Free Accounting and Bookkeeping Sample Business Plan PDF

1 min. read

Updated February 26, 2024

Looking for a free, downloadable accounting and bookkeeping sample business plan PDF to help you create a business plan of your own? Bplans has you covered.

Keep in mind that you don’t need to find a sample business plan that exactly matches your business. Whether you’re launching a larger accounting business in a bustling city or a smaller neighborhood office, the details will be different, but the bones of the plan will be the same.

Are you writing a business plan for your accounting firm because you’re seeking a loan? Is your primary concern building a clear roadmap for growth? Either way, you’re going to want to edit and customize it so it fits your particular company.

No two accounting businesses are alike. Your strategy will be different if you’re partnering with other CPAs, rather than working independently, for example. So take the time to create your own financial forecasts and do enough market research so you have a solid plan for success.

- What should you include in an accounting and bookkeeping business plan?

Your accounting business plan doesn’t need to be hundreds of pages—keep it as short and concise as you can. You’ll probably want to include each of these sections: executive summary, company summary and funding needs, products and services, marketing plan, management team, financial plan, and appendix.

One of the things that makes an accounting business plan different than some other service-based business plans is that you might decide to only work with businesses and not with individuals.

You may offer different tiers of service to different types of clients. If that’s the case, make sure you include ideas like up-selling small businesses from hourly consultation to quarter contracts.

Download this accounting and bookkeeping sample business plan PDF for free right now, or visit Bplans’ gallery of more than 550 sample business plans if you want more options.

There are plenty of reasons accounting business owners can benefit from writing a business plan —you’ll need one if you’re seeking a loan or investment.

Even if you’re not seeking funding, the process of thinking through every aspect of your business will help you make sure you’re not overlooking anything critical as you grow.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

Related Articles

10 Min. Read

Free Wedding Venue Business Plan PDF [2024 Template + Sample Plan]

6 Min. Read

How to Write an Ice Cream Shop Business Plan + Free Sample Plan PDF

12 Min. Read

How to Write a Food Truck Business Plan (2024 + Template)

13 Min. Read

How to Write an Online Fitness Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How To Write a Winning Accounting and Bookkeeping Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for accounting and bookkeeping businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every accounting and bookkeeping business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Accounting and Bookkeeping Business Plan?

An accounting and bookkeeping business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Accounting and Bookkeeping Business Plan?

An accounting and bookkeeping business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Accounting and Bookkeeping Business Plan

The following are the key components of a successful accounting and bookkeeping business plan:

Executive Summary

The executive summary of an accounting and bookkeeping business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your accounting and bookkeeping company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your accounting and bookkeeping business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your accounting and bookkeeping firm, mention this.

Industry Analysis

The industry or market analysis is an important component of an accounting and bookkeeping business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the accounting and bookkeeping industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an accounting and bookkeeping business may include small-to-medium sized businesses and individuals.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or accounting and bookkeeping services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your accounting and bookkeeping business via word of mouth.

Operations Plan

This part of your accounting and bookkeeping business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an accounting and bookkeeping business include reaching $X in sales. Other examples include signing on a certain number of new clients or increasing your client retention rate by a certain amount.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific accounting and bookkeeping industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Accounting and Bookkeeping Company

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Accounting and Bookkeeping Company

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup accounting and bookkeeping business.

Sample Cash Flow Statement for a Startup Accounting and Bookkeeping Company

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your accounting and bookkeeping company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

A well-written accounting and bookkeeping business plan is a critical document for any new business. If you seek funding or investors, it can help you obtain each successfully.

Finish Your Accounting and Bookkeeping Business Plan in 1 Day!

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their accounting firms.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an accounting business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is an Accounting Business Plan?

A business plan provides a snapshot of your accounting business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Accounting Firm

If you’re looking to start an accounting firm or grow your existing accounting business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your accounting business to improve your chances of success. Your accounting business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Accounting Firms

With regards to funding, the main sources of funding for an accounting firm are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for accounting firms.

Finish Your Business Plan Today!

How to write a business plan for an accounting firm.

If you want to start an accounting business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your accounting business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of accounting business you are running and the status. For example, are you a startup, do you have an accounting business that you would like to grow, or are you operating an established accounting business you would like to sell?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overv iew of the accounting industry.

- Discuss the type of accounting business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of accounting business you are operating.

For example, you might specialize in one of the following types of accounting firms:

- Full Service Accounting Firm: Offers a wide range of accounting services.

- Bookkeeping Firm: Typically serves small business clients by maintaining their company finances.

- Tax Firm: Offers tax accounting services for businesses and individuals.

- Audit Firm: Offers auditing services for companies, organizations, and individuals.

In addition to explaining the type of accounting business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, or the amount of revenue earned.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the accounting industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the accounting industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your accounting business plan:

- How big is the accounting industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your accounting business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your accounting business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, organizations, government entities, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of accounting business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are othe r accounting firms.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes CPAs, other accounting service providers, or bookkeeping firms. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of accounting business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide options for multiple customer segments?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a accounting business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type o f accounting company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide auditing services, tax accounting, bookkeeping, or risk accounting services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of yo ur plan, yo u are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your accounting company. Document where your company is situated and mention how the site will impact your success. For example, is your accounting business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your accounting marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your accounting business, including answering calls, scheduling meetings with clients, billing and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to book your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your accounting business to a new city.

