- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Inside Unilever: The Evolving Transnational Company

- Floris A. Maljers

These days, Unilever is often described as one of the foremost transnational companies. Yet our organization of diverse operations around the world is not the outcome of a conscious effort to become what is now known among academics as a transnational. When Unilever was founded in 1930 as a Dutch-British company, it produced soap, processed […]

These days, Unilever is often described as one of the foremost transnational companies. Yet our organization of diverse operations around the world is not the outcome of a conscious effort to become what is now known among academics as a transnational. When Unilever was founded in 1930 as a Dutch-British company, it produced soap, processed foods, and a wide array of other consumer goods in many countries. Ever since then, the company has evolved mainly through a Darwinian system of retaining what was useful and rejecting what no longer worked—in other words, through actual practice as a business responding to the marketplace.

- FM Floris A. Maljers is the co-chairman and CEO of Unilever, the Dutch-British consumer goods group.

Partner Center

Unilever—A Case Study

This article considers key issues relating to the organization and performance of large multinational firms in the post-Second World War period. Although foreign direct investment is defined by ownership and control, in practice the nature of that "control" is far from straightforward. The issue of control is examined, as is the related question of the "stickiness" of knowledge within large international firms. The discussion draws on a case study of the Anglo-Dutch consumer goods manufacturer Unilever, which has been one of the largest direct investors in the United States in the twentieth century. After 1945 Unilever's once successful business in the United States began to decline, yet the parent company maintained an arms-length relationship with its U.S. affiliates, refusing to intervene in their management. Although Unilever "owned" large U.S. businesses, the question of whether it "controlled" them was more debatable.

Some of the central issues related to the organization and performance of multinationals after the Second World War can be illustrated by studying the case of Unilever in the United States. Since Unilever's creation in 1929 by a merger of British and Dutch soap and margarine companies, 1 it has ranked as one of Europe's, and the world's, largest consumer-goods companies. Its sales of $45,679 million in 2000 ranked it fifty-fourth by revenues in the Fortune 500 list of largest companies for that year.

A Complex Organization

Unilever was an organizational curiosity in that, since 1929, it has been headed by two separate British and Dutch companies—Unilever Ltd. (PLC after 1981), and Unilever N.V.—with different sets of shareholders but identical boards of directors. An "Equalization Agreement" provided that the two companies should at all times pay dividends of equivalent value in sterling and guilders. There were two head offices—in London and Rotterdam—and two chairmen. Until 1996 the "chief executive" role was performed by a three-person Special Committee consisting of the two chairmen and one other director.

Beneath the two parent companies a large number of operating companies were active in individual countries. They had many names, often reflecting predecessor firms or companies that had been acquired. Among them were Lever; Van den Bergh & Jurgens; Gibbs; Batchelors; Langnese; and Sunlicht. The name "Unilever" was not used in operating companies or in brand names. Lever Brothers and T. J. Lipton were the two postwar U.S. affiliates. These national operating companies were allocated to either Ltd./PLC or N.V. for historical or other reasons. Lever Brothers was transferred to N.V. in 1937, and until 1987 (when PLC was given a 25 percent shareholding) Unilever's business in the United States was wholly owned by N.V. Unilever's business, and, as a result, counted as part of Dutch foreign direct investment (FDI) in the country. Unilever and its Anglo-Dutch twin Royal Dutch Shell formed major elements in the historically large Dutch FDI in the United States. 2 However, the fact that all dividends were remitted to N.V. in the Netherlands did not mean that the head office in Rotterdam exclusively managed the U.S. affiliates. The Special Committee had both Dutch and British members, and directors and functional departments were based in both countries and had managerial responsibilities without regard for the formality of N.V. or Ltd./PLC ownership. Thus, while ownership lay in the Netherlands, managerial control was Anglo-Dutch.

The organizational complexity was compounded by Unilever's wide portfolio of products and by the changes in these products over time. Edible fats, such as margarine, and soap and detergents were the historical origins of Unilever's business, but decades of diversification resulted in other activities. By the 1950s, Unilever manufactured convenience foods, such as frozen foods and soup, ice cream, meat products, and tea and other drinks. It manufactured personal care products, including toothpaste, shampoo, hairsprays, and deodorants. The oils and fats business also led Unilever into specialty chemicals and animal feeds. In Europe, its food business spanned all stages of the industry, from fishing fleets to retail shops. Among its range of ancillary services were shipping, paper, packaging, plastics, and advertising and market research. Unilever also owned a trading company, called the United Africa Company, which began by importing and exporting into West Africa but, beginning in the 1950s, turned to investing heavily in local manufacturing, especially brewing and textiles. The United Africa Company employed around 70,000 people in the 1970s and was the largest modern business enterprise in West Africa. 3 Unilever's total employment was over 350,000 in the mid-1970s, or around seven times larger than that of Procter & Gamble (hereafter P&G), its main rival in the U.S. detergent and toothpaste markets.

A World-wide Investor

An early multinational investor, by the postwar decades Unilever possessed extensive manufacturing and trading businesses throughout Europe, North and South America, Africa, Asia, and Australia. Unilever was one of the oldest and largest foreign multinationals in the United States. William Lever, founder of the British predecessor of Unilever, first visited the United States in 1888 and by the turn of the century had three manufacturing plants in Cambridge, Massachusetts, Philadelphia, and Vicksburg, Mississippi. 4 The subsequent growth of the business, which was by no means linear, will be reviewed below, but it was always one of the largest foreign investors in the United States. In 1981, a ranking by sales revenues in Forbes put it in twelfth place. 5

Unilever's longevity as an inward investor provides an opportunity to explore in depth a puzzle about inward FDI in the United States. For a number of reasons, including its size, resources, free-market economy, and proclivity toward trade protectionism, the United States has always been a major host economy for foreign firms. It has certainly been the world's largest host since the 1970s, and probably was before 1914 also. 6 Given that most theories of the multinational enterprise suggest that foreign firms possess an "advantage" when they invest in a foreign market, it might be expected that they would earn higher returns than their domestic competitors. 7 This seems to be the general case, but perhaps not for the United States. Considerable anecdotal evidence exists that many foreign firms have experienced significant and sustained problems in the United States, though it is also possible to counter such reports with case studies of sustained success. 8

During the 1990s a series of aggregate studies using tax and other data pointed toward foreign firms earning lower financial returns than their domestic equivalents in the United States. 9 One explanation for this phenomenon might be transfer pricing, but this has proved hard to verify empirically. The industry mix is another possibility, but recent studies have suggested this is not a major factor. More significant influences appear to be market share position—in general, as a foreign owned firm's market share rose, the gap between its return on assets and those for United States—owned companies decreased—and age of the affiliate, with the return on assets of foreign firms rising with their degree of newness. 10 Related to the age effect, there is also the strong, but difficult to quantify, possibility that foreign firms experienced management problems because of idiosyncratic features of the U.S. economy, including not only its size but also the regulatory system and "business culture." The case of Unilever is instructive in investigating these matters, including the issue of whether managing in the United States was particularly hard, even for a company with experience in managing large-scale businesses in some of the world's more challenging political, economic, and financial locations, like Brazil, India, Nigeria, and Turkey.

The story of Unilever in the United States provides rich new empirical evidence on critical issues relating to the functioning of multinationals and their impact. — Geoffrey Jones

Finally, the story of Unilever in the United States provides rich new empirical evidence on critical issues relating to the functioning of multinationals and their impact. It raises the issue of what is meant by "control" within multinationals. Management and control are at the heart of definitions of multinationals and foreign direct investment (as opposed to portfolio investment), yet these are by no means straightforward concepts. A great deal of the theory of multinationals relates to the benefits—or otherwise—of controlling transactions within a firm rather than using market arrangements. In turn, transaction-cost theory postulates that intangibles like knowledge and information can often be transferred more efficiently and effectively within a firm than between independent firms. There are several reasons for this, including the fact that much knowledge is tacit. Indeed, it is well established that sharing technology and communicating knowledge within a firm are neither easy nor costless, though there have not been many empirical studies of such intrafirm transfers. 11 Orjan Sövell and Udo Zander have recently gone so far as to claim that multinationals are "not particularly well equipped to continuously transfer technological knowledge across national borders" and that their "contribution to the international diffusion of knowledge transfers has been overestimated. 12 This study of Unilever in the United States provides compelling new evidence on this issue.

