Ownr Blog > Ownrship 101 > Business Stages > Before You Start > Best Small Business Plan Template For 2024 in Canada

Best Small Business Plan Template For 2024 in Canada

Looking to start a small business in Canada – in 2024 or beyond? Or maybe you’re more of a startup founder. In either case, the best way to begin is with our free business plan template. Here’s how to get going.

- What is a business plan?

A business plan is a framework a business owner can complete in order to make starting or optimizing a business easier. Whether you’re working on your business idea or you’re an established entrepreneur, creating a business plan can help you map out your values and overall approach. It’s one of the best ways to develop or refine your business strategy. A well-structured plan includes some financial projection, a marketing strategy, and operational information important for potential investors and your own purposes.

Many beginners get tripped up thinking about how to write a business plan, which is why we created this sample to point you in the right direction.

- How Canadian startups and small businesses can use a business plan template

If you’re a startup or small business owner, there are a few things you can do to make the best use of a business plan template:

- Get started! Whether you already have a business or you’re in the planning stages, working on a real business plan will help you discover aspects of your company that you may otherwise overlook.

- Make sure your business plan is tailored to your unique situation. It’s just a starting point, so feel free to add or subtract sections depending on your needs.

- Stay up to date on changes in your industry. Your business plan should be a living document that you revisit and update periodically.

- Make use of free resources. We have a lot of helpful content on starting and running a business, so make sure to visit some of our other articles for further education.

- Get feedback from someone with experience. Whether this is a mentor or another entrepreneur, external feedback can be critical to a solid business plan.

- How to write a simple business plan

Keep in mind these are only rough guidelines, because there’s really no “wrong” way to fill out a business plan template. That said, there are a few best practices you may find helpful.

- Leave the executive summary and business overview until the end

The executive summary is a high-level overview of your entire plan. It should include a brief description of your company, what you do, and your target market. The business overview takes a more in-depth look at your business, including your history, products and services, and how you plan to make money.

- Include your financials early on

The financial section is one of the most important parts of your business plan. This is where you’ll include your projected income and expenses, as well as your current financial status. Investors will want to see this information, so it’s important to include it even if you’re not seeking investment yet.

- Make sure your marketing and operations sections are fleshed out

Investors aren’t the only people who will be interested in your business plan. It will serve as your roadmap for navigating the twists and turns of entrepreneurship, so having well-defined marketing and operational objectives is key.

- The three main components of a business plan

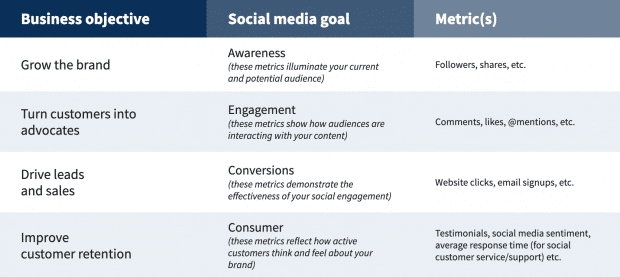

Other than the executive summary and overview, there are three main sections to a business plan: the marketing section, the financial section, and the operations section.

There are also three different ways of thinking about each section: strategic, tactical, and operational.

Strategic thinking defines your larger overarching plans. An example of a broad marketing strategy is paid media (advertisements).

Tactical thinking defines the individual actions within your strategy. An example of tactics within a paid media marketing strategy would be split-testing your copy and creatives.

Operational thinking is all about what is required for the strategies and tactics to take place. For example, if you want to use paid media but lack the time or skills to create your own ads, you’ll need to hire a paid media specialist. This is an operational concern.

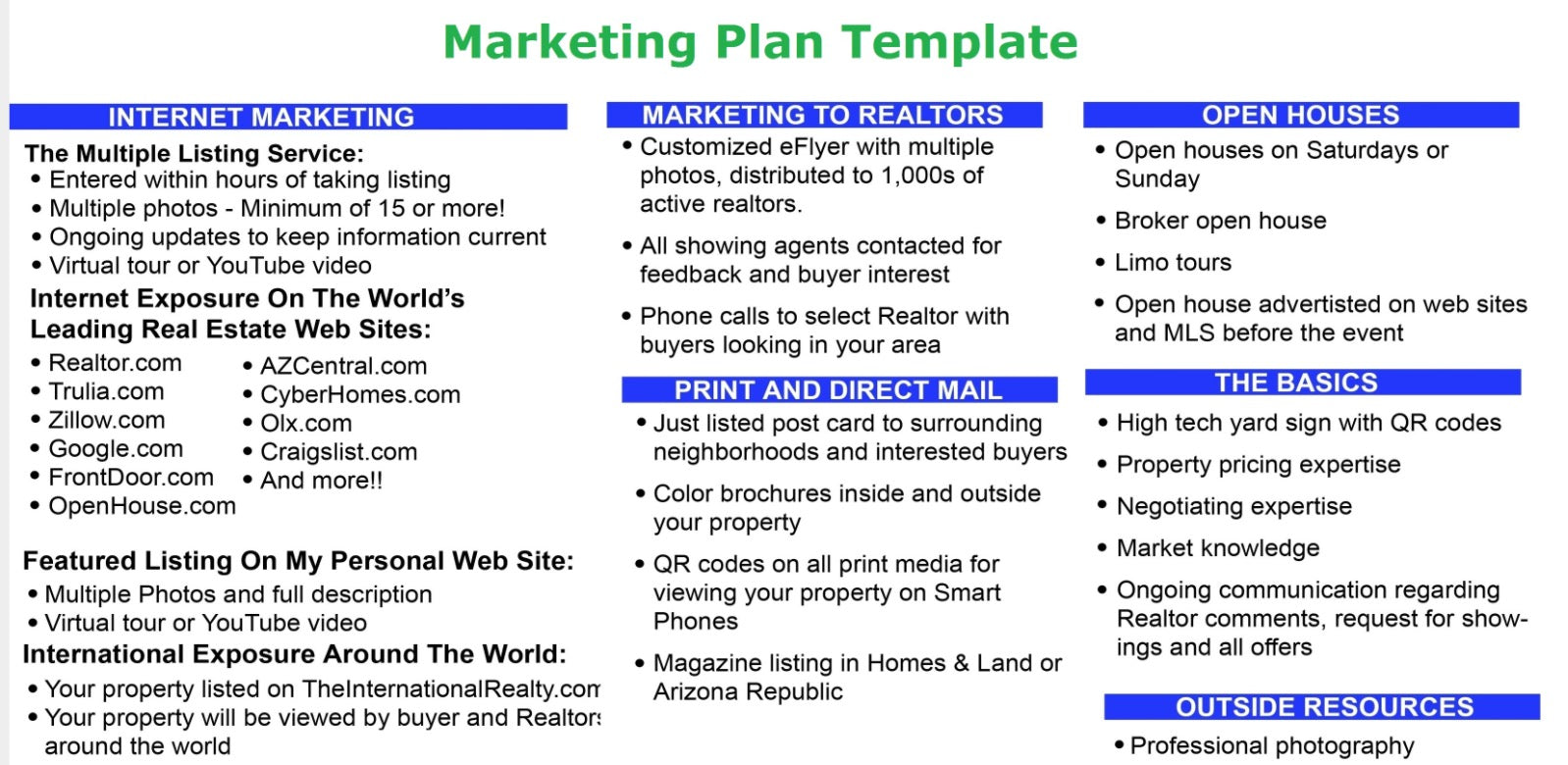

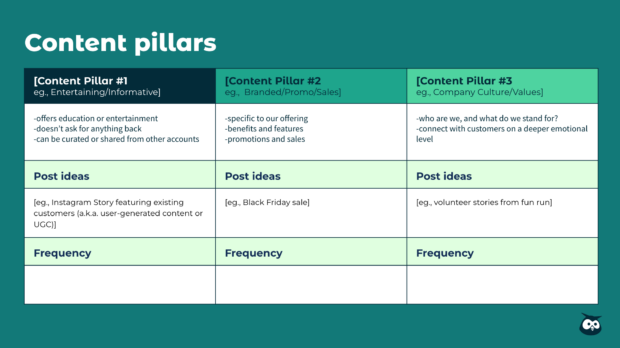

The marketing section should include your overall marketing strategy , including your target market, how you’ll reach them, and what you’ll offer them.

