Step-by-Step Guide to Writing a Simple Business Plan

By Joe Weller | October 11, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

A business plan is the cornerstone of any successful company, regardless of size or industry. This step-by-step guide provides information on writing a business plan for organizations at any stage, complete with free templates and expert advice.

Included on this page, you’ll find a step-by-step guide to writing a business plan and a chart to identify which type of business plan you should write . Plus, find information on how a business plan can help grow a business and expert tips on writing one .

What Is a Business Plan?

A business plan is a document that communicates a company’s goals and ambitions, along with the timeline, finances, and methods needed to achieve them. Additionally, it may include a mission statement and details about the specific products or services offered.

A business plan can highlight varying time periods, depending on the stage of your company and its goals. That said, a typical business plan will include the following benchmarks:

- Product goals and deadlines for each month

- Monthly financials for the first two years

- Profit and loss statements for the first three to five years

- Balance sheet projections for the first three to five years

Startups, entrepreneurs, and small businesses all create business plans to use as a guide as their new company progresses. Larger organizations may also create (and update) a business plan to keep high-level goals, financials, and timelines in check.

While you certainly need to have a formalized outline of your business’s goals and finances, creating a business plan can also help you determine a company’s viability, its profitability (including when it will first turn a profit), and how much money you will need from investors. In turn, a business plan has functional value as well: Not only does outlining goals help keep you accountable on a timeline, it can also attract investors in and of itself and, therefore, act as an effective strategy for growth.

For more information, visit our comprehensive guide to writing a strategic plan or download free strategic plan templates . This page focuses on for-profit business plans, but you can read our article with nonprofit business plan templates .

Business Plan Steps

The specific information in your business plan will vary, depending on the needs and goals of your venture, but a typical plan includes the following ordered elements:

- Executive summary

- Description of business

- Market analysis

- Competitive analysis

- Description of organizational management

- Description of product or services

- Marketing plan

- Sales strategy

- Funding details (or request for funding)

- Financial projections

If your plan is particularly long or complicated, consider adding a table of contents or an appendix for reference. For an in-depth description of each step listed above, read “ How to Write a Business Plan Step by Step ” below.

Broadly speaking, your audience includes anyone with a vested interest in your organization. They can include potential and existing investors, as well as customers, internal team members, suppliers, and vendors.

Do I Need a Simple or Detailed Plan?

Your business’s stage and intended audience dictates the level of detail your plan needs. Corporations require a thorough business plan — up to 100 pages. Small businesses or startups should have a concise plan focusing on financials and strategy.

How to Choose the Right Plan for Your Business

In order to identify which type of business plan you need to create, ask: “What do we want the plan to do?” Identify function first, and form will follow.

Use the chart below as a guide for what type of business plan to create:

Is the Order of Your Business Plan Important?

There is no set order for a business plan, with the exception of the executive summary, which should always come first. Beyond that, simply ensure that you organize the plan in a way that makes sense and flows naturally.

The Difference Between Traditional and Lean Business Plans

A traditional business plan follows the standard structure — because these plans encourage detail, they tend to require more work upfront and can run dozens of pages. A Lean business plan is less common and focuses on summarizing critical points for each section. These plans take much less work and typically run one page in length.

In general, you should use a traditional model for a legacy company, a large company, or any business that does not adhere to Lean (or another Agile method ). Use Lean if you expect the company to pivot quickly or if you already employ a Lean strategy with other business operations. Additionally, a Lean business plan can suffice if the document is for internal use only. Stick to a traditional version for investors, as they may be more sensitive to sudden changes or a high degree of built-in flexibility in the plan.

How to Write a Business Plan Step by Step

Writing a strong business plan requires research and attention to detail for each section. Below, you’ll find a 10-step guide to researching and defining each element in the plan.

Step 1: Executive Summary

The executive summary will always be the first section of your business plan. The goal is to answer the following questions:

- What is the vision and mission of the company?

- What are the company’s short- and long-term goals?

See our roundup of executive summary examples and templates for samples. Read our executive summary guide to learn more about writing one.

