How to Write a Business Proposal [Examples + Template]

Published: December 05, 2023

Here's what every new business owner needs: an extra 8 hours in the day, an endless supply of coffee, and, most importantly, a really strong business proposal.

A business proposal can bridge the gap between you and potential clients. Done correctly, and it will outline your value proposition and persuade a company or organization to do business with you.

Here, we'll take a look at the various kinds of business proposals and go over how to write one. We’ll also see some ideas and examples to help guide yours.

Know exactly what you need? Jump to one of the following sections:

What is a business proposal?

Types of business proposals, how to write a business proposal, business proposal templates, business proposal example, tips for writing a business proposal, business proposal ideas.

A business proposal is a formal document that’s created by a company and given to a prospect to secure a business agreement.

It's a common misconception that business proposals and business plans are the same. However, a proposal helps you sell your product or service — not your business itself.

Think of it this way: instead of assisting your search for investors to fund your business, a proposal helps you seek new customers.

Follow Along With HubSpot's Business Proposal Template

Download the Template for Free

There are two types of business proposals: unsolicited and solicited.

- Unsolicited Business Proposals : With unsolicited business proposals, you approach a potential customer with a proposal, even if they don't request one, to gain their business.

- Solicited Business Proposals : Solicited business proposals are requested by prospective clients so that they can decide whether to do business with your company.

In a solicited business proposal, the other organization asks for a request for proposal (RFP). When a company needs a problem solved, they invite other businesses to submit a proposal that details how they'd solve it.

Free Business Proposal Template

Propose your business as the ideal solution using our Free Business Proposal Templates

- Problem summary

- Proposed solution

- Pricing information

- Project timeline

You're all set!

Click this link to access this resource at any time.

Fill out the form to get your template.

Whether the proposal is solicited or unsolicited, the steps to create your proposal are similar. Make sure it includes three main points:

- A statement of the organization's problem

- Begin with a title page.

- Explain your why with an executive summary.

- State the problem or need.

- Propose a solution.

- Share your qualifications.

- Include pricing options.

- Summarize with a conclusion.

Before writing your business proposal, it's crucial you understand the company. If they've sent you an RFP, make sure you read it carefully, so you know exactly what they want.

I recommend having an initial call or meeting with any new clients to ensure you fully understand their objectives. Ask open-ended questions to understand not just what they want, but why they want it.

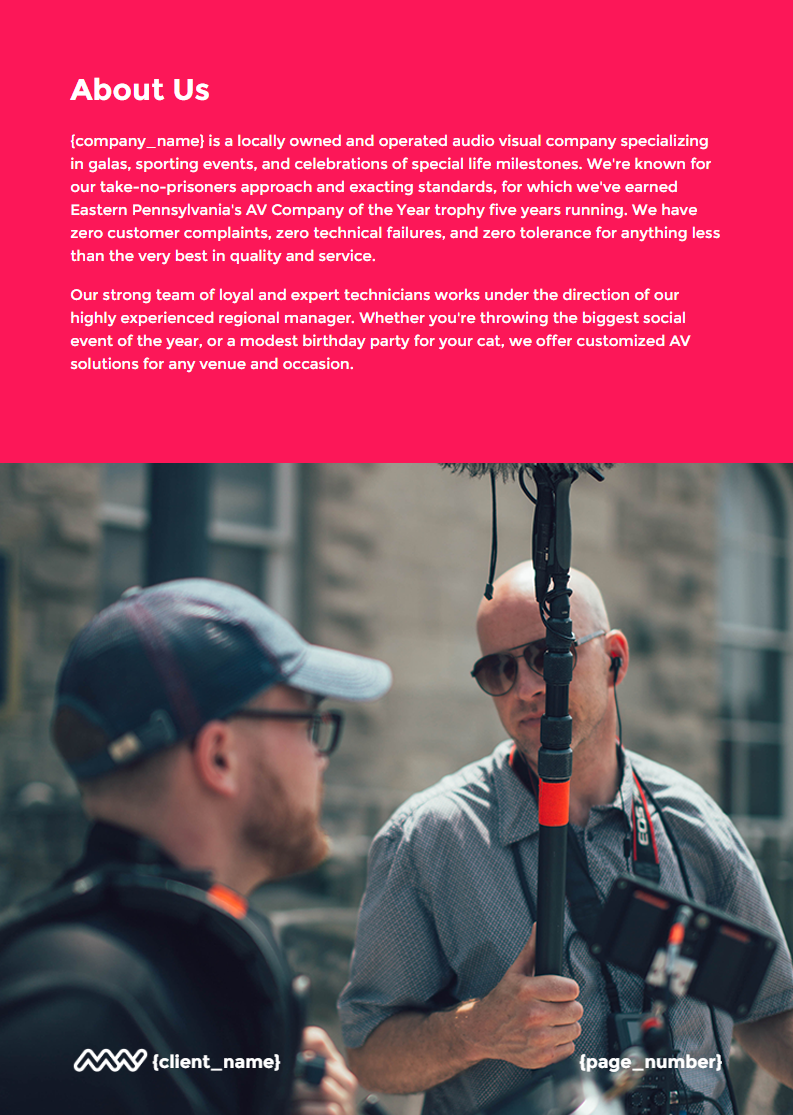

Once you've done your research, it's time to begin writing your business proposal. While there's no one-size-fits-all approach to writing a business proposal, there's several elements most proposals include. (I designed this example business proposal using Canva .)

1. Begin with a title page.

You have to convey some basic information here. Introduce yourself and your business. Be sure to include:

- Your company's name

- The date you submitted the proposal

- The name of the client or individual you're submitting the proposal to

Your title page should reconcile engagement with professionalism. I think of it as your first tone-setter, so you need to make sure yours is sleek, aesthetically appealing, and not too "out there."

Here's an example of what a business proposal template looks like when done right:

The executive summary details exactly why you're sending the proposal and why your solution is the best for the prospective client.

Specificity is key here. Why are you the best choice for them?

Like a value proposition, your executive summary outlines the benefits of your company's products or services and how they can solve your potential client's problem.

After reading your executive summary, the prospect should offer a clear idea of how you can help them, even if they don't read the entire proposal. Here's what one should look like:

3. State the problem or need.

This is where you share a summary of the issue impacting the potential client. This is your opportunity to show them you understand their needs and the problem they need help solving.

In the example above, I included several signals to showcase my expertise – that I've been in the photography biz for 10 years, that I've worked with over 500 clients, and that I've been featured a number of publications.

As you approach this section, focus on presenting yourself as an authority. Consider leveraging tools like:

- Case studies

- Client testimonials

- Relevant awards

- Industry accreditations

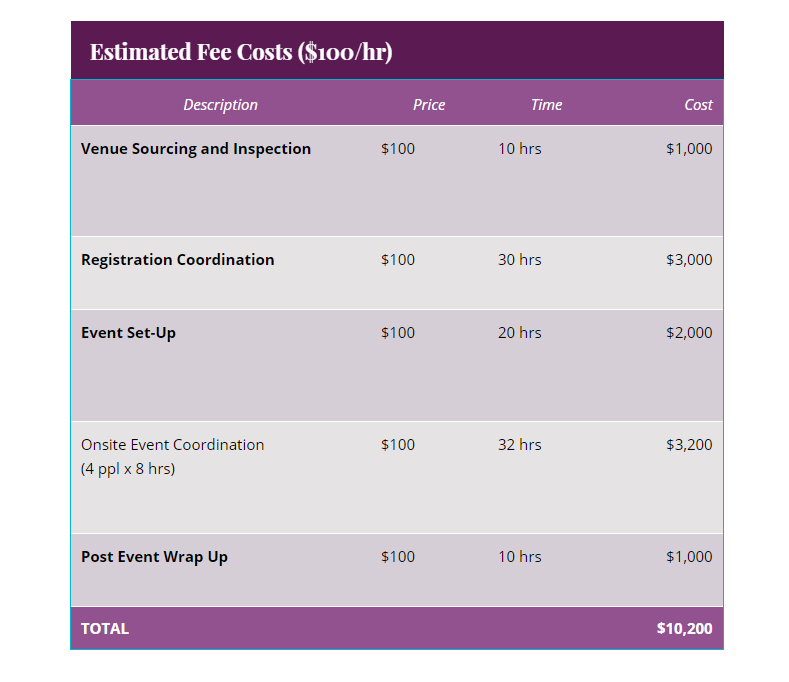

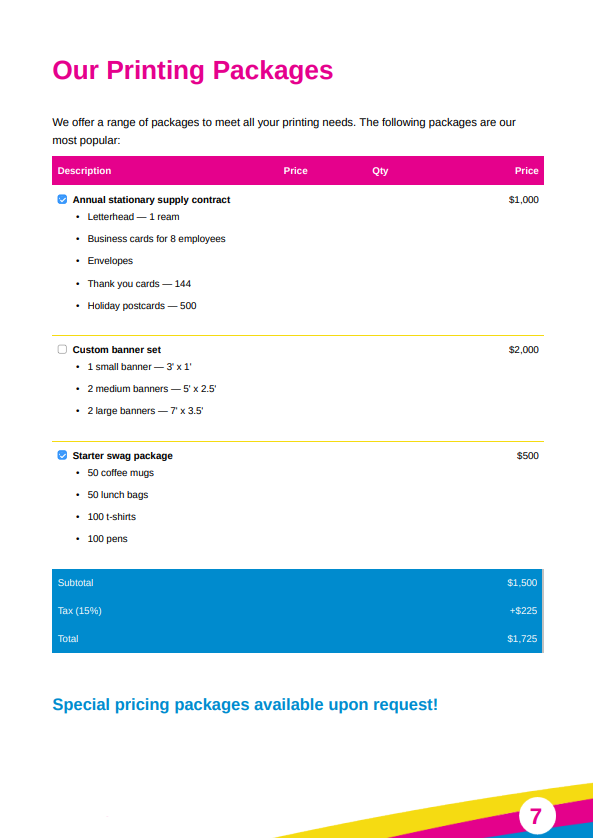

6. Include pricing options.

Pricing is where things can get a bit tricky, as you don't want to under or over-price your product.

The pricing section of your proposal could include:

- A detailed pricing breakdown, including packages, tiers, and add-ons or optional services

- How product features and benefits align with pricing choices

- Pricing for different needs and budgets

- How your pricing compares with competitors

- An FAQ section to respond to anticipated objections and explain your pricing strategy

7. Summarize with a conclusion.

After sharing the above information, simplify it all into one final section.

- First, briefly summarize the proposal. Be sure to share your qualifications and why you’d serve as the best choice.

- Then, to prompt further conversation, confirm your availability to go over the next steps.

- At the end of the proposal, the goal is to have the client ready to work with you. So, be sure to offer your contact information for easy follow-up.

In need of some inspiration before you begin writing? Here are example business proposal templates from popular business proposal software companies you can use to help create your proposal.

1. HubSpot's Free Business Plan Templates

Download these Templates

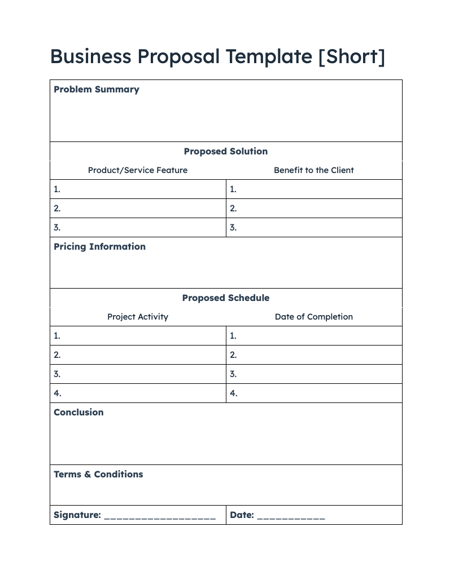

We know how crucial a great business proposal is to your and your client’s success. That's why we've compiled 2 Free Business Proposal Templates for you to use and customize for any of your projects.

You'll gain access to a concise, one-page template (pictured above), as well as a longer template for you to refine your plan and proposal.

Download the templates now to get started on building your proposal.

What We Like

The one-page template is clear, straightforward, and easy to read — without skipping on the key elements of a business proposal. This format is especially useful for busy clients who appreciate brevity and clarity.

2. Web Design Proposal

With advertising on social networks projected to reach $82.23 billion dollars in 2025 , it's in your business's best interest to have a plan for growing your client's social media presence.

To help you in that effort, the information in this social media marketing proposal includes an executive summary to help introduce your high-level ideas, an assessment of the client’s company to show your diligence, and a breakdown of billing to show how your company charges for posting, content creation, and analytics.

This template includes all the bells and whistles of a social media proposal packaged in a fun yet professional design. It also includes helpful writing instructions under each section.

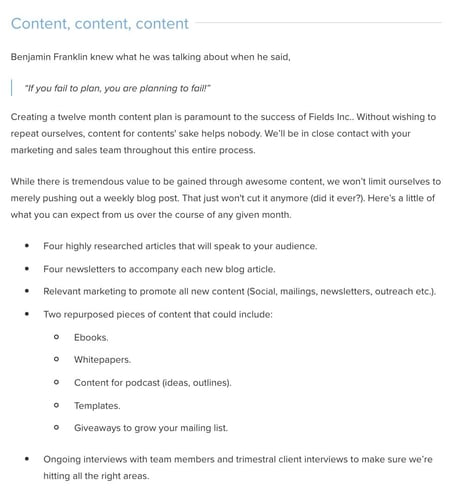

8. Content Marketing Proposal

Business proposal templates are helpful places to get started, but what should your business proposal look like when it's complete? This template should inspire you.

When pitching your content marketing services to clients, this template can help you organize your ideas. While it walks you through initial objectives and how to communicate your prospected results, one of the most helpful parts of this template is the pricing ideas it gives you when charging for your services.

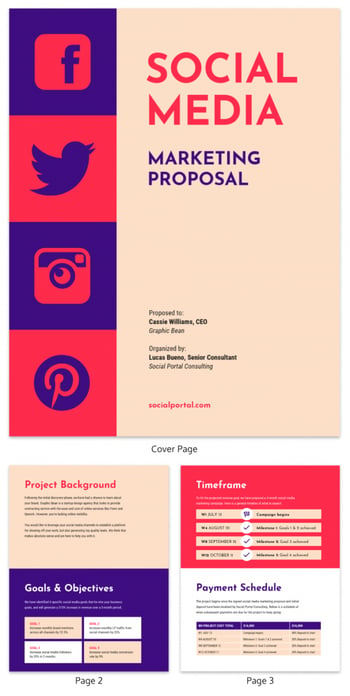

In the business template example below, Social Portal Consulting (SPC) pitches a marketing proposal to Graphic Bean. At first sight, this proposal appeals to the creative. I recommend going a step forward and designing the layout in your or your client’s brand colors.

Besides the design, the social media icons quickly tell the prospect what platforms Social Portal is pitching. Because we see Facebook, Twitter, Instagram, and Pinterest icons, the client instantly knows that this proposal doesn’t include LinkedIn, YouTube, or other platforms.