Management Team

To demonstrate your accounting business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing accounting businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an accounting business or bookkeeping firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance s heet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer discounts for referrals ? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your accounting business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a accounting business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of your most prominent clients. Summary Writing a business plan for your accounting business is a worthwhile endeavor. If you follow the accounting business plan example above, by the time you are done, you will truly be an expert. You will understand the accounting industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful accounting business.

Accounting Business Plan Template FAQs

What is the easiest way to complete my accounting business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your accounting business plan.

How Do You Start an Accounting Business?

Starting an accounting business is easy with these 14 steps:

- Choose the Name for Your Accounting Business

- Create Your Accounting Business Plan

- Choose the Legal Structure for Your Accounting Business

- Secure Startup Funding for Your Accounting Business (If Needed)

- Secure a Location for Your Business

- Register Your Accounting Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Accounting Business

- Buy or Lease the Right Accounting Business Equipment

- Develop Your Accounting Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Accounting Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Accounting business plan?

OR, Let Us Develop Your Plan For You Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan writer can create your business plan for you. Other Helpful Business Plan Articles & Templates

- Sample Business Plans

Bookkeeping Business Plan

Numerous skilled tasks are required for bookkeeping are management of costs, earnings, tax returns, and payroll. Careful planning is required for each of these services as well as others for a bookkeeping business to operate successfully.

How to Write a Bookkeeping Business Plan?

Writing a bookkeeping business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

1. Executive Summary

An executive summary is the first section of the business plan intended to provide an overview of the whole business plan. Generally, it is written after the entire business plan is ready. Here are some components to add to your summary:

Start with a brief introduction:

Market opportunity:, mention your services:, management team:, financial highlights:, call to action:.

Ensure you keep your executive summary concise and clear, use simple language, and avoid jargon.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

Depending on what details of your business are important, you’ll need different elements in your business overview, Still, there are some foundational elements like business name, legal structure, location, history, and mission statement that every business overview should include:

About the business:

Provide all the basic information about your business in this section like:

- The name of your bookkeeping firm and what type of firm it is: a simple bookkeeping firm, audit firm, virtual bookkeeping firm, tax firm, forensic accounting firm, or some other.

- Company structure of your accounting firm whether it is LLC, partnership firm, or some other.

- Location of your business and the reason why you selected that place.

Mission statement:

Business history:, future goals:.

This section should provide an in-depth understanding of your accounting business. Also, the business overview section should be engaging and precise.

3. Market Analysis

Market analysis provides a clear understanding of the market in which your bookkeeping business will run along with the target market, competitors, and growth opportunities. Your market analysis should contain the following essential components:

Target market:

Market size and growth potential:, competitive analysis:, market trends:, regulatory environment:.

Some additional tips for writing the market analysis section of your business plan:

- Use a variety of sources to gather data, including industry reports, market research studies, and surveys.

- Be specific and provide detailed information wherever possible.

- Include charts and graphs to help illustrate your key points.

- Keep your target audience in mind while writing the business plan

4. Products And Services

The product and services section of a virtual bookkeeping business plan should describe the specific services and products that will be offered to customers. To write this section should include the following:

List the services:

- Create a list of the services: the primary services you provide, such as accounting, payroll, tax preparation, and financial statement production, should be briefly described here.

- Describe each service: For each service, provide a detailed description of what it entails, the time required, and the qualifications of the professionals who will provide the service. For example, the firm needs to hire a chartered accountant.

Additional services:

Overall, the product and services section of a business plan should be detailed, informative, and customer-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Develop your unique selling proposition (USP):

Determine your pricing strategy:, marketing strategies:, sales strategies:, customer retention:.

Overall, the sales and marketing strategies section of your business plan should outline your plans to attract and retain customers and generate revenue. Be specific, realistic, and data-driven in your approach, and be prepared to adjust your strategies based on feedback and results.

6. Operations Plan

When writing the operations plan section, it’s important to consider the various aspects of your business processes and procedures involved in operating a business. Here are the components to include in an operations plan:

Describe rules and regulations:

Operational process:.

By including these key elements in your operations plan section, you can create a comprehensive plan that outlines how you will run your bookkeeping business.

7. Management Team

The management team section provides an overview of the individuals responsible for running the virtual accounting firm. This section should provide a detailed description of the experience and qualifications of each manager, as well as their responsibilities and roles.

Key managers:

Organizational structure:, compensation plan:, board of advisors:.

Describe the key personnel of your company and highlight why your business has the fittest team.

8. Financial Plan

When writing the financial plan section of a business plan, it’s important to provide a comprehensive overview of your financial projections for the first few years of your business.

