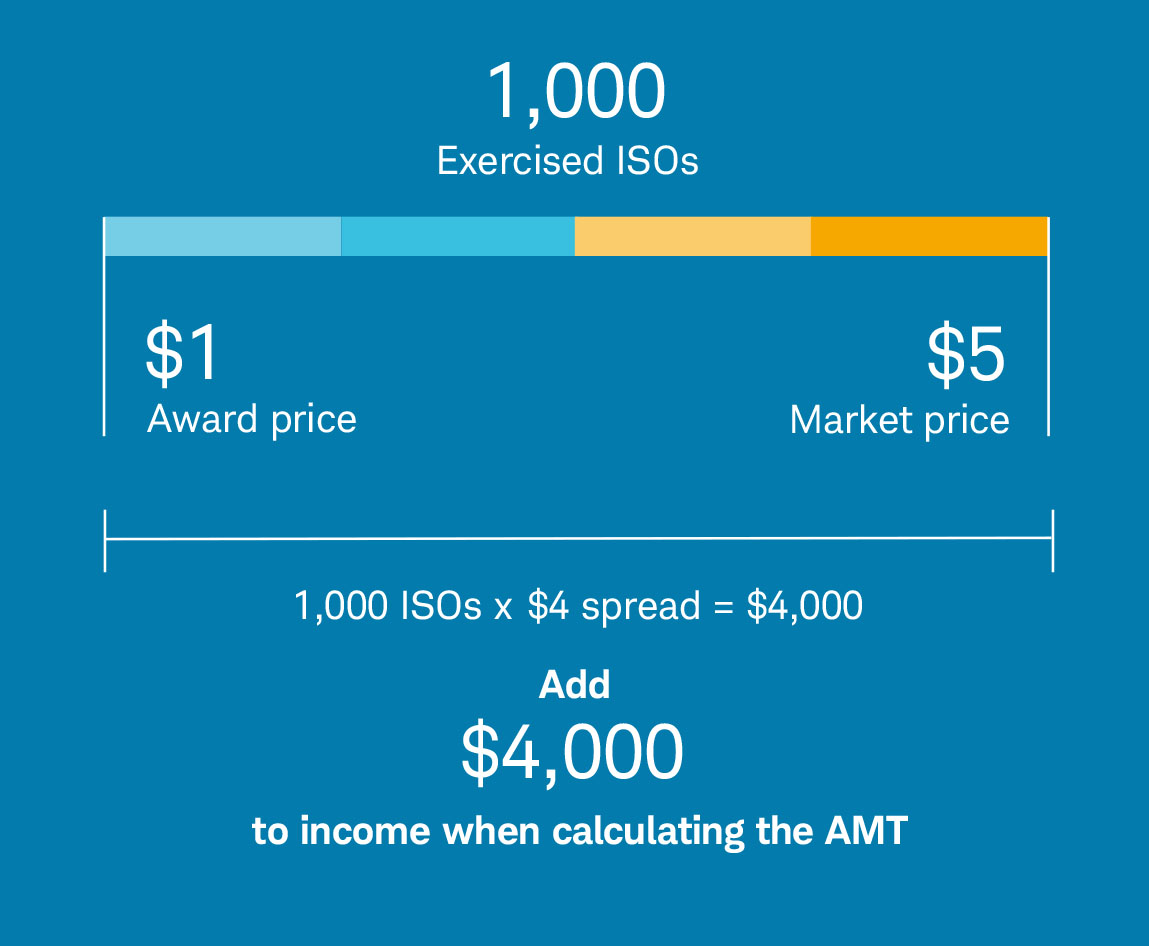

Exercising incentive stock options (ISOs) may trigger something called the alternative minimum tax (AMT), so check with your tax advisor or do an AMT calculation before you exercise ISOs.

For example, if you exercise 1,000 shares at $1 each when they're worth $5 each, you need to add $4,000 to your income to calculate the AMT.

You're taxed on any increase in value you realize on your investment when you sell. How much of each type of tax depends on whether your sale is a qualifying or disqualifying disposition.

A qualifying disposition means the sale occurred after you had held your shares for at least two years from the date your ISOs were granted and one year after exercising your ISOs. With a qualifying disposition, the difference between the value of the shares when you exercised them and the price at which you sold them will be taxed at a more preferential long-term capital gains rate.

If either of these qualifications isn't met, the sale is considered a disqualifying disposition. A disqualifying disposition receives a less favorable tax treatment: The difference between the fair market value on the date you purchased your stock and the purchase price is taxed as ordinary income.

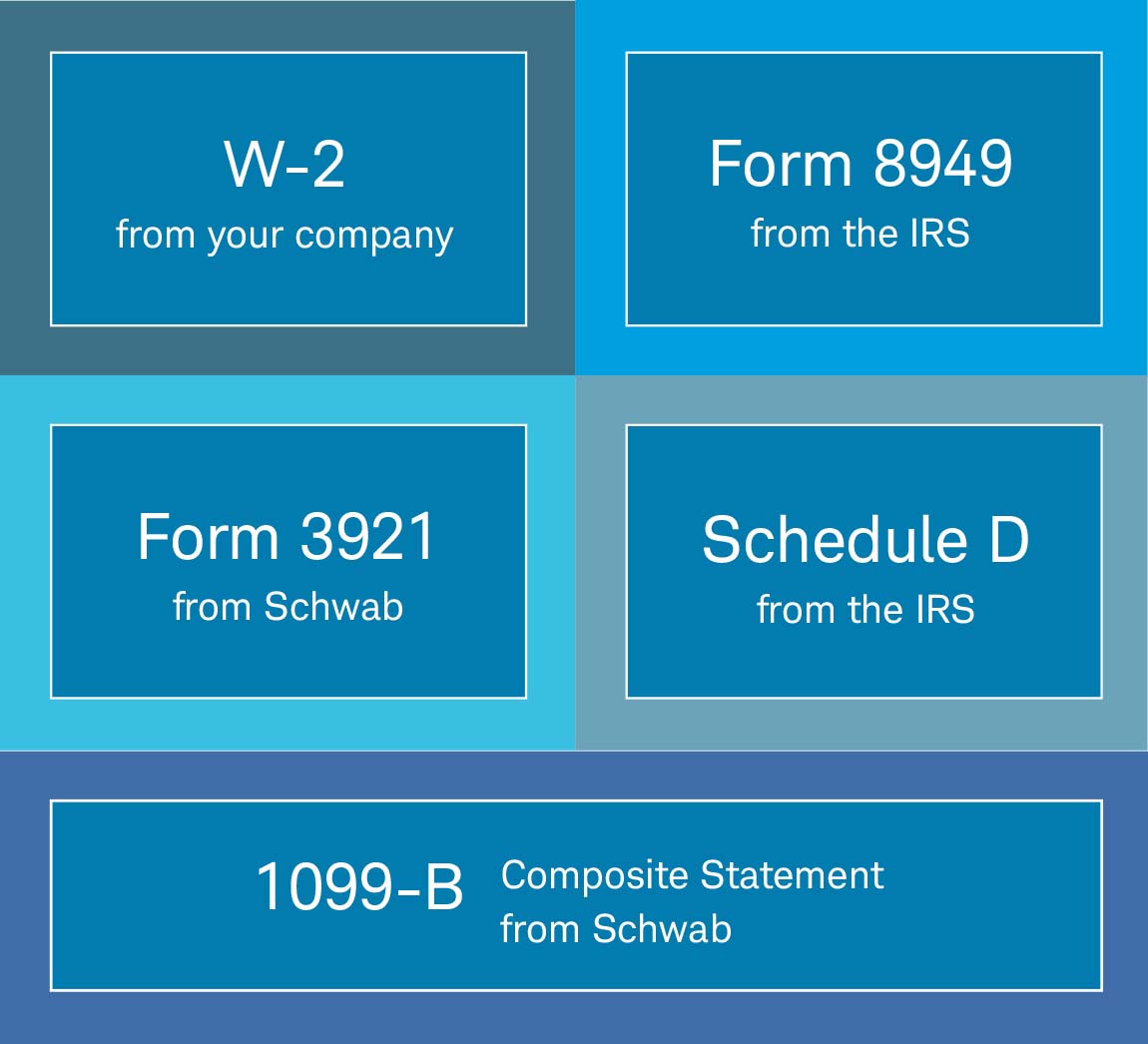

These forms apply to U.S. taxation. If you're an international tax filer, you'll have different obligations—and may need different forms—based on the country you live in.

