- Video Presentation

- Our Lawyers

- Our Services

- Video Testimonials – Real Estate

- Video Testimonials – Immigration

- Client Testimonials

- Appointment

HST on Assignments

- Sign-up to our newsletter?

An assignment is a sales transaction that is carried out between the owner (assignor) and the buyer (assignee). The original owner sells the property to the buyer before the original buyer closes on the property. In short, the buyer sells the property to gain any interest or profit on the house by selling the property before they close on the property.

HST on Assignment Sale

The assignor pays the HST on the assignment sale along with the original price. The assignment agreement is prepared, clearly stating the profit on a transaction. It is advisable to hire a Real Estate lawyer to prepare the agreement with all the necessary information.

Important Changes in the HST on Assignment Sales

In the 2022 Federal Budget, two important changes were introduced in the HST on assignments. The changes that will govern the New Home Contract are as follows:

HST on Assignments is Applicable on all New Home Contracts

The government announced that all Assignment agreements for New Homes entered in on or after May 7 th, 2022 are now subject to HST. In the past, the HST on assignments was decided based on the intention of the original buyer, who often paid no HST on assignments. In short, the government has now removed all exemptions, and every New Home Assignment is subject to HST now.

The intention of the original owner is no longer taken into consideration, and all New Home Assignments are now deemed to be a taxable supply to HST.

Deposits are Exempt from HST under Conditions

The government has removed another confusion that often clouded the judgment of whether or not HST is to be paid on the deposit. To exempt the deposit from HST, the Assignment Agreement must include that part of the assignment price is the reimbursement of the deposit paid by the original buyer under the purchase agreement. In short, the writing must clearly state that the assignment price already includes the deposit, so the HST can be exempt.

As stated in the HST Info Sheet GI-120, the HST is only charged to the extent the assignment price exceeds the deposits paid by the assignor in the New Home Contract. The HST does not apply to the original deposit paid by the assignor. However, the above condition must be met. The HST is only payable on any other amount paid to Assignor over and above the deposit.

Nanda & Associate Lawyers Professional Corporation assists Canadian residents and businesses with their HST needs. Get in touch with us today for more details.

Fill In the form below, We will get in touch with you as soon as possible.

Demo Description

This will close in 0 seconds

We're growing. Join our firm. Learn more about Careers at Schwarz Law.

- Firm Profile

- Testimonials

- Environmental Actions

- Jayson Brian Schwarz

- Jacqueline Moneta

- Konrad Grzymski

- Robin Hammond

- Patrick Squire (Associate Counsel)

- Corinne Lobe (Patent Counsel)

- Corporate and Commercial Business Law

- Commercial Real Estate, Financing & Land Development

- Wills and Estate Law

- Articles & News

- Associate Firms

- Affiliated Firms

HST on Assignments

By: Jayson Schwarz LLM and Hamza Ahmad JD

Many clients think that doing an assignment of a home purchase agreement is a simple transaction, but the reality is far different. It is an extremely complex transaction and if not handled properly can result in the loss of a lot of money. This article describes two issues relating to HST that assignors (seller) and assignees (buyer) should consider when entering pre-construction freehold and condominium assignments.

HST on Assignment Fees

HST is payable on an assignment sale of an Agreement of Purchase and Sale (“APS”). Remember when you do an assignment you are not selling the house or property you are selling your APS. The issue is what you pay the HST on, who pays it and how much that will be. Generally the HST will be in addition to the price and paid for by the buyer.

Your assignment agreement must be clear to show what the profit is on the transaction, as it should only be the profit that is subject to HST.

The standard realtor’s form of an assignment agreement does not include sections on crucial issues regarding HST. It is important you get a lawyer to help carefully draft the assignment agreement to reduce the risk of future issues with CRA. In a resale home situation HST is payable on the profit only provided the assignment agreement is properly drafted.

As an interesting aside, most people would reasonably conclude that getting back your deposit is not subject to HST, but CRA takes the position it is, even after CRA lost in Court and the Court said there is no HST on deposit returns!!!!!!

HST New Housing Rebate

Adjustments on closing can surprise homebuyers new to pre-construction properties and assignments only add to the potential shock. The builder will want to collect the HST on closing of the original purchase where there has been an assignment sale and the buyer will need to get the HST back later.

Newly built properties are subject to HST but some or all the HST payable can be recovered immediately on closing through the HST New Housing Rebate (the “Rebate”). The Rebate has specific rules that may affect a purchaser whom’s circumstances change over time; the Rebate is provided if only the purchaser or an immediate family member resides at the property and if the builder accepts that this is correct and there has been no assignment outside that group.

In pre-construction condominium assignments with occupancy closings, an assignee must confirm whether the unit has ever been occupied. If a unit has been occupied then the assignee may not be eligible for the Rebate.

The moral of the story is that you really should retain an experienced lawyer to help you through these issues whether buying or selling. Realators are great but it is your lawyer who if hired to do so that will take the time to review everything properly and make sure you are protected and that there are no open questions.

Perhaps the most difficult part of writing these articles relates not the actual writing, but thinking of a topic to address. So help us!!! Mail, deliver or fax letters to the magazine or to us, use the web site ( www.schwarzlaw.ca ), email ( [email protected] ) and give us your questions, concerns, critiques and quandaries. We will try to deal with them in print or electronic form.

Also seen on NextHome.ca

- Testimonials

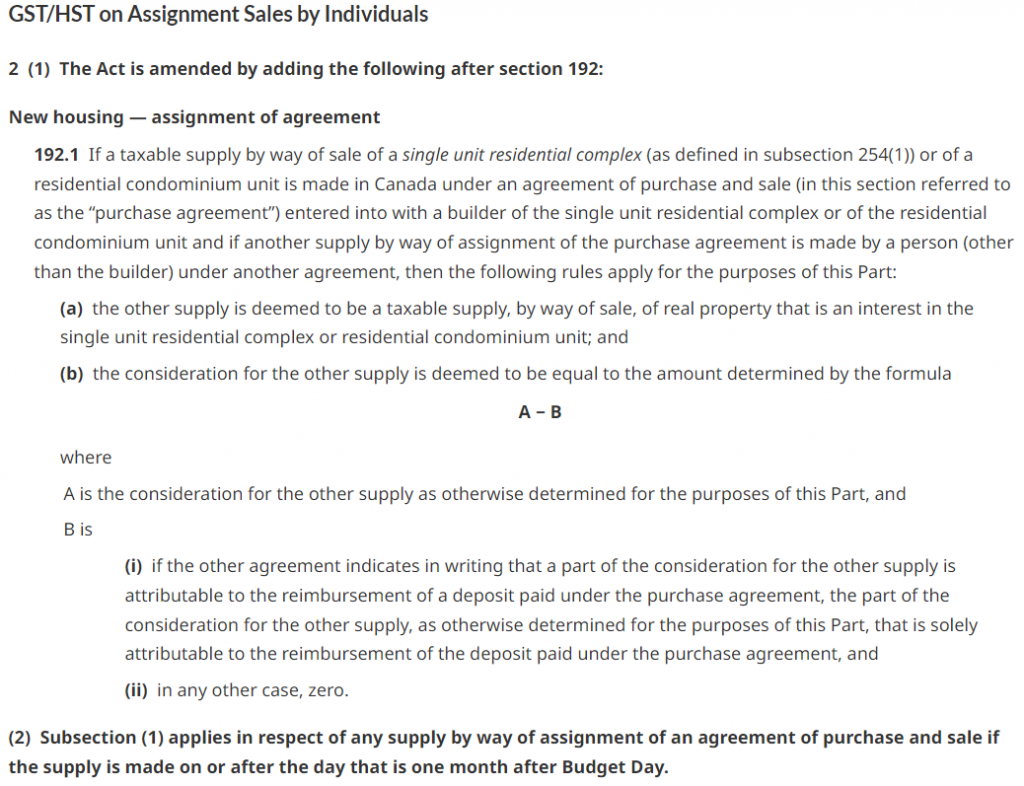

GST/HST Treatment of Assignment Sales after May 7, 2022

On April 7, 2022, the Minister of Finance Canada proposed the changes to the assignment sales. The proposed amendment to the ETA would make all assignment sales, including those made by individuals, in respect of newly constructed or substantially renovated residential housing taxable for GST/HST purposes. Furthermore, the proposed amendment would exclude any amount attributable to a deposit paid by an assignor to a builder from the consideration for a taxable assignment sale, when certain conditions are met. The proposed amendment would apply to all assignment agreements entered into after May 7, 2022.