Lever Brothers In The United States: Building And Losing Competitive Advantage

Lever Brothers, Unilever's first and major affiliate, was remarkably successful in interwar America. After a slow start, especially because of "the obstinate refusal of the American housewife to appreciate Sunlight Soap," Lever's main soap brand in the United Kingdom, the Lever Brothers business in the United States began to grow rapidly under a new president, Francis A. Countway, an American appointed in 1912. 13 Sales rose from $843,466 in 1913, to $12.5 million in 1920, to $18.9 million in 1925. Lever was the first to alert American consumers to the menace of "BO," "Undie Odor," and "Dishpan Hands," and to market the cures in the form of Lifebuoy and Lux Flakes. By the end of the 1930s sales exceeded $90 million, and in 1946 they reached $150 million.

By the interwar years soap had a firmly oligopolistic market structure in the United States. It formed part of the consumer chemicals industry, which sold branded and packaged goods supported by heavy advertising expenditure. In soap, there were also substantial throughput economies, which encouraged concentration. P&G was, to apply Alfred D. Chandler's terminology, "the first mover"; among the main followers were Colgate and Palmolive-Peet, which merged in 1928. Neither P&G nor Colgate Palmolive diversified greatly beyond soap, though P&G's research took it into cooking oils before 1914 and into shampoos in the 1930s. Lever made up the third member of the oligopoly. The three firms together controlled about 80 percent of the U.S. soap market in the 1930s. 14 By the interwar years, this oligopolistic rivalry was extended overseas. Colgate was an active foreign investor, while in 1930 P&G—previously confined to the United States and Canada—acquired a British soap business, which it proceeded to expand, seriously eroding Unilever's market share. 15

The soap and related markets in the United States had a number of characteristics. Although P&G had established a preponderant market share, shares were strongly contested. Entry, other than by acquisition, was already not really an option by the interwar years, so competition took the form of fierce rivalry between incumbent firms with a long experience of one another. During the 1920s and the first half of the 1930s, Lever made substantial progress against P&G. Lever's sales in the United States as a percentage of P&G's sales rose from 14.8 percent between 1924 and 1926 to reach almost 50 percent in 1933. In 1930 P&G suggested purchasing Lever in the United States as part of a world division of markets, but the offer was declined. 16 Lever's success peaked in the early 1930s. Using published figures, Lever estimated its profit as a percentage of capital employed at 26 percent between 1930 and 1932, compared with P&G's 12 percent.

Countway's greatest contribution was in marketing. During the war, Countway put Lever's resources behind Lux soapflakes, promoted as a fine soap that would not damage delicate fabrics just at a time when women's wear was shifting from cotton and lisle to silk and fine fabrics. The campaign featured a variety of tactics, including washing demonstrations at department stores. In 1919 Countway launched Rinso soap powder, coinciding with the advent of the washing machine. In the same year, Lever's agreement with a New York agent to sell its soap everywhere beyond New England was abandoned and a new sales organization was established. Finally, in the mid-1920s, Countway launched, against the advice of the British parent company, a white soap, called "Lux Toilet Soap." J. Walter Thompson was hired to develop a marketing and advertising campaign stressing the glamour of the new product, with very successful results. 17 Lever's share of the U.S. soap market rose from around 2 percent in the early 1920s to 8.5 percent in 1932. 18 Brands were built up by spending heavily on advertising. As a percentage of sales, advertising averaged 25 percent between 1921 and 1933, thereby funding a series of noteworthy campaigns conceived by J. Walter Thompson. This rate of spending was made possible by the low price of oils and fats in the decade and by plowing back profits rather than remitting great dividends. By 1929 Unilever had received $12.2 million from its U.S. business since the time of its start, but thereafter the company reaped benefits, for between 1930 and 1950 cumulative dividends were $50 million. 19

Many foreign firms have experienced significant and sustained problems in the United States. — Geoffrey Jones

After 1933 Lever encountered tougher competition in soap from P&G, though Lever's share of the total U.S. soap market grew to 11 percent in 1938. P&G launched a line of synthetic detergents, including Dreft, in 1933, and came out with Drene, a liquid shampoo, in 1934 both were more effective than solid soap in areas of hard water. However, such products had "teething problems," and their impact on the U.S. market was limited until the war. Countway challenged P&G in another area by entering branded shortening in 1936 with Spry. This also was launched with a massive marketing campaign to attack P&G's Crisco shortening, which had been on sale since 1912. 20 The attack began with a nationwide giveaway of one-pound cans, and the result was "impressive." 21 By 1939 Spry's sales had reached 75 percent of Crisco's, but the resulting price war meant that Lever made no profit on the product until 1941. Lever's sales in general reached as high as 43 percent of P&G's during the early 1940s, and the company further diversified with the purchase of the toothpaste company Pepsodent in 1944. Expansion into margarine followed with the purchase of a Chicago firm in 1948.

The postwar years proved very disappointing for Lever Brothers, for a number of partly related reasons. Countway, on his retirement in 1946, was replaced by the president of Pepsodent, the thirty-four-year-old Charles Luckman, who was credited with the "discovery" of Bob Hope in 1937 when the comedian was used for an advertisement. Countway was a classic "one man band," whose skills in marketing were not matched by much interest in organization building. He never gave much thought to succession, but he liked Luckman. 22 This proved a misjudgment. With his appointment by President Truman to head a food program in Europe at the same time, Luckman became preoccupied with matters outside Lever for a significant portion of his term, though perhaps not to a sufficient degree. Convinced that Lever's management was too old and inbred, he dismissed about 15 percent of the work force soon after taking office, and he completed the transformation by moving the head office from Boston to New York, taking only around one-tenth of the existing executives with him. 23 The head office, constructed in Cambridge by Lever in 1938, was subsequently acquired by MIT and became the Sloan Building.

Luckman's move, which was supported by a firm of management consultants, the Fry Organization of Business Management Experts, was justified on the grounds that the building in Cambridge was not large enough, that it would be easier to find the right personnel in New York, and that Lever would benefit by being closer to the large advertising agencies in the city. 24 There were also rumors that Luckman, who was Jewish, was uncomfortable with what he perceived as widespread anti-Semitism in Boston at that time. The cost of building the New York Park Avenue headquarters, which became established as a "classic" of the new postwar skyscraper, rose steadily from $3.5 million to $6 million. Luckman had trained as an architect at the University of Illinois, and he was very involved in the design of the pioneering New York office.

- 06 May 2024

- Research & Ideas

The Critical Minutes After a Virtual Meeting That Can Build Up or Tear Down Teams

- 03 May 2024

How Much Does Proximity Influence Startup Innovation? 20 Meters' Worth to Be Exact

- 09 May 2024

Called Back to the Office? How You Benefit from Ideas You Didn't Know You Were Missing

- 24 Jan 2024

Why Boeing’s Problems with the 737 MAX Began More Than 25 Years Ago

- 26 Apr 2024

Deion Sanders' Prime Lessons for Leading a Team to Victory

- Globalization

- Consumer Products

- Entertainment and Recreation

- Food and Beverage

- Manufacturing

Sign up for our weekly newsletter

- Find Flashcards

- Why It Works

- Tutors & resellers

- Content partnerships

- Teachers & professors

- Employee training

Brainscape's Knowledge Genome TM

Entrance exams, professional certifications.

- Foreign Languages

- Medical & Nursing

Humanities & Social Studies

Mathematics, health & fitness, business & finance, technology & engineering, food & beverage, random knowledge, see full index.

Case studies: Global Systems and Governance > TNC: Unilever > Flashcards

TNC: Unilever Flashcards

established in

employs……people worldwide

172,000 people worldwide

of the 172,000 employed, …..of those are reserch posts

an estimated…..people use unilever roducts every day

2.5 billion

unilever operates manufacturing facilities in………countries

R and D for unilever is carried out in (5 countries)

- netherlands

unilever aims to have 100% of its plastic packaging recyclable, reusable or compostable by

since 20…, it has been using….% recycled plastic in its Percil detergent packaging

in…………, unilver’s investment is so large and crucial to the economy that the government must…………..

gov. has to consult unilever before creating new economic policies

……………………….International (name of organisation) has found that a unilever subcontracto operating in …………employs children as young as .years old in hazardous conditions. the sub contractor is called

Amnesty Int. Indonesia 8 years old Wilmar

Case studies: Global Systems and Governance (27 decks)

- Globalisation timeline

- The Shrinking World

- Industrialisation in Vietnam: 'Globa. at its best?'

- Pharmaceutical Companies: global shift

- Globalisation of services in India

- Global Shift: Dyson moves to Malaysia

- Containerisation

- China's economy

- World trade organisation (WTO)

- International Monetary Fund (IMF)

- Special & Differential Treatment

- Intergovernmental Panel on Climate Change (IPCC)

- Trade blocs

- TNC: Apple Inc.

- TNC: Unilever

- Banana Trade War

- TNC: general info

- Millennium Development Goals

- Global Commons Treaties

- Crowd funding (Ocean Cleanup)

- NGO (Greenpeace)

- Definitions

- United Nations

- Global Shift: Cadbury's

- Trade Blocks: EU, NAFTA, EFTA, MERCUSOR

- Corporate Training

- Teachers & Schools

- Android App

- Help Center

- Law Education

- All Subjects A-Z

- All Certified Classes

- Earn Money!

