- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

How To Create Financial Projections for Your Business Plan

Building a financial projection as you write out your business plan can help you forecast how much money your business will bring in.

Planning for the future, whether it’s with growth in mind or just staying the course, is central to being a business owner. Part of this planning effort is making financial projections of sales, expenses, and—if all goes well—profits.

Even if your business is a startup that has yet to open its doors, you can still make projections. Here’s how to prepare your business plan financial projections, so your company will thrive.

What are business plan financial projections?

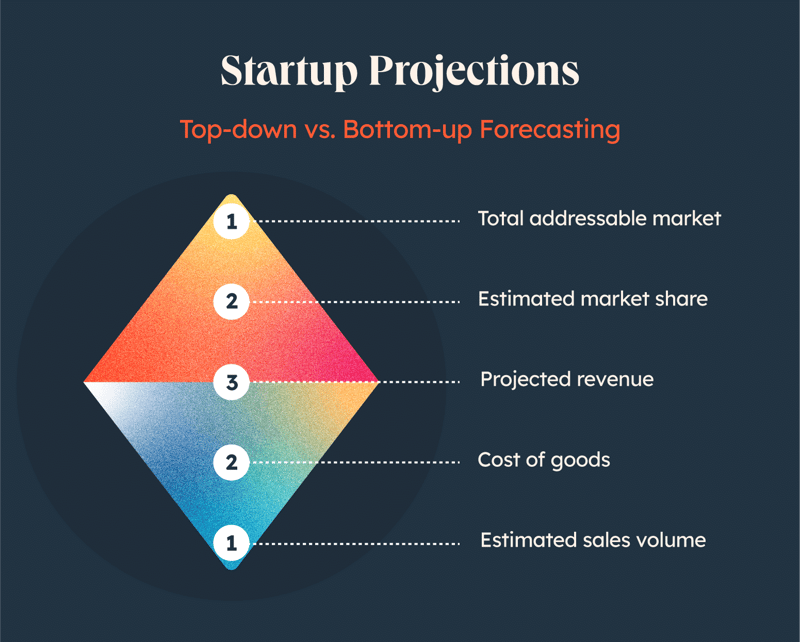

Business plan financial projections are a company’s estimates, or forecasts, of its financial performance at some point in the future. For existing businesses, draw on historical data to detail how your company expects metrics like revenue, expenses, profit, and cash flow to change over time.

Companies can create financial projections for any span of time, but typically they’re for between one and five years. Many companies revisit and amend these projections at least annually.

Creating financial projections is an important part of building a business plan . That’s because realistic estimates help company leaders set business goals, execute financial decisions, manage cash flow , identify areas for operational improvement, seek funding from investors, and more.

What are financial projections used for?

Financial forecasting serves as a useful tool for key stakeholders, both within and outside of the business. They often are used for:

Business planning

Accurate financial projections can help a company establish growth targets and other goals . They’re also used to determine whether ideas like a new product line are financially feasible. Future financial estimates are helpful tools for business contingency planning, which involves considering the monetary impact of adverse events and worst-case scenarios. They also provide a benchmark: If revenue is falling short of projections, for example, the company may need changes to keep business operations on track.

Projections may reveal potential problems—say, unexpected operating expenses that exceed cash inflows. A negative cash flow projection may suggest the business needs to secure funding through outside investments or bank loans, increase sales, improve margins, or cut costs.

When potential investors consider putting their money into a venture, they want a return on that investment. Business projections are a key tool they will use to make that decision. The projections can figure in establishing the valuation of your business, equity stakes, plans for an exit, and more. Investors may also use your projections to ensure that the business is meeting goals and benchmarks.

Loans or lines of credit

Lenders rely on financial projections to determine whether to extend a business loan to your company. They’ll want to see historical financial data like cash flow statements, your balance sheet , and other financial statements—but they’ll also look very closely at your multi-year financial projections. Good candidates can receive higher loan amounts with lower interest rates or more flexible payment plans.

Lenders may also use the estimated value of company assets to determine the collateral to secure the loan. Like investors, lenders typically refer to your projections over time to monitor progress and financial health.

What information is included in financial projections for a business?

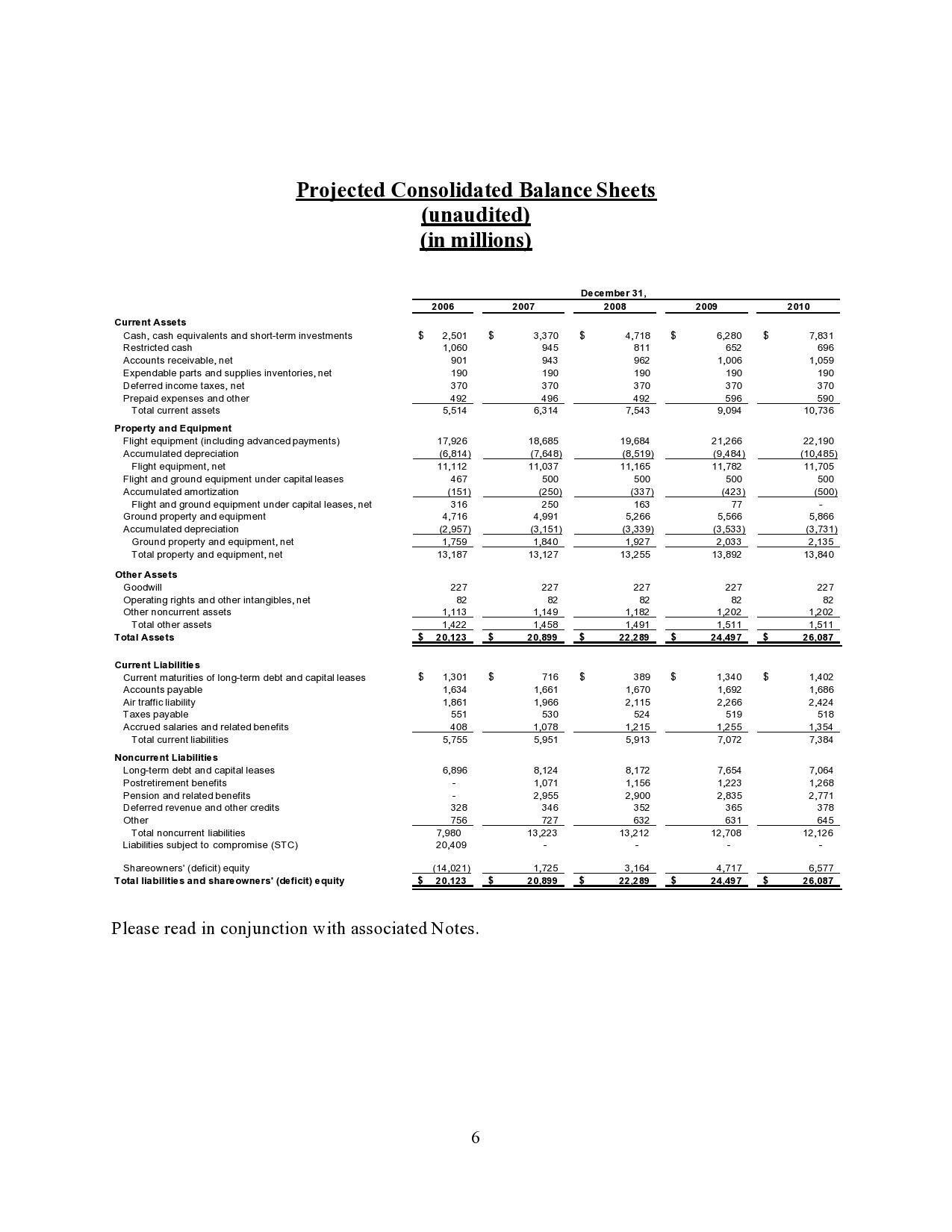

Before sitting down to create projections, you’ll need to collect some data. Owners of an existing business can leverage three financial statements they likely already have: a balance sheet, an annual income statement , and a cash flow statement .

A new business, however, won’t have this historical data. So market research is crucial: Review competitors’ pricing strategies, scour research reports and market analysis , and scrutinize any other publicly available data that can help inform your projections. Beginning with conservative estimates and simple calculations can help you get started, and you can always add to the projections over time.

