Start an Automobile Broker Business: Your Complete Guide

Looking for a new business venture? Why not try your hand at becoming an automobile broker? As an automobile broker, you’ll be responsible for connecting buyers and sellers of cars, trucks, and other vehicles. Not only is it a great way to earn some extra income, but you’ll also get to work with some amazing people and see some incredible vehicles. Ready to get started? Here’s your complete guide to starting an automobile broker business. Trust us – it’s easier than you think! Let’s get started.

Table of Contents

What is an automobile broker business, how do i find customers for my automobile broker business.

Many people might not be familiar with the term “automobile broker,” but it’s actually a valuable service for car buyers. Instead of scouring dealerships and private listings, a car broker can do the legwork for you, searching to find the perfect vehicle at the best price. They often have connections and insider knowledge that give them access to discounts and exclusive deals.

The broker will also handle all of the paperwork and negotiations, making the car-buying process much easier and stress-free. So if you’re in the market for a new car, consider hiring an automobile broker to help streamline your search and save money. It may just be the smartest decision you make.

Why would I want to start an Automobile Broker business?

So, you’re thinking about a career in automobile broking? Great choice! As an auto broker, you’ll have the opportunity to work with a wide range of clients, from individual car buyers to large corporations. You’ll get to help people find the right car for their needs and budget, and you’ll enjoy a high degree of autonomy and flexibility in your work. In this section, we’ll take a look at some of the key reasons why a career in auto broking could be the right choice for you.

Autonomous work with flexible hours

As an auto broker, you’ll have the freedom to work autonomously and set your own hours. This is a great option for entrepreneurs or anyone who prefers not to work within the traditional 9-5 framework. You can structure your work schedule around your other commitments, whether that means fitting in client appointments around your child’s school schedule or taking on extra assignments during your slower periods.

Earn a good income

Auto broking can be a very lucrative career choice. The average auto broker earns a commission of 10-15% on every car sale they broker, which can add up to a healthy income if you’re closing deals regularly. Additionally, many auto brokers also receive bonuses and commissions from car dealerships for bringing them business.

Help people find their perfect car

If you love cars and enjoy working with people, then auto broking could be the perfect career for you! As an auto broker, you’ll get to help clients find the perfect car for their needs and budget. You’ll need to have strong knowledge of the different makes and models of cars on the market so that you can advise your clients accordingly.

Are you looking for a career that offers autonomy, flexibility, and good earning potential? If so, then automobile broking could be the right choice for you! In this blog post, we’ve looked at just some of the reasons why a career in auto broking could be the right fit for you. So what are you waiting for? Start researching today and see if auto broking could be the right career path for you!

How do I start an Automobile Broker business?

Have you ever dreamed of owning your own business? Of being your own boss and setting your own hours? If you love cars, then starting an automobile broker business could be the perfect entrepreneurial venture for you. As an auto broker, you would act as a middleman between buyers and sellers of vehicles, helping to negotiate prices and facilitating the sale. Though it may sound like a daunting task, with a little research and planning, starting your own auto broker business can be a smooth and exciting process. Read on to learn more about how to get started in this car-savvy industry.

What is an automobile broker business and what services do they offer to customers

An automobile broker business is a valuable service for car buyers and sellers. As a broker, your job would be to assist in finding the right vehicle at the best price for customers, whether they are buying or selling. This can include conducting research on available vehicles and negotiating prices with dealerships or private sellers.

You may also provide additional services such as arranging financing and facilitating the transfer of paperwork and ownership. A successful auto broker business requires strong knowledge of the industry and great negotiation skills. It can also be helpful to establish relationships with dealerships to facilitate a smooth transaction process for your clients.

Overall, becoming an automobile broker provides an opportunity to help customers navigate the often complex world of car buying and selling while earning a profit for your business.

How do you start an automobile broker business – the necessary steps

Looking to break into the automotive industry as a broker? It may be a competitive field, but with the proper planning and preparation, you can set yourself up for success.

First, research current laws and regulations in your area regarding automobile brokers. You may need to obtain specific licenses or permits in order to operate legally.

Next, gather information on the most in-demand vehicles and make connections with dealerships or private sellers to acquire these cars for sale.

Lastly, market yourself effectively by creating a website, networking with potential clients, and establishing partnerships with car dealerships or other related businesses. Starting an auto broker business requires diligence and hard work, but if done properly, it can be a profitable venture.

What are some of the challenges that you will face when starting this type of business

Starting a successful auto broker business can be a rewarding and lucrative career, but it also comes with its own set of challenges. First, this industry requires strong networking skills as you will need to build relationships with car dealerships and individual sellers in order to source vehicles for your clients. It’s also important to have an understanding of the car market and pricing, as well as the ability to negotiate on behalf of your clients.

In addition, there is a lot of paperwork and administrative tasks involved in buying and selling cars, including ensuring all necessary documents are completed and filed correctly.

Finally, dealing with customer satisfaction and maintaining good relationships with clients can also present its own set of challenges. However, with dedication and hard work, these challenges can be overcome and lead to a successful auto broker business.

How can you make your automobile broker business successful in the long run

Starting your own automobile broker business can be a challenging and competitive endeavor. However, remaining successful in the long run requires careful planning and strategy. It’s important to have a strong understanding of the industry and current market trends. Networking with reputable dealerships and building a solid reputation within the community can also go a long way in attracting potential customers.

Staying organized and offering personalized customer service can help maintain relationships with clients and drive repeat business. Finally, staying updated on industry developments and being open to adapting to changes can ensure continued success in the ever-evolving automotive world. By following these steps, you will put your auto broker business on the path to long-term success.

What are some tips for maintaining a positive relationship with clients and keeping them happy

As a successful auto broker, maintaining positive relationships with your clients is key. Here are some tips for ensuring happy and satisfied customers:

First, communication is critical. Make sure to clearly outline the process for purchasing or selling a vehicle and ensure that both parties understand any agreements that have been made. Stay in touch throughout the process and follow up with any updates or changes in a timely manner.

Another important element is accountability. Take responsibility for any mistakes that may occur and work quickly to find a solution. This can help build trust and demonstrate your dedication to meeting the needs of your clients.

Additionally, always be open to feedback and make sure to resolve any issues promptly. Keep in mind that excellent customer service can lead to repeat business and referrals, so prioritize building strong connections with your clients at every step of the process.

How much does it cost to start an Automobile Broker business?

The cost of starting an automobile broker business can range from a few hundred dollars to over a thousand. The specific amount will depend on the state in which you wish to operate and the services you plan to offer. Additionally, you will need to factor in the cost of bonding and insurance, as well as any licenses or permits required by your state. In this blog post, we’ll break down the different costs associated with starting an automobile broker business so that you can make an informed decision about whether or not this is the right business for you.

Initial Costs

One of the great things about starting an automobile broker business is that the initial investment is relatively low. You can get started with just a few hundred dollars, which can be used to cover the cost of your state’s business registration fee and any other necessary permits or licenses. If you already have a suitable vehicle, you may not need to invest anything further in order to get started. However, if you do not have a vehicle that meets your state’s requirements for commercial use, you will need to purchase one.

Bonding and Insurance

In order to operate legally, most states require automobile brokers to obtain a surety bond. This bond serves as a guarantee that you will adhere to all applicable laws and regulations when conducting business. The cost of the bond will vary depending on the amount required by your state, but it is typically between $500 and $5,000. In addition to bonding, you will also need to obtain insurance for your business. The specific insurance requirements will vary depending on your state, but they typically include liability insurance and property insurance. The cost of insurance can range from a few hundred dollars per year to several thousand, depending on the coverage levels you choose.

