- Creative & Design

- See all teams

For industries

- Manufacturing

- Professional Services

- Consumer Goods

- Financial Services

- See all industries

- Resource Management

- Project Management

- Workflow Management

- Task Management

- See all use cases

Explore Wrike

- Book a Demo

- Take a Product Tour

- ROI Calculator

- Customer Stories

- Start with Templates

- Gantt Charts

- Custom Item Types

- Project Resource Planning

- Project Views

- Kanban Boards

- Dynamic Request Forms

- Cross-Tagging

- See all features

- Integrations

- Mobile & Desktop Apps

- Resource Hub

- Educational Guides

Upskill and Connect

- Training & Certifications

- Help Center

- Wrike's Community

- Premium Support Packages

- Wrike Professional Services

Explore Wrike for Enterprise

- Enterprise Overview

- Enterprise Customers

- Enterprise Features

What Is Business Forecasting? Why It Matters

April 25, 2021 - 10 min read

Companies conduct business forecasts to determine their goals, targets, and project plans for each new period, whether quarterly, annually, or even 2–5 year planning.

Forecasting helps managers guide strategy and make informed decisions about critical business operations such as sales, expenses, revenue, and resource allocation . When done right, forecasting adds a competitive advantage and can be the difference between successful and unsuccessful companies.

In this guide to business forecasting, we'll cover:

- What is business forecasting?

- What are the best forecasting techniques?

- Why forecasting in management is important

- How to conduct business forecasts

- A few forecasting examples for businesses

An introduction to business forecasting

What is business forecasting? Business forecasting is a projection of future developments of a business or industry based on trends and patterns of past and present data.

This business practice helps determine how to allocate resources and plan strategically for upcoming projects, activities, and costs. Forecasting enables organizations to manage resources , align their goals with present trends, and increase their chances of surviving and staying competitive.

The purpose of forecasts is to develop better strategies and project plans using available, relevant data from the past and present to secure your business's future . Good business forecasting allows organizations to gain unique, proprietary insights into likely future events, leverage their resources, set product team OKR , and become market leaders.

Managers conduct careful and detailed business forecasts to guarantee sound decision-making based on data and logic, not emotions or gut feelings.

What are important business forecasting methods?

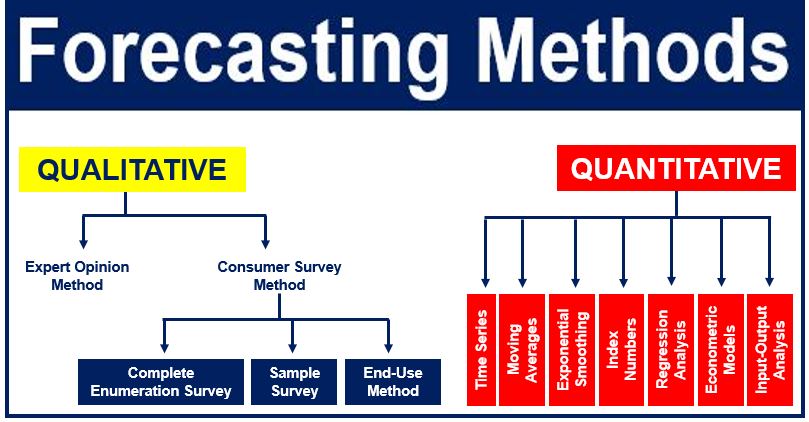

There are several business forecasting methods. They fall into two main approaches:

- Quantitative forecasting

Qualitative forecasting

Quantitative and qualitative forecasting techniques use and provide different sets of data and are needed at different stages of a product's life cycle.

Note that significant changes in a company, such as new product focus, new competitors or competitive strategies, or changing compliance requirements diminish the connection between past and future trends. This makes choosing the right forecasting method even more important.

Quantitative business forecasting

Use quantitative forecasting when there is accurate past data available to analyze patterns and predict the probability of future events in your business or industry.

Quantitative forecasting extracts trends from existing data to determine the more probable results. It connects and analyzes different variables to establish cause and effect between events, elements, and outcomes. An example of data used in quantitative forecasting is past sales numbers.

Quantitative models work with data, numbers, and formulas. There is little human interference in quantitative analysis. Examples of quantitative models in business forecasting include:

- The indicator approach : This approach depends on the relationship between specific indicators being stable over time, e.g., GDP and the unemployment rate. By following the relationship between these two factors, forecasters can estimate a business's performance.

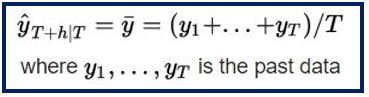

- The average approach : This approach infers that the predictions of future values are equal to the average of the past data. It is best to use this approach only when assuming that the future will resemble the past.

- Econometric modeling : Econometric modeling is a mathematically rigorous approach to forecasting. Forecasters assume the relationships between indicators stay the same and test the consistency and strength of the relationship between datasets.

- Time-series methods : Time-series methods use historical data to predict future outcomes. By tracking what happened in the past, forecasters expect to get a near-accurate view of the future.

Qualitative business forecasting is predictions and projections based on experts' and customers' opinions. This method is best when there is insufficient past data to analyze to reach a quantitative forecast. In these cases, industry experts and forecasters piece together available data to make qualitative predictions.

Qualitative models are most successful with short-term projections. They are expert-driven, bringing up contrasting opinions and reliance on judgment over calculable data. Examples of qualitative models in business forecasting include:

- Market research : This involves polling people – experts, customers, employees – to get their preferences, opinions, and feedback on a product or service.

- Delphi method : The Delphi method relies on asking a panel of experts for their opinions and recommendations and compiling them into a forecast.

How do you choose the right business forecasting technique?

- Choosing the right business forecasting technique depends on many factors. Some of these are:

- Context of the forecast

- Availability and relevance of past data

- Degree of accuracy required

- Allocated time to conduct the forecast

- Period to be forecast

- Costs and benefits of the forecast

- Stage of the product or business needing the forecast

Managers and forecasters must consider the stage of the product or business as this influences the availability of data and how you establish relationships between variables. A new startup with no previous revenue data would be unable to use quantitative methods in its forecast.

The more you understand the use, capabilities, and impact of different forecasting techniques, the more likely you will succeed in business forecasting.

Why is business forecasting important?

Any insight into the future puts your organization at an advantage. Forecasting helps you predict potential issues, make better decisions, and measure the impact of those decisions.

By combining quantitative and qualitative techniques, statistical and econometric models , and objectivity, forecasting becomes a formidable tool for your company.

Business forecasting helps managers develop the best strategies for current and future trends and events. Today, artificial intelligence, forecasting software, and big data make business forecasting easier, more accurate, and personalized to each organization.

Forecasting does not promise an accurate picture of the future or how your business will evolve, but it points in a direction informed by data, logic, and experiential reasoning.

What are the integral elements of business forecasting?

While there are different forecasting techniques and methods, all forecasts follow the same process on a conceptual level. Standard elements of business forecasting include:

- Prepare the stage : Before you begin, develop a system to investigate the current state of business.

- Choose a data point : An example for any business could be "What is our sales projection for next quarter?"

- Choose indicators and data sets : Identify the relevant indicators and data sets you need and decide how to collect the data.

- Make initial assumptions : To kickstart the forecasting process, forecasters may make some assumptions to measure against variables and indicators.

- Select forecasting technique : Pick the technique that fits your forecast best.

- Analyze data : Analyze available data using your selected forecasting technique.

- Estimate forecasts : Estimate future conditions based on data you've gathered to reach data-backed estimates.

- Verify forecasts : Compare your forecast to the eventual results. This helps you identify any problems, tweak errant variables, correct deviations, and continue to improve your forecasting technique.

