- Contact sales

Start free trial

How to Make a Risk Management Plan (Template Included)

You identify them, record them, monitor them and plan for them: risks are an inherent part of every project. Some project risks are bound to become problem areas—like executing a project over the holidays and having to plan the project timeline around them. But there are many risks within any given project that, without risk assessment and risk mitigation strategies, can come as unwelcome surprises to you and your project management team.

That’s where a risk management plan comes in—to help mitigate risks before they become problems. But first, what is project risk management ?

What Is Risk Management?

Risk management is an arm of project management that deals with managing potential project risks. Managing risks is arguably one of the most important aspects of project management.

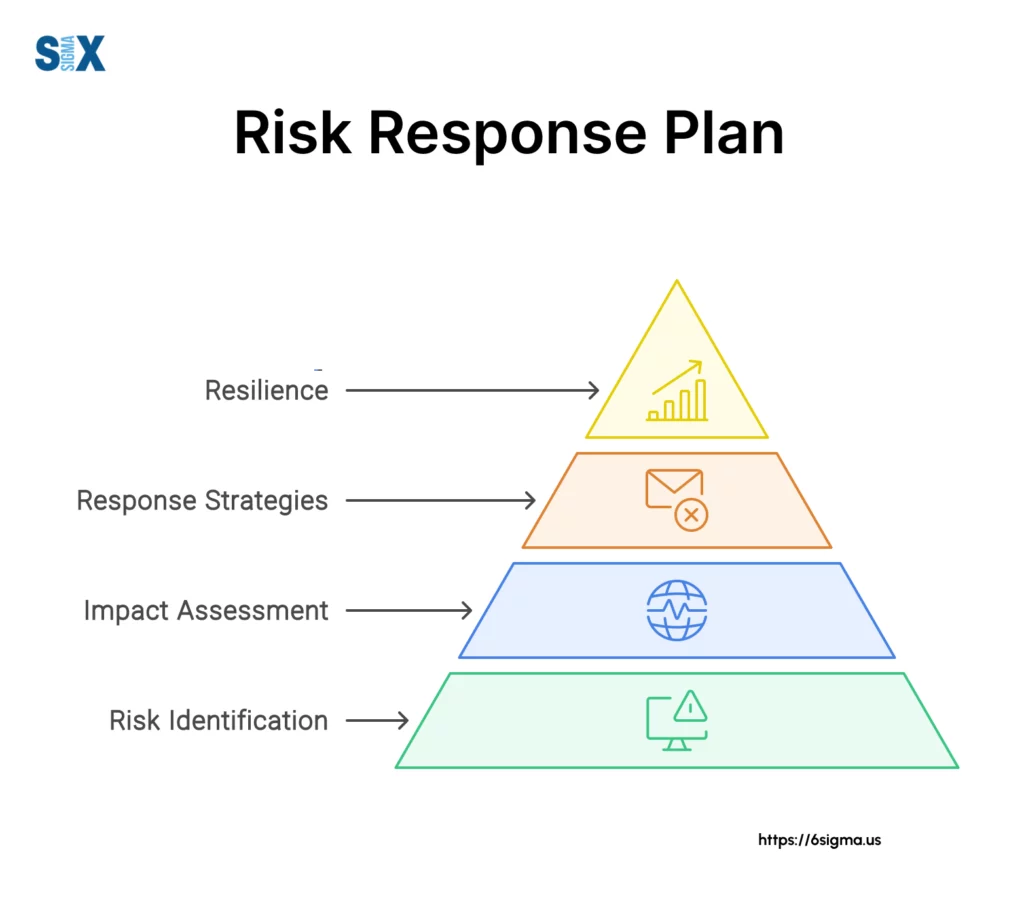

The risk management process has these main steps:

- Risk Identification: The first step to managing project risks is to identify them. Use data sources such as information from past projects or subject matter experts’ opinions to estimate all the potential risks that can impact the project.

- Risk Assessment: Once the project risks are identified, prioritize them by looking at their likelihood and level of impact.

- Risk Mitigation: Now it’s time to create a contingency plan with risk mitigation actions to manage your project risks. You also need to define which team members will be risk owners, responsible for monitoring and controlling risks.

- Risk Monitoring: Risks must be monitored throughout the project life cycle so that they can be controlled.

Even one risk can jeopardize the entire project plan . There isn’t usually just one risk per project, either; there are many risk categories that require assessment and discussion with stakeholders. That’s why risk management needs to be both a proactive and reactive process that is constant throughout the project life cycle. Now let’s define a risk management plan.

What Is a Risk Management Plan?

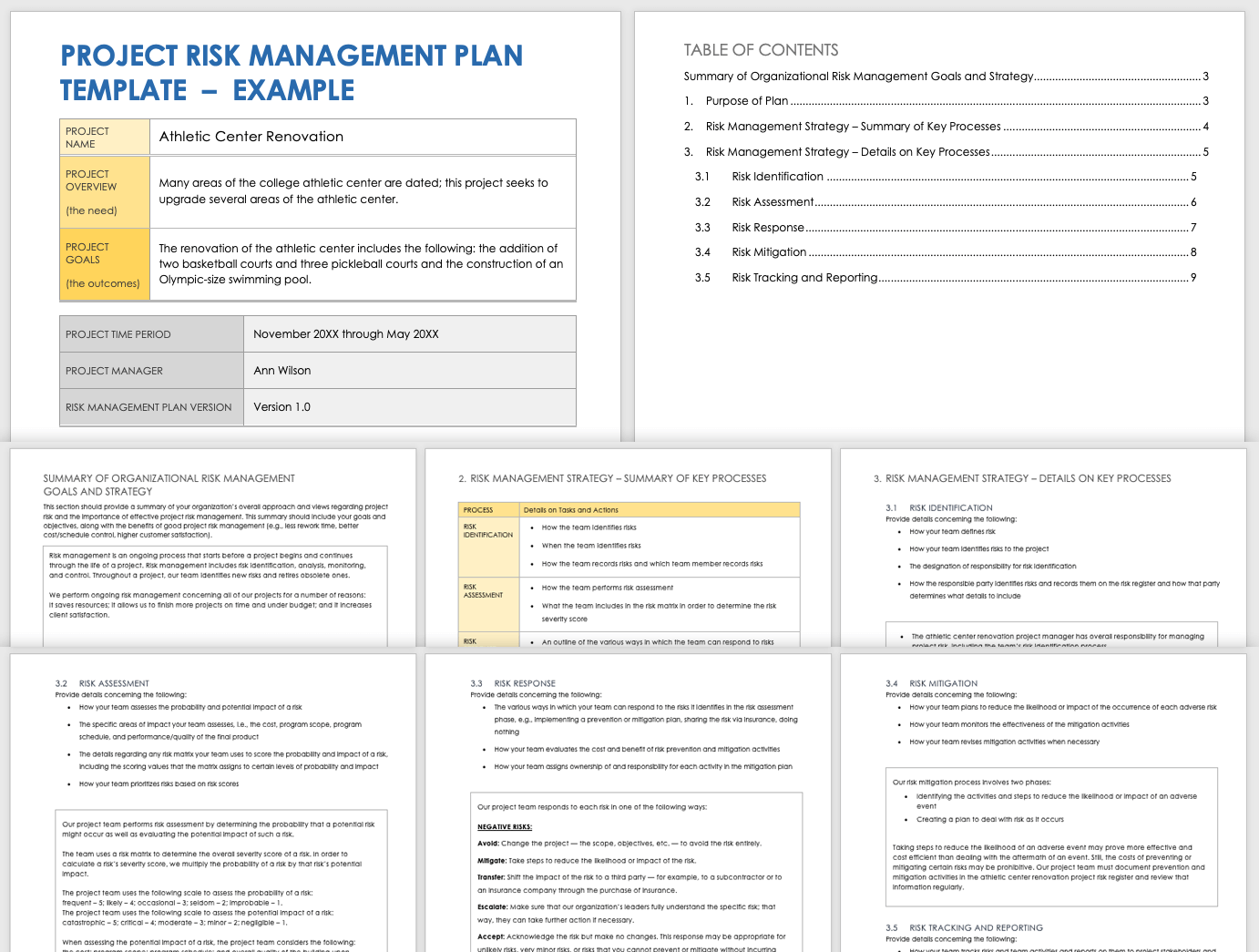

A risk management plan defines how the project’s risk management process will be executed. That includes the budget , tools and approaches that will be used to perform risk identification, assessment, mitigation and monitoring activities.

Get your free

Risk Management Plan Template

Use this free Risk Management Plan Template for Word to manage your projects better.

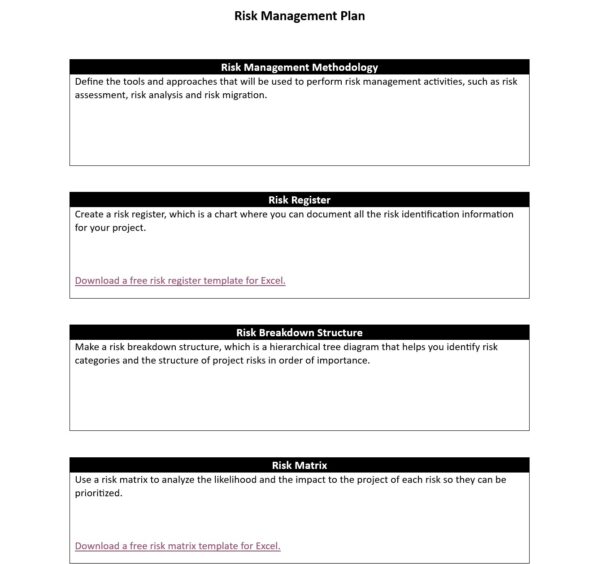

A risk management plan usually includes:

- Methodology: Define the tools and approaches that will be used to perform risk management activities such as risk assessment, risk analysis and risk mitigation strategies.

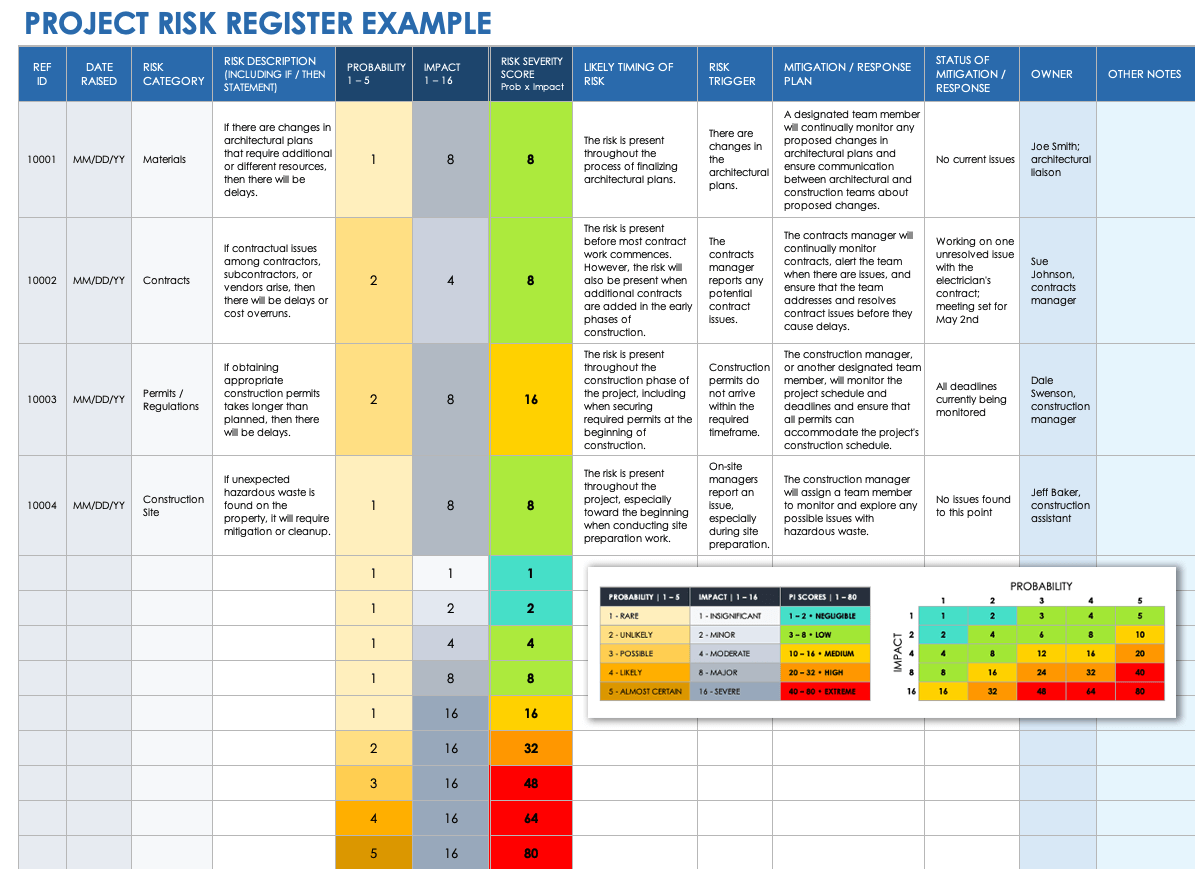

- Risk Register: A risk register is a chart to document the risk identification information.

