- New! Member Benefit New! Member Benefit

- Featured Analytics Hub

- Resources Resources

- Member Directory

- Networking Communities

- Advertise, Exhibit, Sponsor

- Find or Post Jobs

- Learn and Engage Learn and Engage

- Bridge Program

- Compare AACSB-Accredited Schools

- Explore Programs

- Advocacy Advocacy

- Featured AACSB Recognizes 26 Business Schools Leading Boldly

- Diversity, Equity, Inclusion, and Belonging

- Influential Leaders

- Innovations That Inspire

- Connect With Us Connect With Us

- Accredited School Search

- Accreditation

- Learning and Events

- Advertise, Sponsor, Exhibit

- Tips and Advice

- Is Business School Right for Me?

The Importance of Variance Analysis

This critical topic is too often taught to only a handful of students—or neglected in the b-school curriculum altogether.

Variance analysis is an essential tool for business graduates to have in their toolkits as they enter the workforce. Over our decades of experience in executive education, we’ve observed that managers across all industries and functions use variance analysis to measure the ability of their organizations to meet their commitments.

Because variance analysis is such a powerful risk management tool, there is a strong case for including it in the finance portion of any MBA curriculum. Yet fewer than half of finance professors believe they should be teaching this subject; they view it as a topic more typically taught in accounting classes. At the same time, in practice, variance analysis is such a cross-functional tool that it could be taught throughout the business school curriculum—but it’s not. We perceive a worrisome disconnect between the way variance analysis is taught and the way it is used in real life.

Variance Analysis and Its Applications

There are three periods in the life of a business plan: prior period to plan, plan to actual, and prior period to actual. For instance, if a business plan is being formulated for 2019, the “prior period” would be 2018, the “plan to actual” would be the budget for 2019, and the “prior period to actual” would be what really happens in 2019. These three stages are also referred to as planning, meeting commitments, and growth.

For each of these periods, variance analysis looks at the deviations between the targeted objective and the actual outcome. The most common variances are found in price, volume, cost, and productivity. When executives conduct an operational review, they will need to explain why there were positive or negative variances in any of these areas. For instance, did the company miss a target because it lost an anticipated national account or failed to lock in a price contract due to competitive pressure?

Executives who understand variances will improve their risk management, make better decisions, and be more likely to meet commitments. In the process, they’ll produce outcomes that can give an organization a real competitive advantage and, ultimately, create shareholder value.

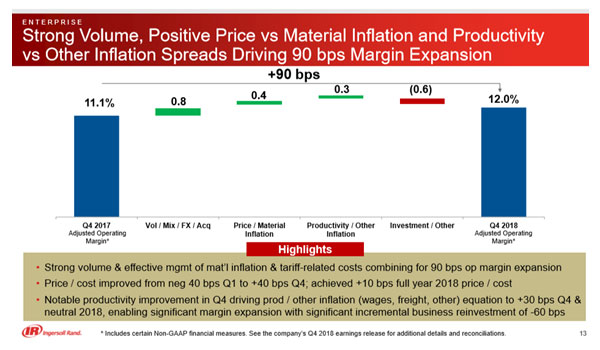

Most businesses apply variance analysis at the operating income level to determine what they projected and what they achieved. The variances usually are displayed in the form of floating bar charts—also known as walk, bridge, or waterfall charts. These graphics are often used in internal corporate documents as well as in investor-facing documents such as quarterly earnings presentations.

While variance analysis can be applied in many functional areas, it is used most often in finance-related fields. Yet, the majority of finance programs at both the graduate and undergraduate levels don’t cover it at all. We surveyed finance faculty in 2013 and accounting faculty in 2017 to determine how they teach and use variance analysis. Among other things, we learned that:

- More than 80 percent of accounting faculty believe that variance analysis is important to a finance career, and they are far more likely to teach it than their finance faculty colleagues.

- Only 59 percent of finance faculty and 48 percent of accounting faculty are familiar with examples of walk charts from real-world companies. Yet these visual portrayals of operating margin variances are commonplace in quarterly earnings presentations and readily found on investor relations websites.

Because universities mostly fail to teach this important topic, corporate educators have been left to fill the learning gap. Many global organizations, in fact, make variance analysis a key subject in their development programs for entry-level financial professionals.

The University Response

We believe it’s critical for universities to better align their curricula with the skills that today’s employers seek in the graduates they hire. Not only do we think variance analysis should be included in the business curriculum, but we could even make an argument for running it as a capstone business course. We offer these suggestions for ways that faculty could integrate this powerful tool across the business school program:

- Both accounting and finance faculty should, as much as is practical, incorporate variance analysis into their classes, particularly focusing on financial planning and analysis. We acknowledge that a dearth of corporate finance texts on the topic will make this a challenge for finance professors. The two of us employ teaching materials in our graduate business and undergraduate finance classes based on experience in the corporate world, and we would be glad to share them with others.

- Faculty who use case studies should always include a case specific to variance analysis tools. Students who pursue careers in corporate finance will almost certainly be required to use such tools, particularly as data and predictive analytics applications are enhanced to improve forecasting accuracy. Two sources of such case studies are TRI Corporation and Harvard Business Publishing.

- Professors can introduce students to real-world applications of variance analysis by showing how it is used in investor relations (IR) pitches. As instructors, the two of us routinely search IR sites for applications of variance analysis. We specifically look for operating margin variance walks (floating bars, brick charts) for visual applications that can make the topic come to life for students. Here’s an example from Ingersoll Rand:

- Faculty from accounting and finance programs should collaborate on when, where, and how to teach variance analysis. At the very least, this will ensure that students gain an understanding of the topic from either a finance or an accounting perspective, but the ideal would be for them to benefit from both perspectives for a holistic understanding. At Fairfield University, accounting programs introduce students to the theory of variance analysis. Then finance programs take an operational and cross-functional approach that addresses planning, meeting commitments, and growth.

- Both accounting and finance faculty should help finance majors understand variance analysis from a practitioner’s standpoint. Discussions about pricing, supply chain, manufacturing costs, risk management, and inflation and deflation around cost inputs can help students grasp the necessity of making trade-offs and balancing short-term and long-term business goals. To make sure students understand the practitioner’s viewpoint, we use corporate business simulations that are more operationally focused, as opposed to being academic in tone.

- To extend the topic to all majors, not just finance and accounting students, faculty from disciplines such as strategy and operations could also incorporate variance analysis into their classes. For instance, if they use business simulations for their capstone courses, they could add a component that covers variance analysis. At Fairfield, we use a variety of competitive business simulations from the corporate world.

- Finally, professors can bring in guest speakers from almost any business functional area and ask them to explain, as part of their presentations, how variance analysis is relevant in their fields. As an example, we often have senior finance executives from Stanley Black & Decker—a company known well-known for its ability to grow and meet its commitments via variance analysis—present to our graduate program. We tap other companies from Fairfield County as well.

In the graduate classes we teach at Fairfield University, we have always tried to connect theory with practice. And we’ve long believed that creating a culture of meeting and exceeding commitments requires aligning interaction across functions in the workplace. With this article, we hope that, at the very least, we can start a larger discussion about the need for cross-disciplinary teaching of variance analysis.

