Articles on Financial markets

Displaying 1 - 20 of 104 articles.

Dow tops 40,000 as stock indexes continue to cross milestones − making many investors feel wealthier

Alexander Kurov , West Virginia University

No one can predict how financial markets will behave with absolute certainty. Here’s why

Benoît Béchard , Université Laval

Grain as a weapon: Russia-Ukraine war reveals how capitalism fuels global hunger

Alicja Paulina Krubnik , McMaster University

How the Israel-Hamas war could affect the world economy and worsen global trade tensions

Daniele Bianchi , Queen Mary University of London

The US role in the global financial system is changing – here’s how it could affect the world’s economy

Steve Schifferes , City, University of London

ChatGPT-powered Wall Street: The benefits and perils of using artificial intelligence to trade stocks and other financial instruments

Pawan Jain , West Virginia University

What is insider trading? Two finance experts explain why it matters to everyone

Alexander Kurov , West Virginia University and Marketa Wolfe , Skidmore College

Plunging pound and crumbling confidence: How the new UK government stumbled into a political and financial crisis of its own making

David McMillan , University of Stirling

How bonds work and why everyone is talking about them right now: a finance expert explains

Why Black Wednesday still matters – it was the start of markets telling politicians what to do

Alexis Stenfors , University of Portsmouth

Russian debt default: two experts explain what it means for Russia and for global financial markets

Nasir Aminu , Cardiff Metropolitan University and Rodrigo Olivares-Caminal , Queen Mary University of London

Insights from Zimbabwe on how to link formal and informal economies

John Luiz , University of Cape Town

Five things that economists know, but sound wrong to most other people

Renaud Foucart , Lancaster University

Could better regulation reconcile trading and ethics?

Aziza Laguecir , EDHEC Business School and Bernard Leca , ESSEC

Ukraine and the financial markets: the winners and losers so far

Gabriella Legrenzi , Keele University ; Reinhold Heinlein , University of the West of England , and Scott Mahadeo , University of Portsmouth

What’s insider trading and why it’s a big problem

Humans v AI: here’s who’s better at making money in financial markets

Barbara Jacquelyn Sahakian , University of Cambridge ; Fabio Cuzzolin , Oxford Brookes University , and Wojtek Buczynski , University of Cambridge

Omicron and market sell-off : don’t be surprised if there’s more turbulence to come

Arturo Bris , International Institute for Management Development (IMD)

Mood, music and money: what our Spotify playlists reveal about the emotional nature of financial markets

Ivan Indriawan , Auckland University of Technology ; Adrian Fernandez-Perez , Auckland University of Technology ; Alexandre Garel , Audencia , and Alex Edmans , London Business School

What is decentralized finance? An expert on bitcoins and blockchains explains the risks and rewards of DeFi

Kevin Werbach , University of Pennsylvania

Related Topics

- Cryptocurrency

- Global financial crisis

- Stock markets

- Wall Street

Top contributors

Professor of Finance and Fred T. Tattersall Excellence in Finance Research Chair, West Virginia University

Professor in Finance, University of Stirling

Associate Professor of Economics, Skidmore College

Dean, School of Management, University of Bath

Associate Professor of Finance, Queen Mary University of London

retired, The University of Western Australia

Professor and Head, School of Business, Monash University

Professor of Housing Economics and Director, UK Collaborative Centre for Housing Evidence, University of Glasgow

Senior Lecturer in Economics, The Open University

Emeritus Professor, University of Nottingham, (currently CEO and Senior Vice President of the PETRA Group), University of Nottingham

Professor of Finance, International Institute for Management Development (IMD)

Discovery Early Career Research Fellow, University of Sydney

Program Director, Trade and Investment, United States Studies Centre, University of Sydney

Professor of Organisational Behaviour, Bayes Business School, City, University of London

Assistant Professor, Nanyang Technological University

- X (Twitter)

- Unfollow topic Follow topic

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Client login

You've come to the right place to find Merrill insights, expert advice and the latest research on a variety of topics.

- Today's markets

- Investment trends

- Portfolio strategies

- Financial planning

- Diverse Viewpoints

- Women investors

Latest perspectives on the markets and global economy

Market briefs, surprising resilience of the s&p 500, investing in a year of election uncertainty, market decode: why we believe this bull market still has room to run, market decode: what’s ahead for the renewable energy sector, what can you do when the markets get volatile, capital market outlook, cio market update audiocast series, weathering the ups and downs of the markets, making sense of today’s fixed income market, choose your advisor in a more personalized way.

All our advisors are committed to putting your needs and priorities first. Find some who match your personal preferences too.

Try Advisor Match

Want us to contact you, you need to answer some questions first.

Then we can provide you with relevant answers.

Important notice: You are now leaving Merrill

By selecting continue, you will be taken to a website that is not affiliated with Merrill and may offer a different privacy policy and level of security. Merrill is not responsible for and does not endorse, guarantee or monitor content, availability, viewpoints, products or services that are offered or expressed on other websites.

You can select the "Return to Merrill" button now to return to the previous page, or you can close the new window after you leave.

- Markets Data

- Cryptofinance

- Capital Markets

- Commodities

- Wealth Management

- Moral Money

- Fund Management

- Work & Careers

- Life & Arts

Lead story in Markets

Managers scale back or ditch bets against London-listed stocks after M&A activity drives sharp share price rises

Brent’s 1.4% drop after 4% fall the previous day follows cartel decision to unwind some production cuts

Elevated interest rates spur demand, despite calls from some countries to move away from US currency

Consob issues combined €4.7mn fine against Optiver and Flow Traders after oilfield engineer’s botched 2022 capital raising

Nifty 50 stock index jumps and rupee strengthens against dollar

Reddit account of Keith Gill suggests day trader holds shares and options worth $260mn in video games retailer

Opinion & Analysis

Ignore the noise and focus on employment

The US, Eurozone, UK and Japan each have reasons to be unhappy

A new bill will tip the balances towards issuers

Top of the perks

Rising margins underpin valuations despite worries that the market is expensive

Promoted Content

Recommended.

