- Mastering Financial Accounting: A Student's Guide to Writing Winning Reports

Writing Winning Financial Accounting Reports: A Student's Toolkit

In the fast-paced world of academia, mastering the art of financial accounting reports is an indispensable skill for students pursuing degrees in finance, accounting, or business. Crafting a well-structured and insightful financial accounting assignment not only demonstrates your understanding of the subject but also sets you apart as a diligent and detail-oriented student. In this blog, we will explore a comprehensive toolkit that will empower you to write winning financial accounting reports and excel in your academic journey. Whether you require assistance with your Financial Accounting assignment or simply seek to enhance your skills in crafting insightful reports, this blog provides valuable insights and strategies to help you succeed in your academic endeavors.

1. Understanding the Assignment Requirements

Before embarking on the journey of crafting a winning financial accounting report, it is crucial to develop a deep understanding of the assignment requirements. Each financial accounting assignment comes with unique specifications that set the stage for your analysis. Let's delve into the essential steps to decode and comprehend these requirements effectively.

Deciphering Assignment Prompts

Start by carefully reading and interpreting the assignment prompts. Identify key elements that provide clues about the focus of your analysis. Phrases such as "financial statement analysis," "industry comparison," or "impact of accounting standards" guide you on the specific areas you need to explore. Create a list of these essential components to serve as the foundation for your research and analysis.

Identifying Key Financial Elements

Understand the financial elements the assignment expects you to analyze. This could include dissecting the balance sheet, income statement, and cash flow statement. Recognize if there's a specific time frame or financial period to consider. Understand the intricacies of the assignment by identifying key financial components.

Grasping the Depth of Analysis Required

Different assignments demand varying levels of analysis. Some may require a broad overview, while others necessitate an in-depth exploration of specific financial ratios, trends, or industry benchmarks. Pay attention to phrases that indicate the depth of analysis expected. Consider whether the assignment requires a comprehensive overview or a detailed examination of specific aspects.

Identifying the Target Audience

Consider the target audience for your financial accounting report. Is it intended for academic evaluation, potential investors, or corporate executives? Tailoring your language, level of detail, and presentation style to the intended audience ensures your report is both relevant and impactful.

Understanding Formatting and Style Guidelines

Every academic institution or course may have specific formatting and style guidelines. Pay close attention to instructions regarding font size, spacing, citation style, and overall document structure. Ensure that your report adheres to the required formatting and style guidelines.

Clarity in Research Objectives

Define clear research objectives based on the assignment requirements. What specific questions or challenges does the assignment aim to address? Establish a roadmap for your analysis, ensuring that your report aligns seamlessly with the overarching goals of the assignment.

2. Conducting In-Depth Research

Once you've deciphered the assignment requirements, the next critical step in writing a compelling financial accounting report is conducting in-depth research. The depth and accuracy of your research not only validate your analysis but also demonstrate your commitment to producing a thorough and well-informed report. Let's explore the key components of conducting in-depth research for your financial accounting assignment.

Exploring Reputable Sources

Begin your research by exploring reputable sources within the field of financial accounting. Utilize academic journals, authoritative textbooks, and industry publications to gather credible information. Online databases like JSTOR, Google Scholar, and financial databases can be valuable tools in uncovering relevant literature. The emphasis should be on quality and reliability to ensure the accuracy of the data you integrate into your report.

Analyzing Historical Financial Data

To provide a comprehensive analysis, delve into the historical financial data of the company or industry under study. Examine annual reports, financial statements, and SEC filings. Look for trends, patterns, and anomalies that may contribute to a more nuanced understanding of the financial landscape. This historical perspective adds depth to your analysis and establishes a foundation for forecasting and future projections.

Utilizing Industry Benchmarks

Benchmarking against industry standards is crucial in evaluating the financial performance of a company. Identify key performance indicators (KPIs) relevant to the industry and compare them with your subject company's metrics. This comparative analysis not only provides context to your findings but also highlights areas of strength or weakness. Incorporate industry benchmarks to enrich your report with a broader perspective.

Examining Regulatory Compliance

Understand the regulatory environment governing financial reporting. Explore the compliance status of the company with accounting standards such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). Analyze the impact of any recent changes in accounting regulations on the financial statements. This scrutiny ensures your report reflects not only financial performance but also adherence to regulatory requirements.

3. Structuring Your Report Effectively

After conducting thorough research, the next crucial step in creating a winning financial accounting report is to structure it effectively. A well-organized report not only facilitates understanding but also showcases your analytical skills and attention to detail. Let's delve into the key components of structuring your financial accounting report in a compelling manner.

Introduction: Setting the Stage

Commence your report with a compelling introduction that sets the stage for what follows. Clearly state the purpose of your analysis and provide a brief overview of the company or industry under scrutiny. Introduce the keywords relevant to your assignment to establish a clear connection with the specified requirements. Craft a thesis statement that succinctly outlines the goals and focus of your report, providing a roadmap for your readers.

Literature Review: Building on Existing Knowledge

If your assignment warrants it, consider incorporating a literature review section. This involves summarizing and synthesizing existing research and insights related to your financial accounting topic. This not only demonstrates your engagement with the broader academic discourse but also provides context for your own analysis. Use this section to showcase your familiarity with key concepts and debates within financial accounting.

Methodology: Transparency in Approach

For assignments involving primary research or unique analytical methods, include a methodology section. Transparently outline the approach you adopted in conducting your analysis. Detail the sources of data, the criteria used in selecting them, and the methods employed in your research. This section adds credibility to your report and allows readers to evaluate the reliability of your findings.

Body: Logical Flow of Analysis

The body of your report is where the core analysis unfolds. Ensure a logical flow by organizing your content into clear sections, each addressing a specific aspect of the assignment requirements. Use headings and subheadings to guide your reader through the analysis. Integrate your research findings, supported by data, charts, and graphs where applicable. Include a discussion of key financial elements, ratios, and relevant industry comparisons.

Discussion: Contextualizing Findings

Move beyond presenting raw data to providing a thoughtful discussion of your findings. Interpret the significance of financial trends, highlight key strengths and weaknesses, and discuss the implications of your analysis. Use this section to showcase your critical thinking skills and your ability to draw meaningful conclusions from the data presented.

Conclusion: Summarizing Key Insights

Craft a robust conclusion that summarizes the key insights derived from your analysis. Reinforce your thesis statement and revisit the main points discussed in the body of the report. Emphasize the significance of your findings in the context of the assignment requirements. This section should leave a lasting impression, highlighting the value of your analysis and its relevance to the overarching goals of the assignment.

4. Utilizing Accounting Software

In the digital age, leveraging accounting software is a game-changer for students aiming to produce comprehensive and visually appealing financial accounting reports. Integrating technology not only streamlines the analysis process but also enhances the presentation of your findings. Let's explore how utilizing accounting software can elevate the quality of your financial accounting assignment.

Efficient Data Processing

One of the primary advantages of accounting software is its ability to efficiently process vast amounts of financial data. Instead of manually inputting and calculating figures, these tools automate the process, reducing the likelihood of errors and ensuring accuracy in your analysis. Whether it's organizing balance sheets, income statements, or cash flow statements, accounting software accelerates the data processing stage of your assignment.

Visual Representation of Data

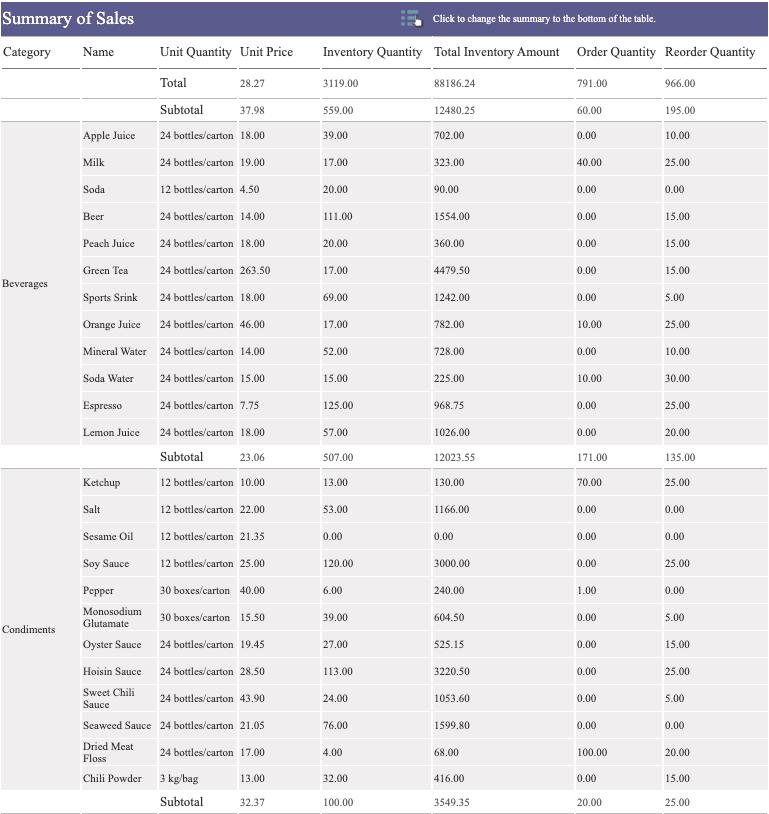

Presentation is key in financial accounting reports, and accounting software facilitates the creation of visually engaging charts, graphs, and tables. Tools like Microsoft Excel or specialized accounting software enable you to transform raw data into clear visual representations. This not only enhances the readability of your report but also communicates complex financial information in a digestible format.

5. Emphasizing Clarity and Conciseness

In the realm of financial accounting reports, clarity and conciseness are paramount. Communicating complex financial information in a straightforward and succinct manner not only enhances reader comprehension but also showcases your mastery of the subject. Let's explore the key strategies for emphasizing clarity and conciseness in your financial accounting assignment.

Clear and Defined Language

The foundation of clarity lies in the use of clear and defined language. Avoid unnecessary jargon and choose words that precisely convey your intended meaning. Strive for simplicity without compromising accuracy. When discussing financial concepts, opt for terms that are widely understood, ensuring that your readers, regardless of their familiarity with finance, can follow your analysis.

Logical Flow of Ideas

Organize your ideas in a logical and coherent sequence. Ensure that each section of your financial accounting report flows seamlessly into the next, guiding the reader through a structured narrative. Use headings and subheadings to create a roadmap for your analysis. This logical flow reinforces the clarity of your thought process and makes it easier for readers to grasp the progression of your arguments.

Avoiding Redundancy

Conciseness is achieved by avoiding unnecessary repetition and redundancy. Once you've made a point or presented a key finding, resist the temptation to restate it excessively. Instead, focus on introducing new information or providing additional context. Each sentence should contribute meaningfully to your analysis, contributing to a concise and impactful narrative.