- Review forecasting process : Review any deviations between your forecasts and actual performance data.

How do you do business forecasting?

Successful business forecasting begins with a collaboration between the manager and forecaster. They work together to answer the following questions:

- What is the purpose of the forecast? How will it be used?

- What are the components and dynamics of the system the forecast is focused on?

- How relevant is past data in estimating the future?

Once these answers are clear, choose the best forecasting methods based on the stage of the product or business life cycle, availability of past data, and skills of the forecasters and managers leading the project.

With the right forecasting method, you can develop your process using the integral elements of business forecasting mentioned above.

How do you get data for business forecasting?

A forecast is only as good as the data supplied. Before collecting data, ask:

- Why do you need it?

- What kind of data do you need?

- When will you collect it?

- Where will you gather it?

- Who is in charge of collecting it?

- How will you collect it?

- How will you analyze it?

When you have these answers, you can start collecting data from two main sources:

- Primary sources : These sources are gathered first-hand using reporting tools — you or members of your team source data through interviews, surveys, research, or observations.

- Secondary sources : Secondary sources are second-hand information or data that others have collected. Examples include government reports, publications, financial statements, competitors' annual reports, journals, and other periodicals.

Business forecasting examples

Some forecasting examples for business include:

- Calculating cash flow forecasts, i.e., predicting your financial needs within a timeframe

- Estimating the threat of new entrants into your market

- Measuring the opportunity of developing a new product or service

- Estimating the costs of recurring bills

- Predicting future sales growth based on past sales performance

- Analyzing relationships between variables, e.g., Facebook ads and potential revenue

- Budgeting contingencies and efficient allocation of resources

- Comparing customer acquisition costs and customer lifetime value over time

What are the limits of business forecasting?

You can follow the rules, use the right methods, and still get your business forecast wrong. It is, after all, an attempt to predict the future. Some limits to business forecasting include:

- Biases and errors by the forecasters or managers

- Incorrect information from employees, experts, or customers

- Inaccurate past numbers

- Sudden change in market conditions

- New industry regulations

How Wrike helps with business forecasting

The more accurate your business forecasting, the more effective your strategies and plans can be. While many things in business are out of your control, having an informed forecast of what lies ahead makes you prepared and confident about the future.

Wrike helps gather data in one central platform, extract insights, and communicate findings with forecasters and managers. Other benefits of Wrike include real-time data, integrations with other forecasting software, streamlined collaboration, and visibility into every business forecasting project.

Are you ready to make projections for your business, allocate your resources for the best results, and improve your business forecasting process? Get started with a two-week free trial of Wrike today.

Kelechi Udoagwu

Kelechi is a freelance writer and founder of Week of Saturdays, a platform for digital freelancers and remote workers living in Africa.

Related articles

Strengthen and Optimize Agency Resource Management

Improve your agency’s resource management processes and learn how Wrike boosts performance across the board with our robust project management software.

Release Management: Definition, Phases, and Benefits

What is release management and how can it improve software development strategy? In this guide, we talk about release management processes and their benefits.

The Definitive Guide to Data-Driven Marketing

Wondering what data-driven marketing is and how to reap its benefits for your business? Find out how to create your own data-driven strategy with our guide.

Get weekly updates in your inbox!

You are now subscribed to wrike news and updates.

Let us know what marketing emails you are interested in by updating your email preferences here .

Sorry, this content is unavailable due to your privacy settings. To view this content, click the “Cookie Preferences” button and accept Advertising Cookies there.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

7 Financial Forecasting Methods to Predict Business Performance

- 21 Jun 2022

Much of accounting involves evaluating past performance. Financial results demonstrate business success to both shareholders and the public. Planning and preparing for the future, however, is just as important.

Shareholders must be reassured that a business has been, and will continue to be, successful. This requires financial forecasting.

Here's an overview of how to use pro forma statements to conduct financial forecasting, along with seven methods you can leverage to predict a business's future performance.

Access your free e-book today.

What Is Financial Forecasting?

Financial forecasting is predicting a company’s financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales. This involves guesswork and assumptions, as many unforeseen factors can influence business performance.

Financial forecasting is important because it informs business decision-making regarding hiring, budgeting, predicting revenue, and strategic planning . It also helps you maintain a forward-focused mindset.

Each financial forecast plays a major role in determining how much attention is given to individual expense items. For example, if you forecast high-level trends for general planning purposes, you can rely more on broad assumptions than specific details. However, if your forecast is concerned with a business’s future, such as a pending merger or acquisition, it's important to be thorough and detailed.

Forecasting with Pro Forma Statements

A common type of forecasting in financial accounting involves using pro forma statements . Pro forma statements focus on a business's future reports, which are highly dependent on assumptions made during preparation, such as expected market conditions.

Because the term "pro forma" refers to projections or forecasts, pro forma statements apply to any financial document, including:

- Income statements

- Balance sheets

- Cash flow statements

These statements serve both internal and external purposes. Internally, you can use them for strategic planning. Identifying future revenues and expenses can greatly impact business decisions related to hiring and budgeting. Pro forma statements can also inform endeavors by creating multiple statements and interchanging variables to conduct side-by-side comparisons of potential outcomes.

Externally, pro forma statements can demonstrate the risk of investing in a business. While this is an effective form of forecasting, investors should know that pro forma statements don't typically comply with generally accepted accounting principles (GAAP) . This is because pro forma statements don't include one-time expenses—such as equipment purchases or company relocations—which allows for greater accuracy because those expenses don't reflect a company’s ongoing operations.

7 Financial Forecasting Methods

Pro forma statements are incredibly valuable when forecasting revenue, expenses, and sales. These findings are often further supported by one of seven financial forecasting methods that determine future income and growth rates.

There are two primary categories of forecasting: quantitative and qualitative.

Quantitative Methods

When producing accurate forecasts, business leaders typically turn to quantitative forecasts , or assumptions about the future based on historical data.

1. Percent of Sales

Internal pro forma statements are often created using percent of sales forecasting . This method calculates future metrics of financial line items as a percentage of sales. For example, the cost of goods sold is likely to increase proportionally with sales; therefore, it’s logical to apply the same growth rate estimate to each.

To forecast the percent of sales, examine the percentage of each account’s historical profits related to sales. To calculate this, divide each account by its sales, assuming the numbers will remain steady. For example, if the cost of goods sold has historically been 30 percent of sales, assume that trend will continue.

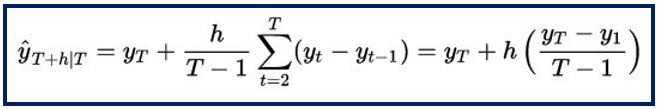

2. Straight Line

The straight-line method assumes a company's historical growth rate will remain constant. Forecasting future revenue involves multiplying a company’s previous year's revenue by its growth rate. For example, if the previous year's growth rate was 12 percent, straight-line forecasting assumes it'll continue to grow by 12 percent next year.

Although straight-line forecasting is an excellent starting point, it doesn't account for market fluctuations or supply chain issues.

3. Moving Average

Moving average involves taking the average—or weighted average—of previous periods to forecast the future. This method involves more closely examining a business’s high or low demands, so it’s often beneficial for short-term forecasting. For example, you can use it to forecast next month’s sales by averaging the previous quarter.

Moving average forecasting can help estimate several metrics. While it’s most commonly applied to future stock prices, it’s also used to estimate future revenue.

To calculate a moving average, use the following formula:

A1 + A2 + A3 … / N

Formula breakdown:

A = Average for a period

N = Total number of periods

Using weighted averages to emphasize recent periods can increase the accuracy of moving average forecasts.