What I learnt in Geography this week.....

My Geography teacher has started an experiment which involves me writing about what I have learnt in my lessons and about any geographical news that interests me. My Geography teacher is also going to write a blog about what she teaches me (and therefore what I should have learnt!) and hopefully the two blogs will match up. The idea is that this will not only help me to consolidate what I learn but that it will also help fellow students do the same and keep up to date with current issues.

Thursday 7 June 2012

A few brief tnc case studies...., 4 comments:.

Thanks for the information, just doing my GCSE's now actually, and you may want to proof read your work as there are a lot of mistypes.

thanks really helped with my homework

Any more environmental impacts?��

dimeapp.in is one of the fastest Live cricket score app performing in the arena of Cricket match scores and You can choose any upcoming match of your choice to watch it over and get full insights over Match history. dimeapp.in is an Ads free cricket app which makes your cricket viewing experience even more exciting plus Accurate match odds with session updates, Search matches date-wise, team-wise, and series-wise too. dimeapp.in is 100% free to download and use an app for viewing All T20, ODI, Domestic and International women/men Test Matches and even IPLs and PSL. You can even watch the World Cup, Asia Cup and upcoming schedules of upcoming matches in this App. dimeapp.in is the No.1 rating app on our list. This app is a lifeline for cricket lovers. Not only, it is interactive & convenient-to-use software, but it furthermore wraps all aspects of cricket. It will give to the detailed stats, rankings & records, Precise odd-even sessions. Even it also helps to skillfully navigate team/date/year wise matches. It also provides daily articles & alerts on feverish cricket headlines. As per reviews and information on the Internet, we will recommend dimeapp.in for a cricket lover to satisfy their craving to know the scores fastest of fast that too with free-subscription & Ads-free...

- Show search

Transforming Business Practices

Building the Case for Green Infrastructure

Research finds that incorporating nature into man-made infrastructure can improve business resilience.

Earlier this year, experts from The Dow Chemical Company, Shell, Swiss Re, and Unilever, working with The Nature Conservancy and a resiliency expert, evaluated a number of business case studies, and developed a white paper with recommendations that green and hybrid infrastructure solutions should become part of the standard toolkit for modern engineers.

Green infrastructure employs elements of natural systems, while traditional gray infrastructure is man-made. Examples of green infrastructure include creating oyster reefs for coastal protection, and reed beds that treat industrial waste water.

The research team evaluated the assumption that green infrastructure can provide more opportunities than gray infrastructure to increase the resilience of industrial business operations against disruptive events such as mechanical failure, power interruption, raw material price increases, and floods. The evaluation concluded that hybrid approaches, utilizing a combination of green and gray infrastructure, may provide an optimum solution to a variety of shocks and improve the overall business resilience.

The case studies gathered to support this research encompass a wide variety of possible applications of green infrastructure. They range from planting trees that cost-effectively remediate contaminated soil (phytoremediation), to constructing wetlands that naturally treat industrial wastewater, to mitigating air pollution through innovative forest management approaches.

This joint-industry effort will continue to explore ways and develop tools to better evaluate green versus gray solutions with the aim to better understand under what circumstances green infrastructure is a cost effective investment.

Members hope to influence fellow companies and organizations to pursue green and/or hybrid solutions when financially appropriate.

Read the White Paper

- International

- Schools directory

- Resources Jobs Schools directory News Search

TNCs in NEE- Nigeria and Shell case study lesson

Subject: Geography

Age range: 14-16

Resource type: Lesson (complete)

Last updated

26 May 2023

- Share through email

- Share through twitter

- Share through linkedin

- Share through facebook

- Share through pinterest

Whole Geography GCSE Lesson- Changing Economic World- NEE- Nigeria Case study. Identifies advantages and disadvantages of TNCs. Video embedded with a worksheet to collect information on Shell in Nigeria. Homework research task on Unilever in Nigeria. Differentiated tasks for high and low ability.

Tes paid licence How can I reuse this?

Get this resource as part of a bundle and save up to 71%

A bundle is a package of resources grouped together to teach a particular topic, or a series of lessons, in one place.

GCSE Geography- Nigeria Case Study- Changing Economic World and Development

Geography AQA Paper 2- The Changing Economic World. Nigeria Case study. Includes: Location, key terms, economic development, TNCs- Shell, environmental challenges and opportunities. Please ask questions- there are videos, images, differentiated tasks, exam practice questions that have peer marking opportunities and homework tasks embedded. Very detailed lessons with many tasks and opportunities for teaching- can be split into two lessons per one lesson to support lower ability and shorter classes, or to stretch out the scheme of learning- some of these lessons require two sessions to teach. Perfect bunch of lessons to use for Year 11 revision as well as teaching new to other GCSE classes.

Your rating is required to reflect your happiness.

It's good to leave some feedback.

Something went wrong, please try again later.

Hi najibs, Can I please ask why this was given 3 stars for future improvement? Thank you

Empty reply does not make any sense for the end user

Report this resource to let us know if it violates our terms and conditions. Our customer service team will review your report and will be in touch.

Not quite what you were looking for? Search by keyword to find the right resource:

Skip to content

Get Revising

Join get revising, already a member.

Case Study - Unilever

- Created by: Former Member

- Created on: 28-10-19 17:11

- Economic change

Report Tue 21st January, 2020 @ 19:22

Are there any other disadvantages because i'm writing an essay about this and i haven't got enough evidence.

Similar Geography resources:

Nigeria Case Study - TNC's 1.0 / 5 based on 1 rating

Economic Development Case Study - India 4.5 / 5 based on 3 ratings

Hazards Case Studies notes 0.0 / 5

Geography Y11 Flashcards 0.0 / 5

Challenges for the Planet 0.0 / 5

Geography Case Study - Nigeria 4.5 / 5 based on 31 ratings

GCSE Geography- Unit 1A- The restless Earth 1.5 / 5 based on 3 ratings

Living World - Thar Desert Case Study (LEDC) 0.0 / 5

natural hazards 0.0 / 5

Nigeria - Case Study 4.0 / 5 based on 9 ratings

Related discussions on The Student Room

- AQA GCSE Geography Paper 2 (8035/2) - 9th June 2023 [Exam Chat] »

- Pot Noodles taste different? »

- Unilever UFLP digital interview - Finance »

- UFLP Unilever program 2024 »

- OCR A Level Geography Human interactions H481/02 - 8 Jun 2022 [Exam Chat] »

- Help - Stuck on A Level Choices. Physics Maths Economics and/or Biology »

- Apprenticeships: »

- Unilever degree apprenticeship 2024 »

- OCR A-Level Geography Human Interactions | [6th June 2023] Exam Chat »

- Geography paper 2 16 marker »

Case Studies

Real-life and hypothetical case studies to demonstrate how our leading-edge safety and environmental sustainability science capabilities are applied.