For more about variance analysis materials, contact us at [email protected] or [email protected] .

- Variance Analysis: Your Secret Weap...

Variance Analysis: Your Secret Weapon for Better Financial Planning in a Volatile Market

Listen to the blog:

Table of content, key takeaways.

- In-depth understanding of variance in enterprises’ cash forecasting and its significance amid market uncertainties

- How to can calculate variance in your enterprise’s cash forecasts and the key benefits of conducting variance analysis in cash flow forecasting

- How to reduce variances in cash forecasting with AI in your treasury processes

Deep dive: What is variance?

For enterprises, variance is the difference between the expected cash inflows or outflows and the actual cash inflows or outflows. In other words, it is the difference between the forecasted cash position and the actual cash position of an enterprise at a given time. This variance can be expressed as a positive or negative number, indicating whether the actual cash inflows or outflows were higher or lower than expected based on the forecast.

Variance is an important metric for enterprises to track as it helps understand how accurate your cash forecasts are and whether you need to adjust your financial plans or take corrective actions. By analyzing variances in cash forecasting, enterprises can identify areas where you are overspending or underperforming and take necessary steps to improve your cash flow and financial performance.

Don’t Let Market Uncertainty Derail Your Financial Performance. Analyze Your Variance Now – Download Variance Analysis Template

Types of variances

Different types of variances can occur in cash forecasting due to various reasons such as changes in market conditions, customer behavior, operational issues, and timing issues, among other factors. These variances can impact both sales revenue and expenses. By understanding the underlying causes of these variances, companies can make necessary adjustments to their forecasting models, mitigate risks, and improve their overall financial performance.

Broadly, variances can be classified into two major categories:

- Materials, Labor, and Variable Overhead Variances

- Fixed Overhead Variances

Materials, labor, and variable overhead variances include price/rate variances and efficiency and quantity variances. Price/rate variances show the differences between industry standard costs and actual pricing for materials while efficiency variances and quantity variances refer to the differences between actual input values and the input amounts specified.

Overhead variances include volume variances and budget variances. Volume variances are differences between actual fixed overhead costs applied and budget fixed overhead costs. Meanwhile, budget variances indicate the differences between actual and budgeted amounts.

Budget variances can be divided into two subgroups: expense variances and revenue variances. Expense variances are all about costs and are easier to control and streamline. That’s why we tend to focus on them more during variance analysis. Revenue variances, on the other hand, are more unpredictable and harder to measure. But they’re also really important because they can help you find ways to improve business processes, increase revenue, and reduce costs. By analyzing revenue variances, you can find opportunities to make your business more efficient and valuable in the long run.

Let’s take a look at an example for variance in budgeting

Let’s say that your enterprise sells widgets, and you’ve projected that you’ll sell $1 million worth of widgets in the next quarter. However, at the end of the quarter, you find that you’ve only sold $800,000 worth of widgets. That’s a variance of $200,000, or 20% of your original plan. By analyzing this variance, you can figure out what went wrong and take steps to improve your sales performance in the next quarter. Here, variance analysis becomes the vital tool that enables you to quickly identify such changes and adjust your strategies accordingly to manage your financial performance and optimize cash forecasting .

Simplify & Streamline Your Cash Forecasting Across Timelines-

Download Cash Forecasting Template

Understanding variance analysis

Variance analysis helps you identify the difference between your planned or expected financial outcomes and what actually happened. It’s like checking if you spent more or less than what you planned to spend. This helps you understand where you went over or under budget and why. It’s important because it allows you to monitor your financial performance, identify trends, and make informed decisions about future planning. By using variance analysis, you can stay on track with your financial goals and improve your bottom line over time.

Role of variance analysis

During times of market uncertainty, your enterprise experiences unexpected changes in revenue, expenses, or other financial metrics. The tightening financial conditions are expected to cause the global economy to grow sluggishly, at a rate of 1.6% in 2023, as per JP Morgan’s 2023 Market Outlook . In such cases, one of the most important tools in your financial management toolkit is variance analysis.

Variance analysis basically helps you see how your organization is doing financially and take proactive actions to reduce risks and improve results . It allows enterprises to compare their forecasted cash flow with their actual cash flow, and to determine the underlying causes of variances, such as changes in market conditions, customer behavior, or operational issues. By performing variance analysis, enterprises can gain valuable insights into their cash flow performance and make informed decisions about how to respond to unexpected changes in the market.

For example, if a company identifies that its actual cash inflows are lower than expected due to a decrease in sales revenue, it can take steps to reduce costs or adjust its pricing strategy to maintain profitability. Similarly, if a company identifies that its actual cash outflows are higher than expected due to unexpected expenses, it can adjust its budget or seek alternative financing options.

How to conduct variance analysis (formula & example)?

The fundamental formulae for collecting the data required for variance analysis are relatively straightforward. There are two basic formulae for calculating variance: positive convention and negative convention.

Positive convention measures variance as a positive value, indicating a negative variance. In positive convention, negative figures show that actual figures are under budget, indicating a positive variance. Let’s take a look at the formula for positive convention:

Actual Spending – Budgeted Spending = Variance

Negative convention calculates negative variances as negative values and positive variances as positive values. Here’s the formula for negative convention in variance analysis:

Budgeted Spending – Actual Spending = Variance

Both conventions are acceptable, as long as they are applied consistently. However, obtaining actual figures for a variance is only the first step – contextual analysis is crucial for gaining actionable insights.

For example, if a CPG company has a budgeted purchase order of $10,000$10,0000 for packaging materials from a supplier but ends up spending $12,0000 in a quarter, they could be concerned since they are over budget by 20%.

However, the overage is only $2,0000 in a budget that might measure in the millions. This presents an opportunity for investigation (are there any inefficiencies in the packaging process? Can the enterprise negotiate a better price with the supplier, or consider alternative packaging materials?). This also poses an opportunity to adjust future budgets to optimize the enterprise’s financial performance. While it may not be a major financial emergency, it still warrants attention to ensure optimal cash flow management .

Benefits of conducting variance analysis

Let’s take a look at the top 4 benefits enterprises can reap by conducting variance analysis for cash forecasting:

Identify discrepancies

Variance analysis helps identify discrepancies between actual cash inflows and outflows and the forecasted amounts. By comparing the forecasted cash flow with actual cash flow, it is easier to identify any discrepancies and take corrective measures.

Refine cash forecasting techniques

Conducting variance analysis allows for a review of past forecasts to identify any errors or biases that may have impacted accuracy. This information can be used to refine forecasting techniques and improve future forecasts.

Improve financial decision-making

Understanding the reasons for variances can provide valuable insights that can help improve financial decision-making, which is critical in a volatile market. For example, if a variance is caused by unexpected expenses, management may decide to reduce expenses or explore cost-saving measures.

Better cash management

By analyzing variances, companies can identify areas where cash management can be improved. This can include better management of accounts receivable or accounts payable, more effective inventory management, or renegotiating payment terms with suppliers.