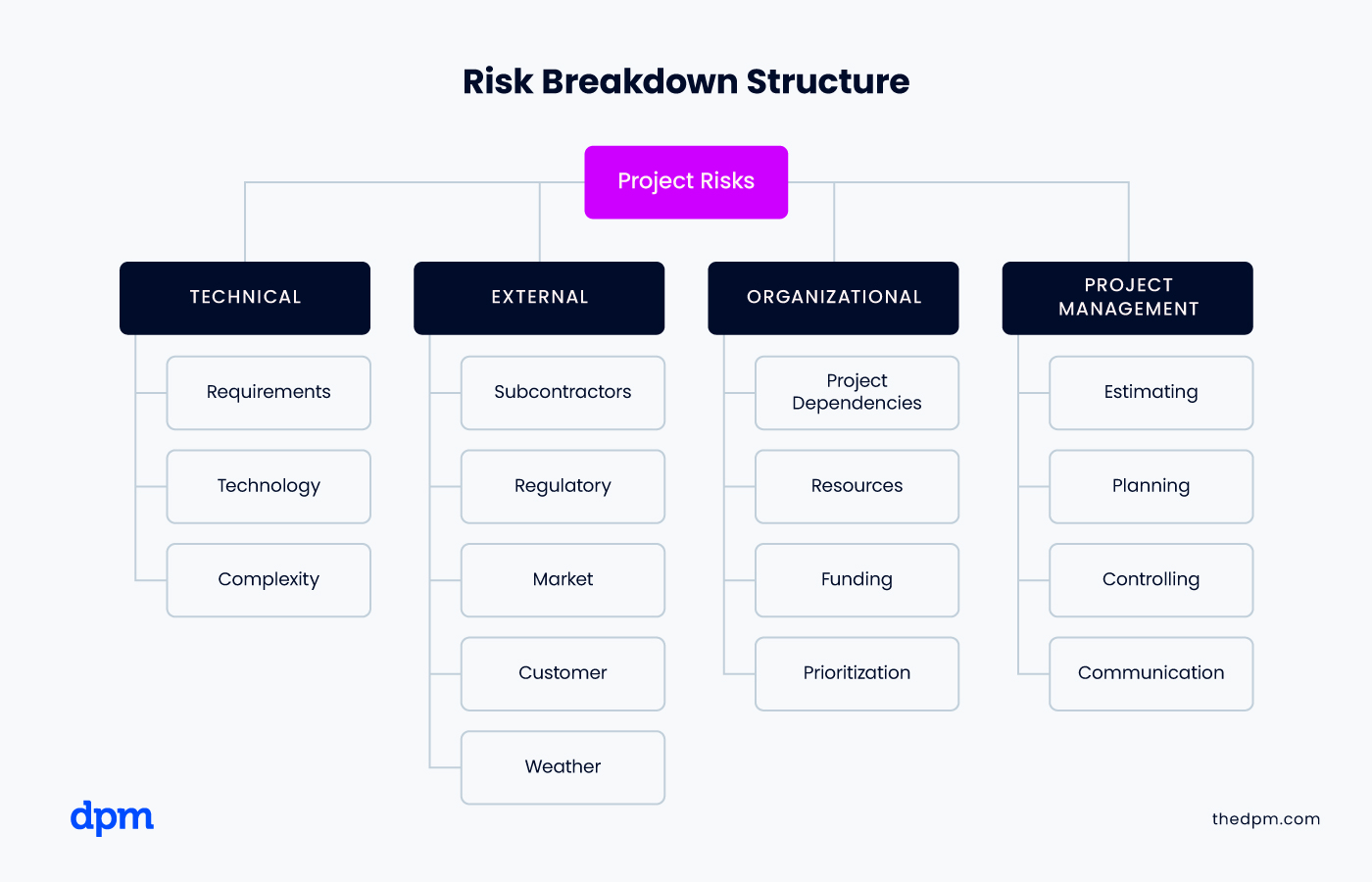

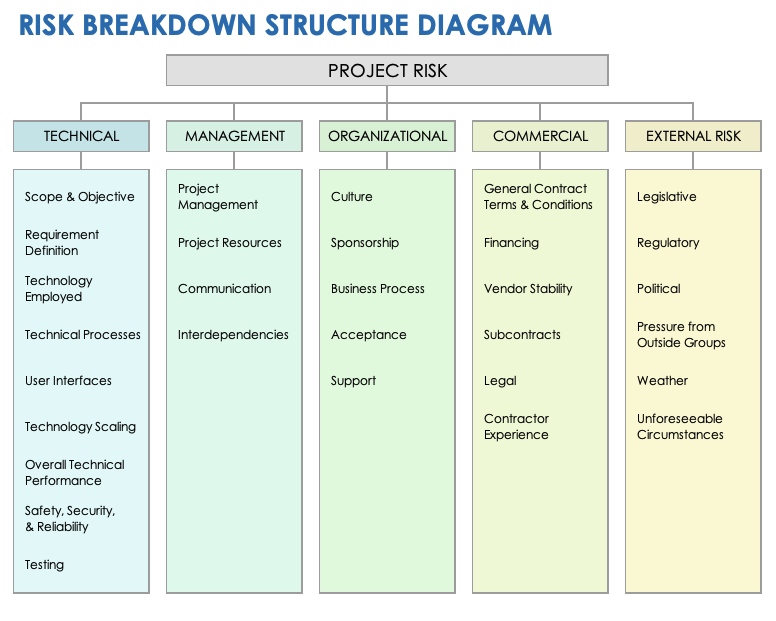

- Risk Breakdown Structure: This is a chart that identifies risk categories and the hierarchical structure of project risks.

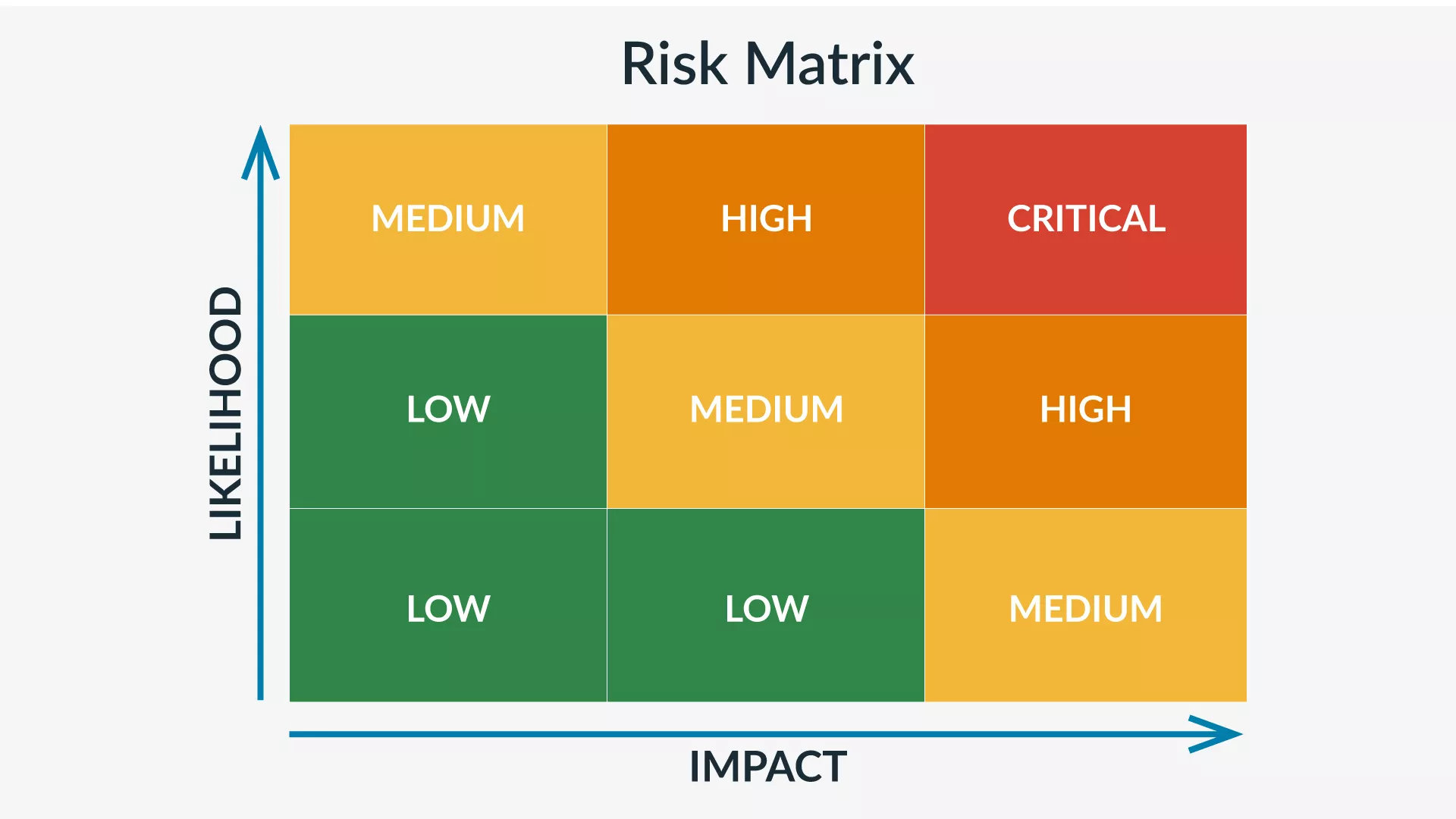

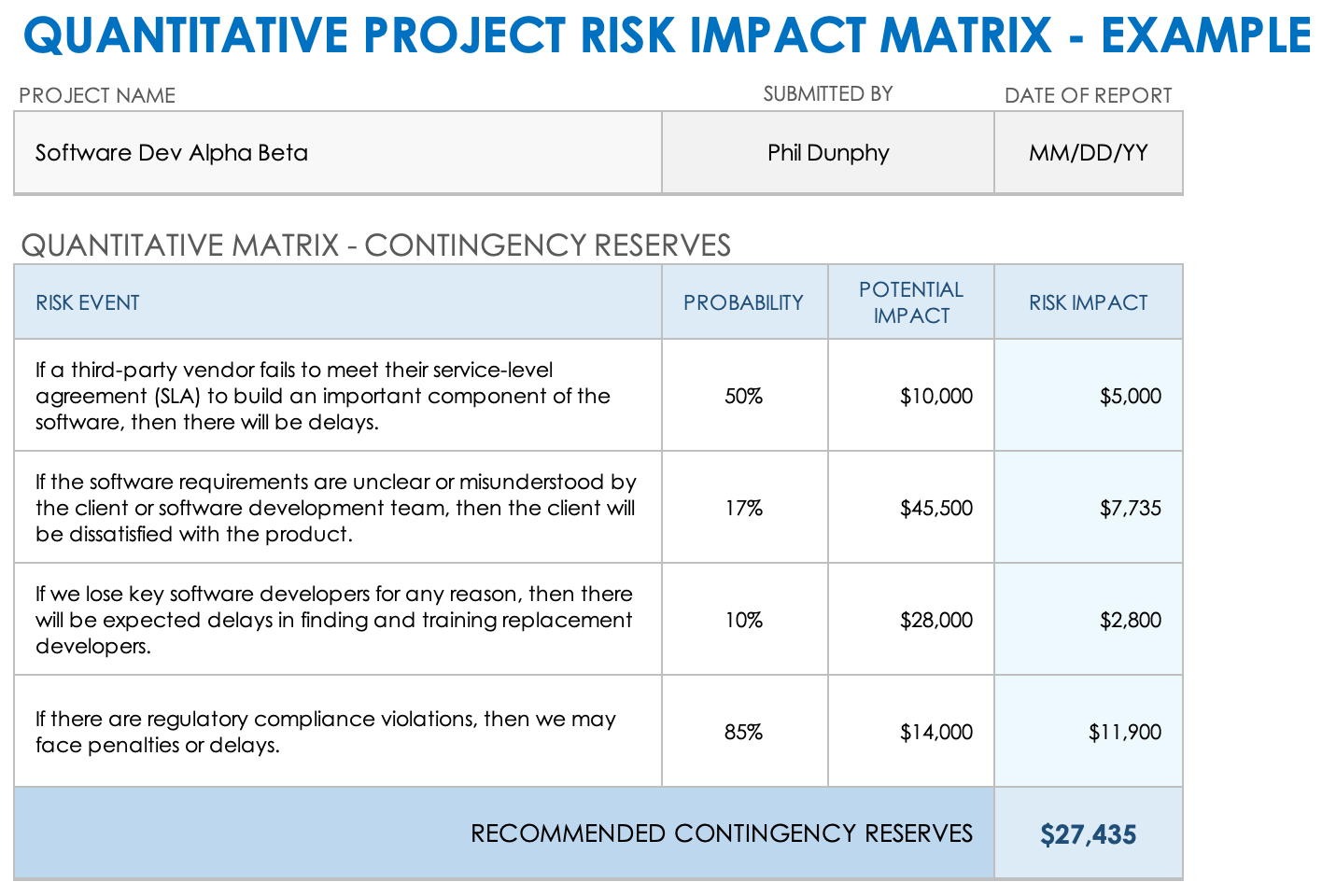

- Risk Assessment Matrix: A risk assessment matrix allows teams to analyze the likelihood and the impact of project risks so they can prioritize them.

