Options Assignment: Navigating the Rights and Obligations

By Tyler Corvin

Ever been blindsided by an unexpected traffic ticket in the mail?

You knew driving came with its set of potential consequences, yet you took to the road regardless. Suddenly, you’re left with a tangible obligation to pay. This unforeseen shift, where what was once a mere possibility becomes an immediate reality, captures the spirit of options assignment within the vast realm of options trading.

Diving into the details, option assignment serves as the bridge between the abstract realm of rights and the concrete world of duties in this field. It’s that unassuming piece in the machinery that can, without warning, change the entire game – often carrying notable financial repercussions. In a domain where every move has implications, truly grasping option assignment is foundational, ensuring not just survival but genuine success.

Join us in this comprehensive exploration of option assignment, arming traders of all experience levels with the knowledge to sail these intricate seas with assuredness and accuracy.

What you’ll learn

What is Options Assignment?

How options assignment works, identifying option assignment , examples of option assignment, managing and mitigating assignment risks, what option assignment means for individual traders.

- Conclusion

Dive into the realm of options trading and you’ll find a tapestry of processes and potential. “Options assignment” is one pivotal cog in this intricate machine. To a newcomer, this term might seem a tad daunting. But a step-by-step walk-through can demystify its core.

In its simplest form, options assignment means carrying out the rights specified in an option contract. Holding an option allows a trader the choice to buy or sell a particular asset, but there’s no compulsion. The moment they opt to use this right, that’s when options assignment kicks in.

Think of it this way: You’ve got a ticket (option) to a show (buy or sell an asset). You decide if and when to attend. When you make the move, that transition is the options assignment.

There are two main types of option assignments:

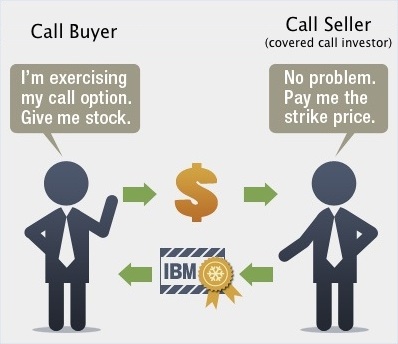

- Call Option Assignment : Triggered when a call option holder exercises their right. The seller of the option then steps into the spotlight, bound to sell the asset at the agreed-upon price.

- Put Option Assignment : Conversely, if a put option holder steps forward, the seller of the put takes the stage. Their role? To buy the asset at the specified rate.

To truly grasp options assignment, one must understand the dance between rights and obligations in options trading.

When a trader buys an option, they’re essentially reserving a right, a possible move. On the other hand, selling an option translates to accepting a duty if the option’s holder chooses to play their card.

Rights with Call Options: Buying a call option grants you a special privilege. You can procure the underlying asset at a set price before the option expires. If you choose to exercise this right, the one who sold you the call gets assigned. Their task? Handing over the asset at that set price.

Obligations with Put Options: Securing a put option empowers you to sell the underlying at a pre-decided rate. Should you exercise this, the put’s seller steps up, committed to buying the asset at the given rate.

Several factors steer the course of options assignment, including intrinsic value, looming expiration dates, and current market vibes. To stay ahead of these influences, many traders utilize option trade alerts for timely insights. And remember, while many options might find buyers, not all see execution. Hence, not every seller will get assigned. For traders, understanding this rhythm is vital, shaping many strategies in options trading.

In the multifaceted world of options trading, discerning option assignment straddles the line between art and science. While no technique guarantees surefire results, several pointers and signals can wave a flag, hinting at an impending assignment.

In-the-Money Options : A robust sign of a looming assignment is the option’s stance relative to its strike price. “In-the-money” refers to an option’s moneyness , and plays a pivotal role in the behavior of option holders. Deeply in-the-money (ITM) options amplify the odds of assignment. An ITM call option, where the market price of the asset towers above the strike price, encourages the holder to exercise and swiftly offload the asset on the market. Conversely, an ITM put option, where the market price trails significantly behind the strike price, incentivizes the holder to scoop up the asset in the market and then exercise the option to vend it at the loftier strike price.

Expiration’s Shadow: The ticking clock of an expiring option raises the assignment stakes, especially if it remains ITM. Many traders make their move just before the eleventh hour to capitalize on their gains.

Dividend Dates in Focus: Call options inching toward expiry ahead of a dividend date, especially if they’re ITM, stand at an elevated assignment crosshair. Option aficionados might play their call options to pocket the dividend, which they’d bag if they possess the core shares.

Extrinsic Value’s Decline : A diminishing time or extrinsic value of an option elevates its exercise odds. When intrinsic value dominates an option’s worth, a holder might be inclined to cash in on this value.

Volume & Open Interest Dynamics : A sudden surge in trading or a dip in open interest can be telltale signs. Understanding volume’s role is crucial as such fluctuations might hint at traders either hopping in or out, suggesting possible exercises and assignments.

Navigating the Post-Assignment Terrain

Grasping the ripple effects of option assignment is vital, highlighting the immediate responsibilities and potential paths for both the buyer and seller.

For the Option Seller:

- Call Option Assignment : For a trader who’s sold a call option, assignment means they’re on the hook to hand over the underlying shares at the strike price. If they’re short on shares, a market purchase is in order—potentially at a loss if market prices overshoot the strike.

- Put Option Assignment: Assignment on a peddled put option necessitates the trader to buy the shares at the strike price . If this price overshadows the market rate, losses loom.

For the Option Buyer:

- Call Option Play : Exercising a call lets the buyer snap up shares at the strike price. They can either nestle with them or trade them off.

- Put Option Play: Exercising a put gives the buyer the reins to sell their shares at the strike price. This play often pays off when the market rate is dwarfed by the strike, ensuring a tidy profit on the dispensed shares.

Post-assignment, all involved must be on their toes, knowing what triggers margin calls , especially if caught off-guard by the assignment. Tax implications may also hover, influenced by the trade’s nature and the tenure of the position.

Being savvy about these subtleties and gearing up for possible turns of events can drastically refine one’s journey through the options trading maze.

Call Option Assignment Scenario

Imagine an investor purchases an Nvidia ( NVDA ) call option at a strike price of $435, hoping that the price of the stock will ascend after finding out that they may be forced to move out of some countries . The option is set to expire in a month. Soon after, not only did NVDA rebound from the news, but they reported very strong quarterly earnings, propelling the stock to $455.

Spotting the favorable trend, the investor opts to wield their right to purchase the stock at the agreed strike price of $435, despite its $455 market value. This initiates the option assignment.

The other investor, having sold the option, must now part with their NVDA shares at $435 apiece. If they’re short on stocks, they’d have to fetch them at the going rate of $455 and let them go at a deficit. The first investor, however, stands at a crossroads: retain the shares in hopes of further gains or swiftly trade them at $455, reaping a neat sum.