- Form 3921 from Schwab with details from your ISO exercise

These forms you'll need to complete yourself:

When filing your taxes, it's important to be mindful of the cost basis you report. Cost basis is the original purchase price you paid for shares (plus commissions, fees, and any transaction costs), but note that stock options are treated differently. In addition to the purchase price, the cost basis on NQSOs needs to be adjusted to include the spread. If you exercised your ISOs, you may need to keep track of more than one cost basis: one for ordinary income and another for AMT.

Using the correct cost basis ensures that you file correctly and aren't taxed more than the required amount. Refer to this cost basis sheet to help you determine the cost basis on your stock plan transactions so you can file your taxes accurately.

Those who have exercised stock options will receive IRS Form 1099-B (U.S. only).

Those who were granted ISOs will also receive the IRS Form 3291 (U.S. only).

What does it mean when stock options are "in the money" vs. "out of the money?"

When the current market price is higher than the award price your employer put in the grant agreement, your options are considered "in the money." If you were to buy the stock and then sell it on the open market, you would make an immediate profit.

When the market price dips below the award price, however, the stock options are "out of the money" or "underwater." In this situation, the stock options have no value, as it would cost you more to exercise your options than to buy them on the open market. Your Schwab One® brokerage account will automatically recognize if your stock options are out of the money and prohibit you from exercising them.

Can I transfer my stock options to another person?

Generally, no. Stock options typically are non-transferrable, with the exceptions of your passing or a court order related to divorce. Refer to your stock option agreement for details about transfers.

What happens to my stock options if my employment ends?

Under most circumstances, a grace period provides the opportunity to exercise vested stock options after your termination date. A common grace period is three months, but it's determined by the terms of each grant. The reason for employment termination is also a factor. In some cases, there is no grace period and rights expire immediately.

What happens to my stock options if I die?

Generally, your heirs or the executors of your estate will have one year from the date of your passing to exercise your vested but unexercised options. Refer to your award agreement(s) for details. Remember to include your stock options and other equity awards in estate planning; if your company permits you to elect a beneficiary, consider doing so.

How do I know if I have stock options?

Your company will notify you when you receive stock options. Grant details are also located in the Equity Award Center. Log in to your Schwab account. From the Summary page under Accounts, scroll down to Employer Sponsored Equity Awards. If you have stock options, you will see a summary of those awards in this section.

Have more questions about your stock options? We're available 24 hours a day, Monday through Friday.

Call 800-654-2593.

If outside the U.S., call 602-355-3408 .

Log in to your account.

Head to the Equity Awards tab, and select the chat icon to be connected directly to a Stock Plan Services Specialist.

Or visit Videos and Forms for more information.

For the Public

FINRA Data provides non-commercial use of data, specifically the ability to save data views and create and manage a Bond Watchlist.

For Industry Professionals

Registered representatives can fulfill Continuing Education requirements, view their industry CRD record and perform other compliance tasks.

- FINRA Gateway

For Member Firms

Firm compliance professionals can access filings and requests, run reports and submit support tickets.

For Case Participants

Arbitration and mediation case participants and FINRA neutrals can view case information and submit documents through this Dispute Resolution Portal.

Need Help? | Check Systems Status

Log In to other FINRA systems

- Frequently Asked Questions

- Interpretive Questions

- Rule Filings

- Rule Filing Status Report

- Requests for Comments

- Rulebook Consolidation

- National Adjudicatory Council (NAC)

- Office of Hearing Officers (OHO)

- Disciplinary Actions Online

- Monthly Disciplinary Actions

- Sanction Guidelines

- Individuals Barred by FINRA

- Broker Dealers

- Capital Acquisition Brokers

- Funding Portals

- Individuals

- Securities Industry Essentials Exam (SIE)

- Continuing Education (CE)

- Classic CRD

- Financial Professional Gateway (FinPro)

- Financial Industry Networking Directory (FIND)

- Conferences & Events

- FINRA Institute at Georgetown

- Financial Learning Experience (FLEX)

- Small Firm Conference Call

- Systems Status

- Entitlement Program

- Market Transparency Reporting Tools

- Regulatory Filing Systems

- Data Transfer Tools

- Cybersecurity Checklist

- Compliance Calendar

- Weekly Update Email Archive

- Peer-2-Peer Compliance Library

- Investor Insights

- Tools & Calculators

- Credit Scores

- Emergency Funds

- Investing Basics

- Investment Products

- Investment Accounts

- Working With an Investment Professional

- Investor Alerts

- Ask and Check

- Avoid Fraud

- Protect Your Identity

- For the Military

- File a Complaint

- FINRA Securities Helpline for Seniors

- Dispute Resolution

- Avenues for Recovery of Losses

Trading Options: Understanding Assignment

The options market can seem to have a language of its own. To the average investor, there are likely a number of unfamiliar terms, but for an individual with a short options position—someone who has sold call or put options—there is perhaps no term more important than " assignment "—the fulfilling of the requirements of an options contract.

Options trading carries risk and requires specific approval from an investor's brokerage firm. For information about the inherent risks and characteristics of the options market, refer to the Characteristics and Risks of Standardized Options also known as the Options Disclosure Document (ODD).

When someone buys options to open a new position ("Buy to Open"), they are buying a right —either the right to buy the underlying security at a specified price (the strike price) in the case of a call option, or the right to sell the underlying security in the case of a put option.

On the flip side, when an individual sells, or writes, an option to open a new position ("Sell to Open"), they are accepting an obligation —either an obligation to sell the underlying security at the strike price in the case of a call option or the obligation to buy that security in the case of a put option. When an individual sells options to open a new position, they are said to be "short" those options. The seller does this in exchange for receiving the option's premium from the buyer.

Learn more about options from FINRA or access free courses like Options 101 at OCC Learning .

American-style options allow the buyer of a contract to exercise at any time during the life of the contract, whereas European-style options can be exercised only during a specified period just prior to expiration. For an investor selling American-style options, one of the risks is that the investor may be called upon at any time during the contract's term to fulfill its obligations. That is, as long as a short options position remains open, the seller may be subject to "assignment" on any day equity markets are open.

What is assignment?

An option assignment represents the seller's obligation to fulfill the terms of the contract by either selling or buying the underlying security at the exercise price. This obligation is triggered when the buyer of an option contract exercises their right to buy or sell the underlying security.

To ensure fairness in the distribution of American-style and European-style option assignments, the Options Clearing Corporation (OCC), which is the options industry clearing house, has an established process to randomly assign exercise notices to firms with an account that has a short option position. Once a firm receives an assignment, it then assigns this notice to one of its customers who has a short option contract of the same series. This short option contract is selected from a pool of such customers, either at random or by some other procedure specific to the brokerage firm.

How does an investor know if an option position will be assigned?

While an option seller will always have some level of uncertainty, being assigned may be a somewhat predictable event. Only about 7% of options positions are typically exercised, but that does not imply that investors can expect to be assigned on only 7% of their short positions. Investors may have some, all or none of their short positions assigned.

And while the majority of American-style options exercises (and assignments) happen on or near the contract's expiration, a long options holder can exercise their right at any time, even if the underlying security is halted for trading. Someone may exercise their options early based upon a significant price movement in the underlying security or if shares become difficult to borrow as the result of a pending corporate action such as a buyout or takeover.

