Charity Business Plan Template

Written by Dave Lavinsky

Charity Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their charity companies. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a charity business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your charity business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

If you’re looking to start a charity business or grow your existing charity company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your charity business to improve your chances of success. Your charity business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Charity Businesses

With regards to funding, the main sources of funding for a charity business are personal savings, credit cards, bank loans, and major donors . When it comes to bank loans, banks will want to review your business plan (hand it to them in person or email to them as a PDF file) and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Donations and bank loans are the most common funding paths for charity companies.

Finish Your Business Plan Today!

How to write a business plan for a charity business.

If you want to start a charity business or expand your current one, you need a business plan. The guide and sample below details the necessary information for how to write each essential component of your charity business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of charity business you are running and the status. For example, are you a startup, do you have a charity business that you would like to grow, or are you operating more than one charity business?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overv iew of the charity business industry.

- Discuss the type of charity business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of charity business you are operating.

For example, you m ight specialize in one of the following types of charity businesses:

- Public charity business: A charity business that is defined by the Internal Revenue Service as a “public service support,” is one that benefits the public at large. This may include chambers of commerce, labor unions, and certain types of insurance companies. If a charity business fits within the specifications set by the IRS, the charity is considered a 501c3 entity, and receives preferential tax treatment.

- Private charity business: By far, the majority of charities fall within the category of “private charities,” which can be identified as serving a specific group of people. This may include philanthropic foundations, churches or synagogues, and other clubs or associations that serve via a privately-funded means. If a private charity business fits within the specifications set by the IRS, the charity is considered a 501c3 entity and receives preferential tax treatment.

In addition to explaining the type of charity business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of people served, the number of charitable outcomes, reaching X number of geographic locations, etc.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the charity business industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the charity business industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your charity business business plan:

- How big is the charity business industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your charity business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Donor Analysis

The donor analysis section of your charity business plan must detail the individuals or business entities who donate or those you expect to donate to your charitable business.

The following are examples of donor segments: individuals, families, foundations and corporations.

As you can imagine, the donor segment(s) you choose will have a great impact on the type of charity business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target donors in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential donors you seek.

Psychographic profiles explain the wants and needs of your target donors . The more you can recognize and define these needs, the better you will do in attracting and retaining your donors . Ideally you can speak with a sample of your target donors before writing your plan to better understand their needs.

Finish Your Charity Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are othe r charity businesses.

Indirect competitors are other options that donors may contribute to that aren’t directly competing with your product or service. This includes service-related charitable endeavors, private foundations, and organizations that serve specific communities, etc. You need to mention direct competition, as well.

For each direct competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of donors do they solicit ?

- What type of charity business are they?

- What is their donation model (cash, assets, estate-wealth)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the donors’ perspective. And don’t be afraid to ask your competitors’ donors what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide recognition for all your donors?

- Will you offer premium products or services for your top-tier donors?

- Will you provide consistent communication with your donors?

- Will you offer directorships or preferential placement for your donors?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a charity business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type o f charity company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide food for the homeless population? Will you improve the neighborhood park? Will you invest in artwork on behalf of your charity to support the art world?

Value : Document the specific value your charity provides and how that compares to your competitors. Essentially in the product and price sub-sections of yo ur plan, yo u are presenting the products and/or services you offer and their respective values.

Place : Place refers to the site of your charity company. Document where your company is situated and mention how the site will impact your success. For example, is your charity business located in an affluent neighborhood, a warehouse, a standalone office, or is it purely online? Discuss how your site might be the ideal location for the donors who contribute and the services you provide.

Promotions : The final part of your charity business marketing plan is where you will document how you will drive potential donors and charitable recipients to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your charity business, including answering calls, planning and providing fund-raising events or campaigns, correspondence with donors and charitable recipients, and maintaining records of acts of service.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to serve your Xth charity recipient, or when you hope to reach $X in donations. It could also be when you expect to expand your charity business to a new city.

Management Team

To demonstrate your charity business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing charity businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a charity business or top-tier donors who are regularly involved in your charity business.

Financial Plan

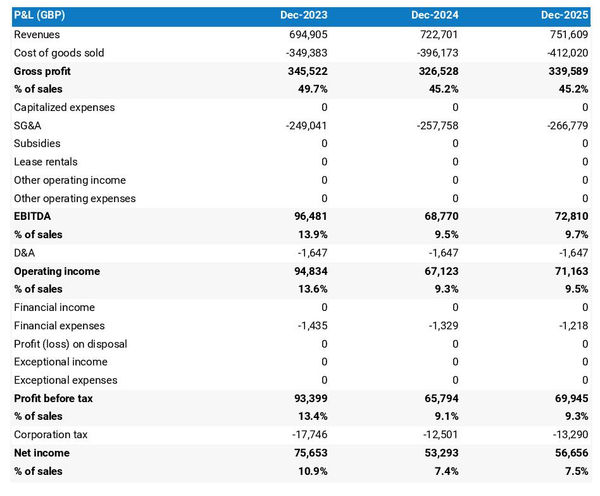

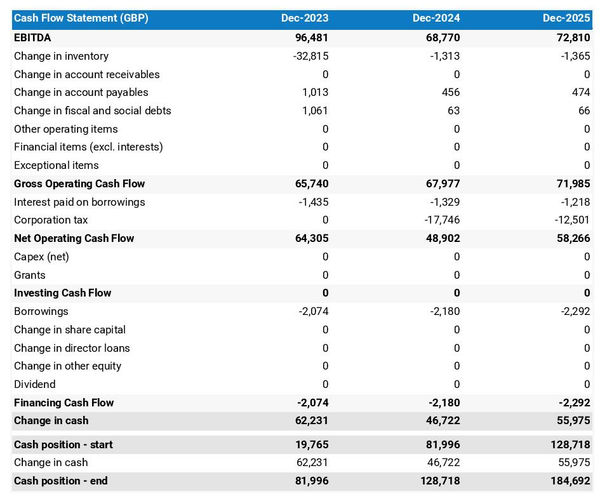

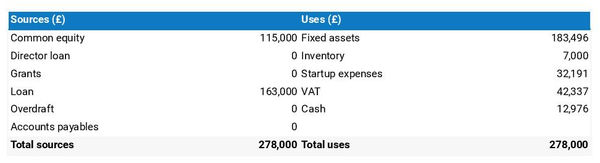

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your donation and gift income statement, balance s heet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. In a charity business, profits can be made through sales; however, the majority of income is received from donor gifts and activity. Your income statement will show several avenues of income as a result. It will demonstrate your receipts and then subtract your costs to show the IRS the activity of your 501c3 organization.

