Starting a Business | How To

How to Write a Business Plan in 7 Steps

Published February 2, 2024

Published Feb 2, 2024

WRITTEN BY: Mary King

Get Your Free Ebook

Your Privacy is important to us.

This article is part of a larger series on Starting a Business .

Starting A Business?

Step 1: Gather Your Information

Step 2: outline your business plan, step 3: write each section, step 4: organize your appendix, step 5: add final details, step 6: add a table of contents, step 7: get feedback, bottom line.

A solid business plan helps you forecast your future business and is a critical tool for raising money or attracting key employees or business partners. A business plan is also an opportunity to show why and how your business will become a success. Learning how to write a business plan successfully requires planning ahead and conducting financial and market research.

How to write a business plan step-by-step:

- Gather your information

- Outline your business plan

- Write each section

- Organize your appendix

- Add final details

- Add a table of contents

- Get feedback.

Your first step is to get organized by gathering all your relevant business information. This will save you time completing the various sections of your business plan. At a minimum, you’ll want to have the following handy:

- Business name, contact information, and address

- Owner(s) names, contact information, and addresses

- Names, contact information, and addresses of any business partners (if you will be working with partners)

- Resume and relevant work history for yourself and any key partners or employees

- Any significant sales, commerce, traffic, and financial data and forecasts

- Customer data (if applicable)

- Any significant data about your nearest competitors’ commerce, traffic, or finances

Now it’s time to outline your business plan, making note of the sections you need to include and what data you want to include in each section. You can create an outline on your own or use a business plan template to help. Whichever route you choose, it is common to include these sections in your business plan outline:

- Introduction

- Executive summary

- Company overview

- Products and services

- Market and industry analysis

- Marketing strategy

- Sales strategy

- Management and organization

- Financial data, analysis, and forecasts

Connect the data you gathered in step one to specific sections of your outline. Make a note if you need to convert some information into charts or images to make them more compelling for potential investors. For example, you’ll want to include relevant work history in your management section and convert your sales forecasts into charts for your financial data section.

Now it’s time to write your business plan. Attack this one section at a time, adding the relevant data as you go.

Executive Summary

The executive summary is an overview of the business plan and should ideally be one, but no more than two, pages in length. Some investors actually only request the executive summary. So make it an informative, persuasive, and concise version of your business plan.

It can be easier to write the executive summary last, after the other sections. Then you can more clearly understand which sections of your business plan are the most important to highlight in the executive summary.

When learning how to write an executive summary for a business plan, remember to include the following:

- Business objectives : Your business objectives are specific and attainable goals for your business. Create at least four business objectives organized by bullet point. If you’re not sure how to phrase your objectives, read our SMART goals examples to understand how to do so.

- Mission statement: The mission statement discusses the aim, purpose, and values of your business. It’s typically a short statement from one sentence to several sentences in length. You may find that your mission statement evolves as your business grows. Learn more on how to write your mission statement in our guide.

Consider also including the following in your executive summary:

- Business description : Similar to a 30-second pitch, describing your business and what makes it unique

- Products and services : The type of products and services you’re providing and their costs

- Competitors : Your biggest competitors and why your business will succeed despite them

- Management and organization : The owners’ backgrounds and how they will help the business succeed; management structure within the business

- Business location (or facility) : Location benefits and the surrounding area

- Target market and ideal customer : Who your ideal customers are and why they’re going to purchase your products or services

- Financial data and projections : Provide brief financial data and projections relevant to your business, such as startup costs, at what month the business will be profitable, and forecasted sales data

- Financing needed : Explanation of the startup funding sources and the amount of financing being requested

The bullets above can be combined into several paragraphs. You can add or remove sections based on your business’ needs. For example, if you don’t have a physical location, you might remove that piece of information. Or, if a web presence is crucial to your success, include two to three sentences about your online strategy .

Company Overview

The company overview (sometimes also called a “business overview”) section highlights your company successes (if you’re already in business) or why it will be successful (if you’re a startup). In the opening paragraph or paragraphs, provide information like location, owners, hours of operation, products, and services.

How you structure this section depends on whether you’re a startup or an established business. A startup will discuss the general expenses and steps needed to open the business, such as permits, build-outs, rent, and marketing. An established business will briefly discuss the company’s financial performance over the past three years.

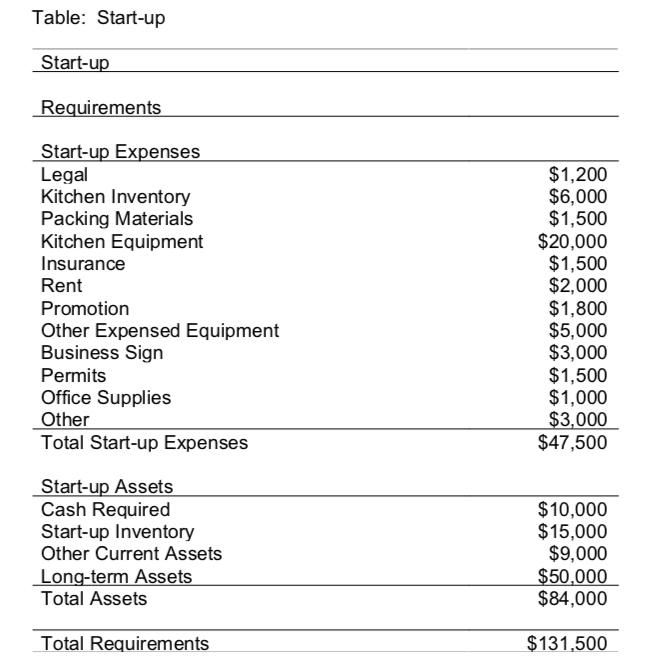

If you’re trying to raise capital from an investor or bank, include a chart listing the items your business will acquire with the capital. For example, if you’re purchasing equipment with the additional funding, list each piece of equipment and the associated cost. At the bottom of the chart, show the total of all expenses, which should be the requested amount of funding.

This startup cost table for a pizza restaurant separates startup expenses from startup assets.

Your company overview should cover the following:

- Location & Facilities : If you have a brick-and-mortar location or a facility, like a warehouse, describe it here. Detail the benefits of your location and the surrounding areas. Write about square footage, leases or ownership, the surrounding area, and a brief description of the population.

