- CFO Services Overview

- CFO Services Packages

- Accounting & Audit Support

- Business Analysis & Cost Structuring

- Business Valuations

- Cash Flow Budgeting & Management

- Entrepreneurship Programmes

- Financial Decision-Making

- Financial Forecasts and Projections

- Financial Gap Analysis

- Financial Technology & Automation

- Fundraising Services

- Implementing Management Accounts

- Post-Investment Financial Management

- Profit Maximization & Dividends

- Risk Mitigation & Internal Controls

- Working Capital Cycle Improvements

- Cloud Accounting Overview

- Cloud Accounting Packages

- Annual Financial Statements

- Business Tax Services

- Independent Reviews of Financial Statements

- Monthly Bookkeeping & Reporting

- Payroll Services

- VAT Registration, Recon & Submissions

- Xero Cloud Accounting

- Automation Overview

- Business Systems Integration

- Custom Workflow Creation

- Systems Gap Analysis

- Tech Stack for Tourism

- Zoho CRM Development

- About Outsourced CFO

- Company Snapshot

The Importance of Financial Planning for your Businesses

When you’re starting out and putting in the hours to turn that business dream into a functioning reality, it can be difficult to think of next week – never mind next year. However, it always pays to plan ahead, especially when it comes to the financial future of your business.

Business Financial Planning:

Financial planning for your business helps you to forecast future financial results and decide how best to use your company’s current financial resources in order to realise both your short-term and long-term plans. Because planning involves looking well into the future, it is a highly creative thinking process as well as an analytical one, and you might need to call in the experts to help you juggle both these aspects of your financial roadmap.

How can financial planning help me achieve my company goals?

Having a strong financial plan for your business is probably the most important single thing that you can do to help yourself succeed. It’s your roadmap, your guideline, a reminder of what your goals are–what you are trying to achieve in the short term and the long term. It is so important that possible investors, bankers, and creditors won’t even set up a meeting with you if you don’t have a financial plan in place. We cannot state this clearly enough – get your business’s financial function set up effectively from the start, and the rest will follow.

Here are 5 benefits of financial planning for your business:

Financial planning can help you:

- Manage your cash flow properly: Good financial planning allows you to set clear expectations regarding your cash flow so that you know where you can spend and where you need to cut back. This is especially important after the initial startup expenditures.

- Allocate your budget: Financial planning for businesses makes for clever budget allocation and allows all players within your company to understand where and how money will be spent, ensuring less friction.

- Set realistic goals: If you don’t know how much you have to work with, you can’t set realistic financial goals that work within your budget. Your vision might be lofty, but it pays to be realistic.

- Mitigate your risk: A good financial plan should prepare for unexpected expenses, as well as times of lower income. That way you can ride out the bad times, but keep your doors open.

- Plan a roadmap for the future: Financial planning helps you clarify your company goals and communicate them to your employees and other stakeholders. This makes it easier for the business owners and top management to make more good decisions when planning to scale.

Most people have some idea of what they would like to achieve financially, but they don’t always know how to go about setting realistic goals. Companies that put in the time and effort to work out an effective and strategic financial plan , will be able to allocate their time and resources effectively, allowing them to expand while ensuring good cash flow and healthy accounts.

Does my business need a financial plan?

In short – yes. If money is the lifeblood of your business, then you cannot afford NOT to have a sound financial plan in place. A good financial plan that you refer back to, will allow you to spot anomalies and positive or negative trends in your finances so that you can take the necessary corrective action. This means that you can make your money work for you – spending when and where it’s needed for growth, and cutting back on those outgoings that are becoming a financial black hole.

We have found that business owners and entrepreneurs are often so involved in the day-to-day running of their businesses, that they don’t have the time and energy to think of long-term financial planning and strategy. This is where we recommend a financial consultant or CFO with the expertise to see what you might miss. Many entrepreneurs are making use of the services of a virtual CFO instead of hiring full-time, as this allows them access to expertise without the cost of a permanent hire.

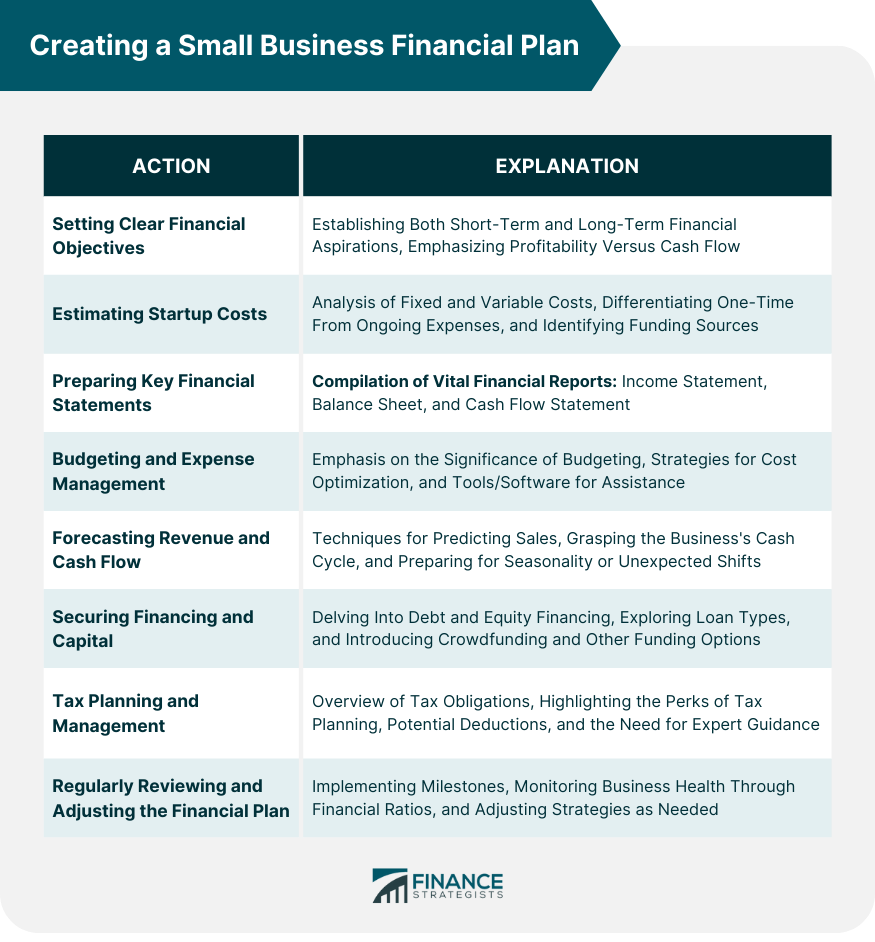

What should be included in a business financial plan?

All business financial plans , whether you’re just starting a business or building an expansion plan, should include at least the following:

- Revenue or income – what money is actually coming into your business.

- Your basic fixed operating costs such as rent and utilities.

- General monthly expenses such as marketing etc.

- Costing of your goods or services – take the time to note every cent and every minute that you put into producing your product or service.

- Total profit or loss – the formula for this is income minus cost of goods or services.

- Actual operating income (total profit minus expenses).

After you have these basics down and feel that you have at least an overview of the financial health of your business, it is important to remember that ‘big-picture’ higher-order financial planning and strategizing are also necessary for the long-term viability of your business. Finance is complex and the finance function is often one of the last frontiers to get fortified by the leadership team. It is also one that becomes increasingly more important as you head towards further expansion, possible fundraises and potential acquisitions. Getting the numbers right is critical. So is developing the right strategy based on analysis, forecasts , and smart financial management . This is where you need the advice of an expert CFO or the assistance of a virtual ‘CFO-as service’ company like Outsourced CFO.

At Outsourced CFO we can assist with getting your financial planning off to a solid start, in order to help you with building long-term profitability for your business. Reach out to us and let’s get your business ready for growth.

Share This Post

Have any questions let's chat..

We love meeting founders and executives! Jump on a call with our team to answer any questions you may have.

GET IN TOUCH

5th floor Vunani Chambers

33 Church Street

Cape Town City Centre

+27 (0) 21 201 2260 (SA)

+1 646 814 0918 (USA)

CFO SERVICES

Cloud accounting.

- Monthly Bookkeeping

- Zoho ERP Development

Start typing and press enter to search

Privacy overview.