When this new regulation starts?

Proposed changes applies in respect of any supply by way of assignment of an agreement of purchase and sale if the supply is made after May 7, 2022.

Who should remit the GST/HST on the assignment sales under the new rule?

The assignor (Seller) in respect of a taxable assignment sale would generally continue to be responsible for collecting the GST/HST and remitting the tax to the Canada Revenue Agency (CRA). If the assignor (Seller) is a non-resident of Canada, the assignee (Purchaser) would continue to be required to self-assess and pay the GST/HST directly to the CRA.

Is the portion of the deposit taxable?

When an assignment agreement is entered into on or after May 7, 2022, and the assignment agreement indicates in writing that “a part of the consideration is attributable to the reimbursement of a deposit paid by the assignor to the builder” under the purchase and sale agreement, the deposit is excluded from GST/HST.

How much should you pay?

For example, John entered an purchase agreement price of $1,000,000 with the Builder A in Ontario (13% HST). He has paid $200,000 deposit and decided to sell this assignment contract before closing. David decided to purchase from John at $1,250,000.

John (Assignor) and David (Assignee)

1. David will pay John $200,000 for the deposit

2. David will give John another $250,000 for profit

3. If the assignment agreement stated “ HST included”, John real profit would be 250,000/1.13 =221,238.94; John should submit this HST $28,761.06 to the CRA.

If the assignment agreement stated “HST not included”. John real profit would be 250,000; and John should charge 250,000*0.13=32,500 from David, and John should submit HST 32,500 to the CRA.

Will this new rule affect the new housing rebate?

Only one new housing rebate application can be made for each new house. Therefore, an assignee (Purchaser) cannot submit a rebate application through a builder for the tax paid to Builder on the purchase of the house and submit a second rebate application for the tax paid to the assignor (Seller) . The assignee (Purchaser) should file their new housing rebate application directly with the CRA including the new housing rebate amount and the tax paid to the assignor.

Reference: Proposed GST/HST Treatment of Assignment Sales - Canada.ca

- All Listings

- Places with Parking

- All of Ontario

- Assignments

- Only at Condo Culture

Top Neighbourhoods

- Innovation District, Kitchener

- Bauer District, Kitchener

- City Centre District, Kitchener

- Midtown, Kitchener

- Belmont District, Kitchener

- Uptown, Waterloo

- How We Help You Invest

- Highest Appreciation Properties

- Cash Flow vs ROI

- Buying vs. Renting

- How We Help Buyers

- Renting vs. Buying - A Case Study

- Buying An Assignment

- Pet-Friendly Buildings

- How We Help Tenants

- How We Help Landlords

- Ontario's Standardized Lease

Selling With Condo Culture

- How We Help Sellers

- Condo Sellers Guide

- About Condo Assignment Selling

- Selling Assignments and HST

- Selling a Condo with a Tenant

Your Property

- What's Your Condo Worth?

- All Buildings

New Developments

Top buildings.

- Caroline Street Private Residences

- Midtown Lofts

- Bauer Lofts

Top Communities

- Station Park, Kitchener

- Garment District, Kitchener

- Kaufman Lofts, Kitchener

- Blackstone, Waterloo

- Seagram Lofts, Waterloo

- DUO at Station Park

Buying in a New Development

- 5 Things to Know when Buying Pre-Construction

- Pre-Construction vs. Resale Investing

How HST Applies to Selling Assignments As of May 7th 2022

By Condo Culture

There have been plenty of conversations amongst the real estate community and assignment sellers regarding the Federal government announcing that they will be making HST payable on profits made by either end-user buyers or investors, effective May 7th, 2022.

Here’s What Has Changed

This additional charge has always been in place with HST on profits being the responsibility of the Seller. There were specific workarounds in place which won’t apply anymore. This regulation already applied to investors, so nothing changes with this particular type of purchaser. The government essentially wants to tighten up on end-users purchasing a pre-construction unit and subsequently assigning. So moving forward, regardless if the intention was to move into your unit as an end-user, any profit from any assignment sale will now be subject to HST .

Savings - Have a Professional Team On Your Side

Even if you’re an end-user buyer and need to sell your unit for whatever reason as an assignment sale, you can deduct certain expenses from your profit to reduce the amount of HST you pay. The commission of your REALTOR®, lawyer and accountant fees, other assignment-related costs, upgrades to the property, and additional ones are potentially eligible. It’s certainly possible to save between 15% to 20% on what you need to pay for HST based on leveraging applicable deductions.

We highly recommend having an experienced REALTOR®, accountant, and lawyer representing you who all have experience with assignment transactions. Your team can help you navigate through the process from start to finish and beyond, so there are no surprises along the way and to ensure you feel comfortable knowing that you didn’t pay more in HST than you need to in order to maximize your ROI.

Condo Culture has a vast amount of expertise handling all types of assignment transactions and we are all over new regulations as they morph and change over time, so be sure to reach out for any of your assignment selling or buying needs. Assignments can offer unique value given their off-market nature with less buyer competition. They are a great option to review as you explore all possible Condo purchase possibilities.

A Simple Assignment Selling Example

When selling an assignment unit, you pay HST on the deposits made on the purchase, plus the 13% on the home’s increase in value once the deal is complete.

Let’s look at an example - if you originally bought a condo for $450K and ultimately sold it as an assignment listing for $650K, then you will need to pay an additional 13% HST on the increase of $200K minus any deductions as outlined above.

Current Exclusive Assignment Opportunities

We have a bunch of fantastic assignment buying options available right now, including these two beauties.

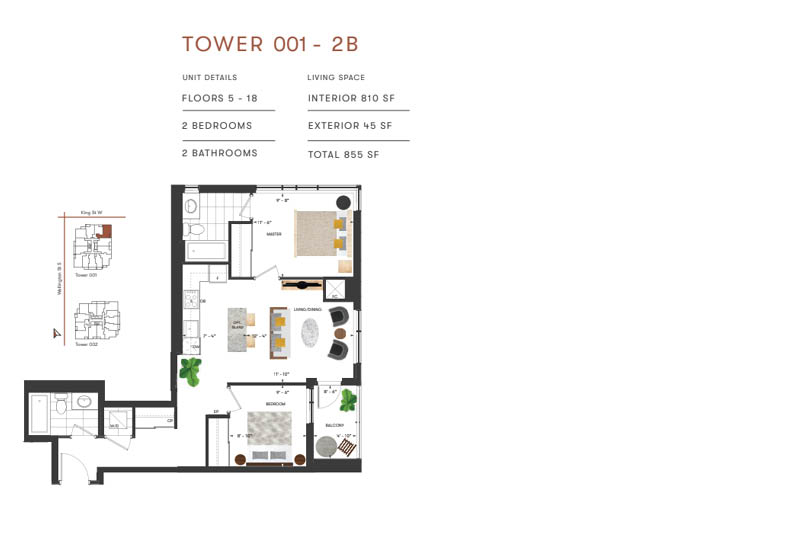

Unit 1012 at Station Park in Tower 1

Highlights:

🛌 2 bedrooms 🛀 2 bathrooms 🚘 1 parking spot 🔐 1 locker ⏹ 810 sq.ft. + a 45 sq.ft balcony ⬆ $18.5K in upgrades on the kitchen and bathroom. Corner unit facing King Street with stunning city views. Expected occupancy: Fall 2022 List price: $699,900

Analysis: This spectacular two-bedroom condo is in a highly sought-after corner unit looking out onto King Street. It’s well priced at $864/sq.ft. and that includes almost $20K in gorgeous upgrades along with a premium lighting package addition, plus a parking spot, as well.

Unit 512 at Station Park in Tower 2

🛌 1 bedroom 🛀 1 bathroom ⏹ 625 sq.ft. + a 60 sq.ft balcony ⬆Entertainment package upgrade included. Corner unit facing both King and Wellington Street with nice 5th-floor views. Expected occupancy: Early 2023 List price: $510,000

Analysis: This wonderful corner unit has a solid price per square foot at $816 including an entertainment package that has been added. It has a generous amount of space for a 1 bedroom unit and a good-sized balcony to lounge, dine, and entertain

We have helped hundreds of clients navigate the unique assignment selling and buying process, and would love to leverage our deep experience to help you succeed with your future transactions. In addition to our Assignment expertise, we are also experts in Condo Resale and Pre-Construction transactions - we are a full spectrum condo brokerage that’s at your service!