- Ownership : Briefly mention the company ownership team and their backgrounds. Show why these owners are likely to be successful in operating this business by providing certain details, such as each owner’s industry experience, previous employers, education, and awards. This will be discussed more in-depth in the management and organization section below.

- Competitive advantage : Ideally, your competitive advantage is what your business can do that your competitors cannot. It’s the one big differentiator that will make your company successful. Many investors are looking for specific competitive advantages, such as patents, proprietary tech, data, and industry relationships. If you don’t have these, describe the top aspect in which your business will do better than competitors, such as quality of products, quality of services, relationships with vendors, or marketing strategy.

Products & Services

The products and services section is the most flexible section because its structure depends on what your business sells. Regardless of what you’re selling, include a description of your business model to explain how your business makes money. Also include future products or services your business could provide one, two, or five years down the road.

List and describe all physical and digital products you plan to sell, as well as any services the business provides. Services don’t necessarily have to be sold for a cost—your business might offer entertainment, like live music or bar games as a free service.

Whether you’re selling products, services, or both, it’s important to discuss fulfillment, or how each will be delivered. If you make or sell physical products, describe how products will be sold, assembled, packed, and shipped. If your business is service-based, describe how a service, such as a window installation, will be ordered and completed. Where will the glass be purchased from and acquired, how will customers place orders, and how will the window be installed?

Market & Industry Analysis

The market and industry analysis section is where you analyze potential customers and the forces that influence your industry. This section is where you make the case as to why your business should succeed, ideally backed by data. You’ll want to do a deep dive into your competitors and discuss their challenges and successes. Learn more about sales targeting to improve how you approach your sales strategy.

Market Segmentation

Market segmentation, or your target market, consists of the customers who are most likely to purchase your products or services. Describe these groups of customers based on demographics, including attributes like age, income, location, and buying habits. Additionally, if you’ll be operating with a business-to-business (B2B) model, use characteristics to describe the ideal businesses to which you’ll sell.

Once your target market is segmented into groups, use market research data to show that those customers are physically located near your business (or are likely to do business with you if you’re online). If you’re opening a daycare, for example, you’ll want to show the data on how many families are in a certain mile radius around your business. You can obtain this kind of data from a free resource, like the U.S. Census and ReferenceUSA .

Once you have at least three segments, briefly outline the strategy you’ll use to reach them. Most likely it will be a combination of marketing, pricing, networking, and sales.

Learn the best approach to product pricing in our guide.

Industry Analysis

Take a look at your business’s industry and explain why it’s a great idea to start a business in that niche. If you’re in a growing industry, a bank is more likely to lend your business capital because it’s predicted to be in demand and have additional customers. Learn about how to find a niche market .

Find industry statistics from a free tool, like the Bureau of Labor Statistics , or a paid tool like the Hoovers Industry Research , which provides professionally curated reports for over 1,000 industries.

Competitor Research

Wrap up the market and industry analysis section by analyzing at least five competitors within a five-mile radius (expand the radius, if needed). Create a table with the five competitors and mention their distance from your business (if applicable), along with their challenges, and successes.

During your analysis, you’ll want to frame their challenges as something you can improve upon. Persuade your reader that your business will provide superior products and services than the competitors.

Marketing Strategy & Implementation Summary

In the opening paragraphs of your marketing strategy and implementation summary, give an overview of the subsections below.

Include any industry trends you may take advantage of. If applicable, include the advertising strategy and budget, stating specific channels. Mention who in the business will be responsible for overseeing the marketing.

Include any platforms and tools the business will use, like your website, social media, email marketing, and video. If you’re hiring a company to do any online work, like creating a website or managing social media, briefly describe them and the overall cost (you can elaborate more on costs in the financial data section ).

Don’t forget to include a subsection for your traditional marketing plan. Traditional marketing encompasses anything not online, such as business cards, flyers, local media, direct mail, magazine advertising, and signage.

Sales Strategy

If sales is an important component of your business, include a section about your sales strategy. Describe the role of the salesperson (or persons), strategies they’ll use to close the deal with clients, lead follow-up procedures, and networking they’ll attend. Also, list any training your sales staff will attend.

Sales Forecast Table

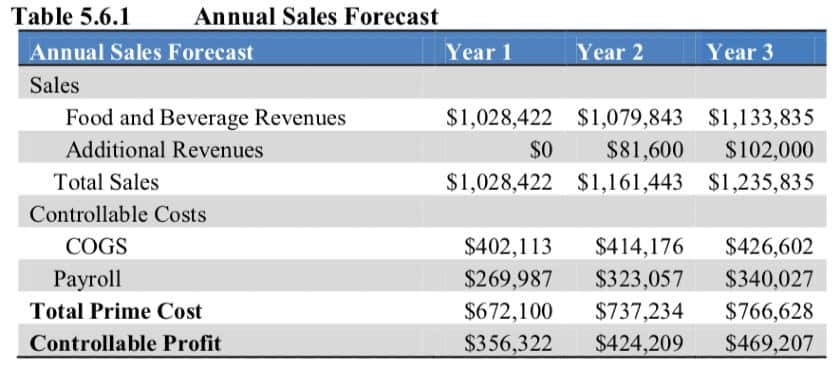

A sales forecast table gives a high-level summary of where you expect your sales and expenses to occur for each of the next three years in business. In the paragraph before the table, state where you expect growth to come from and include a growth percentage rate. The annual sales forecast chart will be broken down further in the financial projections section below.

The annual sales forecast for this restaurant summarizes sales, cost, and profit for the first three years in business.

Pricing Strategy

In the pricing strategy section, discuss product/service pricing, competitor pricing, sales promotions , and discounts—basically anything related to the pricing of what you sell. You should discuss pricing in relation to product and service quality as well. Consider including an overview of pricing for specific products, e.g., pizza price discounts when ordering a specific number of pizzas for catering.