It can be difficult for treasurers to create low-variance cash flow forecasts for enterprises, especially with traditional variance analysis methods that typically involve spreadsheets, due to the large amount of data involved. Moreover, relying on manual variance reduction approaches can lead to a high variance and can be time-consuming, labor-intensive, and expensive, thus, delaying the much-essential decision making.

Role of AI in variance analysis for cash forecasting

Amid turbulent market conditions, as companies prepare for the latter half of 2023 and 2024, enterprises’ finance chiefs are recommending various enhancements to improve decision-making. The most commonly mentioned improvements are the adoption of digital technologies, AI, and automation, and the enhancement of forecasting, scenario planning, and consistency in measuring key performance indicators, as per Deloitte CFO Signals Survey .

This goes to show the significance of adoption of advanced technologies, such as AI, for companies preparing for uncertain markets. Here’s how AI takes variance analysis to the next level – AI-based cash forecasting software helps in variance analysis by taking additional steps to improve the accuracy of the cash forecast by 90-95% . It compares cash forecasts to actual results to check for variances, aligning the forecast with other horizons such as monthly, quarterly, and yearly forecasts, thus, ensuring that the forecast is accurate across various scenarios. AI also analyzes the accuracy of cash forecasts through a line item analysis across multiple horizons, and makes tweaks to the algorithm through an AI-assisted review process. Finally, AI fine-tunes the forecast model and enhances the data as needed to achieve the desired level of forecast accuracy.

Artificial intelligence (AI) can help you generate low-variance cash flow forecasts. It automates data collection from past cash flows, including bank statements, accounts receivable, accounts payable, and other financial transactions and integrates with most financial systems. This data is evaluated to detect patterns and trends that can be utilized to anticipate future cash flows. Based on this historical analysis and regression analysis of complex cash flow categories such as A/R and A/P, AI selects an algorithm that can provide an accurate cash forecast.

Several leading enterprises turn to AI for variance analysis and thereby ensure accurate cash forecasting. It compares forecast, budget, and actual data to improve accuracy by identifying the key drivers.

Benefits of leveraging AI in variance analysis

Here are some of the key benefits you can achieve by conducting variance analysis with AI in cash forecasting:

Improved cash forecasting accuracy with real-time cash analysis

AI can deal with large volumes of data quickly, accurately, and consistently. This can improve the accuracy of your cash forecasts and reduce the risk of errors that may occur from manual data entry or human bias. AI simplifies your cash flow analysis by deep diving into and analyzing a vast amount of data coming in from multiple sources, including historical cash flow data, market trends, and economic indicators, in real time. Thus, it provides instant insights into cash flow variances. This can provide a more comprehensive analysis of cash flow variances, allowing you to identify trends and patterns that may not be apparent through manual analysis.

Real-time cash analysis & Better liquidity management

With AI at its core, cash flow forecasting software can learn from industry-wide seasonal fluctuations to improve forecasting accuracy. AI-powered cash forecasting software that enables variance analysis can also create snapshots of different forecasts and variances to compare them for detailed, category-level analysis. By offering such comprehensive visibility, it helps you respond quickly to changes in cash flow, take corrective action as needed, and manage your enterprise’s liquidity better.

Faster, data-driven decision-making

With real-time analysis and more comprehensive insights on cash forecasts, AI can help you make faster, more informed decisions about cash flow management. This can help organizations respond quickly to changes in cash flow and take corrective action as needed. This is particularly important during times of market uncertainty when cash flow patterns can change rapidly and unexpected events can occur.

Automated reporting

AI can automate the reporting of cash flow variances, providing regular reports that highlight trends and patterns. By automating the reporting process, organizations can save time and resources that would otherwise be spent on manual reporting. This also ensures that reporting is consistent and accurate, eliminating the potential for human error. With regular, real-time reports on cash flow variances, you can stay on top of your enterprise’s cash flow management and identify areas for improvement to maximize your financial performance.

What Will Your ROI Be from AI-Enabled Cash Forecasting?

Analyze Now

HighRadius’ AI-based Cash Forecasting Software is the perfect solution for enterprises looking to improve their cash forecasting process and achieve the above-mentioned benefits. Here are the cash forecasting solution’s key features that can help you reduce variances in cash forecasting and achieve accurate cash forecasts:

- Enhance visibility at a granular level, providing improved reporting to CFOs, through automated data gathering and consolidation of financial data.

- Ensure seamless and continuous data access by easily integrating with ERPs, bank portals, FP&A systems, and legacy systems through APIs, sFTP, and dashboards.

- Improve cash forecasting accuracy with automatic roll-up of forecasts from local to global levels across various cash flow categories, regions, currencies, entities, and horizons.

- Manage exceptional scenarios with spreadsheet functionality in the solution that allows manual adjustments to the forecast.

- Take course correction measures by performing variance analysis over multiple cash flow categories, regions, and durations, as well as the drill-down capability to find the root causes of variances.

- Reduce variance by using bank statement data and fine-tuning forecasts to boost forecast accuracy with a closed-loop feedback model.

- Customize cash forecasting cadence to ensure that forecasts meet the company’s requirements and goals. For instance, For example, companies facing cash deficits can forecast on a daily or weekly basis to avoid debts, while companies with excess cash can forecast quarterly to invest in business growth.

- Maximize profits during peak seasons and reserve cash for off-seasons with the time series algorithm that helps capture seasonal trends.

- Track complex cash flow categories like A/R and A/P by capturing customer-specific variables and identifying patterns in customers’ payment behavior.

Conclusion Closing Thoughts for Treasury Leaders

In a rapidly evolving business landscape, market uncertainties and disruptions can have a significant impact on an enterprise’s financial stability. That’s why having a robust cash flow forecasting system with AI at its core to conduct variance analysis is crucial.

By analyzing large volumes of historical and real-time data, AI-powered cash forecasting software can provide accurate insights into cash flow variances, enabling enterprises to respond quickly to any changes in the market and empowering finance leaders to make informed decisions. It can also learn from industry-wide seasonal fluctuations to provide more accurate cash flow forecasts.

With AI in the cash forecasting process, including variance analysis and scenario modeling, enterprises can better manage their liquidity during times of market uncertainties and prepare themselves for the future, where accurate cash flow forecasting will be critical to their success. It can be a game-changing factor to give you a competitive advantage, improve your enterprise’s financial stability, and help you make data-driven decisions that can help them thrive in the long run.

What is the difference between standard costing and variance analysis?

Standard costing refers to the process of establishing estimated (standard) costs for products or services based on expected levels of input costs, labor costs, overhead costs, and other factors. Variance analysis, on the other hand, is the process of comparing actual costs to standard costs to identify variances, or differences between the expected and actual costs.

What are the three main sources of variance in an analysis?

The three main sources of variance in an analysis for cash forecasting are timing variance, amount variance, and category variance. Timing variance refers to differences in cash flow timing compared to the expected timing, while amount variance is the difference in the actual cash flow amount compared to the expected amount. Category variance refers to differences in the actual cash flow for a specific category compared to the expected cash flow.

What is P&L variance analysis?

P&L (profit & loss) variance analysis is the process of comparing actual financial results to expected results in order to identify differences or variances. This type of variance analysis is typically performed on a company’s income statement, which shows its revenues, expenses, and net profit or loss over a specific period of time.