While maintaining its design, this example outlines Social Portal Consulting’s plans efficiently. It begins by providing insight into Graphic Bean and its goals before elaborating on how SPC can leverage its expertise to help them achieve them.

This business proposal template includes an easy-to-follow timeframe for goals and objectives while keeping the client abreast of how payment will happen across the project.

Overall, this is an excellent example of how to combine the elements of social media marketing into a creative and concise business proposal. Finally, we'll leave you with some business proposal ideas to get you started on your own.

- Start with an outline.

- Keep it simple.

- Stay on brand.

- Quality control.

- Include data and visuals.

- Add social proof.

- Use a call-to-action.

- Create a sense of urgency.

- Make the decision for them.

- Incorporate video into your proposal.

- Include up-sell and add-on opportunities.

- Clarify your terms and conditions.

- Include a space for signatures to document agreement.

- Create a table of contents.

1. Start with an outline.

If you want to produce a thoughtful, effective business proposal, you need to have some idea of what you're hoping to achieve with it.

Before I dive into writing a proposal, I always outline the major sections of the proposal that I want to include. That way, I can stay focused and make sure my message stays intact as I write.

Use these free business proposal templates to make sure that your outline includes everything you need.

2. Keep it simple.

Ultimately, there's no definitive blueprint for how long a business proposal has to be. Yours should be however long it takes to convey the information you want to get across.

That said, I'm a firm believer in quality over quantity, especially when it comes to business proposals. Keep your sentences short and simple, and avoid including too much business jargon.

You want anyone who picks up your proposal to make sense of it. So, be straightforward and don't get too fancy. Aim for substance over flash.

3. Stay on brand.

Don't be afraid to let your company's personality shine through in your proposal. Stay true to your brand and show the client what sets you apart from your competitors.

4. Quality control.

I've made it a habit to add an editing/QA step in my writing process. During this step, I do a quick spelling and grammar check before hitting send.

So, as you draft your proposal, and after checking for the basics, keep scanning this document until it's just right.

Check to make sure your proposal:

- Meets client needs and expectations

- Highlights your value proposition

- Is well-structured and easy to read or skim

- Complies with legal, ethical, and regulatory requirements

- Looks professional and engaging

5. Include data and visuals.

You want your business proposal to capture your prospect's attention and help set you apart from any other ones they might have received. One of the best ways to do that is to include hard, quantitative data that helps stress the value of your business.

Use relevant, compelling figures that highlight what you have to offer. This can establish authority and make your proposal more convincing. It also helps to include visuals such as charts and graphs to enhance your proposal.

6. Add social proof.

From my experience, you can only be so convincing when you're personally talking up how great your business is — which is why adding social proof is key to establishing credibility.

At the end of the day, prospects are skeptical. They may not take you at your word. But they'll likely trust peers and fellow customers. That's why including elements like customer quotes and testimonials can go a long way.

7. Use a call-to-action.

I've learned that the best proposal in the world can only take you so far if you don't clearly define the next steps. That's why you have to make sure the reader knows what to do after reading your proposal.

A clear call-to-action is the best way to get there.

Define and highlight exactly what they should do to act on the interest your proposal has generated. Without that guidance, you might leave your reader in limbo.

HubSpot customers : Use this CTA builder to create powerful customized CTAs.

8. Create a sense of urgency.

No one wants to feel as if they missed out on a great opportunity. From my experience, prospect tend to drag their feet and put off making a decision if there isn't a sense of urgency.

So, as you create your business proposal, your goal should be to add a degree of urgency. When prospective clients read your business proposal they should feel that the best time to sign up for your service is now .

One way I accomplish this is by stating short and long-term goals for their business. They'll have to wait for the long-term goals, but I make the short-term goals so enticing that they'll be ready to begin a collaboration.

9. Make the decision for them.

Craft your copy in a way that seems like saying "no" to the proposal would be stepping over dollars to pick up pennies. Your offer should go above and beyond their expectations. Do everything in your power to remove friction and objections along the way.

10. Incorporate video into your proposal.

If you're creating an online proposal using document file formats like PDF, add multimedia elements. This will enhance the proposal experience, make your document richer, and keep them engaged.

Try adding a video at the beginning as an intro to your proposal. Or, put a video in the project breakdown to verbally discuss some of the more confusing parts.

Extras like this can make an impression. This tip works especially well with prospects who are visual or auditory communicators.

Pro tip : HubSpot Video makes it easy to record and embed video into a website or email for a big proposal boost.

11. Include up-sell and add-on opportunities.

They say you won't receive unless you ask. And readers won't explore the upper tiers of your solutions if you don't give them the opportunity.

So, share some upsells and add-ons about your business that they can act on. Call out a specific pain point and how this extra can add value.

With this step, balance is important. Show them everything your business has to offer without overwhelming your recipient.

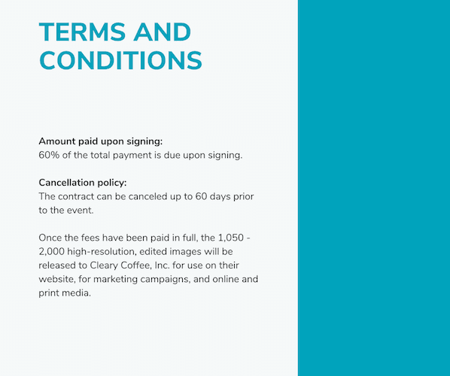

12. Clarify your terms and conditions.

Your business proposal should include details on your project timeline and payment schedule. This summary is basically what you and the client agree to if they accept your proposal.

Don't forget to share this post!

Related articles.

70 Small Business Ideas for Anyone Who Wants to Run Their Own Business

![proposed a business plan How to Start a Business: A Startup Guide for Entrepreneurs [Template]](https://blog.hubspot.com/hubfs/How-to-Start-a-Business-Aug-11-2023-10-39-02-4844-PM.jpg)

How to Start a Business: A Startup Guide for Entrepreneurs [Template]

Door-to-Door Sales: The Complete Guide

Amazon Affiliate Program: How to Become an Amazon Associate to Boost Income

Product Differentiation and What it Means for Your Brand

![proposed a business plan How to Write a Business Proposal [Examples + Template]](https://blog.hubspot.com/hubfs/how-to-write-business-proposal%20%281%29.webp)

The 25 Best PayPal Alternatives of 2023

The First-Mover Advantage, Explained

Intrapreneurship vs. Entrepreneurship: What's the Difference?

What Are Current Assets? Definition + Examples

Propose your business as the ideal solution using this free template.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Step-by-Step Guide to Writing a Simple Business Plan

By Joe Weller | October 11, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

A business plan is the cornerstone of any successful company, regardless of size or industry. This step-by-step guide provides information on writing a business plan for organizations at any stage, complete with free templates and expert advice.

Included on this page, you’ll find a step-by-step guide to writing a business plan and a chart to identify which type of business plan you should write . Plus, find information on how a business plan can help grow a business and expert tips on writing one .

What Is a Business Plan?

A business plan is a document that communicates a company’s goals and ambitions, along with the timeline, finances, and methods needed to achieve them. Additionally, it may include a mission statement and details about the specific products or services offered.

A business plan can highlight varying time periods, depending on the stage of your company and its goals. That said, a typical business plan will include the following benchmarks:

- Product goals and deadlines for each month

- Monthly financials for the first two years

- Profit and loss statements for the first three to five years

- Balance sheet projections for the first three to five years

Startups, entrepreneurs, and small businesses all create business plans to use as a guide as their new company progresses. Larger organizations may also create (and update) a business plan to keep high-level goals, financials, and timelines in check.