In developing your income statement, you need to devise assumptions. For example, will you hold 5 donor events each year, and/or offer acts of service weekly ? And will your charity business grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

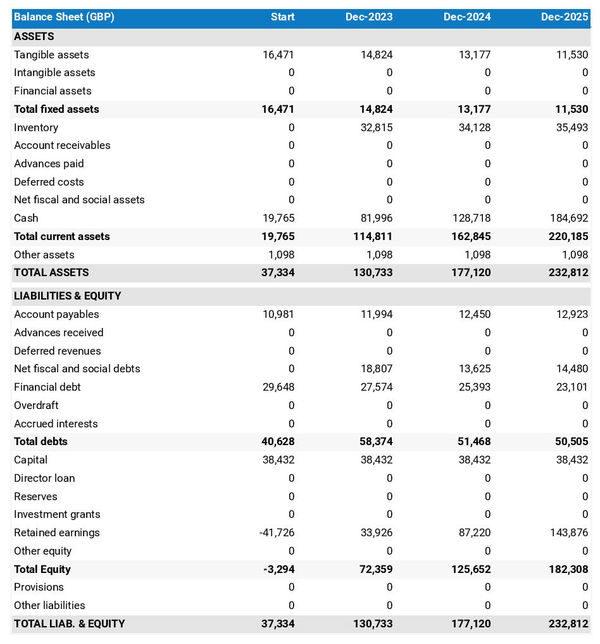

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your charity business, this will not give you an immediate return on the investment. Rather it is an asset that will hopefully help you maintain your charity business for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can generate gifts or assets , but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a charity business business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your list of top-tier donors, or examples of how your charity has changed lives or communities for the better.

Writing a business plan for your charity business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the charity business industry, your competition, and your donors. You will develop a marketing strategy and will understand what it takes to launch and grow a successful charity business.

Don’t you wish there was a faster, easier way to finish your Charity business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Charity Business Business Plan FAQs

What is the easiest way to complete my charity business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your charity business plan.

How Do You Start a Charity Business?

Starting a charity business is easy with these 14 steps:

- Choose the Name for Your Charity Business

- Create Your Charity Business Plan

- Choose the Legal Structure for Your Charity Business

- Secure Startup Funding for Your Charity Business (If Needed)

- Secure a Location for Your Business

- Register Your Charity Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Charity Business

- Buy or Lease the Right Charity Business Equipment

- Develop Your Charity Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Charity Business

- Open for Business

Where Can I Download a Free Business Plan Template PDF?

Click here to download the pdf version of our basic business plan template.

Our free business plan template pdf allows you to see the key sections to complete in your plan and the key questions that each must answer. The business plan pdf will definitely get you started in the right direction.

We do offer a premium version of our business plan template. Click here to learn more about it. The premium version includes numerous features allowing you to quickly and easily create a professional business plan. Its most touted feature is its financial projections template which allows you to simply enter your estimated sales and growth rates, and it automatically calculates your complete five-year financial projections including income statements, balance sheets, and cash flow statements. Here’s the link to our Ultimate Business Plan Template.

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Other Helpful Business Plan Articles & Templates

How to write a business plan for a small charity

Table of Contents

Description of charity

Explaining the audience, swot analysis, opportunities, financial projection, manage your finances for achieving objectives with countingup.

Typical businesses use a plan to secure funding by sharing it as a proposal to investors or forming part of an application to the bank for a loan. For a charity, though, there might be other uses to putting together a business plan . These may include the ability to set out a direction for your organisation or look for sizable donations, which may require you to share a plan.

This guide will make sure that you can get on with reaching your social objectives by showing you how to write a business plan for a charity. It includes:

For a social enterprise (charity), the business’ objectives are different from usual companies. Typical companies may aim to create wealth for the owner, for example. But, according to the UK Government , to be legally considered a charity, your organisation must have a charitable purpose. So the first thing to include in your business plan should be these aims.

If you can make it clear what the objectives of your business are, it provides a greater incentive for people to donate. It might also be helpful to explain why it’s the purpose you chose. With an objective, you should also describe how the organisation plans to help it. For example, if your charity aims to help blind people, they may look to fund guide dogs to be provided for them.

The other key element of your description of your charity should be how you plan to fund it. You may sell products, provide services or ask for donations. There may be other charities helping a similar cause, so you should also describe what makes you unique that will make people want to donate.

Charities rely on funding to fulfil their objectives. Without it, you may struggle to help those you would like to. As a result, running the organisation requires some business thinking. For example, identifying a target audience most likely to donate or pay for products/services shows that you are more likely to reach your goals.

To find your audience, you may have to carry out market research . Speak directly to those affected by the issue you aim to solve and those interested in helping your charity. You can gather information through surveys and interviews to find out as much as possible about your market. Another way to do this is by looking at similar charities’ focus and who they target.

It may be helpful for you to put together a customer profile (sometimes called customer avatar) to use your findings from your market research productively. By having a hypothetical person to think about, you can find insights for where you should be marketing to them and why they would donate.

A customer profile could include:

Putting these details together helps you describe how you plan to market your charity.

For more information on how to market your small business, see: How to Market Your Small Business Effectively: 9 Top Tips

It is essential to understand where the current position of your charity is to help you plan for the future. To think about all aspects of your business, you can do a SWOT analysis . This technique focuses on your strengths, weaknesses, opportunities and threats.

Your organisation’s strengths should provide the reasons that your charity is likely to achieve its goals. For example, you could mention the quotes and information of those who would benefit you in your marketing.

There are likely some weaknesses your charity may have. Identifying them lets you talk about how you will get over them. For example, if you lack experience in financial management, mention that you plan to use an app like Countingup to make it easier.

If you show that there are opportunities your organisation can take advantage of, it might give more confidence to someone willing to donate. For example, if a sports event is coming up later this year that relates to your cause, maybe you could partner with them.

Like any business, there may be potential threats to your charity. But by mentioning them, you can also say how you plan to avoid them. For example, if you sell donated things and you run out, mention your plans to make other things to sell.

