[Rev. 1/25/2023 8:12:52 AM--2022R1]

CHAPTER 107 - DEEDS OF TRUST

GENERAL PROVISIONS

NRS 107.015 Definitions.

NRS 107.020 Transfers in trust of real property to secure obligations.

NRS 107.025 Estate for years: Encumbrance by deed of trust; foreclosure by exercise of power of sale.

NRS 107.026 Priority of certain deeds of trust over other liens.

NRS 107.027 Lease of unit of cooperative: Ownership interest and votes in cooperative association appurtenant to proprietary lease; encumbrances.

NRS 107.028 Trustees: Qualifications; limitations on powers; appointment of new trustee; duties; immunity from liability for certain good faith errors; damages in certain civil actions.

NRS 107.029 Trustees: Declaration of nonmonetary status; objection to declaration.

ADOPTION OF COVENANTS

NRS 107.030 Adoption of covenants by reference.

NRS 107.040 Adoption of covenants by reference in instrument.

NRS 107.050 Parties may enter into different or additional covenants.

ASSUMPTION FEE

NRS 107.055 Amount must be stated in instrument.

ASSIGNMENTS; SUBORDINATION AND WAIVERS AS TO PRIORITY

NRS 107.070 Recording of assignments of beneficial interests and instruments subordinating or waiving priority of deeds of trust.

NRS 107.071 Request by grantor of deed of trust for certified copy of note, deed of trust and assignments.

NRS 107.073 Marginal entries; reconveyance must be recorded if deed of trust recorded by photographic process; presentation of certificate executed by trustee or trustee’s personal representative or assignee.

NRS 107.077 Delivery of documents by beneficiary to trustee; recording by trustee; liability for failure to deliver or record documents; requirements for release of deed of trust when reconveyance not recorded; liability for improperly recording deed of trust; criminal penalty.

NRS 107.078 Partial discharge: Delivery of documents by beneficiary to trustee; recording by trustee; liability for failure to deliver or record documents; requirements for partial release of deed of trust when reconveyance not recorded; criminal penalty.

NRS 107.079 Reconveyance when beneficiary cannot be located or refuses to execute and deliver request for reconveyance; recording of surety bond and declaration required in certain circumstances; fees; liability of trustee for reconveyance; remedy.

DEFAULT AND SALE

NRS 107.0795 “Abandoned residential property” defined. [Expired by limitation.]

NRS 107.080 Trustee’s power of sale: Power conferred; required notices; effect of sale; circumstances in which sale must be declared void; civil actions for noncompliance with certain requirements; duty to post; duty to record; fees.

NRS 107.0805 Trustee’s power of sale: Requirements and conditions; contents of notarized affidavits; circumstances in which sale must be declared void.

NRS 107.081 Time and place of sale; agent holding sale not to be purchaser.

NRS 107.082 Oral postponement of sale.

NRS 107.083 Proceedings after purchaser refuses to pay amount bid.

NRS 107.084 Penalty for removing or defacing notice of sale.

NRS 107.085 Restrictions on trustee’s power of sale concerning certain deeds of trust: Applicability; service of notice; scheduling of date of sale; form of notice; judicial foreclosure not prohibited; “unfair lending practice” defined.

NRS 107.086 Additional requirements for sale of owner-occupied housing: Notice; form; petition for mediation; election to waive mediation; adoption of rules concerning mediation; applicability.

NRS 107.0865 Mediation to negotiate loan modification.

NRS 107.087 Notice of default and election to sell in residential foreclosure: Requirements.

NRS 107.090 Request for notice of default and sale: Recording and contents; mailing of notice; request by association; effect of request.

NRS 107.095 Notice of default: Mailing to guarantor or surety of debt; effect of failure to give.

NRS 107.100 Receiver: Appointment after filing notice of breach and election to sell.

NRS 107.120 Board of county commissioners or governing body of incorporated city may establish by ordinance registry of abandoned residential property. [Expired by limitation.]

NRS 107.130 Expedited procedure for exercise of trustee’s power of sale involving abandoned residential property; inspection of real property to determine abandonment; required notice, certification and affidavit; civil penalty for noncompliance with certain requirements. [Expired by limitation.]

NRS 107.140 Sale in lieu of foreclosure sale: Limitations.

STATEMENT FROM BENEFICIARY OF DEED OF TRUST

NRS 107.200 Contents of statement regarding debt secured by deed of trust.

NRS 107.210 Contents of statement of amount necessary to discharge debt secured by deed of trust.

NRS 107.220 Persons authorized to request statement from beneficiary; proof of identity of successor in interest.

NRS 107.230 Proof of authorization to request statement.

NRS 107.240 Grounds for refusal to deliver statement.

NRS 107.250 Reliance upon accuracy of statement and amended statement; notification of amended statement; recovery of money by beneficiary if statement is deficient.

NRS 107.260 Copy of note or deed of trust for authorized requester.

NRS 107.270 Address to which request for statement must be mailed.

NRS 107.280 Debt to which information contained in statement is applicable.

NRS 107.290 Unclear request for statement deemed to be request for amount necessary to discharge debt.

NRS 107.300 Penalty for failure to deliver statement; bar to recovery of certain damages.

NRS 107.310 Fee for furnishing statement.

NRS 107.311 Applicability of NRS 107.310 .

ADDITIONAL REQUIREMENTS FOR FORECLOSURE OF OWNER-OCCUPIED HOUSING SECURING RESIDENTIAL MORTGAGE LOAN

NRS 107.400 Definitions.

NRS 107.410 “Borrower” defined.

NRS 107.420 “Foreclosure prevention alternative” defined.

NRS 107.430 “Foreclosure sale” defined.

NRS 107.440 “Mortgage servicer” defined.

NRS 107.450 “Residential mortgage loan” defined.

NRS 107.460 Applicability.

NRS 107.470 Right of borrower to pursue more than one foreclosure prevention alternative.

NRS 107.480 Restrictions on trustee’s power of sale and civil actions for foreclosure sales.

NRS 107.490 Duties of mortgage servicer.

NRS 107.500 Requirements before recording of notice of default and election to sell or commencing civil action for foreclosure sale: Notice; contents.

NRS 107.510 Recording of notice of default and election to sell or commencing civil action for foreclosure sale prohibited in certain circumstances; mortgage servicer required to contact borrower; exceptions.

NRS 107.520 Application for foreclosure prevention alternative; acknowledgment of receipt required; contents of acknowledgment; deficiencies in application.

NRS 107.530 Effect of submitting application for foreclosure prevention alternative; offer, acceptance and rejection of foreclosure prevention alternative; denial of application; appeal; fees prohibited.

NRS 107.540 Single point of contact required to be established by mortgage servicer for foreclosure prevention alternative; responsibilities.

NRS 107.550 Dismissal of civil action for foreclosure sale, rescission of notice of default and election to sell or notice of sale and cancellation of pending foreclosure sale required in certain circumstances; effect on mortgagee or beneficiary of deed of trust.

NRS 107.560 Injunctive relief for violation; civil action to recover economic damages; award of costs and attorney’s fees to prevailing party.

NRS 107.015 Definitions. As used in this chapter:

1. “Association” and “unit-owners’ association” have the meanings ascribed to them in NRS 116.011 .

2. “Beneficiary” means the beneficiary of the deed of trust or the successor in interest of the beneficiary or any person designated or authorized to act on behalf of the beneficiary or its successor in interest.

3. “Cooperative” has the meaning ascribed to it in NRS 116.031 .

4. “Facsimile machine” means a device which receives and copies a reproduction or facsimile of a document or photograph which is transmitted electronically or telephonically by telecommunications lines.

5. “Noncommercial lender” means a lender which makes a loan secured by a deed of trust on owner-occupied housing and which is not a bank, financial institution or other entity regulated pursuant to title 55 of NRS.

6. “Owner-occupied housing” means housing that is occupied by an owner as the owner’s primary residence. The term does not include vacant land or any time share or other property regulated under chapter 119A of NRS.

7. “Person with an interest” means any person who has or claims any right, title or interest in, or lien or charge upon, the real property described in a deed of trust, as evidenced by any document or instrument recorded in the office of the county recorder of the county in which any part of the real property is situated.

8. “Proprietary lease” has the meaning ascribed to it in NRS 116.077 .

9. “Residential foreclosure” means the sale of a single-family residence under a power of sale granted by NRS 107.0805 .

