The 2 Simple & Straightforward Methods for Market Sizing Your Business

Published: September 21, 2023

When you’re considering a new venture, one of the first things you should do is determine whether there is a valuable market for it.

Discover the methods to calculate your market size and accurately measure your business’ revenue potential .

Keep reading, or jump to the section you’re looking for:

What is market sizing?

Market sizing terms to know, how to calculate market size, market sizing methods.

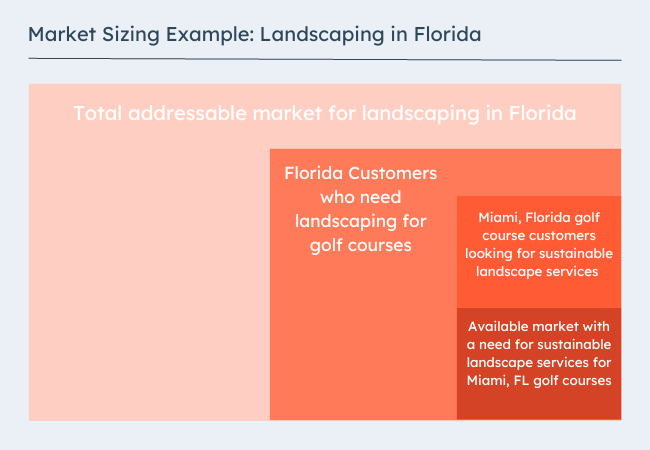

Market sizing is the process of finding how big your product's audience or revenue could be. So, market size is the total number of potential buyers for a product or service and the potential revenue reach based on that population size.

When market sizing, you're calculating customer numbers to measure the growth potential of your business.

.png)

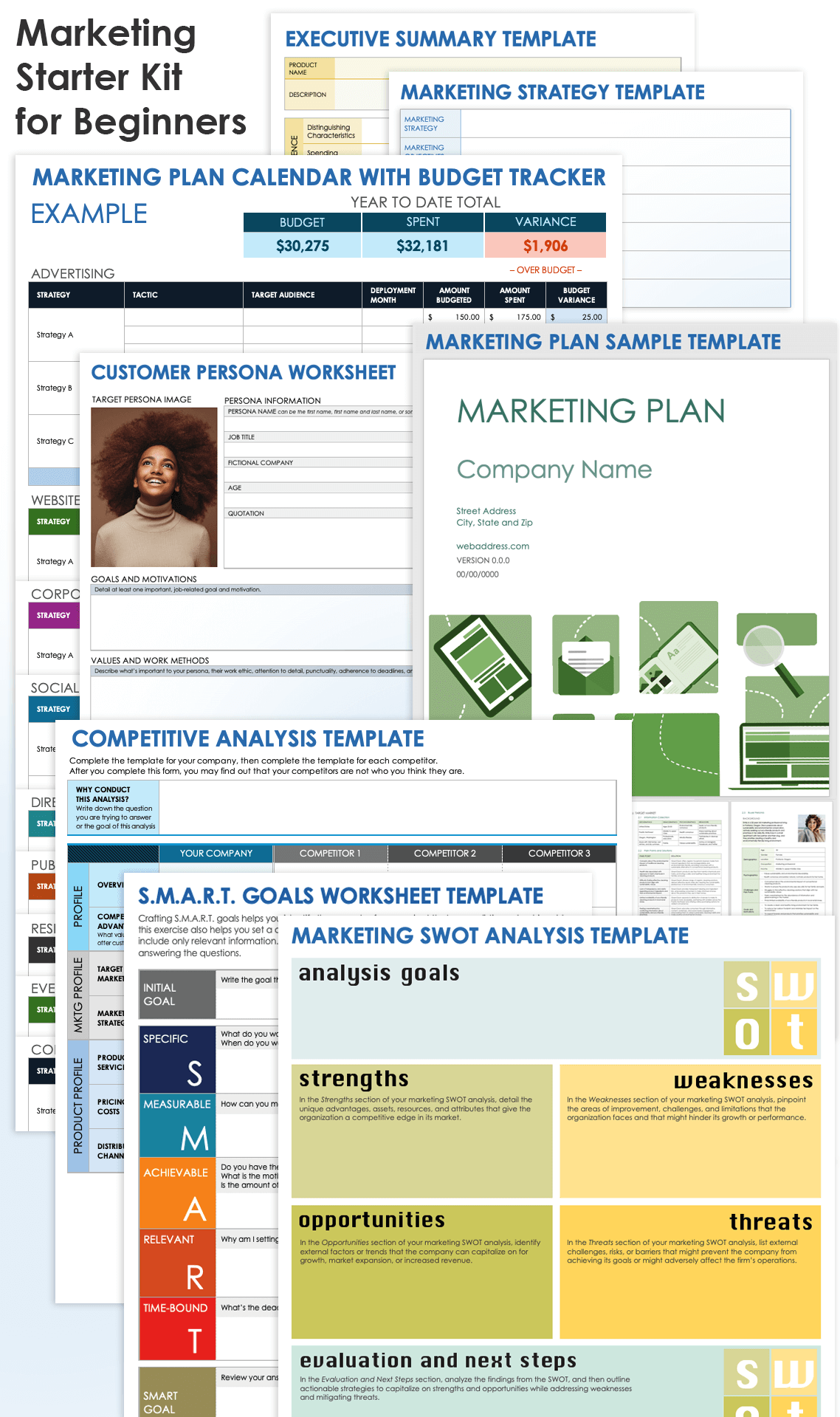

Free Market Research Kit

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why is market size important?

There are several reasons why every business should spend time sizing its market:

- Market sizing helps you figure out if your product is a worthy investment. Say you have a great idea for a product but there are only 100 people who would buy it. From there, you can decide if that population size is worth the cost of manufacturing, production, distribution, and more for your product.

- Market sizing helps you estimate profit and potential for growth. If you know how many people your business has the potential to reach, you can estimate how much revenue you can generate. This is valuable for both business owners as well as investors.

- Market size defines who you’re marketing to and what their needs are. No business can succeed without marketing. Knowing your market size is the first step in understanding your target market and their needs.

- Market sizing helps your business make better decisions. Understanding your market landscape, gaps, and opportunities will inform your decision-making. It can also help you set more realistic goals, assign resources, and refine your strategies.

- Market sizing helps your business minimize risk. Starting or expanding a business is inherently risky. Understanding your market can help you anticipate and prepare for challenges.

Market Size vs. Market Value

Market size is the total potential demand for a product or service. This number usually calculates the number of potential customers, units sold, or revenue generated. So, market size is an estimate of the overall market reach.

Market value refers to the financial worth or estimated market capitalization of a company or industry. It’s a measure of perceived value. It can give you an idea of how much a company could sell for in a given market.

In summary, market size focuses on the potential market opportunity, while market value is the financial value of an individual company or an entire market.

Before diving into how to figure out your market size, there are a few helpful terms you should get to know.