Most Read: Markets

- S&P 500 and Nasdaq Composite close at record highs Live

- Gazprom badly hurt by Ukraine war, says company-commissioned report

- Investors pull cash from ESG funds as performance lags

- How to recognise a slowdown

- Opec+ is running out of road

More Markets

US chip designer briefly overtakes Apple as world’s second-most valuable listed company

Move by UK’s biggest wealth manager reflects increasing scrutiny of sector by financial watchdog

Sustainably focused equity funds suffer net $40bn of outflows in 2024, the first sustained exodus

Fifth Circuit’s decision could imperil other wide-ranging reform efforts by US regulator

New listings could shore up the positive mood in the City

New study warns that up to $286bn in value is at risk in the fossil fuel shipping sector

Also in this newsletter: Have the farmers’ protests petered out?

Research ordered by Russian gas group warns it may not recover lost export revenues for more than a decade

GraniteShares’ proposed YieldBoost ETFs will sell put options on leveraged ETFs, aiming to profit from volatility

The good news for most investors is that country’s broader economic growth story looks intact

Takeover of Africa’s largest pay-TV operator must overcome regulatory hurdles

A CEO’s departure stirred memories of damaging political interference at the Brazilian state-controlled oil major

Fund manager was among the beneficiaries of £39mn of annual company dividends

Environmental campaigners warn that the industry must speed up plans to decarbonise

Recent launches of the first bitcoin and ethereum products in London underline growing competition

Exchange investigates ‘technical issue’ just days after brief disappearance of live data for S&P 500

Rise highlights continuing market unease despite close to record levels of storage

Sale to a group of family offices and investment firms comes as the hedge fund plots IPO

Industry challenger breaks even for first time but makes higher provisions for bad loans

Canberra is trying to create stronger supply chain for critical minerals in the energy transition

Critics of inheritance tax regime call for tighter rules on relief for Aim-listed holdings

Change could accelerate adoption of active ETF strategies

International Edition

Financial Markets

Global balance sheet 2022: Enter volatility

The rise and rise of the global balance sheet: How productively are we using our wealth?

Financial data unbound: The value of open data for individuals and institutions

COVID-19: Making the case for robust digital financial infrastructure

A decade after the global financial crisis: What has (and hasn’t) changed?

More insights.

Digital globalization: The new era of global flows

Climate risk and response: Physical hazards and socioeconomic impacts

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Financial markets

Stock market today: Wall Street barrels to records as Nvidia tops $3 trillion in total value

Stock market today: Asian stocks trade mixed after Wall Street logs modest gains

Technical issues briefly halt trading for some NYSE stocks in the latest glitch to hit Wall Street

Stock market today: Asian shares decline after report shows US manufacturing contracted in May

Stock market today: Wall Street rallies to close out a bloom-filled May

Nvidia’s profit soars, underscoring its dominance in chips for artificial intelligence.

Nvidia overshot Wall Street estimates as its quarterly profit skyrocketed, bolstered by the chipmaking dominance that has made the company an icon of the artificial intelligence boom. (AP Video: Ted Shaffrey)

Wall Street drifts higher; Dow has its first close above 40,000

Argentina reports its first single-digit inflation in 6 months as markets swoon and costs hit home, several meme stocks soars in a reprise of the social-media driven frenzy during pandemic, how major us stock indexes fared wednesday, 6/5/2024, how major us stock indexes fared tuesday, 6/4/2024, designer brands, siteone fall; healthequity, donaldson rise, tuesday, 6/4/2024, how major us stock indexes fared monday, 6/3/2024, how major us stock indexes fared friday, 5/31/2024, how major us stock indexes fared thursday, 5/30/2024.

Stock market today: Asian shares shrug off latest Wall St rout as Chinese factory activity weakens.

How major us stock indexes fared wednesday, 5/29/2024.

Stock market today: Asian shares track Wall Street’s retreat

Stock market today: Asian shares decline after a mixed post-holiday session on Wall Street

Stock market today: World shares are mostly higher after rebound on Wall St

How major us stock indexes fared friday, 5/24/2024, initial public offerings scheduled to debut next week.

Stock market today: Nasdaq sets another record as Wall Street wins back earlier losses

How major us stock indexes fared thursday, 5/23/2024.

Stock market today: Asian shares track Wall Street’s slide on worries over interest rates

How major us stock indexes fared wednesday, 5/22/2024.

Stock market today: Asian shares are mixed, with China stocks down, after Wall St retreat

How major us stock indexes fared tuesday, 5/21/2024, keysight technologies, nordson fall; eli lilly, lam research rise, tuesday, 5/21/2024.

Stock market today: Asian shares mostly higher after Wall Street sets more records

Ivan Boesky, stock trader convicted in insider trading scandal, dead at 87

Stock market today: Asian shares mostly decline after Nasdaq ticks to a record high

How major us stock indexes fared friday, 5/17/2024.

Stock market today: Dow finishes above 40,000 to cap Wall Street’s latest winning week

How major us stock indexes fared thursday, 5/16/2024.

The Dow closed above 40,000 for the first time. The number is big but means little for your 401(k)

How major us stock indexes fared wednesday, 5/15/2024.

Stock market today: Asian shares advance after another round of Wall St records

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

- S&P 500 5,354.03 +1.18%

- Dow 30 38,807.33 +0.25%

- Nasdaq 17,187.90 +1.96%

- Russell 2000 2,063.87 +1.47%

- Crude Oil 74.27 +1.39%

- Gold 2,374.20 +1.14%

- Silver 30.12 +1.70%

- EUR/USD 1.0872 -0.10%

- 10-Yr Bond 4.2890 -1.08%

- GBP/USD 1.2789 +0.15%

- USD/JPY 156.1250 +0.83%

- Bitcoin USD 71,242.23 +1.03%

- CMC Crypto 200 1,517.73 +2.98%

- FTSE 100 8,246.95 +0.18%

- Nikkei 225 38,490.17 -0.89%

Nvidia overtakes Apple as 2nd largest US company

Nvidia's latest surge propelled its stock to another all-time high.

