- Getting Started

- Growing a Business

- Success Stories

How to Write Your Business Plan Deck

Using a deck for your business plan is a quick, to-the-point means of providing your best-selling points while still providing the necessary details. The question is: How do you best organize and minimize the breadth of a business plan in a PowerPoint presentation?

Follow the 10–20–30 rule—ten slides, 20 minutes, and a minimum of a 30-point font. Here’s how it works:

What is the 10–20–30 rule?

1. Your first slide is your title slide, providing the name of the business, your name and title, and contact information— plus a slogan if you have one. If you can, use one succinct sentence to describe what your business does.

2. The next slide should introduce a problem that persists and is relatable to your target market. You want the audience to relate to the problem or understand how it affects others. Use can cite statistics to help support your claims, but narrow them down to one or two.

3. The third slide should get to your solution. In simple terms, briefly describe how your business has figured out how to alleviate the problem. Make sure the audience understands that you have a unique approach. You might also add a few words to support your overall value proposition.

4. Explain how you will make money. What are your revenue sources? Who are your customers? What is your pricing structure? Then, describe briefly about how you expect to profit.

5. This is the slide where you present a little more detail on your operating plan. How does it all work? Is it self-service? Kiosks? Personal service? Give the reader a short version of how the business operates. Provide a summary, from buying the goods to marketing them to sales and shipping. You can include a little technology, but remember to keep it in layman’s terms. This is where you may need a second visual slide to show how it all works.

6. Present your marketing plan in a few short words. After all, if you want to create dynamic advertising and promotional campaigns, what better way to start than briefly explaining how you plan to market the business? Share a few specifics rather than saying “on the internet” or “on TV.” Let your listeners know that you have a marketing plan and can keep it within a reasonable budget.

7. Mention your key competitors—but be nice. Explain what gives you the competitive edge.

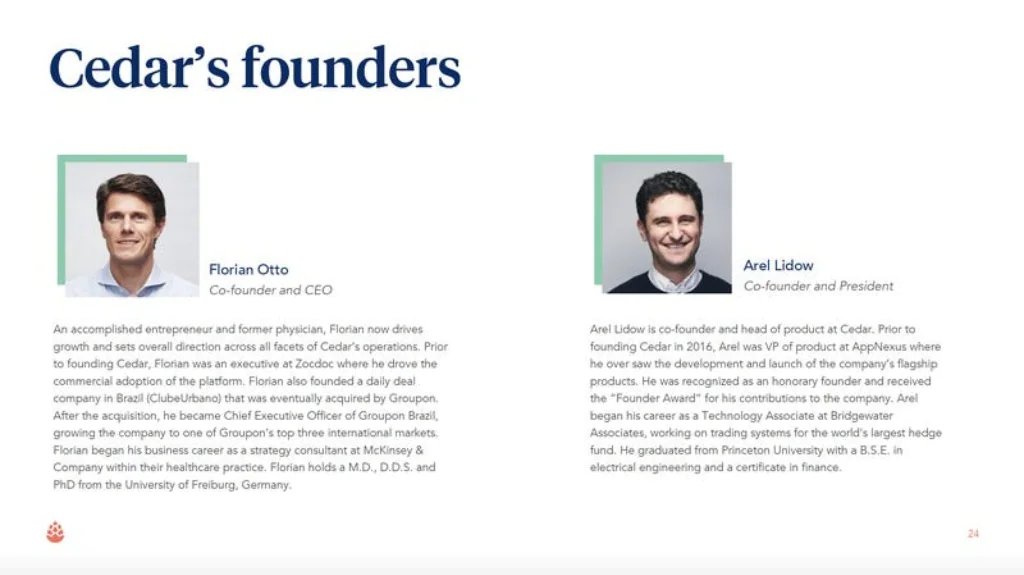

8. This is where you introduce your team, with a few very brief highlights (one line) of each member’s background related to the business. Remember, people invest in other people.

9. Financials. This slide should show a clear projection with a three- to five-year forecast. Explain the method you used to arrive at your numbers.

10. Lastly, show them where your business is at present. What have you done thus far, and how are you looking to move forward sooner rather than later? Offer a positive call to action based on what you have accomplished to date and what you will accomplish in the future.

Should you stop at 10 slides? It depends. There are many ways to go about putting together your deck. If you need to go to twelve slides, do so, but try not to go longer.

Presentation tips

If you are asked to present your business deck, follow these handy do’s and don’ts.

- Don’t talk in jargon . Not everyone is deeply embedded in your industry.

- Don’t read your slides word for word . Your audience can read what’s on the screen. Insteady, highlight something easy for them to digest and use your comments to provide a little deeper explanation. This way, you present more information, some printed and some verbally.

- Take a breath. There’s no need to rush. Remeber to breath between slides so you don’t start motoring along.

- Do not focus on technology. Technology is interesting in small doses, but too much can take the focus off of the human element of your business.

- Don’t overload slides. You’ve heard the term TMI? The same goes for business decks. People can only read and digest so much.

- Less is more. Don’t pack too much into a PowerPoint presentation. You want to avoid the dreaded “PowerPoint Poisoning” effect, in which and overload of information casts a spell on your audience or puts them to sleep.

How to Write a Business Growth Plan

We highly recommend growth planning to get the most from your business plan. It’s an ongoing business planning process that combines the simplicity of the miniplan (or one-page plan) with the ongoing use and focus of the working plan.

It just takes four simple steps:

- Create a plan: Quickly size up the potential of your idea, validate that it can be a real business, and set goals to make it work.

- Build your forecast: Develop an expense budget and financial projections to understand better where your business is now and where it is headed.

- Review the results: Compare your forecast against your actual sales and expenses each month to stay accountable and uncover new ideas.

- Refine your strategy: Adjust your business plan and forecast based on your learnings.

Remember, the goal of growth planning isn’t just to produce documents that you use once and shelve it. Instead, it helps you build a healthier company that will outlast all the business failure statistics. It’s faster than traditional business planning. You can complete an initial one-page plan that covers all of the necessary details about your business in just thirty minutes. You can revise your plan and strategy in minutes instead of hours. This means that your plan stays up-to-date and useful for identifying potential problems and opportunities. It’s concise. Because growth planning requires you to

document your ideas with limited text, your ideas are distilled to their core essence.

Read the full article here

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

[Ruby_E_Template slug=”academy-sidebar”]

Sign in to your account

Username or Email Address

Remember Me

Creating the perfect pitch deck and business plan: Examples and best practices [2022]

- January 7, 2022

I know you’ve probably been told that a good pitch deck and business plan are essential in the world of startups. It’s true — they are — but there is a LOT of conflicting advice out there on how to create them. (Hint: There isn’t just one right way.) I want to share some ideas based on solid research and real-world experience so you can create something that works for you.

What is a pitch deck?

What is its purpose, do you need a pitch deck and a business plan, who should create the pitch deck, how do you create a pitch deck, what is a financial model, what is a financial forecast, how accurate does a startup financial model need to be, what to include in an early-stage pitch deck, what should i avoid putting into my pitch deck, slide #0 – title, slide #1 – executive summary, slide #2 – trends, slide #3 – problem, slide #4 – solution, slide #5 – business model, slide #6 – market, slide #7 – competition, slide #8 – go to market, slide #9 – traction, slide #10 – team, slide #11 – investment proposal (the ask), keep it simple, stick to a consistent layout, make it easy to read, use a pitch deck template, beautiful.ai, key takeaways.

In this article, I’ll discuss what a pitch deck is, explain its purpose and its importance in the outreach process, give you tips and practices to create your perfect pitch deck, and what to include in it. We’ll also look at an example of a pitch deck template, using slides from startups that have raised hundreds of millions from VCs. We’ll also explore why you must build a financial model alongside your pitch deck.

Before we get started, remember that pitching on stage and building your pitch deck are two very different things. Pitching is a form of art. Anyone can present a business plan or startup idea to another person, but only a few pitches are memorable and truly capture the interest of investors.

Practice makes perfect, and the better you get at pitching, the more likely you are to succeed. So sign up to pitch competitions, put yourself out there, and get feedback. The more you pitch, the better you will become at it. It’s better to make mistakes when it doesn’t matter than pitch unprepared to critical investors and risk disaster.

Now let’s dive into what it takes to build a great pitch deck!

Pitch decks are an essential document for every founder to master, but there is a lot of conflicting information out there, and no one-size-fits-all template.

To help you get started, we’ve pulled together pitch deck examples and best practices for new founders and early-stage startups.

Using this information to guide you, you’ll be able to create a pitch that will wow investors and get you the funding that your business needs.

A pitch deck is a condensed business plan that communicates your business idea to investors or partners. It should be clear, concise, and well-organised so that it promotes a conversation, not just information that needs to be digested. The pitch deck is used as an elevator pitch during your outreach process and should highlight the key aspects of your startup in a way that gets investors excited about working with you.

The pitch deck itself isn’t going to fund or run your startup — it’s just one piece of the puzzle — but it’s an important one. As Guy Kawasaki, Chief Evangelist at Canva, former Chief Evangelist at Apple, and author of The Art of the Start puts it .