Even though the primary purpose of the business is not to make a profit for the owners, it’s still essential that the charity covers its costs and makes enough to fund its social activities. So, it could be helpful to provide your business plan with some calculations to reassure those looking to donate towards your organisation that it will go towards a successful venture.

A sales forecast estimates the sales you expect. Multiply your planned prices for products, services or typical donation amounts by the number of customers you expect. Put this to a timescale of a month, quarter or year. You can refer to your projections in later stages and compare your performance.

This section may also be helpful for you to detail what the business would be hoping to use donations for specifically. For example, you may pay a marketing agency for a social media campaign if someone provides significant assistance. If you have a smaller donation, though, that may reach your particular objective.

It is important for your financial projection to be accurate and for you to monitor whether your business is sticking to your expectations. That’s why thousands of business owners use the Countingup app to make their financial admin easier.

Countingup is the business current account with built-in accounting software that allows you to manage all your financial data in one place. With features like automatic expense categorisation, you can see exactly where your costs are going in your charity. To make sure that you can fulfil the objectives of your organisation, cash flow insights let you receive reports about your finances. You can confidently keep on top of your business finances wherever you are.

You can also share your bookkeeping with your accountant instantly without worrying about duplication errors, data lags or inaccuracies. Seamless, simple, and straightforward!

Start your three-month free trial today. Find out more here .

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

Bookkeeping and accounting tips for hairdressers.

As a self-employed hairdresser or salon owner, bookkeeping and accounting can be hard

What expenses can you claim as a childminder?

Being a childminder can be a great way to earn extra income or

How to get more clients as a freelance makeup artist

Whether you’re a professional makeup artist, a bridal makeup artist or a student

How to start a supported living business

Starting a supported living business is a challenging, but incredibly rewarding, way to

How To Start A Vending Machine Business In The UK

Starting a business is a great way to become your own boss and

How to start a dog daycare business

If you think dogs are a treat to be around, you’re not alone.

How to start a babysitting business

If you love spending time with children and offer to babysit for family,

How to start a cat sitting business

Did you know that 24% of the UK population own a cat? That’s

Money laundering regulations for estate agents

In December 2020, the government issued the National risk assessment of money laundering

How to become a freelance bookkeeper

If you enjoy balancing books and organising business finances, becoming a freelance bookkeeper

How to sell jewellery designs to companies

Do you enjoy creating unique jewellery designs? If so, you might want to

How to become a self-employed labourer

Do you enjoy working with your hands and like the idea of being

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, how to write a nonprofit business plan.

A nonprofit business plan ensures your organization’s fundraising and activities align with your core mission.

Every nonprofit needs a mission statement that demonstrates how the organization will support a social cause and provide a public benefit. A nonprofit business plan fleshes out this mission statement in greater detail. These plans include many of the same elements as a for-profit business plan, with a focus on fundraising, creating a board of directors, raising awareness, and staying compliant with IRS regulations. A nonprofit business plan can be instrumental in getting your organization off the ground successfully.

Start with your mission statement

The mission statement is foundational for your nonprofit organization. The IRS will review your mission statement in determining whether to grant you tax-exempt status. This statement also helps you recruit volunteers and staff, fundraise, and plan activities for the year.

[Read more: Writing a Mission Statement: A Step-by-Step Guide ]

Therefore, you should start your business plan with a clear mission statement in the executive summary. The executive summary can also cover, at a high level, the goals, vision, and unique strengths of your nonprofit organization. Keep this section brief, since you will be going into greater detail in later sections.

Identify a board of directors

Many business plans include a section identifying the people behind the operation: your key leaders, volunteers, and full-time employees. For nonprofits, it’s also important to identify your board of directors. The board of directors is ultimately responsible for hiring and managing the CEO of your nonprofit.

“Board members are the fiduciaries who steer the organization towards a sustainable future by adopting sound, ethical, and legal governance and financial management policies, as well as by making sure the nonprofit has adequate resources to advance its mission,” wrote the Council of Nonprofits.

As such, identify members of your board in your business plan to give potential donors confidence in the management of your nonprofit.

Be as realistic as possible about the impact you can make with the funding you hope to gain.

Describe your organization’s activities

In this section, provide more information about what your nonprofit does on a day-to-day basis. What products, training, education, or other services do you provide? What does your organization do to benefit the constituents identified in your mission statement? Here’s an example from the American Red Cross, courtesy of DonorBox :

“The American Red Cross carries out their mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.”

This section should be detailed and get into the operational weeds of how your business delivers on its mission statement. Explain the strategies your team will take to service clients, including outreach and marketing, inventory and equipment needs, a hiring plan, and other key elements.

Write a fundraising plan

This part is the most important element of your business plan. In addition to providing required financial statements (e.g., the income statement, balance sheet, and cash flow statement), identify potential sources of funding for your nonprofit. These may include individual donors, corporate donors, grants, or in-kind support. If you are planning to host a fundraising event, put together a budget for that event and demonstrate the anticipated impact that event will have on your budget.

Create an impact plan

An impact plan ties everything together. It demonstrates how your fundraising and day-to-day activities will further your mission. For potential donors, it can make a very convincing case for why they should invest in your nonprofit.

“This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives,” wrote DonorBox . “These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.”

Be as realistic as possible about the impact you can make with the funding you hope to gain. Revisit your business plan as your organization grows to make sure the goals you’ve set both align with your mission and continue to be within reach.

[Read more: 8 Signs It's Time to Update Your Business Plan ]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Become a small business member and save!

Become an integral voice in the world’s largest business organization when you join the U.S. Chamber of Commerce as a small business member. Members also receive exclusive discounts from B2B partners, including a special offer from FedEx that can help your business save hundreds a year on shipping. Become a member today and start saving!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business strategies

5 business metrics you should analyze every year, how to file an insurance claim for your business, how to delegate tasks to an outside vendor.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Insights & Analysis

- Nonprofit Jobs

Business Planning for Nonprofits

Business planning is a way of systematically answering questions such as, “What problem(s) are we trying to solve?” or “What are we trying to achieve?” and also, “Who will get us there, by when, and how much money and other resources will it take?”

The business planning process takes into account the nonprofit’s mission and vision, the role of the board, and external environmental factors, such as the climate for fundraising.

