- Baltic Equities

- Cryptocurrencies

- Outta bubble

- Personal Growth

- Social Conditioning

- Best of Internet

- Musical Inspiration

- Short Quotes

- Professional Photography

- Alternative Artistic Mastery

- Tolerable Shots

- About Generalist

- Got a question?

Recent Posts

- Reviewing Lesser Known Movies (Part 2)

- Annual Portfolio Overview & Market Outlook for 2024

- Reviewing Lesser Known Movies (Part 1)

- Thieve in the Wire

- Essentials for Alta Via 2: A 9-Day Hike Guide In Italian Dolomites

Stay in touch

Email address:

Prefer Twitter?

Kazakhstan’s SuperApp: Kaspi.kz

Similarly to Reliance Industries write-up , I’ll try to abstain myself from going too deep. I think what Kaspi.kz is today is a testament of superb execution by management and continuous entrenchment of moat.

I want to thank Better Nest for compiling a list of material on kaspi.kz , if your interest throughout the post is maintained I suggest you go there to learn more. Today my goal is to:

- brush over what Kaspi.kz is;

- shareholders with focus on CEO profile;

- key business aspects;

- valuation (no DCF needed, ratios and growth rates will suffice);

- potential upsides;

- risks and climate post Kazakh crisis;

- technical details: instrument, position, disclaimer;

- recommended further reading.

In Short: What is Kaspi.kz?

Businessman Vyacheaslav Kim co-founded and ran Electronics Network of stores in 1993. Enterprenuers at the time were buying banks, so in 2002 he bought one too: Bank Kaspiyskiy. Logic behind it being to provide leases for electronics buyers.

In parallel Mikheil Lomtadze, current CEO, was growing his competencies all around and landed a job and finally a partnership at investment fund Baring Vostok. Kim wanting to transform Kaspiyskiy sought expertise and capital. Two guys connected well, shook hands, exchanged Kaspi ownership, and decided to pivot traditional bank to a technology company , shifting focus from business customers to retail clients. Lomtadze joined company in 2007, which marks the transformation of the bank. In 2008 name was changed to Kaspi bank.

Kaspi.kz Today

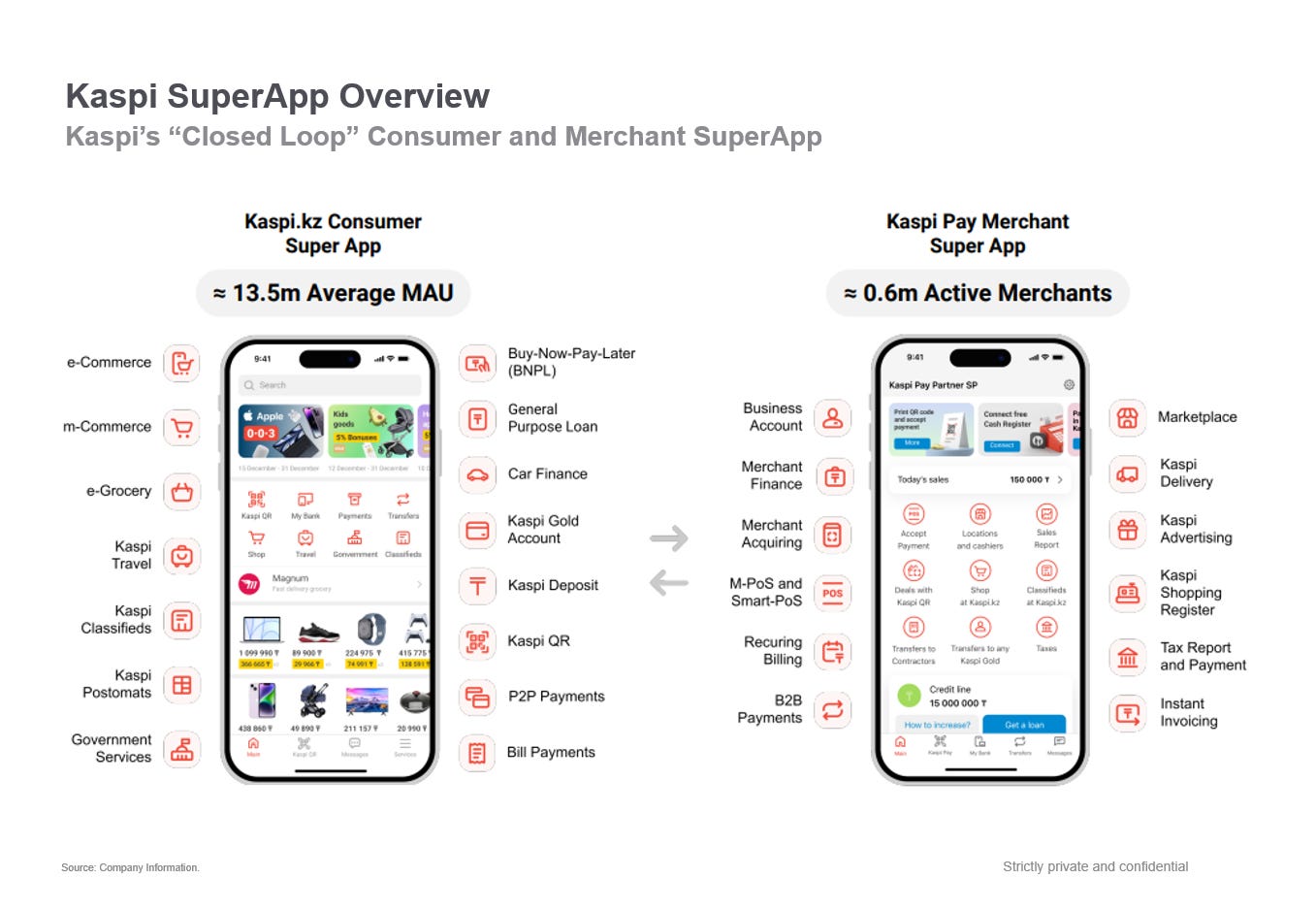

CEO Mikheil Lomtadze likes to refer to Kaspi.kz as customer relations technology company , which puts emphasis on customer satisfaction (famous Bezos attribute) – key aspect of a successful B2C company. However, for investors, the notion of SuperApp is probably more clear. Tenscent’s Wechat started with chat, Kaspi.kz started with a customer finance app and grew from there.

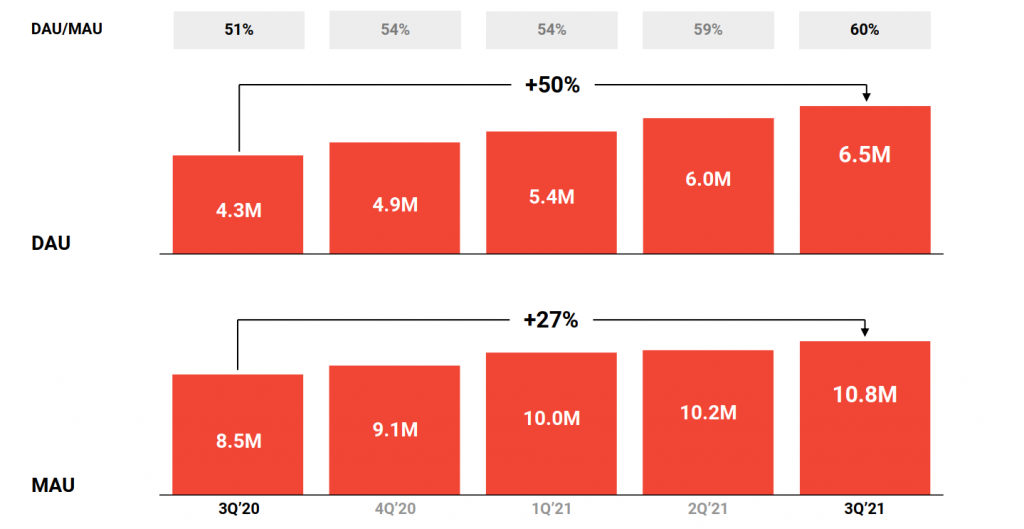

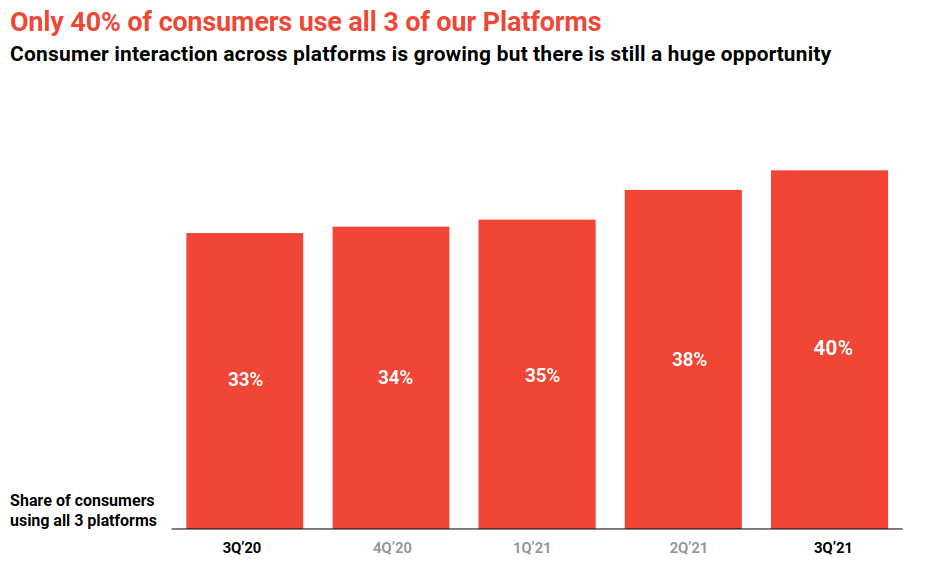

Today Kaspi.kz has 3 main business lines (Payments, Marketplace and transformed legacy – fintech), but more importantly – has become a de facto leader in Kazakhstan’s digital transformation . As of 2021 Q3 57% of Kazakhs use the app monthly (+27% YoY growth), of which 60% are daily users:

Shareholders

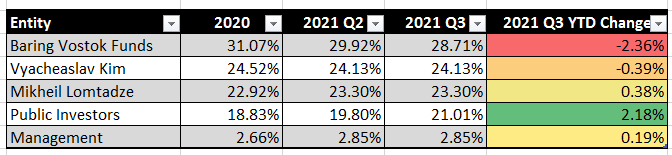

2021 Q3 report currently gives the latest data into Kaspi.kz ownership:

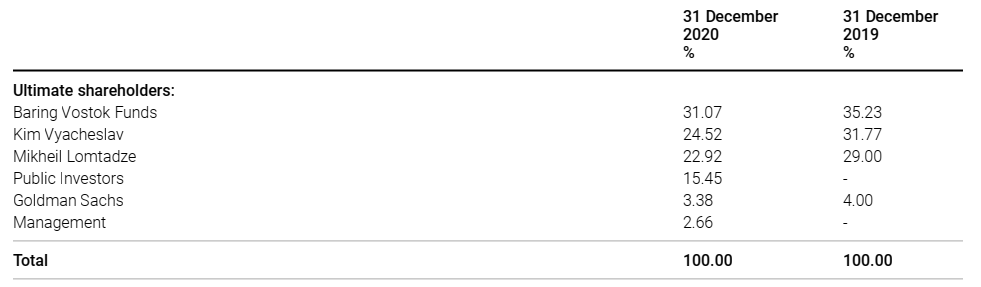

However, in 2020 audited annual report , Goldman Sachs ears are poking out too:

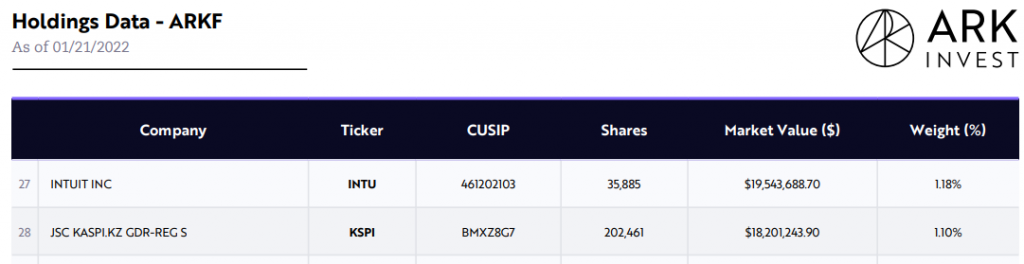

Another notable investor – Ark Funds also has a 18M stake at the time of writing:

I’ll return to this section when we talk about risks, but foreign institutional participation is welcome.

CEO Profile: Mikheil Lomtadze

Mikheil is originally Georgian. Came from a difficult background and was pushed hard by his parents. Education came before entertainment in the household, so he was always busy.

Discovered his talent for sales and networking early while selling fish with his father.

In school, he questioned authority, got into fights (you see the build, right?), and eventually learned that nothing is impossible, through perseverance.

He graduated from Georgia’s European School of Management and MBA from Harvard Business School later on.

In interviews, two aspects always show up:

- emphasis on people you surround your self with (duh);

- intelectual humility .

I can’t say I know the people of the region. I’ve only been to Georgia once. But I would argue, central Asia should share at least some similarities with CEE region. People are direct. Either honesty or dishonesty shines through, unlike someone French.

All Mikheil’s significant wealth is in Kaspi.kz and he sees other personal investments as a distraction . I shared another nugget from the interview recently:

$KSPI CEO Mikheil Lomtadze's one of core beliefs: "being unsatisfied is the most important feeling you can have. Being unsatisfied means you go to work today and you are not satisfied with the things you did yesterday and you always look for the things to improve" — Generalist Lab (@Generalist_Lab) January 20, 2022

His competitive make-or-break mentality , I believe is an engine behind Kaspi’s execution success so far. He’s currently 46 years old and I could not hear any hint of him stepping down.

In his early career, Mikheil recalls “we were a bank, but people still hated us” (not a direct quote). His aspiration has always been to create a product, that people love and from a certain time NPS (net promoter score) became one of KPIs .

People working in Kaspi.kz

Kaspi has an employee ranking system. If you rank at the bottom three times in a row – you are fired. I haven’t read any glassdoor like reviews from former employees and I may disagree with the policy, but numbers are cranking so the system must be working.

As per 2020 audited report, there were 9000+ employees, 1200 of which in data science, IT and product development. Average employment term: 4 years ( average age: 30 )

Two notes here:

- modern fintechs have a problem with UX. Problem? You are frusted talking to a bot and waiting for a human. I suspect significant amount of cheaper (in comparison to west) local workforce is customer support.

- Most senior management members are old-timers from Vostok – Kaspi transformation times.

Kaspi’s Business Model

As mentioned above, Kaspi.kz classifies it’s business in three major lines within the same app, so let’s touch on each of them.

Kaspi.kz took Kazakhstan’s cash-rich ecosystem by storm. From 2020 report, kicking Visa and Mastercard in the teeth:

Kaspi.kz Payments Platform is the largest driving force behind Kazakhstan’s transformation from cash to cashless and digital transactions. Based on NBK data, our TPV corresponded to a market share of 69% in 2020 for total cashless and digital transactions (card payments, P2P payments, internet and mobile payments) effected in Kazakhstan, up from 65% in 2019

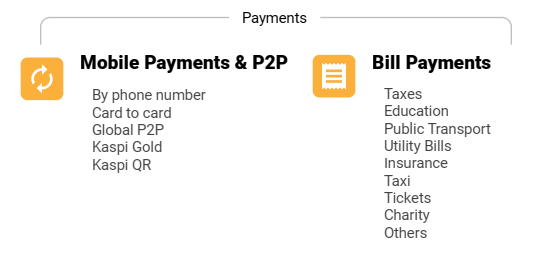

Payments functionality is the most important factor to acquire new customers into Kaspi.kz ecosystem. As you can see, there’s also a wide range of government-related services. One webinar on youtube also suggested there could be voting (as much as it matters in KZ) through the app. But more on government – later.