One business’s financial projections may be more detailed than another’s, but the forecasts typically rely on and include the following:

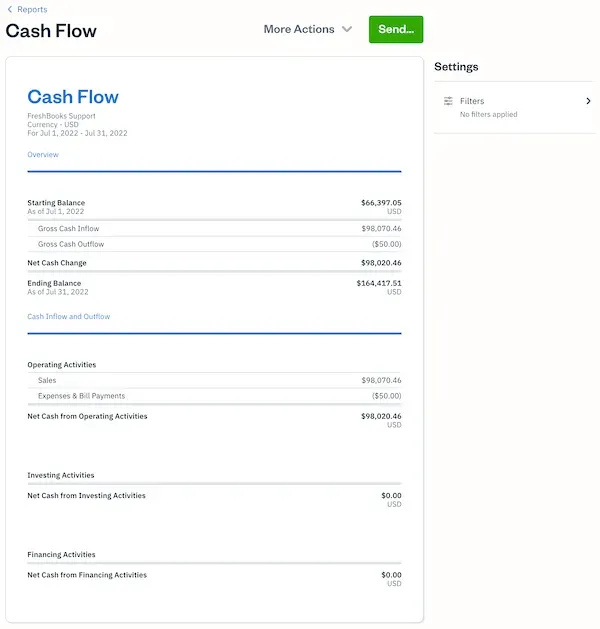

True to its name, a cash flow statement shows the money coming into and going out of the business over time: cash outflows and inflows. Cash flows fall into three main categories:

Income statement

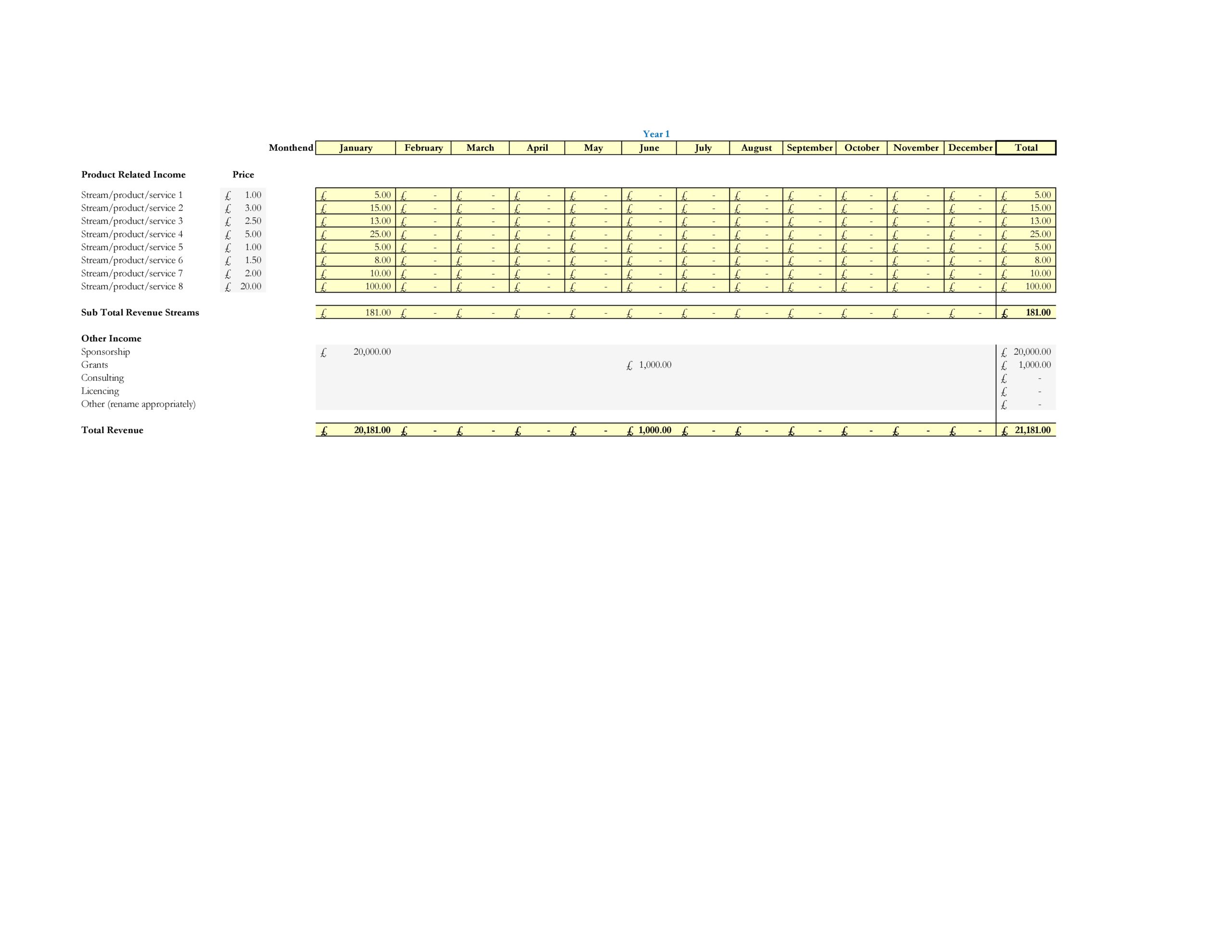

Projected income statements, also known as projected profit and loss statements (P&Ls), forecast the company’s revenue and expenses for a given period.

Generally, this is a table with several line items for each category. Sales projections can include the sales forecast for each individual product or service (many companies break this down by month). Expenses are a similar setup: List your expected costs by category, including recurring expenses such as salaries and rent, as well as variable expenses for raw materials and transportation.

This exercise will also provide you with a net income projection, which is the difference between your revenue and expenses, including any taxes or interest payments. That number is a forecast of your profit or loss, hence why this document is often called a P&L.

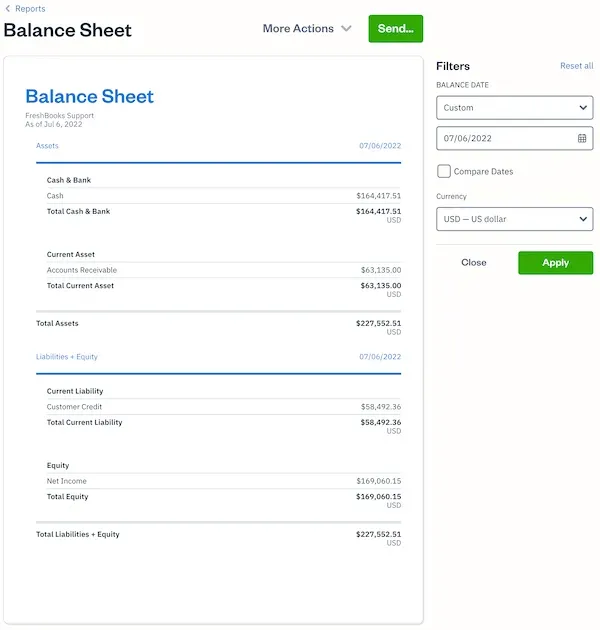

Balance sheet

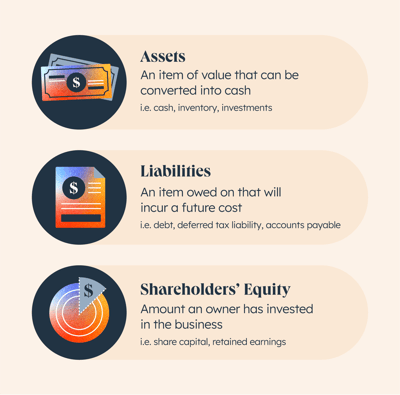

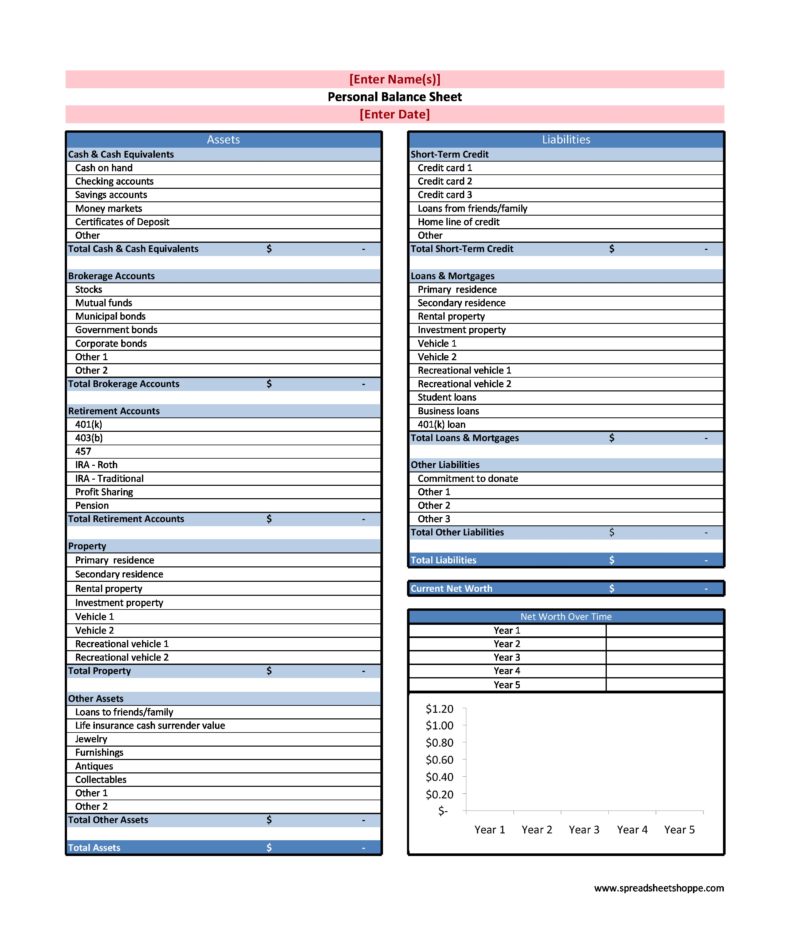

A balance sheet shows a snapshot of your company’s financial position at a specific point in time. Three important elements are included as balance sheet items:

- Assets. Assets are any tangible item of value that the company currently has on hand or will in the future, like cash, inventory, equipment, and accounts receivable. Intangible assets include copyrights, trademarks, patents and other intellectual property .

