Healthcare Business Plan Template

Written by Dave Lavinsky

Healthcare Business Plan

You’ve come to the right place to create your Healthcare business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Healthcare companies.

Below is a template to help you create each section of your Healthcare business plan.

Executive Summary

Business overview.

Riverside Medical is a family medical clinic located in San Francisco, California. Our goal is to provide easy access to quality healthcare, especially for members of the community who have low to moderate incomes. Our clinic provides a wide range of general and preventative healthcare services, including check-ups, minor surgeries, and gynecology. Anyone of any age or group is welcome to visit our clinic to get the healthcare that they need.

Our medical practitioners and supporting staff are well-trained and have a passion for helping improve the health and well-being of our clients. We serve our patients not just with our knowledge and skills but also with our hearts. Our clinic was founded by Samantha Parker, who has been a licensed doctor for nearly 20 years. Her experience and compassion will guide us throughout our mission.

Product Offering

Riverside Medical will provide extensive general care for all ages, creating a complete healthcare solution. Some of the services included in our care include the following:

- Primary care: annual checkups, preventative screenings, health counseling, diagnosis and treatment of common conditions

- Gynecology: PAP tests, annual well-woman exam, and family planning

- Pediatrics: infant care, annual physicals, and immunizations

- Minor procedures: stitches, casts/splints, skin biopsies, cyst removals, and growth lacerations

- Health and wellness: weight loss strategies, nutrition guidance, hormone balance, and preventive and routine services

The costs will depend upon the materials used, the physician’s time, and the amount designated for each procedure. Medical bills will be billed either directly to the patient or to their insurance provider.

Customer Focus

Riverside Medical will primarily serve the community living and working within the San Francisco bay area. The city is diverse and growing and includes people of all ages, ethnicities, and backgrounds. Everyone is welcome to visit our clinic to receive the health care they need.

Management Team

Riverside Medical’s most valuable asset is the expertise and experience of its founder, Samantha Parker. Samantha has been a licensed family doctor for 20 years now. She spent the most recent portion of her career on medical mission trips, where she learned that many people are not privileged to have access to quality medical services. Samantha will be responsible for ensuring the general health of her patients and creating a viable and profitable business medical practice.

Riverside Medical will also employ nurses, expert medical staff, and administrative assistants that also have a passion for healthcare.

Success Factors

Riverside Medical will be able to achieve success by offering the following competitive advantages:

- Location: Riverside Medical’s location is near the center of town. It’s visible from the street with many people walking to and from work on a daily basis, giving them a direct look at our clinic, most of which are part of our target market.

- Patient-oriented service: Riverside Medical will have a staff that prioritizes the needs of the patients and educates them on the proper way how to take care of themselves.

- Management: Samantha Parker has a genuine passion for helping the community, and because of her previous experience, she is fully equipped and overqualified to open this practice. Her unique qualifications will serve customers in a much more sophisticated manner than our competitors.

- Relationships: Having lived in the community for 25 years, Samantha Parker knows many of the local leaders, newspapers, and other influences. Furthermore, she will be able to draw from her ties to previous patients from her work at other clinics to establish a starting clientele.

Financial Highlights

Riverside Medical is seeking a total funding of $800,000 of debt capital to open its clinic. The capital will be used for funding capital expenditures and location build-out, acquiring basic medical supplies and equipment, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

- Clinic design/build: $100,000

- Medical supplies and equipment: $150,000

- Six months of overhead expenses (rent, salaries, utilities): $450,000

- Marketing: $50,000

- Working capital: $50,000

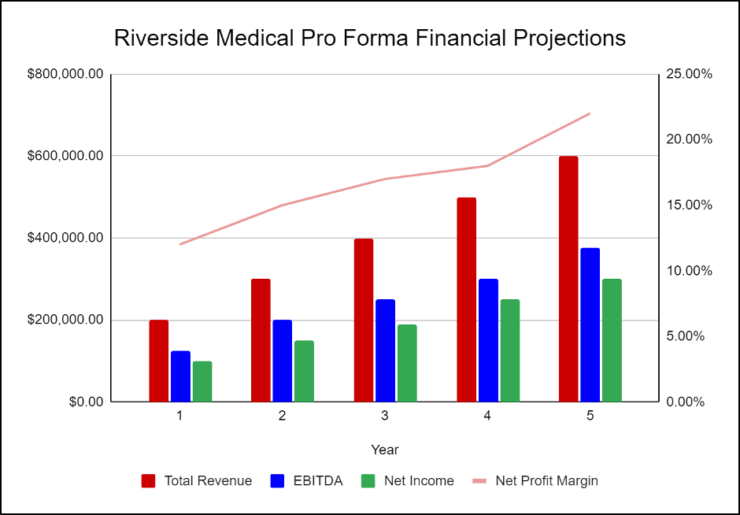

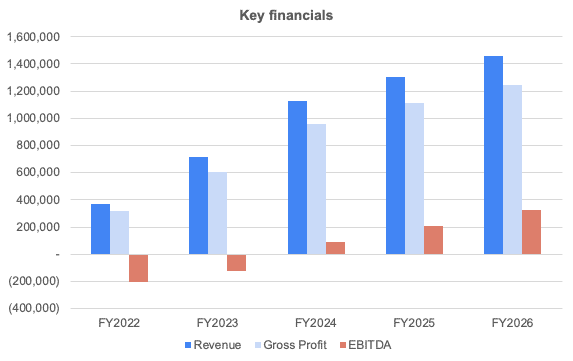

The following graph below outlines the pro forma financial projections for Riverside Medical.

Company Overview

Who is riverside medical, riverside medical history.

Samantha Parker started the clinic with the goal of providing easy access to good quality health service, especially to those members of the community with low to moderate income. After years of planning, she finally started to build Riverside Medical in 2022. She gathered a group of professionals to fund the project and was able to incorporate and register Riverside Medical with their funding support.

Since its incorporation, Riverside Medical has achieved the following milestones:

- Found clinic space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired a contractor for the office build-out

- Determined equipment and fixture requirements

- Began recruiting key employees with previous healthcare experience

- Drafted marketing campaigns to promote the clinic

Riverside Medical Services

Industry analysis.

The global healthcare market is one of the largest and highest-valued industries in the world. According to Global Newswire, the global healthcare services market is currently valued at $7548.52 billion and is expected to reach $10414.36 billion in 2026. This growth is expected to continue for the foreseeable future.

The biggest drivers of industry growth throughout the next decade will be a continual increase in illnesses and diseases as well as a quickly aging population. With more people aging and needing daily/frequent care, hospitals and medical clinics are bound to be in even more demand than they already are.

One obstacle for the industry is the rising cost of care. Though this results in greater profits, more and more Americans cannot afford basic medical care. Therefore, they are opting out of procedures they believe are unnecessary or unimportant.

Despite the challenges of the next decade, the industry is still expected to see substantial growth and expansion.

Customer Analysis

Demographic profile of target market.

Riverside Medical will serve the residents of the San Francisco bay area as well as those who work in the area.

The population of the area experiences a large income gap between the highest earners and the lowest earners. Therefore, it is hard for middle and lower-class families to find quality care that is affordable. As a result, they are in need of the services that we offer and are looking for accessible medical care.

The precise demographics of San Francisco are as follows:

Customer Segmentation

Our clinic is a general family practice and will treat patients of all ages, incomes, physical abilities, races, and ethnicities. As such, there is no need to create marketing materials targeted at only one or two of these groups, but we can appeal to all with a similar message.

Competitive Analysis

Direct and indirect competitors.

Riverside Medical will face competition from other companies with similar business profiles. A description of each competitor company is below.