How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

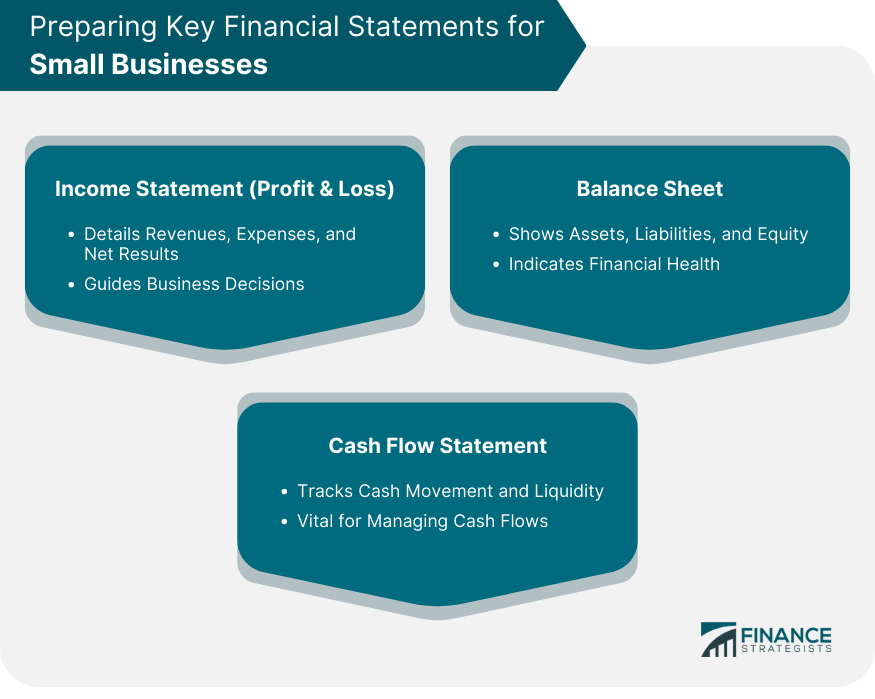

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

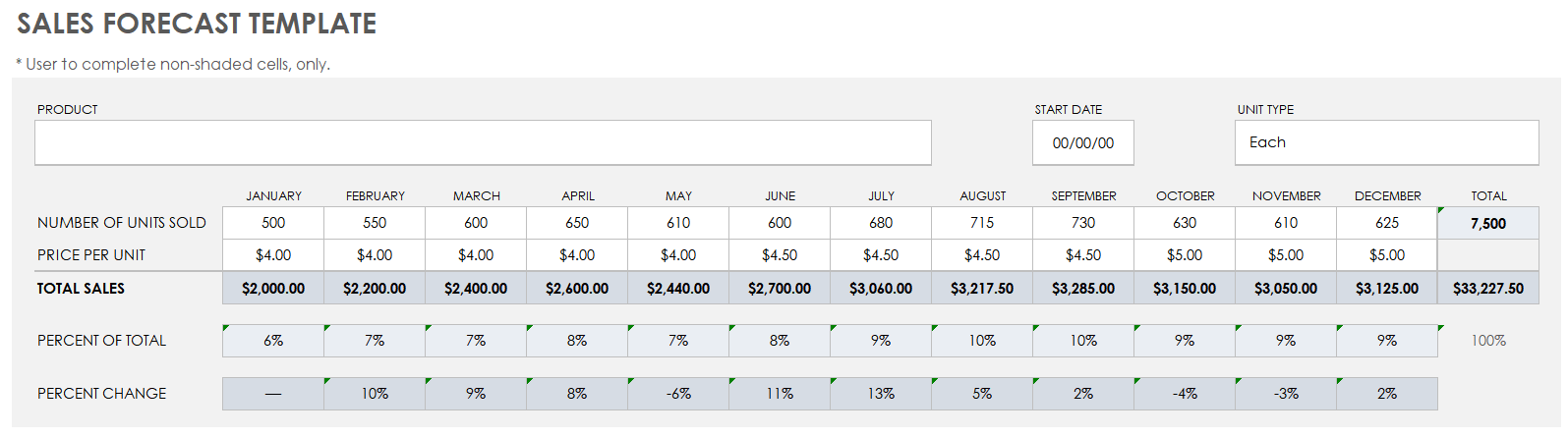

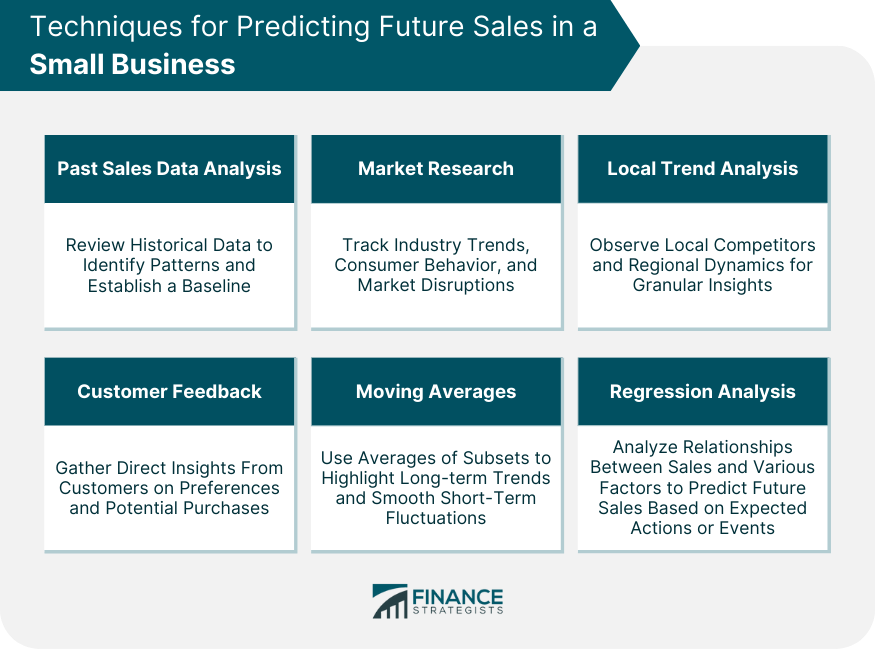

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

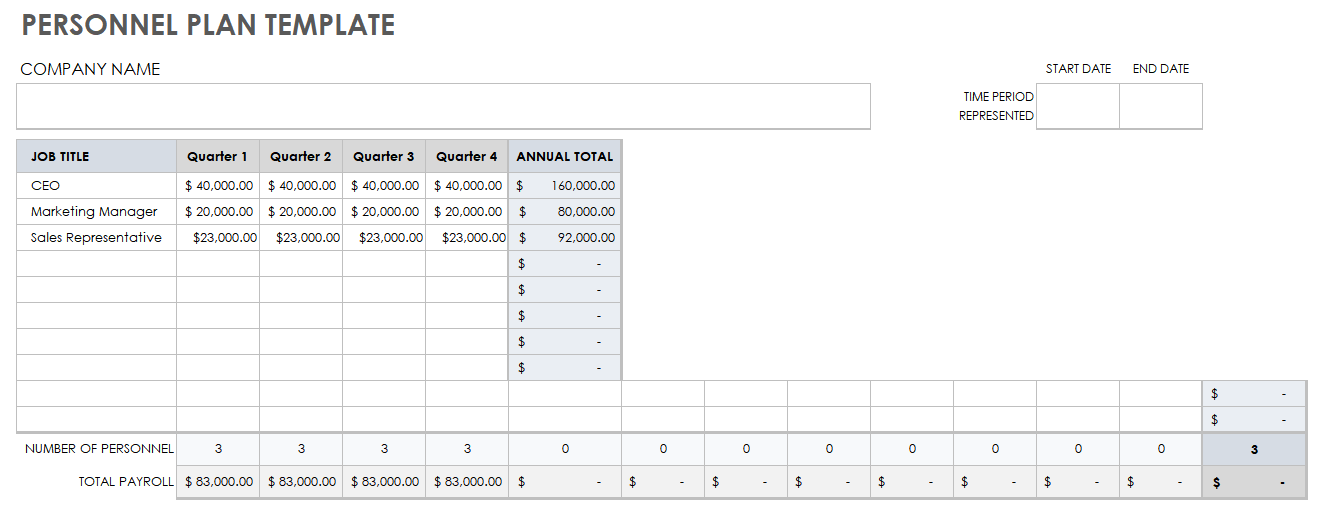

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

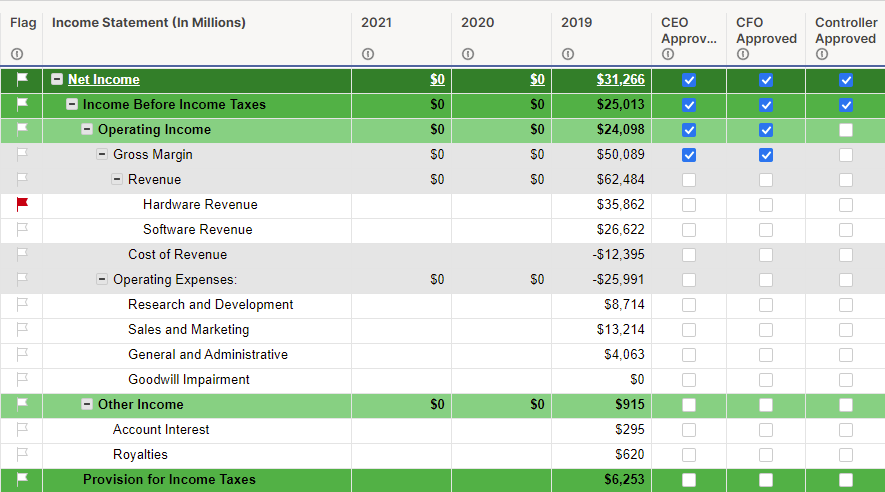

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

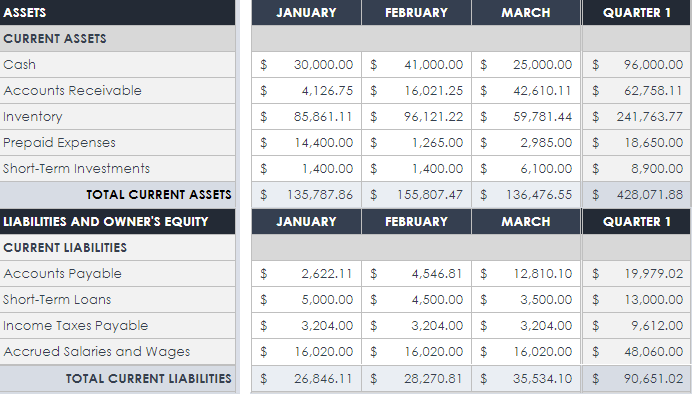

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

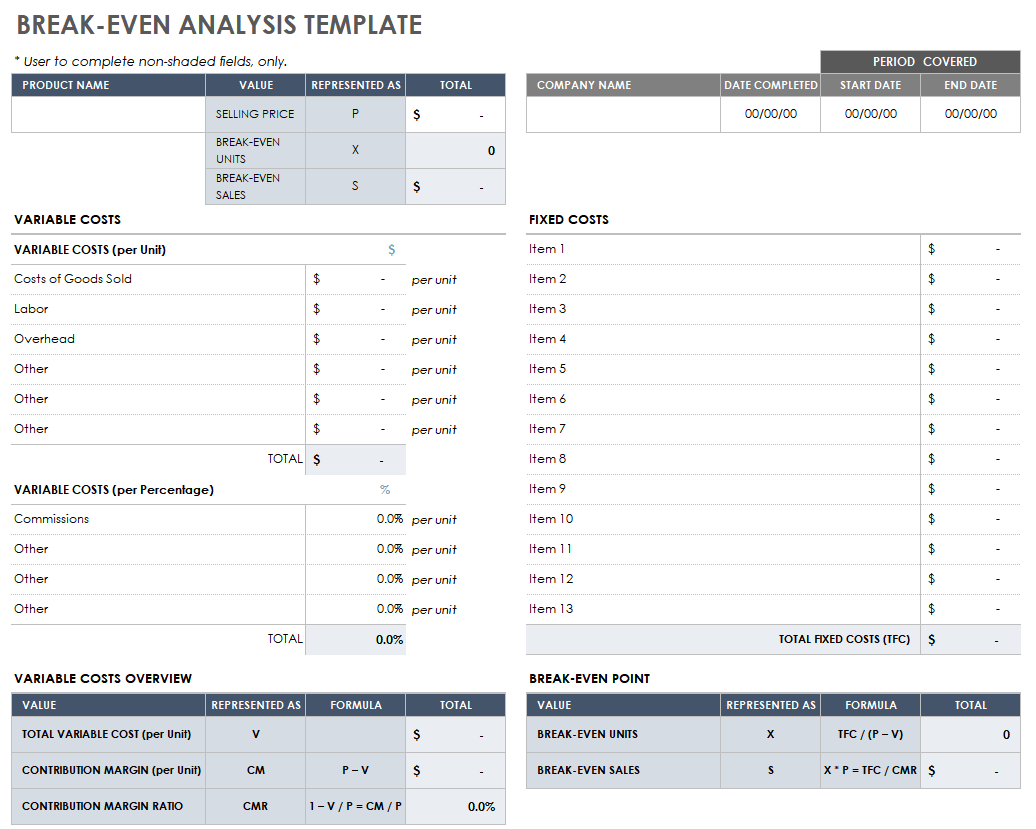

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

6 Min. Read

How to create a business plan cover page

10 Min. Read

How to set milestones in your business plan

Show that you know the competition

3 Min. Read

What to include in your business plan appendix

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Importance and Benefits of Financial Planning in the Growth of a Business

When it comes to running a business, it’s impossible to do so without a clear plan in mind. You need to think about every aspect of your business and develop various plans to fulfill your goals. Otherwise, it’s quite challenging to keep up with the planned strategies of your competitors and run a successful business. Financial planning is perhaps the most crucial factor behind the success of a business. A business plan can never be complete if it lacks an effective financial plan.