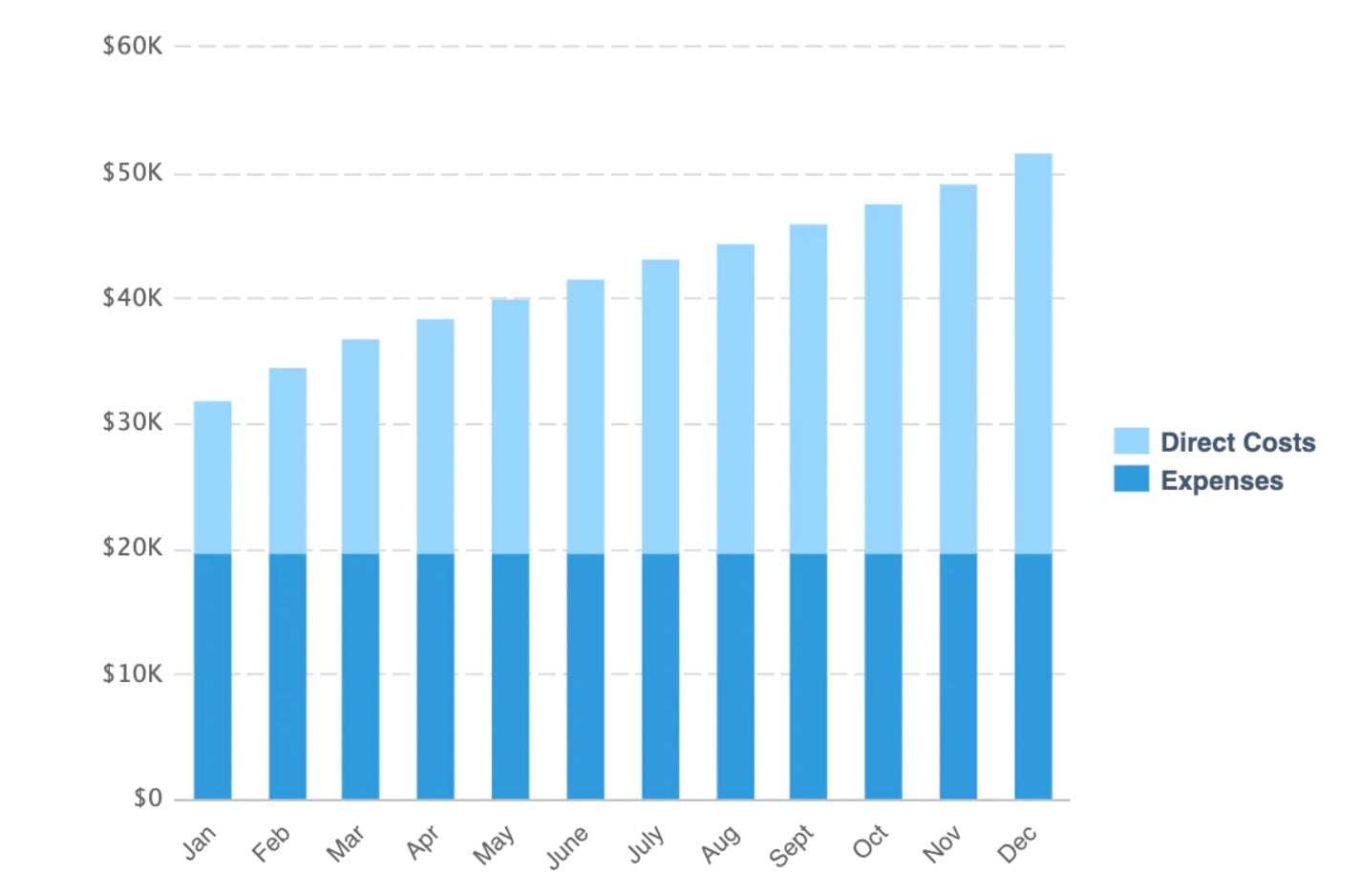

The financial section should include your projected income and expenses, as well as your current financial status. This information is important for investors, but it’s also helpful for you to gauge which marketing and operational initiatives you can afford.

The operations section should include your business’s organizational structure, as well as a plan for hiring and training new employees. This section should also include any documented processes and procedures you plan to use.

- Final tips for creating a business plan

Even if you’re not planning to approach investors, it’s important to have a well-defined business plan. Here are some tips that will make the process easier and more effective:

- Don’t let self-doubt or impostor syndrome stop you . Many entrepreneurs feel like they’re not qualified to write a business plan because they lack clarity around how they want their business to work. Filling out a business plan can actually help you find that clarity, so push through any nagging doubts and put in the work––you’ll be glad you did!

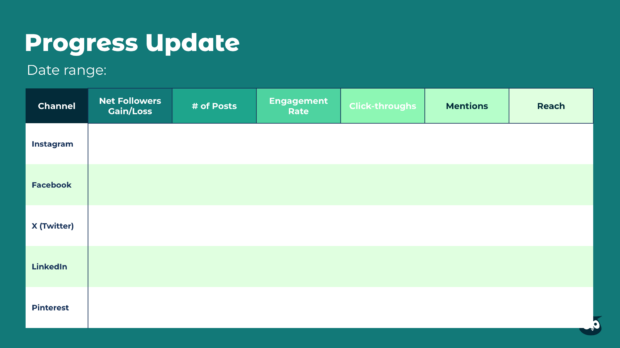

- Understand that the plan can grow with your business. As you evolve, so should your business plan. Keep it updated and track your progress against your goals so you can course-correct as needed.

- Don’t be afraid to make mistakes. Making mistakes is a normal and natural part of being an entrepreneur. What’s important is that you learn from them and continue moving forward.

- Make it your own. The best business plans are the ones that reflect the unique personality and values of the business owner. So don’t be afraid to put your own stamp on it!

Creating a business plan can be a daunting task, but it’s important to have one regardless of your stage in the entrepreneurial journey. The tips we shared will help you create a document that is both informative and reflective of your unique business. Remember to stay flexible as your business grows and make sure to update your plan regularly!

- Download the Canada Starts Business Plan here

This business plan has everything you need to put your best foot forward. Make sure to keep in mind everything you’ve learned, and feel free to add to the template where required. Download the template here .

This article offers general information only, is current as of the date of publication, and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.

- Small Business

- English Selected

Create a business plan

Explore the ways tailored advice from TD can help your business, today.

Starting a Business in Canada

Starting a business can be a challenging and rewarding endeavour. With the right planning, resources, and groundwork you'll enjoy a better chance of success.

Find out if your business idea will work

Clarify your idea and get it in writing

Find the money and manage your cashflow

Think about the legal stuff

TD Business Accounts, lines of credit, and more

Write a Business Plan

Clarify your idea and get it in writing.

There's a lot of work involved in writing a business plan but it prepares you for the even bigger task of starting a business.

It will help refine your idea, outline goals, and make it easier to explain what you hope to accomplish. This comes in handy when you're looking for money.

Download our business plan template which addresses product and service information, competitive analyses, the financial feasibility of starting up, and more.

Why You Need a Plan

If you're pitching your idea to banks or other financial institutions for a loan, you'll need a business plan because people want to see that you've put serious thought into your idea.

Thinking about the details will help you make decisions about your business, and will open you up to new ideas or approaches you might not have considered.

Writing out a business plan will give you an action plan to work with, but if you need help getting started use our interactive checklist .

Why You Need a Unique Selling Point

One of the most important aspects to consider when writing your business plan is asking why customers would buy your product or service .

Will it be better quality? Better price? Is it backed by a guarantee? Will it have more features? Will you be able to provide outstanding customer service?

Once you establish what differentiates you from the competition, it's essential to communicate it consistently when you go to market.

Use our interactive checklist to define your unique selling point.

Determine Demand & Profit Potential

Once you know (or are reasonably sure) that customers are likely to buy your product or service, figure out if you'll be able to make a profit.

Determine what you need in sales to cover costs plus a profit margin. Also ensure you have capacity - the physical ability to work a certain number of hours in a week or produce the required amount of product.

Use our interactive checklist for more ideas on determining demand and profit including ways to research, test marketing, and future trends.

Tools & Calculators

Download our business plan template.

Download our start-up costs template.

Figure out your income vs expenses.

Determine your monthly interest and payments.

Products and services to help get you started

Small business bank accounts.

Discover the benefits of a TD Small Business Bank Account to meet your business needs.

See our accounts

- Business Credit Cards

Choose the cash back, travel rewards, or low interest rate credit card that fits your business needs.

See all cards

Receiving & Making Payments

Keep your cash flow moving successfully and stay on top of things.

Articles on Starting Your Business

Four Steps to Find Out if Your New Idea Will Work

Research, validate, talk to industry insiders, and test your idea to ensure it has what it takes to succeed.

Selling Online and Other Ways to Expand Your Business

Marketplaces, subscription models, drop-shipping, and freemium offers are four ways to expand your business online.

Sources of Small Business Funding

Ways to fund your business include: self-financing, partnering with another business, angel investors, grants.

Breaking Barriers — A series on women entrepreneurs

Get inspired with our first article in a series highlighting successful women entrepreneurs who have overcome challenges to build successful businesses.

Breaking barriers — Spotlighting female entrepreneurs

Get inspired with our latest article in a series highlighting successful women entrepreneurs.

Celebrate Pride with Florence Gagnon

Her journey was so inspirational it was adapted to the silver screen, but it started with a focus on her local community.

Spotlighting Female Entrepreneurs — Gloria Kim, Gloryous Productions

A series of articles that highlight various successful women entrepreneurs who bank with TD Small Business Banking. Discover their success.

Get in touch

Contact an account manager.

Talk to an Account Manager Small Business (AMSB) to discuss your business needs.

Talk to a Small Business Specialist at our Small Business Advice Centre.

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan Miles

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Saving and Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking?

- TD Bank Small Business Banking?

- TD Bank Commercial Banking?

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

Find a Branch

- Call 1-800-769-2511

Create a Business Plan

Think of it as a playbook for your goals, priorities and growth opportunities., how to write a business plan.

Creating a business plan can feel like a huge undertaking when you are starting a new business . And while developing one does require careful thought, studies show that entrepreneurs who have a formal plan are often more successful than those who don’t. Keep reading to see how a business plan benefits you and the details you should include.

Prefer to just get started? Start creating your business plan with the RBC Business Plan Builder.

Content in this Article

What is a business plan? Benefits of writing a business plan Information to include in your business plan Create your plan with the RBC Business Plan Builder

What is a Business Plan?

Benefits of writing a business plan.

Writing a business plan can help you in several ways—here are just a few of the biggest benefits:

- Provides a roadmap. A business plan requires you to be thoughtful about the direction of your business, consider the goals most important to you and how you will achieve them. Think of it as your step-by-step guide for success!

- Reveals gaps or risks you need to address. By looking at your business critically, you’ll be able to identify your strengths as well as areas where you may be vulnerable.

- Shows potential investors, stakeholders or lenders that you’re serious. Attract and engage those who may be interested in your business with all the important information they need to know.