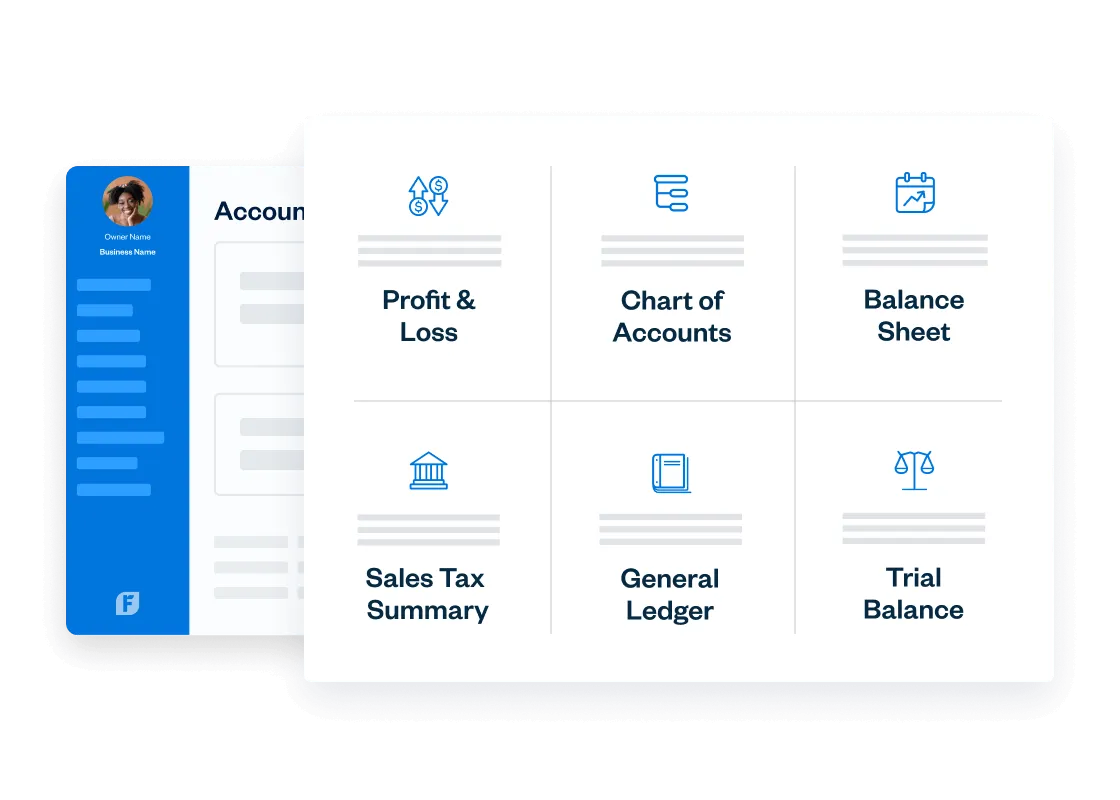

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:, financing needs:.

Remember to be realistic with your financial projections, and to provide supporting evidence for all of your estimates.

9. Appendix

When writing the appendix section, you should include any additional information that supports the main content of your plan. This may include financial statements, market research data, legal documents, and other relevant information.

- Include a table of contents for the appendix section to make it easy for readers to find specific information.

- Include financial statements such as income statements, balance sheets, and cash flow statements. These should be up-to-date and show your financial projections for at least the first three years of your business.

- Provide market research data, such as statistics on the size of the bookkeeping industry, consumer demographics, and trends in the industry.

- Include any legal documents such as permits, licenses, and contracts.

- Provide any additional documentation related to your business plans, such as marketing materials, product brochures, and operational procedures.

- Use clear headings and labels for each section of the appendix so that readers can easily find the information they need.

Remember, the appendix section of your accounting business should only include relevant and important information that supports the main content of your plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This bookkeeping business plan sample will provide an idea for writing a successful virtual bookkeeping business plan, including all the essential components of your business.

After this, if you are still confused about how to write an investment-ready business plan to impress your audience, then download our bookkeeping business plan pdf .

Related Posts

Counseling Private Practice Business

Holding Company Business Plan

Sample Business Plan Template

Financial Plans for Small Business

Tips for Creating a Business Plan Presentation

Creative Business Plan Cover Page

Frequently asked questions, why do you need a bookkeeping business plan.

A business plan is an essential tool for anyone looking to start or run a successful accounting firm. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your bookkeeping success.

How to get funding for your bookkeeping business?

There are several ways to get funding for your business, but one of the most efficient and speedy funding options is self-funding. Other options for funding are!

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your bookkeeping firm, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought options for startups.

- Venture capital – Venture capitalists will invest in your business in exchange for a percentage of shares, so this funding option is also viable.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your bookkeeping business?

There are many business plan writers available, but no one knows your business and idea better than you, so we recommend you write your virtual accounting business plan and outline your vision as you have in your mind.

What is the easiest way to write your bookkeeping business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any bookkeeping business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Search Search Please fill out this field.

Understanding the Legal Requirements

Acquiring bookkeeping skills, creating a business plan for your bookkeeping business, marketing strategies for your bookkeeping business, managing finances in your bookkeeping business, acquiring clients for your bookkeeping business, is bookkeeping a profitable business, can you start your own bookkeeping business, how much should i charge my bookkeeping clients, the bottom line.