Financial planning is essential to control the flow of funds and revenue around your company. It helps you stay updated with the current and future condition of your company’s money while also allowing you to make the most out of your money. After all, profits are the most critical asset of any business, and it’s crucial to keep your money from being wasted. Here are some benefits to further show you the importance of financial planning.

1. Set Clear Goals

To keep working while progressing to become a better company, you need to follow clear goals. Otherwise, you won’t know where your company is headed, running your company blindly. However, you can’t set reliable company goals without a proper financial plan. After all, you need to know your company’s current and future financial position to set goals. For example, knowing your current financial position, you can set goals of gaining even more profits. However, a financial plan also helps you to make sure your goals are realistic enough to be achieved.

However, to benefit from setting clear and realistic goals and making your business progress, you need good financial management skills and knowledge. Alongside your business, you can also use your financial management skills to take advantage of the growing financial services industry. The rapid financial services industry growth also shows just how important financial planning is in the modern business world.

2. Smart Budgeting

Budgeting is a crucial task that every business focuses on. A carefully planned and thoroughly thought-out budget helps a business to make financial decisions and allocate money efficiently for different projects. A smart budget maximizes profits while cutting down costs and losses. However, it’s quite challenging to create a reasonable budget, as companies often miss out on the whole picture.

It is where a financial plan comes into play and helps struggling businesses create a smart budget. A financial plan helps companies gain a deeper insight into their funds, making it easy to see the bigger picture. A financial plan enables you to break down complicated budgets into smaller steps.

3. Avoid Risks

In today’s world, there are many risk factors that your company should avoid at all costs. Financial frauds, theft, and other similar risks can lead to devastating consequences for any company. US businesses can lose 5% of their revenues just to scams. Financial planning is one of the most effective ways to avoid such situations effectively. You may think that financial risks and crises are unpredictable. However, through proper planning and analysis involved in a financial plan, you can prepare for such situations.

A financial plan involves using data analysis of statistical models, which helps you see many patterns and trends. Many trends and patterns can indicate different types of risks, allowing you to take precautionary measures beforehand. Moreover, using your financial plan, you can also allocate appropriate amounts of money for business insurance during risky times.

4. Measure Growth

When it comes to growing a business, it’s essential to measure your progress continuously. Hence, you’re more aware of where your business is headed. Otherwise, it can be quite hard to know if you’re making any progress at all. Financial planning keeps you updated with your company’s financial situation, helping in measuring growth. As you’re more in control of cash flow, budgets, and revenue, you can compare your company’s current assets with previous ones to measure growth.

More importantly, financial planning also gives you an accurate glimpse of your company’s future growth by allowing you to make predictions. Statistical models based on your business’s finance help you spot trends and patterns that show your company’s growth. You can use these trends to make important financial decisions for the future, making you more prepared. Forecasting is essential for a company’s growth and success.

ALSO READ: What Businesses Need To Know To Hire STEM OPT Candidates?

You can’t run a business without making a well-thought plan first. However, behind every successful business plan, there is an effective financial plan. After all, financial planning helps you control your cash flow properly while measuring progress to fulfill your goals. More importantly, the benefits mentioned above further prove the vital role of a financial plan in business. So, make sure to prioritize financial planning if you want to thrive in the modern business world.

Do you have the world's best boss? Enter them to win two tickets to Sandals!

6 Elements of a Successful Financial Plan for a Small Business

Table of Contents

Many small businesses lack a full financial plan, even though evidence shows that it is essential to the long-term success and growth of any business.

For example, a study in the New England Journal of Entrepreneurship found that entrepreneurs with a business plan are more successful than those without one. If you’re not sure how to get started, read on to learn the six key elements of a successful small business financial plan.

What is a business financial plan, and why is it important?

A business financial plan is an overview of a business’s financial situation and a forward-looking projection for growth. A business financial plan typically has six parts: sales forecasting, expense outlay, a statement of financial position, a cash flow projection, a break-even analysis and an operations plan.

A good financial plan helps you manage cash flow and accounts for months when revenue might be lower than expected. It also helps you budget for daily and monthly expenses and plan for taxes each year.

Importantly, a financial plan helps you focus on the long-term growth of your business. That way, you don’t get so caught up in the day-to-day activities that you lose sight of your goals. Focusing on the long-term vision helps you prioritize your financial resources.

Financial plans should be created annually at the beginning of the fiscal year as a collaboration of finance, HR, sales and operations leaders.

The 6 components of a successful financial plan for business

1. sales forecasting.

You should have an estimate of your sales revenue for every month, quarter and year. Identifying any patterns in your sales cycles helps you better understand your business, and this knowledge is invaluable as you plan marketing initiatives and growth strategies .

For instance, a seasonal business can aim to improve sales in the off-season to eventually become a year-round venture. Another business might become better prepared by understanding how upticks and downturns in business relate to factors such as the weather or the economy.

Sales forecasting is also the foundation for setting company growth goals. For instance, you could aim to improve your sales by 10 percent over each previous period.

2. Expense outlay

A full expense plan includes regular expenses, expected future expenses and associated expenses. Regular expenses are the current ongoing costs of your business, including operational costs such as rent, utilities and payroll.

Regular expenses relate to standard business activities that occur each year, such as conference attendance, advertising and marketing, and the office holiday party. It’s a good idea to distinguish essential expenses from expenses that can be reduced or eliminated if needed.

Expected future expenses are known future costs, such as tax rate increases, minimum wage increases or maintenance needs. Generally, a part of the budget should also be allocated to unexpected future expenses, such as damage to your business caused by fire, flood or other unexpected disasters. Planning for future expenses ensures your business is financially prepared via budget reduction, increases in sales or financial assistance.

Associated expenses are the estimated costs of various initiatives, such as acquiring and training new hires, opening a new store or expanding delivery to a new territory. An accurate estimate of associated expenses helps you properly manage growth and prevents your business from exceeding your cost capabilities.

As with expected future expenses, understanding how much capital is required to accomplish various growth goals helps you make the right decision about financing options.

3. Statement of financial position (assets and liabilities)

Assets and liabilities are the foundation of your business’s balance sheet and the primary determinants of your business’s net worth. Tracking both allows you to maximize your business’s potential value.

Small businesses frequently undervalue their assets (such as machinery, property or inventory) and fail to properly account for outstanding bills. Your balance sheet offers a more complete view of your business’s health than a profit-and-loss statement or a cash flow report.

A profit-and-loss statement shows how the business performed over a specific time period, while a balance sheet shows the financial position of the business on any given day.

4. Cash flow projection

You should be able to predict your cash flow on a monthly, quarterly and annual basis. Projecting cash flow for the full year allows you to get ahead of any financial struggles or challenges.

It can also help you identify a cash flow problem before it hurts your business. You can set the most appropriate payment terms, such as how much you charge upfront or how many days after invoicing you expect payment .

A cash flow projection gives you a clear look at how much money is expected to be left at the end of each month so you can plan a possible expansion or other investments. It also helps you budget, such as by spending less one month for the anticipated cash needs of another month.

5. Break-even analysis

A break-even analysis evaluates fixed costs relative to the profit earned by each additional unit you produce and sell. This analysis is essential to understanding your business’s revenue and potential costs versus profits of expansion or growth of your output.

Having your expenses fully fleshed out, as described above, makes your break-even analysis more accurate and useful. A break-even analysis is also the best way to determine your pricing.

In addition, a break-even analysis can tell you how many units you need to sell at various prices to cover your costs. You should aim to set a price that gives you a comfortable margin over your expenses while allowing your business to remain competitive.

6. Operations plan

To run your business as efficiently as possible, craft a detailed overview of your operational needs. Understanding what roles are required for you to operate your business at various volumes of output, how much output or work each employee can handle, and the costs of each stage of your supply chain will aid you in making informed decisions for your business’s growth and efficiency.

It’s important to tightly control expenses, such as payroll or supply chain costs, relative to growth. An operations plan can also make it easier to determine if there is room to optimize your operations or supply chain via automation, new technology or superior supply chain vendors.

For this reason, it is imperative for a business owner to conduct due diligence and become knowledgeable about merchant services before acquiring an account. Once the owner signs a contract, it cannot be changed, unless the business owner breaks the contract and acquires a new account with a new merchant services provider.

Tips on writing a business financial plan

Business owners should create a financial plan annually to ensure they have a clear and accurate picture of their business’s finances and a realistic view for future growth or expansion. A financial plan helps the business’s leaders make informed decisions about purchases, debt, hiring, expense control and overall operations for the year ahead.

A business financial plan is essential if a business owner is looking to sell their business, attract investors or enter a partnership with another business. Here are some tips for writing a business financial plan.

Review the previous year’s plan.

It’s a good idea to compare the previous year’s plan against actual performance and finances to see how accurate the previous plan and forecast were. That way, you can address any discrepancies or overlooked elements in next year’s plan.

Collaborate with other departments.

A business owner or other individual charged with creating the business financial plan should collaborate with the finance department, human resources department, sales team , operations leader, and those in charge of machinery, vehicles or other significant business tools.

Each division should provide the necessary data about projections, value and expenses. All of these elements come together to create a comprehensive financial picture of the business.

Use available resources.

The Small Business Administration (SBA) and SCORE, the SBA’s nonprofit partner, are two excellent resources for learning about financial plans. Both can teach you the elements of a comprehensive plan and how best to work with the different departments in your business to collect the necessary information. Many websites, including business.com , and service providers, such as Intuit, offer advice on this matter.

If you have questions or encounter challenges while creating your business financial plan, seek advice from your accountant or other small business owners in your network. Your city or state has a small business office that you can contact for help.

Several small business organizations offer free financial plan templates for small business owners. You can find templates for the financial plan components listed here via SCORE .