Ongoing Costs

Once you have obtained your bond and insurance and are up and running, there are some ongoing costs that you will need to consider. The first is advertising. Depending on the size and scope of your operation, marketing expenses can range from a few hundred dollars per month to several thousand. Additionally, you will need to factor in the cost of gas and maintenance for your vehicles, as well as any salaries or fees paid to employees or contractors.

The cost of starting an automobile broker business varies depending on numerous factors such as location, services offered, and whether or not you already have a suitable vehicle for commercial use. However, if you do your research and plan carefully, it is possible to get started with just a few hundred dollars in upfront costs. Once you’re up and running, there are some ongoing costs that you’ll need to consider such as advertising and vehicle maintenance, but these should be relatively easy to manage if you’re organized and efficient.

Congratulations on starting your own automobile broker business! This is a fantastic way to be your own boss, set your own hours, and make a great living. But of course, one of the most important questions on your mind right now is “Where do I find customers for my business?” Luckily, we’ve got you covered. Keep reading to learn about the three best places to find customers for your new automobile broker business.

Referrals from Friends and Family

One of the best ways to find new customers is through referrals from friends and family. If you have a close network of people who know and trust you, they are more likely to refer you to their friends and colleagues who might be in the market for an automobile broker. So how do you get these referral? Start by letting your close friends and family know that you’ve started your own business and that you’re looking for customers. Ask them if they know anyone who might need your services, and offer a referral fee if they’re able to connect you with a new customer. Chances are good that you’ll be able to get at least a few referral leads this way.

Online Directories and Listings

Another great way to find potential customers is through online directories and listings. There are numerous websites that list businesses in specific industries, such as automobiles, so that consumers can easily find the businesses they need. This means that if someone is searching for an automobile broker in their area, your business will come up in the search results. In order to make sure that your business is listed in as many online directories as possible, do a search for “automobile broker directory” and see what comes up. Then, claim or create listings for your business on each of the top results. This will help ensure that potential customers can easily find you when they’re searching online.

Local Print or Broadcast Media Advertising

Another effective way to reach potential customers is through local print or broadcast media advertising. If you want to reach a large number of people in your area quickly, advertising in newspapers or on local radio or television stations is a good option. Of course, this type of advertising can be expensive, so it’s important to carefully consider your target audience and whether they’re likely to see or hear your ad before making this investment. Sometimes, spending a bit more money on advertising can pay off if it reaches the right people at the right time.

These are three of the best places to find potential customers for your new automobile broker business. By leveraging referrals from friends and family, creating listings in online directories, and investing in local advertising, you’ll be well on your way to attracting new clients and growing your business!

About Jeremy Reis

Jeremy Reis is a serial entrepreneur from the Franklin, Tennessee area. Jeremy is the founder of multiple businesses and is the VP of Marketing for CRISTA Ministries. Jeremy has his MBA with a focus in Entrepreneurship from The Ohio State University.

The Important Stuff

Privacy Policy

Featured Businesses

Big & Tall Shop

Coffee Shop

Daycare Center

© ExploreStartups 2022

Privacy Policy | Terms Of Service | Site Map

Get Your Car Brokers Business Essentials Today!

Foster growth with 250+ time-saving, business-specific templates. Swift designs, easy tools, all in one place.

Starting Your Thrilling Car Brokers Venture

Launching a Car Brokers business is an exhilarating adventure, promising a world brimming with opportunities and connections. Imagine diving into an industry where your keen eye for value and negotiation skills can lead you to flourish beyond measure. It begins with a foundation solidified by a deep understanding of market demands and customer desires. Cultivating relationships with dealerships and clients forms the bedrock of your venture, turning aspirations into achievements. The path is paved with strategic planning, commitment, and an unwavering passion for automobiles. Embark on this thrilling journey, and witness your dreams accelerating into reality.

Entering the realm of car brokering is akin to setting off on a thrilling road trip. The initial excitement, however, is often met with the bumpy roads of challenges and learning curves. One of the most common hurdles is understanding the intricate regulatory landscape. Each state has its own set of rules governing licensing, contracts, and consumer protection that you must navigate adeptly. Familiarizing yourself with these regulations is crucial to ensuring your business operates within the bounds of legality.

Another significant challenge lies in establishing a robust network. In the car brokerage industry, your network is your net worth. Building relationships with dealerships, auction houses, and private sellers takes time and dedication. It's about proving your reliability, negotiating skills, and ability to deliver on promises. Without a trustworthy network, sourcing cars that meet your client's needs and budget can become an uphill battle.

Understanding Your Market

The foundation of any successful business lies in understanding its market. For car brokers, this means identifying who your clients are, what they want, and how much they are willing to pay. This knowledge enables you to tailor your services and inventory to meet market demands. It's not just about having access to a wide selection of vehicles; it's about having the right vehicles. Precision in understanding market trends can significantly elevate your success rate.

Digital platforms have revolutionized the way we understand market dynamics. They offer insights into consumer behavior, pricing trends, and even competitor strategies. Embracing technology can provide you with a competitive edge in identifying emerging trends and niches within the automotive industry. This proactive approach can position you as a go-to broker for clients seeking specific vehicle types or brands.

Creating a Strong Brand Identity

Your brand is more than just a logo or a color scheme; it's a reflection of your business values and commitment to client satisfaction. Crafting a strong brand identity helps differentiate you from competitors and fosters trust with potential clients. It tells your story and communicates why clients should choose you over other brokers. Every interaction with your brand, be it through your website, social media, or advertising, should reinforce these core values. Consistency in branding builds recognition and loyalty among clients.

In developing your brand identity, consider what makes your service unique. Is it unparalleled customer service? Access to exclusive deals? Or perhaps expertise in luxury or vintage cars? Highlighting these unique selling points (USPs) through your branding efforts can attract the right audience and solidify your position in the market. Remember, in a sea of sameness, distinctive branding can make all the difference.

Leveraging Technology for Efficiency

The digital era has brought about tools that can streamline operations and enhance efficiency significantly. From CRM systems that manage client interactions to platforms that automate inventory management, technology can be a game-changer for car brokers. These tools not only save time but also reduce the margin for error in record-keeping and transaction processing. Adopting technology allows you to focus more on strategic aspects of your business rather than being bogged down by administrative tasks.

Furthermore, an online presence is no longer optional but imperative for success in today's market. A well-designed website acts as your digital showroom where clients can browse available cars, learn about your services, and initiate contact. Social media platforms offer avenues for engagement and promotion, reaching audiences far beyond traditional marketing means. Leveraging these digital tools effectively can catapult your brokerage ahead of competitors.

Negotiating Skills Are Key

Negotiation is at the heart of car brokering. Whether securing deals with suppliers or finalizing sales with clients, effective negotiation tactics can significantly impact profitability. It's not just about haggling for the lowest price but understanding value from both perspectives. Crafting win-win solutions strengthens relationships and fosters repeat business--a vital component for long-term success.

Improving negotiation skills requires practice and patience. Listening carefully to understand needs, empathizing with challenges faced by counterparts, and staying adaptable throughout discussions are essential qualities of successful negotiators. It's also beneficial to stay informed about market prices and trends as this knowledge empowers you during negotiations--it's hard to argue against facts.

Boost campaigns with 250+ editable templates. Save, reuse, and wield design tools for business growth.

Finding Your Competitive Edge

In a marketplace teeming with brokers vying for attention, finding what sets you apart is critical.This could be specialized knowledge in certain types of vehicles or offering exceptional post-purchase support.Your competitive edge should resonate with your target audience's specific needs.It's not enough to be just another option; strive to be the preferred choice.Deep diving into niche markets or personalizing services could unlock untapped opportunities for differentiation.