Ideally, the business planning process also critically examines basic assumptions about the nonprofit’s operating environment. What if the sources of income that exist today change in the future? Is the nonprofit too reliant on one foundation for revenue? What happens if there’s an economic downturn?

A business plan can help the nonprofit and its board be prepared for future risks. What is the likelihood that the planned activities will continue as usual, and that revenue will continue at current levels – and what is Plan B if they don't?

Narrative of a business plan

You can think of a business plan as a narrative or story explaining how the nonprofit will operate given its activities, its sources of revenue, its expenses, and the inevitable changes in its internal and external environments over time. Ideally, your plan will tell the story in a way that will make sense to someone not intimately familiar with the nonprofit’s operations.

According to Propel Nonprofits , business plans usually should have four components that identify revenue sources/mix; operations costs; program costs; and capital structure.

A business plan outlines the expected income sources to support the charitable nonprofit's activities. What types of revenue will the nonprofit rely on to keep its engine running – how much will be earned, how much from government grants or contracts, how much will be contributed? Within each of those broad categories, how much diversification exists, and should they be further diversified? Are there certain factors that need to be in place in order for today’s income streams to continue flowing?

The plan should address the everyday costs needed to operate the organization, as well as costs of specific programs and activities.

The plan may include details about the need for the organization's services (a needs assessment), the likelihood that certain funding will be available (a feasibility study), or changes to the organization's technology or staffing that will be needed in the future.

Another aspect of a business plan could be a "competitive analysis" describing what other entities may be providing similar services in the nonprofit's service and mission areas. What are their sources of revenue and staffing structures? How do their services and capacities differ from those of your nonprofit?

Finally, the business plan should name important assumptions, such as the organization's reserve policies. Do your nonprofit’s policies require it to have at least six months of operating cash on hand? Do you have different types of cash reserves that require different levels of board approval to release?

The idea is to identify the known, and take into consideration the unknown, realities of the nonprofit's operations, and propose how the nonprofit will continue to be financially healthy. If the underlying assumptions or current conditions change, then having a plan can be useful to help identify adjustments that must be made to respond to changes in the nonprofit's operating environment.

Basic format of a business plan

The format may vary depending on the audience. A business plan prepared for a bank to support a loan application may be different than a business plan that board members use as the basis for budgeting. Here is a typical outline of the format for a business plan:

- Table of contents

- Executive summary - Name the problem the nonprofit is trying to solve: its mission, and how it accomplishes its mission.

- People: overview of the nonprofit’s board, staffing, and volunteer structure and who makes what happen

- Market opportunities/competitive analysis

- Programs and services: overview of implementation

- Contingencies: what could change?

- Financial health: what is the current status, and what are the sources of revenue to operate programs and advance the mission over time?

- Assumptions and proposed changes: What needs to be in place for this nonprofit to continue on sound financial footing?

More About Business Planning

Budgeting for Nonprofits

Strategic Planning

Contact your state association of nonprofits for support and resources related to business planning, strategic planning, and other fundamentals of nonprofit leadership.

Additional Resources

- Components of transforming nonprofit business models (Propel Nonprofits)

- The matrix map: a powerful tool for nonprofit sustainability (Nonprofit Quarterly)

- The Nonprofit Business Plan: A Leader's Guide to Creating a Successful Business Model (David La Piana, Heather Gowdy, Lester Olmstead-Rose, and Brent Copen, Turner Publishing)

- Nonprofit Earned Income: Critical Business Model Considerations for Nonprofits (Nonprofit Financial Commons)

- Nonprofit Sustainability: Making Strategic Decisions for Financial Viability (Jan Masaoka, Steve Zimmerman, and Jeanne Bell)

Disclaimer: Information on this website is provided for informational purposes only and is neither intended to be nor should be construed as legal, accounting, tax, investment, or financial advice. Please consult a professional (attorney, accountant, tax advisor) for the latest and most accurate information. The National Council of Nonprofits makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

How to Write a Nonprofit Business Plan

Angelique O'Rourke

13 min. read

Updated October 27, 2023

Believe it or not, creating a business plan for a nonprofit organization is not that different from planning for a traditional business.

Nonprofits sometimes shy away from using the words “business planning,” preferring to use terms like “strategic plan” or “operating plan.” But, the fact is that preparing a plan for a for-profit business and a nonprofit organization are actually pretty similar processes. Both types of organizations need to create forecasts for revenue and plan how they’re going to spend the money they bring in. They also need to manage their cash and ensure that they can stay solvent to accomplish their goals.

In this guide, I’ll explain how to create a plan for your organization that will impress your board of directors, facilitate fundraising, and ensures that you deliver on your mission.

- Why does a nonprofit need a business plan?

Good business planning is about setting goals, getting everyone on the same page, tracking performance metrics, and improving over time. Even when your goal isn’t to increase profits, you still need to be able to run a fiscally healthy organization.

Business planning creates an opportunity to examine the heart of your mission , the financing you’ll need to bring that mission to fruition, and your plan to sustain your operations into the future.

Nonprofits are also responsible for meeting regularly with a board of directors and reporting on your organization’s finances is a critical part of that meeting. As part of your regular financial review with the board, you can compare your actual results to your financial forecast in your business plan. Are you meeting fundraising goals and keeping spending on track? Is the financial position of the organization where you wanted it to be?

In addition to internal use, a solid business plan can help you court major donors who will be interested in having a deeper understanding of how your organization works and your fiscal health and accountability. And you’ll definitely need a formal business plan if you intend to seek outside funding for capital expenses—it’s required by lenders.

Creating a business plan for your organization is a great way to get your management team or board to connect over your vision, goals, and trajectory. Even just going through the planning process with your colleagues will help you take a step back and get some high-level perspective .

- A nonprofit business plan outline

Keep in mind that developing a business plan is an ongoing process. It isn’t about just writing a physical document that is static, but a continually evolving strategy and action plan as your organization progresses over time. It’s essential that you run regular plan review meetings to track your progress against your plan. For most nonprofits, this will coincide with regular reports and meetings with the board of directors.

A nonprofit business plan will include many of the same sections of a standard business plan outline . If you’d like to start simple, you can download our free business plan template as a Word document, and adjust it according to the nonprofit plan outline below.