Effective Use of Visuals

Enhance clarity by incorporating visuals strategically. Graphs, charts, and tables can distill complex numerical data into easily digestible formats. Ensure that each visual element is directly relevant to the point you are making and provides additional clarity to the reader. Clearly label and title visuals, and refer to them in the text to reinforce their significance.

6. Analyzing Financial Ratios

Financial ratios are the bedrock of comprehensive financial analysis, providing invaluable insights into a company's performance, profitability, and financial health. Mastering the analysis of financial ratios is a crucial skill for students undertaking financial accounting assignments. In this section, we'll delve into the essential steps and considerations for effectively analyzing financial ratios in your assignment.

Understanding Key Financial Ratios

Begin your analysis by understanding the key financial ratios relevant to your assignment. These may include liquidity ratios, profitability ratios, leverage ratios, efficiency ratios, and market valuation ratios. Each ratio category provides a unique perspective on different aspects of a company's financial position and performance. Clearly define and introduce each ratio you plan to analyze, setting the stage for a comprehensive examination.

Clear Communication of Analysis Findings

Effectively communicate your analysis findings by translating complex ratio calculations into clear, actionable insights. Ensure that your discussion of ratios is accessible to readers with varying levels of financial expertise. Use plain language summaries to articulate the implications of your ratio analysis and tie them back to the overarching goals of your financial accounting assignment.

7. Incorporating Real-World Examples

In the realm of financial accounting, theory gains practical relevance when anchored in real-world examples. Incorporating concrete cases not only illustrates theoretical concepts but also provides a tangible context for readers. Let's explore how infusing real-world examples can enrich your financial accounting report, offering a deeper understanding of the subject matter.

Application of Accounting Standards

Incorporate real-world examples to showcase how companies adhere to accounting standards. For instance, discuss how a publicly traded company follows Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Provide specific instances of financial statement disclosures, demonstrating how these standards are practically implemented in the corporate landscape.

Conclusion:

In conclusion, writing a winning financial accounting report is not just about meeting the assignment requirements but showcasing a holistic understanding of financial concepts. By embracing the toolkit outlined in this blog, students can elevate their financial accounting assignments from mere submissions to compelling insights that captivate readers and professors alike. Remember, the key lies in understanding the assignment, conducting thorough research, utilizing accounting software, emphasizing clarity, analyzing financial ratios, and incorporating real-world examples. With these tools at your disposal, you are well-equipped to write outstanding financial accounting reports and set yourself on the path to academic success. So, go ahead, write your financial accounting assignment with confidence and finesse, and watch your grades soar.

Post a comment...

Mastering financial accounting: a student's guide to writing winning reports submit your assignment, attached files.

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

Financial Accounting and Reporting Classroom Materials

Financial Accounting and Reporting is an important part of the accounting curriculum. The skills students learn in your classroom will not only prepare them for more advanced courses, but to one day succeed in a career. The below are supplemental curriculum resources that the AICPA Academics team have reviewed and think can be used in the classroom.

Award-Winning Curricula

The Academics team is proud to offer award-winning curricula designed to encourage faculty and expand the knowledge of accounting students. The curricula below is from the Accounting Professors Curriculum Resource tool and has been recognized for excellence with the Bea Sanders/AICPA Innovation and Teaching Award , the George Krull/Grant Thornton AAA Innovation in Junior and Senior-Level Teaching Award, or the Mark Chain/FSA Innovation in Graduate Teaching Award .

- A Better Way to Teach Effective Interest Method Related Problems in Accounting This resource presents a simpler method of teach accounting problems involving the use of the effective interest method. The method stimulates student interest by focusing on the economics of the transaction and relating it to real-life examples.

- Accounting in the Headlines: A News Blog for the Introductory Accounting Classroom This resource shares Wendy Tietz's "Accounting in the Headlines" blog in which she writes stories about real-life companies and events that can be used in the accounting classroom to illustrate introductory financial and managerial accounting concepts.

- Accounting Challenge (ACE): Mobile-Gaming App for Learning Accounting Accounting Challenge is the first mobile-gaming app for teaching financial accounting. ACE aims to enhance learning of accounting outside the classroom by engaging students to play and learn accounting on the go.

- A FASB Accounting Standards Codification Project for Introductory Financial Accounting This exercise is designed as a team project in which introductory accounting students act as a consultants to a client seeking guidance on issues surrounding a start-up venture. Students must access and cite the Codification as the basis for the materials they submit in fulfillment of the project requirements.

- Attracting the Best and Brightest to Accounting: Establishing an Honors Accounting Course This resource presents one school's approach to attracting and recruiting the best and brightest students toward accounting by offering an honors accounting course.

- Beyond Debits and Credits... Service Learning in Accounting This resource presents a service learning project implemented in two accounting courses to enhance student skills in communication and teamwork.

- Business From the Idea to the Seasoned Offering: Accounting and Financial Statements Reflecting Business Activities This project takes accounting education from bookkeeping to holistic active business learning including how financial statements build to reflect the business.

- Chocolate: Accounting as a First year Seminar This resource provides a thematic approach at combining first year seminars and accounting programs using student activities that are simultaneously engaging and assessable.

- Creative Strategies for Teaching MBA Level Accounting This resource presents a new concept for teaching accounting to MBA level students. At its heart, accounting centers on measurement of historical transactions or the measurement of future opportunities. this course turns the focus from rules, to the tools leaders need to manage a complex organization.

- Cultivating Deep Learning in the Principles of Accounting Classes through Philanthropy-Based Education This philanthropy project goes beyond service learning or volunteerism. Students make real decisions that have immediate impacts on their community. Students award funding to not-for-profit agencies based on a competitive proposal process.

- Digital Storytelling for Engaged Student Learning This resource uses digital story telling, a movie, to enhance students' technical competence in accounting. The story uses 12 episodes to follow three young business graduates who started their own business and discover along the way the role of financial information in managing a business venture.

- FASB Accounting Standards Codification: Student-Authored Research Exercises This resource is based on the notion that the best way to learn something is to teach it. Students in a financial accounting graduate class demonstrate their master of GAAP research skills by creating research assignments using the FASB Accounting Standards Codification.

- Forming Groups in the Age of YouTube This resource uses a variation of speed dating as a means for forming groups in an introductory accounting class. By learning more about their classmates prior to self-selecting a group this method allows students to choose better groups.

- Getting Started in the Throughbred Horse Business: A Review of Some Basic Accounting Principles This resource provides reinforcement of common accrual accounting concepts centered on the breeding and racing operations of a small thoroughbred horse business. This curriculum is appropriate to use after students have been exposed to fixed assets, inventory, profit and loss and cash flow reporting.

- IFRS Immersion This resource provides instructions for teaching an IFRS course from the standpoint of foreign companies that have already dealt with the problems and issues associated with converting from local GAAP to international GAAP.

- IFRS Projects Using Dual Reporting of IFRS and U.S. GAAP This resource illustrates integrating IFRS learning into financial accounting curricula by incorporating valuable contrasting information from the dual reporting.

- Integrated Accounting Principles: A New Approach to Traditional Accounting Principles Courses This resource describes an integrated accounting principles course that combines traditional financial and managerial accounting courses into a single six hour course.

- Introducing Freshmen Students in the Accounting/Finance Course to the Library This resource describes a series of online, interactive tutorials and quizzes to help students learn fundamental concepts and skills of company and industry related research.

- Introduction to Financial Accounting Case Project: Arctic Blast Ice Cream Store This case provides an opportunity for students to apply accounting concepts to a simple business venture. The project lasts 4-6 weeks and covers three distinct phases of the management process: business decision making, performance and evaluation.

- Let's Go to the Movies: Using Movies as an Ethics Assignment This project involves students watching a series of predetermined movies and noting the ethical dilemma. At the end of the semester each student must defend one of the movies as a nominee for "A Must See Ethics Movie" for accounting/business students.

- Mini-responsibility Centers: A Strategy for Learning by Leading This resource explains the concept of using mini-responsibility centers (MRCs) to decentralize large financial, managerial and cost accounting courses. In return the students are more focused and engaged.

- Modeling Uncertainty in C-V-P Assignments: Going Beyond the Basics! This resource provides an outline for using the Monte Carlo Simulation to offer graduate students an opportunity to rapidly come to insights about probabilistic model building and interpretation. The simulation combines quantitative skills and qualitative skills along with reports and presentations.

- Northwind Data Query Exercise This project encourages students to consider the evolution of data sources for financial reporting and evaluate how to acquire and manipulate information in this emerging business reality; by actually practicing queries and exporting information to worksheets.

- Reinventing Student Engagement and Collaboration within Introductory Accounting Courses This resource provides ideas for increasing engagement and collaboration in the introductory accounting class. Examples include student projects, flipped classroom applications and in-class problems.

- Responsibilities and Choices: An Active Engagement Exercise for Introductory Accounting Courses This exercise provides students with an opportunity to perform a basic due diligence task, complete a relatively simple working paper to document their work and make a decision. The exercise has embedded moral temptation and ethical issues and examines ethical choices that students make in the presence of time pressure and reward structures that encourage aggressive performance.

- TeachingIFRS.com This document provides information on TeachingIFRS.com which was created in response to the rapid growth of IFRS and lack of high quality and effective teaching resources. The site consolidates and provides links to numerous freely available IFRS pedagogical materials.

- Testing Critical Thinking Skills in Accounting Principles This resource describes a method for testing critical thinking skills in an accounting principles course. Using this method, each testing period is divided into two parts. First, students complete an individual traditional test. The second part is a critical thinking exercise called "the challenge problem".

- The Accounting Profession Post Sarbanes-Oxley: An Approach to Impart Knowledge About the Conceptual Framework and Attract Students to the Accounting Major This document provides the description of a program entitled "The Accounting Profession Post Sarbanes-Oxley". The program provides students with an opportunity to better understand important elements of the conceptual framework. It also provides an overview of the career opportunities in accounting.

- The Accounting Tournament - March Madness in Financial Accounting This resource describes implementation of an end of year comprehensive review using brackets as a model. Students are randomly placed in the bracket and compete against each other for extra credit points.

- The Amazing Accounting Race: An Introductory Accounting Semester Project This project engages students with an exciting internet race around the professional world of accounting. Students obtain clues to complete tasks, encounter detours, road blocks and fast forwards. The assignments utilize students' synthesis skills and computer application skills as they collect facts about accounting careers from the internet and assemble data in an organized format.

- The College to Professional Experience This resource outlines a program that serves to better prepare students for the "real world" by changing the perception of education from "learning by doing" to "doing and making to learn with technology". The project aims to move beyond traditional models of education to leverage technology to facilitate new methods of delivery and understanding.