Business financial plan templates

Many business organizations offer free information that small business owners can use to create their financial plan. For example, the SBA’s Learning Platform offers a course on how to create a business plan. It also offers worksheets and templates to help you get started. You can seek additional help and more personalized service from your local office.

SCORE is the largest volunteer network of business mentors. It began as a group of retired executives (SCORE stands for “Service Corps of Retired Executives”) but has expanded to include business owners and executives from many industries. Advice is free and available online, and there are SBA district offices in every U.S. state. In addition to participating in group or at-home learning, you can be paired with a mentor for individualized help.

SCORE offers templates and tips for creating a small business financial plan. SCORE is an excellent resource because it addresses different levels of experience and offers individualized help.

Other templates can be found in Microsoft Office’s template library, QuickBooks’ online resources, Shopify’s blog and other places. You can also ask your accountant for guidance, since many accountants provide financial planning services in addition to their usual tax services.

Diana Wertz contributed to the writing and research in this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

The Importance of a Financial Plan for a Small Business

- Small Business

- Business Planning & Strategy

- Small Business Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Graph Linear Equations in Excel 2007

Importance of ratio analysis in financial planning, fundamental principles of strategic & business planning models.

- The Importance of Planning in an Organization

- Key Tools for Planning Finances

Going through the process of constructing a financial plan is a valuable exercise for any business owner. The financial plan helps guide the day-to-day decision making of the business. Comparing forecast numbers to actual results yields important information about the overall financial health and efficiency of the business. Even a one-person company needs to have a financial plan in place.

Cash Management and Budgets

Having a financial plan for your business helps you break down what is needed in your shorter-term budgets, says Brilliant Tax & Accounting Services . Many businesses have monthly or seasonal variations in revenues, which translate into periods when cash is plentiful and times when cash shortages occur.

In building the financial plan, the owner takes these cycles into account to keep a tight rein on expenditures during the forecast low revenue periods. Poor cash management can result in negative consequences such as not being able to make payroll. Having a financial plan that is structured so there is always a cash cushion helps the business owner sleep better at night. The cash cushion allows the business to take advantage of opportunities that arise, such as the chance to purchase inventory from a supplier at temporarily reduced prices.

Long-Range View

In business it is easy to become focused on the crises or issues that must be dealt with on a daily basis. The price for being too short-term oriented is that the owner may not spend enough time planning what needs to be done to grow the business long-term. The financial plan, with its forward looking focus, allows the business owner to better see what expenditures need to be made to keep the company on a growth track and to stay ahead of competitors, according to Spend Journal . The financial plan is a blueprint for continual improvement in the company's performance.

Spotting Trends

A business owner makes so many decisions over the course of a month that it can be difficult to tell which decisions resulted in success and which ideas or strategies did not work. Preparing the financial plan involves setting quantifiable targets that can be compared to actual results during the year. The owner can see, for example, whether an increase in advertising expenditures led to the hoped-for jump in sales. Trends in the sales of individual products help the owner make decisions about how to allocate marketing dollars.

Prioritizing Expenditures

Conserving financial resources and allocating capital effectively in a small business is a critical element of success. The benefits of financial planning for business include a business owner identifying the most important expenditures – those that bring about immediate improvements in productivity, efficiency, or market penetration, versus those that can be postponed until cash is more plentiful. Even the largest, most well-capitalized corporations go through this prioritization process, comparing the cost to the benefits of each proposed expenditure.

Measuring Progress

Especially in the early stages of their ventures, small business owners work long hours and deal with numerous challenges. It can be difficult to tell whether progress is being made or whether the business is mired in mediocrity. Seeing that actual results are better than forecast provides the small business owner needed encouragement. A chart showing steady growth in revenues month by month, or a rising cash balance is a great motivating factor. The importance of financial plan in business is similar to the importance of financial planning for students: It helps the owner see, with the clarity of hard data, that the business is on its way to being a success.

- Brilliant Tax & Accounting Services: The Importance of Financial Planning for Small Businesses

- Spend Journal: 9 Key Benefits of Business Financial Planning

Related Articles

How to put a business plan in motion, what is a quarterly budget, about business financial planning, how to write a department business plan, key concepts of financial management, the similarities between a cash budget and long-term financial planning, cash budgeting, forecasting cash flow and account analysis, the role of finance in formulating business strategies, the effects of seasonality on working capital, most popular.

- 1 How to Put a Business Plan in Motion

- 2 What Is a Quarterly Budget?

- 3 About Business Financial Planning

- 4 How to Write a Department Business Plan

How to Develop a Small Business Financial Plan

By Andy Marker | April 29, 2022

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

Link copied

Financial planning is critical for any successful small business, but the process can be complicated. To help you get started, we’ve created a step-by-step guide and rounded up top tips from experts.

Included on this page, you’ll find what to include in a financial plan , steps to develop one , and a downloadable starter kit .

What Is a Small Business Financial Plan?

A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

Financial plans can aid in business goal setting and metrics tracking, as well as provide proof of profitable ideas. Craig Hewitt, Founder of Castos , shares that “creating a financial plan will show you if your business ideas are sustainable. A financial plan will show you where your business stands and help you make better decisions about resource allocation. It will also help you plan growth, survive cash flow shortages, and pitch to investors.”

Why Is It Important for a Small Business to Have a Financial Plan?

All small businesses should create a financial plan. This allows you to assess your business’s financial needs, recognize areas of opportunity, and project your growth over time. A strong financial plan is also a bonus for potential investors.

Mark Daoust , the President and CEO of Quiet Light Brokerage, Inc., explains why a financial plan is important for small businesses: “It can sometimes be difficult for business owners to evaluate their own progress, especially when starting a new company. A financial plan can be helpful in showing increased revenues, cash flow growth, and overall profit in quantifiable data. It's very encouraging for small business owners who are often working long hours and dealing with so many stressful decisions to know that they are on the right track.”

To learn more about other important considerations for a small business, peruse our list of free startup plan, budget, and cost templates .

What Does a Small Business Financial Plan Include?

All small businesses should include an income statement, a balance sheet, and a cash flow statement in their financial plan. You may also include other documents, such as personnel plans, break-even points, and sales forecasts, depending on the business and industry.

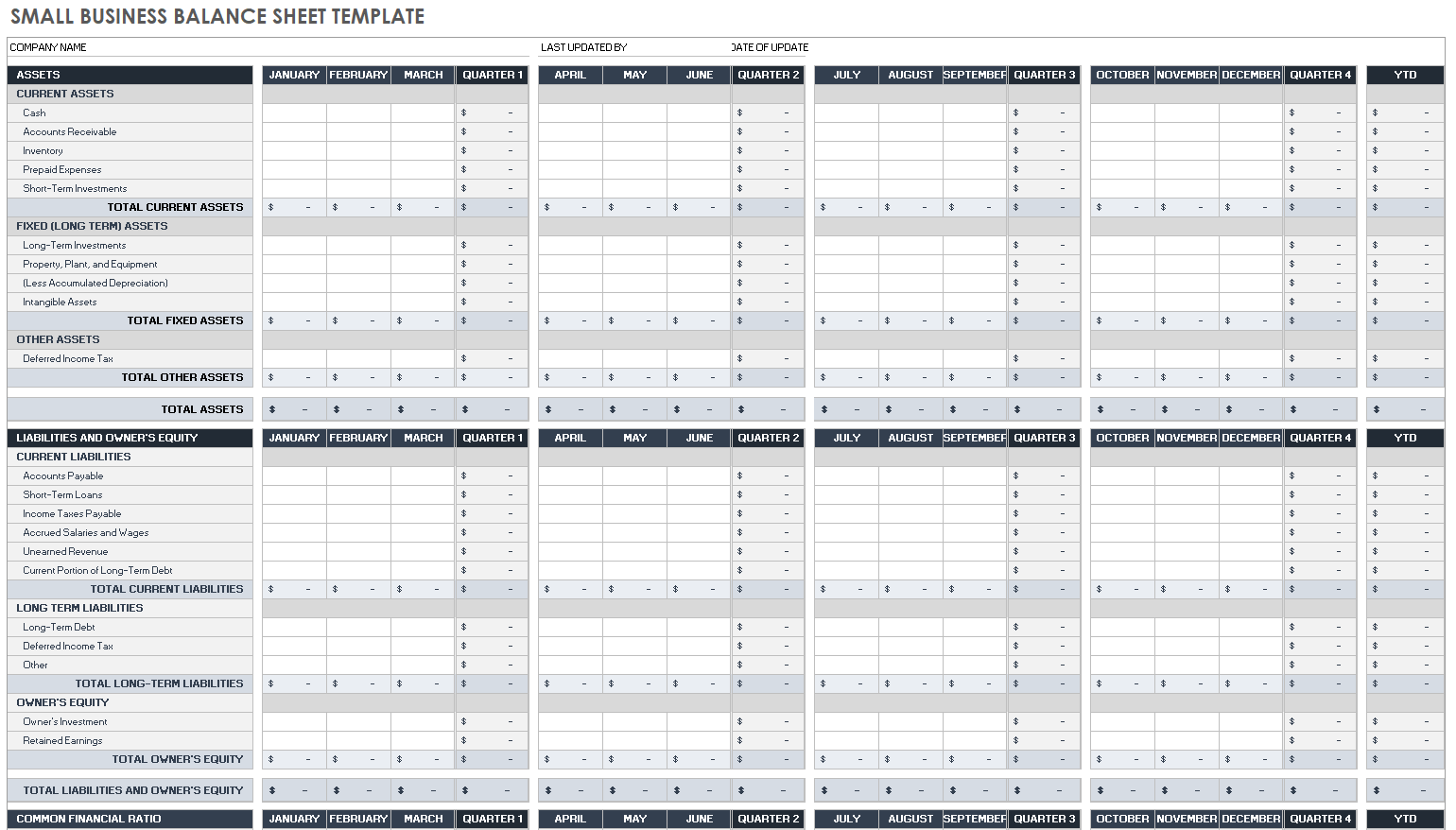

- Balance Sheet: A balance sheet determines the difference between your liabilities and assets to determine your equity. “A balance sheet is a snapshot of a business’s financial position at a particular moment in time,” says Yüzbaşıoğlu. “It adds up everything your business owns and subtracts all debts — the difference reflects the net worth of the business, also referred to as equity .” Yüzbaşıoğlu explains that this statement consists of three parts: assets, liabilities, and equity. “Assets include your money in the bank, accounts receivable, inventories, and more. Liabilities can include your accounts payables, credit card balances, and loan repayments, for example. Equity for most small businesses is just the owner’s equity, but it could also include investors’ shares, retained earnings, or stock proceeds,” he says.