Note: European-style options can only be exercised during a specified period just prior to expiration. In U.S. markets, the majority of options on commodity and index futures are European-style, while options on stocks and exchange-traded funds (ETF) are American-style. So, while SPDR S&P 500, or SPY options, which are options tied to an ETF that tracks the S&P 500, are American-style options, S&P 500 Index options, or SPX options, which are tied to S&P 500 futures contracts, are European-style options.

What happens after an option is assigned?

An investor who is assigned on a short option position is required to meet the terms of the written option contract upon receiving notification of the assignment. In the case of a short equity call, the seller of the option must deliver stock at the strike price and in return receives cash. An investor who doesn't already own the shares will need to acquire and deliver shares in return for cash in the amount of the strike price, multiplied by 100, since each contract represents 100 shares. In the case of a short equity put, the seller of the option is required to purchase the stock at the strike price.

How might an investor's account balance fluctuate after opening a short options position?

It is normal to see an account balance fluctuate after opening a short option position. Investors who have questions or concerns or who do not understand reported trade balances and assets valuations should contact their brokerage firm immediately for an explanation. Please keep in mind that short option positions can incur substantial risk in certain situations.

For example, say XYZ stock is trading at $40 and an investor sells 10 contracts for XYZ July 50 calls at $1.00, collecting a premium of $1,000, since each contract represents 100 shares ($1.00 premium x 10 contracts x 100 shares). Consider what happens if XYZ stock increases to $60, the call is exercised by the option holder and the investor is assigned. Should the investor not own the stock, they must now acquire and deliver 1,000 shares of XYZ at a price of $50 per share. Given the current stock price of $60, the investor's short stock position would result in an unrealized loss of $9,000 (a $10,000 loss from delivering shares $10 below current stock price minus the $1,000 premium collected earlier).

Note: Even if the investor's short call position had not been assigned, the investor's account balance in this example would still be negatively affected—at least until the options expire if they are not exercised. The investor's account position would be updated to reflect the investor's unrealized loss—what they could lose if an option is exercised (and they are assigned) at the current market price. This update does not represent an actual loss (or gain) until the option is actually exercised and the investor is assigned.

What happens if an investor opened a multi-leg strategy, but one leg is assigned?

American-style option holders have the right to exercise their options position prior to expiration regardless of whether the options are in-, at- or out-of-the-money. Investors can be assigned if any market participant holding calls or puts of the same series submits an exercise notice to their brokerage firm. When one leg is assigned, subsequent action may be required, which could include closing or adjusting the remaining position to avoid potential capital or margin implications resulting from the assignment. These actions may not be attractive and may result in a loss or a less-than-ideal gain.

If an investor's short option is assigned, the investor will be required to perform in accordance with their obligation to purchase or deliver the underlying security, regardless of the overall risk of their position when taking into account other options that may be owned as part of the overall multi-leg strategy. If the investor owns an option that serves to limit the risk of the overall spread position, it is up to the investor to exercise that option or to take other action to limit risk.

Below are a couple of examples that underscore how important it is for every investor to understand the risks associated with potential assignment during market hours and potentially adverse price movements in afterhours trading.

Example #1: An investor is short March 50 XYZ puts and long March 55 XYZ puts. At the close of business on March expiration, XYZ is priced at $56 per share, and both puts are out of the money, which means they have no intrinsic value. However, due to an unexpected news announcement shortly after the closing bell, the price of XYZ drops to $40 in after-hours trading. This could result in an assignment of the short March 50 puts, requiring the investor to purchase shares of XYZ at $50 per share. The investor would have needed to exercise the long March 55 puts in order to realize the gain on the initial multi-leg position. If the investor did not exercise the March 55 puts, those puts may expire and the investor may be exposed to the loss on the XYZ purchase at $50, a $10 per share loss with XYZ now trading at $40 per share, without receiving the benefit of selling XYZ at $55.

Example #2: An investor is short March 50 XYZ puts and long April 50 XYZ puts. At the close of business on March expiration, XYZ is priced at $45 per share, and the investor is assigned XYZ stock at $50. The investor will now own shares of XYZ at $50, along with the April 50 XYZ puts, which may be exercised at the investor's discretion. If the investor chooses not to exercise the April 50 puts, they will be required to pay for the shares that were assigned to them on the short March 50 XYZ puts until the April 50 puts are exercised or shares are otherwise disposed of.

Note: In either example, the short put position may be assigned prior to expiration at the discretion of the option holder. Investors can check with their brokerage firm regarding their option exercise procedures and cut-off times.

For options-specific questions, you may contact OCC's Investor Education team at [email protected] , via chat on OptionsEducation.org or subscribe to the OIC newsletter . If you have questions about options trading in your brokerage account, we encourage you to contact your brokerage firm. If after doing so you have not resolved the issue or have additional concerns, you can contact FINRA .

Tips for Managing a Financial Windfall

Trading Terms: Time Parameters and Qualifiers on Stock Orders

It Can Be Hard to Recover from ‘Recovery’ Scams

Spread the Word: What You Need to Know About Bond Spreads

How to Prepare for and Survive Financial Hardship

Option Approval Levels

The Option approval level dictates what types of strategies you can employ in your Schwab account. In order to see the trading level your account is approved for look in the header of the Account Details window.

| Option Trading Approval Levels | |

|---|---|

| Level | Allows you to place: |

If you decide that you would like to apply to upgrade your option trading level, please complete a new Option Trading Application. Schwab will evaluate your application and send a confirmation of the option trading strategy approved for your account.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Multiple leg options strategies will involve multiple commissions. Please read the options disclosure document titled " Characteristics and Risks of Standardized Options ." Member SIPC

Copyright ©Charles Schwab & Co., Inc. 2011. All rights reserved. Member SIPC . (0411-2708)

- Balances & Order Status

- Realized Gain/Loss

- All In One Trade Tool

- Option Trading: Quotes

- Probability Calculator

- Conditional Orders

- Global Trading

- Screener Plus

- Option Screener

- ETF Screener

- Recognia®

- Block Trade Indicator

- News and CNBC TV

- Charting: Overview

- Studies and Drawing Tools

- Positions and Orders on Charts

- Options Charting

- Market Edge®

- Watch List and Momentum

- Trader’s Marketplace

- Learning Center

Options Trading: Trade and Probability Calculator

The Trade & Probability Calculator provides calculations that are hypothetical in nature and do not reflect actual investment results, or guarantee future results. The calculations do not consider commissions or other costs, and do not consider other positions in your account(s) for which this specific trade is taking place. Rather, these values are based solely on the individual contract or pair of contracts in this specific trade. In addition, the calculations do not consider the specific date of dividend, early assignment, and other risks associated with option trading. Options which expire before the estimated dates have calculated values based on underlying prices as of the estimated dates, as if option is expiring on the estimated date. Investment decisions should not be made based solely upon values generated by the Trade & Probability Calculator

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled " Characteristics and Risks of Standardized Options " before considering any option transaction. Call Schwab at 1-800-435-4000 for a current copy.

Securities, ticker symbols, market data and corporate information depict dated information and are shown for informational purposes only.

Options Trading: Basics of a Covered Call Strategy

Choosing and implementing an options strategy like the covered call can be similar to driving a car. There are a lot of moving parts, but once you're familiar with the characteristics, you can steer toward your objective. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved.

What draws investors to the covered call options strategy? A covered call gives someone else the right to purchase stock shares you already own (hence "covered") at a specified price (strike price) and at any time on or before a specified date (expiration date). Covered calls can potentially earn income on stocks you already own. Of course, there's no free lunch; your stock could be called away at any time during the life of the option. But selling (or "writing") covered calls has many other potential uses that many investors may not fully realize.

So, let's pop the hood and look at three features of this basic options strategy: selling stock, collecting dividends, and potentially limiting taxes.

Exit a long position

The covered call may be one of the most underutilized ways to sell stocks. If you already plan to sell at a target price you might consider trying to collect some additional income in the process.