10. “Sale in lieu of a foreclosure sale” has the meaning ascribed to it in NRS 40.429 .

11. “Single-family residence” means a structure that is comprised of not more than four units. The term does not include vacant land or any time share or other property regulated under chapter 119A of NRS.

12. “Surety” means a corporation authorized to transact surety business in this State pursuant to NRS 679A.030 that:

(a) Is included in the United States Department of the Treasury’s Listing of Approved Sureties; and

(b) Issues a surety bond pursuant to this section that does not exceed the underwriting limitations established for that surety by the United States Department of the Treasury.

13. “Surety bond” means a bond issued by a surety for the reconveyance of a deed of trust pursuant to this section.

14. “Title insurer” has the meaning ascribed to it in NRS 692A.070 .

15. “Trustee” means the trustee of record.

16. “Unit” has the meaning ascribed to it in NRS 116.093 .

(Added to NRS by 1995, 1518 ; A 2019, 1344 )

NRS 107.020 Transfers in trust of real property to secure obligations. Transfers in trust of any estate in real property may be made after March 29, 1927, to secure the performance of an obligation or the payment of any debt.

[Part 1:173:1927; A 1949, 70 ; 1943 NCL § 7710]

NRS 107.025 Estate for years: Encumbrance by deed of trust; foreclosure by exercise of power of sale. A deed of trust may encumber an estate for years however created, including a proprietary lease in a cooperative, unless prohibited by the instrument creating the estate, and foreclosure may be had by the exercise of a power of sale in accordance with the provisions of this chapter.

(Added to NRS by 1967, 954 ; A 1979, 708 ; 1989, 506 ; 2019, 1344 )

NRS 107.026 Priority of certain deeds of trust over other liens. Except as otherwise provided in NRS 104.9335 , a deed of trust given to secure a loan made to purchase the real property on which the deed of trust is given has priority over all other liens created against the purchaser before the purchaser acquires title to the real property.

(Added to NRS by 1995, 1522 ; A 1999, 387 )

NRS 107.027 Lease of unit of cooperative: Ownership interest and votes in cooperative association appurtenant to proprietary lease; encumbrances.

1. The ownership interest and votes in the cooperative association entitling the unit’s owner to lease a unit in a cooperative are appurtenant to the proprietary lease. Any security interest in or lien on the proprietary lease encumbers the ownership interest and votes in the cooperative association whether or not the instrument creating the interest or lien expressly includes such interests and votes.

2. No security interest in or lien on the ownership interest or votes in a cooperative association is effective unless the instrument which purports to create the interest or lien encumbers the proprietary lease to which the ownership interest and votes pertain.

(Added to NRS by 1979, 708 ; A 2019, 1345 )

NRS 107.028 Trustees: Qualifications; limitations on powers; appointment of new trustee; duties; immunity from liability for certain good faith errors; damages in certain civil actions.

1. Except as otherwise provided in subsection 4, the trustee under a deed of trust must be:

(a) An attorney licensed to practice law in this State;

(b) A title insurer or title agent authorized to do business in this State pursuant to chapter 692A of NRS;

(c) A person licensed pursuant to chapter 669 of NRS;

(d) A domestic or foreign entity which holds a current state business license issued by the Secretary of State pursuant to chapter 76 of NRS;

(e) A person who does business under the laws of this State, the United States or another state relating to banks, savings banks, savings and loan associations or thrift companies;

(f) A person who is appointed as a fiduciary pursuant to NRS 662.245 ;

(g) A person who acts as a registered agent for a domestic or foreign corporation, limited-liability company, limited partnership or limited-liability partnership;

(h) A person who acts as a trustee of a trust holding real property for the primary purpose of facilitating any transaction with respect to real estate if he or she is not regularly engaged in the business of acting as a trustee for such trusts;

(i) A person who engages in the business of a collection agency pursuant to chapter 649 of NRS; or

(j) A person who engages in the business of an escrow agency, escrow agent or escrow officer pursuant to the provisions of chapter 645A or 692A of NRS.

2. A trustee under a deed of trust must not be the beneficiary of the deed of trust for the purposes of exercising the power of sale pursuant to NRS 107.080 .

3. A trustee under a deed of trust must not:

(a) Lend its name or its corporate capacity to any person who is not qualified to be the trustee under a deed of trust pursuant to subsection 1.

(b) Act individually or in concert with any other person to circumvent the requirements of subsection 1.

4. A beneficiary of record may:

(a) Replace its trustee with another trustee; or

(b) Substitute as trustee only for the purposes of executing a substitution of trustee and a full or partial reconveyance of a deed of trust.

5. The appointment of a new trustee is not effective until the substitution of trustee is recorded in the office of the recorder of the county in which the real property is located.

6. The trustee does not have a fiduciary obligation to the grantor or any other person having an interest in the property which is subject to the deed of trust. The trustee shall act impartially and in good faith with respect to the deed of trust and shall act in accordance with the laws of this State. A rebuttable presumption that a trustee has acted impartially and in good faith exists if the trustee acts in compliance with the provisions of NRS 107.080 . In performing acts required by NRS 107.080 , the trustee incurs no liability for any good faith error resulting from reliance on information provided by the beneficiary regarding the nature and the amount of the default under the obligation secured by the deed of trust if the trustee corrects the good faith error not later than 20 days after discovering the error.

7. If, in an action brought by a grantor, a person who holds title of record or a beneficiary in the district court in and for the county in which the real property is located, the court finds that the trustee did not comply with this section, any other provision of this chapter or any applicable provision of chapter 106 or 205 of NRS, the court must award to the grantor, the person who holds title of record or the beneficiary:

(a) Damages of $5,000 or treble the amount of actual damages, whichever is greater;

(b) An injunction enjoining the exercise of the power of sale until the beneficiary, the successor in interest of the beneficiary or the trustee complies with the requirements of subsections 2, 3 and 4; and

(c) Reasonable attorney’s fees and costs,

Ê unless the court finds good cause for a different award.

(Added to NRS by 2011, 329 ; A 2011, 1746 , 1748 ; 2015, 1613 )

NRS 107.029 Trustees: Declaration of nonmonetary status; objection to declaration.

1. If the trustee under a deed of trust is named in an action in which the deed of trust is the subject and the trustee has a reasonable belief that he or she has been named in the action solely in his or her capacity as trustee and not as a result of any wrongful act or omission made in the performance of his or her duties as trustee, the trustee may, at any time, file a declaration of nonmonetary status. The declaration must be served on the parties in the manner prescribed by Rule 5 of the Nevada Rules of Civil Procedure and must include:

(a) The status of the trustee as trustee under the deed of trust; and

(b) The basis for the trustee’s reasonable belief that he or she has been named as a defendant in the action solely in his or her capacity as trustee and not as a result of any wrongful act or omission made in the performance of his or her duties as trustee.

2. Upon the filing of a declaration of nonmonetary status pursuant to subsection 1, the time in which the trustee is required to file an answer or any other responsive pleading is tolled until notice is given of an order granting an objection to the declaration of nonmonetary status, from which date the trustee has 30 days to file an answer or any other responsive pleading to the complaint.

3. Any party that has appeared in an action described in subsection 1 has 15 days after the date of service of the declaration of nonmonetary status to file an objection. Any objection filed pursuant to this subsection must set forth the factual basis on which the objection is based and must be served on the trustee.

4. If a timely objection is made pursuant to subsection 3, the court shall promptly examine the declaration of nonmonetary status and the objection and shall issue an order as to the validity of the objection. If the court determines the objection is valid, the trustee is required to participate in the action.

5. If no objection is raised within the 15-day period pursuant to subsection 3 or if the court determines the objection is invalid, the trustee is not required to participate any further in the action and is not subject to any money damages or attorney’s fees or costs, except that the trustee is required to respond to any discovery request as a nonparty participant and is bound by any court order relating to the deed of trust.

6. If, at any time during the proceedings under this section, the parties to the action acquire newly discovered evidence indicating the trustee should be made a participant in the action as a result of the trustee’s performance of his or her duties as trustee, the parties may file a motion to amend the pleadings pursuant to Rule 15 of the Nevada Rules of Civil Procedure.

7. For the purposes of this section, “trustee” includes any agent or employee of the trustee who performs some or all the duties of a trustee under this chapter and includes substitute trustees and agents of the beneficiary or trustee.