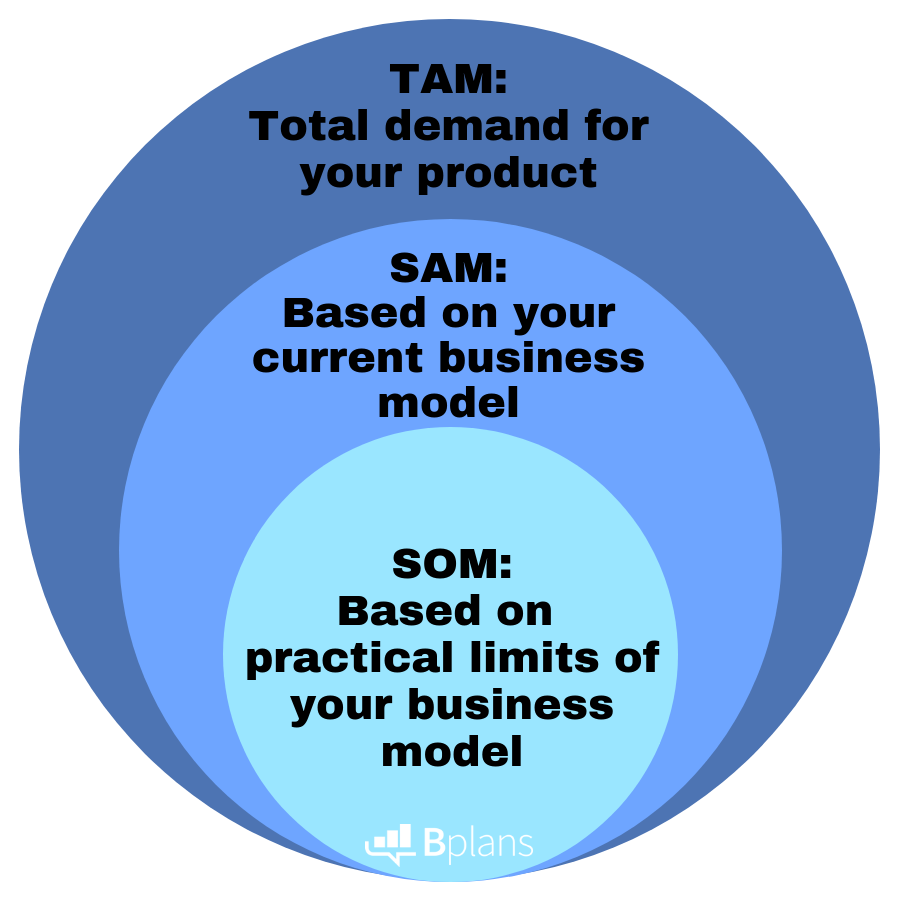

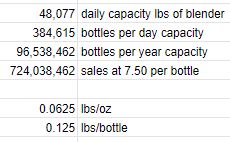

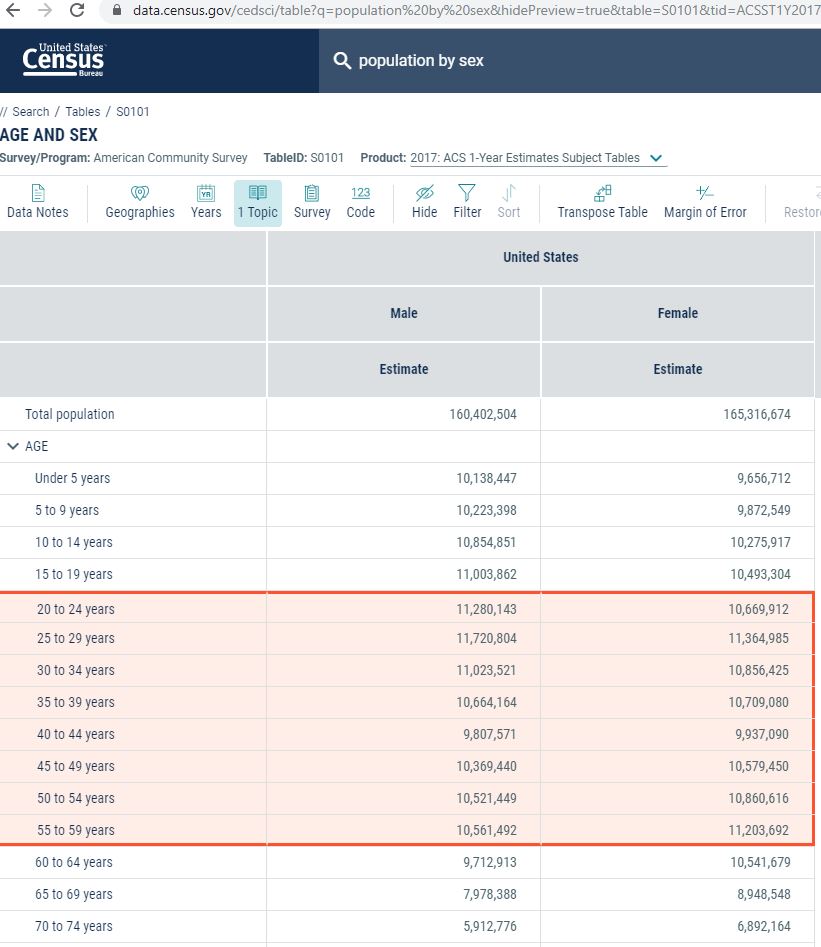

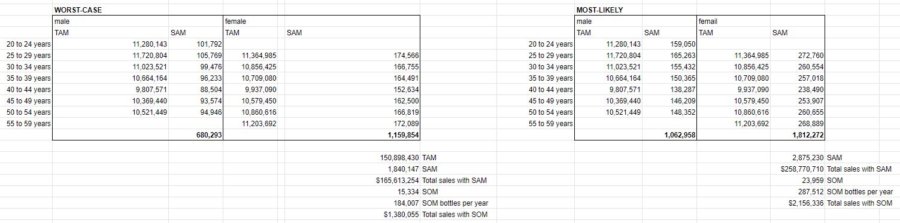

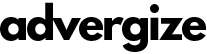

TAM stands for Total Addressable Market. This number is the maximum potential revenue or customer base that a company could achieve if it were to capture 100% of market share.

SAM stands for Serviceable Addressable Market. SAM is a part of the TAM that aligns with the company's resources, capabilities, and target customers.

SOM stands for Serviceable Obtainable Market. SOM is the part of the SAM that a company can get at its current scale. This figure may consider marketing and sales strategies, competitive positioning, and product demand.

Check out this post to learn more about TAM, SAM, and SOM and how to calculate them.

Target Market

A target market is a specific group of customers, industries, or segments that a company focuses on. It's the customer segment that's most likely to show interest, purchase, and appreciate a company's products or services.

Penetration Rate

Penetration rate refers to the percentage of a target market that a company has successfully captured. It shows the level of market share reached by a company in a specific market segment or overall market.

If you're a new business, you can calculate penetration rate by dividing your total customers by the number of potential customers in the target market. Then, multiply the result by 100 to get the percentage.

Learn more about market penetration here.

Market Segmentation

Market segmentation is the process of dividing the total market into distinct groups or segments. Usually, the people in these segments have common characteristics, needs, or behaviors.

Segmenting the market can help you better understand your target customers. It can also help you tailor business strategies, like marketing , to meet specific segment needs.

Value Proposition

A value proposition is the unique benefits that a company offers to its target customers. It differentiates a company's product or service from competitors and creates value for customers.

Understanding the value proposition is crucial in market sizing. This is because it can help you find the specific customer segments that will find the most value in your offer.

Try one of these free value proposition templates to draft your value proposition.

- Start with your total addressable market.

- Find a group of customers to focus on within that target market.

- Figure out how many of those customers are likely to buy your product.

- Multiply that customer number by estimated penetration rate.

While calculating market size takes only a few steps, it's a crucial process. The steps below will help you understand the potential demand and revenue opportunities for your business.

1. Start with your total addressable market.

You can calculate your TAM by multiplying the total customers in a market by the annual value per customer. But before calculating, make sure you take a look at the tips below:

- Define your product or service. While developing a product can be quick, growing a business around a product is more complex. It's important to clearly understand your product or service and how it solves a problem or meets a need in the market.

- Find your market category. Some products fall within more than one industry or market category. This is the first step that will narrow your TAM. So, think carefully about what you expect customers to compare your offer to.

- Conduct market research. Gather relevant data and information about your potential users. If you're new to market research, check out this free market research kit , with research and planning templates.

- Analyze the competition. Conduct competitive analysis to figure out the market share and unique value of your top competitors.

- Define your total addressable market. With the research and analysis you've pulled together, create a realistic TAM estimate.

2. Find a group of customers to focus on within that target market.

Dig into the tips below to quantify the top customers in your market:

- Create your ideal buyer persona. Use the Make My Persona tool to outline the characteristics, demographics, and behaviors of your ideal customers.

- Segment your target market. Start dividing your target market into distinct segments. You might base segments on factors like age, location, interests, or buying behavior.

- Continue market research. Continue collecting data and insights about each segment. This will help you understand how big each segment is, as well as their needs, preferences, pain points, and purchasing habits. Your ongoing market research might include surveys, interviews, focus groups, or analyzing existing market research.

- Set pricing for your product or service. For some products, pricing is a deciding purchase factor. So, if you haven't already, set pricing or a price range for your products.

- Assess segments of your market and prioritize . Think about each segment's size, growth potential, and competition. It's also a good idea to think about how each segment aligns with your company's capabilities and resources. In short, don't just focus on segments that offer the most attractive opportunities. Make sure they align with your strengths and needs.

- Refine your buyer personas. With your prioritized segments, take another look at your ideal customer profile. This will give you a more useful buyer persona for your marketing and sales strategies.

- Confirm your SAM with market testing. Test your target segments with a product or service pilot group, measuring their responses and feedback.

3. Figure out how many of those customers are likely to buy your product.

This step will narrow your scope more intensely on the customers who need exactly what you have to offer. These are the people who are looking for you or a clear alternative to your competitors. To quantify this group:

- Create a customer journey map. From awareness to purchase, this process can help you map out the ideal customer path. From how you expect customers to discover your products to the blockers that might keep them from clicking buy, this step is useful for market sizing and beyond. Use these customer journey templates if you're new to this process.

- Estimate conversion rates. Use historical data, industry benchmarks, or industry research to estimate conversion rates. This can help you quantify expected numbers of leads, prospects, and customers in each segment.

- Figure out buyer intent. Create a ranking or score for each segment to measure their likelihood of purchasing your product. This can help you prioritize segments with the highest conversion potential.

- Create a SOM estimate with your data. The research above will add credibility to your market size estimate. It can also help guide your growth strategies.