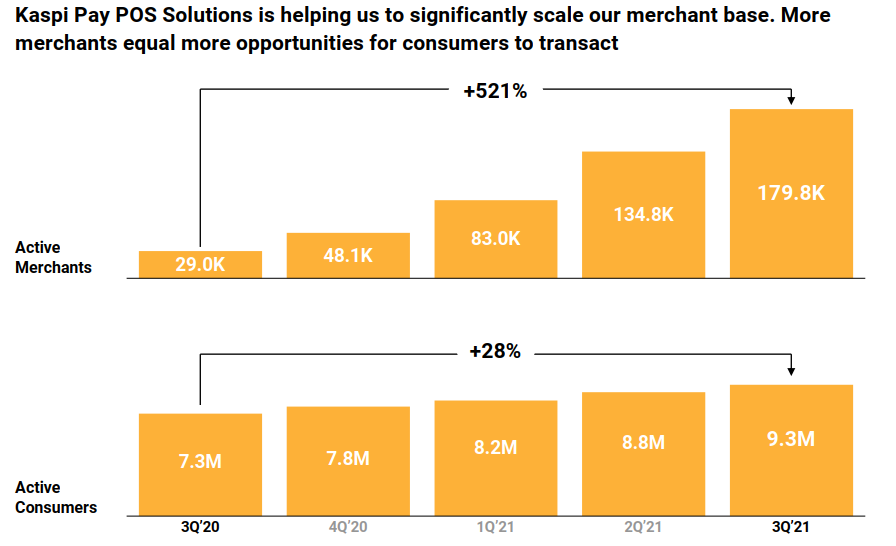

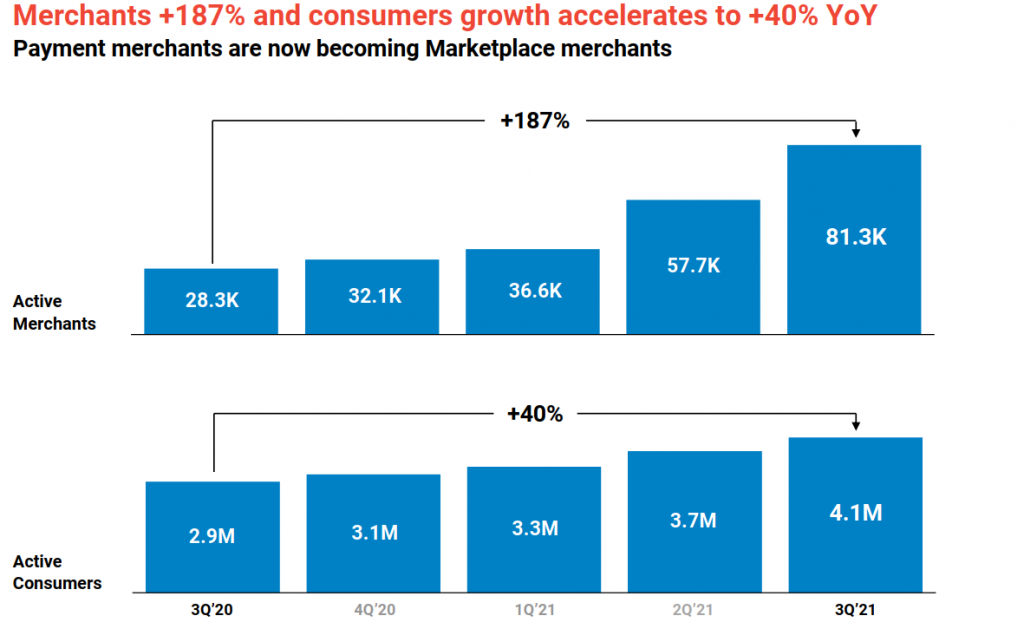

Merchants naturally have a lower base and show significant growth over consumers. From 2021 Q3 earnings deck :

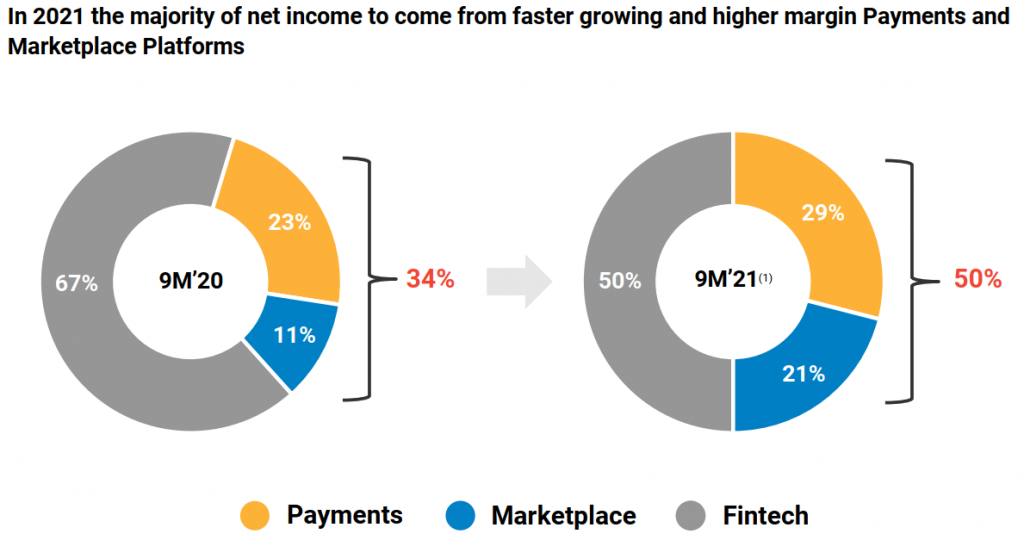

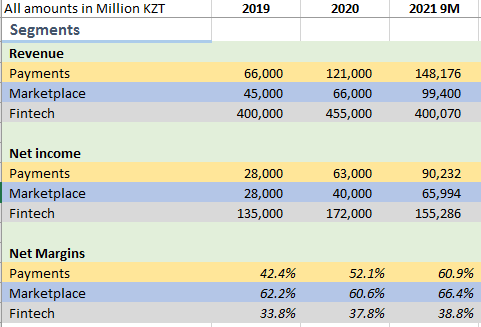

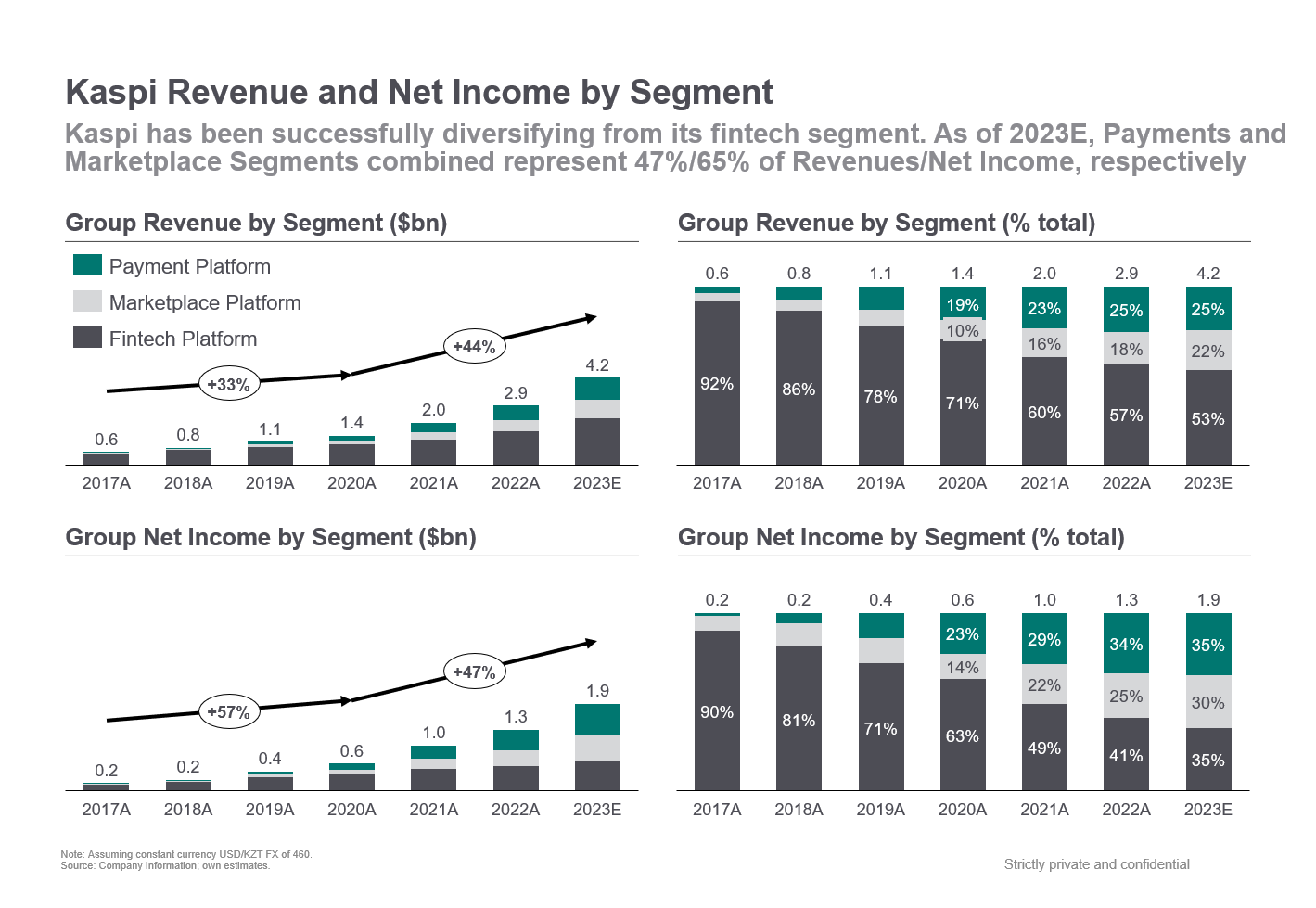

Payments and marketplace businesses are gaining share in overall revenue 50% up from 34% a year ago:

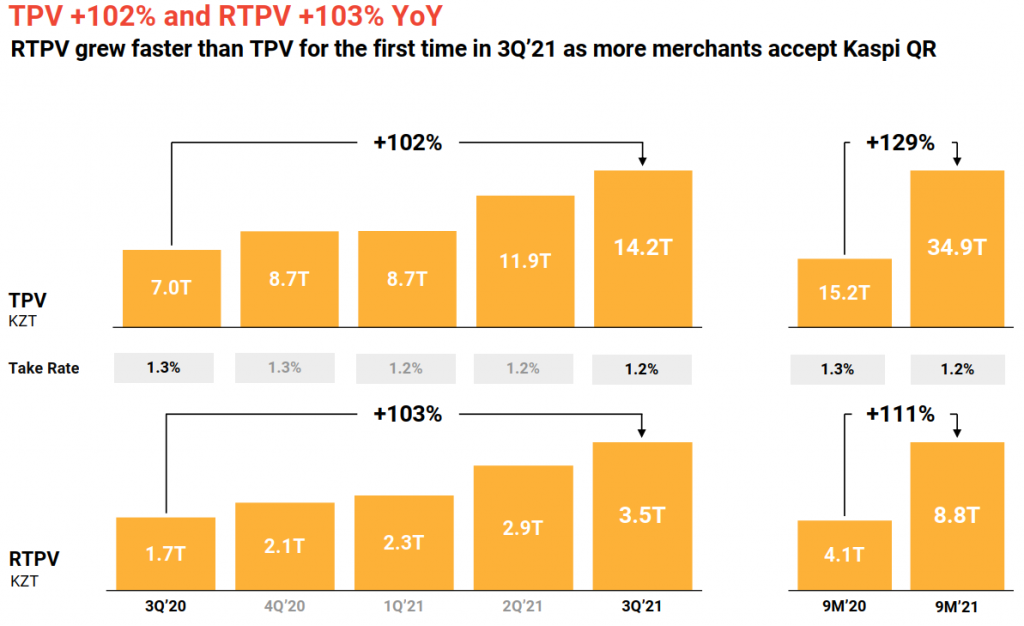

Speaking of margin… It’s a thing of beauty. For 2021 9M net profit margin was 60.9% and has increased almost +1800 bps from 2019. Network effects at play. More merchants – higher RTPV (revenue generating total payment volume) with a marginal incremental cost:

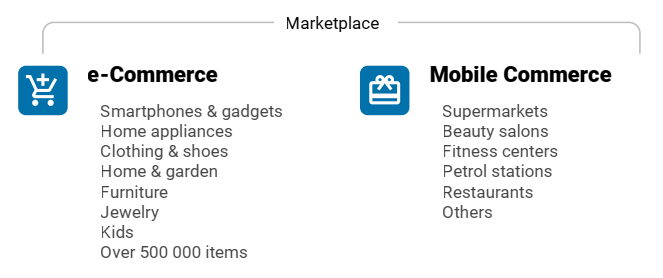

Marketplace

Within the same app a “Amazon” opens up. Difference is: there’s no first party. Kaspi.kz stays lean and only mediates between merchants and customers.

And it’s growing tremendously well too.

New merchants bring new merchandise, which grows consumer selection, deepening the moat in e-commerce, making Kaspi the default choice for consumers. The flywheel dynamics are the same across all marketplaces, so nothing new here. And Kaspi is a dominant player in a country.

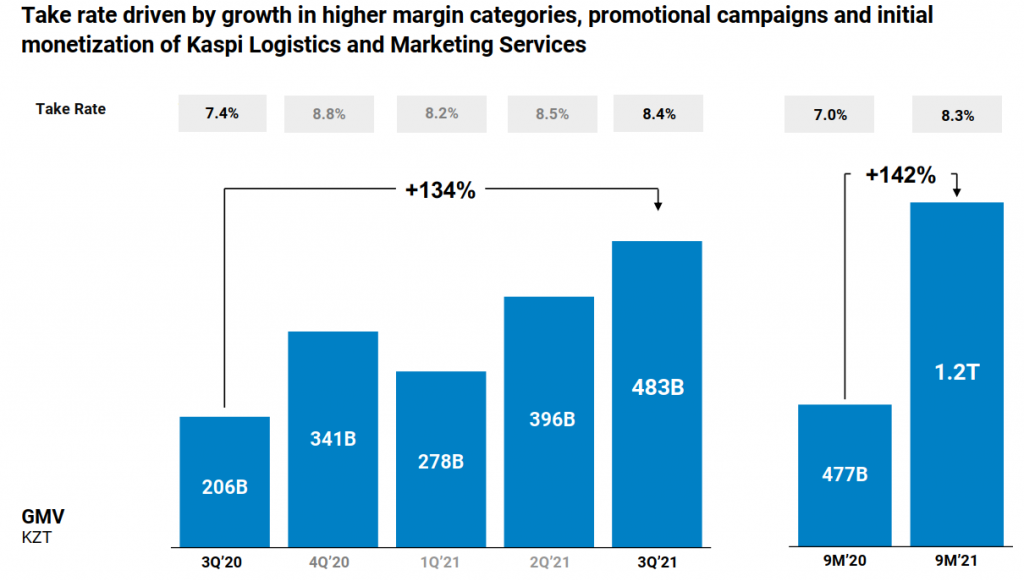

GMV growth YoY exceeds doubling. Take rate is also expanding due to higher-margin categories.

In an interview, CEO spoke, that logistics is something Kaspi is seeking partnerships with (Keeping it asset / CAPEX light). Currently majority of purchases for consumers are free shipping and delivered within 2 days (not to forget KZ is 9th largest country in the world).