Major Tesla shareholder backs Elon Musk's $56B pay package

The latest sign the jobs market is cooling off

Nasdaq, S&P hit fresh highs as Nvidia leads tech surge

Lululemon surges after boosting outlook, buybacks, even after $2t gain, nvidia remains irresistible to many, just 7 ev-charging stations built in 'pathetic' start to us effort, why arm chips pose a threat to intel, amd pc dominance, crowdstrike shares jump as ai boosts cybersecurity demand, amazon labor union affiliates with teamsters, irs decides people who got money from norfolk southern after ohio derailment won't be taxed on it, mexico death linked to bird flu strain that’s new in humans, london hospitals delay operations, switch to paper after hack, s&p 500 hits 25th record this year as tech soars: markets wrap, argentina’s senate poses fresh challenge to milei’s reform bills, amazon's zoox to begin testing robotaxis in austin, miami, nvidia tops $3 trillion in market value as artificial intelligence rally steams ahead, transports-only hedge fund manager hopeful despite ‘perfect negative storm’, a wisconsin mom of 3 who made $250,000 secretly working 2 remote jobs said it allowed her husband to leave a stressful job and become a stay-at-home dad, offer ending soon: earn over $1,000 in travel rewards with the chase sapphire bonus, i’m a shopping expert: 6 things retirees should never put in their grocery cart, elon musk accused of selling $7.5 billion of tesla stock before releasing disappointing sales data that plunged the share price to two-year low, dave ramsey tells caller to 'sell everything' after $26,000 tractor purchase puts 61-year-old in 'emergency mode', johnny depp escapes hollywood horror: $10 million lifeline saves homes as millions face zombie foreclosure fate, u.s. money supply is doing something so scarce that it hasn't happened since the great depression -- and a big move in stocks may be forthcoming, stocks digest soft adp print, lululemon earnings: yahoo finance.

Stocks (^DJI,^GSPC, ^IXIC) are trading in positive territory as markets weigh the latest ADP employment report, which fell short of expectations. The soft print has fueled investor optimism for a potential Federal Reserve interest rate cut. Meanwhile, all eyes are on the highly anticipated first quarter earnings release from retail giant Lululemon Athletica (LULU), which could provide valuable insights into the state of the consumer. Yahoo Finance trending tickers include Taiwan Semiconductor (TSM), Nvidia (NVDA), and Snowflake Inc. (SNOW). Key guests include: 3:15 p.m. ET - Antonio Neri, HPE CEO 3:30 p.m. ET - Jay Woods, Freedom Capital Markets Chief Global Strategist 3:45 p.m. ET - Joe Brusuelas, RSM Chief Economist 4:15 p.m. ET - Aneesha Sherman, Bernstein Senior Analyst 4:40 p.m. ET - Ernie Miller, Verde Clean Fuels CEO

AI will slowly transform the economy: Economist

Avoid Dollar Tree stock in discount retail sector: Strategist

Lululemon stock pops on earnings, buyback plans

Nvidia hits new record high, market cap tops $3 trillion

Build your wealth.

Should you open a CD before the Fed's next meeting?

How the Fed rate decision might influence your savings and CD interest earnings.

Smart Money Moves

15 savings accounts that offer 5% APY and up

Types of u.s. savings bonds and how they work, can you negotiate a higher savings account rate, what is a tiny house, and how much does it cost, how to save for a house in 7 easy steps, more ways to save.

These are the best airline credit cards for June

Earn over $1,000 in travel rewards with chase sapphire bonus, how many credit cards is too many, which credit card is best for me a guide to help you choose., amex platinum vs. chase sapphire reserve: should i switch, investment ideas, top daily gainers, top daily losers, most active stocks, undervalued growth stocks.

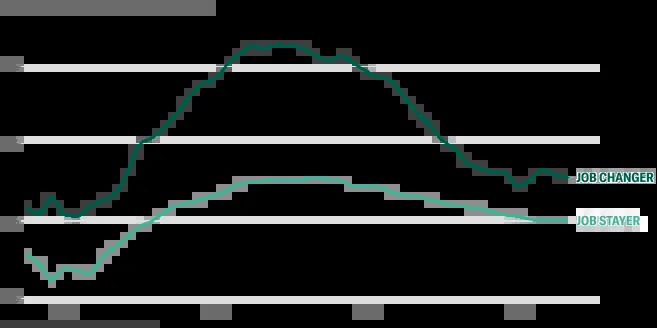

It's not paying as much to jump to a new job

Shrinking wage gains between job 'stayers' and 'switchers' is the latest sign of labor market cooling.

Wage growth keeps slowing for job switchers

ADP data showed that the median year-over-year pay increase for job switchers fell to 7.8% in May.

It adds to growing signs of labor market cooling

Job openings fell sharply in April to their lowest level in more than three years, according to new data this week.

The jobs data teasers are an appetizer for the main event

The June jobs report, set for release Friday, is the biggest piece of data on the docket this week.

A Wisconsin woman who made $250,000 secretly working two jobs says it allowed her husband to focus on childcare.

You can earn 75,000 bonus points when you open a new Chase Sapphire card today. Here’s how much they're worth.

One in four Americans have no retirement savings. Austin Kilgore, a consumer finance expert with the Achieve Center for Consumer Insights, a digital personal finance think tank, said our grocery...

The Tesla CEO faces claims he pocketed $3 billion in ill-gotten gains in late 2022 after learning Q4 vehicle sales would not deliver the 'epic end of year' he promised investors.