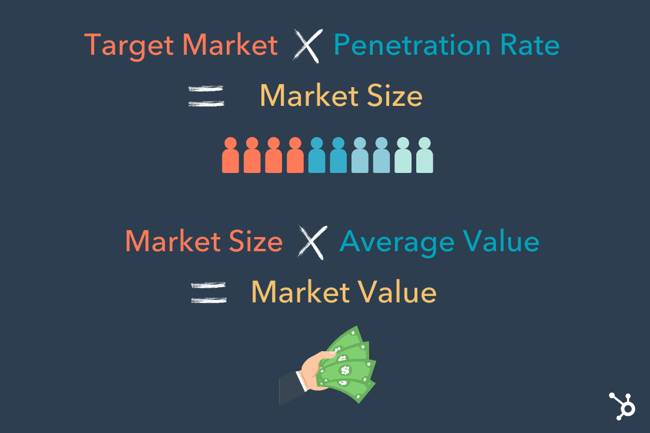

4. Multiply that customer number by estimated penetration rate.

To calculate penetration rate, divide the SOM you calculated above by your TAM, then multiply by 100.

Once you have a calculation for your market size, you'll want to make sure you can trust that number. Keep your market sizing current with these tips:

- Confirm your data is accurate and reliable. As you complete your research, use reliable sources such as industry reports, market studies, or government databases. Also, check to ensure the data you're referencing is up to date.

- Keep up with market growth, seasonality, industry trends, tech advancements, regulatory changes, and economic conditions. These factors can affect both market size and customer demand.

- Review and update your market size estimates regularly. Market conditions change over time. Plan regular reviews of your market size, then update your calculations with new or relevant data.

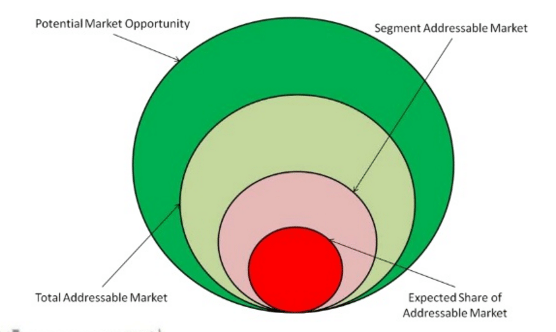

There are two simple methods for market sizing your business. These straightforward processes can help you use data to gauge market size.

Top Down Approach

The first is a top-down approach, in which you start by looking at the market as a whole, then refine it to get an accurate market size. That would look like starting from your total addressable market and filtering from there.

Don't forget to share this post!

Related articles.

![how to determine market size for a business plan Solving the Crisis of Disconnection: How to Unite Your Brand Around Growth [Expert Tips & Data]](https://blog.hubspot.com/hubfs/solving-for-company-disconnection_3.webp)

Solving the Crisis of Disconnection: How to Unite Your Brand Around Growth [Expert Tips & Data]

3 Reasons So Many Business Strategies Fail (And How To Succeed), According to the Strategy Hacker

Business Strategy: What It Is & How to Build an Effective One

How to Automate Your Business's Reporting Workflows

7 Challenges for Growing Businesses (& How to Fix Them)

7 Reasons Scale-Ups Earn Investments, According to HubSpot's Founder

A Marketer's Short & Sweet Guide on Diversification

15 Effective Ways to Cut Costs in Business

How to Find Your Business's White Space Opportunities

How These 7 Companies Thrived During the Recession

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Skip to content.

- Jump to Page Footer.

Webinar: Foreign Investment in 2024

Discover the secrets to prospecting and selecting relevant investors, and unlock the potential of international funding opportunities. Our expert speakers provide invaluable insights on engaging with investors, creating an international investment strategy, and navigating term sheet negotiations.

How to estimate market size: Business and marketing planning for startups

Sizing the market is a necessary task for business and marketing planning, and budgeting for all startups, especially those that seek third-party financing such as venture capital (VC). Even though their investment philosophies may differ, most VCs and angel investors would like to know that they are investing in a market with a large potential size (typically, at least $1 billion).

Understanding your market potential

Even if you do not seek external financing, understanding your market potential is essential for a range of different strategic decisions, in areas such as:

- Product development

- Partnering and distribution

- Organizational design and critical employee skills

Starting point for estimating market size: Know the problem you are solving

The starting point for estimating market size is to understand the problem you solve for customers and the potential value your product generates for them. This is an aspect that many startup founders in the innovation community tend to overlook, since they get excited about the product they’ve developed without thinking about how it benefits their audience.

Depending on your technology, you may have to choose which customer problem to solve first. If this is the case, completing the exercise below may help you better grasp the market size for each application. This will make it easier to prioritize which problem to solve first.

Exercise: Estimating market size

This exercise consists of five steps to help you estimate the total market potential for a product. In each step, we build on a health innovation case study that assumes the problem we solve relates to patient safety in hospitals.

Step 1. Define your target customer

All early-stage entrepreneurs and startups must define their target customer .

Your target customer equals the person or company for whom your technology solves a specific problem. To define your target customer you must:

- Determine who your target customer is.

- Create a profile of your typical/expected target customer.

Given the importance of defining your target customer, it is crucial to set aside enough time to do a proper analysis of this first step.

Case study: We have analyzed patient-safety procedures in a few hospitals. We have determined that our innovative technology would generate the most value in the largest hospitals (the top 25%, ranked by size).

Step 2. Estimate the number of target customers

Estimate the total number of target customers in the market—companies who have a profile similar to that of your target customer.

If you’re a startup venture in Ontario or another Canadian province, you can use industry databases such as those offered by Statistics Canada, U.S. Bureau of Economic Analysis or Hoovers to help you quantify your market.

Case study: By studying publicly available sources, we have found out that in our target group there are 1,300 hospitals in Canada and the United States.

Step 3. Determine your penetration rate

Refine your market size by assuming a penetration rate for your category of product. The penetration rate is a function of the nature of your product. Assume a high penetration rate if your category of product is mission-critical or mandated through regulation; assume a low penetration rate for products with a specialized purpose.

Example: penetration rates of computers versus business intelligence systems:

- Computers, word-processing and internet: It is almost impossible today to operate a business in the developed world without a computer that has word-processing capabilities and is connected to the internet. While the penetration of those three technologies has not quite reached 100%, it is close enough to use that assumption for business growth and planning.

- Business intelligence systems: In theory, most companies would benefit from having a business intelligence system – a type of software that is used to manage and analyze data about finance, sales, and marketing activities, in addition to more specialized purposes. In practice, however, few ventures have the combination of the scale, skills and business practices required to make business intelligence systems a worthwhile investment.This limits the penetration rate to very large organizations that make up maybe less than 1% of all businesses in the developed world. Nevertheless, while 1% may not sound like a lot, it still represents a much larger number of target customers than a new startup could effectively pursue.

Case study: We have studied the factors that drive improvement in patient safety across North America, and found that it depends on provincial and state regulations. Based on areas where patient-safety regulations are strict, we can assume a penetration rate of 70% for our technology .

Step 4. Calculate the potential market size: Volume and value

Market volume.

To find the overall market potential (that is, the potential market volume), multiply your number of target customers by the penetration rate (see steps 2 and 3 above).

Case study : Using our fictitious example, where the number of target customers is 1,300 and the penetration rate is assumed to be 70%, the potential market volume would be calculated as follows:

1,300 hospitals × 70% = 910 hospitals

Market value

To calculate the monetary value of the market, multiply the market volume by your average value (that is, price expectations).

Case study: We assume each sale to a hospital will yield an average value of $2.5 million. To find the market value, we calculate the following:

910 hospitals × $ 2.5 million = $ 2.275 billion

5. Apply the market-size data

Following these steps to estimate your market size (value) is by no means an exact science. Still, there are ways to maximize the effectiveness of this exercise:

- At the time you make your first estimate, examine each assumption you make and what would cause it to change. To factor in the risks of change, calculate best-case and worst-case scenarios in addition to your expected scenario.

- Over time, monitor the accuracy of your initial assumptions and whether you need to modify them.

Case study: Our patient-safety technology may appeal to hospitals of a smaller size than initially assumed, especially if new regulations mandate tighter patient-safety procedures from all hospitals. While such a change would more than double the number of hospitals in our target market, smaller hospitals would not be able to pay as much, in turn driving the expected average price per sale down to $2 million.

Note: This exercise aims at estimating the total market potential for a product. It is important for startups to recognize that both early adopters and laggards are included in those numbers. While early adopters will likely be your customers in years 1 and 2, the laggards may not enter the market until year 20 or later. In terms of our case study, this would mean that the size of the market in year 1 would be about $100 million if early adopters comprise 5% of the overall hospital market for patient safety. For a more detailed understanding of how markets develop, read the article Technology adoption lifecycle .