City Medical

Founded in 2008, City Medical is a membership-based, primary-care practice in the heart of the city. City Medical offers a wide range of primary care services for patients who subscribe to the practice for an annual fee. Patients enjoy personalized care, including office visits, as well as the diagnosis and treatment of common health problems. The patient membership fee covers the services listed below, and most care is received in-office. However, some additional services, such as lab testing and vaccinations, are billed separately. Furthermore, though the annual fee is convenient for some, it is too high for many families, so many are priced out of care at this facility.

Bay Doctors

Bay Doctors is a primary care practice that provides highly personalized medical care in the office or patients’ homes. Bay Doctors includes a team of dedicated healthcare professionals with dual residency in Emergency Medicine and Internal Medicine. The practice offers same-day/next-day appointments, telemedicine, office visits, and home visits. Some of the medical care services they provide are primary care, urgent care, emergency care, gynecology, pediatrics, and minor procedures.

Community Care

Established in 1949, Community Care is a non-profit regional healthcare provider serving the city and surrounding suburbs. This facility offers a wide variety of medical services, including 24-hour emergency care, telemedicine, primary care, and more. In addition to their medical care, they have a wide variety of fundraising activities to raise money to operate the hospital and help families cover the costs of their care.

Competitive Advantage

Riverside Medical enjoys several advantages over its competitors. These advantages include:

Marketing Plan

Brand & value proposition.

The Riverside Medical brand will focus on the company’s unique value proposition:

- Client-focused healthcare services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-hospital expertise in a small-clinic environment

Promotions Strategy

The promotions strategy for Riverside Medical is as follows:

Riverside Medical understands that the best promotion comes from satisfied customers. The company will encourage its patients to refer their friends and family by providing healthcare benefits for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Direct Mail

The company will use a direct mail campaign to promote its brand and draw clients, as well. The campaign will blanket specific neighborhoods with simple, effective mail advertisements that highlight the credentials and credibility of Riverside Medical.

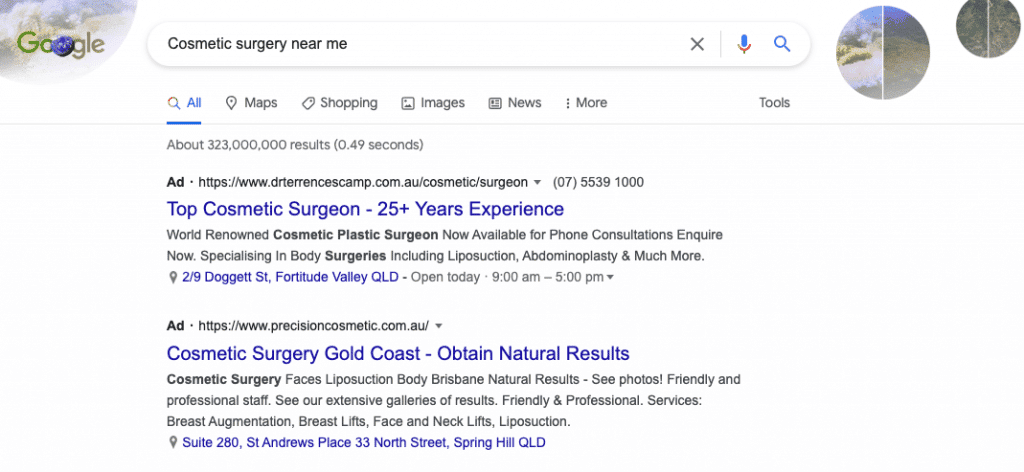

Website/SEO

Riverside Medical will invest heavily in developing a professional website that displays all of the clinic’s services and procedures. The website will also provide information about each doctor and medical staff member. The clinic will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

Riverside Medical will invest heavily in a social media advertising campaign. The marketing manager will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Riverside Medical’s pricing will be lower than big hospitals. Over time, client testimonials will help to maintain our client base and attract new patients. Furthermore, we will be able to provide discounts and incentives for lower-income families by connecting with foundations and charities from people who are interested in helping.

Operations Plan

The following will be the operations plan for Riverside Medical.

Operation Functions:

- Samantha Parker is the founder of Riverside Medical and will operate as the sole doctor until she increases her patient list and hires more medical staff. As the clinic grows, she will operate as the CEO and take charge of all the operations and executive aspects of the business.

- Samantha is assisted by Elizabeth O’Reilly. Elizabeth has experience working as a receptionist at a fast-paced hospital and will act as the receptionist/administrative assistant for the clinic. She will be in charge of the administrative and marketing aspects of the business.

- Samantha is in the process of hiring doctors, nurses, and other medical staff to help with her growing patient list.

Milestones:

The following are a series of path steps that will lead to the vision of long-term success. Riverside Medical expects to achieve the following milestones in the following twelve months:

3/202X Finalize lease agreement

5/202X Design and build out Riverside Medical location

7/202X Hire and train initial staff

9/202X Kickoff of promotional campaign

11/202X Reach break-even

1/202X Reach 1000 patients

Financial Plan

Key revenue & costs.

Riverside Medical’s revenues will come primarily from medical services rendered. The clinic will either bill the patients directly or their insurance providers.

The major cost drivers for the clinic will include labor expenses, lease costs, equipment purchasing and upkeep, and ongoing marketing costs.

Funding Requirements and Use of Funds

Key assumptions.

Below are the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Year 1: 120

- Year 2: 150

- Year 3: 200

- Year 4: 275

- Year 5: 400

- Annual lease: $50,000

Financial Projections

Income statement, balance sheet, cash flow statement, healthcare business plan faqs, what is a healthcare business plan.

A healthcare business plan is a plan to start and/or grow your healthcare business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Healthcare business plan using our Healthcare Business Plan Template here .

What are the Main Types of Healthcare Businesses?

There are a number of different kinds of healthcare businesses , some examples include: Nursing care, Physical home health care, or Home health care aides:

How Do You Get Funding for Your Healthcare Business Plan?

Healthcare businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Healthcare Business?

Starting a healthcare business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Healthcare Business Plan - The first step in starting a business is to create a detailed healthcare business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your healthcare business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your healthcare business is in compliance with local laws.

3. Register Your Healthcare Business - Once you have chosen a legal structure, the next step is to register your healthcare business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your healthcare business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Healthcare Equipment & Supplies - In order to start your healthcare business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your healthcare business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Other Helpful Business Plan Templates

Nonprofit Business Plan Template Non-Emergency Medical Transportation Business Plan Template Medical Practice Business Plan Template Home Health Care Business Plan Template

Healthcare Business Plan Template

Written by Dave Lavinsky

There are several types of Healthcare businesses, from family medicine practices to urgent care centers to home health care agencies. Regardless of the type of healthcare business you have, a business plan will keep you on track and help you grow your healthcare business in an organized way. In addition, if you plan to seek funding, investors and lenders will use your business plan to determine the level of risk.

Download our Ultimate Business Plan Template here >

Below is the business plan outline you should use to create a business plan for your healthcare company. Also, here are links to several healthcare business plan templates:

- Assisted Living Business Plan

- Counseling Private Practice Business Plan Template

- Dental Business Plan

- Home Health Care Business Plan

- Medical Practice Business Plan Template

- Medical Spa Business Plan Template

- Non Medical Home Care Business Plan Template

- Nursing Home Business Plan Template

- Pharmacy Business Plan

- Urgent Care Business Plan

Finish Your Business Plan Today!

Healthcare business plan example outline, executive summary.

Although it serves as the introduction to your business plan, your executive summary should be written last. The first page helps financiers decide whether to read the full plan, so provide the most important information. Give a clear and concise description of your healthcare company. Provide a summary of your market analysis that proves the need for another healthcare business, and explain your company’s unique qualifications to meet that need.