- Small Business

- How to Start a Business

How to Start Your Own Bookkeeping Business: Essential Tips

Understanding the legal requirements

:max_bytes(150000):strip_icc():format(webp)/20171019_172018-5a12f5cdbeba3300373b7964-3d8c34a5e28d41cdb3c4e2df355329f4.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips CURRENT ARTICLE

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

Papakon Mitsanit / Getty Images

Starting a bookkeeping business is something you might be interested in if you naturally love numbers and want to break free of the traditional nine-to-five. It’s possible to offer bookkeeping services to clients in person or remotely, which may be ideal if you would prefer a work-at-home job.

Before starting a bookkeeping business, you’ll first need to know the basics of operating legally. It’s also helpful to understand how to market your services and manage the financial side of running a business.

Key Takeaways

- A degree in accounting is not required to start a bookkeeping business, though a certification in bookkeeping can be helpful to have.

- You’ll need to choose a business structure, and register your business with the proper state authorities if required by law where you live.

- If you plan to hire employees, you may need to obtain workers’ compensation insurance in compliance with state law.

- Developing a solid marketing plan can help you build your brand and attract clients to your business.

The legal requirements for starting a bookkeeping business are similar to any other type of business. Some of the most important things you’ll need include:

- Selecting a business structure (i.e., sole proprietorship, limited liability company, etc.)

- Choosing a name for the business

- Registering your business with the proper state agencies

- Obtaining a federal Employer Identification Number (EIN) and state identification numbers, if necessary

- Applying for any necessary licenses or permits

- Opening a business bank account

- Getting business insurance , including liability coverage and/or home-based business insurance

The exact requirements for starting a small business will depend on the state in which you live. You may need to contact your secretary of state or department of revenue for more information on what paperwork you may need to complete to legally establish your bookkeeping business.

There may be additional steps required if you plan to hire employees for your business. For instance, you may need to obtain workers’ compensation insurance. The requirements for workers’ compensation vary by state. For instance, California requires workers’ compensation for all employers, regardless of the number of employees. In Alabama, on the other hand, businesses are not required to purchase workers’ compensation insurance if they have fewer than five employees.

Some states may impose steep penalties against businesses that fail to obtain workers’ compensation insurance.

Starting a bookkeeping business requires an understanding of accounting and bookkeeping practices. You may need to first complete a training program before you can launch.

For example, you might pursue any of the following:

- Bookkeeping certification

- Tax certification

- Accounting software certification

Unlike the requirements to become an accountant, the training required to become a bookkeeper is less strenuous. It’s possible to find and complete an online training program from home.

As you compare online bookkeeping courses , consider the range of topics covered, the course format, and the cost. Whether it makes sense to obtain just one bookkeeping certification or additional tax and accounting software certificates can depend on your niche and the types of services you plan to offer.

While a degree in accounting may be helpful for starting a bookkeeping business, it’s not an absolute requirement.

A business plan is a detailed overview of how you plan to launch and grow your business. There are several key elements that are typically included in a comprehensive business plan. Here’s what yours might look like as you draft a plan for your bookkeeping business.

- Executive summary : The executive summary should offer a brief overview of what your business is about, your mission, and how you’ll be successful. Your mission statement can also include information about your employees (if you plan to hire any) and your plans for growth.

- Company description : Your company description is an opportunity to provide additional details about your business, including who you plan to serve and what problems you’ll solve for your clients.

- Market analysis : Market analysis allows you to look at your competitors and identify their strengths and weaknesses. Completing this section can help you better understand what makes your bookkeeping business unique.

- Organization and management : This section should describe how your business is legally structured and who’s responsible for running it. If you’re operating as a one-person business, this part of your plan will likely be brief.

- Services : In the services section, you can expand on what types of services you plan to offer as a bookkeeper and who you expect your customers to be.

- Marketing : How you market your bookkeeping business can depend on your niche or target audience and what resources you have to invest in advertising. You’ll use this section to sketch out your marketing plans for attracting clients to your business.

- Financial projections : This section is where you’ll outline how much revenue and profit you expect to make from the business.

Having a business plan to start a bookkeeping business isn’t a requirement, but creating one can help you get some clarity on what your goals are and how you plan to proceed with growing the business. Even if you’re just planning to offer bookkeeping services remotely as a sole proprietor , it can still be helpful to flesh out the exact steps you’ll need to take to succeed.

A business plan may be required if you plan to apply for business financing from banks or investors.

When you start any new business, you can’t expect customers or clients to magically find you. Instead, you’ll have to invest some time (and perhaps, money) in marketing your business.

If you’re specifically interested in working as a bookkeeper remotely, establishing a website and social media profiles may be a starting point for your marketing plan. Both can make it easier for potential clients to find you in online searches. You can also leverage social media to build your brand and increase your visibility.

