How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

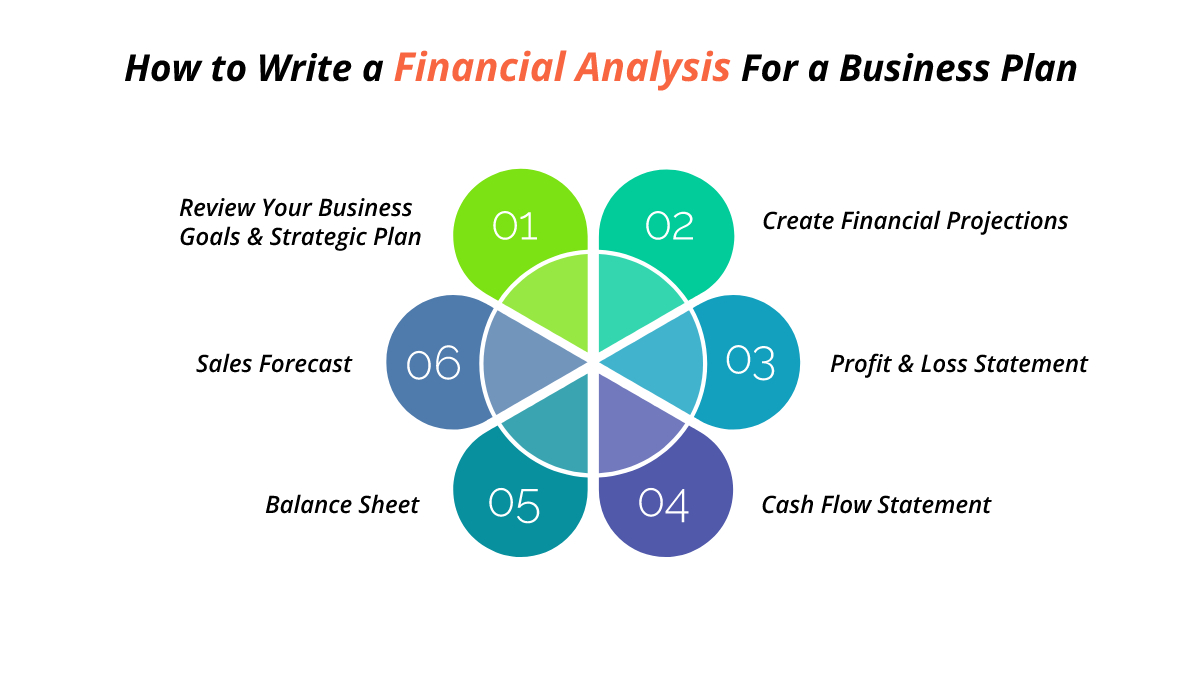

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

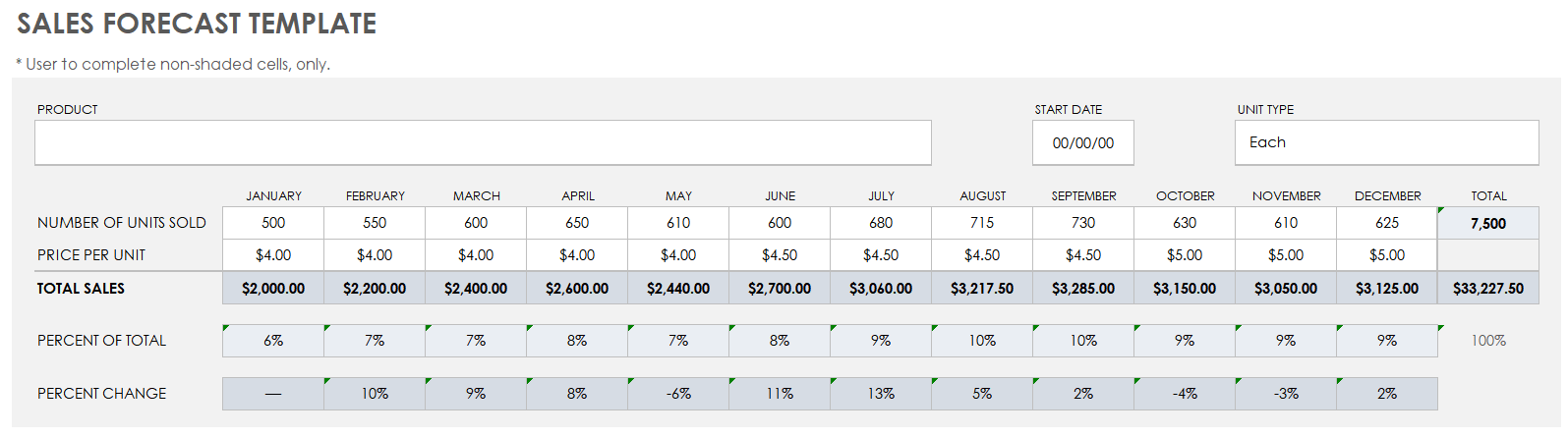

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

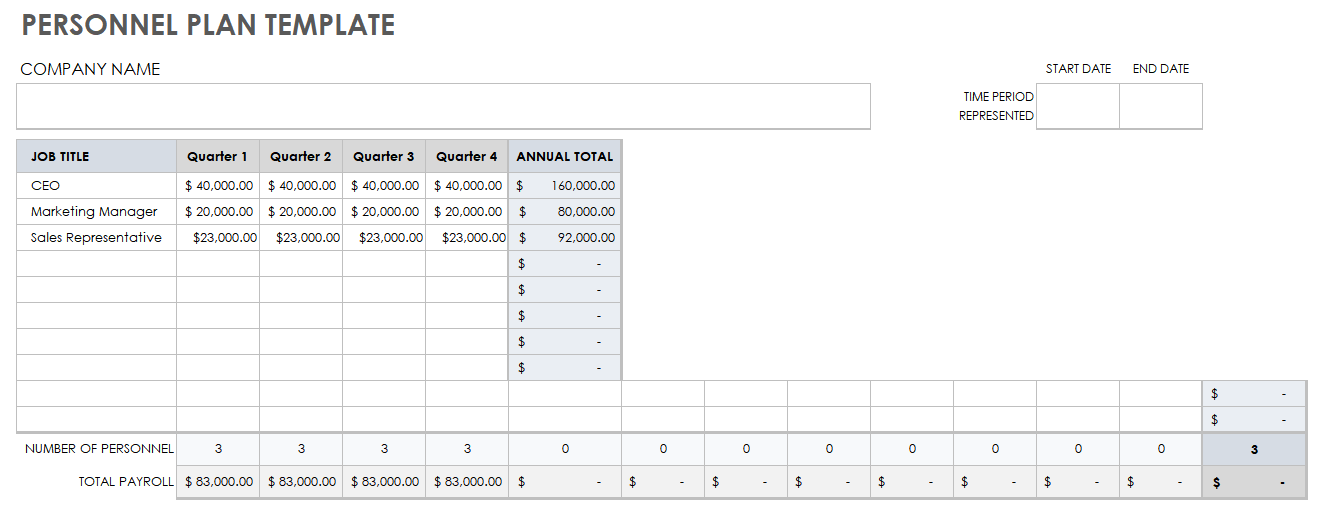

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

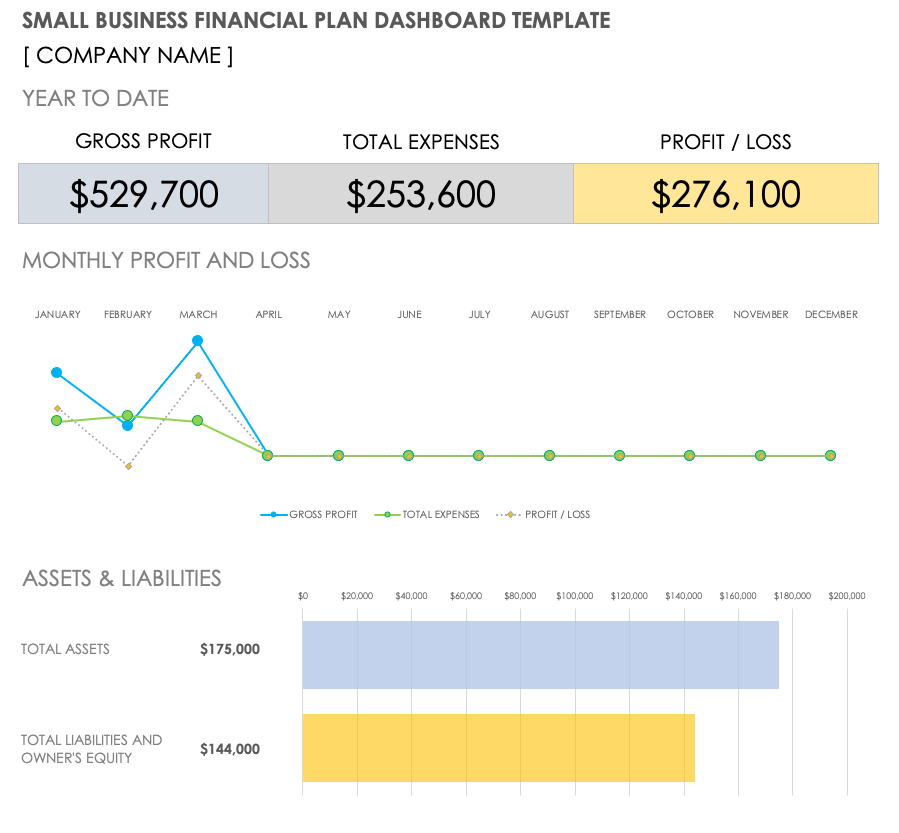

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

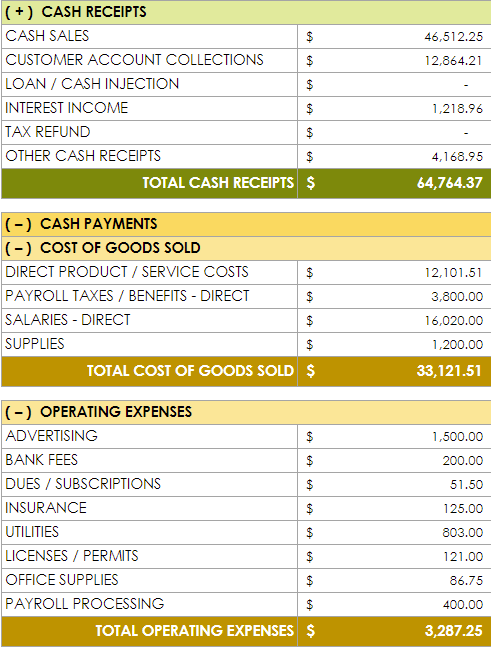

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

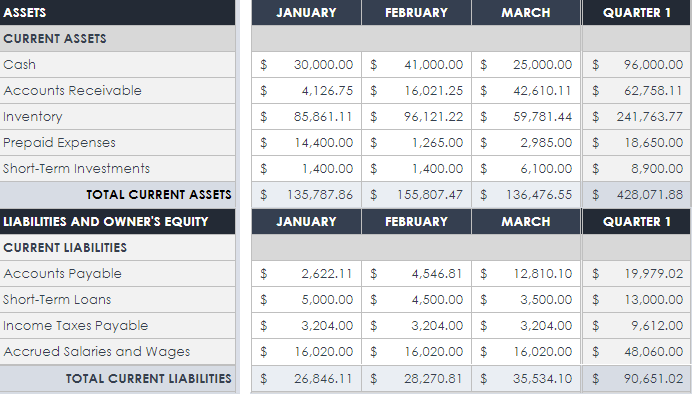

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