I suspect Kaspi has given enough aggregated business volume for shipping carriers, that carriers are the ones in fact subsidizing free shipping. And Kaspi owns logistics software (from what I understand).

Net profit margin is even greater for Marketplace and as of 2021 Q3 was 66.4% (having expanded 400 bps from 2019).

That’s the legacy banking, on top of app, with sprinkles of modern BNPL for consumers. All things lending.

In 2020 Kaspi was leader in consumer loans with 32% market share and second in terms of retail deposits (18% share).

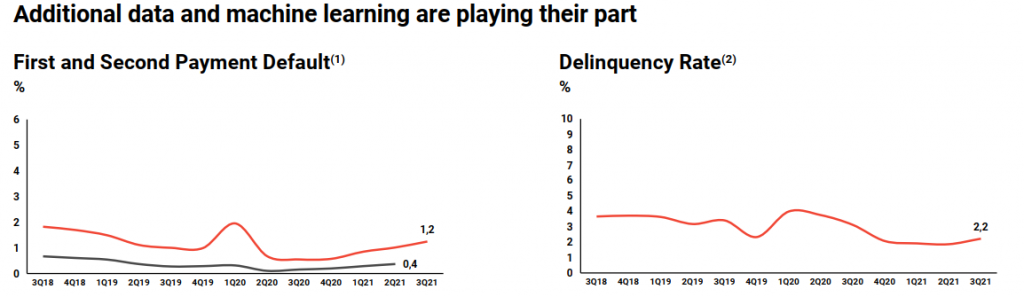

As all (I suppose) modern lending – Kaspi.kz utilizes all of the data it has on user, additionally, it has access to external data sources : LLC First Credit Bureau and JSC State Credit Bureau and Pension Centre.

With time, more data -> better risk profiling -> higher profitability. Classical machine learning in action. However notably models have been hit off-track in 2020 Covid.

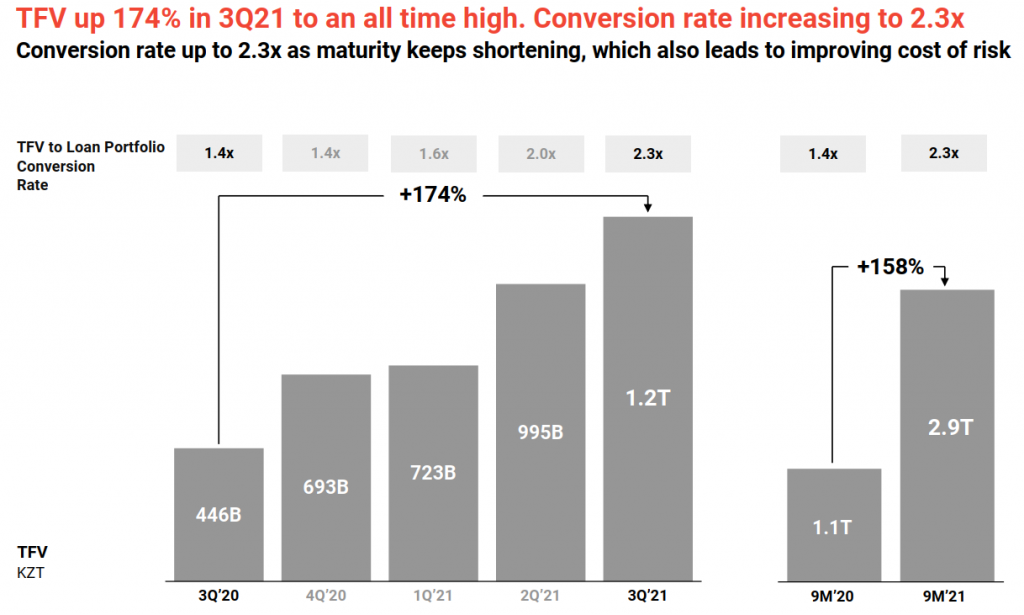

Total value of loans (TFV) provided via app is on a steady growth:

Fintech segment net profit margin for 2021 9M was also solid: 38.8% . Expanding more modestly 500 bps since 2019.

Consolidated Kaspi.kz Fundamentals

Here’s how segments have been performing lately:

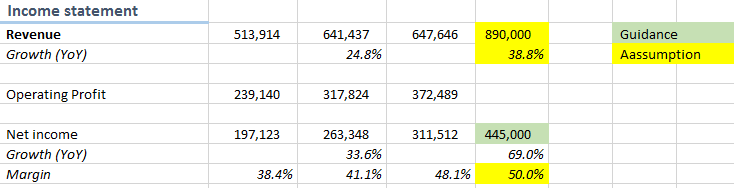

Here are consolidated financials for 2019-2021 years with Net profit for 2021 taken from revised to the upside 2021 Q3 guidance for full year.

Last reported quarter, revenue grew +55% YoY, net income +90%…

Similar to Reliance story, Marketplace and Payments are the new drivers for the company and reacceleration in growth.

Consolidated margins are a testament of network effects and economies of scale again, for both of these new growth drivers. Not only it’s a startup with moat, it’s a high cash conversion, profitable startup .

At 85.75 USD of GDR at the time of writing, this company trades at 16.1 forward (guided) P/E .

Assuming 534 Million KZT in EBIT and 2021 Q3 balance sheet EV/EBIT is at 13.4 .

Want a fun excercise? Let’s see how these look on 2021 9 months income:

- 19.2 EV/EBIT

Not too shabby either for solid growth and margin expanding profile.

…and it pays dividends… From IPO prospectus:

The Company intends to pay dividends annually in the amount of at least 50% of net income, calculated under International Financial Reporting Standards (“IFRS”)

On 445 Bn KZT, at current price, we are looking at 3.1% dividend yield .

Upside Potential

Layering, cross-selling and arpu growth.

There’s this story floating around: Kaspi bought a local ticket company, integrated it into it’s SuperApp and saw a growth way above, what it was growing on it’s own. That’s a real proof of SuperApp accessibility doing its magic. One are for growth is just developing and layering additional services and products .

Maintaining new services adds little to costs, but may contribute significantly to bottom line.

Cross-sell is another. As of 2021 Q3 only 40% of customers use all three platforms. Of course you won’t make everyone take out loans, but I saw Payments MAU < Total MAU’s, which is way easier jump. On-boarding to marketplace is also win-win.

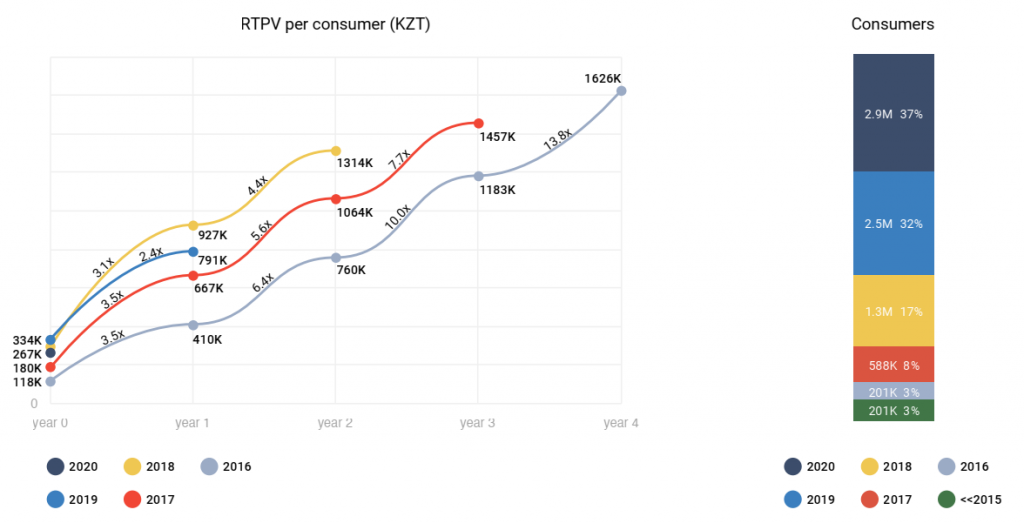

ARPU Growth is another area. Each landed customer is likely to spend more over time as he gets used to shopping/ paying online through the App. Cohort data for both RTPV and GMV look alike:

ARPU growth is somewhat automatic. All Kaspi has to do is maintain high level of customer service.

Saturating Kazakhstan Market

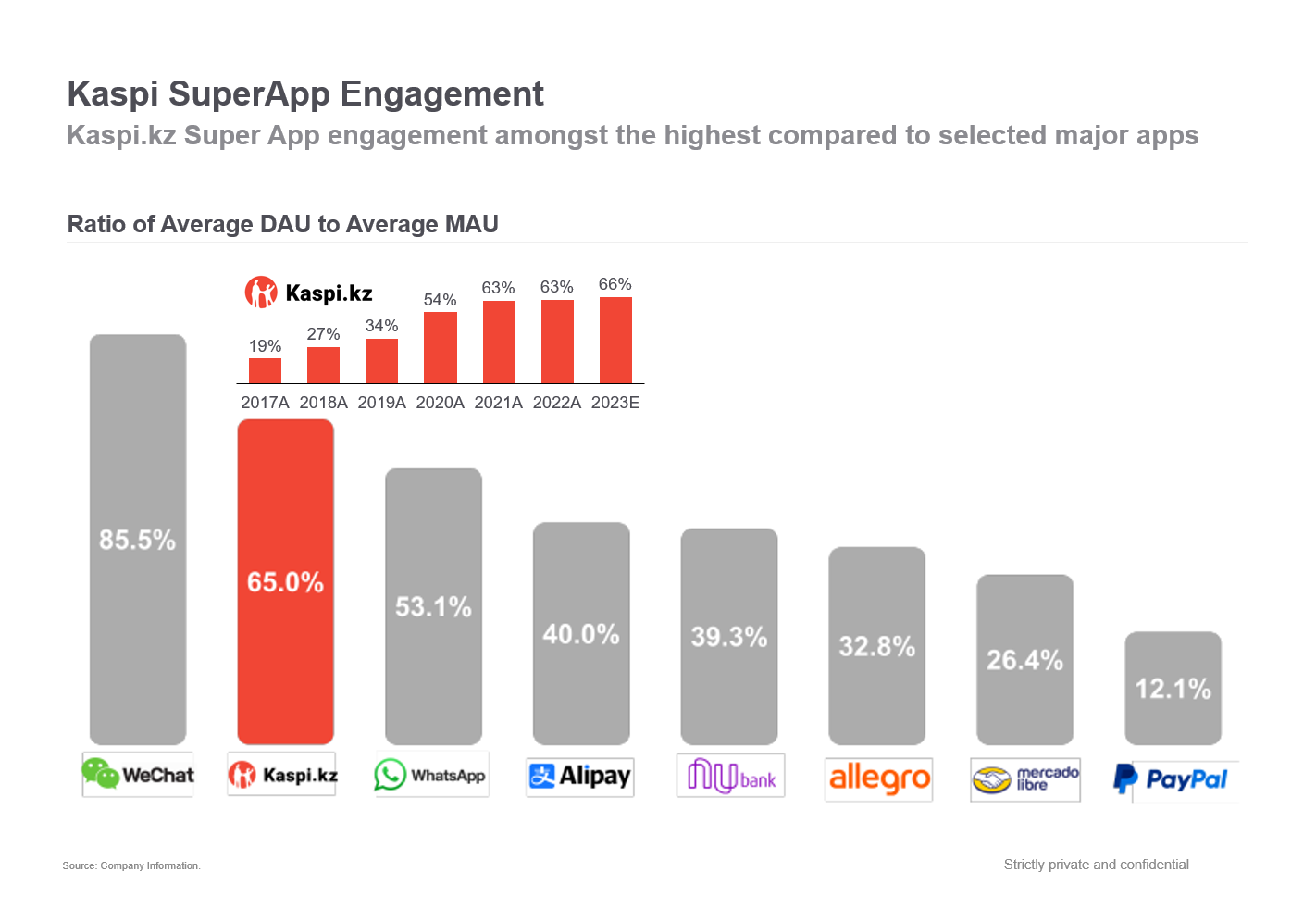

Kazakhstan population is 19M. Kaspi monthly actives crossed half population last year. Notably, DAU/MAU is second best after WeChat among SuperApps.

70.2% of Kazakh population falls under 15–64 years, so I would assume a realistically reachable population is around 14 – 14.5M . (2021 Q3 MAU: 10.8M), which is another 30%+ growth. Not to forget network effects in place compounding profits.

Either way, management already sees the ceiling in home market and speaks of international efforts more often lately.

International Expansion

Online business model makes it way easier to travel across borders. Central Asian region still very much cash-based, but other neighboring markets have tighter competition (my impression on learning about the company). Another regional quality – low e-Commerce penetration and low consumer leverage.

Kaspi is already active in Azerbaijan (population: 10M). In 2019 it acquired real estate and auto classified companies. In 2020 report company notes:

In Azerbaijan our three leading classified platforms have continued to scale their users, revenue and profitability since being acquired by Kaspi.kz in 2019

Another notable thing, is regional marketplace , opening opportunity for merchants to grow their business in outside markets.

In October Kaspi announced it completed the acquisition of a Ukrainian bank. Basically, it’s a banking license purchase. Ukrain population: 44M.

Kaspi.kz has a real shot to become a regional SuperApp for Central Asia markets .

It’s fair to say, Kaspi stock has a regional discount attached to it. No US company with comparable growth rates and profitability could be sold at 17 P/E. This obviously comes with risks.

Adverse Anti-Monopoly Policy

Kazakhstan is democracy on paper, authoritarian in nature. If upper management is friends with government players, I would assume Kaspi is protected. There are even four reasons I think government is unlikely to come after Kaspi:

- Kim Vyacheslav is known to have relations inside government. At one point he served as an advisor to the prime minister;

- My general impression from reading Facebook comments: people love the app, I would assume are even proud of it’s home-grown roots. Government attacking private company would look bad in the eyes of the public (as much as gov. cares, of course);

- It is is gov’s interest to encourage the use of online payments. This lowers shadow economy, gives more observability.

- President Tokayev met with Kaspi founders in 2021 Feb. Gov. services availability through the Kaspi.kz app is an indication of public – private relationship with current leadership.

Taxation is however another discussion. Similar to Evolution , I would argue certain aspects of business could be squeezed harder.

Shareholder Shakeout

There’s a shady entry – exit story of former president Nazarbayev nephew Satybaldy, who supposedly sold this stake before London IPO in 2020 October. There could be a number of informal or undisclosed shareholder agreements between three major parties owning Kaspi.

Co-founders were not willing to share specifics to Forbes on the issue, which sheds some negative light on the subject.

Baring Vostok Exit

Baring Vostok Fund has been an early investor in Yandex (Russian tech giant) and eventually sold their stake. Recent filings show their position decline. This may put sustained pressure on share price if their strategy is eventually exit via public market.

Departure o major institutional shareholder would also be seen as a negative in some investors’ eyes for sure.

Failure to Expand Interntionally

In light of recent headlines on Ukraine it may sound crazy, but I’m trying to get into management’s heads and think through. Worst case: Russia indeed invades and takes over Ukraine, when dust settles, it’s still unlikely Russia would kick its’ ally’s business out of a market. But it would be painful period of uncertainty for sure.

As mentioned above, I did not dive into any specific countries for potential payment or ecommerce fintechs, but my general understanding is other countries will pose greater competitive pressures. Execution and timing are key.

Kazakhstand’s Political Stability

Few days ago I shared an article by Armenian Weekly . This and other readings on 2022 January deadly protests formed my understanding of situation:

Nazarbayev officially stepped down in 2019, but remained a shadow control figure and actual chairman of KZ’s Security Council until 2022 January. People hate the guy and for the longest time assumed second president since independence Kassym-Jomart Tokayev to be a Nazarbayev’s puppet. However January’s events hints, that Tokayev is gaining or gained autonomy. Putin seems to respect KZ boundaries as well and sustained Russian troops presence would have gained negative sentiment among KZ population (Russia as former oppressor).