- Liabilities. Liabilities are anything that the company owes, including taxes, wages, accounts payable, dividends, and unearned revenue, such as customer payments for goods you haven’t yet delivered.

- Shareholder equity. The shareholder equity figure is derived by subtracting total liabilities from total assets. It reflects how much money, or capital, the company would have left over if the business paid all its liabilities at once or liquidated (this figure can be a negative number if liabilities exceed assets). Equity in business is the amount of capital that the owners and any other shareholders have tied up in the company.

They’re called balance sheets because assets always equal liabilities plus shareholder equity.

5 steps for creating financial projections for your business

- Identify the purpose and timeframe for your projections

- Collect relevant historical financial data and market analysis

- Forecast expenses

- Forecast sales

- Build financial projections

The following five steps can help you break down the process of developing financial projections for your company:

1. Identify the purpose and timeframe for your projections

The details of your projections may vary depending on their purpose. Are they for internal planning, pitching investors, or monitoring performance over time? Setting the time frame—monthly, quarterly, annually, or multi-year—will also inform the rest of the steps.

2. Collect relevant historical financial data and market analysis

If available, gather historical financial statements, including balance sheets, cash flow statements, and annual income statements. New companies without this historical data may have to rely on market research, analyst reports, and industry benchmarks—all things that established companies also should use to support their assumptions.

3. Forecast expenses

Identify future spending based on direct costs of producing your goods and services ( cost of goods sold, or COGS) as well as operating expenses, including any recurring and one-time costs. Factor in expected changes in expenses, because this can evolve based on business growth, time in the market, and the launch of new products.

4. Forecast sales

Project sales for each revenue stream, broken down by month. These projections may be based on historical data or market research, and they should account for anticipated or likely changes in market demand and pricing.

5. Build financial projections

Now that you have projected expenses and revenue, you can plug that information into Shopify’s cash flow calculator and cash flow statement template . This information can also be used to forecast your income statement. In turn, these steps inform your calculations on the balance sheet, on which you’ll also account for any assets and liabilities .

Business plan financial projections FAQ

What are the main components of a financial projection in a business plan.

Generally speaking, most financial forecasts include projections for income, balance sheet, and cash flow.

What’s the difference between financial projection and financial forecast?

These two terms are often used interchangeably. Depending on the context, a financial forecast may refer to a more formal and detailed document—one that might include analysis and context for several financial metrics in a more complex financial model.

Do I need accounting or planning software for financial projections?

Not necessarily. Depending on factors like the age and size of your business, you may be able to prepare financial projections using a simple spreadsheet program. Large complicated businesses, however, usually use accounting software and other types of advanced data-management systems.

What are some limitations of financial projections?

Projections are by nature based on human assumptions and, of course, humans can’t truly predict the future—even with the aid of computers and software programs. Financial projections are, at best, estimates based on the information available at the time—not ironclad guarantees of future performance.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The point of sale for every sale.