(Added to NRS by 2015, 1612 )

NRS 107.030 Adoption of covenants by reference. Every deed of trust made after March 29, 1927, may adopt by reference all or any of the following covenants, agreements, obligations, rights and remedies:

1. Covenant No . 1. That grantor agrees to pay and discharge at maturity all taxes and assessments and all other charges and encumbrances which now are or shall hereafter be, or appear to be, a lien upon the premises, or any part thereof; and that grantor will pay all interest or installments due on any prior encumbrance, and that in default thereof, beneficiary may, without demand or notice, pay the same, and beneficiary shall be sole judge of the legality or validity of such taxes, assessments, charges or encumbrances, and the amount necessary to be paid in satisfaction or discharge thereof.

2. Covenant No. 2. That the grantor will at all times keep the buildings and improvements which are now or shall hereafter be erected upon the premises insured against loss or damage by fire, to the amount of at least $........, by some insurance company or companies approved by beneficiary, the policies for which insurance shall be made payable, in case of loss, to beneficiary, and shall be delivered to and held by the beneficiary as further security; and that in default thereof, beneficiary may procure such insurance, not exceeding the amount aforesaid, to be effected either upon the interest of trustee or upon the interest of grantor, or his or her assigns, and in their names, loss, if any, being made payable to beneficiary, and may pay and expend for premiums for such insurance such sums of money as the beneficiary may deem necessary.

3. Covenant No . 3. That if, during the existence of the trust, there be commenced or pending any suit or action affecting the premises, or any part thereof, or the title thereto, or if any adverse claim for or against the premises, or any part thereof, be made or asserted, the trustee or beneficiary may appear or intervene in the suit or action and retain counsel therein and defend same, or otherwise take such action therein as they may be advised, and may settle or compromise same or the adverse claim; and in that behalf and for any of the purposes may pay and expend such sums of money as the trustee or beneficiary may deem to be necessary.

4. Covenant No. 4. That the grantor will pay to trustee and to beneficiary respectively, on demand, the amounts of all sums of money which they shall respectively pay or expend pursuant to the provisions of the implied covenants of this section, or any of them, together with interest upon each of the amounts, until paid, from the time of payment thereof, at the rate of ................ percent per annum.

5. Covenant No. 5. That in case grantor shall well and truly perform the obligation or pay or cause to be paid at maturity the debt or promissory note, and all moneys agreed to be paid, and interest thereon for the security of which the transfer is made, and also the reasonable expenses of the trust in this section specified, then the trustee, its successors or assigns, shall reconvey to the grantor all the estate in the premises conveyed to the trustee by the grantor. Any part of the trust property may be reconveyed at the request of the beneficiary.

6. Covenant No. 6. That if default be made in the performance of the obligation, or in the payment of the debt, or interest thereon, or any part thereof, or in the payment of any of the other moneys agreed to be paid, or of any interest thereon, or if any of the conditions or covenants in this section adopted by reference be violated, and if the notice of breach and election to sell, required by this chapter, be first recorded, then trustee, its successors or assigns, on demand by beneficiary, or assigns, shall sell the above-granted premises, or such part thereof as in its discretion it shall find necessary to sell, in order to accomplish the objects of these trusts, in the manner following, namely:

The trustee shall first give notice of the time and place of such sale, in the manner provided in NRS 107.080 and may postpone such sale not more than three times by proclamation made to the persons assembled at the time and place previously appointed and advertised for such sale, and on the day of sale so advertised, or to which such sale may have been postponed, the trustee may sell the property so advertised, or any portion thereof, at public auction, at the time and place specified in the notice, at a public location in the county in which the property, or any part thereof, to be sold, is situated, to the highest cash bidder. The beneficiary, obligee, creditor, or the holder or holders of the promissory note or notes secured thereby may bid and purchase at such sale. The beneficiary may, after recording the notice of breach and election, waive or withdraw the same or any proceedings thereunder, and shall thereupon be restored to the beneficiary’s former position and have and enjoy the same rights as though such notice had not been recorded.

7. Covenant No. 7. That the trustee, upon such sale, shall make (without warranty), execute and, after due payment made, deliver to purchaser or purchasers, his, her or their heirs or assigns, a deed or deeds of the premises so sold which shall convey to the purchaser all the title of the grantor in the premises, and shall apply the proceeds of the sale thereof in payment, firstly, of the expenses of such sale, together with the reasonable expenses of the trust, including counsel fees, in an amount equal to ................ percent of the amount secured thereby and remaining unpaid or reasonable counsel fees and costs actually incurred, which shall become due upon any default made by grantor in any of the payments aforesaid; and also such sums, if any, as trustee or beneficiary shall have paid, for procuring a search of the title to the premises, or any part thereof, subsequent to the execution of the deed of trust; and in payment, secondly, of the obligation or debts secured, and interest thereon then remaining unpaid, and the amount of all other moneys with interest thereon herein agreed or provided to be paid by grantor; and the balance or surplus of such proceeds of sale it shall pay to grantor, his or her heirs, executors, administrators or assigns.

8. Covenant No. 8. That in the event of a sale of the premises, or any part thereof, and the execution of a deed or deeds therefor under such trust, the recital therein of default, and of recording notice of breach and election of sale, and of the elapsing of the 3-month period, and of the giving of notice of sale, and of a demand by beneficiary, his or her heirs or assigns, that such sale should be made, shall be conclusive proof of such default, recording, election, elapsing of time, and of the due giving of such notice, and that the sale was regularly and validly made on due and proper demand by beneficiary, his or her heirs and assigns; and any such deed or deeds with such recitals therein shall be effectual and conclusive against grantor, his or her heirs and assigns, and all other persons; and the receipt for the purchase money recited or contained in any deed executed to the purchaser as aforesaid shall be sufficient discharge to such purchaser from all obligation to see to the proper application of the purchase money, according to the trusts aforesaid.

9. Covenant No. 9. That the beneficiary or his or her assigns may, from time to time, appoint another trustee, or trustees, to execute the trust created by the deed of trust. An instrument executed and acknowledged by the beneficiary is conclusive proof of the proper appointment of such substituted trustee. Upon the recording of such executed and acknowledged instrument, the new trustee or trustees shall be vested with all the title, interest, powers, duties and trusts in the premises vested in or conferred upon the original trustee. If there be more than one trustee, either may act alone and execute the trusts upon the request of the beneficiary, and all of the trustee’s acts thereunder shall be deemed to be the acts of all trustees, and the recital in any conveyance executed by such sole trustee of such request shall be conclusive evidence thereof, and of the authority of such sole trustee to act.

[2:173:1927; NCL § 7711]—(NRS A 1967, 143 ; 2005, 1621 ; 2013, 1013 ; 2019, 1345 ; 2021, 1416 )

NRS 107.040 Adoption of covenants by reference in instrument.

1. In order to adopt by reference any of the covenants, agreements, obligations, rights and remedies in NRS 107.030 , it shall only be necessary to state in the deed of trust the following: “The following covenants, Nos. ................, ................ and ................ (inserting the respective numbers) of NRS 107.030 are hereby adopted and made a part of this deed of trust.”

2. A deed of trust, in order to fix the amount of insurance to be carried, need not reincorporate the provisions of Covenant No. 2 of NRS 107.030 , but may merely state the following: “Covenant No. 2,” and set out thereafter the amount of insurance to be carried or, if no amount is set out, the amount must be the full replacement value of the buildings and improvements which are now or shall hereafter be erected upon the premises.

3. In order to fix the rate of interest under Covenant No. 4 of NRS 107.030 , it shall only be necessary to state in such deed of trust the following: “Covenant No. 4,” and set out thereafter the rate of interest to be charged thereunder or, if no rate of interest is set out, the rate of interest must be at the highest applicable rate set forth in the note secured by such deed of trust.

4. In order to fix the amount or percent of counsel fees under Covenant No. 7 of NRS 107.030 , it shall only be necessary to state in such deed of trust, the following: “Covenant No. 7,” and set out thereafter the percentage to be allowed or, if no percentage is set out, the amount to be allowed must be reasonable counsel fees and costs actually incurred.