While you certainly need to have a formalized outline of your business’s goals and finances, creating a business plan can also help you determine a company’s viability, its profitability (including when it will first turn a profit), and how much money you will need from investors. In turn, a business plan has functional value as well: Not only does outlining goals help keep you accountable on a timeline, it can also attract investors in and of itself and, therefore, act as an effective strategy for growth.

For more information, visit our comprehensive guide to writing a strategic plan or download free strategic plan templates . This page focuses on for-profit business plans, but you can read our article with nonprofit business plan templates .

Business Plan Steps

The specific information in your business plan will vary, depending on the needs and goals of your venture, but a typical plan includes the following ordered elements:

- Executive summary

- Description of business

- Market analysis

- Competitive analysis

- Description of organizational management

- Description of product or services

- Marketing plan

- Sales strategy

- Funding details (or request for funding)

- Financial projections

If your plan is particularly long or complicated, consider adding a table of contents or an appendix for reference. For an in-depth description of each step listed above, read “ How to Write a Business Plan Step by Step ” below.

Broadly speaking, your audience includes anyone with a vested interest in your organization. They can include potential and existing investors, as well as customers, internal team members, suppliers, and vendors.

Do I Need a Simple or Detailed Plan?

Your business’s stage and intended audience dictates the level of detail your plan needs. Corporations require a thorough business plan — up to 100 pages. Small businesses or startups should have a concise plan focusing on financials and strategy.

How to Choose the Right Plan for Your Business

In order to identify which type of business plan you need to create, ask: “What do we want the plan to do?” Identify function first, and form will follow.

Use the chart below as a guide for what type of business plan to create:

Is the Order of Your Business Plan Important?

There is no set order for a business plan, with the exception of the executive summary, which should always come first. Beyond that, simply ensure that you organize the plan in a way that makes sense and flows naturally.

The Difference Between Traditional and Lean Business Plans

A traditional business plan follows the standard structure — because these plans encourage detail, they tend to require more work upfront and can run dozens of pages. A Lean business plan is less common and focuses on summarizing critical points for each section. These plans take much less work and typically run one page in length.

In general, you should use a traditional model for a legacy company, a large company, or any business that does not adhere to Lean (or another Agile method ). Use Lean if you expect the company to pivot quickly or if you already employ a Lean strategy with other business operations. Additionally, a Lean business plan can suffice if the document is for internal use only. Stick to a traditional version for investors, as they may be more sensitive to sudden changes or a high degree of built-in flexibility in the plan.

How to Write a Business Plan Step by Step

Writing a strong business plan requires research and attention to detail for each section. Below, you’ll find a 10-step guide to researching and defining each element in the plan.

Step 1: Executive Summary

The executive summary will always be the first section of your business plan. The goal is to answer the following questions:

- What is the vision and mission of the company?

- What are the company’s short- and long-term goals?

See our roundup of executive summary examples and templates for samples. Read our executive summary guide to learn more about writing one.

Step 2: Description of Business

The goal of this section is to define the realm, scope, and intent of your venture. To do so, answer the following questions as clearly and concisely as possible:

- What business are we in?

- What does our business do?

Step 3: Market Analysis

In this section, provide evidence that you have surveyed and understand the current marketplace, and that your product or service satisfies a niche in the market. To do so, answer these questions:

- Who is our customer?

- What does that customer value?

Step 4: Competitive Analysis

In many cases, a business plan proposes not a brand-new (or even market-disrupting) venture, but a more competitive version — whether via features, pricing, integrations, etc. — than what is currently available. In this section, answer the following questions to show that your product or service stands to outpace competitors:

- Who is the competition?

- What do they do best?

- What is our unique value proposition?

Step 5: Description of Organizational Management

In this section, write an overview of the team members and other key personnel who are integral to success. List roles and responsibilities, and if possible, note the hierarchy or team structure.

Step 6: Description of Products or Services

In this section, clearly define your product or service, as well as all the effort and resources that go into producing it. The strength of your product largely defines the success of your business, so it’s imperative that you take time to test and refine the product before launching into marketing, sales, or funding details.

Questions to answer in this section are as follows:

- What is the product or service?

- How do we produce it, and what resources are necessary for production?

Step 7: Marketing Plan

In this section, define the marketing strategy for your product or service. This doesn’t need to be as fleshed out as a full marketing plan , but it should answer basic questions, such as the following:

- Who is the target market (if different from existing customer base)?

- What channels will you use to reach your target market?

- What resources does your marketing strategy require, and do you have access to them?

- If possible, do you have a rough estimate of timeline and budget?

- How will you measure success?

Step 8: Sales Plan

Write an overview of the sales strategy, including the priorities of each cycle, steps to achieve these goals, and metrics for success. For the purposes of a business plan, this section does not need to be a comprehensive, in-depth sales plan , but can simply outline the high-level objectives and strategies of your sales efforts.

Start by answering the following questions:

- What is the sales strategy?

- What are the tools and tactics you will use to achieve your goals?

- What are the potential obstacles, and how will you overcome them?

- What is the timeline for sales and turning a profit?

- What are the metrics of success?

Step 9: Funding Details (or Request for Funding)

This section is one of the most critical parts of your business plan, particularly if you are sharing it with investors. You do not need to provide a full financial plan, but you should be able to answer the following questions:

- How much capital do you currently have? How much capital do you need?

- How will you grow the team (onboarding, team structure, training and development)?

- What are your physical needs and constraints (space, equipment, etc.)?

Step 10: Financial Projections

Apart from the fundraising analysis, investors like to see thought-out financial projections for the future. As discussed earlier, depending on the scope and stage of your business, this could be anywhere from one to five years.

While these projections won’t be exact — and will need to be somewhat flexible — you should be able to gauge the following:

- How and when will the company first generate a profit?

- How will the company maintain profit thereafter?

Business Plan Template

Download Business Plan Template

Microsoft Excel | Smartsheet

This basic business plan template has space for all the traditional elements: an executive summary, product or service details, target audience, marketing and sales strategies, etc. In the finances sections, input your baseline numbers, and the template will automatically calculate projections for sales forecasting, financial statements, and more.

For templates tailored to more specific needs, visit this business plan template roundup or download a fill-in-the-blank business plan template to make things easy.

If you are looking for a particular template by file type, visit our pages dedicated exclusively to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates.

How to Write a Simple Business Plan

A simple business plan is a streamlined, lightweight version of the large, traditional model. As opposed to a one-page business plan , which communicates high-level information for quick overviews (such as a stakeholder presentation), a simple business plan can exceed one page.

Below are the steps for creating a generic simple business plan, which are reflected in the template below .

- Write the Executive Summary This section is the same as in the traditional business plan — simply offer an overview of what’s in the business plan, the prospect or core offering, and the short- and long-term goals of the company.

- Add a Company Overview Document the larger company mission and vision.

- Provide the Problem and Solution In straightforward terms, define the problem you are attempting to solve with your product or service and how your company will attempt to do it. Think of this section as the gap in the market you are attempting to close.

- Identify the Target Market Who is your company (and its products or services) attempting to reach? If possible, briefly define your buyer personas .

- Write About the Competition In this section, demonstrate your knowledge of the market by listing the current competitors and outlining your competitive advantage.

- Describe Your Product or Service Offerings Get down to brass tacks and define your product or service. What exactly are you selling?

- Outline Your Marketing Tactics Without getting into too much detail, describe your planned marketing initiatives.

- Add a Timeline and the Metrics You Will Use to Measure Success Offer a rough timeline, including milestones and key performance indicators (KPIs) that you will use to measure your progress.

- Include Your Financial Forecasts Write an overview of your financial plan that demonstrates you have done your research and adequate modeling. You can also list key assumptions that go into this forecasting.