Aside from a website and social media, there are some other options you might consider for marketing your services. They can include:

- Using LinkedIn to build out your professional network and establish credibility

- Joining a local meetup group of bookkeepers in your area

- Joining a professional business association in your area

- Participating in local small business events

- Seeking out opportunities to be a guest on podcasts in the finance niche

- Offering a seminar or workshop, either online or in person

When planning your marketing strategy , it’s important to think about the message you want to send to prospective clients. That message should be consistent across all of the channels you use to market your business, whether that includes YouTube, Facebook, TikTok, or another platform.

It’s also important to consider who your message is targeting. Your marketing content should speak to the needs and pain points of the types of customers you’re most interested in attracting to your business.

Keeping track of cash flow is essential for running any business. As you prepare to start your bookkeeping business, it’s important to keep track of your expenses, which may include:

- Website hosting

- Accounting software

- Customer relationship management (CRM) software

- Cloud storage fees

- Home office supplies (if you’ll be working remotely)

- Registration fees

- Fees for certification or training

- Marketing costs

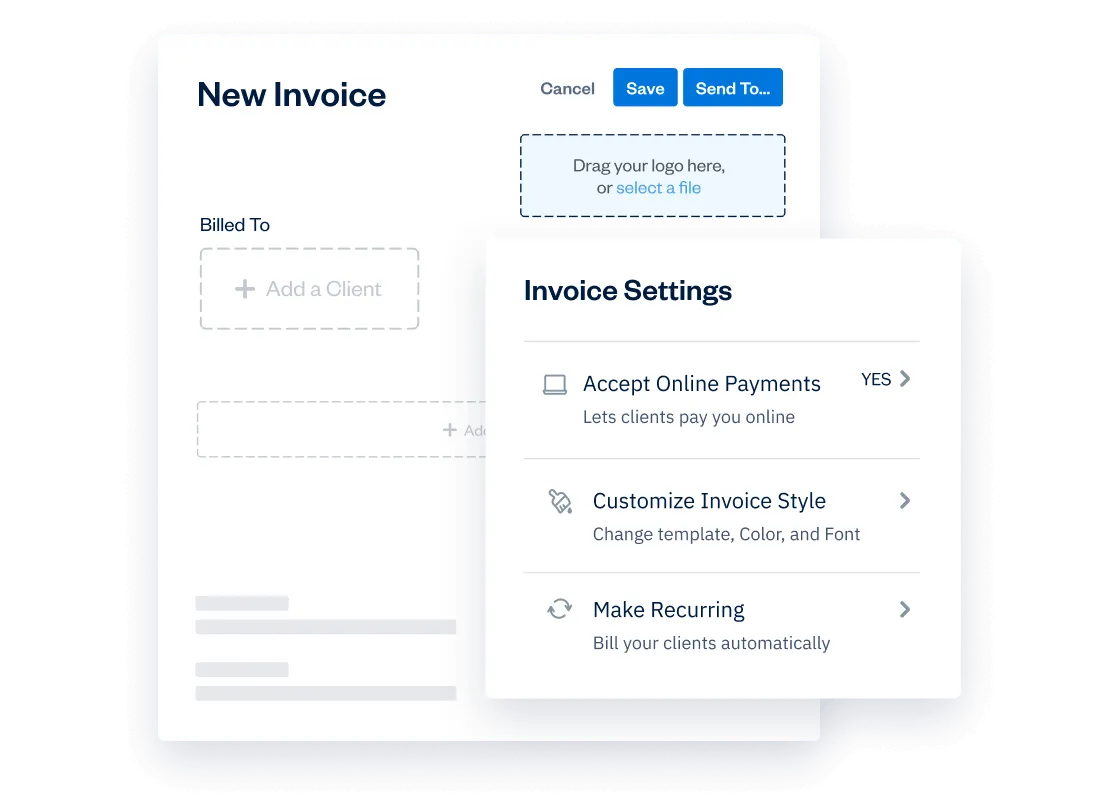

Once your business gets under way, you can make a monthly budget to track your cash inflows and outflows. You’ll also need to give some thought to how you plan to invoice your clients for your services. That includes choosing when to send invoices , how quickly you expect them to be paid, and which payment methods you'll accept.

Running a business also means paying taxes on your earnings. That includes income tax and estimated quarterly taxes . Generally, you’re required to make estimated quarterly tax payments to the Internal Revenue Service (IRS) if:

- You expect to owe at least $1,000 in tax for the year, after subtracting withholding and refundable credits.

- You expect your withholding and refundable credits to be the smaller of 90% of the tax shown on your current year’s return or 100% of the tax shown on your prior year’s return.

If your state imposes an income tax, you’ll also be responsible for making estimated tax payments to your state agency.

Opening a business bank account can make it easier to keep track of what funds go in and out. You can open a business bank account at a traditional bank, credit union, or online bank. You’ll need to provide your personal information, along with your business details, in order to open an account. Comparing fees, features, and accessibility can help you choose the best business bank account for your needs.

You might also consider applying for a business credit card to help cover expenses until you start making money. You can apply for a business credit card using your personal credit score and income ; business credit is not a requirement. If you’re considering a business credit card , you might want to look for one that offers a generous rewards program and/or charges no annual fee.