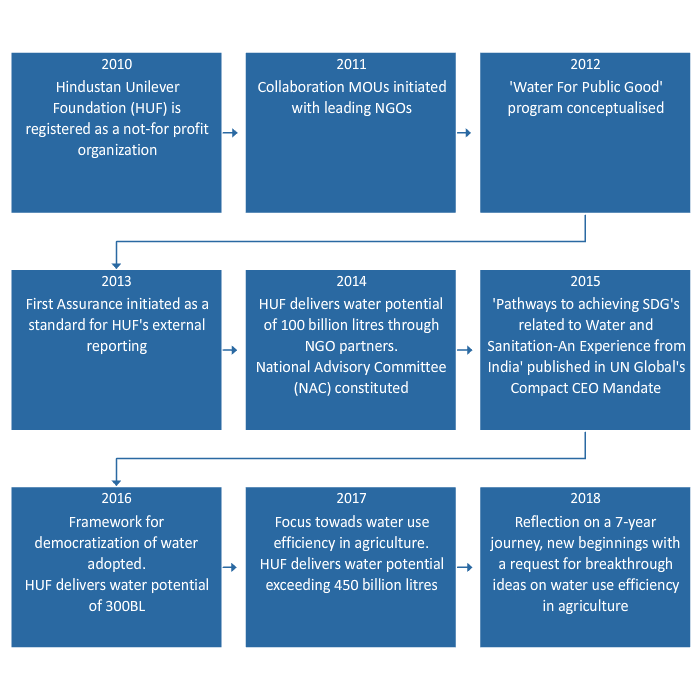

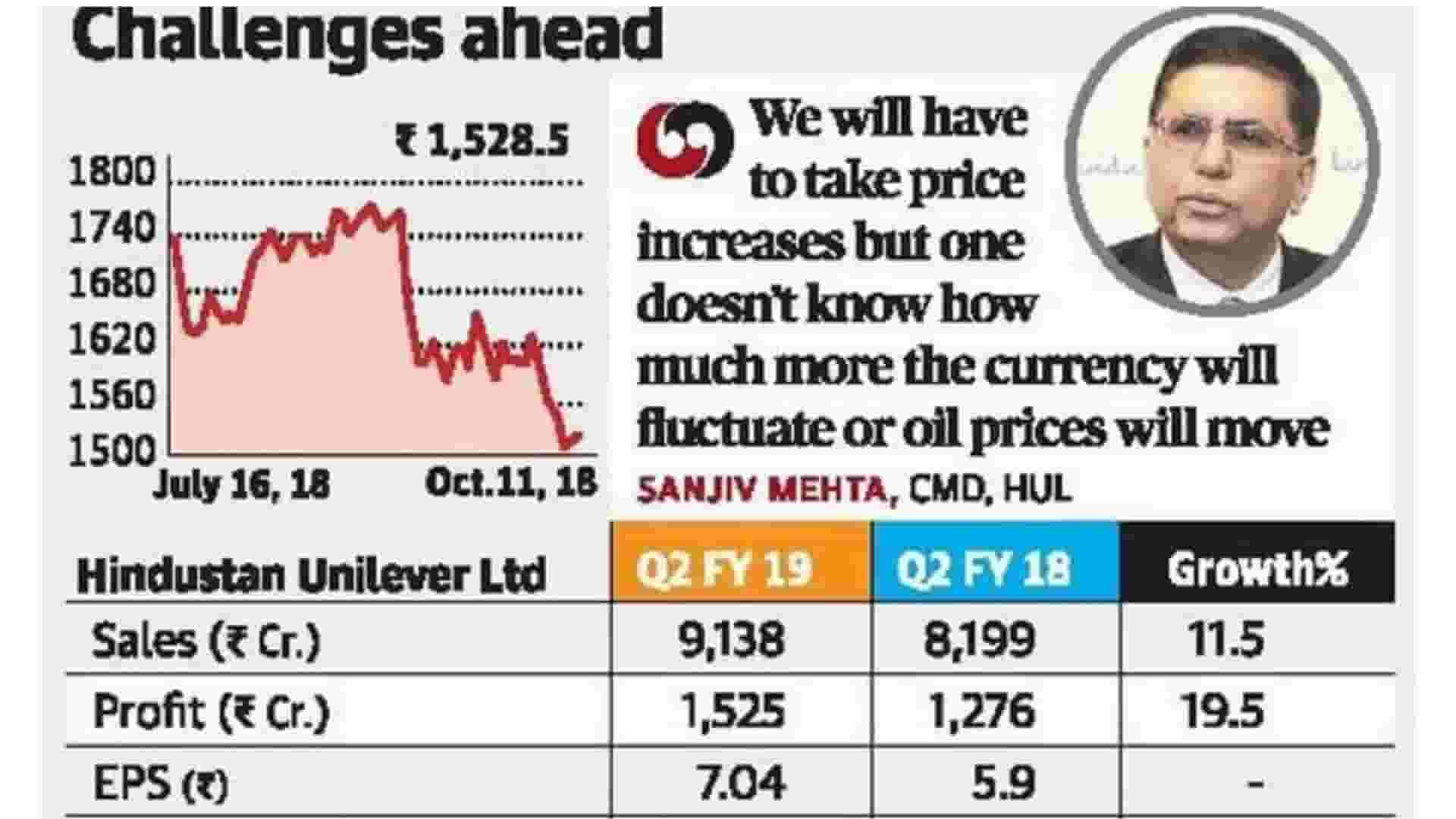

FMCG Giant Hindustan Unilever Limited (HUL) Case Study

Devashish Shrivastava , Anik Banerjee

Hindustan Unilever Limited (HUL) is a British-Dutch assembling organization headquartered in Mumbai, India. The items of Hindustan Unilever Ltd incorporate nourishments, drinks, cleaning specialists, individual consideration items, water purifiers, and purchaser merchandise. HUL was set up in 1933 as Lever Brothers and following the merger of its constituent gatherings in 1956, HUL was renamed Hindustan Lever Limited. The organization was then renamed in June 2007 as "Hindustan Unilever Limited".

At the start of 2019, the Hindustan Unilever Limited portfolio had 35 items marked in 20 classifications and utilized 18,000 representatives with offers of Rs. 34,619 crores in 2017-18. In December 2018, HUL reported its procurement of Glaxo Smithkline's India business for $3.8 billion out of an all value merger manage ratio of 1:4.39.

However, the joining of 3800 representatives of GSK stayed questionable as HUL expressed there was no provision for maintenance of workers in the deal. In January 2019, HUL said that it hopes to finish the merger with Glaxo Smith Kline Consumer Healthcare (GSKCH India) this year.

History And Journey Of Hindustan Unilever Brands And Products Of Hindustan Unilever Business Model of HUL Business Growth In India Expected Future Growth

History And Journey Of Hindustan Unilever

Hindustan Unilever Limited (HUL) is India's biggest quick-moving customer merchandise organization. HUL works in seven business sections.

The cleanser segment incorporates cleansers, cleanser bars, cleanser powders, and scourers. Individual items incorporate items in the classifications of oral consideration, healthy skin (barring cleansers), hair care bath powder, and shading beautifiers. Refreshments incorporate tea and espresso.

Nourishments incorporate staples (atta salt and bread) and culinary items (tomato-based items natural product-based items and soups). Frozen yogurts incorporate frozen yogurts and solidified treats. Others incorporate synthetic substances and water business.

HUL's item portfolio incorporates family unit brands—for example, Lux, Lifebuoy, Surf Excel, Rin, Wheel, Fair and Lovely, Pond's, Vaseline, Lakme, Dove, Clinic Plus, Sunsilk, Pepsodent, Closeup, Axe, Brooke Bond, and Bru, Knorr, Kissan, and Kwality Wall's. HUL is a backup of Unilever, one of the world's driving providers of food products , home care, personal care, and refreshment items with deals in more than 190 nations and a yearly turnover of $6.08 billion in 2020.

Hindustan Unilever Limited traces its origins to Unilever, a British-Dutch multinational company, which is the parent of HUL. William Hesketh Lever was a popular social reformer and is regarded as one of the main propagators of several significant employee benefits options like benefits of health, savings, and more. Thus, his ideologies largely seeped into Unilver and resulted in developing its strong sense of corporate responsibility and leadership. This culture was invariably passed on to the Hindustan Unilever Limited (HUL).

The British-Dutch company Unilever, which emerged as a result of the merger of the operations of Dutch Margarine Unie and British soapmaker Lever Brothers, when it first came to India, discovered the rich and largely unexplored potential of the Indian market. Soon after, the establishment of Hindustan Vanaspati Mfg. Co. Ltd. followed in 1931, which was succeeded by the foundation of Lever Brothers India Limited (1933) and United Traders Limited (1935). The Indian subcontinent had only been importing FMCG products, branded under Lever Brothers since then, the first of which were spotted as early as 1888. Following this, brands like Lifebuoy stepped in 1895, along with other famous companies like Pears, Lux, and Vim. Vanaspati was launched in 1918 and the famous Dalda brand came to the market in 1937.

The 3 Unilever companies - Hindustan Vanaspati Manufacturing Company, Lever Brothers India Limited, and United Traders Limited eventually merged together to form HUL in November 1956. HUL offered 10% of its equity to the Indians and soon swooped into the news, being the first foreign subsidiary to do so.

The organization obtained Lipton in 1972, and Lipton Tea (India) Ltd was consolidated in 1977. Brooke Bond joined the Unilever overlap in 1984 through a global obtaining. Lake's (India) Ltd joined the Unilever overlap through a worldwide securing of Chesebrough Pond's USA in 1986.

The progression of the Indian economy, which began in 1991, denoted an enunciation in the organization's development bend. The expulsion of the administrative structure enabled the organization to investigate every item and open-door section with no imperatives on the creation limit. At the same time, deregulation allowed acquisitions and mergers .

The Tata Oil Mills Company (TOMCO) converged with the organization with effect from April 1, 1993. In 1996, Unilever and Lakme Ltd framed a 50:50 joint endeavor, Lakme Unilever Ltd, to advertise Lakme's market-driven beautifiers and other suitable results. In 1998, Lakme Ltd offered its brands to Unilever and stripped its half stake in the joint venture.