[3:173:1927; NCL § 7712] + [4:173:1927; NCL § 7713]—(NRS A 2013, 1015 ; 2019, 1347 )

NRS 107.050 Parties may enter into different or additional covenants. Nothing in NRS 107.030 and 107.040 shall prevent the parties to any deed of trust from entering into other, different or additional covenants or agreements than those set out in NRS 107.030 .

[5:173:1927; NCL § 7714]—(NRS A 2019, 1348 )

NRS 107.055 Amount must be stated in instrument. If a party to a deed of trust, executed after July 1, 1971, desires to charge an assumption fee for a change in parties, the amount of such charge must be clearly set forth in the deed of trust at the time of execution. Without limiting or prohibiting any other method by which the amount of the charge may be clearly set forth in the deed of trust, the charge may be set forth as:

1. A fixed sum;

2. A percentage of the amount secured by the deed of trust and remaining unpaid at the time of assumption; or

3. The lesser of, the greater of or some combination of the amounts determined by subsections 1 and 2.

(Added to NRS by 1971, 314 ; A 2013, 1015 )

NRS 107.070 Recording of assignments of beneficial interests and instruments subordinating or waiving priority of deeds of trust. The provisions of NRS 106.210 and 106.220 apply to deeds of trust as therein specified.

[Part 1:120:1935; 1931 NCL § 2122.31]—(NRS A 1965, 926 )

NRS 107.071 Request by grantor of deed of trust for certified copy of note, deed of trust and assignments.

1. A grantor of a deed of trust may submit a written request to the servicer of the deed of trust for a certified copy of the note, the deed of trust and all assignments of the note and deed of trust if:

(a) The real property subject to the deed of trust is a single-family dwelling;

(b) The grantor is the owner of record of the real property;

(c) The grantor currently occupies the real property as his or her principal residence; and

(d) The servicer or beneficiary of the deed of trust is a banking or financial institution or any other business entity that is licensed, registered or otherwise authorized to do business in this State.

2. Not more than 10 days after receipt of a written request pursuant to subsection 1, the servicer of the deed of trust shall provide to the grantor the identity, address and any other contact information of the current owner or assignee of the note and deed of trust.

3. If the servicer of the deed of trust does not provide a certified copy of each document requested pursuant to subsection 1 within 30 days after receipt of the request, or if the documents provided by the servicer indicate that the beneficiary of the deed of trust does not have a recorded interest in or lien on the real property which is subject to the deed of trust:

(a) The grantor of the deed of trust may report the servicer and the beneficiary of the deed of trust to the Division of Mortgage Lending or the Division of Financial Institutions of the Department of Business and Industry, whichever is appropriate; and

(b) The appropriate division may take whatever actions it deems necessary and proper, including, without limitation, enforcing any applicable laws or regulations or adopting any additional regulations.

4. As used in this section, “banking or financial institution” has the meaning ascribed to it in NRS 106.295 .

(Added to NRS by 2013, 2774 )

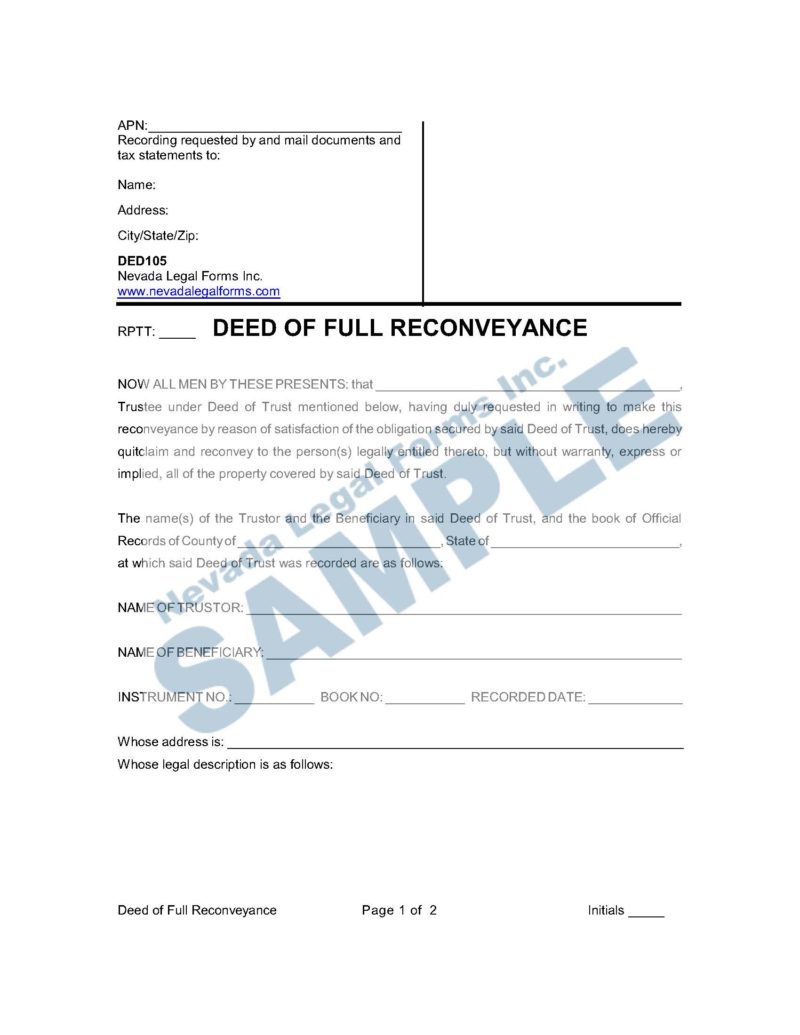

NRS 107.073 Marginal entries; reconveyance must be recorded if deed of trust recorded by photographic process; presentation of certificate executed by trustee or trustee’s personal representative or assignee.

1. Except as otherwise provided in subsection 2, a recorded deed of trust may be discharged by an entry on the margin of the record thereof, signed by the trustee or the trustee’s personal representative or assignee in the presence of the recorder or the recorder’s deputy, acknowledging the satisfaction of or value received for the deed of trust and the debt secured thereby. The recorder or the recorder’s deputy shall subscribe the entry as witness. The entry has the same effect as a reconveyance of the deed of trust acknowledged and recorded as provided by law. The recorder shall properly index each marginal discharge.

2. If the deed of trust has been recorded by a microfilm or other photographic process, a marginal release may not be used and an acknowledged reconveyance of the deed of trust must be recorded.

3. If the recorder or the recorder’s deputy is presented with a certificate executed by the trustee or the trustee’s personal representative or assignee, specifying that the deed of trust has been paid or otherwise satisfied or discharged, the recorder or the recorder’s deputy shall discharge the deed of trust upon the record.

(Added to NRS by 1991, 1103 ; A 1993, 2335 )

NRS 107.077 Delivery of documents by beneficiary to trustee; recording by trustee; liability for failure to deliver or record documents; requirements for release of deed of trust when reconveyance not recorded; liability for improperly recording deed of trust; criminal penalty.

1. Within 21 calendar days after receiving written notice that a debt secured by a deed of trust made on or after October 1, 1991, has been paid or otherwise satisfied or discharged, the beneficiary shall deliver to the trustee or the trustor the original note and deed of trust, if the beneficiary is in possession of those documents, and a properly executed request to reconvey the estate in real property conveyed to the trustee by the grantor. If the beneficiary delivers the original note and deed of trust to the trustee or the trustee has those documents in his or her possession, the trustee shall deliver those documents to the grantor.

2. Within 45 calendar days after a debt secured by a deed of trust made on or after October 1, 1991, is paid or otherwise satisfied or discharged, and a properly executed request to reconvey is received by the trustee, the trustee shall cause to be recorded a reconveyance of the deed of trust.

3. If the beneficiary fails to deliver to the trustee a properly executed request to reconvey pursuant to subsection 1, or if the trustee fails to cause to be recorded a reconveyance of the deed of trust pursuant to subsection 2, the beneficiary or the trustee, as the case may be, is liable in a civil action to the grantor, his or her heirs or assigns in the sum of $1,000, plus reasonable attorney’s fees and the costs of bringing the action, and the beneficiary or the trustee is liable in a civil action to any party to the deed of trust for any actual damages caused by the failure to comply with the provisions of this section and for reasonable attorney’s fees and the costs of bringing the action.