Company Analysis

Your company analysis explains your healthcare business as it exists right now. Describe the company’s founding, current stage of business, and legal structure. Highlight any past milestones, such as lining up clients or hiring healthcare providers with a proven track record. Elaborate on your unique qualifications, such as expertise in a currently underserved niche market.

Industry Analysis

The healthcare industry is incredibly large and diverse, but your analysis should focus on your specific segment of the market. Do you specialize in pediatric healthcare? senior healthcare? emergency medicine? family medicine? Figure out where your healthcare company fits in, and then research the current trends and market projections that affect your niche. Create a detailed strategy for overcoming any obstacles that you uncover.

Customer Analysis

Who will your healthcare company serve? Are they families? The elderly? What is important to them in a healthcare business? How do they select a healthcare provider? Narrow down their demographics as closely as you can, and then figure out what their unique needs are and how you can fulfill them.

Finish Your Healthcare Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your direct competitors are those healthcare companies that fulfill the same needs for the same target market as yours. Your indirect competitors are healthcare businesses that target a different market, or other companies that fulfill a different need for your target market. Describe each of your direct competitors individually, and talk about the things that set your healthcare company apart. Categorize your indirect competitors as a group and talk about them as a whole.

Marketing Plan

A solid marketing plan is based on the four P’s: Product, Price, Promotion, and Place. The Product section describes the healthcare you sell along with any other services you provide. Price will change according to the specifics of the property, but you can delineate your fees here. Promotion is your means of getting new business. Place is your physical office location, along with your web presence and the areas where you sell. Another category, Customer retention, refers to the ways you will build loyalty.

Operations Plan

Your operations plan explains your methods for meeting the goals you set forth. Everyday short-term processes include all of the daily tasks involved in servicing clients. Long-term processes are the ways you will meet your defined business goals, such as expanding into new markets or new types of service.

Management Team

The management team section highlights the backgrounds of the key members of your team. Focus on those aspects that prove your team’s ability to build and run a successful company. A business mentor or advisor can help fill in any gaps, provided you can identify the specific ways that your advisor will influence your company’s growth.

Financial Plan

Investors and lenders heavily scrutinize the financial plan, but it is often the most challenging part of the business plan to write. Healthcare is a strong market, it usually not subject to economic turns. The financial plan requires you to detail your individual revenue streams by implementation timeline and relative importance, and disclose any sources of outside funding. You also need to summarize your past and future Income Statements, Cash Flow Statements, and Balance Sheets, based on key assumptions that must be both reasonable and verifiable based on an analysis of similar companies. You should also provide a solid exit strategy that shows your understanding of the market and your desire to capitalize on profitability.

Your full financial projections should be attached in the appendix along with any other documents that support your claims, such as letters from key partners.

Healthcare Business Plan FAQs

What is the easiest way to complete my healthcare business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Healthcare Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of healthcare business you are operating and the status; for example, are you a startup, do you have a healthcare business that you would like to grow, or are you operating a chain of healthcare businesses?

Don’t you wish there was a faster, easier way to finish your Healthcare business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how our professional business plan writers can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Search Product category Any value Sample Label 1 Sample Label 2 Sample Label 3

How to Write a Business Plan for a Private Clinic: Complete Guide

- January 3, 2023

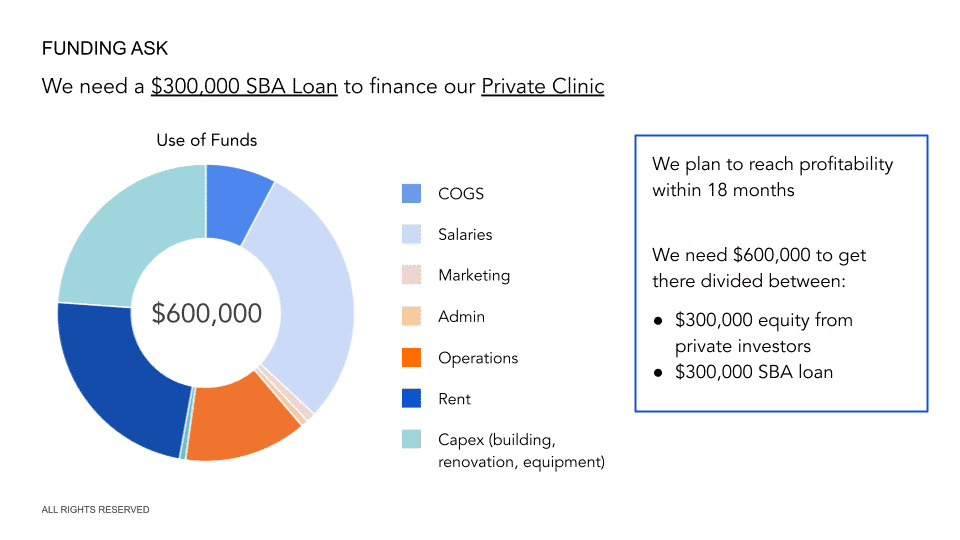

Whether you’re looking to raise funding from private investors or to get a loan from a bank (like a SBA loan) for your private clinic, you will need to prepare a solid business plan.

In this article we go through, step-by-step, all the different sections you need in the business plan of your private clinic.

Whether you want to open a primary care or a specialized clinic (e.g. plastic surgery, chiropractor or any other type of medical clinic), use this template to create a complete, clear and solid business plan that get you funded.

1. Executive Summary

The executive summary of a business plan gives a sneak peek of the information about your business plan to lenders and/or investors.

If the information you provide here is not concise, informative, and scannable, potential lenders and investors will lose interest.

Though the executive summary is the first and the most important section, it should normally be the last section you write because it will have the summary of different sections included in the entire plan.

Why do you need a business plan for a private clinic?

The purpose of a business plan is to secure funding through one of the following channels:

- Obtain bank financing or secure a loan from other lenders (such as a SBA loan )

- Obtain private investments from investment funds, angel investors, etc.

- Obtain a public or a private grant

How to write an executive summary for a private clinic?

Provide a precise and high-level summary of every section that you have included in the business plan of your construction business. The information and the data you include in this segment should grab the attention of potential investors and lenders immediately.

Also make sure that the executive summary doesn’t exceed 2 pages in total: it’s supposed to be a summary for investors and lenders who don’t have time to scroll through 40-50 pages, so keep it short and brief.

The executive summary usually consists of 5 major sub-sections:

- Business overview : describe your medical clinic, where it is located, and what type of inpatient or outpatient care you offer. Also, mention the services and treatments you specialize in and the average price per treatment

- Market analysis : a comprehensive market analysis includes details about your market. Provide information about your target audience (children vs. elderly, health conditions, outpatient care trends and preferences, etc.), as well as the market size , growth and competitors.

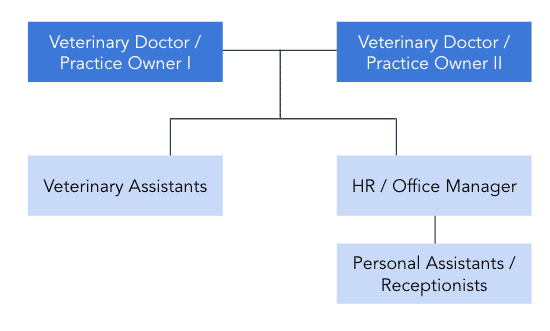

- People : introduce your construction business’ management and employee structure. Provide a brief (no more than a couple of sentences each) of the knowledge and experience of the team. Also, mention how the company will be structured (management roles and reporting lines)

- Financial plan: how much profit and revenue do you expect in the next 5 years? When will you reach the break-even point and start making profits? You can include here a chart with your key financials (revenue, gross profit, net profit )

- Funding ask : what loan/investment/grant are you seeking? How much do you need? How long will this last?