Financial guru Dave Ramsey recently gave critical advice to Teresa, a 61-year-old woman from Arkansas facing severe economic challenges. Teresa, whose call was featured on The Ramsey Show earns $67,000 annually and has about $69,000 in debt, including student and personal loans, one of which she used to purchase a $26,000 tractor. Ramsey did not hold back when he told her, "Broke people don't have $26,000 tractors." He emphasized that Teresa's reluctance to sell the tractor, even at a loss, keep

Hollywood star Johnny Depp escaped a plight many Americans cannot avoid. Last year, the actor, known for his iconic role as Captain Jack Sparrow in Disney's "Pirates of the Caribbean" franchise, took out a $10 million loan to save his two West Hollywood, California, homes from foreclosure. However, most people don't have the financial means to save their homes if they get into trouble, and many abandon them if they can no longer afford their mortgage payments — a practice known as zombie foreclo

M2 money supply hasn't done this since 1933.

Lululemon stock surges after company boosts profit outlook, stock buybacks

Lululemon reported first quarter results after the bell on Wednesday amid growing competition in the athleisure space.

Stock market today: S&P 500, Nasdaq hit record highs as Nvidia leads tech rally

Bets on Fed rate cuts are tentatively rising as investors weigh signs of a softer labor market and cooling economy.

Nvidia closes above $3 trillion for first time, overtakes Apple as second-largest co. in US market

Shares of Nvidia rose more than 5% Wednesday, pushing the company's market cap above Apple for the first time.

Financial Markets

Financial markets refers to the broad activity of buying and selling financial securities and derivatives, including bonds, equities, currencies, commodities, and other financial instruments. Changes in security valuations can affect the flow of capital through the economy, which can impact economic activity and have implications for monetary policy.

As part of its core responsibilities to inform U.S. monetary policy decisions, the SF Fed conducts extensive research on financial markets, financial conditions, and other related topics. This page features a collection of content on financial markets, including topics such as financial conditions, U.S. Treasury markets, securities and derivatives, and currencies and commodities.

Financial Conditions

U.S. Treasury Markets

Securities and Derivatives

Currencies and Commodities

Help our country reach its full economic potential.

Explore financial markets.

Before accessing the site, please choose from the following options.

If you are an Individual Investor and you have queries in respect of your investment in Morgan Stanley Investment Management products, you should contact your Financial Adviser. If you are unable to contact your Financial Advisor and require assistance, please send an email to [email protected]

Stock Market Concentration: How Much Is Too Much?

- Stock market concentration has increased sharply over the past decade, creating a challenging environment for active managers and also raising unease about the loss of diversification, the valuations of the largest stocks, and the effect of flows into index funds.

- In this report, we look at concentration over the past 75 years to see where we stand today and to reflect on what it means for active equity managers.

- We examine which companies have had the largest stock market capitalizations and how that population has changed.

- We ask whether there is a correct level of concentration, both by comparing the U.S. to other global markets and by presenting the possibility that concentration was too low in the past.

- We then seek to determine whether fundamental corporate performance supports the current increase in concentration.

Subscribe to Counterpoint Global Insights - Consilient Observer

Please enter the code sent to your email address.

Valid for 10 minutes only

Invalid Otp

Resend Code

Thank you for Subscribing to Counterpoint Global Insights - Consilient Observer.</p> "> Thank you for Subscribing to Counterpoint Global Insights - Consilient Observer.

DEFINITIONS Market Capitalization is the total dollar market value of all of a company's outstanding shares.

IMPORTANT INFORMATION The views and opinions are those of the author as of the date of publication and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

This material is for the benefit of persons whom the Firm reasonably believes it is permitted to communicate to and should not be forwarded to any other person without the consent of the Firm. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It is the responsibility of every person reading this material to fully observe the laws of any relevant country, including obtaining any governmental or other consent which may be required or observing any other formality which needs to be observed in that country.

This material is a general communication, which is not impartial, is for informational and educational purposes only, not a recommendation to purchase or sell specific securities, or to adopt any particular investment strategy. Information does not address financial objectives, situation or specific needs of individual investors.

Any charts and graphs provided are for illustrative purposes only. Any performance quoted represents past performance. Past performance does not guarantee future results. All investments involve risks, including the possible loss of principal.

For the complete content and important disclosures, refer to the article pdf .

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

Finance articles from across Nature Portfolio

Latest research and reviews.

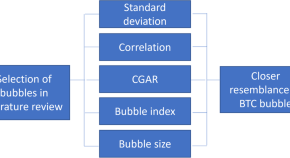

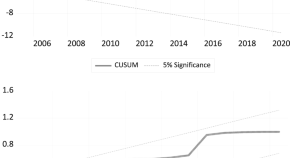

Bitcoin’s bubbly behaviors: does it resemble other financial bubbles of the past?

- Sergio Luis Náñez Alonso

- Javier Jorge-Vázquez

- David Sanz-Bas

Role of collaborative governance in unlocking private investment in sustainable projects

- Chunxian Lu

Better or worse? Revealing the impact of common institutional ownership on annual report readability

- Zhenyu Jiang

- Lingshan Hu

- Zongjun Wang

Relation exploration between clean and fossil energy markets when experiencing climate change uncertainties: substitutes or complements?

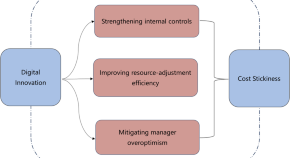

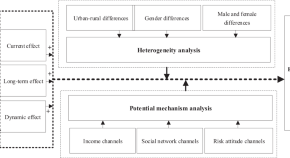

Reducing asymmetric cost behaviors: Evidence from digital innovation

- Kangqi Jiang

Knowledge creates value: the role of financial literacy in entrepreneurial behavior

News and Comment

Hunger, debt and interest rates

Financial imperatives to food system transformation

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial resources while making better use of existing ones. These imperatives are yet to garner greater traction to instigate meaningful change.

- Eugenio Diaz-Bonilla

- Brian McNamara

Central bank digital currencies risk becoming a digital Leviathan

Central bank digital currencies (CBDCs) already exist in several countries, with many more on the way. But although CBDCs can promote financial inclusivity by offering convenience and low transaction costs, their adoption must not lead to the loss of privacy and erosion of civil liberties.

- Andrea Baronchelli

- Hanna Halaburda

- Alexander Teytelboym

ESG performance of ports

An article in Case Studies on Transport Policy quantifies the environmental, social, and governance performances of three ports.