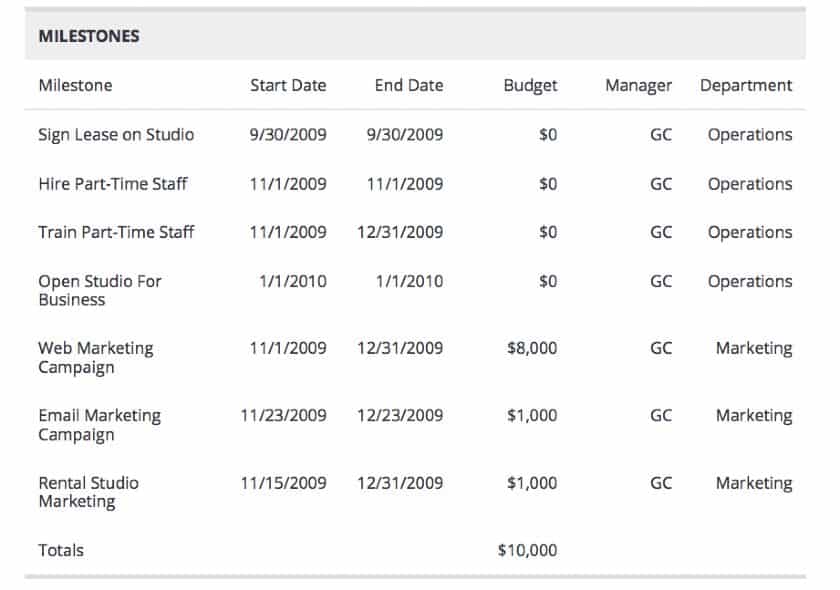

Milestones in a business plan are typically displayed in a table. They outline important tasks to do before the business opens (or expands, if already in business). For each milestone, include the name, estimated start and completion date, cost, person responsible, and department responsible (or outside company responsible). List at least seven milestones.

Milestones for this commercial photography business include hiring staff and completing marketing campaigns.

Management & Organization Summary

The management and organization summary is an in-depth look at the ownership background and key personnel. This is an important section because many investors say they don’t invest in companies, they invest in people. In this section, make the case why you and your team have the experience and knowledge to make this business a success.

Ownership Background

Discuss the owners’ backgrounds and place an emphasis on why that background will ensure the business succeeds. If you don’t have experience managing a retail business, consider finding a co-owner who does. Typically, banks won’t lend to someone who doesn’t have experience in the type of business they’re trying to open.

Management Team Gaps

If there are any experience or knowledge gaps within the management team, state them. List the consultants or employees you will hire to cover the gaps. Investors who know your industry well may recognize gaps within your business plan, and it’s important to state the gaps without waiting for the investor to bring it up. This makes it appear that you know the industry well.

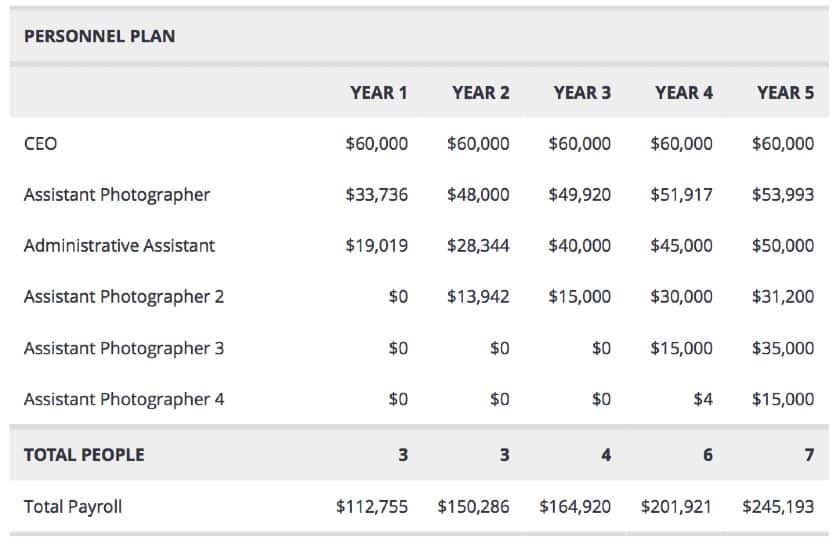

Personnel Plan

The personnel plan outlines every position within your business for at least the next three years. In the opening paragraph, discuss the roles within the company and who will report to whom. Include a table with at least three years of salary projections for each employee in your business. Include a total salary figure at the bottom. This table may be broken down further into salaries for each month in the financial projections or appendix.

This commercial photography business has the CEO at the same salary every year, with their employees’ salaries increasing year over year.

Financial Data & Analysis

The financial data and analysis section is the most difficult part of a business plan. This section requires you to forecast income and expenses for the next three years. You’ll need a working knowledge of common financial statements, like the profit and loss statement, balance sheet, and cash flow statement.

In the opening paragraphs of the financial data and analysis section, give an overview of the sections below. Discuss the break-even point and the projected profit at the first, second, and third year in business. State the assets and liabilities from the projected balance sheet as well.

If you’re getting a loan from a bank, say how long and from what source the loan will be repaid. One of the main pieces of information bankers want to ascertain from financial forecasting is if they will be paid back and how likely that is to happen.

You might also include the following financial reports:

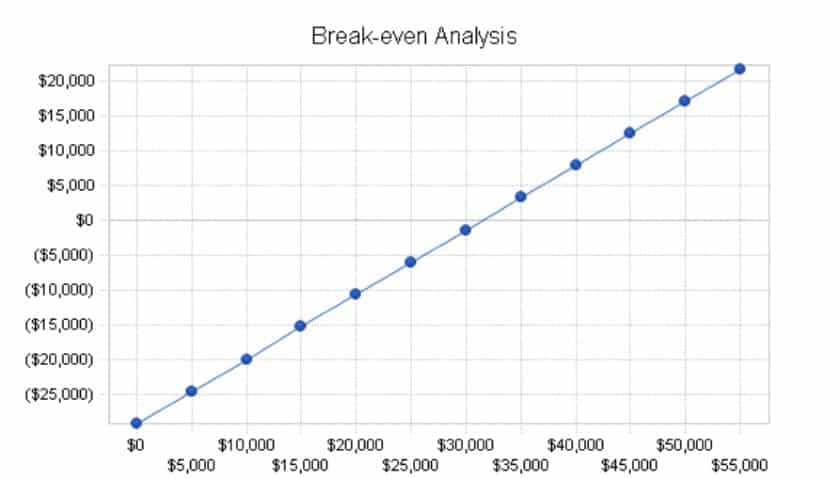

- Break-even analysis : Break-even is when your business starts to make money. Break-even analysis is where you illustrate the point at which your revenue exceeds expenses and a profit occurs. In this section’s opening paragraph, state your monthly fixed costs and average percent variable costs (cost that changes with output, like labor or cost of goods). In the example below, variable costs increase 8% for every additional dollar made.