What seem to have happened in January is an opportunistic gang clash for power .

Regionally everyone wants stability in KZ. Especially Kazakhs. To my own surprise Kazakhstan’s Tenge (local currency) has floated quite beautifully through the crisis. Strong export economy may be the reason:

A real risk one has to be aware of is exposure to business, that primarily conducts its affairs in KZT. Tenge has been devalued in the past .

2022 Q1 Numbers

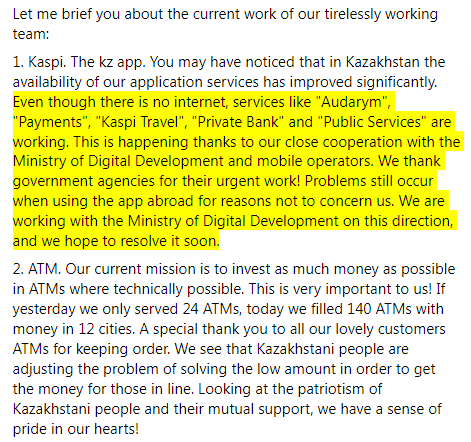

Positive in a negative light. Kazakhstan has shut down internet for nearly a week during clashes in January. I could not download Kaspi’s filings from investor relations. You might expect a dip in 2022 Q1 numbers, however short the disruption. But according to this post from CEO on Facebook :

The government assisted Kaspi in providing its essential services. Also note worthy, 3 point in the same post remarks on the damage done during revolt on headquarters (?).

Position Details

Easiest way to access Kaspi.kz stock is through London GDR’s (1 GDR = 1 stock). ISIN code: US48581R2058. Link on LSE.

Last year my curiously was flirting with Russian stocks for their relative valuation and quite diverse selection. Kaspi.kz is a middle, that satisfies a regional risk / reward profile I was seeking exposure to. Next week I’ll be initiating a position with a family member in a joint purchase. My portion of the position will amount to only 1% of portfolio. Consider it a starting – learning position.

Just a reminder to read my poorly written disclaimer .

Closing Words

Market is usually right. Companies growing 40% with expanding bottom line at 50% net margins don’t trade at 17 P/E. Although Kaspi had nearly a green-field opportunity, making its way into new markets will likely be a lot more pushing elbows, however currency devaluation is primary risk in my opinion.

Kaspi has build from the ground up what western companies like Facebook ( f|_|ck you meta ) only now aspire to do – a SuperApp, that consumers use daily for payments, shopping and other financial or government services. This is a very strong business with modern SaaS buzzwords like network effects and economies of scale actually showing up in financial statements.

CEO is a clear leader. Self-made billionaire from Georgia is humble and always unsatisfied, which drives innovation.

If company maintains its execution, as market trust builds, there’s a reasonable chance for multiple expansion. There’s also a fair shot Kaspi.kz becomes Central Asian SuperApp.

Recommended Material List

To continue learning about the company, this is a non-exhaustive list of material I found most useful:

- Video Interview with CEO

- Writeup by Asaf Rentsler

- Lecture by Mikheil Lomtadze

- Forbes on slim shady shareholder

- Invetor Relations , of course

- Another Generalist writing on Kaspi

- Another CEO interview for PwC

- Podcast on Kaspi with Thomas Bachrach (and other things)

You might also like

Leave A Reply

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The Two Billion Dollar Mystery Behind The Ownership Of London-Listed Kazakh Fintech Kaspi

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Kaspi CEO Mikhail Lomtadze (L), chairman Vyacheslav Kim (R)

Last month, Kaspi.kv, the retail and fintech unicorn from Kazakhstan, made headlines around the world after a successful IPO on the London Stock Exchange at a $6 billion dollar valuation. It was celebrated as the largest international tech IPO in London of 2020.

But Kaspi is not a traditional tech startup with hungry, disruptive founders and hard driving investors. At the heart of Kaspi is a deal among three men and a private equity fund involving billions of dollars that–despite scrutiny from the London Stock Exchange, sponsors and regulators–raises a whole host of questions.

The two most important players at Kaspi are its chairman, Vyacheslav Kim, and CEO Mikhail Lomtadze, whose respective 25% and 23% stakes are currently worth around $2 billion each. But, working alongside Moscow-based private equity fund Baring Vostok, the journey the duo took to become the largest individual shareholders of the company is filled with plot holes.

The largest of which features one Kairat Satybaldy, a former investor and the politically powerful nephew of Kazakhstan’s former president Nursultan Nazarbayev. Satybaldy claims to have walked away from Kaspi in 2018, unloading a very similar sized stake to the one now owned by Lomtadze.

In what’s described by a Kaspi spokesperson as part of a “large transaction,” Kim spent around $390 million buying Kaspi stock in 2018. Then, according to the prospectus, he transferred shares to Lomtadze that at the time were worth an estimated $500 million, in exchange for a “certain non-cash consideration” in December 2018 “pursuant to a long-standing arrangement encompassing their various business interests.”

Added to a 9.9% stake given to Lomtadze by Kim (as part of the same “arrangement”) prior to 2017–Lomtadze was granted a total stake of 31% in Kaspi.

In 2019, Lomtadze’s ownership dropped to 29%; it appears as though he may have sold part of his holding to Goldman Sachs, which acquired a 4% slice of the company that year. Lomtadze now owns 23% of the company, according to filings, worth $2.2 billion.

CEO Mikhail Lomtadze of Kaspi

In a statement to Forbes , a Kaspi spokesperson confirmed the deal, which was made between Lomtadze and Kim in 2007, but said, “It’s not correct to say that Mikhail was just given his stake.” Lomtadze “built” Kaspi, the spokesman says, adding that “it’s quite common for entrepreneurial founders to own large equity stakes in their businesses.” But Lomtadze is not a founder. He arrived at the bank that would become Kaspi as its CEO following an investment in the bank by Baring Vostok, where Lomtadze was a partner.

The spokesman for Kaspi did not explain how Kim came up with hundreds of millions of dollars to buy Kaspi shares, nor on the exact terms of the 2007 deal that made Kim and Lomtadze equal partners. Kaspi said that it couldn’t comment on Kim’s “specific financial arrangements” but added that “[t]he increase in Mikhail [Lomtadze]’s stake is due to the formalization of his partnership agreement with Vyacheslav [Kim] and not related to his annual compensation.”

Kaspi confirms that it took around 13 years—from 2007 until this year–for Kim and Lomtadze to “formalize their shareholder agreement.” It also says that because the company didn’t seek external capital or pre-IPO funding, other than an investment from Baring Vostok in 2006, there was–until now–no need to make the “agreement” formal or public.

Addressing the uncertainty about why an agreement between the pair was not made formal until “the very last moment,” Lomtadze claims in an interview conducted by a partner at PWC and published Tuesday on forbes.kz ( Forbes Kazakhstan, an independent licensee of Forbes) that the two men’s relationship was one of “complete trust and chemistry.”

Kaspi Conquers Kazakhstan

Kaspi’s mobile payments and banking app is used by around half of Kazakhstan’s 18 million people—and in less than a decade, the company has helped begin weaning the country off using cash, claiming in September that daily active users of the app had increased 172% over the prior year. Kaspi says it now accounts for 68% of all electronic transactions in Kazakhstan, a payments footprint almost twice the size of all its competitors combined, including Visa and Mastercard. “People saw how easy it made their lives,” says Dr Atanu Rakshit, assistant professor of economics at Kazakhstan’s Nazarbayev University.

A person downloads the Kaspi application on their smartphone in Almaty

With close ties to Kazakhstan’s government, Kaspi has also emerged as the country’s unofficial national online bank for paying taxes and fines, assuming a role that would otherwise be filled by the civil service or a government department, and further driving new user growth across the country. It even helped distribute social benefits during the pandemic.

Revenues grew 32% to $740 million in the first half of 2020. Profits have jumped too, up 50% to $286 million, while payment transactions hit 718 million for the quarter ending September, Kaspi announced, up by 212% year-over-year, as their app quickly conquered the country during the pandemic.

Although Kaspi’s success in Kazakhstan is clear, what remains unclear is how Kaspi’s puzzling ownership changes passed muster with the powerful institutions scrutinizing Kaspi’s public listing, namely book runners Morgan Stanley, Citigroup and Renaissance Capital, the U.K.’s Financial Conduct Authority and the London Stock Exchange. The concerned parties all referred Forbes to investor relations at Kaspi.

Lomtadze, Kim And Kaspi

Kim, described in a Kaspi press release as a “mathematician and physicist by training, but an entrepreneur by calling,” found success in retail mainly through launching home electronics chain Planet Electronics, which he exited in the mid-2000’s, according to a Kaspi spokesperson, around the time Kaspi “became his principal investment.” Planet Electronics shut down in the late 2000s. Kim is also an investor and chairman of the supervisory board of supermarket group Magnum, described by a local news agency in April as the largest chain in Kazakhstan.

In 2002, Kim, who was 32 at the time, bought Kaspiyskiy—then a recently privatized bank—for an undisclosed sum. “It might have been a bit naive, but buying a bank was a big trend. Every successful entrepreneur was buying a bank, so we did too,” he was quoted as saying in a company statement in July 2019.

Lomtadze, who hails from neighboring Georgia, speaks English and is the public face of Kaspi. One of his country’s earliest free market fundamentalists, Lomtadze attended Georgia’s first ever business school before starting an auditing firm in 1995 and then hopping over the pond for Harvard Business School. He graduated in 2002, the same year he met Michael Calvey, the American founder of Baring Vostok, in New York. “I don't need any salary,” Lomtadze says he told Calvey at their first meeting, speaking to Forbes from Almaty in early November on a video call. “I just want to work with Baring Vostok.” Lomtadze subsequently joined Baring Vostok and became a partner in 2004.

In 2006, Baring Vostok, invested an undisclosed amount in Kaspisky (bank), leading Lomtadze to join forces with Kim in 2007. They rebranded Kaspisky as Kaspi the following year. The duo has since made at least five additional investments in Kazakh businesses, including companies in bill payments, car retail, and online classifieds. By June 2020, Kim held around 31% of Kaspi, while Lomtadze held 25.9%, according to an audited financial statement.

Kairat Satybaldy

The third man with an important connection to Kaspi is Kairat Satybaldy, the nephew of Kazakhstan’s former longtime president Nursultan Nazarbayev. Often described as the son Nazarbayev never had, Satybaldy is a leading figure in the ruling Nur Otan Party, and a member of the country’s business and political elite.

Kazakhstan's former President Nursultan Nazarbayev (L) and Russia's President Vladimir Putin shake hands

Satybaldy claims to have first acquired a stake in Kaspi in 2015, and then became one of the three largest three shareholders alongside Kim and Baring Vostok. According to Kaspi’s company accounts, Satybaldy owned 30% of the firm as of December 2017, while Kim owned 21% and Baring Vostok 38%.

Satybaldy then appeared to cash out prior to Kaspi’s failed 2019 London IPO attempt. This year’s Kaspi IPO prospectus shows that between July and September 2018, Satybaldy (spelled Satybaldyuly in the document) unloaded his entire shareholding in the company through a series of sales on the Kazakhstan Stock Exchange (KASE), and completed his exit on October 1, 2018. (The company was listed on the Kazakh stock exchange but had just four main shareholders.) The prospectus shows that this is the same period during which Kim bought and “transferred” nearly 39.9 million shares to Lomtadze.

Kate Mallinson, associate fellow at London-based policy institute Chatham House, says the movement of “one stake from one shareholder to another with little explanation suggests a typical Kazakh playbook [of] corporate behavior.” Adding, “If Satybaldy’s name had been on the ownership [this year], red flags would have alerted any financial institution interested in the listing. Behind the scenes, the extended Nazarbayev family own most of the banking sector and Kairat [Satybaldy] is one of the most influential economic actors.”

Despite stepping down as Kazakhstan’s president in 2019, Nazarbayev remains the single biggest source of political and economic power in the country, says Mallinson, describing Satybaldy as a “trusted nephew” of Nazarbayev and “one of the most powerful players behind the scenes in Kazakh elite politics.” In other words, Satybaldy is a politically exposed person and would have drawn scrutiny from regulators if he remained a controlling shareholder ahead of the IPO.

Kaspi headquarters in Almaty

Dosym Satpayev, a director of the Risk Assessment Group, an Almaty-based consultancy firm, says that the “point of view” among geopolitical analysts in Kazakhstan is that “the departure of Kairat Satybaldy from Kaspi Bank was formal and is precisely connected with the IPO, since the presence of Kairat Satybaldy among the bank's shareholders could negatively affect the bank's reputation during the IPO.”

Satpayev suggests, “Kairat Satybaldy transferred (or sold) his shares to other shareholders” and these shareholders “may” have “entered into a safe agreement with him that, as nominal owners of the asset, they will take into account his interests and return the shares upon demand to the true owner.” Satpayev suggests that Satybaldy could become a shareholder of Kaspi again, using an offshore entity to do so. Satybaldy could not be reached for comment. The Kazakhstan embassy in London described Satybaldy as a “private citizen” and referred Forbes to direct inquiries to Kaspi.

A Kaspi spokesperson tells Forbes that Satybaldy was a “financial investor with no direct involvement in the company” and has “no connection in any capacity with the company now.” Satybaldy was reported by a Kazakhstan news website in April 2019 as stating that his “investment strategy” is to “invest for three years on average” and he “fully exited from Kaspi.kz, selling my stake to the company and other shareholders” in 2018.

Kaspi has long maintained an open dialogue with top politicians in Kazakhstan and Kim once served as an advisor to the prime minister. “In emerging markets, everything is relationship-driven,” he said in 2019, speaking about Kaspi’s private-public position in a company statement. With such a connection to the political center in Kazakhstan, it remains possible that Satybaldy has not completely stepped away from Kaspi, although Kaspi refutes this allegation.

- Editorial Standards

- Reprints & Permissions

- Harvard Business School →

- Faculty & Research →

- October 2019

- HBS Case Collection

Kaspi.kz IPO

- Format: Print

- | Language: English

- | Pages: 28

About The Author

Victoria Ivashina

More from the authors.

- Faculty Research

Corporate Debt, Boom-Bust Cycles, and Financial Crises

- September 2023

Blackstone Credit and Delaware Basin Resources

Saham group: it's in the genes.

- Corporate Debt, Boom-Bust Cycles, and Financial Crises By: Victoria Ivashina, Sebnem Kalemli-Özcan, Luc Laeven and Karsten Müller

- Blackstone Credit and Delaware Basin Resources By: Victoria Ivashina and Alys Ferragamo

- Saham Group: It's In the Genes By: Christina R. Wing and Esel Çekin

Market Wonders with Michael Wang

Kaspi: Gateway to Digital Convenience in Central Asia (NASDAQ:KSPI)

The thriving kazakh superapp poised for regional dominance.

In the heart of Central Asia, Kaspi is redefining the financial landscape, emerging as a beacon of innovation and convenience. Born as a traditional bank in 2008, it transformed into a dynamic digital ecosystem, encompassing a thriving marketplace, a versatile payment platform, and a broader fintech solution. By seamlessly connecting consumers to a spectrum of ever-increasing services, Kaspi has established itself as a one-stop digital powerhouse, transforming how people live their lives and allowing its users a uniquely digital-first connected experience. This deep dive analysis delves into the intricacies of Kaspi's business model, explores its alluring facets and considerations, and presents what I believe is the most compelling investment case in the markets today.

Investor Relations | Earnings Report 3Q23 | Form F-1 Draft Prospectus

As a paid subscriber, you'll gain access to a proprietary operating and returns model that will empower you to tweak inputs and develop your own investment perspective. My mission is to engage with you and the whole community , question each other’s assumptions, learn and get smarter together so we can make strong and data-driven investment decisions and all achieve financial independence .