The highlights

- Define your target customer

- Estimate the number of target customers

- Determine your penetration rate

- Calculate the potential market size: Volume and value

- Apply the market-size data

- The starting point? Understand the customer problem you solve and the potential value you generate.

Summary: These five steps outline how to estimate a market size—essential when making strategic decisions (e.g, business and marketing planning) and seeking third-party financing (e.g., venture capital).

Researching a market? Our free online course Introduction to Market Sizing offers a practical 30-minute primer on market research and calculating market size.

Want to learn how to understand and talk to your customers? Join us for our next cohort of the Customer Development Immersive.

SWOT analysis: A framework to develop strategic marketing and business goals

Tips & tricks: pitching as a cleantech startup, understand your target customer: know how to conduct market research and apply what you learn, sign up for our monthly startup resources newsletter about building high-growth companies..

- Enter your email *

You may unsubscribe at any time. To find out more, please visit our Privacy Policy .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Market Analysis for a Business Plan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A lot of preparation goes into starting a business before you can open your doors to the public or launch your online store. One of your first steps should be to write a business plan . A business plan will serve as your roadmap when building your business.

Within your business plan, there’s an important section you should pay careful attention to: your market analysis. Your market analysis helps you understand your target market and how you can thrive within it.

Simply put, your market analysis shows that you’ve done your research. It also contributes to your marketing strategy by defining your target customer and researching their buying habits. Overall, a market analysis will yield invaluable data if you have limited knowledge about your market, the market has fierce competition, and if you require a business loan. In this guide, we'll explore how to conduct your own market analysis.

How to conduct a market analysis: A step-by-step guide

In your market analysis, you can expect to cover the following:

Industry outlook

Target market

Market value

Competition

Barriers to entry

Let’s dive into an in-depth look into each section:

Step 1: Define your objective

Before you begin your market analysis, it’s important to define your objective for writing a market analysis. Are you writing it for internal purposes or for external purposes?

If you were doing a market analysis for internal purposes, you might be brainstorming new products to launch or adjusting your marketing tactics. An example of an external purpose might be that you need a market analysis to get approved for a business loan .

The comprehensiveness of your market analysis will depend on your objective. If you’re preparing for a new product launch, you might focus more heavily on researching the competition. A market analysis for a loan approval would require heavy data and research into market size and growth, share potential, and pricing.

Step 2: Provide an industry outlook

An industry outlook is a general direction of where your industry is heading. Lenders want to know whether you’re targeting a growing industry or declining industry. For example, if you’re looking to sell VCRs in 2020, it’s unlikely that your business will succeed.

Starting your market analysis with an industry outlook offers a preliminary view of the market and what to expect in your market analysis. When writing this section, you'll want to include:

Market size

Are you chasing big markets or are you targeting very niche markets? If you’re targeting a niche market, are there enough customers to support your business and buy your product?

Product life cycle

If you develop a product, what will its life cycle look like? Lenders want an overview of how your product will come into fruition after it’s developed and launched. In this section, you can discuss your product’s:

Research and development

Projected growth

How do you see your company performing over time? Calculating your year-over-year growth will help you and lenders see how your business has grown thus far. Calculating your projected growth shows how your business will fare in future projected market conditions.

Step 3: Determine your target market

This section of your market analysis is dedicated to your potential customer. Who is your ideal target customer? How can you cater your product to serve them specifically?

Don’t make the mistake of wanting to sell your product to everybody. Your target customer should be specific. For example, if you’re selling mittens, you wouldn’t want to market to warmer climates like Hawaii. You should target customers who live in colder regions. The more nuanced your target market is, the more information you’ll have to inform your business and marketing strategy.

With that in mind, your target market section should include the following points:

Demographics

This is where you leave nothing to mystery about your ideal customer. You want to know every aspect of your customer so you can best serve them. Dedicate time to researching the following demographics:

Income level

Create a customer persona

Creating a customer persona can help you better understand your customer. It can be easier to market to a person than data on paper. You can give this persona a name, background, and job. Mold this persona into your target customer.

What are your customer’s pain points? How do these pain points influence how they buy products? What matters most to them? Why do they choose one brand over another?

Research and supporting material

Information without data are just claims. To add credibility to your market analysis, you need to include data. Some methods for collecting data include:

Target group surveys

Focus groups

Reading reviews

Feedback surveys

You can also consult resources online. For example, the U.S. Census Bureau can help you find demographics in calculating your market share. The U.S. Department of Commerce and the U.S. Small Business Administration also offer general data that can help you research your target industry.

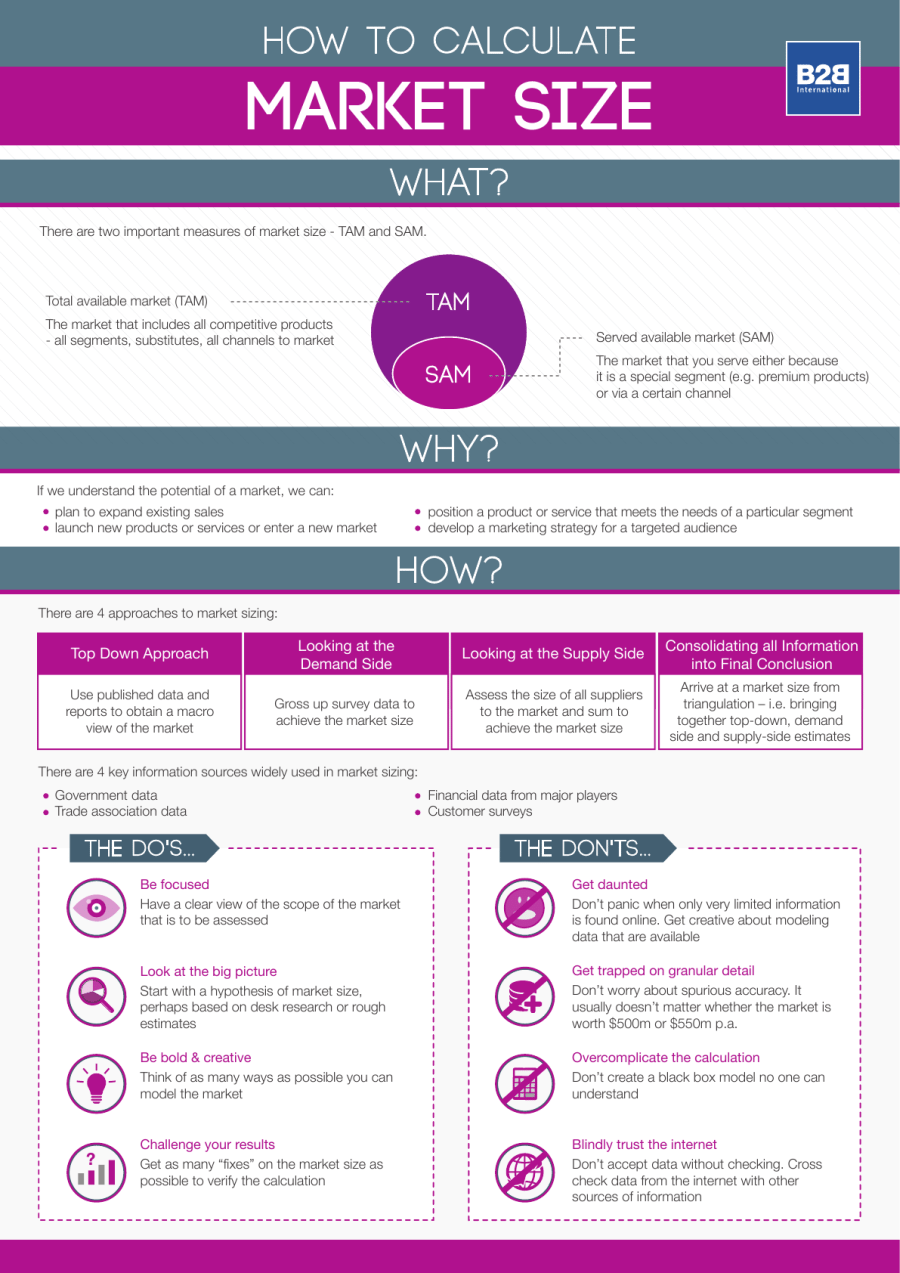

Step 4: Calculate market value

You can use either top-down analysis or bottom-up analysis to calculate an estimate of your market value.

A top-down analysis tends to be the easier option of the two. It requires for you to calculate the entire market and then estimate how much of a share you expect your business to get. For example, let’s assume your target market consists of 100,000 people. If you’re optimistic and manage to get 1% of that market, you can expect to make 1,000 sales.

A bottom-up analysis is more data-driven and requires more research. You calculate the individual factors of your business and then estimate how high you can scale them to arrive at a projected market share. Some factors to consider when doing a bottom-up analysis include:

Where products are sold

Who your competition is

The price per unit

How many consumers you expect to reach

The average amount a customer would buy over time

While a bottom-up analysis requires more data than a top-down analysis, you can usually arrive at a more accurate calculation.