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

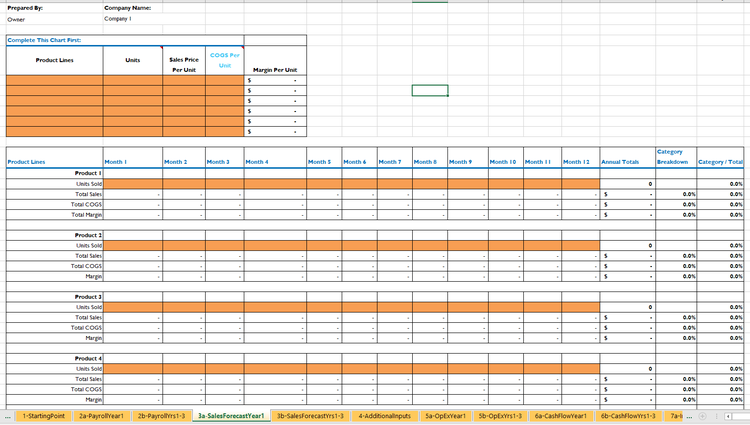

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

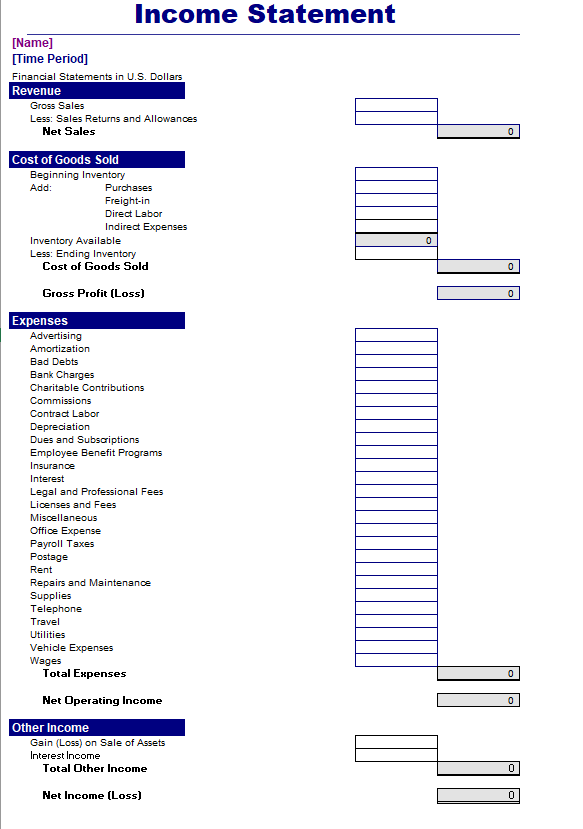

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

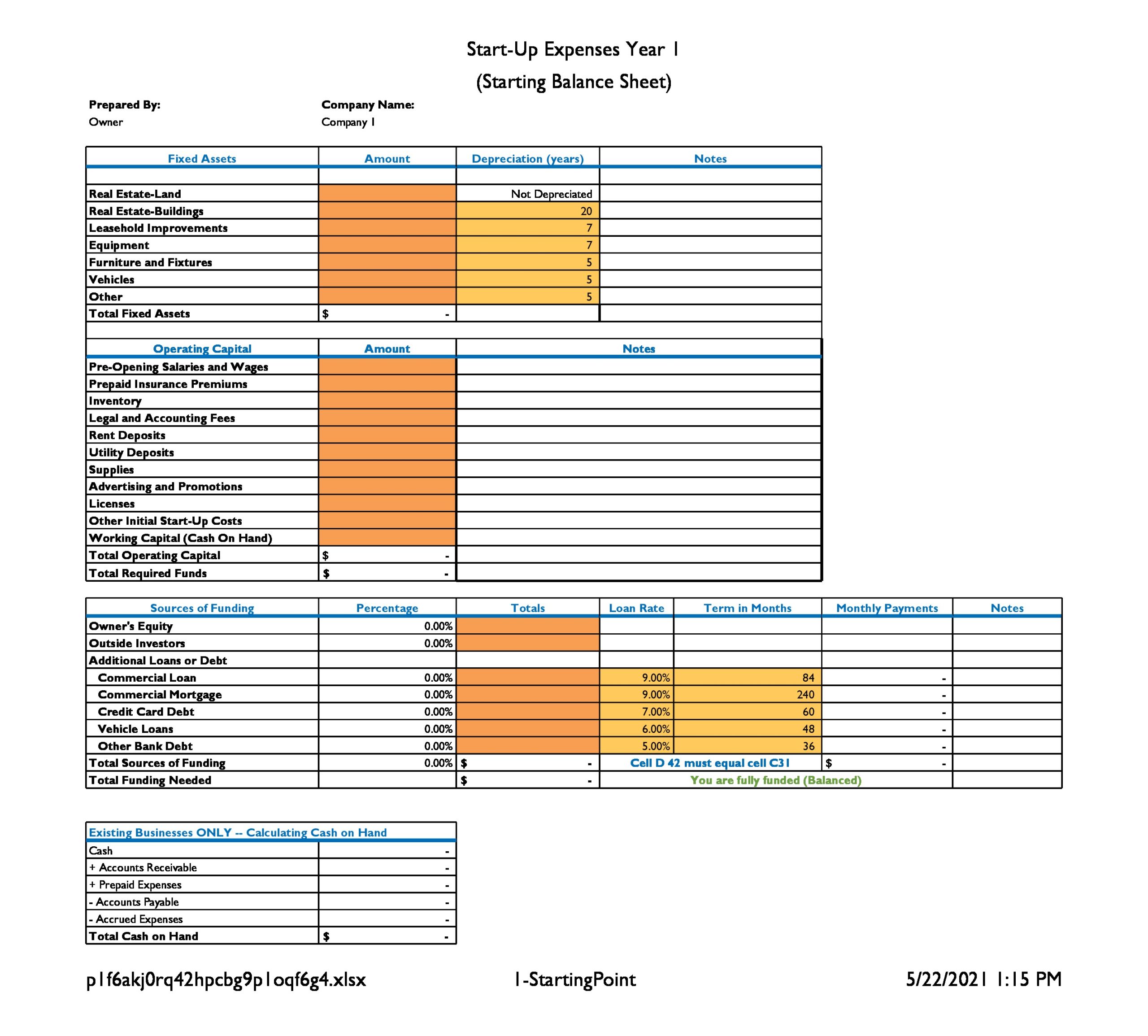

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

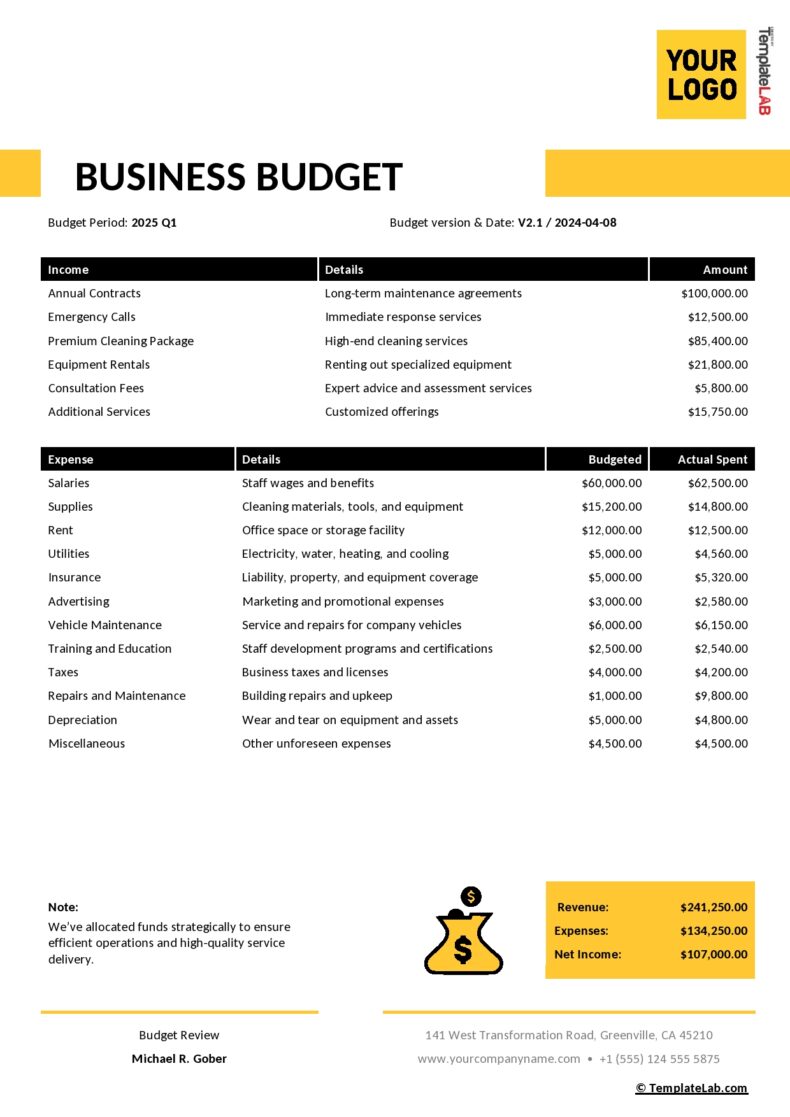

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

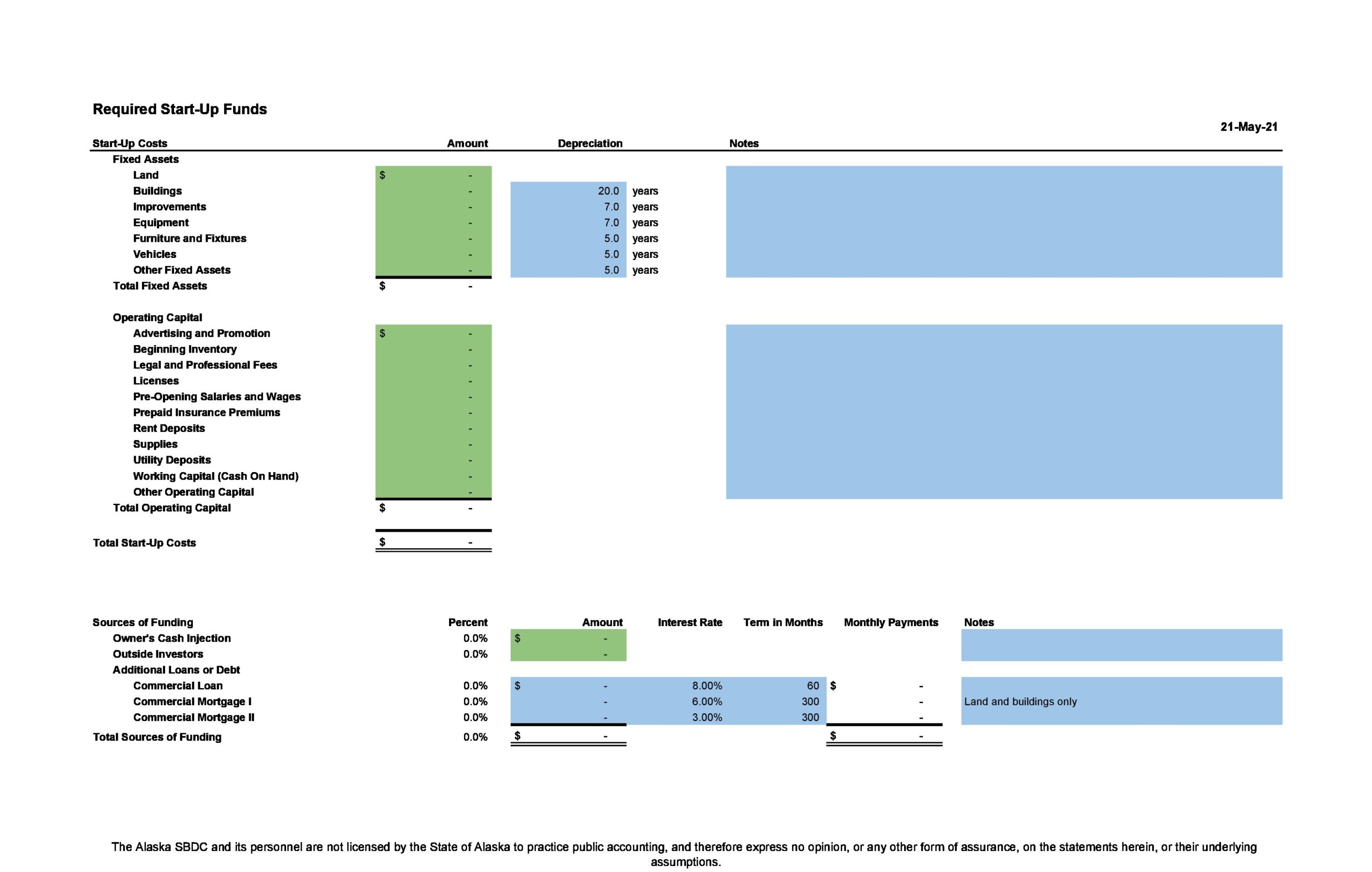

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to Create Financial Projections for Your Business Plan

Written by Dave Lavinsky

Financial projections, also known as financial models, are forecasts of your company’s expected financial performance, typically over the next 5 years.

Over the past 25+ years, we’ve created financial projections for thousands of startups and existing businesses. In doing so, we’ve found 3 key reasons why financial projections are important:

- They help you determine the viability of your new business ideas and/or your need to make modifications to them. For instance, if your initial financial projections show your business idea isn’t profitable, you’ll know that changes are needed (e.g., raising prices, serving new markets, figuring out how to reduce costs, etc.) to make it viable.