Step 2: Description of Business

The goal of this section is to define the realm, scope, and intent of your venture. To do so, answer the following questions as clearly and concisely as possible:

- What business are we in?

- What does our business do?

Step 3: Market Analysis

In this section, provide evidence that you have surveyed and understand the current marketplace, and that your product or service satisfies a niche in the market. To do so, answer these questions:

- Who is our customer?

- What does that customer value?

Step 4: Competitive Analysis

In many cases, a business plan proposes not a brand-new (or even market-disrupting) venture, but a more competitive version — whether via features, pricing, integrations, etc. — than what is currently available. In this section, answer the following questions to show that your product or service stands to outpace competitors:

- Who is the competition?

- What do they do best?

- What is our unique value proposition?

Step 5: Description of Organizational Management

In this section, write an overview of the team members and other key personnel who are integral to success. List roles and responsibilities, and if possible, note the hierarchy or team structure.

Step 6: Description of Products or Services

In this section, clearly define your product or service, as well as all the effort and resources that go into producing it. The strength of your product largely defines the success of your business, so it’s imperative that you take time to test and refine the product before launching into marketing, sales, or funding details.

Questions to answer in this section are as follows:

- What is the product or service?

- How do we produce it, and what resources are necessary for production?

Step 7: Marketing Plan

In this section, define the marketing strategy for your product or service. This doesn’t need to be as fleshed out as a full marketing plan , but it should answer basic questions, such as the following:

- Who is the target market (if different from existing customer base)?

- What channels will you use to reach your target market?

- What resources does your marketing strategy require, and do you have access to them?

- If possible, do you have a rough estimate of timeline and budget?

- How will you measure success?

Step 8: Sales Plan

Write an overview of the sales strategy, including the priorities of each cycle, steps to achieve these goals, and metrics for success. For the purposes of a business plan, this section does not need to be a comprehensive, in-depth sales plan , but can simply outline the high-level objectives and strategies of your sales efforts.

Start by answering the following questions:

- What is the sales strategy?

- What are the tools and tactics you will use to achieve your goals?

- What are the potential obstacles, and how will you overcome them?

- What is the timeline for sales and turning a profit?

- What are the metrics of success?

Step 9: Funding Details (or Request for Funding)

This section is one of the most critical parts of your business plan, particularly if you are sharing it with investors. You do not need to provide a full financial plan, but you should be able to answer the following questions:

- How much capital do you currently have? How much capital do you need?

- How will you grow the team (onboarding, team structure, training and development)?

- What are your physical needs and constraints (space, equipment, etc.)?

Step 10: Financial Projections

Apart from the fundraising analysis, investors like to see thought-out financial projections for the future. As discussed earlier, depending on the scope and stage of your business, this could be anywhere from one to five years.

While these projections won’t be exact — and will need to be somewhat flexible — you should be able to gauge the following:

- How and when will the company first generate a profit?

- How will the company maintain profit thereafter?

Business Plan Template

Download Business Plan Template

Microsoft Excel | Smartsheet

This basic business plan template has space for all the traditional elements: an executive summary, product or service details, target audience, marketing and sales strategies, etc. In the finances sections, input your baseline numbers, and the template will automatically calculate projections for sales forecasting, financial statements, and more.

For templates tailored to more specific needs, visit this business plan template roundup or download a fill-in-the-blank business plan template to make things easy.

If you are looking for a particular template by file type, visit our pages dedicated exclusively to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates.

How to Write a Simple Business Plan

A simple business plan is a streamlined, lightweight version of the large, traditional model. As opposed to a one-page business plan , which communicates high-level information for quick overviews (such as a stakeholder presentation), a simple business plan can exceed one page.

Below are the steps for creating a generic simple business plan, which are reflected in the template below .

- Write the Executive Summary This section is the same as in the traditional business plan — simply offer an overview of what’s in the business plan, the prospect or core offering, and the short- and long-term goals of the company.

- Add a Company Overview Document the larger company mission and vision.