Here's how it works. Let's say XYZ stock is trading at $23 per share, and you want to sell your 100 shares at $25 per share. Sure, you could probably sell your XYZ shares right now for $23 per share in your brokerage account, but you could also sell (write) a covered call with your target price (strike price) of $25 per share.

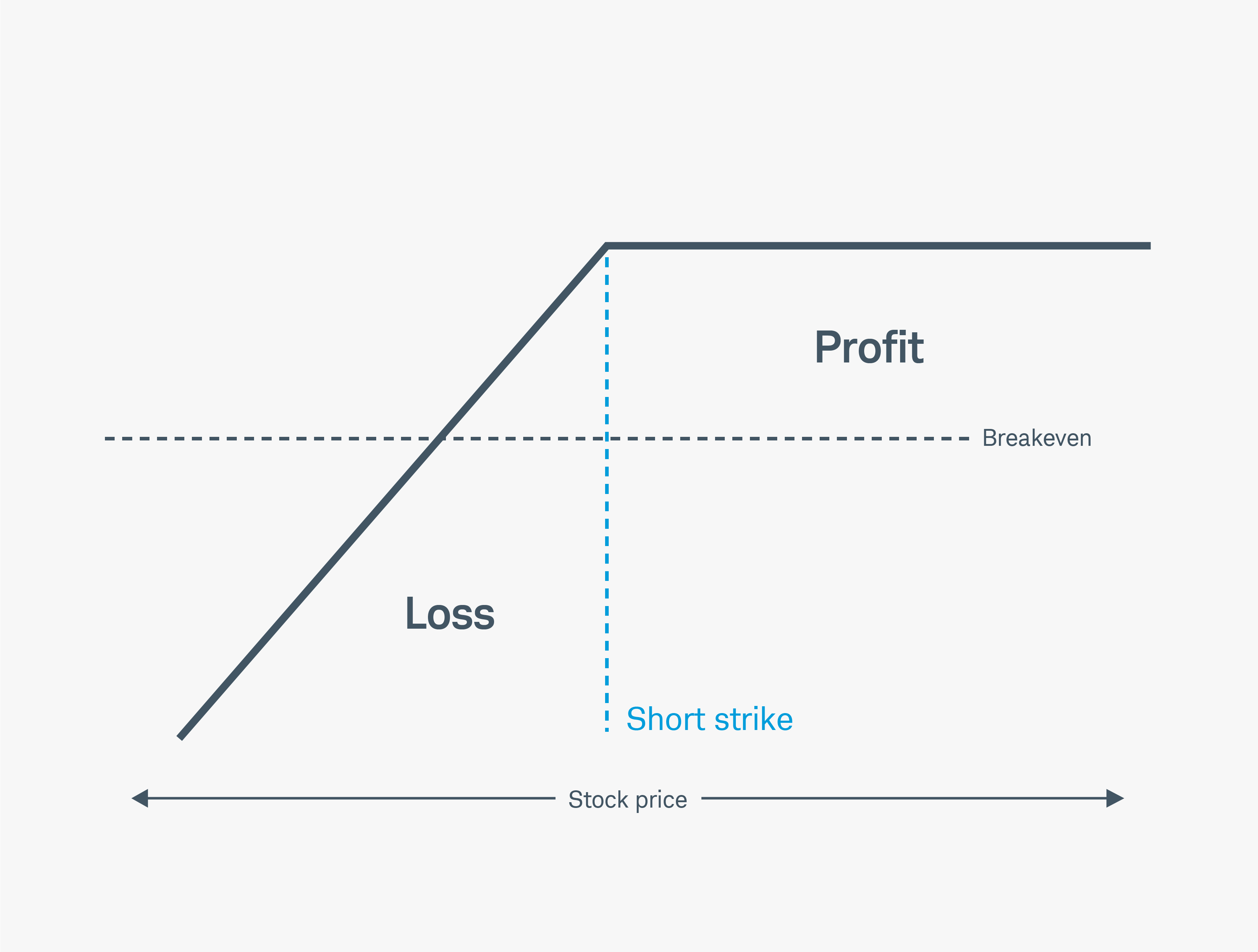

Take a look at the covered call risk profile in the chart below.

If you sell the call, you'll receive cash (premium), which is immediately deposited into your account (minus transaction costs). The cash is yours to keep no matter what happens to the underlying shares. If XYZ rises above $25 at any time until the option expires, you'll likely be assigned on your short option, and your shares of XYZ will be called away from you at the strike price. In fact, that move may fit right into your plan. You received a premium for selling the call, and you made an additional two points (from $23 to $25) on the stock.

As desired, the stock was sold at your target price (i.e., called away from you) at $25. If the stock goes higher than $25, you made what you wanted, but not a penny more. After all, you agreed to sell XYZ at $25. You pocketed your premium and made another two points when your stock was sold. But you won't participate in any stock appreciation above the strike price. Also, keep in mind that transaction costs (commissions, contract fees, and options assignment fees) will reduce your gains.

Covered call risk profile

On the other hand : Even though you'd like to sell XYZ at $25, it's possible that the stock price could fall from $23 to $20, or perhaps even lower. In this case, you'd keep the premium you received and still own the stock on the expiration date. But instead of the two points you hoped to gain, you're now looking at a potential loss (depending on the price at which you originally bought XYZ). In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option.

Hint : Many option traders spend a lot of time analyzing underlying stocks in an effort to avoid unwanted surprises. They use their research to try to improve the odds of choosing stocks that won't suffer a serious, unexpected price decline. But keep in mind, no matter how much research you do, surprises are always possible.

Another hint : Whenever your covered call option is at the money (ATM) or in the money (ITM), your stock could be called away from you. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price.

Keep in mind : If your option is ITM by even one penny when expiration arrives, your stock will likely be called away.

Sell covered calls for premium

Selling covered calls can sometimes feel like you've made a triple play. After you sell a covered call on XYZ, you collect your premium, and you still receive dividends (if any) and any potential capital gains on the underlying stock (unless it's called away). It's important to note that any capital gains received from holding the stock are capped at the strike price.

On the other hand : The option buyer (the person who agreed to buy your option) may also want that dividend, so as the ex-dividend date approaches, the chance your stock will be called away increases.

Hint : The option buyer (or holder) has the right to call the stock away from you any time. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date.

Another hint : Not surprisingly, some option buyers will exercise the call option before the ex-dividend date to capture the dividend for themselves. And if the option is deep ITM, there's a higher probability the stock will be called away from you before you get to collect the dividend. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. When you sell a covered call, you receive premium, but you also give up control of your stock.

Keep in mind : Though early exercise could happen at any time, the likelihood grows as the stock's ex-dividend date approaches.

Get potential tax advantages by selling covered calls

There may be tax advantages to selling covered calls within an individual retirement account (IRA) or other retirement account where premiums, capital gains, and dividends may be tax-deferred. However, there are exceptions, so consult your tax professional to discuss your personal circumstances.

If the stock is held in a taxable brokerage account, there are some tax considerations.

For example, let's say in November you have potential profits on XYZ stock, but for tax purposes, you don't want to sell. You could write a covered call that is currently ITM with a January expiration date. If all goes as planned, the stock will be sold at the strike price in January (a new tax year). Remember, you're always accepting the risk, no matter how small, that your option will be assigned sooner than you planned.

On the other hand : If the stock falls rather than appreciates, you'll likely still be holding the stock, and the call option will expire worthless. You could always consider selling the stock or selling another covered call. Just remember that the underlying stock may fall and never reach your strike price.

Hint : If you believe the benefits of selling covered calls outweigh the risks, you might look for stocks you consider good candidates for covered call writing. A buy-write allows you to simultaneously buy the underlying stock and sell (write) a covered call.