- They are crucial for raising funding. Lenders will always review your financial projections to ensure you can comfortably repay any loans they issue you. Equity investors will nearly always review your projections in determining whether they can achieve their desired return on their investment in your business.

- They help keep your business financially on track by giving you goals. For instance, if your financial projections state your company should generate 100 new clients this year, and the year is halfway done and you’re only at 30 clients, you’ll know you need to readjust your strategy to achieve your goals.

In the remainder of this article, you’ll learn more about financial projections, how to complete them, and how to incorporate them in your business plan.

Download our Ultimate Business Plan Template Here to Quickly & Easily Complete Your Business Plan & Financial Projections

What are Financial Projections?

Financial projections are forecasts or estimations of your company’s future revenues and expenses, serving as a crucial part of business planning. To complete them you must develop multiple assumptions with regards to items like future sales volumes, employee headcount and the cost of supplies and other expenses. Financial projections help you create better strategies to grow your business.

Your financial projections will be the most analyzed part of your business plan by investors and/or banks. While never a precise prediction of future performance, an excellent financial model outlines the core assumptions of your business and helps you and others evaluate capital requirements, risks involved, and rewards that successful execution will deliver.

Having a solid framework in place also will help you compare your performance to the financial projections and evaluate how your business is progressing. If your performance is behind your projections, you will have a framework in place to assess the effects of lowering costs, increasing prices, or even reimagining your model. In the happy case that you exceed your business projections, you can use your framework to plan for accelerated growth, new hires, or additional expansion investments.

Hence, the use of financial projections is multi-fold and crucial for the success of any business. Your financial projections should include three core financial statements – the income statement, the cash flow statement, and the balance sheet. The following section explains each statement in detail.

Necessary Financial Statements

The three financial statements are the income statement, the cash flow statement, and the balance sheet. You will learn how to create each one in detail below.

Income Statement Projection

The projected income statement is also referred to as a profit and loss statement and showcases your business’s revenues and expenses for a specific period.

To create an income statement, you first will need to chart out a sales forecast by taking realistic estimates of units sold and multiplying them by price per unit to arrive at a total sales number. Then, estimate the cost of these units and multiply them by the number of units to get the cost of sales. Finally, calculate your gross margin by subtracting the cost of sales from your sales.

Once you have calculated your gross margin, deduct items like wages, rent, marketing costs, and other expenses that you plan to pay to facilitate your business’s operations. The resulting total represents your projected operating income, which is a critical business metric.

Plan to create an income statement monthly until your projected break-even, or the point at which future revenues outpace total expenses, and you reflect operating profit. From there, annual income statements will suffice.

Sample Income Statement

Consider a sample income statement for a retail store below:

| Profit and Loss | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Sales | $3,607,119 | $4,254,682 | $4,858,315 | $5,385,603 | $5,795,374 |

| Direct Cost of Sales | $2,528,406 | $2,982,315 | $3,405,430 | $3,775,033 | $4,062,261 |

| Gross Margin | $1,078,713 | $1,272,367 | $1,452,884 | $1,610,570 | $1,733,113 |

| Gross Margin | 29.91% | 29.91% | 29.91% | 29.91% | 29.91% |

| Operating Expenses | |||||

| Salaries | $390,000 | $409,500 | $429,975 | $451,474 | $474,047 |

| Taxes and Benefits | $136,500 | $143,325 | $150,491 | $158,016 | $165,917 |

| Marketing | $36,000 | $39,600 | $43,560 | $47,916 | $52,708 |

| Rent | $144,000 | $148,320 | $152,770 | $157,353 | $162,073 |

| Utilities | $36,000 | $37,080 | $38,192 | $39,338 | $40,518 |

| Depreciation | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 |

| Professional, Administrative & Merchant Fees | $108,214 | $127,640 | $145,749 | $161,568 | $173,861 |

| Other | $102,874 | $118,133 | $132,485 | $145,221 | $155,442 |

| Total Operating Expenses | $1,003,587 | $1,073,599 | $1,143,223 | $1,210,885 | $1,274,566 |

| Operating Profit | $75,126 | $198,768 | $309,662 | $399,685 | $458,547 |

| Interest | $0 | $0 | $0 | $0 | $0 |

| Taxes | $15,776 | $41,741 | $65,029 | $83,934 | $96,295 |

| Net Profit | $59,349 | $157,027 | $244,633 | $315,751 | $362,252 |

| Net Margin | 1.65% | 3.69% | 5.04% | 5.86% | 6.25% |

Cash Flow Projection

As the name indicates, a cash flow statement shows the cash flowing in and out of your business. The cash flow statement incorporates cash from business operations and includes cash inflows and outflows from investment and financing activities to deliver a holistic cash picture of your company.

Investment activities include purchasing land or equipment or research & development activities that aren’t necessarily part of daily operations. Cash movements due to financing activities include cash flowing in a business through investors and/or banks and cash flowing out due to debt repayment or distributions made to shareholders.

You should total all these three components of a cash flow projection for any specified period to arrive at a total ending cash balance. Constructing solid cash flow projections will ensure you anticipate capital needs to carry the business to a place of sustainable operations.

Sample Cash Flow Statement

Below is a simple cash flow statement for the same retail store:

| Cash Flow | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Cash Inflow | |||||

| Investments Received | $715,000 | $0 | $0 | $0 | $0 |

| Cash from Sales | $3,607,119 | $4,254,682 | $4,858,315 | $5,385,603 | $5,795,374 |

| Total Cash Inflow | $4,322,119 | $4,254,682 | $4,858,315 | $5,385,603 | $5,795,374 |

| Cash Outflow | |||||

| Preliminary expenses | $15,000 | $0 | $0 | $0 | $0 |

| Direct Cash Spending | $2,919,493 | $3,416,009 | $3,879,994 | $4,287,090 | $4,606,345 |

| Cash for Payables | $528,729 | $627,273 | $679,465 | $728,872 | $773,385 |

| Increase in Inventory | $163,862 | $12,721 | $10,891 | $8,613 | $5,964 |

| Purchase Long-Term Assets | $500,000 | $0 | $0 | $0 | $0 |

| Total Cash Outflow | $4,127,085 | $4,056,003 | $4,570,351 | $5,024,575 | $5,385,694 |

| Net Cash Flow | $195,034 | $198,679 | $287,964 | $361,028 | $409,680 |

| Cash Balance | $195,034 | $393,713 | $681,677 | $1,042,705 | $1,452,385 |

Balance Sheet Projection

A balance sheet shows your company’s assets, liabilities, and owner’s equity for a certain period and provides a snapshot in time of your business performance. Assets include things of value that the business owns, such as inventory, capital, and land. Liabilities, on the other hand, are legally bound commitments like payables for goods or services rendered and debt. Finally, owner’s equity refers to the amount that is remaining once liabilities are paid off. Assets must total – or balance – liabilities and equity.

Your startup financial documents should include annual balance sheets that show the changing balance of assets, liabilities, and equity as the business progresses. Ideally, that progression shows a reduction in liabilities and an increase in equity over time.

While constructing these varied business projections, remember to be flexible. You likely will need to go back and forth between the different financial statements since working on one will necessitate changes to the others.

Sample Balance Sheet

Below is a simple balance sheet for the retail store:

| Balance Sheet | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Assets | |||||

| Current Assets | |||||

| Cash | $195,034 | $393,713 | $681,677 | $1,042,705 | $1,452,385 |

| Inventory | $163,862 | $176,583 | $187,475 | $196,087 | $202,051 |

| Total Current Assets | $358,897 | $570,297 | $869,152 | $1,238,793 | $1,654,437 |

| Long-Term Assets | |||||

| Long-Term Assets | $500,000 | $500,000 | $500,000 | $500,000 | $500,000 |

| Accumulated Depreciation | $50,000 | $100,000 | $150,000 | $200,000 | $250,000 |

| Total Long-term Assets | $450,000 | $400,000 | $350,000 | $300,000 | $250,000 |

| Miscellaneous Assets | |||||

| Intangible Assets | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 |

| Total Miscellaneous Assets | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 |

| Total Assets | $823,897 | $985,297 | $1,234,152 | $1,553,793 | $1,919,437 |

| Liabilities and Capital | |||||

| Liabilities | $0 | $0 | $0 | $0 | $0 |

| Accounts Payable | $49,547 | $53,920 | $58,143 | $62,032 | $65,425 |

| Total Liabilities | $49,547 | $53,920 | $58,143 | $62,032 | $65,425 |

| Capital | |||||

| Paid-in Capital | $715,000 | $715,000 | $715,000 | $715,000 | $715,000 |

| Retained Earnings | $0 | $59,349 | $216,376 | $461,009 | $776,760 |

| Earnings | $59,349 | $157,027 | $244,633 | $315,751 | $362,252 |

| Total Capital | $774,349 | $931,376 | $1,176,009 | $1,491,760 | $1,854,012 |

| Total Liabilities and Capital | $823,897 | $985,297 | $1,234,152 | $1,553,793 | $1,919,437 |

| Net Worth | $774,349 | $931,376 | $1,176,009 | $1,491,760 | $1,854,012 |

How to Finish Your Business Plan and Financial Projections in 1 Day!