Put Option Assignment Scenario

Let’s visualize an investor who speculates a dip in the share price of V.F. Corporation ( VFC ) after seeing news about an activist investor causing shares to jump almost 14% in a day . To hedge their bets, they secures a put option from another investor at a strike price of $18.50, set to lapse in a month.

Fast forward a week, let’s say VFC divulges lackluster quarterly figures, causing the stock to dive to $10. The first investor, seizing the moment, employs their put option, electing to sell their shares at the $18.50 strike price.

When the assignment bell tolls, the other investor finds himself bound to buy the shares from the first investor at the agreed $18.50, a rate that overshadows the current $10 market value. The first investor thus sidesteps the market slump, securing a favorable sale. The other investor, however, absorbs a loss, acquiring stocks at a premium to their market worth.

The realm of options trading is akin to navigating a dynamic river, demanding a sharp comprehension of the risks that lie beneath its surface. A predominant risk that traders often encounter is assignment risk. When one assumes the role of an option seller, they inherit the duty to honor the contract if the buyer opts to exercise. Grasping the gravity of this can make the difference, underscoring the necessity of adept risk management.

A savvy approach to temper assignment risk is by keeping a vigilant eye on the extrinsic value of options. Generally, options rich in extrinsic value tend to resist early assignment. This resistance emerges as the extrinsic value dwindles when the option dives deeper in-the-money, thereby tempting the holder to exercise.

Furthermore, economic currents, ranging from niche corporate updates to sweeping market tides, can be triggers for option assignments. Staying attuned to these economic ripples equips traders with the vision needed to either tweak or maintain their positions. For example, traders may opt to sidestep selling options that are deeply in-the-money, given their higher susceptibility to assignments due to their shrinking extrinsic value.

Incorporating spread tactics, like vertical spreads or iron condors, furnishes an added shield. These strategies can dampen the risk of assignment since one part of the spread frequently balances the risk of its counterpart. Should the specter of a short option assignment hover, traders might contemplate ‘rolling out’ their stance. This move entails repurchasing the short option and subsequently selling another, possibly at a varied strike rate or a more distant expiry.

Yet, despite these protective layers, it remains pivotal for traders to brace for possible assignments. Maintaining ample liquidity, be it in capital or necessary shares, can avert unfavorable scenarios like hasty liquidations or stiff margin charges. Engaging regularly with brokers can also shed light, occasionally offering a heads-up on looming assignments.

In conclusion, the bedrock of risk management in options trading is rooted in perpetual learning. As traders hone their craft, their adeptness at forecasting and navigating assignment risks sharpens.

In the intricate world of options trading, option assignments aren’t just nuanced details; they’re pivotal moments with deep-seated implications for individual traders and the health of their portfolios. Beyond the immediate financial aftermath, assignments can reshape trading plans, risk dynamics, and the overarching path of an investor’s journey.

At its core, option assignments can transform a trader’s asset landscape. Consider a trader who’s short on a call option. If they’re assigned, they might be compelled to supply the underlying stock. This can result in a rapid stock outflow from their portfolio or, if they don’t possess the stock, birth a short stock stance. On the flip side, a trader short on a put option who faces assignment may find themselves buying the stock at the strike price, thereby dipping into their cash reserves.

These immediate shifts can generate broader portfolio ripples. An unexpected gain or shedding of stocks can jostle a trader’s asset distribution, veering it off their envisioned path. If, for instance, a trader had charted a particular stock-to-cash distribution or a meticulous diversification blueprint, an option assignment might throw a spanner in the works.

Additionally, assignments can serve as a real-world litmus test for a trader’s risk-handling prowess . A surprise assignment might spark margin calls for those not sufficiently fortified with capital. It stands as a poignant nudge about the essence of ensuring liquidity and safeguarding against the unpredictable whims of the market.

Strategically speaking, recurrent assignments might signal it’s time for traders to recalibrate. Are the options they’re offloading too submerged in-the-money? Have they factored in pivotal market shifts that might heighten early exercise odds? Such reflective moments can pave the way for refining and elevating trading methods.

In the multifaceted world of options trading, option assignment stands out as both a potential boon and a challenge. Far from being a simple checkbox in the process, its ramifications can mold the contours of a trader’s portfolio and steer long-term tactics. The importance of comprehending and adeptly managing option assignment resonates, whether you’re dipping your toes into options for the first time or weaving through intricate trades with seasoned expertise.

Furthermore, mastering options trading is about integrating its myriad concepts into a cohesive playbook. Whether it’s differentiating trading strategies like the iron condor from the iron butterfly strategy or delving deep into the nuances of option assignments, each component enriches the narrative of a trader’s odyssey. As markets shift and new hurdles arise, a solid grasp of foundational principles remains an invaluable asset. In this perpetual dance of learning and evolution, may your trading maneuvers always be well-informed, proactive, and adept.

Understanding Options Assignment: FAQs

What factors influence the likelihood of an option being assigned.

Several factors come into play, including the option’s intrinsic value , the time remaining until expiration, and upcoming dividend announcements. Options that are deep in the money or nearing their expiration date are more likely to be assigned.

Are Some Option Styles More Prone to Assignment than Others?

Absolutely. When considering different option styles , it’s essential to note that American-style options can be exercised at any point before their expiration, which means they face a higher risk of early assignment. In contrast, European-style options can only be exercised at expiration.

How Do Current Market Trends Impact Assignment Risk?

Factors like market volatility, notable price shifts, and external economic happenings can amplify the chances of an option being assigned. For example, an option might be assigned before a company’s ex-dividend date if the expected dividend outweighs the weakening of theta decay .

Can Traders Reverse or Counter the Effects of an Option Assignment?

Once an option has been assigned, it’s set in stone. However, traders can maneuver within the market to balance out the implications of the assignment, such as procuring or selling the underlying asset.

Are There Any Fees Tied to Option Assignments?

Indeed, brokers usually impose a fee for both assignments and exercises. The specific fee can differ depending on the broker, making it essential for traders to understand their brokerage’s charging scheme.

Flex Options: Explained to Traders

Sharpe Ratio Formula: Calculation, Example

Preemptive Rights in Stock Trading

What Exactly is Spot Price?

Interpreting the Inside Day Pattern

Please upgrade your browser

E*TRADE uses features that may not be supported by your current browser and might not work as intended. For the best user experience, please use an updated browser .

Understanding assignment risk in Level 3 and 4 options strategies

E*TRADE from Morgan Stanley

With all options strategies that contain a short option position, an investor or trader needs to keep in mind the consequences of having that option assigned , either at expiration or early (i.e., prior to expiration). Remember that, in principle, with American-style options a short position can be assigned to you at any time. On this page, we’ll run through the results and possible responses for various scenarios where a trader may be left with a short position following an assignment.