Capturing this essence involves introspection but also espionage--understanding what others do welland where gaps lie.Embrace continuous learning as market demands evolve.Adapting swiftly not only keeps you relevant but could redefine benchmarks within your sector.Innovation doesn't always mean reinvention; sometimes,it's about doing things better than anyone else.

Utilizing Design Tools like Desygner

In today's visually driven market,presentation matters immensely.Desygner emerges as an invaluable tool for creating professional-looking marketing materials without requiring extensive design skills.Its user-friendly interface allows you to craft advertisements,business cards,and social media posts that align with your brand identity effortlessly.Visual consistency enhances brand recall,making such tools instrumental in building a cohesive image across various platforms.

Beyond aesthetics,Desygner facilitates collaboration--crucial when working within teamsor liaising with external partners.Changes can be made on-the-fly,ensuring all promotional materials are up-to-dateand reflective of ongoing offers or events.In leveraging Desygner,you empower your brokerage with the abilityto quickly adapt marketing strategies,ensuring messages resonate clearlyand effectively with intended audiences.

Sealing the Deal: Your Pathway to a Successful Car Broker Business

In summary, embarking on a journey to establish a car broker business presents an exciting opportunity with plenty of growth potential. To navigate this path successfully, it's imperative that you undertake thorough market research and develop a robust business plan. This foundational step cannot be overstated as it underpins your entire operation, guiding you through the intricate maze of the automotive industry.

Another key element is securing the necessary licenses and insurance policies. These legal requirements are not just formalities; they're a protective shield for your business, safeguarding against unforeseen events and ensuring compliance with industry standards. Equally important is establishing a strong online presence. In today's digital age, your online persona can significantly amplify your reach and attract a wider audience.

Networking is the lifeblood of a car broker business. Building relationships with dealerships, clients, and other stakeholders opens up avenues for better deals, exclusive offers, and referrals. This aspect of the business demands persistent effort and excellent communication skills. Additionally, mastering negotiation techniques will empower you to secure advantageous terms for your clients, thereby enhancing your reputation and client satisfaction.

To effectively manage all these tasks, adopting efficient tools and software becomes indispensable. Here's where services like Desygner come into play, offering streamlined solutions for your marketing needs.

- Conduct comprehensive market research

- Develop a detailed business plan

- Acquire necessary licenses and insurance

- Build a compelling online presence

- Forge strong networking connections

- Hone your negotiation skills

- Implement efficient management tools

- Leverage Desygner for marketing materials

To sum up, while establishing a car broker business involves navigating through various challenges, adhering to these guidelines will set you on the path to success. Remember to leverage modern tools like Desygner to enhance your marketing efforts. Sign up at Desygner today to elevate your branding strategy!

Effective Marketing for Your Car Brokers Business

Innovative Strategies for Car Broker Content Creation

UNLOCK YOUR BUSINESS POTENTIAL!

Get every material you need for your business in just a few clicks

BizFundingResource.com

Auto Broker Business Plan and SWOT Analysis

Auto Broker Business Plan, Marketing Plan, How To Guide, and Funding Directory

The Auto Broker Business Plan and Business Development toolkit features 18 different documents that you can use for capital raising or general business planning purposes. Our product line also features comprehensive information regarding to how to start an Auto Broker business. All business planning packages come with easy-to-use instructions so that you can reduce the time needed to create a professional business plan and presentation.

Your Business Planning Package will be immediately emailed to you after you make your purchase.

- Bank/Investor Ready!

- Complete Industry Research

- 3 Year Excel Financial Model

- Business Plan (26 to 30 pages)

- Loan Amortization and ROI Tools

- Three SWOT Analysis Templates

- Easy to Use Instructions

- All Documents Delivered in Word, Excel, and PDF Format

- Meets SBA Requirements

Auto brokers work in a unique capacity within the car selling industry given that they source a specific vehicle on behalf of a buyer. The gross margins, as such, are extremely high from providing the services to the general public. One of the nice things about these businesses is that they are able to render their services both directly to individual buyers as well as car wholesalers and car dealers. There are always a number of specialty car dealers that need to source a specific vehicle for their client. As such, these businesses are able to operate with strong gross margins and a low operating and overhead cost. Typically, the startup cost associated with an automotive broker ranges anywhere from $30,000 to $50,000 depending on whether or not the business is actually going to take possession of any vehicle is sourced on behalf of the customer. Usually, if an auto broker is going to be sourcing vehicles directly and acquiring from for their own account and they are going to be able to obtain a line of credit that is secured by the vehicle inventory that is being purchased. Almost all banks and lenders are willing to extend this type of credit to an automotive brokerage business. Additionally, it should be noted that these businesses are relatively immune from negative changes in the economy but an economic recession almost always has a modest impact on top line income.

An automotive brokerage business plan should be included if an individual owner operator is seeking to acquire capital from a financial institution or private investor. Most importantly, a three-year profit and loss statement, cash flow analysis, balance sheet, breakeven analysis, and business ratios page should be developed so that the financial institution or investor can understand how the business will repay its obligations on a month-to-month basis. Although many automotive brokers will operate in a more localized capacity, the power of the Internet has allowed these businesses to immediately have a nationwide presence from the onset of their operations. It should be noted within the business planning document how the individual auto broker will be able to develop ongoing relationships with car dealers and car wholesalers on a nationwide basis immediately upon launching business operations. A demographic analysis regarding the types of buyers should be included as well with a focus on median household income, median family income, and the percentage of income that is available for the purchase of a new or used vehicle. Given that everyone does need a car, the demographic analysis is included within the business planning document can be somewhat broad.

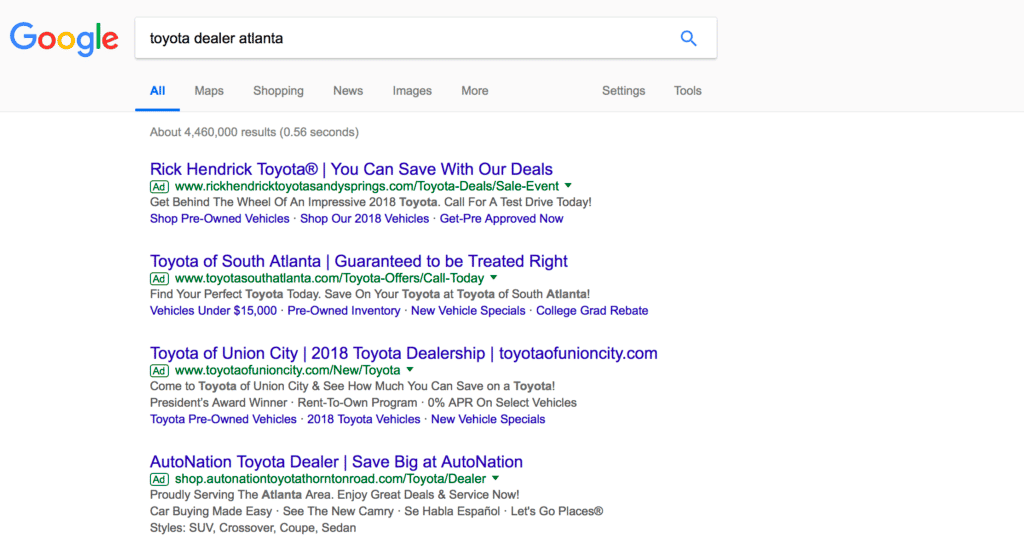

Of equal importance to the business plan is the auto broker marketing plan. This document needs to be at least 10 to 15 pages in length and should showcase primarily how the brokerage will operate in an online capacity. Many third-party websites such as auto trader.com, eBay.com, and others allow for auto brokers to place advertisements on these websites in order to make sales. As such, it is imperative that the auto broker not only maintain a proprietary website but also ongoing platforms that allow for the sales of vehicles directly to the general public. This is especially true of the auto broker is going to be acquiring vehicles for their own account and needs to have a method for ensuring inventory turnover. Many auto brokers also maintain profiles on popular social media platforms such as FaceBook, Twitter, Google+, Instagram, and Reddit. This is important especially if the auto broker is going to be selling cars directly to the general public and provided that these firms are able to maintain a strong following the inventory turnover rate can be increased significantly. A presence on social media, especially with a profile that has strong reviews, also boost the brand-name visibility of the business while ensuring that customers are working with a legitimate car selling and car brokering operation. Almost all businesses these days do maintain some presence on social media in order to boost their online visibility. Beyond this type of marketing, many auto brokers will also use pay per click marketing in order to drive traffic to their respective websites. If done correctly this can produce a very strong return on investment as it relates to the underlying advertising budget. Many auto brokers we use a third-party firm to provide the ongoing management of this type of marketing. While these expenses may be high, in the long run it is very much worth it if the auto broker does not have the proper internal staff to manage their Internet marketing.