In 1994, the organization and US-based Kimberly Clark Corporation framed a 50:50 joint endeavor—Kimberly-Clark Lever Ltd—which markets Huggies Diapers and Kotex Sanitary Pads. The organization likewise set up a backup in Nepal called Unilever Nepal Limited (UNL). UNL's production line speaks to the biggest assembling interest in the Himalayan kingdom. In the1992, Brooke Bond gained Kothari General Foods with critical interests in instant coffee.

In 1993, HUL acquired Kissan from the UB Group and the Dollops ice-cream business from Cadbury India. Tea Estates and Doom Dooma, two major organizations of Unilever, were converged with Brooke Bond. At that point, in 1994, Brooke Bond India and Lipton India converged to shape Brooke Bond Lipton India Ltd (BBLIL) to empower more noteworthy concentration and guarantee collaboration in the customary beverages business. BBL converged with Unilever with effect from January 1, 1996.

The internal rebuilding finished with the merger of Pond's (India) Limited (PIL) with HUL in 1998. The two organizations had huge covers in personal products, specialty chemicals, and export organizations; other than a typical appropriation framework since 1993 for personal products. The two additionally had a typical administration pool and an innovation base.

In January 2000, the administration chose to grant 74% value in Modern Foods to Unilever. This started the divestment of government value in open division endeavors (PSU) to private area accomplices. The organization's entrance into bread production is a key augmentation of the organization's wheat business. In 2002, the organization procured the administration's residual stake in Modern Foods.

In 2002, the organization made its entry into Ayurvedic well-being with its Ayush item range and Ayush therapy centers. In 2003, the organization procured the Cooked Shrimp and Pasteurized Crabmeat business of the Amalgam Group of Companies, an innovator in marine products trades. Additionally, the organization propelled Hindustan Unilever Network Direct to home business. In 2004, the organization launched the 'Pureit' water purifier.

In 2005, Lever India Exports, Lipton India Exports Ltd, Merry climate Food Products, Toc Disinfectants Ltd, and International Fisheries Ltd were amalgamated within Unilever. In February 2006, Vasishti Detergents Ltd (VDL) converged with Unilever. In September 2006, Modern Foods Industries (India) Ltd & Modern Foods and Nutrition Industries Ltd were included. In October 2006, Unilever stripped its 51% controlling stake in Unilever India Shared Services Ltd, currently known as Capgemini Business Services Pvt. Ltd., to Cap Gemini SA.

In March 2007, Sangam Direct, a non-store home conveyance retail business managed by Unilever India Exports Ltd (UIEL) and a completely possessed auxiliary, was moved to Wadhavan Foods Retail Pvt Ltd (WFRPL) in a droop deal business. Likewise, Unilever completed the demerger of its operational offices in Shamnagar, Jamnagar, and Janmam and shaped three autonomous organizations —Shamnagar Estates Ltd., Jamnagar Properties Ltd, and Hindustan Kwality Walls Foods Ltd. In June 2007, the organization changed its name from Hindustan Lever Ltd to Hindustan Unilever Limited.

In 2008, the organization reported its coordinated efforts with the Indian Dental Association (IDA) related to World Dental Federation (FDI) through the Pepsodent brand to help improve the oral well-being and cleanliness benchmarks in India. In April 2008, the organization demerged and moved certain immovable properties to Brooke Bond Real Estates Pvt Ltd. In January 2010, the organization introduced its new corporate office.

In April 2010, Unilever affirmed the plan of amalgamation of Bon Ltd, an entirely possessed backup of Hindustan Unilever Limited, with it. The selected date for the previously mentioned plan was 1 April 2009 and the plan was made viable from April 28, 2010. Ensuing to the amalgamation, Bon Ltd stopped being an auxiliary of the company.

During 2010-11, Kissan forayed into a new market fragment in three major classifications. It propelled Kissan Fruit and Soya, a delightful mix of organic product juice and soya milk, which appreciated a separated suggestion in this market. The brand likewise went into the Indian (non-sweet) spreads showcase with the dispatch of Kissan Creamy Spread over key towns. In the bakery division, the organization propelled two new items—Chapi and Cream Rolls. The organization stripped 43.31% stake in Hindustan Field Services Pvt Ltd for Smollan Group (the JV accomplice).

Along these lines, Hindustan Field Services Pvt. Ltd. stopped being a backup organization. Lakme Lever Pvt Ltd, a completely claimed auxiliary of HUL, extended the system of Lakme Beauty Salons in that year with the opening of 11 franchises and oversaw salons alongside 18 franchisees' salons.

In December 2011, the organization demerged the FMCG sends-out business, including explicit fares related to assembling units of the organization, into its entirely claimed backup Unilever India Exports Ltd (UIEL). The plan wound up successful on January 1, 2012.

In 2012, the organization went into a concurrence with Unilever to showcase Brylcreem in India. During the year under audit, Unilever and elements of Piramal Realty (Ajay Piramal Group) consented to an arrangement for the task of HUL's leasehold privileges of the land and building named Gulita arranged at Worli Sea Face Mumbai for an exchange estimation of Rs. 452.5 Crore.

On 22 January 2013, the Board of Directors of HUL affirmed a proposition to consent to another arrangement with its parent organization Unilever for the arrangement of innovation exchange imprint permit, trademark registration, and other services on 1 February 2013. This new understanding underlined that the loyalty cost of 1.4% of turnover payable by HUL to Unilever will increment in a staged way to an eminence cost of 3.15% of turnover, no later than the money-related year finishing 31 March 2018.

The expansion in eminence cost in the period from 1 February 2013 to 31 March 2014 is assessed to be 0.5% of turnover and from there on in the scope of 0.3% to 0.7% of turnover in each money related year, paving the way to a complete evaluated sovereignty cost increment of 1.75% of turnover contrasted with existing courses of action no later than the monetary year finishing 31 March 2018.

In 2014, Unilever reported an organization with Internet.org, a Facebook-directed coalition of accomplices to see how web access can be expanded to contact millions of individuals crosswise over India. The organization additionally dispatched Prabhat activity for network improvement in towns around its industrial facilities during the year under survey. Furthermore, the organization also went into association with MTV to embrace its brands during the year under review. In 2015, the organization propelled The Unilever Foundry.

During the year under audit, the organization was perceived as the most inventive advertiser at the Mobile Marketing Association (MMA). The organization additionally resuscitated Ayush with e-dispatch during the year. Besides, it also propelled the 'Swachh Aadat Swachh Bharat' program in India during the year under review. On 8 September 2015, HUL reported that it has further consented to bring forth an arrangement for the deal and the transfer of its bread and pastry shop business under the brand Modern to Nimman Foods Private Limited, an investee organization of the Everstone Group, for an undisclosed amount.

Brands And Products Of Hindustan Unilever

HUL is the market chief in Indian buyer items with products in more than 20 purchaser classes (for example, cleansers, tea, cleansers, and shampoos among others). Sixteen of HUL's brands were included in the ACNielsen Brand Equity rundown of 100 Most Trusted Brands Annual Survey (2014) which was completed by Brand Equity, an enhancement of The Economic Times. There are many brands and products owned by Hindustan Uniliver:

Food Products

- Annapurna salt and Atta (once known as Kissan Annapurna)

- Brooke Bond 3 Roses, Taj Mahal, Taaza and Red Label tea

- Kissan squashes, kinds of ketchup, squeezes and sticks

- Lipton ice tea

- Knorr soups and supper creators and soupy noodles

- Kwality Wall's solidified treat

- Modern Bread, prepared to eat chapattis and other pastry shop things (presently offered to Everstone Capital)

- Magnum (ice cream)

Homecare Brands

- Wheel cleaner

- Cif Cream Cleaner

- comfort cleansing agents

- Domex disinfectant/toilet and bathroom cleaner

- Rin detergent products

- sunlight cleanser and shading care

- Surf Excel cleanser and delicate wash

- Vim dishwash

- magic – Water Saver

Personal Care Brands

- Aviance Beauty Solutions and products

- Axe deodorant and aftershave lotion and soap and accessories

- Lever Ayush Therapy ayurvedic health care and personal care products and items

- International breeze

- Brylcreem hair cream, hair gel and hair products

- Clear anti-dandruff hair products

- Clinic Plus shampoo and oil

- Close Up toothpaste

- Dove skin cleansing & hair care range: bar, lotions, creams, and antiperspirant deodorants

- Denim shaving products

- Fair and Lovely, skin lightening cream

- Indulekha ayurvedic hair oil

- Lakmé beauty products and salons

- Lifebuoy soaps and handwash range

- Liril 2000 soap

- Lux soap, body wash, and deodorant

- Pears soap, body wash

- Pepsodent toothpaste

- Pond's talcs and creams

- Sunsilk shampoo

- Sure antiperspirant

- Vaseline petroleum jelly, skincare lotions

- Vaseline and relevant products

Water Purifier Products

- Pureit water purifier

Business Model of HUL

Hindustan Unilever is an FMCG company that leverages its Direct to Consumer (D2C) business model and has made over 50 billion in revenue, as discovered in 2017. The company has crossed INR 50,000 cr ($6.55 bn) in turnover during FY21, as per the reports on April 2022. HUL is the first pure FMCG brand to hit such a milestone.

