- Crafting an Effective Partner Business Plan: Essential Elements for Success

Share this article

Print/Download PDF

By Harrison Barnes

Rate this article

900 Reviews Average: 5 out of 5

Discuss Partners on Top Law Schools

- ideas on how to network with judge's son who is partner?

- Networking/taking a partner at a firm out to lunch?

- NYC Study Partners- for those truly motivated

- 165+/Retake Study Partner?

- Arizona Study Partner

Partner Business Plans: Key Elements

- The Crucial Role of Business Plans in Law Firm Partner Success

- Maximize Portables in Your Business Plan in Order to Maximize Interest in You

The Importance of a Great Business Plan

Professional Goals For Partner Status

Making an evaluation of your existing practice, describing your vision as a partner, creating a strategy for growth.

- A partner's fit culturally

- The viability of a partner's practice for the long-term

- A partner's record of excellent client service to long-term clients and producing business

- A partner's history of consistently increasing collections

- A partner's practice fit in connection with the firm's strategic plan for expansion

- Whether a partner's practice area is one that is targeted for growth

- Whether the partner brings portable business and/or specific expertise needed in a particular practice area

- The opportunities the partner would bring for business development and significant cross-selling were the partner to join the firm

- Whether the partner's historical information is reflective of consistent productivity

- Whether the partner's client base fits within the firm's client structure

- Any potential conflicts that would preclude the firm from hiring the partner

- A partner's current compensation and compensation expectation

- A partner's potential contribution to the firm's bottom line/profitability

- A partner's fit within the firm's current attorney roster

- A partner's reason for leaving his or her current firm (voluntary/mutual arrangement) and whether the partner would be a problem

- Creative: Serve as a marketing piece on the partner and enable the firm to assess the partner's business potential. It should also provide an outlet to the partner to step out of the resume format and chart his or her previous performance and future prospects for business in a creative format.

- Illustrative: Illustrate to a firm that the partner is thinking about his or her practice as a business and set forth his or her plan for the future.

- Persuasive: Persuade the firm to hire the partner.

- Historical: Chart a historical record of the partner's history of creating business opportunities and his or her ability to develop and foster client relationships over an extended period of time.

- Demonstrative: Demonstrate a partner's business-development skills, initiative, and ability to contribute not only to his or her own success but also to the success of his or her colleagues through cross-selling efforts. It should also demonstrate ways a partner can contribute to a firm's financial bottom line, enhance its practice-group development, and ultimately bring added value to the team.

- Prophetic: Prophesy what the partner believes he or she will be able to accomplish in his or her practice and for the firm in the short and long term.

- Preparatory: Prepare the partner for the interviewing process.

Introduction

- Provide a narrative including professional history, practice overview, and a description of areas of expertise. This section may highlight briefly particular areas of expertise that the firm does not currently have.

- Describe the partner's role historically as a business developer.

- Briefly touch upon why the partner believes he or she would be a good fit for a particular firm.

Market Research/Analysis

- Give analysis of local need for services in partner's practice area.

- Describe local competition/other law firms with similar practices.

- Give overview of need in local market for partners with his or her expertise.

- Describe why partner believes firm provides the best platform in the marketplace for his or her particular practice area.

Current Client Base

- Describe current portable clients (use generic or specific).

- Describe key industries serviced.

- Discuss other partners' clients partner is servicing.

Additional Contacts to Develop

- Discuss contacts not yet tapped.

- Given market analysis, project possible targets in local, regional, national, or international markets.

- Discuss possible expansion of business from current client base.

Cross-Selling Opportunities

- Describe cross-selling opportunities with current clients.

- Describe cross-selling opportunities with known key clients of prospective firm.

- Discuss other practice areas at current firm to which partner is delegating work.

- Discuss services your clients are requesting that you cannot currently service at your firm and could otherwise capture at the new firm .

Other Business-Development Sources

- Describe additional business contacts you are pursuing or plan to pursue

- Speeches, publications

- Community organizations

- Bar associations

- Internal marketing initiatives

- Client seminars/newsletters

Long-Term Strategy Goals and Targets

- Set targets for expansion of practice in terms of collections, attorneys, and clients/industries.

- Consider possibility of local to regional to national growth patterns.

- Consider growth in other key competencies which may be affected by partner's long-term success.

- Discuss long-term strategies in connection with firm's overall strategic plan and practice-group development plans.

Historical Collections, Billing Rates, and Billable Hours

- If a partner with a lower billing rate structure, chart the anticipated rate increases by portable client or anticipated timeline for rate increases to current clients. Discuss any alternative billing arrangements you currently have in place with clients.

- Include three-year client collections history by client (as originating attorney and as billing attorney on other attorneys' matters). Include projection for current fiscal year.

- Include three-year billing rate history.

- Include three-year historical compensation history (including bonus information).

- Include three-year billable hour history.

- Note pending projects contributing to future collections.

- Include a summary of anticipated collection projections for the next three to five years.

- Business-development budget

- Time commitments from partners in other practice areas for cross-selling purposes

- Key staff needed (secretary, paralegals, etc.)

- Foreign-language skill requirements

- Travel expenses

- Marketing materials, presentations, etc.

Creative Conclusion

- Recap key points in plan, added value partner brings, and reasons he or she would be a good fit.

- Emphasize flexibility of plan and eagerness and willingness to discuss and modify in accordance with firm's plans and objectives.

- See 30 Ways to Generate Business as an Attorney for more information.

Want to continue reading?

Become a free bcg attorney search subscriber..

Once you become a subscriber you will have unlimited access to all of BCG’s articles.

There is absolutely no cost!

Harrison Barnes does a weekly free webinar with live Q&A for attorneys and law students each Wednesday at 10:00 am PST. You can attend anonymously and ask questions about your career, this article, or any other legal career-related topics. You can sign up for the weekly webinar here: Register on Zoom

Harrison also does a weekly free webinar with live Q&A for law firms, companies, and others who hire attorneys each Wednesday at 10:00 am PST. You can sign up for the weekly webinar here: Register on Zoom

You can browse a list of past webinars here: Webinar Replays

You can also listen to Harrison Barnes Podcasts here: Attorney Career Advice Podcasts

You can also read Harrison Barnes' articles and books here: Harrison's Perspectives

Harrison Barnes is the legal profession's mentor and may be the only person in your legal career who will tell you why you are not reaching your full potential and what you really need to do to grow as an attorney--regardless of how much it hurts. If you prefer truth to stagnation, growth to comfort, and actionable ideas instead of fluffy concepts, you and Harrison will get along just fine. If, however, you want to stay where you are, talk about your past successes, and feel comfortable, Harrison is not for you.

Truly great mentors are like parents, doctors, therapists, spiritual figures, and others because in order to help you they need to expose you to pain and expose your weaknesses. But suppose you act on the advice and pain created by a mentor. In that case, you will become better: a better attorney, better employees, a better boss, know where you are going, and appreciate where you have been--you will hopefully also become a happier and better person. As you learn from Harrison, he hopes he will become your mentor.

To read more career and life advice articles visit Harrison's personal blog.

Article Categories

- Legal Recruiter ➝

- Attorney Career Advice ➝

- Advice for Partners ➝

- Business Plans

Do you want a better legal career?