Don’t you wish there was a faster, easier way to finish your plan and financial projections?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

How to Create Financial Projections

When it comes to financial forecasting, simplicity is key. Your financial projections do not have to be overly sophisticated and complicated to impress, and convoluted projections likely will have the opposite effect on potential investors. Keep your tables and graphs simple and fill them with credible data that inspires confidence in your plan and vision. The below tips will help bolster your financial projections.

Create a List of Assumptions

Your financial projections should be tied to a list of assumptions. For example, one assumption will be the initial monthly cash sales you achieve. Another assumption will be your monthly growth rate. As you can imagine, changing either of these assumptions will significantly impact your financial projections.

As a result, tie your income statement, balance sheet, and cash flow statements to your assumptions. That way, if you change your assumptions, all of your financial projections automatically update.

Below are the key assumptions to include in your financial model:

For EACH essential product or service you offer:

- What is the number of units you expect to sell each month?

- What is your expected monthly sales growth rate?

- What is the average price that you will charge per product or service unit sold?

- How much do you expect to raise your prices each year?

- How much does it cost you to produce or deliver each unit sold?

- How much (if at all) do you expect your direct product costs to grow each year?

For EACH subscription/membership, you offer:

- What is the monthly/quarterly/annual price of your membership?

- How many members do you have now, or how many members do you expect to gain in the first month/quarter/year?

- What is your projected monthly/quarterly/annual growth rate in the number of members?

- What is your projected monthly/quarterly/annual member churn (the percentage of members that will cancel each month/quarter/year)?

- What is the average monthly/quarterly/annual direct cost to serve each member (if applicable)?

Cost Assumptions

- What is your monthly salary? What is the annual growth rate in your salary?

- What is your monthly salary for the rest of your team? What is the expected annual growth rate in your team’s salaries?

- What is your initial monthly marketing expense? What is the expected annual growth rate in your marketing expense?

- What is your initial monthly rent + utility expense? What is the expected annual growth rate in your rent + utility expense?

- What is your initial monthly insurance expense? What is the expected annual growth rate in your insurance expense?

- What is your initial monthly office supplies expense? What is the expected annual growth rate in your office supplies expense?

- What is your initial monthly cost for “other” expenses? What is the expected annual growth rate in your “other” expenses?

Capital Expenditures, Funding, Tax, and Balance Sheet Items

- How much money do you need for Capital Expenditures in your first year (to buy computers, desks, equipment, space build-out, etc.)?

- How much other funding do you need right now?

- What percent of the funding will be financed by Debt (versus equity)?

- What Corporate Tax Rate would you like to apply to company profits?

- What is your Current Liabilities Turnover (in the number of days)?

- What are your Current Assets, excluding cash (in the number of days)?

- What is your Depreciation rate?

- What is your Amortization number of Years?

- What is the number of years in which your debt (loan) must be paid back?

- What is your Debt Payback interest rate?

Create Two Financial Projection Scenarios

It would be best if you used your assumptions to create two sets of financial projections that exhibit two very different scenarios. One is your best-case scenario, and the other is your worst-case. Investors are usually very interested in how a business plan will play out in both these scenarios, allowing them to better analyze the robustness and potential profitability of a business.

Conduct a Ratio Analysis

Gain an understanding of average industry financial ratios, including operating ratios, profitability ratios, return on investment ratios, and the like. You can then compare your own estimates with these existing ratios to evaluate costs you may have overlooked or find historical financial data to support your projected performance. This ratio analysis helps ensure your financial projections are neither excessively optimistic nor excessively pessimistic.

Be Realistic

It is easy to get carried away when dealing with estimates and you end up with very optimistic financial projections that will feel untenable to an objective audience. Investors are quick to notice and question inflated figures. Rather than excite investors, such scenarios will compromise your legitimacy.

Create Multi-Year Financial Projections

The first year of your financial projections should be presented on a granular, monthly basis. For subsequent years, annual projections will suffice. It is advised to have three- or five-year projections ready when you start courting investors. Since your plan needs to be succinct, you can add yearly projections as appendices to your main plan.

You should now know how to create financial projections for your business plan. In addition to creating your full projections as their own document, you will need to insert your financial projections into your plan. In your executive summary, Insert your topline projections, that is, just your sales, gross margins, recurring expenses, EBITDA (earnings before interest, taxes, depreciation, and amortization), and net income). In the financial plan section of your plan, insert your key assumptions and a little more detail than your topline projections. Include your full financial model in the appendix of your plan.

Other Helpful Business Plan Articles & Templates

Falling leaves. Falling prices 🍂 70% Off for 3 Months. Buy Now & Save

70% Off for 3 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make financial projections for business.

Writing a solid business plan should be the first step for any business owner looking to create a successful business.

As a small business owner, you will want to get the attention of investors, partners, or potential highly skilled employees. It is, therefore, important to have a realistic financial forecast incorporated into your business plan.

We’ll break down a financial projection and how to utilize it to give your business the best start possible.

Key Takeaways

Accurate financial projections are essential for businesses to succeed. In this article, we’ll explain everything you need to know about creating financial projections for your business. Here’s what you need to know about financial projections:

- A financial projection is a group of financial statements that are used to forecast future performance

- Creating financial projections can break down into 5 simple steps: sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections

- Financial projections can offer huge benefits to your business, including helping with forecasting future performance, ensuring steady cash flow, and planning key moves around the growth of the business

Here’s What We’ll Cover:

What Is a Financial Projection?

How to Create a Financial Projection

What goes into a financial projection, what are financial projections used for.

Financial Projections Advantages

Frequently Asked Questions

What Is Financial Projection?

A financial projection is essentially a set of financial statements . These statements will forecast future revenues and expenses.

Any projection includes your cash inflows and outlays, your general income, and your balance sheet.

They are perfect for showing bankers and investors how you plan to repay business loans. They also show what you intend to do with your money and how you expect your business to grow.

Most projections are for the first 3-5 years of business, but some include a 10-year forecast too.

Either way, you will need to develop a short and mid-term projection broken down month by month.

As you are just starting out with your business, you won’t be expected to provide exact details. Most financial projections are rough guesses. But they should also be educated guesses based on market trends, research, and looking at similar businesses.

It’s incredibly important for financial statements to be realistic. Most investors will be able to spot a fanciful projection from a mile away.

In general, most people would prefer to be given realistic projections, even if they’re not as impressive.

Financial projections are created to help business owners gain insight into the future of their company’s financials.

The question is, how to create financial projections? For business plan purposes, it’s important that you follow the best practices of financial projection closely. This will ensure you get accurate insight, which is vital for existing businesses and new business startups alike.

Here are the steps for creating accurate financial projections for your business.

1. Start With A Sales Projection

For starters, you’ll need to project how much your business will make in sales. If you’re creating a sales forecast for an existing business, you’ll have past performance records to project your next period. Past data can provide useful information for your financial projection, such as if your sales do better in one season than another.

Be sure also to consider external factors, such as the economy at large, the potential for added tariffs and taxes in the future, supply chain issues, or industry downturns.

The process is almost the same for new businesses, only without past data to refer to. Business startups will need to do more research on their industry to gain insight into potential future sales.

2. Create Your Expense Projection

Next, create an expense projection for your business. In a sense, this is an easier task than a sales projection since it seems simpler to predict your own behaviors than your customers. However, it’s vital that you expect the unexpected.

Optimism is great, but the worst-case scenario must be considered and accounted for in your expense projection. From accidents in the workplace to natural disasters, rising trade prices, to unexpected supply disruptions, you need to consider these large expenses in your projection.

Something always comes up, so we suggest you add a 10-15% margin on your expense projection.

3. Create Your Balance Sheet Projection

A balance sheet projection is used to get a clear look at your business’s financial position related to assets, liabilities , and equity, giving you a more holistic view of the company’s overall financial health.

For startup businesses, this can prove to be a lot of work since you won’t have existing records of past performance to pull from. This will need to be factored into your industry research to create an accurate financial projection.

For existing businesses, it will be more straightforward. Use your past and current balance sheets to predict your business’s position in the next 1-3 years. If you use a cloud-based, online accounting software with the feature to generate balance sheets, such as the one offered by FreshBooks, you’ll be able to quickly create balance sheets for your financial projection within the app.