- Provide the Problem and Solution In straightforward terms, define the problem you are attempting to solve with your product or service and how your company will attempt to do it. Think of this section as the gap in the market you are attempting to close.

- Identify the Target Market Who is your company (and its products or services) attempting to reach? If possible, briefly define your buyer personas .

- Write About the Competition In this section, demonstrate your knowledge of the market by listing the current competitors and outlining your competitive advantage.

- Describe Your Product or Service Offerings Get down to brass tacks and define your product or service. What exactly are you selling?

- Outline Your Marketing Tactics Without getting into too much detail, describe your planned marketing initiatives.

- Add a Timeline and the Metrics You Will Use to Measure Success Offer a rough timeline, including milestones and key performance indicators (KPIs) that you will use to measure your progress.

- Include Your Financial Forecasts Write an overview of your financial plan that demonstrates you have done your research and adequate modeling. You can also list key assumptions that go into this forecasting.

- Identify Your Financing Needs This section is where you will make your funding request. Based on everything in the business plan, list your proposed sources of funding, as well as how you will use it.

Simple Business Plan Template

Download Simple Business Plan Template

Microsoft Excel | Microsoft Word | Adobe PDF | Smartsheet

Use this simple business plan template to outline each aspect of your organization, including information about financing and opportunities to seek out further funding. This template is completely customizable to fit the needs of any business, whether it’s a startup or large company.

Read our article offering free simple business plan templates or free 30-60-90-day business plan templates to find more tailored options. You can also explore our collection of one page business templates .

How to Write a Business Plan for a Lean Startup

A Lean startup business plan is a more Agile approach to a traditional version. The plan focuses more on activities, processes, and relationships (and maintains flexibility in all aspects), rather than on concrete deliverables and timelines.

While there is some overlap between a traditional and a Lean business plan, you can write a Lean plan by following the steps below:

- Add Your Value Proposition Take a streamlined approach to describing your product or service. What is the unique value your startup aims to deliver to customers? Make sure the team is aligned on the core offering and that you can state it in clear, simple language.

- List Your Key Partners List any other businesses you will work with to realize your vision, including external vendors, suppliers, and partners. This section demonstrates that you have thoughtfully considered the resources you can provide internally, identified areas for external assistance, and conducted research to find alternatives.

- Note the Key Activities Describe the key activities of your business, including sourcing, production, marketing, distribution channels, and customer relationships.

- Include Your Key Resources List the critical resources — including personnel, equipment, space, and intellectual property — that will enable you to deliver your unique value.

- Identify Your Customer Relationships and Channels In this section, document how you will reach and build relationships with customers. Provide a high-level map of the customer experience from start to finish, including the spaces in which you will interact with the customer (online, retail, etc.).

- Detail Your Marketing Channels Describe the marketing methods and communication platforms you will use to identify and nurture your relationships with customers. These could be email, advertising, social media, etc.

- Explain the Cost Structure This section is especially necessary in the early stages of a business. Will you prioritize maximizing value or keeping costs low? List the foundational startup costs and how you will move toward profit over time.

- Share Your Revenue Streams Over time, how will the company make money? Include both the direct product or service purchase, as well as secondary sources of revenue, such as subscriptions, selling advertising space, fundraising, etc.

Lean Business Plan Template for Startups

Download Lean Business Plan Template for Startups

Microsoft Word | Adobe PDF

Startup leaders can use this Lean business plan template to relay the most critical information from a traditional plan. You’ll find all the sections listed above, including spaces for industry and product overviews, cost structure and sources of revenue, and key metrics, and a timeline. The template is completely customizable, so you can edit it to suit the objectives of your Lean startups.

See our wide variety of startup business plan templates for more options.

How to Write a Business Plan for a Loan

A business plan for a loan, often called a loan proposal , includes many of the same aspects of a traditional business plan, as well as additional financial documents, such as a credit history, a loan request, and a loan repayment plan.

In addition, you may be asked to include personal and business financial statements, a form of collateral, and equity investment information.

Download free financial templates to support your business plan.