- Laura Zinke

Venture capital accelerates food technology innovation

Start-ups are now the predominant source of innovation in all categories of food technology. Venture capital can accelerate innovation by enabling start-ups to pursue niche areas, iterate more rapidly and take more risks than larger companies, writes Samir Kaul.

Challenges for a climate risk disclosure mandate

The United States and other G7 countries are considering a framework for mandatory climate risk disclosure by companies. However, unless a globally acceptable hybrid corporate governance model can be forged to address the disparities among different countries’ governance systems, the proposed framework may not succeed.

- Paul Griffin

- Amy Myers Jaffe

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Financial Markets and Portfolio Management

- Official publication of the Swiss Financial Analysts Association.

- Serves as a bridge between innovative research and its practical applications.

- Publishes academic and applied research articles, shorter 'Perspectives,' book reviews, and survey articles dedicated to current topics of interest to the financial community.

- Markus Schmid

Latest issue

Volume 38, Issue 1

Latest articles

Nuno fernandes: climate finance.

- Martin Nerlinger

Herding the crowds: how sentiment affects crowdsourced earnings estimates

- John Garcia

Report of the editor 2023

Ben mezrich, dumb money (harper collins publishers, 2023).

- Joshua Traut

A simple test of misspecification for linear asset pricing models

- Antoine Giannetti

Journal information

- ABS Academic Journal Quality Guide

- Australian Business Deans Council (ABDC) Journal Quality List

- Emerging Sources Citation Index

- Google Scholar

- Norwegian Register for Scientific Journals and Series

- OCLC WorldCat Discovery Service

- Research Papers in Economics (RePEc)

- TD Net Discovery Service

- UGC-CARE List (India)

Rights and permissions

Editorial policies

© Swiss Society for Financial Market Research

- Find a journal

- Publish with us

- Track your research

Our investment and economic outlook, May 2024

Red time: 14 minutes

“If the AI impact approaches that of electricity, our base case is that [productivity] growth will offset demographic pressures, producing an economic and financial future that exceeds consensus expectations,” Joe Davis, Vanguard global chief economist and the lead researcher, writes in this recent commentary .

The new research harnesses a uniquely long and rich dataset that captures historical shifts in megatrends that have driven about 60% of the change in per capita GDP growth. It finds that, among megatrends that also include demographics, fiscal deficits, and globalization, only technology has been a consistent, powerful driver of not only growth but also the Federal Reserve’s nominal target for short-term interest rates, inflation, and stock market valuations.

Notes: The chart breaks down three drivers of technology: augmentation, efficiency, and transformation. Augmentation refers to technological advances where humans benefit from machines, such as personal computers and power tools, raising productivity and trend employment. Efficiency refers to advances that raise GDP per worker, usually by automating away tasks previously performed by human labor. Transformation refers to GPTs that (eventually) unleash creative destruction through the economy. Our forthcoming research quantifies the prospects of AI transforming the economy in the years ahead.

Source: Vanguard calculations, as of May 2024.

Vanguard’s outlook for financial markets

Region-by-region outlook.

The views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of May 15, 2024.

United States

Inflation isn’t yet on a sustainable path toward the Federal Reserve’s 2% target. The headline Consumer Price Index rose 3.4% year over year and 0.3% month over month in April. Core inflation, which excludes volatile food and energy prices, remained elevated, at 3.6% year over year and 0.3% month over month.

- Another closely watched indicator, retail sales volumes, changed little in April compared with March. The pace of sales matters, and Vanguard will watch this indicator closely. But we continue to believe the U.S. consumer remains resilient and will be a catalyst for growth, as this recent article discusses.

- On top of a greater-than-expected rise in producer prices (0.5% month over month) in April, the data underscore our view that the Fed won’t likely be in position to cut its monetary policy interest rate target (currently, 5.25%–5.5%) this year.

- We recently increased our forecast for 2024 core Personal Consumption Expenditures (PCE) price index inflation from 2.6% to 2.9%. The PCE is the Fed’s preferred inflation measure to guide policymaking,

- We continue to foresee full-year 2024 economic growth slightly above trend around 2%.

Will the Bank of Canada (BOC) begin a rate-cutting cycle next month? The Consumer Price Index (CPI) for April, which Statistics Canada is set to release on May 21, could be key. We expect the BOC to cut its overnight rate target by 25 basis points on June 5, but a rate cut could be in jeopardy if the pace of inflation rises for a second consecutive month.

- As in the U.S., the “last mile” of inflation reduction could be the most challenging. We continue to foresee the year-over-year pace of core inflation falling by year-end into the BOC’s target range of 2%–2.5%. Shelter prices, up 6.5% year over year in March, remain an upside risk amid immigration-fueled population growth.

- We foresee the BOC trimming its overnight policy rate by 50 to 75 basis points this year, to a year-end range of 4.25%–4.5%. (A basis point is one-hundredth of a percentage point.)

- We recently increased our forecast of 2024 economic growth from about 1% to a range of 1.25%–1.5%. Still, restrictive monetary policy skews risks to the downside.

- We forecast a year-end unemployment rate of 6%–6.5% amid weak economic growth. It held steady at 6.1% in April.

Stronger growth momentum, higher energy prices, and a more hawkish outlook for the U.S. Federal Reserve have led us to raise our outlook for the European Central Bank (ECB) deposit facility rate at year-end. We’ve also increased our forecasts for full-year GDP growth and core inflation.

- We foresee three ECB quarter-point rate cuts this year, down from our previous outlook for five such cuts. That would leave the key monetary policy rate at 3.25% at year-end. We continue to anticipate the first rate cut occurring at the ECB’s June 6 meeting.

- We have nudged up our year-end 2024 core inflation forecast to 2.2% from 2.1%.

- We’ve increased our outlook for full-year economic growth to 0.8% from 0.6%.

- Unemployment remained steady at 6.5%, a record low, in March and likely will end 2024 around that level. However, we believe the labor market is softer than unemployment would suggest, as job vacancy rates have receded, labor hoarding remains elevated, and the number of hours worked has stagnated.