Information to Include in Your Business Plan

Create an executive summary Describe the current business environment Outline your marketing and pricing strategies Describe how your business will operate Detail your financing and cash flow needs Describe your team (even if it’s just you) Identify risks and how you’ll protect your business Write a conclusion Include your contact information

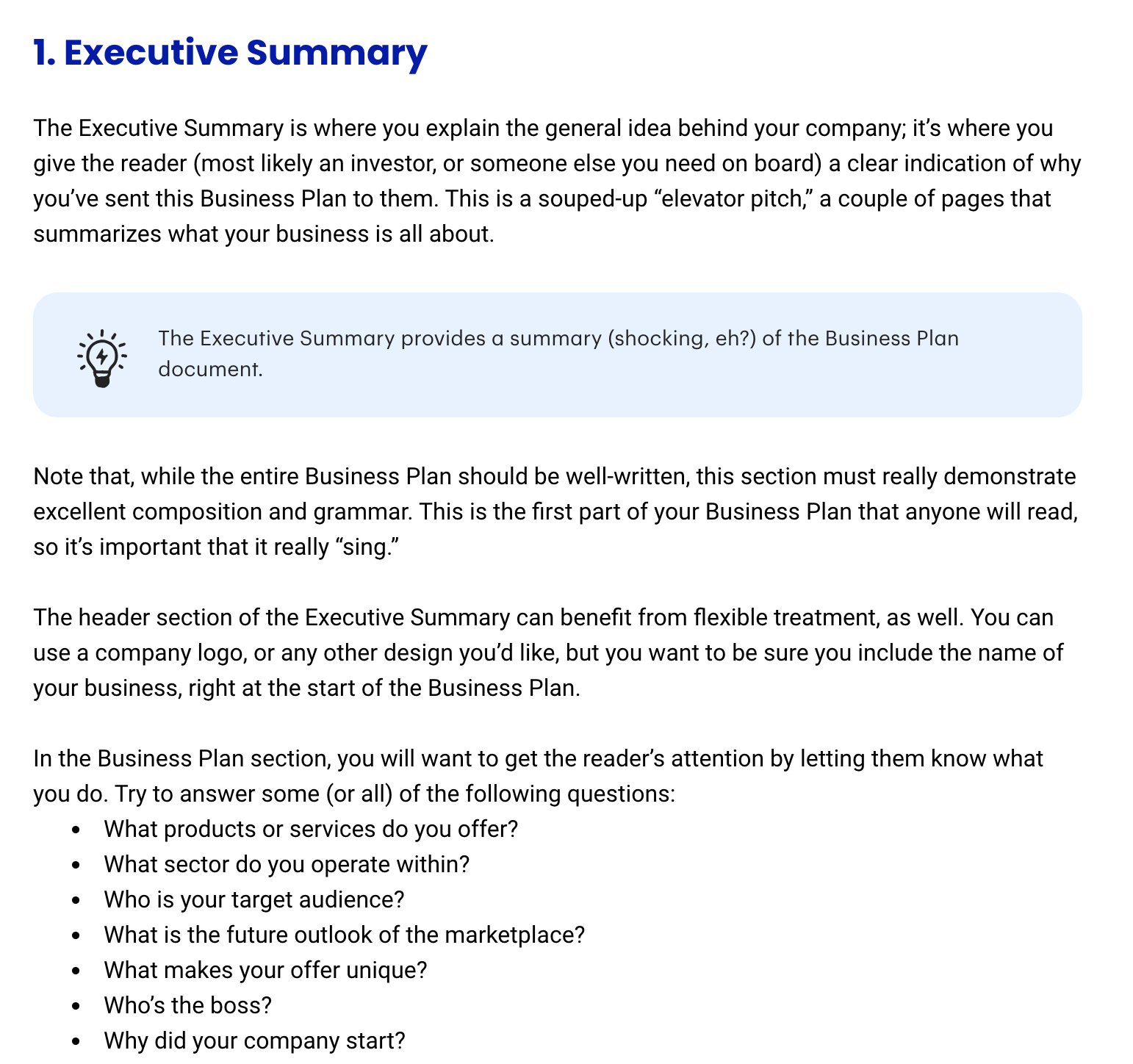

Create an Executive Summary

After your cover page and table of contents, include an executive summary. Since this is the first thing readers will see, it should be clear, grab their attention and identify what your business does.

What to include:

- Your industry, target market and how your business is different from the competition

- Your business structure (sole proprietorship, corporation, etc.)

- What stage your business is in

- Your experience and credentials, as well as your team’s, if applicable

- Financial projections for the business (or performance to date, if you’re already operating)

- Calculate your estimated revenue - how to calculate revenue

Tip: Write your executive summary last and keep it to one page. While it’s structurally the first section, it will summarize everything else in your plan.

Describe the Current Business Environment

This should be a detailed history and summary of your business, identifying the product(s) or service(s) you’re offering and how you will solve a problem or need in the market. Be sure to include any pre-market research or testing you’ve conducted that speaks to the viability of your idea.

When you’re starting a business , your bank and potential investors don’t have historical data to review. Your plan must clearly convey your strategy, competencies and the reasons your venture will succeed. (If your business is already established, you’ll want to cover where you started and how you got here.)

- Where you want your business to go—and how you’ll get there. What are your goals? How will you generate sales?

- What your business does. What needs does your business fulfill? Where will you sell your products or services?

- Your business set up. How is your business structured ? Are there other owners or shareholders?

- How you know your business will work. What market research or testing have you done? Are there trends?

Tip: Revisit your business idea by asking yourself these 7 key questions or use our business idea checklist to see the steps you may need to take to get to opening day.

Outline Your Marketing and Pricing Strategies

This is your opportunity to explain how you’re going to get customers to buy your products or services. This section involves identifying your ideal customers, your pricing strategy and more.

- Your products, service and unique selling proposition. What are the features of your product or service and what makes it unique compared to what your competitors offer? How will you draw customers away from competitors?

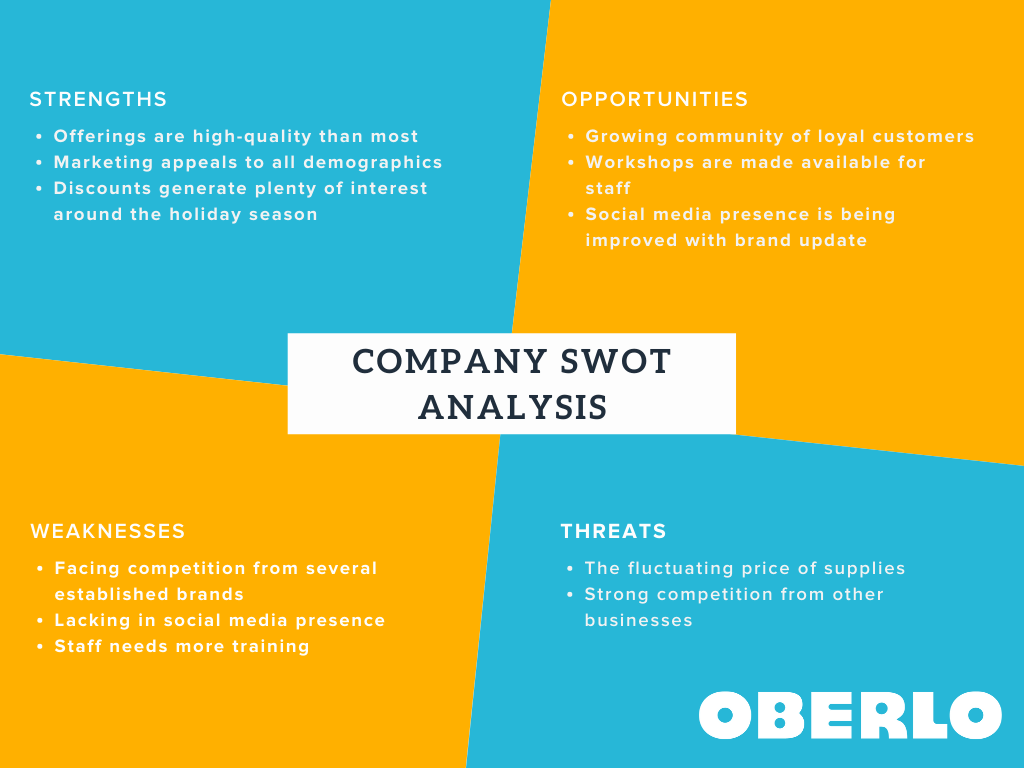

Tip: Completing a strengths, weaknesses, opportunities and threats (SWOT) analysis may help you write this section. Download a FREE SWOT Analysis Template

- Your pricing strategy. How will your pricing be competitive, but still allow you to make a profit? Check out how to decide on a pricing strategy.

- Your sales and delivery strategy. How will you will generate sales? Will you sell directly to customers or through other businesses? How much will it cost to produce and ship your product?