The break-even point for this document shredding business is $31,500 in a month.

- Projected profit & loss: The profit and loss table is a month-by-month breakdown of income and expenses (including startup expenses). Typically, you should expect your business to show a profit within the first year of operating and increase in years two and three. Be sure to show income and expenses month-by-month for the first two years in operation. Create a separate chart that shows income and expenses year-by-year for the first three years.

- Projected cash flow : The cash flow section shows your business’s monthly incoming and outgoing cash. It should cover the first two years in business. Mention what you plan to do with excess cash. See how to run a statement cash flow in QuickBooks Online .

- Projected balance sheet: The balance sheet shows the net worth of the business and the financial position of the company on a specific date. It focuses on the assets and liabilities of the business. Ideally, the balance sheet should show that the net worth of your business increases. Prepare a projected year-by-year balance sheet for the first three years.

- Business ratios: Also called financial ratios, these are a way to evaluate business performance. It’s helpful to compare your projected business ratios to the industry standard. Project your business ratios by year for the first three years.

The appendix is where you put information about the business that doesn’t fit in the above categories. What you put here largely depends on the type of business you’re creating. It’s a good idea to put any visual components in the appendix. A restaurant might add an image of the menu and an artist rendering of the interior and exterior, for example.

Consider including the following items in your business plan appendix:

- Artist mock-up of interior

- Building permits

- Equipment documentation

- Incorporation documents

- Leases and agreements

- Letters of recommendation

- Licenses and permits

- Marketing materials

- Media coverage

- Supplier agreements

An appendix isn’t required in a business plan, but it’s highly recommended for additional persuasion. Documents like media coverage, agreements, and equipment documentation show the investor and banker you’re serious about the business. If your appendix is more than 10 pages, consider creating a second table of contents just for the appendix.

Detailed Financial Projections

Put the more detailed projections in the appendix. The financial projections in the previous section is typically a year-by-year breakdown for three years in the future. But many bankers and investors want to see the first two years broken down month-by-month for at least the profit and loss statement, balance sheet, cash flow, and personnel plan.

Typically, you can print out the spreadsheet in smaller font and include it in the appendix. You don’t need to create additional charts for the appendix.

With all of your information organized, now it’s time to add the final details, like cover pages and a nondisclosure agreement (NDA).

- Cover Page: The cover page provides contact information about the business and its owner. The cover page should have the business name and who prepared it, including your name, address, phone number, and email address. Additionally, if the registered company name with the state is different from the business name, you may want to add that as a “company name.”

- Nondisclosure Agreement: An NDA ((also called a confidentiality agreement) is a legal document that safeguards business information. You’d want someone to sign it before reading your business plan if you believe they could use the information to their advantage and your disadvantage, such as to steal your business idea or marketing strategy.

Fit Small Business provides a free non-disclosure agreement.

Once your final details are added, proofread all the sections of your business plan, ensuring that the information is accurate and that all spelling and grammar are correct. If there are any illustrations, projections, or additional information you forgot to include, now is the time to add it.

The final step is adding a table of contents so that bankers and potential investors can easily navigate your business plan. A table of contents lists the sections and subsections of your business plan. All of the headers above (Executive Summary, Business Objectives, Company Overview, Products and Services, and so on) are considered sections of a business plan. You can number the sections for additional organization. For example, 1.0 is the executive summary, 1.1 is the business objectives, and 1.2 is the mission statement.

Editing and formatting can change the pagination of your business plan. So you’ll save yourself work if you finalize the business plan content first, then arrange the table of contents at the end.

Congratulations! You’ve captured your business idea and plan for profitability on paper. Before you send this business plan to loan officers and potential investors, ask friends, family, and other supportive business owners to read it and provide feedback. They may notice typos or other errors that you missed. They may also identify details you can add to make your business plan more persuasive.

Frequently Asked Questions (FAQs) About How to Write a Business Plan

These are the most common questions I hear about writing a business plan.

What needs to be in a business plan?

What you should put in a business plan depends on its purpose and your industry. If you’re seeking funding from a bank or investor, you’re going to need most of the sections above, with a strong focus on your financial projections. If you are using your business plan to attract key employees (like a chef for your restaurant), mock-ups and vendor agreements will be more useful. Think about the information that will help your target reader make a decision about whether to get involved with your business—whether that is a location, a business model, or product idea—and be sure your business plan includes that information.

How do you write a business plan for a startup?

The business plan for a startup is similar to a business plan for an established business. The startup business plan will include startup costs, which will be listed by item and factored into the financial projections. Additionally, since your business hasn’t proven it can be successful yet, you may need additional information about the ownership, business model, market, and industry to convince the reader your business will succeed.

How long does it take to write a business plan?

A simple business plan may only take a couple of hours. However, for the business plan provided with this template, which includes financial projections, it may take over 60 hours to research the income and costs associated with running your business. You also have to format those costs into a chart, because it’s best to showcase the data with easy-to-understand charts.

Is writing a business plan hard?

Creating a business plan for funding from a bank or investor is a detailed process. Unless you have a background in financial statements, the financial projections may be difficult for the average business owner. But you can ask for help; it is common to hire a bookkeeper or accountant to assist you with financial projects to ensure your math is correct. Outside of the projections, most other business plan sections are simple, though you’ll want to give yourself time to make each section persuasive.

Every type of business, whether it’s a side hustle or a multimillion-dollar business, should have a business plan. The industry analysis and market segmentation sections validate your business idea. Researching and forecasting financial projections helps you logically think through income and expenses, which lessens the risk of business failure. Remember to get feedback on your business plan from business employees and associates. If necessary, have them sign an NDA before they review the plan.

About the Author

Find Mary On LinkedIn Twitter

Mary King is an expert restaurant and small business contributor at Fit Small Business. With more than a decade of small business experience, Mary has worked with some of the best restaurants in the world, and some of the most forward-thinking hospitality programs in the country. Mary’s firsthand operational experience ranges from independent food trucks to the grand scale of Michelin-starred restaurants, from small trades-based businesses to cutting-edge co-working spaces.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

Step-by-Step Guide to Writing a Simple Business Plan

By Joe Weller | October 11, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

A business plan is the cornerstone of any successful company, regardless of size or industry. This step-by-step guide provides information on writing a business plan for organizations at any stage, complete with free templates and expert advice.