Kaspi's Evolutionary Journey

Kaspi's journey from its origins as a traditional bank to a leading digital SuperApp is a remarkable tale of evolution and foresight. Founded in Kazakhstan in 2002, it initially operated within the conventional banking framework. However, visionary leadership and a relentless focus on innovation saw Kaspi pivot dramatically following Mikheil Lomtadze becoming the CEO in 2007. By leveraging technology, Kaspi expanded beyond banking, offering a marketplace platform that revolutionized retail and e-commerce in the region. Adding payment solutions and fintech services transformed Kaspi into a holistic SuperApp, simplifying the financial and commercial needs of millions, all under one digital roof. This evolution wasn't just a change of services but a reimagining of consumer engagement, setting Kaspi apart as a vanguard of digital transformation in Central Asia. As of 3Q23, Kaspi has 13.5m Monthly Active Users (MAU) and an impressive 8.8m Daily Active Users (DAU) across Kazakhstan with its ~20m population.

Fintech, Payments, and Marketplace Flywheel

Kaspi offers a comprehensive range of services across three key segments which mutually reinforce each other in a virtuous flywheel:

I. Payments Segment :

Kaspi's payments segment has fundamentally transformed transaction methods in Kazakhstan. Its mobile wallet facilitates instant payments, transfers, bill payments, and mobile top-ups, integrating seamlessly into the daily lives of its users. The efficiency, security, and convenience it offers draw parallels to established fintech players like Block (NYSE:SQ).

Kaspi monetizes this segment by taking a fee on processed transaction volumes. With Kaspi Pay, the Company effectively circumvents traditional card networks and provides payment processing services akin to Adyen (albeit mostly to SMBs rather than enterprises; ADYEN.AS). This dual role allows Kaspi to capture value at multiple points in the transaction chain.

In 2019, Kaspi processed a modest 2% of Kazakhstan's transaction volumes, with the majority dominated by Visa and Mastercard. However, in a striking shift, Kaspi has now emerged as the leading payment provider in the country. Today, over 90% of in-store transactions made through Kaspi are processed using its Kaspi Pay acquiring service, underscoring its rapid ascendancy and the effectiveness of its strategy in overtaking traditional payment giants. This dramatic growth highlights Kaspi's deep market penetration and capability to revolutionize payment systems in a strikingly short time frame.

Key Metrics 2023E (see model for details) : 12.9m Active Users (94% of Group MAU), $63bn processed volume (44% YoY growth), 1.65% take rate (down from 1.67% in 2022A) —> $1.0bn Revenue (43% YoY growth) with $0.7bn Net Income (65% margin)

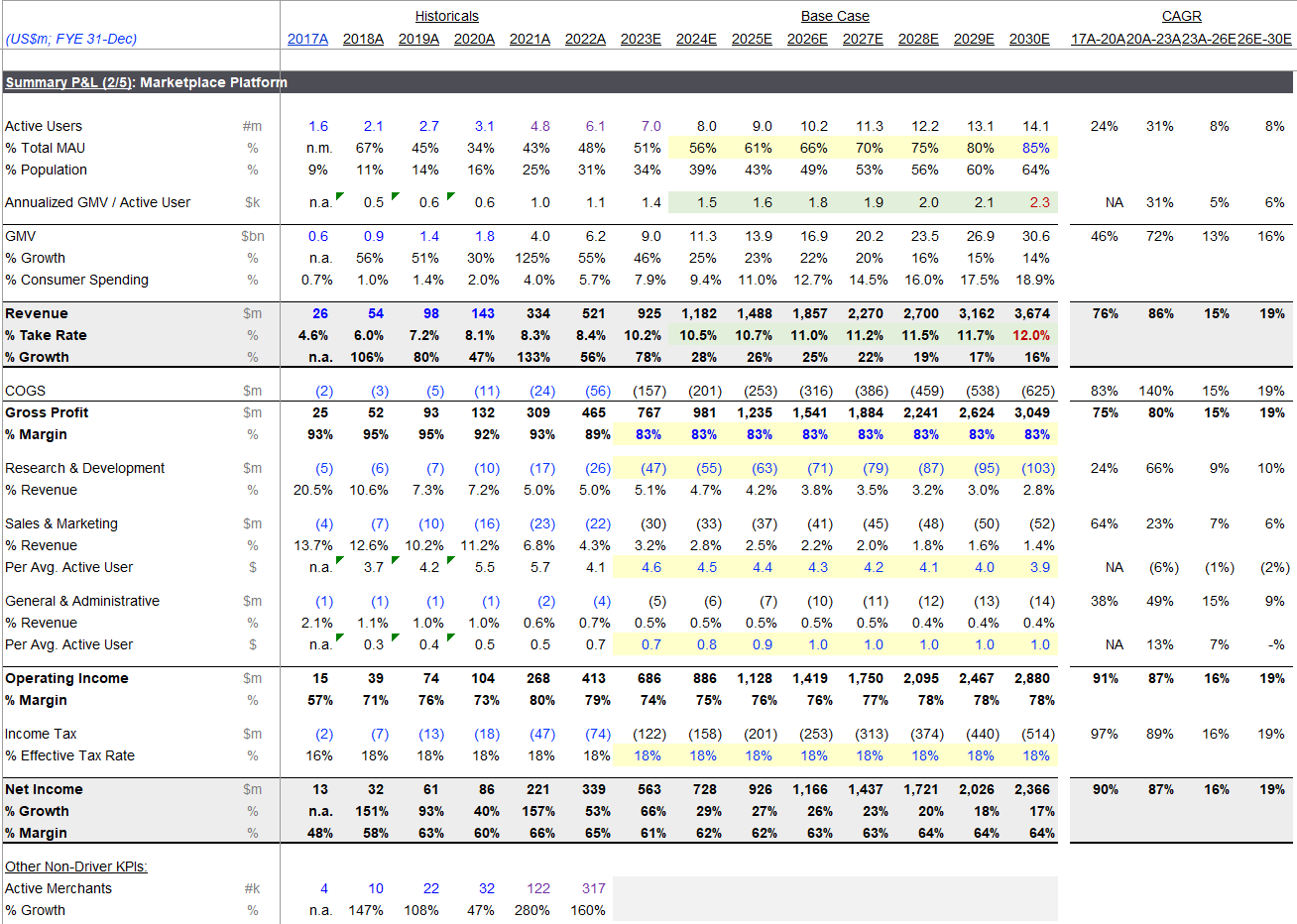

II. Marketplace Segment :

Kaspi's marketplace segment marks its strategic positioning in e-commerce, creating a dynamic platform for buyers and sellers. This segment, rapidly evolving to mirror the likes of Amazon (NASDAQ:AMZN), offers diverse products and services, streamlining online shopping experiences with remarkable ease and efficiency.

It broadens consumer choices and empowers local businesses by giving them a digital presence and access to a wider customer base. E-commerce is still in its early innings in Kazakhstan, with current penetration of only 10.7% and expected to reach 20%+ by 2027E. Initially focused on electronics, the platform has successfully branched into various other SKU categories (from 2.4m in 3Q22 to 4.5m in 3Q23). This expansion is a strategic move that has significantly driven up the take rate – from 6.0% in 2018 to an estimated 10.3% in 2023E. This increase in the take rate is a clear indicator of the platform's growing appeal and efficiency in the e-commerce space. Comparatively, Mercado Libre has a take rate of ~14%, suggesting that there is still meaningful room for Kaspi to grow and increase its take rate further in the coming years.

Additionally, Kaspi's marketplace segment has significantly enhanced convenience for its customers by introducing Postomats (akin to InPost; INPST.AS). These automated parcel delivery terminals allow for easy, secure, and swift collection of online purchases, further streamlining the e-commerce experience - there are currently 5.2k terminals through which customers pick up 37% of all e-commerce orders.

Key Metrics 2023E (see model for details) : 7.0m Active Users (51% of Group MAU), $9bn GMV (46% YoY growth), 10.2% take rate (up from 8.4% in 2022A) —> $0.9bn Revenue (78% YoY growth) with $0.6bn Net Income (61% margin)

III. Fintech Segment :

Kaspi's fintech segment stands at the forefront of its offerings, providing innovative financial solutions. This segment includes a diverse range of banking services, loans, and credit products, such as a buy-now-pay-later (BNPL) option, all seamlessly accessible through its digital platform. This arm of Kaspi is akin to the fintech services offered by companies like Block/AfterPay (NYSE:SQ) or Affirm (NASDAQ:AFRM), designed to simplify and enhance the personal finance management experience with its tech-driven approach.

Kaspi excels in its fintech metrics, primarily due to its effective risk management capabilities. The Company's extensive real-time data on customer lifestyles and transactions enables it to predict delinquencies accurately. This proficiency is reflected in a low and consistent delinquency rate of ~2%, with improving loss rate vintages. Even during unprecedented challenges like the Covid-19 pandemic, Kaspi managed to maintain stability without any significant disruptions or spikes in delinquencies. This resilience and handling of risks underscore Kaspi's strength in the fintech sector, offering customers a reliable and secure financial service platform.

Key Metrics 2023E (see model for details) : 6.1m Loan Customers (45% of Group MAU), $7.5bn Average Net Loan Portfolio (33% YoY growth), 34% yield (flat vs 34% in 2022A) —> $2.2bn Revenue (38% YoY growth) with $0.7bn Net Income (30% margin)

Indeed, all three segments are fast-growing and profitable. Kaspi’s strategy to ensure profitability in each segment from the outset was necessitated by its limited access to funding, eliminating the possibility of cash burn typically seen in growth-stage companies. This approach, born out of necessity, has become a deeply ingrained cultural element within the Company, guiding its business practices and shaping its sustainable growth model. In 2023E, I expect Kaspi to generate ~$4.2bn Revenues (47% YoY growth) and ~$1.9bn Net Income (42% YoY growth, 42% margin).

Each segment demonstrates Kaspi's commitment to leveraging technology for financial and commercial convenience, cementing its status as a SuperApp in the region. As shown below, Kaspi’s journey from a pure-play fintech provider towards a holistic SuperApp stands out when looking at Revenue and Net Income breakdown by segment.

Kaspi transcends being “just” a consumer-focused SuperApp; it's also pivotal for merchants, creating a self-reinforcing ecosystem offering businesses tools for sales, payments, and customer engagement to empower them to thrive in the digital economy. This dual approach enhances consumer experiences and drives merchant success, fostering a closed-loop ecosystem where both parties benefit and contribute to Kaspi's expansive network. This symbiotic relationship underpins the platform's continual growth and innovation.

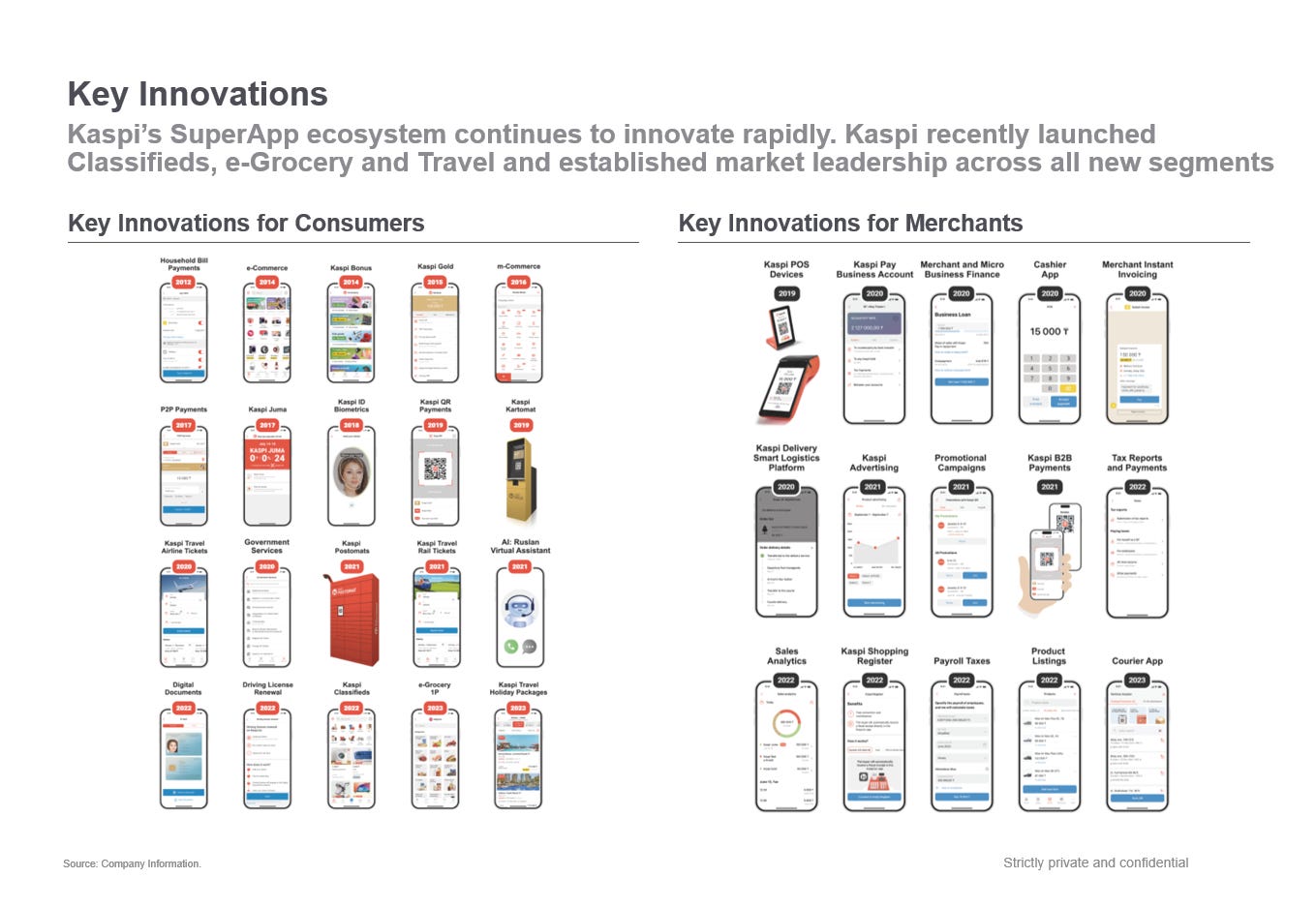

Speaking about the pace of innovation, Kaspi’s commitment to keep reinventing itself and expanding its addressable market is evident in its continuous product launches, including many of its latest ventures. The SuperApp has adeptly expanded into new domains with the launch of Classifieds (akin to AutoTrader; LON:AUTO), e-Grocery (akin to DoorDash; NASDAQ:DASH), and Travel services (akin to Booking.com; NASDAQ:BKNG), rapidly establishing market leadership in each. This expansion not only diversifies Kaspi's offerings but also cements its status as a pivotal, all-encompassing platform for consumers' diverse needs in Kazakhstan, from daily essentials to leisure and lifestyle.