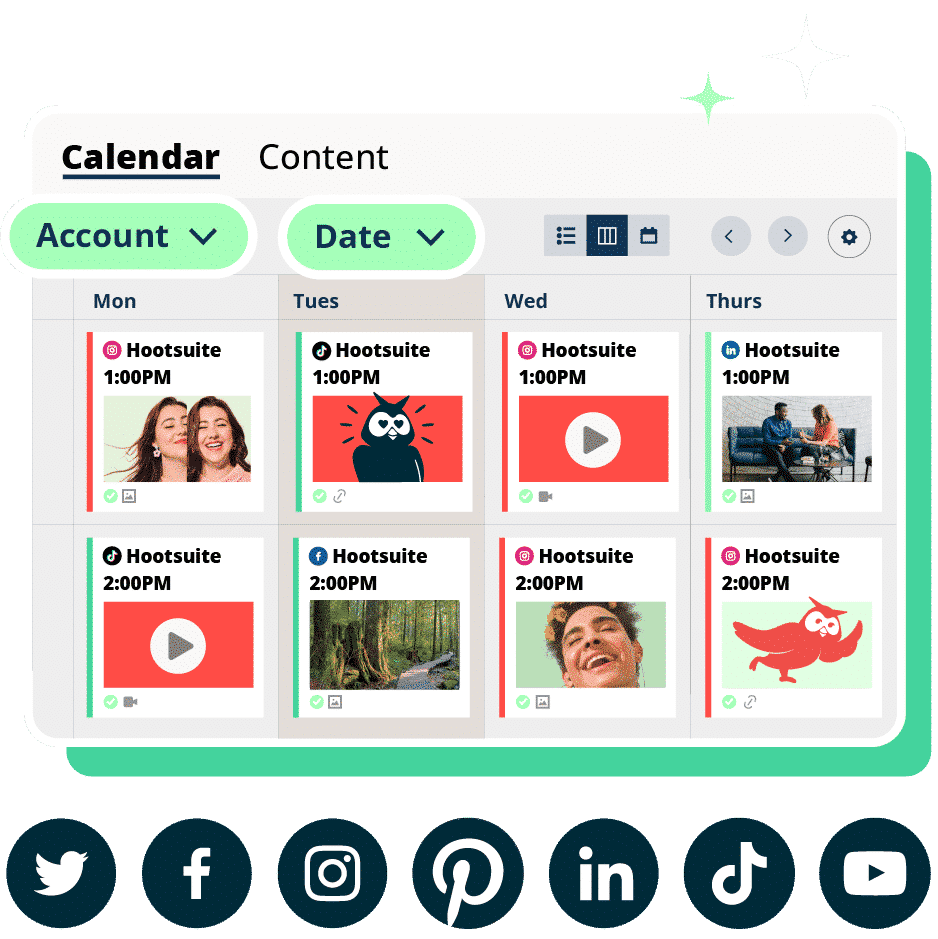

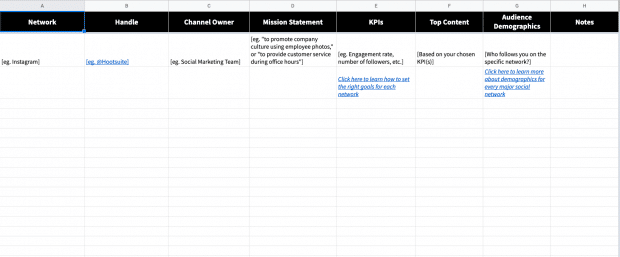

- Advertising and promotion strategy. Which advertising and promotion tactics (website, digital marketing, social media, email) will reach your audience most effectively?

Tip: Choose a few channels to do well instead of pursuing all of them at once. That way, you’ll be better able to direct your focus and monitor your progress.

Describe How Your Business Will Operate

The operations section of your business plan should describe what’s physically necessary for your business, as well as any partners who help keep things running smoothly.

This section contains four main categories:

- Your stage of development. This should highlight what you’ve done to date to get the business operational, then follow up with an explanation of what still needs to be done.

- The production process. This lays out the details of your day-to-day operations, manufacturing details, inventory, costs, outsourcing and more.

- Getting products and services to customers. What is your supply chain and distribution strategy?

- Partners and allies. Who are the people and organizations that support you? Who are key suppliers and vendors?

Third-party groups may be able to help you in your journey. For example, Futurpreneur serves entrepreneurs age 18-39 who want access to business resources, financing and mentoring.

Detail Your Financing and Cash Flow Needs

Use this section to determine how strong your business is financially. Be realistic about expenses and projected income so you can properly assess your financial health early on and make sure you have enough cash for the first year.

- Startup costs. What are your one-time and ongoing expenses? How will you cover the costs? Check out how to determine your start-up costs and working capital or use our Startup Costs Calculator .

- Profit margin and break-even point. How will you make a profit and calculate margins? What is your break-even point? Suggested reading: The Difference Between Cash Flow and Profit

- Balance sheet. What assets, liabilities and capital do you have at this point in time?

- Financing. What are your sources of financing —savings, loans, grants? What are your repayment terms, if any?

- Cash flow forecast. What is your 12-month cash flow forecast? Estimate it now: Cash Flow Forecast Template

Describe Your Team (Even if It’s Just You)

This section should describe your current team as well as anyone you might need to hire to round out your company.

- Skills and strengths. What skills do you and/or your team have that are critical to the business?

- Management style and structure. How will you manage your team? Who will employees report to?

Identify Risks and How You’ll Protect Your Business

Every business comes with some risk, so it’s better to be prepared for them now rather than be surprised later. Use this section to explore potential risks and how you’ll protect your business .

- Obstacles your business may face. How could the economy, your competition, supply chain or another circumstance affect your business? How do you plan to minimize and handle these and other risks?

- How you’ll protect against losing market share (new competition). Do you have any agreements or vendors you’ll rely on?

- How you’ll prevent critical data loss. Outline what you will do to reduce the impact of data loss, such as backing up all computer data regularly, using cloud providers, employee rules on installing software and other policies.

- How you’ll protect intellectual assets. Will employees sign confidentiality agreements to protect processes, trade secrets and other intellectual property? See How Intellectual Property (IP) in Canada Works .

- Compliance requirements. What rules, regulations and licences will you need to comply with to operate?

- Insurance needs. Does your industry require specific coverage, such as professional liability or other insurance?

Write a Conclusion

This is the last thing readers will see, so you want it to be strong. Use your conclusion to reinforce your goals and objectives. If you need financing, clearly state the amount you need and how it will be used. As with your executive summary, your conclusion should be succinct, clear and leave a positive impression.

Include Your Contact Information

Potential investors and lenders need to know how to reach you. Don’t forget to include your business name, contact information, website and social media presence in your plan.

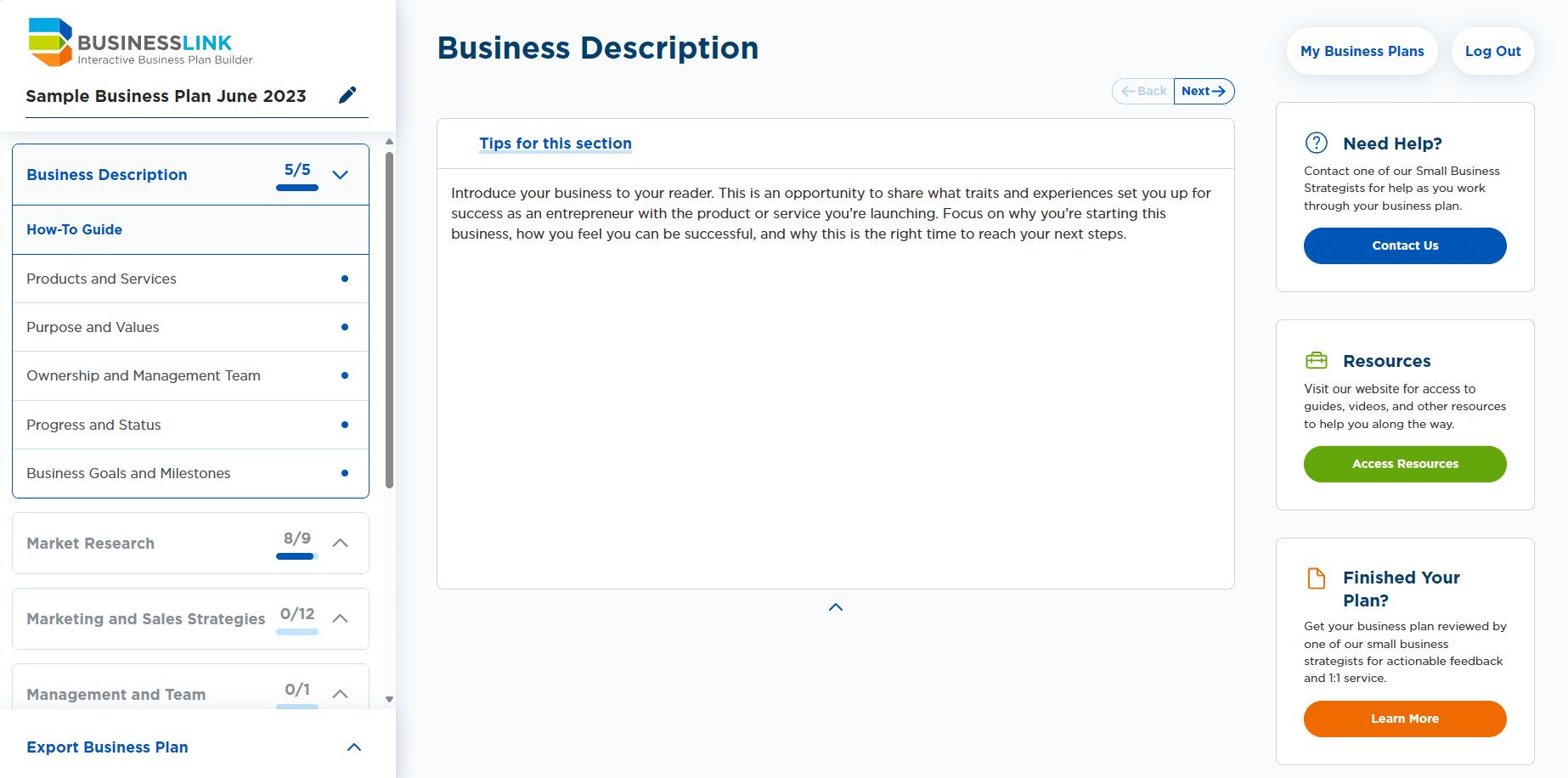

Create Your Plan with the RBC Business Plan Builder

This comprehensive template will guide you through a series of questions, resources and tips to help you write your plan. Best of all, you can go at your own pace and come back to work on it anytime.

Want to Talk Business?

Get help clarifying your goals, setting up, opening an account and more.

We look forward to meeting with you! Here’s how to get in touch:

Call us 24/7: 1-800-769-2511

Thanks for stopping by. We’re here to help when you’re ready. In the meantime:

Use our FREE step-by-step guide to help make your dream of starting a business a reality.