4. Except as otherwise provided in this subsection, if a reconveyance is not recorded pursuant to subsection 2 within:

(a) Seventy-five calendar days after the payment, satisfaction or discharge of the debt, if the payment, satisfaction or discharge was made on or after October 1, 1993; or

(b) Ninety calendar days after the payment, satisfaction or discharge of the debt, if the payment, satisfaction or discharge was made before October 1, 1993,

Ê a title insurer may prepare and cause to be recorded a release of the deed of trust. At least 30 calendar days before the recording of a release pursuant to this subsection, the title insurer shall mail, by first-class mail, postage prepaid, notice of the intention to record the release of the deed of trust to the trustee, trustor and beneficiary of record, or their successors in interest, at the last known address of each such person. A release prepared and recorded pursuant to this subsection shall be deemed a reconveyance of a deed of trust. The title insurer shall not cause a release to be recorded pursuant to this subsection if the title insurer receives written instructions to the contrary from the trustee, the trustor, the owner of the land, the holder of the escrow or the owner of the debt secured by the deed of trust or his or her agent.

5. The release prepared pursuant to subsection 4 must set forth:

(a) The name of the beneficiary;

(b) The name of the trustor;

(c) The recording reference to the deed of trust;

(d) A statement that the debt secured by the deed of trust has been paid in full or otherwise satisfied or discharged;

(e) The date and amount of payment or other satisfaction or discharge; and

(f) The name and address of the title insurer issuing the release.

6. A release prepared and recorded pursuant to subsection 4 does not relieve a beneficiary or trustee of the requirements imposed by subsections 1 and 2.

7. A trustee may charge a reasonable fee to the trustor or the owner of the land for services relating to the preparation, execution or recordation of a reconveyance or release pursuant to this section. A trustee shall not require the fees to be paid before the opening of an escrow, or earlier than 60 calendar days before the payment, satisfaction or discharge of the debt secured by the deed of trust. If a fee charged pursuant to this subsection does not exceed $100, the fee is conclusively presumed to be reasonable.

8. In addition to any other remedy provided by law, a title insurer who improperly causes to be recorded a release of a deed of trust pursuant to this section is liable for actual damages and for a reasonable attorney’s fee and the costs of bringing the action to any person who is injured because of the improper recordation of the release.

9. Any person who willfully violates this section is guilty of a misdemeanor.

(Added to NRS by 1991, 1103 ; A 1993, 2336 ; 1995, 1522 ; 1999, 57 ; 2011, 330 , 1748 )

NRS 107.078 Partial discharge: Delivery of documents by beneficiary to trustee; recording by trustee; liability for failure to deliver or record documents; requirements for partial release of deed of trust when reconveyance not recorded; criminal penalty.

1. If a deed of trust made on or after October 1, 1995, authorizes the grantor to discharge in part the debt secured by the deed of trust and the deed of trust authorizes a partial reconveyance of the estate in real property in consideration of a partial discharge, the beneficiary shall, within 21 calendar days after receiving notice that the debt secured by the deed of trust has been partially discharged, deliver to the trustee a properly executed request for a partial reconveyance of the estate in real property conveyed to the trustee by the grantor.

2. Within 45 calendar days after a debt secured by a deed of trust made on or after October 1, 1995, is partially discharged and a properly executed request for a partial reconveyance is received by the trustee, the trustee shall cause to be recorded a partial reconveyance of the deed of trust.

3. If the beneficiary fails to deliver to the trustee a properly executed request for a partial reconveyance pursuant to subsection 1, or if the trustee fails to cause to be recorded a partial reconveyance of the deed of trust pursuant to subsection 2, the beneficiary or the trustee, as the case may be, is liable in a civil action to the grantor, the grantor’s heirs or assigns in the amount of $1,000, plus reasonable attorney’s fees and the costs of bringing the action, and the beneficiary or trustee is liable in a civil action to any party to the deed of trust for any actual damages caused by the failure to comply with the provisions of this section and for reasonable attorney’s fees and the costs of bringing the action.

4. Except as otherwise provided in this subsection, if a partial reconveyance is not recorded pursuant to subsection 2 within 75 calendar days after the partial satisfaction of the debt and if the satisfaction was made on or after October 1, 1995, a title insurer may prepare and cause to be recorded a partial release of the deed of trust. At least 30 calendar days before the recording of a partial release pursuant to this subsection, the title insurer shall mail, by first-class mail, postage prepaid, notice of the intention to record the partial release of the deed of trust to the trustee, trustor and beneficiary of record, or their successors in interest, at the last known address of each such person. A partial release prepared and recorded pursuant to this subsection shall be deemed a partial reconveyance of a deed of trust. The title insurer shall not cause a partial release to be recorded pursuant to this subsection if the title insurer receives written instructions to the contrary from the trustee, trustor, owner of the land, holder of the escrow or owner of the debt secured by the deed of trust or his or her agent.

(d) A statement that the debt secured by the deed of trust has been partially discharged;

(e) The date and amount of partial payment or other partial satisfaction or discharge;

(f) The name and address of the title insurer issuing the partial release; and

(g) The legal description of the estate in real property which is reconveyed.

6. A partial release prepared and recorded pursuant to subsection 4 does not relieve a beneficiary or trustee of the requirements imposed by subsections 1 and 2.

7. A trustee may charge a reasonable fee to the trustor or the owner of the land for services relating to the preparation, execution or recordation of a partial reconveyance or partial release pursuant to this section. A trustee shall not require the fees to be paid before the opening of an escrow or earlier than 60 calendar days before the partial payment or partial satisfaction or discharge of the debt secured by the deed of trust. If a fee charged pursuant to this subsection does not exceed $100, the fee is conclusively presumed to be reasonable.

8. In addition to any other remedy provided by law, a title insurer who improperly causes to be recorded a partial release of a deed of trust pursuant to this section is liable for actual damages and for a reasonable attorney’s fee and the costs of bringing the action to any person who is injured because of the improper recordation of the partial release.

(Added to NRS by 1995, 1521 ; A 1999, 58 ; 2011, 331 , 1748 )

NRS 107.079 Reconveyance when beneficiary cannot be located or refuses to execute and deliver request for reconveyance; recording of surety bond and declaration required in certain circumstances; fees; liability of trustee for reconveyance; remedy.

1. Whenever the debt or obligation secured by a deed of trust has been paid in full or otherwise satisfied and the current beneficiary of record cannot be located after diligent search as described in subsection 9 or refuses to execute and deliver a proper request to reconvey the estate in real property conveyed to the trustee by the grantor, as required by NRS 107.077 , or whenever a balance, including, without limitation, principal and interest, remains due on the debt secured by the deed of trust and the trustor or the trustor’s successor in interest cannot locate after diligent search the current beneficiary of record, the trustor or the trustor’s successor in interest may record or cause to be recorded a surety bond that meets the requirements of subsection 2 and a declaration that meets the requirements of subsection 3.

2. The surety bond recorded pursuant to subsection 1 must:

(a) Be acceptable to the trustee;

(b) Be issued by a surety authorized to issue surety bonds in this State in an amount equal to the greater of:

(1) Two times the amount of the original obligation or debt secured by the deed of trust plus any principal amounts, including, without limitation, advances, indicated in a recorded amendment thereto; or

(2) One-and-a-half times the total amount computed pursuant to subparagraph (1) plus any accrued interest on that amount;

(c) Be conditioned on payment of any amount which the beneficiary recovers in an action to enforce the obligation or recover the debt secured by the deed of trust, plus costs and reasonable attorney’s fees;

(d) Be made payable to the trustee who executes a reconveyance pursuant to subsection 4 and the beneficiary or the beneficiary’s successor in interest; and

(e) Contain a statement of:

(1) The recording date and instrument number or book and page number of the recorded deed of trust;

(2) The names of the original trustor and beneficiary;

(3) The amount shown as the original principal amount secured by the deed of trust; and

(4) The recording information and new principal amount shown in any recorded amendment to the deed of trust.