Tips for Writing a Business Plan

Outside of including all the key details in your business plan, you have several options to elevate the document for the highest chance of winning funding and other resources. Follow these tips from experts:.

- Keep It Simple: Avner Brodsky , the Co-Founder and CEO of Lezgo Limited, an online marketing company, uses the acronym KISS (keep it short and simple) as a variation on this idea. “The business plan is not a college thesis,” he says. “Just focus on providing the essential information.”

- Do Adequate Research: Michael Dean, the Co-Founder of Pool Research , encourages business leaders to “invest time in research, both internal and external (market, finance, legal etc.). Avoid being overly ambitious or presumptive. Instead, keep everything objective, balanced, and accurate.” Your plan needs to stand on its own, and you must have the data to back up any claims or forecasting you make. As Brodsky explains, “Your business needs to be grounded on the realities of the market in your chosen location. Get the most recent data from authoritative sources so that the figures are vetted by experts and are reliable.”

- Set Clear Goals: Make sure your plan includes clear, time-based goals. “Short-term goals are key to momentum growth and are especially important to identify for new businesses,” advises Dean.

- Know (and Address) Your Weaknesses: “This awareness sets you up to overcome your weak points much quicker than waiting for them to arise,” shares Dean. Brodsky recommends performing a full SWOT analysis to identify your weaknesses, too. “Your business will fare better with self-knowledge, which will help you better define the mission of your business, as well as the strategies you will choose to achieve your objectives,” he adds.

- Seek Peer or Mentor Review: “Ask for feedback on your drafts and for areas to improve,” advises Brodsky. “When your mind is filled with dreams for your business, sometimes it is an outsider who can tell you what you’re missing and will save your business from being a product of whimsy.”

Outside of these more practical tips, the language you use is also important and may make or break your business plan.

Shaun Heng, VP of Operations at Coin Market Cap , gives the following advice on the writing, “Your business plan is your sales pitch to an investor. And as with any sales pitch, you need to strike the right tone and hit a few emotional chords. This is a little tricky in a business plan, because you also need to be formal and matter-of-fact. But you can still impress by weaving in descriptive language and saying things in a more elegant way.

“A great way to do this is by expanding your vocabulary, avoiding word repetition, and using business language. Instead of saying that something ‘will bring in as many customers as possible,’ try saying ‘will garner the largest possible market segment.’ Elevate your writing with precise descriptive words and you'll impress even the busiest investor.”

Additionally, Dean recommends that you “stay consistent and concise by keeping your tone and style steady throughout, and your language clear and precise. Include only what is 100 percent necessary.”

Resources for Writing a Business Plan

While a template provides a great outline of what to include in a business plan, a live document or more robust program can provide additional functionality, visibility, and real-time updates. The U.S. Small Business Association also curates resources for writing a business plan.

Additionally, you can use business plan software to house data, attach documentation, and share information with stakeholders. Popular options include LivePlan, Enloop, BizPlanner, PlanGuru, and iPlanner.

How a Business Plan Helps to Grow Your Business

A business plan — both the exercise of creating one and the document — can grow your business by helping you to refine your product, target audience, sales plan, identify opportunities, secure funding, and build new partnerships.

Outside of these immediate returns, writing a business plan is a useful exercise in that it forces you to research the market, which prompts you to forge your unique value proposition and identify ways to beat the competition. Doing so will also help you build (and keep you accountable to) attainable financial and product milestones. And down the line, it will serve as a welcome guide as hurdles inevitably arise.

Streamline Your Business Planning Activities with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

10 Essential Components of a Business Plan and How to Write Them

Business Plan Template

Ayush Jalan

- January 4, 2024

12 Min Read

A business plan is an essential document for any business, whether it’s a startup or an established enterprise. It’s the first thing any interested investor will ask for if they like your business idea and want to partner with you.

That’s why it’s important to pay attention when writing your business plan and the components inside it. An incomplete business plan can give the impression that you’re unqualified—discouraging investors and lenders.

A good business plan reduces ambiguity and communicates all essential details such as your financials, market analysis, competitive analysis, and a timeline for implementation of the plan. In this article, we’ll discuss the 10 important business plan components.