- Risk Response Plan: A risk response plan is a project management document that explains the risk mitigation strategies that will be employed to manage risks.

- Roles and responsibilities: The risk management team members have responsibilities as risk owners. They need to monitor project risks and supervise their risk response actions.

- Budget: Have a section to identify the funds required to perform risk management activities.

- Timing: Include a section to define the schedule for the risk management activities.

How to Make a Risk Management Plan

For every web design and development project, construction project or product design, there will be risks. That’s the nature of project management. But that’s also why it’s always best to get ahead of them as much as possible by developing a risk management plan. We’ve outlined the steps to make a risk management plan below.

1. Risk Identification

Risk identification occurs at the beginning of the project planning phase, as well as throughout the project life cycle. While many risks are considered “known risks,” others might require additional research.

Create a risk breakdown structure to identify project risks and classify them into risk categories. You can do this by interviewing all project stakeholders and industry experts. Many project risks can be divided into risk categories, like technical or organizational, and listed out by specific sub-categories like technology, interfaces, performance, logistics, budget, etc. Additionally, create a risk register to share with everyone interviewed for a centralized location of all known risks revealed during the identification phase.

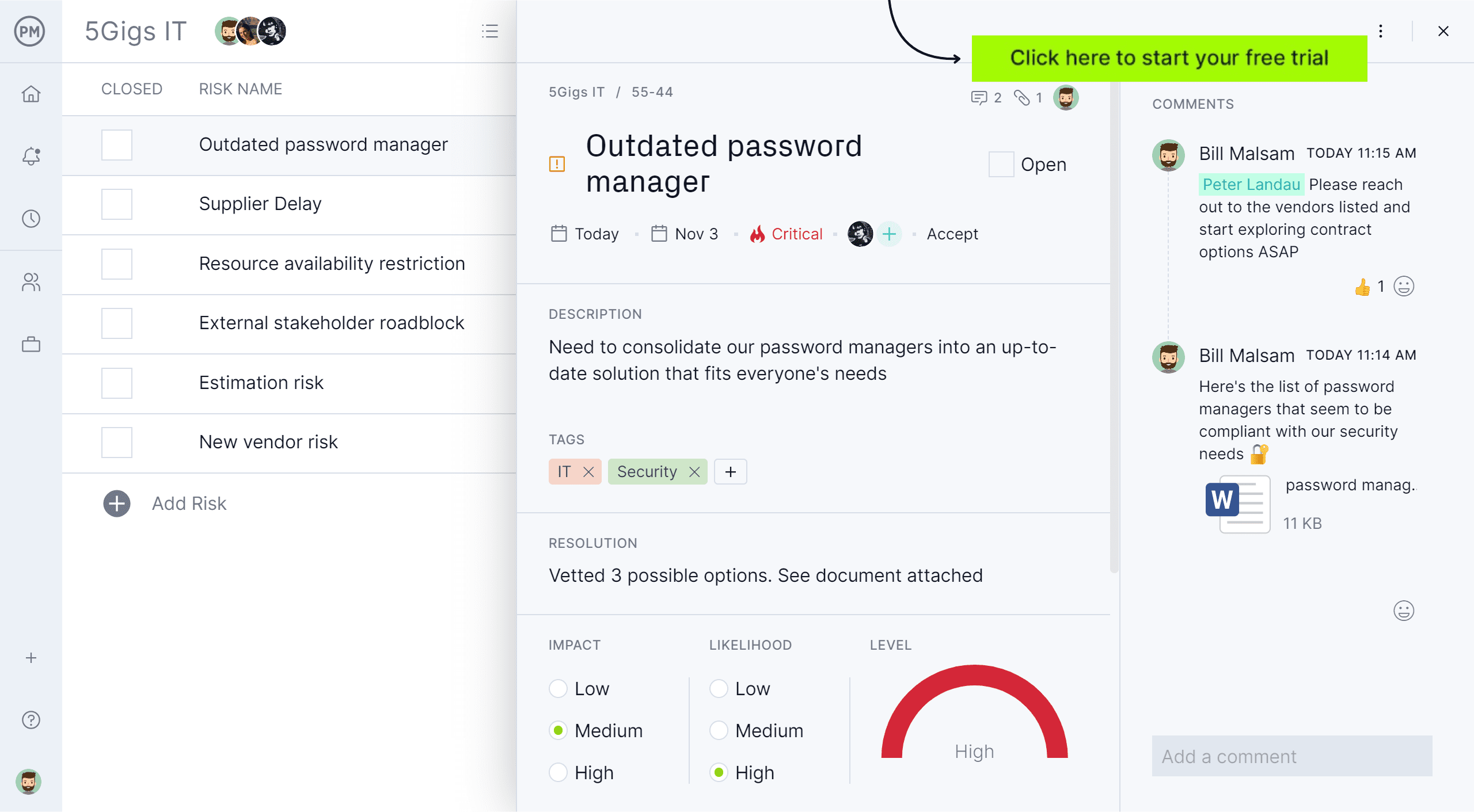

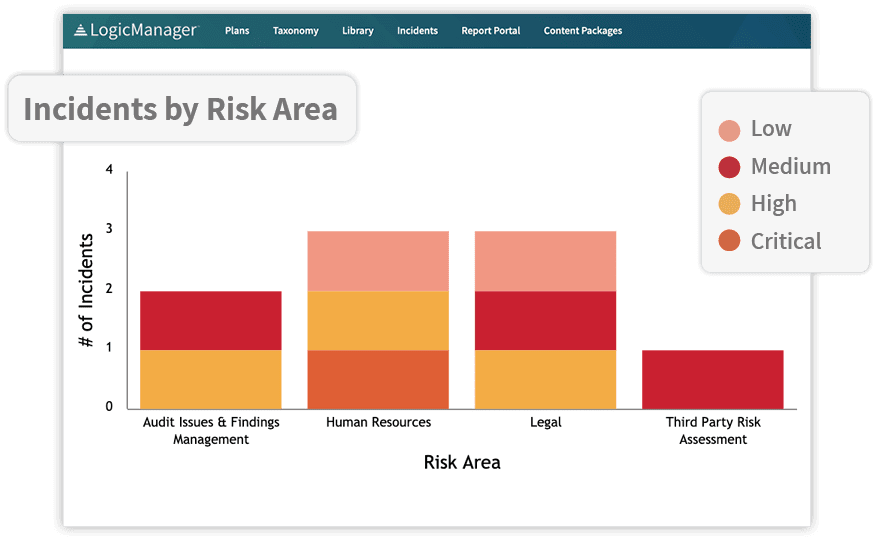

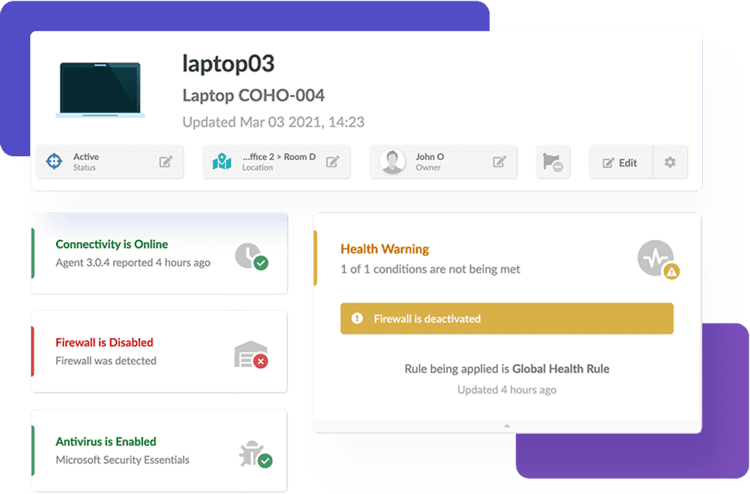

It’s easy to create a risk register using online project management software. For example, use the list view on ProjectManager to capture all project risks, add their priority level and assign a team member to own identify and resolve them. Better than to-do list apps, you can attach files and tags and monitor progress. Track the percentage complete and even view risks from the project menu. Keep risks from derailing projects by signing up for a free trial of ProjectManager.

2. Risk Assessment

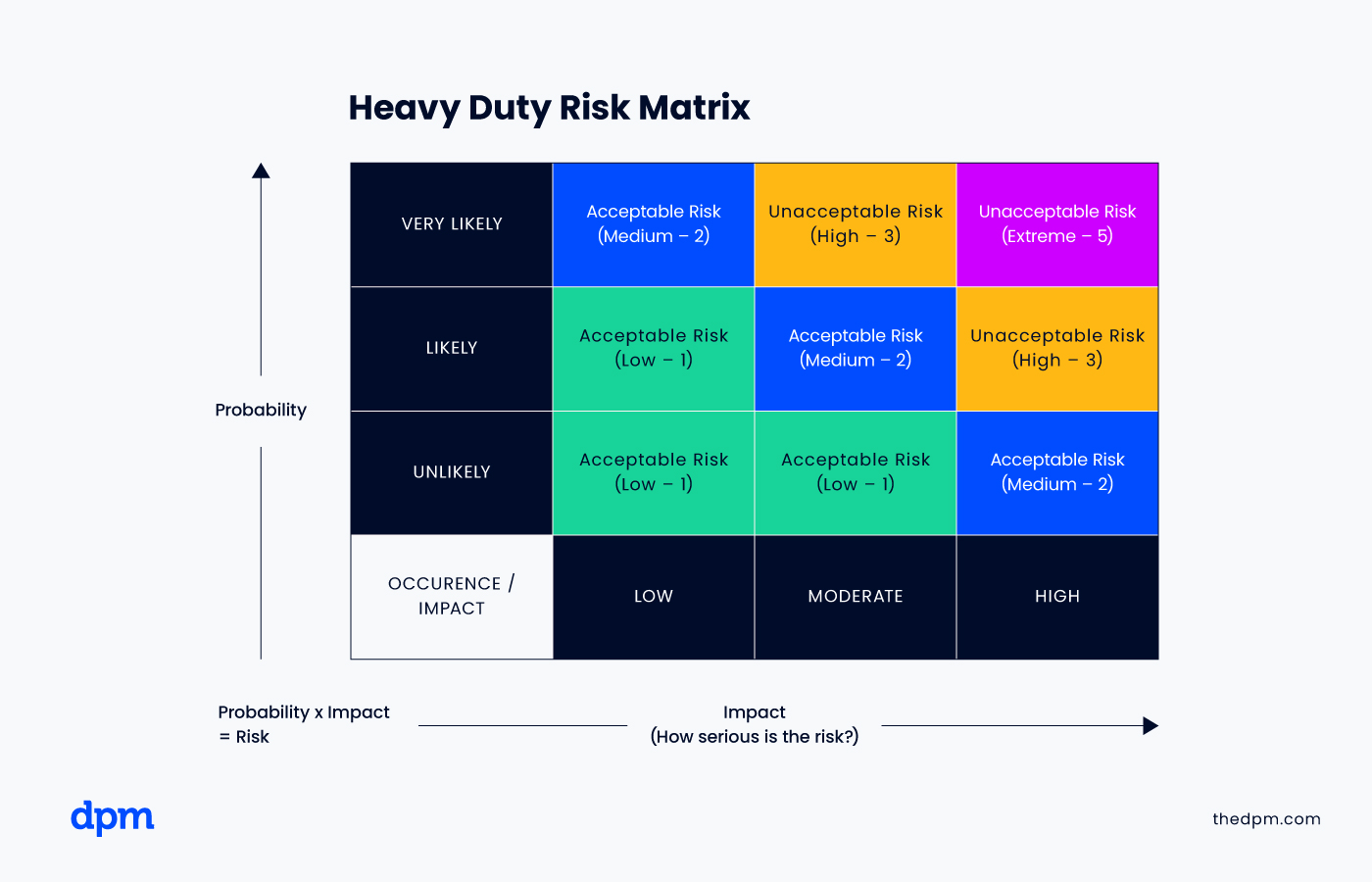

In this next phase, review the qualitative and quantitative impact of the risk—like the likelihood of the risk occurring versus the impact it would have on the project—and map that out into a risk assessment matrix

First, you’ll do this by assigning the risk likelihood a score from low probability to high probability. Then, map out the risk impact from low to medium to high and assign each a score. This provides an idea of how likely the risk is to impact project success as well as how urgent the response will need to be.