The purpose of a pitch is to stimulate interest, not to close a deal.

While the pitch deck is an information-packed overview of your startup, it should be more than just numbers and figures. A winning pitch deck also captures the imagination by telling a story and getting the audience emotionally involved. People don’t buy products, they buy stories — pitch decks help people to see your startup as a compelling narrative instead of just an idea on paper.

A pitch deck helps you generate interest from investors so that they will fund or work with your company in some way. It is a way to quickly pitch your business idea and get feedback, without having to go through the entire business plan. The pitch deck should be used as a tool to start a conversation with potential investors so that you can get their feedback and determine if they are interested in what you’re doing.

For an early-stage startup, the pitch deck and financial model are the business plan. There are too many uncertainties to waste time writing a 100-page business plan. Founders should use tools like the Lean Canvas to help them think through the different aspects of their business, but a pitch deck and financial model are essential when trying to raise money and get investment.

The pitch deck should be created by the founder or co-founder of the company. They are the ones who know the most about their business and can best pitch it to investors. Remember, the pitch deck isn’t what wins you the investment, but it will start the conversation and get people interested in what you’re doing.

There is no one-size-fits-all answer for this question, as the pitch deck needs to be tailored to your specific startup and its investors. However, there are some best practices that you can use to make sure your pitch deck is as compelling as possible.

Financial Model

The pitch deck should always include a financial model, typically as a supporting document, that shows financial projections for the next three to five years. This will help investors understand how you will manage the financial risks associated with your startup.

A financial model is a document that shows how your business will make money and what kind of return investors can expect on their investment. It includes projected revenue, expenses, and profits over a specific period of time.

Investors will expect to see a three to five-year financial forecast, broken down by year and month.

The financial model should also include a section on the startup’s burn rate – how much money the company is spending each month and how long it can continue to do so before running out of funds.

A financial forecast is a projection of future income, expenses, and profits. It typically covers a period of three to five years and breaks down revenue, expenses, and net cash flow by month.

The financial model doesn’t need to be complex, but it should show a realistic understanding of the numbers behind your startup.

It is important to remember that venture capitalists and angel investors do not expect your financial forecasts to be 100% accurate – they simply want to see that you have put thought into your business, that your operational plans are accounted for, and that you understand the basics of financial forecasting.

Pitch Deck Structure

As a founder, you’ll quickly learn that you’ll need more than one pitch deck. Different pitch decks are used for different purposes, and you may end up using a pitch deck that is specific to your target investor, the stage of investment, or the format in which you’ll be pitching.

This means that there is no magic formula for your pitch deck structure. However, there are a few essential slides that should be in every business pitch deck.

- Title or cover slide

- Market size and opportunity

These slides will give the pitch deck a good structure and focus on the key elements that you want to talk about. There may be more slides depending on your company, but those are the main ones that should always appear somewhere in every pitch deck.

Early-stage startup pitch decks are used to spark interest in your idea and the founding team. Venture capital firms and angel investors will be comfortable with greater uncertainty and higher risk in this pitch deck, so there is more leeway to experiment with different ideas and concepts. This doesn’t mean that you should just throw in everything without a thought though!

At this early stage, there will be multiple unknowns that you are setting out to solve, including exactly how you’ll build your solution to the problem, how you’ll find your scaleable route to market, and maybe even how you’ll convert users to paying customers.

It’s normal to not have all the answers to these questions, and that’s OK! It doesn’t mean that you should pitch an idea if you don’t know how it will work yet. All of this is just a reality check for potential investors — they need to see that you have a realistic idea of what you need to do and a plan for how you might do it.

It’s a common mistake for first-time founders to try to put too much information into their pitch decks. This can include everything from detailed financial models to a full history of the company’s founding story. While it’s important to have all this information ready, it’s best to save it for when you’re actually speaking with investors.

Your pitch deck should be focused on your idea and the current state of your company. It should be set up in a way that clearly lays out who you are, what problem you’re solving, and how you plan to solve it. You want investors to see the actual value in investing in your startup so avoid including anything that’s not absolutely necessary for them to understand this concept.

– Do not include unnecessary information or graphics

– Keep your pitch deck to a maximum of 20 slides

– Stick to clear and concise language

– Make sure all the data is accurate and up to date

Be cautious about adding in anything that doesn’t support your pitch deck theme or the key points you want to make. If it isn’t relevant, remove it! You don’t have time for extra fluff when pitching investors; be direct and focus on what matters most.

Early-Stage Pitch Deck Example

The following pitch deck template is a good example of how you can tell a story that builds investor confidence in your startup idea. Using this format will set a great first impression and can help you with raising capital.

This is the most important slide in the whole deck, you need to grab the attention of the investor with a title slide that convinces them to keep reading. Your title slide must:

- Showcase your logo and brand name.

- In one phrase, state your value proposition.

- Engage the reader by promising them an interesting pitch.

It’s important to make your startup feel credible and trustworthy. Just as people will judge a book by the cover, investors will judge your pitch deck in less than five seconds, so make sure you have a strong first impression!

A common mistake that founders make with the title slide is not making the most of the opportunity. Taking inspiration from other industries, a prize-winning sticker on a book cover or a wine bottle has a tremendous impact on sales. What can you do to make your pitch deck stand out?

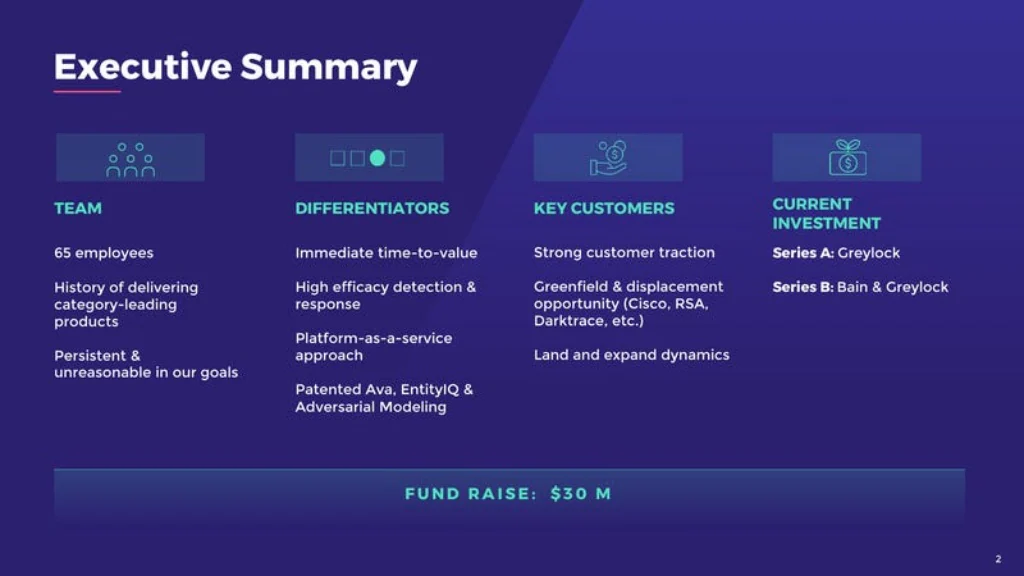

After catching your audience’s attention, you should include a company summary on slide one. Investors are unlikely to know anything about you or your company, so this is where you need to tell them what you do, where you’re going, and why they should care.

In just a few sentences, you should be able to concisely state the following:

- What your company does

- The stage you’re at

- The traction you’ve made so far

- Where you’re heading

If the title slide is about grabbing attention, the executive summary is about keeping it.

You need to get investors hooked and hungry for more information.

With the investor’s attention now captured, it’s time to give them some context. What industry are you in? What trends are happening in that industry?

Trends are the market conditions that you have zero influence over. But, by showing how you understand them and how they impact your startup, you can demonstrate that not only is your startup inevitable, but that the risk of failure is also reduced.

Your goal with the trends slide is to show that your startup idea isn’t some crazy gamble, it’s obvious and inevitable, and that the market is about to change in a big way.

In the context of startup ideas, the important things to consider about trends are whether they are weak or strong, societal and cultural, or technological.

Weak Trends: These are usually easy to spot and include things like the aging population, increasing internet penetration rates, or a growing demand for a new product or service.

Strong Trends: These are hard to argue against. They will be big and happening quickly. They could be something like the rise of mobile payments, a technology reaching critical mass, or a new way of thinking about an old problem.

Technological Trends: These trends focus on the development of new technologies. For instance, the rise of drones, Web3, and artificial intelligence technologies are all technological trends that would be relevant to an investor pitch deck when combined with a startup idea.

Societal and Cultural Trends: These trends are about the way people are living their lives, and integrating new technologies into them. A good example of this is the trend towards health and wellness. This could be anything from the increasing popularity of mindfulness to people taking more interest in their food.

It’s important to consider societal trends alongside advances in technology, just because a technology is possible, doesn’t mean that people will want to use it (remember Google Glass?).