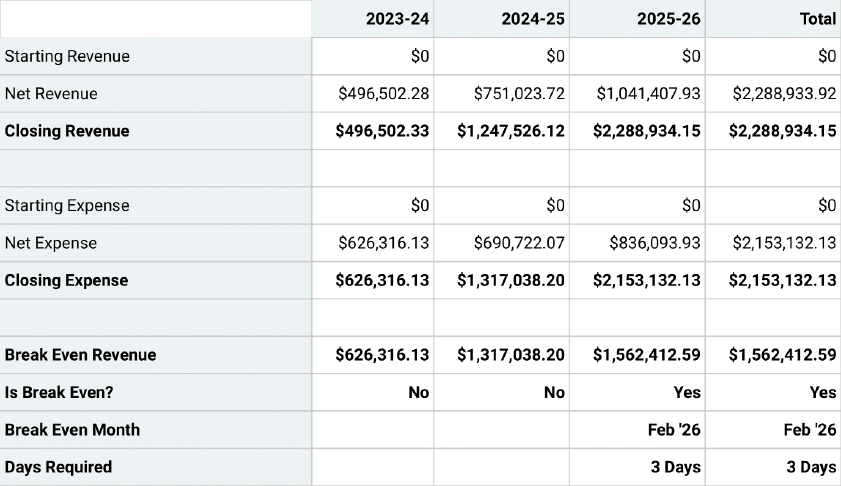

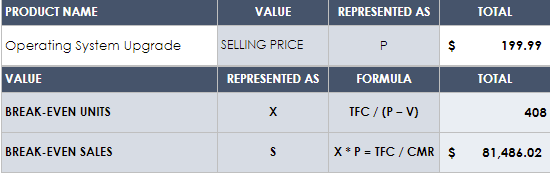

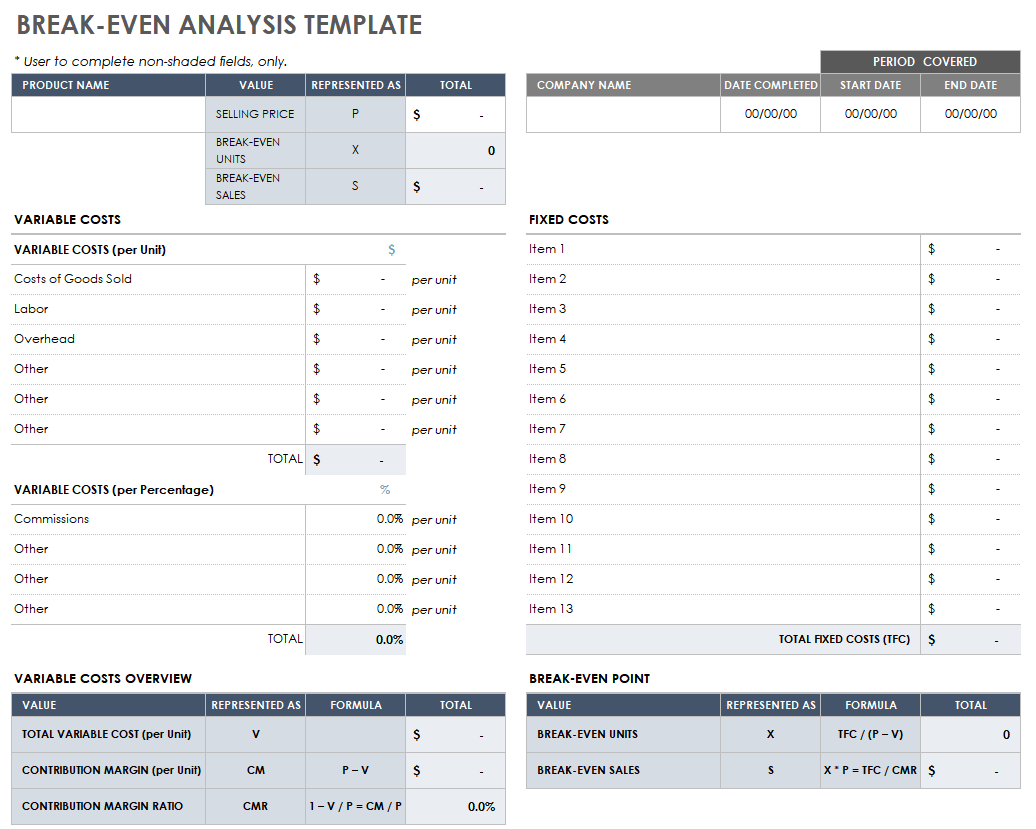

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

6 Min. Read

How to create a business plan cover page

10 Min. Read

How to set milestones in your business plan

Show that you know the competition

3 Min. Read

What to include in your business plan appendix

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Planning, Startups, Stories

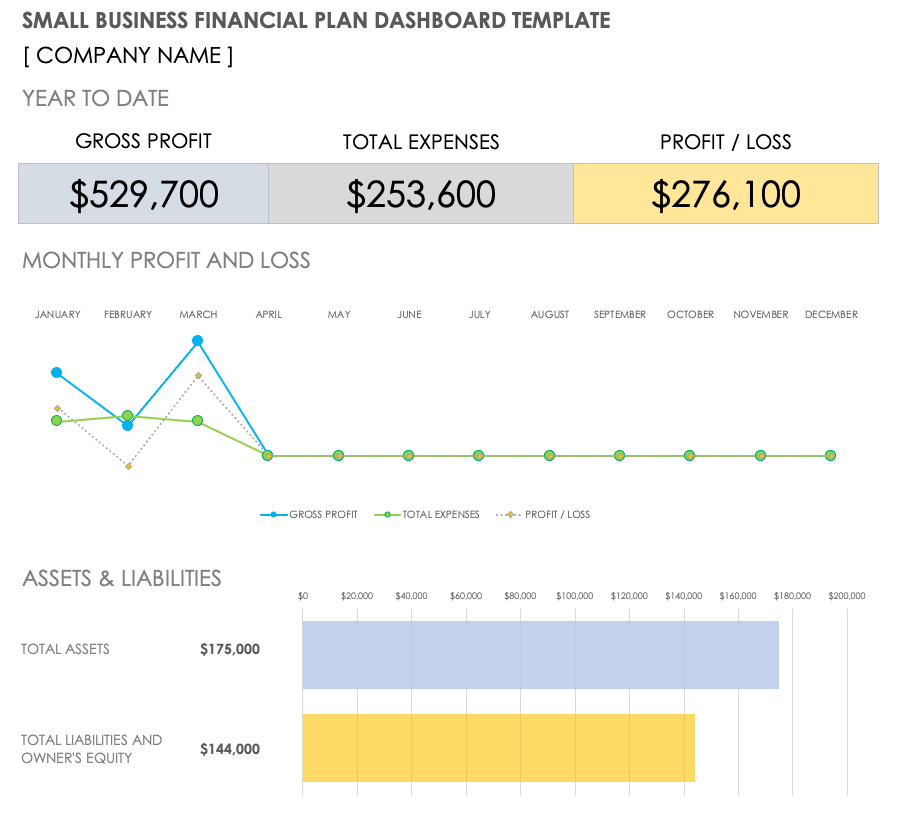

Tim berry on business planning, starting and growing your business, and having a life in the meantime., what do business plan financials look like.