- Identify Your Financing Needs This section is where you will make your funding request. Based on everything in the business plan, list your proposed sources of funding, as well as how you will use it.

Simple Business Plan Template

Download Simple Business Plan Template

Microsoft Excel | Microsoft Word | Adobe PDF | Smartsheet

Use this simple business plan template to outline each aspect of your organization, including information about financing and opportunities to seek out further funding. This template is completely customizable to fit the needs of any business, whether it’s a startup or large company.

Read our article offering free simple business plan templates or free 30-60-90-day business plan templates to find more tailored options. You can also explore our collection of one page business templates .

How to Write a Business Plan for a Lean Startup

A Lean startup business plan is a more Agile approach to a traditional version. The plan focuses more on activities, processes, and relationships (and maintains flexibility in all aspects), rather than on concrete deliverables and timelines.

While there is some overlap between a traditional and a Lean business plan, you can write a Lean plan by following the steps below:

- Add Your Value Proposition Take a streamlined approach to describing your product or service. What is the unique value your startup aims to deliver to customers? Make sure the team is aligned on the core offering and that you can state it in clear, simple language.

- List Your Key Partners List any other businesses you will work with to realize your vision, including external vendors, suppliers, and partners. This section demonstrates that you have thoughtfully considered the resources you can provide internally, identified areas for external assistance, and conducted research to find alternatives.

- Note the Key Activities Describe the key activities of your business, including sourcing, production, marketing, distribution channels, and customer relationships.

- Include Your Key Resources List the critical resources — including personnel, equipment, space, and intellectual property — that will enable you to deliver your unique value.

- Identify Your Customer Relationships and Channels In this section, document how you will reach and build relationships with customers. Provide a high-level map of the customer experience from start to finish, including the spaces in which you will interact with the customer (online, retail, etc.).

- Detail Your Marketing Channels Describe the marketing methods and communication platforms you will use to identify and nurture your relationships with customers. These could be email, advertising, social media, etc.

- Explain the Cost Structure This section is especially necessary in the early stages of a business. Will you prioritize maximizing value or keeping costs low? List the foundational startup costs and how you will move toward profit over time.

- Share Your Revenue Streams Over time, how will the company make money? Include both the direct product or service purchase, as well as secondary sources of revenue, such as subscriptions, selling advertising space, fundraising, etc.

Lean Business Plan Template for Startups

Download Lean Business Plan Template for Startups

Microsoft Word | Adobe PDF

Startup leaders can use this Lean business plan template to relay the most critical information from a traditional plan. You’ll find all the sections listed above, including spaces for industry and product overviews, cost structure and sources of revenue, and key metrics, and a timeline. The template is completely customizable, so you can edit it to suit the objectives of your Lean startups.

See our wide variety of startup business plan templates for more options.

How to Write a Business Plan for a Loan

A business plan for a loan, often called a loan proposal , includes many of the same aspects of a traditional business plan, as well as additional financial documents, such as a credit history, a loan request, and a loan repayment plan.

In addition, you may be asked to include personal and business financial statements, a form of collateral, and equity investment information.

Download free financial templates to support your business plan.

Tips for Writing a Business Plan

Outside of including all the key details in your business plan, you have several options to elevate the document for the highest chance of winning funding and other resources. Follow these tips from experts:.

- Keep It Simple: Avner Brodsky , the Co-Founder and CEO of Lezgo Limited, an online marketing company, uses the acronym KISS (keep it short and simple) as a variation on this idea. “The business plan is not a college thesis,” he says. “Just focus on providing the essential information.”

- Do Adequate Research: Michael Dean, the Co-Founder of Pool Research , encourages business leaders to “invest time in research, both internal and external (market, finance, legal etc.). Avoid being overly ambitious or presumptive. Instead, keep everything objective, balanced, and accurate.” Your plan needs to stand on its own, and you must have the data to back up any claims or forecasting you make. As Brodsky explains, “Your business needs to be grounded on the realities of the market in your chosen location. Get the most recent data from authoritative sources so that the figures are vetted by experts and are reliable.”

- Set Clear Goals: Make sure your plan includes clear, time-based goals. “Short-term goals are key to momentum growth and are especially important to identify for new businesses,” advises Dean.

- Know (and Address) Your Weaknesses: “This awareness sets you up to overcome your weak points much quicker than waiting for them to arise,” shares Dean. Brodsky recommends performing a full SWOT analysis to identify your weaknesses, too. “Your business will fare better with self-knowledge, which will help you better define the mission of your business, as well as the strategies you will choose to achieve your objectives,” he adds.

- Seek Peer or Mentor Review: “Ask for feedback on your drafts and for areas to improve,” advises Brodsky. “When your mind is filled with dreams for your business, sometimes it is an outsider who can tell you what you’re missing and will save your business from being a product of whimsy.”

Outside of these more practical tips, the language you use is also important and may make or break your business plan.

Shaun Heng, VP of Operations at Coin Market Cap , gives the following advice on the writing, “Your business plan is your sales pitch to an investor. And as with any sales pitch, you need to strike the right tone and hit a few emotional chords. This is a little tricky in a business plan, because you also need to be formal and matter-of-fact. But you can still impress by weaving in descriptive language and saying things in a more elegant way.

“A great way to do this is by expanding your vocabulary, avoiding word repetition, and using business language. Instead of saying that something ‘will bring in as many customers as possible,’ try saying ‘will garner the largest possible market segment.’ Elevate your writing with precise descriptive words and you'll impress even the busiest investor.”

Additionally, Dean recommends that you “stay consistent and concise by keeping your tone and style steady throughout, and your language clear and precise. Include only what is 100 percent necessary.”

Resources for Writing a Business Plan

While a template provides a great outline of what to include in a business plan, a live document or more robust program can provide additional functionality, visibility, and real-time updates. The U.S. Small Business Association also curates resources for writing a business plan.

Additionally, you can use business plan software to house data, attach documentation, and share information with stakeholders. Popular options include LivePlan, Enloop, BizPlanner, PlanGuru, and iPlanner.

How a Business Plan Helps to Grow Your Business

A business plan — both the exercise of creating one and the document — can grow your business by helping you to refine your product, target audience, sales plan, identify opportunities, secure funding, and build new partnerships.

Outside of these immediate returns, writing a business plan is a useful exercise in that it forces you to research the market, which prompts you to forge your unique value proposition and identify ways to beat the competition. Doing so will also help you build (and keep you accountable to) attainable financial and product milestones. And down the line, it will serve as a welcome guide as hurdles inevitably arise.

Streamline Your Business Planning Activities with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-14343635291-33bf053f368c43f6a792e94775285bbd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

550+ Business Plan Examples to Launch Your Business

Need help writing your business plan? Explore over 550 industry-specific business plan examples for inspiration.

Find your business plan example

Accounting, Insurance & Compliance Business Plans

- View All 25

Children & Pets Business Plans

- Children's Education & Recreation

- View All 33

Cleaning, Repairs & Maintenance Business Plans

- Auto Detail & Repair

- Cleaning Products

- View All 39

Clothing & Fashion Brand Business Plans

- Clothing & Fashion Design

- View All 26

Construction, Architecture & Engineering Business Plans

- Architecture

- Construction

- View All 46

Consulting, Advertising & Marketing Business Plans

- Advertising

- View All 54

Education Business Plans

- Education Consulting

- Education Products

Business plan template: There's an easier way to get your business plan done.