United Kingdom

Recent signals point to an uptick in economic activity and a firming of inflation persistence, leading Vanguard to increase its outlook for 2024 GDP growth, from 0.3% to 0.7%, and its outlook for year-end core inflation, from 2.6% to 2.8%.

- We continue to believe the Bank of England (BOE) will cut interest rates in August, but amid more hawkish global monetary policy developments we have dialed down our expectations for the depth of cuts this year. We anticipate a quarterly cadence of monetary policy easing, translating to two cuts in 2024 and four in 2025. That would bring the bank rate to 4.75% by year-end and 3.75% by year-end 2025.

- Our higher full-year GDP forecast reflects a first-quarter recovery, which occurred amid gradually rising real incomes, loosening financial conditions, and improved activity in the euro area. However, we expect full-year 2024 growth to be below trend due to headwinds from still-contractionary monetary and fiscal policy.

- As in the euro area, the labor market’s gradual loosening appears mainly driven by soft factors such as reduced vacancies and fewer hours worked, rather than an increase in unemployment. We foresee a year-end 2024 unemployment rate in a range of 4%–4.5%.

After a strong start to the year and with a four-month deflationary period apparently behind it, China’s economy seems on its way to 2024 GDP growth of “around 5%,” the target set at a Politburo meeting two months ago. However, given continued pressure on the property sector and weak consumer confidence, we remain cautious about the sustainability of growth momentum.

- Especially weak credit data make China’s economic challenges hard to ignore. Total social financing , the broadest indicator of China’s aggregate credit demand—including government bonds, bank loans, and even the shadow banking system—declined by 200 billion yuan (28 billion U.S. dollars) in April, the first negative reading since the indicator was first tracked in 2002. For the first four months of the year, total social financing is down by nearly 20% year over year.

- As part of efforts to stimulate the economy, the government on May 17 will hold the first sales of what is expected to be a 1 trillion yuan (138 billion U.S. dollars) issuance of special long-term treasury bonds. Similar bonds were issued during the 1997 Asian financial crisis, the 2008 global financial crisis, and the 2020 onset of COVID-19. The risk for structural imbalances remains, given policy priorities for investment and manufacturing upgrades over more direct measures to support consumer spending.

- We foresee full-year core inflation around 1% and full-year headline inflation of 0.8%—well below the 3% inflation target set by the People’s Bank of China (PBOC).

- To support the economy and given low levels of inflation, we expect the PBOC to ease its policy rate from 2.5% to 2.2% in 2024 and to cut banks’ reserve requirement ratios. However, we expect any easing in the near-term to be marginal. The Fed’s policy pause may limit room for the PBOC to ease meaningfully.

Sticky inflation continued in the first quarter, a development that the Reserve Bank of Australia (RBA) underscored in its May 7 monetary policy announcement. The RBA left its cash rate target unchanged at 4.35%, a more than 12-year-high level that has been in place for more than six months.

- We forecast that core inflation will fall to 3% on a year-over-year basis by year-end, still above the midpoint of the RBA’s 2%–3% target range. We foresee the RBA being one of the last central banks in developed markets to cut rates, doing so only in 2025.

- We expect the unemployment rate to rise to around 4.6% by year-end, as financial conditions tighten in an environment of elevated interest rates. It was 3.8% in March.

- Productivity has been slow to pick up, contributing to unit labor costs growing at a rate above what would be consistent with the RBA’s 2%–3% inflation target and prolonging the RBA’s path to eventual monetary policy easing.

- We continue to expect that Australia will avoid recession in 2024, with below-trend economic growth around 1%. GDP grew by 1.5% for all of 2023. Australia’s economy was last in recession in 1991.

Emerging markets

Sticky inflation and the path of U.S. policy rates have the attention of central bankers in Latin America’s leading economies. On May 8, Brazil’s central bank cut its key interest rate to 10.5%. Though a smaller cut than it had signaled at its previous policy meeting, it was the bank’s seventh consecutive rate reduction. One day later, Mexico’s central bank held rates steady, having initiated its first cut of the policy cycle a meeting earlier.

- While Banco de México (Banxico) maintained its 11% target for the overnight interbank rate, we have raised our outlook for Banxico’s year-end policy rate by 50 basis points to a range of 9.5%–10%, suggesting cuts of 100 to 150 basis points over the remainder of 2024. (A basis point is one-hundredth of a percentage point.)

- We’ve also modestly increased our forecast for year-end core inflation in Mexico to 3.7%–3.9%, largely in line with Banxico’s view.

- Amid continued strength in the U.S. economy, we recently upgraded our forecast of GDP growth in Mexico . U.S. demand for Mexican goods has remained strong, and domestic wages and consumption are holding up. We expect below-trend 2024 GDP growth of 1.75%–2.25%.

- We continue to forecast about 4% average 2024 GDP growth for emerging markets worldwide , led by growth of about 5% for emerging Asia. We anticipate growth of 2%–2.5% for emerging Europe and Latin America, though U.S. growth could have positive implications for Mexico and all of Latin America.

- All investing is subject to risk, including the possible loss of the money you invest.

- Investments in bonds are subject to interest rate, credit, and inflation risk.

- Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

Global Chief Economist and Global Head, Investment Strategy Group

Mr. Davis is Vanguard's global chief economist and the global head of Vanguard Investment Strategy Group, whose research and client-facing team develops asset allocation strategies and conducts research on the capital markets, the global economy, and asset-allocation strategies. Mr. Davis also chairs the firm's Strategic Asset Allocation Committee for multi-asset-class investment solutions. As Vanguard's global chief economist, Mr. Davis is a member of the senior portfolio management team for Vanguard Fixed Income Group. Mr. Davis is a frequent keynote speaker, helped develop Vanguard Capital Markets Model and the firm's annual economic and capital markets outlook, has published white papers in leading academic and practitioner journals, and currently serves on the editorial board of the Journal of Portfolio Management . Mr. Davis earned his B.A. summa cum laude from Saint Joseph's University, his M.A. and Ph.D. in economics at Duke University, and is a graduate of the Advanced Management Program at the Wharton School at the University of Pennsylvania.