Stay up-to-date on the latest resources, money-saving offers and business advice.

See How an Advisor Can Help You

RBC business advisors can help your company at every stage—from starting up to simplifying operations and funding growth. An RBC business advisor will work with you to:

- Understand your vision and business goals

- Set up the right financial products and solutions

- Explore options to effectively manage cash flow, pay employees and get paid

- Connect you to a suite of business advice and solutions that go beyond traditional banking

View Legal Disclaimers Hide Legal Disclaimers

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

Free Business Plan Template for Small Businesses (2024)

Use this free business plan template to write your business plan quickly and efficiently.

A good business plan is essential to successfully starting your business — and the easiest way to simplify the work of writing a business plan is to start with a business plan template.

You’re already investing time and energy in refining your business model and planning your launch—there’s no need to reinvent the wheel when it comes to writing a business plan. Instead, to help build a complete and effective plan, lean on time-tested structures created by other entrepreneurs and startups.

Ahead, learn what it takes to create a solid business plan and download Shopify's free business plan template to get started on your dream today.

What this free business plan template includes

- Executive summary

- Company overview

- Products or services offered

- Market analysis

- Marketing plan

- Logistics and operations plan

- Financial plan

This business plan outline is designed to ensure you’re thinking through all of the important facets of starting a new business. It’s intended to help new business owners and entrepreneurs consider the full scope of running a business and identify functional areas they may not have considered or where they may need to level up their skills as they grow.

That said, it may not include the specific details or structure preferred by a potential investor or lender. If your goal with a business plan is to secure funding , check with your target organizations—typically banks or investors—to see if they have business plan templates you can follow to maximize your chances of success.

Our free business plan template includes seven key elements typically found in the traditional business plan format:

1. Executive summary

This is a one-page summary of your whole plan, typically written after the rest of the plan is completed. The description section of your executive summary will also cover your management team, business objectives and strategy, and other background information about the brand.

2. Company overview

This section of your business plan will answer two fundamental questions: “Who are you?” and “What do you plan to do?” Answering these questions clarifies why your company exists, what sets it apart from others, and why it’s a good investment opportunity. This section will detail the reasons for your business’s existence, its goals, and its guiding principles.

3. Products or services offered

What you sell and the most important features of your products or services. It also includes any plans for intellectual property, like patent filings or copyright. If you do market research for new product lines, it will show up in this section of your business plan.

4. Market analysis

This section includes everything from estimated market size to your target markets and competitive advantage. It’ll include a competitive analysis of your industry to address competitors’ strengths and weaknesses. Market research is an important part of ensuring you have a viable idea.

5. Marketing plan

How you intend to get the word out about your business, and what strategic decisions you’ve made about things like your pricing strategy. It also covers potential customers’ demographics, your sales plan, and your metrics and milestones for success.

6. Logistics and operations plan

Everything that needs to happen to turn your raw materials into products and get them into the hands of your customers.

7. Financial plan

It’s important to include a look at your financial projections, including both revenue and expense projections. This section includes templates for three key financial statements: an income statement, a balance sheet, and a cash-flow statement . You can also include whether or not you need a business loan and how much you’ll need.

Business plan examples

What do financial projections look like on paper? How do you write an executive summary? What should your company description include? Business plan examples can help answer some of these questions and transform your business idea into an actionable plan.

Professional business plan example

Inside our template, we’ve filled out a sample business plan featuring a fictional ecommerce business .

The sample is set up to help you get a sense of each section and understand how they apply to the planning and evaluation stages of a business plan. If you’re looking for funding, this example won’t be a complete or formal look at business plans, but it will give you a great place to start and notes about where to expand.

Lean business plan example

A lean business plan format is a shortened version of your more detailed business plan. It’s helpful when modifying your plan for a specific audience, like investors or new hires.

Also known as a one-page business plan, it includes only the most important, need-to-know information, such as:

- Company description

- Key members of your team

- Customer segments

💡 Tip: For a step-by-step guide to creating a lean business plan (including a sample business plan), read our guide on how to create a lean business plan .

Benefits of writing a solid business plan

It’s tempting to dive right into execution when you’re excited about a new business or side project, but taking the time to write a thorough business plan and get your thoughts on paper allows you to do a number of beneficial things:

- Test the viability of your business idea. Whether you’ve got one business idea or many, business plans can make an idea more tangible, helping you see if it’s truly viable and ensure you’ve found a target market.

- Plan for your next phase. Whether your goal is to start a new business or scale an existing business to the next level, a business plan can help you understand what needs to happen and identify gaps to address.

- Clarify marketing strategy, goals, and tactics. Writing a business plan can show you the actionable next steps to take on a big, abstract idea. It can also help you narrow your strategy and identify clear-cut tactics that will support it.

- Scope the necessary work. Without a concrete plan, cost overruns and delays are all but certain. A business plan can help you see the full scope of work to be done and adjust your investment of time and money accordingly.

- Hire and build partnerships. When you need buy-in from potential employees and business partners, especially in the early stages of your business, a clearly written business plan is one of the best tools at your disposal. A business plan provides a refined look at your goals for the business, letting partners judge for themselves whether or not they agree with your vision.

- Secure funds. Seeking financing for your business—whether from venture capital, financial institutions, or Shopify Capital —is one of the most common reasons to create a business plan.

Why you should you use a template for a business plan

A business plan can be as informal or formal as your situation calls for, but even if you’re a fan of the back-of-the-napkin approach to planning, there are some key benefits to starting your plan from an existing outline or simple business plan template.

No blank-page paralysis

A blank page can be intimidating to even the most seasoned writers. Using an established business planning process and template can help you get past the inertia of starting your business plan, and it allows you to skip the work of building an outline from scratch. You can always adjust a template to suit your needs.

Guidance on what to include in each section

If you’ve never sat through a business class, you might never have created a SWOT analysis or financial projections. Templates that offer guidance—in plain language—about how to fill in each section can help you navigate sometimes-daunting business jargon and create a complete and effective plan.

Knowing you’ve considered every section

In some cases, you may not need to complete every section of a startup business plan template, but its initial structure shows you you’re choosing to omit a section as opposed to forgetting to include it in the first place.

Tips for creating a successful business plan

There are some high-level strategic guidelines beyond the advice included in this free business plan template that can help you write an effective, complete plan while minimizing busywork.

Understand the audience for your plan

If you’re writing a business plan for yourself in order to get clarity on your ideas and your industry as a whole, you may not need to include the same level of detail or polish you would with a business plan you want to send to potential investors. Knowing who will read your plan will help you decide how much time to spend on it.

Know your goals

Understanding the goals of your plan can help you set the right scope. If your goal is to use the plan as a roadmap for growth, you may invest more time in it than if your goal is to understand the competitive landscape of a new industry.

Take it step by step

Writing a 10- to 15-page document can feel daunting, so try to tackle one section at a time. Select a couple of sections you feel most confident writing and start there—you can start on the next few sections once those are complete. Jot down bullet-point notes in each section before you start writing to organize your thoughts and streamline the writing process.

Maximize your business planning efforts

Planning is key to the financial success of any type of business , whether you’re a startup, non-profit, or corporation.

To make sure your efforts are focused on the highest-value parts of your own business planning, like clarifying your goals, setting a strategy, and understanding the target market and competitive landscape, lean on a business plan outline to handle the structure and format for you. Even if you eventually omit sections, you’ll save yourself time and energy by starting with a framework already in place.

Business plan template FAQ

What is the purpose of a business plan.

The purpose of your business plan is to describe a new business opportunity or an existing one. It clarifies the business strategy, marketing plan, financial forecasts, potential providers, and more information about the company.

How do I write a simple business plan?

- Choose a business plan format, such as a traditional or a one-page business plan.

- Find a business plan template.

- Read through a business plan sample.

- Fill in the sections of your business plan.

What is the best business plan template?

If you need help writing a business plan, Shopify’s template is one of the most beginner-friendly options you’ll find. It’s comprehensive, well-written, and helps you fill out every section.

What are the 5 essential parts of a business plan?

The five essential parts of a traditional business plan include:

- Executive summary: This is a brief overview of the business plan, summarizing the key points and highlighting the main points of the plan.

- Business description: This section outlines the business concept and how it will be executed.

- Market analysis: This section provides an in-depth look at the target market and how the business will compete in the marketplace.

- Financial plan: This section details the financial projections for the business, including sales forecasts, capital requirements, and a break-even analysis.

- Management and organization: This section describes the management team and the organizational structure of the business.

Are there any free business plan templates?

There are several free templates for business plans for small business owners available online, including Shopify’s own version. Download a copy for your business.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The point of sale for every sale.

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Latest from Shopify

Jun 11, 2024

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Personal Finance

How to Start a Small Business in Canada: 10 Essential Steps

Starting a business can seem daunting, but getting started on your entrepreneurial journey doesn’t have to be as scary as you think. Here’s a quick and easy breakdown of starting a small business in Canada.

1. Find a business idea

Whether you’re starting a side hustle or have dreams of a multi-million dollar corporation, the first thing you need to do is to come up with a plan or a strategy. Ask yourself: What will you provide, and who are your target customers?

Business experts point to two main tips for those looking to start a business.

- Will your business provide the solution to a problem?

- Do you know the industry inside and out?

If your business idea checks off both of those boxes, it is probably worth pursuing.

2. Create a business plan

Take the time to do the research and create a strong business plan. It doesn’t need to be a 100-page PDF, but you’ll need some figures, estimates and an understanding of your cash flow to back up your proposal. The more realistic and well-researched your plan is, the more likely you are to obtain financial support from the bank or another lender.

3. Choose a name for your business

Chances are you already have some ideas in mind, but there are a few things to consider before you commit to a business name.

- Does the name make it obvious to customers what you are selling?