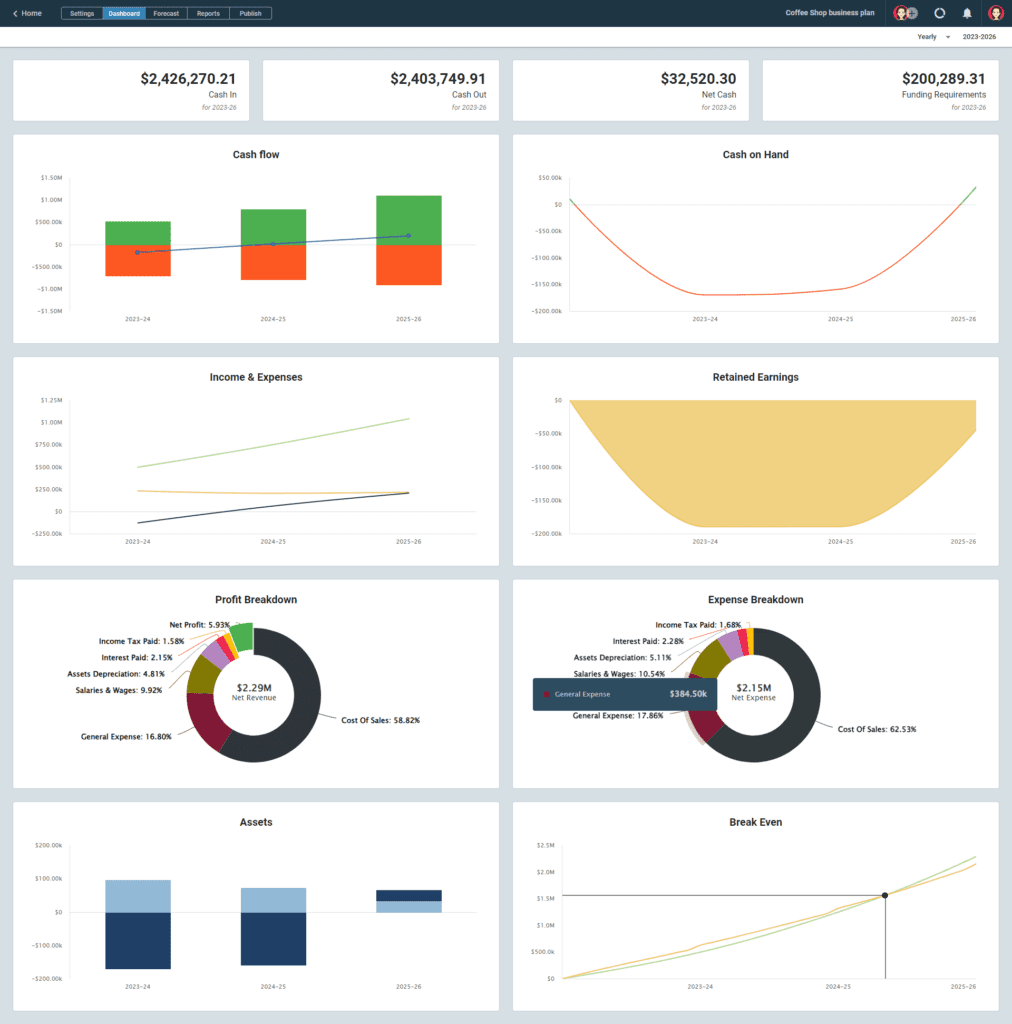

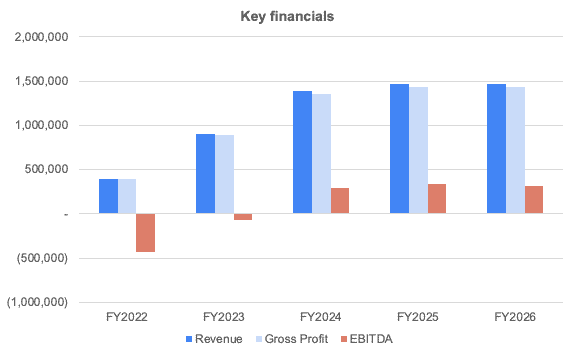

People often ask: What do business plan financials look like? You can get away with a sales forecast, spending budget, and cash flow plan. That’s enough for actually running your startup. It’s the essential numbers in a lean business plan.

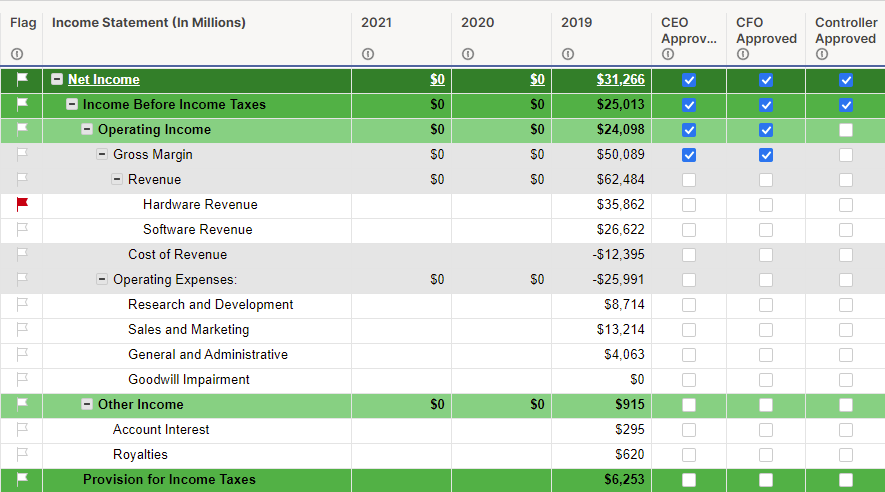

If you want to do it right you take it further and present projected (also called Pro Forma) versions of the three main business plan financial statements: Income Statement (also called Profit & Loss), Balance Sheet, and Cash Flow. Here’s how they are related to each other:

And here’s another view:

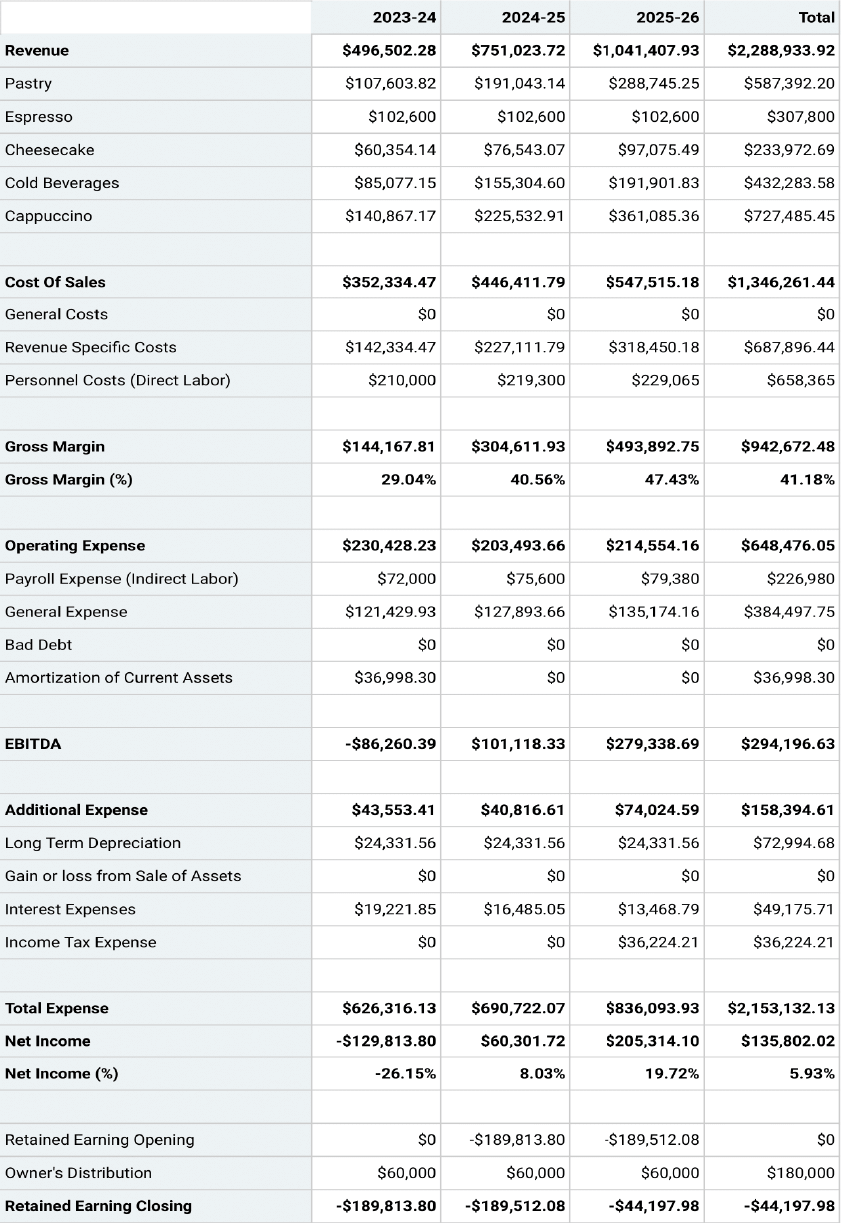

Projected Profit and Loss (also called Income)

This is where you project sales, costs, and expenses; and what’s left over is profits. Here is a general summary , and you might also check out Your Profits are Way Too High , How to Forecast Sales and Profits Without Just Guessing . Profits are the performance of the business over a specified period of time, like a month, quarter, or year. You project sales , direct costs, and expenses .

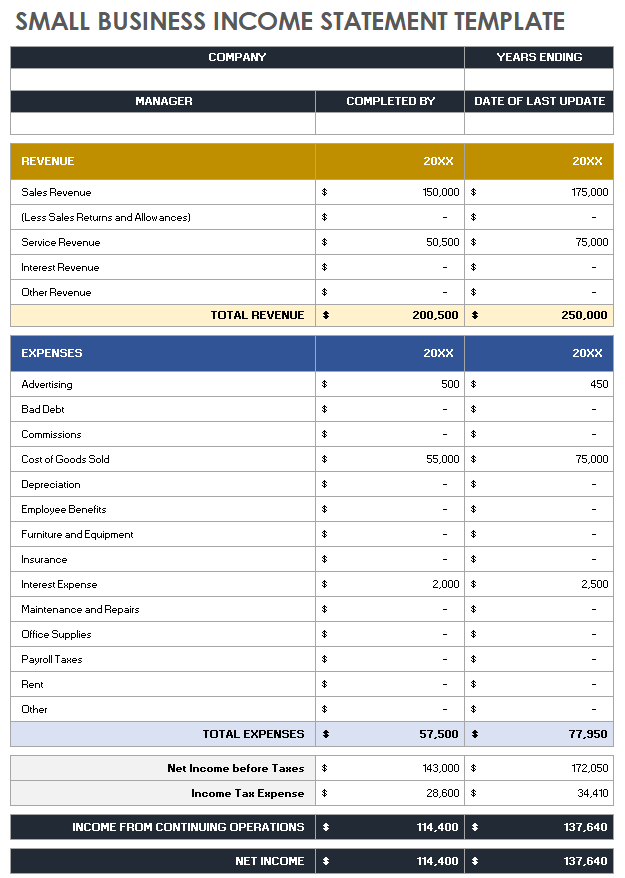

Here’s what it looks like in a plan.