Once you’ve covered all the legal aspects of starting your business, it’s time to start finding your first clients. There are a few ways you can go about doing this. These include:

- Looking for remote bookkeeping opportunities on freelance job boards

- Establishing profiles on sites like Fiverr or Upwork, which connect companies with freelance workers

- Reaching out to local businesses to ask if they need bookkeeping services

- Running ads on social media

- Joining local small business directories

- Offering a free consultation to local businesses

- Asking friends, family, or other business owners for referrals

Once you start getting your first clients, it’s important to focus on customer satisfaction. Clients who are happy with your services are more likely to stay loyal and continue to hire you. They also may be willing to refer you to people they know who might need a good bookkeeper.

Bookkeeping has the potential to be a profitable business if you’re able to maintain a solid roster of clients who are willing to pay competitive rates for your services. A typically remote bookkeeper’s salary is just over $63,600 a year, but it’s possible to make much more than that, depending on your clientele and the rates you charge.

It’s possible to start a bookkeeping business from scratch, even if you don’t have a professional or educational background in accounting or bookkeeping. Having a degree or certification in either area could be an advantage, but it’s possible to acquire the skills you need to become a bookkeeper online. Likewise, you don’t need to have experience running a business, but that could also prove helpful.

The amount you should charge your bookkeeping clients can depend on a number of factors, including how much experience you have, which certifications you hold, the types of services you offer, and the types of individuals or businesses you work with. Someone who’s new to the profession, for example, may start their rates at $20 an hour, while someone with several years of experience may charge $35 an hour or more. Researching average bookkeeper salaries for your area can give you an idea of what your competitors may charge.

Starting a bookkeeping business can be a great opportunity to take control of your career. Before diving in, however, it’s important to understand what’s involved to get your new business up and running. The more prepared you are before launching, the greater your chances of succeeding as an expert bookkeeper.

U.S. Small Business Administration. “ Launch Your Business .”

Insureon. “ State Laws for Workers’ Compensation .”

U.S. Small Business Administration. “ Write Your Business Plan .”

Internal Revenue Service. “ Estimated Tax .”

Glassdoor. “ Remote Bookkeeper Salaries .”

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1163568066-3e01187e658a45beb064ab64166d9e68.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Creating your business plan

It’s time to get things down on paper. Your business plan is vital to reality checking all those ideas you have.

What to do on day zero

If you already know what you want to be called, lock down the name and register the URL. Now take some time to see what’s working for other bookkeepers. Find the ones in your area and check out their websites – plus their LinkedIn and Facebook profiles – to see what makes them tick. How do they speak to the market? What services do they offer? How much do they charge? Use this research to help start the plan for your bookkeeping business.

But what if I already know the plan?

It’s great if you already know how you’re going to get started, but it’s still important to write everything down. For one thing, you’ll want to record all your golden ideas before they’re forgotten. Plus the writing process will help you interrogate those ideas.

Putting them on a timeline, costing them out, and fitting them around each other might reveal a thing or two. Perhaps some assumptions will need to be rethought, or some ideas will have to be skipped in favor of others. It’s a great way to organize your thinking.

Start with a working one-pager

The key to a business plan is to start out simple, and build on it as you go. Begin with a few headings and bullet points that map out your vision, goals, milestones and predictions.

Don’t let it get out of hand or bog you down. That’s not what a business plan is for. It’s supposed to help you get started. So set yourself a target of producing a one page plan to start.

Choose your words carefully

Decide how you’re going to talk about your business, and which words you’ll use. It’ll be helpful in settling on a value proposition and relating to clients. You can use your chosen terms in your elevator pitch, on your website, in blurbs about your business – and in your business plan.

Sections for a one-page business plan

1. Value proposition: Explain why clients will be better off with you.

2. The problem you’re solving: Describe the status quo and say why it’s not ideal.

3. Target market and competition: Profile the clients you want, and the bookkeeping solutions they use now.

4. Sales and marketing: Show how you’ll reach your target market, and what you’ll say to them.

5. Budget and sales: Work out your costs and predict how much you can earn over the first couple of years.

6. Milestones: Identify all the things that need to happen and map them against a timeline.

7. The team: Identify the people that will be involved (including consultants) and outline their roles.

8. Funding: Show how you’ll bankroll the business, especially as you wait for fees to start rolling in.

9. Contingency plan: What will you do if your cash flow isn’t what you budgeted?

You may eventually draw up a longer business plan, or you may stick with a short one. It depends on your working style, and the level of risk you’re taking on. Your plan will probably be more detailed if you’re taking on a lot of debt.

You can download a copy of our one-page or multi-page business plan template .

Staying alive

Once you’ve got your plan nailed down, remember you really don’t. You should treat your plan as a living document and keep tweaking it as things evolve. That’s another reason why it’s good to have a short plan, which you’re much more likely to update as you go. Try to be agile and open to change.

The discipline of maintaining your business plan will help you:

- discover and solve problems – putting things in black and white will show up holes in your thinking.

- get feedback from others – you can share your plan to get feedback from trusted advisors.

- go for more finance – an up-to-date business plan (and budget) means you’re always ready to apply for loans.