Executive summary

The executive summary of a nonprofit business plan is typically the first section of the plan to be read, but the last to be written. That’s because this section is a general overview of everything else in the business plan – the overall snapshot of what your vision is for the organization.

Write it as though you might share with a prospective donor, or someone unfamiliar with your organization: avoid internal jargon or acronyms, and write it so that someone who has never heard of you would understand what you’re doing.

Your executive summary should provide a very brief overview of your organization’s mission. It should describe who you serve, how you provide the services that you offer, and how you fundraise.

If you are putting together a plan to share with potential donors, you should include an overview of what you are asking for and how you intend to use the funds raised.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Opportunity

Start this section of your nonprofit plan by describing the problem that you are solving for your clients or your community at large. Then say how your organization solves the problem.

A great way to present your opportunity is with a positioning statement . Here’s a formula you can use to define your positioning:

For [target market description] who [target market need], [this product] [how it meets the need]. Unlike [key competition], it [most important distinguishing feature].

And here’s an example of a positioning statement using the formula:

For children, ages five to 12 (target market) who are struggling with reading (their need), Tutors Changing Lives (your organization or program name) helps them get up to grade-level reading through a once a week class (your solution).

Unlike the school district’s general after-school homework lab (your state-funded competition), our program specifically helps children learn to read within six months (how you’re different).

Your organization is special or you wouldn’t spend so much time devoted to it. Layout some of the nuts and bolts about what makes it great in this opening section of your business plan. Your nonprofit probably changes lives, changes your community, or maybe even changes the world. Explain how it does this.

This is where you really go into detail about the programs you’re offering. You’ll want to describe how many people you serve and how you serve them.

Target audience

In a for-profit business plan, this section would be used to define your target market . For nonprofit organizations, it’s basically the same thing but framed as who you’re serving with your organization. Who benefits from your services?

Not all organizations have clients that they serve directly, so you might exclude this section if that’s the case. For example, an environmental preservation organization might have a goal of acquiring land to preserve natural habitats. The organization isn’t directly serving individual groups of people and is instead trying to benefit the environment as a whole.

Similar organizations

Everyone has competition —nonprofits, too. You’re competing with other nonprofits for donor attention and support, and you’re competing with other organizations serving your target population. Even if your program is the only one in your area providing a specific service, you still have competition.

Think about what your prospective clients were doing about their problem (the one your organization is solving) before you came on this scene. If you’re running an after-school tutoring organization, you might be competing with after school sports programs for clients. Even though your organizations have fundamentally different missions.

For many nonprofit organizations, competing for funding is an important issue. You’ll want to use this section of your plan to explain who donors would choose your organization instead of similar organizations for their donations.

Future services and programs

If you’re running a regional nonprofit, do you want to be national in five years? If you’re currently serving children ages two to four, do you want to expand to ages five to 12? Use this section to talk about your long-term goals.

Just like a traditional business, you’ll benefit by laying out a long-term plan. Not only does it help guide your nonprofit, but it also provides a roadmap for the board as well as potential investors.

Promotion and outreach strategies

In a for-profit business plan, this section would be about marketing and sales strategies. For nonprofits, you’re going to talk about how you’re going to reach your target client population.

You’ll probably do some combination of:

- Advertising: print and direct mail, television, radio, and so on.

- Public relations: press releases, activities to promote brand awareness, and so on.

- Digital marketing: website, email, blog, social media, and so on.

Similar to the “target audience” section above, you may remove this section if you don’t promote your organization to clients and others who use your services.

Costs and fees

Instead of including a pricing section, a nonprofit business plan should include a costs or fees section.

Talk about how your program is funded, and whether the costs your clients pay are the same for everyone, or based on income level, or something else. If your clients pay less for your service than it costs to run the program, how will you make up the difference?

If you don’t charge for your services and programs, you can state that here or remove this section.

Fundraising sources

Fundraising is critical for most nonprofit organizations. This portion of your business plan will detail who your key fundraising sources are.

Similar to understanding who your target audience for your services is, you’ll also want to know who your target market is for fundraising. Who are your supporters? What kind of person donates to your organization? Creating a “donor persona” could be a useful exercise to help you reflect on this subject and streamline your fundraising approach.

You’ll also want to define different tiers of prospective donors and how you plan on connecting with them. You’re probably going to include information about your annual giving program (usually lower-tier donors) and your major gifts program (folks who give larger amounts).

If you’re a private school, for example, you might think of your main target market as alumni who graduated during a certain year, at a certain income level. If you’re building a bequest program to build your endowment, your target market might be a specific population with interest in your cause who is at retirement age.

Do some research. The key here is not to report your target donors as everyone in a 3,000-mile radius with a wallet. The more specific you can be about your prospective donors —their demographics, income level, and interests, the more targeted (and less costly) your outreach can be.

Fundraising activities

How will you reach your donors with your message? Use this section of your business plan to explain how you will market your organization to potential donors and generate revenue.

You might use a combination of direct mail, advertising, and fundraising events. Detail the key activities and programs that you’ll use to reach your donors and raise money.

Strategic alliances and partnerships

Use this section to talk about how you’ll work with other organizations. Maybe you need to use a room in the local public library to run your program for the first year. Maybe your organization provides mental health counselors in local schools, so you partner with your school district.

In some instances, you might also be relying on public health programs like Medicaid to fund your program costs. Mention all those strategic partnerships here, especially if your program would have trouble existing without the partnership.

Milestones and metrics

Without milestones and metrics for your nonprofit, it will be more difficult to execute on your mission. Milestones and metrics are guideposts along the way that are indicators that your program is working and that your organization is healthy.

They might include elements of your fundraising goals—like monthly or quarterly donation goals, or it might be more about your participation metrics. Since most nonprofits working with foundations for grants do complex reporting on some of these, don’t feel like you have to re-write every single goal and metric for your organization here. Think about your bigger goals, and if you need to, include more information in your business plan’s appendix.

If you’re revisiting your plan on a monthly basis, and we recommend that you do, the items here might speak directly to the questions you know your board will ask in your monthly trustee meeting. The point is to avoid surprises by having eyes on your organization’s performance. Having these goals, and being able to change course if you’re not meeting them, will help your organization avoid falling into a budget deficit.

Key assumptions and risks

Your nonprofit exists to serve a particular population or cause. Before you designed your key programs or services, you probably did some research to validate that there’s a need for what you’re offering.