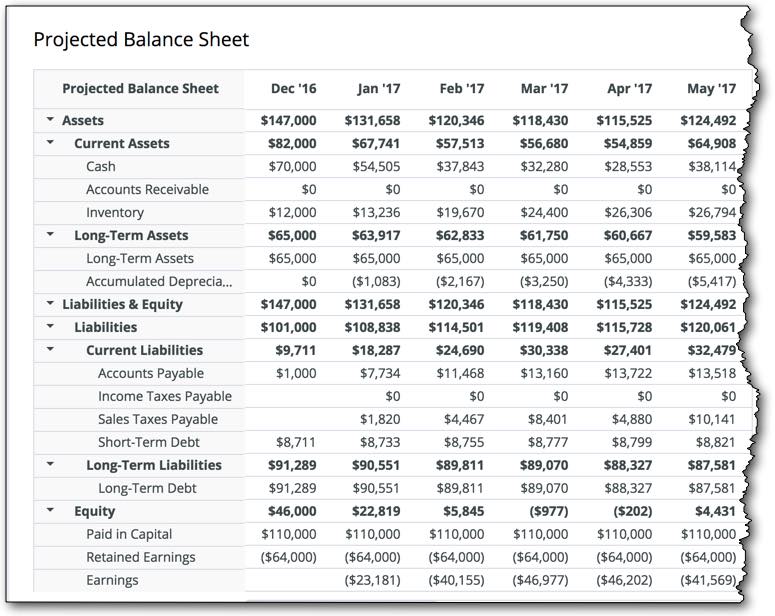

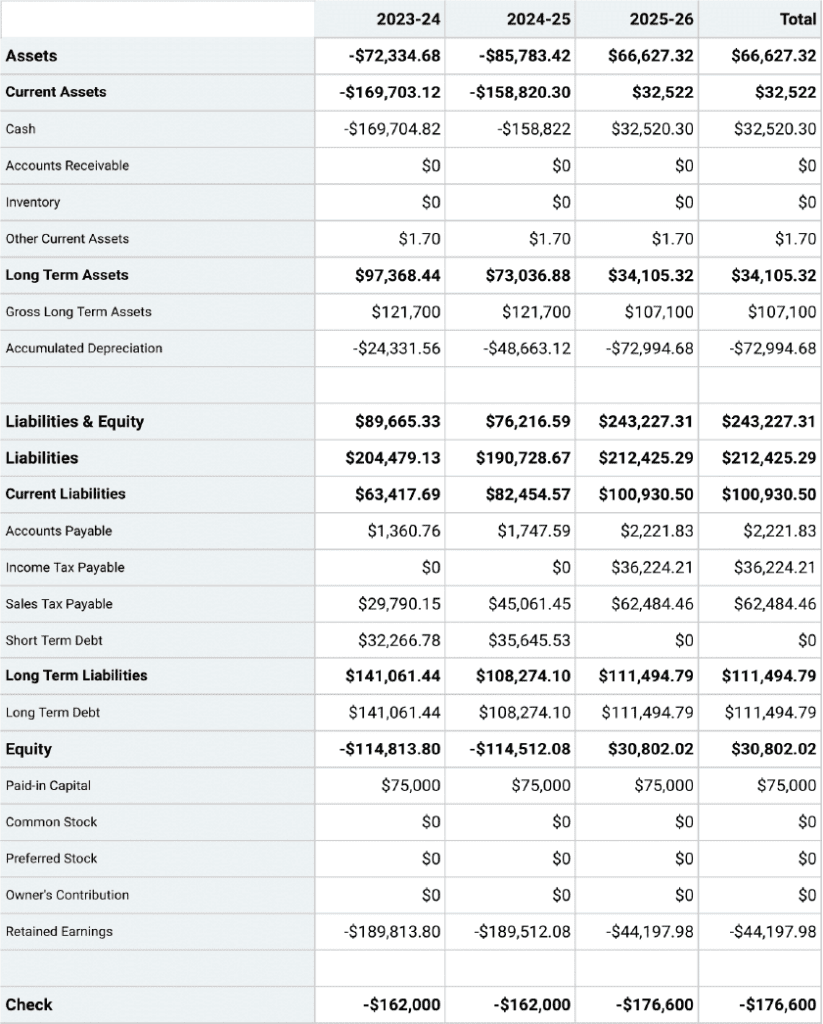

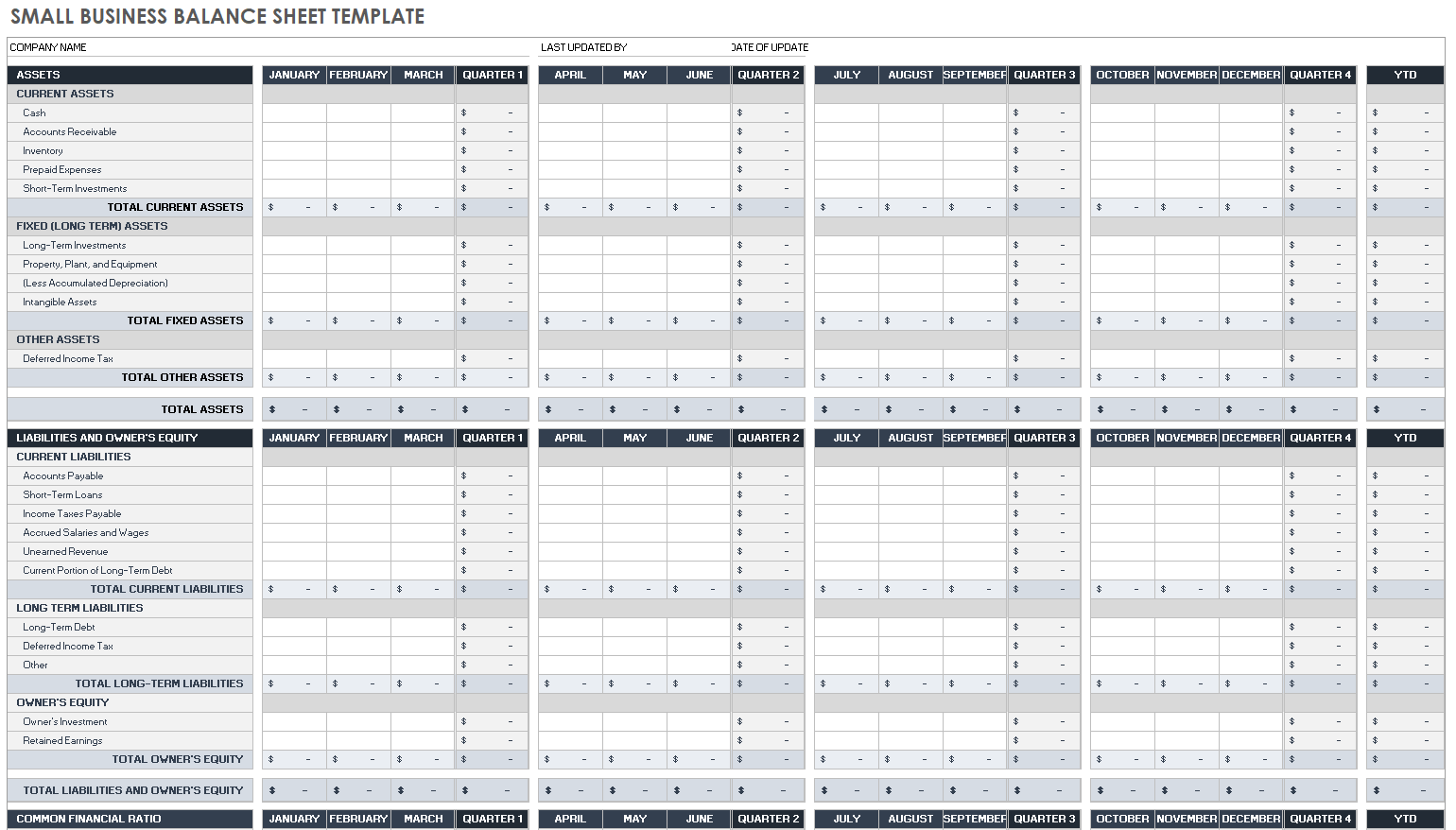

Projected Balance Sheet

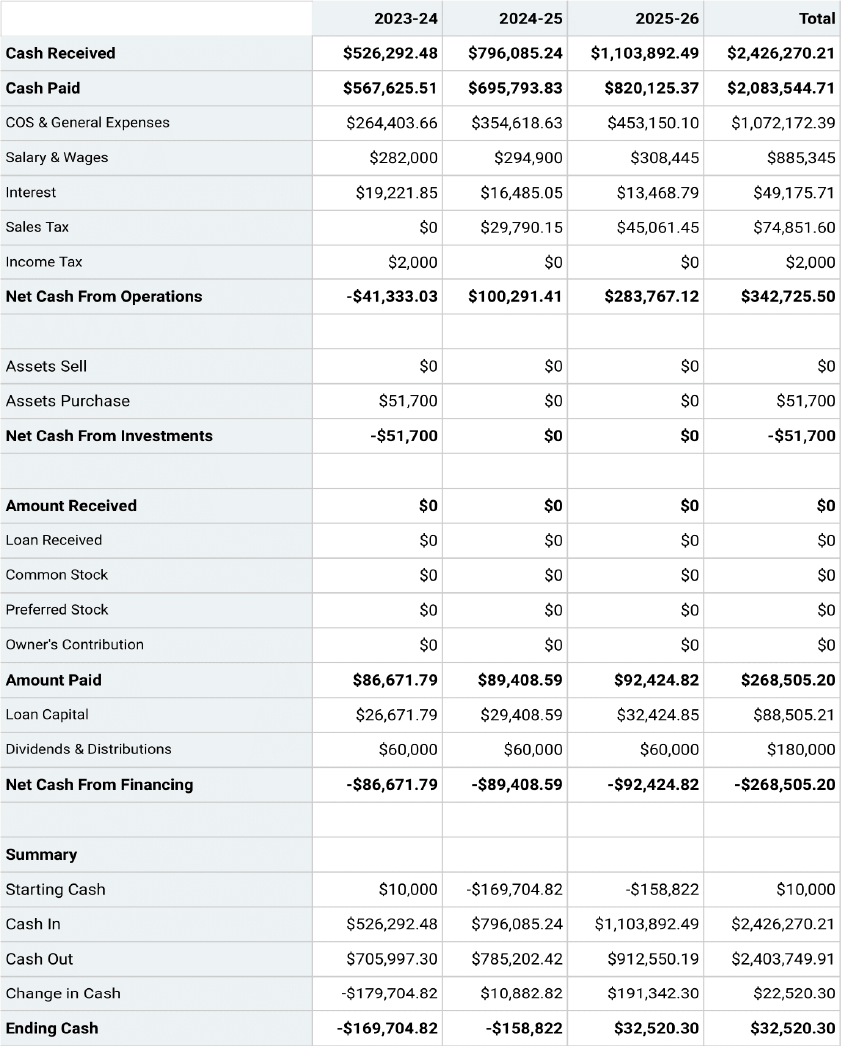

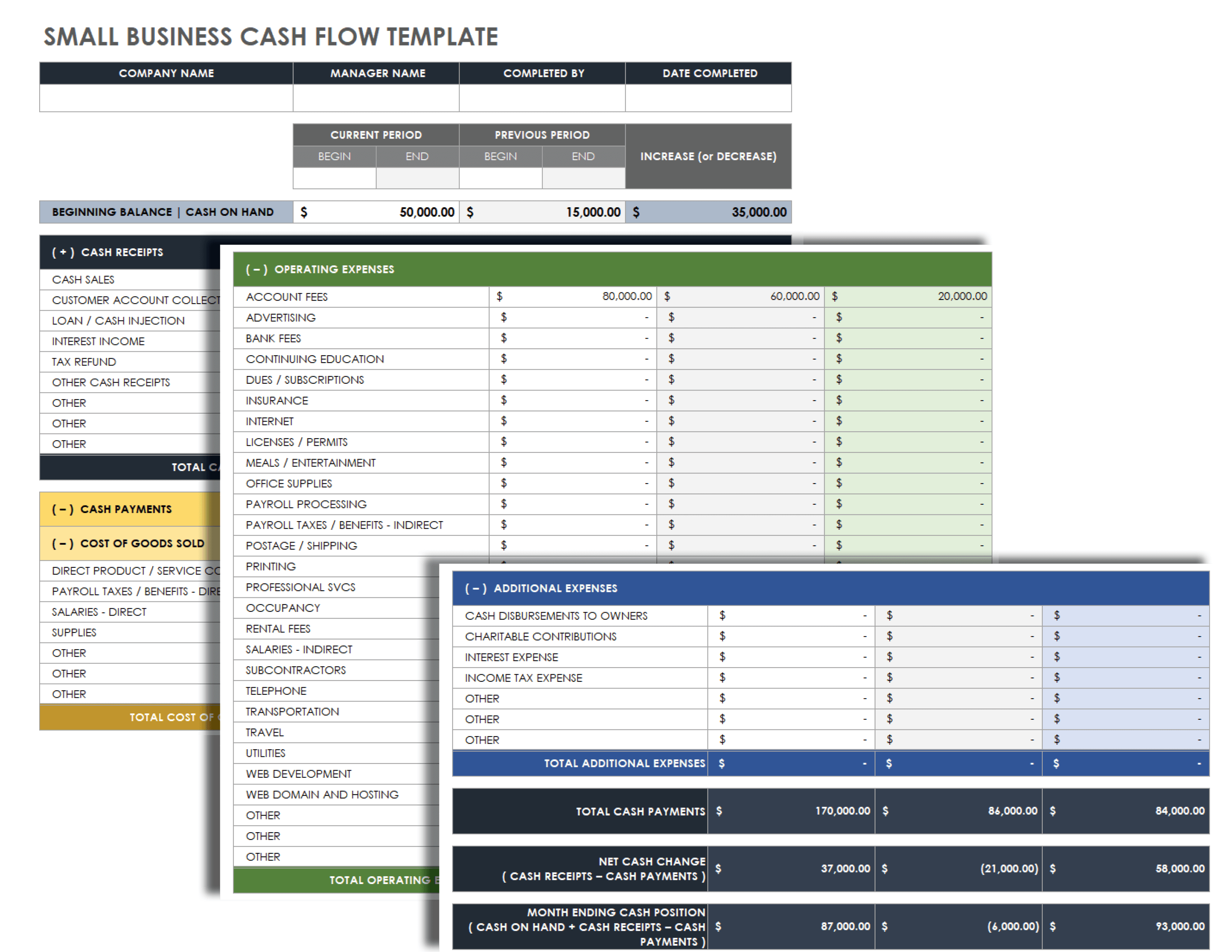

Projected Cash Flow

The cash flow is the most important, because your business lives on cash, not profits . You can project cash flow using the direct method , or the indirect method . Either way works if you do it right. Here’s an example of what an indirect cash flow projection looks like in a business plan.

Do It Right?

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

Key Financial Metrics for Your Business Plan

Posted september 6, 2018 by noah parsons.

Digging into your business’s financials can feel a bit like eating your fruits and vegetables, but what’s good for your business’s health is good for you.

When you’re putting a business plan together, the financial plan can feel like the most intimidating part. If you’re like most business owners, you probably didn’t go to business school or have a degree in accounting.

That’s O.K. This article will explain everything that you need to include in your financial plan so you get off to a good start.

All business plans, whether you’re just starting a business or building a plan for an existing business, should include the following:

Profit and loss statement, cash flow statement, balance sheet, sales forecast, personnel plan.

- and maybe some business ratios and/or a break-even analysis

Even if you’re in the very beginning stages of your business, these financial statements can still work for you.

The good news is that they don’t have to be difficult to create or hard to understand. With just a few educated guesses about how much you might sell and what your expenses will be, you’ll be well on your way to creating a complete financial plan.

A profit and loss statement is essentially an explanation of how your business made a profit (or incurred a loss) over a certain period of time. It’s a table that lists all of your revenue streams and all of your expenses—typically for a three-month period—and lists at the very bottom the total amount of net profit or loss.

This is a financial statement that goes by a few different names—profit and loss statement, income statement, pro forma income statement, P&L (short for “profit and loss”)—but no matter what you call it, it’s an essential report and very important to understand.

There are different formats for profit and loss statements, depending on the type of business you’re in and the structure of your business (nonprofit, LLC, C-Corp, etc.).

A typical profit and loss statement should include:

- Your revenue (also called sales)

- Your “cost of sale” or “cost of goods sold” (COGS)—keep in mind, some types of companies, such as a services firm, may not have COGS

- Your gross margin , which is your revenue less your COGS

These three components (revenue, COGS, and gross margin) are the backbone of your business model —i.e., how you make money.

You’ll also list your operating expenses, which are the expenses associated with running your business that aren’t incurred directly by making a sale. They’re the fixed expenses that don’t fluctuate depending on the strength or weakness of your revenue in a given month—think rent, utilities, and insurance.

Your gross margin less your operating expenses will give you your operating income:

Gross Margin – Operating Expenses = Operating Income

Depending on how you classify some of your expenses, your operating income will typically be equivalent to your “earnings before interest, taxes, depreciation, and amortization” (EBITDA)—basically, how much money you made in profit before you take your accounting and tax obligations into consideration. This is also called your “profit before interest and taxes,” gross profit, and “contribution to overhead”—many names, but they all refer to the same number.

Your so-called “bottom line”—officially, your net income, which is found at the very end (or, bottom line) of your profit and loss statement—is your EBITDA less the “ITDA.” Just subtract your expenses for interest, taxes, depreciation, and amortization from your EBITDA, and you have your net income:

Operating Income – Interest, Taxes, Depreciation, and Amortization Expenses = Net Income