- guide growth – regular focus on the big picture will help you make strategic decisions rather than instinctive ones.

Have a succession plan

You will also need a succession plan. What will happen when you step away from the business? Will you sell it? Who to? A family member, a staff member, or someone on the open market?

A good succession plan will make sure the business can survive and thrive without you. That it will perform for its clients and its new owners. And it should give you the flexibility to step away from the business at short notice, if required or desired.

Learn more in our guide to succession planning.

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Starting a bookkeeping business

Work through the big decisions around accreditation, services to offer, fees to charge, and how to find clients.

You’ll need some training and certification to become a professional bookkeeper. Find out where this is available.

With a foundation of knowledge, skills and experience, take the next steps in setting up as a bookkeeper.

You need to nail down what services you’ll offer, who to, and how. Don’t promise more than you’re able to deliver.

Designing your bookkeeping business around a specific type of client or your strengths can be a successful way to go.

How do you walk the line between profitable for you and affordable for your clients? And help clients budget?

You might deliver an awesome service at a great price, but what if no one knows? Let’s look at marketing your services.

Download the bookkeeping business guide

A guide to help you work through the big decisions around starting a bookkeeping business. Fill out the form to receive the guide as a PDF.

Privacy notice .

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Included Safe and secure

- Included Cancel any time

- Included 24/7 online support

Or compare all plans

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

You’ve come to the right place to create your Accounting business plan.

We have helped over 5,000 entrepreneurs and business owners create business accounting plans and many have used them to start or grow their accounting firms.

Below is a template to help you create each section of your Accounting business plan.

Executive Summary

Business overview.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana. We provide a full suite of accounting services to local businesses, including bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. His expertise, reputation, and loyal clientbase will ensure that our firm is successful.

Product Offering

DeSanta & Co will offer its clients a full suite of accounting services. These services include bookkeeping, accounting, tax services, and auditing. The company will employ a large and diverse staff of professional accountants to ensure we can offer as many services as possible.

Customer Focus

DeSanta & Co will serve small and medium-sized businesses located in the Indianapolis, Indiana area. Most of these businesses will have less than 1000 employees and earn a revenue less than $10 million per year. We will also offer limited services to individuals, such as tax prep and help.

Management Team

DeSanta & Co’s most valuable asset is the expertise and experience of its founder, Michael DeSanta. Michael has been a certified public accountant (CPA) for the past 20 years. Throughout his career, he has developed a loyal client base, and many clients have stated that they will switch to DeSanta & Co once the company is established and running. Michael’s combination of skills, accounting knowledge, and loyal following will ensure that DeSanta & Co is a successful firm.

Success Factors

DeSanta & Co will be able to achieve success by offering the following competitive advantages:

- Michael DeSanta will initially help the clientbase that he has built carefully over the past twenty years.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our accounting services at an affordable rate.

Financial Highlights

DeSanta & Co is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

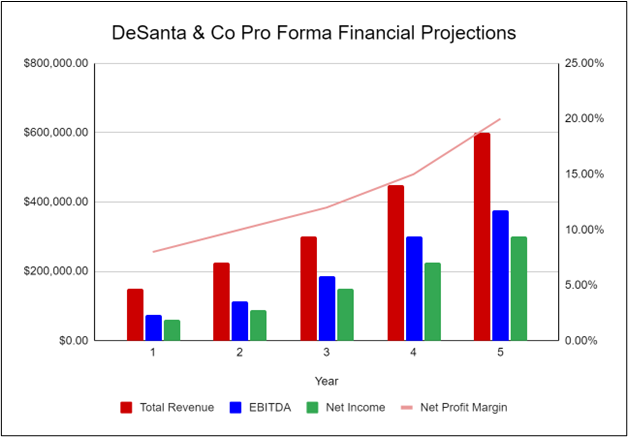

The following graph below outlines the pro forma financial projections for DeSanta & Co.

Company Overview

Who is desanta & co.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana that provides local businesses with a full suite of accounting services. We are a small firm but have considerable experience, so we can offer better quality of services than our competition. We expect that our most popular services will include bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. After working for several accounting firms around town, he surveyed his clientbase to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Michael to finally launch his business.

DeSanta & Co History

Upon surveying his clientbase and finding a potential office, Michael DeSanta incorporated DeSanta & Co as an S-Corporation in April 2023.

The business is currently being run out of Michael’s home office, but once the lease on DeSanta & Co’s office location is finalized, all operations will be run from there.

Since incorporation, DeSanta & Co has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

DeSanta & Co Services

DeSanta & Co will provide the following services to its clients:

- Bookkeeping

- Tax services

- Advisory services

- Investment services

- Management consulting

- Valuation and planning

Industry Analysis

The accounting industry is essential to the success of other businesses and industries. Accountants record and track financial transactions, which helps businesses ensure they are making a profit. As such, accounting services are always in demand and the industry often sees great growth.

There are several essential services that accounting firms can provide to businesses and individuals. The most popular services include bookkeeping, tax services, advisory services, and valuation and planning. Though most businesses employ their own accountants, many businesses are switching to hiring accounting firms to save on costs.