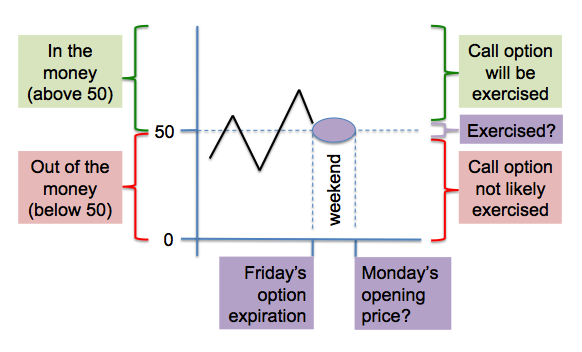

Before we look at specifics, here’s an important note about risk related to out-of-the-money options: Normally, you would not receive an assignment on an option that expires out of the money. However, even if a short position appears to be out of the money, it might still be assigned to you if the stock were to move against you just prior to expiration or in extended aftermarket or weekend trading hours. The only way to eliminate this risk is to buy-to-close the short option.

- Short (naked) calls

Credit call spreads

Credit put spreads, debit call spreads, debit put spreads.

- When all legs are in-the-money or all are out-of-the-money at expiration

Another important note : In any case where you close out an options position, the standard contract fee (commission) will be charged unless the trade qualifies for the E*TRADE Dime Buyback Program . There is no contract fee or commission when an option is assigned to you.

Short (naked) call

If you experience an early assignment.

An early assignment is most likely to happen if the call option is deep in the money and the stock’s ex-dividend date is close to the option expiration date.

If your account does not hold the shares needed to cover the obligation, an early assignment would create a short stock position in your account. This may incur borrowing fees and make you responsible for any dividend payments.

Also note that if you hold a short call on a stock that has a dividend payment coming in the near future, you may be responsible for paying the dividend even if you close the position before it expires.

An early assignment generally happens when the put option is deep in the money and the underlying stock does not have an ex-dividend date between the current time and the expiration of the option.

Short call + long call

(The same principles apply to both two-leg and four-leg strategies)

This would leave your account short the shares you’ve been assigned, but the risk of the position would not change . The long call still functions to cover the short share position. Typically, you would buy shares to cover the short and simultaneously sell the long leg of the spread.

Pay attention to short in-the-money call legs on the day prior to the stock’s ex-dividend date, because an assignment that evening would put you in a short stock position where you are responsible for paying the dividend. If there’s a risk of early assignment, consider closing the spread.

Short put + long put

Early assignment would leave your account long the shares you’ve been assigned. If your account does not have enough buying power to purchase the shares when they are assigned, this may create a Fed call in your account.

However, the long put still functions to cover the position because it gives you the right to sell shares at the long put strike price. Typically, you would sell the shares in the market and close out the long put simultaneously.

Here's a call example

- Let’s say that you’re short a 100 call and long a 110 call on XYZ stock; both legs are in-the-money.

- You receive an assignment notification on your short 100 call, meaning you sell 100 shares of XYZ stock at 100. Now, you have $10,000 in short stock proceeds, your account is short 100 shares of stock, and you still hold the long 110 call.

- Exercise your long 110 call, which would cover the short stock position in your account.

- Or, buy 100 shares of XYZ stock (to cover your short stock position) and sell to close the long 110 call.

Here's a put example:

- Let’s say that you’re short a 105 put and long a 95 put on XYZ stock; the short leg is in-the-money.

- You receive an assignment notification on your short 105 put, meaning you buy 100 shares of XYZ stock at 105. Now, your account has been debited $10,500 for the stock purchase, you hold 100 shares of stock, and you still hold the long 95 put.

- The debit in your account may be subject to margin charges or even a Fed call, but your risk profile has not changed.

- You can sell to close 100 shares of stock and sell to close the long 95 put.

Long call + short call

Debit spreads have the same early assignment risk as credit spreads only if the short leg is in-the-money.

An early assignment would leave your account short the shares you’ve been assigned, but the risk of the position would not change . The long call still functions to cover the short share position. Typically, you would buy shares to cover the short share position and simultaneously sell the remaining long leg of the spread.

Long put + short put

An early assignment would leave your account long the shares you’ve been assigned. If your account does not have enough buying power to purchase the shares when they are assigned, this may create a Fed call in your account.

All spreads that have a short leg

(when all legs are in-the-money or all are out-of-the-money)

Pay attention to short in-the-money call legs on the day prior to the stock’s ex-dividend date because an assignment that evening would put you in a short stock position where you are responsible for paying the dividend. If there’s a risk of early assignment, consider closing the spread.

However, the long put still functions to cover the long stock position because it gives you the right to sell shares at the long put strike price. Typically, you would sell the shares in the market and close out the long put simultaneously.

What to read next...

How to buy call options, how to buy put options, potentially protect a stock position against a market drop, looking to expand your financial knowledge.

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

The Risks of Options Assignment

Any trader holding a short option position should understand the risks of early assignment. An early assignment occurs when a trader is forced to buy or sell stock when the short option is exercised by the long option holder. Understanding how assignment works can help a trader take steps to reduce their potential losses.

Understanding the basics of assignment

An option gives the owner the right but not the obligation to buy or sell stock at a set price. An assignment forces the short options seller to take action. Here are the main actions that can result from an assignment notice:

- Short call assignment: The option seller must sell shares of the underlying stock at the strike price.

- Short put assignment: The option seller must buy shares of the underlying stock at the strike price.

For traders with long options positions, it's possible to choose to exercise the option, buying or selling according to the contract before it expires. With a long call exercise, shares of the underlying stock are bought at the strike price while a long put exercise results in selling shares of the underlying stock at the strike price.

When a trader might get assigned

There are two components to the price of an option: intrinsic 1 and extrinsic 2 value. In the case of exercising an in-the-money 3 (ITM) long call, a trader would buy the stock at the strike price, which is lower than its prevailing price. In the case of a long put that isn't being used as a hedge for a long stock position, the trader shorts the stock for a price higher than its prevailing price. A trader only captures an ITM option's intrinsic value if they sell the stock (after exercising a long call) or buy the stock (after exercising a long put) immediately upon exercise.

Without taking these actions, a trader takes on the risks associated with holding a long or short stock position. The question of whether a short option might be assigned depends on if there's a perceived benefit to a trader exercising a long option that another trader has short. One way to attempt to gauge if an option could be potentially assigned is to consider the associated dividend. An options seller might be more likely to get assigned on a short call for an upcoming ex-dividend if its time value is less than the dividend. It's more likely to get assigned holding a short put if the time value has mostly decayed or if the put is deep ITM and close to expiration with a wide bid/ask spread on the stock.

It's possible to view this information on the Trade page of the thinkorswim ® trading platform. Review past dividends, the price of the short call, and the price of the put at the call's strike price. While past performance cannot be relied upon to continue, this information can help a trader determine whether assignment is more or less likely.

Reducing the risk associated with assignment

If a trader has a covered call that's ITM and it's assigned, the trader will deliver the long stock out of their account to cover the assignment.