For further reading on profit and loss statements (a.k.a., income statements), including an example of what a profit and loss statement actually looks like, check out “ How to Read and Analyze an Income Statement.” And if you want to start building your own, download our free Income Statement Example .

A cash flow statement (also called a “statement of cash flows”) is an explanation of how much cash your business brought in, how much cash it paid out, and what its ending cash balance was, typically per-month.

That might sound like sales, expenses, and profits, but it’s not.

Consider this: What happens when you send out an invoice to a client, but they don’t pay it by the due date ? What happens when you pay your own bills late, or early? These kinds of things aren’t reflected in your profit and loss statement, but they are explained in your cash flow statement.

Your cash flow statement is just as important as your profit and loss statement. Businesses run on cash—there are no two ways around it.

Without a thorough understanding of how much cash you have, where your cash is coming from, where it’s going, and on what schedule, you’re going to have a hard time running a healthy business. And without the cash flow statement, which lays that information out neatly for lenders and investors, you’re not going to be able to raise funds. No business plan is complete without a cash flow plan.

The cash flow statement helps you understand the difference between what your profit and loss statement reports as income—your profit—and what your actual cash position is.

It is possible to be extremely profitable and still not have enough cash to pay your expenses and keep your business afloat, and it is also possible to be unprofitable but still have enough cash on hand to keep the doors open for several months and buy yourself time to turn things around—that’s why this financial statement is so important to understand.

How cash versus accrual accounting affects the cash flow statement

There are two methods of accounting—the cash method and the accrual method.

The cash method means that you just account for your sales and expenses as they happen, without worrying about matching up the expenses that are related to a particular sale or vice versa.

The accrual method means that you account for your sales and expenses at the same time—if you got a big preorder for a new product, for example, you’d wait to account for all of your preorder sales revenue until you’d actually started manufacturing and delivering the product. Matching revenue with the related expenses is what’s referred to as “the matching principle,” and is the basis of accrual accounting.

If you use the cash method of accounting in your business, your cash flow statement isn’t going to be very different from what you see in your profit and loss statement. That might seem like it makes things simpler, but I actually advise against it. I think that the accrual method of accounting gives you the best sense of how your business operates, and that you should consider switching to it if you aren’t using it already.

For the best sense of how your business operates, you should consider switching to accrual accounting if you aren’t using it already.

Here’s why: Let’s say you operate a summer camp business. You might receive payment from a camper in March, several months before camp actually starts in July—using the accrual method, you wouldn’t recognize the revenue until you’ve performed the service, so both the revenue and the expenses for the camp would be accounted for in the month of July.

With the cash method, you would have recognized the revenue back in March, but all of the expenses in July, which would have made it look like you were profitable in all of the months leading up to the camp, but unprofitable during the month that camp actually took place.

Cash accounting can get a little unwieldy when it comes time to evaluate how profitable an event or product was, and can make it harder to really understand the ins and outs of your business operations. For the best look at how your business works, accrual accounting is the way to go.

Your balance sheet is a snapshot of your business’s financial position—at a particular moment in time, how are you doing? How much cash do you have in the bank, how much do your customers owe you, and how much do you owe your vendors?