Keep in mind : You may be subject to two commissions: one for the buy on the stock and one for the write of the call. Even basic options strategies like covered calls require education, research, and practice. Remember, no options strategy may be right for you unless it's true to your investment goals and risk tolerance.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled " Characteristics and Risks of Standardized Options " before considering any options transaction. Call Schwab at 800-435-4000 for a current copy. Supporting documentation for any claims or statistical information is available upon request.

Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.

Commissions, taxes, and transaction costs are not included in this discussion but can affect the final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

What to Know About Zero-Days-to-Expiration Options

Watch video: What to Know About Zero-Days-to-Expiration Options

Upbeat music plays throughout.

On-screen text: Disclosure: Some ETFs trade to 4:15pm ET.

Narrator: Zero-days-to-expiration options are contracts that expire at the end of the current trading day rather than days or weeks in the future. Known as 0DTE options, they offer options traders a chance to make a quick profit off a small price change in an underlying security, but can also quickly lead to substantial losses.

Remember that the information here is strictly for educational purposes only. It shouldn't be considered, individualized advice or a recommendation. Also, options trading involves unique risks and is not suitable for all investors. 0DTE options can magnify some of those risks, but we'll talk more about that in a minute.

Daily 0DTE options started trading in 2022 and, by November of 2023, they accounted for half of all the S&P 500 ® index (SPX) options volume. If you're not familiar with options, check out our basic options videos.

On-screen text: Options buyer benefits.

Narrator: These options may have a unique draw for more sophisticated options buyers because they can provide traders with an opportunity to quickly capitalize on the volatility of an index or ETF in a short amount of time.

They also tend to have lower premiums compared to longer-dated options, which can make them a less expensive vehicle when trying to take advantage of a short-term volatility opportunity.

On-screen text: Option seller benefits.

Animation: A timeline of the trading day shows the symbol for theta growing throughout the day as the hours to expiration diminishes ahead of the close.

Narrator: Option sellers may be drawn to the fast time decay and the potential for quick returns. There's a lot to consider before you start trading 0DTE options, like the fact that leverage is a two-edged sword that can cut both buyers and sellers.

If you think about it, every options contract on an underlying optionable index, stock, or ETF becomes a 0DTE contract on its expiration date. In the past, there were only expirations once a month or once a week, but now there are options that expire every day.

So, while the concept isn't new, it's important to remember that the short-term nature of the options means they can experience significant price swings right before they expire.

As of 2023, these contracts are available on major stock indexes and some index ETFs. One important difference between index options and equity options is how they settle. Index options settle in cash, whereas equity options, like those used for ETFs, settle in shares of the security.

So, why would a trader consider an option with the average lifespan of a mayfly? There are a few reasons.

First, they can provide the potential of big profits for long option traders. Imagine the SPX was trading at 4,955 and a trader bought a 4,955 at-the-money call option for $11.50. The index rallied 1% to 5,004. At the end of the day, the call option might be worth $49 for a profit about $38, not including commissions or fees. That's more than a 300% profit off a 1% move in the index.

Animation: The original premium or debit is $11.50, or $1,150 with the multiplier. The premium grows to $49, or $4,900. A profit of $37.50, or $3,750, is the result.

Narrator: But remember, options cut the other way too. If the price of the index fell or even stayed the same, the trader could lose their entire investment.

Second, they offer quick time decay for option sellers. Once again, imagine the SPX was trading at 4,955 and a trader sold a 4,935 put for $5.90. If the index were to rise, go sideways, or even come down to 4,936, the trader could keep the entire credit. However, if the index fell below 4,935, the trader would begin to incur losses. While initially, the losses might only erase the gains from the sale of the put, the losses could grow quickly. Unlike the first example, a trader could lose substantially more than their initial credit.

Animation. A graph shows the underlying price falling. The premium grows to $34.90, or $3,490. The difference in the credit and the current premium results in a loss.

Narrator: If the index fell 1% to 4,906, the trader would lose $2,900, not accounting for commissions or fees. Additionally, the margin requirement for selling index options can be substantial and traders are required to maintain sufficient account equity for the short position.

Third, 0DTE options are potentially less expensive compared to options with more days to expiration because they have less time value. This means that time decay will work faster. For this reason, it's especially important to make sure that if you trade 0DTE options, you do so consistent with your risk appetite.

Fourth, 0DTE options that expire don't count against the pattern day trading rule. Opening and closing a 0DTE option on the same day before expiration does count, however. To learn more about the pattern day trading rule, check out some of our other education on the subject.

Finally, due to the high volume, the bid/ask spread tends to be tight. Tight spreads can help lower trading costs.

There's risk to these trades, though, which work mostly like regular options but on a truncated timetable. The options greeks are an important tool to understanding how 0DTE trades work because they can provide insight to how to manage the inherent risk. The greeks are theoretical measurements of how a contract is influenced by changes in price, time, and volatility. The greeks for 0DTE are the same as longer-dated options—long calls have positive delta and gamma, negative theta, and positive vega. But what you must be prepared for is that many of the values are much higher than with longer-dated options and some change quite a bit throughout the day. That means that a trade can turn positive or negative very quickly.

Animation: A timeline of the trading day shows the symbol for theta rising throughout the day as the hours to expiration diminishes ahead of the close.

Narrator: One important factor is time decay, which is measured by theta, theta the rate at which extrinsic value melts. When the option gets closer to expiration, it melts faster. Because 0DTE options are so close to expiration, time decay will occur at higher speed than longer options. And that speed can increase throughout the day, diminishing the chances that a long trade will succeed if it hasn't already happened.

If a long call trader doesn't get the immediate move to the upside they were hoping for, they may consider closing quickly to avoid potentially losing all the invested capital when the contract expires.

At the same time, 0DTE options become more highly attuned to the price of the underlying as the day goes on. That's because of an increase in gamma, which tracks changes in the delta of an option.

Animation: A long call has a premium of $181, a Delta of .56, and a Gamma of .10. The gamma reduces the delta to .46 and the premium falls to $75.58.

Narrator: So, in a single trading session, even a minor change in the price of the underlying asset of a 0DTE option can greatly affect the delta which in turn changes the value of the option before it expires.

Short option traders should consider gamma risk because late market rallies or selloffs could turn a positive trade to negative, very quickly. Gamma risk can also hurt long option traders because a change in direction could reduce profit and compound losses.

Zero-days-to-expiration options are a popular but risky trading vehicle that are best suited for experienced option traders with a high tolerance for risk. Consider practicing trading 0DTE options using the thinkorswim ® paperMoney ® platform before committing real money to your strategies. Also, consider developing a trading plan that defines when to enter and exit trades, as well as how much you're willing to risk on each trade.

On-screen text: [Schwab logo] Own your tomorrow ®

Just getting started with options?

More from charles schwab.

Weekly Trader's Outlook

Today's Options Market Update

Income-Generating ETFs: Covered-Call vs. Dividend?

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled " Characteristics and Risks of Standardized Options " before considering any option transaction. Supporting documentation for any claims or statistical information is available upon request.

Short options can be assigned at any time up to expiration regardless of the In-The-Money (ITM) amount. An ITM option has a higher risk of being assigned early.

With long options, investors may lose 100% of funds invested.

Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Investing involves risk, including loss of principal.

- Best Stock Brokers Best Stock Trading Apps Best Stock Trading Platforms for Beginners Best Paper Trading Platforms Best Day Trading Platforms

- Best Futures Trading Platforms Best Options Trading Platforms Best Penny Stock Brokers Best International Brokers All Guides arrow_right_alt

- Robinhood vs Webull Charles Schwab vs E*TRADE Fidelity vs Robinhood TradeStation vs Interactive Brokers

- E*TRADE vs Interactive Brokers Charles Schwab vs Fidelity Merrill Edge vs Fidelity Compare Brokers arrow_right_alt

- done About Us done How We Test done Why Trust Us done Our Policy on AI done Media

- done 2024 Annual Awards done Historical Rankings done How We Make Money done Meet the Team

Fidelity vs Charles Schwab 2024

Written by StockBrokers.com

Is Fidelity better than Charles Schwab? After testing 18 of the best online brokers , our analysis finds that Fidelity (98.7%) is better than Charles Schwab (96.6%). Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use mobile app.