Click here to learn more about the features of FreshBooks accounting software.

4. Make Your Income Statement Projection

Next up, create an income statement projection. An income statement is used to declare the net income of a business after all expenses have been made. In other words, it states the profits of a business.

For currently operating businesses, you can use your past income statements and the changes between them to create accurate predictions for the next 1-3 years. You can also use accounting software to generate your income statements automatically.

You’ll need to work on rough estimates for new businesses or those still in the planning phase. It’s vital that you stay realistic and do your utmost to create an accurate, good-faith projection of future income.

5. Finally, Create Your Cash Flow Projection

Last but not least is to generate your projected cash flow statement. A cash flow projection forecasts the movement of all money to and from your business. It’s intertwined with a business’s balance sheet and income statement, which is no different when creating projections.

If your business has been operating for six months or more, you can create a fairly accurate cash flow projection with your past cash flow financial statements. For new businesses, you’ll need to factor in this step of creating a financial forecast when doing your industry research.

It needs to include five elements to ensure an accurate, useful financial forecast for your business. These financial statements come together to provide greater insight into the projected future of a business’s financial health. These include:

Income Statement

A standard income statement summarizes your company’s revenues and expenses over a period. This is normally done either quarterly or annually.

The income statement is where you will do the bulk of your forecasting.

On any income statement, you’re likely to find the following:

- Revenue: Your revenue earned through sales.

- Expenses: The amount you’ve spent, including your product costs and your overheads.

- Pre-Tax Earnings: This is your income before you’ve paid tax.

- Net Income: The total revenues minus your total expenses.

Net income is the most important number. If the number is positive, then you’re earning a profit, if it’s negative, it means your expenses outweigh your revenue and you’re making a loss.

Cash Flow Statement

Your cash flow statement will show any potential investor whether you are a good credit risk. It also shows them if you can successfully repay any loans you are granted.

You can break a cash flow statement into three parts:

- Cash Revenues: An overview of your calculated cash sales for a given time period.

- Cash Disbursements: You list all the cash expenditures you expect to pay.

- Net Cash Revenue: Take the cash revenues minus your cash disbursements.

Balance Sheet

Your balance sheet will show your business’s net worth at a given time.

A balance sheet is split up into three different sections:

- Assets: An asset is a tangible object of value that your company owns. It could be things like stock or property such as warehouses or offices.

- Liabilities: These are any debts your business owes.

- Equity: Your equity is the summary of your assets minus your liabilities.

Looking for an easy-to-use yet capable online accounting software? FreshBooks accounting software is a cloud-based solution that makes financial projections simple. With countless financial reporting features and detailed guides on creating accurate financial forecasts, FreshBooks can help you gain the insight you need to let your business thrive. Click here to give FreshBooks a try for free.

Financial projections have many uses for current business owners and startup entrepreneurs. Provided your financial forecasting follows the best practices for an accurate projection, your data will be used for:

- Internal planning and budgeting – Your finances will be the main factor in whether or not you’ll be able to execute your business plan to completion. Financial projections allow you to make it happen.

- Attracting investors and securing funding – Whether you’re receiving financing from bank loans, investors, or both, an accurate projection will be essential in receiving the funds you need.

- Evaluating business performance and identifying areas for improvement – Financial projections help you keep track of your business’s financial health, allowing you to plan ahead and avoid unwelcome surprises.

- Making strategic business decisions – Timing is important in business, especially when it comes to major expenditures (new product rollouts, large-scale marketing, expansion, etc.). Financial projections allow you to make an informed strategy for these big decisions.

Financial Projections Advantages

Creating clear financial projections for your business startup or existing company has countless benefits. Focusing on creating (and maintaining) good financial forecasting for your business will:

- Help you make vital financial decisions for the business in the future

- Help you plan and strategize for growth and expansion

- Demonstrate to bankers how you will repay your loans

- Demonstrate to investors how you will repay financing

- Identify your most essential financing needs in the future

- Assist in fine-tuning your pricing

- Be helpful when strategizing your production plan

- Be a useful tool for planning your major expenditures strategically

- Help you keep an eye on your cash flow for the future

Your financial forecast is an essential part of your business plan, whether you’re still in the early startup phases or already running an established business. However, it’s vital that you follow the best practices laid out above to ensure you receive the full benefits of comprehensive financial forecasting.

If you’re looking for a useful tool to save time on the administrative tasks of financial forecasting, FreshBooks can help. With the ability to instantly generate the reports you need and get a birds-eye-view of your business’s past performance and overall financial help, it will be easier to create useful financial projections that provide insight into your financial future.

FAQs on Financial Projections

More questions about financial forecasting, projections, and how these processes fit into your business plan? Here are some frequently asked questions by business owners.

Why are financial projections important?

Financial projections allow you to gain insight into your business’s economic trajectory. This helps business owners make financial decisions, secure funding, and more. Additionally, financial projections provide early warning of roadblocks and challenges that may lay ahead for the company, making it easier to plan for a clear course of action.

What is an example of a financial projection?

A projection is an overall look at a business’s forecasted performance. It’s made up of several different statements and reports, such as a cash flow statement, income statement, profit and loss statement, and sales statement. You can find free templates and examples of many of these reports via FreshBooks. Click here to view our selection of accounting templates.

Are financial forecasts and financial projections the same?

Technically, there is a difference between forecasting and projections, though many use the terms interchangeably. Financial forecasting often refers to shorter-term (<1 year) predictions of financial performance, while financial projections usually focus on a larger time scale (2-3 years).

What is the most widely used method for financial forecasting?

The most common method of accurate forecasting is the straight-line forecasting method. It’s most often used for projecting the growth of a business’s revenue growth over a set period. If you notice that your records indicate a 4% growth of revenue per year for five years running, it would be reasonable to assume that this will continue year-over-year.

What is the purpose of a financial projection?

Projection aims to get deeper, more nuanced insight into a business’s financial health and viability. It allows business owners to anticipate expenses and profit growth, giving them the tools to secure funding and loans and strategize major business decisions. It’s an essential accounting process that all business owners should prioritize in their business plans.

Michelle Alexander, CPA

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

- Solutions Company creation Business account Certified accounting Invoicing Expense management

- Resources Contact Sales (WhatsApp) Help Center Blog

You are reading...

Home > Start a Business > Small Business Financial Projections: A Step-by-Step Guide

Small Business Financial Projections: A Step-by-Step Guide

Published on 20 March 2024

8 mins read

As in most areas of business, however, a little prep, planning and guidance can help you overcome your challenges, and to create well-planned financial projections involves taking the process one step at a time.

Here's a step-by-step guide to crafting financial projections that not only reflect your business's potential but also its challenges.

1. Understand the Importance

2. start with your sales forecast.

Begin by estimating your sales over a specific period. Consider factors like market size, competition, trends, and your marketing strategy. Remember, it's better to be conservative than overly optimistic.

3. Estimate Costs

List down all potential expenses. This includes fixed costs like rent and salaries, and variable costs like production materials. Don't forget seasonal expenses or one-off costs like equipment purchases.

4. Predict Cash Flow

5. factor in taxes and regulations.

Begin your Business Adventure in Portugal Today!

6. Consider Different Scenarios

7. regularly update your projections.

Your first financial projection won't be your last. As your business grows and the market evolves, revisit and revise your projections. This ensures they remain relevant and reflective of current realities.

8. Seek Expert Advice

If numbers aren't your forte, consider seeking help. A financial advisor or accountant can provide valuable insights, ensuring your projections are both accurate and comprehensive.

9. Use Technology

Leverage modern tools and software. They not only simplify the process but also offer templates, analytics, and insights that can be invaluable for a small business owner.

10. Trust Your Instincts, But Rely on Data

While gut feelings have their place in business, financial projections should be grounded in data. Use market research, historical data, and industry benchmarks to inform your projections.

Financial projections, while rooted in numbers, are essentially a reflection of your business vision. They're a roadmap, guiding you through the challenges and opportunities that lie ahead. Let your financial projections be the compass that navigates your entrepreneurial journey!

Frequently Asked Questions (FAQs)

1. what are financial projections, and why are they important for small businesses.

Financial projections are estimates of a business's future financial performance, including revenue, expenses, and cash flow. They are crucial for small businesses as they help in anticipating challenges, setting realistic goals, and making informed decisions.

2. How do I start creating financial projections for my small business?

Begin by estimating your sales, listing all potential expenses, predicting cash flow, and factoring in taxes and regulations. Our step-by-step guide above provides detailed instructions.

3. What role does cash flow play in financial projections?

4. should i consider different scenarios when creating financial projections.

Yes, it's advisable to create best-case, worst-case, and most likely financial scenarios. This prepares you for unexpected changes and helps in risk management.