A trader with a call vertical spread 4 where both options are ITM and the ex-dividend date is approaching may want to exercise the long option component before the ex-dividend date to have long stock to deliver against the potential assignment of the short call. The trader could also close the ITM call vertical spread before the ex-dividend date. It might be cheaper to pay the fees to close the trade.

Another scenario is a call vertical spread where the ITM option is short and the out-of-the-money (OTM) option is long. In this case, the trader may consider closing the position or rolling it to a further expiration before the ex-dividend date. This move can possibly help the trader avoid having short stock on the ex-dividend date and being liable for the dividend.

Depending on the situation, a trader long an ITM call might decide it's better to close the trade ahead of the ex-dividend date. On the ex-dividend date, the price of the stock drops by the amount of the dividend. The drop in the stock price offsets what a trader would've earned on the dividend and there would still be fees on top of the price of the put.

Assess the risk

When an option is converted to stock through exercise or assignment, the position's risk profile changes. This change could increase the margin requirements, or subject a trader to a margin call, 5 or both. This can happen at or before expiration during early assignment. The exercise of a long option position can be more likely to trigger a margin call since naked short option trades typically carry substantial margin requirements.

Even with early exercise, a trader can still be assigned on a short option any time prior to the option's expiration.

1 The intrinsic value of an options contract is determined based on whether it's in the money if it were to be exercised immediately. It is a measure of the strike price as compared to the underlying security's market price. For a call option, the strike price should be lower than the underlying's market price to have intrinsic value. For a put option the strike price should be higher than underlying's market price to have intrinsic value.

2 The extrinsic value of an options contract is determined by factors other than the price of the underlying security, such as the dividend rate of the underlying, time remaining on the contract, and the volatility of the underlying. Sometimes it's referred to as the time value or premium value.

3 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

4 The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month.

5 A margin call is issued when the account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when buying power is exceeded. Margin calls may be met by depositing funds, selling stock, or depositing securities. A broker may forcibly liquidate all or part of the account without prior notice, regardless of intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Weekly Trader's Outlook

Today's Options Market Update

What to Know About Trading Futures Options

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled Characteristics and Risks of Standardized Options before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested.

Spread trading must be done in a margin account.

Multiple leg options strategies will involve multiple commissions.

Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

- Search Search Please fill out this field.

- Assets & Markets

What Is an Option Assignment?

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-30f78c37d3174fe298f9407f0b5413e2.jpeg)

Definition and Examples of Assignment

How does assignment work, what it means for individual investors.

Morsa Images / Getty Images

An option assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price. Let’s explain what that means in more detail.

Key Takeaways

- An assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price.

- If you sell an option and get assigned, you have to fulfill the transaction outlined in the option.

- You can only get assigned if you sell options, not if you buy them.

- Assignment is relatively rare, with only 7% of options ultimately getting assigned.

An assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price. Let’s explain what that means in more detail.

When you sell an option to someone, you’re selling them the right to make you engage in a future transaction. For example, if you sell someone a put option , you’re promising to buy a stock at a set price any time between when the transaction happens and the expiration date of the option.

If the holder of the option doesn’t do anything with the option by the expiration date, the option expires. However, if they decide that they want to go through with the transaction, they will exercise the option.

If the holder of an option chooses to exercise it, the seller will receive a notification, called an assignment, letting them know that the option holder is exercising their right to complete the transaction. The seller is legally obligated to fulfill the terms of the options contract.

For example, if you sell a call option on XYZ with a strike price of $40 and the buyer chooses to exercise the option, you’ll be assigned the obligation to fulfill that contract. You’ll have to buy 100 shares of XYZ at whatever the market price is, or take the shares from your own portfolio and sell them to the option holder for $40 each.

Options traders only have to worry about assignment if they sell options contracts. Those who buy options don’t have to worry about assignment because in this case, they have the power to exercise a contract, or choose not to.

The options market is huge, in that options are traded on large exchanges and you likely do not know who you’re buying contracts from or selling them to. It’s not like you sell an option to someone you know and they send you an email if they choose to exercise the contract, rather it is an organized process.

In the U.S., the Options Clearing Corporation (OCC), which is considered the options industry clearinghouse, helps to facilitate the exchange of options contracts. It guarantees a fair process of option assignments, ensuring that the obligations in the contract are fulfilled.

When an investor chooses to exercise a contract, the OCC randomly assigns the obligation to someone who sold the option being exercised. For example, if 100 people sold XYZ calls with a strike of $40, and one of those options gets exercised, the OCC will randomly assign that obligation to one of the 100 sellers.

In general, assignments are uncommon. About 7% of options get exercised, with the remaining 93% expiring. Assignment also tends to grow more common as the expiration date nears.

If you are assigned the obligation to fulfill an options contract you sold, it means you have to accept the related loss and fulfill the contract. Usually, your broker will handle the transaction on your behalf automatically.

If you’re an individual investor, you only have to worry about assignment if you’re involved in selling options. Even then, assignments aren't incredibly common. Less than 7% of options get assigned and they tend to get assigned as the option’s expiration date gets closer.

Having an option assigned does mean that you are forced to lock in a loss on an option, which can hurt. However, if you’re truly worried about assignment, you can plan to close your position at some point before the expiration date or use options strategies that don’t involve selling options that could get exercised.

The Options Industry Council. " Options Assignment FAQ: How Can I Tell When I Will Be Assigned? " Accessed Oct. 18, 2021.

Will I Be Assigned?

by Mike Scanlin

As the market nears closing time on expiration Friday, covered call writers want to know if they will be assigned or not for tax reasons, margin reasons, and portfolio optimization reasons. Let's look at the issue from the point of view of both people involved in the trade: the option holder who is long the call option, and the covered call writer who is short the same call option.

Option Assignment

"Assignment" means the call option you sold short as part of your covered call trade is now being exercised. That means some option holder somewhere wants his stock and you have been chosen by the OCC (Options Clearing Corp) to receive the assignment. It's a random process; each time the OCC gets an exercise notice they randomly choose from among all the short calls (in the same series) who will receive the assignment.

If you are chosen by OCC your broker will be notified and your broker will, in turn, notify you. You will need to make good on your promise to deliver the shares of stock and, in exchange, receive the strike-price-per-share in cash, as per the option agreement.

What determines if the option holder exercises?

It's really up to them. It's their option and they can do what they want with it. They can even exercise it if the stock price is below the strike price of the option (i.e. it's out of the money). It wouldn't make any economic sense to do so, but it is allowed. The option holder has the right to exercise at any time for any reason.

Normal circumstances when call options are exercised by rational people

(1) The stock closes above the strike price on the option's expiration day.

This is the typical case for exercise. The option holder exercises his in-the-money option to acquire the stock for less than the current price. He only has to pay the strike price. If the stock closes at $43 and the strike price is 40, he only pays $40/share to acquire the stock.