- The Farming Game and the Introductory Financial Accounting Course: An Accounting Simulation The Farming Game enables students to develop many of the skill-based competencies needed by students entering the accounting profession, regardless of career path. The Game provides experiential learning of various accounting principles. It is a learning opportunity that offers students a degree of reality and a larger view of the system.

- Understand FX Risk by Playing Monopoly This resource uses a short version of Monopoly to understand the FX risk impact on net income.

- Back to the Future: Using Accounting History to Explore Professional Opportunities In this project students read an article about a period of time in accounting history and present their findings to the class in a video format. Students then tie what they have learned in the presentations to the field of accounting today as well as the future.

- From Pacioli to Picasso: Using Art to Enhance Critical Thinking in Accounting Capstone Courses This resource outlines using name cards, picture drawings and classic artwork to help students enhance their critical thinking skills. The exercise sets the tone for a course that requires them to think about more than rules and regulations and instead delve into the "why" and "what could be."

- Digging Deep: Using Forensic Analytics as a Context to Teach Microsoft Excel and Access This resource describes a graduate level case that focuses on the development of technology skills through the lens of forensic analysis.

- Who Moved My Classroom? Community Linked Learning and Assessment This resource describes three exercises that expand learning beyond the classroom. The first exercise allows students to discover the linkage between classroom studies and what practitioners do in the "real world". The second allows students to apply the COSO model to internal controls. The third requires students to interpret financial statements for a friend.

Additional Materials

Here are additional materials we reviewed and think are useful to incorporate into the classroom.

- IIRC Database of Research on Integrated Reporting The International Integrated Reporting Council (IIRC) launched the <IR> Academic Database, a searchable collection of more than 200 articles, books, chapters, dissertations, and other pieces of scholarly research on the advancement, adoption, and practice of integrated reporting.

- A destination is only as good as its compass. The new My 360 is here to help you create a free plan personalized to your financial needs by helping guide you through all the resources 360 Degrees of Financial Literacy has to offer.

We are the American Institute of CPAs, the world’s largest member association representing the accounting profession. Our history of serving the public interest stretches back to 1887. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education and consulting.

About AICPA

- Mission and History

- Annual Reports

- AICPA Media Center

- AICPA Research

- Jobs at AICPA

- Order questions

- Forgot Password

- Store policies

Association of International Certified Professional Accountants. All rights reserved.

- Terms & Conditions

Why Do You Need To Visualize Your Accounting Reports?

Table of Contents

1) What Are Accounting Reports?

2) Why Do You Need Accounting Reports?

3) Types Of Accounting Reports

4) Accounting Reports Examples

5) Accounting KPIs Examples

6) How To Create Accounting Reports

7) The Role Of Visuals In Accountant Reports

Accounting reports are essential to maintaining the financial health of your organization. They help track its evolution over time and identify opportunities to improve business transactions and cash flow, as well as support tax and legal requirements.

Created centuries ago with the development of trade and commerce, accounting is now the backbone of any business’ financial world. A company needs a fluent, accurate accounting system to flourish and disqualify itself immediately when it cannot keep its standards right. It facilitates comparison, eliminates ambiguity, and is the only way to disclose a business’s financial status to its stakeholders.

In this guide, we will go over the different types of basic accounting reports and KPIs, why you need them, and how you can make and present them – this last point is crucial in the communication of your financial story, especially when we consider all that is at stake with accountancy.

What Are Accounting Reports?

Accounting reports are periodic statements that present the financial status of a company at a certain point in time or over a stated time period. It details business transactions and operations.

They are a compilation of financial metrics that infers from a business's accounting records. Their nature varies, as they can be brief or custom-made with a specific purpose: detailing sales per region, the profitability of a product, etc.

Essential types of accounting reports

Typically these types of reports are considered to be financial statements which include:

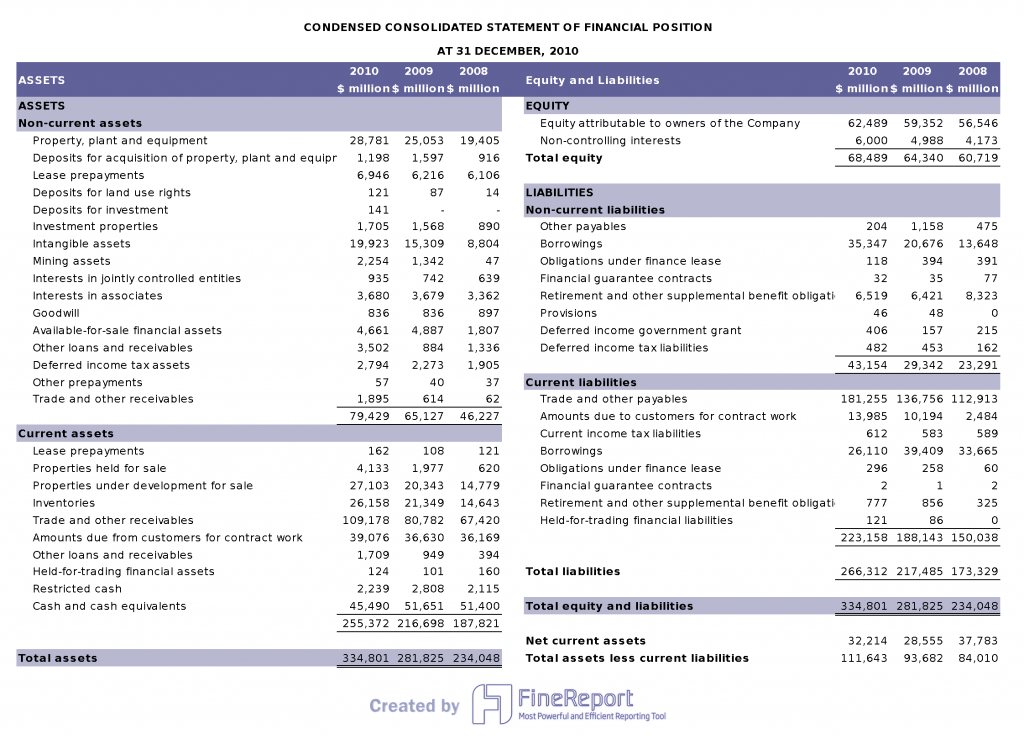

- Balance sheet: a snapshot of a business at a specific time and shows the ending assets, liability, and equity balances as of the balance sheet date. It is useful to measure the financial reserves and liquidity of a business.

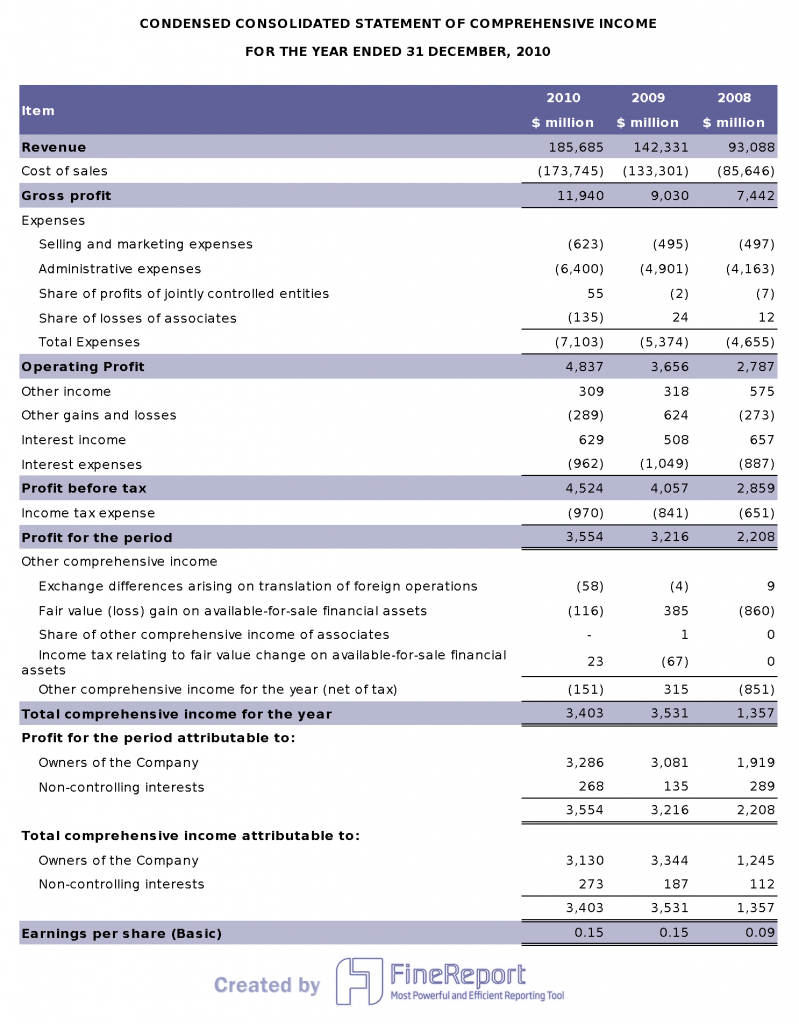

- Income statement: is also known as a profit and loss report. It details the revenue earned over a certain period of time.

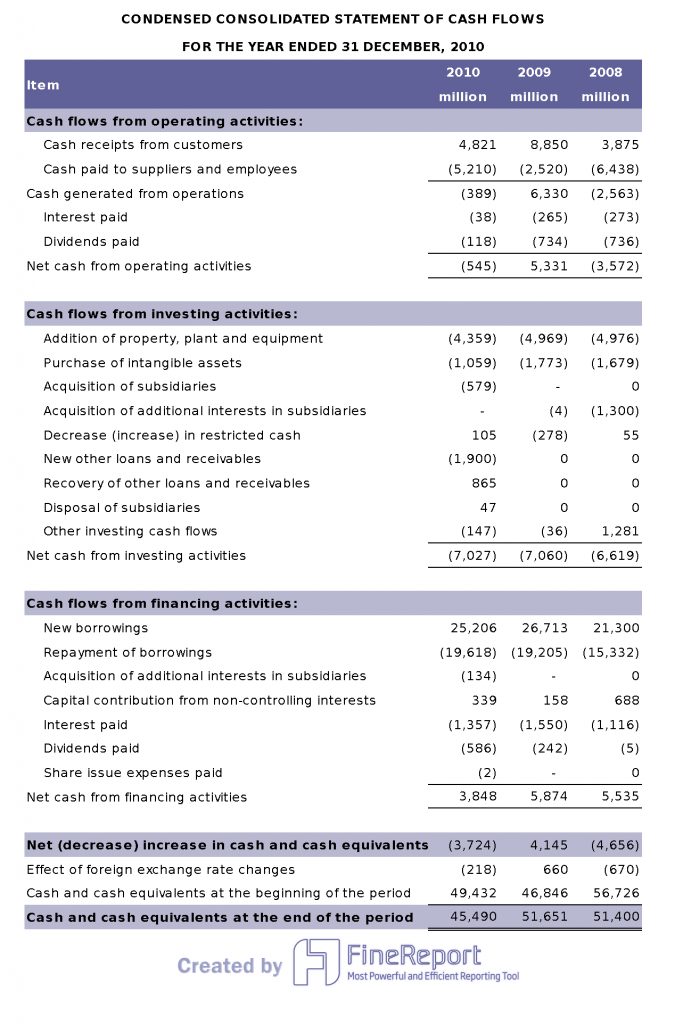

- Cash flow statement: as the name states, it is a statement of the flows of cash both in and out. It details the sources and uses of cash in relation to a business's operations, investments, and financing. It is often considered the most reliable source of information when it comes to the cash generation capacity of a firm.