Building into emerging trends can lead to you raising millions without even having a pitch deck , like Hopin, or still whilst the world is in lockdown and your app is still in beta – like Clubhouse.

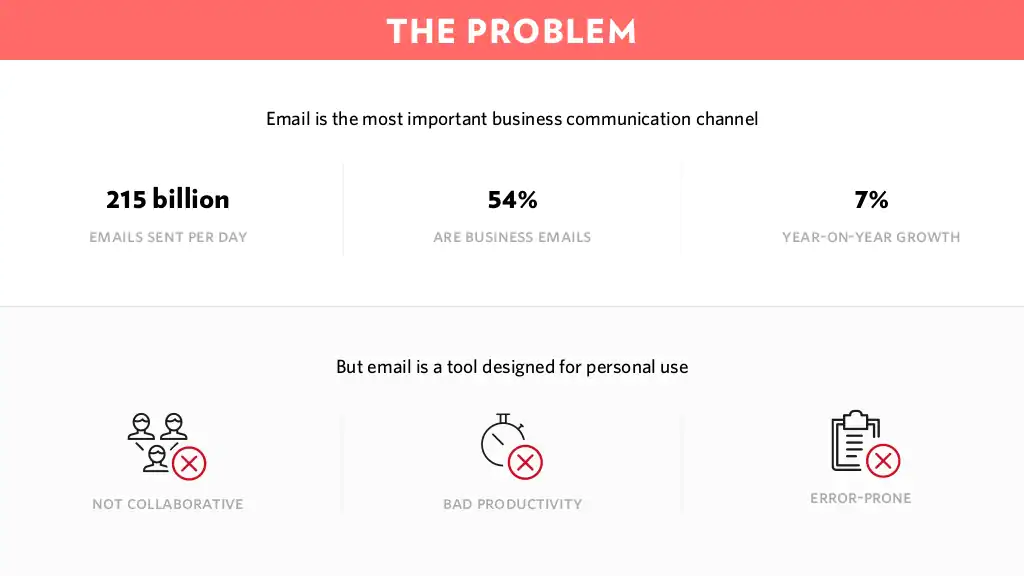

Now that you’ve got the pitch deck rolling, it’s time to talk about your startup idea. What problem are you solving? What is happening right now? What are people not happy with?

When it comes to the problem slide, be specific. Don’t just say that there is a problem. Tell them what it is and make your audience feel the pain; they should be able to recall having had it themselves or easily empathise with those that do.

As a founder, you need to prove that you have a deep awareness and understanding of the problem you’re solving. You need to demonstrate that you can stand in the shoes of your customers and see the problem as they do.

Ideally, you should be able to summarise all of this into a problem statement. This is a simple one or two-sentence explanation that describes the problem, identifies the pain points, and explains why it needs solving.

Providing data to back up your problem statement is also important, but it doesn’t have to be complicated. You’re not trying to show the size of the market, just the severity of the problem.

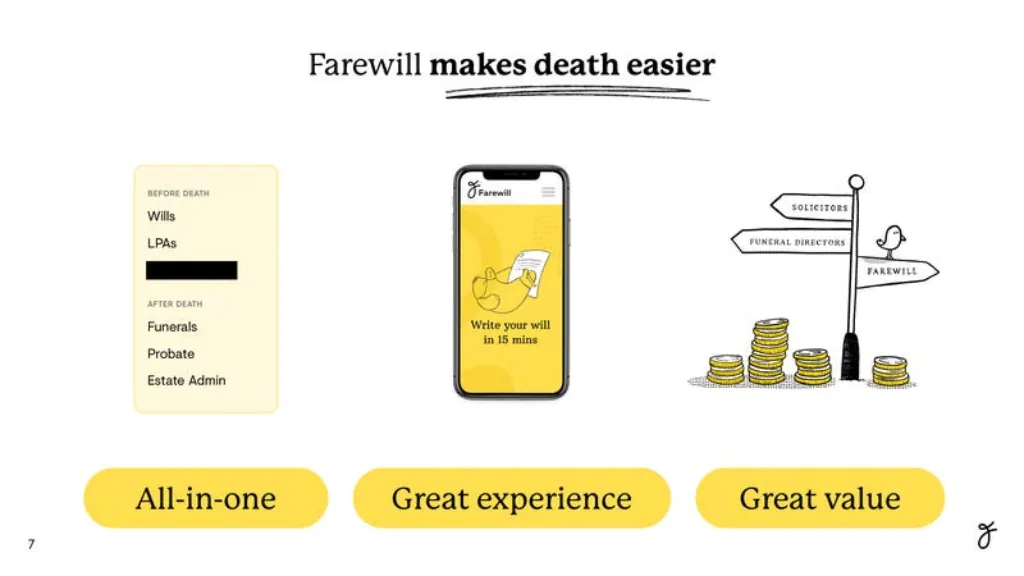

Having built up an understanding of the problem, you now need to explain how you plan on solving it. What is your solution? How will your startup solve this problem? What makes your product or service different?

Your solution slide should be clear, concise, and easy to understand. You should have a brief paragraph explaining what your startup does, followed by supporting information in the form of screenshots, images, or diagrams.

Remember, during live pitching or conversations, you may be able to talk about your solution in more detail – maybe even showcase a live demo – but in your pitch deck, you need to keep it simple.

If you’re having trouble boiling down your complex solution then consider how you would sell it to a potential customer. If you can pitch it to them in a way that they understand and see the value, then your pitch deck will be able to do the same.

With the problem and solution explained, it’s time to move on to your business model. This is a critical slide for any pitch deck as it demonstrates how you plan to make money from your startup idea. It’s showing your investors that you understand the business side of things and that you have a plan for growth.

This slide can be a little tricky to get right, as you don’t want to overload your audience with too much information (especially at idea stage, when you don’t have a fully formed business model). However, you need to convey that the unit economics make sense and that there is a path to profitability.

There are lots of different ways to structure this slide, but the most common model breaks it down into a one-paragraph pitch of your business model, followed by one or two diagrams showing the relationships between your costs and revenue. By using simple visuals, you can convey complex ideas far more effectively than words alone.

Unfortunately, pitch decks don’t have the space to explore every aspect of your business model. It’s a good idea to create a separate document for this, which you can then share with interested investors or partners.

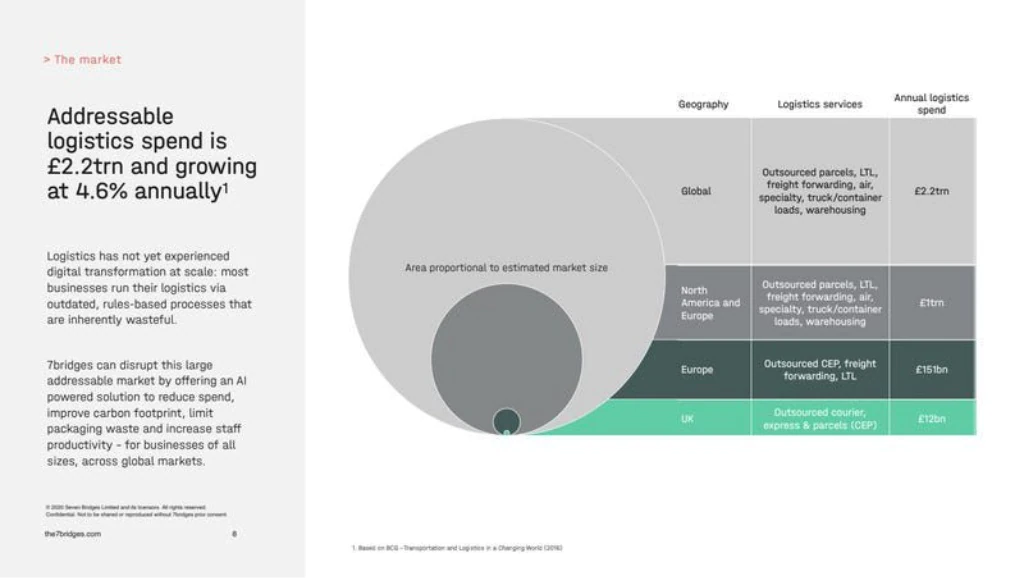

Now it’s time to move on to the all-important question of market size. Market sizing for early-stage startups can be a contentious issue.

Many entrepreneurs think that they need to show huge total addressable markets (TAM), and pitch themselves as the next billion-dollar startup. However, most sophisticated investors how that for most early-stage startups this is not appropriate.

Pitching a large TAM isn’t going to impress investors, they’ve seen it all before, but pitching yourself as the best company in your segment will demonstrate that you have a great understanding of your industry and the opportunity at hand.

It’s most important to be able to show that there is a market for your product or service, that it’s growing, and that there is room for you to compete. You don’t need to pitch yourself as a billion-dollar company, just pitch that you have a good understanding of the market segment, that people are spending money solving this type of problem, and that you’re going to be one of the best companies in your space.

For example, if your idea is to launch the next big analytics platform, don’t pitch a market size that includes every business in the world. Instead, focus on a specific industry or sector and show how behaviours in that industry are changing, paving the way for your product or service.