Hi, I'm Harrison Barnes. I'm serious about improving Lawyers' legal careers. My only question is, will it be yours?

About Harrison Barnes

Harrison is the founder of BCG Attorney Search and several companies in the legal employment space that collectively gets thousands of attorneys jobs each year. Harrison is widely considered the most successful recruiter in the United States and personally places multiple attorneys most weeks. His articles on legal search and placement are read by attorneys, law students and others millions of times per year.

Find Similar Articles:

- strategic Partnerships

- risk Analysis

- regulatory Compliance

- professional Development

- Partner Business Plans

- legal Advice

- law Firm Planning

- governance Strategies

- goal Setting

- financial Management

- crisis Management

- corporate Structure

- contract Negotiation

- conflict Resolution

- business Law

Active Interview Jobs

Featured jobs.

Location: California - Santa Ana

Location: New York - New York City

Location: California - San Jose

Most Viewed Jobs

Location: New York - Syracuse

Location: Illinois - Chicago

Upload Your Resume

Upload your resume to receive matching jobs at top law firms in your inbox.

Additional Resources

- Harrison's Perspectives

- Specific Practice Areas

- The Winning Mindset

BCG Reviews

1. I enjoyed that BCG gave me options, and lots of them. I also enjoyed that BCG connected me with a specialized recruit.... Read more >

Savian Gray-Sommerville

University of North Carolina School of Law, Class Of 2020

One of my favorite things about working with BCG was how responsive they were. Working with BCG made my job search easie.... Read more >

Isaac Swaiman

University of Minnesota Law School, Class Of 2013

My favorite thing was working with my legal placement professional at BCG. She was very responsive with questions that I.... Read more >

Christopher C.

UC Berkeley School of Law, Class Of 2013

I would say that my legal placement professional was extremely attentive, sometimes I would message or email her on the .... Read more >

Kara Maddalena

Northeastern University School of Law, Class Of 2014

Working with BCG gave me access to opportunities that weren't necessarily posted in the market place. The job I ended up.... Read more >

Alison Holdway

New York University School of Law, Class Of 2014

I liked the amount of opportunities that were available, the responsiveness of the person I worked with, and the amount .... Read more >

Tasha Thomas

The George Washington University Law School, Class Of 2014

Popular Articles by Harrison Barnes

- What is Bar Reciprocity and Which States Allow You to Waive Into the Bar?

- What Do Law Firm Titles Mean: Of Counsel, Non-Equity Partner, Equity Partner Explained

- Top 6 Things Attorneys and Law Students Need to Remove from Their Resumes ASAP

- Why Going In-house Is Often the Worst Decision a Good Attorney Can Ever Make

- Top 9 Ways For Any Attorney To Generate a Huge Book of Business

Helpful Links

- The BCG Attorney Search Guide to Basic Law Firm Economics and the Billable Hour: What Every Attorney Needs to Understand to Get Ahead

- Quick Reference Guide to Practice Areas

- Refer BCG Attorney Search to a Friend

- BCG Attorney Search Core Values

- Recent BCG Attorney Search Placements

- What Makes a World Class Legal Recruiter

- What Makes BCG Attorney Search The Greatest Recruiting Firm in the World

- Top 10 Characteristics of Superstar Associates Who Make Partner

- Off-the-Record Interview Tips From Law Firm Interviewers

- Relocating Overseas

- Writing Samples: Top-12 Frequently Asked Questions

- The 'Dark Side' of Going In-house

- "Waive" Goodbye To Taking Another Bar Exam: Typical Requirements and Tips to Effectively Manage the Waive-in Process

- Changing Your Practice Area

- Moving Your Career to Another City

- A Comprehensive Guide to Working with a Legal Recruiter

- A Comprehensive Guide to Bar Reciprocity: What States Have Reciprocity for Lawyers and Allow You to Waive into The Bar

Related Articles

A Career Guide for Law Firm Partners

Practice Management

Marketing Your Law Firm Through Practice Groups

Related Video

- What is a Counsel and How does it Compare to a Partner�

Related Podcast

- How Any Attorney Can Get a $100+ Million Book of Business, Become a Partner in a Major Law Firm, or Start a Successful Business and Retire Whenever They Want�

When you use BCG Attorney Search you will get an unfair advantage because you will use the best legal placement company in the world for finding permanent law firm positions.

Don't miss out!

Submit Your Resume for Review

Register for Unlimited Access to BCG

Sign-up to receive the latest articles and alerts

Already a subscriber? Sign in here.

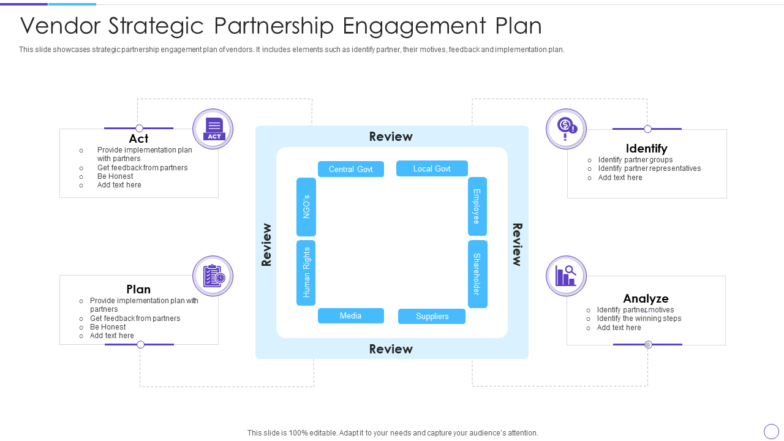

Improving the management of complex business partnerships

Partnerships never go out of style. Companies regularly seek partners with complementary capabilities to gain access to new markets and channels, share intellectual property or infrastructure, or reduce risk. The more complex the business environment becomes—for instance, as new technologies emerge or as innovation cycles get faster—the more such relationships make sense. And the better companies get at managing individual relationships, the more likely it is that they will become “partners of choice” and able to build entire portfolios of practical and value-creating partnerships.

Of course, the perennial problems associated with managing business partnerships don’t go away either—particularly as companies increasingly strike relationships with partners in different sectors and geographies. The last time we polled executives on their perceived risks for strategic partnerships, 1 Observations collected in McKinsey’s 2015 survey of more than 1,250 executives. Sixty-eight percent said they expect their organizations to increase the number of joint ventures or large partnerships they participate in over the next five years. A separate, follow-up survey in 2018 showed that 73 percent of participants expect their companies to increase the number of large partnerships they engage in. the main ones were: partners’ disagreements on the central objectives for the relationship, poor communication practices among partners, poor governance processes, and, when market or other circumstances change, partners’ inability to identify and quickly make the changes needed for the relationship to succeed (exhibit).

In our work helping executive teams set up and navigate complex partnerships, we have witnessed firsthand how these problems crop up, and we have observed the different ways companies deal with them . The reality is: successful partnerships don’t just happen. Strong partners set a clear foundation for business relationships and nurture them. They emphasize accountability within and across partner companies, and they use metrics to gauge success. And they are willing to change things up if needed. Focusing on these priorities can help partnerships thrive and create more value than they would otherwise.