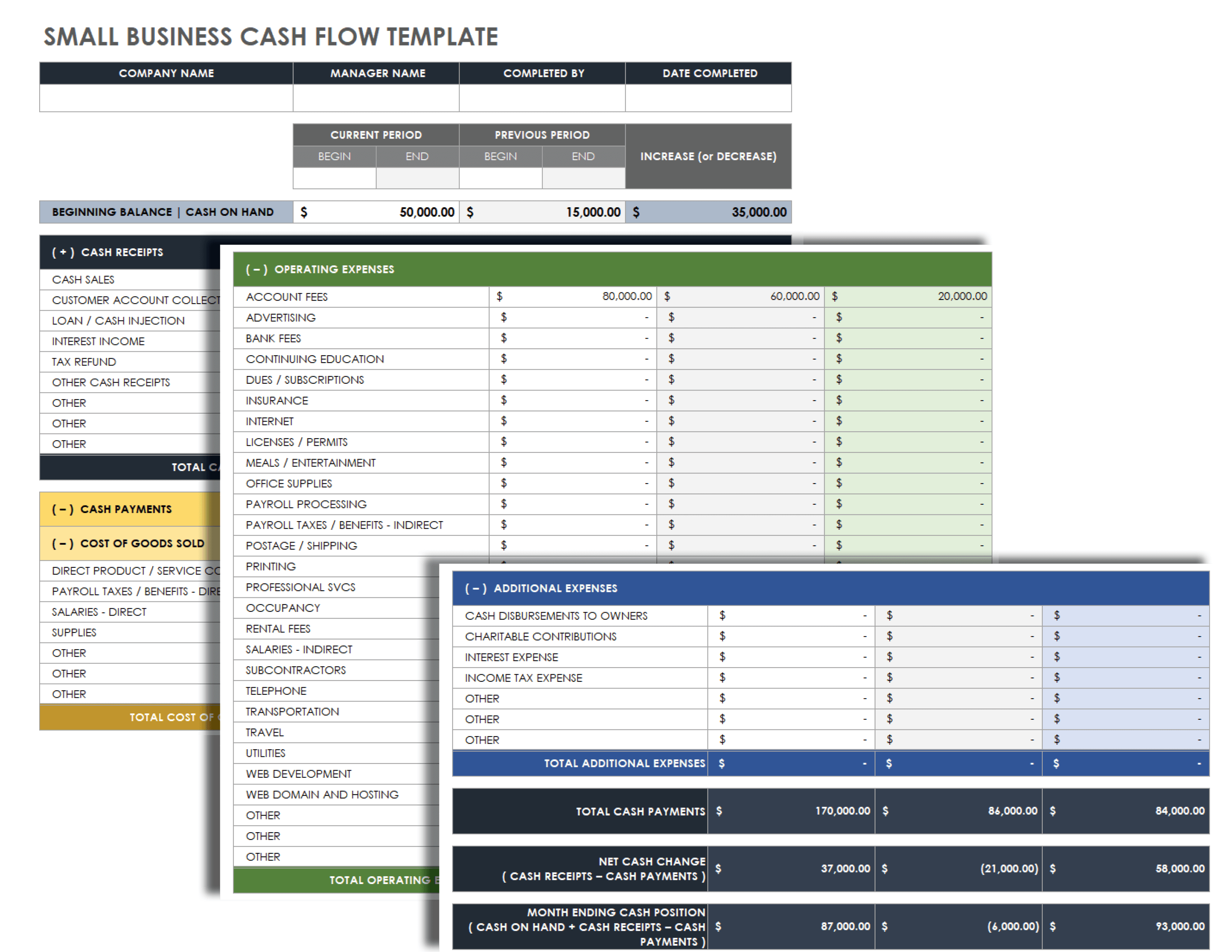

- Cash Flow Statement: A cash flow statement shows where the money is coming from and where it is going. For existing businesses, this will include bank statements that list deposits and expenditures. A new business may not have much cash flow information, but it can include all startup costs and funding sources. “A cash flow statement shows how much cash is generated and used during a given period of time. It documents all the money flowing in and out of your business,” explains Yüzbaşıoğlu.

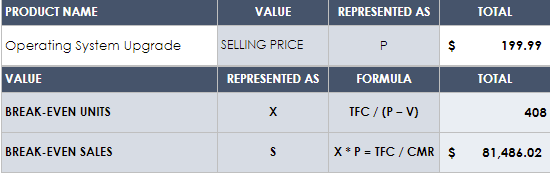

- Break-Even Analysis: A break-even analysis is a projection of how long it will take you to recoup your investments, such as expenses from startup costs or ongoing projects. In order to perform this analysis, Yüzbaşıoğlu explains, “You need to know the difference between fixed costs and variable costs. Fixed costs are the expenses that stay the same, regardless of how much you sell or don't sell. For example, expenses such as rent, wages, and accounting fees are typically fixed. Variable costs are the expenses that change in accordance with production or sales volume. “In other words, [a break-even analysis] determines the units of products or services you need to sell at least to cover your production costs. Generally, to calculate the break-even point in business, divide fixed costs by the gross profit margin. This produces a dollar figure that a company needs to break even,” Yüzbaşıoğlu shares.

- Personnel Plan: A personnel plan is an outline of various positions or departments that states what they do, why they are necessary, and how much they cost. This document is generally more useful for large businesses, or those that find themselves spending a large percentage of their budget on labor.

- Sales Forecast: A sales forecast can help determine how many sales and how much money you expect to make in a given time period. To learn more about various methods of predicting these figures, check out our guide to sales forecasting .

How to Write a Small Business Financial Plan

Writing a financial plan begins with collecting financial information from your small business. Create income statements, balance sheets, and cash flow statements, and any other documents you need using that information. Then share those documents with relevant stakeholders.

“Creating a financial plan is key to any business and essential for success: It provides protection and an opportunity to grow,” says Yüzbaşıoğlu. “You can use [the financial plan] to make better-informed decisions about things like resource allocation on future projects and to help shape the success of your company.”

1. Create a Plan

Create a strategic business plan that includes your business strategy and goals, and define their financial impact. Your financial plan will inform decisions for every aspect of your business, so it is important to know what is important and what is at stake.

2. Gather Financial Information

Collect all of the available financial information about your business. Organize bank statements, loan information, sales numbers, inventory costs, payroll information, and any other income and expenses your business has incurred. If you have not already started to do so, regularly record all of this information and store it in an easily accessible place.

3. Create an Income Statement

Your income statement should display revenue, expenses, and profit for a given time period. Your revenue minus your expenses equals your profit or loss. Many businesses create a new statement yearly or quarterly, but small businesses with less cash flow may benefit from creating statements for shorter time frames.

4. Create a Balance Sheet

Your balance sheet is a snapshot of your business’s financial status at a particular moment in time. You should update it on the same schedule as your income statement. To determine your equity, calculate all of your assets minus your liabilities.

5. Create a Cash Flow Statement

As mentioned above, the cash flow statement shows all past and projected cash flow for your business. “Your cash flow statement needs to cover three sections: operating activities, investing activities, and financing activities,” suggests Hewitt. “Operating activities are the movement of cash from the sale or purchase of goods or services. Investing activities are the sale or purchase of long-term assets. Financing activities are transactions with creditors and investments.”

6. Create Other Documents as Needed

Depending on the age, size, and industry of your business, you may find it useful to include these other documents in your financial plan as well.

- Sales Forecast: Your sales forecast should reference sales numbers from your past to estimate sales numbers for your future. Sales forecasts may be more useful for established companies with historical numbers to compare to, but small businesses can use forecasts to set goals and break records month over month. “To make future financial projections, start with a sales forecast,” says Yüzbaşıoğlu. “Project your sales over the course of 12 months. After projecting sales, calculate your cost of sales (also called cost of goods or direct costs). This will let you calculate gross margin. Gross margin is sales less the cost of sales, and it's a useful number for comparing with different standard industry ratios.”

7. Save the Plan for Reference and Share as Needed

The most important part of a financial plan is sharing it with stakeholders. You can also use much of the same information in your financial plan to create a budget for your small business.

Additionally, be sure to conduct regular reviews, as things will inevitably change. “My best tip for small businesses when creating a financial plan is to schedule reviews. Once you have your plan in place, it is essential that you review it often and compare how well the strategy fits with the actual monthly expenses. This will help you adjust your plan accordingly and prepare for the year ahead,” suggests Janet Patterson, Loan and Finance Expert at Highway Title Loans.