Medical Clinic Financial Model

Download an expert-built 5-year Excel financial model for your business plan

2. Medical Clinic Business Overview

In this section, you should explain in simple terms the type of clinic you wish to open. Here are a few questions you may want to answer:

- Where exactly is your medical clinic located? And why did you choose that location?

- What type of medical clinic are you opening (franchise vs. independent)?

- Are you opening a primary care or a specialized health clinic?

- Which medical services will you provide? For whom (what is your target audience)?

- What is the capacity of your private clinic? How many beds? How many doctors/specialists will there be?

- What will be the legal structure of your company (partnership, corporation)?

a) Rationale

Before we jump into the business, it’s always good practice to give an overview of the rationale behind this project. In other words: why did you decide to open such clinic in your area today?

For example, if there are no plastic surgery clinics in the area despite strong market demand, you could come in to fill the existing market gap after conducting a proper market analysis.

b) Business Concept

Now, it’s time to explain your business model. Firstly, business owners can choose between independent practices or franchising.

But that’s not all. You must also decide on the specific type of clinic you want to open. And that’s only possible after answering the following questions;

- Will you specialize in primary care or specialty medicine?

- Is this a franchise or an independent clinic?

- Is this a solo, group or hospital-owned practice?

What are the different types of medical clinics?

Here are a few business models commonly used by medical professionals:

- Solo practice : you will be the main partner of the clinic and have full control. A major pitfall of a solo practice is the high startup costs for leasing the property, purchasing the medical equipment, managing administrative functions and marketing your business

- Group practice : you partner with other physicians or practitioners instead. This business model comes with fewer responsibilities, with well-defined roles for every individual. Also, it provides easy access to capital, lowering the startup and operating costs along the way

- Hospital-owned practice : a medical clinic within the hospital premises. Here, you work with a fixed schedule, getting limited freedom compared to a solo practice. But the upside is that you can capitalize on the hospital’s resources, making it easier to establish your practice and market it to your target audience.

c) Treatments and Services

In addition to the business model of your clinic, let’s now take a look at the services and treatments you offer.

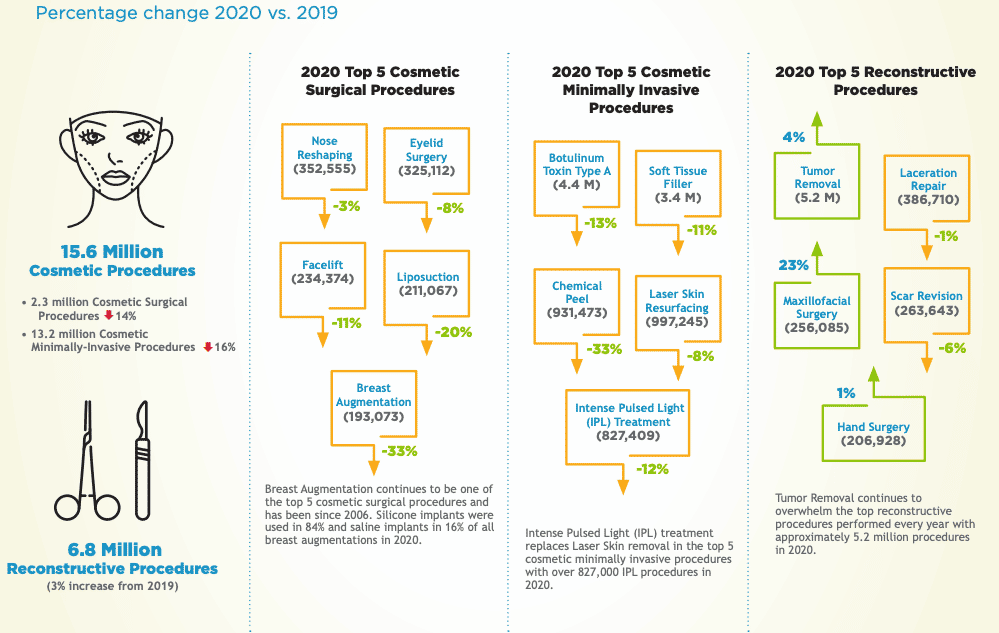

For example, a plastic surgery clinic with reconstructive procedures could offer the following treatments:

- Head/face/eyes (Facelift, forehead lift, eyelid lift, ear pinning, hair replacement surgery, nasal surgery, nose reshaping, etc.)

- Mouth and teeth (oral surgery)

- Breasts (Breast augmentation, breast reconstruction, breast reduction, breast lift)

- Abdomen (Liposuction, tummy tuck, etc.)

- Hand and upper limb

- Skin (Chemical peel, vein removal, scar revision, tattoo removal, dermaplaning, laser skin resurfacing)

d) Pricing Strategy

Lenders and investors will want to see your pricing strategy . We recommend you create a summary table with the main services you offer as well as their prices.

You can start by determining the average cost of similar medical services in your area before making your pricing list.

When creating your pricing structure, consider the necessary elements, like the local regulations and whether most consumers rely on insurance bodies to cover their medical expenses or fund them from their pockets.

e) Legal Structure

Finally, your business overview section should specify what type of business structure you want. Is this a corporation or a partnership (LLC)? Who are the investors? How much equity percentage do they own? Is there a Board of Directors? If so, whom? Do they have experience in the industry?

3. Medical Clinic Market Overview

One of the most important steps when writing a medical clinic’s business plan is understanding the market you’re in. Try to address here the following questions:

- Industry size & growth : how big is the industry in your area? What is its growth/decline rate, and what factors contribute to its growth/decline in the region?

- Competition overview : how many competitors are there? How do they compare vs. your business? How can you differentiate yourself from them?

- Customer analysis : who is your target market ? What type of inpatient and/or outpatient treatments do they need?

a) Medical Industry Size & Growth

The cosmetic surgery industry was worth $20.1 billion in 2022 (+2.3% CAGR from 2017-22).

In total, there were 22.4 million procedures in 2019: that’s an average price per procedure of around $900.

In terms of plastic surgeons, there were approximately 7,000 in the US in 2020 .

b) Competition Overview

In addition to an overview of the market size, you should also describe who are your competitors in the area where you plan to open your clinic.

Find useful information about your competitors’ biggest strengths and weaknesses , products and services , and marketing strategies.

For example, create a summary table that compares your competitors’ treatments, marketing strategies, pricing ranges, target audience, etc.

c) Customer Analysis

Finally, take some time to understand your target audience. Here are a few elements you must look into:

- What is the average spend per capita on medical procedures (for example plastic surgery)?

- How often do people need such treatments?

- The most sought-after treatments

- What’s the average price of a treatment / service?

4. Sales & Marketing

The next section of your medical clinic’s business plan should outline your customer acquisition strategy. Start by answering the following questions:

- What are the different marketing strategies you will use?

- What are your unique selling points (USPs)?

- How will you track the success of your marketing strategy ?

- What is your customer acquisition cost (CAC)?

- What is your marketing budget?

- Will you consider any offers or promotions to attract new clients?

What marketing channels do private clinics use?

A few marketing channels used by clinics include;

- Content marketing on social media and blogs

- Email, SMS marketing

- Online local listing (Google Business)

- Word-of-mouth advertisement, recommendations

- PPC ads, Facebook ads, etc.

5. Management & People

You must address two things here:

- The management team and their experience / track record

- The organizational structure : different team members and who reports to whom?