To make it efficient for all risk management team members and project stakeholders to understand the risk assessment matrix, assign an overall risk score by multiplying the impact level score with the risk probability score.

3. Create a Risk Response Plan

A risk response is the action plan taken to mitigate project risks when they occur. The risk response plan includes risk mitigation strategies to mitigate the impact of project risks. Doing this usually comes with a price—at the expense of your time or your budget. So you’ll want to allocate resources, time and money for your risk management needs before creating the risk management plan.

4. Assign Risk Owners

Next, assign a risk owner to each project risk. Those risk owners become accountable for monitoring the risks assigned to them and supervising the execution of the risk response if needed.

Related: Risk Tracking Template

When creating the risk register and risk assessment matrix, list out the risk owners, that way no one is confused as to who will need to implement the risk response strategies once the project risks occur, and each risk owner can take immediate action.

Be sure to record the exact risk response for each project risk with a risk register and have the risk response plan approved by all stakeholders before implementation. That way, there’s a record of the issue and the resolution to review once the project is finalized.

5. Understand Your Triggers

This can happen with or without a risk already having impacted the project—especially during project milestones as a means of reviewing project progress. If they have, consider reclassifying those existing risks.

Even if those triggers haven’t been met, it’s best to come up with a backup plan as the project progresses—maybe the conditions for a certain risk won’t exist after a certain point has been reached in the project.

6. Make a Backup Plan

Consider your risk register and risk assessment matrix a living document. Project risks can change in classification at any point, and because of that, come up with a contingency plan as part of the process.

Contingency planning includes discovering new risks during project milestones and reevaluating existing risks to see if any conditions for those risks have been met. Any reclassification of a risk means adjusting your contingency plan.

7. Measure Your Risk Threshold

Measuring your risk threshold is all about discovering which risk is too high and consulting with project stakeholders to consider whether or not it’s worth it to continue the project—worth it whether in time, money or scope .

Here’s how the risk threshold is typically determined: consider your risks that have a score of “very high”, or more than a few “high” scores, and consult with your leadership team and project stakeholders to determine if the project itself may be at risk of failure. Project risks that require additional consultation are risks that have passed the risk threshold.

To keep a close eye on risks as they raise issues in the project, use project management software. ProjectManager has real-time dashboards embedded in our tool, unlike other software that require teams to manually build them. We automatically calculate the health of projects, checking if teams are on time or running behind. Get a high-level view of how much you’re spending, progress and more. The quicker the risk is identified, the faster you can resolve it.

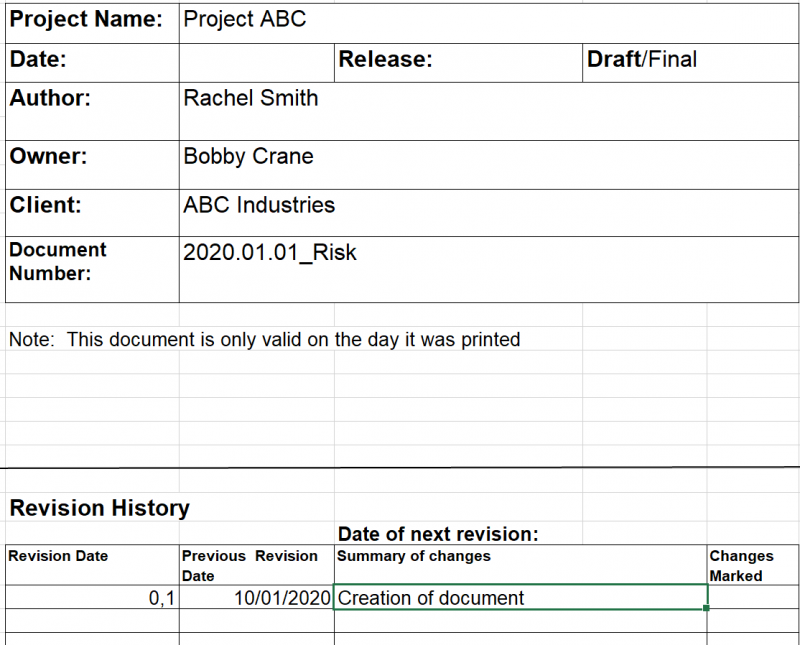

Free Risk Management Plan Template

This free risk management plan template will help prepare your team for any risks inherent in the project. This Word document includes sections for your risk management methodology, risk register, risk breakdown structure and more. It’s so thorough, you’re sure to be ready for whatever comes your way. Download the template today.

Best Practices for Maintaining Your Risk Management Plan

Risk management plans only fail in a few ways: incrementally because of insufficient budget, via modeling errors or by ignoring your risks outright.

Your risk management plan is constantly evolving throughout the project life cycle, from beginning to end. So the best practices are to focus on the monitoring phase of the risk management plan. Continue to evaluate and reevaluate your risks and their scores, and address risks at every project milestone.

Project dashboards and other risk-tracking features can be a lifesaver for maintaining your risk management plan. Watch the video below to see just how important project management dashboards, live data and project reports can be for keeping projects on track and budget.

In addition to routine risk monitoring, at each milestone, conduct another round of interviews with the same checklist you used at the beginning of the project, and re-interview project stakeholders, risk management team members, customers (if applicable) and industry experts.

Record their answers, adjust the risk register and risk assessment matrix if necessary, and report all relevant updates of your risk management plan to key project stakeholders. This process and level of transparency help identify any new risks to be assessed and shows if any previous risks have expired.

How ProjectManager Can Help Your Risk Management Plan

A risk management plan is only as good as the risk management features you have to implement and track them. ProjectManager is online project management software that lets you view risks directly in the project menu. You can tag risks as open or closed and even make a risk matrix directly in the software. You get visibility into risks and can track them in real time, sharing and viewing the risk history.

Tracking & Monitor Risks in Real Time

Managing risk is only the start. You must also monitor risk and track it from the point that you first identified it. Real-time dashboards provide a high-level view of slippage, workload, cost and more. Customizable reports can be shared with stakeholders and filtered to show only what they need to see. Risk tracking has never been easier.

Risks are bound to happen no matter the project. However, if you have the right tools to better navigate the risk management planning process, you can better mitigate errors. ProjectManager is online project management software that updates in real time, giving you all the latest information on your risks, issues and changes. Start a free 30-day trial and start managing your risks better.

Deliver your projects on time and on budget

Start planning your projects.

- Sign up for free

- SafetyCulture

- Risk Management

- Risk Management Plan

Why Your Business Needs a Risk Management Plan

Understand the basics of risk management planning and discover how essential it is for your business to have one.

What is a Risk Management Plan?

A risk management plan is a systematic and structured plan to identify, analyze, assess, measure, and monitor risks and threats to an organization. It serves as an important tool for managing the risks that affect the running of an organization.

Simply put, a risk management plan is a comprehensive strategy that identifies and analyzes potential risks to a business or organization and devises solutions to minimize or avoid them, maximizing the probability of success or reaching organizational goals.

How Do You Plan for a Risk Management Plan?

Creating a risk management plan can seem daunting, but it’s important to have one in place to help protect your business from risks. Here are the basic steps you need to take to create a risk management plan:

Step 1: Develop a solid risk culture

An essential component of any successful risk management plan is the establishment of strong risk culture. Risk culture is commonly known as the shared values, beliefs, and attitudes toward the handling of risks throughout the organization.

It is the responsibility of senior management and the board of directors to create the company culture and set the tone from the top-down and communicated throughout the organization.

Step 2: Engage key stakeholders

Stakeholders emerged from various functions inside and outside of your organization. They could be employees, customers, vendors, etc. In order to plan risk management properly, it is important to engage with them every step of the way. This is because stakeholders provide you with a detailed representation of all facets of your business along with corresponding risks.

Step 3: Create appropriate risk management policies

A clear policy with delineated roles, responsibilities, and templates is essential for an effective risk management strategy. This will help you identify all risks that could potentially affect your business, evaluate the impact of those risks, and develop plans to mitigate them.

Step 4: Communicate

Communication is one of the most important aspects of risk management planning. It is critical for an effective risk management plan to have a good understanding of how communication works and how it can help you to manage risk.

Step 5: Implement transparent monitoring

By implementing transparent risk monitoring processes, we can be sure that all risk mitigation endeavors are effective. A risk management plan is an always-changing and essential process. With these best practices, you should be able to create a strategy for your organization.

5 Steps in a Risk Management Process

To make an effective risk management plan, it is essential to know the process of risk management as it is a systematic process used by a company in managing risks.

- Risk Identification – Risk Identification is the process of determining which risks could potentially affect the organization. It involves brainstorming, reviewing past events, and analyzing current trends.

- Risk Analysis – Risk Analysis is the process of determining the probability that a particular risk will occur and the potential impact it could have on the organization. This step also involves prioritizing risks in order of importance.

- Risk Control – Risk Control is the process of implementing measures to reduce or eliminate the risks identified in the previous two steps. This may involve changing processes or procedures, investing in new technology, or increasing insurance coverage.

- Risk Financing – Risk Financing is the process of setting aside funds to cover the costs associated with a potential risk. This may involve purchasing insurance, establishing a reserve fund, or self-insuring.

- Claims Management – Claims Management is the process of dealing with actual or potential claims arising from a risk event. This includes investigating claims, negotiating settlements, and paying out benefits.

Digitize the way you Work

Empower your team with SafetyCulture to perform checks, train staff, report issues, and automate tasks with our digital platform.

How to Create a Risk Management Plan

Now that you understand the basics of a risk management plan, it’s time to talk about how to create one. This is important, as it will ensure that your plan is effective and can be used to identify and mitigate any risks that may occur.

There are a few key steps to writing a risk management plan:

- Assess your risks – The first step is to list and assess all of the risks that your business may face. This includes anything from natural disasters to cyberattacks.

- Mitigate your risks – Once you have identified the risks, you need to come up with ways to mitigate them. This could include developing contingency plans , increasing security measures, or purchasing insurance policies.

- Review and update – It’s important to review and update your risk management plan regularly, as new risks may emerge and old risks may change.

By following these steps, you can create a risk management plan that will help protect your business from any potential dangers.

Create Your Risk Management Plan with SafetyCulture (formerly iAuditor)

Why use safetyculture.

SafetyCulture can help you create a risk management plan specific to your organization. It features an audit tool that can be used to identify potential risks, as well as thousands of customized templates and forms to help you document and track your risk management activities.

SafetyCulture provides a mobile application to access and store your risk management plan, automatically generate reports after an inspection, and share those reports with the appropriate people. Having SafetyCulture as part of your digital risk management process creates data sets that better inform your decisions and encourage compliance within your organization.

Risk Management Plan Template

This free risk management plan template lets you identify the risks, record the risks’ impact on a project, assess the likelihood, seriousness and grade. Also, specify planned mitigation strategies and assign corrective actions needed to responsible individuals. Breakdown costs and set the timeline of mitigation actions.

SafetyCulture Content Team

Related articles

- Layer of Protection Analysis

Discover the key aspects of and strategies for LOPA to effectively evaluate and enhance safety systems in high-risk industries.

- Find out more

- Dust Hazard Analysis

Explore the essential components of DHA, its significance, and the strategies for ensuring industrial safety.

- Reputational Risk

Learn more about reputational risk, why it’s important that businesses properly manage it, and how to effectively implement risk mitigation strategies.

Related pages

- Hazard Assessment Software

- Process Hazard Analysis Software

- EHS Risk Assessment Software

- Integrated Risk Management Software

- Operational Risk Management Software

- Reputation Management

- Environmental Aspects and Impacts

- Safety Improvement Plan Template

- Contract Risk Assessment Checklist

- Point of Work Risk Assessment Template

- 7 Best Risk Assessment Templates

- 5×5 Risk Matrix Template

Uncovering Hidden Risks: A Comprehensive Guide to Business Plan Risk Analysis

A modern business plan that will lead your business on the road to success must have another critical element. That element is a part where you will need to cover possible risks related to your small business. So, you need to focus on managing risk and use risk management processes if you want to succeed as an entrepreneur.

How can you manage risks?

You can always plan and predict future things in a certain way that will happen, but your impact is not always in your hands. There are many external factors when it comes to the business world. They will always influence the realization of your plans. Not only the realization but also the results you will achieve in implementing the specific plan. Because of that, you need to look at these factors through the prism of the risk if you want to implement an appropriate management process while implementing your business plan.

By conducting a thorough risk analysis, you can manage risks by identifying potential threats and uncertainties that could impact your business. From market fluctuations and regulatory changes to competitive pressures and technological disruptions, no risk will go unnoticed. With these insights, you can develop contingency plans and implement risk mitigation strategies to safeguard your business’s interests.

This guide will provide practical tips and real-life examples to illustrate the importance of proper risk analysis. Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Why is Risk Analysis Important for Business Planning?