Select Brokers

- check_box_outline_blank check_box Ally Invest

- check_box_outline_blank check_box Charles Schwab

- check_box_outline_blank check_box Citi Self Invest

- check_box_outline_blank check_box E*TRADE

- check_box_outline_blank check_box eToro

- check_box_outline_blank check_box Fidelity

- check_box_outline_blank check_box Firstrade

- check_box_outline_blank check_box Interactive Brokers

- check_box_outline_blank check_box J.P. Morgan Self-Directed Investing

- check_box_outline_blank check_box Merrill Edge

- check_box_outline_blank check_box Public.com

- check_box_outline_blank check_box Robinhood

- check_box_outline_blank check_box SoFi Invest

- check_box_outline_blank check_box tastytrade

- check_box_outline_blank check_box TD Ameritrade

- check_box_outline_blank check_box TradeStation

- check_box_outline_blank check_box Tradier

- check_box_outline_blank check_box Vanguard

- check_box_outline_blank check_box Webull

+ Add Broker

Close Menu ×

| Overall Rating | Fidelity | Charles Schwab | |

|---|---|---|---|

| Overall | |||

| Commissions & Fees | |||

| Investment Options | |||

| Platforms & Tools | |||

| Mobile Trading Apps | |||

| Research | |||

| Customer Service | |||

| Education | |||

| Ease Of Use | |||

| Winner | |||

| Review |

| Broker Screenshots | Fidelity | Charles Schwab | |

|---|---|---|---|

| Trading Platform & Tools Gallery (click to expand) | - | ||

| Research Gallery (click to expand) | |||

| Mobile Trading Apps Gallery (click to expand) | |||

| Education Gallery (click to expand) |

| Trading Fees | Fidelity | Charles Schwab | |

|---|---|---|---|

| Minimum Deposit | $0.00 | $0.00 | |

| Stock Trades | $0.00 | $0.00 | |

| Penny Stock Fees (OTC) info | $0.00 | $6.95 | |

| Mutual Fund Trade Fee | Varies info | Varies | |

| Options (Per Contract) | $0.65 | $0.65 | |

| Futures (Per Contract) | (Not offered) | $2.25 | |

| Broker Assisted Trade Fee | $32.95 | $25 |

| Margin Rates | Fidelity | Charles Schwab | |

|---|---|---|---|

| Margin Rate Under $25,000 | 13.575% | 13.575% | |

| Margin Rate $25,000 to $49,999.99 | 13.075% | 13.075% | |

| Margin Rate $50,000 to $99,999.99 | 12.125% | 12.125% | |

| Margin Rate $100,000 to $249,999.99 | 12.075% | 12.075% | |

| Margin Rate $250,000 to $499,999.99 | 11.825% | 11.825% | |

| Margin Rate $500,000 to $999,999.99 | 9.5% | Varies info | |

| Margin Rate Above $1,000,000 | 9.25% | Varies info |

| Account Fees | Fidelity | Charles Schwab | |

|---|---|---|---|

| IRA Annual Fee | $0.00 | $0.00 | |

| IRA Closure Fee | $0.00 | $0.00 | |

| Account Transfer Out (Partial) info | $0.00 | $0.00 | |

| Account Transfer Out (Full) info | $0.00 | $50.00 | |

| Options Exercise Fee | $0.00 | $0.00 | |

| Options Assignment Fee | $0.00 | $0.00 |

| Investment Options | Fidelity | Charles Schwab | |

|---|---|---|---|

| Stock Trading info | Yes | Yes | |

| Margin Trading | Yes | Yes | |

| Fractional Shares info | Yes | Yes | |

| OTC Stocks info | Yes | Yes | |

| Options Trading info | Yes | Yes | |

| Complex Options Max Legs info | 4 | 4 | |

| Futures Trading info | No | Yes | |

| Forex Trading info | No | Yes | |

| Crypto Trading info | Yes | No | |

| Crypto Trading - Total Coins info | 2 | 0 | |

| Mutual Funds (No Load) info | 5843 | 15163 | |

| Mutual Funds (Total) info | 10000 | 18145 | |

| Bonds (US Treasury) info | Yes | Yes | |

| Bonds (Corporate) info | Yes | Yes | |

| Bonds (Municipal) info | Yes | Yes | |

| Traditional IRAs info | Yes | Yes | |

| Roth IRAs info | Yes | Yes | |

| Advisor Services info | Yes | Yes | |

| International Countries (Stocks) info | 25 | 13 |

| Order Types | Fidelity | Charles Schwab | |

|---|---|---|---|

| Order Type - Market info | Yes | Yes | |

| Order Type - Limit info | Yes | Yes | |

| Order Type - After Hours info | Yes | Yes | |

| Order Type - Stop info | Yes | Yes | |

| Order Type - Trailing Stop info | Yes | Yes | |

| Order Type - OCO info | Yes | Yes | |

| Order Type - OTO info | Yes | Yes | |

| Order Type - Broker Assisted info | Yes | Yes |

| Beginners | Fidelity | Charles Schwab | |

|---|---|---|---|

| Education (Stocks) info | Yes | Yes | |

| Education (ETFs) info | Yes | Yes | |

| Education (Options) info | Yes | Yes | |

| Education (Mutual Funds) info | Yes | Yes | |

| Education (Bonds) info | Yes | Yes | |

| Education (Retirement) info | Yes | Yes | |

| Retirement Calculator info | Yes | Yes | |

| Investor Dictionary info | Yes | Yes | |

| Paper Trading info | No | No | |

| Videos info | Yes | Yes | |

| Webinars info | Yes | Yes | |

| Webinars (Archived) info | Yes | Yes | |

| Progress Tracking info | Yes | Yes | |

| Interactive Learning - Quizzes info | Yes | Yes |

| Stock Trading Apps | Fidelity | Charles Schwab | |

|---|---|---|---|

| iPhone App info | Yes | Yes | |

| Android App info | Yes | Yes | |

| Apple Watch App info | Yes | Yes | |

| Trading - Stocks info | Yes | Yes | |

| Trading - After-Hours info | Yes | Yes | |

| Trading - Simple Options info | Yes | Yes | |

| Trading - Complex Options info | Yes | Yes | |

| Order Ticket RT Quotes info | Yes | Yes | |

| Order Ticket SRT Quotes info | Yes | No |

| Stock App Features | Fidelity | Charles Schwab | |

|---|---|---|---|

| Market Movers (Top Gainers) info | Yes | Yes | |

| Stream Live TV info | Yes | Yes | |

| Videos on Demand info | Yes | Yes | |

| Stock Alerts info | Yes | Yes | |

| Option Chains Viewable info | Yes | Yes | |

| Watch List (Real-time) info | Yes | Yes | |

| Watch List (Streaming) info | Yes | Yes | |

| Watch Lists - Create & Manage info | Yes | Yes | |

| Watch Lists - Column Customization info | Yes | Yes | |

| Watch Lists - Total Fields info | 92 | 580 |

| Stock App Charting | Fidelity | Charles Schwab | |

|---|---|---|---|

| Charting - After-Hours info | Yes | No | |

| Charting - Can Turn Horizontally info | Yes | Yes | |

| Charting - Multiple Time Frames info | Yes | Yes | |

| Charting - Technical Studies info | 129 | 373 | |

| Charting - Study Customizations info | Yes | Yes | |

| Charting - Stock Comparisons info | Yes | Yes |

| Trading Platforms | Fidelity | Charles Schwab | |

|---|---|---|---|

| Active Trading Platform info | Active Trader Pro | thinkorswim info | |

| Desktop Trading Platform info | Yes | Yes | |

| Desktop Platform (Mac) info | Yes | No | |

| Web Trading Platform info | Yes | Yes | |

| Paper Trading info | No | No | |

| Trade Journal info | Yes | Yes | |

| Watch Lists - Total Fields info | 92 | 580 |

| Stock Chart Features | Fidelity | Charles Schwab | |

|---|---|---|---|

| Charting - Adjust Trades on Chart info | Yes | Yes | |