Included on this page, you’ll find a step-by-step guide to writing a business plan and a chart to identify which type of business plan you should write . Plus, find information on how a business plan can help grow a business and expert tips on writing one .

What Is a Business Plan?

A business plan is a document that communicates a company’s goals and ambitions, along with the timeline, finances, and methods needed to achieve them. Additionally, it may include a mission statement and details about the specific products or services offered.

A business plan can highlight varying time periods, depending on the stage of your company and its goals. That said, a typical business plan will include the following benchmarks:

- Product goals and deadlines for each month

- Monthly financials for the first two years

- Profit and loss statements for the first three to five years

- Balance sheet projections for the first three to five years

Startups, entrepreneurs, and small businesses all create business plans to use as a guide as their new company progresses. Larger organizations may also create (and update) a business plan to keep high-level goals, financials, and timelines in check.

While you certainly need to have a formalized outline of your business’s goals and finances, creating a business plan can also help you determine a company’s viability, its profitability (including when it will first turn a profit), and how much money you will need from investors. In turn, a business plan has functional value as well: Not only does outlining goals help keep you accountable on a timeline, it can also attract investors in and of itself and, therefore, act as an effective strategy for growth.

For more information, visit our comprehensive guide to writing a strategic plan or download free strategic plan templates . This page focuses on for-profit business plans, but you can read our article with nonprofit business plan templates .

Business Plan Steps

The specific information in your business plan will vary, depending on the needs and goals of your venture, but a typical plan includes the following ordered elements:

- Executive summary

- Description of business

- Market analysis

- Competitive analysis

- Description of organizational management

- Description of product or services

- Marketing plan

- Sales strategy

- Funding details (or request for funding)

- Financial projections

If your plan is particularly long or complicated, consider adding a table of contents or an appendix for reference. For an in-depth description of each step listed above, read “ How to Write a Business Plan Step by Step ” below.

Broadly speaking, your audience includes anyone with a vested interest in your organization. They can include potential and existing investors, as well as customers, internal team members, suppliers, and vendors.

Do I Need a Simple or Detailed Plan?

Your business’s stage and intended audience dictates the level of detail your plan needs. Corporations require a thorough business plan — up to 100 pages. Small businesses or startups should have a concise plan focusing on financials and strategy.

How to Choose the Right Plan for Your Business

In order to identify which type of business plan you need to create, ask: “What do we want the plan to do?” Identify function first, and form will follow.

Use the chart below as a guide for what type of business plan to create:

Is the Order of Your Business Plan Important?

There is no set order for a business plan, with the exception of the executive summary, which should always come first. Beyond that, simply ensure that you organize the plan in a way that makes sense and flows naturally.

The Difference Between Traditional and Lean Business Plans

A traditional business plan follows the standard structure — because these plans encourage detail, they tend to require more work upfront and can run dozens of pages. A Lean business plan is less common and focuses on summarizing critical points for each section. These plans take much less work and typically run one page in length.

In general, you should use a traditional model for a legacy company, a large company, or any business that does not adhere to Lean (or another Agile method ). Use Lean if you expect the company to pivot quickly or if you already employ a Lean strategy with other business operations. Additionally, a Lean business plan can suffice if the document is for internal use only. Stick to a traditional version for investors, as they may be more sensitive to sudden changes or a high degree of built-in flexibility in the plan.

How to Write a Business Plan Step by Step

Writing a strong business plan requires research and attention to detail for each section. Below, you’ll find a 10-step guide to researching and defining each element in the plan.

Step 1: Executive Summary

The executive summary will always be the first section of your business plan. The goal is to answer the following questions:

- What is the vision and mission of the company?

- What are the company’s short- and long-term goals?

See our roundup of executive summary examples and templates for samples. Read our executive summary guide to learn more about writing one.

Step 2: Description of Business

The goal of this section is to define the realm, scope, and intent of your venture. To do so, answer the following questions as clearly and concisely as possible:

- What business are we in?

- What does our business do?

Step 3: Market Analysis

In this section, provide evidence that you have surveyed and understand the current marketplace, and that your product or service satisfies a niche in the market. To do so, answer these questions:

- Who is our customer?

- What does that customer value?

Step 4: Competitive Analysis

In many cases, a business plan proposes not a brand-new (or even market-disrupting) venture, but a more competitive version — whether via features, pricing, integrations, etc. — than what is currently available. In this section, answer the following questions to show that your product or service stands to outpace competitors:

- Who is the competition?

- What do they do best?

- What is our unique value proposition?

Step 5: Description of Organizational Management

In this section, write an overview of the team members and other key personnel who are integral to success. List roles and responsibilities, and if possible, note the hierarchy or team structure.

Step 6: Description of Products or Services

In this section, clearly define your product or service, as well as all the effort and resources that go into producing it. The strength of your product largely defines the success of your business, so it’s imperative that you take time to test and refine the product before launching into marketing, sales, or funding details.

Questions to answer in this section are as follows:

- What is the product or service?

- How do we produce it, and what resources are necessary for production?

Step 7: Marketing Plan

In this section, define the marketing strategy for your product or service. This doesn’t need to be as fleshed out as a full marketing plan , but it should answer basic questions, such as the following:

- Who is the target market (if different from existing customer base)?

- What channels will you use to reach your target market?

- What resources does your marketing strategy require, and do you have access to them?

- If possible, do you have a rough estimate of timeline and budget?

- How will you measure success?

Step 8: Sales Plan

Write an overview of the sales strategy, including the priorities of each cycle, steps to achieve these goals, and metrics for success. For the purposes of a business plan, this section does not need to be a comprehensive, in-depth sales plan , but can simply outline the high-level objectives and strategies of your sales efforts.

Start by answering the following questions:

- What is the sales strategy?

- What are the tools and tactics you will use to achieve your goals?

- What are the potential obstacles, and how will you overcome them?

- What is the timeline for sales and turning a profit?

- What are the metrics of success?

Step 9: Funding Details (or Request for Funding)

This section is one of the most critical parts of your business plan, particularly if you are sharing it with investors. You do not need to provide a full financial plan, but you should be able to answer the following questions:

- How much capital do you currently have? How much capital do you need?

- How will you grow the team (onboarding, team structure, training and development)?