But you probably are also taking some calculated risks. In this section, talk about the unknowns for your organization. If you name them, you can address them.

For example, if you think there’s a need for a children’s literacy program, maybe you surveyed teachers or parents in your area to verify the need. But because you haven’t launched the program yet, one of your unknowns might be whether the kids will actually show up.

Management team and company

Who is going to be involved and what are their duties? What do these individuals bring to the table?

Include both the management team of the day-to-day aspects of your nonprofit as well as board members and mention those who may overlap between the two roles. Highlight their qualifications: titles, degrees, relevant past accomplishments, and designated responsibilities should be included in this section. It adds a personal touch to mention team members who are especially qualified because they’re close to the cause or have special first-hand experience with or knowledge of the population you’re serving.

There are probably some amazing, dedicated people with stellar qualifications on your team—this is the place to feature them (and don’t forget to include yourself!).

Financial plan

The financial plan is essential to any organization that’s seeking funding, but also incredibly useful internally to keep track of what you’ve done so far financially and where you’d like to see the organization go in the future.

The financial section of your business plan should include a long-term budget and cash flow statement with a three to five-year forecast. This will allow you to see that the organization has its basic financial needs covered. Any nonprofit has its standard level of funding required to stay operational, so it’s essential to make sure your organization will consistently maintain at least that much in the coffers.

From that point, it’s all about future planning: If you exceed your fundraising goals, what will be done with the surplus? What will you do if you don’t meet your fundraising goals? Are you accounting for appropriate amounts going to payroll and administrative costs over time? Thinking through a forecast of your financial plan over the next several years will help ensure that your organization is sustainable.

Money management skills are just as important in a nonprofit as they are in a for-profit business. Knowing the financial details of your organization is incredibly important in a world where the public is ranking the credibility of charities based on what percentage of donations makes it to the programs and services. As a nonprofit, people are interested in the details of how money is being dispersed within organizations, with this information often being posted online on sites like Charity Navigator, so the public can make informed decisions about donating.

Potential contributors will do their research—so make sure you do too. No matter who your donors are, they will want to know they can trust your organization with their money. A robust financial plan is a solid foundation for reference that your nonprofit is on the right track.

- Business planning is ongoing

It’s important to remember that a business plan doesn’t have to be set in stone. It acts as a roadmap, something that you can come back to as a guide, then revise and edit to suit your purpose at a given time.

I recommend that you review your financial plan once a month to see if your organization is on track, and then revise your plan as necessary .

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Angelique is a skilled writer, editor, and social media specialist, as well as an actor and model with a demonstrated history of theater, film, commercial and print work.

Table of Contents

Related Articles

7 Min. Read

8 Steps to Write a Useful Internal Business Plan

14 Min. Read

How to Write a Five-Year Business Plan

11 Min. Read

Fundamentals of Lean Planning Explained

5 Min. Read

How to Write a Growth-Oriented Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

How To Write a Business Plan for Charity & Nonprofit Marketplace in 9 Steps: Checklist

By alex ryzhkov, resources on charity & nonprofit marketplace.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

Welcome to our blog post on how to write a business plan for the charity and nonprofit marketplace! With the growing demand for socially impactful initiatives, it's crucial for organizations in this industry to have a solid plan in place. Did you know that the volunteer-based model is the most common and sought-after business model for nonprofits in the US? According to recent statistics, volunteerism in the US has been steadily increasing, with around 77.4 million Americans volunteering their time in 2020 alone (source: Bureau of Labor Statistics) . In this article, we will guide you through the essential steps to create a comprehensive business plan that will set your organization up for success.

The first step in writing a business plan for the charity and nonprofit marketplace is to identify the mission and vision of your organization. This will serve as the foundation for all your activities and guide your decision-making process. Next, conducting thorough market research and analyzing the current landscape will help you understand the existing challenges, opportunities, and trends in the industry.

Defining your target audience and beneficiaries is crucial to ensure that your organization is effectively addressing the needs of the community. Identifying potential partners and collaborators can also greatly enhance your reach and impact. Additionally, determining the legal structure of your organization and obtaining necessary registrations will ensure compliance and credibility.

A clear financial plan and budget are essential for any nonprofit. It is crucial to identify potential funding sources, create a realistic budget, and develop strategies for sustainability. Establishing key performance indicators and metrics for success will help you measure your progress and make informed decisions.

Creating a marketing and communication strategy is essential to raise awareness about your organization's mission and attract support. Finally, developing a strategic plan to guide your organization's activities is crucial for achieving long-term goals and making a significant impact in your community.

By following these nine steps, you can ensure that your business plan for the charity and nonprofit marketplace is comprehensive, strategic, and well-prepared. Stay tuned for our in-depth articles on each step, where we will provide valuable insights and practical tips to help you succeed in this rewarding industry.

Identify The Mission And Vision Of The Charity & Nonprofit Marketplace

At the core of every successful charity and nonprofit marketplace is a clear and compelling mission and vision statement. These statements serve as the foundation for the organization's purpose and guide its activities and decision-making processes. By identifying and articulating the mission and vision, the charity or nonprofit marketplace can establish a sense of direction and communicate its goals to stakeholders.

The mission statement should succinctly describe the purpose of the organization and the impact it aims to make in the community or cause it serves. It should answer the question of why the organization exists and what specific problem it seeks to address. The mission statement should be concise, memorable, and clearly convey the organization's values and principles.

- Ensure the mission statement aligns with the organization's goals and activities.

- Include specific and measurable language to define the desired impact.

- Consider involving key stakeholders, such as volunteers and beneficiaries, in the development process to ensure inclusivity and diversity of perspectives.

The vision statement, on the other hand, presents a future-oriented picture of what the organization aspires to achieve in the long term. It serves as a guiding light and inspires stakeholders to work towards a common goal. A well-crafted vision statement creates a sense of motivation and purpose, helping the charity or nonprofit marketplace to stay focused on its ultimate objective.

- Frame the vision statement in a way that captures the imagination and inspires action.

- Ensure the vision is realistic and achievable, yet ambitious enough to drive progress.

- Regularly review and revise the mission and vision statements to ensure they remain relevant to the organization's evolving needs and goals.

- Identify the mission and vision of the charity and nonprofit marketplace to establish a clear purpose and direction.