Small businesses often fail because of managerial weaknesses. Thus, having a strong management team is vital. Highlight the experience and education of senior managers that you intend to hire to oversee your private clinic.

For the partners of the clinic, describe their duties, responsibilities, and roles. Also, highlight their previous experience and track record.

For the receptionists, personal assistants, office managers, medical assistants, etc. no need to go into a lot of detail, especially as it’s likely you won’t have hired them yet before you get the funding you need, which is the objective of this business plan.

Organization Structure

Even if you haven’t already hired anyone yet, you must provide a chart of the organizational structure defining the hierarchy of reporting.

6. Financial Plan

The financial plan is perhaps, with the executive summary, the most important section of any business plan for a private clinic.

Indeed, a solid financial plan tells lenders that your business is viable and can repay the loan you need from them. If you’re looking to raise equity from private investors, a solid financial plan will prove them your private clinic is an attractive investment.

There should be 2 sections to your financial plan section:

- The startup costs of your private clinic

- The 5-year financial projections

a) Startup Costs

Before we expand on 5-year financial projections in the following section, it’s always best practice to start with listing the startup costs of your project. For a private clinic, startup costs are all the expenses you incur before you open your clinic.

These expenses typically are: the lease for the space, the renovation costs, the equipment and furniture.

Logically, the startup costs vary depending on the size of your clinic, the treatments you will offer (and therefore the equipment you need), the quality of the equipment and furniture, whether you buy the real estate or rent a commercial space, etc.

b) Financial Projections

In addition to startup costs, you will now need to build a solid 5-year financial model for your private clinic. Your financial projections should be built using a spreadsheet (e.g. Excel or Google Sheets) and presented in the form of tables and charts.

As usual, keep it concise here and save details (for example detailed financial statements, financial metrics, key assumptions used for the projections) for the appendix instead.

Your financial projections should answer at least the following questions:

- How much revenue do you expect to generate over the next 5 years?

- When do you expect to break even?

- How much cash will you burn until you get there?

- What’s the impact of a change in pricing (say 15%) on your margins?

- What is your average customer acquisition cost?

You should include here your 3 financial statements (income statement, balance sheet and cash flow statement). This means you must forecast:

- The number of patients you can receive in a day or week;

- The number of procedures you can perform ;

- Your expected revenue ;

- Operating costs to run the business ;

- Any other cash flow items (e.g. capex, debt repayment, etc.).

When projecting your revenue, make sure to sensitize pricing (prices of treatments and services) and your sales volume (number of customers). Indeed, a small change in these assumptions may have a significant impact on your revenues and profits.

7. Use of Funds

This is the last section of the business plan of your private clinic. Now that we have explained what your private clinic’s business model and services are, your marketing strategy, etc., this section must now answer the following questions:

- How much funding do you need?

- What financial instrument(s) do you need: is this equity or debt, or even a free-money public grant?

- How long will this funding last?

- Where else does the money come from? If you apply for a SBA loan for example, where does the other part of the investment come from (your own capital, private investors?)

If you raise debt:

- What percentage of the total funding the loan represents?

- What is the corresponding Debt Service Coverage Ratio ?

If you raise equity

- What percentage ownership are you selling as part of this funding round?

- What is the corresponding valuation of your business?

Use of Funds

Any private clinic business plan should include a clear use of funds section. This is where you explain how the money will be spent.

Will you spend most of the loan / investment in paying your employees’ salaries? Or will it cover mostly the cost for the lease deposit for the space, the renovation and equipment?

For the use of funds, we also recommend using a pie chart like the one we have in our financial model template where we outline the main expenses categories as shown below.

Privacy Overview

How to Write a Business Plan for Healthcare

- Small Business

- Business Planning & Strategy

- Write a Business Plan

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Start a Financial Services Business

Example of a medical transportation business plan, how do i start a home business caring for elderly people.

- How to Create an Audit Template for a Client Account Review

- How to Get Federal Funding for a Clinic Start-Up

Writing a business plan for a healthcare involves preparing a document that outlines the services you plan to provide and how you intend to run your company. Health care businesses usually deal with reimbursement, fee schedules, billing systems, managed care contracts and operational issues. By describing how your company handles these challenges, you can prove to potential investors that your business strategy is sound and worthy of their investment.

Available Internet Resources

Use the resources provided by websites, such as the Business.gov and the Small Business Administration Small Business Planner websites, to get started writing your health care business plan. Use the self-assessment tool provided by the Small Business Administration website as well as other resources, such as free online courses, access to online mentoring and templates.

Description of Your Health Care Business

Write a description of your health care business. For example, list how your service offers elderly or disabled clients non-medical support at home. If you plan to purchase and run a franchise operation, the parent company typically provides information and training that describes the business.

For example, urgent care center businesses typically provide care by a certified physician, on-site lab services, prescription services and extended hours. Describe the skills and experience of your staff, such as technicians.

Marketing Strategy and Competitive Analysis

Use resources, such as the Plunkett Research website, to identify the industry outlook and trends in the health care industry. Identify your competitors. Analyze their strengths and weaknesses. Prepare your own promotional campaigns, which could mean describing your plans to develop a website to advertise your services or conduct an email marketing campaign to attract new customers.

Describe your community and how you intend to obtain referrals, such as making connections with doctors and hospital administrative personnel. These health care professionals frequently refer patients requiring home health care to local reputable agencies providing quality service to discharged patients.

Organization and Management

Add a section describing how you intend to organize your health care business. List the software programs you intend to use for charting and billing. Establish a mechanism for receiving payment and obtaining reimbursement for services. List the licenses required to operate a health care business in your state, using the resources provided by the Business.gov website.

Ensure that you meet the guidelines for providing health care services and that your services can be reimbursed by Medicare, Medicaid and private insurance.

Financial and Strategic Goals

Describe how you plan to finance your company and specify a multi-year plan. For example, state the number of patients you hope to serve by the end of the first year. Classify these patients by type, such as home health care or personal injury cases. Set success criteria, such as 80 percent customer satisfaction as reported by follow-up surveys you conduct with clients.

Use the resources provided by the Business.gov website to pay your taxes and ensure you adhere to all the required regulations.

- Bplans.com: Free Medical and Health Care Business Plans

- Applied Health Strategies: Working Draft of the Safety Net ACO Business Plan for the “Next Coalition”

- Entrepreneur: Health and Personal Care

- SCORE: Templates for Your Business

- Small Business Administration: Assessment Tool

Tara Duggan is a Project Management Professional (PMP) specializing in knowledge management and instructional design. For over 25 years she has developed quality training materials for a variety of products and services supporting such companies as Digital Equipment Corporation, Compaq and HP. Her freelance work is published on various websites.

Related Articles

How to start a medical staffing company, an outpatient clinic's organizational structure, how to start a medical staffing company for under $1000, how to start a computer recycling business, how to write a business plan for a spa, how to start a safety training consulting business, how to write a business plan for an errand business, how to start a recruitment business, how to start a customer service business, most popular.