- What are your physical needs and constraints (space, equipment, etc.)?

Step 10: Financial Projections

Apart from the fundraising analysis, investors like to see thought-out financial projections for the future. As discussed earlier, depending on the scope and stage of your business, this could be anywhere from one to five years.

While these projections won’t be exact — and will need to be somewhat flexible — you should be able to gauge the following:

- How and when will the company first generate a profit?

- How will the company maintain profit thereafter?

Business Plan Template

Download Business Plan Template

Microsoft Excel | Smartsheet

This basic business plan template has space for all the traditional elements: an executive summary, product or service details, target audience, marketing and sales strategies, etc. In the finances sections, input your baseline numbers, and the template will automatically calculate projections for sales forecasting, financial statements, and more.

For templates tailored to more specific needs, visit this business plan template roundup or download a fill-in-the-blank business plan template to make things easy.

If you are looking for a particular template by file type, visit our pages dedicated exclusively to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates.

How to Write a Simple Business Plan

A simple business plan is a streamlined, lightweight version of the large, traditional model. As opposed to a one-page business plan , which communicates high-level information for quick overviews (such as a stakeholder presentation), a simple business plan can exceed one page.

Below are the steps for creating a generic simple business plan, which are reflected in the template below .

- Write the Executive Summary This section is the same as in the traditional business plan — simply offer an overview of what’s in the business plan, the prospect or core offering, and the short- and long-term goals of the company.

- Add a Company Overview Document the larger company mission and vision.

- Provide the Problem and Solution In straightforward terms, define the problem you are attempting to solve with your product or service and how your company will attempt to do it. Think of this section as the gap in the market you are attempting to close.

- Identify the Target Market Who is your company (and its products or services) attempting to reach? If possible, briefly define your buyer personas .

- Write About the Competition In this section, demonstrate your knowledge of the market by listing the current competitors and outlining your competitive advantage.

- Describe Your Product or Service Offerings Get down to brass tacks and define your product or service. What exactly are you selling?

- Outline Your Marketing Tactics Without getting into too much detail, describe your planned marketing initiatives.

- Add a Timeline and the Metrics You Will Use to Measure Success Offer a rough timeline, including milestones and key performance indicators (KPIs) that you will use to measure your progress.

- Include Your Financial Forecasts Write an overview of your financial plan that demonstrates you have done your research and adequate modeling. You can also list key assumptions that go into this forecasting.

- Identify Your Financing Needs This section is where you will make your funding request. Based on everything in the business plan, list your proposed sources of funding, as well as how you will use it.

Simple Business Plan Template

Download Simple Business Plan Template

Microsoft Excel | Microsoft Word | Adobe PDF | Smartsheet

Use this simple business plan template to outline each aspect of your organization, including information about financing and opportunities to seek out further funding. This template is completely customizable to fit the needs of any business, whether it’s a startup or large company.

Read our article offering free simple business plan templates or free 30-60-90-day business plan templates to find more tailored options. You can also explore our collection of one page business templates .

How to Write a Business Plan for a Lean Startup

A Lean startup business plan is a more Agile approach to a traditional version. The plan focuses more on activities, processes, and relationships (and maintains flexibility in all aspects), rather than on concrete deliverables and timelines.

While there is some overlap between a traditional and a Lean business plan, you can write a Lean plan by following the steps below:

- Add Your Value Proposition Take a streamlined approach to describing your product or service. What is the unique value your startup aims to deliver to customers? Make sure the team is aligned on the core offering and that you can state it in clear, simple language.

- List Your Key Partners List any other businesses you will work with to realize your vision, including external vendors, suppliers, and partners. This section demonstrates that you have thoughtfully considered the resources you can provide internally, identified areas for external assistance, and conducted research to find alternatives.

- Note the Key Activities Describe the key activities of your business, including sourcing, production, marketing, distribution channels, and customer relationships.

- Include Your Key Resources List the critical resources — including personnel, equipment, space, and intellectual property — that will enable you to deliver your unique value.

- Identify Your Customer Relationships and Channels In this section, document how you will reach and build relationships with customers. Provide a high-level map of the customer experience from start to finish, including the spaces in which you will interact with the customer (online, retail, etc.).

- Detail Your Marketing Channels Describe the marketing methods and communication platforms you will use to identify and nurture your relationships with customers. These could be email, advertising, social media, etc.

- Explain the Cost Structure This section is especially necessary in the early stages of a business. Will you prioritize maximizing value or keeping costs low? List the foundational startup costs and how you will move toward profit over time.

- Share Your Revenue Streams Over time, how will the company make money? Include both the direct product or service purchase, as well as secondary sources of revenue, such as subscriptions, selling advertising space, fundraising, etc.

Lean Business Plan Template for Startups

Download Lean Business Plan Template for Startups

Microsoft Word | Adobe PDF

Startup leaders can use this Lean business plan template to relay the most critical information from a traditional plan. You’ll find all the sections listed above, including spaces for industry and product overviews, cost structure and sources of revenue, and key metrics, and a timeline. The template is completely customizable, so you can edit it to suit the objectives of your Lean startups.

See our wide variety of startup business plan templates for more options.

How to Write a Business Plan for a Loan

A business plan for a loan, often called a loan proposal , includes many of the same aspects of a traditional business plan, as well as additional financial documents, such as a credit history, a loan request, and a loan repayment plan.

In addition, you may be asked to include personal and business financial statements, a form of collateral, and equity investment information.

Download free financial templates to support your business plan.

Tips for Writing a Business Plan

Outside of including all the key details in your business plan, you have several options to elevate the document for the highest chance of winning funding and other resources. Follow these tips from experts:.

- Keep It Simple: Avner Brodsky , the Co-Founder and CEO of Lezgo Limited, an online marketing company, uses the acronym KISS (keep it short and simple) as a variation on this idea. “The business plan is not a college thesis,” he says. “Just focus on providing the essential information.”

- Do Adequate Research: Michael Dean, the Co-Founder of Pool Research , encourages business leaders to “invest time in research, both internal and external (market, finance, legal etc.). Avoid being overly ambitious or presumptive. Instead, keep everything objective, balanced, and accurate.” Your plan needs to stand on its own, and you must have the data to back up any claims or forecasting you make. As Brodsky explains, “Your business needs to be grounded on the realities of the market in your chosen location. Get the most recent data from authoritative sources so that the figures are vetted by experts and are reliable.”