To learn more about our assignment selling and buying approach and unique expertise, be sure to read this informative article and connect with us if you have any questions or got any type of condo business to take care of.

Share This Post

2022 Changes to GST/HST on Assignments

- Post author By Edward Tse

- Post date 11 May 2022

- 4 Comments on 2022 Changes to GST/HST on Assignments

The 2022 Federal budget included a few changes to the way some real estate transactions are taxed. The two mains changes are the new residential property flipping rule and changes to the way GST/HST on assignments is taxed for individual. In this post I will be discussing the latter.

Summary of the changes to GST/HST on assignments effective May 7th 2022:

- The new change makes it so that there is GST/HST on assignments regardless of original intentions. Previously, if the original intention of entering the pre-construction contract/Agreement of Purchase and Sale (APS) was for personal use, GST/HST on assignments did not apply. But if the intention was to sell for profit or flip the property, GST/HST applied.

- The legislation officially recognizes that GST/HST is not payable on the portion of the consideration exchanged that represents the deposit that the assignor paid to the seller/builder.

I have seen people talk about these changes as if it will slow down the housing market because they seem to incorrectly assume that GST/HST on assignments is double levied or increased. The changes actually add certainty to the way GST/HST on assignments are taxed.

Let’s do an example of pre- and post- May 7th 2022 changes. Here is the assignment details (closely maps on to OREA Form 145/150 Schedule B):

- Purchase Price on the original APS = $1,000,000

- Payment by Assignee to Assignor for this Assignment Agreement = $100,000*

- Total Purchase Price including the Original APS and this Assignment Agreement: $1,100,000

- Deposit paid by the Assignor to the seller under the original APS to be paid by the Assignee to the Assignor: $200,000

**For the sake of simplicity, this excludes GST/HST but in practice, most assignment agreements will stipulate that GST/HST is included

Under the pre-May 7th 2022 rules according to the CRA*, GST/HST would have been payable on the whole amount that the assignee pays to the assignor, $300,000, which results in HST payable of $39,000 in Ontario (13%*300,000).

*Note that it was the CRA’s view that GST/HST is levied on the deposit. In reality this was challenged successfully in a 2013 Tax Court case and a taxpayer can file their GST/HST return without including the amount attributable to the deposit. But the CRA continued to levy GST/HST on the deposit amount in audits and reassessments so taxpayers unaware of the Tax Court ruling would end up paying additional GST/HST.

Under the post-May 7th 2022 rules, GST/HST on assignments is officially only payable on the payment by the assignee to the assignor, $100,000, which results in HST payable of $13,000 in Ontario. This will force the CRA to update their practice guidelines and hopefully they will no longer expect GST/HST on deposits in audits and reassessments.

The Nitty-Gritty

Lately, I have seen a lot of incorrect information shared by investors, agents, accountants, and lawyers regarding the new GST/HST changes so I hope that this post can put to rest any uncertainty on this issue by giving concrete examples and referring to the budget documents (the link goes to the Supplementary Information attached to the Federal Budget).

Many people are confused about the new changes to GST/HST on assignments and I think it largely stems from the imprecise use of language when talking about assignment agreements.

Before we begin, let’s start with some general definitions I will use in this post and are relevant in assignments:

- APS = Agreement of Purchase of Sale = Pre-Construction Contract

- Buyer = Assignor. The buyer is the individual who signed APS to buy the property. They will also be the assignor in the assignment agreement by assigning the APS to the assignee.

- Seller = Builder. The seller is the builder who signed the APS to sell the property. Note that most pre-construction agreements have a clause that give the seller some rights in an assignment of the contract (ie. seek seller permission and/or an assignment fee).

- Assignee = first occupant. The assignee is the person who will be assigned the APS and wants to eventually close on the property and live in it therefore, in most cases, they will be the first occupant.

- Taxable Supply – means a supply that is made in the course of a commercial activity (from the Excise Tax Act (the “ ETA “) S123(1))

- Budget Day – April 7th 2022.

There are two main paragraphs most relevant to the new changes and I will explain what both of them mean. The first:

Budget 2022 proposes to amend the Excise Tax Act to make all assignment sales in respect of newly constructed or substantially renovated residential housing taxable for GST/HST purposes. As a result, the GST/HST would apply to the total amount paid for a new home by its first occupant and there would be greater certainty regarding the GST/HST treatment of assignment sales. Supplementary Information for the 2022 Federal Budget (https://budget.gc.ca/2022/report-rapport/tm-mf-en.html#a5_2)

I believe some people have misinterpreted this paragraph, specifically the underlined section. The total amount paid by the first occupant is the purchase price on the APS (net of GST/HST as it is usually included in the price) plus the amount the first occupant/assignee paid for the assignment contract (also net of GST/HST).

The legislators have reframed the GST/HST on assignment sales from a taxable supply provided by the assignor, to the GST/HST owed because that is the “true purchase price” that the first occupant paid for the property. There is no double taxation. The amount of GST/HST on assignments is just being levied on the original APS price plus the additional amount the assignee paid to the assignor.

Which leads to the next paragraph:

Typically, the consideration for an assignment sale includes an amount attributable to a deposit that had previously been paid to the builder by the assignor. Since the deposit would already be subject to GST/HST when applied by the builder to the purchase price on closing, Budget 2022 proposes that the amount attributable to the deposit be excluded from the consideration for a taxable assignment sale. Supplementary Information for the 2022 Federal Budget (https://budget.gc.ca/2022/report-rapport/tm-mf-en.html#a5_2)

The GST/HST on the deposit never made sense because the assignee was essentially returning the deposit that the assignor already paid to the builder which was already subject to GST/HST in the APS. This new reframing of the assignment sale solves that quirk because the deposit is already accounted for in the assignee’s “true purchase price”.

The Nittier-Gritt ier

So this is where going to law school comes in handy. If the above has not convinced you, please read on but otherwise, this might be a bit dense as I convert each part of the change to the ETA in everyday language that even a non-tax lawyer can understand (hopefully).

If a taxable supply by way of sale of a single unit residential complex (as defined in subsection 254(1)) or of a residential condominium unit is made in Canada under an agreement of purchase and sale (in this section referred to as the “purchase agreement”) entered into with a builder of the single unit residential complex or of the residential condominium unit […]

Translation/simplification: If a taxable supply by way of an APS is entered into …

[…]and if another supply by way of assignment of the purchase agreement is made by a person (other than the builder) under another agreement, then the following rules apply for the purposes of this Part:

Translation/simplification: …and if there is another supply (profit from the assignment) by way of the assignment of the APS, then the following rules apply:

(a) the other supply is deemed to be a taxable supply, by way of sale, of real property that is an interest in the single unit residential complex or residential condominium unit; and

They key phrase here is “other supply” because it does not refer to the original taxable supply which would have been the entire purchase price of the property in the APS. Instead, the “other supply” refers to the profit the assignor made in assigning the APS to the assignee.

Translation/simplification: (a) the profit from the assignment agreement is deemed to be a taxable supply.

(b) the consideration for the other supply is deemed to be equal to the amount determined by the formula A-B where

Translation/simplification: (b) the profit from the assignment agreement is determined by the following formula A-B where

A is the consideration for the other supply as otherwise determined for the purposes of this Part, and

Translation/simplification: A is the total amount the assignor received before HST, and

B is (i) if the other agreement indicates in writing that a part of the consideration for the other supply is attributable to the reimbursement of a deposit paid under the purchase agreement, the part of the consideration for the other supply, as otherwise determined for the purposes of this Part, that is solely attributable to the reimbursement of the deposit paid under the purchase agreement, and (ii) in any other case, zero.

Translation/simplification: B is a reimbursement from the assignee to the assignor for the deposit paid in the APS if applicable

And putting it all together:

If a taxable supply by way of an APS is entered into and if there is another supply (profit from the assignment) by way of the assignment of the APS, then the following rules apply

(a) the profit from the assignment agreement is deemed to be a taxable supply.