These are just three of the main types of accounting statements that businesses use for their daily financial operations. We will cover this more in detail later in the post with a few financial dashboard examples. But before we delve any deeper, let’s consider who uses financial accounting reports.

Who benefits from accounting reporting?

There are a multitude of people in modern organizations that stand to benefit from accounting reports and analysis. Let’s take a closer look.

- Accountants: As you might have guessed, accountants and individuals who operate in relevant financial teams frequently use accounting metrics to ensure the compliant regulation of funds while drilling deeper into trends or patterns. Using trend-based visualizations to their advantage, accountants can improve an organization’s overall financial efficiency while developing forward-thinking tax strategies (which are particularly beneficial when a company is looking to grow or sell its brand or assets to another organization).

- Insurers: To assess risk and provide ample protection to their clients, insurers use accounting KPIs to their advantage. Gaining access to accurate visualizations means that insurers can come to grips with potential fiscal risks so they can propose appropriate coverage for the right premiums.

- Shareholders: Shareholders or financial stakeholders also work with accounting reporting software to gain an objective and accurate view of both a company’s existing and prospective value. Using a mix of historic, predictive, and real-time data, shareholders can make sound investment decisions while assisting with strategies that will ultimately benefit a company’s long-term fiscal growth.

- Lenders: Financial lenders like banks use visual accountant reports to make swift and informed decisions when it comes to offering businesses a loan. Working with the right visualizations and metrics, fiscal lenders can provide loans with repayment terms and rates that reflect a company’s existing financial health as well as the potential level of risk they pose.

Why Do You Need Accounting Reports?

These reports are essential elements of a business, regardless of its size. As we have said, they are very useful when it comes to maintaining a track record of transactions, cash flow, income, etc. But they also reduce the risk of reporting inconsistencies to investors, financial managers, or worse, tax authorities. You can be sanctioned for accountancy inaccuracies. That’s why you want to avoid them at all costs. Some other benefits you can reap from these analytical tools include:

- Knowing the business's financial health: Generating accounting reports is crucial for the correct management and functioning of a business. They provide all the key information needed to paint an accurate picture of the company’s financial health and help decision-makers make key financial and non-financial decisions to ensure the company is growing in a profitable way. Having an objective view of the financial situation enables top management to make better-informed decisions for investments, sales, and purchases.

- Maintaining a budget : In order to ensure the correct functioning of the different strategies and activities, managers need to set a budget that will cover everything while still ensuring profitability. This is a fundamental aspect, especially considering that a shocking 82% of small businesses fail due to cash flow mismanagement. Smart accounting reports prevent this from happening by providing businesses with everything needed to make the best decisions and build a sustainable budget.

- Organize transactions and invoices : Transparency is key when it comes to efficient financial reporting . Reporting in accounting helps you do just that by providing an efficient bookkeeping system of all transactions and invoices to keep close track of every movement. Having a centralized location for transactions with the time, date, and nature of the transaction helps organizations understand money and goods distribution.

- Stay compliant with law and tax regulations : The risk of greed, theft, and dishonesty exists everywhere – and every month, we discover corporate abuse somewhere in the world. Companies have to be held accountable for their methods and ways of running a business, and therefore specific areas were enforced to eliminate fraud (auditing, income taxation, …). For that purpose, monthly accounting reports serve as a means for businesses to prove to authorities that they are staying compliant with any laws and tax regulations. They assist organizations in calculating the correct amounts of taxes to pay, keeping in mind regulatory guidelines.

- Improve relationship with investors : As we said already, professional accountant reports provide a complete picture of a company’s financial health. This also proves to be a very useful document for attracting new investors and keeping the ones you already have happy.

- Minimize errors : You might have full trust in your accountant's reporting abilities. However, managing data and sensitive information manually is both time-consuming and risky due to the possibility of human error. With modern accounting statements generated with professional online reporting software , the process of calculation and report generation is done automatically. This means more time to make informed decisions as well as significant mitigation of errors that can resonate across the organization.

Accounting statements will let you keep track of business transactions, but they will also help you maintain a budget, predict cash flow, and forecast revenue. They also allow for an assessment of the current situation compared to a previous one and/or compared to a forecast—the more accurate the records, the better the financial analysis or projection.

In general, a well-implemented accounting reporting system makes it easier to access the financial statements you need whenever you need them. Good accountancy helps financial analysts to understand and interpret the data and thus communicate it effectively. To do so, however, you need several tools: good accounting software but also a solid online data visualization tool . We will go deeper into the role of visuals for efficient financial analysis, but first, let's take a deeper look into the common types of financial reports.

Types Of Accounting Reports

Now that we have an accounting report definition and analysis as well as a list of insightful benefits organizations can reap from them, it is time to go deeper into the topic by looking at the main accounting report types and what is their main purpose.

1. General Ledger

Starting off with the general ledger, it's the foundation of your business bookkeeping, used to organize and summarize all your financial transactions. This report is often used to prepare for an audit, apply for a loan, and balance your books. It is composed of various accounts, which represent categories that show where your money is going and where it is coming from. Common account types include your assets, liabilities, equity, revenue, and expenses.

Another key element from a general ledger report is debits and credits. These represent whether the amount of money your business has increased or decreased. The meaning of these two changes depends on the type of account being observed. For instance, when we are talking about assets, cost of sales, inventory, and other related accounts, a debit increases the amount of money, and a credit decreases it. On the other side, when we talk about fiscal concepts like liabilities, revenue, equity, and capital, to name a few, a credit increases the money in the account and debit decreases it.

2. Profit & Loss

The profit and loss statement portrays details regarding a business's revenues, costs, and expenses over an accounting period which is usually a quarter or a year. It is one of the most popular or common reports as it essentially tells organizations if they are able to generate profit by increasing revenue or decreasing costs or both. This information enables managers to make important decisions such as budget planning, adjusting expenses, and evaluating profit generation, to name a few.

Also widely known as an income statement, this type of report is composed of 4 key indicators: income, expenses, costs of goods sold, and net income. It can be compared to other periods to see how things changed over time, as well as highlight areas of the business that could be more profitable.

3. Balance Sheet

The balance sheet is another of the most important reports in accounting. It summarizes a company’s assets, liabilities, and shareholders’ equity during an observed period of time. In short, it provides a complete picture of an organization’s liquidity by listing what it owns and owes, as well as what is invested by shareholders.

That said, the balance sheet has 3 main components: assets which is everything your company owns that can be turned into cash, liabilities which is everything your company owes to others; and equity which is the value of ownership of your company. By looking at these 3 elements together, you get a complete picture of your company’s financial health and can extract deeper conclusions such as the effectiveness of your pricing strategies or if you are spending too much. Lastly, a balance sheet is also a great document to show to potential investors or to apply for a loan, as it shows how financially stable you are.

4. Cash Flow Statement

A cash flow statement is the third of the most important financial accounting reports, together with the P&L and the balance sheet. It provides insights into a company’s inflows and outflows of cash during a specific period of time, which can conclude in a positive or negative cash flow. A positive one indicates you earned more than what you spent and you are able to pay creditors and investors, while a negative one means you spent more than you earned.

There are two ways to use a cash flow statement. On one hand, we have the direct method, which considers all movements of cash from core operating activities. And on the other hand, we have the indirect method, which considers cash movements coming from operations, investments, and financing activities. The sum of these three core elements is called the net cash flow, and it is often used by investors to determine the value of a business’s stock.

5. Statement Of Retained Earnings

As its name suggests, this report portrays the beginning and ending of retained earnings over an observed period of time. In short, retained earnings are a portion of the company’s profit that is retained from the net income at the end of an accounting period for future use as shareholder’s equity, paying liabilities, or investing.

Also known as a statement of owner’s equity or a statement of shareholder's equity, this report is used by analysts to understand how profits are being utilized. It can be used as a complement to a balance sheet or income statement as well as a separate document. Its main three components include the beginning retained earnings, net income, and dividends paid to shareholders. This type of report is done once in every accounting period, and it allows businesses to understand if they are in a position to finance operations and pay off debt or if there is a deficit.

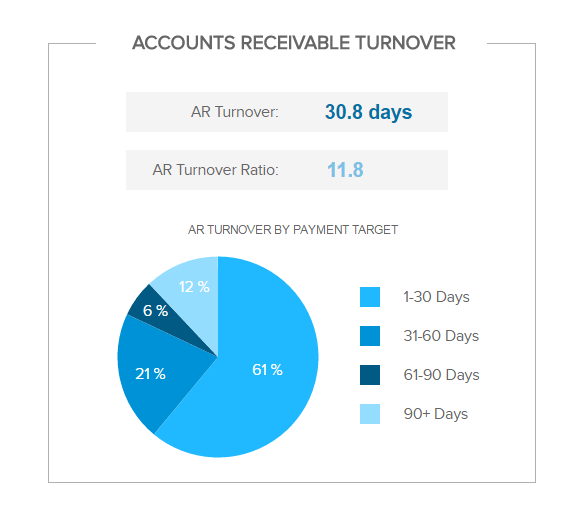

6. Accounts Receivable Aging

Next in our list of types of accounting report examples, we have the accounts receivable (AR) aging report. This report type categorizes a company’s AR by the time they’ve been outstanding or, in other words, have not been paid yet. Receivables arise when a company offers its customers services or goods on credit. For example, an energy company provides electricity to its customers and cashes them once the month is finished based on their consumption.

Generally, the receivables are broken down into time intervals that can be 1 to 30 days up to 90+ days, along with details such as the customer name, money balance, and days past. Businesses use this report to keep a record of customers' debt and stay on top of collections and any bad debt.