Risk analysis is essential to business planning as it allows you to proactively identify and assess potential risks that could impact your business objectives. When you conduct a comprehensive risk analysis, you can gain a deeper understanding of the threats your business may face and can take proactive measures to mitigate them.

One of the key benefits of risk analysis is that it enables you to prioritize risks based on their potential impact and likelihood of occurrence . This helps you allocate resources effectively and develop contingency plans that address the most critical risks.

Additionally, risk analysis allows you to identify opportunities that may arise from certain risks , enabling you to capitalize on them and gain a competitive advantage.

It is important to adopt a systematic approach to effectively analyze risks in your business plan. This involves identifying risks across various market, operational, financial, and legal areas. By considering risks from multiple perspectives, you can develop a holistic understanding of your business’s potential challenges.

What is a Risk for Your Small Business?

In dictionaries, the risk is usually defined as:

The possibility of dangerous or bad consequences becomes true .

When it comes to businesses, entrepreneurs , or in this case, the business planning process, it is possible that some aspects of the business plan will not be implemented as planned. Such a situation could have dangerous or harmful consequences for your small business.

It is simple. If you don’t implement something you have in your business plan, there will be some negative consequences for your small business.

Here is how you can write the business plan in 30 steps .

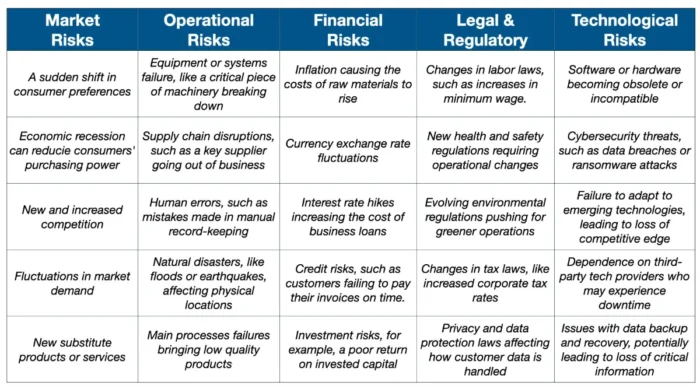

Types of Risks in Business Planning

When conducting a business risk assessment for your business plan, it is essential to consider various types of risks that could impact your venture. Here are some common types of risks to be aware of:

1. Market risks

These risks arise from fluctuations in the market, including changes in consumer preferences, economic conditions, and industry trends. Market risks can impact your business’s demand, pricing, and market share.

2. Operational risk

Operational risk is associated with internal processes, systems, and human resources. These risks include equipment failure, supply chain disruptions, employee errors, and regulatory compliance issues.

3. Financial risks

Financial risks pertain to managing financial resources and include factors such as cash flow volatility, debt levels, currency fluctuations, and interest rate changes.

4. Legal and regulatory risks

Legal and regulatory risks arise from changes in laws, regulations, and compliance requirements. Failure to comply with legal and regulatory obligations can result in penalties, lawsuits, and reputational damage.

5. Technological risks

Technological risks arise from rapid technological advancements and the potential disruptions they can cause your business. These risks include cybersecurity threats, data breaches, and outdated technology infrastructure.

Basic Characteristics of Risk

Before you start with the development of your small business risk management process, you will need to know and consider the essential characteristics of the possible risk for your company.

What are the basic characteristics of a possible risk?

The risk for your company is partially unknown.

Your entrepreneurial work will be too easy if it is easy to predict possible risks for your company. The biggest problem is that the risk is partially unknown. Here we are talking about the future, and we want to prepare for that future. So, the risk is partially unknown because it will possibly appear in the future, not now.

The risk to your business will change over time.

Because your businesses operate in a highly dynamic environment, you cannot expect it to be something like the default. You cannot expect the risk to always exist in the same shape, form, or consequence for your company.

You can predict the risk.

It is something that, if we want, we can predict through a systematic process . You can easily predict the risk if you install an appropriate risk management process in your small business.

The risk can and should be managed.

You can always focus your resources on eliminating or reducing risk in the areas expected to appear.

Risk Management Process You Should Implement

The risk management process cannot be seen as static in your company. Instead of that, it must be seen as an interactive process in which information will continuously be updated and analyzed. You and your small business members will act on them, and you will review all risk elements in a specified period.

Adopting a systematic approach to identifying and assessing risks in your business plan is crucial. Here are some steps to consider:

1. Risk Identification

First, you must identify risk areas . Ask and respond to the following questions:

- What are my company’s most significant risks?

- What are the risk types I will need to follow?

In business, identifying risk areas is the process of pinpointing potential threats or hazards that could negatively impact your business’s ability to conduct operations, achieve business objectives, or fulfill strategic goals.

Just as meteorologists use data to predict potential storms and help us prepare, you can use risk identification to foresee possible challenges and create plans to deal with them.

Risk can arise from various sources, such as financial uncertainty, legal liabilities, strategic management errors, accidents, natural disasters, and even pandemic situations. Natural disasters can not be predicted or avoided, but you can prepare if they appear.

For example, a retail business might identify risks like fluctuating market trends, supply chain disruptions, cybersecurity threats, or changes in consumer behavior. As you can see, the main risk areas are related to types of risk: market, financial, operational, legal and regulatory, and technological risks.

You can also use business model elements to start with something concrete:

- Value proposition,

- Customers ,

- Customers relationships ,

- Distribution channels,

- Key resources and

- Key partners.

It is not necessarily that there will be risk in all areas and that the risk will be with the same intensity for all areas. So, based on your business environment, the industry in which your business operates, and the business model, you will need to determine in which of these areas there is a possible risk.

Also, you must stay informed about external factors impacting your business, such as industry trends, economic conditions, and regulatory changes. This will help you identify emerging risks and adapt your risk management strategies accordingly.

The idea for this step is to create a table where you will have identified potential risks in each important area of your business.

2. Risk Profiling

Conduct a detailed analysis of each identified risk, including its potential impact on your business objectives and the likelihood of occurrence. This will help you develop a comprehensive understanding of the risks you face.

Qualitative Risk Analysis

The qualitative risk analysis process involves assessing and prioritizing risks based on ranking or scoring systems to classify risks into low, medium, or high categories. For this analysis, you can use customer surveys or interviews.

Qualitative risk analysis is quick, straightforward, and doesn’t require specialized statistical knowledge to conduct a business risk assessment. The main negative side is its subjectivity, as it relies heavily on thinking about something or expert judgment.

This method is best suited for initial risk assessments or when there is insufficient quantitative analysis data .

For example, if we consider the previously identified risk of a sudden shift in consumer preferences, a qualitative analysis might rate its likelihood as 7 out of 10 and its impact as 8 out of 10, placing it in the high-priority quadrant of our risk matrix. But, qualitative analysis can also use surveys and interviews where you can ask open questions and use the qualitative research process to make this scaling. This is much better because you want to lower the subjectivism level when doing business risk assessment.

Quantitative Risk Analysis

On the other side, the quantitative risk analysis method involves numerical and statistical techniques to estimate the probability and potential impact of risks. It provides more objective and detailed information about risks.

Quantitative risk analysis can provide specific, data-driven insights, making it easier to make informed decisions and allocate resources effectively. The negative side of this method is that it can be time-consuming, complex, and requires sufficient data.

You can use this approachfor more complex projects or when you need precise data to inform decisions, especially after a qualitative analysis has identified high-priority risks.

For example , for the risk of currency exchange rate fluctuations, a quantitative analysis might involve analyzing historical exchange rate data to calculate the probability of a significant fluctuation and then using your financial data to estimate the potential monetary impact.

Both methods play crucial roles in effectively managing risks. Qualitative risk analysis helps to identify and prioritize risks quickly, while quantitative analysis provides detailed insights for informed decision-making.

3. Business Risk Assessment Matrix

Once you have identified potential risks and analyzed their likelihood and potential impact, you can create a business risk assessment matrix to evaluate each risk’s likelihood and impact. This matrix will help you prioritize risks and allocate resources accordingly.

A business risk assessment matrix, sometimes called a probability and impact matrix, is a tool you can use to assess and prioritize different types of risks based on their likelihood (probability) and potential damage (impact). Here’s a step-by-step process to create one:

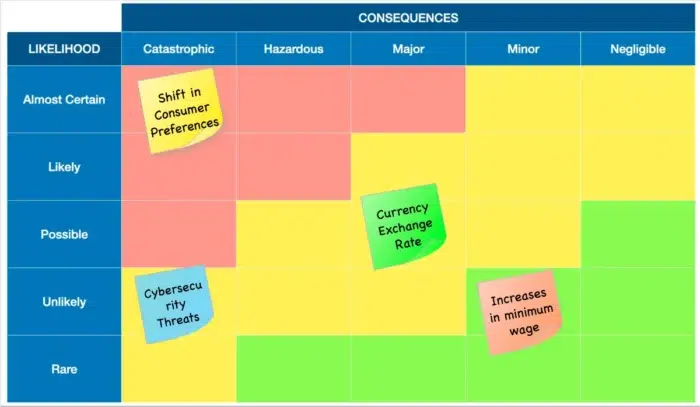

- Step 1: Begin by listing out your risks . For our example, let’s consider four of the risks we identified earlier: a sudden shift in consumer preferences (Market Risk), currency exchange rate fluctuations (Financial Risk), an increase in the minimum wage (Legal), and cybersecurity threats (Technological Risk).

- Step 2: Determine the likelihood of each risk occurring . In the process of risk profiling, we’ve determined that a sudden shift in consumer preferences is highly likely, currency exchange rate fluctuations are moderately likely, an increase in the minimum wage, and cybersecurity threats are less likely but still possible.

- Step 3: Assess the potential impact of each risk on your business if it were to occur . In our example, we might find that a sudden shift in consumer preferences could have a high impact, currency exchange rate fluctuations a moderate impact, an increase in minimum wage minor impact, and cybersecurity threats a high impact.

- Step 4: Plot these risks on your risk matrix . The vertical axis represents the likelihood (high to low), and the horizontal axis represents the consequences (high to low).

By visualizing these risks in a risk assessment matrix format, you can more easily identify which risks require immediate attention and which ones might need long-term strategies.

4. Develop Risk Indicators for Each Risk You Have Identified

The question is, how will you measure the business risks for your company?

Risk indicators are metrics used to measure and predict potential threats to your business. Simply, a risk indicator is a measure that should tell you whether the risk appears or not in a particular area you have defined previously. They act like a business’s early warning system. When these indicators change, it’s a signal that the risk level may be increasing.

For example, for distribution channels, an indicator can be a delay in delivery for a minimum of three days. This indicator will tell you something is wrong with that channel, and you must respond appropriately.

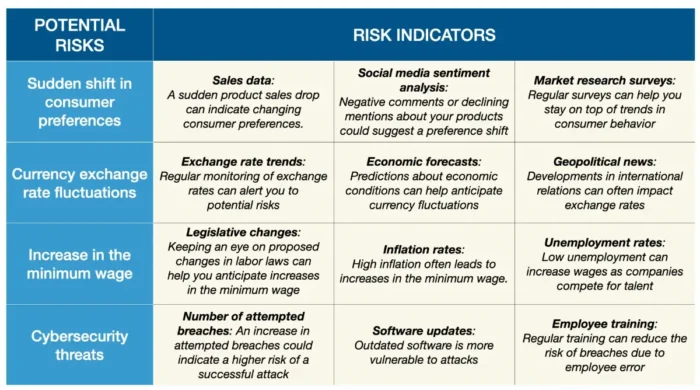

Now, let’s consider some risk indicators for the risks we have already identified and analyzed:

If you conduct all the steps until now, you can have a similar table with risk indicators in your business plan. You should monitor these indicators regularly, and if you notice a significant change, such as a drop in sales or an increase in attempted breaches, it’s time to investigate and take some action steps. This might involve updating your product line, hedging against currency risk, budgeting for higher wages, or improving your cybersecurity measures.

Remember, risk indicators can’t predict the future with certainty. But they can give you valuable insights that can help you prepare for potential threats.

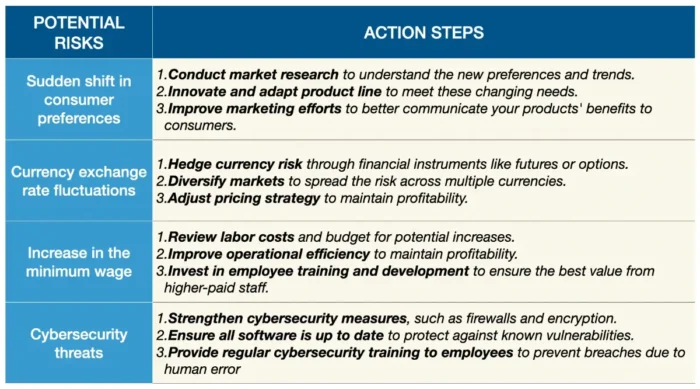

5. Define Possible Action Steps

The question is, what can you do regarding the risk if the risk indicator tells you that there is a potential risk?