- 1 How to Start a Medical Staffing Company

- 2 An Outpatient Clinic's Organizational Structure

- 3 How to Start a Medical Staffing Company for Under $1000

- 4 How to Start a Computer Recycling Business

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

Medical & Health Care Business Plans

- IT, Staffing & Customer Service

- Construction, Architecture & Engineering

- Food, Beverage & Restaurant

- Real Estate & Rentals

- Mobile Apps & Software

- Education & Training

- Beauty Salon & Fitness

- Medical & Health Care

- Retail, Consumers & E-commerce

- Entertainment & Media

- Transportation, Logistics & Travel

- Agriculture, Farm & Food Production

- Nonprofit & Community

- Manufacturing & Wholesale

- Clothing & Fashion

- Children & Pets

- Fine Art & Crafts

- Cleaning, Maintenance & Repair

- Hotel & Lodging

- Finance & Investing

- Consulting, Advertising & Marketing

- Accounting, Insurance & Compliance

How To Write an Apothecary Business Plan + Template

How to Write Sober Living Home Business Plan + Free Template

Mobile Phlebotomy Business Plan

Yoga Studio Business Plan

Esthetician Business Plan

Urgent Care Business Plan

Health Coaching Business Plan

Medical Lab Business Plan

Optometrist Business Plan

IV Hydration Business Plan

CrossFit Gym Business Plan

Medical Transport Business Plan

Medical Billing Business Plan

Mental Health Private Practice Business Plan

Telemedicine Business Plan

Veterinary Clinic Business Plan

Rehabilitation Center Business Plan

Hospital Business Plan

Counseling Private Practice Business Plan

Chiropractic Business Plan

Dental Business Plan

Medical Practice Business Plan

Physical Therapy Business Plan

Wellness center Business Plan

Senior Daycare Business Plan

Cannabis Cultivation Business Plan

Tanning Salon Business Plan

CBD Business Plan

Non-Medical Home Care Business Plan

Medical Spa Business Plan

Gym Business Plan

Medical Equipment Business Plan

Massage Therapy Business Plan

Pharmacy Business Plan

Home Health Care Business Plan

Dispensary Business Plan

Skin Care Business Plan

Residential Assisted Living Business Plan

Personal Trainer Business Plan

Did you find what you are looking for.

Whether you plan to start a professional medical practice or a veterinary clinic, you need a clear roadmap to drive it to success.

Need help writing a business plan for your healthcare business?

This library of healthcare and medical business plan examples here can inspire and guide you as you begin to plan your business. So, don’t worry; we got you covered on that part.

Let’s learn more about these sample health and medicine business plans, starting with their benefits.

Benefits of using an industry-specific business plan example

Believe it or not, using an industry-specific business plan example is the best and probably the quickest way of writing a business plan.

Doubt it? Hold, this may change your perception; an extended list of the benefits of using an industry-specific business plan template.

- Inspiration : Reading a business-specific template can be incredibly helpful in getting content inspiration. Furthermore, it helps you gain insights into how to present your business idea, products, vision, and mission.

- Risk-free method : You are taking a reference from a real-life, let’s say, health coaching business plan—so you know this plan has worked in the past or uses a method subscribed by experts.

- Deep market understanding : Analyzing and reading such examples can provide clarity and develop a deeper market understanding of complex industry trends and issues you may not know but relate directly to the realities of your business landscape.

- Increased credibility : A business plan developed using an example follows a standard business plan format, wisely presents your business, and provides invaluable insights into your business. There’s no question it establishes you as a credible business owner, demonstrating your deep business and market understanding.

- Realistic financial projections : Financial forecasting being a critical aspect of your plan, this real-life example can help you better understand how they project their financials—ultimately helping you set realistic projections for your business.

These were the benefits; let’s briefly discuss choosing an medical business plan template that best suits your business niche.

Choosing a Medical and Health Care Business Plan

This category itself has 30+ business plan templates for various healthcare businesses. With many similar business types and templates, you may not find the most suitable one through manual scrolling.

Here are the steps to consider while choosing the most suitable business plan template.

Identify your business type

Are you going to be a rehabilitation providing nature therapy? Or a medical lab? Or planning on starting an urgent care center?

Asking yourself these questions will help you identify your business type, which will help in choosing a niche-specific business plan template.

Once you identify your business type, you can choose between templates for different business segments.

Search for the template

We have an in-built search feature, so you can easily search for a business-specific template using your business name as a key term. Once you have the search results, choose the most suitable one. Simple as that.

Review the example

Look closely at the content of the sample business plan you are considering. Analyze its sections and components to identify relevant as well as unnecessary areas.

Since all the Upmetrics templates are tailored to specific business needs, there won’t be many fundamental customizations. However, a hybrid business model targeting multiple customer segments may require adjustments.

For instance, if you plan to start a medical practice that also provides urgent care services—you may need to make necessary adjustments in some of your business plan sections based on your service offerings.

No big deal—you can view and copy sections from other business plan examples or write using AI while customizing a template.

That’s how you find and select the most suitable medical business plan template. Still haven’t found the perfect business plan example? Here’s the next step for you.

Explore 400+ business plan examples

Discover Upmetrics’ library of 400+ business plan examples to help you write your business plan. Upmetrics is a modern and intuitive business plan app that streamlines business planning with its free templates and AI-powered features. So what are you waiting for? Download your example and draft a perfect business plan.

From simple template to full finished business plan

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

.png?width=3000&name=SemblePeach%20Tint%202%20Hero%20(2).png)

7 steps to writing a business plan for your healthcare business

Creating a strong business plan is the key to a successful private healthcare business.

When it comes to building your private healthcare business, writing a strong business plan and implementing it properly is perhaps the most effective strategy to propel your business to success. Whether you are just starting out, or are already an established healthcare practice, it is never too late to write your business plan and put it in place.

We’ve put together seven steps to help you write a healthcare business plan and then implement it. You can also find a sample private practice business plan PDF here to get you started!

Download our free Business Plan template here!

1. Identify your end goal

Perhaps the most important step of writing a business plan is identifying what it is you are trying to achieve. Identifying clear business goals will enable you to build a step-by-step plan to ultimately achieve these aims.

Dr Gero Baiarda, Clinical Director at GPDQ, states the importance of knowing your practice’s aims in our ‘Launching a Private Practice’ ebook. He states that identifying your purpose, vision, and mission, will help keep you consistent and accountable to your goals. Knowing exactly what you are seeking to achieve in your business will mean that your business plan is tailored to achieving that goal at every step.

2. Get to know your business in numbers

To write a business plan that will enable you to reach your goals, you need to understand how your business is currently performing . Obtaining a complete and in-depth overview of the health of your business will help you to make concrete and achievable goals based on accurate data.

Tracking data is also essential as you progress further with your business. You can’t make a successful business plan without knowing your business inside and out, and you won’t be able to understand how you are performing against your business plan without measuring data as you go.

Make sure you have access to business management tools that allow you to track the key data, such as revenue, patient numbers, cash flow, and other financial and patient demographics which will be useful for your growth goals.

Find out more about Semble’s business management tools here.

3. Break it into smaller steps

With a business goal in mind, the best way to create a business plan is to break it down into smaller, achievable steps. By doing this you will be able to map out a clear trajectory for your business over the next months or years and it will be easier to track your progress against your aims and expectations.

Work backwards from the end goal to create smaller steps, each with a clear, quantifiable goal, such as reaching a revenue goal in a certain month or number of patients reached. If you work well with visuals, experiment with creating a visual diagram or board that you can keep close at hand to check and measure up against as you grow your healthcare business.

4. Identify key successes and failures

A business plan is about improving and growing your business, and to do this it is important to understand your strengths and weaknesses. Consider what has worked well for your business and what has not.

For example, how is your staff management? Does your team work well together, understand their individual roles, and achieve tasks efficiently ?

By identifying main strengths, you can work them into your plan to help you improve business performance. Identifying any weaknesses will enable you to know areas that need some attention and a greater input of time and resources to help you build an all-around stronger business.

5. Get to know your target market

An understanding of your patient’s needs is essential to performing well in the market. Your patient population will depend to an extent on the healthcare services you are offering, but conducting key market research into the specific needs of your patients will help you to create a unique and tailored service that will perform better in the market.