The accounting industry is expected to grow over the next several years. According to The Business Research Company, the accounting industry is expected to grow at a CAGR of 4.2% from now until 2027. This growth is due to the increasing demand for accountants worldwide. This increase in demand and industry growth ensures that DeSanta & Co will achieve success.

Customer Analysis

Demographic profile of target market, customer segmentation.

DeSanta & Co will primarily target the following customer profiles:

- Local small businesses

- Medium-sized businesses

- Individuals

Competitive Analysis

Direct and indirect competitors.

DeSanta & Co will face competition from other companies with similar business profiles. A description of each competitor company is below.

Perkins & Smith

Perkins & Smith is a small accounting firm that has intentionally remained small so that they can have stronger relationships with their clients. Since they opened in 1960, Perkins & Smith has been one of the leading accounting firms in the Four State Region. They offer a wide range of services including accounting, bookkeeping, payroll services, tax prep and planning, and advisory services. They have built up a loyal clientele and maintained a strong, positive reputation since their opening decades ago.

Premiere Accounting

Premiere Accounting is a large accounting firm that specializes in helping large businesses with accounting, taxes, and similar services. Since opening in 1995, they have acquired a loyal client base, including several multi-billion dollar companies. They employ over a hundred professionals who all have diverse backgrounds. This helps serve their diverse clientele and ensures they are meeting the specific needs of every business that works with them.

Jackson Brothers Accounting

Jackson Brothers Accounting is a privately held accountant practice that has been popular in the area since 1985. They offer a wide variety of services including, tax planning and preparation, payroll processing, financial planning, and small business accounting. Though they are open to helping nearly all businesses and sectors, they primarily focus on local small businesses and startups.

Competitive Advantage

DeSanta & Co will be able to offer the following advantages over the competition:

- Client-oriented service : DeSanta & Co will put a focus on customer service and maintaining long-term relationships. We aim to be the best accounting firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management : Michael has been extremely successful working in the accounting sector and will be able to use his previous experience to help his clients better than the competition.

- Relationships : Having lived in the community for 25 years, Michael DeSanta knows many of the local leaders, newspapers and other influences.

Marketing Plan

Brand & value proposition.

DeSanta & Co will offer a unique value proposition to its clientele:

- Client-focused financial services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for DeSanta & Co is as follows:

Targeted Cold Calls

DeSanta & Co will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need accounting services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

DeSanta & Co understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

DeSanta & Co will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

DeSanta & Co will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

The fees and hourly pricing of DeSanta & Co will be moderate and competitive so clients feel they are receiving great value when utilizing our accounting services.

Operations Plan

The following will be the operations plan for DeSanta & Co. Operation Functions:

- Michael DeSanta will be the Owner of DeSanta & Co. In addition to providing accounting services, he will also manage the general operations of the business.

- Michael DeSanta is joined by a full-time administrative assistant, Jessica Baker, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Michael will hire more accounting professionals to provide the company’s services, attract more clients, and grow our business further.

Milestones:

DeSanta & Co will have the following milestones completed in the next six months.

- 6/2023 Finalize lease agreement

- 7/2023 Design and build out DeSanta & Co

- 8/2023 Hire and train initial staff

- 9/2023 Kickoff of promotional campaign

- 10/2023 Launch DeSanta & Co

- 11/2023 Reach break-even

Though he has never run his own business, Michael DeSanta has worked as an accountant long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other accounting firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key revenue & costs.

DeSanta & Co’s revenues will primarily come from charging clients for the accounting services we provide. We will charge our clients an hourly rate that will vary depending on the services they need.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients:

- Year 4: 100

- Year 5: 125

- Annual Rent: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, accounting business plan faqs, what is an accounting business plan.

An accounting business plan is a plan to start and/or grow your accounting business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Accounting business plan using our Accounting Business Plan Template here .

What are the Main Types of Accounting Businesses?

There are a number of different kinds of accounting businesses , some examples include: Full Service Accounting Firm, Bookkeeping Firm, Tax Firm, and Audit Firm.

How Do You Get Funding for Your Accounting Business Plan?

Accounting businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Accounting Business?

Starting an accounting business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Accounting Business Plan - The first step in starting a business is to create a detailed accounting business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your accounting business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your accounting business is in compliance with local laws.

3. Register Your Accounting Business - Once you have chosen a legal structure, the next step is to register your accounting business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your accounting business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Accounting Equipment & Supplies - In order to start your accounting business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your accounting business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful accounting business:

- How to Start an Accounting Business

Accounting | How To

How To Start a Bookkeeping Business in 8 Steps + Checklist

Updated June 24, 2023

Updated Jun 24, 2023

Published March 13, 2023

Published Mar 13, 2023

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Danielle Bauter

This article is part of a larger series on Accounting Software .

- 1. Create a Business Plan

- 2. Earn Your Certifications

- 3. Register & Organize Your Bookkeeping Business

- 4. Set Up Business Operations for Your Bookkeeping Business

- 5. Get the Right Accounting Software

- 6. Fund Your Bookkeeping Business

- 7. Set Up a Home Office for Your Bookkeeping Business