(2) For in-the-money options, the day before ex-dividend day when there is zero time premium remaining in the option.

This is called "early exercise" and normally only happens when there is no time premium left in the option because the option holder forfeits any remaining time premium when he exercises. It doesn't make economic sense for him to exercise when there is still time premium remaining in the option; he's better off just selling the option in that case. But if there is zero time premium and he knows the stock is likely to open lower the next morning by the amount of the dividend that is about to be paid, he will do an early exercise to capture the dividend.

What about the day before earnings?

That's not a good time to exercise an option. There will be lots of time premium in the option (which will be forfeited if exercised) because of earnings uncertainty. If the option holder wants out of the position (maybe he's worried about volatility decreasing after earnings come out which could lower the value of his option) then he's better off just selling the option instead of exercising it.

What if the stock closes very near the strike price?

This one is tricky.

For starters, stocks continue to trade for several hours in the aftermarket after the regular market closes. The stock's closing price Friday at 4pm Eastern Time (regular market hours closing) may not represent the closing price during extended hours trading. And option holders have until Saturday (when options technically expire) to give their brokers exercise notices. So it's possible for a stock to close just below the strike price during regular hours on expiration Friday but then close above the strike price in extended hours. In that case the option would likely be exercised.

But not always.

It depends on several factors: (1) What are the transaction costs of the person doing the exercising? (2) What is the personal opinion of the option holder for the stock at Monday morning's open? It's possible the option could finish slightly in the money during extended trading hours and still not be exercised because the option holder believes the stock will open lower (below the strike price) on Monday morning. Maybe there's some event happening over the weekend that he believes will cause the stock (or the whole market) to open lower on Monday.

Imagine a covered call that has been written at a strike of 50. On expiration Friday at the close the stock's price was within a few pennies of 50 (above or below; it doesn't matter). Will it be exercised?

It depends on what the option holder believes will happen Monday morning. And not all option holders believe the same thing, causing less than 100% of all 50-strike options to be exercised. And since option assignment is random, you can't be sure if you'll be assigned or not. The purple oval here is a mystery and subject to personal opinion:

The decision to exercise (or not) is the option holder's right but not his obligation . He can let in-the-money options expire unexercised if he so chooses, based on his beliefs of where the stock will open on the next trading day.

My stock is within a few cents of the strike price and it's almost closing time on expiration day. What should I do?

This is the most common question. The answer is "it depends", "do you feel lucky?", and "you can never tell for sure." If you don't want the stock called away for whatever reason (taxes, margin, etc) then buy the call option back before the option market closes. It may cost you a nickel or two (plus an option trade commission) but that's the only certain way to avoid assignment.

Remember, stocks trade for a few more hours after the regular market closes so if your stock closes 10 cents below the strike during regular hours but then rises 25 cents above the strike during extended hours then you are probably out of luck. It will likely be called away (unlike stocks, options don't trade after hours, so you can't buy the option back during extended trading hours).

If you are in a situation where you don't want something called away then the best plan is to monitor the amount of time premium remaining in the option. Most option holders won't exercise if the time premium is greater than zero. If your time premium is getting small (5 to 10 cents, depends on the bid-ask spread of the underlying stock) then it's a good time to roll the option to something that has more time premium in it. The greater the time premium the smaller chance of exercise.

How do I calculate time premium?

The short answer for in-the-money options is (strike price + call price) minus stock price. So if the stock is 53 and you've sold a 50-strike call currently trading at 4 then the time premium is (50 + 4) - 53 = 1. There is 1 point of time premium in the option.

The longer answer is that stocks and options have bid prices and ask prices. So which to use? Or should you use the last trade price? We'll cover that in a future article . In the mean time, check out the tutorial on time premium .

Like covered calls? Check out our Covered Call Screener

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.

- Covered Call Newsletter

- Covered Call Blog

- Search Search Please fill out this field.

- Options and Derivatives

- Strategy & Education

Assignment: Definition in Finance, How It Works, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

What Is an Assignment?

Assignment most often refers to one of two definitions in the financial world:

- The transfer of an individual's rights or property to another person or business. This concept exists in a variety of business transactions and is often spelled out contractually.

- In trading, assignment occurs when an option contract is exercised. The owner of the contract exercises the contract and assigns the option writer to an obligation to complete the requirements of the contract.

Key Takeaways

- Assignment is a transfer of rights or property from one party to another.

- Options assignments occur when option buyers exercise their rights to a position in a security.

- Other examples of assignments can be found in wages, mortgages, and leases.

Uses For Assignments

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, or other asset of value. to another entity through a written agreement.

Assignment rights happen every day in many different situations. A payee, like a utility or a merchant, assigns the right to collect payment from a written check to a bank. A merchant can assign the funds from a line of credit to a manufacturing third party that makes a product that the merchant will eventually sell. A trademark owner can transfer, sell, or give another person interest in the trademark or logo. A homeowner who sells their house assigns the deed to the new buyer.

To be effective, an assignment must involve parties with legal capacity, consideration, consent, and legality of the object.

A wage assignment is a forced payment of an obligation by automatic withholding from an employee’s pay. Courts issue wage assignments for people late with child or spousal support, taxes, loans, or other obligations. Money is automatically subtracted from a worker's paycheck without consent if they have a history of nonpayment. For example, a person delinquent on $100 monthly loan payments has a wage assignment deducting the money from their paycheck and sent to the lender. Wage assignments are helpful in paying back long-term debts.

Another instance can be found in a mortgage assignment. This is where a mortgage deed gives a lender interest in a mortgaged property in return for payments received. Lenders often sell mortgages to third parties, such as other lenders. A mortgage assignment document clarifies the assignment of contract and instructs the borrower in making future mortgage payments, and potentially modifies the mortgage terms.

A final example involves a lease assignment. This benefits a relocating tenant wanting to end a lease early or a landlord looking for rent payments to pay creditors. Once the new tenant signs the lease, taking over responsibility for rent payments and other obligations, the previous tenant is released from those responsibilities. In a separate lease assignment, a landlord agrees to pay a creditor through an assignment of rent due under rental property leases. The agreement is used to pay a mortgage lender if the landlord defaults on the loan or files for bankruptcy . Any rental income would then be paid directly to the lender.

Options Assignment

Options can be assigned when a buyer decides to exercise their right to buy (or sell) stock at a particular strike price . The corresponding seller of the option is not determined when a buyer opens an option trade, but only at the time that an option holder decides to exercise their right to buy stock. So an option seller with open positions is matched with the exercising buyer via automated lottery. The randomly selected seller is then assigned to fulfill the buyer's rights. This is known as an option assignment.

Once assigned, the writer (seller) of the option will have the obligation to sell (if a call option ) or buy (if a put option ) the designated number of shares of stock at the agreed-upon price (the strike price). For instance, if the writer sold calls they would be obligated to sell the stock, and the process is often referred to as having the stock called away . For puts, the buyer of the option sells stock (puts stock shares) to the writer in the form of a short-sold position.