Related Resources

4 Cash Flow Forecasting Best Practices to Navigate Economic Uncertainties

How to Improve the Accuracy of Accounts Payable Forecasting

7 Practical Tips to Improve Your Cash Flow potential

Streamline your order-to-cash operations with highradius.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

Please fill in the details below

Get the hottest Accounts Receivable stories

Delivered straight to your inbox.

- Order To Cash

- Credit Cloud

- Electronic Invoicing

- Cash Application Management

- Deductions Management

- Collections Management

- B2B Payments

- Payment Gateway

- Surcharge Management

- Interchange Fee Optimizer

- Payment Gateway For SAP

- Record To Report

- Financial Close Management

- Account Reconciliation

- Anomaly Management

- Accounts Payable Automation

- Treasury & Risk

- Cash Management

- Cash Forecasting

- Treasury Payments

- Learn & Transform

- Whitepapers

- Courses & Certifications

- Why Choose Us

- Data Sheets

- Case Studies

- Analyst Reports

- Integration Capabilities

- Partner Ecosystem

- Speed to Value

- Company Overview

- Leadership Team

- Upcoming Events

- Schedule a Demo

- Privacy Policy

HighRadius Corporation 2107 CityWest Blvd, Suite 1100, Houston, TX 77042

We have seen financial services costs decline by $2.5M while the volume, quality, and productivity increase.

Colleen Zdrojewski

Trusted By 800+ Global Businesses

Variance Analysis: Understanding its Importance in Financial Management

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Variance Analysis Definition

Variance analysis is a financial and quantitative method used to identify and understand the degree of difference between actual and planned behavior in budgeting or financial accounting. It aids in determining the causes and degrees of variances, aiding organizations in decision making and performance improvements.

Purpose of Variance Analysis

Refining budgets.

Variance analysis plays a crucial role in refining business budgets. By comparing the budgeted figures to actual results, it aids managers in identifying where they overspent or underspent. By pinpointing the areas of overspending, businesses can then implement strategies to curtail costs and ensure they remain on-budget in future periods. Similarly, underspending might signal missed opportunities or inefficiently allocated resources, prompting a reevaluation of spending priorities.

Forecasting Future Financial Results

Variance analysis also plays a critical role in financial forecasting. The insight gathered from comparing actual results to budgeted figures can be used to formulate more accurate and realistic projections for future financial periods. It facilitates an understanding of the trends and factors that influence expenditure or income, thereby enabling a business to adjust its predictions and plans accordingly. This enhanced accuracy in forecasting ultimately leads to better performance management and strategic decision-making.

Improving Operational Efficiency

Another significant purpose of variance analysis is to enable businesses to improve their operational efficiency. By identifying the variances in different operations, a business can gain a better understanding of the areas where efficiency can be improved. For instance, if labor cost variances are consistently unfavorable, it might imply the need for staff training or process automation. Ultimately, improving operational efficiency can lead to cost reductions, productivity enhancements, and improved profit margins.

By refining budgets, aiding in forecasting future financial results, and improving operational efficiency, variance analysis serves as a vital tool in strategic financial management for any business.

Types of Variance Analysis

In the realm of finance, there are several types of variance analysis that we can use to better understand a company's performance and help influence decision making.

Sales Variance

Sales Variance measures the difference between the actual sales and the budgeted or expected sales. It enables businesses to understand the reasons for their performance, be it favorable or unfavorable. If there's a negative sales variance, it might indicate the need for a new marketing strategy. Conversely, a positive sales variance can reinforce effective sales tactics currently in place.

Volume Variance

Volume variance, closely related to sales variance, evaluates the impact of changes in the number of units sold on a company's net income. It can be broken down into sales volume and direct materials volume variances. Sales volume variance examines the overall units sold against the budget, while direct materials volume variance analyzes whether the company used more or less materials than planned. Consequently, the information provided by volume variance analysis can be vital in revising production and cost control strategies.

Cost Variance

Cost variance refers to the discrepancy between a project's budgeted cost and the actual cost incurred. Analyzing cost variance helps to keep a project financially on track. A high positive cost variance might indicate good financial performance, but it could also indicate underutilization of resources. Conversely, negative cost variance could suggest overspending, highlighting the need for tighter financial control.

Each of these types of variance analysis provides unique insights into different aspects of finance and contributes to a more holistic understanding of a company's performance. Armed with this information, decision-makers can pinpoint where things are going right or wrong and take appropriate action.

The Process of Conducting Variance Analysis

Step 1: identify the variables.

The first step in conducting variance analysis involves identifying the different variables that contribute to the performance of a certain business operation. Examples of such variables could be the cost of production, selling price, quantity sold et al. It is crucial to understand these variables and ascertain how they impact the overall business or specific project profitability.

Step 2: Determine Actual Performance

At this stage, analysts gather all relevant data and quantify actual performance. This may entail collecting records on sales, expenditures, production volume or any other relevant factors that have been identified in step one. This data needs to be precise and comprehensive in order to provide an accurate representation of the actual performance.

Step 3: Set Standard or Expected Performance

Once you’ve identified variables and have compiled data on actual performance, the next step involves setting standard or expected performance benchmarks. This might involve using historical performance data, industry standards or forecasts. The expected performance serves as a reference point against which actual performance is compared.

Step 4: Calculate Variances

Once both actual and standard performances are clearly defined, you can calculate the variances. This is essentially determining the differences between what was expected and what happened in reality. This could be calculated in units, percentage or monetary value depending on the variables being measured. The variances may be favorable (better than expected) or unfavorable (worse than expected).

Step 5: Analyze Variances

After determining variance, the next step is to analyze the results. This implies digging deeper into the data to discern exactly why variances occurred. The analysis could reveal issues such as inefficiencies, inaccuracies in estimation, unforeseen market conditions or other factors causing the variance.

Step 6: Report the Performance

This step involves collating all the information into a comprehensive report. The report should be clear and concise, summarizing all the findings and providing actionable recommendations. This report will help the management in decision-making, understanding where improvements can be made and how to strategically plan for the future.

Step 7: Implement Strategies and Monitor Effects

Finally, strategies based on the insights from the variance analysis are implemented, and its effects are closely monitored. The ultimate goal of variance analysis is not only to identify and understand discrepancies but to leverage that understanding to enhance future performance.

Role of Variance Analysis in Budgeting

In the budgeting process, variance analysis plays a vital role by rendering an analytical tool for management to assess the budget's effectiveness. Budgets are essential for financial planning and control. They provide a standard against which actual performance can be measured. Variance analysis is a method employed by managers to understand the reasons behind the differences in actual and predicted performance.

Budgeting and Variance Analysis

Quite often, the actual outcomes do not align with the budgeted estimates due to various factors, such as market trends, unexpected expenses, or changes in business strategies. Here, variance analysis comes into play. By analyzing budget variances, managers can compare actual results to expected ones. This comparison enables them to troubleshoot variances that are out of the acceptable range or conspicuous in their recurrence. As a result, they can make more informed decisions about resource allocation, adjusting goals, or revising business strategy.