Establish a clear foundation

It seems obvious that partner companies would strive to find common ground from the start—particularly in the case of large joint ventures in which each side has a big financial stake, or in partnerships in which there are extreme differences in cultures, communications, and expectations.

Yet, in a rush to complete the deal, discussions about common goals often get overlooked. This is especially true in strategic alliances within an industry, where everyone assumes that because they are operating in the same sector they are already on the same page. By skipping this step, companies increase the stress and tension placed on the partnership and reduce the odds of its success. For instance, the day-to-day operators end up receiving confusing guidance or conflicting priorities from partner organizations.

Would you like to learn more about our Strategy & Corporate Finance Practice ?

How can the partners combat it? The individuals expected to lead day-to-day operations of the partnership, whether business-unit executives or alliance managers, should be part of negotiations at the outset. This happens less often than you think because business-development teams and lawyers are typically charged with hammering out the terms of the deal—the objectives, scope, and governance structure—while the operations piece often gets sorted out after the fact.

Transparency during negotiations is the only way to ensure that everyone understands the partners’ goals (whether their primary focus is on improving operations or launching a new strategy) and that everyone is using the same measures of success. Even more important, transparency encourages trust and collaboration among partners, which is especially important when you consider the number of executives across the organizations who will likely rotate in and out of leadership roles during the life of the relationship.

Inevitably, points of tension will emerge. For instance, companies often disagree on financial flows or decision rights. But we have seen partners articulate such differences during the negotiation period, find agreement on priorities, and reset timelines and milestones. They defused much of the tension up front, so when new wrinkles—such as market shifts and changes in partners’ strategies—did emerge, the companies were more easily able to avoid costly setbacks and delays in the business activities they were pursuing together.

Nurture the relationship

Even business relationships that start off solidly can erode, given individual biases and common communication and collaboration issues. There are several measures partners can take to avoid these traps.

Connect socially

If executives in the partner organizations actively look for opportunities to understand one another, good collaboration and communication at the operations level are likely to follow. Given time and geographic constraints, it can be hard for them to do so, but as one energy-sector executive who has negotiated and managed dozens of partnerships noted, “It’s important to spend as much time as you can on their turf.” He says about 30 to 40 percent of partnership meetings are about business; the rest of the time is spent building friendships and trust.

Keep everyone in the loop

Skipping the step of keeping everyone informed can create unnecessary confusion and rework for partner organizations. That is what happened in the case of an industrial joint venture: the first partner in the joint venture included a key business-unit leader in all venture-related discussions. The second partner apprised a key business-unit leader about major developments, but this individual did not actually join the discussions until late in the joint-venture negotiation. At that point, as he learned more about the agreement, he flagged several issues, including inconsistencies in the partners’ access to vendors and related data. He immediately recognized these issues because they directly affected operations in his division. Because he hadn’t been included in early discussions, however, the partners wasted time designing an operating model for the joint venture that would likely not work for one of them. They had to go back to the drawing board.

Recognize each other’s capabilities, cultures, and motivations

Partners come together to take advantage of complementary geographies, corresponding sales and marketing strengths, or compatibilities in other functional areas. But it is important to understand which partner is best at what . This process must start before the deal is completed—but cannot stop at signing. In the case of one consumer-goods joint venture, for instance, the two partner organizations felt confident in their plan to combine the manufacturing strength of one company with the sales and marketing strengths of the other. During their discussions on how to handle financial reporting, however, it became clear that the partner with sales and marketing strengths had a spike in forecasting, budgeting, and reporting expertise. The product team for the first partner had originally expected to manage these finance tasks, but both partner teams ultimately agreed that the second partner should take them on. In this way, they were able to enhance the joint venture’s ongoing operations and ensure its viability.

Equally important is understanding each partner’s motivation behind the deal. This is a common point of focus during early negotiations; it should continue to be discussed as part of day-to-day operations—particularly if there are secondary motivators, such as access to suppliers or transfer of capabilities, that are important to each partner. Within one energy-sector partnership, for instance, the nonoperating partner was keen to understand how its local workforce would receive training over the course of the partnership. This company wanted to enhance the skills of the local workforce to create more opportunities for long-term employment in the region. The operating partner incorporated training and skill-evaluation metrics in the venture’s quarterly updates, thus improving the companies’ communication on the topic and explicitly acknowledging the importance of this point to its partner.

Invest in tools, processes, and personnel

Bringing different business cultures together can be challenging, given partners’ varying communication styles and expectations. The good news is that there are a range of tools—among them, financial models, key performance indicators, playbooks, and portfolio reviews—companies can use to help bridge any gaps. And not all these interventions are technology dependent. Some companies simply standardize the format of partnership meetings and agendas so that teams know what to expect. Others follow stringent reporting requirements.

Another good move is to convene an alliance-management team. This group tracks and reviews the partnership’s progress against defined metrics and helps to spot potential areas of concern—ideally with enough time to change course. Such teams take different forms. One pharmaceutical company with dozens of commercial and research partnerships has a nine-member alliance-management team charged mostly with monitoring and flagging potential issues for business-unit leaders, so it consists of primarily junior members and one senior leader who interacts directly with partners. An energy company with four large-scale joint ventures has taken a different approach: its alliance-management team comprises four people, but each is an experienced business leader who can serve as a resource for the respective joint-venture-leadership teams.

Sometimes partnerships need a structural shake-up—and not just as an act of last resort.

How companies structure these teams depends on concrete factors—the number and complexity of the partnerships, for instance—as well as intangibles like executive support for alliances and joint ventures and the experiences and capabilities of the individuals who would make up the alliance-management team.

Emphasize accountability and metrics

Good governance is the linchpin for successful partnerships; as such, it is critical that senior executives from the partner organizations remain involved in oversight of the partnership. At the very least, each partner should assign a senior line executive from the company to be “deal sponsor”—someone who can keep operations leaders and alliance managers focused on priorities, advocate for resources when needed, and generally create an environment in which everyone can act with more confidence and coordination.

Additionally, the partners must define “success” for their operations teams: What metrics will they use to determine whether they have hit their goals, and how will they track them? Some companies have built responsibility matrices; others have used detailed process maps or project stage gates to clarify expectations, timelines, and critical performance measures. When partnerships are initially formed, it is usually the business-development teams that are responsible for building the case for the deal and identifying the value that may be created for both sides. As the partnership evolves, the operations teams must take over this task, but they will need ongoing guidance from senior leaders in the partner organizations.

Build a dynamic partnership

Sometimes partnerships need a structural shake-up—and not just as an act of last resort. For instance, it might be less critical to revisit the structure of a partnership in which both sides are focused on joint commercialization of complementary products than it would be for a partnership focused on the joint development of a set of new technologies. But there are some basic rules of thumb for considering changes in partnership structure.

Partner organizations must acknowledge that the scope of the relationship is likely to shift over time. This will be the case whether the partners are in a single- or multiasset venture, expect that services will be shared, anticipate expansion, or have any geographic, regulatory, or structural complexities. Accepting the inevitable will encourage partners to plan more carefully at the outset. For example, during negotiations, the partners in a pharmaceutical partnership determined that they had different views on future demand for drugs in development. This wasn’t a deal breaker, however. Instead, the partners designated a formula by which financial flows would be evaluated at specific intervals to address any changes in expected performance. This allowed the partners to adjust the partnership based on changes in market demand or the emergence of new products. All changes could be incorporated fairly into the financial splits of the partnership.