The business model of Hindustan Unilever is propelled with the idea of making living sustainable feasible for the masses. With sustainable living, HUL wants to bring about:

- Bettering the future of the children

- A future full of confidence

- A future full of health

- A future that is better for the planet

- A future that is better for the farming and farmers of India

The beauty and personal care segment of Hindustan Unilever helps the company see the most profit, while the food and refreshments segment is declared as the fastest-growing segment of the company. Home care is another segment of the company among its 3 primary segments.

The Hindustan Unilever company gets its competitive advantage from the global footprint it has and the track record of the company for enhancing value for its consumers around the globe.

Some of the prominent patterns that are noticeable in the business model of HUL are:

Reverse Innovation

Reverse innovation refers to the process of building products for industrial countries and then adapting them to the emerging markets. The technique of reverse innovation is what is truly wielded by HUL, which has been a prominent inspiration for many other big brands. The 'Knorr Stock Pot’ that the brand came up with is an excellent example of leveraging reverse innovation. This technique was mastered by HUL by taking references from the famous ‘Dense Soup treasure,’ which was the first major example of reverse innovation, launched in China in 2007.

Focussing on the financially weak

In contrast to the other foreign subsidiaries, HUL ideated to focus on the financially weaker sections of the country, which led them to focus on the majority of the Indian people. Citing the discovery of Wheel detergent powder is one of the examples where Hindustan Unilever created products for the majority of the Indian consumers. Wheel had lower oil-to-water ratio, which enabled Indian to wash textiles even in rivers with hands. Wheel was then made available cleverly by the brand in the local corner shops as well as via door-to-door representatives.

Staying keen on the Triple Bottom Line

While most of the companies solely focus on the profit part of the follow the Triple Bottom Line with only a little focus on the other segments, HUL has a new approach where the brand decided aimed for the other segments, thereby caring for people and the planet.

HUL largely focuses on the people, including its consumers and others. For instance, the company changed the name of one of its popular products "Fair and Lovely" to "Glow and Lovely", following the All Black Lives Matter movement that raged globally. This instantly made HUL a favourite!

Significant Distribution Strategy

The distribution strategy that Hindustan Unilever follows is exemplary! It focuses on hyperlocal markets, retail stores, wholesalers, hypermarkets convenience stores, ecommerce, and more. This hugely helps in the promotion of the HUL products and moving them fast to the consumers!

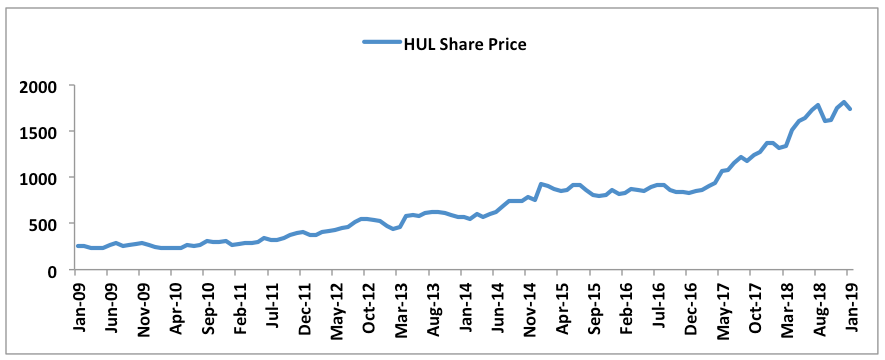

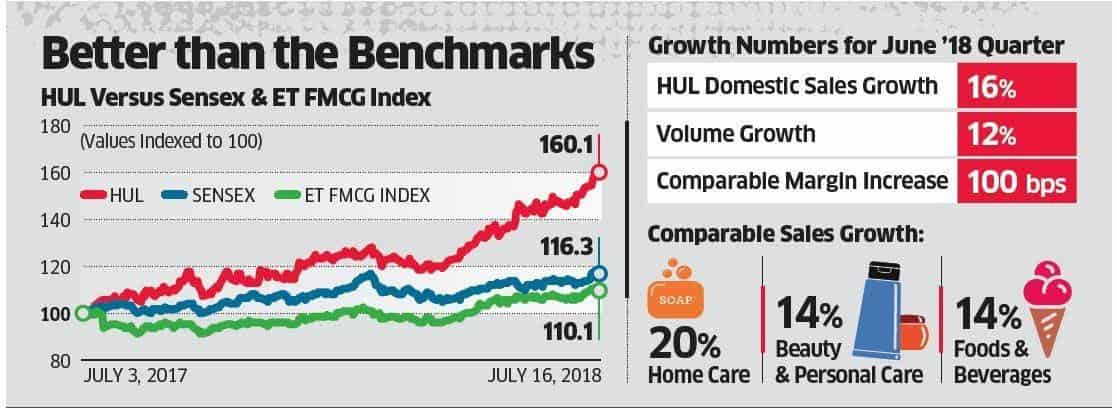

Business Growth In India

FMCG giant Hindustan Unilever Limited (HUL) announced a 15.98% development in solidified net benefit at Rs 6,060 crore for the monetary year finished March 31, 2019, when contrasted with Rs 5,225 crore in 2018. The net profit that HUL witnessed in FY21 rose by 18% YoY at Rs 7,954 crore.

Remarking on the profit, HUL Chairman and Managing Director Sanjiv Mehta stated, "We have conveyed a solid execution for the quarter regardless of some balance in rustic market development. Our attention to fortifying the center and driving business sector advancement has been reliably conveying great outcomes. We have now developed top line and primary concern for the eighth continuous year and our 2019 outcomes were a demonstration of both our technique and execution."

"Given the large-scale monetary pointers, close term advertise development has directed. Notwithstanding, the medium-term viewpoint remains positive. As an association, we are well-situated to react with speed and nimbleness to address the issues of our shoppers. We stay concentrated on our vital plan of conveying predictable, focused, beneficial, and dependable development," he included.

"Together with the between time profit of Rs 9 for each offer, the all-out profit for the money-related year closure March 31, 2019, adds up to Rs. 22 for every offer," the organization said. "Combined income for 2018-19 remained at Rs 39,860 crore, up from Rs 36,622 crore a year sooner," HUL said in a document to the Bombay Stock Exchange.

HUL's business in India developed by 12%, driven by 10% volume development in the household advertise. In the January-March quarter, the organization posted 13.84% development in its independent net benefit at Rs 1,538 crore when contrasted with Rs 1,351 crore in a similar quarter a year ago. The offers of the organization remained at Rs 9,809 crore in Q4FY19 from Rs 9,003 crore in Q4FY18, enrolling a development of 8.95%. The working benefit (EBITDA) for the March quarter was up 13% year-on-year at Rs 2,321 crore and the EBITDA edge was up 90 bps.

The organization said that the edge improved because of judicious administration of instability in costs (unrefined and money driven) alongside improved blend and working influence.

HUL reported that its Earnings before interest, tax, depreciation and amortisation (EBITDA) stood at Rs 11,324 crore, while the EBITDA margin was reported to be 25% during FY21.

Also read : Unknown Facts About Famous Brands | A Case Study

Expected Future Growth

Hindustan Unilever NSE 0.01 % (HUL) may clock 9-10% development in June quarter benefit despite a slight balance in volumes because of value climbs crosswise over classes. IIFL Institutional Equities expects the FMCG major to report a 6% volume development, a slight control from the 7% volume development recorded in the past quarter.

"Our channel checks give us a feeling that the organization has started value climbs crosswise over classes, (for example, cleansers, espresso), among others. We along these lines gauge a business development of 9%, like the past quarter level. We expect the slight withdrawal in gross edge to be counterbalanced by influence in promotion spending and different costs. In general, EBITDA and PAT are relied upon to develop at 13% and 12%, individually," IIFL said. IDFC Securities expects HUL to report 10.3% to ascend in benefit at Rs 1,728 crore. It sees deals developing at 8% to Rs 10,250 crore.

"We expect 6% volume development and factor in deals development of 11% in home consideration and 7% in close to home consideration portions. Lower advertisement spends (down 80 bps YoY) and commands over different overheads will help EBITDA edges," it stated while proposing edge at 24.3% against 23.7% the previous year. Edelweiss sees income, Ebitda, and benefit development at 7.3%, 8.6%, and 7.7% YoY.