Again, you don’t need to go into too much detail in your pitch deck. A one-paragraph pitch of your market size is usually enough, followed by a simple diagram showing the trends that are opening up opportunities for your startup.

This is another key slide for any pitch deck, as it demonstrates that you have done your research and that you understand the competitive landscape.

Start by defining the market segment you are targeting, and then show the key points of differentiation when compared to your primary competitors.

Describe how they fit into the customer’s perspective of the market, show where their strengths and weaknesses lie, and how you plan to compete with them.

This isn’t the place for a full analysis of your competitors, but you should be able to pitch yourself as the best company in your space, with a clear understanding of how you’re going to win.

There are two common ways to visualise your competitor analysis, the magic quadrant (or 2×2 matrix) and a comparison table.

The magic quadrant is a way of plotting your competitors on two axes, based on two factors that you’ll pluck from thin air. These visualisations are rarely credible unless you have a lot of experience in the market you are analysing, or they’ve been produced by large consultancies like Deloitte or Gartner.

On the other hand, comparison tables can be very effective as they’re easy to digest, position you alongside recognisable brands, and allow you to highlight the key differences between your company and your competitors. By comparing factors that are demonstrably important to customers, you’ll come across as more credible and able to back up your pitch with cold, hard facts.

Now it’s time to talk about marketing and sales strategy, or how you’re going to get your product or service in front of customers. This is where you’ll pitch your go-to-market strategy. Your go-to-market slide should include the following elements:

- The channels you will use to reach your target audience

- The actions you will take to put your product in front of potential customers

- The milestones you will hit as you progress through your go-to-market plan

- The resources you will require to reach your target successfully

Start by describing your target market and how you plan to reach them. This might include explaining your distribution channels, sales strategy, or marketing approach. You can also use this slide to talk about any partnerships you have in place, or how you plan to leverage them.

Next, explain the actions you will take to reach your target audience, and how you plan to measure success. These actions should fit within each of the channels that you’ve already identified. For example, if you’re using digital marketing, your actions might be things like website development, SEO, or social media campaigns.

Lastly, list the key milestones you will hit as you progress through your go-to-market plan, and identify the resources you will require to achieve them. You can include your team, budget for marketing activities, or specific assets like signage.

As a startup, traction is key. Investors want to see that you’re making progress and that your product is resonating with customers. This slide is often one of the trickiest for startups at idea-stage, as it can be difficult to show commercial progress and it will be too early for product-market fit.

There are a few different ways to pitch traction, and you need to choose the one that works best with your company and the stage you’re at. Some options include user base, revenue growth, or market validation.

If you’re focusing on your user base, you’ll want to pitch a clear and compelling story about your customer base. If you have a small data set, it’s worth showcasing your first 100 customers as this makes the numbers seem more real.

If you have a large customer base, pitch your exponential growth in terms of percentage or absolute figures. For example, pitch how many customers you signed in the past quarter or year.

Revenue Growth

If you’re focusing on revenue growth, pitch your current (or projected) sales figures. You can also pitch the average ticket size or value of your deals. Alternatively, pitch your revenue growth (in terms of percentage or absolute figures) over the past year.

Market Validation

If your product is still at idea-stage and still has a long way to go before it’s ready for market, pitch your progress in terms of real-world validation. For example, pitch the number of people who have registered to use your product or service, or pitch the number of companies that have expressed interest during interviews.

Most importantly, be honest about your progress. If they are interested, investors will dig into your traction claims and you’ll need to back them up with data – if it turns out that you’ve lied or embellished the facts, you’ll not only lose trust and credibility, you’ll probably lose the investment too.

Having set the scene in which your startup operates, it’s time to introduce the management team behind your startup. Investors will be keen to learn about who is leading your company and how they will transform your idea into a profitable business.

The focus here must be you and your co-founders. People invest in people, so you’ll need to show how you have the vision, experience, and motivation required to deliver on your pitch.

Keep your team slide short and sweet. You’ll want to include the founding team, highlighting their relevant experience in the industry or field that you’re operating within.

Pictures help to make your presentation more personal, so make sure you have a good quality headshot of each team member, consistently formatted so that everyone appears the same size and in focus.

The team slide should only include the founding team, though it is acceptable to include key team members, as well as notable advisors or investors if beneficial. If you do this, ensure that there is a clear visual separation between the two groups.

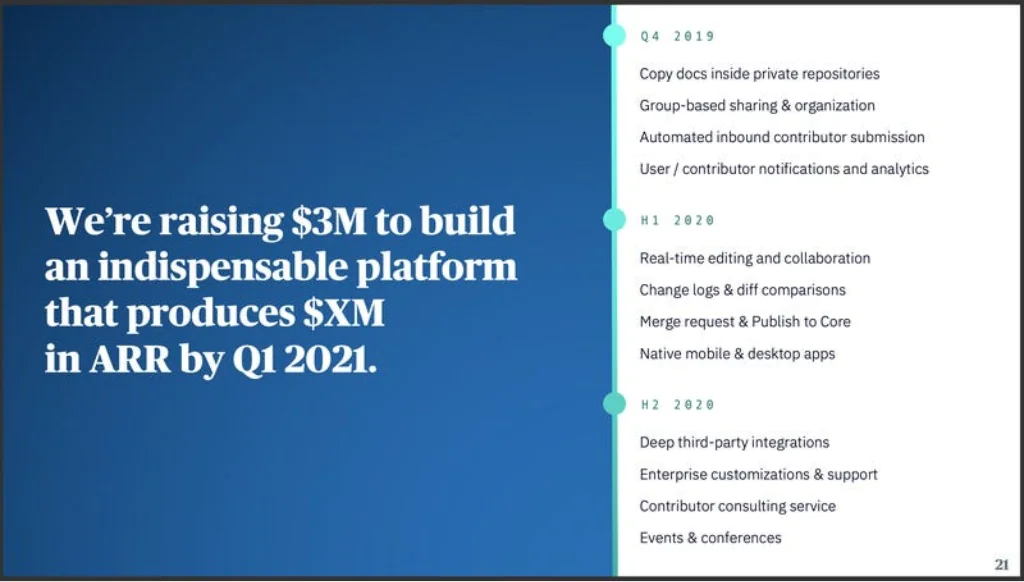

This is the big one. The pitch deck wouldn’t be complete without a clear proposal of what you’re asking for from your investors. This slide should clearly state the amount of money you’re seeking, as well as what you plan to do with it.

It’s important to remember that investors are looking for a return on their investment (ROI), so your proposal must be realistic and demonstrate how you will use the funds raised to reach key growth milestones.

To convince investors, your “Ask slide” will need to answer these three questions:

- How much are you seeking to raise?

- What will you do with the money?

- What do you intend to accomplish with the funds?

Always remember to pitch the ask in terms of how it benefits the investor – not just you. For example, if you’re seeking a £100,000 investment, explain how that money will help you reach a specific milestone that will create value for your investors.

Be specific about how much you need to raise, and where you plan to deploy the money. This will show that you’ve done your homework and understand how you will grow your business.

A simple pie chart with the breakdown of how you plan to use funds can go a long way towards demonstrating to investors that you’re serious about using their money wisely. For example, if 25 percent goes towards marketing spend, 30 percent for technology development, and 45 percent for new hires, that’s a good indication you have your priorities straight.

It’s unlikely that you will be profitable before the next round of funding, but it is usually worth highlighting the key numbers from your financial projections to give investors an idea of the scale and trajectory of your business.

Perhaps the most important factor in your investment ask is demonstrating that you understand how much capital you require to hit key growth milestones without requiring further funding rounds for at least 12-18 months. This is something that almost every investor will expect you to have a solid plan for.

Pitch Deck Design

Whether you’re sharing your deck by email or presenting on stage, the design of your pitch deck matters. However, you can’t afford to hire a professional pitch deck designer to help. So, what do you do?

KEEP. IT. SIMPLE.

Your pitch deck is not the place to show off your design skills – or highlight any lack of expertise in this department! The only goal of your pitch deck is to communicate information clearly and concisely so that investors understand what you’re pitching and can get excited about it.

Keep your presentation simple, use bold typography, highlight key information, and stick to a maximum of two or three colors. Resist the urge to use lots of graphics and animations, as these can be distracting and take up valuable space on your slides.

How to design a better pitch deck

There are a lot of things to consider when designing your pitch deck presentation. Below are some tips on how to make your pitch more effective:

The average investor has a short attention span, so keep your deck concise and easy to follow. Use clear language, avoid complex graphs and charts, and stick to a maximum of 15 slides.

Use the same fonts, colors, and layouts throughout your pitch deck to create a cohesive look.

Slides that are crowded with text and images will be difficult for your audience to read and comprehend.

A pitch deck template is a great way to ensure that your pitch deck looks professional and follows the proper design guidelines.

Pitch deck design tools

Today, there is a huge selection of online design tools and no-code builders to help you build your perfect deck. Below are just a few of the design platforms that can help you craft your pitch.