4. Simple Linear Regression

Simple linear regression forecasts metrics based on a relationship between two variables: dependent and independent. The dependent variable represents the forecasted amount, while the independent variable is the factor that influences the dependent variable.

The equation for simple linear regression is:

Y = Dependent variable (the forecasted number)

B = Regression line's slope

X = Independent variable

A = Y-intercept

5. Multiple Linear Regression

If two or more variables directly impact a company's performance, business leaders might turn to multiple linear regression . This allows for a more accurate forecast, as it accounts for several variables that ultimately influence performance.

To forecast using multiple linear regression, a linear relationship must exist between the dependent and independent variables. Additionally, the independent variables can’t be so closely correlated that it’s impossible to tell which impacts the dependent variable.

Qualitative Methods

When it comes to forecasting, numbers don't always tell the whole story. There are additional factors that influence performance and can't be quantified. Qualitative forecasting relies on experts’ knowledge and experience to predict performance rather than historical numerical data.

These forecasting methods are often called into question, as they're more subjective than quantitative methods. Yet, they can provide valuable insight into forecasts and account for factors that can’t be predicted using historical data.

6. Delphi Method

The Delphi method of forecasting involves consulting experts who analyze market conditions to predict a company's performance.

A facilitator reaches out to those experts with questionnaires, requesting forecasts of business performance based on their experience and knowledge. The facilitator then compiles their analyses and sends them to other experts for comments. The goal is to continue circulating them until a consensus is reached.

7. Market Research

Market research is essential for organizational planning. It helps business leaders obtain a holistic market view based on competition, fluctuating conditions, and consumer patterns. It’s also critical for startups when historical data isn’t available. New businesses can benefit from financial forecasting because it’s essential for recruiting investors and budgeting during the first few months of operation.

When conducting market research, begin with a hypothesis and determine what methods are needed. Sending out consumer surveys is an excellent way to better understand consumer behavior when you don’t have numerical data to inform decisions.

Improve Your Forecasting Skills

Financial forecasting is never a guarantee, but it’s critical for decision-making. Regardless of your business’s industry or stage, it’s important to maintain a forward-thinking mindset—learning from past patterns is an excellent way to plan for the future.

If you’re interested in further exploring financial forecasting and its role in business, consider taking an online course, such as Financial Accounting , to discover how to use it alongside other financial tools to shape your business.

Do you want to take your financial accounting skills to the next level? Consider enrolling in Financial Accounting —one of three courses comprising our Credential of Readiness (CORe) program —to learn how to use financial principles to inform business decisions. Not sure which course is right for you? Download our free flowchart .

About the Author

- Contact sales

Start free trial

Business Forecasting: Why You Need It & How to Do It

Table of Contents

What is business forecasting, the importance of business forecasting, business forecasting process, business forecasting methods, elements of business forecasting, sources of data for forecasting, business forecasting only goes so far, how projectmanager helps business forecasting.

Well-run organizations don’t fly by the seat of their pants; they’re constantly working on business forecasting and business planning. Every decision and every process is based on data obtained from business forecasting, business intelligence tools, market research and scenario planning. Companies focus their energies on ways to predict market trends to help them set successful long-term strategies.

Some business forecasts are based on highly sophisticated statistical methods while others are based on experience and past data. Others simply follow a gut feeling. One thing remains constant: all industries rely on business forecasting.

Business forecasting refers to the process of predicting future market conditions by using business intelligence tools and forecasting methods to analyze historical data.

Business forecasting can be either qualitative or quantitative. Quantitative business forecasting relies on subject matter experts and market research while quantitative business forecasting focuses only on data analysis.