3. The declaration recorded pursuant to subsection 1 must:

(a) Be signed under penalty of perjury by the trustor or the trustor’s successor in interest;

(b) State that it is recorded pursuant to this section;

(c) State the name of the original trustor;

(d) State the name of the beneficiary;

(e) State the name and address of the person making the declaration;

(f) Except as otherwise provided in subsection 8, contain a statement of the following, whichever is applicable:

(1) That the obligation or debt secured by the deed of trust has been paid in full or otherwise satisfied and the current beneficiary of record cannot be located after diligent search or refuses to execute and deliver a proper request to reconvey the estate in real property conveyed to the trustee by the grantor, as required by NRS 107.077 ; or

(2) That a balance, including, without limitation, principal and interest, remains due on the debt secured by the deed of trust and the trustor or the trustor’s successor in interest cannot locate after diligent search the current beneficiary of record;

(g) Contain a statement that the declarant has mailed by certified mail, return receipt requested, to the last known address of the person to whom payments under the deed of trust were made and to the last beneficiary of record at the address indicated for such beneficiary on the instrument creating, assigning or conveying the deed of trust, a notice of the recording of the surety bond and declaration pursuant to this section, of the name and address of the trustee, of the beneficiary’s right to record a written objection to the reconveyance of the deed of trust pursuant to this section and of the requirement to notify the trustee in writing of any such objection; and

(h) Contain the date of the mailing of any notice pursuant to this section and the name and address of each person to whom such a notice was mailed.

4. Not earlier than 30 days after the recording of the surety bond and declaration pursuant to subsections 1, 2 and 3, delivery to the trustee of the fees charged by the trustee for the preparation, execution or recordation of a reconveyance pursuant to subsection 7 of NRS 107.077 , plus costs incurred by the trustee, and a demand for reconveyance under NRS 107.077 , the trustee shall execute and record or cause to be recorded a reconveyance of the deed of trust pursuant to NRS 107.077 , unless the trustee has received a written objection to the reconveyance of the deed of trust from the beneficiary of record within 30 days after the recording of the surety bond and declaration pursuant to subsections 1, 2 and 3. The recording of a reconveyance pursuant to this subsection has the same effect as a reconveyance of the deed of trust pursuant to NRS 107.077 and releases the lien of the deed of trust. A trustee is not liable to any person for the execution and recording of a reconveyance pursuant to this section if the trustee acted in reliance upon the substantial compliance with this section by the trustor or the trustor’s successor in interest. The sole remedy for a person damaged by the reconveyance of a deed of trust pursuant to this section is an action for damages against the trustor or the person making the declaration described in subsection 3 or an action against the surety bond.

5. Upon the recording of a reconveyance of the deed of trust pursuant to subsection 4, interest no longer accrues on any balance remaining due under the obligation or debt secured by the deed of trust to the extent that the balance due has been stated in the declaration described in subsection 3. Notwithstanding any provision of chapter 120A of NRS, any amount of the balance remaining due under the obligation or debt secured by the deed of trust, including, without limitation, principal and interest, which is remitted to the issuer of the surety bond described in subsection 2 in connection with the issuance of that surety bond must, if unclaimed within 3 years after remittance, be property that is presumed abandoned for the purposes of chapter 120A of NRS. From the date on which the amount is paid or delivered to the Administrator of Unclaimed Property pursuant to NRS 120A.570 , the issuer of the surety bond is relieved of any liability to pay to the beneficiary or his or her heirs or successors in interest the amount paid or delivered to the Administrator.

6. Any failure to comply with the provisions of this section does not affect the rights of a bona fide purchaser or encumbrancer for value.

7. This section shall not be deemed to create an exclusive procedure for the reconveyance of a deed of trust and the issuance of surety bonds and declarations to release the lien of a deed of trust, and shall not affect any other procedures, whether or not such procedures are set forth in statute, for the reconveyance of a deed of trust and the issuance of surety bonds and declaration to release the lien of a deed of trust.

8. For the purposes of this section, the trustor or the trustor’s successor in interest may substitute the current trustee of record without conferring any duties upon that trustee other than duties which are incidental to the execution of a reconveyance pursuant to this section, if:

(a) The debt or obligation secured by a deed of trust has been paid in full or otherwise satisfied;

(b) The current trustee of record and the current beneficiary of record cannot be located after diligent search as described in subsection 9;

(c) The declaration filed pursuant to subsection 3:

(1) In addition to the information required to be stated in the declaration pursuant to subsection 3, states that the current trustee of record and the current beneficiary of record cannot be located after diligent search; and

(2) In lieu of the statement required by paragraph (f) of subsection 3, contains a statement that the obligation or debt secured by the deed of trust has been paid in full or otherwise satisfied and the current beneficiary of record cannot be located after diligent search or refuses to execute and deliver a proper request to reconvey the estate in real property conveyed to the trustee by the grantor, as required by NRS 107.077 ;

(d) The substitute trustee is a title insurer that agrees to accept the substitution, except that this paragraph does not impose a duty on a title insurer to accept the substitution; and

(e) The surety bond required by this section is for a period of not less than 5 years.

9. For the purposes of subsection 1, a diligent search has been conducted if:

(a) A notice stating the intent to record a surety bond and declaration pursuant to this section, the name and address of the trustee, the beneficiary’s right to record a written objection to the reconveyance of the deed of trust pursuant to this section and the requirement to notify the trustee in writing of any such objection, has been mailed by certified mail, return receipt requested, to the last known address of the person to whom payments under the deed of trust were made and to the last beneficiary of record at the address indicated for such beneficiary on the instrument creating, assigning or conveying the deed of trust.

(b) A search has been conducted of the telephone directory in the city where the beneficiary of record or trustee of record, whichever is applicable, maintained its last known address or place of business.

(c) If the beneficiary of record or the beneficiary’s successor in interest, or the trustee of record or the trustee’s successor in interest, whichever is applicable, is a business entity, a search has been conducted of the records of the Secretary of State and the records of the agency or officer of the state of organization of the beneficiary, trustee or successor, if known.

(d) If the beneficiary of record or trustee of record is a state or national bank or state or federal savings and loan association or savings bank, an inquiry concerning the location of the beneficiary or trustee has been made to the regulator of the bank, savings and loan association or savings bank.

(Added to NRS by 2013, 2169 ; A 2019, 1348 )

NRS 107.0795 “Abandoned residential property” defined. Expired by limitation. (See chapter 330, Statutes of Nevada 2013, at page 1555 , and chapter 123, Statutes of Nevada 2017, at page 546 .)

NRS 107.080 Trustee’s power of sale: Power conferred; required notices; effect of sale; circumstances in which sale must be declared void; civil actions for noncompliance with certain requirements; duty to post; duty to record; fees.

1. Except as otherwise provided in NRS 106.210 , 107.0805 , 107.085 and 107.086 , if any transfer in trust of any estate in real property is made after March 29, 1927, to secure the performance of an obligation or the payment of any debt, a power of sale is hereby conferred upon the trustee to be exercised after a breach of the obligation for which the transfer is security.

2. The power of sale must not be exercised, however, until:

(a) In the case of any deed of trust coming into force:

(1) On or after July 1, 1949, and before July 1, 1957, the grantor, the person who holds the title of record, a beneficiary under a subordinate deed of trust or any other person who has a subordinate lien or encumbrance of record on the property has, for a period of 15 days, computed as prescribed in subsection 3, failed to make good the deficiency in performance or payment; or

(2) On or after July 1, 1957, the grantor, the person who holds the title of record, a beneficiary under a subordinate deed of trust or any other person who has a subordinate lien or encumbrance of record on the property has, for a period of 35 days, computed as prescribed in subsection 3, failed to make good the deficiency in performance or payment.

(b) The beneficiary, the successor in interest of the beneficiary or the trustee first executes and causes to be recorded in the office of the recorder of the county wherein the trust property, or some part thereof, is situated a notice of the breach and of the election to sell or cause to be sold the property to satisfy the obligation.

(c) The beneficiary or its successor in interest or the servicer of the obligation or debt secured by the deed of trust has instructed the trustee to exercise the power of sale with respect to the property.

(d) Not less than 3 months have elapsed after the recording of the notice.

3. The 15- or 35-day period provided in paragraph (a) of subsection 2 commences on the first day following the day upon which the notice of default and election to sell is recorded in the office of the county recorder of the county in which the property is located and a copy of the notice of default and election to sell is mailed by registered or certified mail, return receipt requested and with postage prepaid to the grantor or, to the person who holds the title of record on the date the notice of default and election to sell is recorded, and, if the property is operated as a facility licensed under chapter 449 of NRS, to the State Board of Health, at their respective addresses, if known, otherwise to the address of the trust property or, if authorized by the parties, delivered by electronic transmission. The notice of default and election to sell must describe the deficiency in performance or payment and may contain a notice of intent to declare the entire unpaid balance due if acceleration is permitted by the obligation secured by the deed of trust, but acceleration must not occur if the deficiency in performance or payment is made good and any costs, fees and expenses incident to the preparation or recordation of the notice and incident to the making good of the deficiency in performance or payment are paid within the time specified in subsection 2.