- Does it reflect positively on the business?

- Is it easy to pronounce, spell and remember?

- Is it unique enough to avoid any potential legal issues?

Once you settle on a business name, you’ll want to make sure it’s available. If the name has already been taken, you can’t legally use it. But legality aside, you also want a unique name to avoid confusion.

You can start with an internet search on your preferred business name but be sure to dig deeper. Search national name databases in Canada, such as Nuans and Canada’s Business Registries , and provincial and territorial databases.

4. Register your new business with the government

You may or may not have to register the name of your start-up, depending on how the business is structured. You don’t need to register if you are the sole proprietor operating under your legal name, like a freelancer. However, if your business is a partnership or corporation, you do need to register the name, and you may also want to register a trademark.

Further registration requirements will again depend on the type of business structure you use, and where you set up shop. The Government of Canada’s website offers links to start-up business support for each province/territory.

5. Apply for any required permits and licenses

The requirements for what kinds of permits and licenses you may need before launching your business vary depending on your location and the type of business you’re running. Still, they may be necessary at all three levels of government.

BizPal has a handy online search tool that allows you to enter your business’s location (municipality) and industry type to find out which permits and licenses you require.

6. Apply for a CRA business number

On top of business permits and licenses, you’ll also want to apply for a business number, used for income tax purposes. You can do this online or by phone through the Canada Revenue Agency (CRA).

Make sure to research the basics of paying taxes when you’re self-employed.

7. Open a business bank account

It’s a good idea to keep your business banking separate from your personal banking, and using a business bank account is the easiest way to do this.

Business bank accounts function like regular bank accounts but often also include features and perks designed for different business types’ varying sizes and needs.

8. Apply for a business credit card

A business credit card is another great way to keep your personal finances separate. The best business credit cards operate like a personal credit card and come in handy when purchasing supplies, meals for clients, gas for company vehicles, and other business expenses.

9. Get financing to fund your business

Launching a new business can be a costly endeavour. So, even if you have some healthy savings set aside for your start-up, you may need some help.

To get funding for your small business, consider asking friends or family to invest in the venture or give you a loan. You can also go the traditional route and borrow money from a bank or another lender. Remember, you’ll need a good business plan to be approved!

It’s worth noting that the Government of Canada also offers many small-business grants, including options for First Nations businesses, new immigrants to Canada and even former military members. Take a look at this Business Benefits Finder to see if anything applies to you.

10. Ask for help

It takes a lot of work to start your own business. Thankfully, however, several resources are available to help you get up and running. Take the time to do your research along the way and, if you like, consider working with a mentor who can guide you through the entrepreneurial process.

About the Author

Hannah Logan is a freelance writer and blogger who specializes in personal finance and travel. You can follow her personal travel blog EatSleepBreatheTravel.com or find her on Instagram @hannahlogan21.

DIVE EVEN DEEPER

A budget is a plan that helps you manage your money so you can spend and save wisely. Learn how to make a budget — and how to stick to it.

Understanding the Main Types of Debt

Debt can be divided into several types: secured and unsecured, good and bad. Other types of debt include credit card debt, student loans, medical bills and mortgages.

Do You Need a Business Bank Account?

A business bank account allows a company or a self-employed person to perform banking transactions under a business name.

What Is a Business Credit Card?

A business credit card is a way to charge expenses related to a company. Size and financial needs of the company should be considered before getting a business credit card.

- Best Business Plan Software In Canada

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Best Business Plan Software In Canada For June 2024

Updated: Jun 3, 2024, 12:18pm

Fact Checked

Writing a business plan not only helps you stay on track as you start a new business but it can also help you secure funding. You can create one from scratch with a simple template, but business plan software often has features to make it easier, more nuanced and overall better. It could even make the difference between bringing investors on board and going it alone. So, Forbes Advisor Canada found the best business plan software that has the features you need at an affordable price.

The Best Business Plan Software of 2024

Business sorter, forbes advisor ratings, methodology, how to choose a business plan software, benefits of business plan software, frequently asked questions (faqs).

- Best Project Management Software

- Best Free Project Management Software

- Best Task Management Software

- Wrike: Best overall

- Smartsheet: Best for goal management

- LivePlan: Best for financial forecasting

- Aha!: Best for roadmapping

- Bizplan: Best for beginners

- IdeaBuddy: Best for ideation

- iPlanner: Best for no-frills business planning

- Enloop: Best for automatic business plan creation

- AchieveIt: Best for consultant groups

- Business Sorter: Best for teams

BEST OVERALL

Starting price

Free; $9.80 USD ($13.17 CAD) per user

Team messaging

Roadmapping.

Wrike is a project management (PM) tool that works well as business plan software because it gives you tools to help you gather and compare your data. Wrike makes it easy to start your business plan with its collaboration tools, business plan templates, drag-and-drop interface and goal management features. Another benefit of using Wrike to build your plan is that you see your ideas and goals from multiple views: Gantt chart, calendar or board views.

There are a few reasons why it’s a good idea to use Wrike for your business plan. First, you can map out exactly what your business goals are in a project, invite teammates to collaborate and message business partners to discuss everything. Plus, you can export your data when you’re ready to put all the details into a presentation to hand over to potential investors.

Wrike offers a free plan that’s good for putting your vision down in task and project form, but you may want to upgrade to a paid plan to invite collaborators, get custom workflows and add more views and automations. Paid plan pricing ranges from $9.80 USD ($13.17 CAD) per user, per month, to $24.80 USD ($33.27 CAD) per user, per month, both billed annually.

Who should use it: Wrike makes it easy for any new business owner to create a business plan and collaborate with others on financial and operational goals. Plus, it provides value after you finalize your business plan because it’s a good pick for a PM tool.

- Roadmapping ability

- Multiple views (Gantt, calendar and board)

- Business plan templates included

- Goal management via projects and tasks

- Free plan available

- Affordable plans

- No pitching tools

- No financial tools

BEST FOR GOAL MANAGEMENT

$9 CAD per user, per month

(billed annually)

(added cost)

Using PM software like Smartsheet is a good idea for starting a business plan because it includes all the tools you need to collaborate and plan across multiple teams or stakeholders. It’s especially good for real-time goal management. Get your ideas in place, go over market and competitive research from other teammates and finalize everything together.

Smartsheet won’t help you write your business plan, but it does give you a place to compile all the data and then you can use one of its free business plan templates. As you figure out your milestones, you can invite an unlimited number of viewers to see how it’s going. The only downsides are that Smartsheet doesn’t have a native messaging app (you’ll have to use an integration), only commenting is allowed and there’s no free plan.

Paid plans from Smartsheet cost $9 CAD per user, per month, or $33 CAD per user, per month (billed annually for both). The low-priced Pro plan limits you to 10 editors, but the Business plan allows unlimited editors (but it also has a three-user minimum).

Who should use it: Smartsheet lets you make changes in real-time, so it’s a good option for those who are just starting to piece together a plan and looking for a way to manage ideas and goals before finalizing a business plan.

- Discounts for non-profits available

- Automations on every plan

- Popular integrations allowed on low-tier plan

- 30-day free trial

- No free plan

- Only 10 viewers allowed on low-tier plan

- Three-user minimum on Business plan

BEST FOR FINANCIAL FORECASTING

$15 USD ($20.12 CAD) per month

One of the strongest cases for using LivePlan to create your business plan is its financial forecasting. It isn’t just a single feature, rather it’s a tool that lets you turn your balance sheet and cash flow statements into charts, graphs and what-if situations to help you show possible investors the best- and worst-case scenarios for your business.

There are two plans available: Standard or Premium (there is no free plan). The low-priced plan, which costs $15 USD ($20.12 CAD) per month (billed annually), doesn’t limit your contributors or guests and includes instructions to help you complete a business plan. It even includes financial forecasting features and more than 500 sample plans to get you started.

The Premium plan costs $30 USD ($40.24 CAD) per month (billed annually), but it’s full-featured. You get a milestone planner and industry benchmark data, which can save you research time. Another timesaver: At this plan level, you can integrate QuickBooks or Xero to add your financial data seamlessly.

Who should use it: LivePlan is business plan software that includes prompts and accounting software integrations, making it great for new business owners that want easy financial forecasting.

- Unlimited guests and contributors

- Export finished business plan as PowerPoint presentation

- Includes step-by-step instructions with prompts

- 35-day money-back guarantee

- No free trial

BEST FOR ROADMAPPING

$59 USD ($79.12 CAD) per user, per month

Every business plan starts with strategy and Aha! makes it easier to map out what you plan to do to get from point A to point Z. Aha! is primarily roadmapping software that product teams use to plan features, products or bug fixes. Any business in any industry can use it to shape ideas and strategy into plans and milestones.

Much like product development, business plans have phases and Aha! is ideal for the first few phases of business planning. Although you won’t find a scorecard feature with Aha! Roadmaps, you can score and prioritize your business vision and goals. Finally, you can present your plan to viewers (stakeholders) before you create your official business plan and secure funding.

There are three plans from which you can choose: Premium at $59 USD ($79.12 CAD) per user, per month; Enterprise at $99 USD ($132.75 CAD) per user, per month; and Enterprise+ at $149 USD ($199.80 CAD) per user, per month, all billed annually. The only reason to upgrade to either Enterprise plan is if you want to add on automation, development tools and custom worksheets and tables.

Who should use it: Aha! Roadmaps is a great tool to help you strategize and get your ideas for your business in one place. You can use the presentation feature to share your business’s roadmap on your way to creating your finalized business plan.

- User-friendly interface

- Ability to score and prioritize ideas

- Share roadmaps with others

- Expensive for business plan creation

- Has a bit of a learning curve

BEST FOR BEGINNERS

$20.75 USD ($27.82 CAD) per month

Bizplan is specifically for business plan creation. It offers a guided walkthrough of each section you need for a complete business plan to use for funding or pitching to partners. Plug in the information, from your mission and goals to financial forecasts, and Bizplan will do the math and create the visual charts you need to get your point across.