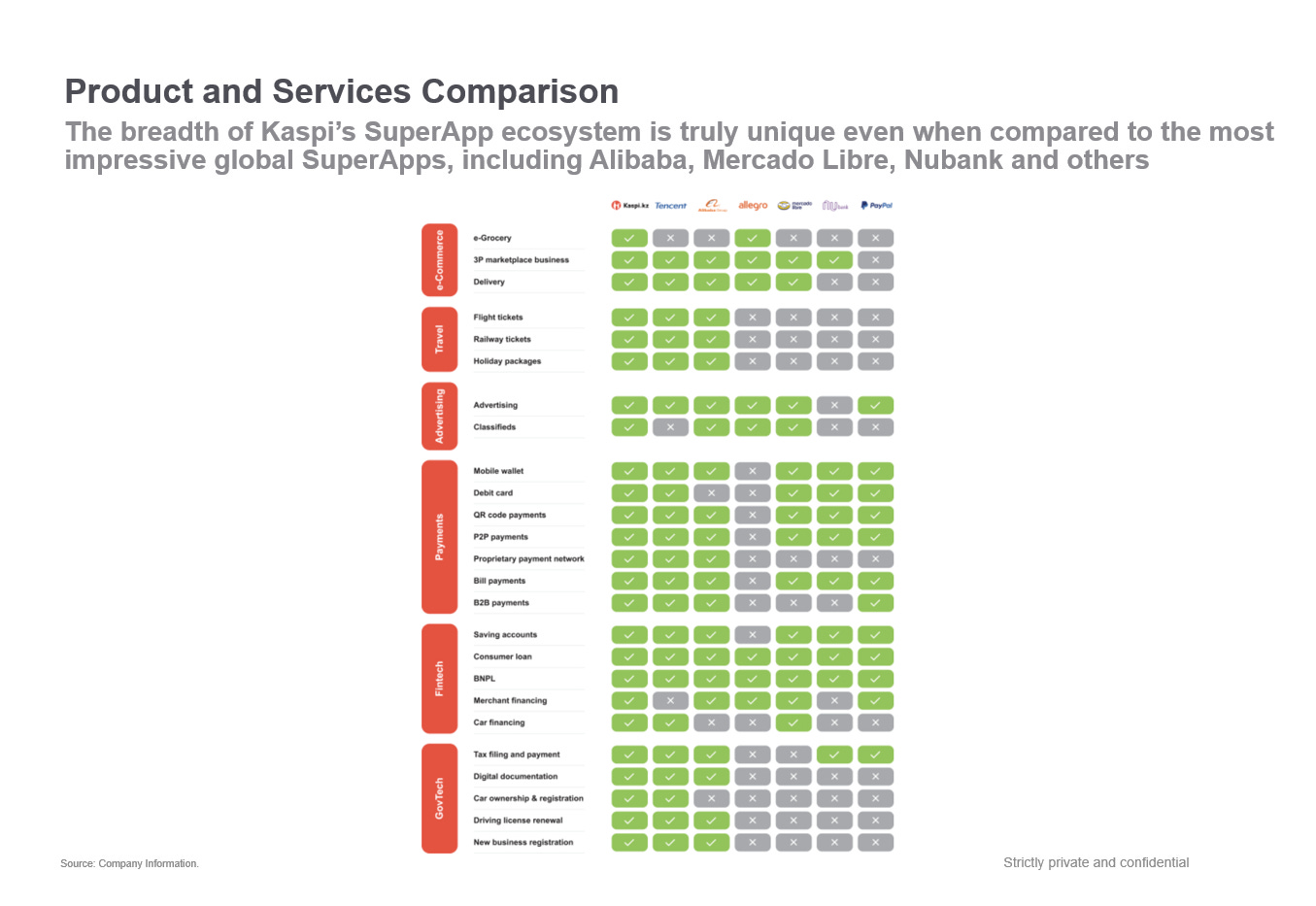

As of writing, Kaspi has arguably established the widest set of products and features across all major SuperApps globally, including such behemoths as Alibaba, Mercado Libre, and Nubank. The Company is not stopping there; rumours suggest that the business is debating launching taxi services as soon as 2024, though it is yet to be confirmed (akin to Uber; NYSE:UBER). What might come as a surprise is that Kaspi plays a pivotal role in streamlining government-related services for its citizens. This aspect of Kaspi's platform simplifies various bureaucratic processes, enhancing public service accessibility and efficiency. Such functionality benefits users and reflects Kaspi's positive and constructive relationship with the government, showcasing a collaborative approach to technological and societal advancement. In fact, Kazakh President Kassym-Jomart Tokayev has, on multiple occasions, emphasized the important role of Kaspi in capital market development of Kazakhstan, its impact on improving the life of Kazakh people and overall seems understandably proud and supportive of the business (Kaspi has all it needs to become a truly formative business in the context of Central Asia as Shopify became in Canada, and thus drive entrepreneurship and be a force of innovation in the region).

Kaspi’s innovative nature has been rewarded by a significant surge in user engagement, with its DAU to MAU ratio climbing to an impressive 65% as of 2Q23, a leap from 27% just five years ago. This metric, a testament to the SuperApp's sticky user experience, is second only to WeChat's 86%, largely attributed to its messaging capabilities (akin to WhatsApp). Kaspi's multifaceted platform fosters habitual user interaction, with its diversified services seamlessly integrating into its consumers' daily digital routines. Note that the only meaningful competitor is Halyk Bank; however, it is first and foremost a bank with limited SuperApp-like functionalities, hence not much focus on the competitive landscape in this deep dive as Kaspi is truly one-of-a-kind 800-pound gorilla in its end-markets.

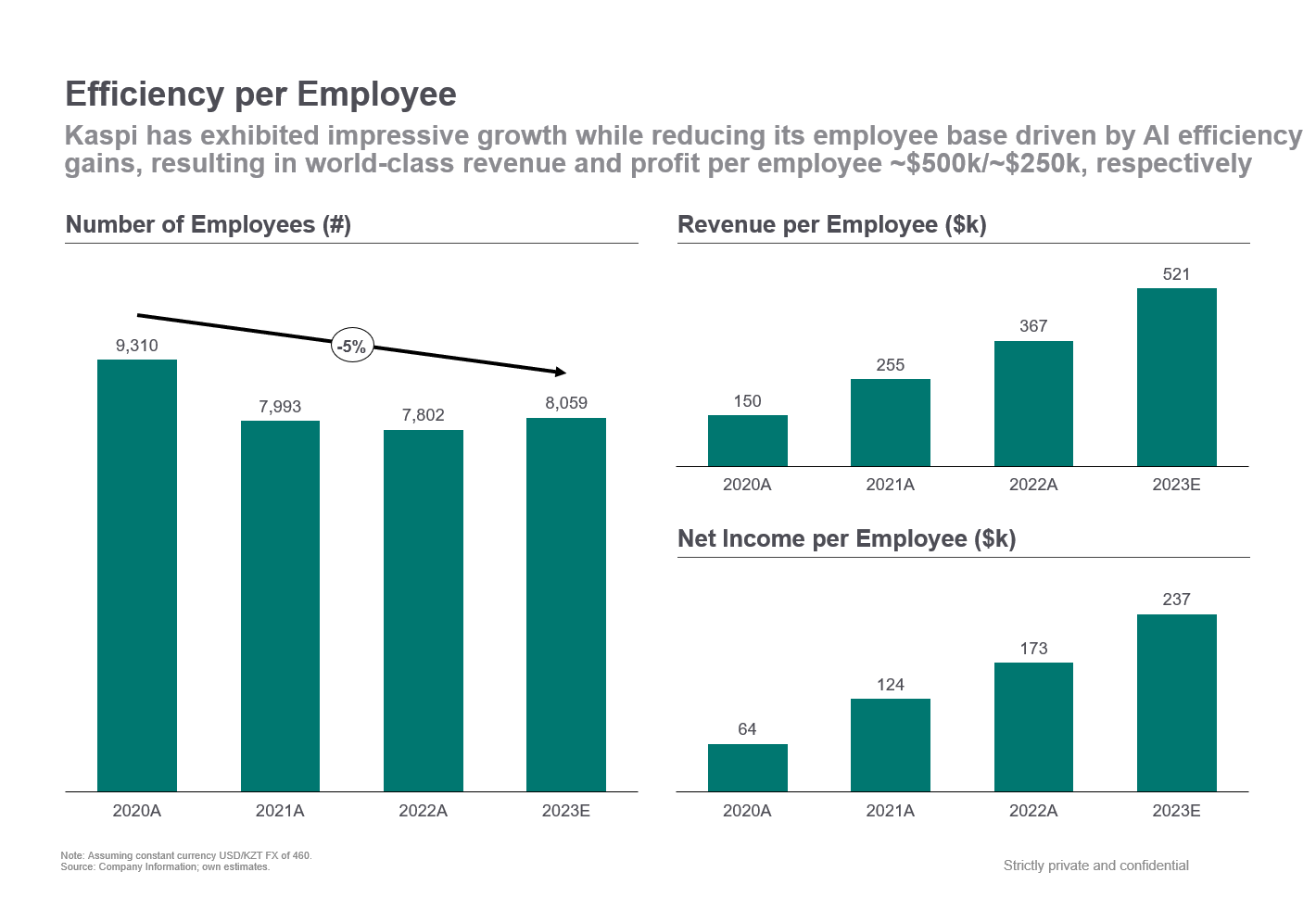

Redefining Efficiency in High-Growth Markets

Efficient growth is vital for scaling a business successfully with a strong Return on Invested Capital (ROIC). Otherwise, businesses end up “spinning the wheels” with growth materially slowing down with scale, profitability being difficult or impossible to reach, and in the worst cases, both of the above combined with the need for incremental capital raises resulting in ongoing shareholder dilution. Unfortunately, few businesses globally can achieve sustainable and attractive growth efficiencies. Most companies struggle to achieve high ROIC, which applies even to the leading cloud businesses, considered one of the best business models in the history of capitalism. Even the best-of-the-class SaaS companies currently face a median marketing spend payback period (on a Gross Profit basis) of around 28 months (see Meritech Software Pulse ). Over time, as businesses scale, efficiency often wanes—initial easy wins are exhausted, and attracting more elusive customers becomes challenging and costly.

Conversely, Kaspi's SuperApp enjoys extremely high engagement, making consumer participation essential to living their lives efficiently - it is not an understatement to say that not using Kaspi in Kazakhstan is equivalent to being an unbanked individual with no form of identification in the Western World. For merchants, Kaspi provides the optimal way to reach their audience, much like specialized platforms such as Rightmove (LSE:RMW) for real estate in the UK or Mercado Libre for e-commerce in LatAm, though as discussed, Kaspi's scope is far broader. This allows for essentially non-existent churn outside merchants going out of business.

Kaspi's efficiency goes beyond its attractive business model and is further propelled by its innovative use of Artificial Intelligence (AI). This technological edge sharpens Kaspi's operational acumen, enabling the Company to scale its revenues with a lean and, in fact, shrinking workforce. The SuperApp's ability to enhance user engagement and merchant success through AI translates into remarkable financial metrics per Full-Time Employee (FTE), reflecting a synergy of growth, profitability, and efficiency rarely seen in the market. I will let the below data speak for itself and highly recommend you compare the below metrics with an excellent database provided by Meritech in their Public SaaS Comparables Table (where you will quickly find that Net Income per Employee is not a disclosed metric because it is not meaningful for the vast majority of publicly listed high-growth companies as they are deeply cash burning due to the above discussed efficiency-related constraints).

A Customer-First Vision by CEO Mikhail Lomtadze

Kaspi's management, under CEO Mikhail Lomtadze, embodies a long-term, customer-centric philosophy, focusing on product excellence and user experience above all. Lomtadze's strategy hinges on understanding and continually investing in Kaspi's competitive edge, a practice that has led to an ever-expanding market advantage. This approach is reflected in the Company's Net Promoter Score (NPS), which impressively rose from below 40% in the early 2010s to an outstanding ~90%, signalling that customers don’t just use Kaspi — they genuinely love it. This customer satisfaction parallels how Amazon has captivated its user base, making it essentially irrational not to use its services.

“We always proactively seek consumer feedback to evaluate if we are delivering on our mission. Through our Kaspi.kz Super App, we send push notifications asking our consumers to evaluate the quality of specific services and provide us with feedback, shortly after use. On average, approximately 200,000 consumers per month give us such feedback. The data and results we derive from feedback form an integral part of our product development process. For our employees, consumer feedback forms the main KPIs by which they are held accountable.”

Furthermore, this customer-first approach is deeply ingrained in the Company's ethos, partly because all executive officers and members of the Board of Directors as a group (9 persons in total) hold a significant stake in the business, owning 57% of the outstanding shares, currently worth ~$10bn. This substantial ownership ensures that the management's interests are closely aligned with the long-term success and sustainability of Kaspi, mirroring the commitment to continually enhancing service quality and value. Under Lomtadze's stewardship, Kaspi is not just maintaining its market position but is set to become even more integral to its customers' lives. To better understand the impressive culture, I suggest watching publicly available videos on YouTube , listening to quarterly report recordings, and perhaps reading through the Kaspi.kz IPO Harvard Business School Case Study .

Kazakhstan Beyond Borat: A Digital Powerhouse and Eurasian Economic Strategic Keystone

While some may hesitate to invest in an asset exposed to Kazakhstan's economy, perceiving it as an underexplored market funnily known through the "Borat" films, the country's reality is strikingly different. Kazakhstan is exceptionally digitally savvy, with a robust online infrastructure facilitated by the rise of tech giants like Kaspi.

It's also a pivotal node for the Belt and Road Initiative (BRI), vital for Eurasian economic integration, from which all regional stakeholders, including China, Europe, Russia and the Middle East, stand to gain (hence, in my view, the irrelevance of the potential worry that Kazakhstan might face a similar devastating destiny as Ukraine). The nation's commitment to BRI is evidenced by significant infrastructure investments and a surge in trade volume with all stakeholders (including increasingly with Europe to provide Oil & Gas, and with France specifically to replace Niger as the core provider of uranium). Kazakhstan's role extends beyond logistics; it's pivotal in industrial and agricultural collaborations under the BRI, with numerous joint projects underway. These partnerships underscore Kazakhstan's growing importance in regional and global economic dynamics. In 2023, Foreign Direct Investments in Kazakhstan grew by 18% and reached $28bn, a record high for Kazakhstan over the past decade.