An auto broker SWOT analysis should be developed as well. As relates to strengths, auto brokers are one of the few companies within this industry that are able to generate significant gross margins from direct brokering services as well as sales of vehicles. Their operations can be contracted during times of economic recession so that they are able to remain profitable and cash flow positive in any economic climate. As relates to weaknesses, this is an industry that is highly competitive and cars are a commodity. This lends to both being a strength and weakness at the same time. The underlying operating costs can also be high especially as it relates to marketing and advertising fees. For opportunities, most auto brokers will seek to expand their working capital line of credit so that they can purchase and deal in a larger number of vehicles on an ongoing basis. This is really the only way that these be businesses are able to expand. For threats, this is a highly established industry and there are going to be no issues moving forward with changes in regulation or technology that would impact the way that these businesses conduct their operations. Given the auto brokers do not maintain large inventories on their books they can scale back or require additional vehicles that are in demand among the general public. The high gross margins generated from revenues coupled with the moderate overhead and operating costs makes an auto broker a strong small business investment.

The Enlightened Mindset

Exploring the World of Knowledge and Understanding

Welcome to the world's first fully AI generated website!

How to Start an Auto Broker Business: A Step-by-Step Guide

By Happy Sharer

Introduction

An auto broker is a professional who helps customers buy or lease a vehicle at the best price possible. They act as intermediaries between buyers and dealerships and can help customers save time and money by providing access to discounts and special offers that may not be available directly from the dealership. Being an auto broker can be a lucrative and rewarding career, but it does require some specialized knowledge and skills.

Steps for Starting an Auto Broker Business

Starting an auto broker business requires a significant amount of preparation and planning. Here are some steps you should take to get started:

Identify Essential Skills and Knowledge Needed

Auto brokers must have a comprehensive understanding of the automotive industry, including how cars are priced, the different types of financing options available, and the laws and regulations that govern the industry. You should also be familiar with sales techniques and customer service principles. Additionally, having a strong network of contacts in the industry can be invaluable when it comes to finding leads and closing deals.

Understand Legal Requirements

You’ll need to comply with all applicable laws and regulations in your state or country before you can start your business. This includes registering your business entity, obtaining any necessary licenses or permits, and understanding consumer protection laws. Make sure you research the requirements in your area thoroughly before you begin.

Develop a Business Plan

Having a detailed business plan is essential for any successful business, and this is no different when it comes to starting an auto broker business. Your plan should include an analysis of the market, a description of your services, a marketing strategy, and a financial plan. It will serve as a roadmap for your business and should be updated regularly as your business grows and evolves.

Secure Financing

You’ll need to secure financing in order to cover your startup costs. This may include personal loans, small business loans, or other forms of financing. Make sure you shop around for the best rates and terms before committing to any loan.

Obtain Necessary Licenses and Permits

Depending on where you live, you may need to obtain special licenses or permits in order to operate an auto broker business. Be sure to check with your local government to determine which licenses or permits you need and how to obtain them.

Strategies for Finding Customers and Growing Your Business

Once you’ve established your business, you’ll need to focus on finding customers and growing your business. Here are some strategies you can use:

Building relationships with other people in the automotive industry is one of the most effective ways to find clients. Attend industry events, join relevant online forums, and reach out to potential customers to introduce yourself and your services.

Advertising

Advertising your auto broker business is essential for success. Consider placing ads in local newspapers, magazines, and websites, as well as utilizing search engine optimization (SEO) techniques to increase your visibility online. You should also consider creating a website for your business and using social media to promote your services.

Social Media

Social media is a powerful tool for connecting with potential customers. Utilize platforms like Facebook, Instagram, and Twitter to share updates about your business, showcase your services, and engage with your followers.

Word-of-mouth referrals are one of the most effective ways to drive business. Encourage satisfied customers to spread the word about your services and offer incentives for referrals.

Tips for Negotiating Deals and Maximizing Profits

Negotiating deals is an important part of being an auto broker and can help you maximize your profits. Here are some tips to keep in mind:

Research the Market

Do your research to understand the current market conditions, including car prices, financing options, and dealer incentives. This will give you the information you need to negotiate the best deal possible.

Know Your Customer’s Needs

Get to know your customers and understand their needs so you can tailor your negotiation strategy to meet those needs. Be prepared to make compromises and be flexible in order to close the deal.

Use Persuasive Language

Learn how to effectively communicate your points and use persuasive language when negotiating. This will help you build trust and get the best deal possible.

Leverage Technology

Technology can be a great asset when negotiating. Use it to quickly find the best deals, compare prices, and stay up-to-date on the latest trends in the industry.

Starting an auto broker business requires dedication, hard work, and a thorough understanding of the industry. By following the steps outlined above, you can set yourself up for success and start making money as an auto broker. Make sure to keep learning and growing as you go, and you’ll be well on your way to building a successful business.

(Note: Is this article not meeting your expectations? Do you have knowledge or insights to share? Unlock new opportunities and expand your reach by joining our authors team. Click Registration to join us and share your expertise with our readers.)

Hi, I'm Happy Sharer and I love sharing interesting and useful knowledge with others. I have a passion for learning and enjoy explaining complex concepts in a simple way.

Related Post

Making croatia travel arrangements, make their day extra special: celebrate with a customized cake, top 4 most asked questions when applying for etias, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Expert Guide: Removing Gel Nail Polish at Home Safely

Trading crypto in bull and bear markets: a comprehensive examination of the differences.

- What is an Auto Broker and how do you become one?

What is the difference between an Auto Dealer and an Auto Broker?

Here is an example to illustrate the difference between an auto dealer and an auto broker:, how do you become an auto broker, how do you become an auto broker in california, how much does it cost to be an auto broker, benefits of being an auto broker, how much money do auto brokers make, ways to make money as an auto broker, where can i find an auto broker near me.

Auto Brokers are professionals who act as an intermediary between car buyers and dealerships to help buyers find the specific make and model they want to purchase.

Auto Brokers can access a wide range of new and used vehicles through their dealer networks. They often negotiate better prices, trade-in values, and financing terms than consumers could negotiate on their own.

Licensed Auto Brokers can sell vehicles to buyers in any state, online, or in person at their office. Other states may differ; visit their DMV licensing website for more details.

Generally speaking, Auto Dealers sell new or used vehicles from their on-site inventory at their dealership. Auto brokers have more flexibility in the type of vehicles they can offer, and they are not limited to the inventory of a single dealership. They can source vehicles from a variety of sources.

A Dealer may choose to be both an Auto Dealer and an Auto Broker.