Avoiding blind spots in your next joint venture

Partners should also consider the potential for restructuring during the negotiation process—ideally framing the potential endgame for the relationship. What market shifts might occur, how might that affect both sides’ interests and incentives, and what mechanisms would allow for orderly restructuring? When one oil and gas joint venture began struggling, the joint-venture leader realized he was being pulled in opposing directions by the two partner companies because of the companies’ conflicting incentives. “It made the alliance completely unstable,” he told us. He brought the partners back to the negotiation table to determine how to reconcile these conflicting incentives, restructure their agreement, and continue the relationship, thus avoiding deep resentment and frustration on both sides of the deal.

Such dialogues about the partnership’s future, while potentially stressful, should be conducted regularly—at least annually.

The implementation of these four principles requires some forethought and care. Every relationship comes with its own idiosyncrasies, after all, depending on industry, geography, previous experience, and strategy. Managing relationships outside of developed markets, for instance, can present additional challenges involving local cultures, integration norms, and regulatory complexities. Even in these emerging-market deals, however, the principles can serve as effective prerequisites for initiating discussions about how to change long-standing practices and mind-sets.

An emphasis on clarity, proactive management, accountability, and agility can not only extend the life span of a partnership or joint venture but also help companies build the capability to establish more of them—and, in the process, create outsize value and productivity in their organizations.

Ruth De Backer is a partner in McKinsey’s New York office, where Eileen Kelly Rinaudo is a senior expert.

Explore a career with us

Related articles.

Joint ventures on the rise

M&A as competitive advantage

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Types

How To Build a Winning Business Partnership

Darrell Zahorsky is an expert in search engine optimization (SEO) and marketing. He has worked for companies and clients such as Blackberry, ADP, and Subway.

Have the Same Vision

- Define Roles

Choose the Right Structure

Anticipate disputes, spell out financial responsibilities.

- Plan for How to Get Out

Hold Partner Meetings

Revisit the agreement as you grow, the partnership agreement, frequently asked questions. (faqs).

Dan Dalton / Getty Images

Partnerships are a simple way for two or more people to own a business together. There are several types of partnerships that differ in terms of who is liable for debts and lawsuits. You may want to form a partnership to test a business idea before committing to a more formal business structure.

There are quite a few issues you should address with your prospective partner before forming a partnership. Attend to these issues before you start, and you have a better chance of a successful venture.

Key Takeaways

- A partnership is a business structure that involve two or more people who are in business together.

- A successful partnership starts with partners who have the same vision for the business.

- As you create your partnership you should define roles, spell out financial contributions and pay, decide what happens when you have disputes, and discuss what happens when one or all parties want to end the partnership.

- Continue to revisit your partnership agreement as your business grows.

For a partnership to be successful, all parties involved should agree on the same strategic direction for the company. If one partner wants to build a well-known national chain of retail outlets and the other partner only cares about earning a decent living, the business is destined to fail. Set a clear, agreed-upon course for the business that meets the needs of both partners.

Define Business Roles and Responsibilities

A winning business partnership capitalizes on the strengths and skills of each partner. Divide business roles according to each individual's strengths. For example, if one partner is strong in marketing, operations, and finance and the other partner excels in sales, human resources and leadership then split tasks accordingly.

Binding agreement authority is the ability to enter into contracts with other entities. You might consider deciding if any partner has this authority, and in what scope. You and your business partner could split this authority based on the responsibilities you each take on.

If your partner is responsible for procurement, they could enter a contract with a supplier without needing to confer with you. By agreeing who can make these kinds of decisions, you mitigate the risk of conflicts down the road.

The structure you choose for your business will dictate how you and your partner pay taxes for the business. Limited liability companies and general partnerships have different liabilities and tax responsibilities.

Avoid the 50-50 Split

It may seem logical and fair to equally split decision making. However, this kind of split can impair decisions. Instead of a stalemate when you can't come to a compromise, consider developing a way to overcome differences.

If this is not possible, then consider using an outside source to weigh in on big-ticket disagreements. You may not want this source to have final decision ability, but see if they will analyze the situation and give you their opinion for a course of action. If needed, get more than one opinion.

There will be disagreements between partners. Not many pairs of people can agree 100% of the time. You should consider how you are going to handle disputes between each other, with employees, suppliers, customers or any other stakeholders.

One way to deal with this is to include a mandatory arbitration clause in your partnership agreement and the contracts you make with other entities. Arbitration is the use of an outside party to determine the outcome of disagreements and disputes.

Arbitration is a legally recognized method of dispute resolution. Binding arbitration means that all parties involved agree to abide by the decision of the arbitrator.

You should decide with your partner how much each of you is going to contribute to setting up your business or partnership. If you are both already operating, the costs may not be as high as if you both needed to start out.

Everyone has their own limit for tolerating risk. Financial risk can be more stressful than physical risk because it affects much more than your own safety. You should discuss with your partner how much financial risk you both can tolerate, and set limits.

An example of risk could be the method that you choose to finance your business. There is generally more risk involved with debt financing than with equity financing (using loans to finance instead of issuing shares, venture capitalists, etc.).

You may not have much of a choice at first how you finance your business, but be sure all parties understand the risks, and how much each person is responsible for.

The type of business you put together will also dictate the risk that you assume. Creating a limited liability company keeps owners from personal responsibility for the debts of a failed business.

When you create your partnership, you should discuss the expectations for pay.

Most businesses do not generate profit within the first year or even the second year . The number one reason new businesses fail is that they don't have enough cash to pay the business' and owner's bills. Ensure you and your business partner know how you are going to make ends meet.

Generally, in a partnership, the assets belong to the business unless specified in the partnership agreement. Partners will then own a percentage of the value of the company property based on the agreement. This is usually only a concern for businesses when they are closing out, and owners are working through who gets what.

Plan for Buy-Outs, Dissolutions, and Exits

Partnerships dissolve for many reasons. One partner may decide the partnership is no longer beneficial. You should include buy-out terms in case one partner wants to leave.

You might consider adding a dissolution clause to the partnership agreement. If the partnership is not working out, it would be beneficial to have pre-agreed terms for splitting things up.

An exit strategy is a plan if both partners should want out. This is can be accomplished by selling the company, or by selling all the inventory, assets, and interests a business has.

A strong business partnership is built on open communication. Meet on a regular basis so you can share grievances, review roles, provide constructive criticism, and discuss future plans for the growth or direction of your business.

Your business may grow over time as you and your partner work together. You may want to readdress your partnership agreement as your business grows. You may need to add more partners, include senior employees, and include expansion agreements.

You could include this in your initial agreement, but it might be better to wait until you are in a position to consider growth and expansion.

It is simple to set up a partnership because there are no legal documents to file. A written agreement, signed by all partners, is a legal document recognized by law.

Partnerships are often an oral agreement between two or more parties. Oral agreements can present problems in case of disagreements, even though they are legally binding. Instead, avoid potential problems by drawing up a partnership agreement.