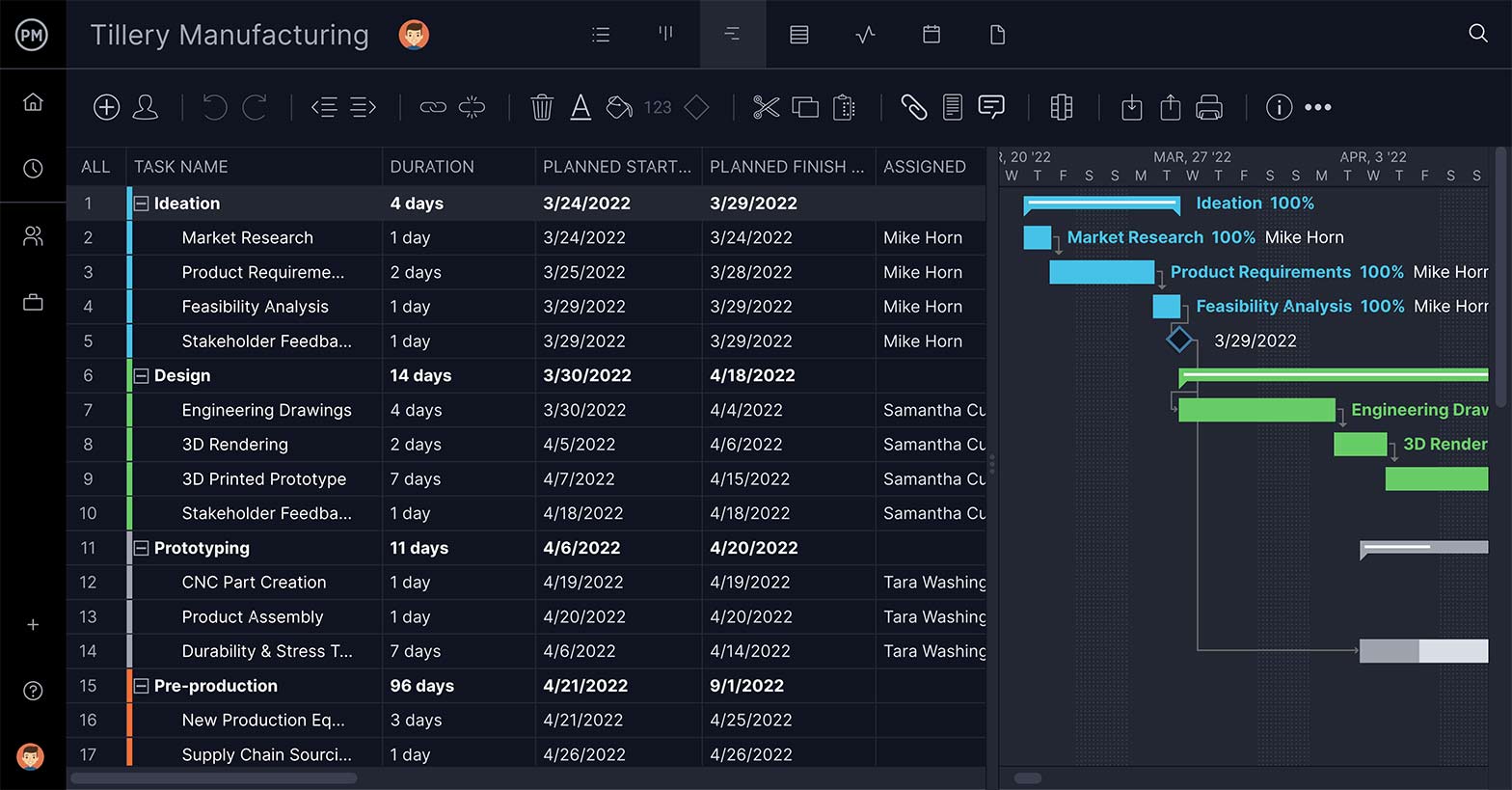

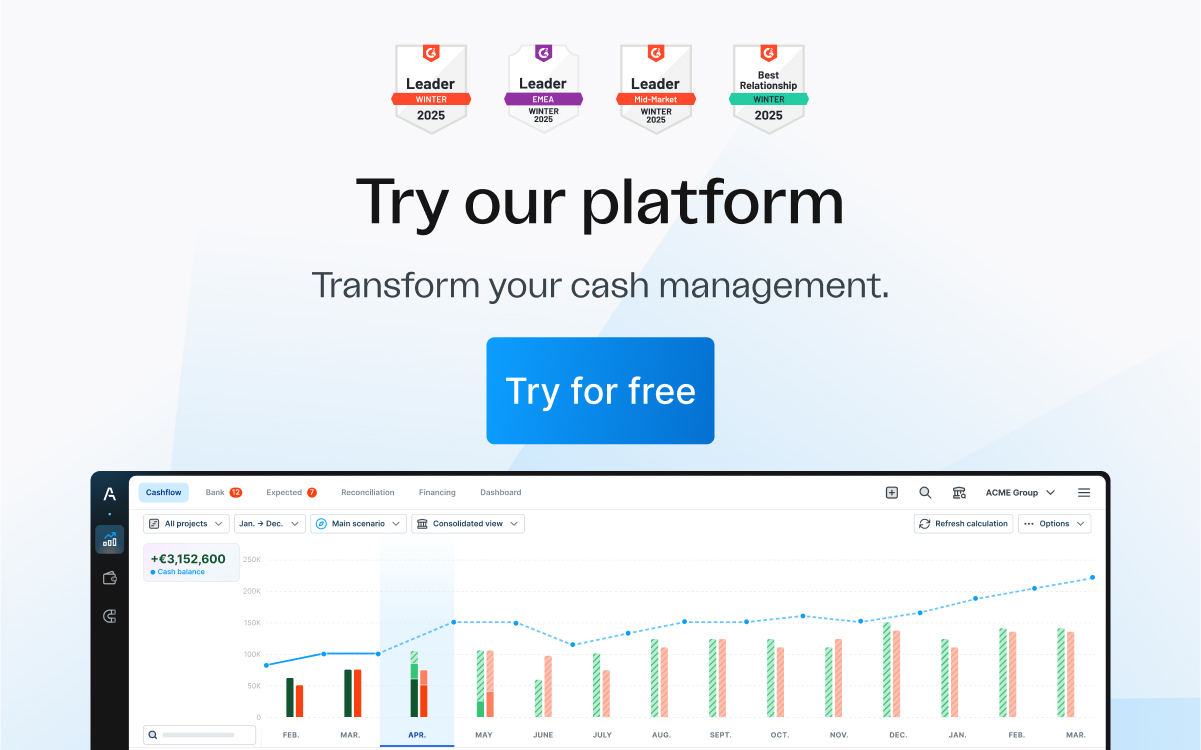

You can access historical data with project management tools such as ProjectManager , project management software that delivers real-time data for more insightful business forecasting. Our live dashboard requires no setup and automatically captures six project metrics which are displayed in easy-to-read graphs and charts. Get a high-level view of your project for better business planning. Get started with ProjectManager for free today.

Quantitative Forecasting

Quantitative forecasting is applicable when there is accurate past data available to predict the probability of future events. This method pulls patterns from the data that allow for more probable outcomes. The data used in quantitative forecasting can include in-house data such as sales numbers and professionally gathered data such as census statistics. Generally, quantitative forecasting seeks to connect different variables in order to establish cause and effect relationships that can be exploited to benefit the business.

Qualitative Forecasting

Qualitative forecasting is based on the opinion and judgment of consumers and experts. This business forecasting method is useful if you have insufficient historical data to make any statistically relevant conclusions. In such cases, an expert can help piece together the known bits of data you do have to try to make a qualitative prediction from that known information.

Qualitative business forecasting is also useful when little is known about the future in your industry. Relying on historical data is useless if that data is not relevant to the uncharted future you are approaching. This can be the case in innovative industries, or if there’s a new constraint entering the market that has never occurred before such as new tax law.

Business forecasting is critical for businesses whenever the future is uncertain or whenever an important strategic business decision is being made. The more the business can focus on the probable outcome, the more success the organization has as it moves forward.

Here are the steps that a business forecaster should typically follow:

- Define the question or problem you need to solve with your business forecasting efforts. For example, you might be interested in estimating whether your organization will be able to meet product demand for the next quarter.

- Identify the datasets and variables that need to be taken into consideration. In this case, datasets such as the sales records from the previous year and variables related to capacity, production and demand planning .

- Choose a business forecasting method that adjusts to your dataset and forecasting goals. That depends on whether your problem or question can be solved using a qualitative, quantitative or mixed approach.

- Based on the analysis of historical data, you can proceed to estimate future business performance. Keep in mind that the accuracy of your business forecasting depends on the quality of your data.

- Determine the discrepancy between your business forecast and actual business performance. Document your findings and improve your business forecasting process.

As stated above, there are two main types of business forecasting methods, qualitative and quantitative. We’ve compiled some of the more common forecasting models from both sides below.

Delphi Method

This qualitative business forecasting method consists in gathering a panel of subject matter experts and getting their opinions on the same topic in a manner in which they can’t know each other’s thoughts. This is done to prevent bias , which makes it possible for a manager to objectively compare their opinions and see if there are patterns, consensus or division.

Market Research

There are many market research techniques that evaluate the behavior of customers and their response to a certain product or service. Some of those market research methods collect and analyze quantitative data, such as digital marketing metrics and others qualitative data, such as product testing, or customer interviews.

Time Series Analysis

Also referred to as “trend analysis method,” this business forecasting technique simply requires the forecaster to analyze historical data to identify trends. This data analysis process requires statistical analysis as outliers need to be removed. More recent data should be given more weight to better reflect the current state of the business.

The Average Approach

The average approach says that the predictions of all future values are equal to the mean of the past data. Past data is required to use this method, so it can be considered a type of quantitative forecasting. This approach is often used when you need to predict unknown values as it allows you to make calculations based on past averages, where one assumes that the future will closely resemble the past.

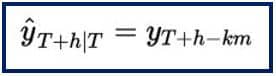

The Naïve Approach

The naïve approach is the most cost-effective and is often used as a benchmark to compare against more sophisticated methods. It’s only used for time series data where forecasts are made equal to the last observed value. This approach is useful in industries and sectors where past patterns are unlikely to be reproduced in the future. In such cases, the most recent observed value may prove to be the most informative.

- Develop the Basis: Before you can start forecasting, you must develop a system to investigate the current economic situation around you. That includes your industry and its present position as well as its popular products to better estimate sales and general business operations.

- Estimating Future Business Operations: Now comes the estimation of future conditions, such as the course that future events are likely to take in your industry. Again, this is based on collected data to help with quantitative estimates for the scale of operations in the future.

- Regulating Forecasts: Whatever your forecast is, it must be compared to actual results. This is the only way to find deviations from the norm. Then the reasons for those deviations must be figured out, so action can be taken to correct those deviations in the future.

- Reviewing Forecasting Process: By reviewing the deviations between forecasts and actual performance data, improvements are made in the process, allowing you to refine and review the information for accuracy.

Your forecast will only be as good as the data you put into it. Before collecting data, ask yourself these questions:

- Why collect data?

- What kind of data?

- When to collect it?

- Where to collect it?

- Who will collect it?

- How will it be collected?

These are the questions that will shape your plan for the collection of data, a crucial facet of business forecasting. Once you have your plan, you can collect data from a variety of sources.

Primary Sources

Primary sources contain first-hand data, often collected with reporting tools . These are the ones that you or the person assigned this task to collect personally. If primary data is not available, you must go out and source it through interviews, questionnaires or observations.