John is a car buyer who is looking to purchase a new car. He finds out the local auto dealership has a limited selection of cars and the prices are non-negotiable. John leaves the dealership feeling frustrated because he was unable to find the specific car he wanted at a price he was willing to pay. Later, John contacts a local Auto Broker and tells them what type of car he is looking for, including the make, model, and specific features he wants. The Auto Broker has access to a network of dealerships and within a few days, the Auto Broker is able to locate the exact car John was looking for and negotiate a better price on his behalf. John is thrilled with the results and is able to purchase the car he wants at a price he is comfortable with.

In this example, the auto dealer was limited by their inventory and unable to negotiate on price, while the auto broker could access a wider range of vehicles and negotiate a better price for the customer. This highlights the difference between an auto dealer and an auto broker and the benefits of working with a retail dealer with their broker endorsement.

Most states require Auto Brokers to obtain a license like an Auto Dealer. Several states don’t have a different Broker requirement and allow any licensed Dealer to provide Broker services. To determine the specific requirements for becoming an auto broker in your state, consult your state’s Department of Motor Vehicles or a licensed auto broker.

California requires you to be a licensed “Retail” dealer to be able to add the “Auto Broker Endorsement” to that license. You can add the broker endorsement while applying for your license or anytime in the future. The California DMV has 3 general steps:

- Take the Online DMV Pre-License Training

- Pass the 40-question test at the DMV

- Apply for your Dealer License and add the Broker Endorsement

We have a free “12 Step Checklist” to get a California Dealer License .

Adding a Broker endorsement to your license is inexpensive once you have obtained your Dealer license. For example, California only charges $100/yr and you can remove it at any time.

- Flexibility: You can set your schedule and work independently with little to no inventory.

- High earning potential: Successful Brokers can earn a significant income by earning commissions on leases and vehicle sales.

- Knowledge of the Industry: You will gain a deep understanding of the car buying process and the many options available to buyers.

- Networking: The opportunity to build relationships with various industry professionals, including car dealers, finance companies, and car buyers.

- Helping Customers: Help customers find the perfect vehicle through your network of a wide variety of different dealers.

- Negotiating Power: You will have and learn the skills and knowledge to negotiate the best deals on cars and financing terms for your clients.

- Special Plates (Dealer Plates): Auto Brokers in California (for example) also get dealer plates to drive their inventory vehicles.

Typically, Auto Brokers earn a commission (not a salary) from the dealership for each vehicle they sell or lease. The commission can range from a few hundred dollars for a lower-priced vehicle to several thousand dollars for a high-end vehicle. The exact commission is usually negotiated between the auto broker and the dealership, and the amount can vary depending on a variety of factors, including the type of vehicle, price, arrangements with the selling dealership, and the level of service provided.

Auto Brokers may charge a fee to the customer for their services in addition to the commission earned from the dealership. The fee can be a flat rate or a percentage of the vehicle’s purchase price.

Like any other profession, the earning potential for an Auto Broker can be influenced by their experience, location, market conditions, and the individual Broker’s efforts and abilities. The more successful an auto broker is in generating business and closing deals, the more money they can potentially earn.

Auto Brokers can sell vehicles and refer lease deals in any state, online, or in-person. Here are some other ways that an Auto Broker can generate revenue:

- Commission-based sales: As mentioned earlier, auto brokers can earn a commission from the dealership for each vehicle they sell or lease. The commission is usually a percentage of the vehicle’s purchase price or lease amount.

- Service fees: Some auto brokers charge a fee to the customer for their services in addition to the commission earned from the dealership. The fee can be a flat rate or a percentage of the vehicle’s purchase price.

- Volume bonuses: Some dealerships may offer volume bonuses to auto brokers who sell a high volume of vehicles in a given period of time.

- Upselling: Auto brokers can earn additional revenue by selling additional products or services, such as extended warranties, gap insurance, or vehicle accessories, to customers during the sales process.

- Marketing and advertising services: Some auto brokers offer marketing and advertising services to dealerships and may earn a fee for these services.

- Leasing management: Auto brokers specializing in leasing can earn revenue by managing the leasing process for both the customer and the dealership, including negotiating terms and handling paperwork.

If you are in the market for a new or used vehicle, you can find an auto broker near you by searching online for “auto broker near me” or by area like “auto broker near me in Los Angeles”. This will bring up a list of auto brokers in your area, their contact information and reviews from previous customers.

When choosing an auto broker, it’s important to consider their experience, reputation, and the types of vehicles they specialize in.

Once you have chosen an auto broker, they will work with you to identify the type of vehicle you are interested in and help you find the best deal. They will handle the negotiation process with dealerships and help you complete all the necessary paperwork. With an auto broker on your side, you can feel confident that you are getting a fair price and that the buying or leasing process will be smooth and stress-free.

You can also check your state’s the Department of Motor Vehicles (DMV) and see if they have a list of licensed Auto Brokers. California’s DMV has a dealer license search listed on their website.

New here? Create a Free Account

Have an account login, create a free account, back to login, change password.

Search Product category Any value Sample Label 1 Sample Label 2 Sample Label 3

Car Dealership Business Plan: Complete Guide

- January 11, 2023

Whether you’re looking to raise funding from private investors or to get a loan from a bank (like a SBA loan) for your car dealership, you will need to prepare a solid business plan.

In this article we go through, step-by-step, all the different sections you need in your car dealership business plan. Use this template to create a complete, clear and solid business plan that get you funded.

1. Executive Summary

The executive summary of a business plan gives a sneak peek of the information about your business plan to lenders and/or investors.

If the information you provide here is not concise, informative, and scannable, potential lenders and investors may lose interest.

Though the executive summary is the first and the most important section, it should normally be the last section you write because it will have the summary of different sections included in the entire business plan below.

Why do you need a business plan for your car dealership?

The purpose of a business plan is to secure funding through one of the following channels:

- Obtain bank financing or secure a loan from other lenders (such as a SBA loan )

- Obtain private investments from investment funds, angel investors, etc.

- Obtain a public or a private grant

How to write an executive summary for your car dealership?

Provide a precise and high-level summary of every section that you have included in the business plan. The information and the data you include in this segment should grab the attention of potential investors and lenders immediately. Also make sure that the executive summary doesn’t exceed 2 pages.

The executive summary usually consists of the 5 main paragraphs:

- Business overview : introduce your car dealership: what is your business model (franchise vs. independent business ; new vs. used car dealership), how many cars will you have in inventory? Are you partnering with any car manufacturer(s)? Where would your store be located? Etc.

- Market overview : briefly analyze the car dealership industry in your area ( market size and growth), your competitors and target customers: average income of your target audience , demographic distribution, customer preferences etc.

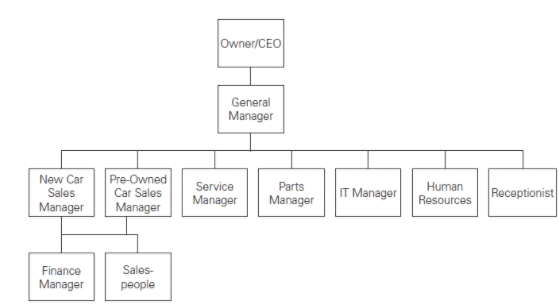

- Management & people : introduce the management team and their industry experience. Mention your business partner(s), if any. Also give here an overview of the different teams, roles and their reporting lines