Suppose a trader owns 100 call options on company ABC's stock with a strike price of $10 per share. The stock is now trading at $30 and ABC is due to pay a dividend shortly. As a result, the trader exercises the options early and receives 10,000 shares of ABC paid at $10. At the same time, the other side of the long call (the short call) is assigned the contract and must deliver the shares to the long.

:max_bytes(150000):strip_icc():format(webp)/investor-viewing-company-share-price-market-data-on-a-laptop-computer-713768437-c4eda9ee28224ad6be4f6912822227af.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

First steps for call options

Congratulations! You've graduated from Stock Investing University. You now have a firm grasp on buying and selling stocks. But you've heard there’s more to investing than just buying low and selling high—it may be time to consider investing with options. Unlike stocks, options allow you to gain exposure to a stock, whether it's on the rise, fall, or even moving sideways. Like a Swiss Army knife, options give you the versatility to persevere during the tough times and prosper during the good times.

Why use options?

Options are more advanced tools that can help investors limit risk, increase income, and plan ahead.

What are call options?

A call option is a contract between a buyer and a seller to purchase a certain stock at a certain price up until a defined expiration date. The buyer of a call has the right, not the obligation, to exercise the call and purchase the stocks. On the other hand, the seller of the call has the obligation and not the right to deliver the stock if assigned by the buyer.

For instance, 1 ABC 110 call option gives the owner the right to buy 100 ABC Inc. shares for $110 each (that's the strike price), regardless of the market price of ABC shares, until the option's expiration date.

Suppose ABC shares are trading at $100 today—the owner of the ABC 110 call option hopes shares rise above $110—any appreciation above that represents the potential payout. If you exercise the call when shares trade at $120, then you buy 100 ABC shares for $110 and voilà: your return is $10 per share for a total gain of $1,000.

But all that fun isn't free. A call buyer must pay the seller a premium: for example, a price of $3 per share. Since the ABC 110 call option then costs $300 and paid out $1,000, the net return is $700.

These examples do not include any commissions or fees that may be incurred, as well as tax implications.

A long call: speculation or planning ahead

A "long call" is a purchased call option with an open right to buy shares. The buyer with the "long call position" paid for the right to buy shares in the underlying stock at the strike price and costs a fraction of the underlying stock price and has upside potential value (if the stock price of the underlying stock increases).

A long call can be used for speculation. For example, take companies that have product launches occurring around the same time every year. You could speculate by purchasing a call if you think the stock price will appreciate after the launch.

A long call can also help you plan ahead. For example, you may have an upcoming bonus that you would like to invest in a stock today, but what if it didn't pay out until the following month? To plan ahead and lock in the price of the stock today, you could purchase a long call with the intent to exercise your right to purchase the shares once you receive your bonus.

A short call: boosting income

A "short call" is the open obligation to sell shares. The seller of a call with the "short call position" received payment for the call but is obligated to sell shares of the underlying stock at the strike price of the call until the expiration date. A short call is used to create income: The investor earns the premium but has upside risk (if the underlying stock price rises above the strike price).

Both new and seasoned investors will use short calls to boost their income but, more often than not, do so when the call is "covered." So in case you are assigned, you are simply selling stock that you already own.

An "uncovered" call carries significantly more risk and a potential for unlimited losses because you are obligated to find shares to sell to the call purchaser. Imagine if you had to buy shares which were 20% more expensive than the price you are selling them for. Yikes!

Exercise of a call

A long call investor hopes the price of the underlying stock rises above the exercise price because only at that point does it make sense to exercise a call. Why would you exercise your right to buy ABC shares for $110 each when anybody can buy them on the market for less than that?

"Exercising a long call" means the call option owner is demanding to buy the stock from the call seller. Upon exercise of a call, shares are deposited into your account and cash to pay for the shares and commission is withdrawn (just like a normal stock purchase).

It's important to note that exercising is not the only way to turn an options trade profitable. For options that are "in-the-money," most investors will sell their option contracts in the market to someone else prior to expiration to collect their profits.

Assignment of a short call

A short call investor hopes the price of the underlying stock does not rise above the strike price. If it does, the long call investor might exercise the call and create an "assignment." An assignment can occur on any business day before the expiration date. If it does, the short call investor must sell shares at the exercise price.

Remember, the call is "covered" if you sell shares you already own but, if it's "uncovered," you must find shares to sell to the call purchaser.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options . Supporting documentation for any claims, if applicable, will be furnished upon request.

Apply to trade options

Complete an options application to get approved.

More to explore

Options strategy guide, learn more about options, subscribe to fidelity viewpoints ®, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. investing for beginners finding stock and sector ideas advanced trading strategies trading options stocks using technical analysis © 2017 by marketsnacks. reprinted with permission from marketsnacks. the statements and opinions expressed in this article are those of the author. fidelity investments cannot guarantee the accuracy or completeness of any statements or data. 777335.3 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

- Skip to main content

- Skip to primary sidebar

Additional menu

Options With Davis

Options Made Easy For Everyone

Short Put Assignment – How To Avoid It & What To Do If Assigned

posted on April 28, 2023

You probably sold a Put Option thinking the market would go up.

But now your Short Put is In-the-Money (ITM) and you’re either in danger of getting assigned, or you may have already been assigned the shares.

If you’ve already been assigned, you may be panicking now.

That’s because the unexpected assignment of the shares made your cash balance negative and you could be in danger of a margin call.

In both cases what do you do?

How do you avoid getting assigned if your Short Put is now ITM?

What do you do if you’re already been assigned the shares?

And what do you do if you get a margin call?

What To Do If You Get A Margin Call?

So the most urgent matter to address is if you get a margin call.

If you get a margin call, you want to deal with it immediately.

That’s because if you don’t do anything, your broker can liquidate your positions to meet their margin requirement.

That could mean closing out other positions other than your Short Put position.

So if you have multiple positions, the broker could randomly close positions in your account.

At this point, you have two choices.

The first choice is to add more funds to meet the margin requirement.

The second choice is to close out positions on your own to meet the margin requirement.

According to FINRA (Financial Industry Regulatory Authority), you have two to five days to meet the call:

That should be more than enough time to transfer funds into your account (if you still have more funds), or to close out positions in your account to meet the margin call.

What To Do If Your Short Put Is Assigned

If your Short Put is already assigned, that means you’re now Long 100 shares per Put Option.

In this case, to reverse the assignment and reinstate your original Short Put position, you need to do two things:

- Sell the shares.

- Sell a Put at the same strike but with a longer DTE.

And you do these two things simultaneously in a single order ticket:

By doing it in a single ticket, you do not have any spreading risk because they will move in tandem.

So when you do this, you will reinstate the same Short Put strike but with a longer DTE.