Secondary Sources

Secondary sources contain published data or data that has been collected by others. This includes official reports from governments, publications, financial statements from banks or other financial institutions, annual reports of companies, journals, newspapers, magazines and other periodicals.

If business forecasting were a crystal ball, then everyone would be reaping the rewards of their foresight. While business forecasting is a tool to get a better view of what the future might have in store, there’s the argument that it’s wasting valuable time and resources on little return.

It’s true; you can follow the steps, use a variety of methodologies and still get it wrong. It is, after all, the future. There’s no way to ever manage all the variables that can impact future events. There are errors in calculations and the innate prejudices of the people managing the process, all of which add to the unpredictability of the results.

While you’re not going to have a clear, unobscured vision of the future by using business forecasting, it can provide you with insight into probable future trends to give your organization an advantage. Even a small step can be a great leap forward in the highly competitive world of business. By combining statistical and econometric models with experience, skill and objectivity, business forecasting is a formidable tool for any organization looking for a competitive advantage.

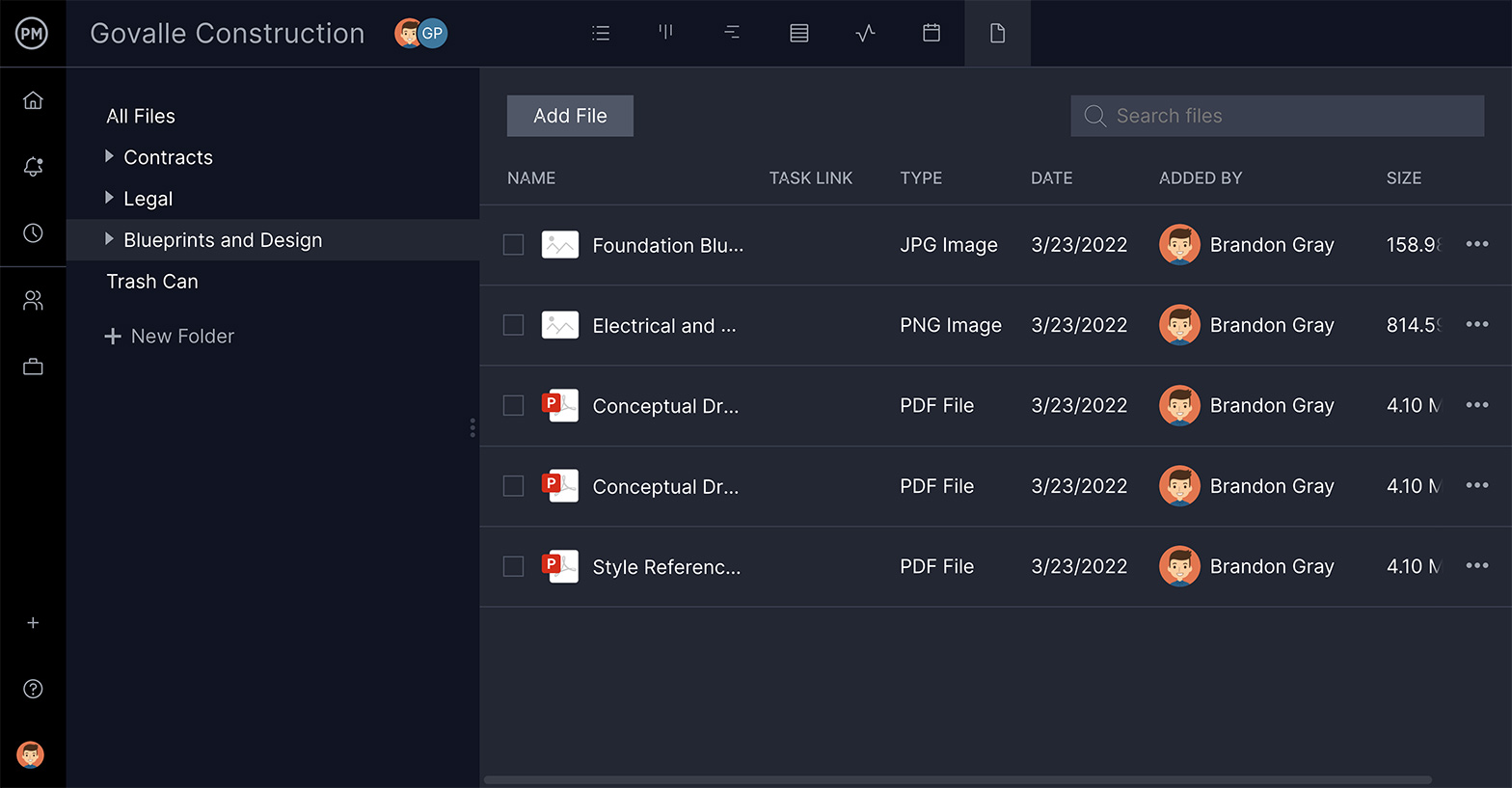

Clearly, business forecasting is a project unto itself. To manage a project and collect the data in a way that’s useful in the future, you need a project management tool that can help you plan your process and select the data that helps you decide on a way forward.

ProjectManager is award-winning software that organizes projects with features that address every phase. The first thing in forecasting is choosing how you’ll take action and make a plan. For example, if you’re going to interview customers to see where the market is likely headed, you’ll need to schedule those interviews. Our online Gantt chart places those interviews as tasks on a timeline so you can get everyone interviewed before your deadline.

Store All of Your Data in One Place

Those interviews will produce a lot of paperwork, and your data needs to be collected and stored somewhere easily accessible. You can attach notes to each task so the paperwork for each interviewee is saved with the notes that you took. You can also tag those tasks to make it easier to filter the project and locate the interview subjects for which you’re looking. If you’re worried that there’ll be too many documents and images attached to one task, don’t worry as we have unlimited file storage.

ProjectManager can’t predict the future, but it does provide you with the tools you need to take advantage of business forecasting. Our project management software collects data in real-time, and stores past data, allowing you to filter information and pull up the metrics you need to make the right decision. Try it today with this free 30-day trial.

Deliver your projects on time and on budget

Start planning your projects.

- Group Training

- Individual Training

- Individual Certification

- Corporate Certification

- Companies Certified

- Testimonial

- Companies w/ Certification

- Levels of Certification

- Certification Details

- Sample Exams

- Recertification

- Preparation Materials

- Exam Schedule

- CPF Prep/Review

- Research Reports

- Virtual Conference Recordings

- Cancellation Policy

- Refund Policy for Events

- Ambassador Program

- Member Companies

- Partnership

- Apply to Speak

- Subscription

- S&OP Self-Assessment

- Sponsored Content

- Become a Sponsor

- Exhibit at IBF Events

| --> --> |

| by clicking on "ACCEPT" |

What Is Business Forecasting?

What exactly is business forecasting? To help answer this question, consider this. Whether you realize it or not, virtually every business decision and process is based on a forecast. Anything you plan is generally based on an assumption of something happening in the future which, by definition, is a forecast. Not all forecasts are derived from sophisticated methods, but an educated guess about the future is more valuable for the purposes of planning than no forecast at all.

It does not matter which industry you are in, whether your company manufactures products or offers services, or whether your company is small or large, you must have forecasts to plan effectively. Of course, the more accurate the forecasts, the better the plan. It stands to reason that if we know what happened in the past and why, or have insight into what may occur next, we can then predict what is likely to happen in the future. With this information, we can potentially alter the future to the company’s advantage.

Business Forecasting Drives Better Decision Making

Business Forecasting is the process of using analytics, data, insights, and experience to make predictions and respond to various business needs. The insight gained by Business Forecasting enables companies to automate and optimize their business processes. A Forecaster’s goal is to go beyond knowing what has happened and provide the best assessment of what will happen in the future to drive better decision making.