- To develop a compelling mission statement, succinctly describe the purpose, impact, values, and principles of the organization.

- Create a future-oriented vision statement that inspires stakeholders and aligns with the organization's long-term goals.

Conduct Market Research And Analyze The Current Landscape

Market research is a crucial step in developing a successful business plan for the charity and nonprofit marketplace. By conducting thorough research and analyzing the current landscape, you can gain valuable insights that will inform your strategy and help you stand out in a crowded market.

When conducting market research, consider the following:

- Identify the existing nonprofits: Take note of the nonprofits operating in your chosen cause area. Analyze their missions, programs, and impact to understand what sets them apart and how you can differentiate your organization.

- Assess the community needs: Understand the specific needs and challenges within your target community. This will help you tailor your programs and services to address those needs effectively.

- Analyze the competitive landscape: Identify the key players in your field, including both nonprofits and other organizations with similar missions. Evaluate their strengths, weaknesses, and strategies to identify opportunities for collaboration or areas where you can offer a unique value proposition.

- Study donor behaviors: Understand the motivations and preferences of potential donors. This will inform your fundraising efforts and enable you to develop targeted strategies to attract and retain donors.

Tips for conducting market research:

- Utilize online resources such as nonprofit directories, industry reports, and social media platforms to gather information about existing nonprofits and their impact.

- Engage with local community members and stakeholders to gain firsthand knowledge of the specific needs and challenges in your target area.

- Survey potential donors and volunteers to understand their motivations, expectations, and preferences.

- Stay updated on industry trends, news, and emerging practices to stay ahead of the curve in your market.

By conducting comprehensive market research and analyzing the current landscape, you will gain valuable insights that will shape your business plan. This step sets the foundation for a strategic approach, allowing you to identify your unique positioning and develop strategies that resonate with your target audience.

Define The Target Audience And Beneficiaries

Defining the target audience and beneficiaries of your charity or nonprofit organization is a critical step in creating a successful business plan. Identifying who your organization aims to serve will guide your decisions, strategies, and resource allocation. It ensures that your efforts are focused on addressing the specific needs of your intended beneficiaries, increasing the impact and effectiveness of your programs.

When defining your target audience, consider the demographics, psychographics, and characteristics that make up the group of individuals or communities you aim to reach. This may include factors such as age, gender, location, income level, education, interests, and values. The more specific and targeted your audience definition, the better you can tailor your programs and services to meet their unique needs.

Additionally, consider the beneficiaries of your organization's activities. These are the individuals or groups who directly benefit from the services and support provided by your nonprofit. Clearly identifying and understanding the needs and challenges faced by these beneficiaries is crucial in developing impactful programs and initiatives. For example, if your charity focuses on providing food assistance, your beneficiaries may include low-income families, homeless individuals, or elderly populations with limited access to nutritious meals.

A thorough understanding of your target audience and beneficiaries will enable you to create tailored and effective solutions that truly make a positive difference in their lives. It will also help you in crafting compelling messaging and designing targeted outreach efforts to reach and engage the right people.

Tips for Defining Your Target Audience and Beneficiaries:

- Conduct surveys, interviews, and focus groups to gather insights directly from your target audience and beneficiaries.

- Utilize existing data and research on similar demographics to develop a clearer understanding of their needs and preferences.

- Consider collaborating with other organizations or experts who have experience working with similar target audiences for valuable insights.

- Regularly review and update your audience definition as your organization evolves and new information becomes available.

Identify Potential Partners And Collaborators

Identifying potential partners and collaborators is a crucial step in building a successful charity or nonprofit organization. These partnerships can provide valuable resources, expertise, and support that will contribute to the overall mission and impact of your organization. Here are some important considerations when identifying potential partners and collaborators:

- Shared Values: Look for partners and collaborators who share similar values and a passion for the cause you are supporting. Finding individuals or organizations that align with your mission will create a stronger foundation and increase the likelihood of a successful partnership.

- Complementary Expertise: Identify partners and collaborators who bring unique skills and expertise to the table. Look for individuals or organizations that can fill gaps in your organization's capabilities and help you achieve your goals more efficiently.

- Established Networks: Consider partnering with organizations or individuals who have established networks within the nonprofit or charitable sector. These networks can give your organization access to new audiences, potential donors, and additional resources.

- Strategic Alliances: Explore opportunities for strategic alliances with other nonprofit organizations or businesses that have similar goals. By collaborating with like-minded organizations, you can amplify your efforts and create a bigger impact together.

- Research and network within the nonprofit and charitable sector to identify potential partners and collaborators.

- Attend industry conferences, workshops, and networking events to meet like-minded individuals and organizations.

- Utilize online platforms and social media to connect with potential partners and collaborators.

- Develop a clear value proposition and articulate the benefits of partnership to attract potential partners.

Remember, effective partnerships and collaborations can help your organization broaden its reach, enhance its capabilities, and ultimately achieve its mission more effectively. Take the time to identify the right partners, nurture those relationships, and work together to create a positive and lasting impact on the communities you serve.

Determine The Legal Structure And Obtain Necessary Registrations

Determining the legal structure of your charity or nonprofit organization is a critical step in ensuring its stability and compliance with relevant laws and regulations. It is important to carefully consider the options available and choose the structure that best aligns with your organization's goals and activities.

Here are some important considerations when determining the legal structure:

- Research the types of legal structures: Familiarize yourself with the various legal structures available for nonprofit organizations, such as 501(c)(3) status, which offers tax-exempt status and allows donors to receive tax deductions for their contributions.

- Consult with legal professionals: Seek guidance from an attorney or legal consultant who specializes in nonprofit law. They can provide valuable insights and help you navigate the complexities of legal requirements.

- Consider governance issues: Assess the governance structure and decide on options such as having a board of directors, trustees, or executive committees. Define the roles and responsibilities of each governing body to ensure efficient decision-making and accountability.

- Register with the appropriate authorities: Once you have determined the legal structure, you will need to register your organization with the relevant authorities, such as the state's Secretary of State office, to obtain the necessary legal status and recognition.

Helpful Tips:

- Research local, state, and federal laws pertaining to nonprofit organizations in your area to ensure compliance.

- Consider consulting with an accountant to understand any financial reporting requirements specific to your legal structure.

- Ensure you have a comprehensive understanding of the legal obligations and responsibilities that come with your chosen legal structure to protect the integrity of your organization.