An easy-to-use platform that allows startups to build a beautiful slide deck without any special design skills. Start from scratch or create your slides using predefined pitch deck templates.

https://slidebean.com/

Offers a wide range of design tools and templates for creating professional pitch decks. The free version includes limited features, while the paid plans start at $12/month.

This pitch deck design app is great for startups and entrepreneurs who need to create a pitch deck quickly. The basic plan starts at $12/month (billed annually) but there is a 14-day free trial.

https://www.beautiful.ai/

The tools provided by Pitch allow you to quickly produce a high-quality pitch. Even if you’re not a designer, you can create a strong pitch deck that looks great. The basic plan is free, but you’ll need to upgrade to the paid plans for more features.

https://pitch.com/

While these design tools can be extremely powerful, it still pays to follow the same basic guidelines to ensure that your pitch deck is easy for investors to understand; Keep it simple, avoid animation, stick to a consistent layout, and make sure your text and images are easy to read.

When you’re trying to capture investors’ attention and raise equity funding, you need to show them that you have a good plan. But startups aren’t traditional businesses and they don’t use traditional business plans.

like the Holy Grail, the business plan remains largely unattainable and mythological. Most experts wouldn’t agree, but a business plan is of limited usefulness for a startup because entrepreneurs base so much of their plans on assumptions, “visions,” and unknowns. Guy Kawasaki

This is why pitch decks are the perfect approach to sharing a startup business plan.

Fundamentally, your pitch deck is used to share your vision, attract investors, and start conversations. As a founder, you should be prepared for investors who may not “get” your pitch deck right away — this doesn’t mean that they aren’t interested in what you’re doing.

Be prepared to answer questions and have an engaging conversation about your startup. Investors want to see that you have a clear understanding of your business, the problem you’re solving, and how you plan on making money. They also want to know that you’re capable of executing your vision.

Remember, pitch decks are just one part of the overall investment process. If you’re able to create a pitch deck that effectively communicates your idea and leaves investors wanting more, then you’re on the right track!

10 Corporate Deck Examples & Templates (That Stand Out)

Get tips for creating an impressive corporate pitch deck, see high-performing corporate slide deck examples, and grab a battle-tested corporate deck template.

8 minute read

helped business professionals at:

Short answer

What does a corporate deck include.

A typical corporate deck includes the following elements:

- Introduction (UVP + hook)

- Problem (your market segment has)

- Solution (you have that no one can copy)

- Market size and opportunity

- Business and revenue model

- Traction and validation

- Marketing/growth strategy

- Team (authority & experience)

- Investment and use of funds

Without an outstanding deck, you won't get funded.

The highly competitive business landscape makes it challenging to impress investors with your pitch. Countless hours spent crafting the perfect pitch may not be enough.

If you don't have a well-crafted corporate deck, you risk losing investors and missing out on the funding your business needs to succeed.

Read on to learn the key components of a winning corporate deck and get insights from templated corporate deck examples that have successfully secured funding for other companies. Let’s go!

What is a corporate deck?

A corporate deck, or corporate pitch deck, is a presentation designed to convey the essential aspects of a business to potential investors, partners, or stakeholders. A corporate deck includes slides that outline the company's business model, products or services, target market, competition, team, financials, and growth strategy.

Corporate pitch deck vs. startup pitch deck

The difference between a corporate deck and a startup deck is subtle. While a corporate deck is pitched to corporate incubators or departments for projects under the corporate umbrella, a startup pitch deck is pitched to investors as an independent business with the promise of a successful exit.

What is the goal of a corporate deck?

The goal of a corporate deck is to secure their investment, partnership, or stakeholder buy-in. To achieve this objective, corporate pitch decks should be heavily focused on showing the impact of the product, service or initiative on market-share, growth, and revenue.

If you're looking for other types of business presentations, check out our dedicated guides:

- Make a Sales Pitch Deck That Turns ‘Maybe’ to ‘Yes!’

- Create a Sales One-Pager (Examples, Writing Tips, Templates)

- Make a Winning Business Proposal Presentation in 12 Steps

- How to Create a Marketing Deck (Strategy, Tips & Templates)

Why most corporate decks fail (and how to avoid it)

The hard truth is that 99% of corporate decks fail to impress investors. That's a staggering statistic, but it's not surprising given the common pitfalls that many companies fall into when creating their presentations.

Here are the reasons why corporate decks fail and how to avoid these mistakes:

1. They use static slides that kill engagement

Static slides are engagement killers - there’s no option to visualize your data, include an actionable CTA, or deliver a pleasant reader experience on a mobile device.

Reengage your audience by incorporating interactive elements into your deck. Things such as videos, animations, clickable charts, or interactive ROI calculators.

Interactive content allows investors to explore the data on their own at their preferred pace. And when you allow investors to interact with your presentation, you’re increasing the chances of them reading it in full by 41% .

2. They offer facts rather than tell a story

Corporate slide decks that rely too heavily on listing out facts and figures are dry and tiring.

Instead of spouting facts, structure your deck around a compelling narrative that captures investors' attention and makes them care about your mission and vision.

If you’re not sure how to get started, here’s a video on how to improve storytelling in a pitch deck:

3. They are generic and fail to personalize

Investors are swamped with corporate decks on a daily basis, and they can smell generic from a mile away.

If you truly want to stand out from the crowd, you need to do your research ahead of time to understand the specific needs of your target audience.

By understanding what matters most to them, you can create a presentation that speaks directly to their concerns and demonstrates how your company can deliver value. Personalization gets 68% more people to read your deck in full .

4. They fail to use behavior data to continually optimize

Make sure you’re making data-driven decks instead of flying blind. If you’re sending out PDFs or PowerPoints that collect zero data about how readers engage with your deck there’s no way you’ll ever achieve a top performing deck.

The good news is that Storydoc decks collect insight on how your audience interacts with your deck, down to the slide and even button level. Where they skip, where they linger and when they share it with other decision-makers. Imagine what you could do with this info!

Corporate deck examples that stand out

A beautiful corporate presentation deck is a basic requirement - it’s not gonna make you stand out.

To create a deck that drives real results you’ll wanna take a close look at our list of the top corporate deck examples.

These corporate deck samples were all created using Storydoc and have been optimized for high engagement.

And the best part? All the examples are templated, which means you can use any of them to create your best-performing corporate deck in minutes!

Jump ahead to each example:

Startup pitch deck

What makes this deck great:

- The cover slide video enhances interaction, increasing engagement by up to 32% . This boosts the chances of potential investors reading the deck in its entirety and taking the desired action at the end.

- The roadmap slide offers a clear and concise presentation of your start-up’s journey. Meanwhile, various data visualization elements are perfect for demonstrating financial projections, proving that your business is making progress.

- The calendar integration on the final slide simplifies the process for investors to schedule the next meeting immediately after going through your corporate deck.

Light mode invest pitch deck

- The minimalist design makes your deck easy to follow even for those unfamiliar with the industry.

- With image and video placeholders , showcasing your solution and how it solves problems is effortless, without relying on complicated terminology.

- The interactive slides showcase the team behind your solution, illustrating their capability to steer it towards success.

Light mode product pitch deck

- The powerful personalization features enable you to produce an infinite number of versions of your deck in just a few clicks, resulting in 68% more people reading it entirely .

- The AI assistant lets you create relevant visuals or copy for the corporate pitch deck in just a few clicks.

- The intuitive editor automatically extracts the essential visuals of your company, ensuring that your deck maintains its brand consistency.

Investor pitch deck

- The fresh, contemporary design is sure to capture the attention of potential investors, particularly in trend-led industries.

- The perfect balance of text-based slides and engaging visuals enables you to present your key metrics while providing necessary context.

- The scroll-based interactive design facilitates explaining your solution to potential investors and guides them through a compelling narrative.

Pitch deck essentials

- The compact design makes it easy to communicate essential information in fewer slides, saving the investors' time.

- Various interactive slides provide potential investors with all the critical insights at first glance. By clicking through tabs, they can discover more about your solution, enhancing their engagement.

- The smart CTAs allow you to incorporate a live chat widget or calendar, smoothly directing potential investors to the next step.

Product pitch deck

- The combination of visual slides is ideal for presenting the product's primary features and use cases without overloading investors with walls of text.

- Videos that can be embedded and played directly from the deck allow you to include case studies from past customers to legitimize your product.

- An easy, intuitive editor ensures complete control over your presentation. If you release a new product version or make a typo in the specs, you can quickly make the necessary tweaks at any time, even after sending your deck.

- Powerful interactive design that doesn't detract from the main message. By using our running numbers slides and data visualization elements, you can present key metrics or financial projections to potential investors in an eye-catching, easy-to-understand format.

- Several data visualization elements that can be customized to your specific use case. You can also add real-time variables to your charts.

- The dynamic content allows your audience to interact with the deck. For example, you can embed an interactive ROI calculator that they can fill out to determine if they're getting their money's worth.

General invest pitch deck

- The versatile components make it suitable for pre-seed, seed, or series A funding. It includes all the necessary corporate deck elements that you can use to create a master deck.