10 Important Business Plan Components

A comprehensive and well-thought-out business plan acts as a roadmap that guides you in making sound decisions and taking the right actions at the right times. Here are its key components and what to include in them.

1. Executive summary

The executive summary is one of the most important parts of a business plan. It’s the first thing potential investors will read and should therefore provide a clear overview of your business and its goals.

In other words, it helps the reader get a better idea of what to expect from your company. So, when writing an executive summary of your business, don’t forget to mention your mission and vision statement.

Mission statement

A mission statement is a brief statement that outlines your objectives and what you want to achieve. It acts as a guiding principle that informs decisions and provides a clear direction for the organization to follow.

For instance, Google’s mission is to “organize the world’s information and make it universally accessible and useful.” It’s short, inspiring, and immediately communicates what the company does.

A mission statement should be realistic, and hint towards a goal that is achievable in a reasonable amount of time with the resources you currently have or are going to acquire in the near future.

Vision statement

While a mission statement is more actionable and has an immediate effect on the daily activities of the company, a vision statement is more aspirational and has a much broader scope.

In other words, it highlights where the company aims to go in the future and the positive change it hopes to make in the world within its lifetime.

2. Company description

The second component of your business plan is the company description. Here, you provide a brief overview of your company, its products or services, and its history. You can also add any notable achievements if they are significant enough for an investor to know.

A company overview offers a quick bird’s-eye view of things such as your business model , operational capabilities, financials, business philosophy, size of the team, code of conduct, and short-term and long-term objectives.

Products and services

The products and services part of your company description explains what your business offers to its customers, how it’s delivered, and the costs involved in acquiring new customers and executing a sale.

Company History

Company history is the timeline of events that took place in your business from its origin to the present day. It includes a brief profile of the founder(s) and their background, the date the company was founded, any notable achievements and milestones, and other similar facts and details.

If you’re a startup, you’ll probably not have much of a history to write about. In that case, you can share stories of the challenges your startup faced during its inception and how your team overcame them.

3. Market analysis

The market analysis section of your business plan provides an in-depth analysis of the industry, target market, and competition. It should underline the risks and opportunities associated with your industry, and also comment on the attributes of your target customer.

Demographics and segmentation

Understanding the demographics of your customers plays a big role in how well you’re able to identify their traits and serve them.

By dividing your target audience into smaller and more manageable groups, you can tailor your services and products to better meet their needs.

You can use demographics such as age, gender, income, location, ethnicity, and education level to better understand the preferences and behaviors of each segment, and use that data to create more effective marketing strategies.

Target market and size

Understanding your target market lies at the core of all your marketing endeavors. After all, if you don’t have a clear idea of who you’re serving, you won’t be able to serve well no matter how big your budget is.

For instance, Starbucks’ primary target market includes working professionals and office workers. The company has positioned itself such that many of its customers start their day with its coffee.

Estimating the market size helps you know how much scope there is to scale your business in the future. In other words, you’re trying to determine how much potential revenue exists in this market and if it’s worth the investment.

Market need

The next step is to figure out the market need, i.e., the prevalent pain points that people in that market experience. The easiest way to find these pain points is to read the negative reviews people leave on Amazon for products that are similar to yours.

The better your product solves those pain points, the better your chances of capturing that market. In addition, since your product is solving a problem that your rivals can’t, you can also charge a premium price.

To better identify the needs of your target customers, it helps to take into account things such as local cultural values, industry trends, buying habits, tastes and preferences, price elasticity, and more.

4. Product Summary

The product summary section of your business plan goes into detail about the features and benefits that your products and services offer, and how they differ from your competitors. It also outlines the manufacturing process, pricing, cost of production, inventory, packaging, and capital requirements.

5. Competitive analysis

Unless you’ve discovered an untapped market, you’re probably going to face serious competition and it’s only going to increase as you scale your business later down the line.