| Charting - Indicators / Studies info | 129 | 374 | |

| Charting - Drawing Tools info | 38 | 24 | |

| Charting - Notes info | Yes | Yes | |

| Charting - Index Overlays info | Yes | Yes | |

| Charting - Historical Trades info | Yes | Yes | |

| Charting - Corporate Events info | Yes | Yes | |

| Charting - Custom Date Range info | Yes | Yes | |

| Charting - Custom Time Bars info | Yes | Yes | |

| Charting - Automated Analysis info | Yes | Yes | |

| Charting - Save Profiles info | Yes | Yes | |

| Trade Ideas - Technical Analysis info | Yes | Yes | |

| Charting - Study Customizations info | 5 | 35 | |

| Charting - Custom Studies info | No | Yes |

| Day Trading | Fidelity | Charles Schwab | |

|---|---|---|---|

| Streaming Time & Sales info | Yes | Yes | |

| Streaming TV info | Yes | Yes | |

| Direct Market Routing - Stocks info | Yes | Yes | |

| Ladder Trading info | No | Yes | |

| Trade Hot Keys info | Yes | Yes | |

| Level 2 Quotes - Stocks info | Yes | Yes | |

| Trade Ideas - Backtesting info | Yes | Yes | |

| Trade Ideas - Backtesting Adv info | No | Yes | |

| Short Locator info | Yes | Yes | |

| Order Liquidity Rebates info | No | No |

| Research Overview | Fidelity | Charles Schwab | |

|---|---|---|---|

| Research - Stocks info | Yes | Yes | |

| Research - ETFs info | Yes | Yes | |

| Research - Mutual Funds info | Yes | Yes | |

| Research - Pink Sheets / OTCBB info | Yes | Yes | |

| Research - Bonds info | Yes | Yes | |

| Screener - Stocks info | Yes | Yes | |

| Screener - ETFs info | Yes | Yes | |

| Screener - Mutual Funds info | Yes | Yes | |

| Screener - Bonds info | Yes | Yes | |

| Misc - Portfolio Allocation info | Yes | Yes |

| Stock Research | Fidelity | Charles Schwab | |

|---|---|---|---|

| Stock Research - PDF Reports info | 11 | 7 | |

| Stock Research - Earnings info | Yes | Yes | |

| Stock Research - Insiders info | Yes | Yes | |

| Stock Research - Social info | Yes | Yes | |

| Stock Research - News info | Yes | Yes | |

| Stock Research - ESG info | Yes | Yes | |

| Stock Research - SEC Filings info | Yes | Yes |

| ETF Research | Fidelity | Charles Schwab | |

|---|---|---|---|

| ETFs - Strategy Overview info | Yes | Yes | |

| ETF Fund Facts - Inception Date info | Yes | Yes | |

| ETF Fund Facts - Expense Ratio info | Yes | Yes | |

| ETF Fund Facts - Net Assets info | Yes | Yes | |

| ETF Fund Facts - Total Holdings info | Yes | Yes | |

| ETFs - Top 10 Holdings info | Yes | Yes | |

| ETFs - Sector Exposure info | Yes | Yes | |

| ETFs - Risk Analysis info | Yes | Yes | |

| ETFs - Ratings info | Yes | Yes | |

| ETFs - Morningstar StyleMap info | Yes | Yes | |

| ETFs - PDF Reports info | Yes | Yes |

| Mutual Fund Research | Fidelity | Charles Schwab | |

|---|---|---|---|

| Mutual Funds - Strategy Overview info | Yes | Yes | |

| Mutual Funds - Performance Chart info | Yes | Yes | |

| Mutual Funds - Performance Analysis info | Yes | Yes | |

| Mutual Funds - Prospectus info | Yes | Yes | |

| Mutual Funds - 3rd Party Ratings info | Yes | Yes | |

| Mutual Funds - Fees Breakdown info | Yes | Yes | |

| Mutual Funds - Top 10 Holdings info | Yes | Yes | |

| Mutual Funds - Asset Allocation info | Yes | Yes | |

| Mutual Funds - Sector Allocation info | Yes | Yes | |

| Mutual Funds - Country Allocation info | Yes | Yes | |

| Mutual Funds - StyleMap info | Yes | Yes |

| Options Trading | Fidelity | Charles Schwab | |

|---|---|---|---|

| Option Chains - Basic View info | Yes | Yes | |

| Option Chains - Strategy View info | Yes | Yes | |

| Option Chains - Streaming info | Yes | Yes | |

| Option Chains - Total Columns info | 26 | 31 | |

| Option Chains - Greeks info | 5 | 5 | |

| Option Chains - Quick Analysis info | Yes | Yes | |

| Option Analysis - P&L Charts info | Yes | Yes | |

| Option Probability Analysis info | Yes | Yes | |

| Option Probability Analysis Adv info | Yes | Yes | |

| Option Positions - Greeks info | Yes | Yes | |

| Option Positions - Greeks Streaming info | Yes | Yes | |

| Option Positions - Adv Analysis info | Yes | Yes | |

| Option Positions - Rolling info | Yes | Yes | |

| Option Positions - Grouping info | Yes | Yes |

| Banking | Fidelity | Charles Schwab | |

|---|---|---|---|

| Bank (Member FDIC) info | No | Yes | |

| Checking Accounts info | No | Yes | |

| Savings Accounts info | No | Yes | |

| Credit Cards info | Yes | Yes | |

| Debit Cards info | Yes | Yes | |

| Mortgage Loans info | No | Yes |

| Customer Service | Fidelity | Charles Schwab | |

|---|---|---|---|

| Phone Support (Prospect Customers) info | Yes | Yes | |

| Phone Support (Current Customers) info | Yes | Yes | |

| Email Support info | Yes | Yes | |

| Live Chat (Prospect Customers) info | Yes | No | |

| Live Chat (Current Customers) info | Yes | Yes | |

| 24/7 Support info | Yes | Yes |

| Overall | Fidelity | Charles Schwab | |

|---|---|---|---|

| Overall | |||

| Commissions & Fees | |||

| Investment Options | |||

| Platforms & Tools | |||

| Mobile Trading Apps | |||

| Research | |||

| Education | |||

| Ease Of Use | |||

| Winner | |||

| Review |

Fidelity vs Charles Schwab Comparison

Comparing brokers side by side is no easy task. We spend hundreds of hours each year testing the platforms, mobile apps, trading tools and general ease of use among online brokerages, as well as comparing commissions and fees, to find the best online broker .

Though many U.S. brokers offer basic trading features, such as an app, charting tools, stock research and educational content, the depth of those features can vary widely. Let's compare Fidelity vs Charles Schwab.

Is Fidelity or Charles Schwab better for beginners?

In stock trading, the more you know, the better you’ll do. Taking advantage of resources like articles, webinars, videos and interactive elements is a great way to shorten the learning curve. In our analysis, we examine the availability of several different types of educational materials.

For 2024, our review finds that Fidelity offers more comprehensive new investor education for beginning investors than Charles Schwab. Both Fidelity and Charles Schwab offer Videos, Education (Stocks), Education (ETFs), Education (Options), Education (Mutual Funds), Education (Bonds) and Education (Retirement). Neither have Paper Trading.

What about Fidelity vs Charles Schwab pricing?

Fidelity and Charles Schwab charge the same amount for regular stock trades, $0.00. Fidelity and Charles Schwab both charge $0.65 per option contract. For futures , Charles Schwab charges $2.25 per contract and Fidelity charges (Not offered) per contract. For a deeper dive, see our best brokers for free stock trading or options trading guides.