Step 5: Get to know your competition

Before you start a business, you need to research the level of competition within your market. Are there certain companies getting the lion’s share of the market? How can you position yourself to stand out from the competition?

There are two types of competitors that you should be aware of: direct competitors and indirect competitors.

Direct competitors are other businesses who sell the same product as you. If you and the company across town both sell apples, you are direct competitors.

An indirect competitor sells a different but similar product to yours. If that company across town sells oranges instead, they are an indirect competitor. Apples and oranges are different but they still target a similar market: people who eat fruits.

Also, here are some questions you want to answer when writing this section of your market analysis:

What are your competitor’s strengths?

What are your competitor’s weaknesses?

How can you cover your competitor’s weaknesses in your own business?

How can you solve the same problems better or differently than your competitors?

How can you leverage technology to better serve your customers?

How big of a threat are your competitors if you open your business?

Step 6: Identify your barriers

Writing a market analysis can help you identify some glaring barriers to starting your business. Researching these barriers will help you avoid any costly legal or business mistakes down the line. Some entry barriers to address in your marketing analysis include:

Technology: How rapid is technology advancing and can it render your product obsolete within the next five years?

Branding: You need to establish your brand identity to stand out in a saturated market.

Cost of entry: Startup costs, like renting a space and hiring employees, are expensive. Also, specialty equipment often comes with hefty price tags. (Consider researching equipment financing to help finance these purchases.)

Location: You need to secure a prime location if you’re opening a physical store.

Competition: A market with fierce competition can be a steep uphill battle (like attempting to go toe-to-toe with Apple or Amazon).

Step 7: Know the regulations

When starting a business, it’s your responsibility to research governmental and state business regulations within your market. Some regulations to keep in mind include (but aren’t limited to):

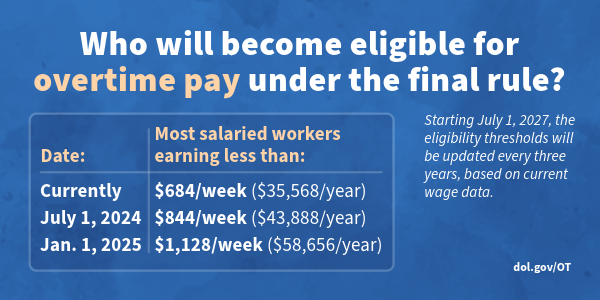

Employment and labor laws

Advertising

Environmental regulations

If you’re a newer entrepreneur and this is your first business, this part can be daunting so you might want to consult with a business attorney. A legal professional will help you identify the legal requirements specific to your business. You can also check online legal help sites like LegalZoom or Rocket Lawyer.

Tips when writing your market analysis

We wouldn’t be surprised if you feel overwhelmed by the sheer volume of information needed in a market analysis. Keep in mind, though, this research is key to launching a successful business. You don’t want to cut corners, but here are a few tips to help you out when writing your market analysis:

Use visual aids

Nobody likes 30 pages of nothing but text. Using visual aids can break up those text blocks, making your market analysis more visually appealing. When discussing statistics and metrics, charts and graphs will help you better communicate your data.

Include a summary

If you’ve ever read an article from an academic journal, you’ll notice that writers include an abstract that offers the reader a preview.

Use this same tactic when writing your market analysis. It will prime the reader of your market highlights before they dive into the hard data.

Get to the point

It’s better to keep your market analysis concise than to stuff it with fluff and repetition. You’ll want to present your data, analyze it, and then tie it back into how your business can thrive within your target market.

Revisit your market analysis regularly

Markets are always changing and it's important that your business changes with your target market. Revisiting your market analysis ensures that your business operations align with changing market conditions. The best businesses are the ones that can adapt.

Why should you write a market analysis?

Your market analysis helps you look at factors within your market to determine if it’s a good fit for your business model. A market analysis will help you:

1. Learn how to analyze the market need

Markets are always shifting and it’s a good idea to identify current and projected market conditions. These trends will help you understand the size of your market and whether there are paying customers waiting for you. Doing a market analysis helps you confirm that your target market is a lucrative market.

2. Learn about your customers

The best way to serve your customer is to understand them. A market analysis will examine your customer’s buying habits, pain points, and desires. This information will aid you in developing a business that addresses those points.

3. Get approved for a business loan

Starting a business, especially if it’s your first one, requires startup funding. A good first step is to apply for a business loan with your bank or other financial institution.

A thorough market analysis shows that you’re professional, prepared, and worth the investment from lenders. This preparation inspires confidence within the lender that you can build a business and repay the loan.

4. Beat the competition

Your research will offer valuable insight and certain advantages that the competition might not have. For example, thoroughly understanding your customer’s pain points and desires will help you develop a superior product or service than your competitors. If your business is already up and running, an updated market analysis can upgrade your marketing strategy or help you launch a new product.

Final thoughts

There is a saying that the first step to cutting down a tree is to sharpen an axe. In other words, preparation is the key to success. In business, preparation increases the chances that your business will succeed, even in a competitive market.

The market analysis section of your business plan separates the entrepreneurs who have done their homework from those who haven’t. Now that you’ve learned how to write a market analysis, it’s time for you to sharpen your axe and grow a successful business. And keep in mind, if you need help crafting your business plan, you can always turn to business plan software or a free template to help you stay organized.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

How to Determine Market Size for a Business Plan

- Small Business

- Advertising & Marketing

- Business Marketing Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

The Tax Basis and Selling Expenses for Land

How to approach new clients, how to calculate variable contribution margin.

- Examples of Market Needs in a Marketing Plan

- Similarities Between Facebook & Twitter

If you do things right, your business plan is the first step in your journey toward becoming an entrepreneur, but the key is to ensure that every detail is correct. One of the most important aspects of your business plan is to determine the market size for the products or services that you intend to offer your target audience. Any legitimate investor will want to know that his investment has the potential for a sizeable return, and he will base his decision, in large part, on the size of the market that you’re trying to enter. Sizing up your market is also beneficial for developing new products and services.

Define Your Ideal Customer

You can’t begin to determine the market size without defining your ideal customer, who is also known as your targeted audience. The best way to figure this out is to know exactly what problem your product or service solves for the people most likely to be interested in making a purchase. For example, if you’re selling a gadget that can locate any remote control device in a person’s house, research may tell you that your ideal customer is a man in the 25- to 50-year old age range.

You arrived at this targeted consumer because your research told you that men dominate possession of television remote control devices, and are therefore more likely to misplace them, and then will be more likely to need your device. This process isn’t simply to determine not only who will buy your product or service, but also to help you eliminate people who will not be attracted to what you’re selling.

Define Your Piece of the Overall Market

The good news is that there isn't any company that's already established in your market that has a monopoly on that market. However, to have any chance of success, you must define the piece of that market that you are going to target. You can do this by taking the biggest player in the field and finding out how much of the market it has captured. For example, if you’re entering the TV device market, you may learn that customers spent $2 billion on these devices in 2017.

You also learn that Panasonic accounts for $1.5 billion of that market, so you know that the remaining $500 million is spread out among multiple smaller companies, and is the piece you'd would like to bite from.

Determine Your Percentage of that Piece of the Market

Just because you have now defined the size of your piece of the market doesn’t mean that you’re done because you still have to figure out your percentage of that piece. To do that, you have to know where you intend to sell your product or service, how many of that product or service you project to sell in a year, as well as the number of similar products and services that sold in the market the previous five years.

The projected number of sales will tell you what percentage of the market you can reasonably hope to capture, typically somewhere between 1 to 5 percent.

- GrowThink: How to Size an Emerging Market in Your Business Plan

- Entrepreneur: 5 Strategies to Effectively Determine Your Market Size

- Startups: How to Calculate the size of Your Target Plan

- Include potential market, target market and market share in your business plan. This will show readers how you arrived at your figures. You want to demonstrate a rational process that starts with a very large number and gradually reduces it to a smaller number you can expect to sell to. Showing the entire process will prove that your method was not arbitrary.

Sampson Quain is an experienced content writer with a wide range of expertise in small business, digital marketing, SEO marketing, SEM marketing, and social media outreach. He has written primarily for the EHow brand of Demand Studios as well as business strategy sites such as Digital Authority.

Related Articles

How to upload a photo with a comment to facebook via an app, how to estimate market penetration, how to calculate a served available market & a target market, how to find your scanner on android, how to calculate market share for start-up companies, how to factory reset a sony walkman a series, how to calculate total sales revenue in economics, how to create a backup firmware image of an iphone, how to figure market penetration, most popular.