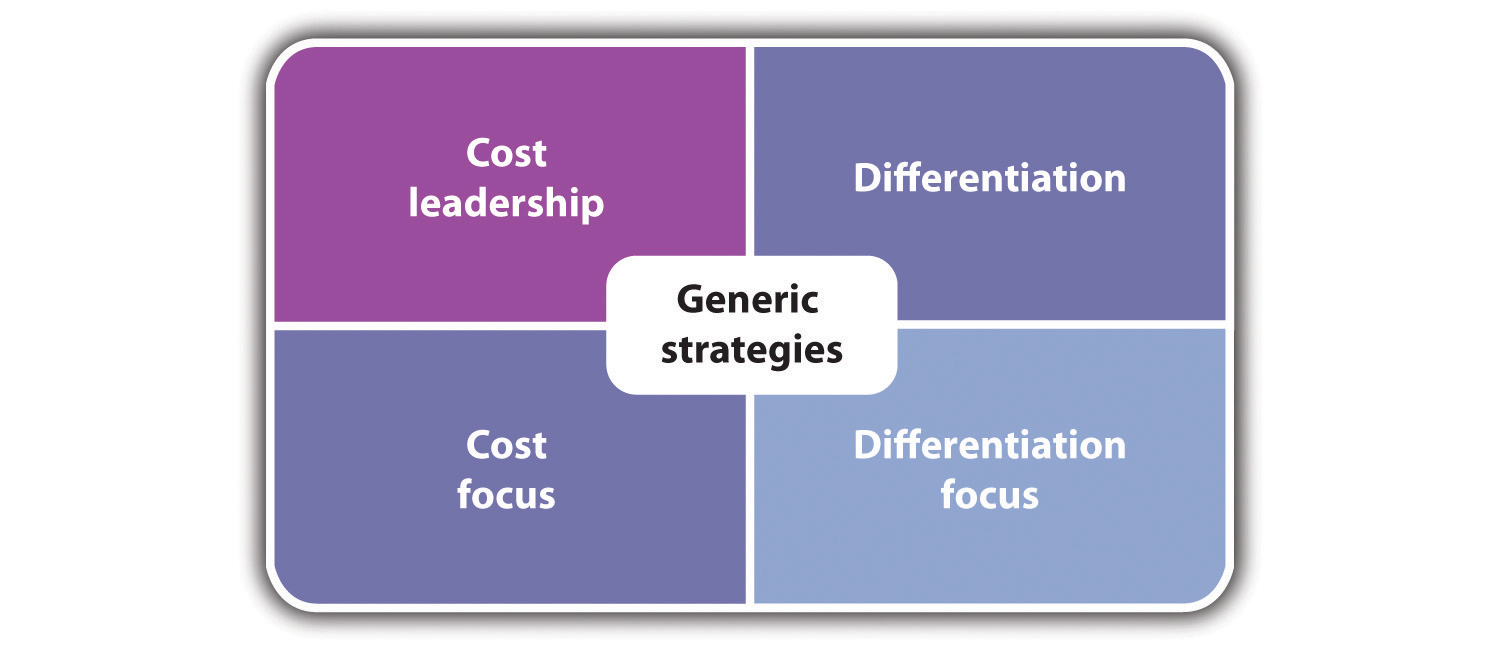

This is where the competitive analysis section helps; it gives an overview of the competitive landscape, introduces your immediate rivals, and highlights the current dominant companies and their market share.

In such an environment, it helps to have certain competitive advantages against your rivals so you can stand out in the market. Simply put, a competitive advantage is the additional value you can provide to your customers that your rivals can’t—perhaps via unique product features, excellent customer service, or more.

Want to Perform Competitive Analysis for Your Business?

Discover your competition’s secrets effortlessly with our user-friendly and Free Competitor Analysis Generator!

6. Marketing and sales plan

The marketing and sales plan is one of the most important business plan components. It explains how you plan to penetrate the market, position your brand in the minds of the buyers, build brand loyalty, increase sales, and remain competitive in an ever-changing business environment.

Unique selling proposition

A unique selling proposition (USP) conveys how your products and services differ from those of your competitors, and the added value those differences provide.