Your partnership agreement should include the following (at a minimum):

- Amount of equity invested by each partner

- The type of business

- How profits and loss will be shared

- Decision-making policies

- Partners' pay and other compensation such as bonuses

- Distribution of assets upon dissolution of the business

- Provisions for changes to the partnership or provisions for dissolving the partnership

- Parameters of a dispute settlement clause

- Settlement of the business in case of death or incapacitation

- Restrictions regarding authority and expenditures

- Expected length of the partnership

It's always worth considering a business partnership structure when you find someone who complements your skill set and you know will add value to your company. These partnerships can be enjoyable and lucrative if the right foundation is cemented in the beginning.

What kinds of business partnerships are there?

There are three types of partnerships. A general partnership (GP) involves partners who all have liability for debts and lawsuits. In a limited partnership (LP), one or more general partners manage the business and have liability, while other partners don't participate in the operations and don't have liability. Finally, in a limited liability partnership (LLP), all partners have limited liability.

What's the difference between a partnership and an LLC?

A limited liability company (LLC) with two or more members (owners) is treated as a partnership for income tax purposes. The main difference between an LLC and a partnership is that in an LLC, members don't hold personal liability for the company. In many partnerships, only limited partners are protected from personal liability for the company.

Small Business Administration. " Choose a Business Structure ."

Cornell Law School Legal Information Institute. " Alternative Dispute Resolution ."

Small Business Administration Office of Advocacy. " Small Business Facts ."

Internal Revenue Service. " Limited Liability Company (LLC) ."

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

Related Content

Partnership business: what it is & how to successfully create one.

Published: January 03, 2024

Updated: January 04, 2024

What is a partnership business? Explore the benefits and drawbacks of a partnership business, the types of partnership businesses that exist, and how to set one up.

There are many ways to form a business, and each has its own distinct advantages and drawbacks. The four main types of business entities are partnership, sole proprietorship, corporation, and limited liability company (LLC).

A partnership business, by definition, consists of two or more people who combine resources to form a business and agree to share risks, profits, and losses. Common partnership business examples include law firms, physician groups, real estate investment firms, and accounting groups.

By comparison, a sole proprietorship places all the responsibilities, risks, and rewards of operating the business on one person, while a corporation operates as its own legal entity, separate from the individuals who own it. An LLC is a hybrid of a partnership and a corporation that allows its owners (known as members) to earn profits and losses without incurring personal liability for the company’s debts.

For many individuals, going into business with a partner offers a chance to build experience and expertise with others. This article takes a deep dive into partnerships, what they are, how they work, and how to manage them.

What Is a Business Partnership and How Does it Work?

A business partnership is an arrangement in which two or more individuals co-own a business entity and share in its profits and losses. This co-ownership is formalized through a partnership agreement that outlines roles, responsibilities, and profit-sharing structures.

Business partnerships can take several forms, each with unique characteristics:

- General partnerships (GPs): All partners are equally liable for the organization’s debts, obligations, and liabilities.

- Limited partnerships (LPs): Some partners have limited liability and restricted management roles, while others, known as general partners, assume full liability.

- Limited liability partnerships (LLPs): All partners can actively manage the business, with liability protections for all partners. Specifics vary by state, but partners in an LLP are typically not personally liable for business debts or the negligence of other partners.

- Limited liability limited partnerships (LLLPs): All partners have limited liability against partnership obligations, even those stemming from the actions of their co-partners. However, only general partners can actively manage the business.

Advantages and Disadvantages of a Partnership Business

Understanding the pros and cons of forming a partnership can help you decide whether it’s the most beneficial structure for your organization.

- Stronger financial position: The ability to pool resources can provide your business with more capital and access to new investors, while better positioning the company to borrow money. Sharing business expenses with partners can also help you save more than you could on your own.

- Shared expertise: Sharing skills and institutional knowledge is a key benefit of a business partnership. This can help broaden your expertise and the versatility of your business.

- A broader network: By sharing contacts and connections with business partners, you can develop new relationships and expand your professional network.

- Fresh eyes: Bringing in partners can provide new perspectives on how you do business by seeing things from a different angle. Partners can offer fresh ideas, market strategies, and inspiration to grow your business.

Disadvantages

- Liability: The primary drawback of a general partnership is that all partners are fully liable for the financial obligations of the business and share losses, debt, and risk. This means creditors can seize any partner’s personal assets if these obligations aren’t met.

- Loss of full control: Unlike sole proprietors, who are used to complete decision-making autonomy, partners in a partnership must share decision-making authority and may need to compromise when there’s a disagreement.

- Potential for conflict: Having more than one person making business decisions creates the potential for differences of opinion that can lead to conflict. Partners may also become bitter if they feel like one person isn’t contributing his or her fair share.

- Difficult to sell: A partner can’t sell a business without the consent of all the other partners, unless stated otherwise in a partnership agreement. This could potentially create a stalemate if and when a partner wants to leave.

- Risk of instability: Without a comprehensive, predetermined partnership agreement in place, unexpected events, like a partner’s decision to leave , their death, or an illness may put the future of the company in jeopardy.

How to Create a Partnership Business

Working with one or more partners can add complexity to setting up a business. Adhering to certain steps can help simplify the process.

Select a partnership structure

To determine the ideal partnership structure, assess your liability preferences an desired management structure. Investment needs and future business goals can also dictate the best partnership choice. For instance, if you’re seeking significant external investment without giving investors a role in daily management, an LP might be ideal. Conversely, if you anticipate rapid growth and want to limit personal liabilities while maintaining managerial control, an LLP or LLLP could be a better fit.

State-specific laws can also affect partnership functions and rights, so that may be another consideration to keep in mind.

Choose partners and their roles

Find partners you trust, as this decision sets the tone and terms of your business. Decide how much it will cost to join the partnership, what percentage of the profits each partner will receive, and which roles and responsibilities each partner will have. Some partners may contribute equity or ownership share in the business, while others might be salaried partners who are paid as employees.

Name your business

Your partnership’s name is often a prospect’s first impression of your business. Consider a name that accurately represents the purpose of your partnership business or that incorporates the names of your partners as well as any designations, such as LLP or GP. Make sure to pick a unique name that isn’t already in use or trademarked to prevent legal complications.

Register your partnership

In the U.S., partnership businesses must register their names with the state in which they plan to operate. Additionally, registration might be necessary to obtain the appropriate business licenses or permits required by that state or local jurisdiction. Note that specific requirements can vary from state to state. Registration is typically required to open a business bank account, and will also help prevent inadvertently choosing the same name as an existing business.

Obtain a business identification number

In the U.S., business partnerships must obtain a business identification number from the Internal Revenue Service (IRS).

Create a partnership agreement

After you and your partners agree to their roles and responsibilities, get everything in writing. An attorney can help you draft a business partnership agreement to detail provisions, such as each partner’s rights and duties, financial obligations, profit distribution, ownership, dispute resolution, confidentiality, and exit strategy.

Secure necessary licenses and permits

To comply with federal, state, and local laws and regulations, partnerships may need specific permits or licenses to operate. For instance, the nature of the business activity and where it’s located can dictate state licensure requirements. Certain business activities may also require specialized licenses. For example, restaurants might need health permits, liquor licenses, or music licensing. Professional services – such as law, medicine, or accounting – often need professional licenses.

Bringing in partners can provide new perspectives on how you do business by seeing things from a different angle. Partners can offer fresh ideas, market strategies, and inspiration to grow your business.