Many people think of a Business Forecast as how many of something we will sell next week. That is part of it, but Business Forecasting can encompass anything that identifies the likelihood of a future outcome, provides comparative information using analytics, or drives data-driven business decisions.

What Is Business Forecasting Used For?

Business Forecasting can be used for:

- Strategic planning and decision-making (long-term planning)

- Finance and accounting (budgets and cost controls)

- Marketing (consumer behavior, life cycle management, pricing)

- Operations and supply chain (resource planning, production, logistics, inventory)

Business Forecasting Techniques

At the heart of business process decision making is the forecast, which involves techniques including:

- Qualitative Forecasting : Refers to the use of opinion or educated guesses in developing forecasts.

- Quantitative Forecasting : Used to develop a future forecast using past data and, often, statistical or mathematical models.

These techniques, along with analyzing data and the use of statistical algorithms, can also be the foundation and input into a Demand Plan. For some companies, the forecast may be considered the Baseline Demand Forecast and is more statistically driven, and is a critical part of Demand Planning.

Nice to meet you.

Enter your email to receive our weekly G2 Tea newsletter with the hottest marketing news, trends, and expert opinions.

What Is Business Forecasting? Predictions to Drive Success

May 17, 2024

Types of business forecasts

Business forecasting methods, benefits of business forecasting, business forecasting challenges, business forecasting vs. scenario planning, business forecasting process, business forecasting examples.

It’s time to look inside your crystal ball and start forecasting. Forecasting gives you the tools you need to make reliable predictions about foreseeable events.

What is business forecasting?

Business forecasting is the process of analyzing data to predict future company needs and make insight-driven development decisions.

There’s really no downside to being prepared! Building a strong forecast prepares businesses for potential issues and identifies areas for profitable growth. Even if your predictions end up being inaccurate, you’ll have all the necessary data and information to get closer to the final forecast.

Some companies utilize predictive analytics software to collect and analyze the data necessary to make an accurate business forecast. Predictive analytics solutions give you the tools to store data, organize information into comprehensive datasets, develop predictive models to forecast business opportunities, adapt datasets to data changes, and allow import/export from other data channels.

Businesses can create various types of forecasts with business forecasting strategies. Because historical data and market trends affect so many aspects of business, comprehensive predictions can help prepare almost every element of your company.

- General business forecasting predicts overall market trends and external factors that affect your business’ success.

- Accounting forecasting creates projections of future business costs .

- Budget forecasting makes predictions for allocating the budget needed for future projects or addressing potential issues. Budgeting and forecasting software is an indispensable tool if you’re looking to forecast for budgeting your business activities.

- Financial forecasting projects a company’s monetary value as a whole. You can use the current assets and liabilities from your balance sheet to help you make a prediction.

- Demand forecasting predicts the future needs of your target customer base.

- Supply forecasting works with demand forecasting to allocate the necessary resources for fulfilling upcoming customer demands.

- Sales forecasting predicts the expected success of the company offerings and how it’ll affect future sales and cash flow.

- Capital forecasting makes predictions about a company’s future assets and liabilities.

There are two main types of business forecasting methods: quantitative and qualitative. While both have unique approaches, they’re similar in their goals and the information used to make predictions – company data and market knowledge.

Quantitative forecasting

The quantitative forecasting method relies on historical data to predict future needs and trends. The data can be from your own company, market activity, or both. It focuses on cold, hard numbers that can show clear courses of change and action. This method is beneficial for companies that have an extensive amount of data at their disposal.

There are four quantitative forecasting methods:

- Trend series method: Also referred to as time series analysis, this is the most common forecasting method. Trend series collects as much historical data as possible to identify common shifts over time. This method is useful if your company has a lot of past data that already shows reliable trends.

- The average approach: This method is also based on repetitive trends. The average approach assumes that the average of past metrics will predict future events. Companies most commonly use the average approach for inventory forecasting.

- Indicator approach: This approach follows different sets of indicator data that help predict potential influences on the general economic conditions, specific target markets, and supply chain. Some examples of indicators include changes in Gross Domestic Product (GDP), unemployment rate, and Consumer Price Index (CPI). By monitoring the applicable indicators, companies can easily predict how these changes may affect their own business needs and profitability by observing how they interact with each other. This approach would be the most effective for companies whose sales are heavily affected by specific economic factors.

- Econometric modeling: This method takes a mathematical approach using regression analysis to measure the consistency in company data over time. Regression analysis uses statistical equations to predict how variables of interest interact and affect a company. The data used in this analysis can be internal datasets or external factors that can affect a business, such as market trends, weather, GDP growth, political changes, and more. Econometric modeling observes the consistency in those datasets and factors to identify the potential for repeat scenarios in the future.

Qualitative forecasting

The qualitative forecasting method relies on the input of those who influence your company’s success. This includes your target customer base and even your leadership team. This method is beneficial for companies that don’t have enough complex data to conduct a quantitative forecast.

There are two approaches to qualitative forecasting:

- Market research: The process of collecting data points through direct correspondence with the market community. This includes conducting surveys, polls, and focus groups to gather real-time feedback and opinions from the target market. Market research looks at competitors to see how they adjust to market fluctuations and adapt to changing supply and demand . Companies commonly utilize market research to forecast expected sales for new product launches.

- Delphi method: This method collects forecasting data from company professionals. The company’s foreseeable needs are presented to a panel of experts, who then work together to forecast the expectations and business decisions that can be made with the derived insights. This method is used to create long-term business predictions and can also be applied to sales forecasts.

There are several benefits to making effective forecasts for your business. You gain valuable insights into its different aspects and the future of its success.

- Foresee upcoming changes with a heads up on potential market changes that can affect your business. With the right prediction, you can strategize the decisions to succeed in the face of the challenges ahead before they become costly surprises.

- Decrease the cost of unexpected demand by preparing ahead of time. Business forecasting is a great starting point for demand planning . If you plan to incorporate demand forecasting into your business processes, you’ll be prepared for upcoming market demands and avoid the extra costs associated with an influx of demand that you weren’t ready for.

- Increase customer satisfaction by giving them what they want, when they want it. Demand planning doesn’t just benefit you. With the right business forecast, your company can offer products or services to the target industry and meet their expectations. A company ready to serve its market is always met with customer satisfaction and loyalty.

- Set long- and short-term goals by tracking your progress. Business forecasting tools help you outline your future company objectives. Continuous predictions allow you to track the progress of your proposed goals as those future expectations become the present reality.

- Learn from the past by analyzing it. Forecasting enables you to collect and study extensive historical company data. Keeping a close eye on this data can help you identify where things may have gone wrong in the past. With this new information, your company can make the necessary adjustments to avoid similar mistakes in the future.

While the benefits of business forecasting highlight all of the amazing advantages it has to offer, it’s not a surefire way to prepare for the future. Companies who plan to forecast should also keep the challenges in mind and make sure that forecasting has more pros than cons for their business. Below are some of the notable challenges of business forecasting.

- You can’t always expect the unexpected. While old data can help you gain insights into company processes and learn from mistakes, history doesn’t always repeat itself. Business forecasting isn’t a perfect process, and although helpful, it may not precisely predict future trends or business matters using old company data alone. It operates on the assumption that what happened will most likely happen again. Unfortunately, this is not always the case, and the hard work put into preparing for a forecasted event may never come to fruition.

- It takes time to create an accurate forecast. Forecasting can be a lengthy process when started from scratch. Some companies find it challenging to gather the resources needed to begin predicting and allocate the time to do it correctly.

- Historical data will always be outdated. There’s no way to know what’ll happen next. Although historical information is very valuable, it’s forever considered “old”. Forecasts are never based on the present and, therefore, are only as accurate as the data you already collected.