- The ability to add customizable fields that can be filled in within seconds, making it possible to personalize your corporate deck at scale.

- The intuitive, user-friendly editor ensures that anything you add automatically adjusts to the overall deck layout. This means you don't have to worry about breaking the design.

Creative pitch deck

- The attention-grabbing design , featuring vibrant colors and animated elements, can convert casual scrollers into engaged readers.

- The fully interactive layout of this corporate deck increases interaction and extends the average reading time.

- The combination of visual and data visualization slides enables you to showcase snippets of your portfolio while emphasizing the most crucial metrics.

Bonus: successful corporate deck example by a Storydoc client

Finally, we left the best for last - a real-life corporate deck example created for one of our clients operating in the medical cannabis industry. It has been designed according to the best practices for creating a powerful corporate deck and delivered outstanding results.

- The running numbers slides enable readers to quickly and easily access the most critical metrics.

- The roadmap slide provides a clear and concise visualization of the company's current growth and significant milestones.

- The narrator slide simplifies complex financial metrics by directing the reader's attention to the exact numbers they should be focusing on at any given time.

How to create a corporate deck that stands out?

Putting together a corporate deck that leaves an impression and gets buy-in takes a lot of time and effort (and know-how) to get right.

But the truth is this task does not have to be so daunting. You can dramatically cut down the time and effort involved by leveraging corporate deck templates .

We have some tried and tested corporate pitch deck templates for you that are optimized for engagement and designed for making a lasting impression.

Make your best deck ever.

How to measure the effectiveness of a corporate deck.

To create a highly performing deck in the top 1%, it’s critical to measure performance, identify problems, and fix them.

Key corporate deck performance metrics to measure and optimize:

- Open rate: Measure the percentage of investors who open your corporate deck to understand how effective your deck is at generating initial interest.

- Reading time: Measure the total amount of time viewers spend reading your deck to gauge their level of interest.

- Engagement: Track how long viewers stay on each slide, how often they interact with the deck, or where they drop off to determine which parts of your corporate deck are most captivating and identify areas for improvement.

- CTA conversion rate: Measure the percentage of investors who take the desired action, such as scheduling a meeting, after viewing your corporate deck.

Here's a short video explaining how to get started with our analytics panel:

What is the best tool for making a corporate deck?

The best tool for making a corporate deck is intuitive, has lots of ready-made templates, and provides an outcome that stands out.

There are 2 types of tools on the market, legacy tools and next-generation tools, but only the next-gen tools will help you stand out.

Legacy tools like PowerPoint and Google Slides, Canva, and Visme will make same-old decks. But our own next-gen corporate deck creator makes interactive content experiences that make an impression.

Grab a template and see for yourself -

Hi, I'm Dominika, Content Specialist at Storydoc. As a creative professional with experience in fashion, I'm here to show you how to amplify your brand message through the power of storytelling and eye-catching visuals.

Found this post useful?

Subscribe to our monthly newsletter.

Get notified as more awesome content goes live.

(No spam, no ads, opt-out whenever)

You've just joined an elite group of people that make the top performing 1% of sales and marketing collateral.

Create your best corporate deck to date

Stop losing opportunities to ineffective presentations. Your new amazing deck is one click away!

Find answers to frequently asked questions.

Application

Term loan customers, line of credit customers, what products does ondeck offer.

We offer both business term loans and business lines of credit . When you apply with us, you’ll use one application and we’ll evaluate which product best fits your business’s cash flow and funding needs.

What are OnDeck’s loan amounts and terms?

Our term loan can offer from $5,000 to $250,000 in funding, with term lengths ranging from 18 to 24 months.

Our line of credit has a maximum limit of $100,000. A line of credit is a form of revolving credit, so as you pay down your balance, those funds will become available to use again.

Is OnDeck an unsecured loan?

OnDeck offers an unsecured line of credit . Our term loan is secured, but to provide maximum flexibility, we don’t require any specific amount, type or value of collateral. Plus, there is no appraisal or specific assets required.

Instead, we secure our term loans by placing a general lien on the assets of the business and they’re backed by a personal guarantee. We don’t take personal assets of the guarantors as collateral.

How do I qualify for OnDeck financing?

To qualify for funding from OnDeck, your business should have the following characteristics:

- Minimum one year in business.

- Minimum of $100,000 in annual revenue.

- Minimum 625 personal FICO score of the business owner.

- Business checking account.

Does OnDeck perform a hard or soft inquiry on my credit?

When determining eligibility, we’ll perform a soft credit check on the business owner’s personal credit.

What information do I need to apply?

Typically, we only require basic information about yourself and your business. We may ask for:

- Business Tax ID.

- Last three months of business bank statements.

- Social Security number of business owner(s).

How does the application process work?

Our application process is simple and typically takes about 10 minutes. You’ll complete one application, and we’ll evaluate which product is the best fit. You can apply online or over the phone by calling (888) 269-4246 .

What industries do you work with?

We work with more than 700 different kinds of businesses including restaurants, auto repair shops, healthcare professionals, contractors and many other service providers.

We don’t serve these restricted industries .

What are your rates and fees?

For term loans, your rate will be determined by the health of your business and cash flow. We charge an origination fee of 0% to 4% on your loan, and if you renew you may be eligible for subsequent reductions.

Is there any obligation if I apply?

No. If you apply for funding from OnDeck, there is no obligation to accept the loan offer. Your loan offer is valid for 30 days, at which time it expires.

How quickly can I receive an OnDeck loan?

OnDeck can deliver decisions in minutes and funding as soon as the same day. †

How does term loan funding work?

We fund term loans through the Automated Clearinghouse (ACH) system. If you’re approved, the funds will be deposited into your business bank as soon as the same day. †

What is line of credit instant funding? *

If you’re approved for a line of credit and have an eligible business debit card, instant funding * can give you immediate access to your line of credit funds.

We can transfer your funds within seconds or minutes, meaning you don’t need to wait the typical one to two business days it takes for a standard ACH transfer.

You can use instant funding * to make draws whenever you need funds — including nights, weekends and holidays.

Instant funding * is available to our line of credit customers with an eligible debit card associated with the business bank account that we have on file.

Sign in to your account to see if you qualify for instant funding. *

What is the difference between line of credit instant funding * and ACH?

Instant funding * is a funding method that uses a debit card network to process transactions. It usually takes seconds for funds to transfer through the network and reflect in your bank account. Funds are typically available to use immediately but may take up to 30 minutes.

ACH is a standard bank transfer to your verified business checking account. It is subject to standard bank transfer timing and can take one to two business days.

What kind of debit card can be used for line of credit instant funding? *

Instant funding * transfers money using the debit card network. In order to use it, you will need an active debit card attached to your business checking account.

We don’t support transferring funds to a personal debit card. You need a business debit card associated with the business bank account that we have on file. If you don’t have a debit card for the business bank account, you can still continue to make withdrawals using ACH.

Is there a limit to an amount that I can draw using instant funding? *

Yes, currently OnDeck only supports daily draws of $10,000 or less via instant funding. * For draws of more than $10,000 please use ACH.

Keep in mind your bank may have its own daily, weekly or other transfer restrictions on push-to-debit transfers as well. (A push-to-debit transfer is the payment technology that makes instant funding * possible.)

How does repayment work?

OnDeck will deduct payments from your business bank account on a daily, weekly or monthly basis, depending on what type of funding you’re approved for.

As an OnDeck customer, you’ll have access to an online account where you can monitor your loan and payment activity.

I can’t log in to my OnDeck account online, what do I do?

After clicking on “Sign In” you can access your account by clicking “Forgot Credentials” and verifying your information. You may also have password reset instructions emailed to you by clicking on “Reset Password.”

If you’re still having trouble accessing your account, please call (888) 556-3483 and our team can assist you.

Where can I see my current balance for my term loan or line of credit?

You can see your current balance through your online account.

Can I change my bank information online?

Currently, you aren’t able to update your bank information online. Please reach out to one of our loan advisors for more assistance at (888) 556-3483 .

OnDeck has filed a UCC on my business. How do I get this released?

Once your loan is paid in full, please email OnDeck Customer Support at [email protected] with a written request to release the UCC.

If you need payment support, please reach out to our loan advisors at (888) 556-3483 .

What other small business financing options are available for me?

Small businesses have more financing options today than ever before, yet navigating the maze of loan types and lenders can make it challenging to choose the right loan and the right lender for your business. Visit our blog to learn about other funding options or you may qualify for a business line of credit with our partners at Headway Capital .

How much of my payments go toward principal and interest?

This number will vary depending on the funding you receive and how close you are to paying off the balance. You can check your monthly statements, which you can access through your online account. If there isn’t a statement available, give us a call at (888) 556-3483 and one of our loan advisors will be happy to help.

I have questions about payments such as how to make additional payments or payment relief options.

An OnDeck loan advisor can help you with all your payment questions. Give us a call at (888) 556-3483 and we’ll be happy to help.

I believe there was an extra payment taken from my account. Why would I be seeing this?

ACH transactions take 24 hours to process so your account will always draft the day after we initiate the payment.