- 1 How to Upload a Photo With a Comment to Facebook via an App

- 2 How to Estimate Market Penetration

- 3 How to Calculate a Served Available Market & a Target Market

- 4 How to Find Your Scanner on Android

%20(1).png)

Market Size Calculator (With AI Summary)

Whether you're a seasoned entrepreneur or a budding startup enthusiast, understanding your potential market size is crucial. It helps validate your business idea, attracts investors, and forms the backbone of your business plan. But how do you estimate market size without spending a fortune? Let's explore the principles of market sizing and introduce our free Market Size Calculator tool.

What is Market Size?

Market size refers to the number of potential customers or the total revenue potential for your product or service. It gives you an idea of the potential growth and profitability of your business idea.

Top-Down vs. Bottom-Up Approach

- Top-Down : This method begins with a broader view, usually a global or national statistic, and then narrows down. For instance, if you're starting a makeup brand, you'd look at the global beauty market's value and estimate your brand's potential share.

- Bottom-Up : This starts with granular data, perhaps a survey or pilot, and then scales it up. If you sold 100 products in a test market of 10,000 people, you'd predict sales for a larger population.

Factors to Consider

- Segmentation : Segment your market by age, location, gender, interests, etc., to get a clearer picture.

- Growth Rate : Understand how fast your industry or target market is growing. A stable market might mean less potential, but also less volatility.

- Market Trends : Stay updated with industry trends. For instance, a growing trend towards remote work might mean an increasing market for home office supplies.

Best Practices and Tips

- Use Multiple Sources : Don’t rely on just one statistic or survey. Using various data sources can give a more accurate picture.

- Stay Updated : Markets change. Regularly update your data, especially if there's a significant shift in the industry.

- Validate with Primary Research : After your secondary research (existing data), validate your findings with primary research, such as surveys or interviews.

- Consider the Competition : While assessing the market size, remember that you're not alone. Factor in competitors and their market share.

Using Our Free Market Size Calculator Tool

Our easy-to-use Market Size Calculator tool provides a quick estimate based on the inputs you provide. Here's how to utilize it:

- Business Idea : Describe your business idea briefly. This gives context to the estimation.

- Target Geography : Select where you plan to operate or sell. This could be as specific as a country or as broad as globally.

- Trend : Is your industry growing, stable, or declining? Your estimate will be adjusted based on this trend.

- Characteristic Traits : Mention specific traits of your target market. This helps in refining the estimate. For instance, if you're selling a high-end tech gadget, traits like "Tech enthusiasts" or "High income" might be relevant.

- Click 'Estimate Market Size' : Once you've filled in the relevant fields, hit the button. Don’t worry if you're unsure about some inputs; you can leave them blank.

- Interpret the Results : GPT-4 will generate an estimate and a summary. This result considers various factors based on the inputs provided. It gives you an immediate sense of potential reach and revenue.

Estimating your target market size doesn’t have to be a daunting task. With the right understanding and tools, you can get a fairly accurate picture without investing in expensive research. Our free Market Size Calculator tool, powered by GPT-4, simplifies this process, providing entrepreneurs with valuable insights within seconds. Whether you're drafting a business plan, seeking investment, or just evaluating an idea, understanding your market size is the first step towards entrepreneurial success.

Generating...

Start automating your business growth, today⚡

Create your first AI assistant & project in minutes.⚡

.png)

Bizway is brought to you by Landmark Labs Ltd.

©2024 Bizway Labs

Hey there! Free trials are available for Standard and Essentials plans. Start for free today.

Try Mailchimp risk-free with a 1-month trial. Start for free today .

Market Sizing: Key to Strategic Business Planning

Learn how market sizing can help you make informed strategic decisions for your business. Discover the key steps and benefits with this market sizing cheat sheet.

As a business operator, you already understand the value of strategic planning. When you gather data and perform analysis before making essential decisions, you can avoid a lot of pitfalls and steer the business in a healthy direction.

One aspect of strategic planning that many businesses still overlook is market size. It’s a process that can help you determine the value of a new business strategy before it is instituted.

If you’re looking to expand your products or services, grow your audience , or if you’re looking to break into new locations, using a market sizing approach should be one of your first steps.

Take a few minutes to learn more about what market sizing is, how it works, and how it can help you with your strategic planning. When you learn how to fit it into your existing operation, you’ll have one more tool pushing your business to greater heights.

What is market sizing?

As the name suggests, market sizing is the process of figuring out how large a market size is for a particular product or service.

More specifically, it’s an attempt to estimate the total number of buyers in a target region for that good or service and how much revenue those buyers can generate.

Figuring out how many people are potential customers (your target market) is essential for businesses. It enables you to gauge the true potential of your business model, and using that information, you can allocate resources accordingly.

Here’s a simple market sizing example. Imagine Walmart wants to open a new store in a small town.

Understanding their market size, they can estimate the monthly revenue for the new store. That can help them determine how large the store should be and how much product to carry. Without these estimates, they could overinvest in the town, and the store might fail.

While Walmart provides an opaque example, this applies just as well to any niche market .

How to determine market size

You can get an extremely generalized estimate of your market size by doing a simple calculation.

First, what is the population size of the people in the market (or what is the market size?)?

For the Walmart example, it’s the total number of adults in the new town. For a business that sells web development services, it’s the total number of businesses in the area that could benefit from a website.

Multiply the population size by your average sale (or average expected sale) value. That’s your market potential.

Naturally, this is a high-end estimate, but it can help you determine the upper limit of your business plan’s potential.

Benefits of market sizing for businesses

At this point, the market sizing question might sound interesting, but there’s still a lot to cover. Estimating a new market size is a tricky business.

What makes it worth the effort and cost?

Implementing a market sizing approach comes with some powerful benefits. The information you gain can inform all kinds of business decisions. In particular, market sizing can help you understand demand, find customers, size up the competition, and figure out long-term market trends.

Understanding the demand for your product or service

Estimating total market demand can be tricky , but it’s invaluable. When you have a clear grasp on how popular or in-demand your offer will be, it cleans up revenue estimates.

That, in turn, gives you mathematical values to determine marketing budgets, profit margins, and all of the numbers that go into determining your bottom line.

Understanding demand empowers you to make informed decisions at every step.

Identifying target customers

Identifying target customers is useful for estimating the market size in the first place, but that’s only the beginning.

Identifying your target market can help you figure out exactly when and where to focus your marketing efforts. You have to find customers in order to sell to them, and market sizing can give you a head start on that front.

Evaluating competition

Advanced market sizing methods won’t just tell you how big your potential market currently is. It will also estimate market saturation. In other words, the research will tell you how many people have access to competing products or services.

When you combine this type of competitor analysis with other metrics like demand, you can make even cleaner business estimates. You can also get a feel for what it will take to compete with existing businesses, and you can build that into your marketing strategies early.

Determining market trends

Lastly, you can estimate market trends while you gauge the overall market for your new business line. Obviously, it’s important to know if your industry and market are likely to grow or shrink.

In either case, you can strategize around trends and think about your specific market fit . Maybe your new service is best used as a temporary means to boost business.

Maybe, it’s the future direction for the whole organization. Market trends can help you think in these terms.

How to calculate market size

Comprehensive market sizing involves a deep look at many different metrics and aspects of the target market. It’s an involved process.

Whether you perform all of the research on your own, or you outsource market sizing to specialists, you want to make sure the research hits four major areas.

Conduct market research

Market research is where you get detailed information about potential buyers. This is where you investigate closely to determine how many people in an area are likely to purchase your product or service.

This is best done by taking a look at competitors (to see how much they’re already selling things similar to your offer), direct feedback (with surveys, social media polls, and/or focus groups), and population data (like total spending in the area and household spending reports).

Analyze market data

Once you collect all of your market data, it’s time for analytics. There are a few limits to how deep you can go with your analysis, but there are a few key points to include.

First, try to get a timeline for all of your data. This helps you establish trends to see if interest and/or spending is growing or shrinking over time. Time-dependent trends are helpful in any area you want to analyze.

Second, be meticulous about variance in the data. Some data will be extremely valuable. Other groups of data won’t be as telling. Diligent reporting of variance will help you tell the difference.

Third, try to tie your metrics to monetary value. The primary goal of this research is to figure out how to allocate resources, so in any reasonable way possible, figure out the dollar value of each metric.

Calculate market size

With all of this information, you’re going to try to estimate your expected total sales. You want high and low estimates to really set the stage for your business strategy. Remember to calculate revenue and profit margins while you’re at it.

The goal here is to see the raw finances in your new market before you fully invest.

Use industry benchmarks

Lastly, you can take a deeper look by running your numbers through standardized benchmark comparisons. Cash flow forecasting, NPVs, and IRRs are examples of well-established analytics that can set benchmarks for comparison.

The industry benchmarks will also help you highlight your modeling assumptions, and you can further test the impact of those assumptions on your projections. This helps you clean up your estimation ranges and ultimately improves the value of your market sizing overall.