4. The trustee, or other person authorized to make the sale under the terms of the deed of trust, shall, after expiration of the applicable period specified in paragraph (d) of subsection 2 following the recording of the notice of breach and election to sell, and before the making of the sale, give notice of the time and place thereof by recording the notice of sale and by:

(a) Providing the notice to each trustor, any other person entitled to notice pursuant to this section and, if the property is operated as a facility licensed under chapter 449 of NRS, the State Board of Health, by personal service, by electronic transmission if authorized by the parties or by mailing the notice by registered or certified mail to the last known address of the trustor and any other person entitled to such notice pursuant to this section;

(b) Posting a similar notice particularly describing the property, for 20 days successively, in a public place in the county where the property is situated; and

(c) Publishing a copy of the notice three times, once each week for 3 consecutive weeks, in a newspaper of general circulation in the county where the property is situated or, if the property is a time share, by posting a copy of the notice on an Internet website and publishing a statement in a newspaper in the manner required by subsection 3 of NRS 119A.560 .

5. Every sale made under the provisions of this section and other sections of this chapter vests in the purchaser the title of the grantor and any successors in interest without equity or right of redemption. Except as otherwise provided in subsection 7, a sale made pursuant to this section must be declared void by any court of competent jurisdiction in the county where the sale took place if:

(a) The trustee or other person authorized to make the sale does not substantially comply with the provisions of this section;

(b) Except as otherwise provided in subsection 6, an action is commenced in the county where the sale took place within 30 days after the date on which the trustee’s deed upon sale is recorded pursuant to subsection 10 in the office of the county recorder of the county in which the property is located; and

(c) A notice of lis pendens providing notice of the pendency of the action is recorded in the office of the county recorder of the county where the sale took place within 5 days after commencement of the action.

6. If proper notice is not provided pursuant to subsection 3 or paragraph (a) of subsection 4 to the grantor, to the person who holds the title of record on the date the notice of default and election to sell is recorded, to each trustor or to any other person entitled to such notice, the person who did not receive such proper notice may commence an action pursuant to subsection 5 within 90 days after the date of the sale.

7. Upon expiration of the time for commencing an action which is set forth in subsections 5 and 6, any failure to comply with the provisions of this section or any other provision of this chapter does not affect the rights of a bona fide purchaser as described in NRS 111.180 .

8. If, in an action brought by the grantor or the person who holds title of record in the district court in and for the county in which the real property is located, the court finds that the beneficiary, the successor in interest of the beneficiary or the trustee did not comply with any requirement of subsection 2, 3 or 4, the court must award to the grantor or the person who holds title of record:

Ê unless the court finds good cause for a different award. The remedy provided in this subsection is in addition to the remedy provided in subsection 5.

9. The sale or assignment of a proprietary lease in a cooperative vests in the purchaser or assignee title to the ownership interest and votes in the cooperative association which accompany the proprietary lease.

10. After a sale of property is conducted pursuant to this section, the trustee shall:

(a) Within 30 days after the date of the sale, record the trustee’s deed upon sale in the office of the county recorder of the county in which the property is located; or

(b) Within 20 days after the date of the sale, deliver the trustee’s deed upon sale to the successful bidder. Within 10 days after the date of delivery of the deed by the trustee, the successful bidder shall record the trustee’s deed upon sale in the office of the county recorder of the county in which the property is located.

11. Within 5 days after recording the trustee’s deed upon sale, the trustee or successful bidder, whoever recorded the trustee’s deed upon sale pursuant to subsection 10, shall cause a copy of the trustee’s deed upon sale to be posted conspicuously on the property. The failure of a trustee or successful bidder to effect the posting required by this subsection does not affect the validity of a sale of the property to a bona fide purchaser for value without knowledge of the failure.

12. If the successful bidder fails to record the trustee’s deed upon sale pursuant to paragraph (b) of subsection 10, the successful bidder:

(a) Is liable in a civil action to any party that is a senior lienholder against the property that is the subject of the sale in a sum of up to $500 and for reasonable attorney’s fees and the costs of bringing the action; and

(b) Is liable in a civil action for any actual damages caused by the failure to comply with the provisions of subsection 10 and for reasonable attorney’s fees and the costs of bringing the action.

13. The county recorder shall, in addition to any other fee, at the time of recording a notice of default and election to sell collect:

(a) A fee of $150 for deposit in the State General Fund.

(b) A fee of $95 for deposit in the Account for Foreclosure Mediation Assistance, which is hereby created in the State General Fund. The Account must be administered by the Interim Finance Committee and the money in the Account may be expended only for the purpose of:

(1) Supporting a program of foreclosure mediation; and

(2) The development and maintenance of an Internet portal for a program of foreclosure mediation pursuant to subsection 16 of NRS 107.086 .

(c) A fee of $5 to be paid over to the county treasurer on or before the fifth day of each month for the preceding calendar month. The county recorder may direct that 1.5 percent of the fees collected by the county recorder pursuant to this paragraph be transferred into a special account for use by the office of the county recorder. The county treasurer shall remit quarterly to the organization operating the program for legal services that receives the fees charged pursuant to NRS 19.031 for the operation of programs for the indigent all the money received from the county recorder pursuant to this paragraph.

14. The fees collected pursuant to paragraphs (a) and (b) of subsection 13 must be paid over to the county treasurer by the county recorder on or before the fifth day of each month for the preceding calendar month, and, except as otherwise provided in this subsection, must be placed to the credit of the State General Fund or the Account for Foreclosure Mediation Assistance as prescribed pursuant to subsection 13. The county recorder may direct that 1.5 percent of the fees collected by the county recorder be transferred into a special account for use by the office of the county recorder. The county treasurer shall, on or before the 15th day of each month, remit the fees deposited by the county recorder pursuant to this subsection to the State Controller for credit to the State General Fund or the Account as prescribed in subsection 13.

15. The beneficiary, the successor in interest of the beneficiary or the trustee who causes to be recorded the notice of default and election to sell shall not charge the grantor or the successor in interest of the grantor any portion of any fee required to be paid pursuant to subsection 13.

[Part 1:173:1927; A 1949, 70 ; 1943 NCL § 7710]—(NRS A 1957, 631 ; 1959, 10 ; 1961, 23 ; 1965, 611 , 1242 ; 1967, 198 ; 1979, 708 ; 1987, 1644 ; 1989, 1770 ; 2003, 2893 ; 2005, 1623 ; 2007, 2447 ; 2009, 1003 , 1755 , 2481 , 2789 ; 2010, 26th Special Session, 77 ; 2011, 332 , 1748 , 3509 , 3535 , 3654 ; 2013, 1418 , 1548 , 2195 ; 2015, 1614 , 3317 ; 2017, 546 , 4085 , 4105 , 4106 ; 2019, 1352 )

NRS 107.0805 Trustee’s power of sale: Requirements and conditions; contents of notarized affidavits; circumstances in which sale must be declared void.

1. In addition to the requirements set forth in NRS 107.080 , 107.085 and 107.086 , the power of sale for a residential foreclosure is subject to the following requirements and conditions and must not be executed until:

(a) In the case of any deed of trust which concerns owner-occupied housing, the grantor, the person who holds the title of record, a beneficiary under a subordinate deed of trust or any other person who has a subordinate lien or encumbrance of record on the property has, for a period that commences in the manner and subject to the requirements described in subsection 2 and expires 5 days before the date of sale, failed to make good the deficiency in performance or payment.

(b) The beneficiary, the successor in interest of the beneficiary or the trustee first executes and causes to be recorded in the office of the recorder of the county wherein the trust property, or some part thereof, is situated a notice of the breach and of the election to sell or cause to be sold the property pursuant to subsection 2 of NRS 107.080 , together with a notarized affidavit of authority to exercise the power of sale. The affidavit required by this paragraph must state under penalty of perjury the following information, which must be based on the direct, personal knowledge of the affiant or the personal knowledge which the affiant acquired by a review of the business records of the beneficiary, the successor in interest of the beneficiary or the servicer of the obligation or debt secured by the deed of trust, which business records must meet the standards set forth in NRS 51.135 :

(1) The full name and business address of the current trustee or the current trustee’s personal representative or assignee, the current holder of the note secured by the deed of trust, the current beneficiary of record and the current servicer of the obligation or debt secured by the deed of trust.