5. How often should I update my financial projections?

Regular updates are essential. As your business grows and market conditions change, revisit and revise your projections to ensure they remain accurate and relevant.

6. What if I'm not confident in my financial projection skills?

If numbers aren't your strength, consider seeking expert advice from a financial advisor or accountant. They can provide valuable insights and ensure your projections are accurate.

7. Are there modern tools and software to assist with financial projections?

Yes, there are various online tools and software that can simplify the process. They offer templates, analytics, and insights that can be invaluable for small business owners.

8. How can I ensure my financial projections are grounded in data?

To ensure accuracy, base your financial projections on market research, historical data, and industry benchmarks. This data-driven approach is essential for reliable projections.

9. Why are financial projections considered a reflection of a business's vision?

Financial projections are not just numbers; they are a roadmap that guides your business through challenges and opportunities. They reflect your vision and help you navigate your entrepreneurial journey effectively.

Written by Rauva

Our specialised team focuses on bringing relevant and useful content everyday for our community of entrepeneurs. We love to stay updated and we thrive on sharing the best news with you.

Subscribe to our newsletter

Receive the latests insights and trends to help you start and run your business.

Start your 30-day free trial

Full flexibility. cancel anytime. no hidden fees., available on.

4.7 on Trustpilot

4.4 on app store, 4.6 on play store, want to stay updated with our latest news.

No spam, ever. Your email address will only be used for the company news.

This device is too small

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

- Small Business

- The Top 10 Accounting Software for Small Businesses

What are Financial Projections and Why Do You Need Them?

See Full Bio

Our Small Business Expert

If you run a multimillion-dollar empire, it’s likely that your accounting staff is using enterprise-level software that can quickly and easily produce financial projections.

But if you’re a sole proprietor, freelancer, or micro-business owner, you’re likely to use data from your accounting software in order to prepare financial projections, but the software won’t help you in the preparation itself.

While that may sound confusing, it just means that most software applications such as QuickBooks Online , Sage 50cloud Accounting , and Xero can create the financial statements needed for you to prepare your financial projections, but the software itself will not be used in the actual creation of the projections.

At a glance: How you can create and utilize financial projections

- Three financial statements -- a balance sheet, income statement, and cash-flow statement -- are required for any financial projections you create.

- New businesses need financial projections, too. If you’re still in the planning stages, be aware that you will still need to prepare projections for your business plan.

- You’ll likely be using a template to prepare your projections. While accounting software provides the basis for your financial projections, most small business accounting software applications aren’t capable of producing financial projections.

Overview: What are financial projections?

Financial projections are an important part of managing your business. Preparing financial projections may seem like a daunting task for small business owners, but if you can create financial statements, you can create financial projections. Similar to creating a budget, financial projections are a way to forecast future revenue and expenses for your business.

Frequently used as a way to attract future investors, financial projections are also an important component when preparing a business plan for a new business or creating a strategic plan for your current business.

You can create both short-term and long-term financial projections, with most business owners using both types of projections:

Short-term projections: Short-term projections usually cover a year and are typically broken down by month.

Long-term projections : Long-term projections typically cover the next three to five years and are usually used when creating a strategic plan, or for attracting investors.

What are financial projections used for?

Financial projections can be used in a variety of ways, but they’re usually used to attract investors or when applying for a bank loan or line of credit.

Here are a few situations that would call for financial projections:

- You’re creating a business plan: One of the first things potential investors or banks want to see is a financial projection for your business, even if it isn’t operational yet.

- You’re hoping to attract investors: When looking to invest in a business, investors typically look for financial viability. No one will invest in a business without a financial projection that outlines variables such as expenses, revenue, and growth patterns.

- You’re applying for a loan or line of credit: Again, banks or other financial institutions are interested in the financial health of your business. This means providing them not just with current financial statements that outline current business performance, but also where you see your business next year, and the year after.

- You want to get a better handle on your business: You may not be in the market to attract investors or obtain a bank loan, but you do want to be able to map out your potential growth and create budgets allowing your business grow and thrive. Financial projections can help here, too.

How to create financial projections for your small business

When you’re creating financial projections for your business, the same information is required whether your business is up and running or still in the planning stages.

The difference is whether you can create your projections using historical financial data, or if you’ll need to start from scratch. This includes creating projections based on your own experience in the field, or by doing some market research in the industry in which your business will operate.

Step 1: Create a sales projection

Sales projections are an important component of your financial projections. For existing businesses, you can base your projections on past performance obtained from your financial statements. For instance, if your sales tend to be higher in the summer and fall, you’ll want to include that in your projections.

You’ll also need to take under consideration some outside factors, such as the current and projected health of the economy, whether your inventory may be affected by additional tariffs, and whether there’s been a downturn in your industry.

While we all want to be optimistic about our businesses, be sure to plan realistically.

This is one of Microsoft Excel's templates for sales forecasting. Image source: Author

Those still in the planning stages can follow the exact same plan (minus historical data), but you’ll need to do some additional research into the health of similar businesses in your proposed industry in order to plan as accurately as possible.

Step 2: Create an expense projection

Creating an expense projection may initially seem a bit simpler, because it’s easier to predict possible expenses than it is to predict the buying habits of current or potential customers.

For those working from history, you can predict with some certainty what your fixed expenses are, such as your rent or mortgage, along with recurring expenses such as utilities and payroll.

However, it’s much harder to predict those one-time expenses that have the potential to destroy your business.

What if the roof leaks in your business and destroys 75% of your inventory? What if you import the majority of your inventory from China, and you’re hit with escalating prices?

The “what ifs” can drive any of us crazy. All you can do is project expenses to the best of your ability, and maybe tack on an additional 15% to your initial number.

Step 3: Create a balance sheet projection

If you’re using accounting software and your business has been operational for at least a few months, you’ll be able to create a balance sheet directly from your software.

A balance sheet shows the financial position of your business, listing assets, liabilities, and equity balances for a particular time frame.

When creating your financial projections, you can use your current balance sheet totals to better predict where your business will be one to three years down the road.

For those of you in the planning stages, create a balance sheet based on the information you have collected from industry research.

Step 4: Create an income statement projection

Current business owners can easily create an income statement projection by using your current income statement to estimate your projected numbers.

This Excel template can be used to display revenue, cost of goods sold, expenses, and other income to identify net income. Image source: Author

An income statement provides a view of the net income of your business after things such as cost of goods sold, taxes, and other expenses have been subtracted.

This can give you a good idea of how your business is currently performing as well as serve as the basis for estimating net income for the next one to three years.

If you're in the planning stages, producing a possible income statement demonstrates that you’ve done your research and have created a good-faith estimate of your income for the next three years.

If you’re not sure where to start, visit market research firms such as Allied Market Research, which can give you an overview of your targeted industry, including product sales, target markets, and current and expected industry growth levels.

Step 5: Create a cash flow projection

The last step in completing your financial projection is the cash flow statement. The cash flow statement ties into both the income statement and the balance sheet, displaying any cash or cash-related activities that affect your business.

The cash flow statement shows how money is being spent, a must for those looking to attract an investor or obtain financing.

Again, you can use your current cash flow statement if your business has been operational for at least six months, while those of you in the start-up phase can use the data you’ve collected in order to create a credible cash flow projection.

Benefits of using accounting software for your financial projections

If you’re an existing business owner, you’re likely using accounting software to track your financial transactions. If so, the availability of financial reports such as a balance sheet, income statement, and cash flow statement are valuable resources when creating financial projections.

Here are some of the benefits of using accounting software:

- Accuracy: Unless you’re still in the planning stages, having the ability to create various financial reports and transactional histories from your software application helps to ensure your financial projections are based on accurate numbers.

- Availability of data: Being able to pull financial reports can go a long way in preparing financial projections. While you’ll likely create the projections themselves using a spreadsheet application such as Microsoft Excel, the data for your projections is readily available for you and others to access and review.

- Credibility: Being able to include supporting financial statements created by your accounting software with your financial projections lends credibility to your business and signals that you’re serious.

If you’re looking for a template to use to create financial projections, SCORE offers a downloadable financial projections template from Excel.

Finding the best way to create financial projections

While you’ll likely be using a template to create your financial projections, don’t underestimate the important role accounting software plays in creating accurate financial projections -- a necessity if you’re looking for investors or additional financing for your business.

If you’re still using manual ledgers or spreadsheet software to manage your business, it may be time to step up to the next level of professionalism by choosing and implementing an accounting software application that works for your business.

If you’re not sure which accounting software is right for you, be sure to check out our accounting software reviews .

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2024 The Ascent. All rights reserved.

Our work is reader-supported, meaning that we may earn a commission from the products and services mentioned.

How to Create Financial Projections for your Business Plan

- Last Updated: September 10, 2024

- By: StartUp 101

Advertising Disclosure