Value in Identification

Perhaps one of the most valuable aspects of variance analysis is its contribution to identifying areas where actual performance deviates from budgeted expectations. It helps in evaluating the effectiveness of budgeting and also in identifying areas of inefficiencies or better-than-expected performance. For instance, if the actual cost exceeds the budgeted cost for a specific department, it's an indicator that the department could benefit from cost-reduction efforts. On the other hand, if the revenues exceed the budgeted revenue, it indicates an opportunity to capitalize on something that is generating more income than anticipated.

Guiding Future Budgets

Variance analysis can also be utilized for validation of future budget assumptions, making it an essential element in strategic decision-making. The results of the variance analysis—both favorable and unfavorable—provide valuable lessons for building more accurate and realistic future budgets.

In conclusion, variance analysis is a critical tool that allows managers to control business finances better, learn from past budgeting mistakes, and create improved, more accurate financial forecasts. Its role is invaluable for any organization aiming to ensure efficient resource allocation, cost control, and financial stability.

Variance Analysis and CSR

Utilizing variance analysis in the context of Corporate Social Responsibility is essential for businesses striving to make a positive impact on society while still maintaining a profitable model. CSR initiatives often involve considerable investment, so it's vital to effectively evaluate their financial impact and ensure that they don't lead to significant overspending.

Using Variance Analysis to Evaluate Financial Impact of CSR Initiatives

Evaluating the financial implications of any new initiative involves comparing the actual results to the budgeted expectations, and CSR initiatives aren't exempt from this. Variance analysis acts as a critical tool in this process.

You'll first need to determine the budgeted cost of each CSR initiative, including everything from direct spendings, like funding for community projects and infrastructure, to indirect costs like staff time. After implementing the initiative, you'll then use variance analysis to compare the budgeted cost to the actual expenditure.

If you find that the actual cost is more than the planned budget (unfavorable variance), you can look deeper into the elements causing this overspending. Maybe the logistics costs were higher than planned, or perhaps an unexpected expense cropped up partway through the project. Either way, understanding and addressing these disparities can help ensure better financial management of CSR initiatives in the future.

Conversely, a situation where the actual cost is less than the budgeted amount (favorable variance) signifies under-spending. While this may seem positive at first, it could indicate that certain activities were not implemented as planned, possibly undermining the effectiveness of the initiative.

Ensuring CSR Initiatives Stay Within Budget

A critical aspect of maintaining control over financial resources is ensuring spending stays within budget. Variance analysis aids in this process too, by highlighting where your CSR initiatives are overspending, underspending, or staying on track.

By closely monitoring variances, you can identify which areas are straining your budget and take corrective action. This might involve renegotiating vendor contracts, adjusting timelines, or reallocating resources. On the flip side, you can use positive variances as an opportunity to scale up the initiatives that are driving success.

In conclusion, applying variance analysis to CSR initiatives can provide valuable insights that can help keep these initiatives within budget and allow for effective evaluation of their financial implications. This process enables businesses to maintain financial stability while meeting their social responsibility objectives, creating a balanced approach to profit and purpose.

Significance of Variance Analysis for Sustainability

Variance analysis is integral to a business organization's pursuit of sustainability. It can help track and manage spending on green initiatives, sustainable practices, and environmental responsibilities, becoming crucial when trying to balance cost-cutting and sustainability goals.

Economic Sustainability and Variance Analysis

Financial sustainability is closely linked to economic sustainability. Through variance analysis, organizations can identify discrepancies between budgeted and actual expenses to uphold economic sustainability. Such an approach helps keep a check on the allocation and use of resources. In a sustainable setting, variance analysis can indicate if an organization is spending too much on certain sustainability initiatives or not sufficiently funding necessary ones.

Portfolio Sustainability

Additionally, variance analysis plays a key role in the sustainability of a company's portfolio. The shifts in market trends, changes in customer preferences towards sustainable products, or policy changes promoting sustainable practices can lead to variances in projected and actual outcomes of projects. By conducting frequent variance analysis, organizations may anticipate such fluctuations, adjust their budgets accordingly, and maintain the sustainability of their investments.

Variance analysis in Energy Efficiency

Similar significance is seen in the energy sector as well. Variance analysis can highlight deviations in energy consumption, which is crucial for organizations striving to minimize their carbon footprint. It can help identify inefficient energy practices, enabling a shift towards more sustainable usage.

Improving Decision Making

Variance analysis also aids in making informed decisions about future strategies for sustainability. It can provide actionable insights into which practices are having the most positive sustainable impact and are cost-effective. Thus, it assists in strategic decision-making regarding the allocation of resources to various sustainable practices.

To summarize, variance analysis, by scrutinizing and interpreting variations in the anticipated and actual resource usage, plays a vital role in a business organization's sustainability strides. It facilitates efficient resource allocation, comprehends market fluctuations, ensures energy efficiency, and improves decision-making, all of which are crucial to upholding sustainable practices.

Variance Analysis in Performance Management

Variance analysis at organizational level.

Variance analysis is instrumental in measuring organizational or department’s financial health and efficiency. It plays a significant role in performance management as it enables managers to dig deeper into the financial information and isolate the areas that are performing well or need improvement.

By comparing actual results to expected budgeted outcomes, managers can understand the financial performance of different departments or the organization as a whole. The disparities between what was budgeted and what has actually been achieved, or the variances, become key pointers to operational inefficiencies, wastages or even opportunities.

As a Budgeting Tool

Variance analysis helps organizations ensure they are on track with their budgets. If a department overspends in a certain area, variance analysis will signal this to managers. They will then have a chance to probe into the reasons and take corrective actions promptly.

This tool also promotes transparency in budgeting process, as managers re-evaluate the budget regularly, taking into account actual costs and identifying areas of overspending.

Enhancing Productivity and Efficiency

Within operations, variance analysis can be leveraged to improve productivity and efficiency. For example, if a department is consistently producing lower than anticipated results, management can use variance analysis to diagnose the cause.

They could look closer into production processes, labor hours, or raw materials. Depending on the findings, reforms can be made to rectify issues, such as providing additional staff training or streamlining production methods.

Performance Evaluation and Planning

Variance analysis also proves valuable in performance evaluation and future planning. By identifying areas where performance is lagging behind expectations, management gets insights into where improvements are necessary. Employees can be incentivized to meet targets, possibly improving overall performance.

Moreover, variance analysis can aid in setting more accurate future forecasts. By scrutinizing past performances and learning from them, organizations can make more informed and realistic predictions, contributing to better strategic planning.

Challenges and Limitations of Variance Analysis

Handling data incorrectly.

One common issue with variance analysis is improper data handling. Incorrect or incomplete data can lead to inaccurate results, making it hard to take appropriate action or make reliable decisions. It's essential to ensure data is accurate, complete, and up-to-date before proceeding with variance analysis.

To tackle this problem, organizations should develop robust data management practices. Data validation procedures should be in place to minimize the chances of errors infiltrating the analysis. Additionally, continuous data updates are crucial to keep up with any changes that may occur.

Temporal Discrepancies

Timing differences can pose significant challenges in variance analysis. Financial data from one period might not be perfectly comparable to that from another. Factors such as inflation, seasonality, and macroeconomic conditions can significantly affect the comparison, leading to misleading conclusions.