With a longer DTE, there will be more extrinsic value in your Option, which reduces the chances of getting an early assignment.

When You’re In Danger of Early Assignment

The next thing to know is exactly when you’re in danger of getting assigned.

It doesn’t mean that if your Put is ITM, you’d automatically be assigned.

In fact, it’s very rare to get assigned.

The only time you’re likely to get assigned is if the following happens:

- Short Put is ITM.

- And extrinsic value is very little.

- And very few DTE (days to expiration).

The biggest factor that determines whether you have a likelihood of getting assigned is if your extrinsic value is very little.

That’s because when the extrinsic value of the Put is very little, it may not benefit the Put buyer to hold on to the Option.

But as long as there’s still a decent amount of extrinsic value left, you’re unlikely to get assigned even if your Put is ITM.

Understanding The Mindset of Put Buyers

To understand this a little better, we need to get into the mindset of Put buyers and see when they would likely exercise.

Let’s assume you sold a Put on AMZN at the strike price of 120 for $2.00.

Now, let’s switch to the Put buyer’s perspective.

That would mean that the Put buyer bought a Put at the strike price of 120 for $2.00.

The next step is to understand why did this person buy a Put Option.

In general, there are two main reasons why someone would buy a Put Option:

- To speculate a move to the downside (either as a single Option or part of a spread trade ).

- To protect their Long stock position.

Next, we want to map out the different scenarios that can happen and see if the Put buyer would actually exercise their Option in each of the scenarios.

Scenario 1: The stock drops to $115.

Let’s say the stock drops to $115 and the Put Option is now worth $6.00.

So that’s a $4.00 increase in the Put’s value.

Of the $6.00, the value is divided into intrinsic value and extrinsic value:

- Intrinsic value = $5.00

- Extrinsic value = $1.00

When the Put buyer bought the Put, it was just $2.00 of extrinsic value (no intrinsic value because it’s OTM).

After the stock dropped to $115, it gained $5.00 of intrinsic value and lost $1.00 extrinsic value.

Here’s a question for you:

If you were the Put buyer, would you exercise your Put Option?

To know the answer, we want to compare the two choices a Put buyer has at this point.

The first choice is to exercise the Put Option.

By exercising, the Put buyer would either be Short 100 shares at $120, or if the Put buyer already has 100 shares of the stock it would be sold away at $120.

In both cases, when exercising, the Put buyer immediately forfeits the extrinsic value of $1.00.

So if he became Short 100 shares at $120 and immediately sold at $115, his profit would be $5 per share minus the $2 he paid for the Put, which equals $3 profit per share.

If he initially already had 100 shares of the stock, he would be saving $3 loss per share.

The second choice is to just sell off the Put Option.

By selling the Put Option, the Put buyer would have made $4 (bought for $2 and sold for $6).

So in this scenario, it would make more sense for the Put buyer to simply sell off his Put Option than to exercise it.

Scenario 2: The stock drops to $105 with 30 DTE.

In this scenario, the stock has dropped significantly but there’s still 30 DTE left in the Put Option.

The value of the Put has now ballooned to $15.05:

- Intrinsic Value = $15.00

- Extrinsic Value = $0.05

The Put is now deep ITM and there’s very little extrinsic value left.

However, there are still 30 DTE left in the Put Option.

If you were the Put buyer, would you exercise the Put?

In this scenario, it still is unlikely that you’d get assigned because there are still many days left to the Put’s expiration.

If the Put buyer anticipates the stock to fall further, it still makes sense to hold on to the Put until it’s closer to expiration before making a decision to exercise or not.

And if he exercises it, he will forfeit the $0.05 in extrinsic value (which is an additional $5 in profit).

Furthermore, exercising can incur further charges.

So in general, Put buyers would rather just sell off the Put than exercise it.

Scenario 3: The stock drops to $105 with 7 DTE.

In this scenario, the stock also drops to $105 but there’s 7 DTE left.

The value of the Put is now $15.01:

- Extrinsic Value = $0.01

In this case, if you were the Put buyer, would it make sense for you to exercise the Option?

The answer is yes.

That’s because there are not that many days left to the Put’s expiration.

And there’s pretty much no extrinsic value left.

So if your Put doesn’t have much extrinsic value left and there are not many days left to expiration, then it’s highly likely you’d get assigned.

So how do you avoid early assignments?

How To Avoid Early Assignment

The best way to avoid any early assignments is by simply rolling your Short Put .

There are two ways to do this:

- Defensive Method: This method is to proactively roll your Short Put out & down the moment it gets breached to avoid getting ITM. This way you will always keep the delta below 50 so there’s no chance of an early assignment.

- 21 DTE Method: Since we already know that it’s unlikely for an Option to be exercised when there’s still more than 21 DTE left, we only look to roll around the 21 DTE mark. Oftentimes, the Put could be ITM before the 21 DTE mark but is OTM by the time it’s 21 DTE. So if at 21 DTE the Put is ITM, we roll. If it’s OTM, we do nothing and let Theta do its work.

When you use these two methods, the chances of getting assigned on your Short Put get reduced significantly.

Reader Interactions

January 5, 2024 at 3:37 AM

so if you’re somewhere in the middle ie your neutral on the stock. and the put you sold had a strike of 145 and the stock is say 142 what about taking ownership of the stock at the 142 and selling say a 144 call for 3$ getting it called away and then start over selling puts ?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Nervous about stocks? This portfolio security blanket gives you income and a market edge.

I f you’re worried that the U.S. stock market is vulnerable to a pullback because it is up so much and valuations seem rich, here’s a savvy tactic to consider.

Extract income from the options market by selling covered calls against your stock positions. If you are new to options, this strategy actually is pretty simple. It’s also preferable to selling stock and moving to cash as a hedge against potential declines.

That’s because it’s nearly impossible to call the top of a market. Sell too early and you miss out on gains. And if you do sell, it’ll be hard to get back in at the right time. As famed investor Peter Lynch observed: Far more money has been lost preparing for corrections, than has been lost in the corrections themselves.

Call option boot camp

For help with understanding the best way to sell covered calls for income, let’s turn to Barry Martin, manager of the Shelton Equity Income Investor fund EQTIX. He’s been using this tactic for 25 years. His fund beats competitors in the Morningstar Direct derivative-income strategies category by around three percentage points annualized over the past three-to-five years, and recently paid an 8% yield.

Let’s start with some basic definitions: A stock option gives you the right to buy or sell 100 shares at a specific price, by a stated date. Call options offer the right to buy shares while puts grant the right to sell.

If you think the market might consolidate or go sideways for awhile, a sensible tactic is to sell covered-call options against your stock positions to pull in some income. These are “covered” calls because you own the underlying stock you are selling someone the right to buy. This “covers” you against the risk of loss if the stock skyrockets while you are locked in to selling at a lower price. Yes, you will miss out on upside. But it won’t be a cash loss, since you own the stock to deliver.