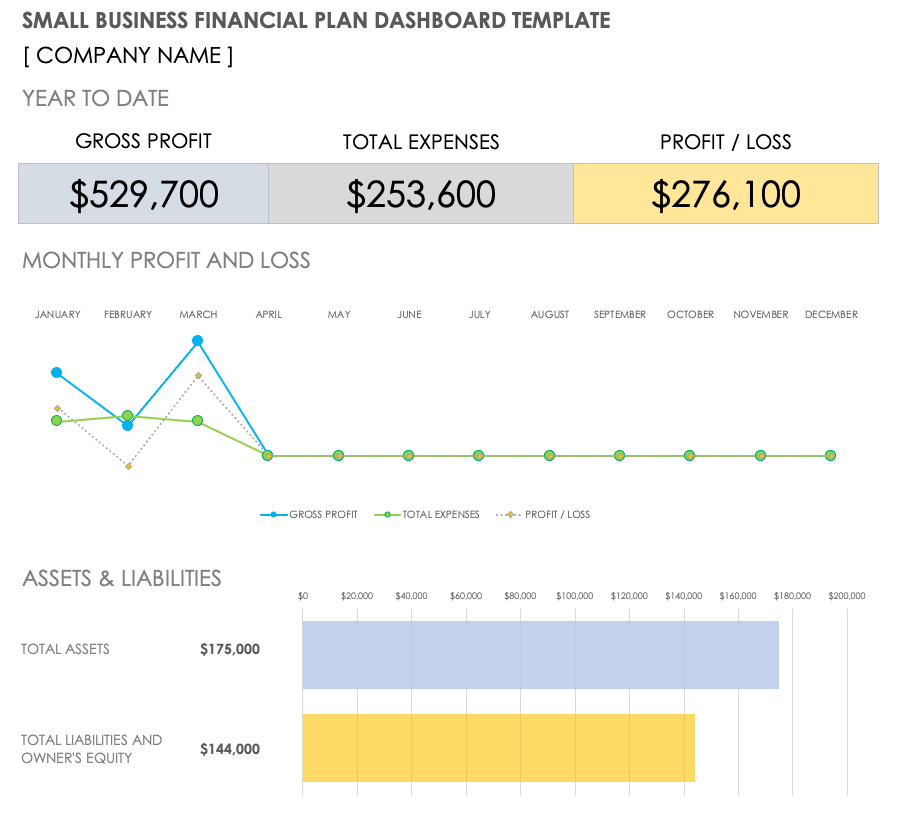

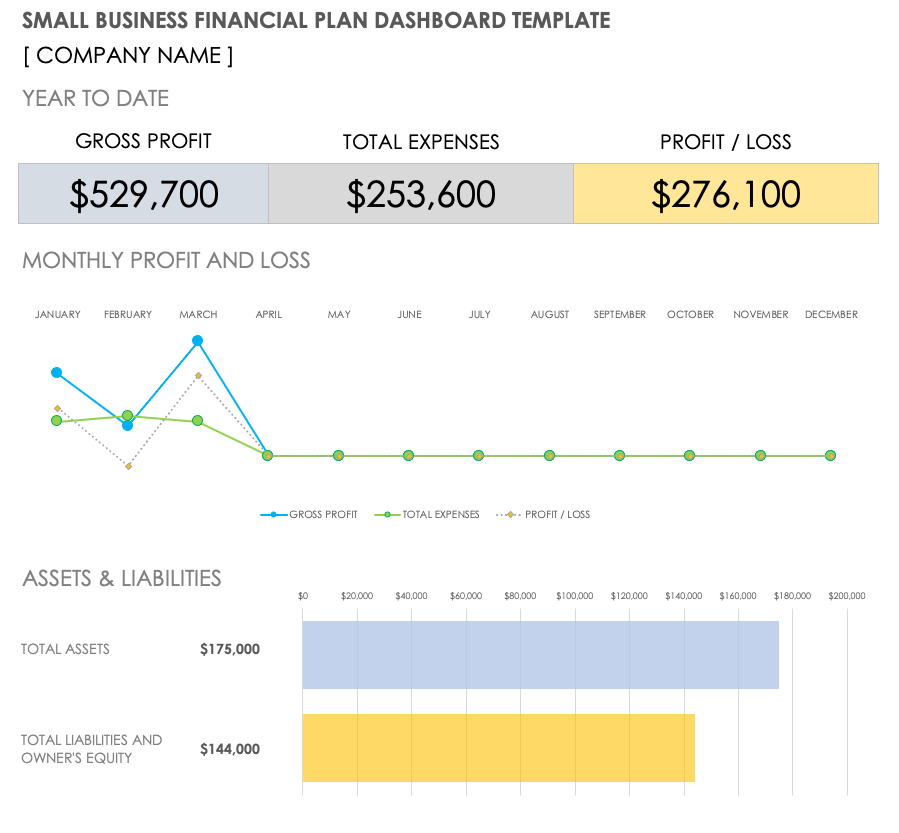

Small Business Financial Plan Example

Download Small Business Financial Plan Example Microsoft Excel | Google Sheets

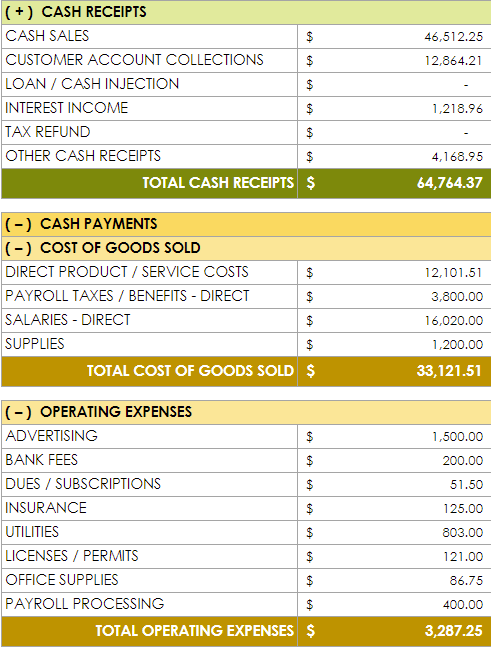

Here is an example of what a completed small business financial plan dashboard might look like. Once you have completed your income statement, balance sheet, and cash flow statements, use a template to create visual graphs to display the information to make it easier to read and share. In this example, this small business plots its income and cash flow statements quarterly, but you may find it valuable to update yours more often.

Small Business Financial Plan Starter Kit

Download Small Business Financial Plan Starter Kit

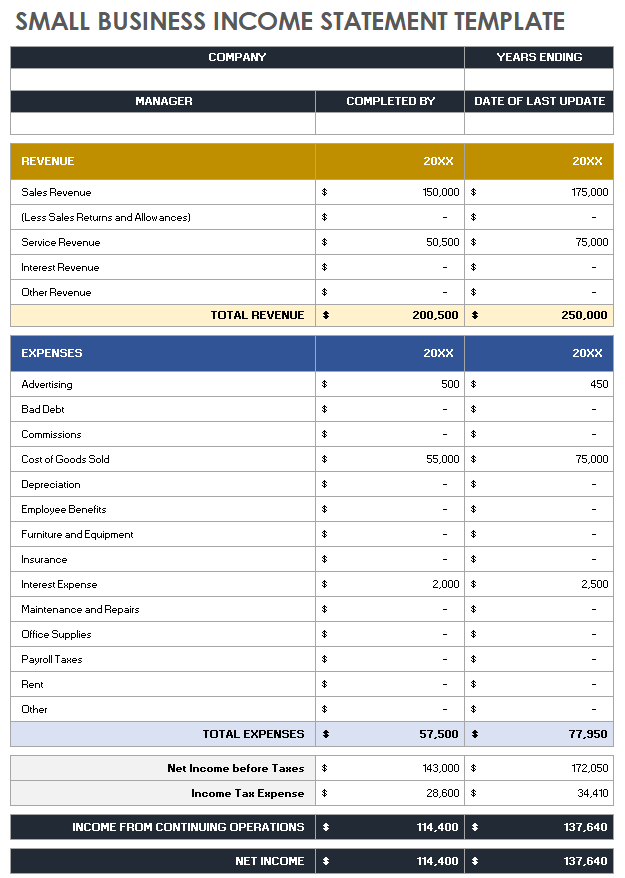

We’ve created this small business financial plan starter kit to help you get organized and complete your financial plan. In this kit, you will find a fully customizable income statement template, a balance sheet template, a cash flow statement template, and a dashboard template to display results. We have also included templates for break-even analysis, a personnel plan, and sales forecasts to meet your ongoing financial planning needs.

Small Business Income Statement Template

Download Small Business Income Statement Template Microsoft Excel | Google Sheets

Use this small business income statement template to input your income information and track your growth over time. This template is filled to track by the year, but you can also track by months or quarters. The template is fully customizable to suit your business needs.

Small Business Balance Sheet Template

Download Small Business Balance Sheet Template Microsoft Excel | Google Sheets

This customizable balance sheet template was created with small businesses in mind. Use it to create a snapshot of your company’s assets, liabilities, and equity quarter over quarter.

Small Business Cash Flow Statement Template

Download Small Business Cash Flow Template Microsoft Excel | Google Sheets

Use this customizable cash flow statement template to stay organized when documenting your cash flow. Note the time frame and input all of your financial data in the appropriate cell. With this information, the template will automatically generate your total cash payments, net cash change, and ending cash position.

Break-Even Analysis Template

Download Break-Even Analysis Template Microsoft Excel | Google Sheets

This powerful template can help you determine the point at which you will break even on product investment. Input the sale price of the product, as well as its various associated costs, and this template will display the number of units needed to break even on your initial costs.

Personnel Plan Template

Download Personnel Plan Template Microsoft Excel | Google Sheets

Use this simple personnel plan template to help organize and define the monetary cost of the various roles or departments within your company. This template will generate a labor cost total that you can use to compare roles and determine whether you need to make cuts or identify areas for growth.

Sales Forecast Template

Download Sales Forecast Template Microsoft Excel | Google Sheets

Use this customizable template to forecast your sales month over month and determine the percentage changes. You can use this template to set goals and track sales history as well.

Small Business Financial Plan Dashboard Template

Download Small Business Financial Plan Dashboard Template Microsoft Excel | Google Sheets

This dashboard template provides a visual example of a small business financial plan. It presents the information from your income statement, balance sheet, and cash flow statement in a graphical form that is easy to read and share.

Tips for Completing a Financial Plan for a Small Business

You can simplify the development of your small business financial plan in many ways, from outlining your goals to considering where you may need help. We’ve outlined a few tips from our experts below:

- Outline Your Business Goals: Before you create a financial plan, outline your business goals. This will help you determine where money is being well spent to achieve those goals and where it may not be. “Before applying for financing or investment, list the expected business goals for the next three to five years. You can ask a certified public accountant for help in this regard,” says Thé. The U.S. Small Business Administration or a local small business development center can also help you to understand the local market and important factors for business success. For more help, check out our quick how-to guide on writing a business plan .

- Make Sure You Have the Right Permits and Insurance: One of the best ways to keep your financial plan on track is to anticipate large expenditures. Double- and triple-check that you have the permits and insurances you need so that you do not incur any fines or surprise expenses down the line. “If you own your own business, you're no longer able to count on your employer for your insurance needs. It's important to have a plan for how you're going to pay for this additional expense and make sure that you know what specific insurance you need to cover your business,” suggests Daost.

- Separate Personal Goals from Business Goals: Be as unbiased as possible when creating and laying out your business’s financial goals. Your financial and prestige goals as a business owner may be loftier than what your business can currently achieve in the present. Inflating sales forecasts or income numbers will only come back to bite you in the end.

- Consider Hiring Help: You don’t know what you don’t know, but fortunately, many financial experts are ready to help you. “Hiring financial advisors can help you make sound financial decisions for your business and create a financial roadmap to follow. Many businesses fail in the first few years due to poor planning, which leads to costly mistakes. Having a financial advisor can help keep your business alive, make a profit, and thrive,” says Hewitt.

- Include Less Obvious Expenses: No income or expense is too small to consider — it all matters when you are creating your financial plan. “I wish I had known that you’re supposed to incorporate anticipated internal hidden expenses in the plan as well,” Patterson shares. “I formulated my first financial plan myself and didn’t have enough knowledge back then. Hence, I missed out on essential expenses, like office maintenance, that are less common.”

Do Small Business Owners Need a Financial Planner?

Not all small business owners need a designated financial planner, but you should understand the documents and information that make up a financial plan. If you do not hire an advisor, you must be informed about your own finances.

Small business owners tend to wear many hats, but Powell says, “it depends on the organization of the owner and their experience with the financial side of operating businesses.” Hiring a financial advisor can take some tasks off your plate and save you time to focus on the many other details that need your attention. Financial planners are experts in their field and may have more intimate knowledge of market trends and changing tax information that can end up saving you money in the long run.