(2) That the beneficiary under the deed of trust, the successor in interest of the beneficiary or the trustee is in actual or constructive possession of the note secured by the deed of trust or that the beneficiary or its successor in interest or the trustee is entitled to enforce the obligation or debt secured by the deed of trust. For the purposes of this subparagraph, if the obligation or debt is an instrument, as defined in subsection 2 of NRS 104.3103 , a beneficiary or its successor in interest or the trustee is entitled to enforce the instrument if the beneficiary or its successor in interest or the trustee is:

(I) The holder of the instrument;

(II) A nonholder in possession of the instrument who has the rights of a holder; or

(III) A person not in possession of the instrument who is entitled to enforce the instrument pursuant to a court order issued under NRS 104.3309 .

(3) That the beneficiary or its successor in interest, the servicer of the obligation or debt secured by the deed of trust or the trustee, or an attorney representing any of those persons, has sent to the obligor or borrower of the obligation or debt secured by the deed of trust a written statement of:

(I) That amount of payment required to make good the deficiency in performance or payment, avoid the exercise of the power of sale and reinstate the terms and conditions of the underlying obligation or debt existing before the deficiency in performance or payment, as of the date of the statement;

(II) The amount in default;

(III) The principal amount of the obligation or debt secured by the deed of trust;

(IV) The amount of accrued interest and late charges;

(V) A good faith estimate of all fees imposed in connection with the exercise of the power of sale; and

(VI) Contact information for obtaining the most current amounts due and the local or toll-free telephone number described in subparagraph (4).

(4) A local or toll-free telephone number that the obligor or borrower of the obligation or debt may call to receive the most current amounts due and a recitation of the information contained in the affidavit.

(5) The date and the recordation number or other unique designation of, and the name of each assignee under, each recorded assignment of the deed of trust. The information required to be stated in the affidavit pursuant to this subparagraph may be based on:

(I) The direct, personal knowledge of the affiant;

(II) The personal knowledge which the affiant acquired by a review of the business records of the beneficiary, the successor in interest of the beneficiary or the servicer of the obligation or debt secured by the deed of trust, which business records must meet the standards set forth in NRS 51.135 ;

(III) Information contained in the records of the recorder of the county in which the property is located; or

(IV) The title guaranty or title insurance issued by a title insurer or title agent authorized to do business in this State pursuant to chapter 692A of NRS.

2. The period provided in paragraph (a) of subsection 1 commences on the first day following the day upon which the notice of default and election to sell is recorded in the office of the county recorder of the county in which the property is located and a copy of the notice of default and election to sell is mailed by registered or certified mail, return receipt requested and with postage prepaid, to the grantor or to the person who holds the title of record on the date the notice of default and election to sell is recorded, at their respective addresses, if known, otherwise to the address of the trust property or, if authorized by the parties, delivered by electronic transmission. In addition to meeting the requirements set forth in subsection 1 and NRS 107.080 , the notice of default and election must:

(a) If the property is subject to the requirements of NRS 107.400 to 107.560 , inclusive, contain the declaration required by subsection 6 of NRS 107.510 ; and

(b) Comply with the provisions of NRS 107.087 .

3. In addition to providing notice pursuant to the requirements set forth in subsection 4 of NRS 107.080 , the trustee, or other person authorized to make the sale under the terms of the deed of trust with respect to a residential foreclosure, shall, after expiration of the applicable period specified in paragraph (d) of subsection 2 of NRS 107.080 , following the recording of the notice of breach and election to sell, and before the making of the sale, comply with the provisions of NRS 107.087 .

4. In addition to the grounds provided in paragraph (a) of subsection 5 of NRS 107.080 , a sale made pursuant to this section must be declared void by any court of competent jurisdiction in the county where the sale took place if the trustee or other person authorized to make the sale does not substantially comply with any applicable provisions set forth in NRS 107.086 and 107.087 , and the applicant otherwise complies with subsection 5 of NRS 107.080 .

(Added to NRS by 2017, 546 , 4083 ; A 2019, 1356 )

NRS 107.081 Time and place of sale; agent holding sale not to be purchaser.

1. All sales of property pursuant to NRS 107.080 must be made at auction to the highest bidder and must be made between the hours of 9 a.m. and 5 p.m. The agent holding the sale must not become a purchaser at the sale or be interested in any purchase at such a sale.

2. All sales of real property must be made at the public location in the county designated by the governing body of the county for that purpose.

(Added to NRS by 2005, 1620 ; A 2017, 545 )

NRS 107.082 Oral postponement of sale.

1. If a sale of property pursuant to NRS 107.080 is postponed by oral proclamation, the sale must be postponed to a later date at the same time and location.

2. If such a sale has been postponed by oral proclamation three times, any new sale information must be provided by notice as provided in NRS 107.080 .

(Added to NRS by 2005, 1621 )

NRS 107.083 Proceedings after purchaser refuses to pay amount bid.

1. If a purchaser refuses to pay the amount the purchaser bid for the property struck off at a sale pursuant to NRS 107.080 , the agent may again sell the property to the highest bidder, after again giving the notice previously provided.

2. If any loss is incurred from the purchaser refusing to pay the amount of the bid, the agent may recover the amount of the loss, with costs, for the benefit of the party aggrieved, by motion upon previous notice of 5 days to the purchaser, before any court of competent jurisdiction.

3. The court shall proceed in a summary manner in the hearing and disposition of such a motion, and give judgment and issue execution therefor forthwith, but the refusing purchaser may request a jury. The same proceedings may be had against any subsequent purchaser who refuses to pay, and the agent may, in the agent’s discretion, thereafter reject the bid of any person so refusing.

4. An agent is not liable for any amount other than the amount bid by the second or subsequent purchaser and the amount collected from the purchaser who refused to pay.

NRS 107.084 Penalty for removing or defacing notice of sale. It is unlawful for a person to willfully remove or deface a notice posted pursuant to subsection 4 of NRS 107.080 , if done before the sale or, if the default is satisfied before the sale, before the satisfaction of the default. In addition to any other penalty, any person who violates this section is liable in the amount of $500 to any person aggrieved by the removal or defacing of the notice.

(Added to NRS by 2005, 1620 ; A 2009, 2791 )

NRS 107.085 Restrictions on trustee’s power of sale concerning certain deeds of trust: Applicability; service of notice; scheduling of date of sale; form of notice; judicial foreclosure not prohibited; “unfair lending practice” defined.

1. With regard to a deed of trust for an estate in real property to secure the performance of an obligation or the payment of a debt, the provisions of this section apply to the exercise of a power of sale pursuant to NRS 107.080 only if:

(a) The deed of trust becomes effective on or after October 1, 2003, and, on the date the deed of trust is made, the deed of trust is subject to the provisions of § 152 of the Home Ownership and Equity Protection Act of 1994, 15 U.S.C. § 1602(bb), and the regulations adopted by the Board of Governors of the Federal Reserve System pursuant thereto, including, without limitation, 12 C.F.R. § 226.32; or

(b) The deed of trust concerns owner-occupied housing.

2. The trustee shall not exercise a power of sale pursuant to NRS 107.080 unless:

(a) In the manner required by subsection 3, not later than 60 days before the date of the sale, the trustee causes to be served upon the grantor or the person who holds the title of record a notice in the form described in subsection 3; and

(b) If an action is filed in a court of competent jurisdiction claiming an unfair lending practice in connection with the deed of trust, the date of the sale is not less than 30 days after the date the most recent such action is filed.

3. The notice described in subsection 2 must be:

(a) Served upon the grantor or the person who holds the title of record:

(1) Except as otherwise provided in subparagraph (2), by personal service or, if personal service cannot be timely effected, in such other manner as a court determines is reasonably calculated to afford notice to the grantor or the person who holds the title of record; or

(2) If the deed of trust concerns owner-occupied housing:

(I) By personal service;

(II) If the grantor or the person who holds the title of record is absent from his or her place of residence or from his or her usual place of business, by leaving a copy with a person of suitable age and discretion at either place and mailing a copy to the grantor or the person who holds the title of record at his or her place of residence or place of business; or