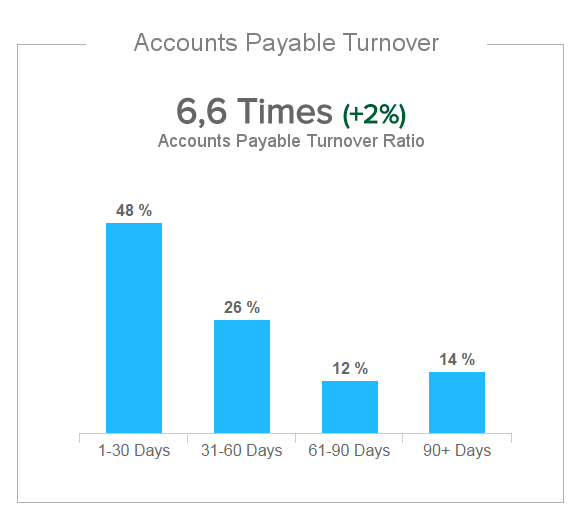

7. Accounts Payable Aging

Following on the same line as the previous report type, the accounts payable (AP) aging shows the money your business owes to others instead of what others owe to you. Examples of AP include transportation and logistics, production materials, energy/power, and building leases, among others.

The AP aging report is intended to provide businesses with a quick idea of all payments that are due in the immediate future. Typically, payments are separated into different time intervals, for example, a 30-day period. Managers use the information extracted from these statements to manage cash flow, build budgets, and calculate future expenses, among other things.

Accounting Reports Example & Samples

With the help of financial analytics software, you can connect your various data sources and work on them conjointly. This eliminates potential data silos and creates a single source of information. The intuitive drag-and-drop interface will make it even easier to build professional financial accounting reports.

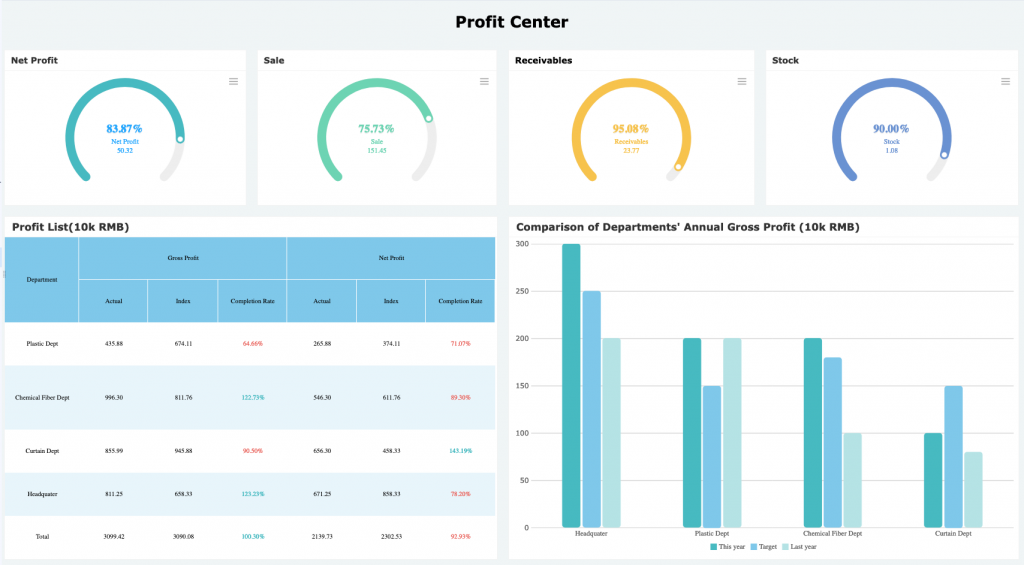

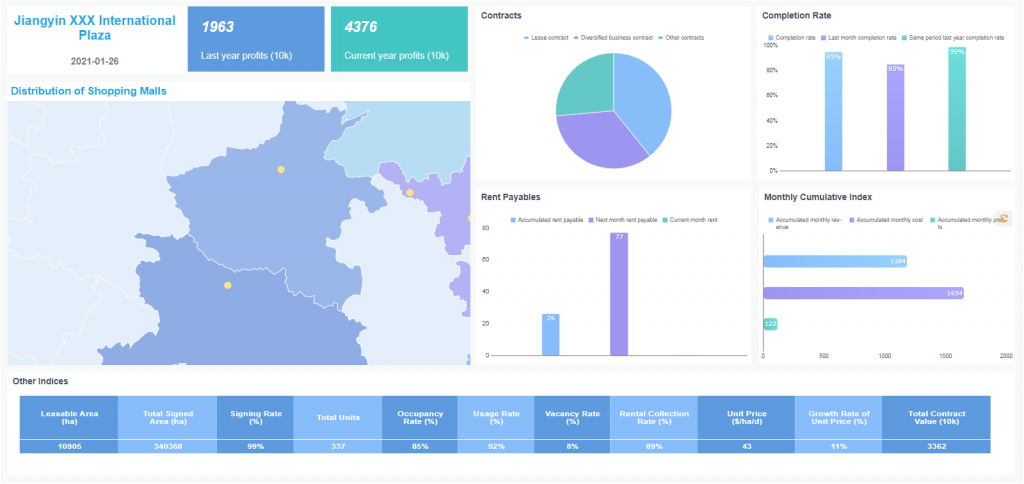

We just went through the main types of accountant reports. As mentioned, there are 3 big report types often used by organizations to assess their financial performance in various aspects. These are the balance sheet, the income statement, and the cash flow statement. Here we will see how these reports can be elevated with the help of interactive visualizations and a dashboard generator . Let’s dive into our management accounting reports examples!

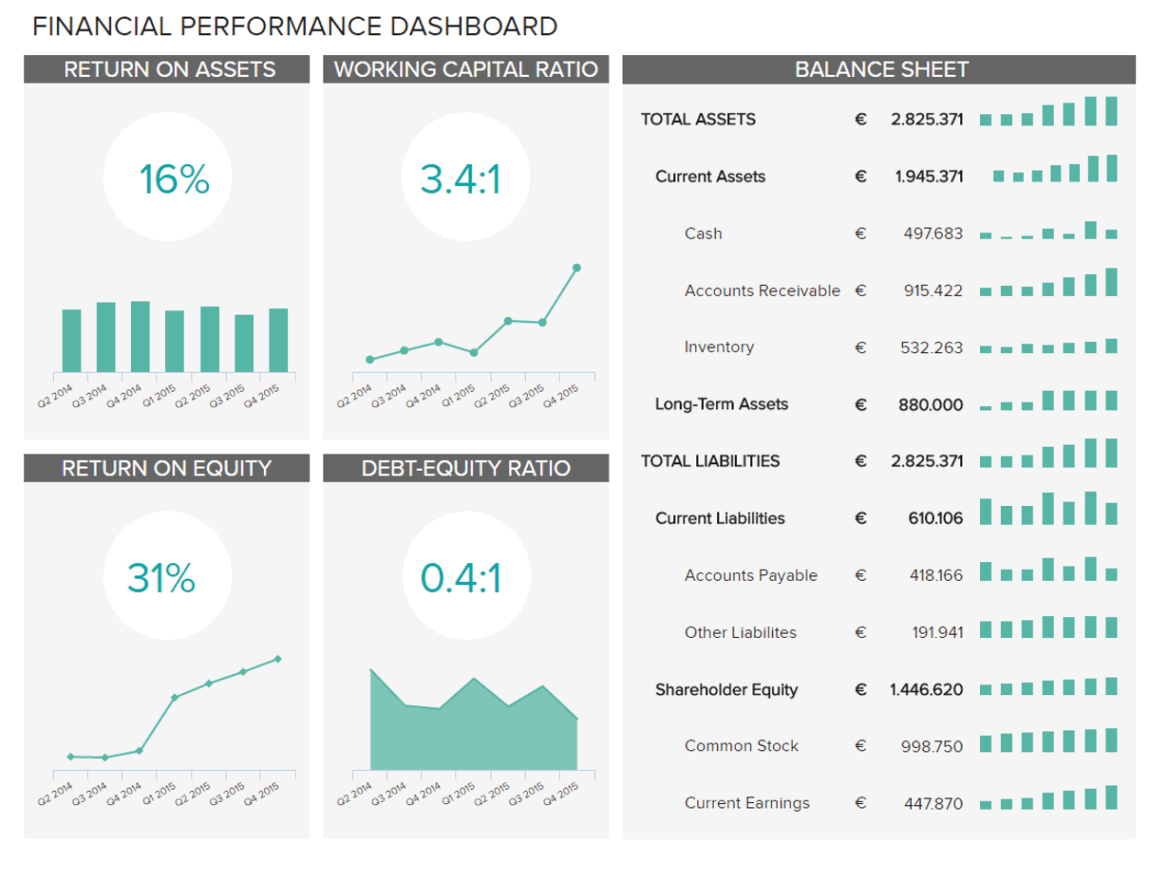

The Balance Sheet

The balance sheet is a snapshot of your business finances at a moment in time, showing assets and liabilities. It is a good testimony of how efficient you are at spending your capital.

**click to enlarge**

This dashboard presents four important metrics when it comes to understanding how your assets are being managed: ROA (Return on Asset), ROE (Return on Equity), Working Capital Ratio, and Debt-Equity ratio. Each of them is detailed, thanks to its evolution over time. On the side, the balance sheet is summarized, showing the current assets (inventory, AR, and cash) and long-term assets, as well as the liabilities.

Having your balance sheet visualized that way is a great advantage to keeping an eye on the essential facets of your company’s progress and ensuring viability and success in the long run.