Martin uses the strategy for income, and also because it dampens portfolio volatility. Volatility creates risk, because it can scare people out of the stock market at exactly the wrong time, when stocks are down a lot.

Here are three basic covered-call selling guidelines Martin shared in a recent interview:

1. Stick to quality names : This protects against downside losses in the position you sell calls against. After all, it doesn’t make sense to earn income by selling calls, but lose more because the underlying stock declines while you wait for the call option to expire.

For Martin, “quality” means leading companies with strong brands and a loyal customer base. He likes companies that generate free cash flow and have reasonable debt levels. The defensive nature these qualities create is important because selling covered calls offers asymmetric return potential. The upside is capped, but you are exposed to a lot of potential downside risk.

As examples of quality, Martin’s top 10 fund holdings include Apple

Options in these stocks have liquidity and relatively higher premiums (prices) because the stocks are fairly volatile. In general, options prices go up as volatility in the underlying stock increases. You can think of selling calls as making money from volatility. Martin also reduces portfolio risk by not overweighting sectors or holdings.

2. Keep the timelines tight: Martin prefers to sell call options set to expire in around 45 to 60 days. That’s because most of the decay in the time value of options happens in this time frame, and it speeds up as the life of the options shortens. A lot of the time value decays in the last 20 days of an option’s life.

3. Sell options just a little bit out of the money: A call option is out of the money when the strike price of the option is above the price of the underlying stock. For example, AT&T closed on Thursday at just over $17 a share. So, call options priced at $18 and above are out of the money.

If you sell covered calls and the stock shoots up a lot, you lose out on the upside.

Martin likes to sell options that are around 7%-10% out of the money. Here’s how I think about this target. At these prices, there is enough premium in the option to generate meaningful income. But the strike price is high enough above the stock price to limit the odds of the stock getting called away from you.

Now let’s put it all together and look at an example, using a stock from Martin’s fund. Let’s say you own 1,000 shares of Pfizer which closed on Thursday at $27.66 a share. Applying the 45-60 day and 7%-10% rules, you could sell call options expiring May 17 with a strike price of $30. That would generate $380 in income since the bid on this call is 38 cents a contract. A contract represents 100 shares, so to derive its value multiply the bid times 100. The stock would get called away from you if it traded above $30 a share on the expiration date. If not, you keep the shares and can repeat the call-options sale.

There’s a risk in having the stock called away from you, because of tax reasons. For example, you might be a month shy of holding a name for more than a year, which lowers the tax rate on gains.

There’s also the risk that if you sell covered calls and the stock shoots up a lot, you lose out on the upside. Another challenge is that the income you generate is a short-term capital gain, which is taxed at a higher rate than dividends or long-term gains. One way around this is to use this strategy in tax protected accounts like IRAs.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned AAPL, META, AMZN and GOOGL. Brush has suggested AAPL, META, AMZN, GOOGL, LMT, BRK.B, LLY, T and PFE in his stock newsletter, Brush Up on Stocks . Follow him on X @mbrushstocks .

More: Wall Street’s biggest bull renews call for small-cap stocks to rise 50% in 2024

Plus: S&P 500 isn’t letting anything get in its way as momentum and fundamentals stay strong

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

Marvell Technology Has Unusual Call Options Activity - Highlighting Its Underlying Value

March 20, 2024 — 02:35 pm EDT

Written by Mark R. Hake, CFA for Barchart ->

Marvell Technology Inc. ( MRVL ), the semiconductor manufacturer based in Delaware, is showing large unusual call options activity today. This highlights the stock's value, based on its strong free cash flow and AI demand growth. This could also be a copycat effect from the huge popularity of Nvidia ( NVDA ) stock.

The Barchart Unusual Stock Options Report today shows this large unusual call option volume in MRVL stock. The Report indicates that over 2,500 call option contracts were traded in the $63.00 strike price expiring on March 28 .

Given that MRVL stock is trading today at $65.24, this means that these call options are in-the-money (ITM) by $2.24 per contract (i.e., $65.24-$63.00). The price of the calls traded was $3.05 in the mid-price, which means that there is $0.81 of extrinsic value in the premium (i.e., $3.05-$2.24).

That means that the investors in these call options hope that the stock will rise over $66.05 per share (i.e., $63.00 strike price + $3.05 premium) before closing on March 28. That represents a potential upside in MRVL stock of 1.24% (i.e., $66.05/$65.24-1).

These investors in MRVL ITM calls are finding it easier to buy calls and potentially make a huge gain. There were 23 times the normal outstanding number of call options traded at this strike price. This implies that they believe that MRVL stock could rise between now and the end of the month.

For example, assuming the stock hits $70 on or before March 28, the intrinsic value of the options would be $7.00 (i.e., $70-$63 strike price). That implies the purchasers of these calls at $3.05 would more than double their money (i.e., ($7.00/$3.05-1)x100 = 129.5%. And this would be just with a 7.3% increase in the value of the stock (i.e., $70/$65.24-1).

Why would the investors make this investment? Is the stock undervalued? I can make a case that it looks cheap here, although this is on a long-term basis.

Free Cash Flow Strength

First, the bad news and why the stock is cheap. On March 7, Marvell Technology reported just a 1% increase in Q4 sales for the quarter ending Feb. 3 and a decrease of 6.96% in sales for its fiscal year.

However, Marvel said its non-GAAP net income was $401.6 million on sales of $1,427 billion for the quarter. That represents a strong 28.1% adj. net income margin. Moreover, its free cash flow (FCF) for the quarter came in strong at $475.6 million, which represents an FCF margin of 33.3%.

Therefore, despite the weak sales the company is very profitable. In addition, Marvell Technology says its data center and AI-related sales are strong. This is also what is powering Nvidia.

Moreover, the company was able to not only pay a dividend from its FCF but also buy back shares.

Going forward, analysts project $5.32 billion in sales for the year ending Jan. 2025 and $7.01 billion for the following year. That puts it on a run rate of sales of $6.165 billion sometime in the next 12 months (NTM).

So, applying a 33.3% FCF margin to this NTM revenue estimate shows that FCF could exceed $2 billion (i.e., $6.165b x 0.333 = $2.05 billion FCF). That is almost double the $1.034 billion in FCF it made during its FY ending Feb. 3, 2024.

Moreover, if we apply a 3% FCF yield metric to this $2 billion FCF estimate the market cap could eventually reach $68.3 billion. That is 21% higher than its existing $56.34 billion market cap. In other words, we can make a case that, on a long-term basis over the next 12 months, the stock looks to be at least 21% too cheap.

The bottom line here is that investors might be overlooking the underlying value of MRVL stock. One way to play this is to buy in-the-money (ITM) calls, especially if you believe the stock is due to rise in the near term.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Stocks mentioned

More related articles.

This data feed is not available at this time.

Sign up for Smart Investing to get the latest news, strategies and tips to help you invest smarter.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.