The Business Partnership Agreement

A business partnership agreement is a written contract between partners that specifies their obligations and contributions to the business, as well as other conditions of their relationship. Every business partnership agreement should detail the following clauses:

- Who makes decisions: Determine how you will make important decisions and what to do when partners disagree or when there’s a tie.

- Percentage of ownership: It’s important to calculate and clarify how much of the business each partner owns. Also indicate how much money each partner contributed upon joining the business, and what should happen if the business needs more money to operate.

- Distribution of profits and losses: Set a formula for how partners will share earnings as well as losses. This might be based on ownership percentage, specific roles, or other criteria.

- Exit and transition strategies: Come up with contingency plans for what should happen if a partner dies, becomes disabled, or wants to leave the company. Specify the rights of the remaining partners in such situations.

Does a Partnership Business Make Sense for Your Company?

Before you decide whether a partnership is the ideal business type for your organization, consult with an outside expert to carefully consider the following:

- Legal liability: How much liability is ownership willing to assume? If you’re adequately insured and can afford to put your personal assets at risk, the financial opportunities of a partnership might be worth the risk.

- Long-term plans: Look ahead to what might happen to the business in the future. In a partnership business, it’s important to consider who will take over the business after the founding partners are no longer involved.

- Costs: Although corporations offer stronger liability protection compared to partnerships, they require more extensive record-keeping and reporting, thus incurring higher administrative costs than other business entities. They’re also the most expensive business type to form, making partnerships a more attractive option for many.

- Operational freedom: The business structure you choose can dictate how much flexibility, administrative responsibilities, and decision-making power you’ll have. Corporations tend to be the most restrictive in these areas. If you’re looking for more freedom, less bureaucracy and the authority to call the shots, a sole proprietorship might be the right choice for you. Partnerships fit somewhere in between, combining the benefits of autonomy and shared decision-making responsibilities.

The Bottom Line

Business partnerships have many advantages for someone looking to form a new company. Because they include several variations from which to choose, partnerships often combine the best attributes of other business types, offering flexibility around costs, liability, and autonomy. Selecting the right business type, however, often comes down to the unique circumstances of each business. Consider consulting legal and business experts to understand the implications of each business type, as well as the various federal and state requirements necessary to create them.

A version of this article was originally published January 15, 2020.

Photo: Getty Images

Trending Content

Business Plan for Partnership Firm

A business plan for partnership firm is recommended for anyone entering into a business partnership. 3 min read updated on February 01, 2023

Updated November 2, 2020:

A business plan for a partnership firm is recommended for anyone entering into a business partnership. A business partnership is two or more people working together to run a business. Each person takes on equal risks and rewards that come from the business. A proper business plan is ideal for handling current and future business decisions.

Steps For Planning a Business Partnership

- Write a mission statement to clearly state the direction and goals the business plans to take. By writing a mission statement, the partners agree to the company's direction now and in the future.

- Develop a reimbursement plan for the costs and investments incurred during startup. The amount of money provided for the startup is not always equal. Therefore, it is beneficial to make a plan that takes this into account with repayment and returns on investment. Avoiding arguments over the value of the startup amount versus levels of sweat equity will be removed with a reimbursement plan.

- Create a method to resolve partner disputes. If an odd number of members are part of the partnership, you can choose to vote democratically. In the case of two partners, the partners may split areas of the business having the final say. For example, one person can make final decisions on marketing and sales planning, while the other person makes final decisions on financial planning.

- Appoint an outside panel of advisors, or ombudsman , to resolve any internal disputes. Trusted experts should always be used to avoid ruining the partner relationship.

- Divide all the responsibilities of the partners related to labor and management and assign the amount of compensation they will receive. The compensation is not always equal based on the workload the partner takes on.

- Request that outside experts review the partnership agreement for any legal or accounting mistakes. The experts may be able to point out unknown problems that exist in the agreement. This review should take place before the partnership begins business operations.

Partnership Deed

A partnership deed and partnership agreement are the same, but the partnership deed is in writing . A partnership agreement can exist solely through verbal communications or actions. A partnership deed is recommended for businesses as it clearly defines the terms of the partnership.

The partnership deed helps prove the agreed-upon terms if there are any conflicts. Without a deed, the rules to settle disputes will fall to the state laws where the partnership exists. This creates another issue where one partner may file suit to benefit from the existing laws. Legal action can be avoided with a partnership deed that lists all details of the business that the partners agreed to when they began the business.

Partner Business Plans

When legal firms are looking to add a new partner, a well-written business plan that shows the new partners' intent to grow the business will make them stand out from the rest of the applicants. The business plan should exceed the expectations of the firm.

The key elements of the business plan are:

- Create an introduction that details your professional history, areas of expertise, and why you are the right fit for the firm.

- Provide market research and analysis of the needs of the local area, what competition exists, and why the firm offers the best way to reach this marketplace.

- Describe your current client base, prospective clients, and untapped areas you'd like to reach.

- Include any cross-selling opportunities that exist with current and prospective clients.

- Share ways you can develop business sources including publications, speeches, client seminars, newsletters, and similar.

- Explain your long-term strategy to meet the goals and targets that will benefit the firm.

- Show a history of collections, billing rates, and billable hours and projections for the current year, three-years, and five-years.

- Time the partners must invest.

- Key staff will be needed (paralegals, secretaries, etc.)

- Travel expenses.

- Marketing materials,

- Presentations.

- Foreign language skill requirements.

End with a conclusion that is creative recaps the important points in the plan, what value will be added to the firm, and why you are the best fit for the firm.

If you need help with a business plan for a partnership firm, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Limited Partnership Rules: Everything You Need To Know

- Purpose of Partnership: Everything You Need To Know

- Authority of Partners in Partnership: What You Need to Know

- Partnership Agreement Between Company and Individual

- Limited Company Partnership Agreement

- How to Make a Partnership Agreement Legally Binding?

- Contract for Business Partners

- Disadvantages of Partnership

- General Partnership

- Partnership and Company

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

- Why crowdspring

- Trust and Security

- Case Studies

- How it Works

- Want more revenue? Discover the power of good design.

- Brand Identity

- Entrepreneurship

- Small Business

Navigating Business Partnerships: Your Comprehensive Guide to Success

Will your business idea succeed? Take our quiz - completely confidential and free!

Deciding on a legal business structure is a critical first step when starting a new company. It impacts everything – from how you report income and your level of personal liability to compliance with legal obligations at all governmental levels.

For many, forming a business partnership is a strategic move. Partnerships can offer a synergy of expertise and resources, creating a collective capability greater than the sum of its parts. Unlike an LLC, a partnership implies that the business is conducted by individuals who share the management and profits.

What is a partnership?

A partnership is when two or more people or groups agree to run a business together. Each partner shares in the profits, losses, and business decisions. Partnerships can be formed between individuals, businesses, or organizations – anyone who wants to work together to make a profit and move forward with shared goals. Simply put, it's a team running a business, sharing the ups, downs, and responsibilities.

Once you’ve formed a partnership, it’s pivotal to clearly and legally document the understandings and expectations between partners. This step ensures a smoother business operation and helps prevent potential disputes. This brings us to another crucial term – the partnership agreement , which outlines the detailed terms and conditions among partners.

What is a partnership agreement?