The balance sheet is standardized, and consists of three types of accounts:

- Assets (accounts receivable, money in the bank, inventory, etc.)

- Liabilities (accounts payable, credit card balances, loan repayments, etc.)

- Equity (for most small businesses, this is just the owner’s equity, but it could include investors’ shares, retained earnings, stock proceeds, etc.)

It’s called a balance sheet because it’s an equation that needs to balance out:

Assets = Liabilities + Equity

The total of your liabilities plus your total equity always equals the total of your assets.

At the end of the accounting year, your total profit or loss adds to or subtracts from your retained earnings (a component of your equity). That makes your retained earnings your business’s cumulative profit and loss since the business’s inception.

However, if you are a sole proprietor or other pass-through tax entity, “retained earnings” doesn’t really apply to you—your retained earnings will always equal zero, as all profits and losses are passed through to the owners and not rolled over or retained like they are in a corporation.

If you’d like more help creating your balance sheet, check out our free downloadable Balance Sheet Template .

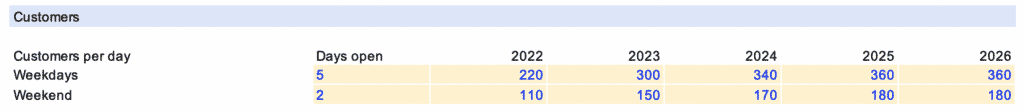

The sales forecast is exactly what it sounds like: your projections, or forecast, of what you think you will sell in a given period (typically, a year to three years). Your sales forecast is an incredibly important part of your business plan, especially when lenders or investors are involved, and should be an ongoing part of your business planning process.

Your sales forecast should be an ongoing part of your business planning process.

You should create a forecast that is consistent with the sales number you use in your profit and loss statement. In fact, in our business planning software , LivePlan, the sales forecast auto-fills the profit and loss statement.

There isn’t a one-size-fits-all kind of sales forecast—every business will have different needs. How you segment and organize your forecast depends on what kind of business you have and how thoroughly you want to track your sales.

Some helpful questions to ask yourself are:

- How many customers do you anticipate?

- How much will you charge them?

- How often will you charge them?

Your sales forecast can be as detailed as you want it to be, or you can simplify your forecast by summarizing it. However you choose to do a sales forecast, you should definitely have one.

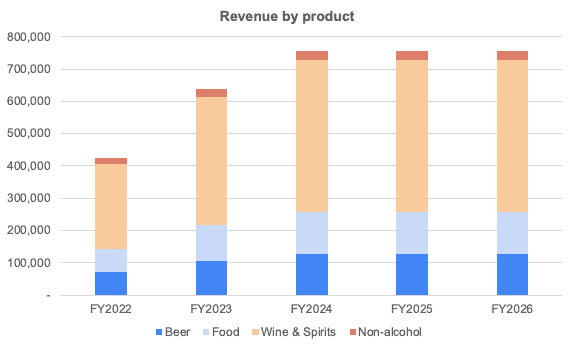

Generally, you’ll want to break down your sales forecast into segments that are helpful to you for planning and marketing purposes. If you own a restaurant, for example, you’d probably want to separate your forecasts for dinner and lunch sales; if you own a gym, it might be helpful to differentiate between single memberships, family memberships, club shop sales, and extra services like personal training sessions. If you want to get really specific, you might even break your forecast down by product, with a separate line for every product you sell.

Along with each segment of forecasted sales, you’ll want to include that segment’s “cost of goods sold” (COGS). The difference between your forecasted revenue and your forecasted COGS is your forecasted gross margin .

The importance of the personnel plan depends largely on the type of business you have. If you are a sole proprietor with no employees, this might not be that important and could be summarized in a sentence of two. But if you are a larger business with high labor costs, you should spend the time necessary to figure out how your personnel affects your business.

Think of the personnel plan as a justification of each team member’s necessity to the business.

If you create a personnel plan, it should include a description of each member of your management team, explaining what they bring to the table in terms of training, expertise, and product or market knowledge. If you’re writing a business plan to present to lenders or investors, you could think of this as a justification of each team member’s necessity to the business, and a justification of their salary (and/or equity share, if applicable). This would fall in the company overview section of your business plan.

You can also choose to use this section to list entire departments if that is a better fit for your business and the intentions you have for your business plan . There’s no rule that says you have to list only individual members of the management team.

This is also where you would list team members or departments that you’ve budgeted for but haven’t hired yet. Describe who your ideal candidate(s) is/are, and justify your budgeted salary range(s).

Additional calculations you might find useful:

Business ratios.

If you have your profit and loss statement, your cash flow statement, and your balance sheet, you have all the numbers you need to calculate the standard business ratios . These ratios aren’t necessary to include in a business plan—especially for an internal plan—but knowing some key ratios is almost always a good idea.

You’d probably want some profitability ratios, like:

- Gross margin

- Return on sales

- Return on assets

- Return on investment

And you’d probably want some liquidity ratios, such as:

- Debt-to-equity

- Current ratio

- Working capital

Of these, the most common ratios used by business owners and requested by bankers are probably gross margin, return on investment (ROI), and debt-to-equity.

Break-even analysis

Your break-even analysis is a calculation of how much you will need to sell in order to “break-even” (i.e., how much you will need to sell in order to pay for all of your expenses).

Consider a restaurant: It has to be open, with the tables set and the menus printed and with the bartender and all of the cooks and servers working, in order to make even one sale. But if it only sold one dinner, the restaurant would be operating at a loss—even a $50 meal isn’t going to cover the night’s utility bills. So the restaurant owner might use a break-even analysis to get an idea of how many meals the restaurant needs to sell on a given night in order to cover its expenses.

In determining your break-even point, you’ll need to figure out the contribution margin of what you’re selling. In the case of a restaurant, the contribution margin will be the price of the meal less any associated costs. For example, the customer pays $50 for the meal. The food costs are $10 and the wages paid to prepare and serve the meal are $15. Your contribution margin is $25 ($50 – $10 – $15 = $25).

Using this model you can determine how high your sales revenue needs to be in order for you to break even. If your monthly fixed costs are $5,000 and you average a 50 percent contribution margin (like in our example with the restaurant), you’ll need to have sales of $10,000 in order to break even.

Your financial plan might feel overwhelming when you get started, but the truth is that this section of your business plan is absolutely essential to understand.

Even if you end up outsourcing your bookkeeping and regular financial analysis to an accounting firm, you—the business owner—should be able to read and understand these documents and make decisions based on what you learn from them. Using a business dashboard tool can help, so you’re not wading through spreadsheets to put your figures on the important details.

If you create and present financial statements that all work together to tell the story of your business, and if you can answer questions about where your numbers are coming from, your chances of securing funding from investors or lenders are much higher.

Further resources:

For more business financial concepts made simple, check out these articles on cash burn rate , direct costs , net profit , operating margin , accounts payable , accounts receivable , cash flow , profit and loss statement , balance sheet , and expense budgeting .

Like this post? Share with a friend!

Noah Parsons

Posted in management, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

4 Steps to Creating a Financial Plan for Your Small Business

When it comes to long-term business success, preparation is the name of the game. And the key to that preparation is a solid financial plan that sets forth a business’s short- and long-term financial goals and how it intends to reach them. Used by company decision-makers and potential partners, investors and lenders, alike, a financial plan typically includes the company’s sales forecast, cash flow projection, expected expenses, key financial metrics and more. Here is what small businesses should understand to create a comprehensive financial plan of their own.

What Is a Financial Plan?

A financial plan is a document that businesses use to detail and manage their finances, ensure efficient allocation of resources and inform a plethora of decisions — everything from setting prices, to expanding the business, to optimizing operations, to name just a few. The financial plan provides a clear understanding of the company’s current financial standing; outlines its strategies, goals and projections; makes clear whether an idea is sustainable and worthy of investment; and monitors the business’s financial health as it grows and matures. Financial plans can be adjusted over time as forecasts become replaced with real-world results and market forces change.

A financial plan is an integral part of an overall business plan, ensuring financial objectives align with overall business goals. It typically contains a description of the business, financial statements, personnel plan, risk analysis and relevant key performance indicators (KPIs) and ratios. By providing a comprehensive view of the company’s finances and future goals, financial plans also assist in attracting investors and other sources of funding.

Key Takeaways

- A financial plan details a business’s current standing and helps business leaders make informed decisions about future endeavors and strategies.

- A financial plan includes three major financial statements: the income statement, balance sheet and cash flow statement.

- A financial plan answers essential questions and helps track progress toward goals.

- Financial management software gives decision-makers the tools they need to make strategic decisions.

Why Is a Financial Plan Important to Your Small Business?

A financial plan can provide small businesses with greater confidence in their short- and long-term endeavors by helping them determine ways to best allocate and invest their resources. The process of creating the plan forces businesses to think through how different decisions could impact revenue and which occasions call for dipping into reserve funds. It’s also a helpful tool for monitoring performance, managing cash flow and tracking financial metrics.

Simply put, a financial plan shows where the business stands; over time, its analysis will reveal whether its investments were worthwhile and worth repeating. In addition, when a business is courting potential partners, investors and lenders, the financial plan spotlights the business’s commitment to spending wisely and meeting its financial obligations.

Benefits of a Financial Plan

A financial plan is only as effective as the data foundation it’s built on and the business’s flexibility to revisit it amid changing market forces and demand shifts. Done correctly, a financial plan helps small businesses stay on track so they can reach their short-term and long-term goals. Among the benefits that effective financial planning delivers:

- A clear view of goals and objectives: As with any type of business plan, it’s imperative that everyone in a company is on the same financial page. With clear responsibilities and expected results mapped out, every team member from the top down sees what needs to be done, when to do it and why.

- More accurate budgets and projections: A comprehensive financial plan leads to realistic budgets that allocate resources appropriately and plan for future revenue and expenses. Financial projections also help small businesses lay out steps to maintain business continuity during periods of cash flow volatility or market uncertainty.

- External funding opportunities: With a detailed financial plan in hand, potential partners, lenders and investors can see exactly where their money will go and how it will be used. The inclusion of stellar financial records, including past and current liabilities, can also assure external funding sources that they will be repaid.

- Performance monitoring and course correction: Small businesses can continue to benefit from their financial plans long after the plan has been created. By continuously monitoring results and comparing them with initial projections, businesses have the opportunity to adjust their plans as needed.