Entertainment & Recreation Business Plans

- Entertainment

- Film & Television

- View All 60

Events Business Plans

- Event Planning

- View All 17

Farm & Agriculture Business Plans

- Agri-tourism

- Agriculture Consulting

- View All 16

Finance & Investing Business Plans

- Financial Planning

- View All 10

Fine Art & Crafts Business Plans

Fitness & Beauty Business Plans

- Salon & Spa

- View All 36

Food and Beverage Business Plans

- Bar & Brewery

- View All 77

Hotel & Lodging Business Plans

- Bed and Breakfast

IT, Staffing & Customer Service Business Plans

- Administrative Services

- Customer Service

- View All 22

Manufacturing & Wholesale Business Plans

- Cleaning & Cosmetics Manufacturing

- View All 68

Medical & Health Business Plans

- Dental Practice

- Health Administration

- View All 41

Nonprofit Business Plans

- Co-op Nonprofit

- Food & Housing Nonprofit

- View All 13

Real Estate & Rentals Business Plans

- Equipment Rental

Retail & Ecommerce Business Plans

- Car Dealership

- View All 116

Technology Business Plans

- Apps & Software

- Communication Technology

Transportation, Travel & Logistics Business Plans

- Airline, Taxi & Shuttle

- View All 62

View all sample business plans

Example business plan format

Before you start exploring our library of business plan examples, it's worth taking the time to understand the traditional business plan format . You'll find that the plans in this library and most investor-approved business plans will include the following sections:

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally only one to two pages. You should also plan to write this section last after you've written your full business plan.

Your executive summary should include a summary of the problem you are solving, a description of your product or service, an overview of your target market, a brief description of your team, a summary of your financials, and your funding requirements (if you are raising money).

Products & services

The products & services chapter of your business plan is where the real meat of your plan lives. It includes information about the problem that you're solving, your solution, and any traction that proves that it truly meets the need you identified.

This is your chance to explain why you're in business and that people care about what you offer. It needs to go beyond a simple product or service description and get to the heart of why your business works and benefits your customers.

Market analysis

Conducting a market analysis ensures that you fully understand the market that you're entering and who you'll be selling to. This section is where you will showcase all of the information about your potential customers. You'll cover your target market as well as information about the growth of your market and your industry. Focus on outlining why the market you're entering is viable and creating a realistic persona for your ideal customer base.

Competition

Part of defining your opportunity is determining what your competitive advantage may be. To do this effectively you need to get to know your competitors just as well as your target customers. Every business will have competition, if you don't then you're either in a very young industry or there's a good reason no one is pursuing this specific venture.

To succeed, you want to be sure you know who your competitors are, how they operate, necessary financial benchmarks, and how you're business will be positioned. Start by identifying who your competitors are or will be during your market research. Then leverage competitive analysis tools like the competitive matrix and positioning map to solidify where your business stands in relation to the competition.

Marketing & sales

The marketing and sales plan section of your business plan details how you plan to reach your target market segments. You'll address how you plan on selling to those target markets, what your pricing plan is, and what types of activities and partnerships you need to make your business a success.

The operations section covers the day-to-day workflows for your business to deliver your product or service. What's included here fully depends on the type of business. Typically you can expect to add details on your business location, sourcing and fulfillment, use of technology, and any partnerships or agreements that are in place.

Milestones & metrics

The milestones section is where you lay out strategic milestones to reach your business goals.

A good milestone clearly lays out the parameters of the task at hand and sets expectations for its execution. You'll want to include a description of the task, a proposed due date, who is responsible, and eventually a budget that's attached. You don't need extensive project planning in this section, just key milestones that you want to hit and when you plan to hit them.

You should also discuss key metrics, which are the numbers you will track to determine your success. Some common data points worth tracking include conversion rates, customer acquisition costs, profit, etc.

Company & team

Use this section to describe your current team and who you need to hire. If you intend to pursue funding, you'll need to highlight the relevant experience of your team members. Basically, this is where you prove that this is the right team to successfully start and grow the business. You will also need to provide a quick overview of your legal structure and history if you're already up and running.

Financial projections

Your financial plan should include a sales and revenue forecast, profit and loss statement, cash flow statement, and a balance sheet. You may not have established financials of any kind at this stage. Not to worry, rather than getting all of the details ironed out, focus on making projections and strategic forecasts for your business. You can always update your financial statements as you begin operations and start bringing in actual accounting data.

Now, if you intend to pitch to investors or submit a loan application, you'll also need a "use of funds" report in this section. This outlines how you intend to leverage any funding for your business and how much you're looking to acquire. Like the rest of your financials, this can always be updated later on.

The appendix isn't a required element of your business plan. However, it is a useful place to add any charts, tables, definitions, legal notes, or other critical information that supports your plan. These are often lengthier or out-of-place information that simply didn't work naturally into the structure of your plan. You'll notice that in these business plan examples, the appendix mainly includes extended financial statements.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. To get the most out of your plan, it's best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you'll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or in any other situation where the full details of your business must be understood by another individual.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear format in favor of a cell-based template. It encourages you to build connections between every element of your business. It's faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan . This format is a simplified version of the traditional plan that focuses on the core aspects of your business.

By starting with a one-page plan , you give yourself a minimal document to build from. You'll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan.

Growth planning

Growth planning is more than a specific type of business plan. It's a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, forecast, review, and refine based on your performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27 minutes . However, it's even easier to convert into a more detailed plan thanks to how heavily it's tied to your financials. The overall goal of growth planning isn't to just produce documents that you use once and shelve. Instead, the growth planning process helps you build a healthier company that thrives in times of growth and remain stable through times of crisis.

It's faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Download a free sample business plan template

Ready to start writing your own plan but aren't sure where to start? Download our free business plan template that's been updated for 2024.

This simple, modern, investor-approved business plan template is designed to make planning easy. It's a proven format that has helped over 1 million businesses write business plans for bank loans, funding pitches, business expansion, and even business sales. It includes additional instructions for how to write each section and is formatted to be SBA-lender approved. All you need to do is fill in the blanks.

How to use an example business plan to help you write your own

How do you know what elements need to be included in your business plan, especially if you've never written one before? Looking at examples can help you visualize what a full, traditional plan looks like, so you know what you're aiming for before you get started. Here's how to get the most out of a sample business plan.

Choose a business plan example from a similar type of company

You don't need to find an example business plan that's an exact fit for your business. Your business location, target market, and even your particular product or service may not match up exactly with the plans in our gallery. But, you don't need an exact match for it to be helpful. Instead, look for a plan that's related to the type of business you're starting.

For example, if you want to start a vegetarian restaurant, a plan for a steakhouse can be a great match. While the specifics of your actual startup will differ, the elements you'd want to include in your restaurant's business plan are likely to be very similar.

Use a business plan example as a guide

Every startup and small business is unique, so you'll want to avoid copying an example business plan word for word. It just won't be as helpful, since each business is unique. You want your plan to be a useful tool for starting a business —and getting funding if you need it.

One of the key benefits of writing a business plan is simply going through the process. When you sit down to write, you'll naturally think through important pieces, like your startup costs, your target market , and any market analysis or research you'll need to do to be successful.

You'll also look at where you stand among your competition (and everyone has competition), and lay out your goals and the milestones you'll need to meet. Looking at an example business plan's financials section can be helpful because you can see what should be included, but take them with a grain of salt. Don't assume that financial projections for a sample company will fit your own small business.

If you're looking for more resources to help you get started, our business planning guide is a good place to start. You can also download our free business plan template .

Think of business planning as a process, instead of a document

Think about business planning as something you do often , rather than a document you create once and never look at again. If you take the time to write a plan that really fits your own company, it will be a better, more useful tool to grow your business. It should also make it easier to share your vision and strategy so everyone on your team is on the same page.