Oliver Capel, Managing Director at Medico Digital, explains that market research and patient demographics such as age, gender, religion, income level, and more, can help you to cultivate a more targeted and effective marketing strategy because it provides insight into what sort of marketing materials will be best received by patients. For example, a young mother will respond differently to marketing than a 60-year old male retiree.

Explore how to use patient market research to improve your business performance in Chapter 2 of the ‘Launching a Private Practice’ ebook .

6. Schedule regular time for business management

You can’t expect to see results in business growth if you don’t invest the time and energy into nurturing it. Whether that be investing in your own development with business management learning time, or setting aside a weekly hour for growth strategy and progress reviewing, it is essential that you carve out time to work on your business.

There are many online courses, books, and guides for basic business management which could help you learn invaluable skills for managing and growing your healthcare business. Start by identifying areas where you have less knowledge and schedule in an hour a week for learning, planning, and strategy.

Even as little as one hour a week will have a profound effect on your business skills and management, and the results will soon be evident!

7. Get your team on board

There is little point in setting goals if your team is unaware of what they are. Sharing business goals with your team and employees means that everyone can do their part to reach certain milestones and improve the business. It also helps to create a stronger network that you can rely on to carry out delegated tasks and ease the burden of both business management and the day-to-day running of your private healthcare practice.

Whether it be improving customer service with better bedside manner, or making changes to workflows to improve efficiency, making your team aware of the end goal will help them understand why change is needed and thus more likely to get on board.

Get started writing your business plan with this free private healthcare practice business plan PDF!

- Follow us on Facebook

- Follow us on Twitter

- Follow us on LinkedIn

You may also like...

Grow your practice.

Using your data for business performance - Part 1: Financial Data

Discover the key financial data you should be tracking in your private healthcare practice and how to use it to improve business performance.

Using your data for business performance - Part 2: Patient treatment journeys

Discover how tracking the treatment journey and outcomes can help you to improve your private healthcare business.

Building a data-driven private healthcare practice

Why tracking business data is essential for growing your private healthcare business

ZenBusinessPlans

100+ Sample Healthcare Business Plans and Templates

Without healthcare, some people with medical conditions would be unable to survive, and we would not be able to access medical assistance when needed. Access to healthcare and treatment is something that is a right by law in many countries, and it should be treated as such.

There are a lot of reasons why you might be considering setting up a business, and there is no better time to start taking the first step. Entrepreneurs have already begun to use the healthcare system to their advantage, and it can be a great source of additional income for those who are wanting to set up their own business or even begin saving for retirement.

Creating your own business within the healthcare field can open a lot of doors for you. That is why this guide has been created to help you learn everything you need to know about starting a healthcare business. It has been aimed at people who want to get started on a new project that will eventually allow them to build a reputation as a local entrepreneur.

Sample Healthcare Business Plans

1. assisted living business plan.

Residential assisted living facilities are created for people who are independent but require day-to-day assistance to be able to carry out basic tasks such as taking their medications, bathing, feeding themselves amongst others. It is important to state that people in licensed residential care may require more assistance daily as they usually have complex health care needs.

2. Drug Rehab Business Plan

A drug rehab center is a specialized clinic that has medical staff who provide outpatient services that are related to the diagnosis as well as treatment of alcohol, drugs, and other substance abuse. The size of this business depends on the kind of firm it is, as for-profit firms tend to be larger and more highly concentrated in the industry than public and nonprofit firms.

3. Sober Living Home Business Plan

A sober living house (SLH), which is also known as a sober home is a facility that provides safe housing and supportive, structured living conditions for people moving out of drug rehabilitation programs. Sober living houses serve as a transitional environment between such programs and mainstream society.

Many sober living facilities also accept people who are in recovery from substance use disorders but have not recently completed a rehabilitation program.

4. Foster Care Group Home Business Plan

A group home is a community-based, long-term facility for specific types of residents (juveniles) who cannot live with their families due to behavioral issues. It is important to state that some group homes treat the mentally ill and the disabled.

5. Non Medical Home Care Business Plan

With more senior citizens preferring to age at home for as long as they can, there is a massive demand for non-medical home care providers in the United States. According to reports, non-medical home care has become one of the fastest-growing businesses – but it is not to be confused with medical home care.

Medical home care providers tend to offer licensed nursing and rehab services that are prescribed by a physician with stipulated guidelines.

6. Non Emergency Medical Transportation Business Plan

Non-medical transportation businesses help people get to pre-scheduled healthcare appointments, including doctor visits, rehab, clinical testing, follow-up exams, and more. In recent times, the demand for safe and reliable public transportation for people with medical issues and disabilities, particularly in rural communities, has witnessed massive growth.

According to industry reports, this demand is expected to continue growing and also remain strong in any economic climate.

7. Elderly Group Home Business Plan

An elderly group home is a facility or business that provides a comfortable living environment that is restricted in the kind of care they provide. This means that an elderly group home does not provide the high level of care provided at nursing homes, but they give elderly people the option to live among peers.

8. Maternity Group Home Business Plan

A maternity group home or preferably the Maternity Group Home Program (MGH) is a niche-group home facility that supports community-based, adult-supervised, transitional living arrangements for homeless pregnant or parenting young women who are between the ages of 16 and 22, as well as their dependent children.

The maternity group home business is designed to provide an environment where young mothers can function independently in the community.

9. Hospice Agency Business Plan

A hospice agency is a public agency or private organization or a subdivision of either that is engaged in providing care to terminally ill individuals, and has a valid Medicare provider agreement. The industry rakes in a whooping sum of $24 billion annually with an annual growth rate projected at -0.2 percent between 2016 and 2022.

10. Medical Spa Business Plan

A medical spa is a business that typically offers numerous health treatments. Unlike regular spas, medical spas pay detailed attention to more difficult issues such as widespread discoloration and wrinkles. The treatments include deeper chemical peels, injections (such as Botox), and laser treatments.

11. Medical Supply Business Plan

A medical supply company is a business that purchases medical and surgical equipment, instruments, and supplies, stores these items at distribution centers, and delivers these products to medical practitioners, clinics, hospitals, etc.

Recent data made available online shows that the global medical supplies market was worth USD 80 billion in the year 2019 and it is projected to reach USD 95.04 billion by 2026.

12. Teeth Whitening Business Plan

A teeth whitening clinic is a business that primarily provides elective dental services that improve the appearance of teeth and gums. Some teeth whitening clinics go as far as offering services that include cosmetic crown and bridgework, veneers, inlays and outlays, and direct bonding which is not generally covered by insurance, making them highly discretionary.

Available data from the United States shows that the value of the global teeth whitening market amounted to about 6.14 billion U.S. dollars in 2020, and is forecasted to grow to 8.21 billion U.S. dollars by 2026.

13. Medical Waste Disposal Business Plan

A medical waste disposal company is a business that disposes of medical waste. Medical waste essentially comprises wastes generated in the hospitals, laboratories, clinics, diagnostic centers et al. This waste can be harmful to humans if not properly disposed of.

14. IV Hydration Therapy Business Plan

An IV hydration therapy clinic is a business that offers hydration therapy to its patients. Hydration therapy is a simple treatment that delivers fluids directly into your bloodstream through a small IV inserted into your arm.

The fluids may also include vitamins, electrolytes, antioxidants, and even medications. Available data from the United States shows that the global intravenous solutions market size is expected to reach USD 18.9 billion by 2028 according to a new report by Grand View Research, Inc.

15. Adult Daycare Business Plan

An adult daycare center is a non-residential daycare facility that provides support in the area of health, nutrition, social, and daily living needs of adults in a professionally staffed, group setting. Adult daycare is designed to provide adults with transitional care and short-term rehabilitation especially when they are discharged from the hospital or when their family members are not around to take care of them.