Components of a Small Business Financial Plan

A sound financial plan is instrumental to the success and stability of a small business. Whether the business is starting from scratch or modifying its plan, the best financial plans include the following elements:

Income statement: The income statement reports the business’s net profit or loss over a specific period of time, such a month, quarter or year. Also known as a profit-and-loss statement (P&L) or pro forma income statement, the income statement includes the following elements:

- Cost of goods sold (COGS): The direct costs involved in producing goods or services.

- Operating expenses: Rent, utilities and other costs involved in running the business.

- Revenue streams: Usually in the form of sales and subscription services, among other sources.

- Total net profit or loss: Derived from the total amount of sales less expenses and taxes.

Balance sheet: The balance sheet reports the business’s current financial standing, focusing on what it owns, what it owes and shareholder equity:

- Assets: Available cash, goods and other owned resources.

- Liabilities: Amounts owed to suppliers, personnel, landlords, creditors, etc.

Shareholder equity: Measures the company’s net worth, calculated with this formula:

Shareholder Equity = Assets – Liability

The balance sheet lists assets, liabilities and equity in chart format, with assets in the left column and liabilities and equity on the right. When complete — and as the name implies —the two sides should balance out to zero, as shown on the sample balance sheet below. The balance sheet is used with other financial statements to calculate business financial ratios (discussed soon).

Balance Sheet

Cash flow projection: Cash flow projection is a part of the cash flow statement , which is perhaps one of the most critical aspects of a financial plan. After all, businesses run on cash. The cash flow statement documents how much cash came in and went out of the business during a specific time period. This reveals its liquidity, meaning how much cash it has on hand. The cash flow projection should display how much cash a business currently has, where it’s going, where future cash will come from and a schedule for each activity.

Personnel plan: A business needs the right people to meet its goals and maintain a healthy cash flow. A personnel plan looks at existing positions, helps determine when it’s time to bring on more team members and determines whether new hires should be full-time, part-time or work on a contractual basis. It also examines compensation levels, including benefits, and forecasts those costs against potential business growth to gauge whether the potential benefits of new hires justify the expense.

Business ratios: In addition to a big-picture view of the business, decision-makers will need to drill down to specific aspects of the business to understand how individual areas are performing. Business ratios , such as net profit margin, return on equity, accounts payable turnover, assets to sales, working capital and total debt to total assets, help evaluate the business’s financial health. Data used to calculate these ratios come from the P&L statement, balance sheet and cash flow statement. Business ratios contextualize financial data — for example, net profit margin shows the profitability of a company’s operations in relation to its revenue. They are often used to help request funding from a bank or investor, as well.

Sales forecast: How much will you sell in a specific period? A sales forecast needs to be an ongoing part of any planning process since it helps predict cash flow and the organization’s overall health. A forecast needs to be consistent with the sales number within your P&L statement. Organizing and segmenting your sales forecast will depend on how thoroughly you want to track sales and the business you have. For example, if you own a hotel and giftshop, you may want to track separately sales from guests staying the night and sales from the shop.

Cash flow projection: Perhaps one of the most critical aspects of your financial plan is your cash flow statement . Your business runs on cash. Understanding how much cash is coming in and when to expect it shows the difference between your profit and cash position. It should display how much cash you have now, where it’s going, where it will come from and a schedule for each activity.

Income projections: Businesses can use their sales forecasts to estimate how much money they are on track to make in a given period, usually a year. This income projection is calculated by subtracting anticipated expenses from revenue. In some cases, the income projection is rolled into the P&L statement.

Assets and liabilities: Assets and liabilities appear on the business’s balance sheet. Assets are what a company owns and are typically divided into current and long-term assets. Current assets can be converted into cash within a year and include stocks, inventory and accounts receivable. Long-term assets are tangible or fixed assets designed for long-term use, such as furniture, fixtures, buildings, machinery and vehicles.

Liabilities are business obligations that are also classified as current and long-term. Current liabilities are due to be paid within a year and include accrued payroll, taxes payable and short-term loans. Long-term liabilities include shareholder loans or bank debt that mature more than a year later.

Break-even analysis: The break-even point is how much a business must sell to exactly cover all of its fixed and variable expenses, including COGS, salaries and rent. When revenue exceeds expenses, the business makes a profit. The break-even point is used to guide sales revenue and volume goals; determination requires first calculating contribution margin , which is the amount of sales revenue a company has, less its variable costs, to put toward paying its fixed costs. Businesses can use break-even analyses to better evaluate their expenses and calculate how much to mark up its goods and services to be able to turn a profit.

Four Steps to Create a Financial Plan for Your Small Business

Financial plans require deliberate planning and careful implementation. The following four steps can help small businesses get started and ensure their plans can help them achieve their goals.

Create a strategic plan

Before looking at any numbers, a strategic plan focuses on what the company wants to accomplish and what it needs to achieve its goals. Will it need to buy more equipment or hire additional staff? How will its goals affect cash flow? What other resources are needed to meet its goals? A strategic financial plan answers these questions and determines how the plan will impact the company’s finances. Creating a list of existing expenses and assets is also helpful and will inform the remaining financial planning steps.

Create financial projections

Financial projections should be based on anticipated expenses and sales forecasts . These projections look at the business’s goals and estimate the costs needed to reach them in the face of a variety of potential scenarios, such as best-case, worst-case and most likely to happen. Accountants may be brought in to review the plan with stakeholders and suggest how to explain the plan to external audiences, such as investors and lenders.

Plan for contingencies

Financial plans should use data from the cash flow statement and balance sheet to inform worst-case scenario plans, such as when incoming cash dries up or the business takes an unexpected turn. Some common contingencies include keeping cash reserves or a substantial line of credit for quick access to funds during slow periods. Another option is to produce a plan to sell off assets to help break even.

Monitor and compare goals

Actual results in the cash flow statement, income projections and relevant business ratios should be analyzed throughout the year to see how closely real-life results adhered to projections. Regular check-ins also help businesses spot potential problems before they can get worse and inform course corrections.

Three Questions Your Financial Plan Should Answer

A small business financial plan should be tailored to the needs and expectations of its intended audience, whether it is potential investors, lenders, partners or internal stakeholders. Once the plan is created, all parties should, at minimum, understand:

How will the business make money?

What does the business need to achieve its goals?

What is the business’s operating budget ?

Financial plans that don’t answer these questions will need more work. Otherwise, a business risks starting a new venture without a clear path forward, and decision-makers will lack the necessary insights that a detailed financial plan would have provided.

Improve Your Financial Planning With Financial Management Software

Using spreadsheets for financial planning may get the job done when a business is first getting started, but this approach can quickly become overwhelming, especially when collaborating with others and as the business grows.

NetSuite’s cloud-based financial management platform simplifies the labor-intensive process through automation. NetSuite Planning and Budgeting automatically consolidates real-time data for analysis, reporting and forecasting, thereby improving efficiency. With intuitive dashboards and sophisticated forecasting tools, businesses can create accurate financial plans, track progress and modify strategies in order to achieve and maintain long-term success. The solution also allows for scenario planning and workforce planning, plus prebuilt data synchronization with NetSuite ERP means the entire business is working with the same up-to-date information.

Whether a business is first getting started, looking to expand, trying to secure outside funding or monitoring its growth, it will need to create a financial plan. This plan lays out the business’s short- and long-term objectives, details its current and projected finances, specifies how it will invest its resources and helps track its progress. Not only does a financial plan guide the business along its way, but it is typically required by outside sources of funding that don’t invest or lend their money to just any company. Creating a financial plan may take some time, but successful small businesses know it is well worth the effort.

#1 Cloud Accounting Software

Small Business Financial Plan FAQs

How do I write a small business financial plan?

Writing a small business financial plan is a four-step process. It begins with creating a strategic plan, which covers the company’s goals and what it needs to achieve them. The next step is to create financial projections, which are dependent on anticipating sales and expenses. Step three plans for contingencies: For example, what if the business were to lose a significant client? Finally, the business must monitor its goals, comparing actual results to projections and adjusting as needed.

What is the best financial statement for a small business?

The income statement, also known as the profit and loss (P&L) statement, is often considered the most important financial statement for small businesses, as it summarizes profits and losses and the business’s bottom line over a specific financial period. For financial plans, the cash flow statement and the balance sheet are also critical financial statements.

How often should businesses update their financial plans?

Financial plans can be updated whenever a business deems appropriate. Many businesses create three- and five-year plans and adjust them annually. If a market experiences a large shift, such as a spike in demand or an economic downturn, a financial plan may need to be updated to reflect the new market.

What are some common mistakes to avoid when creating a small business financial plan?

Some common mistakes to avoid when creating a small business financial plan include underestimating expenses, overestimating revenue, failing to plan for contingencies and adhering to plans too strictly when circumstances change. Plans should be regularly updated to reflect real-world results and current market trends.

How do I account for uncertainty and potential risks in my small business financial plan?

Small businesses can plan for uncertainty by maintaining cash reserves and opening lines of credit to cover periods of lower income or high expenses. Plans and projections should also take into account a variety of potential scenarios, from best case to worst case.

What is a typical business financial plan?

A typical business financial plan is a document that details a business’s goals, strategies and projections over a specific period of time. It is used as a roadmap for the organization’s financial activities and provides a framework for decision-making, resource allocation and performance evaluation.

What are the seven components of a financial plan?

Financial plans can vary to suit the business’s needs, but seven components to include are the income statement, operating income, net income, cash flow statement, balance sheet, financial projections and business ratios. Various financial key performance indicators and a break-even analysis are typically included as well.

What is an example of a financial plan?

A financial plan serves as a snapshot of the business’s current standing and how it plans to grow. For example, a restaurant looking to secure approval for a loan will be asked to provide a financial plan. This plan will include an executive summary of the business, a description and history of the company, market research into customer base and competition, sales and marketing strategies, key performance indicators and organizational structure. It will also include elements focusing on the future, such as financial projections, potential risks and funding requirements and strategies.

Financial Management

Small Business Financial Management: Tips, Importance and Challenges

It is remarkably difficult to start a small business. Only about half stay open for five years, and only a third make it to the 10-year mark. That’s why it’s vital to make every effort to succeed. And one of the most fundamental skills and tools for any small business owner is sound financial management.