A partnership agreement is a contract between business partners. It answers: Who owns what? Who does what? How will profits (and losses) be shared? It also sets the rules for solving disagreements and explains what happens if a partner leaves or passes away. It's a safety net, ensuring everyone knows the plan and preventing future disputes.

In my nearly 30 years as an attorney, entrepreneur, and advisor, I have navigated the nuances of different business structures, often evaluating the unique benefits and challenges of forming a partnership. And as an attorney, I’ve drafted hundreds of partnership agreements for various ventures. And I was a partner in numerous legal partnerships (which historically had to be structured as partnerships). This guide is your roadmap, with practical advice, actionable tips, and best practices from mentoring hundreds of entrepreneurs and small businesses and helping thousands start and expand their ventures.

Partnerships: A Comprehensive Guide

Types of business structures, benefits of forming a partnership, disadvantages of partnerships, types of partnerships, taxes and partnerships, how to start a partnership, partnership agreement: everything you need to know, frequently asked questions about partnerships.

Before diving into the details, let’s look at the popular types of business structures :

Sole proprietorship: This business is owned and operated by a single individual. This person maintains complete control over the company but bears all the risk.

LLC (Limited Liability Company) : This business structure merges the characteristics of corporations, partnerships, and sole proprietorships. It provides limited liability protection to its owners or members.

Corporation : A corporation is a business entity legally separate from its owners or shareholders. It can sell shares of stock to raise capital, something a sole proprietorship or partnership can’t do.

Hire an expert to form your company and save time. Our trusted partners can help: Northwest ($39 + state fee) or Bizee ($199 + state fee) . We recommend Northwest. After evaluating the leading registration companies, Northwest stands out as our top choice due to its competitive pricing, exceptional customer support, and commitment to privacy. Pay just $39 + state fees and you'll get a free year of registered agent service, articles of organization, privacy, and client support from local experts.

Embarking on a business journey with a partner isn’t just about having company. It’s about combining strengths, sharing responsibilities, and multiplying resources to create a resilient, resourceful, and robust venture.

Forming a partnership can weave a safety net, enabling the business to take leaps with shared risk and blend diverse skills to brew innovation and stability. From shared financial responsibilities to melding distinct skills, a partnership opens up a world where mutual benefits are not just possible but are often amplified. Here are fifteen tangible benefits for people when choosing a partnership structure:

- Shared responsibility. Partnerships often result in shared responsibility, which can lessen individual load. If one partner is adept at digital marketing, they can focus on online promotions, while the other, perhaps skilled in operations, manages order fulfillment. In a retail shop, one partner could manage in-store operations while the other takes care of supplier relationships and inventory management.

- Diverse skill set. Partners often bring varied skills and expertise, enhancing the business’s capabilities. One partner could focus on website design and UX design, while the other manages content creation and customer service. One partner could specialize in sales and customer interaction on the shop floor, while the other could focus on back-end operations and stock management.

- Enhanced creativity. With more minds at work, partnerships often foster enhanced creativity and innovation and can help you develop the best business ideas . An online design store can have one partner focused on creating unique designs while the other ensures they are showcased innovatively on the platform. While one partner brings innovative culinary ideas to a restaurant, the other might introduce fresh, customer-engaging service strategies.

- Risk mitigation. Having a partner means risks, especially financial ones, are shared. Both partners share the financial burden if an e-commerce platform fails to perform as expected. In a physical store, if a new product line doesn’t sell as projected, both partners absorb the financial impact.

- More resources. Partnerships can mean access to more resources, such as capital, clientele, and industry contacts. In an IT firm, one partner might bring in financial investments while the other brings a rich client database. In a consultancy , one partner may offer a spacious office for client meetings while the other brings in crucial industry contacts.

- Networking opportunities. More partners typically equate to a wider network, which can be leveraged for business growth. An online advertising agency can benefit from one partner’s digital influencer contacts while utilizing the other’s connection with ad platforms. In a real estate business , one partner’s connections with property dealers and the other’s links with advertising agencies can be beneficial.

- Improved decision-making. Different perspectives often lead to well-rounded decision-making. In a digital magazine, editorial and technical decisions can be balanced between partners with expertise in each field. In a bookstore, one partner might select the inventory based on literary knowledge, while the other ensures technological tools (like point-of-sale [POS] systems) are updated and efficient.

- Flexibility . Partnerships often provide flexibility in management and operations. In an e-learning platform, partners can manage course updates and student interactions alternately, ensuring continual operation even during vacations. In a clinic, partners can alternate their duty hours to provide consistent services without burnout.

- Tax benefits. Partnerships can offer various tax benefits, depending on jurisdiction. An online consultancy might benefit from tax deductions available for partnerships in its operational domain. A manufacturing unit run as a partnership may avail of certain tax credits available in its location.

- Easier to form. Forming a partnership can often be less complex and requires fewer formalities, paperwork, and expenses. Two freelancers might combine services and form a partnership firm with minimal documentation. Two artisans might join to create and sell products in a shared physical space with less bureaucratic involvement.

- Boosted financial capability. A partnership can amplify a business’s financial prowess by pooling all partners’ monetary resources and creditworthiness. In a SaaS business , while one partner might inject direct capital, the other might facilitate a loan due to their robust credit history. A coffee shop partnership might see one partner contributing more towards initial capital while the other agrees to a higher profit-sharing ratio to balance the scales.

- Companionship and moral support. A partner can offer emotional and moral support, making the entrepreneurial journey less isolating. When running an online retail store, partners can buoy each other during slow sales, brainstorm new strategies, and provide moral support. In a physical fitness center, when one partner feels disheartened due to challenging situations, the other can provide encouragement and shared resolve to navigate through.

- Client satisfaction. With multiple partners, client needs can be addressed more comprehensively and responsively. A digital marketing firm can provide client services across varied time zones, with partners strategically located in different regions. A consulting firm with partners specialized in various domains can offer clients a one-stop solution, enhancing client satisfaction and retention.

- Flexibility in ownership transfer. Partnerships generally facilitate smoother transitions in ownership compared to other business structures. In an online tutoring platform, a partner wishing to exit can transfer their ownership stake to the remaining partner or a new entity more fluidly. In a law firm, a retiring partner might transfer their stake to an existing partner or a new entrant, ensuring continued business operations without complex restructuring.

- Greater borrowing capacity. Partnerships often have a larger borrowing capacity than sole proprietorships due to combined assets and credit. An e-commerce partnership might secure a more substantial loan to scale operations, utilizing the combined assets and collateral of the partners. A manufacturing business partnership could leverage partners’ combined creditworthiness to secure better borrowing terms for expansion or upgrading machinery.

Free Business Startup Kit

Receive six actionable guides, including a how to start a business checklist, detailed comparisons of LLCs, corporations, sole proprietorships, and partnerships to determine the best fit for your business, plus insights on crafting a compelling pitch deck to attract investors.

- How to Start a Business Checklist

- Starting a Corporation Guide

- Is an LLC Right for You?