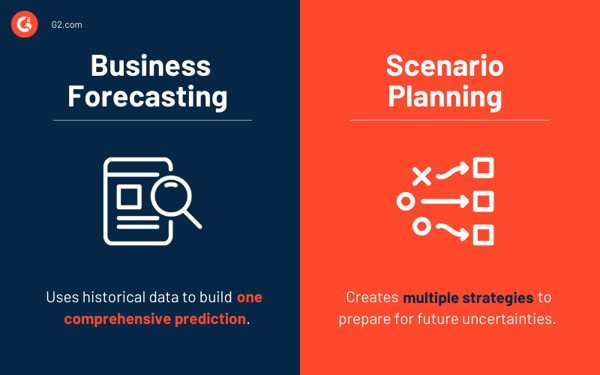

Business forecasting is often confused with scenario planning because of their shared goal of preparing for the future. Both rely on learning from past mistakes and reflecting on what decisions must be made to drive success. However, business forecasting and scenario planning differ in the preparation process.

Business forecasting focuses on a problem at hand and uses historical data to predict what might happen next. It emphasizes predictive analytics and the need to eliminate existing uncertainties. The problem can be as broad as the actual performance of the entire company, or as specific as how a single product might sell in the future based on past market trends.

While built on tangible data, forecasting is essentially a guess of the future and you need to make assumptions ahead of time to prepare for any predicted issues. Forecasting is an all-hands-on-deck approach that involves many departments, including analysts, economists, managers, and more.

Scenario planning creates multiple scenarios to help prepare for the future. With these scenarios in mind, a company can begin planning a course of action to achieve the desired outcome. This includes creating step-by-step strategies and timelines for achieving objectives.

While business forecasting focuses on past information, scenario planning takes the past, present, and future into consideration with learnings from the past, understanding the capabilities of the present, and aspiring for future success. Although a team’s input is important in scenario planning, company’s primary decision-makers carry out the bulk of the process.

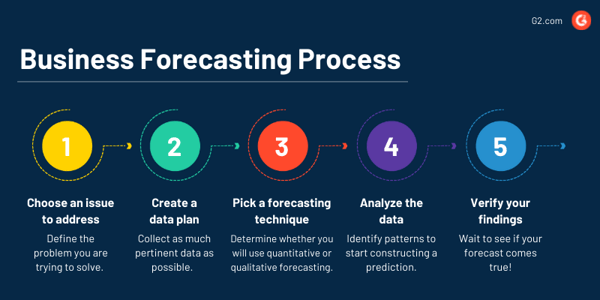

The way a company forecasts is always unique to its needs and resources, but the primary forecasting process can be summed up in five steps. These steps outline how business forecasting starts with a problem and ends with not only a solution but valuable learnings.

1. Choose an issue to address

The first step in predicting the future is choosing the problem you’re trying to solve or the question you’re trying to answer. This can be as simple as determining whether your audience will be interested in a new product your company is developing. Because this step doesn’t yet involve any data, it relies on internal considerations and decisions to define the problem at hand.

2. Create a data plan

The next step in forecasting is to collect as much data as possible and decide how to use it. This may require digging up some extensive historical company data and examining the past and present market trends. Suppose your company is trying to launch a new product. In this case, the gathered data can be a culmination of the performance of your previous product and the current performance of similar competing products in the target market.

3. Pick a forecasting technique

After collecting the necessary data, it’s time to choose a business forecasting technique that works with the available resources and the type of prediction. All the forecasting models are effective and get you on the right track, but one may be more favorable than others in creating a unique, comprehensive forecast.

For example, if you have extensive data on hand, quantitative forecasting is ideal for interpretation. Qualitative forecasting is best if you have less hard data available and are willing to invest in extensive market research.

4. Analyze the data

Once the ball starts rolling, you can begin identifying patterns in the past and predict the probability of their repetition. This information will help your company’s decision-makers determine what to do beforehand to prepare for the predicted scenarios.

5. Verify your findings

The end of business forecasting is simple. You wait to see if what you predicted actually happens. This step is especially important in determining not only the success of your forecast but also the effectiveness of the entire process. Having done some forecasting, you can compare the present experience with these forecasts to identify potential areas for growth.

When in doubt, never throw away “old” data. The final information of one forecasting process can also be used as the past data for another forecast. It’s like a life cycle of business development predictions.

With the different types of business forecasting come different potential use cases. A company may choose to utilize several elements of business forecasting to prepare for various situations. Here are some real-life examples where business forecasting would be valuable.

The seasoned veteran

Suppose you represent a company that has been in the market for a long time but has never tried business forecasting. Because of the long history of company data, you choose to try out quantitative business forecasting. Your aim is to make predictions using the most cost-effective and least time-consuming method. With those considerations, you may opt for the trend series method to manually identify common trends in old data, determine the likelihood of repeat instances, and forecast accordingly.

The new kid on the block

Imagine you are a new company that has entered the market to start selling your own brand of smartphones. You may think that business forecasting is impossible because you don’t have any historical company data to work off of. However, you can utilize qualitative business forecasting! Because the smartphone industry is a highly competitive one, you can use market research to take advantage of publicly available market data.

The one who wants the best of both worlds

Imagine you work for a recruiting company that has noticed that the country’s unemployment rate heavily affects company performance and has the data to prove it. As you have a clear indicator that directly impacts the potential for success, using the indicator approach to create long-term predictions would be the right call.

However, your company stresses the importance of integrating expert knowledge into the forecasting process. This extra note means that some qualitative forecasting can be used as well. You may choose to use the Delphi method to collect expert opinions and weigh that into the final forecasts as well.

What do the stars have in store for you?

Creating comprehensive predictions isn’t rocket science. With business forecasting, seeing the future is as easy as learning from the past. What you do with your findings is what will set you apart.

Want to start forecasting for your business? Learn more about business analytics and how it helps collect the necessary data and insights.

Alexandra Vazquez is a Senior Content Marketing Specialist at G2. She received her Business Administration degree from Florida International University and is a published playwright. Alexandra's expertise lies in writing for the Supply Chain and Commerce personas, with articles focusing on topics such as demand planning, inventory management, consumer behavior, and business forecasting. In her spare time, she enjoys collecting board games, playing karaoke, and watching trashy reality TV.

Recommended Articles

Contributor Network

A Guide to Choosing the Right Platform For Digital Business Cards

When was the last time you attended a business event and returned empty-handed? It's hard to...

by Mayuri Bangar

AI for Business Texting: Enhance Your Communication Strategy

AI's transformative impact has grown across all aspects of our lives. From anticipating retail...

by Jennifer Adler

5 Impactful Sustainable Business Practices

Sustainability is no longer a choice; it's a necessity.

by Lee Shields

Get this exclusive AI content editing guide.

By downloading this guide, you are also subscribing to the weekly G2 Tea newsletter to receive marketing news and trends. You can learn more about G2's privacy policy here .

- Company management

Navigating the future with business forecasting

In today's dynamic and ever-changing business environment, organisations must make accurate future predictions to stay competitive and thrive. Business forecasting is one tool that enables companies to make informed decisions about their future.

What is business forecasting?

Business forecasting is predicting future outcomes based on past and present data. This involves analysing historical trends, market conditions, customer behaviour, and other relevant factors to determine prospects and threats.

The main goal of business forecasting is to develop an informed estimate of future events and circumstances . This enables businesses to make strategic decisions and prepare for future expansion.

Why is business forecasting important?

Forecasting is important for businesses as :

- It helps organisations to make strategic plans for the future.

- Helps organisations to allocate resources effectively and efficiently.

- Plays a crucial role in financial planning by helping businesses estimate future revenues, expenses, and profits.