"We anticipate that HUL's volume should grow 5% YoY on a high base of 12% YoY development. Q1FY18 was affected by GST dispatch thus the best approach to take a gander at volume development is three years' normal, which will be 5.6%. Delicate quality in the second 50% of Q4FY19 proceeded for the full quarter in Q1FY20. Provincial development is presently at a similar level as urban development. A mixed value climb of 2.5% has been taken. On EBITDA edge front, we expect 20-30 bps YoY development," the business said.

What is Hindustan Unilever origin?

Hindustan Unilever or Hindustan Unilever Limited (HUL) is an Indian subsidiary of Unilever, which sprung from its Dutch-British roots. HUL is headquartered in Mumbai.

Who is the owner of Hindustan Unilever Limited?

HUL is owned by Unilever, its British multinational parent, headquartered in London.

What is HUL?

HUL is the acronym for Hindustan Unilever Limited.

Who are Hindustan Unilever founders?

Hindustan Unilever founders can be cited as 3 parent companies - Hindustan Vanaspati Mfg. Co. Ltd., Lever Brothers India Limited, and United Traders Limited, which were merged to form HUL.

Must have tools for startups - Recommended by StartupTalky

- Manage your business smoothly- Google Workspace

National Technology Day: Experts Share Insights on Technology Trends and Innovations

National Technology Day is celebrated on May 11th as an occasion to honor Indian scientists, engineers, and technologists. It's a time to recognise the endless possibilities technology offers and ensure responsible innovation. Nowadays, with AI being the talk of the town, or better to say, the talk of the world,

AI Squared Acquires Multiwoven to Accelerate Delivery of Data and AI Insights into Business Applications

Acquisition of leading open-source reverse ETL (rETL) platform comes on the heels of robust Series A funding round. Mumbai, May 10, 2024: AI Squared , a leading technology provider for integrating information into web-based business applications, announces its acquisition of the world’s number one open-source Reverse ETL (rETL) company, Multiwoven.

Sony Marketing Strategy: An In-depth Analysis of its 7Ps Approach

The Sony Group Corporation is a Japanese global enterprise with its head office in Minato, Tokyo. As a significant player in the technology industry, it is among the biggest producers of consumer and business electronics worldwide and the biggest console maker and publisher of video games. Sony Entertainment Inc., is

Harnessing the Sky: How Atmospheric Water Generation Can Combat Global Water Scarcity

The article has been contributed by Mr. Navkaran Singh Bagga, CEO & Founder, Akvo. In today’s world, water scarcity affects over two billion people globally, posing a severe threat to both human health and economic stability. Innovative solutions are imperative to address this crisis. Akvo's atmospheric water generator (AWG) technology

Woke no more

Companies were starting to support political causes. Now they're too scared to speak up.

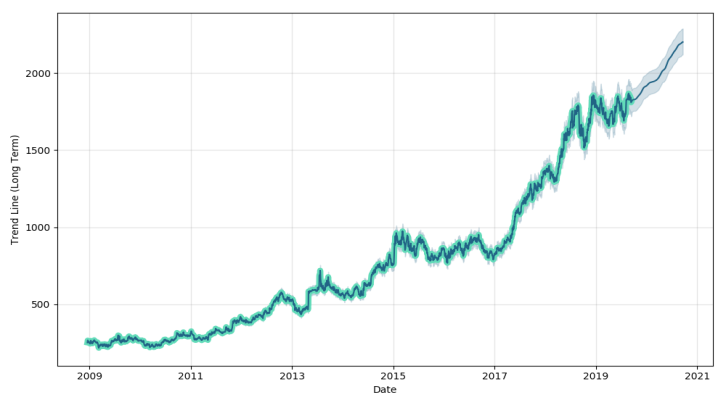

Unilever spent years crafting its image as a corporate goody-two-shoes. The owner of Dove, Vaseline, Hellmann's, and a bunch of other brands axed quarterly reporting and earnings guidance in the name of focusing on sustainable long-term growth. Under Paul Polman , its CEO from 2009 to 2019, it said it would take into consideration all its stakeholders, not just shareholders, and set out to halve its environmental footprint — including greenhouse-gas emissions, waste, and water use — while doubling its sales over a decade. Five years and two chief executives later, Unilever is changing its tune . It's not doing a U-turn on environmental, social, and governance efforts, but it says it's being more realistic about what it can achieve and when. And, oh, those shareholders Unilever wasn't so beholden to? It's paying them a little more mind now, too.

Unilever isn't alone in this. Plenty of companies are reining in their rhetoric and in some cases action on issues such as sustainability and diversity. They're being extra cautious about weighing in on the social and political debates of the day, especially in an election year. In some cases they're telling their workers to cool it, too; Google, for example, fired more than two dozen workers for protesting its contract with Israel's government .

"Many executives have made the decision that it's sometimes safer to just be silent versus to take a stance, because they have a fiduciary responsibility to their shareholders and their bottom line and are very concerned about how this will be perceived," said Naomi Wheeless, a board director for Eventbrite who was formerly a global head of customer success at Square.

Call it the great un-wokening.

Over the past decade, many corporations have at least professed to take a more active role in social issues, under pressure from their customers and, more importantly, employees. Companies pushed back on North Carolina's "bathroom bill" in 2016, and when Donald Trump took the White House, many spoke out against his policies on immigration and the environment. Around that time, the Business Roundtable said it was time to rethink the purpose of a company , and BlackRock's Larry Fink expressed all sorts of thoughts about the importance of companies being responsible social stewards.

In the wake of George Floyd's murder in 2020, corporate America put out endless statements about the horror of what had happened and pledged to undertake diversity, equity, and inclusion initiatives. An expectation arose that big businesses would take a stand on issues — if Congress wouldn't do something on guns, at least Dick's Sporting Goods would .

"You can almost say that ESG ran unopposed for a few years," said Andrew Jones, a senior researcher at the Conference Board's ESG Center.

It's a bona fide countermovement against both ESG and DEI.

Then came the backlash. Over the past couple of years there's been an uproar, especially among conservatives, about the rise of "woke capitalism." Bud Light came under scrutiny from the right when it partnered with the transgender influencer Dylan Mulvaney for a small-scale Instagram campaign last spring. Then Target took heat about its Pride merchandise , with some customers destroying displays in stores over a campaign it has run for years. These high-profile examples spooked companies, which are now afraid to poke the hyped-up right-wing bear. In the market, ESG funds haven't been doing so hot . According to Morningstar, investors pulled $13 billion out of sustainable funds in 2023 amid underperformance and political unease.

"It's a bona fide countermovement against both ESG and DEI," said Philip Mirvis, an organizational psychologist and research fellow at Babson College's Social Innovation Lab. "Certainly for businesses, this is about making money. And in the conventional logic, all of these issues represent risks."

After last year's Bud Light debacle, which was a real blow to its business , executives fear they'll be the next target of some anti-woke outcry. In a 2023 Conference Board survey of more than 100 large US companies, almost half of respondents said they'd gotten some ESG backlash, and nearly two-thirds said they expected the problem to persist or get worse over the next two years. Jones told me the surveys suggest companies are antsy about mentioning DEI too much, too. He said it's not necessarily the case that companies aren't doing any work on sustainability and diversity, but they're definitely changing how they talk about it.

The chilling effect is palpable. Fink won't say "ESG" anymore because, he says, it's been "weaponized." Asset managers are quieting down on ESG as part of a "greenhushing" trend. Some companies that made a big deal about their DEI efforts in 2020 are downsizing those, too . Data provided to me by FactSet, a financial-data company, shows that mentions of ESG and DEI in S&P 500 companies' quarterly earnings calls with analysts have taken a nosedive over the past few years. For the fourth quarter of 2020, 131 companies mentioned ESG, and 34 mentioned DEI or diversity and inclusion. For the fourth quarter of 2023, those numbers dropped to 28 and four.

While the backlash has certainly driven the quieting, in some cases companies are talking less about their social commitments because they got out over their skis on their pledges. Companies such as AIG, Amazon, and ExxonMobil have scaled back some of their climate initiatives.

"We saw a lot of companies make very bold commitments — we're going to be net-zero emissions by whatever date, 2040, 2050," Jones said. "And often those commitments came but there wasn't always the underlying work."

Alison Taylor, an associate professor at New York University's Stern School of Business who wrote the book "Higher Ground: How Business Can Do the Right Thing in a Turbulent World," told me that, in her view, corporate America's about-face isn't as abrupt as it seems. C-suites have become more Republican over the past decade, and in loudly proclaiming to be do-gooders, companies have also drawn attention to their political donations, which often don't align with their rhetoric. Additionally, the issues dominating political and social discussions are much thornier than they were in the recent past — speaking out against white supremacists in Charlottesville is a bit of a gimme, weighing in on the Israeli-Palestinian conflict is not.