A strong USP will stand out in a competitive market and make potential customers more likely to switch to your brand—essentially capturing the market share of your rivals.

Marketing Plan

Your product might be unique, but if people don’t even know that it exists, it won’t sell. That’s where marketing comes in.

A marketing plan outlines strategies for reaching your target market and achieving sales goals. It also outlines the budget required for advertising and promotion.

You may also include data on the target market, target demographics, objectives, strategies, a timeline, budget, and the metrics considered for evaluating success.

Sales and distribution plan

Once people are made aware of your product, the next step is to ensure it reaches them. This means having a competent sales and distribution plan and a strong supply chain.

Lay out strategies for reaching potential customers, such as online marketing, lead generation, retail distribution channels, or direct sales.

Your goal here is to minimize sales costs and address the risks involved with the distribution of your product. If you’re selling ice cream, for example, you would have to account for the costs of refrigeration and cold storage.

Pricing strategy

Pricing is a very sensitive yet important part of any business. When creating a pricing strategy , you need to consider factors such as market demand, cost of production, competitor prices, disposable income of target customers, and profitability goals.

Some businesses have a small profit margin but sell large volumes of their product, while others sell fewer units but with a massive markup. You will have to decide for yourself which approach you want to follow.

Before setting your marketing plans into action, you need a budget for them. This means writing down how much money you’ll need, how it will be used, and the potential return you are estimating on this investment.

A budget should be flexible, meaning that it should be open to changes as the market shifts and customer behavior evolves. The goal here is to make sure that the company is making the best use of its resources by minimizing the wastage of funds.

7. Operations plan

The operations plan section of your business plan provides an overview of how the business is run and its day-to-day operations. This section is especially important for manufacturing businesses.

It includes a description of your business structure, the roles and responsibilities of each team member, the resources needed, and the procedures you will use to ensure the smooth functioning of your business. The goal here is to maximize output whilst minimizing the wastage of raw material or human labor.

8. Management team

At the core of any successful business lies a dedicated, qualified, and experienced management team overlooking key business activities.

This section provides an overview of the key members of your management team including their credentials, professional background, role and responsibilities, experience, and qualifications.

A lot of investors give special attention to this section as it helps them ascertain the competence and work ethic of the members involved.

Organizational structure

An organizational structure defines the roles, responsibilities, decision-making processes, and authority of each individual or department in an organization.

Having a clear organizational structure improves communication, increases efficiency, promotes collaboration, and makes it easier to delegate tasks. Startups usually have a flatter organizational hierarchy whereas established businesses have a more traditional structure of power and authority.

9. Financial Plan

Financials are usually the least fun thing to talk about, but they are important nonetheless as they provide an overview of your current financial position, capital requirements, projections, and plans for repayment of any loans.

Your financial plan should also include an analysis of your startup costs, operating costs, administration costs, and sources of revenue.

Funding requirements

Once an investor has read through your business plan, it’s time to request funding. Investors will want to see an accurate and detailed breakdown of the funds required and an explanation of why the requested funds are necessary for the operation and expansion of your business.

10. Appendix

The appendix is the last section of your business plan and it includes additional supporting documents such as resumes of key team members, market research documents, financial statements, and legal documents.

In other words, anything important or relevant that couldn’t fit in any of the former sections of your business plan goes in the appendix.

Write a Business Plan Worth Reading

Starting a business is never easy, but it’s a little less overwhelming if you have a well-made business plan. It helps you better navigate the industry, reduce risk, stay competitive, and make the best use of your time and money.

Remember, since every business is unique, every business plan is unique too, and must be regularly updated to keep up with changing industry trends. Also, it’s very likely that interested investors will give you feedback, so make sure to implement their recommendations as well.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

About the Author

Ayush is a writer with an academic background in business and marketing. Being a tech-enthusiast, he likes to keep a sharp eye on the latest tech gadgets and innovations. When he's not working, you can find him writing poetry, gaming, playing the ukulele, catching up with friends, and indulging in creative philosophies.

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.