Addressing this problem requires adjusting data for such variables where possible or adding caveats to the analysis to indicate that timing differences may affect the results.

Overemphasis on Quantitative Analysis

Variance analysis is based on numbers and quantitative data; therefore, it could potentially lead to an overemphasis on these aspects, ignoring other qualitative factors that could be informing the variances.

To address this, it's crucial to use variance analysis as part of a broader evaluation strategy. Incorporate qualitative perspectives and industry insights to ensure a comprehensive understanding. Cross-functional team input can also provide different viewpoints, enriching the analysis process.

Neglecting Small Variances

Sometimes, little attention is paid to small variances, which might accumulate over time and create significant issues. This problem arises from the thinking that only substantial variances need attention.

Addressing small variances is through cumulative tracking; even small differences ought to be examined over time. This approach ensures that recurring small variances do not go unnoticed and can help in proactive problem-solving.

High Dependence on Benchmark

Variance analysis relies heavily on an initial budget or forecast benchmark. If the benchmark set is unrealistic, variance analysis might end up indicating problems that are not real or missing issues that are present.

To deal with this challenge, careful and realistic planning and forecasting should be emphasized. By ensuring that the benchmark set is achievable and reasonable, variance analysis can yield more accurate and useful results.

Lack of Action

A common mistake with variance analysis is failing to act upon it. The purpose of variance analysis is to inform decisions and stimulate action where necessary. Failing to act on the analysis renders the whole exercise futile.

Overcoming this obstacle requires a readiness and commitment to adjusting strategies, taking corrective actions, or redefining goals based on the insights drawn from the analysis. Openness to change based on the variance findings is a must for effective use of this analysis.

Share this article with a friend:

About the author.

Inspired Economist

Related posts.

Accounting Close Explained: A Comprehensive Guide to the Process

Accounts Payable Essentials: From Invoice Processing to Payment

Operating Profit Margin: Understanding Corporate Earnings Power

Capital Rationing: How Companies Manage Limited Resources

Licensing Revenue Model: An In-Depth Look at Profit Generation

Operating Income: Understanding its Significance in Business Finance

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Human Capital Management: Understanding the Value of Your Workforce

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Start typing and press enter to search

- Get started

What is Variance Analysis: A Frontier for Analysis

There are a variety of ways by which you can assess your business’ overall financial health and success. By utilising data analytics and performing variance analysis, you may become aware of business practices or decisions that need to be amended. But, many times, most businesses have a hard time conducting variance analysis because data is in many places, running analytics hasn’t yet been optimised to glean useful insights, and manipulating the data takes too much time.

We’ll outline what variance analysis means, the ways in which you can carry it out smarter so it is more useful and how automation tools can help perform the work for you so that you can use variance analysis to a greater advantage.

Table of Contents

1. What is the Variance Analysis?

2. Importance of Variance Analysis

3. The Role of Variance Analysis

4. Example of Variance Analysis

5. What are the Key Terms of Variance Analysis?

6. What are the Most Common Types of Variance Analysis?

7. Challenges of Variance Analysis

8. How Automation Tools Can Help

What is the Variance Analysis?

Variance analysis is a method of assessing the difference between estimated budgets and actual numbers. It’s a quantitative method that helps to maintain better control over a business. When using variance analysis, one best practice is to review variances on a trend line so that you can readily pinpoint any dramatic shifts. Once you find anything that is suspect, variance analysis can help you to investigate the reason behind the big difference in what’s planned and what happened financially.

During a reporting period, you can sum all variances to see if your business is over or under-performing. When you notice a significant shift in the variance trend line, then you can become aware of dysfunction and work to resolve it. But, where do you begin and how can you pinpoint what’s causing the variance? This is where automation can help to assess the data points and highlight the issues.

The variance analysis that you choose to focus on will depend on the type of business you operate. The reason for variances also are dependent on certain factors, like:

- Market conditions

- Budgeting standards

- Difficulty benchmarking

- Material variances

- Overhead variances

- Labour variances

Importance of Variance Analysis

Variance analysis provides organisations with a lot of benefits, including:

- Planning: Helps managers to budget smarter and more accurately

- Control: Assists in more significant control management of departments and budgeting

- Responsibility: Helps with the assignment of trust within an organisation

- Monitoring: Helps to monitor success and failure

- Sets Expectations : Encourages forward-thinking and helps to set benchmarks

Variance analysis becomes an integral part of an organisation’s information system. Not only does it help to regulate control across departments, but it also provides a running tab of what can be realistically expected versus what occurs.

The Role of Variance Analysis

Variance analysis is used to assess the price and quantity of materials, labour and overhead costs. These numbers are reported to management. While it’s not necessary to focus on every variance, it becomes a signalling mechanism when a variance is salient. In this way, management can rely on variance analysis to help to improve the company’s overall performance or process improvement protocol.

More importantly, variance analysis plays a significant role in decision-making and how managers approach tasks and projects. When performed correctly and consistently, it can help to keep teams on the right path to achieve long-term business goals. However, many businesses fail to reap the benefits of variance analysis because it has to be performed consistently and promptly to work.

To accurately forecast future revenue or costs, it is necessary to have organised data from history. This calls for automation solutions such as SolveXia that can store all data in a centralised location and can automatically be pulled, manipulated and transformed into insights for decision-making. When your financial team is being pulled in so many directions and spends time on low-value time-consuming data entry and repetitive tasks, then variance analysis can easily fall by the wayside. A data automation tool can maximise your team’s productivity by pulling data from various sources, providing real-time analytics and reports to key stakeholders.

Example of Variance Analysis

Let’s take a look at how this works in a real-world scenario with a sample of variance analysis.

A business uses variance analysis to find there is a $50,000 variance in one of its cost centres.

To determine how and why this happened, it requires further variance analysis to understand if the difference came from price changes or a difference in the quantity of materials being used. Maybe it is a growing trend or a one-off event. It could also be erroneous data entry. Either way, if the company aims to keep costs low and operate at its maximum efficiency, then it’s necessary to have these results immediately to help manage future operations.

For accurate variance analysis, data must be correct to reflect what happened. With automation, you will be able to quickly link up all your data systems and compare historical data with current data without human interference and the system will highlight what has since changed allowing the business to find the source of the issue fast and understand quickly if it is a cause for concern, or if there is a risk or opportunity in the business.

What are the Key Terms of Variance Analysis?

With these variance analysis examples in mind, there are some key terms to remember when performing your own analysis and to better understand its purpose. Take a look:

- Overhead costs: Overhead costs are a business; operating expenses, such as office rent costs, insurance costs, and the like. In order to minimise expenses, companies audit their own operating expenses to see where overhead costs may be cut.

- Variable price and rate variance: These refer to the changes in the cost of products or services. They may change because of unforeseen reasons or be adjusted to better reflect consumer demands and supply rates.

- Budgets: Budgets are financial plans used to allocate spending and mitigate against overspending. Budgets can be revised in real-time to meet goals.

- Fixed budget variance: Fixed budget variance refers to the difference between overhead costs in a budget and the actual amount of overhead costs in a variance period.