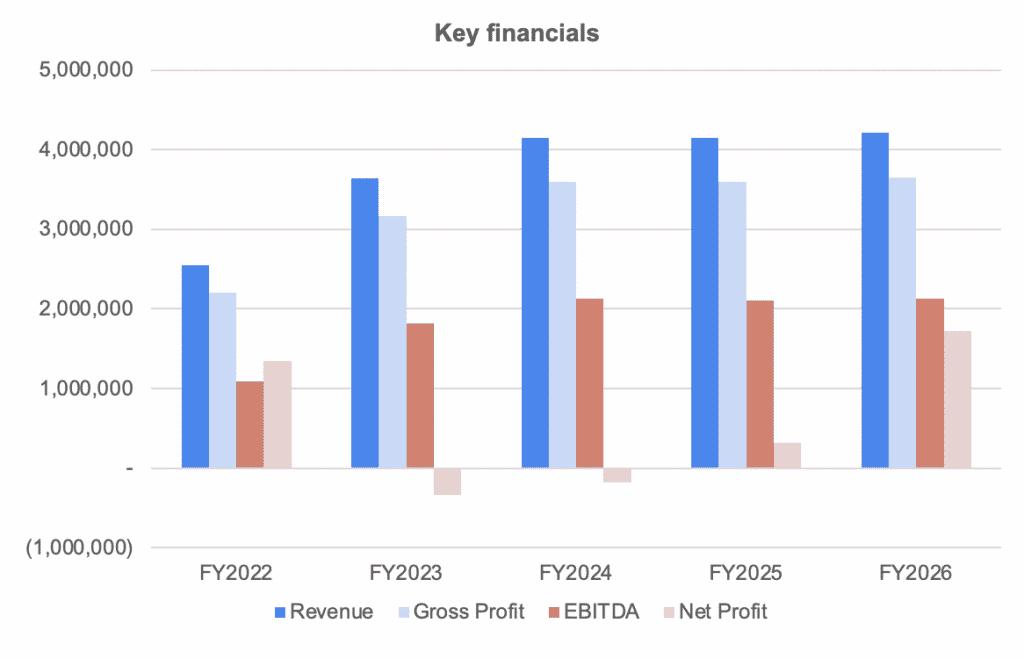

- Financial plan : how much profit and revenue do you expect in the next 5 years? When will you reach the break-even point and start making profits? Also include here a small chart with your key financials (revenue, net profit )

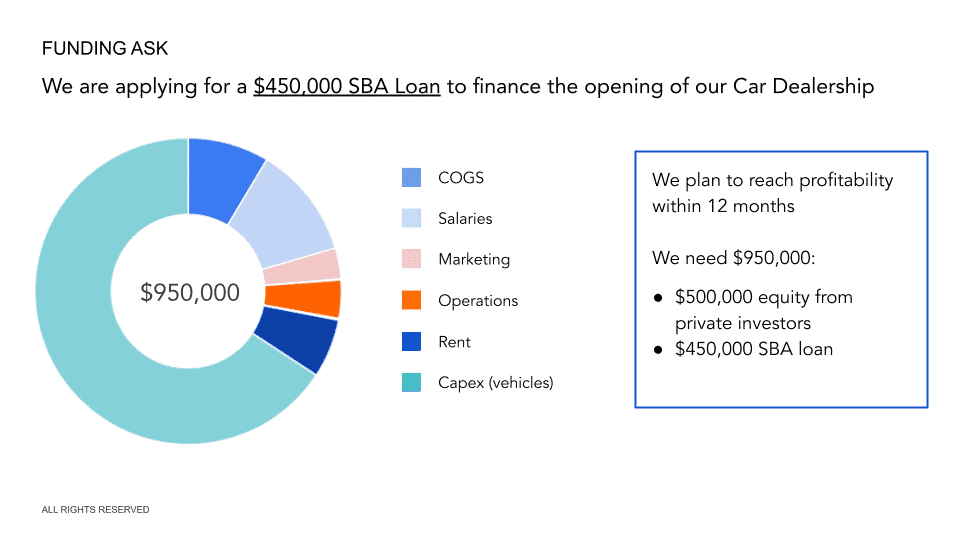

- Funding ask : what loan/investment/grant are you seeking? How much do you need? How long will this last? How will you spend the money?

Car Dealership Financial Model

Download an expert-built 5-year Excel financial model for your business plan

2. Business Overview

In the business overview section of your car dealership business plan, you should expand on what your company sells, to whom, and how it is structured. A few examples of questions you must answer here are:

- The history behind the project: why did you choose to open a car dealership today?

- Your business model : Are you franchising or is this an independent store? Are you selling new or used vehicles?

- Products & services : What vehicles / brands do you plan to sell? Are you planning to add any additional services (e.g. car repair & checkups, etc.)

- What is the legal structure of your company? Who are the directors / shareholders?

a) History of the Project

Briefly explain how did you come up with the plan to start a car dealership business. What motivated you to get into this business venture?

Also try to demonstrate to investors your interest and passion for the car industry and car dealership in general.

For example, you might have worked in a car dealership and/or at a car manufacturer sales department in the past, and found immense growth potential for this type of business in your area.

b) Business Model

Explain in this section what business model you chose for your car dealership. Here are a few questions you must answer:

- Will you start an independent dealership, franchise model, chain store, etc.?

- Will you open a brand-specific dealership?

- Would your car dealership deal in new cars, used cars, or both?

- Do you plan to open an online dealership?

- Would you offer service and repairs in your car dealership?

c) Products & Services

Now that we have briefly introduced what your business model is, you must explain in detail what exactly you intend to sell. There are 2 things here:

- Products (cars): what vehicles and brands do you intend to sell? Why did you choose these vehicles / brands?

- Services : if you offer additional services (e.g. car repairs, checkups), explain what they are

In addition to the products and services , you should also include a list of prices for each. Of course, this doesn’t need to be exact. Car prices fluctuate based on various factors. Yet, you must be able to provide a range of prices for each category (e.g. sedan, luxury cars, vans, etc.).

If you specialize in a specific brand, you can provide a list of prices per model in appendix as well.

The prices are important as they will allow investors to tie your product offering with your financial projections later on.

d) Legal Structure

Explain the legal structure of your nursing home in this section. Are you starting a corporation, a limited liability company, or a partnership? Who are the investors? How much equity do they actually own? Is there a board of directors? Do they have prior industry experience?

3. Car Dealership Market Overview

A complete understanding of the car dealership industry is important for the success of your business.

Therefore, you must cover here 3 important areas:

- Status quo : how big is the car dealership industry in your area? How fast is the market growing? What are the trends fuelling this growth (or decline)?

- Competition overview : how many car dealership competitors are there? How do they compare vs. your business? How can you differentiate yourself from them?

- Customer analysis : what are your target customers? What are their customer preferences?

a) Status quo

When looking at the car dealership industry, try to start at the national level (US) and narrow it down to your service area (a city for example). You should answer 2 important questions here:

How big is the car dealership industry in your area?

How fast is the car dealership industry growing in your area, how big is the car dealership industry in the us.

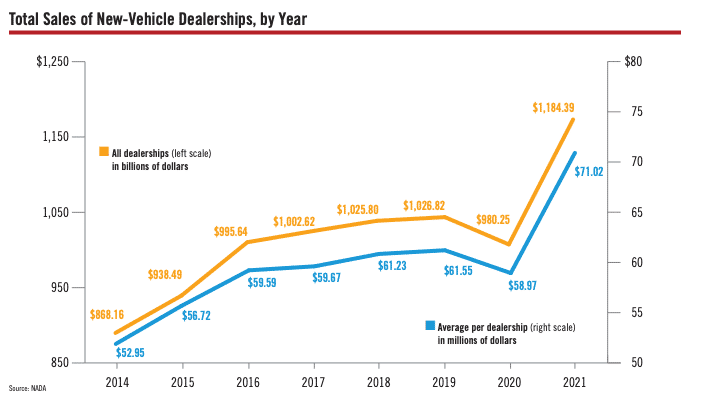

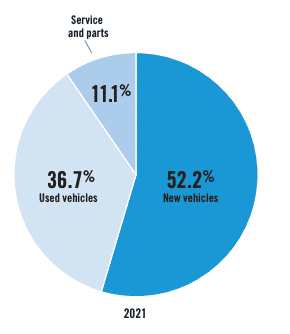

The auto parts and car dealership industry in the US is huge: it was worth $1.18 trillion in 2021 as per the National Automobile Dealers Association . As per the same report, there were 16,676 light vehicles car dealerships in the US in 2021 which generate an average revenue of $71 million.