Bizplan is very easy to use because it includes prompts and questions that take away the manual effort of figuring out what you need, so you can simply focus on providing the answers. When you’re satisfied you included all the data needed, you can invite stakeholders and consultants to look it over and add comments for approval or change requests. A unique feature of Bizplan is it gives you access to Fundable, a crowdfunding platform, on which you can share your business plan to try to generate funding.

Monthly pricing costs $29 USD ($38.89 CAD), but you can opt for annual pricing that averages to $20.75 USD ($27.82 CAD) per month. If you expect to need business plan software for much longer than a year, there’s a lifetime access option for $349 USD ($468.01 CAD) flat. All plans come with all features and access, including business courses, business planning tools and a route to investors.

Who should use it: If it’s your first time creating a business plan, Bizplan is a great choice to help guide you through all the sections you need to include in your plan for potential investors and partners.

- Monthly, annual and lifetime plans

- Unlimited business plans

- Unlimited collaborators

- Step-by-step instructions

- Modular, drag-and-drop interface

- Online business courses

- Access to Fundable

- Financial forecasting

- No roadmapping tools

- Lack of customization

- Only integrates with Xero

BEST FOR IDEATION

Free; $7 CAD per month

IdeaBuddy is a basic business plan tool that lets you start for free, which is great for beginners who aren’t quite ready to create a plan. The idea plan feature is great because it lets you lay out your business plan on one page, giving you an overview. There are built-in sticky notes for brainstorming and custom templates to start you off with a bit of a guide (or just create your own).

Another great feature of IdeaBuddy is the whiteboard, which lets you drag and drop various elements, draw on them and collaborate with others to come up with your perfect business idea. That feature is locked behind the highest tier, so you’ll have to pay $26 CAD per month (billed annually) to use it. However, that plan also gives you up to 10 collaborators and 10 ideas.

Other plans are more limiting: The free plan is for a solopreneur who has a single idea to work on and the Dreamer plan is $7 CAD per month while the Founder plan is $13 CAD per month, both billed annually. The Dreamer plan is also limited to one idea, but you get one collaborator, while the Founder plan gives you up to three ideas and three collaborators. Plus, you’ll get access to the paid plans to export and share your plan with viewers.

Who should use it: IdeaBuddy is just what it sounds like: It’s best for ideation. You can create a full-fledged business plan, but this program is best suited for the very beginning stages of business creation.

- Free forever plan

- Affordable paid plans

- Monthly and annual billing options

- Easy to use

- Export to Word, Excel or as PDF

- Flexible whiteboard feature

- May be too basic for some users

- Doesn’t offer much guidance

BEST FOR NO-FRILLS BUSINESS PLANNING

$59 USD ($79.12 CAD) for one year

Business plan software doesn’t have to be fancy to be effective, and iPlanner certainly fits that bill. It’s been around since 2007 and it doesn’t appear to have updated its look or functions. The browser-based business planning software gives you a place to build out your business model and a business plan.

There are two different software options from iPlanner: Strategy Designer and -Framework. The Strategy Designer costs $59 USD ($79.12 CAD) for three plans, but it’s a one-time fee for the year. Choose it if you want a more condensed and no-frills kind of business plan. You can export it to Word or as a PDF.

Who should use it: iPlanner is best for those who have created a business plan before and don’t need hand-holding or fancy features.

- Business modelling option

- Samples on site for demoing

- Export to Word or as PDF

- No free plan or trial

- Not a lot of guidance

- Outdated interface

BEST FOR AUTOMATIC BUSINESS PLAN CREATION

$11 USD ($14.75 CAD) per month

Enloop is a unique business plan app that generates a business plan for you based on the information you provide. You can edit the text Enloop writes for you to make it more specific or change numbers in your financial forecasts as you see fit. Enloop offers a scorecard that updates as you change things, finish sections and make your business plan overall better.

Then Enloop compares your financial forecasts to industry standards, so you don’t have to do the research. The software shows you up to 16 ratios, such as sales, inventory and payables and then shows you what the average is for your industry as it compares to your financials. Enloop then gives you either a pass or fail so that you can modify your plan before you put anything into play.

Although Enloop doesn’t offer a free plan, there is a free trial for one week so you can see if it’s right for you. The Detailed plan costs $11 USD ($14.75 CAD) per month while the Performance plan is $24 USD ($32.18 CAD) per month, both billed annually. The biggest difference between the two plans is how many financial ratios Enloop analyzes: The Detailed plan only gets three ratios and Performance plan gets 16.

Who should use it: Enloop is best for those who have some experience creating business plans, not necessarily for those who are starting from scratch as there are no brainstorming or strategizing tools included. Use Enloop to create business plans quickly.

- Three business plans for each tier

- Generates a business plan automatically

- Compares your financials to industry standards

- Seven-day free trial available

- Scorecards indicate odds of success

- No messaging team members through app

- Not meant for strategizing

BEST FOR CONSULTANT GROUPS

Contact sales

Not everyone wants to go it alone when creating business plans and consultants are often hired for industry expertise and business plan creation. AchieveIt offers generous plans that won’t limit the number of plans and projects you can create, so you can work on multiple business plans at one time.

Specifically, AchieveIt is planning software meant for medium to large teams to work on projects simultaneously. For business planning, it’s a great option for those strategizing and analyzing a variety of data points with multiple people—all of AchieveIt’s plans have a minimum requirement of 20 users.

Unfortunately, pricing is only available by contacting the sales department. There is no pricing listed on company’s website

Who should use it: AchieveIt is a good choice for large businesses that need planning software and for business plan purposes, it makes most sense for established consultant groups.

- Unlimited plans and projects

- Collaboration tools

- Goal management

- 20-user minimum

- Pricier than most competitors

- Integrations at added cost

BEST FOR TEAMS

$10 USD ($13.41 CAD) per month

When you’re ready to craft your business plan, it can help immensely to have business planning software like Business Sorter. The cloud-based app makes it easy for you to start a plan and kicks off your business planning with a SWOT analysis (strengths, weaknesses, opportunities, threats). Then, you can follow a guide to build your plan with each section divided by areas. After which, you can choose cards to help steer you toward the right objectives and goals for your business.

You won’t find roadmapping tools in Business Sorter, but the card system keeps you on track (and even gives you goals you may not have considered). As you prioritize goals, you’ll find steps you need to take that guide you to completing your business plan. Every plan allows multiple users, so you can collaborate on what takes precedence.

Plans start at $10 USD ($13.41 CAD) per month, billed annually, and allow you to have three users on board. For 10 users, the Medium plan costs $30 USD ($40.23 CAD) per month, billed annually, and if you need 30 users, the Large Team plan will run you $80 USD ($107.29 CAD) per month, billed annually. It’s one of the most affordable business planning apps for teams.

Who should use it: Although Business Sorter doesn’t offer a messaging tool, it’s still one of the best options for teams. You don’t have to pay per person, but you can add multiple people to the account to work on creating business plans.

- Easy-to-use business plan templates

- Free trial available

- Card system helps guide your goal setting

- Create up to 40 business plans

- Plans limit user count

- No messaging in app

- Very limited integrations

| Company | Forbes Advisor Rating | Starting Price | Team messaging | Learn More CTA text | Learn more CTA below text | LEARN MORE | Roadmapping |

|---|---|---|---|---|---|---|---|

| Wrike | Free; $9.80 USD ($13.17 CAD) per user, per month | Yes | Yes | ||||

| Smartsheet | $9 CAD per user, per month (billed annually) | Yes (added cost) | Yes | ||||

| LivePlan | $15 USD ($20.12 CAD) per month (billed annually) | Yes | Yes | ||||

| Aha! | $59 USD ($79.12 CAD) per user, per month (billed annually) | Yes (added cost) | Yes | ||||

| Bizplan | $20.75 USD ($27.82 CAD) per month (billed annually) | Yes | No | ||||