(b) the profit from the assignment agreement is determined by the following formula A-B where

- A is the total amount the assignor received before HST, and

- B is a reimbursement from the assignee to the assignor for the deposit paid in the preconstruction agreement if applicable

This new change introduces more certainty and logic into the tax code which is good for society overall.

Realistically, this only disadvantages those who have a change in circumstance and are “forced” to assign their property before closing. For example, this could be due to interest rate hikes that prevent a taxpayer from obtaining a mortgage or getting a new job elsewhere and no longer needing the property.

But it does create a positive incentive for real estate flippers to follow the law as it closes off one of the avenues for avoiding GST/HST on assignments (though income tax is a whole other issue). I don’t think it will have any meaningful effect on house prices, unless people believe in the incorrect information.

4 replies on “2022 Changes to GST/HST on Assignments”

First, I love the article. I called CRA. The gentlemen there said he is not aware of any changes from May 7th and says HST is still chargeable on the deposit. This makes no sense that the deposit should have ever been considered to be taxed.

Thank you! Yes, the CRA phone reps aren’t really held accountable for the information they give out so if there is ever any conflicting information I would triple check it. As I mention in the post as well, the CRA continued to audit and reassess HST on the whole deposit. I guess the CRA auditors rely on their practice guidance which, as far as I can tell, is from 2011 and wasn’t updated even after the 2013 case against their interpretation. Hopefully they will be issued new practice guidance soon but it might take awhile for it to trickle down to the CRA phone reps.

Awesome article Ed. 👏

Thanks, glad it was helpful!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Preparing for the tidal wave of Canadian tax changes

2024 Canadian ESG Reporting Insights

Findings from the 2024 Global Digital Trust Insights

27th Annual Global CEO Survey—Canadian insights

Impacts of Pillar Two on Canadian M&A

How risk intelligence data mining is changing the way companies manage third-party risks

2023 Canadian holiday outlook

Embracing the future of capital markets

Five opportunities facing Canadian government and public-sector organizations

Emerging Trends in Real Estate® 2024

How can Canadian family business founders and owners create the right outcomes

Managed Services

Building trust for today and tomorrow

PwC Canada collaborates with Google Cloud to create industry-leading solution to help combat cybersecurity threats

PwC Canada makes $200M investment to expand AI capabilities

Apply today! Now hiring students and new graduates

We’re empowering women to thrive in tech

Why join our assurance practice?

Loading Results

No Match Found

Tax Insights: GST/HST issues relating to the assignment of agreements to purchase newly constructed condominiums

February 01, 2021

Issue 2021-03

The combination of rising home prices and the financial stress and uncertainty created by the COVID-19 pandemic is resulting in more condominium purchasers reconsidering their acquisition. While some buyers always planned to assign their agreements of purchase and sale (APS) to a third party, many other buyers that originally intended to lease or reside in their condominium units are also assigning their APS. There are a number of reasons for this, one of which is a reduction in the demand for rental condominiums in many Canadian cities. As discussed in a recent Tax Court of Canada decision, Chen Sun v. The Queen, 2020 TCC 112, there are many Goods and Services Tax/Harmonized Sales Tax (GST/HST) issues to consider when an APS is assigned to a third party, including whether:

- GST/HST is payable by the assignee on the assignment fee and the amount attributable to the deposit that was paid by the assignor to the builder of the property

- the assignee is eligible to claim the GST/HST new housing rebate

- the new housing rebate can be assigned to the builder and credited against the purchase price

Is the assignment of an APS a taxable supply

The assignment of an APS will constitute a taxable supply, unless it qualifies for an exemption. This is because “real property” is defined to include an interest in real property, and the making of a supply of real property (other than an exempt supply) is deemed to be made in the course of a “commercial activity.” The sale of an interest in a residential complex by a person that is not a “builder” is generally exempt; however, the sale of an interest in a new home or condominium is generally subject to GST/HST when the assignor is a “builder.”

A “builder” is defined in a manner which can potentially include someone that is merely entering into an APS with a builder. For example, subject to a specific exclusion that only applies to individuals, someone that acquires an interest in a home before it is occupied (or a condominium before it is registered) can be a builder if their primary purpose was to either:

- sell the home to any person

- lease the home to someone other than an individual for their personal use

Individuals are excluded from being a builder if they did not acquire their interest in the course of a business or an adventure or concern in the nature of trade, which is determined by considering the following factors:

- nature of the property sold

- length of period of ownership

- frequency or number of other similar transactions by the taxpayer

- work expended on or in connection with the property realized

- circumstances that were responsible for the sale of the property

- taxpayer’s motive or intention

To the extent that the assignor is a “builder,” GST/HST will be payable on the value of consideration that is paid by the assignee and the assignor will be required to collect GST/HST unless the assignee is registered for GST/HST.

The Canada Revenue Agency (CRA) considers an amount paid by an assignee on account of the assignor’s deposit to be part of the consideration paid for the assignment of an APS, and is therefore subject to GST/HST if the assignor is a builder. Accordingly, unless the assignment is restructured to result in the builder refunding the deposit to the assignor and receiving a replacement deposit from the assignee, the assignee may pay double tax on the deposit. It is also important to note that the Tax Court of Canada’s decision in Casa Blanca Homes Ltd. v. The Queen, 2013 TCC 338 contradicts the CRA’s view. In Casa Blanca Homes Ltd., the Tax Court of Canada held that the amount paid to the assignor relating to the deposit constituted an exempt supply of a financial service and would therefore not be subject to GST/HST.

Can the assignee claim the GST/HST new housing rebate

The assignment of an APS may also impact the assignee’s eligibility to claim the new housing rebate, as evidenced by the Tax Court of Canada’s recent decision in Chen Sun. The federal new housing rebate is equal to 36% of the federal component of GST/HST paid, up to a maximum of $6,300 (for homes valued at $350,000), with the rebate being gradually reduced and phased out when the value of the home reaches $450,000. For properties in Ontario, the provincial new housing rebate is equal to 75% of the provincial component of GST/HST paid, up to a maximum of $24,000 (for homes valued at $400,000 or higher).

For a purchaser to be eligible for the new housing rebate, the following conditions must be met:

- the purchaser must be an individual that is acquiring the home from a builder, as opposed to an assignor who may not be a builder

- at the time the individual becomes liable or assumes liability, they must acquire the home as their primary place of residence or that of a relation

- ownership of the property must be transferred to the individual after construction is substantially completed

- the first person to occupy the home must be the individual or a relation

- all persons named on the APS must meet the aforementioned conditions

When the purchaser qualifies for the new housing rebate, the builder is generally entitled to pay or credit the rebate amount to the purchaser pursuant to subsection 254(4) of the Excise Tax Act.

In situations where a third party is acquiring ownership of a home or condominium and they receive title directly from the builder, it does not necessarily mean that the APS has been assigned to the third party and that the builder has sold the condominium to the assignee. As argued by the Crown in Chen Sun, if the builder has not accepted the assignment, then the assignee may not be the person that is acquiring the condominium from the builder. Fortunately, in Chen Sun, the court ultimately held that the APS was in fact assigned on the basis that the builder, by its conduct, accepted the assignment and therefore the builder did sell the condominium directly to the assignee. Accordingly, the assignee was eligible to claim the new housing rebate (and the builder was entitled to credit the assignee with the rebate) because the assignee acquired the condominium from the builder and the other conditions to claim the rebate were satisfied.

How should builders deal with assignments

As the builder and purchaser are jointly and severally liable for housing rebates that have been claimed in error, it is important for builders to make sure that purchasers qualify for the rebate before they pay or credit the purchaser with the rebate. The CRA heavily scrutinizes rebate claims and, to the extent each and every condition to claim the rebate is not satisfied, the CRA will deny the rebate claim. In situations where an APS has been assigned, builders should consider whether:

- they should credit the assignee with the housing rebate or advise the assignee to file the rebate claim directly with the CRA

- it is easier to “tear” up the original APS and enter into a new APS with the assignee

- the assignment has been clearly documented so that there is no dispute that the assignee has become the purchaser under the APS, which may not be the case when only the title is transferred to the assignee at the assignor’s direction

The takeaway

All parties to a transaction in which an APS is being assigned and a housing rebate is being claimed should consider the GST/HST implications of the assignment. Failure to structure these assignments in an appropriate manner can significantly increase GST/HST costs for the respective parties, including:

- builders being assessed penalties for erroneously crediting the housing rebate to assignees

- assignors being assessed penalties for failing to collect tax on the assignments

- assignees paying GST/HST on the replacement deposits

PwC can help structure these assignments in a tax-efficient manner.