Does Fidelity or Charles Schwab offer a wider range of investment options?

Looking at a full range of investment options, including order types and international trading, our research has found that Charles Schwab offers a more comprehensive offering than Fidelity. Fidelity ranks #3 out of 18 brokers for our Investment Options category, while Charles Schwab ranks #2.

Fidelity offers investors access to Stock Trading, Fractional Shares, Options Trading, OTC Stocks, Mutual Funds and Advisor Services, while Charles Schwab offers investors access to Stock Trading, Fractional Shares, Options Trading, OTC Stocks, Mutual Funds, Futures Trading, Forex Trading and Advisor Services. Looking at Mutual Funds, Fidelity trails Charles Schwab in its offering of no transaction fee (NTF) mutual funds, with Charles Schwab offering 6085 and Fidelity offering 3401.

Do Fidelity and Charles Schwab offer cryptocurrency?

In our analysis of top U.S. brokerages, we research whether each broker offers the ability to trade cash cryptocurrency , such as bitcoin and ethereum. Though crypto has risen steadily in popularity, availability still varies from broker to broker. Our review finds that Fidelity offers crypto trading, while Charles Schwab does not.

Which trading platform is better: Fidelity or Charles Schwab?

To compare the day trading platforms of Fidelity and Charles Schwab, we focused on trading tools and functionality across both web and desktop-based platforms. Popular day trading platform tools include streaming real-time quotes, stock alerts, trading hotkeys, direct market routing, streaming time and sales, customizable watch lists, backtesting, and fully functional charting packages, among many others. For day trading, Charles Schwab offers a better experience.

Does Fidelity or Charles Schwab offer a better stock trading app?

After testing 25 features across the stock trading apps of Fidelity and Charles Schwab, we found Fidelity to be better overall. The best stock market apps are easy to use, have excellent design, and deliver a fully featured online trading experience. Fidelity ranks #3 out of 18 brokers, while Charles Schwab ranks #4.

Fidelity Trading App Gallery

Charles Schwab Trading App Gallery

Which broker is better for researching stocks?

For research, Charles Schwab offers superior market research than Fidelity. Fidelity ranks #5 and Charles Schwab ranks #1.

Over the years, we've found that the best brokers provide rich market commentary, a variety of third-party research reports, and thorough quote screens that are not just easy to navigate, but that also include a comprehensive selection of fundamental data. Robust stock, ETFs, and mutual fund screeners are also must-haves for trade idea generation.

How do Fidelity and Charles Schwab compare in terms of minimum deposit required?

Fidelity requires a minimum deposit of $0.00, while Charles Schwab requires a minimum deposit of $0.00. From our testing, we found that SoFi is the only broker that requires a minimum deposit.

Which broker offers better margin rates for accounts under $25,000?

Fidelity charges 13.575% for accounts under $25,000 while Charles Schwab charges a margin rate of 13.575%. The industry average of the 18 brokers we track is 9%.

Does Fidelity offer fractional shares? Does Charles Schwab?

Fidelity and Charles Schwab allow traders to trade fractional shares. Our research has found that 52% of brokers offer fractional shares investing. Fractional shares allow traders to buy a part of a whole share of stock. For example, if Amazon is trading at $1,000, you could buy half a share for $500.

Can you trade penny stocks with Fidelity or Charles Schwab?

Both Fidelity and Charles Schwab allow you to trade penny stocks. Fidelity charges $0.00 per trade while Charles Schwab charges $6.95. Penny stocks are companies whose shares trade for under $5 and are listed over the counter (OTC). For brokers that do offer penny stock trades , the average commission is $3.

Does either broker offer banking?

Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Debit Cards and Credit Cards are offered by Fidelity, while Charles Schwab offers Checking Accounts, Savings Accounts, Debit Cards, Credit Cards and Mortgage Loans.

Which broker offers stronger customer service?

StockBrokers.com partners with customer experience research group Confero to conduct phone tests from locations across the United States to thoroughly evaluate the quality and speed of brokerage customer service. (Read more about How We Test .) Here are the results of our current testing.

Fidelity was rated 1st out of 13 brokers, with an overall score of 9.31 out of 10.

Charles Schwab was rated 3rd out of 13 brokers, with an overall score of 9.1 out of 10.

Is Fidelity good?

Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use mobile app.

In the 2024 StockBrokers.com Annual Awards, Fidelity was rated No. 1 Broker Overall and No. 1 for Innovation, Phone Support, Beginners, Commissions & Fees, IRA Accounts, Penny Stock Trading, Customer Service, and Education. It also placed among Best in Class for Commissions & Fees, Research, Platforms & Tools, Mobile Trading Apps, Investment Options, Education, Ease of Use, Day Trading, and High Net Worth Investors.

Is Charles Schwab good?

With the addition of TD Ameritrade's thinkorswim platforms and the enhancement of several features, Schwab is now a vigorous competitor with thought-provoking research and commentary and a client experience to fit any preference.

In the 2024 StockBrokers.com Annual Awards, Charles Schwab was ranked No. 1 for Research, High Net Worth Investors, Bond Research, Desktop Stock Trading Platform, and Trader App. It was among Best in Class for Commissions & Fees, Platforms & Tools, Mobile Trading Apps, Investment Options, Education, Ease of Use, Day Trading, Beginners, Customer Service, Futures Trading, Options Trading, Penny Stock Trading, IRA Accounts and Overall.

Fidelity vs Charles Schwab Winner

Overall winner: Fidelity

Popular trading guides

- Best Stock Trading Platforms for Beginners of June 2024

- Best Stock Trading Apps of 2024

- Best Paper Trading Platforms of June 2024

- Best Options Trading Platforms & Brokers

- Best Futures Trading Platforms of June 2024

- Best Day Trading Platforms of June 2024

- Best Brokers for Penny Stock Trading of June 2024

- Best Stock Brokers for June 2024

More trading guides

Popular stock broker reviews, more comparisons.

Was this page helpful? Yes or No

- Yekaterinburg

- Novosibirsk

- Vladivostok

- Tours to Russia

- Practicalities

- Russia in Lists

Rusmania • Deep into Russia

Out of the Centre

Savvino-storozhevsky monastery and museum.

Zvenigorod's most famous sight is the Savvino-Storozhevsky Monastery, which was founded in 1398 by the monk Savva from the Troitse-Sergieva Lavra, at the invitation and with the support of Prince Yury Dmitrievich of Zvenigorod. Savva was later canonised as St Sabbas (Savva) of Storozhev. The monastery late flourished under the reign of Tsar Alexis, who chose the monastery as his family church and often went on pilgrimage there and made lots of donations to it. Most of the monastery’s buildings date from this time. The monastery is heavily fortified with thick walls and six towers, the most impressive of which is the Krasny Tower which also serves as the eastern entrance. The monastery was closed in 1918 and only reopened in 1995. In 1998 Patriarch Alexius II took part in a service to return the relics of St Sabbas to the monastery. Today the monastery has the status of a stauropegic monastery, which is second in status to a lavra. In addition to being a working monastery, it also holds the Zvenigorod Historical, Architectural and Art Museum.

Belfry and Neighbouring Churches

Located near the main entrance is the monastery's belfry which is perhaps the calling card of the monastery due to its uniqueness. It was built in the 1650s and the St Sergius of Radonezh’s Church was opened on the middle tier in the mid-17th century, although it was originally dedicated to the Trinity. The belfry's 35-tonne Great Bladgovestny Bell fell in 1941 and was only restored and returned in 2003. Attached to the belfry is a large refectory and the Transfiguration Church, both of which were built on the orders of Tsar Alexis in the 1650s.

To the left of the belfry is another, smaller, refectory which is attached to the Trinity Gate-Church, which was also constructed in the 1650s on the orders of Tsar Alexis who made it his own family church. The church is elaborately decorated with colourful trims and underneath the archway is a beautiful 19th century fresco.

Nativity of Virgin Mary Cathedral