By taking the time to determine the legal structure and obtain the necessary registrations, you are setting your charity or nonprofit organization on a solid foundation for success, ensuring compliance, and gaining credibility in the eyes of donors, partners, and the community you serve.

Develop A Clear Financial Plan And Budget

A clear financial plan is crucial for the success of any charity or nonprofit organization. It helps in ensuring financial stability, managing resources effectively, and achieving the organization's goals and objectives. Here are the steps to develop a clear financial plan and budget:

- Assess the organization's current financial situation: Start by reviewing your organization's current financial status. Evaluate your assets, liabilities, and existing sources of income. This will provide a foundation for building your financial plan.

- Set financial goals: Clearly define your financial goals and objectives. Determine the amount of funding required to sustain and expand your organization's operations. This will help you understand the scale of financial support you need to seek.

- Identify potential sources of income: Explore different funding options such as grants, donations, sponsorships, fundraising events, and government support. Consider diversifying your revenue streams to reduce dependency on a single source.

- Create a detailed budget: This is the core of your financial plan. Develop a comprehensive budget that outlines the expected income and expenses for each project or program. Include both fixed and variable costs to provide a realistic estimate of your organization's financial requirements.

- Allocate resources wisely: Once you have a budget in place, allocate resources in a way that aligns with your organization's priorities. Ensure that necessary funds are allocated to critical programs and operational expenses.

- Implement financial controls: Establish financial controls and policies that govern spending, expense reimbursement, and financial reporting. This will ensure transparency, accuracy, and accountability in managing the organization's finances.

- Monitor and review: Regularly monitor your financial performance against the budget and make necessary adjustments. Conduct periodic reviews to assess the effectiveness of your financial plan and identify areas for improvement.

- Consider seeking professional guidance from an accountant or financial advisor to develop a robust financial plan.

- Regularly communicate your financial goals, progress, and achievements with donors and stakeholders to build trust and transparency.

- Stay up-to-date with relevant tax regulations and reporting requirements to ensure compliance.

- Build contingencies into your financial plan to mitigate unforeseen expenses or funding gaps.

- Align your financial plan with your organization's mission and strategic objectives to maximize impact.

Establish Key Performance Indicators And Metrics For Success

When it comes to running a successful charity or nonprofit organization, establishing key performance indicators (KPIs) and metrics for success is crucial. These measurements will help you track your progress, evaluate your impact, and make informed decisions to ensure your organization is effectively meeting its goals. Here are some important steps to consider when establishing KPIs and metrics for success:

- Align KPIs with the mission and vision: Start by identifying the key objectives and goals of your organization. Your KPIs should align directly with these objectives, ensuring that you measure what matters most to the success and impact of your organization.

- Choose relevant metrics: Select specific metrics that will provide meaningful data related to your organization's activities and outcomes. Whether it's the number of beneficiaries served, funds raised, or volunteer retention rates, choose metrics that accurately reflect the progress and impact of your organization.

- Set measurable targets: Establish clear benchmarks or targets for each KPI. These targets should be specific, measurable, attainable, relevant, and time-bound (SMART) to provide a clear framework for evaluating your organization's performance. Regularly assess your progress towards these targets to identify areas of improvement.

- Regularly track and analyze data: Implement systems and processes that allow you to collect and analyze data related to your chosen metrics. This may involve using tracking tools, surveys, or other data collection methods. Regularly review this data to assess your progress, identify trends, and make data-driven decisions.

- Communicate and report: Establish a regular reporting process to keep your board, staff, and stakeholders informed about the organization's progress towards its KPIs. Prepare clear and concise reports that highlight both successes and challenges, and use this information to inform strategic discussions and actions.

- Focus on quality over quantity when choosing your KPIs. It's better to track a few meaningful metrics effectively than to track numerous metrics that provide little actionable insight.

- Regularly revisit and evaluate your KPIs to ensure they remain relevant to your organization's evolving mission and goals. Adjust them if necessary to reflect changing priorities or strategies.

- Engage your staff, volunteers, and beneficiaries in the KPI-setting process. Their input can help you identify additional metrics that capture the nuances of your organization's impact.

Create A Marketing And Communication Strategy

Marketing and communication are essential for the success and growth of any charity or nonprofit organization. A well-planned strategy helps in raising awareness, attracting donors and volunteers, and building a positive reputation in the community. Here are some important steps to create an effective marketing and communication strategy:

- Identify Your Target Audience: Determine who your organization wants to reach with its message. Understand their demographics, interests, and motivations to tailor your communication efforts.

- Define Your Unique Selling Proposition: Identify what sets your organization apart from others in the nonprofit marketplace. Highlight the key benefits and impact of your work to attract supporters.

- Establish Clear Communication Goals: Set specific objectives for your marketing and communication efforts. Whether it's increasing donations, volunteer recruitment, or community engagement, having clear goals ensures focused messaging.

- Create Compelling Content: Develop engaging and inspiring content that aligns with your mission and resonates with your target audience. This can include blog posts, social media updates, videos, and impactful stories.

- Utilize Multiple Communication Channels: Determine the most effective channels to reach your target audience. This could include social media platforms, email newsletters, website, press releases, events, and partnerships.

- Build Relationships: Cultivate strong relationships with your donors, volunteers, and beneficiaries. Regularly communicate with them, express gratitude, and keep them updated on the impact of their support.

- Measure and Analyze Results: Track the effectiveness of your marketing and communication efforts. Monitor metrics such as website traffic, social media engagement, email open rates, and donation patterns to refine your strategy.

Tips for Creating an Effective Marketing and Communication Strategy:

- Develop a consistent brand identity that reflects your organization's values and resonates with your target audience.

- Use storytelling techniques to convey the impact of your work and evoke emotions in your audience.

- Engage with your supporters by responding to their comments, messages, and inquiries promptly and thoughtfully.

- Collaborate with influencers, media outlets, and other organizations to amplify your message and reach a wider audience.

- Regularly review and update your marketing and communication strategy to adapt to changing trends and audience preferences.

By creating a well-thought-out marketing and communication strategy, your charity or nonprofit organization can effectively convey its mission, attract supporters, and make a significant impact in the charity and nonprofit marketplace.

Develop a Strategic Plan to Guide the Organization's Activities