Download a PDF

Related services

Real estate

Subscribe to tax publications

Brent Murray

Partner, PwC Law LLP

Tel: +1 416 947 8960

Wayne Mandel

Director, PwC Canada

Tel: + 1 905 738 2914

Fred Cassano

Partner, National Real Estate Tax Leader, PwC Canada

Tel: +1 905 418 3469

Ken Griffin

Partner, PwC Canada

Tel: +1 416 815 5211

Dean Landry

National Tax Leader, PwC Canada

Tel: +1 416 815 5090

© 2018 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Cookies info

- Terms & Conditions

- Site Provider

- Accessibility

Thank you for your message

The New Proposed HST Treatment On Pre-Construction Assignment Of Sales

- 1759 Avenue Road Toronto - M5M-3Y8

- Contact Us By Dialing 416-250-6400

- Working Hours Mon - Sat 8:00 to 18:00

Assignment Sales and HST

An assignment sale is a type of real estate transaction that occurs when a buyer of a pre- construction home or condo decides to sell their rights to purchase the property to another buyer before the construction of the building is complete. This type of sale transfers the purchase agreement from the original buyer to the new buyer (known as the “assignee”)

As of May 2022, the government introduced a new rule requiring HST (Harmonized Sales Tax) to be paid on all assignment sales of single-unit residential or condo properties that are newly constructed or renovated. This means that the assignee must pay HST on the difference between the original purchase price and the resale price.

For example, if a pre-construction home was originally purchased for $500,000 and then sold as an assignment sale for $600,000, the assignee must pay $13,000 in HST (calculated as 13% of $100,000, which is the difference between the original purchase price and the resale price).

It is the responsibility of the lawyers involved in the transaction to make sure that the HST portion is remitted correctly, taking into account various factors such as the date of the assignment and the completion date of the building.

Despite the introduction of HST, an assignment sale still continues to have many benefits, such as being a more convenient way for original buyers to sell their rights to the property without having to go through hurdles of selling a fully completed property.

- Privacy Policy

- Website Terms

- Cookies Policy

- Payment Terms

- Why work with us

All Website Contents and Advertising Contents are The Exclusive Property of Cactus Law

(844) 538-2937 or ( 416) 593-4357

Real Estate Assignment Sales – New Tax Rules

The Federal Budget for 2022 has made amendments to Part IX of the Excise Tax Act (“ETA”). Effective May 7, 2022, all assignment sales in respect of newly constructed or substantially renovated single unit residential complexes or residential condominium units are taxable.

For clarity, with respect to residential housing transactions, the purchaser (assignor) enters into an agreement of Purchase and Sale with the builder and then sells (assigns) their “rights and obligations” in the agreement of Purchase and Sale to another person (assignee).

Typically, the closing date for a pre-constructions residential property can take several months or even years. During this time, purchasers may decide to assign their rights outlined in the Purchase and Sale agreement to an assignee. The Federal Budget for 2022 now imposes GST/HST tax obligations on assignors and assignees. Essentially, an individual assignor of residential real estate now must collect GST/HST remit it to the CRA. This rule is applicable even to those who do not have a GST/HST number and believe that they are not purchasing and assigning in the course of commercial activity. In cases where the assignor is a non-resident, the assignee is obligated to self-assess the GST/HST. Prior to this amendment, the GST/HST liability depended on whether an individual purchased and assigned their rights in the course of commercial activity and if the purchaser’s true intentions were to live in and use the property, then there would be no GST/HST liability.

Deposit Portion of Assignments

Where an assignment agreement is entered into on or after May 7, 2022, the Budget confirms that GST/HST would not be applicable to the deposit portion of the assignment price. However, it must be indicated in writing that a part of the consideration is attributable to the reimbursement of a deposit paid by the assignor to the builder under the Purchase and Sale agreement. This means that an assignor would only be liable for GST/HST on the amount above the deposit. This also eliminates double taxation and is consistent with the holding from current caselaw, Casa Blanca Homes Ltd. v. The Queen , 2013 TCC 338 .

Where an assignment agreement is entered into before May 7, 2022, and the assignment sale is taxable, the total amount payable for the sale is subject to the GST/HST, this includes any amount paid by the assignor as a deposit to the builder, whether or not this amount is separately identified.

“Anti-flipping” Rule

Budget 2022 further proposes that sales of residential properties owned for less than 12 months are deemed to generate business income under the Income Tax Act (“ITA”). These are subject to limited exceptions such as divorce, or relocation for employment purposes. In terms of assignment sales, it has not yet been determined whether the proposed “anti-flipping” rules would apply since taxpayers do not technically “own” the properties. Tax practitioners are carefully monitoring this. For more information see our previous blog discussing this .

If you have questions about the new rules contact us today !

**Disclaimer

This article provides information of a general nature only. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in this article. If you have specific legal questions, you should consult a lawyer.

Related posts:

- Withholding Tax for Non-Residents on Real Estate Sales

- Assigning Property and the GST/HST Implications

- How Real Estate Agents can Incorporate a Company

- Capital Gains – Canadians Selling U.S. Real Estate

- Business Expenses for Real Estate Agents

Jason Rosen

Rafia javaid, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

ADVO TAX LAW

PROFESSIONAL CORPORATION

- May 11, 2022

Tax Implications of a Real Estate Assignment: a Tax Exposure Calculator

This article provides an overview of GST/HST and Income Tax rules (current and proposed by the Federal Budget 2022) as they apply to real estate assignments sales.

In order to illustrate the points we discuss in the article, we have created a fun and interactive Assignment Tax Exposure Calculator for real estate assignments in Ontario (HST rate 13%) that result in business income for Income Tax purposes . If your assignment sale results in capital gain for Income Tax purposes, this calculator won't work for you (we might create one for our readers, if there is enough interest). Talk to your tax advisor to determine whether your assignment sale would result in business income or in capital gain.

We hope that our readers enjoy testing their business strategies with our Tax Exposure Calculator as they plan their assignment sales, but we caution them not to rely on the calculator in lieu of professional tax, legal or accounting advice.

Federal Budget 2022

A typical purchase agreement for a pre-construction residential property has a closing date scheduled months, often years in advance. As purchasers wait for the construction to complete/the transaction to close, some choose to assign their rights under the purchase agreement for the property for a fee. Federal Budget 2022 proposes new tax rules that will affect both such assignors and assignees.

Take, for example, Rebecca who purchased a pre-construction condominium in Downtown Toronto in 2017 for $300,000 (including HST) with a November 2022 tentative closing date. She provided a deposit of $60,000 to the builder. At the time of purchase, Rebecca’s intention was to live in the condo. As years went by, Rebecca changed her mind about living in Downtown; she decided to live in the suburbs instead. Lucky for Rebecca, the market value of her pre-construction condo surged to $500,000. In June 2022, Rebecca assigns her rights under the purchase agreement for the condo to a new purchaser who is willing to pay $260,000 ($60,000 to reimburse her for the deposit she made + $200,000 on account of the increase in price). Rebecca thinks she made an impressive profit of $200,000 but she did not consider taxes.

If you are like Rebecca, Federal Budget 2022 has some good news and some bad news for you (but mostly bad).

GST/HST to Apply on All Assignment Sales

The bad news is that effective May 7, 2022, under the Excise Tax Act (Canada) (“ETA”) every individual assignor of residential real estate would have to collect GST/HST on their assignment profit and remit it to the CRA. The rule will apply even to those who believe they are unrelated to the business of real estate and did not have a GST/HST number. Where an assignor is a non-resident, the assignee would be required to self-assess and pay the GST/HST to the CRA. In my example, Rebecca would have to remit 13% HST included in the $200,000 assignment profit ($23,008) directly to the CRA.

Before the Budget proposal, Rebecca’s HST liability depended on whether or not she purchased and assigned a condo in the course of a commercial activity. If Rebecca’s true intentions were to live in the condo, she would have been exempt from HST.

Income from Assignment: Business Income or Capital Gain?