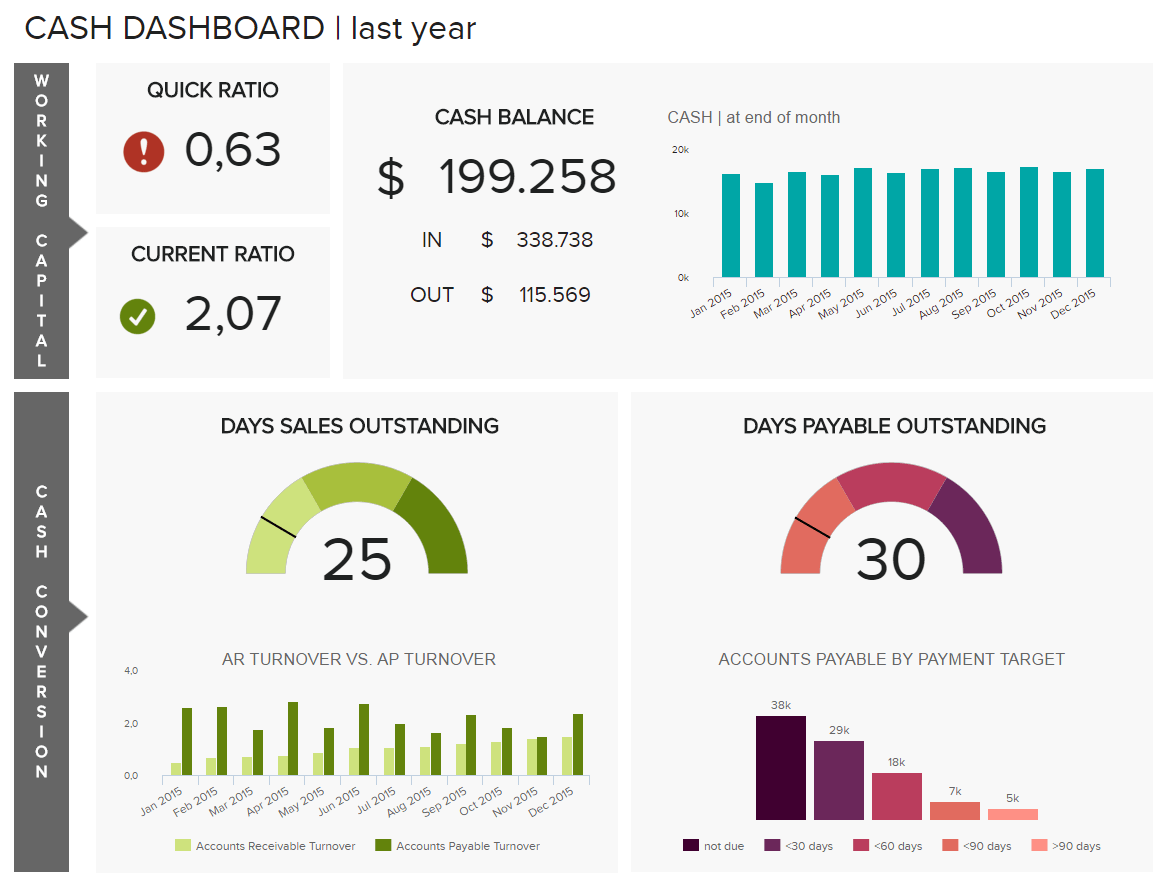

The Cash Flow Statement

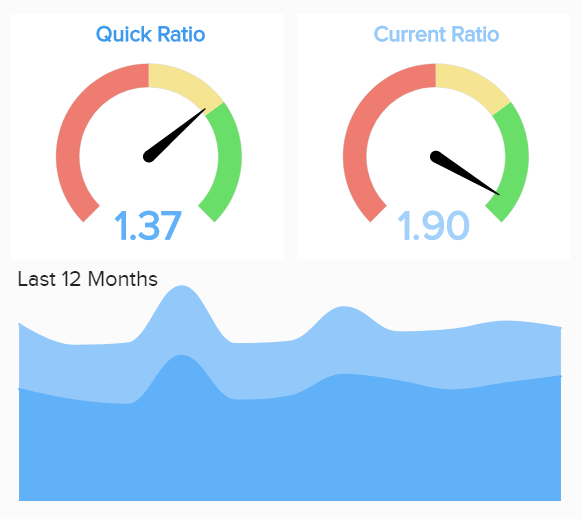

This accounting report sample will monitor what goes in and out of your treasury. It gives a good overview of your liquidity and cash flow situation and, at the same time, gives a good indication of how you can improve it: tracking and optimizing the accounts payable and receivable. It then details the quick and current ratio, along with the cash balance.

Visualizing your cash flow statement is critical because you immediately know whether you are still on track or not. That’s an essential asset since your main goal is to keep the financial fluidity necessary to survive and thrive.

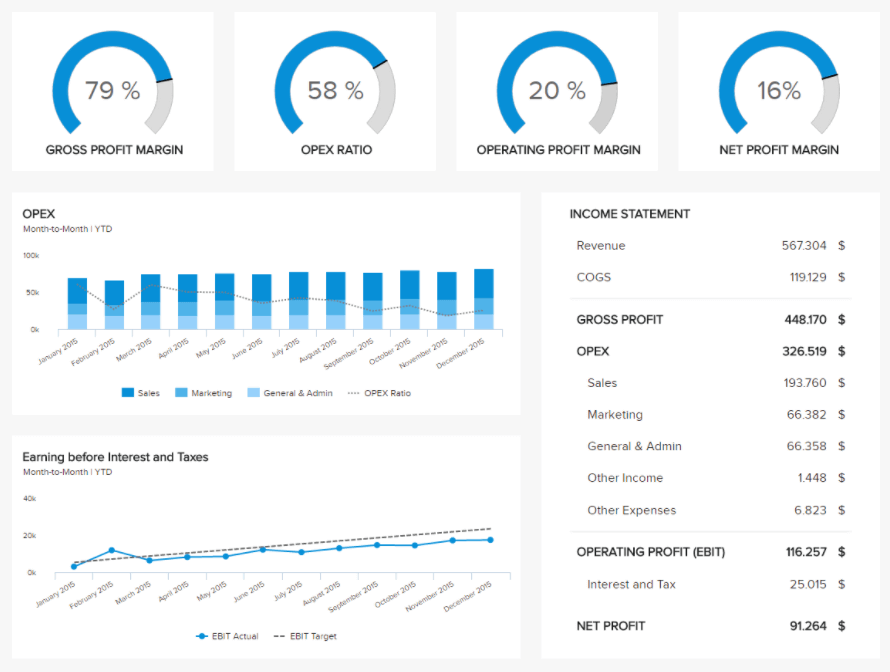

The Income Statement

The last of our examples provide an easy-to-understand view of the income statement by detailing all of its components, from the gross to the net profit, as well as all the other performance ratios.

As stated above, the income statement helps you evaluate the profit and loss. It gives the month-to-month trends of the OPEX ratio and each of its components, the EBIT (earnings before taxes) evolution over the year, and finally sums up the four categories into the overall income statement.

That visualization is much more efficient and communicative than any table in Excel. It is a great help if you want to evaluate your performance in light of market fluctuations, investments, and other operational considerations.

Accounting KPIs & Metrics For Your Reports

Now that we’ve explored a dynamic mix of real-life accounting management reports, let’s drill down a little more by looking at the essential visualizations that result in consistently successful outcomes related to financial accounting reporting.

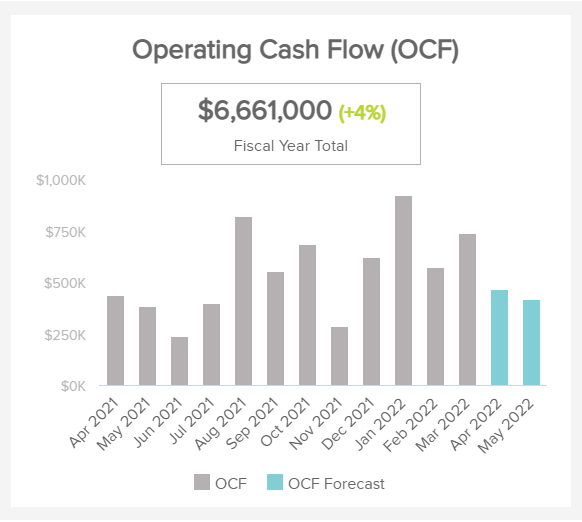

1. Operating Cash Flow (OCF)

This essential accountant report metric offers an objective overview of the cash your company generates based on its regular or everyday operations. By omitting any additional investments or deals from the mix, this powerful visual will help you gauge whether your company is healthy enough to sustain itself and grow through its base strategies and operations. If you notice any anomalies, you will be able to act swiftly and take targeted actions to improve your OCF levels, boosting your business’s financial health in the process.

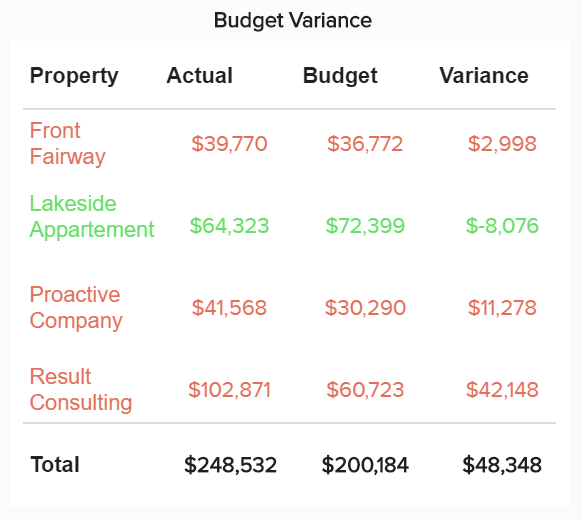

2. Budget Variance

A staple of any valuable accounting annual report, the budget variance is a KPI that presents actual figures compared to budgeted or projected figures based on key financial investments or categories. This dynamic metric serves up real-time fiscal information while calculating the difference or variance of each financial category automatically. Working with this visualization will give you the tools you need to understand which areas of the business are underperforming and get to the root of the issue. Being able to drill down into any potential issues with ease will empower you to make more accurate budgetary projections while keeping your revenue flowing across the board.

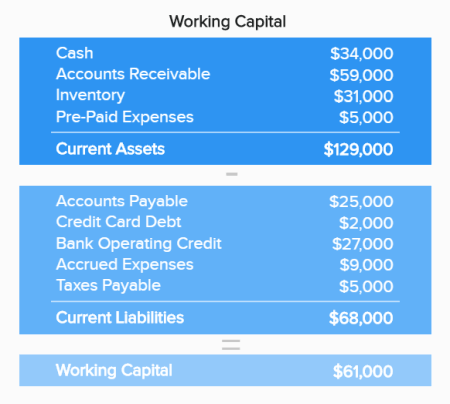

3. Working Capital

Presented in a dynamic listed format, the working capital KPI will give you an informed overview of your business’s general financial stability at any given time. Working with this metric will allow you to see what working capital you have remaining after subtracting your company’s key liabilities, including outgoings such as inventory, prepaid expenses, and taxes payable (these liabilities can be tailored and customized to reflect your specific liabilities). By keeping a keen eye on this accounting KPI, you can maintain a firm grip on your ongoing fiscal health and formulate strategies that will not only protect the organization but result in progress.

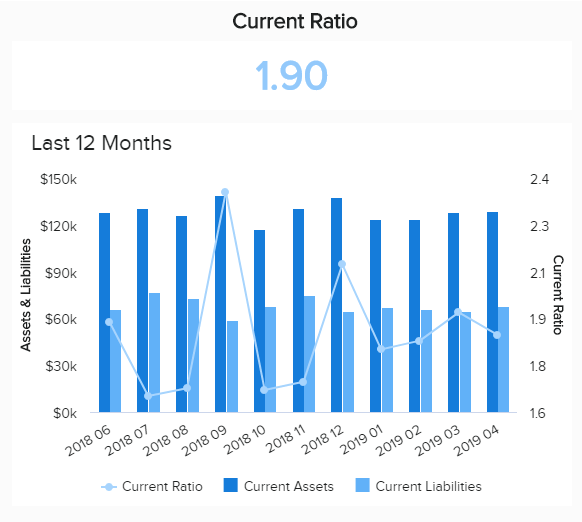

4. Current Ratio

Knowing that you can pay your short-term obligations is essential to maintaining balanced, healthy, and progressive accounts. A trend-based marker of financial liquidity, tracking this KPI will help you uncover trends based on your ability to pay your debts or outgoings with efficiency. The current ratio is calculated by dividing your existing assets and liabilities. The higher your current ratio, the better, and by weaving this most valuable of visuals into your accounting analytics mix, you will ensure your business’s short-term health remains buoyant at all times.