"Now what we've got is the end of Roe v. Wade, and we've got the Middle East, and we've got issues where they're much, much more divisive and difficult," Taylor said.

Taylor, a longtime skeptic of CEO activism, isn't surprised the friendly-corporation-next-door schtick has gone awry, but it has clearly caught some employees unawares. Some corporations have encouraged the creation of employee resource groups, which organize people by social identities and beliefs and in some cases embolden them to push for change. Google workers have previously participated in walkouts and protests and kept their jobs . Many were bewildered to find that this time around, the company was no longer having it. Instead, it's firing those protesting and reminding everyone, "This is a business."

"A company is not a democracy, and so all these leaders wanted to imply it was a democracy when it suited them," Taylor said. "Now it doesn't suit them."

It's unclear whether this trend of companies trying to stick to straight business is a blip or a more permanent reversal. Bud Light and its parent company, Anheuser-Busch, have generally steered clear of anything that might be read as controversial since the Dylan Mulvaney debacle; their main message since then has been "We love America." Target told me it didn't have anything to share on its 2024 Pride plans yet, but it has publicly acknowledged it's likely to make some modifications.

A company is not a democracy, and so all these leaders wanted to imply it was a democracy when it suited them. Now it doesn't suit them.

Many of the people I spoke to for this story described executives as more on edge because of the election this year; come 2025, that may ease. The anti-woke crowd is extra fired up about certain issues right now, but that may not last — attention spans are short, and hot-button issues are constantly changing.

Still, companies' backing down on sustainability and diversity efforts, even temporarily, could prove short-sighted. Sure, you saved yourself a headache now, but in the long run, setting up a business to weather the climate crisis is a good bet. So is hiring diverse workers and appealing to new demographics. Despite the controversy last year, at the heart of Bud Light's campaign was an understandable business decision: It wants to appeal to a younger, more diverse consumer base.

Underlying this all is one central question: Just how "woke" are companies anyway?

Commitments to social responsibility are never far-reaching, said Kenneth Pucker, a former Timberland chief operating officer and current professor of practice at the Fletcher School at Tufts University. "It's always on the margins because the main goal of executives — the real responsibility, the way the structure of the system is organized, the way incentives work, the way the rules govern — is money making."

This may be a great un-wokening, but maybe corporate America was actually never that committed to the idea in the first place.

Emily Stewart is a senior correspondent at Business Insider, writing about business and the economy.

About Discourse Stories

Through our Discourse journalism, Business Insider seeks to explore and illuminate the day’s most fascinating issues and ideas. Our writers provide thought-provoking perspectives, informed by analysis, reporting, and expertise. Read more Discourse stories here .

Related stories

More from Economy

Most popular

- Main content

IMAGES

VIDEO

COMMENTS

From the Magazine (September-October 1992) These days, Unilever is often described as one of the foremost transnational companies. Yet our organization of diverse operations around the world is ...

100% of it will be sustainably sourced. Three main goals of 10 Year Sustainable plan. 1. Improving health and well-being of customers and consumers2. Reducing company's overall impact on environment 3. Enhancing livelihoods.

A Trans National Corporation (TNC) is a company that has operations (factories, offices, research and development, shops) in more than one country.Many TNCs are large and have well‐known brands. Often TNCs have their headquarters and areas of research, development and product innovation in the country they start in, and manufacturing and factories in other countries (often poorer ones to ...

Unilever—A Case Study. As one of the oldest and largest foreign multinationals doing business in the U.S., the history of Unilever's investment in the United States offers a unique opportunity to understand the significant problems encountered by foreign firms. Harvard Business School professor Geoffrey Jones has done extensive research on ...

Study with Quizlet and memorize flashcards containing terms like Unilever's operations in Nigeria started in 1923 with soap manufacturing using palm oil, It employs about 1500 people with the products are aimed at the growing Nigerian market, Unilever works with the local community to develop new products, encourages high standards of employment and environmental stewardship, uses palm oil ...

12. Q. What disease did Unilever lead an education campaign about in Kenya? A. HIV/AIDS. Study Unilever TNC Case Study flashcards from Sam Garcia's class online, or in Brainscape's iPhone or Android app. Learn faster with spaced repetition.

CASE STUDY - Tesco: Tesco is a major UK-based retailer, and used to be found within the UK only. However it has rapidly expanded and become the world's third largest retailer behind Walmart and Carrefour. It currently employs. around 500,000 people and operates in more than 14 countries around the world.

Study TNC Case Study 2- Unilever flashcards from Sam Garcia's class online, or in Brainscape's iPhone or Android app. Learn faster with spaced repetition.

Start studying Aspects of globalisation: A manufacturing TNC: Unilever (case study). Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Study TNC: Unilever flashcards from Guillaume Bastos Martin's class online, or in Brainscape's iPhone or Android app. Learn faster with spaced repetition. ... TNC: Unilever Flashcards Preview Case studies: Global Systems and Governance > TNC: Unilever > Flashcards

The GI team, composed of experts from The Dow Chemical Company, Shell, Swiss Re, and Unilever, working with The Nature Conservancy and an academic resiliency expert, evaluated a number of business case studies from their respective organizations and from literature where GI solutions have been or may be implemented.

Nigeria has the highest GDP for Africa, and has the 27th largest economy in the world (larger than Norway, Greece and the UAE) Nigeria has a large supply of oil, which they sell to the world. Countries that supply oil have large political influence over those who don't. Nigeria has the 7th largest population in the world, with 200 million ...

Many transnational corporations close trans-national corporation (TNC) A company that operates in many different countries. (TNCs) have set up factories and offices in India. The country is an ...

Unilever Case Study. 360° - the Business Transformation Journal No. 11 | August 2014. CASE STUDY. 77. the use of cloud capabilities to innovat e . at speed a nd to utilize and b ene t from all .

8. Unilever - a TNC Plus case studies from agriculture types presentations - Extensive commercial pastoralism in the Pampas, Irrigation agriculture in the Nile Valley, Intensive subsistence farming in the Ganges Valley Intensive commercial mixed agriculture in the Netherlands Cold environments Rivers and management 1.

Now, I realise that everyone, in my class atleast, did a different TNC case study as a research class, on top of the notes we made on Wal-Mart after watching that documentary, but a few people have asked me to write about a couple of notes on some TNCs - as well as Wal-Mart I have chosen Rio Tinto (that is the one my group did) and Unilever as ...

Earlier this year, experts from The Dow Chemical Company, Shell, Swiss Re, and Unilever, working with The Nature Conservancy and a resiliency expert, evaluated a number of business case studies, and developed a white paper with recommendations that green and hybrid infrastructure solutions should become part of the standard toolkit for modern engineers.

Age range: 14-16. Resource type: Lesson (complete) File previews. pptx, 256.09 KB. pptx, 1.08 MB. Whole Geography GCSE Lesson- Changing Economic World- NEE- Nigeria Case study. Identifies advantages and disadvantages of TNCs. Video embedded with a worksheet to collect information on Shell in Nigeria. Homework research task on Unilever in Nigeria.

Unilever employs 16 000 people in India. More companies mean a greater income for India. Unilever has annual sales of over $4.5 billion. ... Nigeria Case Study - TNC's. 1.0 / 5 based on 1 rating. Economic Development Case Study - India. 4.5 / 5 based on 3 ratings. Hazards Case Studies notes. 0.0 / 5. Geography Y11 Flashcards. 0.0 / 5 ...

Current page: Case Studies. Case Studies. Real-life and hypothetical case studies to demonstrate how our leading-edge safety and environmental sustainability science capabilities are applied. ... Get in touch with Unilever PLC and specialist teams in our headquarters, or find contacts around the world. Contact us . Cookie Notice;

Case Study of a TNC: Coca Cola . About. Coca-Cola is a carbonated soft drink sold in the stores, restaurants, and vending machines of more than 200 countries. It is the number one manufacturer of soft drinks in the world. Their headquarters is situated in Atlanta Georgia, USA. It is probably the best known brand symbol in the world.

2nd Edition • ISBN: 9781464113079 David G Myers. 901 solutions. 1 / 2. Study with Quizlet and memorize flashcards containing terms like Unilever, Coca Cola, UN fishing and Whaling Summary and more.

Hindustan Unilever Limited (HUL) is a British-Dutch assembling organization headquartered in Mumbai, India. The items of Hindustan Unilever Ltd incorporate nourishments, drinks, cleaning specialists, individual consideration items, water purifiers, and purchaser merchandise. HUL was set up in 1933 as Lever Brothers and following the merger of ...

Emily Stewart. May 9, 2024, 2:57 AM PDT. Unilever spent years crafting its image as a corporate goody-two-shoes. The owner of Dove, Vaseline, Hellmann's, and a bunch of other brands axed quarterly ...