Sales are divided between new (52%) and used vehicles (37%) as well as services and parts (11%).

After the US, assess the size of the car wash industry in your city or area. Focus on the zone where you plan to offer your services.

Naturally, you might not be able to get the data for your specific city or region. Instead, you can estimate the size of your market, for more information on how to do it, read our article on how to estimate TAM, SAM and SOM for your startup .

Luckily, NADA publishes statistics per state so you can narrow it down easily. For your city instead, you will need to do work out some estimates. To give you an example, let’s assume you plan to operate in an area where there are already 30 car dealership businesses (in a 25 miles radius for example).

Assuming our business is based in Connecticut, we can use the state’s average annual turnover of $49,661 : we can reasonably assume that the car dealership industry is worth $1.5 million in your area . In other words, there are over 35,100 light vehicles (new and used) being sold in your area each year (assuming the average retail price of $43,000).

Now that we know your area’s market size, let’s look at growth instead.

Fortunately, you can use NADA’s number again as they publish annual reports. Just use your state’s market size growth, and explain the growth (or decline). This can be due to average car prices, or volume.

b) Competition overview

You should discuss both your direct and indirect competition in your business plan. Other car dealerships in the region will be your immediate competitors. Internet auctions, individual dealers, etc., will be your indirect competitors.

In this section, you should also discuss the essential components of the business models of your main competitors. Your research should be focused on their clientele, the kinds of cars they offer, and their strengths and weaknesses .

A thorough competitive analysis is crucial as it may allow you to discover and address a customer need or preference that none of your rivals is addressing today.

Here are some of the questions that you must answer in this section:

- How many competitors are there in the area where you want to open your car dealership?

- Are they franchises or independent stores?

- Do they partner with specific car manufacturers?

- What type of cars do they offer (luxury, economy, used, new, etc.)?

- What is the average price range of the cars they sell?

- How many employees do they have?

- Do they offer services and repairs?

- Do your competitors offer buyback on the cars sold by them previously to the client?

- What type of offers and discounts do they offer to attract customers?

- How many cars / vehicles do they sell on average per month?

c) Customer analysis

Now that we have a good idea of the car dealership industry in your area as well as competition, now is time to focus on your target audience: customers.

Knowing your customer is extremely important before you get into any business. This is all the more relevant for car dealership where customer preferences and tastes are very different.

For example, if you are planning to get into a luxury car dealership business, you should look into:

- The estimated population of high-income people in your area

- Types of luxury cars that are in demand (hatchback, sedan, SUV, etc.)

- Shopping preference of your target customers (online or offline)

- How frequently do they buy (or exchange) new cars?

- Is their buying decision influenced by offers or discounts?

- What features do your target customers want in their new luxury cars?

- What type of additional services do they expect from their dealers?

4. Sales & Marketing Strategy

This is the section of your business plan where you outline your customer acquisition strategy. Try to answer the following questions:

- What are the different marketing strategies you will use?

- What are your Unique Selling Points (USPs)? In other words, how do you differentiate from your competitors?

- How do you intend to track the success of your marketing strategy ?

- What is your CAC or customer acquisition cost?

- What is your marketing budget?

What marketing channels do car dealerships use?

A few marketing channels that car dealership businesses typically use are:

- Signage, billboards

- PPC ads, Facebook ads, etc.

- Print media

- Loyalty programs

- Online local listing (Google Business)

- Content marketing (share content like vehicle maintenance tips, safe driving tips, etc.) on platforms like blogs, social media, etc.

- Word of mouth, recommendations

You must have a fair and nearly accurate estimate of your marketing budget. Therefore, make sure to budget for marketing accordingly in your financial projections.

What are your Unique Selling Propositions (USPs)?

In other words, how do you differentiate yourself vs. competitors? This is very important as you might need to win customers from competitors.

A few examples of USPs are:

- Products: you may be the exclusive distributor or a car make in your area for example

- Services : you may offer repairs and regular checkups for your customers

- Location : you store is closer to a busy road and/or to where your customers live

Your USPs will depend on your business model, competitor analysis, and target audience. Whatever your USPs are, it should appeal to your potential customers and attract them.

5. Management & People

You must address 2 things here:

- The management team and their experience/track record

- The organizational structure: the different team members and who reports to whom

Small businesses often fail because of managerial weaknesses. Thus, having a strong management team is vital. Highlight the experience and education of senior managers that you intend to hire to oversee your car dealership.

Describe their duties, responsibilities, and roles. Also, highlight their previous experience and explain how they succeeded in their previous roles.

Organization Structure

Even if you haven’t already hired a VP of sales, sales managers, support staff and any other relevant staff members, you must provide a chart of the organizational structure outlining the different teams, roles and their reporting lines.

6. Financial Plan

The financial plan is perhaps, with the executive summary, the most important section of any business plan.

Indeed, a solid financial plan tells lenders that your business is viable and can repay the loan you need from them. If you’re looking to raise equity from private investors, a solid financial plan will prove them your car dealership is an attractive investment.

There should be 3 sections to your financial plan section:

- Your historical financials (only if you already operate the business and have financial accounts to show)

- The startup costs of your project (if you plan to start a new car dealership, or purchase new inventory, expand your store, etc.)

- The 5-year financial projections

a) Historical Financials (if any)

In the scenario where you already have some historical financials (a few quarters or a few years), include them. A summary of your financial statements in the form of charts e.g. revenue, gross profit and net profit is enough, save the rest for the appendix.

If you don’t have any, don’t worry, most new businesses don’t have any historical financials and that’s ok. If so, jump to Startup Costs instead.

b) Startup Costs

Before we expand on 5-year financial projections in the following section, it’s always best practice to start with listing the startup costs of your project. For a car dealership, startup costs are all the expenses you incur before you open your shop and starting making sales. These expenses typically are:

- The lease deposit for the commercial space you rent (if you don’t buy it)

- The design and renovation of the existing facilities

- The inventory costs (the initial stock of vehicles you must buy to sell them at opening)

For example, let’s assume you want to buy 30 light vehicles as a start for inventory, and you take on a loan where you need to put down 15% upfront. Now, assuming these vehicles each cost $50,000 on average, this means you must put down $300,000 yourself. This comes in addition with any other startup cost mentioned above (lease deposit, renovation costs, etc.).

c) 5-Year Financial Projections

In addition to startup costs, you will now need to build a solid 5-year financial model as part of your business plan for your car dealership .

Your financial projections should be built using a spreadsheet (e.g. Excel or Google Sheets) and presented in the form of tables and charts in your business plan.

As usual, keep it concise here and save details (for example detailed financial statements, financial metrics, key assumptions used for the projections) for the appendix instead.

Your financial projections should answer at least the following questions:

- How much revenue do you expect to generate over the next 5 years?

- When do you expect to break even?

- How much cash will you burn until you get there?

- What’s the impact of a change in pricing (say 20%) on your margins?

- What is your average customer acquisition cost?

You should include here your 3 financial statements (income statement, balance sheet and cash flow statement). This means you must forecast:

- The number of vehicles you sell over time ;

- Your expected revenue ;

- Operating costs to run the business ;

- Any other cash flow items (e.g. capex, debt repayment, etc.).

When projecting your revenue, make sure to sensitize pricing and the number of customers as a small change in these assumptions will have a big impact on your revenues.