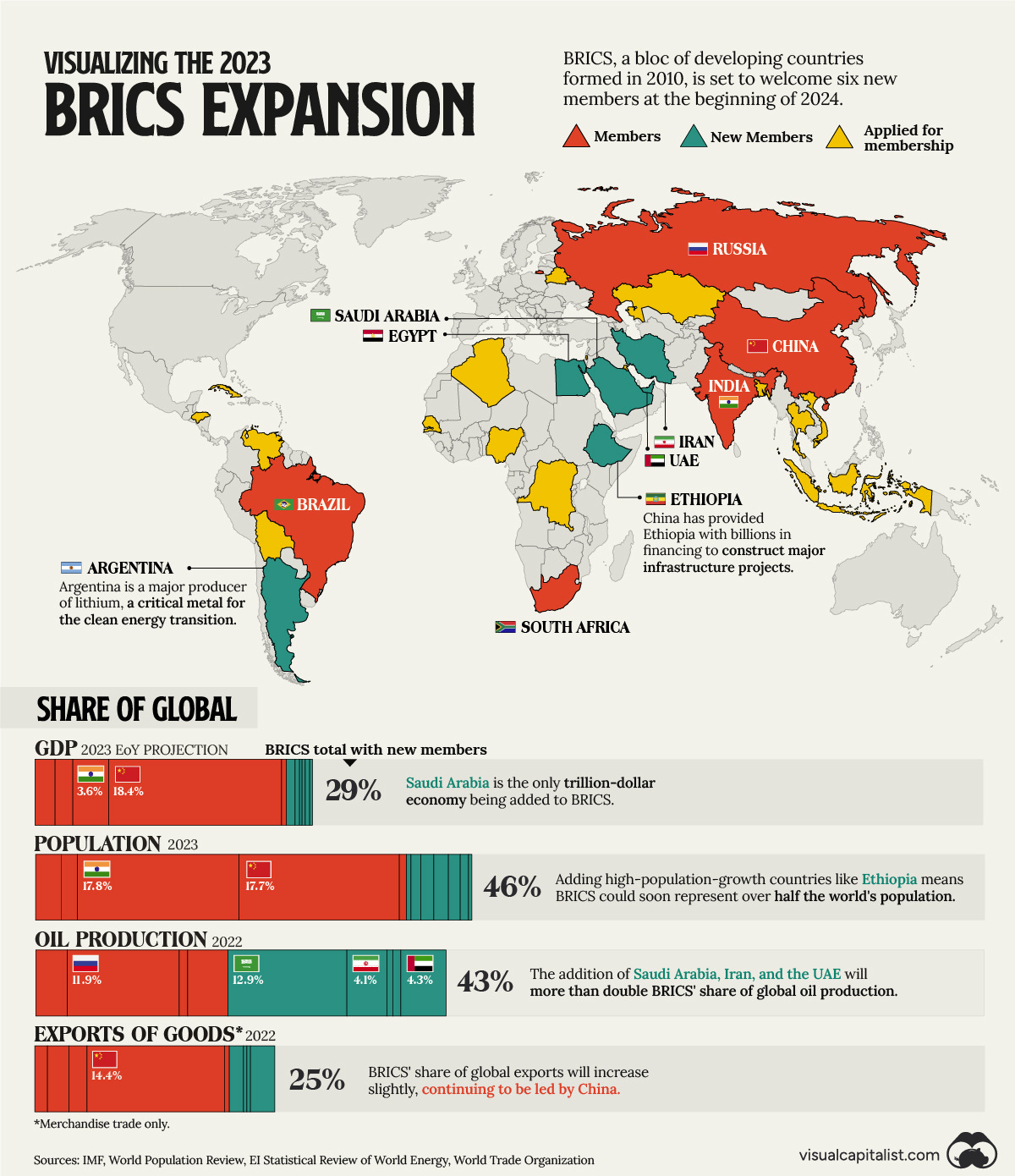

It is also worth noting that on January 1, 2024, the UAE, Saudi Arabia, Ethiopia, Egypt, and Iran officially became members of BRICS. They joined Brazil, Russia, India, China, and South Africa as a formidable economic powerhouse, representing 29% of global GDP and 43% of global oil production. Kazakhstan has shown a keen interest in joining BRICS and will likely do so in the coming year(s), further cementing its geopolitical and economic significance.

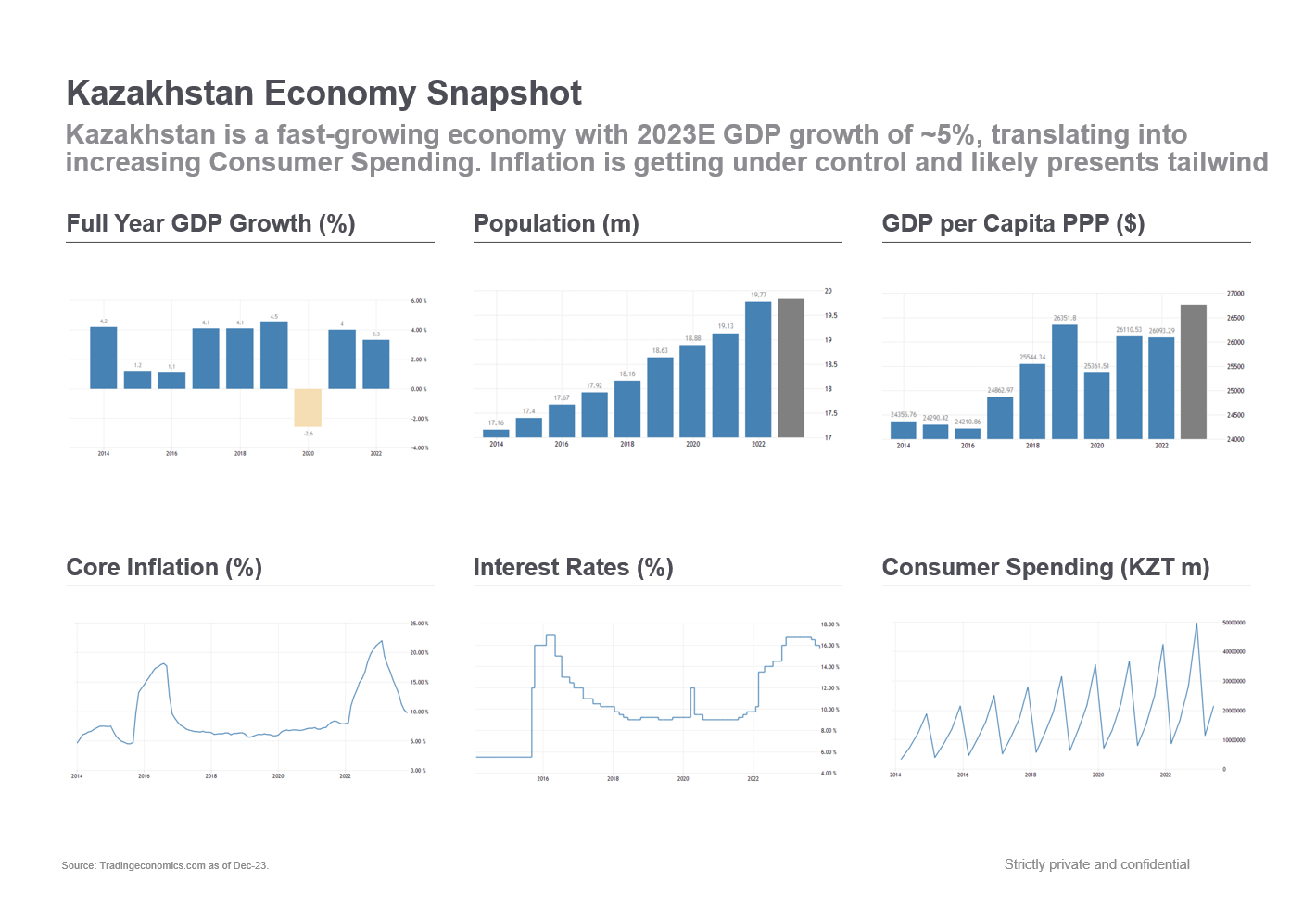

Economically, Kazakhstan showcases a trade surplus, abundant natural resources, and a trajectory of growing GDP and income per capita, with inflation increasingly being tamed, resulting in decreasing interest rates, which should further accelerate the economy's and Kaspi’s growth. Below is an overview of a few selected statistics, though I urge you to explore an excellent TradingEconomics database with a broader set of economic indicators that would allow you to form your view based on your risk tolerance.

It is also worth mentioning that Moody's upgraded Kazakhstan's outlook from "stable" to "positive" on October 27, 2023, acknowledging the country's significant progress in diversifying its economy and demonstrating stronger growth prospects than its peers. This positive shift reflects Kazakhstan's commitment to reforms and improving the effectiveness of state institutions. Moody's recognizes Kazakhstan's low debt burden (~25% Debt to GDP vs ~130% in the US) and substantial international reserves, enhancing its resilience to external risks and underscoring its economic strengths.

The Kazakhstani Tenge (KZT) has experienced historical depreciation, largely influenced by external factors and the nation's reliance on raw materials, particularly oil and metals, which account for a significant portion of its economy and currency revenues. This dependence prompted efforts by the Kazakh government to diversify the economy away from these sectors, aiming to mitigate the impact of fluctuating commodity prices on the national currency.

In recent years, the Tenge has shown signs of strengthening. For instance, in 2023, the US dollar exchange rate against the Tenge decreased by ~2%, making Tenge one of the few currencies globally strengthening versus the US dollar. This recent strengthening is attributed to various factors, including economic measures taken by the National Bank of Kazakhstan, the country's growing economic resilience, Kazakhstan's substantial reserves, including assets of the National Fund and gold and forex reserves of the National Bank, which are significant relative to the country's GDP.

Operating & Returns Model

I'm committed to ensuring that all my readers, including those who access my free content, receive valuable insights. To this end, I'm sharing key excerpts from my comprehensive operating & returns model, offering a glimpse into the detailed analysis available. Below, you'll find a snippet of the Marketplace Platform Deep Dive and an overview of the Summary P&L and Returns calculations.

However, to truly delve deeper and tailor your investment thesis, I've reserved the full model for my paid subscribers. This exclusive content includes a Kazakh Macro Overview, an in-depth analysis of both the Payments and Fintech Platforms, a Summary of Operating Free Cash Flow build, and detailed Capital Allocation calculations, which are crucial for reinvesting dividends. My paid subscribers support my work, and in return, I ensure they receive substantial additional value, enabling a more nuanced and personalized investment approach.

Potential Multibagger Hiding in Plain Sight?

It's startling to observe Kaspi's valuation given all that has been discussed thus far, especially when compared with Mercado Libre. Despite Kaspi's robust business model, substantial profitability, a deep competitive moat, and significant market traction, it's shocking to see it trading at a mere ~7x NTM P/E. This is drastically low compared to Mercado Libre's ~48x NTM P/E. Kaspi's strong NTM dividend yield of ~10% and its consistent share buybacks add further to its appeal (note that the business is continuously buying back ~$2.5m worth of shares per week, which more than offsets any dilution from stock-based compensation, yet another attractive facet of Kaspi compared to most of the growth-stage businesses in the Western World). This stark disparity in valuation, with Kaspi valued at a ~85% discount to Mercado Libre, is not just surprising but potentially indicates a massive undervaluation for a Company with Kaspi's impressive credentials.

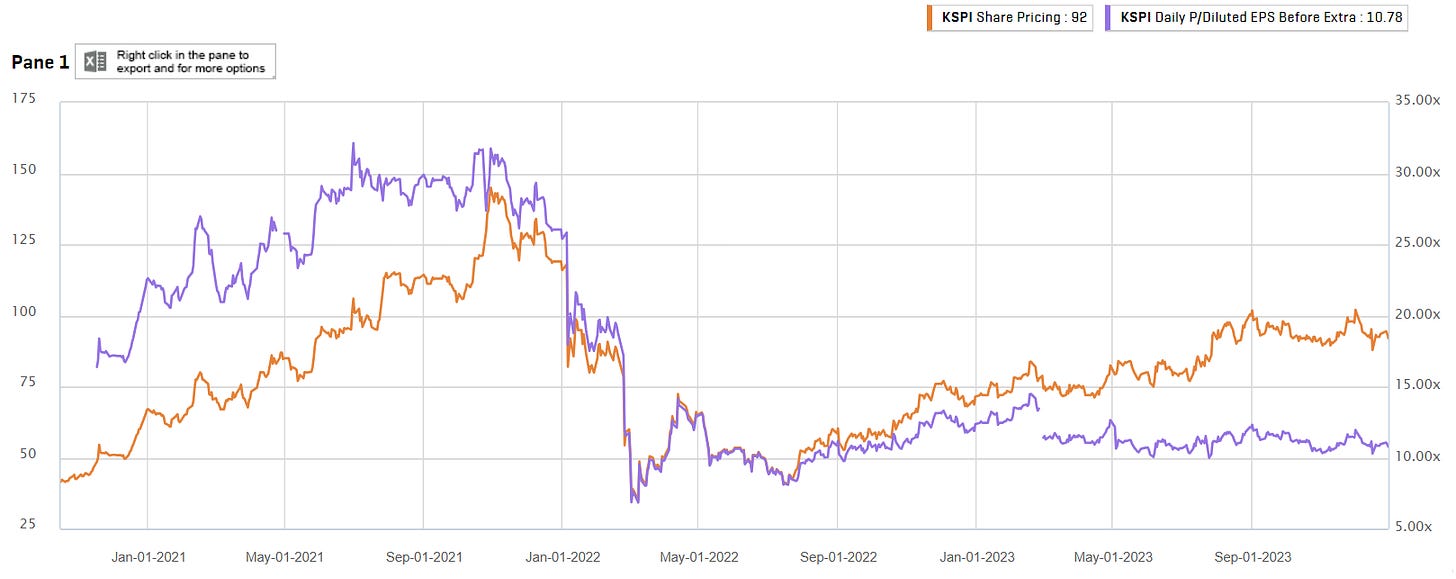

Note: The chart below shows LTM P/E (the current ~10x LTM P/E translates into ~7x NTM P/E).

Before 2022, Kaspi was trading at ~20x NTM P/E (while the Company was meaningfully smaller and its product and service offering far less developed). However, geopolitical tensions, notably the Ukraine war, sparked concerns about regional stability, leading to a sharp decline in the stock's valuation to the ~7x NTM P/E territory, where it has stayed since. This undervaluation persists despite Kazakhstan's distinct geopolitical context; the likelihood of similar conflicts spilling into Kazakhstan is widely considered very low by regional experts.

Kaspi's impending NASDAQ listing in 1Q24E could be a major catalyst for revaluation (Kaspi is currently listed on the London Stock Exchange). The listing is expected to significantly raise the Company's profile among international investors, attracting the attention of equity research analysts, emerging market hedge funds, and investors seeking exposure to growing fintech, e-commerce, and payments sectors. This increased visibility and subsequent analysis could lead to a more accurate appreciation of Kaspi's true market value. Based on my analysis, here are the expected returns for Kaspi:

Downside Case (15% probability) : With a ~10% NTM dividend yield and ~20% NTM growth, maintaining a constant multiple, we could see a 1.3x Money on Invested Capital (MOIC) in one year.

Base Case (50% probability) : Adding potential multiple expansion back to the 20x NTM P/E to the same dividend yield and ~30% NTM growth, the expectation is a 3.7x 1-year MOIC.

Upside Case (35% probability) : Should the multiple expand to 30x NTM P/E, closer to Mercado Libre (yet still far below ~48x), and growth deliving ~35% NTM growth, a 6.0x MOIC is conceivable.

As attractive as the above illustrative returns appear, the real upside lies in holding Kaspi for the long term, given its vast potential. For a detailed assessment of this potential, I encourage you to explore the financial model available in the paid section.

Putting My Money Where My Mouth Is

In the spirit of Charlie Munger's wisdom, which emphasizes the value of decisive action in investing, I have embarked on a significant personal financial decision. Drawing from my extensive professional investing experience across the world’s leading investment banks and technology-focused private equity firms, I believe I have identified a rare opportunity in the market. Kaspi, a Company that debuted on the London Stock Exchange two years ago, presents what I believe to be a deeply mispriced opportunity. It has somehow stayed under the radar of many international investors, likely due to its listing on the less-observed London exchange (no helpful research analysis covering the stock, daily trading volume of ~$3m, which should be more of a rounding error considering the Market Capitalization of nearly $20bn). Recognizing this, I am investing a substantial portion of my liquid wealth in Kaspi and committing to a long-term hold. This decision is driven by my conviction in Kaspi's potential and my belief that the market will eventually recognize and correct this undervaluation, resulting in potential returns that I currently do not see in other publicly listed investment opportunities.

To all my current, new, and future subscribers, I deeply value and appreciate you! I also warmly invite you to embark on this thrilling journey with me. Your insights and discussions are not just welcomed but crucial as we collectively explore Market Wonders . Together, we aim to uncover opportunities that lead us towards our common goal of financial independence . Let's engage, learn, and grow together in this exciting pursuit!

Analyst’s Disclosure: I have a beneficial long position in the shares of Kaspi either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from my paid subscribers). I have no business relationship with any company whose stock is mentioned in this article. Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for any particular investor.

Ready for more?

- Friday, 12 April, 2024

- Almaty 41 °F / 5 °C

- Astana 41 °F / 5 °C

- All Stories

- Kazakhstan Region Profiles: A Deep Dive Into the Heart of Central Asia

- State of the Nation

- Election 2022

- Election 2023

- Astana International Forum

- Kazakhstan’s Presidency in SCO

- Central Asia

“APP”etite for Innovation: Look at Kazakhstan’s First Nasdaq Listed Company, Kaspi.kz

By Assel Nussupova in Business , International on 26 January 2024

Over 30 years ago, Kazakhstan was little known outside Central Asia despite its vast size and rich resources. Long isolated under Russian and then Soviet rule, it only opened to global trade after declaring independence in 1991, embarking on a journey towards a market-oriented, capitalistic society. This transition included integrating concepts like competition and innovation into its economic vocabulary. Despite significant strides, such as attracting global corporations to its oil sector and modernizing its infrastructure and government, Kazakhstan struggled for international recognition, potentially needing a notable brand or celebrity to elevate its global profile.