- Set Clear Goals: Make sure your plan includes clear, time-based goals. “Short-term goals are key to momentum growth and are especially important to identify for new businesses,” advises Dean.

- Know (and Address) Your Weaknesses: “This awareness sets you up to overcome your weak points much quicker than waiting for them to arise,” shares Dean. Brodsky recommends performing a full SWOT analysis to identify your weaknesses, too. “Your business will fare better with self-knowledge, which will help you better define the mission of your business, as well as the strategies you will choose to achieve your objectives,” he adds.

- Seek Peer or Mentor Review: “Ask for feedback on your drafts and for areas to improve,” advises Brodsky. “When your mind is filled with dreams for your business, sometimes it is an outsider who can tell you what you’re missing and will save your business from being a product of whimsy.”

Outside of these more practical tips, the language you use is also important and may make or break your business plan.

Shaun Heng, VP of Operations at Coin Market Cap , gives the following advice on the writing, “Your business plan is your sales pitch to an investor. And as with any sales pitch, you need to strike the right tone and hit a few emotional chords. This is a little tricky in a business plan, because you also need to be formal and matter-of-fact. But you can still impress by weaving in descriptive language and saying things in a more elegant way.

“A great way to do this is by expanding your vocabulary, avoiding word repetition, and using business language. Instead of saying that something ‘will bring in as many customers as possible,’ try saying ‘will garner the largest possible market segment.’ Elevate your writing with precise descriptive words and you'll impress even the busiest investor.”

Additionally, Dean recommends that you “stay consistent and concise by keeping your tone and style steady throughout, and your language clear and precise. Include only what is 100 percent necessary.”

Resources for Writing a Business Plan

While a template provides a great outline of what to include in a business plan, a live document or more robust program can provide additional functionality, visibility, and real-time updates. The U.S. Small Business Association also curates resources for writing a business plan.

Additionally, you can use business plan software to house data, attach documentation, and share information with stakeholders. Popular options include LivePlan, Enloop, BizPlanner, PlanGuru, and iPlanner.

How a Business Plan Helps to Grow Your Business

A business plan — both the exercise of creating one and the document — can grow your business by helping you to refine your product, target audience, sales plan, identify opportunities, secure funding, and build new partnerships.

Outside of these immediate returns, writing a business plan is a useful exercise in that it forces you to research the market, which prompts you to forge your unique value proposition and identify ways to beat the competition. Doing so will also help you build (and keep you accountable to) attainable financial and product milestones. And down the line, it will serve as a welcome guide as hurdles inevitably arise.

Streamline Your Business Planning Activities with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to make a business plan

Table of Contents

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Join thousands of teams using Miro to do their best work yet.

- Small Business Tax Prep

Small Business Services

- Self-Employed

Small Business Owners

- Block Advisors News Center

- Build Your Business

- Manage Your Business

- All Categories

October 31, 2023

Block Advisors

How to Write a Business Plan Step-By-Step

October 31, 2023 • Block Advisors

QUICK ANSWER:

- A business plan outlines your business’s goals, services, financing, and more.

- Business plans vary in length and complexity but should always include an explanation of what your business will do and how it will do it.

- Business plans serve as a guide for business owners and employees and are key to boosting investor confidence.

Whether you’re a serial entrepreneur or just getting your first small business idea off the ground, creating a business plan is an important step. Good business planning will help you clarify your goals and objectives, identify strategies, and note any potential issues or roadblocks you might face.

Not every business owner chooses to write a business plan, but many find it to be a valuable step to take when starting a business. Creating a business plan can seem daunting and confusing at first. But taking the time to plan and research can be very beneficial, especially for first-time small business owners.

If you want to learn how to create a business plan or if you feel you just need a little business plan help, read on!

What is a Business Plan?

A business plan serves as a comprehensive document that outlines your business’s goals, services, financing, leadership, and more details essential to its success. Think of the plan as the who, what, and why of your new business:

Who are the major players in your business?

What goods or services do you offer and why are they important?

Why are you in business and why should customers choose you?

Business plans can range in complexity and length, but, at their core, all plans explain what the business will do and how it will do it. A business plan serves as a guide for business owners and employees and should boost investor confidence. Some important advantages of business plans include:

- Shows investors you have an in-demand product or service, a solid team to achieve business goals, and the potential for growth and scalability.

- Increases the likelihood of securing a business loan, locking in investments, or raising capital. >>Read: A Guide to Raising Capital as a Small Business Founder

- Helps recognize partnership opportunities with other companies.

- Identifies and defines competitors within your given industry.

Looking for an examples of a successful business plan? Check out the SBA’s business plan page for walkthroughs of different business plan outlines.

How to Write a Business Plan: 10 Simple Steps

Starting with a blank page is undoubtedly intimidating. So, begin with a structured business plan template including the key elements for each section. Once your outline is complete, it’ll be time to fill in the details. Don’t worry, you’ll know how to write a business plan in no time. We’ve broken each section down to help you write a business plan in a few simple steps.

1. Brainstorm and Draft an Executive Summary for Your Business Plan

This will be the first page of your business plan. Think of it as your business’ written elevator pitch. In this high level summary, include a mission statement, a short description of the products or services you will be providing, and a summary of your financial and growth projections.

This section will be the first part people read, but you may find it easier to write it last. Writing it after building out the rest of your plan may help you condense the most important information into a concise statement. You’ll need to streamline your thoughts from the other sections into a one page or less summary.

2. Create a Business Description

In this next section, describe your business. Add more specific details than the executive summary. You should include your business’s registered name, the address of your business’s location, basic information about your business structure , and the names of key people involved in the business.

The company description should also answer these two questions:

- Who are you?

- What do you plan to do?

Explain why you’re in business. Show how you are different from competitors. Tell investors why they should finance your company. This section is often more inspirational and emotional. Make sure you grab the reader’s attention. The goal is to get them to believe in your vision as much as you do.

What business structure is right for my company?