Potential limits of market sizing

Market sizing is a powerful tool that can help you make better business decisions while you’re still in the planning phase. But, it’s not perfect, and it’s not a magic bullet. It’s just a way to increase the amount of information you have available to inform your business decisions.

It can help to look at some of the common limitations of this analytical process.

The first limitation has to do with your assumptions. At the end of the day, you don’t know how many people will buy your stuff, and you don’t know how much they will buy when they do make a purchase. You can only guess, and regardless of how hard you try, your guess will never be perfect.

Another limitation is something that impairs any attempt to predict the future. There are always complete unknowns that you can’t anticipate. Natural disasters can reshape your market in an instant. Unexpected legislation or regulations could change the rules of your industry.

The unexpected is vast, and market sizing can’t account for it at all.

Last, and most important, is that market sizing can breed overconfidence. It’s a way to gauge potential, not a guarantee.

When market sizing data looks promising, it can be easy to get overly optimistic, and that can lead to risky investment behavior. If you keep decisions grounded, though, market sizing is on your list of useful tools that can improve your business strategy.

Use market sizing for strategic business planning

As we know by now, market sizing is a crucial step in strategic business planning that involves estimating the potential market demand for a product or service.

It provides an understanding of the size and growth potential of the market, the competition, and the market share that a company can capture.

By using market sizing, businesses can identify growth opportunities, optimize pricing, develop marketing strategies, and make informed decisions about investments and resource allocation.

By following the key steps of market sizing, businesses can make informed decisions about their products, services, and overall business strategy. Incorporating market size data into your planning process can help you stay ahead of the competition and achieve long-term success.

If you haven’t been utilizing market sizing for your business strategy, it’s time to take a closer look, and Mailchimp can help. You’ll find a long list of resources that can amplify your market sizing and many other aspects of business planning and execution.

How it works

For Business

Join Mind Tools

Article • 10 min read

Market Sizing

Estimating product potential.

By the Mind Tools Content Team

Imagine that you've just spent three years building a fantastic business – your product is great, your website is cutting edge, your people are well-trained and enthusiastic, and your customers love what you do.

The problem is, you're running at a loss – there simply aren't enough customers in the market to support the business.

This is a heartbreaking, and very common, position to be in. It's why many professional entrepreneurs and investors conduct "market sizing" exercises before they invest in a new business.

In this article, we'll look at how you can analyze your market size, and how you can use this data to make informed strategic decisions.

What Is Market Sizing?

The "market size" is made up of the total number of potential buyers of a product or service within a given market, and the total revenue that these sales may generate.

It's important to calculate and understand market size for several reasons.

First, entrepreneurs and organizations can use market sizing to estimate how much profit they could potentially earn from a new business, product or service. This helps decision-makers to decide whether they should invest in it.

If you choose to move forward, this analysis will also help you to develop a marketing strategy that addresses the unique needs and potential of your core market.

Market sizing can also help you to estimate the number of people that you may need to hire before you launch a new product or service, rather than "feeling your way" as you test your new market. If you know this from the start, you can optimize your approach to recruitment, so that you have the right people in place when you need them.

Market Sizing Methods

There are two methods that are commonly used for market sizing:

1. Top Down Market Sizing – although the top-down method is simple, it's often unreliable and overly optimistic. It looks at the "relevant" market size for your product or service, and then calculates how much your organization might earn from it.

For example, imagine that your organization markets learning resources to schools. Your research shows that there are 6,000 relevant schools in your country. You know that the average sale per school is around $50,000, which means that your market size is $300 million.

Of course, this is an incredibly optimistic and unrealistic figure. Not every school needs your products, and they're unlikely to purchase $50,000 worth of goods each, so it could be a real challenge to capture even a small percentage of this market. A top-down approach gives you inflated data, and you often can't rely on it to make good decisions.

2. Bottom-Up – This approach is often more time-consuming than top-down market sizing, because you do all of your own market research and you don't rely solely on generalized forecasts and trends. However, you'll get a more realistic and accurate assessment of your market's potential.

In this article, we'll focus on how you can use a bottom-up approach to determing your market size.

How to Calculate Market Size

Follow these three steps to identify your market size:

1. Define Your Target Market

To predict the size of your market, you need to know the type of person that your product or service is best suited to. Your offering has to fulfilll a need – or solve a problem – uniquely well for a group of people, and you need to define who these people are.

Also, think about how you can access these customers – there's no point considering them if you can't reach them cost-effectively.

You can use market segmentation to divide your market into specific groups. This will give you a greater understanding of each group that your product or service will appeal to, and will enable you to tailor your offering to the specific needs of each group.

Once you've identified the different possible segments in your market, choose the ones that you want to focus on to build your business.

Now you need to determine how large the market is for each segment you've identified. To do this, contact business organizations, data providers, civic organizations, city and state development offices, or regulatory agencies that handle business and commerce; and do what you can to source a list of potential clients in your chosen segments.

Your organization wants to develop point-of-sale software for mid-sized grocery stores. But, before you invest the time and money to develop the software, you need to make sure that the market is large enough, and that people are interested enough in your product to buy it.

After researching online and contacting your region's business and commerce department, you determine that there are roughly 10,000 mid-sized grocery stores in your country, and you source a list of these stores.

2. Use Market Research to Assess Interest in Your Product

Obviously, not everyone in your target market will want to buy your product. So your next step is to estimate realistic interest.

One way to do this is to focus on competitors who target the same group of buyers. What is their market share? And what are their annual sales for similar products or services?

If your competitors are exclusively focused on this market, this can give you a good estimate of potential market size. However, it can be almost impossible to source this information if they focus on other markets as well, or if they are part of larger business groups.

Another way to assess interest is through individual interviews, focus groups , and surveys. Question a sufficiently large sample of people or businesses that fall within your target market, and explain what you have to offer. The larger your sample, the better your analysis will be.

Ask them questions like:

- Does this product interest you?

- What would they feel comfortable paying for it?

- How likely would you be to purchase this product or a similar product within the next two years?

It's important to draw conservative conclusions based on the feedback you get from these focus groups or surveys. Often, people will say one thing and do another. People often "think twice" before actually making a purchase, and this is especially true as budgets, interests, and market conditions change.

Over the course of three months, you talk to 100 randomly selected mid-sized grocery stores, which represent one percent of your target market. You explain the idea behind the new software, and the benefits it will provide to the store owners.

After the presentations are finished, 35 stores express a strong interest in the software, and a willingness to buy once it's available. To be conservative, you reduce this number to 18. So, 18 percent of stores in your market will be interested in this product. Out of 10,000 possible grocery stores, this means that 1,800 could buy.

It will obviously take a lot of time to set up and conduct this type of research. Think carefully about any other market research information you might need, and, where appropriate, gather this at the same time.

Step 3: Calculate Potential Sales

You now have a more realistic figure that represents how popular your product or service could be to your target market. Use this data to decide whether your product is worth the investment and risk.

To do this, develop a financial model of your business using the data you have gathered (see our articles on Cash Flow Forecasting and use of NPVs and IRRs for more on this.)

Then, identify key assumptions within your model, and test these using a technique such as Scenario Analysis .

You've determined that 1,800 grocery stores might invest in your software, which costs $30,000. If 100 percent of these stores purchase the software, this would result in a return of $54 million.

Your organization has already estimated that it will have to invest at least $7 million to develop, test, and market the new software. This investment is only 13 percent of potential annual revenues, so the risk is low, even if the response isn't as positive as predicted. Your organization therefore decides to move forward with the development of new software.

Your "market size" is the total number of likely buyers of your product or service within a given market. This information can be particularly useful to businesses and entreprenuers looking to invest in new products. It can also support strategic decision making and enable you to create an evidence-led marketing strategy.

There are two methods you can use to determine your market size:

- Top Down – this looks at the "relevant" market size for your product or service, and then calculates how much your organization might earn from it.

- Bottom Up – you complete your own market research to get a more realistic and accurate market size for your product or service.

To calculate market size using the bottom-up approach, follow these three steps:

- Define your target market.

- Use market research to assess interest in your product.

- Calculate potential sales.

You've accessed 1 of your 2 free resources.

Get unlimited access

Discover more content

Michael porter's generic strategies.

Strategic Options for Competitive Advantage

Porter's Generic Strategies

Choosing Your Route to Success

Add comment

Comments (0)

Be the first to comment!

Get 30% off your first year of Mind Tools

Great teams begin with empowered leaders. Our tools and resources offer the support to let you flourish into leadership. Join today!

Sign-up to our newsletter

Subscribing to the Mind Tools newsletter will keep you up-to-date with our latest updates and newest resources.

Subscribe now

Business Skills

Personal Development

Leadership and Management

Member Extras

Most Popular

Newest Releases

What Is Stakeholder Management?

GE-McKinsey Matrix

Mind Tools Store

About Mind Tools Content

Discover something new today

Business reports.