What are the Most Common Types of Variance Analysis?

Here’s a look at the most common types of variance that occur within organisations:

1. Material yield variance:

This is the difference between what you expected to use and what you used, multiplied by the cost of the materials. You can calculate this with this formula: (the actual unit used - standard unit usage) x standard cost per unit.

This helps companies determine if they are using more materials than they actually need to be. With this variance known, companies can adjust their purchase orders from suppliers and reduce waste.

2. Labour efficiency variance:

This is a measure of how well you utilise labour relative to what you expect to need. The variance is calculated by (actual hours - standard hours) x standard rate.

With this number in mind, companies can assess how efficiently their labour is being used and if the pricing is a good fit for the business’ needs.

3. Fixed overhead spending variance:

The difference between the actual fixed overhead expense and the budgeted overhead expense. Since this is supposed to be a fixed amount, it shouldn’t vary so much from the budget.

If the variance is high between the budget and the actuals, it signals room for improvement in which the company can revisit its budget plans. It’s useful to more accurate budget allocation to see if more money can go to different places for the business to function more effectively.

4. Purchase price variance:

Take the actual price paid for raw materials and subtract the standard cost times the number of units used.

5. Labour rate variance:

Same as above, but with labour instead of products. Take the actual price paid for a direct job, subtract the standard cost and multiply by the number of units used (wages).

6. Variable overhead spending variance:

Subtract the standard variable overhead cost per unit from the actual cost incurred. Then, multiply the remainder by the total unit quantity of output.

7. Variable overhead efficiency variance:

This is the difference between how many hours were worked versus what was budgeted for the work. It is calculated by standard overhead rate x (actual hours - standard hours).

Not every organisation will focus on the same variance calculations. Depending on your service line and business goals, you will choose what variance analysis makes the most sense to track to ensure you are maximising efficiency and minimising costs.

Challenges of Variance Analysis

From all we know, there is a lot in favour of using variance analysis to help control business and manage finances well. However, there are challenges to variance analysis.

- Time delay: Variances are calculated at each month’s end by the accounting team. Then, the information is shared with management teams. But, organisations don’t pause their inputs and outputs while waiting for variance analysis to happen so that this time delay could result in delayed red flags.

- Source information: Some of the information needed to calculate variances don’t always appear in regular accounting reports. Therefore, it may take extra effort on behalf of a finance team to find this information. If management won’t correct problems by using this information, then it is more of a cost (in time) than it is a benefit (in solutions).

- Standard-setting: Setting benchmarks and estimations could come from different sources and standards or even be affected by politics. So, when a variance is recorded, it may be possible that it doesn’t also result in useful information.

How Automation Tools Can Help

Variance analysis is based on numbers and data. When you have data spread out across spreadsheets and in different records within an organisation, then compiling and assessing data becomes tricky and timely. One of the challenges with variance analysis from the get-go is the timeliness of reporting, so this is where automation tools can come in to maximise efficiency.

Automation tools such as SolveXia help to benefit variance analysis by providing:

- Data integrity: Allow the software to compile and store data that is unaltered, accurate and safe from errors. It also removes low-value manual tasks so staff can focus on high-value analytics to drive more significant insights and success.

- Visibility: Anyone who is granted access to an automation tool can take a look at the numbers themselves, which helps to improve transparency within a business. It provides real-time dashboards and real-time alerts so that variances that pose strategic risks or opportunities are flagged up as they happen, and the correct people are notified in real-time. This also improves compliance and enables processes to be mapped out, removing critical man dependency.

- Timeliness: Automation tools can collect, transform and process data in seconds. This means that information can be accumulated and shared much more quickly than when relying on it being done manually. Reports can be sent out by the system automatically to designated people, so the right people have the correct information at their fingertips.

- Connected data: Data is connected and all in one place when it’s being stored in an automated software solution. It connects with all legacy systems, so everything is in one place to run analytics to gain more precise insights than ever before.

Wrap Up: Measure to Manage

Managing a business comes down to measuring inputs and outputs. By keeping track of budgets and actuals, you can utilise variance analysis to flag any significant fluctuations from what was otherwise expected.

You can leverage automated software solutions like SolveXia to help store and manage data and information. These tools also help businesses thrive by maximising productivity and lowering costs. Automation solutions can quickly collect, transform and process mass amounts of data in seconds, relieving your team of having to perform time-consuming data entry and manual manipulation. With all data stored and centralised, you can standardise processes and automate workflows to reduce errors and adhere to compliance. There’s a lot you can accomplish when you include automation solutions into your day-to-day workflows. Stakeholders, customers and employees all reap the benefits of automation solutions.

Related Posts

Our top guides, our top guide, popular posts, free up time and reduce errors, intelligent reconciliation solution, intelligent rebate management solution, recommended for you.

Request a Demo

Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Reconciliation Data Sheet

Download our data sheet to learn how to automate your reconciliations for increased accuracy, speed and control.

Regulatory Reporting Data Sheet

Download our data sheet to learn how you can prepare, validate and submit regulatory returns 10x faster with automation.

Financial Automation Data Sheet

Download our data sheet to learn how you can run your processes up to 100x faster and with 98% fewer errors.

Rebate Management Data Sheet

Download our data sheet to learn how you can manage complex vendor and customer rebates and commission reporting at scale.

Top 10 Automation Challenges for CFOs

Learn how you can avoid and overcome the biggest challenges facing CFOs who want to automate.

Latest Blog Posts

What is Data Wrangling & Why it's so Important

Good business decisions rely on data. Accurate data starts with data wrangling. But, data wrangling takes time. Find out more:

.jpeg)

5 Data Analysis Software You Need to Know About

Choosing the right data analysis software is a serious decision. See the list of possible tools make the decision-making easier.

.jpg)

Accounting for Accounts Receivables: Overcome the Risks

Accounting for accounts receivables is an intricate process that poses numerous potential risks. Automation software can mitigate this risk.

How to Conduct Variance Analysis in Excel

Variance analysis is a fundamental tool used by businesses to analyze changes in financial results or operational efficiencies over time. It helps businesses understand the root cause of differences between actual and budgeted results, which can be used to make informed decisions for future planning. Conducting variance analysis in Excel is a straightforward task that can be achieved with just a few clicks. In this article, we will explore the concept of variance analysis and learn how to use it in Excel to improve business performance.

Table of Contents

What is Variance Analysis and Why is it Important?

Variance analysis is a financial management tool used to analyze differences between actual and budgeted results. These variances can be either favorable (in which actual results exceed budgeted results) or unfavorable (in which actual results fall short of budgeted results). In both cases, it is essential to determine why the performance differed from expectations, so that corrective measures can be taken for future budgeting and planning.

Companies use variance analysis to measure financial performance at the end of each reporting period and to highlight potential areas of improvement. It is a powerful tool to analyze profit margins and manage expenses, which can ultimately enhance the overall business performance.

One of the key benefits of variance analysis is that it helps businesses to identify trends and patterns in their financial performance. By analyzing variances over multiple reporting periods, companies can gain insights into the factors that are driving their financial results. This can help them to make more informed decisions about future budgeting and planning, and to identify areas where they may need to adjust their strategies.