Yüzbaşıoğlu adds, “Small business owners can greatly benefit from working with a financial advisor. A successful small business often requires more than just the skills of an entrepreneur; a financial advisor can help the company effectively manage risks and maximize opportunities.”

For more examples of the tasks a financial planner might be able to help with, check through our list of free financial planning templates .

Drive Small Business Success with Financial Planning in Smartsheet

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today .

Connect your people, processes, and tools with one simple, easy-to-use platform.

9 key benefits of business financial planning

Published on January 31, 2024

)

Building a business financial plan is never easy. It requires effort, good data, and a fair amount of imagination. And if you’ve never done this before, you’ll likely hit a few roadblocks along the way.

But this post will show you why it’s so valuable, nonetheless.

A good financial plan keeps you focused and on track as the company grows , when new challenges arise, and when unexpected crises hit. It helps you communicate clearly with staff and investors, and build a modern, transparent business.

And there are plenty of other advantages .

We’ll explore nine of our favorites shortly. But first, let’s define exactly what we’re talking about.

What is business financial planning?

Your company’s financial plan is essentially just the financial section of your overall business plan . It applies real financial data and projections to put the rest of your business plan in context.

And crucially, it is forward-looking. While you use existing accounting figures (if you have them already) and experience to create your plan, it’s not simply a copy/paste of your accounting data. Instead, you look at your business goals and define the level of investment you’re willing to make to achieve each of these.

But this doesn’t mean that financial plans are just “made up.” If anything, this section of your business plan is the most grounded in reality.

As Elizabeth Wasserman writes for Inc :

“A business plan is all conceptual until you start filling in the numbers and terms. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line.

The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business.”

The importance of financial planning in business

This probably won’t come as a surprise to most readers, but financial planning is essential to building a successful business. Your business plan dictates how you plan to do business over the next month, quarter, year, or longer - depending on how far out you plan.

It includes an assessment of the business environment, your goals, resources needed to reach these goals, team and resource budgets, and highlights any risks you might face. While you can’t guarantee that everything will play out exactly as planned, this exercise prepares you for what’s to come.

We’ll look at the precise individual benefits next, but suffice it to say that, without a clear financial plan, you’re basically just hoping for the best .

9 benefits of financial planning for business

So what exactly can you hope to gain from business financial planning? The benefits of business planning are probably endless, but here are nine clear advantages.

1. Clear company goals

This is really the starting point for your whole financial plan. What is the company supposed to achieve in the next quarter, year, three years, and so on?

Early on, you’ll want to establish that there is a real need for your business , and that your business fills this need. This is also known as “product/market fit.” For many startups, the first several years may be devoted to building a product and establishing that product/market fit. So this would be your chief one-to-two year goal, with smaller checkpoints along the way.

Crucially, if this is your key goal, you won’t set lofty sales targets or huge marketing KPIs. What’s the point of investing in sales and marketing for new customers, if the product isn’t ready to sell?

We’ll refer back to your company goals throughout this post, so it’s worth getting a handle on them from the start.

2. Sensible cash flow management

Your financial plan should also set clear expectations for cash flow - the amount coming in and out of the company. In the beginning, you’ll of course spend more than you make. But what is an acceptable level of expense, and how will you stay on track?

As part of this plan, you also need to figure out how you’ll measure cash flow easily. You may not have seasoned finance experts in the team, so can you accurately and efficiently keep track of where your money’s going?

By making your plan now, you can anticipate challenges both in receiving money and spending it , and identify ways to do both more effectively.

3. Smart budget allocation

This is obviously closely related to cash flow management (above) and cost reductions (below). Once you have a clear understanding of the amount of funding you have to spend - whether through sales income or investments - you need to figure out how you’ll actually spend it.

The company has its overall budget - essentially its “burn rate” for each quarter or year. Break this down into specific team budgets (product development, marketing, customer support, etc), and ensure that the amounts dedicated to each reflect their importance.

Budgets give each team their own constraints from within which to build . They know what resources are available to them, and can plan out campaigns and personal or product development accordingly.

At the company level, tracking project or team budgets is always going to be easier than monitoring spending as a whole . Once you break each budget down, it’s relatively straightforward to keep an eye on who’s spending what.

Get our free marketing budget template to help.

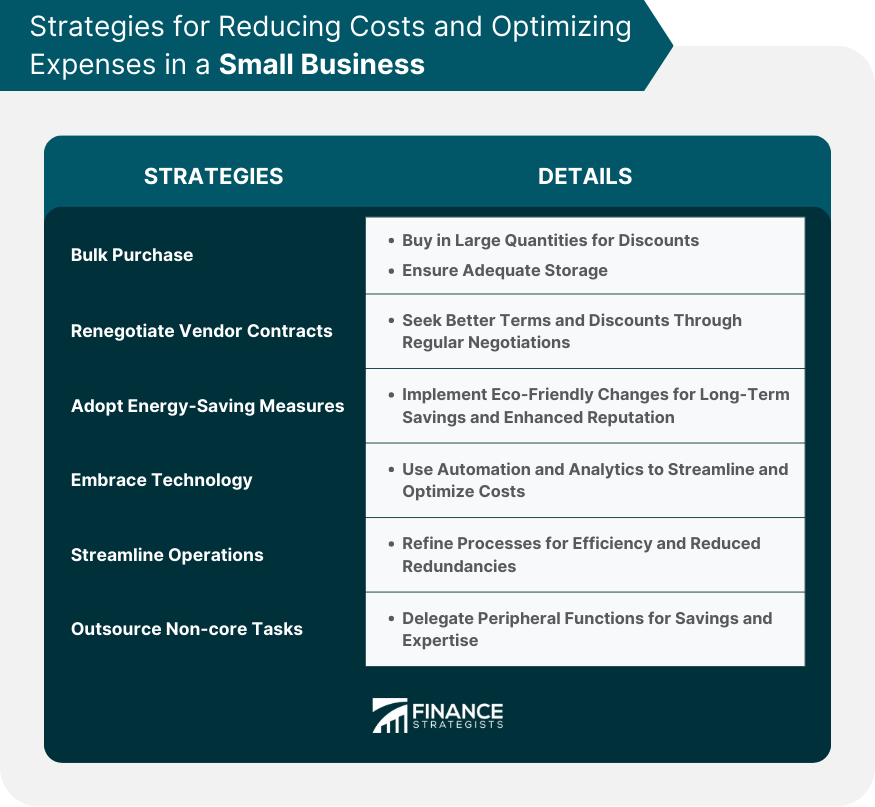

4. Necessary cost reductions

Aside from setting out how much you can afford to spend (and on what), a financial plan also lets you spot savings ahead of time. If you’ve already been in business for some time, building your financial plan involves first looking back at what you’ve already spent and how fast you’re currently growing.

As you set out your budget(s) for next year, you’ll refer back to past spending and identify unnecessary or over-inflated costs along the way. And then for next year’s budget , you simply adjust accordingly.

This conscious effort is all part of spend control , the practice of keeping company spending in line with your expectations. Even better, a quarterly or annual review almost always unearths areas where you can save money and put your resources to better use.

Learn more about effective spend control .

5. Risk mitigation

A crucial aspect of the finance team’s role is to help companies avoid and navigate risk - from financial fraud to economic crisis . And while plenty of risks are hard to predict or even avoid, there are plenty that you can see coming.

Your financial plan should make room for certain business insurance expenses, losses through risky inefficiencies, and perhaps set aside resources for unexpected expenses . Particularly during turbulent times, you may in fact create several financial forecasts which show different outcomes for the business: one where revenue is easy to come by, and one or two others where times are tougher.

Again, the point is to have contingency plans in place, and to attempt to determine how your roadmap changes if you grow only 20% next quarter instead of 30% (or 50%) . There’s no reason to go overboard, but you can find risky areas within the business, and also consider your best responses if things go wrong.

6. Crisis management

The first thing that tends to happen in any company crisis is you review and re-build your plans. Which of course means that you must have a clear business plan in the first place . Otherwise, your crisis response is simply to improvise.

As the 2020 financial crisis unfolded, the key refrain we heard from finance leaders was the need to reforecast constantly. Nobody truly knew how long the crisis would last, or how it would impact their business. So companies created new financial plans on a monthly or quarterly basis, at least.

And those with robust and well thought-out financial plans found this process easier. They weren't starting from scratch over and over, and they’d already identified obvious risks and the key levers to pull in response.

7. Smooth fundraising

Let’s shift away from risk entirely now. Whether you’re a brand new startup, a sustainable company that needs a small cash injection, or looking for a significant series-level investment, at some point you’ll likely need funds.

And the first thing any prospective investor or bank will ask you for is your business plan . They want to see how you intend to grow the business, what risks and uncertainties are involved, and how you’ll put their money to good use.

A financial plan that speaks to investors is critical, and the better your history of planning is, the more likely they’ll trust your projections. So whether or not you’re looking for funds today , a business financial plan is an important tool in your chest.

8. A growth roadmap

Finally, your financial plan helps you analyze your current situation, and project where you want the business to be in the future . Again, your wider business plan will do this on a broad level: the markets you’d like to be present in; the number of employees you’ll have; the products or services you hope to sell.

The financial section adds data to these goals, and plugs in your level of investment along the way . For example, if you wish to hire 100 new employees this year, your financial plan will likely need to include recruiters, and a specific budget to find new talent.

Take the time to set out how large you expect the company to be, your expenses with a larger company, and the amount of revenue coming in to compensate. If you’ve raised venture capital to help grow financially , you can probably expect to burn cash faster than you make it - this is normal.

But if you burn through money and can’t reach your growth targets, then you’ll need to re-evaluate your position. So set those growth targets out now, and you’ll be able to assess as you go.

9. Transparency with staff and investors

We already mentioned how necessary your financial plan is for investors. So we won’t dive into them more here.

But the same is true for staff. It is now expected that company executives will be open and honest with staff . Some startups go so far as to publicize their salaries for the world to see.

At the very least, modern employees want to see that the company is in good hands and on the road to success. And when executives can share the financial plan in all-hands meetings, they bring real data to what would otherwise be a business plan lacking in details.

Employees love to see key figures like revenue coming in, costs, and where you are on the road to profitability .

What to include in a business financial plan

We won’t go into too much detail here, but it’s worth giving an idea of what belongs in the typical financial plan.

A three-year financial plan is most common. But whatever the period in question is, your plan should include:

Sales projections : Project your expected sales growth for the near future, as well as the cost of sales . You can break these down in different pricing groups, products, and other important factors.