Answer these six questions to help you find your fit

3. Outline Your Business Goals

This section should serve as an objective statement. Explain what you want to accomplish and your timeline. Business goals and objectives give you a clear focus. They drive your business to success, so dream big. Include objectives that will help you reach each goal. Don’t forget to make your goals and objectives SMART – that is, they should be:

S pecific | M easurable | A ttainable | R elevant | T ime-bound

4. Conduct and Summarize Market Research

Next, outline your ideal customer with some research. Do the math to estimate the potential size of your target market. Make sure you are choosing the right market for your product, one with plenty of customers who want and need your product. Define your customer’s pain points. Explain your expertise in relation to the market. Show how your product or service fills an important gap and brings value to your customers. Use your findings to build out a value proposition statement.

5. Conduct a Competitive Analysis

In a similar way, you’ll also want to conduct and include a competitive analysis. The purpose of this analysis is to determine the strengths and weaknesses of competitors in your market, strategies that will give you a competitive advantage, and how your company is different. Some people choose to conduct a competitive analysis using the SWOT method .

6. Outline Your Marketing and Sales Strategies

Your marketing sales strategy can make or break your business. Your marketing plan should outline your current sales decisions as well as future marketing strategies. In this section, you should reiterate your value proposition, target markets, and customer segments. Then, include details such as:

- A launch plan

- Growth tactics and strategies

- A customer retention plan

- Advertising and promotion channels (i.e. social media, print, search engines, etc.)

7. Describe Your Product or Service

By this point, your products or services have probably been mentioned in several areas of the business plan. But it’s still important to include a separate section that outlines their key details. Describe what you’re offering and how it fits in the current market. Also include details about the benefits, production process, and life cycle of your products. If you have any trademarks or patents, include them here. This is also a good time to ask yourself, “Should my plan include visual aids?”

[ Read More Must-Have Tips to Start Your Small Business ]

8. Compile Financial Plans

Financial health is crucial to the success of any business. If you’re just starting your business, you likely won’t have financial data yet. However, you still need to prepare a budget and financial plan. If you have them, include income statements , balance sheets , and cash flow statements . You can also include reporting metrics such as net income and your ratio of liquidity to debt repayment ability.

If you haven’t launched your business yet, include realistic projections of the same information. Set clear financial goals and include projected milestones. Share information about the budget. What are the business operations costs? Ensure you are comprehensive when considering what costs you may need to prepare for.

9. Build a Management and Operations Plan

Identify your team members. Highlight their expertise and qualifications. Outline roles that still need to be filled now to establish your company and later as the business grows. Read More: 8 tax steps to take when hiring employees >>

Include a section detailing your logistics and operations plan. Consider all parts of your operation. Create a plan that provides details on suppliers, production, equipment, shipment and fulfillment, and inventory. This shows how your business will get done.

10. Create an Appendix – A Place for Additional Information and Documents

Lastly, assemble an organized appendix. This section can contain any other relevant information a reader might need to enhance their understanding of other sections. If you feel like the appendix is getting long, consider adding a table of contents at the beginning of this section. Appendices often include documents such as:

- Licenses and permits

- Bank statements

- Resumes of key employees

- Equipment leases

How to Create a Business Plan: The Bottom Line

A business plan helps you identify clear goals and provides your business direction. Many small business plans are 10-20 pages in length. But as long as the essentials are covered, feel empowered to build a plan that works for you and your company’s needs. Creating a business plan will help you identify your market and target customers, define business aims, and foster long-term financial health.

We’re ready to help you get your business started on the right foot today, and help you find long-term satisfaction as you pursue your business dream. Writing a business plan can be exciting. But if the steps to starting your business are feeling overwhelming, Block Advisors is here to help. Make an appointment today – our experts can assist you with tax prep , bookkeeping , payroll , business formation , and more .

Recommended for you

Defining employee compensation and taxable wages, a guide to raising capital as a small business founder, how to onboard new employees for their first day, find tax help in your area..

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, writing a business plan here’s how to do it, step by step.

At the foundation of every strong business is a solid business plan. Looking to develop a business plan for your new venture? Here’s what to include in each step.

In our Startup2021 series, we're helping aspiring entrepreneurs navigate the new business climate of the COVID-19 era. Each week, we'll share an in-depth look at one step you can to take toward launching your business in 2021.

At the foundation of every strong business is a solid business plan. A business plan outlines important information regarding a company’s operations and goals, and serves as a blueprint for how to achieve those goals. This document not only helps entrepreneurs think through and research their venture thoroughly, it also demonstrates to investors the viability of the business idea.

If you’re looking to develop a business plan for your new venture, it’s important to include all the necessary information. Here are the nine sections to include in a strong business plan, step by step.

1. Executive summary.

Your business plan should begin with an executive summary, which outlines what your company is about and why it will succeed. This section includes your mission statement, a brief description of the product or service you are offering, a summary of your plans and basic logistical details about your team.

2. Company description.

Your company description should further detail the logistics of your business, such as its registered name, address and key people involved. Here, you should also provide specific information about your product or service, including who your business serves and what problem you solve for that population.

3. Market analysis.

Conducting thorough market research can help you understand the nature of your industry, as well as how to stand out from competitors. Include a summary of your research findings in this section. Consider any trends or themes that emerge, what other successful businesses in the field are doing (or failing to do) and how your business can do better.

[Read: How to Conduct a Market Analysis ]

4. Organization and management.

This section should include your business’s legal structure — for example, whether you are incorporating as an S or C corporation, forming a partnership or operating as an LLC or sole proprietor. Provide pertinent information on your leadership team and other key employees, including each relevant individual’s percent of ownership and extent of involvement.

Describe how you will attract and retain your customer base, including what makes you stand out from competitors, and detail the actual sales process.

5. Products/services.

Your product or service is the crux of your business idea, so you’ll want to ensure you make a strong case for it being on the market. Use this section to elaborate on your product or service throughout its life cycle, including how it works, who it serves, what it costs and why it is better than the competition. If you have any pending or current intellectual property, include this information here. You can also detail any research and development for your product or service in this section.

6. Marketing and sales.

In this section, you should explain what your marketing and sales strategies are, and how you will execute them. (Note that these strategies will likely evolve over time, and you can always make adjustments as needed.) Describe how you will attract and retain your customer base, including what makes you stand out from competitors, and detail the actual sales process.

[Read: 5 KPIs to Measure Your Business’s Marketing Success ]

7. Funding request.

If you’re seeking funding, this section is critical for investors to understand the level of funding you need. Specify what type of funding you need (debt or equity) and how much, as well as how that capital will be used. You should also include information on any future financial plans, such as selling your business or paying off debts.

8. Financial projections.