5. Quick Ratio

Also known as the ‘acid test’, this prime accounting reports example will empower you to assess the ongoing health of your organization’s liquidity at a glance. With trend-based info highlighting peaks and troughs over a 12-month period, as well as dynamic visual markers showcasing both quick and current ratios, you can assess the stability of your near-cash assets, as well as a mix of additional liquidity factors, with ease. The aim here is to boost your current ratio and ultimately improve how your company converts its assets or investments into cash. This powerful visualization will help you do just that.

6. Accounts Payable Turnover

Accounts payable turnover is an essential addition to any well-rounded accounting reports list. Monitoring this metric regularly will give you a granular overview of how quickly and consistently you pay your expenses back over a set timeframe. Broken down into a digestible column chart format, this dynamic visual serves up insights based on how swiftly you pay back your expenses based on different time ranges from 1 - 30 days to 90+ days. Checking in with this KPI frequently will give you the intelligence you need to sharpen your AP strategy and make yourself more attractive to potential investors.

7. Accounts Receivable Turnover

Accounts receivable turnover will give you a razor-sharp appraisal of how quickly and consistently you collect your payments. Not only will tracking this KPI help you maintain financial stability throughout the year, but it will also give you a clear gauge of how effective you are in extending credits. If you notice any dips in your AR figures or ratios, you will be able to get to the heart of the issue with pinpoint precision and revise your processes to increase the rate at which your company can transform credit sales into cash—an essential element of any accounting analytics dashboard.

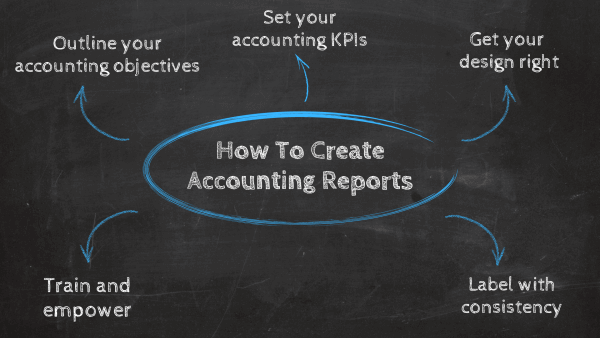

How To Create Modern Accounting Reports

Now that we’ve explored our definitive list of accounting reports and covered all of the fundamentals of visual account-based analytics, we’re going to consider how to create them in a way that ensures ongoing financial success.

- Outline your accounting objectives: Before you start developing your reports, it’s important to drill down deeper into the specific fiscal objectives that extend beyond essentials like AP, AR, tax information, and balance sheets. Do you, for instance, want to stabilize your short-term liquidity or find more efficient ways of balancing your working capital? Set your goals, and you will give your report creation efforts a definitive direction.

- Set your accounting KPIs: Armed with your specific goals and objectives, you will be able to set the financial KPIs that will help your business get to where it needs to be. Matching your metrics to your goals will ensure that you have all of the visual intelligence you need to keep meeting or even exceeding your company’s most essential accounting-based benchmarks.

- Get your design right: With your visual KPIs in place, you will now need to make sure that your report is clear, clutter-free, and 100% accessible to every user. When you’re designing your accounting report format, prioritizing substance over style is essential. It’s vital that every visualization is arranged in a way that is easy to navigate while avoiding visual clutter where possible. Our guide to dashboard design best practices will help you with your efforts.

- Label with consistency: Expanding on our previous point, when creating a successful accounting business report, you should label all of your visuals and informational elements consistently. Ensure your labeling follows a uniform format (using the same punctuation, numeric style, or abbreviations, for example) to ensure everything is clear, fluent, and easy to digest. Following a clear and consistent labeling format is essential to making sure every relevant stakeholder can use your reports to their full potential while avoiding any confusion that could lead to error.

- Train and empower: Without providing adequate support and training, your reports will offer limited value to members of your financial team. By taking the time to master every function or feature of your reports’ dashboard software, you will benefit from filters, drill down options, and analytical automation capabilities. Armed with this knowledge, you can run regular internal training workshops to give everyone the tools they need to succeed with the power of visual reporting. Taking the time to roll out training and developing a data-driven culture across the business means that you will see the best possible return on investment (ROI) for your analytical efforts.

Tip: In addition to following these essential tips, gathering regular feedback from all relevant users will give you the intelligence you need to continually evolve and improve your reporting efforts for ongoing financial success.

Why Does Data Visualization Matter For Your Accounting Report?

Like in any business area today, managers are confronted with a growing amount of data to assimilate and from which they have to make sound decisions. Visualizing all this data by creating managerial accounting reports addresses informational overload and improves the quality of decision-making.

However, introducing visualization to the accounting world doesn’t come as easy as we would think at first. In a field obsessed with calculating every dollar to the precise cent, it can be easy to end up trapped in a maze of detailed numbers and tables. Yet, there are more than tables to visualize the results of an accounting report.

Let's take a real-life example. If you are a food company, for instance, with several subsidiaries spread across the country: you need to have an accurate and easy-to-grasp view of the cash that goes in and out of each store and its evolution. To do so, dashboard software comes in handy, as it lets you see which unit runs out of cash and the criticality of the situation in relation to profits or losses from other stores. The same goes if you have several suppliers to pay while your customers delay their liability: with real-time visualization of what’s in and what’s out, you are in a better position to avoid being in the red for too long. Indeed, you won’t need to wait for the next report to be produced: the dashboard is automatically updated every time you perform a change in the source. Besides, the possibility of adding data alerts will always keep you safe, as you will be notified as soon as something changes in your insights.

As we see, DataViz isn’t just eye candy to please managers. It is a powerful way to exceed your reporting process and communicate all your work in a comprehensible and accessible way to anyone. It will help you analyze your potential problems or pain points and explain them better. Trying to present these reports in the least detail and you will end up creating a visualization more impenetrable than the table you first tried to replace.

So, let’s take a step back and see what can be done. Excel tables are extremely powerful and essential for any accountant, and so are Lexware and Infor. Yet, they lack data visualization that could really make sense and help get the full understanding of the balance sheet and income statement they hold in store. As seen with our list of examples, a modern online data analysis tool provides you with a mix of advanced analytical features as well as intuitive visualization options that can be easily accessed and shared for a collaborative data-driven approach.

Key Takeaways

Accounting reports are not just visuals of your organization’s revenue and expenses. They also provide insights into cash flow management and a snapshot of its financial health. These reports are great for identifying potential issues and opportunities within your business and communicating them to internal stakeholders, insurance carriers, and lenders alike, provided you use the right tools.

Implementing dashboard reporting software to make sense of all the info you handle will help you greatly in communicating your insights. Dataviz helps accountants tell better data stories in an accessible way to everyone.

In summary, here are the main types of accounting reports:

- General Ledger

- Profit & Loss

- Balance Sheet

- Cash Flow Statement

- Statement Of Retained Earnings

- Accounts Receivable Aging

- Accounts Payable Aging

To start your financial visualization journey now and see how much your reports could benefit from it, why not start our free 14-day trial ?

5.4 Appendix: Complete a Comprehensive Accounting Cycle for a Business

We have gone through the entire accounting cycle for Printing Plus with the steps spread over three chapters. Let’s go through the complete accounting cycle for another company here. The full accounting cycle diagram is presented in Figure 5.14 .

We next take a look at a comprehensive example that works through the entire accounting cycle for Clip’em Cliff. Clifford Girard retired from the US Marine Corps after 20 years of active duty. Cliff decides it would be fun to become a barber and open his own shop called “Clip’em Cliff.” He will run the barber shop out of his home for the first couple of months while he identifies a new location for his shop.

Since his Marines career included several years of logistics, he is also going to operate a consulting practice where he will help budding barbers create a barbering practice. He will charge a flat fee or a per hour charge. His consulting practice will be recognized as service revenue and will provide additional revenue while he develops his barbering practice.

He obtains a barber’s license after the required training and is ready to open his shop on August 1. Table 5.2 shows his transactions from the first month of business.

Transaction 1: On August 1, 2019, Cliff issues $70,000 shares of common stock for cash.

- Clip’em Cliff now has more cash. Cash is an asset, which is increasing on the debit side.

- When the company issues stock, this yields a higher common stock figure than before issuance. The common stock account is increasing on the credit side.

Transaction 2: On August 3, 2019, Cliff purchases barbering equipment for $45,000; $37,500 was paid immediately with cash, and the remaining $7,500 was billed to Cliff with payment due in 30 days.

- Clip’em Cliff now has more equipment than before. Equipment is an asset, which is increasing on the debit side for $45,000.

- Cash is used to pay for $37,500. Cash is an asset, decreasing on the credit side.

- Cliff asked to be billed, which means he did not pay cash immediately for $7,500 of the equipment. Accounts Payable is used to signal this short-term liability. Accounts payable is increasing on the credit side.

Transaction 3: On August 6, 2019, Cliff purchases supplies for $300 cash.

- Clip’em Cliff now has less cash. Cash is an asset, which is decreasing on the credit side.

- Supplies, an asset account, is increasing on the debit side.

Transaction 4: On August 10, 2019, provides $4,000 in services to a customer who asks to be billed for the services.

- Clip’em Cliff provided service, thus earning revenue. Revenue impacts equity, and increases on the credit side.

- The customer did not pay immediately for the service and owes Cliff payment. This is an Accounts Receivable for Cliff. Accounts Receivable is an asset that is increasing on the debit side.

Transaction 5: On August 13, 2019, Cliff pays a $75 utility bill with cash.

- Clip’em Cliff now has less cash than before. Cash is an asset that is decreasing on the credit side.

- Utility payments are billed expenses. Utility Expense negatively impacts equity, and increases on the debit side.

Transaction 6: On August 14, 2019, Cliff receives $3,200 cash in advance from a customer for services to be rendered.

- The customer has not yet received services but already paid the company. This means the company owes the customer the service. This creates a liability to the customer, and revenue cannot yet be recognized. Unearned Revenue is the liability account, which is increasing on the credit side.

Transaction 7: On August 16, 2019, Cliff distributed $150 cash in dividends to stockholders.

- When the company pays out dividends, this decreases equity and increases the dividends account. Dividends increases on the debit side.

Transaction 8: On August 17, 2019, Cliff receives $5,200 cash from a customer for services rendered.

- Clip’em Cliff now has more cash than before. Cash is an asset, which is increasing on the debit side.

- Service was provided, which means revenue can be recognized. Service Revenue increases equity. Service Revenue is increasing on the credit side.