Adjust your plan regularly to use it as a business management tool

Keep in mind that businesses that use their plan as a management tool to help run their business grow 30 percent faster than those businesses that don't. For that to be true for your company, you'll think of a part of your business planning process as tracking your actual results against your financial forecast on a regular basis.

If things are going well, your plan will help you think about how you can re-invest in your business. If you find that you're not meeting goals, you might need to adjust your budgets or your sales forecast. Either way, tracking your progress compared to your plan can help you adjust quickly when you identify challenges and opportunities—it's one of the most powerful things you can do to grow your business.

Prepare to pitch your business

If you're planning to pitch your business to investors or seek out any funding, you'll need a pitch deck to accompany your business plan. A pitch deck is designed to inform people about your business. You want your pitch deck to be short and easy to follow, so it's best to keep your presentation under 20 slides.

Your pitch deck and pitch presentation are likely some of the first things that an investor will see to learn more about your company. So, you need to be informative and pique their interest. Luckily, just like you can leverage an example business plan template to write your plan, we also have a gallery of over 50 pitch decks for you to reference.

With this gallery, you have the option to view specific industry pitches or get inspired by real-world pitch deck examples.

Ready to get started?

Now that you know how to use an example business plan to help you write a plan for your business, it's time to find the right one.

Use the search bar below to get started and find the right match for your business idea.

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

How to Write a Business Proposal [Steps, Tips, & Templates]

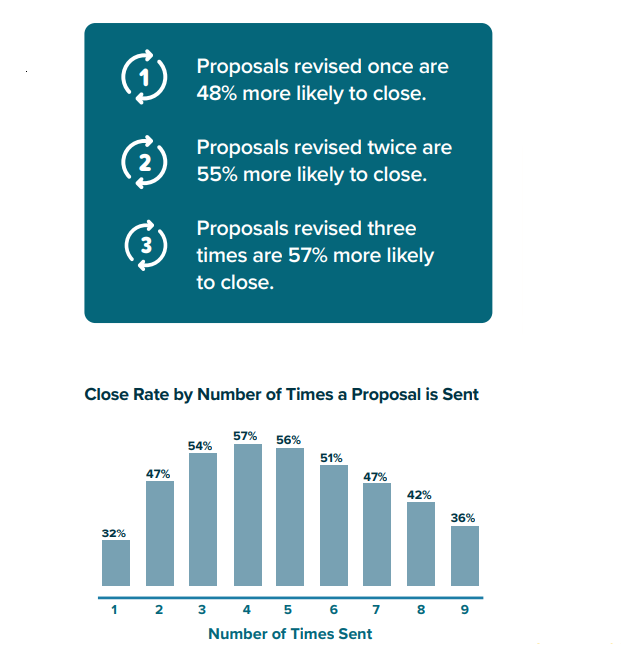

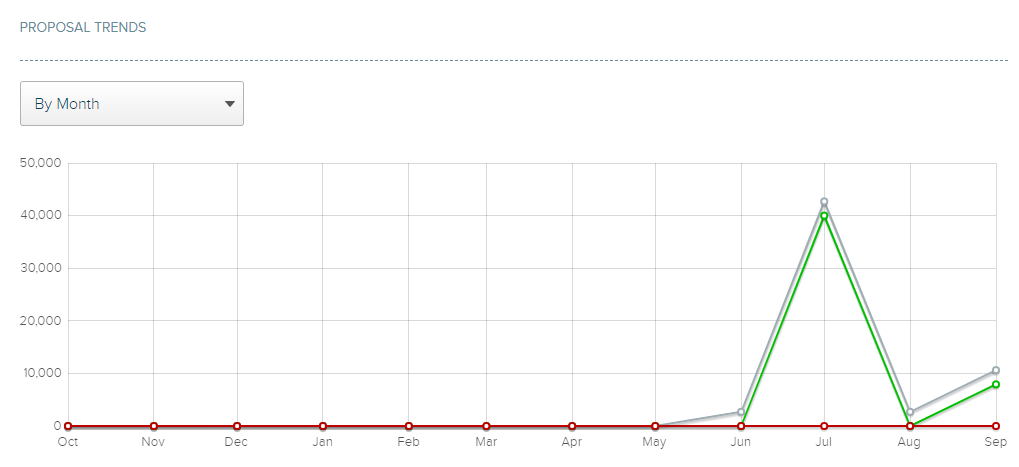

You need to send a business proposal, and you want it to close. But how can you improve your chances?

Every year, we analyze the proposals sent with our software to discover what makes closing more likely. We used this research to craft this very guide .

To help you write better business proposals, we’ve curated the essential proposal format, a step-by-step process, plenty of templates to help you get started, and strategies for following up.

From images to esignatures, keep reading for data-backed insights into the most successful proposals.

What’s in this guide:

What is a business proposal?

Basic proposal format, what to prepare before writing a business proposal, how to write a business proposal in 7 steps, 8 business proposal templates, 5 ideas to take your business proposal to the next level, what to do after you send a business proposal, using analytics for business proposal insights.

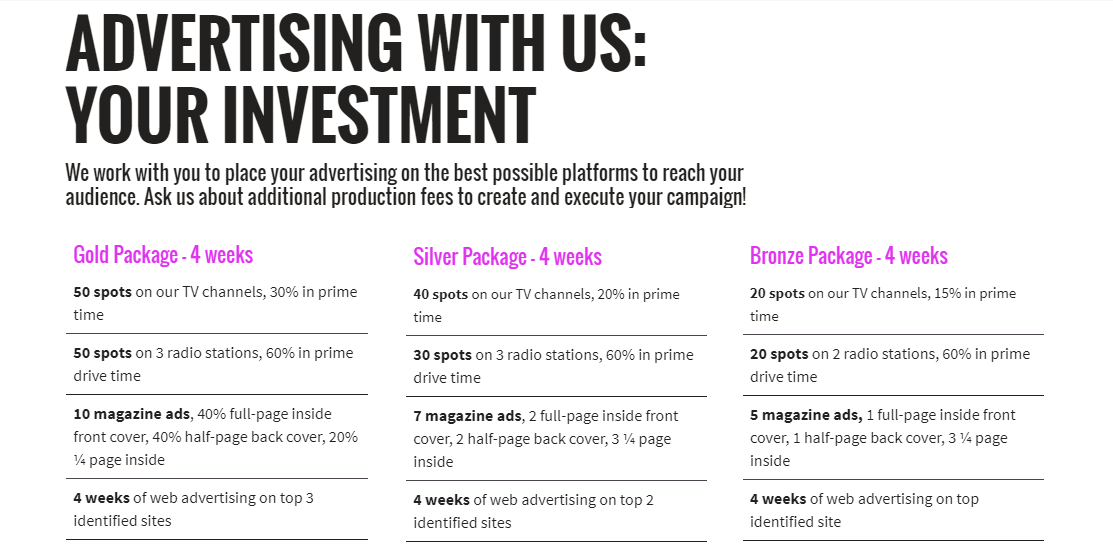

A business proposal is sent by a salesperson or account manager to a prospective client in order to pitch a product or service. A great proposal should include an executive summary or cover letter, details on the project timelines and deliverables, what makes the company the right choice for the job, and pricing and payment details.

Business proposals are typically sent from one business to another for all sorts of different services, such as enterprise software subscriptions, interior design, accounting, marketing, event catering, etc.

The purpose of a business proposal is to:

Sell your product or service with details, client results, testimonials, etc.

Clarify what is and isn’t included in the proposal to accurately manage expectations

Layout terms and conditions to protect both parties

Lock in the deal right away with esignatures built into the proposal

Large corporations and government agencies will typically send out a request for proposal to competing companies and then choose the best (or cheapest) one.