- Helps organisations to identify problems, potential risks and uncertainties and develop risk management strategies to mitigate them.

- Provides decision-makers with valuable insights and data, which can help them make better-informed decisions and develop short & long term success strategies .

Related article: The best cash flow forecasting software in 2023

Business forecasting process

Effective business forecasting requires careful planning and execution. The following steps provide a comprehensive guide on how to develop a successful forecasting plan:

Define the objective : The first step in the business forecasting process is to define the objective of the forecast by identifying the key performance indicators (KPIs) such as sales, revenue, or market share.

Gather data : Next, gather relevant data, including historical data on the KPIs, market trends, and other variables that may impact the forecast.

Analyse the data : Once the data has been gathered, it must be analysed to identify patterns, trends, and other factors that may impact the forecast. This can be done using statistical models, machine learning algorithms, or other analytical tools.

Develop the forecast : Based on the analysis of the data, a forecast can be developed using the insights gained from the data analysis to generate a prediction of future performance on the KPIs.

Validate the forecast : Now, it should be validated to ensure its accuracy. This can be done by comparing the forecast to actual performance data from past periods.

Implement the forecast : Finally, the forecast can be used to make informed decisions about business operations. This involves adjusting resource allocation, pricing strategies, or other aspects of the business based on the predicted future performance.

As business forecasting is an iterative process, it's important to monitor actual performance against the forecast and adjust the forecast as required to ensure its accuracy over time.

👉 Watch our video on cash flow forecasting

What are 2 basic methods of forecasting in business?

Two main methods of forecasting are:

Qualitative forecasting : This approach uses expert opinions, market research, surveys, and other subjective data to predict future trends. Qualitative forecasting is useful when historical data is limited, and the future is uncertain.

Quantitative forecasting : This method relies on historical data and statistical analysis to predict future trends. Quantitative forecasting is suitable for industries with a lot of historical data and stable market conditions.

4 Basic forecasting techniques

The four basic forecasting techniques are:

Trend analysis : This method identifies patterns and trends in historical data to predict future values. Trend analysis helps forecast long-term trends.

Regression analysis : Regression analysis is helpful for forecasting in complex environments where multiple variables are involved. This approach identifies the relationship between two or more variables to predict future values.

Moving average : This method calculates the average of past data points to identify trends and predict future values. Moving averages are helpful for forecasting in stable and predictable environments.

Exponential smoothing : Exponential smoothing is helpful for forecasting in rapidly changing environments. This technique assigns more weight to recent data points than older ones to predict future values.

A few other business forecasting techniques are:

- Scenario analysis

- Judgmental forecasting

- Causal forecasting

- Econometric forecasting

- Delphi method

- Simulation modelling

See also: Improving liquidity in your business in 5 easy ways

5 Forecast models:

Forecast models in business forecasting are mathematical or statistical tools used to predict future trends and outcomes based on historical data and various influencing factors. These models are designed to analyse patterns, relationships, and dependencies within the data to generate reliable forecasts.

The forecast models serve as valuable tools for businesses to anticipate demand, sales, market trends, financial performance, and other crucial factors, enabling them to make informed decisions and develop effective strategies. By leveraging these forecast models, businesses can make data-driven decisions, improve resource allocation, optimise inventory levels, and enhance operational efficiency.

There are several types of forecast models commonly used in business forecasting, such as:

1. Time Series Models: These models analyse historical data to identify patterns and make predictions based on the assumption that future trends will continue in a similar pattern. Time series models, such as moving averages and exponential smoothing, are commonly used in businesses to forecast demand, sales, and financial metrics. These models can predict future trends by analysing historical patterns and seasonality and help businesses optimise inventory management, production planning, and resource allocation.

2. Regression Models: Regression analysis uses historical data to establish relationships between variables, allowing for the prediction of one variable based on the values of other related variables. It is widely applied in business forecasting to understand the relationships between variables. For example, businesses may use regression models to forecast sales based on factors like marketing expenditure, pricing, and macroeconomic indicators. These models provide insights into the impact of different variables on business performance and inform strategic decision-making.

3. Exponential Smoothing Models: Exponential smoothing models place greater emphasis on recent data points, giving them more weight in the forecast calculation while gradually decreasing the impact of older data. Exponential smoothing models are helpful for short-term forecasting and are commonly employed in inventory management and sales forecasting. By assigning different weights to recent and older data points, these models give more significance to recent trends, allowing businesses to adapt quickly to changes in demand.

4. Econometric Models: These models incorporate economic theory and statistical techniques to forecast business outcomes by considering factors such as GDP, inflation, interest rates, and other macroeconomic indicators. These models are applied in areas such as financial forecasting, market analysis, and pricing strategies. By considering macroeconomic factors and their impact on specific industries, businesses can predict market conditions and adjust their strategy accordingly.

5. Machine Learning Models: Machine learning algorithms can analyse large volumes of data, identify complex patterns, and make forecasts based on the identified patterns. Machine learning algorithms, including neural networks, decision trees, and random forests, can be utilised to forecast various business metrics. These models can analyse large datasets, identify complex patterns, and make accurate predictions. Businesses apply machine learning models for demand forecasting, customer behaviour analysis, fraud detection, and personalised marketing campaigns.

What are examples of business forecasts?

Let's take the example of business forecasting for a company that manufactures and sells organic skincare products. Based on the assumptions, that the company has been in business for a few years and has historical sales data, it could use that data to forecast its sales using trend analysis for the next year.

They might consider such cases and scenarios, as mentioned under:

- Past sales trends : If sales have steadily increased by 10% each year, they might assume they will see similar growth in the coming year.

- Market trends : They would also look at broader trends - Whether more people are becoming interested in organic products. Is there a new ingredient that is gaining popularity? These factors could influence the company's sales.

- Marketing initiatives: If the company plans to launch a new product line or run a major advertising campaign, it might expect a boost in sales.

Using this information, the company could create a sales forecast for the following year. They might forecast a 10% increase in sales based on historical trends, plus an additional 5% increase based on market trends and marketing initiatives.

Business Forecasting Software

Business forecasting software uses cutting-edge algorithms and statistical approaches to analyse historical data and current market conditions to generate accurate forecasts about future outcomes. It helps organisations to predict future trends, patterns, and behaviours related to their business operations.

Business forecasting software is used by companies in various industries. Its key features include data visualisation tools, predictive analytics, scenario planning, and automated reporting.

Using a business forecasting software:

- Businesses can make more informed decisions about resource allocation, budgeting, and strategic planning.

- Businesses can identify potential risks and opportunities and adjust their operations to stay competitive in a rapidly changing market.

Wrapping Up

Business forecasting emerges as a vital tool for organisations aiming to make well-informed decisions regarding the future.

By following a comprehensive process that includes defining the objective, gathering data, selecting the methodology, developing the forecast, and monitoring and reviewing, companies can develop accurate and reliable predictions that inform strategic decisions and drive growth.

Subscribe to our newsletter

You may also like.

201 Borough High Street London SE1 1JA

- Cash management

- Liquidity planning

- Banking & ERP

- Supplier management

- Cash collection

- Cash flow monitoring

- Cash flow forecast

- Consolidation

- Debt management

- Late payment reminders

- Supplier Invoice Management

- Custom dashboards

- Manufacturing

- Restaurants

- Construction

- Real estate

Company size

- Mid-sized Companies

- £10M - £50M revenue

- £1M - £10M revenue

- Resource center

- Excel models

- Practical guides

- Cashflow management

- Costs and revenue management

- Financial management

- Company creation

- Terms of Use

- General Terms of Service

- Privacy Policy

- Legal Notice

- Integrations

- We're hiring

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.