Another element of bad news does not directly follow from the proposals, but raises concerns. Some commentators believe that, as an indirect effect of the Budget, we may see more assignment sales treated as business income (taxed at full rates) as opposed to capital gain (taxed at half rates) under the Income Tax Act (Canada) (“ITA”).

First, if all assignments are “taxable supplies” subject to GST/HST under the ETA, it generally implies the existence of a “commercial activity.” In its turn, a commercial activity generally implies business income treatment under the ITA. Granted, if an activity is deemed to be a “taxable supply” under the ETA, the deeming rule should not extend to a different Act, the ITA, but tax practitioners are watching carefully.

Second, Budget 2022 includes a new “anti-flipping” rule, which deems sales of residential properties owned for less than 12 months to generate business income under the ITA, subject to limited “life events” exceptions, such as a divorce or a job relocation. It is unclear whether the proposed “anti-flipping” rule would apply to assignments when taxpayers technically do not “own” the properties. Stay tuned.

In any event, the new “acceptable” list of life events replaces the current capital vs. income legal test entirely. Instead of determining whether the condo was Rebecca’s capital property or inventory, the focus shifts to merely checking whether her reason to sell/assign was on the list of the “acceptable” ones.

If Rebecca’s assignment profit is treated as business income for income tax purposes, her highest marginal tax rate would be 53.53% in Ontario. In very rough terms, Rebecca should budget well over 50% of her assignment profits for HST remittances and income tax. Depending on her marginal tax rate, she may be able to only keep about $88,000 of her original $200,000 assignment profit.

Before the Budget proposal, Rebecca’s intentions for the property (business or personal) would have been a question of fact. If she could prove that she intended to live in the condo, she would pay no HST and pay tax on capital gain. Her total tax liability would have been approximately $50,000 (25% of the $200,000 assignment profit).

No HST On Deposit Portion of Assignment Price

But there is also good news: the Budget proposes to exclude deposits from consideration for taxable supplies by assignment for GST/HST purposes. This means that GST/HST will only apply on the profit portion of the assignment price (in Rebecca’s case, $200,000), and not on the entire assignment price, which includes the deposit ($260,000). This is a welcome change that eliminates double taxation and is consistent with current caselaw ( Casa Blanca Homes Ltd. v. The Queen , 2013 TCC 338).

To generally estimate Income Tax and HST (Ontario) implications of an assignment that results in a business income, check out the Assignment Tax Exposure Calculator on our website .

IMPORTANT: Always speak to your tax professional to estimate or determine tax consequences applicable to your specific situation. DO NOT rely on our calculator for an accurate estimation of your tax liability. Nothing in this article constitutes legal advice and no solicitor-client relationship is created. If you require legal advice pertaining to your specific situation, please contact our tax lawyer .

If you enjoyed this article, please do not forget to s ubscribe to our blog and our social media for important updates.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

#advotaxlaw #annamalazhavaya #taxlawyer #taxlawyerToronto #taxlawyermississauga #taxlawyeretobicoke #taxlitigationlawyer #hst #realestate #gstcanada #torontotax #filingtaxescanada #revenuecanada #canadarevenueagency #taxcreditscanada #hstrebatecanada #hstcanadatax #realestatetoronto #realestatebuilder #residentialbuilder #buildertoronto #intention #principalresidence #craaudit #craappeal #taxcourt #penalties #assignment #preconstruction #budget2022 #businessincome #taxcalculator #taxexposurecalculator #hstonassignment

Recent Posts

Basic Guide on Bare Trusts for Canadian Taxpayers

The Future of Tax Audits Looks Digital

True or False? Political Rumours Around Taxing Gain on Principal Residence: The 2021 Edition

- Services Overview

- Accounting Services

- Tax Planning

- Business Planning

- Business Valuation

- Mergers and Acquisitions

- Corporate Finance

- Litigation Support and Dispute Resolution

- Succession & Estate Planning

- HR Consulting

- IT Consulting & Workflow Automation

- Agriculture

- Condominiums

- Construction

- Not-For-Profit

- Real Estate

- See the Difference

- RLB People Presents: Email Etiquette

- HR Seminar: Strategies for Building a Resilient Workforce

- Careers Overview

- Career Opportunities

- Guelph Office

- Fergus Office

- Kitchener Office

- Orangeville Office

- Shelburne Office

- IT Consulting & Workflow Automation

- Events/Trainings

- The RLB Difference

- Events & Training

Blog GST/HST on Assignment of New Housing Agreements

GST/HST on Assignment of New Housing Agreements

GST/HST on Assignment of New Housing Agreements

On April 7 th , the Government of Canada released the federal budget for 2022 which included several new proposals with the goal of growing the economy and making life more affordable. One of the changes pertains to GST/HST on assignments of a purchase and sale agreement for newly constructed housing, including condominium units.

Often upon entering into a purchase and sale agreement with a builder for the construction and sale of a new house, the purchaser may be entitled to assign their rights under the agreement to another person (an assignee). Following the assignment, the purchase and sale agreement is generally then between the builder and the assignee.

Previous Legislation

Whether or not GST/HST applies on the assignment of a purchase and sale agreement depends on whether the person selling the interest is considered a “builder” for GST/HST purposes. This typically depends on the person’s original intention at the time of acquiring the interest, when entering into the agreement. Generally, only if the original purchaser entered into the agreement with the builder for a purpose other than that of selling the interest, may an exemption from GST/HST be available. These rules often depend on the specific facts of the circumstance and leave room for ambiguity.

New/Current Legislation

Under the new legislation, GST/HST will apply to all assignments. From the purchaser’s perspective, GST/HST will only apply to their profit, and they are not required to apply GST/HST on their original deposit, to prevent double taxation. The GST/HST on the deposits previously made should be handled by the original builder. For example, if the purchaser previously made a $50,000 deposit to the original builder and agrees to sell the contract for $100,000, the GST/HST applies only to the $50,000 of profit.

Form GST62

Form GST62 is a non-personalized GST/HST form that should be prepared and remitted with the taxes owing. This form, along with the taxes owing, will be due by the end of next month after the sale occurs.

GST/HST Rebate

Typically, homeowners who intend to move into the housing or property can assign the rebate to the home builder and have that amount credited from their purchase price. In the assignment situation, the second purchaser can choose to consider GST/HST paid to both the builder and the assignor when they file their rebate. Whether or not that is beneficial will depend on the value of the property.

The timing of the new legislation is set for one month after the budget was announced which would be May 7 th , 2022. If you have any further questions, the RLB team would be happy to assist you!

Authors: Eric Tuffnail and Blake De Luca

View Related Articles

Language selection

- Français fr

GI-120 Assignment of a Purchase and Sale Agreement for a New House or Condominium Unit

You can view this publication in:

HTML gi-120-e.html

Last update: 2011-07-06

Page details

Everything you need to know about Preconstruction Assignment Sales

Have you sold pre-construction homes before closing on assignments?

Have you wondered about what are the tax implications on selling pre-construction homes before closing?

We often advise our clients to not to sell their pre-construction homes before closing if possible. It can trigger a series of tax implications – HST and income tax implications.

Before the announcement of Budget 2022, CRA had adopted the policies that HST would be applicable on not just the assignment fees, but also the deposit.

This could be a huge tax cost that most investors weren’t aware of.

Now, let’s use an example to explain .

Say you agree to purchase a pre-construction home for $700,000. You sign the agreement of purchase and sale and pay a deposit of $100,000 to the builder.

The new home is expected to be completed a few years later.

You decided to sell the property on assignment before it’s ready for closing for an additional $50,000.

Scenario 1: When you signed the agreement of purchase and sale, you intended to move into the property and use it as your primary residence.

Life circumstances change. You now decided to sell the property before closing. You sold it on assignment before May 6, 2022 .

HST: As your intention was to move into the property as your primary residence, you had no HST liability obligation.

Again, intention is subjective. If you’re questioned in court, you would have to provide evidence to prove your own intention.

Most clients thought that the CRA would have to prove that they were wrong. The truth however is that the taxpayers are the one who have the responsibility to prove to CRA their own filing position.

Make sure your have documentation proving your initial intention.

Income Tax: Assuming you have strong documentation proving that you did intend to purchase this pre-construction home as your primary residence, the $50,000 assignment fees could be reported as capital gain.

Scenario 2: When you signed the agreement of purchase and sale, you intended to move into the property and use it as your primary residence.