- Starting a Sole Proprietorship

- Starting Business Partnerships

- Creating a Powerful Pitch Deck

Being tethered to another person or entity in business could mean conflicts, liability, and intricate financial management. Here are ten potential drawbacks of partnerships:

- Conflict in decision making. Decisions might be contested when more than one person is involved, and conflicts can arise. Two partners in an e-commerce platform might disagree on inventory purchasing decisions. Partners in a bookstore might have conflicts over which books to stock and promote. This is common in other types of entities, too. Over the years, I’ve had many conflicts with partners in partnerships, LLCs, and corporations. However, this is often legally more complicated in partnerships because they are often equal, and it’s not always clear who makes the final decision.

- Joint liability. All partners share the burden of business debts and liabilities. All partners in a digital marketing agency may be liable for a debt incurred due to a failed campaign. In a restaurant business, partners are responsible for any debts accrued due to a failed event or investment.

- Profit sharing. All profits have to be shared among partners, sometimes leading to discontent. Profits from a thriving online coaching platform must be distributed among all partners, potentially sparking disputes. Profits from a successful promotional event at a retail shop must be shared among partners, possibly igniting conflicts.

- Limited capital. Raising funds can be limited to the personal funds or creditworthiness of the partners. An app development partnership may find difficulty scaling due to limited capital investment. Due to constrained capital, a dental practice partnership may struggle to expand to new locations.

- Business continuity. Partnerships may face continuity issues due to the withdrawal or death of a partner. An online consultancy may face disruptions if a key partner departs unexpectedly. A partner’s sudden exit from a law firm could potentially destabilize client relationships and ongoing cases. I’ve seen this happen often at law firms and other professional partnerships.

- Diverse risk appetite. Partners might have different thresholds for risk, which can influence business strategies. A partner in a FinTech startup might be reluctant to explore a new, innovative, but risky feature, contrary to the other’s willingness. Partners in a construction business might disagree on taking up a large, potentially lucrative, but risky project.

- Limited expertise. Limited to the partners’ skills and knowledge, some areas may lack expertise. A blogging platform run by content creators might lack technical optimization due to limited IT knowledge. A physiotherapy clinic may not optimize its marketing strategies due to a lack of marketing expertise among the partners.

- Shared losses. All partners have to bear losses, which can impact personal finances. If an online retail business incurs losses, the personal savings of all partners may be impacted. In an event management partnership, a failed event could dent the personal financial health of all partners.

- Complicated exit strategy. Exiting or dissolving a partnership can be complex and may affect business operations. Leaving or dissolving a partnership in a web development business might disrupt ongoing projects. A partner’s exit from a salon business might involve intricate valuation and division of assets.

- Customer trust. When a partner leaves or a partnership dissolves, it might erode customer trust and loyalty. In a SaaS business, customers might feel uncertain about the continuity and reliability of the service upon changes in partnership. Patrons of a local cafe might be skeptical about quality consistency if a well-known partner departs.

Recognizing these potential challenges allows prospective partners to tread wisely, crafting strategies that mitigate these risks and leveraging the benefits to navigate the potential hurdles of partnership businesses.

Partnerships are not a one-size-fits-all model. There are various forms, each bearing its distinct set of rules, liabilities, and operational methods:

General Partnership (GP)

All partners share equal rights, responsibilities, and liabilities in a general partnership.

Best for: Consulting firms, law practices, small retail businesses, and local service providers. Not ideal for: Ventures with unequal investment or involvement, high-risk businesses, and tech startups with substantial liability.

Limited Partnership (LP)

Some partners enjoy limited liability and are not involved in management, while others have unlimited liability and manage the business.

Best for: Real estate investment groups, film production companies, family businesses wanting to involve silent members, and venture capital firms. Not ideal for: Small businesses with active partners, technology companies, and businesses that require all partners to be involved in management.

Limited Liability Partnership (LLP)

All partners have limited liability and can be involved in business management.

Best for: Professional practices like law and accountancy firms (my law firms started as partnerships and converted to LLPs when state laws permitted this conversion), consulting businesses, medical practices, and design agencies. Not ideal for: Businesses desiring simplicity in structure, sole proprietorships, manufacturing businesses with high liability.

Joint Venture

Two entities come together for a specific project or a specified period.

Best for: Construction companies on a specific project, tech companies collaborating on a product, multinational business expansions, and research and development projects. Not ideal for: Ongoing, long-term businesses, small local businesses, independent entrepreneurs, and ventures requiring a singular brand identity.

Strategic Alliances

Businesses collaborate and form strategic partnerships for mutual benefit without forming a new entity.

Best for: Airlines sharing certain routes, e-commerce, and retail collaborations, tech companies sharing technology, and cross-promotional marketing campaigns. Not ideal for: Businesses desiring shared liability and responsibility, ventures that need a unified brand, and small businesses with limited resources.

Limited Liability Limited Partnership (LLLP)

A variation of the LP where even general partners can have limited liability.

Best for: Large investment projects, family estate planning, agricultural operations, and certain real estate investments. Not ideal for: Small scale businesses, tech startups, businesses with straightforward operational needs, and single-location service providers.

Depending on different businesses’ unique financial and operational configurations, partnership taxes could be either an ally or an adversary. While a partnership as a business entity does not pay taxes, the profits pass through to partners who report this income on their personal tax returns.

Businesses that benefit from partnership taxation

- Consulting firms. Shifting income among partners can optimize individual tax scenarios.

- Real estate investment groups. Using pass-through taxation to manage investment gains and losses effectively.

- Small local retailers. Capitalizing on simplicity and avoiding double taxation.

- Family businesses. Managing estate planning and wealth transfer with a flexible partnership structure.

- Law practices. Mitigating liability and enjoying the flexibility of distributing profits.

- Freelance and creative agencies. Navigating varying incomes through beneficial income-splitting among partners.

- Joint ventures in research and development. Appropriating expenses and research credits optimally among entities.

- Professional practices (e.g., doctors, architects). Managing professional income with flexibility among partners.

- Craftsmanship businesses (e.g., boutique craft shops). Handling often fluctuating incomes and expenditures in a straightforward manner.

- Educational services. Distributing educational revenue and operating expenses effectively among partners.

Businesses potentially disadvantaged by partnership taxation

- High-tech startups. Potential challenges with investment funding and allocation of losses.

- Large-scale manufacturing businesses. The complexity in managing and allocating large expenses and revenues.

- Corporations with international operations. Navigating through international tax law and potential double taxation issues.

- Venture capital firms. Managing investor returns and extensive financial portfolios.

- E-commerce giants. Handling extensive online transactions, international sales, and VAT.

- Robust franchise operations. Distributing income and managing expenses across various entities.

- Large agricultural businesses. Allocating extensive operational costs and managing international trade.

- Biotech companies. Allocating extensive R&D expenses and managing investor relations.

- High-risk businesses (e.g., adventure tourism). Balancing high liability with the fiscal flexibility of a partnership.

- Companies with high capital expenditure (CAPEX) . Managing the allocation of significant CAPEX and related depreciation.

1. Choose a business name

Your partnership’s business name must embody your brand while adhering to your state’s regulations. Typically, it should be unique and not misleadingly imply that you’re a government agency or an unauthorized industry.

Brainstorm potential names and ensure they align with your brand message. Run a name check to confirm that no business in your state has claimed it. Also, check for available domain names to create a business website with the same name.

2. Draft a partnership agreement

This crucial document outlines how your partnership will function. Though not legally required in all jurisdictions, a partnership agreement can prevent future disputes.