Transaction 9: On August 19, 2019, Cliff paid $2,000 toward the outstanding liability from the August 3 transaction.

- Accounts Payable is a liability account, decreasing on the debit side.

Transaction 10: On August 22, 2019, Cliff paid $4,600 cash in salaries expense to employees.

- When the company pays salaries, this is an expense to the business. Salaries Expense reduces equity by increasing on the debit side.

Transaction 11: On August 28, 2019, the customer from the August 10 transaction pays $1,500 cash toward Cliff’s account.

- The customer made a partial payment on their outstanding account. This reduces Accounts Receivable. Accounts Receivable is an asset account decreasing on the credit side.

- Cash is an asset, increasing on the debit side.

The complete journal for August is presented in Figure 5.15 .

Once all journal entries have been created, the next step in the accounting cycle is to post journal information to the ledger. The ledger is visually represented by T-accounts. Cliff will go through each transaction and transfer the account information into the debit or credit side of that ledger account. Any account that has more than one transaction needs to have a final balance calculated. This happens by taking the difference between the debits and credits in an account.

Clip’em Cliff’s ledger represented by T-accounts is presented in Figure 5.16 .

You will notice that the sum of the asset account balances in Cliff’s ledger equals the sum of the liability and equity account balances at $83,075. The final debit or credit balance in each account is transferred to the unadjusted trial balance in the corresponding debit or credit column as illustrated in Figure 5.17 .

Once all of the account balances are transferred to the correct columns, each column is totaled. The total in the debit column must match the total in the credit column to remain balanced. The unadjusted trial balance for Clip’em Cliff appears in Figure 5.18 .

The unadjusted trial balance shows a debit and credit balance of $87,900. Remember, the unadjusted trial balance is prepared before any period-end adjustments are made.

On August 31, Cliff has the transactions shown in Table 5.3 requiring adjustment.

Adjusting Transaction 1: Cliff took an inventory of supplies and discovered that $250 of supplies remain unused at the end of the month.

- $250 of supplies remain at the end of August. The company began the month with $300 worth of supplies. Therefore, $50 of supplies were used during the month and must be recorded (300 – 250). Supplies is an asset that is decreasing (credit).

- Supplies is a type of prepaid expense, that when used, becomes an expense. Supplies Expense would increase (debit) for the $50 of supplies used during August.

Adjusting Transaction 2: The equipment purchased on August 3 depreciated $2,500 during the month of August.

- Equipment cost of $2,500 was allocated during August. This depreciation will affect the Accumulated Depreciation–Equipment account and the Depreciation Expense–Equipment account. While we are not doing depreciation calculations here, you will come across more complex calculations, such as depreciation in Long-Term Assets .

- Accumulated Depreciation–Equipment is a contra asset account (contrary to Equipment) and increases (credit) for $2,500.

- Depreciation Expense–Equipment is an expense account that is increasing (debit) for $2,500.

Adjusting Transaction 3: Clip’em Cliff performed $1,100 of services during August for the customer from the August 14 transaction.

- The customer from the August 14 transaction gave the company $3,200 in advanced payment for services. By the end of August the company had earned $1,100 of the advanced payment. This means that the company still has yet to provide $2,100 in services to that customer.

- Since some of the unearned revenue is now earned, Unearned Revenue would decrease. Unearned Revenue is a liability account and decreases on the debit side.

- The company can now recognize the $1,100 as earned revenue. Service Revenue increases (credit) for $1,100.

Adjusting Transaction 4: Reviewing the company bank statement, Clip’em Cliff identifies $350 of interest earned during the month of August that was previously unrecorded.

- Interest is revenue for the company on money kept in a money market account at the bank. The company only sees the bank statement at the end of the month and needs to record as received interest revenue reflected on the bank statement.

- Interest Revenue is a revenue account that increases (credit) for $350.

- Since Clip’em Cliff has yet to collect this interest revenue, it is considered a receivable. Interest Receivable increases (debit) for $350.

Adjusting Transaction 5: Unpaid and previously unrecorded income taxes for the month are $3,400.

- Income taxes are an expense to the business that accumulate during the period but are only paid at predetermined times throughout the year. This period did not require payment but did accumulate income tax.

- Income Tax Expense is an expense account that negatively affects equity. Income Tax Expense increases on the debit side.

- The company owes the tax money but has not yet paid, signaling a liability. Income Tax Payable is a liability that is increasing on the credit side.

The summary of adjusting journal entries for Clip’em Cliff is presented in Figure 5.19 .

Now that all of the adjusting entries are journalized, they must be posted to the ledger. Posting adjusting entries is the same process as posting the general journal entries. Each journalized account figure will transfer to the corresponding ledger account on either the debit or credit side as illustrated in Figure 5.20 .

We would normally use a general ledger, but for illustrative purposes, we are using T-accounts to represent the ledgers. The T-accounts after the adjusting entries are posted are presented in Figure 5.21 .

You will notice that the sum of the asset account balances equals the sum of the liability and equity account balances at $80,875. The final debit or credit balance in each account is transferred to the adjusted trial balance, the same way the general ledger transferred to the unadjusted trial balance.

The next step in the cycle is to prepare the adjusted trial balance. Clip’em Cliff’s adjusted trial balance is shown in Figure 5.22 .

The adjusted trial balance shows a debit and credit balance of $94,150. Once the adjusted trial balance is prepared, Cliff can prepare his financial statements (step 7 in the cycle). We only prepare the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is discussed in detail in Statement of Cash Flows .

To prepare your financial statements, you want to work with your adjusted trial balance.

Remember, revenues and expenses go on an income statement. Dividends, net income (loss), and retained earnings balances go on the statement of retained earnings. On a balance sheet you find assets, contra assets, liabilities, and stockholders’ equity accounts.

The income statement for Clip’em Cliff is shown in Figure 5.23 .

Note that expenses were only $25 less than revenues. For the first month of operations, Cliff welcomes any income. Cliff will want to increase income in the next period to show growth for investors and lenders.

Next, Cliff prepares the following statement of retained earnings ( Figure 5.24 ).

The beginning retained earnings balance is zero because Cliff just began operations and does not have a balance to carry over to a future period. The ending retained earnings balance is –$125. You probably never want to have a negative value on your retained earnings statement, but this situation is not totally unusual for an organization in its initial operations. Cliff will want to improve this outcome going forward. It might make sense for Cliff to not pay dividends until he increases his net income.

Cliff then prepares the balance sheet for Clip’em Cliff as shown in Figure 5.25 .

The balance sheet shows total assets of $80,875, which equals total liabilities and equity. Now that the financial statements are complete, Cliff will go to the next step in the accounting cycle, preparing and posting closing entries. To do this, Cliff needs his adjusted trial balance information.

Cliff will only close temporary accounts, which include revenues, expenses, income summary, and dividends. The first entry closes revenue accounts to income summary. To close revenues, Cliff will debit revenue accounts and credit income summary.

The second entry closes expense accounts to income summary. To close expenses, Cliff will credit expense accounts and debit income summary.

The third entry closes income summary to retained earnings. To find the balance, take the difference between the income summary amount in the first and second entries (10,650 – 10,625). To close income summary, Cliff would debit Income Summary and credit Retained Earnings.

The fourth closing entry closes dividends to retained earnings. To close dividends, Cliff will credit Dividends, and debit Retained Earnings.

Once all of the closing entries are journalized, Cliff will post this information to the ledger. The closed accounts with their final balances, as well as Retained Earnings, are presented in Figure 5.26 .

Now that the temporary accounts are closed, they are ready for accumulation in the next period.

The last step for the month of August is step 9, preparing the post-closing trial balance. The post-closing trial balance should only contain permanent account information. No temporary accounts should appear on this trial balance. Clip’em Cliff’s post-closing trial balance is presented in Figure 5.27 .

At this point, Cliff has completed the accounting cycle for August. He is now ready to begin the process again for September, and future periods.

Concepts In Practice

Reversing entries.

One step in the accounting cycle that we did not cover is reversing entries. Reversing entries can be made at the beginning of a new period to certain accruals. The company will reverse adjusting entries made in the prior period to the revenue and expense accruals.

It can be difficult to keep track of accruals from prior periods, as support documentation may not be readily available in current or future periods. This requires an accountant to remember when these accruals came from. By reversing these accruals, there is a reduced risk for counting revenues and expenses twice. The support documentation received in the current or future period for an accrual will be easier to match to prior revenues and expenses with the reversal.

Link to Learning

As we have learned, the current ratio shows how well a company can cover short-term debt with short-term assets. Look through the balance sheet in the 2017 Annual Report for Target and calculate the current ratio. What does the outcome mean for Target ?

Think It Through

Using liquidity ratios to evaluate financial performance.

You own a landscaping business that has just begun operations. You made several expensive equipment purchases in your first month to get your business started. These purchases very much reduced your cash-on-hand, and in turn your liquidity suffered in the following months with a low working capital and current ratio.

Your business is now in its eighth month of operation, and while you are starting to see a growth in sales, you are not seeing a significant change in your working capital or current ratio from the low numbers in your early months. What could you attribute to this stagnancy in liquidity? Is there anything you can do as a business owner to better these liquidity measurements? What will happen if you cannot change your liquidity or it gets worse?

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 1: Financial Accounting

- Publication date: Apr 11, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-financial-accounting/pages/5-4-appendix-complete-a-comprehensive-accounting-cycle-for-a-business

© Dec 13, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Why FineReport

Product Features

Smart Report

Visualizations & Dashboards

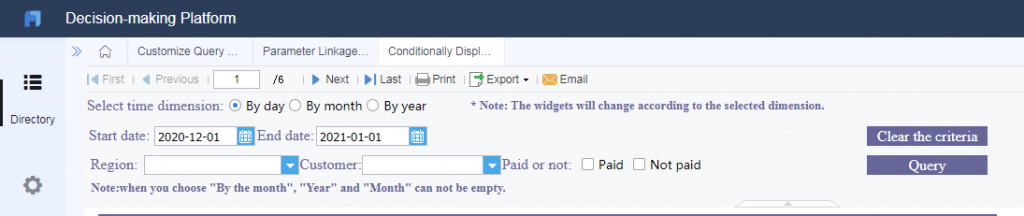

Decision-making Platform

Visual Chart

Data Collection

Deployment & Integration

Documentation

Getting Started

Training Videos

Learning Path

Certification

Bahasa Indonesia

Create Reports and BI dashboards in 5 minutes!

In business finance, precision is vital for conveying accurate assessments to investors, shareholders, and employees. Companies commonly use accounting reports to ensure transparency in financial performance communication, necessitating meticulous preparation.

This article starts with the accounting report’s definition and meaning and then lists the company’s three most important accounting reports. Also, an effective method for generating accounting reports by using a professional reporting tool will be introduced.