Life circumstances change. You now decided to sell the property before closing. You sold it on assignment after May 6, 2022 .

Budget 2022 changed the rule. For all assignment sales happened after May 6, 2022, regardless of your intention, you’re required to pay HST on the assignment sales.

HST implication:

This means that the $50,000 collected is no longer all yours. This $50,000 collected, if you don’t charge HST on top, is inclusive of HST.

You must remit the HST to CRA on sale on assignment. In this case, it would have been $5.8K.

Presumably, you would also be able to claim Input Tax Credit, which is the HST you paid on services that you used to allow you to sell the property. This includes the HST you paid on your legal cost and HST you paid on brokerage fees.

The net amount can be remitted to CRA.

Income Tax Implication:

Budget 2022 also made some rule changes when it comes down to sale of property. The sale of a property within one year of ownership is considered on income account, meaning 100% of the profit you make is taxable, with some exceptions allowed, effective Jan 1, 2023.

When you apply this new rule to this scenario, it is unknown as to whether an assignment sale is considered a flipped property. It’s difficult to say whether this rule is applicable to assignment sale at this point.

Regardless, you still would need to keep proper and relevant documentation supporting your intention that you were trying to move into the property as your primary residence. With proper documentation, you could still report the net income from assignment sale on capital account, meaning only 50% of the profit you make is taxable.

In our example, assuming client didn’t incur other cost of selling, the client would be reporting $44K of capital gain, 50% of which would be taxable.

Scenario 3: When you signed the agreement of purchase and sale, you intended to rent out your property.

Interest rate changed. You now decided to sell the property before closing. You sold it on assignment before May 6, 2022 .

Your intent was never to move into the property as your primary residence or have any of your family members moving in, as a result HST is applicable on assignment sale.

Assignment fees are subject to HST. $50,000 assignment fees you collected are subjected to HST.

CRA also adopted the position that the deposits $100K are also subject to HST as well. Ouch!

You thought you made $50,000 – but after considering the HST on assignment fees $5.8K and HST on deposits $11.5K, you really only net $33K.

This calculation hasn’t considered the brokerage fees as well as the lawyer fees yet. Yikes!

Income Tax implication:

The net amount profit of $33K (assuming there’s no brokerage fees or lawyer fees, if you have, the net profit is lower) would likely have to be reported as income, 100% of it is taxable.

If you own the property in your personal name, the entire amount is added to your job income or whatever income you have in your personal name. You’re taxed at the respective marginal tax rates, which can be as high as 53.5% in Ontario.

Triple Yikes!

If you own the property in the corporation, the profit is taxed as regular business income, most likely at 12.2% for qualified small businesses.

Scenario 4: When you signed the agreement of purchase and sale, you intended to rent out your property.

Interest rate changed. You now decided to sell the property before closing. You sold it on assignment AFTER May 12, 2022 .

The Government also recognized that charging HST on deposits were not right. Budget 2022 specified that HST would no longer be charged on deposits .

Assignment fees are subject to HST but deposits are not subject to HST anymore to avoid double taxation.

Assignment fees are reported as income 100% taxable.

So continuing with the same example, HST is applicable on the $50,000 assignment fees, meaning that you would incur HST liability of $5.8K as calculated above.

Again, you could offset the HST liability with the HST you pay on realtor commission as well as lawyer fees on closing.

The net amount would have to be paid to CRA.

The net profit of $44K (assuming there’s no brokerage fees or lawyer fees, if you have, the net profit is lower) would likely have to be reported as income, 100% of it is taxable.

Similar to Scenario 3, if you own the property in your personal name, the entire amount is added to your job income or whatever income you have in your personal name. You’re taxed at the respective marginal tax rates, which can be as high as 53.5% in Ontario.

Now that we’ve gone through the assignment sales tax implication in details – Are you still planning to sell your properties on assignment?

Let us know below.

Lastly, our team has been working tirelessly to prepare for the upcoming Wealth Hacker Conference on preparing everyone for the upcoming recession. We have experts such as Dalia sharing her insights on how to protect your portfolio and grow from this recession. If you are lost, join us at the upcoming Wealth Hacker Conference.

Visit WealthHacker.ca now to get your tickets.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant

Related Posts

Big News for Bare Trusts: CRA’s New Take on T3 Filing Penalties

To Sell or Not to Sell: Making Smart Decisions about Your Real Estate Investments

How To Claim Home Office Expenses (2024 Update)

Trusts in Real Estate: Lessons from a Key HST Court Case

Hit enter to search or ESC to close

- About our Firm

- Community Involvement

- Bram Potechin

- Eli M. Udell

- Yasmin M. Vinograd

- Merredith MacLennan

- Mitchell Besner

- Charlene Kavanagh

- Brent Timmons

- Matthew Reardon

- Patrick R.J. Fontaine

- Nathan Serratore

- Jennyfer Kinnell

- Leanne Storms

- Margaret E. Hawkins

- Caroline Bedard

- Philip Byun (변동욱)

- Noah Potechin (Of Counsel)

- Chuck Merovitz

- Support Team

- Administration

- Commercial Disputes

- Estate Litigation

- Contesting A Will

- Construction Law

- Real Estate Litigation

- Landlords & Commercial Tenants

- Other Disputes

- Wrongful Dismissal

- Human Rights In The Workplace

- Business Insolvency

- Personal Bankruptcy

- Advising Creditors

- Mortgage Enforcement

- Advising Trustees

- Buying and Selling Your Home

- Commercial Transactions

- Builders & Developers

- Investing In Real Estate

- Banking and Finance

- Corporate Formation and Governance

- Commercial Contracting and Leasing

- M&A and Corporate Transactions

- Corporate Services

- Helpful Resources

- Videos and Presentations

- linkedin-in

- Business Law (60)

- Disputes and Litigation (62)

- Employment Law (31)

- Estate Litigation (35)

- Insolvency and Collections (13)

- Litigation (2)

- MP News (10)

- Real Estate Law (133)

- Uncategorized (4)

- Wills and Estates (28)

Merovitz Potechin Blog

Assignment of new home agreements, new rules for gst/hst payments and the new housing rebate.

By Frank Bourgault of Merovitz Potechin LLP on Thursday April 28, 2022.

The 2022 Federal Budget was tabled on April 7, 2022 (the “Budget”). Given the growing demand for new homes, it comes as little surprise that the government has proposed various new rules aimed at addressing affordability in the real estate market. Notably, certain measures are intended to curtail what is perceived by some as unfair or imbalanced situations in the market, namely the flipping of properties and the assignment of agreements of purchase and sale (“Agreements”) for new homes.

Here we will summarize the impact of the federal government’s new rules regarding assignments of Agreements.

Payment of GST/HST on Assignment Sales by Individuals

The new rules regarding assignments of Agreements address the payment and collection of GST/HST on the consideration paid by an assignee to an assignor under an assignment transaction. In turn, such new rules may affect the amount of the GST/HST New Housing Rebate credited to an assignee.

To appreciate the new rules, it is worth taking a step back. First, consider a situation where a buyer has been permitted to assign an Agreement to a third-party buyer. In such a situation, the original buyer (the “Assignor”) will oftentimes collect a fee from a new buyer (the “Assignee”) in exchange for the assignment. This fee collected from the Assignee may represent all or part of the deposit paid by the Assignor to the builder pursuant to the Agreement. Alternatively, the assignment price may be greater than the deposit paid. In this latter scenario, the Assignor is effectively making a profit on the assignment sale. In years past, this scenario has proven lucrative to those speculating on real property.

The Budget has brought the GST/HST issue associated with the above scenario back into focus. Is GST/HST is payable on the assignment sale? In other words, should the Assignor be collecting GST/HST on the “profit” component of the assignment and remitting same to Canada Revenue Agency? Why does this matter to you?

Prior to this year’s Budget, the answer to this question depended on the circumstances:

- If the Assignor originally entered into an Agreement with a builder for the primary purpose of selling their interest in the Agreement, the assignment sale was a taxable supply. GST/HST was applicable on the “profit” and ought to be collected and remitted to CRA by the assignor; OR

- If the Assignor had originally entered into the Agreement for another primary purpose, such as to occupy the home as a primary place of residence, the assignment sale would generally be exempt from HST/GST.

The Budget has now changed the rules of the game. This fact-based determination no longer applies.