When am I eligible to reapply for funding?

You may be eligible for additional funding if you’ve reached six months of repayment or you’ve paid down 40% of your term loan — whichever comes first. However, you may want to speak with your loan advisor for more information before applying.

There is a hold on my line of credit. Who should I contact?

Please contact our payment support team at (888) 556-3483 .

I don’t need my line of credit anymore. How do I close it out?

If you need to permanently close your line of credit, please email [email protected] and request the closure.

Why don’t I see the instant funding * option on my account?

OnDeck’s instant funding * is available for customers with eligible debit cards. If you’d like more information you can contact our loan advisors at (888) 556-3483 .

Why did my instant funding * withdrawal fail after being successful before?

Instant funding * can fail for the following reasons:

- You recently got a new debit card issued for the account and you are still using an old debit card for the transaction.

- You have reached your account’s daily, weekly or monthly limits imposed by your bank.

- Your bank might be temporarily suspending push-to-debit transfers.

If you continue to see failed instant funding * draws, we recommend reaching out to your bank.

I used instant funding * for my draw. Why don’t I see the funds in my bank account right away?

It can take up to 30 minutes for an instant funding * withdrawal to reflect on your bank account.

If you don’t see the transfer after 30 minutes, please reach out to your bank. When speaking with your bank it’s important to explain that the funds will appear as an original credit transaction (OCT), which is a direct credit to your debit card.

I’m using my business debit card to register for instant funding * but I’m getting the error “Your card issuer does not support fund transfer to business debit cards.”

Not all banks support push-to-debit transfers. Some banks only support instant funding * for some of the debit cards and some banks don’t support instant funding * for any of their debit cards.

I’m using my correct business address to register for instant funding * but I’m getting the error “Please review all data fields and submit.”

To register your debit card, please make sure that:

- Your debit card has been activated.

- Your debit card hasn’t expired.

- The address you entered matches the address on your bank statement.

I’m on the draw page but I don’t see the instant funding * option. Will I still be able to make a draw using instant funding? *

If the instant funding * option isn’t available then the service may be temporarily unavailable. For more information or support, you can contact our team.

Unable to find the answer you’re looking for?

Is your business based in .

If so, please visit our website.

AI Presentation Maker

Pitch Deck vs Business Plan: Differences and Which to Use

Table of Contents

Have you ever spent time deciding between creating a pitch deck vs business plan? For startups and new business owners, where every minute counts, it’s crucial to concentrate on activities that deliver the most significant impact.

This blog article demystifies the pitch deck vs business plan, whether you aim to attract investors, secure a loan, or win over partners and clients. We’ll start with pitch decks, followed by business plans, with the goal of helping you choose wisely – so you can spend less time on paperwork and more time building your business.

1. What is a pitch deck?

A pitch deck is a slideshow that concisely conveys your business idea, market opportunity, and value proposition in a presentation format. Also known as a business or investor deck, they are used to quickly present business ideas, products, or services in 10 to 20 slides.

Purpose of a pitch deck

The purpose of a pitch deck is similar to that of an elevator pitch: tell a compelling story to grab the attention of potential investors, partners, or clients.

The goal isn’t to seal a deal on the spot but to spark sufficient interest to secure follow-up meetings and negotiate potential funding.

How long should a pitch deck be?

Your pitch deck should pack a punch, not bore your investors. Aim for 10-20 impactful slides . For complex ideas or specific industries, slightly more might be okay.

The 10/20/30 rule is your friend: make a 10-slide deck that grabs attention. Investors see hundreds of pitch decks a year. Choose quality over quantity – make each slide count!

💡 Related article: How many slides do you need for a 10-minute presentation?

What should be in a pitch deck

Most successful pitch decks follow a similar flow to keep investors hooked. The tried-and-tested 10-slide pitch deck format is a great starting point but be prepared to adjust or add slides for emphasis.

These are the 10 core slides for a pitch deck based on Guy Kawasaki’s 10/20/30 rule:

- Problem slide

- Solution slide

- Market size and opportunity

- Product/service

- Business model

- Competition

- Financials and key metrics

- Ask (funding needs)

Here are additional slides you may include based on specific business and investor preferences:

- Introduction

- Go-to-market (GTM) slide

- Sales and marketing strategy

- Use of funds

- Exit strategy

💡 Learn more about the 10/20/30 rule: How to create a pitch deck (and the 10 slides you need)

Pitch deck examples

Curious how some tech unicorns have pitched their ideas in the early stages? Here are two examples that have proven successful.

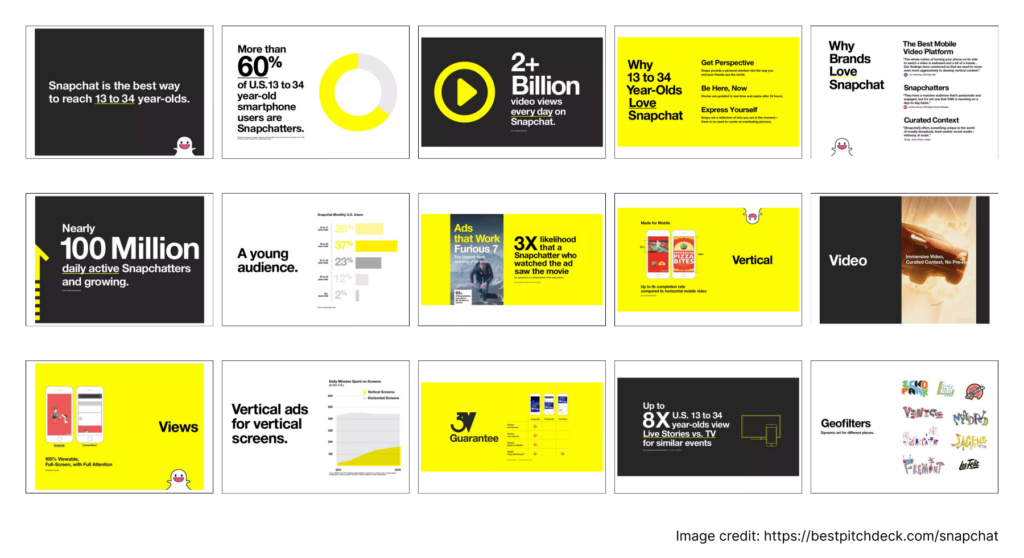

✅ Snapchat pitch deck (2013, Pre-seed)

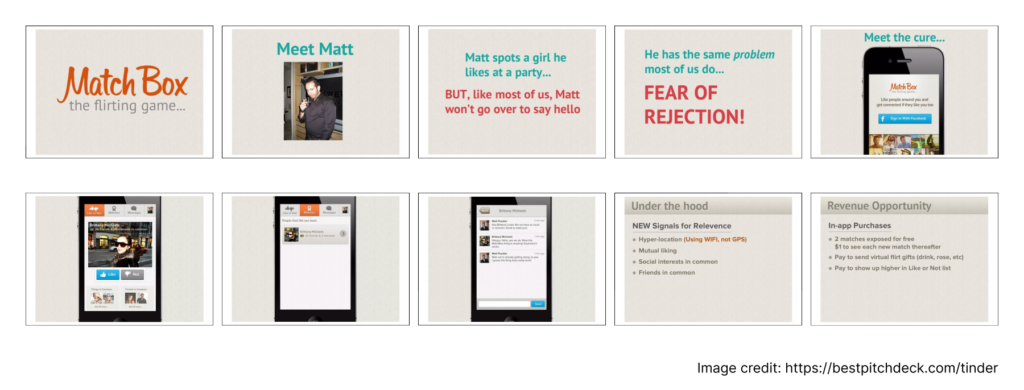

✅ Tinder pitch deck (2016, Seed)

Examples from Best Pitch Decks

2. What is a business plan?

A business plan is a written document with detailed information that acts as a roadmap for your business. A traditional business plan is a formal document that outlines all aspects of your business, including its goals, strategies, market analysis, operational structure, and financial forecasts for the next 3 to 5 years. Most business plans are created in a Word document or report format, ranging from 10 to hundreds of pages long.

There are other types of less formal business plans used by startups or for internal alignment:

- Lean startup plan/Lean canvas: Summarizes the value proposition and business model into a single page, with a focus on the problem-solution fit.

- One-page business plan: Fits the essential information of a business into one page. Great for quickly testing an idea’s viability or getting immediate feedback.

- Internal business plan: Less formal, designed for use within an organization — for example, a feasibility business plan, operations plan, strategic, or expansion plan.

Purpose of a business plan

Business plans aren’t just for paperwork – they drive action and results. Think of your business plan as a multi-purpose tool that serves several vital functions:

- Attract investors

- Fundraising or securing loans

- Map your strategy

- Provide a strategic roadmap

- Track business progress or provide a performance benchmark

- Win over partners, talents, and potential hires

Components of a business plan

Business plans don’t have a right or wrong format; only different situations call for other formats. You can mix different plan types to prioritize components that directly support your objectives.