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Please guide me on selecting research titles

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

FinancialResearch.gov

Conferences, 2024 financial stability conference – call for papers.

Published: June 4, 2024

Share on Facebook Share on Linked In Logo for Twitter

The Federal Reserve Bank of Cleveland and the Office of Financial Research invite the submission of research and policy-oriented papers for the 2024 Financial Stability Conference on November 21–22, 2024. The conference will be held in person in Cleveland, Ohio, and virtually.

Markets and institutions, increasingly interconnected, are being challenged by the dizzying pace of changes in the financial system, accelerating the buildup of risk and threats to solvency. Regulatory adaptations add another layer of complexity to the issue. Increasingly sophisticated algorithms and the rise of generative artificial intelligence may create new vulnerabilities across the system as banks, nonbank financial institutions, and financial markets exploit nascent opportunities. The twelfth annual conference will explore how firms and markets can become resilient or even antifragile and how regulators can encourage and accommodate needed changes.

Conference Format

The conference will bring together policymakers, market participants, and researchers in two types of sessions:

- Policy Discussions These sessions include keynote addresses and panel discussions in which participants from industry, regulatory agencies, and academia share their insights.

- Research Forums These forums follow the format of an academic workshop and comprise sessions to discuss submitted papers.

We welcome submissions of research on topics related to potential financial stability risks faced by financial markets and institutions, sources of financial system resilience, and related public policy. Conference topics include but are not limited to the following:

Emerging Risks

As the financial system continues to evolve, new risks emerge along with new businesses, new strategies, and new technologies. Old problems take on new dimensions as fiscal and monetary policies adapt to new economic and political realities, thereby adding new stresses to regulatory frameworks that themselves struggle to adapt. As information technology moves risk out of closely regulated sectors, it also creates new vulnerabilities from cyber-attacks. A rapidly changing physical environment and the prospect of nonhuman intelligences add even more uncertainty.

- Financial stability concerns related to faster payments and equity transactions such as the implementation of t+1 settlement

- The financial stability implications of generative AI and deep learning

- Cryptocurrencies, smart contracts, and blockchain

- Cyber-attacks

- Climate risk

- Interaction of monetary policy with macroprudential supervision

- Sources of resilience in the financial sector

Financial Institutions

A riskier macroeconomic environment poses challenges for financial institutions and their supervisors. Risk management tools and strategies will be tested by fluctuations in inflation and output and by new regulations designed to mitigate vulnerabilities. Network effects, including interactions with a rapidly evolving fintech and crypto sector, may lead to further risks at a systemic level. How are institutions adapting to these risks and associated regulatory changes? How prepared are regulators and policymakers? Are existing microprudential and macroprudential toolkits sufficient?

- Bank lending to nonbank financial institutions (NBFI)

- Insurance markets

- Banking as a service (BaaS)

- Regional banks

- Interest rate risk

- Risks of rapid growth

- Unrealized losses on balance sheets and mark-to-market accounting

- Impact of reforms to lenders of last resort, deposit Insurance, capital rules, and the FHLB system

Financial Markets

Inflation and the associated responses of central banks around the world have contributed to stress to financial markets that has not been seen in the recent past. Financial stability threats may arise from resulting reallocations through volatility spikes, fire sales, and financial contagion. The continued development of algorithms, decentralized finance (DeFi), and complex artificial intelligence has the potential to add novel risks to financial markets. To what extent do investors recognize these risks, and how does recognition affect investors’ allocations? How does opacity resulting from deficiencies in reporting, risk management, and operation standards for these risks affect investor behavior?

- Risks associated with high levels and issuance of public debt (for example, recent volatility around Treasury funding announcements, concerns about primary dealers and principal trading firms, the SEC’s recent rule about what defines a dealer and what that might mean for Treasury markets)

- Short-term funding

- Implications of deficits, central bank balance sheet policies, and financial stability

- The impact of technological innovation on financial markets

Real Estate Markets

Real estate is often one of the sectors most affected by and can be a cause of financial instability. Construction and housing play a major role in the transmission of monetary policy, and real estate-based lending remains a major activity of banks, insurance companies, and mortgage companies. A complex and active securities market ties together financial institutions and markets in both residential and commercial real estate.

- Commercial real estate (CRE)

- Nonbank originators and servicers

- International contagion

- Implications of remote work and the impact of COVID-19

- Effects of monetary policy on real estate markets

Scientific Committee

- Vikas Agarwal, Georgia State University

- Marco Di Maggio, Harvard University

- Michael Fleming, Federal Reserve Bank of New York

- Rod Garratt, University of California, Santa Barbara

- Mariassunta Giannetti, Stockholm School of Economics

- Arpit Gupta, New York University, Stern School of Business

- Zhiguo He, Stanford University

- Zhaogang Song, Johns Hopkins University

- Russell R. Wermers, Robert H. Smith School of Business, The University of Maryland at College Park

Paper Submission Procedure

The deadline for submissions is Friday, July 5, 2024. Please submit completed papers through Conference Maker . Notification of acceptance will be provided by Friday, September 6, 2024. Final conference papers are due on Friday, November 1, 2024. In-person paper presentations are preferred. Questions should be directed to [email protected] .

Back to Conferences

You are now leaving the OFR’s website.

You will be redirected to:

You are now leaving the OFR Website. The website associated with the link you have selected is located on another server and is not subject to Federal information quality, privacy, security, and related guidelines. To remain on the OFR Website, click 'Cancel'. To continue to the other website you selected, click 'Proceed'. The OFR does not endorse this other website, its sponsor, or any of the views, activities, products, or services offered on the website or by any advertiser on the website.

Thank you for visiting www.financialresearch.gov.

- My View My View

- Following Following

- Saved Saved

Axos Financial shares fall after Hindenburg takes short position

- Medium Text

Sign up here.