The Budget will amend the Excise Tax Act to make all assignment sales of new homes taxable for GST/HST purposes. Put simply, an Assignor will be required to collect and remit GST/HST on the profit made on every assignment sale, irrespective of their original intention when they entered into an Agreement. This measure will apply in respect of any assignment agreement entered into on or after the day that is one month after Budget Day.

GST/HST New Housing Rebates

For new homebuilders, the takeaway from the above is that the new rules may affect the amount of GST/HST New Housing Rebate (the “Rebate”) granted to an assignee, should the builder agree to accept an assignment of the Rebate from the assignee in the first place. This is because the Rebate amount is determined based on the total consideration payable for a taxable supply of a home, including any other taxable supply of an interest in the home such as the profit on the assignment sale. As such, where a homebuilder elects to accept an assignment of the Rebate and give a credit to the Assignee for the Rebate amount on the statement of adjustments, the calculation of the Rebate will need to include both the sale price of the home as well as the profit received by the assignor in excess of the original deposit paid.

The homebuilder will therefore need to know the amount of profit on the assignment sale in order to properly determine the amount of the applicable Rebate. If you are a homebuilder or a new homebuyer and have questions about assignments of Agreements or the GSH/HST New Housing Rebate, contact the Real Estate Lawyers at Merovitz Potechin LLP .

The content on this website is for information purposes only and is not legal advice, which cannot be given without knowing the facts of a specific situation. You should never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. The use of the website does not establish a solicitor and client relationship. If you would like to discuss your specific legal needs with us, please contact our office at 613-563-7544 and one of our lawyers will be happy to assist you.

Posted By: Frank Bourgault of Merovitz Potechin LLP

Related Posts

Hst new housing rebate – what new home builders should know.

Most agreements of purchase and sale for newly built homes in Ontario are premised on buyers qualifying for the HST...

By Frank Bourgault of Merovitz Potechin LLP on Monday September 30, 2019.

HST New Housing Rebate – What New Homebuyers Should Know

In Ontario, the sale of newly built homes is subject to GST/HST. This means that anyone in Ontario who purchases...

By Frank Bourgault of Merovitz Potechin LLP on Wednesday October 30, 2019.

Federal Budget 2022: Ottawa to Implement Canada-Wide Anti-Flipping Tax

The 2022 Federal Budget introduces a new deeming rule to ensure profits from flipping residential real estate are subject to...

By Frank Bourgault of Merovitz Potechin LLP on Wednesday April 20, 2022.

Merovitz Potechin LLP 300-1565 Carling Avenue Ottawa, ON K1Z 8R1

Phone : 613-563-7544

Fax : 613-563-4577

613-563-7544

613-563-4577

" * " indicates required fields

Request A Consultation

- Name * First Name Last Name

- How did you hear about us? * How did you hear about us? Accountant Referral Advertisement / Signage Bank Referral Bing Broker Referral Event / Seminar Family / Friend Facebook Google Insolvency Trustee Referral Law Firm / Lawyer Referral Lawyer.com Law Society of Ontario LinkedIn Merovitz Potechin Lawyer / Staff Referral Real Estate Agent Referral Yelp OTHER

- If you selected "OTHER" please indicate:

- Area of Assistance * Area of Assistance Will / Powers of Attorney Corporate / Business Law Real Estate Estate Litigation General Litigation and Disputes Employment Law Unknown

- Brief description of your legal issue *

- Email This field is for validation purposes and should be left unchanged.

- Agreement of Purchase and Sale

- Conveyancing

- Estate Administration

- Estate Planning

- Chattels and Fixtures

- Surveys and Boundaries

- RECO Discipline

- Contract Law

- Agent Obligations

- Residential Tenancies

- Market Conditions

- Interesting

- Expert Witness

- Arbitrations and Mediations

- AEA Program

- List of Courses

- Testimonials

HST Clause in the Agreement of Purchase and Sale

From time to time, the HST clause in the Agreement of Purchase and Sale is filled out incorrectly. This could prove to be a big mistake.

This is the HST Clause in the standard form Agreement of Purchase and Sale (2016 version):

7. HST: If the sale of the Property (Real Property as described above) is subject to Harmonized Sales Tax (HST), then such tax shall be …………………………………………………. (included in/in addition to)….. the Purchase Price. If the sale of the Property is not subject to HST, Seller agrees to certify on or before closing, that the sale of the Property is not subject to HST. Any HST on chattels, if applicable, is not included in the Purchase Price.

The blank space is to include either the words:

- “in addition to”

Missing the correct phrase could lead to a $130,000.00 error on a million dollar property.

Normally, resale residential properties are exempt. However, sometimes a business has been conducted upon the premises. Only the Seller would really know.

The result is important to both parties. Sometimes, the “saving grace” will be that the Buyer registers, obtains an HST number, and is able to offset the tax that might otherwise have been payable.

Consider a small business as a Seller to a non-profit organization as a Buyer. The Buyer is exempt from HST and will not be able to register. This won’t work, and we have a problem to the size of 13% of the purchase price.

Depending upon various software programs, either of the two provisions may be the default setting. On occasion throughout negotiations, this may change by accident. If it does, since it is part of the printed portion of the document, it may not be noticed or initialled. This again would be a 13% error.

It should be noted that, if the HST does not apply, then the Seller is to certify that fact.

From time to time, there may be appliances or chattels sold at the same time. HST would apply. Such HST would be in addition to the purchase price.

For new homes constructed by builders, the HST is often “included” since they wish to take advantage of an attractive “all in” price for consumers. In those cases, HST will be included and the buyers will assign their right to a New Home HST Rebate directly to the Builder. The Buyer must occupy the premises. This rebate is not for investors, however another rebate would be.

Assignments can create a problem. In a number of cases, although the original purchase had an “all in” price, on an assignment the builder may not provide that same opportunity to an assignee. This means that the assignee will have to pay the full purchase price PLUS HST and then submit an application for a refund which might easily take six (6) months.

Brian Madigan LL.B., Broker

www.OntarioRealEstateSource.com

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Privacy Overview

LAWYER SEARCH

- Search for:

Assignments of Agreement of Purchase and Sale – An Overview

What is an assignment.

The assignment of an agreement of purchase and sale is a legal transaction whereby a party to a contract transfers their rights and obligations in that agreement and associated property, to another party. It is commonly used in Ontario real estate transactions as a means of selling a property before the original purchase agreement is completed. Assignments are often pursued by buyers or investors who wish to purchase a property for a lower price than the original purchase price or who seek to benefit from a changing market or financial circumstances. In an assignment, the original purchaser (the assignor) sells their rights and benefits under the agreement to a third party (the assignee) for a negotiated price.

Benefits, Disadvantages, and Uses of an Assignment Transaction

There are several benefits to pursuing an assignment. For the assignor, it may provide an opportunity to sell the property at a profit without having to close on the purchase themselves. It may also allow them to avoid closing costs and other fees associated with the purchase. For the assignee, an assignment can offer an opportunity to purchase a property at a lower price than the original purchase price, particularly if the market has changed or the original purchaser is in financial distress. However, there are also potential drawbacks to assignments, such as uncertainty regarding the closing date, tax implications, higher than anticipated closing costs and the potential for disputes between parties.

Assignment Process

The assignment process typically involves several steps. First, the assignor must find a willing assignee who is willing to purchase their interest in the property. They may need to advertise the property and assignment (provided this is permitted by the original vendor in a pre-construction transaction) and negotiate a price with the assignee. Once an assignee is found, the parties must draft an assignment agreement that outlines the terms of the assignment, including the purchase price, closing date, obligations of each party and other relevant details. The assignment agreement must be signed by both the assignor and assignee and may need to be registered with the relevant authorities, such as the Land Registry Office. Finally, the assignee assumes the rights and benefits of the original agreement and is responsible for completing the purchase on the closing date. Throughout the assignment process, it’s important to seek legal advice and follow the requirements outlined in the original purchase agreement.

Fees and Default

Assignment agreements generally include an ‘Assignment Fee’ payable by the assignee to the assignor in exchange for the right to acquire the property. It is important to determine when this fee is payable. If any funds are to be released to the assignor prior to the completion of the original transaction, it must be specified. Otherwise, the default is that they are to be held in trust by the assignor’s solicitor, until the completion of the original agreement of purchase and sale.