How to Start a Healthcare Business in 2023

If you have taken the time to carefully research your business idea, and have decided which direction you’d like to go down, then it is time to start thinking about how you want to go about creating your healthcare business. These are some of the steps that you should take on your journey to setting up your business, and some key things to think about.

1. Conduct Your Own Market Research

Firstly, an essential first step when it comes to creating any kind of business is the market research. This step cannot be stressed enough, and you should carefully consider whether there is a gap in the market for your product or service.

Luckily, within the healthcare industry there is often a lot of room for improvement, so you could use this as an opportunity to provide something that you think your local healthcare system needs.

2. Create a Business Plan

Try to be as specific as possible in order to know what direction you plan on taking your business down. This can allow you to approach local funders who might be interested in helping you out, because they will know where their money will be going as well as the fact that you have worked hard to find a gap in the market.

It is better to be over prepared, because it allows you to adapt without worrying about the consequences as much. In addition to this, creating a more detailed business plan can help you follow an appropriate time frame, and encourage you to stay passionate about your agenda.

3. How Will You Fund Your Business?

If you are new to the world of entrepreneurship, you might not know that businesses can cost a lot of money. Creating brands and advertising alone can be very expensive, which is why you should allow the time to think about how you intend to fund your business.

This can be using your savings account, or even asking local investors or other entrepreneurs if they would like to invest in the set-up of your business for a certain percentage of revenue once you begin to see profit.

If this isn’t an option for you, then you should consider applying for a loan. Schedule a meeting with your bank supplier in order to see what your options are, and what kind of interest rates you would face during the repayment period.

4. Will You Have a Designated Business Location?

Some people find it easier to imagine their business in a physical location, whether that involves a small store or setting up a stall at the next community event. However, it largely depends on the service offered.

For example, if you are providing at-home care or online services then there is less need for a store, whereas you might want a business location if your business involves a personal touch. This can include selling medical supplies, or specially designed uniform for hospital workers.

5. Identify Your Business Structure

This is something that new business owners tend to overlook, but it is important to think about your business structure because it will determine how your business functions legally.

From taxes to workers’ wages, the business structure is an important part of any business when it is in its early stages. Ensuring that you have taken the time to carefully consider business structure can allow you to focus on generating clients and a customer base during the later stages.

6. Decide On Your Business’s Name

This can be more challenging than you might have anticipated, because a catchy name can be a little difficult to come up with. Try to find something unique to you and your business that isn’t too long. A good business name is easy to remember and say. It is also worth avoiding using a name that already exists because this can cause confusion as well as legal complications.

7. Register Your Business

Once you have a unique name and rough idea about your branding, you should register your business. This can help to legally protect your brand name, and make it feel more legitimate. Registering your business can allow you to claim ownership of your brand name and ensure that nobody else can use it for their business.

8. Apply For The Correct Taxes

You do not want to get into legal trouble within the first few weeks of business, so you should apply for the correct taxes that agree with your business structure as soon as possible.

When completing forms like these, it is worth doing your own research in order to figure out which taxes you need to pay and what to apply for. Another thing that you can do is speak with a lawyer about what steps you need to take in order to make your business legal.

9. Open A Business Bank Account

This can be done using an Employer Identification Number (EIN), which is also needed to deal with the taxes of your business. Opening a business account can allow you to apply for more benefits within your bank supplier, as well as using it to apply for business loans if you need one.

Once you get to the stage of growth that you can hire additional employees, you will want to use your business bank account in order to pay wages as well as your own income.

10. Apply For Your Business License And Permits

Make sure that your business is running legally in order to prevent additional challenges from arising. This can be a complex process, and it could be worth consulting a lawyer about what licenses and permits you will need. Because the requirements differ between state, industry, and location, it is definitely worth seeking appropriate advice before applying for the right permits and licenses.

Tips on How to Build a Sustainable Healthcare Business

In order to ensure that your business will stay as active as it can be over a long period of time, you should consider some of the following things. This can allow you to continue to make money, and keep investors as well as your clients happy.

Some businesses tend to hit the ground running for several months, and then begin to plummet. Try to do some of the following things in order to keep your business gaining momentum for as long as possible.

a. Keep Yourself Educated

Always understand what is happening in your business and industry as a whole. This can allow you to anticipate your business’ next moves as well as figure out how you can adapt to the changing market. Take the time to learn about how current affairs are affecting the healthcare industry as a whole, because it can help you to make predictions and figure out what you should do to stay on top of your business.

b. Know Your Competitors

They always say to keep your enemies close, and it’s mostly so that you can figure out what they might be planning next. Keep a close eye on your competitors and try to figure out how their marketing strategy differs from yours. You could also compare their branding and target audience, depending on the specific service provided.

c. Build a Strong Business Plan

This can be something that sets you apart from other businesses on the horizon, because a good quality, strong business plan allows you to stick to your guns and focus on the moment. Rather than worrying about what your next moves are or what you need to change, you can rest easy knowing that you have already created a comprehensive business plan.

d. Build a Strong Branding Strategy

Try to think about how you can make your brand stand out from the crowd. Create a dilemma that needs to be solved, and offer a solution through your business. Try to use this to generate local interest, because these will be your main clients unless you set up an online site.

e. Build a Strong Marketing Strategy

Again, try to present your business as a solution to a problem, whether that is a hole in the market or lack of resources. Try to do your own research in order to figure out how different businesses in the past have failed, and which were more successful.

Make your research more specific by comparing your competitors’ marketing strategies and think about how you can adapt that and make it stronger.

f. Know Your Target Audience

This depends largely on the type of service your business provides, but it is worth knowing your target audience so that you know how to reach them. In addition, it is worth changing your language, tone, and advertising platform depending on your audience.

For example, younger people might not want to receive a pamphlet in the mail, whereas older audiences might not appreciate digital marketing as much.

g. Always Stay Passionate

This is something that cannot be underestimated. Try to focus on your audience, competitors and do what you need to do to stay motivated.

Setting up a business can be challenging, which is why a lot of people need to be reminded to stay passionate about their brand. It can be easy to lose sight of what is important to you, so you should try to keep some level of perspective and stick to what works best for you.

How to create a business plan for a medical practice

Starting a medical practice is no small feat. You may consider it lucrative and the right step for your career but have you considered all that it takes to start and run a medical practice? This is what a business plan is for.

A business plan is a strategic planning document that lays out in detail the objectives and goals of a company and also how the company plans to achieve its goals. A business plan can be considered a road map for any business that details a business’ profile, products and services, marketing, financials, operations and organizational structure.

Developing a business plan requires strategic planning to identify the mission and vision, target audience, operations and financials of your medical practice. This is a crucial step when starting your medical practice. In this article we will share about how to write a business plan for a new medical practice.

Why you need a business plan for a medical practice

Just like any other business, a business plan is very important before starting a medical practice. In a recent Sermo poll, 52% of respondents indicated it is important to get a business plan for your medical practice and we will share reasons why.

- A business plan helps to define the core essence of your medical practice. With a medical practice business plan, you can properly define your practice’s vision, mission, goals and target audience.

- With a medical practice business plan, one can properly estimate the financial cost of starting up as well make financial projections for a time period.

- A medical business plan can help define marketing for your practice and set SMART marketing goals.

- A medical business plan helps to strategically identify and define all the stakeholders relevant to your practice and their role in the success of your practice.

- A SWOT analysis is a core part of any business plan. This will help the medical practice understand its strengths, its competitors, opportunities and the environment where it plans to operate in.

Types of business plans for a medical practice