Once the risk has appeared and is located, it is time to take concrete action steps. The goals of this step are not only to reduce or eliminate the impact of the risk for your company but also to prevent them in the future and reduce or eliminate their influence on the business operations or the execution of your business plan.

For example, for distribution channels with delivery delayed more than three days, possible activities can be the following:

- Apologizing to the customers for the delay,

- Determining the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons,

- Consideration of alternative distribution channels, etc.

In this part of the business plan for each risk area and indicator, try to standardize all possible actions. You can not expect that they will be final. But, you can cover some basic guidelines that must be implemented if the risk appears. Here is an example of how this part will look in your business plan related to risks we have already identified through the risk assessment process.

6. Monitoring

Because this risk management process is dynamic , you must apply the monitoring process. In such a way, you can ensure the elimination of a specific kind of risk in the future, and you will allocate your resources to new possible risks.

After implementing the actions, you need to ask yourself the following questions:

- Are the actions taken regarding the risk the proper measures?

- Can you improve something regarding the risk management process? Is there a need for new risk indicators?

Techniques and Tools for Business Plan Risk Assessment

Various risk analysis methods, techniques, and tools are available to conduct an effective risk analysis for your business plan. Here are some commonly used ones:

1. SWOT analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help you identify internal strengths and weaknesses and external opportunities and threats. This analysis provides valuable insights into possible business risks and opportunities.

2. PESTEL analysis

A PESTEL (Political, Economic, Sociocultural, Technological, Environmental, Legal) analysis assesses the external factors that could impact your business. This analysis will help you identify risks and opportunities arising from these factors.

3. Scenario analysis

Consider different scenarios that could impact your business, such as best-case, worst-case, and most likely scenarios, as a part of your risk assessment process. You can anticipate potential risks and develop appropriate response strategies by analyzing these scenarios.

4. Monte Carlo simulation

Monte Carlo simulation uses random sampling and probability distributions to model various scenarios and assess their potential impact on your business. This technique provides you with a more accurate understanding of risk exposure.

5. Risk register

A risk register is a risk analysis tool that helps you record and track identified risks and their relevant details, such as impact, likelihood, mitigation strategies, and responsible parties. This tool ensures that risks are appropriately managed and monitored.

6. Business Impact Analysis (BIA)

Business impact analysis helps you understand the potential effects of various disruptions on your business operations and objectives. It’s about identifying what could go wrong and understanding how it could impact your bottom line. So, you can conduct business impact analysis as a part of your risk assessment inside your business plan.

7. Failure Mode and Effects Analysis (FMEA)

Using FMEA in your risk assessment process, you can proactively address potential problems, ensuring your business operations run as smoothly as you planned. It’s all about preparing for the worst while striving for the best.

8. Risk-Benefit Analysis (RBA)

The risk-benefit analysis allows you to make informed decisions, balancing the potential for gain against the potential for loss. It helps you choose the best path, even when the way forward isn’t entirely clear. This tool is a systematic approach to understanding the specific business risk and benefits associated with a decision, process, or project.

9. Cost-Benefit Analysis

By conducting a cost-benefit analysis as a part of your risk assessments, you can make data-driven decisions that consider both the possible risks (costs) and rewards (benefits). This approach provides a clear picture of the potential return on investment, enabling more effective and confident decision-making.

These techniques and tools allow you to conduct a comprehensive risk analysis for your business plan.

Mitigating and Managing Risks in a Business Plan

Identifying risks in your business plan is only the first step. To ensure the success of your venture, it is crucial to develop effective risk mitigation and management strategies. Here are some critical steps to consider:

- Risk avoidance : Some risks may be too high to justify taking. In such cases, consider avoiding these risks altogether by adjusting your business plan or exploring alternative strategies.

- Risk transfer : Transferring risks to third parties, such as insurance companies or outsourcing partners, can help mitigate their impact on your business. Evaluate opportunities for risk transfer and consider appropriate insurance coverage.

- Risk reduction : Implement measures to reduce the likelihood and impact of identified risks. This may involve improving internal processes, implementing safety protocols, or diversifying your supplier base .

- Risk acceptance : Some risks may be unavoidable or negatively impact your business. In such cases, accepting the risks and developing contingency plans can help minimize their impact.

In conclusion, a comprehensive risk analysis is essential for identifying, assessing, and managing different types of risk that could impact your success.

Conducting a thorough risk analysis can safeguard your business’s interests, capitalize on opportunities, and increase your chances of long-term success.

Related Posts

How to Write a Business Plan in 36 Steps

Risk Tolerance in Entrepreneurship: A Guide to Successful Business

Business Goals Questions to Develop SMART Goals

Risk Management Guide: Everything You Need to Know About Business Risk

Start typing and press enter to search.

- Share on Twitter

- Share on LinkedIn

- Share on Facebook

- Share on Pinterest

- Share through Email

How To Create A Risk Management Plan + Template & Examples

Emily has been working in project management for over 13 years. In this time, she has worked using a variety of project management methodologies and has been a strategic project manager, facilitator, and Scrum master. She is also an avid coach and trainer, who wants to ensure the development of the next generation of project professionals through training, knowledge sharing and team building.

Sarah is a project manager and strategy consultant with 15 years of experience leading cross-functional teams to execute complex multi-million dollar projects. She excels at diagnosing, prioritizing, and solving organizational challenges and cultivating strong relationships to improve how teams do business. Sarah is passionate about productivity, leadership, building community, and her home state of New Jersey.

Dramatically reduce your chances of project failure with a risk management plan: learn how to create one for your projects, get some examples, and download our template!

A clear and detailed risk management plan helps you assess the impact of project risks and understand the potential outcomes of your decisions. It can be a useful tool to support decision making in the face of uncertainty.

However, I have seen projects fail because stakeholders did not take the risk management plan seriously or because the project failed to implement a risk management strategy.

Read on to learn how you can avoid these mistakes for your projects.

What Is A Risk Management Plan?

A risk management plan, or RMP, is a document describing how your project team will monitor and respond to unexpected or uncertain events that could impact the project.

The risk management plan:

- analyzes the potential risks that exist in your organization or project

- identifies how you will respond to those risks if they arise

- assigns a responsible person to monitor each risk and take action, if needed.

Team members and stakeholders should collaborate to create a project risk management plan after starting to develop a project management plan but before the project begins.

What’s Covered In A Risk Management Plan?

The fidelity of your risk management plan will vary depending on the nature of your project and the standard operating procedures that your organization uses.

A project risk management plan seeks to answer:

- What is this project, and why does it matter?

- Why is risk management important for the project’s success?

- What will the team do to identify, log, assess, and monitor risks throughout the project?

- What categories of risk will we manage?

- What methodology will be used for risk identification and to evaluate risk severity?

- What is expected of the people who own the risks?

- How much risk is too much risk?

- What are the risks, and what are we going to do about them?

Depending on the project, this document could be hundreds of pages—or it could be less than a dozen. So how do you decide how much detail to provide? Here are two illustrative examples (but by no means are they the only ways to do it!).

PS. If you’re looking for additional information, we also did a workshop on managing risk that’s available for DPM members .

2 Types Of Risk Management Plans

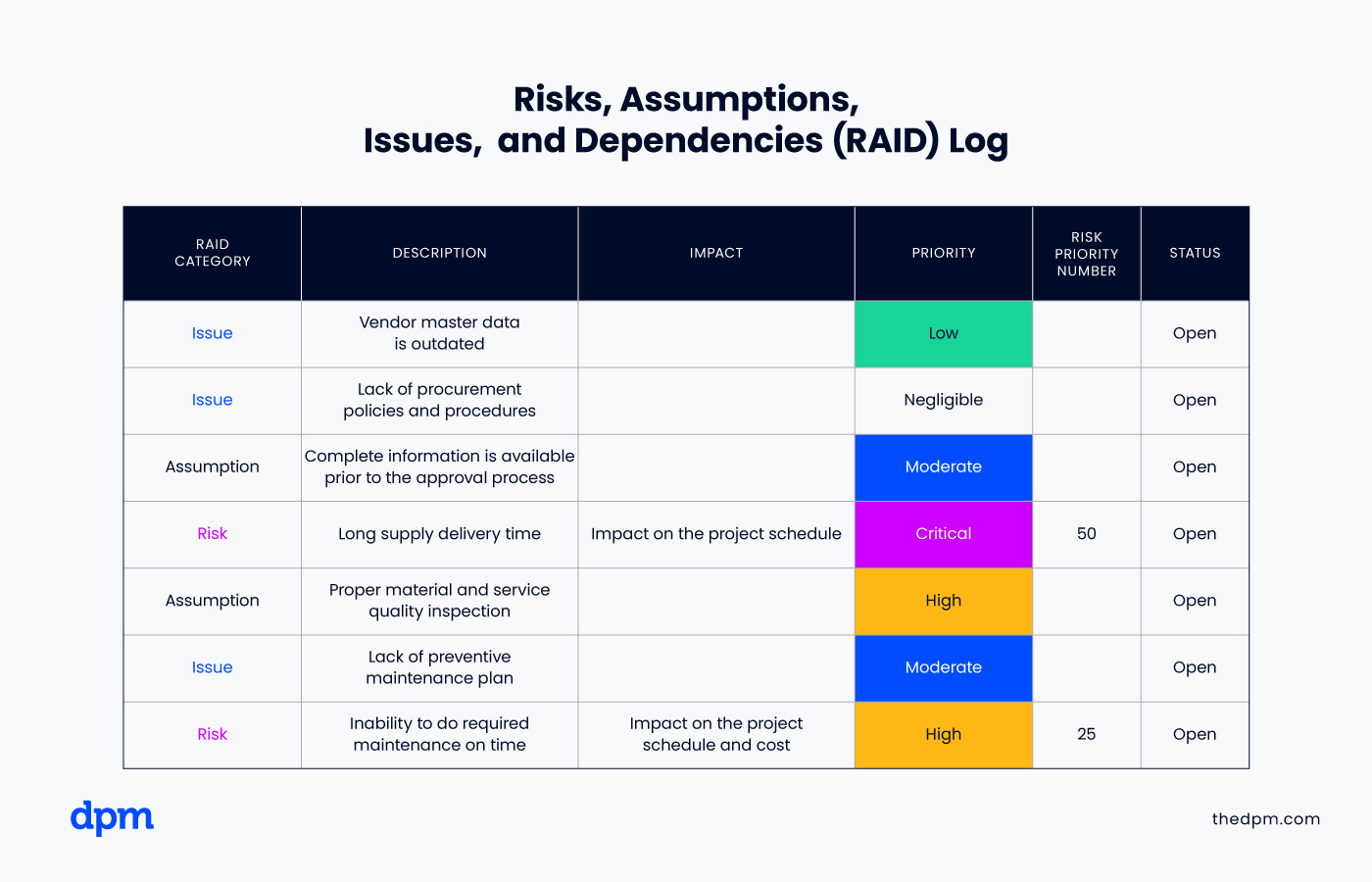

In this section, we’ll cover 2 common types of risk management plans—a RAID log and a risk matrix.

#1: Simpler Version—Lightweight RAID Log

In its most minimal form, a risk management plan could be a handful of pages describing:

- how and when to assess risk

- the roles and responsibilities for risk owners

- at what point the project risk should trigger an escalation.

Instead of a formal risk register designed to calculate risk severity, a lightweight risk management approach may simply involve maintaining a risk list in your weekly status report .

This list (also known as a RAID log) tracks risks, assumptions, issues, and dependencies so that the project team and sponsor can review and further discuss.

When to use it : this approach could be useful for a small non-technical project being executed by a team of 3-4 people in an organization that does not have a standard approach to risk management.

Sign up to get weekly insights, tips, and other helpful content from digital project management experts.

- Your email *

- Yes, I want to sign up to receive regular emails filled with tips, expert insights, and more to build my PM practice.

- By submitting you agree to receive occasional emails and acknowledge our Privacy Policy . You can unsubscribe at any time. Protected by reCAPTCHA; Google Privacy Policy and Terms of Service apply.

- Name This field is for validation purposes and should be left unchanged.

#2: Complex Version—Risk Matrix

When an organization already has a culture of risk management, there may be a template to follow that demands a high level of detail. These details may include a full description of the methodology that the organization will follow to perform qualitative and quantitative risk analysis, along with an impact matrix.

An impact matrix, or risk assessment matrix, shows the relationship between risk factors in calculating risk severity. Risks that are high-probability and high-impact are the most severe.

An organization may design its risk register template to prioritize and assign a numerical severity score to measure the level of risk.

Additionally, you may need to create a risk breakdown structure to decompose higher-level risk categories into smaller, more specific risk subcategories

When to use it : making a detailed risk management plan isn’t about creating complexity for complexity’s sake—you and your team will be glad to have this level of detail on a large enterprise project that involves larger teams, multiple stakeholders, and high stakes that could have a significant impact on the business.

The concept of enterprise project management has evolved to include digital tools and methodologies.