Mikhail Lomtadze during the bell ringing ceremony at Nasdaq to mark the company’s stock listing on Jan. 19 in New York. Photo credit: Nasdaq.

In recent years, Kazakhstan’s global recognition has increased, partly thanks to notable figures like professional boxer Gennady Golovkin, the first Kazakh featured in an Apple Watch commercial and Nike’s Jordan brand, and singer Dimash Kudaibergen, known for his exceptional vocal range. Despite their contributions, the country’s image as resource-dependent persisted. However, significant changes have been occurring. Five years ago, Kazakhstan’s first president Nursultan Nazarbayev stepped down, succeeded by Kassym-Jomart Tokayev, who has focused on reforms, technology adoption, and fostering an entrepreneurial economy. These efforts, along with the rise of tech-savvy entrepreneurs, are reshaping Kazakhstan’s global image, highlighting its intellectual potential and talent beyond natural resources.

In a thriving market economy like Kazakhstan’s, capital gravitates towards the most efficient and profitable ventures. A prime example is the innovative super app Kaspi.kz, which offers a range of services from cashless payments to vacation booking and accessing government services. This app has not only enhanced the lives of millions in Kazakhstan but also raised the country’s profile. Recently, Kaspi.kz made headlines with its successful Nasdaq IPO, a first for a Kazakh company.

Photo credit: Nasdaq. Behind Kaspi’s success is CEO Mikhail Lomtadze, a co-founder who envisioned greatness against the odds. Under his leadership, Kaspi.kz has become the largest and most advanced company in Kazakhstan and Central Asia. In 2022, the app processed more transactions than Mastercard and Visa combined in Kazakhstan.

Kaspi’s Nasdaq debut, following its listing on the London Stock Exchange less than three years prior, marks a significant milestone. The company’s achievements have not gone unnoticed by the government of Kazakhstan. President Tokayev recently met with the company’s co-founders Vyacheslav Kim and Mikhail Lomtadze. We had the opportunity to delve deeper into the company’s journey in an interview with Lomtadze.

Here’s our Q&A with Lomtadze.

Your company focuses on three main areas (payment, marketplace, fintech). Could you tell a little about the products and services you offer? Who is your target customer base?

We operate a two-sided Super App business model: the Kaspi.kz Super App for consumers and the Kaspi Pay Super App for merchants and entrepreneurs.

Photo credit: Nasdaq.

Being a Super App first is at the core of everything we do. We call our mobile applications Super Apps because, unlike single-purpose apps, our apps integrate different and complex services that are used on a daily basis in one place, in a way that is simple and seamless for users.

With the Kaspi.kz Super App, consumers can shop online with fast and free e-Commerce and e-Grocery delivery, use m-Commerce to find and shop at local merchants, book travel and holidays with Kaspi Travel, pay with Kaspi QR throughout Kazakhstan, shop with our BNPL products, pay their household bills and save for the future. With integrated Government Services, consumers can also access digital documents, including passports, renew their driving licenses, and transfer car ownership.

The Kaspi.kz Super App has 13.5 million average monthly active users, 65% of whom access our services daily, giving it one of the highest levels of daily engagement among major mobile apps globally, trailing only behind Tencent’s WeChat in China.

With the Kaspi Pay Super App, merchants can sell online using e-Commerce or list their businesses and offers using m-Commerce, organize nationwide delivery with Kaspi Delivery Smart Logistics, run ad campaigns with Kaspi Advertising, participate in our promotional events and access merchant financing. Merchants can issue and instantly settle invoices, accept payments, pay suppliers and track their turnover. Kaspi Classifieds allows merchants to advertise their services and job opportunities. Merchants also have access to Government Services, including tools to initially register their business, issue fiscal receipts for all types of payments, calculate and pay their taxes, and file tax reports.

What is the company’s revenue model, and how does it plan to achieve long-term profitability?

With our two-sided Super App business model, the Kaspi.kz and Kaspi Pay Super Apps connect and facilitate transactions between consumers and merchants, from which we generate revenue. Popular payments and shopping products attract more customers, which in turn attracts more merchants, which in turn leads to more consumers and transactions. We also integrate financing options for both consumers and merchants.

Our Super Apps technology platform leads to high levels of operational efficiency and offers a powerful mix of scale and profitability.

We typically target large addressable markets, such as grocery and travel, where scale translates into meaningful net income and net income growth. As a result, we believe our Super App business model creates a structurally more profitable business than a stand-alone equivalent model.

What growth strategy has Kaspi.kz outlined post-IPO, and how does it plan to use the funds raised?

Our mission is to improve people’s daily lives by developing innovative, highly relevant, world-class mobile services. We see a substantial growth opportunity as we keep growing by innovating and digitizing more aspects of daily life.

In fact, we have a proven track record of creating new revenue streams. In only the last three years, among other services, we have launched Kaspi Travel, Kaspi B2B Payments and Kaspi Postomats. More recently, we launched e-Grocery and Kaspi Classifieds. These services are in different areas, but all benefit from the powerful network effects inherent to our Super App business model. We also keep developing value-added tools for merchants, such as advertising, new delivery offerings and invoicing products.

We believe digitalization will remain a powerful driver of economic transformation globally, and particularly in Kazakhstan and the surrounding region, where consumers are increasingly demanding digital solutions. Kazakhstan’s social and economic backdrop, namely the country’s young and growing population, rapidly increasing income levels and fast-growing GDP is incredibly supportive.

Our Nasdaq IPO did not raise new funds for the company but was designed to increase stock trading liquidity by attracting a wide range of new, high quality, international investors, most of whom have never invested in Kazakhstan before.

What’s the most exciting upcoming development or project at Kaspi.kz that you are particularly enthusiastic about? Where do you envision the company in 10 years?

We have a proven track record of introducing products and services that have been quickly adopted.

With the opportunities offered by digitalization, the pipeline of our new products remains strong.

We also want to take Kaspi.kz to other markets. Over the long term, our ambition is to serve 100 million users. With our highly scalable, asset-light Super App business model, we believe we can expand into new geographies as quickly and efficiently as we have expanded into new verticals in Kazakhstan.

While you have a strong foothold in Kazakhstan, which regions or segments hold the most potential for you to expand to?

In Azerbaijan we operate the leading classifieds platforms Turbo.az (cars), Tap.az (new and used items) and Bina.az (real estate). Since 2021, we have operated the payments platform Portmone in Ukraine. In Uzbekistan we are invested in Autoelon.uz, a leading car marketplace.

Over the long term, our ambition is to extend our geographical reach and profitably serve 100 million users, up from 13.5 million we currently serve.

Our asset-light, Super App business model is highly scalable and will allow us to expand into new geographies as quickly and efficiently as we have expanded into new business line verticals in Kazakhstan. We regularly review and assess the status of markets in neighboring countries as well as other select markets.

As we expand, our strategy will be driven by our Super App business model, and we will aim to target large addressable and profitable market segments, with the opportunity to scale all our platforms and offer a deep suite of products.

What measures have you taken to ensure the security of data and financial transactions on your platform?

One example is our Kaspi ID biometrics proprietary technology which we use to enable transactions, prevents fraud and provides extra security to our consumers. Face recognition technology also enables transactions in our Super Apps and at our ATMs.

What role do you see AI playing in your business currently and in the future?

This is a very popular question currently but we never jump on the latest bandwagon. In the case of AI, although I like to joke that it’s no substitute for our own intelligence, we have been seeing the significant benefits that it brings over the years.

For example, we developed our AI-powered virtual assistant several years ago and now leverage this powerful tool across many areas of our consumer-facing functions. Even with rapid growth, the total number of our full-time employees has been reduced from 9,310 in 2020 to 7,802 in 2022. Our virtual assistant, “Ruslan,” now does the work of approximately 1,000 employees across multiple functions, saving us approximately ₸5.3 billion (approximately $11 million) annually. I suspect you won’t find many fast-growing technology companies that have been able to reduce their headcount substantially, and “Ruslan” is just one of a growing number of examples of how we are using AI to improve what we do.

The Kazakh government is signaling that it wants to embrace technology, diversify the economy and attract foreign investment. How does Kaspi.kz fit into the emerging Kazakh economy?

Kaspi.kz is at the forefront of the new digital revolution, redefined by our Super Apps. The combination of our scale with consumers and merchants, reinforced by our Super App strategy, puts us in an extremely strong position. With the multi-year structural growth opportunity offered by digitalization in Kazakhstan still ahead of us, we thoroughly intend to capture it.

As Kazakhstan’s first Nasdaq listed company, we are showcasing to the world’s largest investors many of the positives that Kazakhstan has to offer. Over the next couple of years these investors will travel to Kazakhstan, not only to visit Kaspi.kz but to seek out the next wave of high growth and innovative investment opportunities.

From the author:

The future seems very bright for Kaspi.kz, a super-app focused on providing a super experience for its eager customers, simplifying transactions and engagement in an ever-widening variety of digital areas. Its history-making IPO on the Nasdaq provided inspiration for other Kazakh companies to seek out greater engagement with the global economy. While Kazakhstan’s economic past has often been defined by oil and gas, Kaspi.kz is proving that technology and innovation also flow abundantly through the land.

Get The Astana Times stories sent directly to you! Sign up via the website or subscribe to our Twitter , Facebook , Instagram , Telegram , YouTube and Tiktok !

Most Recent Stories

- Tokayev Outlines Priorities for Kazakhstan’s Science, Technology Development

- Kostanai Region Recovers After Flood: Residents Share Personal Experience

- Kazakh Artists Rally Support for Flood Rescuers (Video)

- Kazakhstan, Belarus Set to Foster Cooperation

- Kazakhstan, Georgia to Enhance Cooperation in Trans-Caspian International Transport Route

- Kazakhstan, Finland Strengthen Trade and Transport Ties at Commission Meeting

- News Digest: Foreign Media on Trans-Caspian International Transport Route, Critical Raw Materials and More

- Brussels Meeting Focuses on Kazakhstan-EU Trade, Investment Ties

- National Bank of Kazakhstan Keeps Base Rate at 14.75%

- Kazakhstan Evacuates Almost 100,000 People Amid Massive Floods

- Dialogue of Civilisations

- Editor’s Picks

- International

- Constitutional Referendum

- National Overview

- © 2010-2024 The Astana Times

- Privacy Policy

- About Us

Fintech Heavyweight Kaspi.kz Valued at $17.5 Billion in Tepid Nasdaq Debut

The Kaspi Bank logo in seen at the bank's branch in Almaty, Kazakhstan October 7, 2019. REUTERS/Pavel Mikheyev/File Photo

(Reuters) -Kaspi.kz was valued at $17.51 billion when its shares debuted 0.5% above their offer price on Friday, a day after the Kazakhstan-based banking and fintech giant fetched $1 billion for its investors in an upsized IPO.

The lukewarm reception, especially on a day when the benchmark S&P 500 index was just shy of a record close, indicated investor caution around new listings was firmly in place, spilling into 2024 after almost two years of sluggish U.S. IPO markets.

Still, a string of startups such as Reddit and ServiceTitan are looking to go public over the next few months, as dovish expectations around the Federal Reserve's interest rate trajectory encourages IPO hopefuls.

Kaspi.kz's American depositary shares opened at $92.50 each, compared with their IPO price of $92.

Its share sale had fetched over $1 billion for its billionaire executives, co-founder Vyacheslav Kim and CEO Mikheil Lomtadze, as well as another shareholder, Asia Equity Partners. No proceeds went to the company.

The investors upsized their offering to 11.3 million shares on Thursday, from earlier plans to sell 9 million shares.

Kaspi.kz operates through three segments - payments, marketplace and fintech - and caters to both consumers and merchants. Besides e-commerce purchases, its app lets customers access buy now, pay later (BNPL) debt, renew their driving licenses and register their businesses.

The diversification that conglomerates like Kaspi.kz offer can benefit investors, since one unit can cushion the hit if another suffers.

On the other hand, myriad businesses can bring their own risks and make it harder for markets to evaluate the company. For instance, Kaspi.kz's sprawling empire includes an e-grocery business, which is known for its logistical complexity and is viewed as a low-margin business.

Morgan Stanley, J.P. Morgan and Citigroup are the lead underwriters for the IPO.

The company is already listed on the London Stock Exchange, where its valuation exceeds $19 billion.

(Reporting by Niket Nishant in Bengaluru; Editing by Devika Syamnath)

Copyright 2024 Thomson Reuters .

Tags: United States

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

Is it time to invest internationally.

Kate Stalter April 11, 2024

Cheap Dividend Stocks to Buy Under $10

Wayne Duggan April 11, 2024

5 Best Large-Cap Growth Stocks

Glenn Fydenkevez April 11, 2024

7 Dividend Kings to Buy and Hold Forever

Tony Dong April 11, 2024

5 Socially Responsible Investing Apps

Coryanne Hicks April 10, 2024

7 Diabetes and Weight Loss Drug Stocks

Brian O'Connell April 10, 2024

7 Best Socially Responsible Funds

Jeff Reeves April 10, 2024

Fidelity Mutual Funds to Buy and Hold

Tony Dong April 10, 2024

Dividend Stocks to Buy and Hold

Wayne Duggan April 9, 2024

What Is a Stock Market Correction?

Marc Guberti April 9, 2024

If You Invested $10,000 in SMCI IPO

6 of the Best AI ETFs to Buy Now

Tony Dong April 9, 2024

7 Best Cybersecurity Stocks to Buy

Glenn Fydenkevez April 8, 2024

How Bitcoin Mining Is Evolving

Matt Whittaker April 8, 2024

9 of the Best Bond ETFs to Buy Now

Tony Dong April 8, 2024

10 Best Tech Stocks to Buy for 2024

Wayne Duggan April 8, 2024

About the Methodology

U.S. News Staff April 8, 2024

9 Growth Stocks That Also Pay Dividends

Jeff Reeves April 5, 2024

Effects of the Bitcoin Halving Event

Dmytro Spilka April 5, 2024

9 Best Cheap Stocks to Buy Under $5

Ian Bezek April 5, 2024

The largest Payments, Marketplace and Fintech Ecosystem in Kazakhstan

- About Kaspi.kz

Our Platforms

- Financial Information

Our Mobile App

All our services in one Mobile App becoming part of our customers’ daily lives

We have developed an integrated consumer-focused Ecosystem of innovative and diversified services around our three revenue-generating Platforms. Our Platforms enable participants to connect and interact, creating value for each participant of the Kaspi.kz Ecosystem.

- Marketplace

ELECTRONIC VERSIONS OF THE MATERIALS YOU ARE SEEKING TO ACCESS (THE “MATERIALS”) ARE BEING MADE AVAILABLE ON THIS WEBSITE BY JOINT STOCK COMPANY KASPI.KZ (THE “COMPANY”) FOR INFORMATION PURPOSES ONLY. THE MATERIALS ARE NOT DIRECTED AT OR INTENDED TO BE ACCESSIBLE BY PERSONS LOCATED IN THE UNITED STATES OF AMERICA (INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OF AMERICA AND THE DISTRICT OF COLUMBIA) (THE “UNITED STATES”) OR PERSONS RESIDENT OR LOCATED IN AUSTRALIA, CANADA, OR JAPAN OR ANY OTHER JURISDICTION WHERE THE EXTENSION OF AVAILABILITY OF THE MATERIALS WOULD BREACH ANY APPLICABLE LAW OR REGULATION.