A business proposal is very different from a business plan, because it is typically written to clarify a paid engagement between two companies. This might be a short project or a long contract. A business plan, on the other hand, is typically an internal document crafted to chart a businesses path forward towards goals, such as market expansion, revenue growth, new product lines, etc.

Types of business proposals

There are many different types of business proposals. They are typically broken down by industry.

Here are some common types of business proposals, by industry :

Real estate and construction

Professional services

Proposals can also be categorized based on the type of offering :

One-off projects

Recurring subscription

Ongoing service

Package options

Later on in this guide, we include a variety of proposal templates. Depending on what you selling, you might find it easier to begin with a template designed for your industry or for the type of offer you’re selling (such as a one-off project). So be sure to peruse through the previews of each proposal so that you can see which template will save you the most time.

Business proposal example

An excellent business proposal addresses the client’s pain points and showcases the proposed solution.

Here’s an example business proposal to inspire you. The accounting proposal kicks things off with an attractive cover page.

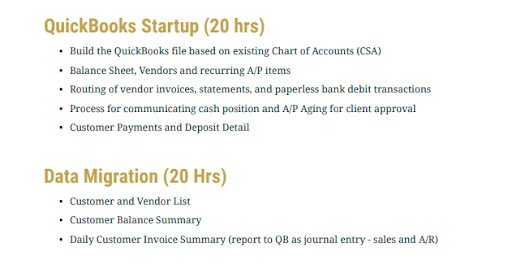

All in all, it includes the cover page, an executive summary letter, an about us section, team photos and bios, a project summary, a breakdown of the proposed services, a pricing section, onboarding steps, and a contract with esignatures.

The services breakdown offers a great example of how to categorize your services and provide hourly estimates.

After researching over 1 million proposals, we found that winning proposals are most likely to include all of the following.

Here’s the idea proposal structure :

1. Cover page

The cover page, also called a title page, should be kept simple. It prominently features a photograph or graphic design that is on-brand, you can use graphic design templates as a starting point. It also usually includes the project name, or the client name, as well as your company name. Some companies might include contact information on the cover page, while others will save that for a separate page.

Check out this cover page , which is bright, bold, and on-brand.

2. Executive summary

The executive summary is essentially your pitch.

It’s your shot at capturing the client’s attention and showing them that you have an approach that will exceed their expectations.

It’s typically written in paragraph form (1 to 3 paragraphs) but can also include a bulleted list for a more skimmable style.

Make sure that your executive summary includes:

A quick description of the client’s problem or starting point

How your company will serve the client and why you’re suggesting this unique approach

Why your company is the best choice (average results, unique selling propositions, differentiators, awards, etc.)

This content marketing proposal offers an excellent example of an executive summary. Though in this proposal, the section is instead titled “Focus and Objectives.” What makes it great is that it’s on brand, goal-oriented, personable, and skimmable.

3. Approach or solution

In this section, you write about your process and why you approach things the way you do. For example, a Facebook marketing agency might say that they believe that creative work is essential to advertising success, and that’s why they devote 90% of their time to developing videos, images, and copy.

Some companies will craft a custom approach section for each client, while others will re-use the section again and again. It all comes down to the number of services you offer and how much or how little you customize your work.

In corporate training, it’s essential to clarify your approach so the client knows why your system will be effective. In this training template example , their process shows the essential steps in their proprietary approach.

4. About the company

This is your chance to brag. In your company bio, be sure to mention all of the important things that set your company apart. That might include your management style, the talent you have on your team, your average client retention rate or contract length, and any accolades.

With their location, awards, and team structure, this About Us page is an excellent example of how to sell yourself with authority.

5. Deliverables

Use the deliverables section to summarize exactly what the client will receive from the engagement.

A TikTok ads management firm might include 15 ad creatives per month in their deliverables, for example. While an accounting firm might list the reports that will be sent weekly or monthly, along with the bookkeeping service.

In a construction project, on the other hand, the company might showcase the different milestones that the project will hit, and when these milestones are expected to be completed.

In this proposal , the Deliverables section is titled “Scope of Services,” and it includes a list of all of the services that the prospective client will receive. Deliverables are mentioned within the scope, including a logo, brand colors, business cards, and brand guidelines.

6. Social proof or work samples

No matter what you sell, prospective clients will want to know that you have the right experience for the job.

Social proof can come in the form of written testimonials and case studies, video testimonials and case studies, portfolio photographs, G2 and Capterra badges, and rating averages from Google, Trustpilot, or other review sites.

For an architecture firm, construction company, or website designer, work examples can prove more powerful than testimonials. Prospects want to see what you can do. This architecture proposal showcases the company’s work on a rehabilitation project.

The pricing section is of course the one that your clients will read again and again and deliberate over. That’s why it’s so important to make it clear, simple, and well-formatted.

Tables are a great way to showcase what’s included in the total project cost or to provide package options.

Similar to interior design and construction services, event planning typically includes both hourly costs and hard costs (for products and venues). Here’s an example of an event management proposal that includes a breakdown of the hourly work and the hard costs.

8. Terms and conditions

When you use modern proposal software , you can build a contract right into your proposal, eliminating the need for separate contract software.

Your proposal should include legal jargon that can protect both you and your client. You might have a statement of work and a master service agreement or terms and conditions.

In this website design proposal , there are 6 pages in total for the contract section. The potential client can easily click around to view all of these pages and share the proposal with their legal team if needed.

For proposals that are longer than 8 pages, it’s wise to include a table of contents. If you use Proposify as your proposal software, then every proposal will automatically have the table of contents on the left-hand side, making it easier for the potential client to click around and review important sections multiple times.

A lot goes into writing a proposal. Before you can get to the writing part, you need to prepare.

This means talking with the client to figure out their needs, using your experience to pitch the best project, and talking with colleagues who will be involved in the project to see if they agree on the services you plan to propose.

You might also need to talk with your legal department and ask them for a contract template that you can include at the end of the proposal so that when the client signs off, it's legally binding.

Everything you need to prepare to write a business proposal:

An understanding of the client's needs

Your determination of the best approach

Details that will get the client to say yes

Agreement with internal colleagues

The pricing options you want to offer

Knowledge of who needs to sign off

Legal contract language or templates

To be a good writer , you must be concise, specific, and detailed. It really is that simple. The more examples and details you provide, the better.

That said, it does help to follow a process so that you can be sure you’re providing everything that the decision-makers expect and more.

Here are the 7 essential steps for writing a business proposal:

Step 1. Determine the client’s needs

The first step is to figure out what your client needs.

As mentioned in our section on preparation above, you’ll need to speak with your client. If this is a new client, it might take two to five sales calls to collect all of the information you need. For an existing client, you can probably figure out what to include in their renewal proposal with just one call.

But of course, asking your client what they need isn’t enough. You need to use your expertise to choose the best solution for them, even if it’s not what they want or expect.

Step 2. Kick off your proposal with a template

Once you’ve done your due diligence, the next step is to choose a proposal template so you’ll save time on both writing and designing.

You can use a template that matches your specific business or click around to find one with all the sections and a design style you like. Even if it’s not created for your specific industry, it’ll be easy to update the content to match your service or product.

Check out our full library of proposal templates.

Step 3. Write the evergreen messaging about your company

It’s always smart to tackle writing section by section. This way, you don’t get overwhelmed.

We recommend starting with the sections that are relevant to your business and that can be reused again and again. Your value propositions should guide the content.

Tackle these sections:

The cover page

The approach section

The about us page and team bios

The social proof or portfolio pieces

By starting off with what makes your company special, you’ll break the ice during your writing process and also create your own custom template that you can use for further proposal writing.