In terms of tooling, there are some great options available for managing risk on your project. Many organizations favor spreadsheets as part of an enterprise business software bundle, but there are also some providers that support risk management planning specifically.

Two examples of risk management software are Wrike and monday.com . These tools integrate the entire risk management process with the wider project management plan.

The most important consideration is not the tool used, but rather the discussions you’ll have with your team and your project sponsor about how to navigate risks to increase the likelihood of project success.

How To Make A Risk Management Plan

Below is a step-by-step guide to developing your own version of a risk management plan. Keep in mind that the nature of these steps may vary depending on the type of project involved, so don’t be afraid to tailor these steps to meet project and organizational needs.

The first 2 steps in the process are preparing supporting documentation and setting the context.

Next, decide how you want to identify & assess risks, and continuously identify those risks.

The next steps in the risk management process include assigning risk owners, populating your risk register, and then publishing it.

Make sure to monitor and assess risks throughout the project, and once the project is over, archive the risk management plan in a way that it can be reused for future projects.

1. Prepare supporting documentation

You’ll want to review existing project management documentation to help you craft your risk management plan. This documentation includes:

- Project Charter: among other things, this document establishes the project objectives , the project sponsor, and you as the project manager. Frankly, it gives you the right to create a project management plan and then a risk management plan within that. If formal project charters aren’t used at your organization, you should at least have this documented in an email or a less formal brief.

- Project Management Plan: not to be confused with the project strategy , this document outlines how you’ll manage, monitor, and control your project, including what methodology to use, how to report progress, how to escalate issues, etc. Your risk management plan should act as a subcomponent of the project management plan.

- Stakeholder Register: it’s good to have a solid idea of who the project stakeholders are before assessing risk. Each of these stakeholder groups presents a different set of risks when it comes to people, processes, and technology. You can also invite stakeholders to identify risks throughout the project and even nominate them as risk owners!

2. Set the context

Once you have your supporting documentation available, use it to frame up the discussion around your risk management plan. Specifically, take the project description and objectives from the project charter and use them to outline the business value of the project and the negative impacts that would result should the project fail .

The introduction to your risk management plan should explain the intent of this document and its relationship to the overarching project management plan. Use this context to drive a conversation about risk management with your team and your project sponsor.

3. Decide with your team how to identify and assess risks

Different methodologies are appropriate for different types of projects. The methods you choose also need to be sustainable for the team to perform throughout the project.

The key here is to have the right discussions and gather input to build consensus with your team and your stakeholders early in the project life cycle. Use these discussions to agree on risk categories, risk response plans, and ways to calculate risk severity.

4. Continuously identify risks

Once you’ve decided on the methodology to use, now the real fun begins—thinking about the things that could go astray during your project!

A great way to do this is to hold a risk workshop—a group session involving your team, key stakeholders, project sponsor, and subject matter experts to identify, evaluate, and plan responses to risks.

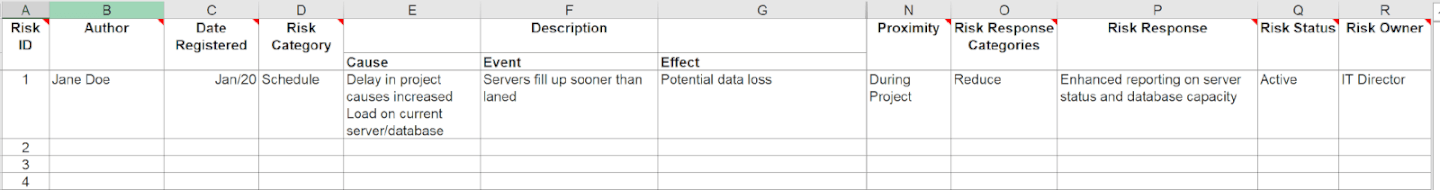

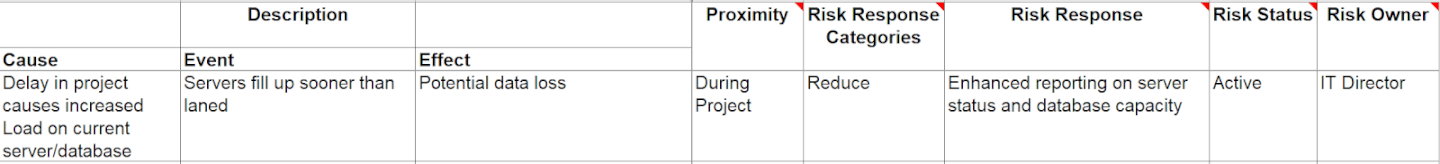

In the example below, I have used a simple overview from a sample project. During the workshop, you’d discuss everything in columns E-R and make sure that you have clear, SMART outcomes to put in each of the boxes. (SMART stands for specific, measurable, action-oriented, realistic, and timebound.)

I like to keep a copy of the risk register on my desk during the workshop to make sure that each column is discussed and populated appropriately. After the workshop, add any supporting details to finalize the document.

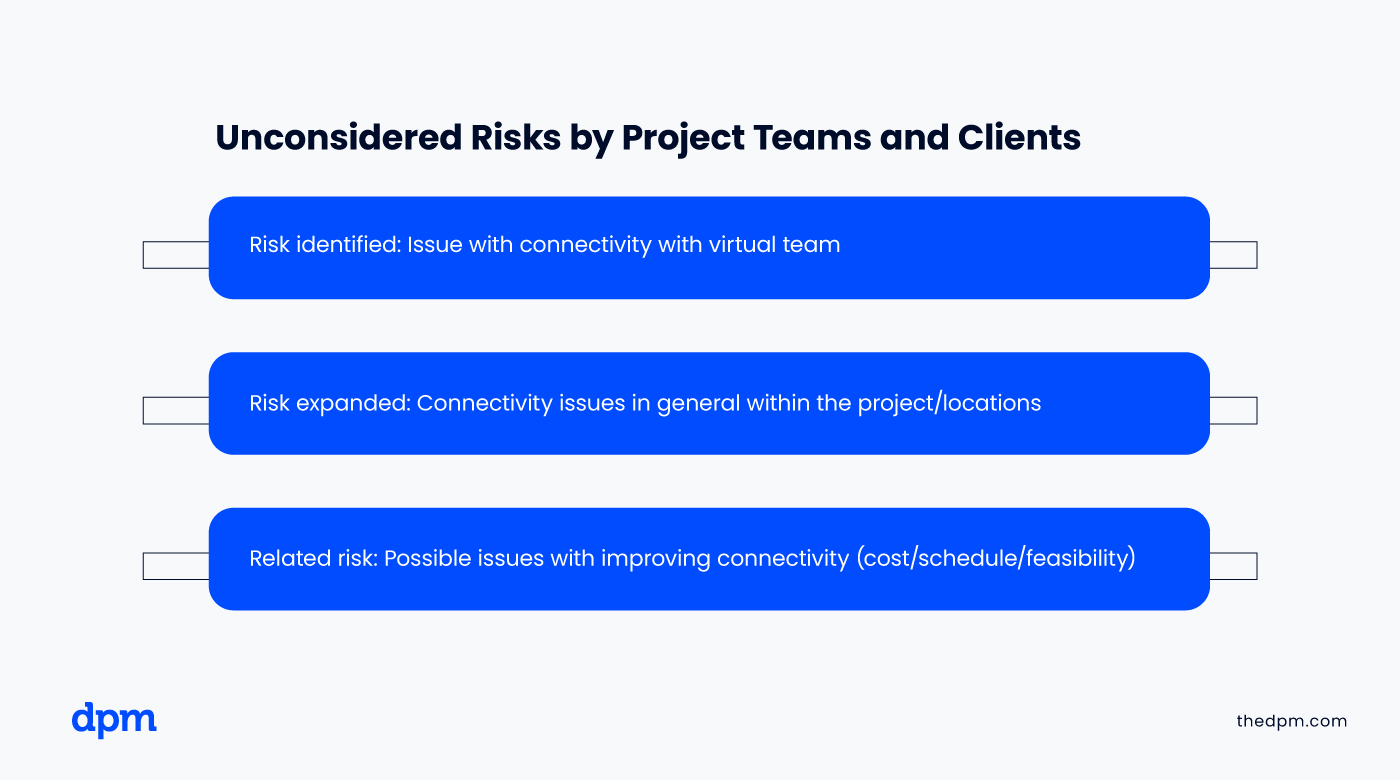

The project manager’s role during a risk workshop is to facilitate the meeting effectively. This involves brainstorming with stakeholders to evaluate both known risks and possible risks that may not have been considered. It could look something like this:

At the end of the workshop, your goal is to come away with stakeholder alignment on project risks, the desired risk response, and the expected impact of the risks. Stakeholder buy-in is critical for a successful risk response, so time in the workshop is likely to be time well-spent.

5. Assign risk owners

As you identify risks, you should work with the team to assign owners (including yourself). Project managers are responsible for risk management too!

That being said, the project manager can’t own everything. Assigning risk owners can be the most difficult area of risk management to finalize because it requires stakeholder accountability.

Make sure that risk owners have reviewed the risk management plan and are clear on their responsibilities. Follow up with them as you monitor risk throughout the project life cycle.

6. Populate the risk register

Following the risk workshop, finish populating any information required for the risk register . This includes a description of the risk, the risk response category, detailed risk response, risk status, and risk owner.

What’s important to remember during this exercise is ensuring that the risk response reflects the severity and importance of the risk. You can then review the broader risk register to understand any wider correlations that might exist among risks.

7. Publish the risk register

Send around the updated risk register within 48 hours of the workshop to give everyone time to read and process the output.

You can also use the risk register within wider project discussions to explain or define the timeline for a project or specific actions that need to be completed. It’s important to be timely so that the output can be used in other project artifacts.

8. Monitor and assess risks continuously throughout the project

New risks are introduced to a project constantly. In fact, mitigating one risk might create another risk or leave “residual risk.”

If feasible within your project constraints, try to run risk workshops periodically throughout the duration of the project or incorporate risk register reviews into other recurring planning activities.

Nothing feels quite as deflating as when you swerve to avoid one risk only to drive blindly into another, much bigger risk.

9. Archive your risk management plan in a reusable & accessible format

After your project, it’s a good idea to archive your risk management plan for future reference.

There are many reasons why (in fact, it may be mandatory in your organization), but here’s the main one: while not every risk management plan suits every project, the risk and response strategies may remain applicable. Use past risks to create a foundation for your next project.

Examples Of Risk Management Plans In Action

Admittedly, the word “risk” is itself a bit broad. Not having enough resources to hit the project deadline is a risk. Hurricane season is a risk. Disruption of the space-time continuum is a risk.

So, where do you draw the line on what types of risks to consider—which risks have a large enough potential impact to require attention, or even a contingency plan?

Here’s one way to think about it:

If the item is related to people, processes, resources, or technology and has any likelihood of threatening project success, you should log it as a risk.

Now, you might not need to do a comprehensive analysis on every risk in your risk register, but you do need to revisit the risks identified and conduct risk monitoring throughout the project. If someone starts testing a time machine near your office, for example, your highly unlikely space-time continuum risk has escalated.

Does this matter?

Yes. To prove it, here’s a simple example of risk management that saved a project:

A colleague was working on a service design project that required in-person research (this was before COVID-19), and on her RACI chart , she had clearly communicated to the client that it was the client’s responsibility to book a meeting space to conduct this research. She had logged a risk with her team that the client might not be able to secure a space.

Two days before the research commenced, the client informed her they weren’t able to secure the space. Luckily, her risk mitigation strategy on this particular risk was to book a backup space at the office, which she had done weeks ago.

Something that could have stalled the project for weeks had become nothing more than an email that said something like “All good, we’ll use our space."

Here’s another example:

An agency agreed to an aggressive timeline for a highly technical project. The team had raised concerns as the project was being initiated, but leadership still wanted to proceed. The project manager and technical architect logged the timeline risk before the project started, and their risk response strategy was to re-evaluate the project timeline using a Monte Carlo simulation.

After calculating a pessimistic, optimistic, and likely duration for every project activity on the critical path, they determined mathematically that the project had a 3% chance of hitting the deadline.

The project manager raised this with the client, and the client agreed to re-scope the project and re-baseline the project before getting going. It was too big of a risk for them to take.

Risk Register Template

There are a lot of risk register templates available online, and I would recommend looking at one that fits your needs, rather than one that includes every possible scenario.

In the risk management plan template available in DPM Membership , we’ve tried to keep the risk register as simple as possible to ensure that you’re able to enter the relevant information for your project.

Best Practices For Risk Management Plans

Consider these best practices to help you craft an effective risk management plan:

- Develop the risk management plan during the project planning phase, after you’ve developed the project charter and the project management plan, to give stakeholders the necessary context

- Adapt the format and level of detail of the risk management plan to align with the needs of the project, industry, and organization that you support

- Assign a risk owner to every risk identified in your risk register, and hold them accountable for the risk response

- Continuously identify risks throughout the project life cycle and update the risk register accordingly

- During project closing , archive your risk management plan and use it to inform risk planning on future projects.