Reporting by Arasu Kannagi Basil and Pritam Biswas in Bengaluru and Koh Qui Ging and Carolina Mandl in New York Editing by Shinjini Ganguli, Matthew Lewis and Nick Zieminski

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Markets Chevron

Canada's stock market hails BoC rate cut, loonie dips

Canadian stocks and bonds rallied on Wednesday, while the loonie touched a near two-week low against its U.S. counterpart, after the Bank of Canada became the first central bank among G7 countries to cut interest rates, raising prospects for Canada's economy.

- Bitfarms-stock

- News for Bitfarms

Analysts Offer Insights on Financial Companies: Bitfarms (BITF), Deutsche Bank AG (DB) and Oklo Inc (OKLO)

Analysts have been eager to weigh in on the Financial sector with new ratings on Bitfarms ( BITF – Research Report ), Deutsche Bank AG ( DB – Research Report ) and Oklo Inc ( OKLO – Research Report ).

Bitfarms (BITF)

H.C. Wainwright analyst Mike Colonnese initiated coverage with a Buy rating on Bitfarms today and set a price target of $4.00 . The company’s shares closed last Monday at $2.33.

According to TipRanks.com , Colonnese is a 5-star analyst with an average return of 55.0% and a 57.1% success rate. Colonnese covers the Financial sector, focusing on stocks such as Coinbase Global, Riot Platforms, and Cipher Mining.

Currently, the analyst consensus on Bitfarms is a Strong Buy with an average price target of $4.01, representing a 76.7% upside. In a report issued on May 21, Compass Point also maintained a Buy rating on the stock with a $6.00 price target.

See today’s best-performing stocks on TipRanks >>

Deutsche Bank AG (DB)

In a report released today, Anke Reingen from RBC Capital maintained a Buy rating on Deutsche Bank AG, with a price target of EUR17.75 . The company’s shares closed last Monday at $16.85, close to its 52-week high of $17.96.

Reingen has an average return of 3.3% when recommending Deutsche Bank AG.

According to TipRanks.com , Reingen is ranked #296 out of 8883 analysts.

Deutsche Bank AG has an analyst consensus of Moderate Buy, with a price target consensus of $19.13, representing a 14.6% upside. In a report issued on May 30, J.P. Morgan also maintained a Buy rating on the stock with a EUR17.70 price target.

Oklo Inc (OKLO)

Citi analyst Vikram Bagri initiated coverage with a Hold rating on Oklo Inc today and set a price target of $11.00 . The company’s shares closed last Monday at $9.29.

According to TipRanks.com , Bagri is ranked #8791 out of 8883 analysts.

The word on The Street in general, suggests a Hold analyst consensus rating for Oklo Inc with a $11.00 average price target.

TipRanks has tracked 36,000 company insiders and found that a few of them are better than others when it comes to timing their transactions. See which 3 stocks are most likely to make moves following their insider activities.

Read More on BITF:

- Bitfarms Accelerates Growth with Enhanced Efficiency

- Bitfarms Provides May 2024 Production and Operations Update

- Bitfarms Shareholders Elect New Directors

- Bitfarms Announces Results of Annual General and Special Meeting of Shareholders

- Here’s What You Missed in Crypto This Week

Bitfarms News MORE

Related stocks.

IMAGES

VIDEO

COMMENTS

New research on financial markets from Harvard Business School faculty on issues including the extent to which investor sentiment drives credit booms and busts, why retail executives underplay current performance to investors, and the effects of education, cognitive ability, and financial literacy on financial market participation.

No news or press releases for in the last 30 days. The latest finance and stock market news covering the Dow, S&P 500, banking, investing and regulation.

Find the latest stock market news from every corner of the globe at Reuters.com, your online source for breaking international market and finance news

Browse Financial markets news, research and ... The latest market breakthrough follows the S&P 500 topping 5,000 in February. ... Decentralized finance makes it easier for virtually anyone to take ...

The Journal of Finance publishes leading research across all the major fields of financial research. It is the most widely cited academic journal on finance. Each issue of the journal reaches over 8,000 academics, finance professionals, libraries, government and financial institutions around the world. Published six times a year, the journal is the official publication of The American Finance ...

Bloomberg delivers business and markets news, data, analysis, and video to the world, featuring stories from Businessweek and Bloomberg News on everything pertaining to markets

Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading and investment decisions.

Stay on top of the changing markets and dive deep into insights from experts. Get the latest perspectives on today's stock market and the global economy. ... expert advice and the latest research on a variety of topics. Select a topic of interest: Today's markets; Investment trends;

MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more.

Breaking news and in-depth coverage from the global business and financial markets. The latest corporate earnings reports from the stock market and insights into the future of digital currency.

Learn about McKinsey Global Institute's research on Financial Markets. ... Financial Markets. Global balance sheet 2022: Enter volatility. December 15, 2022 - Growth in the global balance sheet accelerated during the pandemic, but paused in 2022. ... The new era of global flows. February 24, ...

Article 100702. View PDF. Article preview. Read the latest articles of Journal of Financial Markets at ScienceDirect.com, Elsevier's leading platform of peer-reviewed scholarly literature.

Macroeconomics matter: Leading economic indicators and the cross-section of global stock returns. Huaigang Long, Adam Zaremba, Wenyu Zhou, Elie Bouri. Article 100736. View PDF. Article preview. Read the latest articles of Journal of Financial Markets at ScienceDirect.com, Elsevier's leading platform of peer-reviewed scholarly literature.

Forthcoming research may analyse the effect of investor sentiment on specific sectors (Houlihan and Creamer 2021), as well as the impact of diverse types of news on financial markets (Heston and Sinha 2017). This is important for understanding how markets process information.

Founded in 1846, AP today remains the most trusted source of fast, accurate, unbiased news in all formats and the essential provider of the technology and services vital to the news business. More than half the world's population sees AP journalism every day. Follow the latest developments in global financial markets with updates from AP News.

Finance Worldline in exclusive talks for Credem's shop payments business June 4, 2024. Technology category Swiss financial regulator wants to be able to name and shame banks June 4, 2024. Future ...