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Related Articles

How to Write a Business Plan Complete Guide

How to Calculate Business Startup Costs

How to Prepare a Financial Plan for Small Business?

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

- Search Search Please fill out this field.

- Building Your Business

How To Create Financial Projections for Your Business

Learn how to anticipate your business’s financial performance

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-26at1.24.14PM-16d178cb2ee74d71946d658ab027e210.png)

- Understanding Financial Projections & Forecasting

Why Forecasting Is Critical for Your Business

Key financial statements for forecasting, how to create your financial projections, frequently asked questions (faqs).

Maskot / Getty Images

Just like a weather forecast lets you know that wearing closed-toe shoes will be important for that afternoon downpour later, a good financial forecast allows you to better anticipate financial highs and lows for your business.

Neglecting to compile financial projections for your business may signal to investors that you’re unprepared for the future, which may cause you to lose out on funding opportunities.

Read on to learn more about financial projections, how to compile and use them in a business plan, and why they can be crucial for every business owner.

Key Takeaways

- Financial forecasting is a projection of your business's future revenues and expenses based on comparative data analysis, industry research, and more.

- Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts, which can be attractive to investors.

- Some of the key components to include in a financial projection include a sales projection, break-even analysis, and pro forma balance sheet and income statement.

- A financial projection can not only attract investors, but helps business owners anticipate fixed costs, find a break-even point, and prepare for the unexpected.

Understanding Financial Projections and Forecasting

Financial forecasting is an educated estimate of future revenues and expenses that involves comparative analysis to get a snapshot of what could happen in your business’s future.

This process helps in making predictions about future business performance based on current financial information, industry trends, and economic conditions. Financial forecasting also helps businesses make decisions about investments, financing sources, inventory management, cost control strategies, and even whether to move into another market.

Developing both short- and mid-term projections is usually necessary to help you determine immediate production and personnel needs as well as future resource requirements for raw materials, equipment, and machinery.

Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts. They can also be used to make informed decisions about the business’s plans. Creating an accurate, adaptive financial projection for your business offers many benefits, including:

- Attracting investors and convincing them to fund your business

- Anticipating problems before they arise

- Visualizing your small-business objectives and budgets

- Demonstrating how you will repay small-business loans

- Planning for more significant business expenses

- Showing business growth potential

- Helping with proper pricing and production planning

Financial forecasting is essentially predicting the revenue and expenses for a business venture. Whether your business is new or established, forecasting can play a vital role in helping you plan for the future and budget your funds.

Creating financial projections may be a necessary exercise for many businesses, particularly those that do not have sufficient cash flow or need to rely on customer credit to maintain operations. Compiling financial information, knowing your market, and understanding what your potential investors are looking for can enable you to make intelligent decisions about your assets and resources.

The income statement, balance sheet, and statement of cash flow are three key financial reports needed for forecasting that can also provide analysts with crucial information about a business's financial health. Here is a closer look at each.

Income Statement

An income statement, also known as a profit and loss statement or P&L, is a financial document that provides an overview of an organization's revenues, expenses, and net income.

Balance Sheet

The balance sheet is a snapshot of the business's assets and liabilities at a certain point in time. Sometimes referred to as the “financial portrait” of a business, the balance sheet provides an overview of how much money the business has, what it owes, and its net worth.

The assets side of the balance sheet includes what the business owns as well as future ownership items. The other side of the sheet includes liabilities and equity, which represent what it owes or what others owe to the business.

A balance sheet that shows hypothetical calculations and future financial projections is also referred to as a “pro forma” balance sheet.

Cash Flow Statement

A cash flow statement monitors the business’s inflows and outflows—both cash and non-cash. Cash flow is the business’s projected earnings before interest, taxes, depreciation, and amortization ( EBITDA ) minus capital investments.

Here's how to compile your financial projections and fit the results into the three above statements.

A financial projections spreadsheet for your business should include these metrics and figures:

- Sales forecast

- Balance sheet

- Operating expenses

- Payroll expenses (if applicable)

- Amortization and depreciation

- Cash flow statement

- Income statement

- Cost of goods sold (COGS)

- Break-even analysis

Here are key steps to account for creating your financial projections.

Projecting Sales

The first step for a financial forecast starts with projecting your business’s sales, which are typically derived from past revenue as well as industry research. These projections allow businesses to understand what their risks are and how much they will need in terms of staffing, resources, and funding.

Sales forecasts also enable businesses to decide on important levels such as product variety, price points, and inventory capacity.

Income Statement Calculations

A projected income statement shows how much you expect in revenue and profit—as well as your estimated expenses and losses—over a specific time in the future. Like a standard income statement, elements on a projection include revenue, COGS, and expenses that you’ll calculate to determine figures such as the business’s gross profit margin and net income.

If you’re developing a hypothetical, or pro forma, income statement, you can use historical data from previous years’ income statements. You can also do a comparative analysis of two different income statement periods to come up with your figures.

Anticipate Fixed Costs

Fixed business costs are expenses that do not change based on the number of products sold. The best way to anticipate fixed business costs is to research your industry and prepare a budget using actual numbers from competitors in the industry. Anticipating fixed costs ensures your business doesn’t overpay for its needs and balances out its variable costs. A few examples of fixed business costs include:

- Rent or mortgage payments

- Operating expenses (also called selling, general and administrative expenses or SG&A)

- Utility bills

- Insurance premiums

Unfortunately, it might not be possible to predict accurately how much your fixed costs will change in a year due to variables such as inflation, property, and interest rates. It’s best to slightly overestimate fixed costs just in case you need to account for these potential fluctuations.

Find Your Break-Even Point

The break-even point (BEP) is the number at which a business has the same expenses as its revenue. In other words, it occurs when your operations generate enough revenue to cover all of your business’s costs and expenses. The BEP will differ depending on the type of business, market conditions, and other factors.

To find this number, you need to determine two things: your fixed costs and variable costs. Once you have these figures, you can find your BEP using this formula:

Break-even point = fixed expenses ➗ 1 – (variable expenses ➗ sales)

The BEP is an essential consideration for any projection because it is the point at which total revenue from a project equals total cost. This makes it the point of either profit or loss.

Plan for the Unexpected

It is necessary to have the proper financial safeguards in place to prepare for any unanticipated costs. A sudden vehicle repair, a leaky roof, or broken equipment can quickly derail your budget if you aren't prepared. Cash management is a financial management plan that ensures a business has enough cash on hand to maintain operations and meet short-term obligations.

To maintain cash reserves, you can apply for overdraft protection or an overdraft line of credit. Overdraft protection can be set up by a bank or credit card business and provides short-term loans if the account balance falls below zero. On the other hand, a line of credit is an agreement with a lending institution in which they provide you with an unsecured loan at any time until your balance reaches zero again.

How do you make financial projections for startups?

Financial projections for startups can be hard to complete. Historical financial data may not be available. Find someone with financial projections experience to give insight on risks and outcomes.

Consider business forecasting, too, which incorporates assumptions about the exponential growth of your business.

Startups can also benefit from using EBITDA to get a better look at potential cash flow.

What are the benefits associated with forecasting business finances?

Forecasting can be beneficial for businesses in many ways, including:

- Providing better understanding of your business cash flow

- Easing the process of planning and budgeting for the future based on income

- Improving decision-making

- Providing valuable insight into what's in their future

- Making decisions on how to best allocate resources for success

How many years should your financial forecast be?

Your financial forecast should either be projected over a specific time period or projected into perpetuity. There are various methods for determining how long a financial forecasting projection should go out, but many businesses use one to five years as a standard timeframe.

U.S. Small Business Administration. " Market Research and Competitive Analysis ."

Score. " Financial Projections Template ."

How to Develop a Small Business Financial Plan

By Andy Marker | April 29, 2022

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

Link copied

Financial planning is critical for any successful small business, but the process can be complicated. To help you get started, we’ve created a step-by-step guide and rounded up top tips from experts.

Included on this page, you’ll find what to include in a financial plan , steps to develop one , and a downloadable starter kit .

What Is a Small Business Financial Plan?

A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

Financial plans can aid in business goal setting and metrics tracking, as well as provide proof of profitable ideas. Craig Hewitt, Founder of Castos , shares that “creating a financial plan will show you if your business ideas are sustainable. A financial plan will show you where your business stands and help you make better decisions about resource allocation. It will also help you plan growth, survive cash flow shortages, and pitch to investors.”

Why Is It Important for a Small Business to Have a Financial Plan?

All small businesses should create a financial plan. This allows you to assess your business’s financial needs, recognize areas of opportunity, and project your growth over time. A strong financial plan is also a bonus for potential investors.

Mark Daoust , the President and CEO of Quiet Light Brokerage, Inc., explains why a financial plan is important for small businesses: “It can sometimes be difficult for business owners to evaluate their own progress, especially when starting a new company. A financial plan can be helpful in showing increased revenues, cash flow growth, and overall profit in quantifiable data. It's very encouraging for small business owners who are often working long hours and dealing with so many stressful decisions to know that they are on the right track.”

To learn more about other important considerations for a small business, peruse our list of free startup plan, budget, and cost templates .

What Does a Small Business Financial Plan Include?

All small businesses should include an income statement, a balance sheet, and a cash flow statement in their financial plan. You may also include other documents, such as personnel plans, break-even points, and sales forecasts, depending on the business and industry.

- Balance Sheet: A balance sheet determines the difference between your liabilities and assets to determine your equity. “A balance sheet is a snapshot of a business’s financial position at a particular moment in time,” says Yüzbaşıoğlu. “It adds up everything your business owns and subtracts all debts — the difference reflects the net worth of the business, also referred to as equity .” Yüzbaşıoğlu explains that this statement consists of three parts: assets, liabilities, and equity. “Assets include your money in the bank, accounts receivable, inventories, and more. Liabilities can include your accounts payables, credit card balances, and loan repayments, for example. Equity for most small businesses is just the owner’s equity, but it could also include investors’ shares, retained earnings, or stock proceeds,” he says.

- Cash Flow Statement: A cash flow statement shows where the money is coming from and where it is going. For existing businesses, this will include bank statements that list deposits and expenditures. A new business may not have much cash flow information, but it can include all startup costs and funding sources. “A cash flow statement shows how much cash is generated and used during a given period of time. It documents all the money flowing in and out of your business,” explains Yüzbaşıoğlu.