What's Next?

Whether you’re a novice project manager or a seasoned pro, having a good risk management plan is vital to project success. And, the key to a successful risk management plan is adaptability. You need to make sure that, with every project you run, you can adapt the risk management plan to your project, industry, and organization.

Dive deeper into these strategies by enrolling in one of these comprehensive risk management courses .

17 Project Risk Management Courses To Take In 2024

Project Risk Management: How To Do It Well & 5 Expert Tips

Time Tracking: Your Secret Risk Management Superpower

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Risk Management & Why Is It Important?

- 24 Oct 2023

Businesses can’t operate without risk. Economic, technological, environmental, and competitive factors introduce obstacles that companies must not only manage but overcome.

According to PwC’s Global Risk Survey , organizations that embrace strategic risk management are five times more likely to deliver stakeholder confidence and better business outcomes and two times more likely to expect faster revenue growth.

If you want to enhance your job performance and identify and mitigate risk more effectively, here’s a breakdown of what risk management is and why it’s important.

Access your free e-book today.

What Is Risk Management?

Risk management is the systematic process of identifying, assessing, and mitigating threats or uncertainties that can affect your organization. It involves analyzing risks’ likelihood and impact, developing strategies to minimize harm, and monitoring measures’ effectiveness.

“Competing successfully in any industry involves some level of risk,” says Harvard Business School Professor Robert Simons, who teaches the online course Strategy Execution . “But high-performing businesses with high-pressure cultures are especially vulnerable. As a manager, you need to know how and why these risks arise and how to avoid them.”

According to Strategy Execution , strategic risk has three main causes:

- Pressures due to growth: This is often caused by an accelerated rate of expansion that makes staffing or industry knowledge gaps more harmful to your business.

- Pressures due to culture: While entrepreneurial risk-taking can come with rewards, executive resistance and internal competition can cause problems.

- Pressures due to information management: Since information is key to effective leadership , gaps in performance measures can result in decentralized decision-making.

These pressures can lead to several types of risk that you must manage or mitigate to avoid reputational, financial, or strategic failures. However, risks aren’t always obvious.

“I think one of the challenges firms face is the ability to properly identify their risks,” says HBS Professor Eugene Soltes in Strategy Execution .

Therefore, it’s crucial to pinpoint unexpected events or conditions that could significantly impede your organization’s business strategy .

Related: Business Strategy vs. Strategy Execution: Which Course Is Right for Me?

According to Strategy Execution , strategic risk comprises:

- Operations risk: This occurs when internal operational errors interrupt your products or services’ flow. For example, shipping tainted products can negatively affect food distribution companies.

- Asset impairment risk: When your company’s assets lose a significant portion of their current value because of a decreased likelihood of receiving future cash flows . For instance, losing property assets, like a manufacturing plant, due to a natural disaster.

- Competitive risk: Changes in the competitive environment can interrupt your organization’s ability to create value and differentiate its offerings—eventually leading to a significant loss in revenue.

- Franchise risk: When your organization’s value erodes because stakeholders lose confidence in its objectives. This primarily results from failing to control any of the strategic risk sources listed above.

Understanding these risks is essential to ensuring your organization’s long-term success. Here’s a deeper dive into why risk management is important.

4 Reasons Why Risk Management Is Important

1. protects organization’s reputation.

In many cases, effective risk management proactively protects your organization from incidents that can affect its reputation.

“Franchise risk is a concern for all businesses,“ Simons says in Strategy Execution . “However, it's especially pressing for businesses whose reputations depend on the trust of key constituents.”

For example, airlines are particularly susceptible to franchise risk because of unforeseen events, such as flight delays and cancellations caused by weather or mechanical failure. While such incidents are considered operational risks, they can be incredibly damaging.

In 2016, Delta Airlines experienced a national computer outage, resulting in over 2,000 flight cancellations. Delta not only lost an estimated $150 million but took a hit to its reputation as a reliable airline that prided itself on “canceling cancellations.”

While Delta bounced back, the incident illustrates how mitigating operational errors can make or break your organization.

2. Minimizes Losses

Most businesses create risk management teams to avoid major financial losses. Yet, various risks can still impact their bottom lines.

A Vault Platform study found that dealing with workplace misconduct cost U.S. businesses over $20 billion in 2021. In addition, Soltes says in Strategy Execution that corporate fines for misconduct have risen 40-fold in the U.S. over the last 20 years.

One way to mitigate financial losses related to employee misconduct is by implementing internal controls. According to Strategy Execution , internal controls are the policies and procedures designed to ensure reliable accounting information and safeguard company assets.

“Managers use internal controls to limit the opportunities employees have to expose the business to risk,” Simons says in the course.

One company that could have benefited from implementing internal controls is Volkswagen (VW). In 2015, VW whistle-blowers revealed that the company’s engineers deliberately manipulated diesel vehicles’ emissions data to make them appear more environmentally friendly.

This led to severe consequences, including regulatory penalties, expensive vehicle recalls, and legal settlements—all of which resulted in significant financial losses. By 2018, U.S. authorities had extracted $25 billion in fines, penalties, civil damages, and restitution from the company.

Had VW maintained more rigorous internal controls to ensure transparency, compliance, and proper oversight of its engineering practices, perhaps it could have detected—or even averted—the situation.

Related: What Are Business Ethics & Why Are They Important?

3. Encourages Innovation and Growth

Risk management isn’t just about avoiding negative outcomes. It can also be the catalyst that drives your organization’s innovation and growth.

“Risks may not be pleasant to think about, but they’re inevitable if you want to push your business to innovate and remain competitive,” Simons says in Strategy Execution .

According to PwC , 83 percent of companies’ business strategies focus on growth, despite risks and mixed economic signals. In Strategy Execution , Simons notes that competitive risk is a challenge you must constantly monitor and address.

“Any firm operating in a competitive market must focus its attention on changes in the external environment that could impair its ability to create value for its customers,” Simons says.

This requires incorporating boundary systems —explicit statements that define and communicate risks to avoid—to ensure internal controls don’t extinguish innovation.

“Boundary systems are essential levers in businesses to give people freedom,” Simons says. “In such circumstances, you don’t want to stifle innovation or entrepreneurial behavior by telling people how to do their jobs. And if you want to remain competitive, you’ll need to innovate and adapt.”

Netflix is an example of how risk management can inspire innovation. In the early 2000s, the company was primarily known for its DVD-by-mail rental service. With growing competition from video rental stores, Netflix went against the grain and introduced its streaming service. This changed the market, resulting in a booming industry nearly a decade later.

Netflix’s innovation didn’t stop there. Once the steaming services market became highly competitive, the company shifted once again to gain a competitive edge. It ventured into producing original content, which ultimately helped differentiate its platform and attract additional subscribers.

By offering more freedom within internal controls, you can encourage innovation and constant growth.

4. Enhances Decision-Making

Risk management also provides a structured framework for decision-making. This can be beneficial if your business is inclined toward risks that are difficult to manage.

By pulling data from existing control systems to develop hypothetical scenarios, you can discuss and debate strategies’ efficacy before executing them.

“Interactive control systems are the formal information systems managers use to personally involve themselves in the decision activities of subordinates,” Simons says in Strategy Execution . “Decision activities that relate to and impact strategic uncertainties.”

JPMorgan Chase, one of the most prominent financial institutions in the world, is particularly susceptible to cyber risks because it compiles vast amounts of sensitive customer data . According to PwC , cybersecurity is the number one business risk on managers’ minds, with 78 percent worried about more frequent or broader cyber attacks.

Using data science techniques like machine learning algorithms enables JPMorgan Chase’s leadership not only to detect and prevent cyber attacks but address and mitigate risk.

Start Managing Your Organization's Risk

Risk management is essential to business. While some risk is inevitable, your ability to identify and mitigate it can benefit your organization.

But you can’t plan for everything. According to the Harvard Business Review , some risks are so remote that no one could have imagined them. Some result from a perfect storm of incidents, while others materialize rapidly and on enormous scales.

By taking an online strategy course , you can build the knowledge and skills to identify strategic risks and ensure they don’t undermine your business. For example, through an interactive learning experience, Strategy Execution enables you to draw insights from real-world business examples and better understand how to approach risk management.

Do you want to mitigate your organization’s risks? Explore Strategy Execution —one of our online strategy courses —and download our free strategy e-book to gain the insights to build a successful strategy.

About the Author

- +1 (800) 826-0777

- VIRTUAL TOUR

- Mass Notification

- Threat Intelligence

- Employee Safety Monitoring

- Travel Risk Management

- Emergency Preparedness

- Remote Workforce

- Location and Asset Protection

- Critical Communication

- Business Continuity

- Why AlertMedia

- Who We Serve

- Customer Spotlights

- Resource Library

- Downloads & Guides

What Is a Risk Management Plan? Action Steps & Examples to Get You Started

Your business shouldn’t falter when faced with a problem. Learn to adapt and react to any disruption quickly and confidently with a risk management plan.

What Is a Risk Management Plan?

- Risk Management Plan Template & Examples

- 4 Steps to Build a Plan

Knowing what could go wrong is the first step to making things go right—from protecting employee safety to ensuring smooth project success to managing complicated supply chains.

Thinking proactively about your potential risks is key, explains Lukas Quanstrom, Co-Founder and CEO of Ontic , in an interview on The Employee Safety Podcast . “By adopting a proactive security approach, you can collect pre-incident threat indicators to gather critical knowledge needed to prevent bad things from happening. These pre-incident indicators come in many forms: perhaps it’s a threatening letter, a dark-web post, or an employee tip.”

This approach is known as risk management, a system that applies to all industries and professionals responsible for project management, business continuity, and security. For any team, a risk management plan is a necessary blueprint that outlines how to prioritize and handle risks so you can minimize their impact on the organization’s objectives and projects.

Download Our Risk Mitigation Plan Template

A risk management plan (RMP) documents all the potential risks and obstacles that could impact a given project or initiative. The document’s purpose is to list a range of things that could go wrong and to explain how the team will track, manage, and/or eliminate those risks that get in the way of project objectives.

Other documents like business continuity plans, disaster recovery plans, and risk assessments are similar but generally cover a much larger scope and account for a broader set of potential threats.

The kinds of risks you cover in a risk management plan will be more focused, with targeted reporting and response requirements. For example, one risk to a project could be a key team member taking unexpected time off due to illness or injury. The risk management plan should outline the potential impact, how to deal with the scenario, and who will be involved in addressing any skill or labor gaps.

Project risk management plans are a great tool for project managers and emergency managers alike. These plans are:

- Flexible and applicable to any project

- Completed before an emergency so an emergency response can occur quickly and effectively

- Suited for both emergency and non-emergent situations

- Easily shared between departments and stakeholders

Risk management plans are ubiquitous and applied in every industry. Safety leaders from across the country have shared their own unique risk management plan templates and methodologies. Download this free template to make building your own plan much easier.

You can also explore the following examples to help get you started:

- Healthcare Provider Service Organization

- Connecticut Department of Social Services

How to Create a Risk Management Plan

Building a risk management plan can seem incredibly intimidating, but it doesn’t have to be.

Here is what the process looks like:

1. Find key stakeholders

The first step is determining who should be involved in your risk management plan. This should include any project managers or team leaders, key employees involved, and additional stakeholders.

Decide who needs to be involved, and then create a communication plan for when and how you will bring them into the planning process. Some stakeholders will need to be involved in creating the plan while others will only need to be informed once it is complete.

When you have a list put together, set up a meeting with everyone involved in the plan’s creation so you can collect all the information at one time.

How to Conduct a Risk Assessment

This video will help you facilitate an effective risk assessment at your organization.

2. Identify and qualify project risks

Next, perform risk identification to determine what risk events you face and qualify them to help you better prepare. The level of detail you go into in this step will greatly depend on your organization’s scale, industries, deliverables, and a project’s importance to the business. The bigger and more critical the project is, the more detailed your risk analysis should be.

“NOTE: If you can’t gather all key stakeholders together to identify the possible risks, make sure to request feedback from each of them on the list. Anticipating all the different factors on your own will be difficult, and you might miss an important risk that a stakeholder would readily recognize.”

The best way to do this is to gather all the key stakeholders together and make a list of all potential impacts. These can be as simple as running out of a key resource or as complicated as an unexpected natural disaster, but they should all clearly pose a risk to the completion or deadline of the project.

Suppose you are integrating a risk management plan into your existing emergency plan. In that case, you can use your risk assessments or business continuity plans as references for figuring out what risks your business usually faces.

Once you have your list of known risks, qualify the level of risk in each case. The best way to do this is to create a risk assessment matrix.

A risk matrix maps each risk on two dimensions: the likelihood and the expected impact. If a risk has a low probability and low impact, it will be much easier to manage and can likely be dealt with once it occurs. However, mitigating negative impacts should be a higher priority if a risk has a high probability and a severe impact.