| IdeaBuddy | Free; $7 CAD per month (billed annually) | No | No | ||||

| iPlanner | $59 USD ($79.12 CAD) for one year | No | No | ||||

| Enloop | $11 USD ($14.75 CAD) per month (billed annually) | No | Yes | ||||

| AchieveIt | Contact Sales | No | No | ||||

| Business Sorter | $10 USD ($13.41 CAD) per month (billed annually) | No | No |

| 3 | ||||

|---|---|---|---|---|

| 3 |

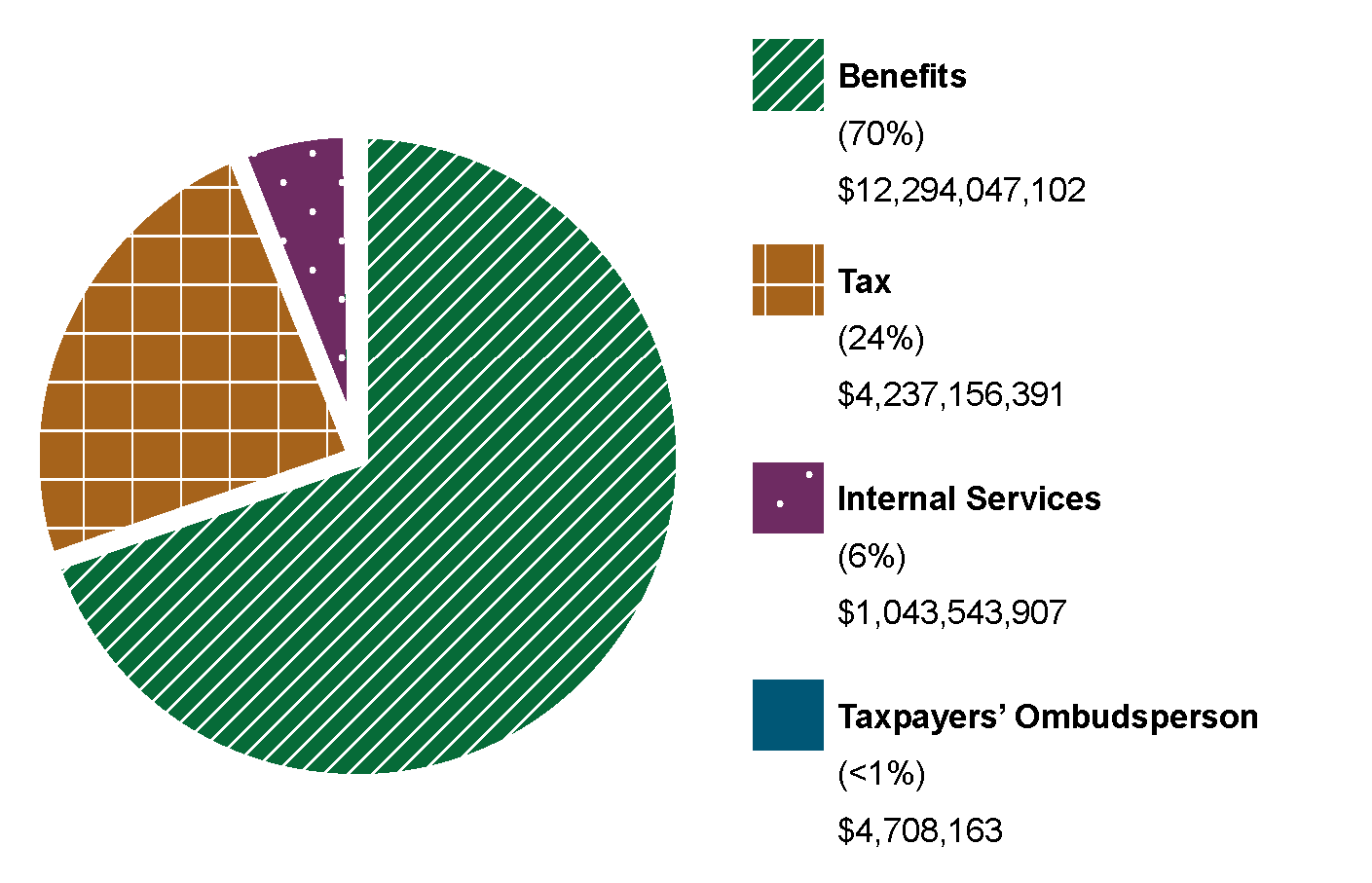

Financial, human resources and performance information for the CRA’s program inventory is available on GC InfoBase .

More detailed results and explanations are found in the CRA's Departmental Results Reports .

B. Benefits administration

The CRA’s core responsibility for benefits administration is to ensure that Canadians:

- get the support and information they need to know what benefits and credits they may be eligible to receive;

- receive their benefit and refund payments in a timely manner;

- have avenues of redress when they disagree with a decision on their benefit eligibility.

The CRA uses its federal tax delivery infrastructure to administer almost 200 services and ongoing benefits and one-time payment programs for the provinces and territories, including:

- Canada child benefit

- goods and services tax/harmonized sales tax credit

- children’s special allowances

- disability tax credit

- Canada workers benefit

- provincial and territorial programs

These services and benefits contribute directly to the economic and social well-being of Canadians by supporting individuals, families, children, and caregivers.

The following CRA program supports the core responsibility for benefits administration:

- Benefits – The CRA ensures that Canadians obtain the support and information they need to know what benefits they may be eligible to receive, that they receive their benefit payments in a timely manner, and have avenues of redress when they disagree with a decision on their benefit eligibility.

Supporting information on planned expenditures, human resources, and results related to CRA’s program inventory is available on GC InfoBase

- Planned spending Footnote 4 : $12,294,047,102

- Planned full-time resources: 2,360

For each result related to benefits administration, the following table shows the approved performance indicators, results from the three most recently reported fiscal years, and the targets to be achieved by March 31, 2025.

Table 2: Performance indicators, results, and targets for benefits administration

| 5 | ||||

Internal services

Internal services are the services provided within a department so it can meet its corporate obligations and deliver its programs. There are 11 categories of internal services:

- management and oversight

- communication

- human resource management

- financial management

- information management

- information technology

- real property management

- material management

- acquisition management

- Planned spending: 1,043,543,907

- Planned full-time resources: 7,565

Strategic priorities and plans to deliver

1. deliver seamless client experiences and tailored interactions that are digital first.

The CRA will ensure that its services are delivered in an efficient, timely, and easily accessible manner for all Canadians in the official language of their choice. This is a continuation of its People First Philosophy and key to improving Canadians’ satisfaction with the CRA’s service and key to improving Canadians’ satisfaction with the CRA’s service and their perception of the CRA. Understanding people’s needs, expectations, and experiences remains crucial in helping the CRA create and improve programs and services, which is making a difference in its culture. An internal service culture survey confirmed that clients’ needs are at the forefront of employees’ minds as they conduct their work.

Continuing to improve services for Canadians requires a digital transformation, to keep pace with technological change and evolve into a modern, digital tax and benefits administration. The CRA is using the Government of Canada’s Digital Standards as an essential part of its digital transformation with the goal of making it easier for Canadians to access information, apply for benefits, and meet tax obligations digitally. The CRA is striving to become an organization where people are equipped and empowered to adapt to new ways of working and thinking, where processes are updated, reimagined, and shared within the CRA. It is also working to make sure the technology is designed and adapted through modern, agile, secure and user-centric approaches.

The CRA is making significant investments in modern information technology (IT) platforms and tools. The evidence coming from web analytics, user feedback, and call centre data has helped the CRA improve online interactions and tasks. In May 2023, web content improvements on Canada.ca made it easier to find, navigate, and use information to settle the taxes of a deceased person. Accelerating the adoption of modern application development practices and experimenting with emerging technologies will continue to advance the CRA’s digital transformation journey.

Additionally, the CRA is continuing the transformation of the Scientific Research & Experimental Development (SR&ED) program to further improve the service experience it provides to businesses. This program is the largest single source of federal government support designed to advance research and development in Canada and provides on average $3.4 billion annually in tax credits to over 17,000 businesses. The SR&ED Program is accelerating the use of digital tools that will make it easier for businesses to access tax incentives. Recent results include:

- launching an interactive version of the SR&ED Self-Assessment and Learning Tool (SALT) , and

- adding a new feature for claimants to submit their SALT summary results in My Business Account to request pre-claim services.

This work helped to optimize the CRA’s Web presence and client experience by enabling individuals and businesses to easily access clear, timely, and accurate information about incentives, expenditures and investment taxes and credits on Canada.ca.

The CRA is dedicated to providing a simple client experience that meets Canadians’ service expectations. The CRA’s digital transformation will simplify and streamline tax processes for taxpayers and practitioners, making the application process for benefits simpler and online portals easier to access. For example, intuitive and interactive portals, new chatbots, and online chat services with live agents will make it easier for clients to access a wide range of services and information.

The CRA will also create an internal Accessibility Hub, which will house resources for employees to use to design and deliver programs and services that are easy to access by all Canadians, including persons with disabilities. The CRA will implement a performance measurement framework for accessibility, which will assess the CRA’s overall level of accessibility across all aspects of its operations.

The CRA will work to further integrate service delivery for Canadians. The CRA is supporting the Government’s examination of the ways the full suite of government services are delivered for Canadians. It is working closely with Service Canada to identify opportunities to expand the current range of services offered on behalf of the CRA to make life easier for Canadians.

The ePayroll project is a significant project that will simplify client interactions by making them digital. With the support of Employment and Social Development Canada and the Treasury Board of Canada Secretariat, the CRA has been preparing to build and implement an ePayroll service. The ultimate outcome is envisioned to be a near real-time information service that will modernize and streamline the way Canadian employers provide payroll, employment, and demographic information to multiple departments and agencies of the Government of Canada. This service will improve the speed and accuracy in delivering government services and benefits to Canadians while reducing the administrative burden on Canadian employers and businesses of all sizes. Phase I of the ePayroll project is focused on developing a fully costed implementation plan by March 2024.

Our commitments to Canadians in 2024–25:

- Provide accessible and flexible digital options for Canadians to contact the CRA with expanded chat services.

- Leverage the current direct deposit service through financial institutions’ technology to enable first time filers to sign up for direct deposit.

- Enable clients (individuals, businesses, representatives) to easily track the progress of their requests online through the secure portal and receive electronic notifications of any status changes.

- Provide additional digital notification functionality, on an opt-in basis, within My Business Account.

- Allow claimants of the SR&ED tax incentives to access simplified information and tools, start to build their claim, and track the status of their submitted claims through a Client Portal.

- Improve end-to-end client journeys by enhancing the ways in which CRA collects, responds to and uses client feedback.

One of the CRA’s primary goals is to ensure Canadians are aware of, and receive the benefits and credits they qualify for. The CRA has taken important steps to improve access to benefits for underserved populations and Indigenous communities. This work must continue to recognize the unique challenges some Canadians face. The CRA will intensify its engagement and support initiatives to ensure that Canadians have access to the benefits to which they are entitled.

Through the CVITP, community organizations hold free tax clinics to help modest-income individuals file their income tax and benefit returns. The number of returns filed through the CVITP increased by 15% from 640,000 in 2021 to 738,280 in 2022. The refund, credit and benefits entitlements amounts through the CVITP have increased from approximately $ 1.5 billion in 2021 to $ 1.8 billion in 2022. The CRA is focused on reaching underserved populations and is continuing to work with community organizations to raise awareness about available benefits, and how to access them. For the 2024–25 fiscal year, the CRA plans to increase the number of returns filed through the CVITP by a further 10%.