7. Funding Ask

This is the last section of the business plan of your car dealership. Now that we have explained what type of vehicles your company sells to whom and at what price, but also what’s your marketing strategy, where you go and how you get there, this section must answer the following questions:

- How much funding do you need?

- What financial instrument(s) do you need: is this equity or debt, or even a free-money public grant?

- How long will this funding last?

- Where else does the money come from? If you apply for a SBA loan for example, where does the other part of the investment come from (your own capital, private investors?)

If you raise debt:

- What percentage of the total funding the loan represents?

- What is the corresponding Debt Service Coverage Ratio ?

If you raise equity

- What percentage ownership are you selling as part of this funding round?

- What is the corresponding valuation of your business?

Use of Funds

Any business plan should include a clear use of funds section. This is where you explain how the money will be spent.

Will you spend most of the loan / investment to acquire the cost for the inventory (the vehicles)? Or will it cover mostly the cost of buying the land and building the store?

Those are very important questions you should be able to answer in the blink of an eye. Don’t worry, this should come straight from your financial projections. If you’ve built solid projections like in our car dealership financial model template , you won’t have any issues answering these questions.

For the use of funds, we recommend using a pie chart like the one we have in our financial model template where we outline the main expenses categories as shown below.

Privacy Overview

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

- Retail, Consumers & E-commerce

Car Dealership Business Plan

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Car Dealership Business Plan?

Writing a car dealership business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section of the business plan intended to provide an overview of the whole business plan. Generally, it is written after the entire business plan is ready. Here are some components to add to your summary:

Start with a brief introduction:

Market opportunity:, mention your services:, management team:, financial highlights:, call to action:.

Ensure you keep your executive summary concise and clear, use simple language, and avoid jargon.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

Depending on what details of your business are important, you’ll need different elements in your business overview. Still, there are some foundational elements like business name, legal structure, location, history, and mission statement that every business overview should include:

About the business:

Provide all the basic information about your business in this section like:

- The name of the car dealership business and the concept behind it: new car dealership, used car dealership, small car dealership, luxury car dealership, private seller, online retailer, or something else.

- Company structure of your car dealership business whether it is a sole proprietorship, LLC, partnership firm, or others.

- Location of your car dealership and the reason why you selected that place.

Mission statement:

Business history:, future goals:.

This section should provide an in-depth understanding of your car dealership business. Also, the business overview section should be engaging and precise.

3. Market Analysis

Market analysis provides a clear understanding of the market in which your car dealership business will run along with the target market, competitors, and growth opportunities. Your market analysis should contain the following essential components:

Target market:

Market size and growth potential:, competitive analysis:, market trends:, regulatory environment:.

Some additional tips for writing the market analysis section of your business plan:

- Use a variety of sources to gather data, including industry reports, market research studies, and surveys.

- Be specific and provide detailed information wherever possible.

- Include charts and graphs to help illustrate your key points.

- Keep your target audience in mind while writing the business plan.

4. Products And Services

The product and services section of a car dealership business plan should describe the specific services and products that will be offered to customers. To write this section should include the following:

List the product and services:

- Create a list of the services that your car dealership will offer, which may luxury cars, new cars, used cars, maintenance, repairs, etc.

- Describe each product and service: For each service, provide a detailed description of what it entails, and the qualifications of the professionals who will provide the service.

Emphasize safety and quality:

Overall, a business plan’s product and services section should be detailed, informative, and customer-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Develop your unique selling proposition (USP):

Determine your pricing strategy:, marketing strategies:, sales strategies:.

Overall, the sales and marketing strategies section of your business plan should outline your plans to attract and retain customers and generate revenue. Be specific, realistic, and data-driven in your approach, and be prepared to adjust your strategies based on feedback and results.

6. Operations Plan

When writing the operations plan section, it’s important to consider the various aspects of your business processes and procedures involved in operating a business. Here are the components to include in an operations plan:

Hiring plan:

Operational process:, inventory management:.

By including these key elements in your operations plan section, you can create a comprehensive plan that outlines how you will run your car dealership business.

7. Management Team

The management team section provides an overview of the individuals responsible for running the car dealership business. This section should provide a detailed description of the experience and qualifications of each manager, as well as their responsibilities and roles.

Key managers:

Organizational structure:, compensation plan:, board of advisors:.

Describe the key personnel of your company and highlight why your business has the fittest team.

8. Financial Plan

When writing the financial plan section of a business plan, it’s important to provide a comprehensive overview of your financial projections for the first few years of your business.

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:, financing needs:.

Remember to be realistic with your financial projections, and to provide supporting evidence for all of your estimates.

9. Appendix

When writing the appendix section, you should include any additional information that supports the main content of your plan. This may include financial statements, market research data, legal documents, and other relevant information.

- Include a table of contents for the appendix section to make it easy for readers to find specific information.

- Include financial statements such as income statements, balance sheets, and cash flow statements. These should be up-to-date and show your financial projections for at least the first three years of your business.

- Provide market research data, such as statistics on the size of the industry, consumer demographics, and trends in the industry.

- Include any legal documents such as permits, licenses, and contracts.

- Provide any additional documentation related to your business plans, such as marketing materials, product brochures, and operational procedures.

- Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your car dealership business should only include relevant and important information that supports the main content of your plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This car dealership business plan sample will provide an idea for writing a successful business plan, including all the essential components of your business.

After this, if you are still confused about how to write an investment-ready business plan to impress your audience, then download our car dealership business plan pdf .

Related Posts

Car Rental Business Plan

Sample Business Plans Template Example

Freight Brokerage Business Plan

How to Write Business Plan for Small Business

Frequently asked questions, why do you need a car dealership business plan.

A business plan is essential for anyone looking to start or run a successful car dealership. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your car dealership business.

How to get funding for your car dealership business?

There are several ways to get funding for your car dealership business, but one of the most efficient and speedy funding options is self-funding. Other options for funding are:

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your car dealership, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought options for startups.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your car dealership business?

There are many business plan writers available, but no one knows your business and idea better than you, so we recommend you write your car dealership business plan and outline your vision as you have in your mind.

What is the easiest way to write your car dealership business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any car dealership business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Member Log In

A Step-By-Step Course To The Auto Broker Business

Auto broker business.

The BEST Model

Now… the “Auto Broker Course” teaches you everything you need to know to start and build your auto broker business. From finding clients to taking trade-ins, to pricing your service.

And… to be completely upfront, the “Auto Broker Course” is a SUBSET of the larger “Master Course” which includes training on wholesaling, being a small dealer, an auto broker, and much much more. See the Master Course Syllabus to understand the scope of the entire training available here at the Auto Dealer Academy. Some people JUST want the “Auto Broker” Training, so therefore I offer that option.

Are you interested in becoming an Auto Broker? Keep reading…

You should… it’s a GREAT career. From my experience, people prefer driving over walking. So, cars are ALWAYS in demand – good or bad economy.

If you want to be an auto broker, you probably need step-by-step training & support … teaching you everything from A-Z. That’s what we do at the Auto Dealer Academy.

Now.. let’s get to the good stuff.

In MOST states, there is NO auto brokers license. You simply get an auto dealers license and operate your business with the Auto Broker Model as I teach in my training course.

There are a few states with the designation of “auto broker” such as in California.

What is an Auto Broker? Do you want to become an auto broker?

Let me show you!

An auto broker is an independent car buying professional who will search, negotiate, and purchase a new or used car deal on the behalf of their customer/client for a profit.

You are the middle man locating & buying the vehicles for your clients are ready, willing, and able to purchase (we need to make sure they have the financial ability to purchase by making SURE they are pre-approved by a lending institution). You are their personal auto broker – a full-service auto broker.