What to include in a traditional business plan:

- Executive summary: A concise overview of your entire business plan, highlighting the most critical points.

- Company description: What your business does, the problem it solves, your target market, and competitive advantages.

- Market analysis: Research data like market size, trends, competitors, and customer demographics.

- Organization and management: The business structure, roles, and experience of key team members.

- Products or services: Details on your offer, including features, benefits, pricing, and any intellectual property considerations.

- Sales and marketing strategy: How you plan to reach your target customers (market) and tactics to promote and drive sales.

- Financial projections: Forecasts of your income, expenses, cash flow, and profitability for the next 1 to 5 years.

- Funding request: If you are fundraising, state the amount, how it will be used, and the terms you offer investors.

- Appendix: Include any supplemental information and documents.

💡 Pro tip: Customize your plan! Add, remove, or rearrange sections to achieve your goals.

How long should a business plan be?

Think about your reader and your goal. Need a detailed plan for a bank loan? That might be 15-25 pages. Want a quick internal roadmap? A one-page Lean Canvas could work. Consider your industry, who’s reading it, and what you need the plan to do.

💡 Pro tip: Choose quality over quantity. Focus on clarity, regardless of length.

How long does it take to write a business plan?

It can take anything from 20 minutes to 20 weeks. The whole process of creating a business plan can be time-consuming (if opting for a long format), and it can also be quick (for example, the Lean Canvas).

The general advice is: Don’t overthink your first business plan. Start simple, move fast, and build as you grow. Business plans aren’t static, so be prepared to refine and expand your plan as the business evolves.

💡 Pro tip: It’s not uncommon to uncover some challenging sections while writing the plan – the key is to show awareness of these issues and ways to overcome them.

Business plan templates

Not sure where to start? Use these example plans and templates from these reputable sources to get you started:

- SBA.gov: Write your business plan – Has the traditional business plan and lean startup business plan templates

- SCORE.org – Has business plan templates for a startup , an established business , and the Business Model Canvas

- Bplans has over 550 business plan examples across multiple industries, which you can use for inspiration.

Create presentation slides with AI in Seconds in Google Slides

10M+ Installs

Works with Google Slides

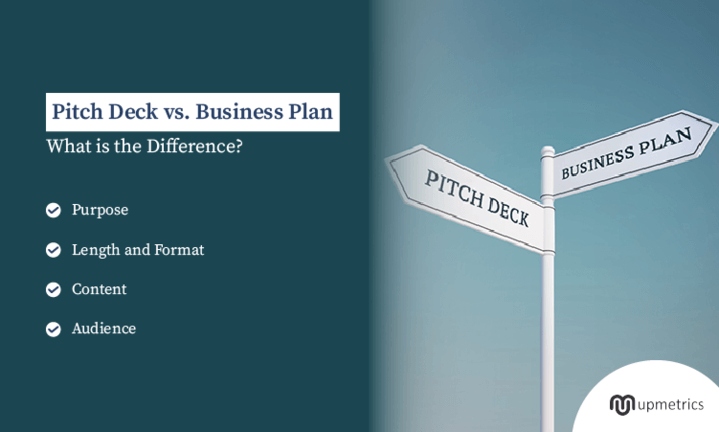

3. Pitch deck vs business plan: the differences

Now that you understand pitch decks and business plans, let’s dive into their key differences.

- Pitch decks are short and punchy, designed to grab investors’ attention and get you that crucial meeting.

- Business plans are thorough and detailed documents, perfect for in-depth analysis or large funding requests.

💡 Think of it this way: Pitch decks are the attention-grabbing movie trailers that sell the whole project. Business plans are your complete blueprint.

Both documents can serve you, but understanding their differences helps you select the best tool for attracting investment or charting your company’s path.

4. Do you need a pitch deck or a business plan?

In the past, business plans were the standard document to present a business idea to investors. However, simple business plans and pitch decks are increasingly popular, especially in startups.

Here’s how to choose the right tool for the job:

🎯 Pitches and investor meetings

Pitch decks provide a snapshot of your business or idea’s potential to spark interest and secure future investor meetings.

🎯 Early stages or for idea validation

Use a simple business plan or Lean Canvas, as the format forces you to focus on the core problem you’re solving and the solution.

🎯 Internal roadmap and planning

Formal business plans will aid in longer-term strategic planning, or they can be shorter since they are for internal use.

🎯 Complex business model

Create a thorough business plan with intricate details; short plans and pitch decks wouldn’t cut it for specific industries or complicated business models.

🎯 Fundraising, loans, or traditional financing

Banks, investors, and government-funded grant applications often require a detailed business plan. Whether you seek debt or equity funding, angel investors, VCs, and banks need compelling reasons to support your venture.

💡 Pro tip: You’ll still need a traditional business plan for detailed strategy or significant funding!

- No design skills required

- 3 presentations/month free

- Don’t need to learn a new software

5. Conclusion

Pitch decks and business plans aren’t simply documents – they’re essential tools for driving your business forward. Now that you know the difference, consider your current needs. Ready to capture investor attention? Start crafting a compelling pitch deck. Need a detailed roadmap? Begin writing a winning business plan. Use the resources in this guide to get started and put your business on the right track toward success!

When should you write a business plan?

According to research by Harvard Business Review , between six and 12 months after deciding to start a business. For various reasons, crafting a comprehensive business plan either earlier or later doesn’t necessarily impact business success:

- Most startups pivot from their original ideas and plans.

- The time needed to create a thorough plan is better spent on other business activities (at least initially).

- Creating an elaborate plan may distract entrepreneurs from seeing opportunities in real time and responding to real customers’ needs.

Planning is valuable, and entrepreneurs who plan are more likely to start a successful business. However, you don’t need a complex business plan to begin working on your business. It’s okay to create a plan early on but remember; it’s more about being strategic with your time than trying to forecast the future from the start.

What’s the difference between a business plan and a canvas?

They differ in complexity and length. Business plans are longer and more detailed and are typically used to secure funding from investors or financial institutes.

A canvas, Lean Canvas , or business plan canvas, is a 1-page business plan. The Lean Canvas template helps you deconstruct your idea and focus on finding customer problems worth solving without a significant time investment.

It is popular as a direct replacement for traditional business plans within startups. The canvas can be used for quick and efficient brainstorming of multiple business models in a few hours or less.

How do I turn a business plan into a pitch deck?

Once you’ve done the groundwork of creating a business plan, you can reuse some of the insights, data, and information for a pitch deck.

- First, extract the core details from the business plan, such as the problem you solve, the solution, the size of the market, team strengths, and financials.

- Translate that information into your chosen pitch deck template (for example, the 10-slide pitch deck ) or use an AI presentation generator tool such as SlidesAI to structure your slides.

- Add and emphasize visuals. Replace some text with charts, diagrams, and graphs whenever applicable.

- Edit and keep the pitch deck focused and clear. Quality over quantity!

- Get feedback, practice your pitch, and then iterate on the deck until you are ready to show it to investors.

💡 Related article: 5 best free AI pitch deck generators 2024

Is a pitch deck only for investors?

No, while the primary purpose of a pitch deck is to attract funding, it can be adapted for various audiences and goals, such as partnerships, customers (especially enterprise customers), grant applications, startup or pitch competitions, or even for internal alignment within your team.

Save Time and Effortlessly Create Presentations with SlidesAI

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

Quickbooks Sync and compare with your quickbooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how it works →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

Business Consultant & Advisors Plan with your team members and clients

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

- 400+ Sample Business Plans

Pitch Deck VS. Business Plan: What is the Difference

- May 8, 2024

Pitch deck or a business plan—confused about which of these business documents you should create for your business?

Well, the short answer is both.

But, in a thriving startup world, where time’s a chase, knowing what will help you to make the most significant impact will make the choice easier.

Through this blog post, let’s help you understand the key differences between these two documents, i.e. pitch deck vs business plan , and instances when you will need them.

Ready to get started? Let’s dive right in.

What is a pitch deck?

A pitch deck is a concise visual presentation, often used by startups and emerging entrepreneurs, to introduce their business potential in front of investors and potential stakeholders.

These presentations explain the key details of your plan such as the problem, solution, revenue model, traction, financials, and organizational team through engaging visuals and simple text blocks.

Pitch decks hook the audience to your excellent business idea and persuade them to engage further or take action.

Pitch decks are important for a quick business introduction. But let’s now gather a basic overview of what a business plan is.

What is a business plan?

A business plan is a professional document outlining the goals, strategies, and operational aspects of your business. It serves as a guide for decision-making and offers a roadmap to achieve your business objectives.

Business plans, in general, include key components like executive summary, company overview, market analysis, products and services, marketing and sales strategy, operation plan, management team, and financial plan.

It’s one detailed document that will help you to secure funds from potential investors.

Now, that you have gathered a fair understanding of pitch decks and business plans, let’s understand what makes them different.

Difference between a pitch deck and a business plan

Pitch decks are crisp offering a macro overview of your business idea through sharp and remarkable visuals. Business plans, on the other hand, are immaculately detailed, offering a micro overview of what your business does and where it aims to reach.