Using the Right Format for Sharing Information

Making the Right Career Move

Choosing the Role That's Best for You

How Emotionally Intelligent Are You?

Boosting Your People Skills

Self-Assessment

What's Your Leadership Style?

Learn About the Strengths and Weaknesses of the Way You Like to Lead

Recommended for you

The outsiders.

Will Thorndike

Expert Interviews

Business Operations and Process Management

Strategy Tools

Customer Service

Business Ethics and Values

Handling Information and Data

Project Management

Knowledge Management

Self-Development and Goal Setting

Time Management

Presentation Skills

Learning Skills

Career Skills

Communication Skills

Negotiation, Persuasion and Influence

Working With Others

Difficult Conversations

Creativity Tools

Self-Management

Work-Life Balance

Stress Management and Wellbeing

Coaching and Mentoring

Change Management

Team Management

Managing Conflict

Delegation and Empowerment

Performance Management

Leadership Skills

Developing Your Team

Talent Management

Problem Solving

Decision Making

Member Podcast

How to Use TAM, SAM, SOM to Determine Market Size

Caroline Cummings

3 min. read

Updated October 27, 2023

Having viewed several business plans over the years, a common (and very important) item missing from most plans is a breakdown of the company’s TAM, SAM, and SOM.

Wondering what these acronyms mean? Well, you’re not alone—many entrepreneurs are not familiar with these terms.

- What is TAM?

TAM = Total Addressable/Available Market is the total market for your product. This is everyone in the world who could buy your product, regardless of the competition in the market.

- What is SAM?

SAM = Serviceable Available Market is the portion of the market that you can acquire. For example, your product may only be available in one language, so your SAM would be the subset of the TAM that speaks the language that your product is developed for.

- What is SOM?

SOM = Service Obtainable Market is the subset of your SAM that you will realistically get to use your product. This is effectively your target market that you will initially try to sell to.

- How do you identify TAM, SAM, and SOM?

Identifying your TAM, SAM, and SOM requires some market research (levels of research vary depending on your product and market potential), but once you gather the research through your market analysis , you’ll have a better idea of the percentages that coincide with each area.

- Why is identifying your SOM important?

Identifying your SOM, or your target marke t, is an important step because building a marketing plan around your TAM—in other words, everyone—is a huge waste of resources. Figuring out who exactly you think will actually buy your product will help focus your reach.

What’s an example of TAM, SAM, SOM?

You’re starting a concierge service in your city that focuses on doing tasks/running errands for busy people.

Your TAM (total available market) would be all people who may have a need for help doing tasks and running errands in your town. If your town has 150,000 people, you may find (through market research) that the total possible demand for your business in your city is 33 percent (or 50,000 people). You might arrive at this number by excluding people who are under 18 years old and other groups of people who can’t purchase your services.

Your SAM (serviceable available market) would be the portion of that 50,000 whom your current business model is targeting (this will be outlined in your business plan). For example, your business model focused on serving people who are ages 35 to 55, with small children and disposable income. You may then discover that there are 20,000 of these people, which means your SAM is 40 percent of your TAM.

Your SOM (serviceable obtainable market) would be the portion of your SAM that your business model can currently realistically serve. For example, you may only have three employees (yourself and two others) and can only serve people who live within a 2-mile radius of downtown, so realistically what percentage of your SAM (20,000 people) can you reach in the first 2 to 3 years?

Let’s assume your company can effectively provide concierge services to 100 people a month or 1,200 people a year. This means your SOM is about 6 percent of your SAM.

If you’re seeking funding, savvy investors will ask you for these items in your business plan, and they’ll want you to be able to back up your numbers. This is why conducting some market research upfront is important—and even advisable before you begin writing your business plan. It gives you the validation of your market potential.

Hopefully, this clears up a bit of the market reach acronym soup!

See why 1.2 million entrepreneurs have written their business plans with LivePlan

An entrepreneur. A disruptor. An advocate. Caroline has been the CEO and co-founder of two tech startups—one failed and one she sold. She is passionate about helping other entrepreneurs realize their full potential and learn how to step outside of their comfort zones to catalyze their growth. Caroline is currently executive director of Oregon RAIN . She provides strategic leadership for the organization’s personnel, development, stakeholder relations, and community partnerships. In her dual role as the venture catalyst manager, Cummings oversees the execution of RAIN’s Rural Venture Catalyst programs. She provides outreach and support to small and rural communities; she coaches and mentors regional entrepreneurs, builds strategic local partnerships, and leads educational workshops.

.png?format=auto)

Table of Contents

- What’s an example of TAM, SAM, SOM?

Related Articles

10 Min. Read

How to Create a Detailed User or Buyer Persona

9 Min. Read

How to Write a Customer Analysis

4 Min. Read

How to Define Your Target Market

7 Min. Read

Target Market Examples

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Memberships

- (855) 926-9675

Estimating Market Size: The Complete Guide For Startups And Small Businesses

By Gregg Jackowitz, Managing Director of Sales and Marketing, Bond Collective

Estimating market size is a crucial first step in the development of any startup or small business. And it really doesn’t matter what industry you’re in — or want to be in — getting an accurate picture of your market size reveals insights that can drive both the present and future success of your business.

Why is knowing your market size so important? And how can you get started putting together a realistic profile of your target market? We’ll answer those questions in this article.

Why Is Knowing Market Size Important?

Put simply, estimating your business’s market size will provide you with key data points. Those data points will then inform your decisions for the present and help you grow your business over time.

Here are four key variables that you can uncover by evaluating your market size.

1) Strategy

Market size has a dramatic effect on the strategy your startup uses in the present and near future. Think of market size as a roadmap that you can reference to get to your destination.

If you know where you are and where you want to go, you can use the map — the data that market size reveals — to plot out a course and make decisions. With a map in hand, your choices are clearer because you’re not trying to target everyone, just a distinct group of people.

More specifically, market size influences components of your business such as:

Office space (i.e., how much)

Raising capital

Developing new products

2) Advantage

Every startup needs a competitive advantage. Estimating market size before making any big moves helps that advantage coalesce.

While your product (or service) has a wide potential market, realistically, your business can only capture a small percentage of that market. Once you’ve identified that percentage — through estimating market size — you can determine what features and what value-adds will give your startup a competitive advantage over all the other startups vying for the same market share.

This will help you set your product apart, position it as unique, and achieve the success you’re looking for.

The business market as a whole is a big place. Even your specific piece of that market (let’s say pens) is a big place. But after estimating your market size, you’ll get a much clearer picture of your target demographic (the people who will be buying your pens).

This knowledge will allow you to do two things that your competitors can’t:

Identify trends in consumer behavior

See whether your industry is growing or declining

Armed with that knowledge, you can begin to formulate your business strategy and gain the competitive advantage we talked about earlier.

4) Profitability

Profitability is the goal of every startup and small business. Identifying your market size makes profitability possible, or at least more probable.

Estimating your market size reveals whether or not there are enough potential customers who will actually buy your product. With that number, you can find out if the price you’ve set will move your business into the black. It will also show you whether the market you’re going after is too small to create the profit you need.

Now that you understand why estimating market size is crucial to your business’s success, we’ll show you how to get started doing it.

5 Essential Steps For Estimating Market Size

1) clarify the problem your product solves and the value it generates.

This is a step that many startups and small businesses skip because they’re excited about the product and are chomping at the bit to get going. Resist the urge to jump right in before clarifying the problem your product solves and the value it generates ( understanding your own brand ).

For example, if you produce a pen that uses 50 percent less ink than similar pens, you’ve solved the problem of people quickly running out of ink. As a result, your customer doesn’t have re-fill or replace their pen as often, which is also better for the environment. That’s the problem solved and the value it generates.

Of course, this is a very simple example and there are doubtless other problems solved and value-adds associated with our hypothetical pen. But this basic information will help you narrow down your target audience in the steps below.

2) Identify Your Market & Define Your Target Customer

The next step in estimating your market size is to identify your market and define your target customer. If we continue with the pen-as-product analogy started above, then our market is all pen users. That immediately eliminates young children who are more likely to use pencils or crayons.

Even without the young children, we still have an extremely large market (all people over the age of 12, let’s say). But are we trying to sell to all of them? No. The problem(s) our pen solves and the value it generates eliminate even more of the market.

With this information, we define our target customer as business people with an appreciation for quality writing instruments. Let’s say, for the sake of argument, that those people — our target customer — make up 20 percent of the total pen market (all pen users). Hypothetically, then, that leaves us with 2.3 million potential customers.

3) Estimate Your Part Of The Market & The Number Of Target Customers

As a startup or small business with realistic expectations, you know you won’t achieve 100-percent market share (even the largest, most established businesses never do). So what part of that 20 percent can we access right away?

Most startups and small businesses can expect to access somewhere between one and five percent of their target market at the beginning.