Expenses & budgets : Most important here are costs - separated into fixed and variable expenses. (Lower fixed costs usually mean lower risk for the business).

Profit & loss statement : Alternatively, you can create a cash flow statement, which achieves a similar outcome. You essentially want to project money in and money out over the next three years.

Assets & liabilities : These will usually be separated from your P&L statement, and will certainly include startup costs and assets for new businesses.

Break-even analysis : Ideally, you’ll be able to identify your break-even point within the coming three years.

Hiring & team structure : This one is not essential, but it makes sense to add as part of your business plan. Who will you need - and when will you acquire them - in order to reach your goals?

For more information - especially on forecasting in uncertain times - read our expert’s guide to startup financial planning .

There’s no time like the present to create your business financial plan

We’ve seen nine excellent reasons to get to work on your company financial plan as soon as possible. As we explored, the financials form a critical part of your overall business plan , without which you’ll have a hard time assessing your performance as a company.

Of course, this exercise requires projection - you can’t just rely on the numbers you have today. But that’s not the same thing as guesswork . Follow best practices and consider all potential outcomes, and you’ll walk away with a clear roadmap to get you to business success in the foreseeable future.

From there, it’s a matter of putting in the work, measuring success, and regularly updating your financial plan.

More reads on Business strategy

)

11 top HRIS software and tools

)

Effortless bookkeeping with our new "Payment Inbox" feature

)

Interview with Mong-Trang Sarrazin, CFO at Doctolib

Get started with spendesk.

Close the books 4x faster , collect over 95% of receipts on time , and get 100% visibility over company spending.

Financial Planning

Financial planning definition.

Financial planning enables a business to determine how it will afford to achieve its objectives and strategic goals. A business typically sets a vision and objectives, and then immediately creates a financial plan to support those goals. The financial plan describes all of the resources and activities that the company will require—and the expected timeframes—for achieving these objectives.

Financial planning is crucial to organizational success because it compliments the business plan as a whole, confirming that set objectives are financially achievable.

The financial planning process includes multiple tasks, including:

- Confirming the vision and objectives of the business

- Assessing the business environment and company priorities

- Identifying which resources the business needs to achieve its objectives

- Assigning costs business costs centers included in the plan

- Quantifying the amount of equipment, labor, materials, and other resources needed

- Creating and setting a budget

- Identifying any issues and risks with the budget

- Establishing the time period of the plan or planning horizon, either short-term (typically 12 months) or long-term (2 to 5 years)

- Preparing a full financial plan summarizing all key investments, budgets and departmental costs

Generally, the financial partner role includes three areas:

- Strategic financial management;

- Determining financial management objectives; and

- Managing the planning cycle itself.

- Connecting business partners and teams to financial plan

What Is Financial Planning?

Financial planning is the process of assessing the current financial situation of a business to identify future financial goals and how to achieve them. The financial plan itself is a document that serves as a roadmap for a company’s financial growth. It reflects the current status of the business, what progress they intend to make, and how they intend to make it.

Financial plans include budgets, but the terms are not interchangeable. Budgets are just one piece of a financial business plan, which should also include other important information that contribute to a complete picture of a business’ financial health, such as detailed, itemized breakdowns of company assets; typical expenditures; and forecasts of income, cash flow, and revenue.

Typically, business financial plans also focus on specific growth goals and other long-term objectives, as well as potential obstacles to achieving those objectives. A detailed financial planning checklist can identify overlooked opportunities and highlight possible risks that will affect the growth plan.

The comprehensive financial planning process in business is designed to determine how to most effectively use the company’s financial resources to support the objectives of the organization, both short- and long-range, by accurately forecasting future financial results. Financial planning processes are both analytical and informative, balancing the use of data and metrics to predict the future as well as institutional knowledge in departments and teams.

What is Financial Planning and Analysis (FP&A)?

Financial planning and analysis (FP&A) is a group within a company’s finance organization that supports the health of the organization by engaging in several types of activities: budgeting, integrated financial planning, modeling, and forecasting; decision support via reporting on management and performance; and various special projects. FP&A solutions link corporate strategy and execution, enhancing the ability of the finance department to manage performance.

FP&A professionals provide senior management with forecasts of the company’s operating performance and profit and loss for each upcoming quarter and year. These forecasts allow leadership to assess investments and strategic plans for effectiveness and progress. They also enable improved communication between external stakeholders and management.

To map out future goals and plans and evaluate the company’s progress toward achieving its goals, corporate FP&A professionals analyze the company’s operational aspects both quantitatively and qualitatively. FP&A analysts review past company performance, consider business and economic trends, and identify risks and possible obstacles, all to more effectively forecast future financial results for a company.

In contrast to accountants, who are tasked with accurate recordkeeping, consolidations and reporting, financial analysts must analyze and evaluate the totality of a company’s financial activities and map out the financial future of the business. FP&A professionals manage a broad range of financial scenarios and plans, including capital expenditures, expenses, financial statements, income, investments, and taxes.

Budgeting, planning, modeling, and forecasting

The primary responsibility of FP&A is to anchor the company, unite the business and translate plans to actionable & informed results. . So, what is financial planning and analysis, and how does it look in practice?

Senior management creates and drives the strategic plan in a top-down way, setting net income and revenue goals, core strategic initiatives, and other high-level business targets for the company’s next 2 to 10 years. FP&A’s corporate performance management aim is to develop the financial plan needed to achieve the strategic plan created by management.

In the past, financial planning and analysis teams developed annual budgets that remained mostly static and updated annually. However, whether in tandem with a traditional budget or as a replacement altogether, modern FP&A teams are increasingly developing rolling forecasts to cope with stale static budgets. Other important tasks of FP&A teams that are related to the budgeting, planning, and forecasting process include:

- Creating, maintaining, and updating detailed forecasts and financial models of future business operations

- Comparing budgets and forecasts to historical results, and conducting variance analysis to illustrate to management how actual performance and the rolling forecast or budget compare, suggesting ways to improve future performance

- Assessing expansion and growth opportunities based on forecasts and other projections

- Mapping out capital expenditures and investments, and other growth plans

- Generating long-term financial forecasts in the three- to five-year range

Decision support and reporting

FP&A reports variances and forecasts, naturally. However, the team also advises management using that data, offering support on decisions concerning performance improvement, risk minimization, or risk benefit analysis of new opportunities from outside and within the company.

One primary piece of this the FP&A team typically generates is the monthly budget versus actual variance comparison. This report explanations of variances; analysis of historical financials; an updated version of the forecast with opportunities and risks related to the current stage of plan; and Key Performance Indicators (KPIs). Ideally, this report or analysis offers leadership information sufficient to identify ways to meet specific goals or optimize performance, and answer imminent questions of stakeholders. However, the true goal of the budget vs. actual report should be to inform the business around gaps or opportunities that inform the future.

Other ongoing pieces of the FP&A team’s reporting and decision support role include:

- Using key financial ratios such as the current ratio, debt to equity ratio, and interest coverage ratio to gauge the overall financial health of the business

- Identifying which company products, product lines, or services generate the most net profit

- Determining which products, product lines, or services have the highest and lowest profit margins—separate from total profit

- Assessing and evaluating each department’s cost-efficiency in light of the percentage of total company financial resources it consumes

- Collaborating with departments to prepare and consolidate budgets into a single corporate budget

- Preparing other internal reports in support of decision making for executive leadership

Special projects

Inevitably, the FP&A team works on special projects, depending on the size and needs of the business. For example:

Capital allocation. How much of the organization’s capital should be spent, and on what? Based on factors such as return on investment (ROI) and comparisons with increased stock dividends, different possible investments, and other ways the business could utilize its cash flow, are the company’s current investments and assets the best use of excess working capital?

Market research. What are the sizes and contours of a given market in which the organization may have a competitive advantage? Who are its laggards and leaders, and what potential opportunities does it hold for the company?

M&A. Which potential buy-side support, acquisition targets, integration, and divestiture opportunities exist for the company?

Process optimization. How can the company improve problems of process and workflow inefficiency? How can tools and technology in use by the business speak to and work with each other more effectively?

Ultimately, the FP&A team provides upper management with advice and analysis concerning how to best deploy the organization’s financial resources for optimal growth and increased profitability, while avoiding serious financial risk.

What is Corporate Financial Planning and Analysis?

Corporate financial planning is the process of determining what a company’s financial needs and goals for the future are, and how best to achieve them. Corporate financial planning considers the individual circumstances of the company as well as its broader economic context to determine which activities and investments would be most advantageous and appropriate. Generally, because short-term market trends are more predictable, short-term corporate financial planning involves less uncertainty and more readily adaptable financial plans.

Balanced corporate financial planning should elucidate how the company can achieve its goals and priorities while upholding its values. A financial plan for a corporation achieves at least two aims.

First, it forces management to think about the company’s prospects for business success objectively by basing their analysis on company finances. It also gives lenders and investors a good reason to invest into the business performance, by showing the growth and profit projections. Unrealistic or unbalanced financial plans or plans that understate profits tell investors to reconsider their investment or evaluation.

As a basic matter, three financial statements form the core of a corporate financial plan: income statement, statement of cash flow, and balance sheet. These statements clarify how much profit the business earns, and how much cash actually comes in, compared to the income reflected in accounts receivables. They also detail the relationships between corporate liabilities, corporate assets, and owner equity.

What is the Financial Planning Process?

The financial planning process results in the development of a financial plan, a financial forecast, or both. There are several well-understood steps in this process, and they often come out of sequence, depending on the deliverable or project at hand. However, it’s often simplest to think about these as steps in financial planning as financial planning tips, all of which are parts of a larger, flexible financial planning process.

With that in mind, these key components of financial planning for businesses are, in a sense, a set of best practices for your financial planning checklist.

Forecast revenue

Project revenue or sales for the next three years in a spreadsheet, or even better, in Planful. You’ll track numbers at least monthly in year one, and quarterly in years two and three.

Ideally you want to include sections that track unit sales, pricing, units times price to calculate sales, unit costs, and units times unit cost to calculate COGS or cost of goods sold, also called direct costs. Calculate gross margin, which is sales less cost of sales, and it’s a useful number for considering a new line of business or a new product expansion.

Budget expenses

Here you want to determine the actual cost of making the revenue you have forecasted. Differentiate between fixed costs such as payroll and rent and variable costs such as most promotional and advertising expenses. Lower fixed costs mean less risk; higher fixed costs may signal a need for reduced risk tolerance.

Remember, this is not accountancy, but a forecast, so you will have to estimate things such as taxes and interest. Use run rates or average assumptions whenever possible, and estimate taxes by multiplying estimated profits by estimated tax percentage rate. Then estimate interest by multiplying estimated debts balance by estimated interest rate.

Project cash flow