Another important use of variance analysis is in identifying areas of risk within a business. By analyzing variances in different areas of the business, such as sales, expenses, and production costs, companies can identify potential areas of risk and take steps to mitigate them. This can help to reduce the likelihood of financial losses and improve the overall financial health of the business.

Understanding the Types of Variances

There are two main types of variances in variance analysis: price variances and quantity variances.

Price variances relate to changes in the price of goods or services, which can be caused by changes in market conditions or operational inefficiencies. Quantity variances, on the other hand, are based on changes in the volume of production or service delivery.

It is crucial to understand the type of variance you are dealing with, as this can help you to identify the underlying cause and take appropriate action.

Price variances can be further broken down into two subcategories: favorable and unfavorable. A favorable price variance occurs when the actual price paid for a good or service is lower than the expected price. This can be due to negotiating better deals with suppliers or taking advantage of market fluctuations. An unfavorable price variance, on the other hand, occurs when the actual price paid is higher than the expected price. This can be caused by factors such as inflation or unexpected price increases from suppliers.

Quantity variances can also be broken down into favorable and unfavorable categories. A favorable quantity variance occurs when the actual quantity produced or delivered is higher than the expected quantity. This can be due to increased efficiency in production or better demand for the product or service. An unfavorable quantity variance occurs when the actual quantity produced or delivered is lower than the expected quantity. This can be caused by factors such as equipment breakdowns or labor shortages.

Identifying the Causes of Variances

Once you have identified the type of variance, it is time to establish the root cause. Conducting a variance analysis in Excel can help you identify the key drivers contributing to the variance. Possible causes could include changes in the market, pricing strategy, changes in the cost of labor or raw materials, or operational inefficiencies.

Identifying the cause of a variance is crucial to the success of any business. Once you have identified the root cause of the problem, you can develop effective solutions to correct the issue and prevent it from recurring in the future.

One important factor to consider when identifying the causes of variances is the timing of the variance. For example, if the variance occurred during a specific time period, it may be related to a seasonal trend or a specific event that occurred during that time. Understanding the timing of the variance can help you narrow down potential causes and develop targeted solutions.

Another factor to consider is the impact of external factors on the variance. For example, changes in government regulations or economic conditions can have a significant impact on a business’s performance. It is important to consider these external factors when identifying the root cause of a variance and developing solutions to address it.

Setting up the Spreadsheet for Variance Analysis

The first step in conducting variance analysis in Excel is to set up the necessary worksheet. The area allocated for variance analysis should contain the actual results, budgeted results, and the calculations used to determine the variance amount and percentage.

It is essential to ensure that the data is correctly formatted and that the formulas are accurate to ensure that the information generated from the analysis is reliable. You can use the simple functions available in Excel, such as SUM, AVERAGE, and IF statements, to perform the required calculations.

Additionally, it is recommended to label each column and row clearly to avoid confusion and make it easier to interpret the results. It is also important to regularly update the data in the spreadsheet to ensure that the analysis is based on the most recent information available. By following these steps, you can effectively set up a spreadsheet for variance analysis and make informed decisions based on the results.

Creating a Budget vs Actual Variance Report in Excel

Creating a Budget vs Actual Variance Report involves comparing actual results against the budgeted results to determine the variance. The report usually contains the following information:

- Budgeted amount

- Actual amount

- Variance amount

- Percentage variance

The report can be presented in the form of a table or a chart for easy interpretation and analysis. You can also customize the report by adding additional columns or including conditional formatting options to highlight significant variances.

It is important to note that creating a Budget vs Actual Variance Report is not a one-time task. It should be done regularly, such as monthly or quarterly, to track the progress of the budget and identify any potential issues early on. Additionally, the report can be used to make informed decisions about future budgeting and resource allocation.

Analyzing the Variance Report: Key Metrics to Look For

While analyzing the variance report, there are a few key metrics to look for, including:

- Excessive variances: When the variance is significantly high or low, it signals an issue that needs to be addressed.

- Trending: Analyzing the variances over time can help identify trends and underlying issues.

- Root cause analysis: Digging deeper into the variances can help establish the causes so that corrective action can be taken.

Identifying trends and the root causes of the variances is crucial to understanding the financial performance of the business. It enables businesses to take corrective measures quickly and develop long-term strategies for improvement.

Another important metric to consider when analyzing the variance report is the impact of external factors. External factors such as changes in the market, economic conditions, or government policies can significantly affect the financial performance of a business. By analyzing the variance report in conjunction with external factors, businesses can gain a better understanding of the impact of these factors on their financial performance and make informed decisions accordingly.

Using Conditional Formatting to Highlight Significant Variances

Conditional formatting is a powerful tool that you can use to highlight significant variances. It draws attention to the most important data by automatically highlighting cells that meet certain criteria.

You can use conditional formatting to highlight excessive variances, negative variances, or positive variances, depending on your requirements. This technique simplifies the analysis process and makes it easier to identify potential issues quickly.

Tips for Effective Variance Analysis in Excel

Here are a few tips to consider when conducting variance analysis in Excel:

- Ensure that the data used for the analysis is accurate and reliable.

- Use a consistent format for presenting the report.

- Include visual representations to make the data more accessible.

- Review the report periodically to identify trends and make necessary adjustments.

Avoiding Common Mistakes in Variance Analysis

Common mistakes when conducting variance analysis in Excel include:

- Using incomplete data sets

- Using erroneous calculations

- Not including all relevant data

To avoid these mistakes, always begin with a complete data set, double check your calculations, and ensure all relevant data is incorporated into the analysis.

Best Practices for Interpreting and Presenting Variance Analysis Results

To effectively interpret and present variance analysis results, keep the following best practices in mind:

- Ensure that the report is easy to read and understand by incorporating visual aids.

- Ensure that the report is accurate and reliable.

- Share the report with stakeholders to ensure that everyone is on the same page.

- Identify the root cause of variance and develop an action plan to address the issue.

Automating Variance Analysis with Pivot Tables and Macros

Excel has several features that allow you to automate variance analysis, including Pivot Tables and Macros.

Pivot Tables can help you quickly summarize and analyze large data sets. You can use them to create custom reports from the data, making it easy to identify variances and trends. Macros can automate repetitive tasks, such as formatting reports, saving files, generating invoices, and other activities to help streamline your workflow.

Advanced Techniques for Forecasting and Predictive Analysis using Variance Data

Advanced techniques include using variance data to create forecasts for future performance. Based on historical trends and patterns, you can use the data to make accurate predictions about future performance.

Predictive analysis provides insights into what to expect and enables businesses to make data-driven decisions.

Case Study: A Practical Example of Variance Analysis in Excel.

To illustrate the practical application of variance analysis in Excel, consider the case study of a brick-and-mortar retailer. The retailer wanted to analyze the variance between actual and budgeted sales figures for each of its stores. After conducting a variance analysis, the retailer discovered that one of its stores was consistently underperforming, and the cause was found to be related to the location of the store.

The retailer used this data to develop a data-driven relocation strategy that resulted in the store’s revenue increasing by 20% year-over-year.

Conclusion: The Importance of Incorporating Variance Analysis into Your Business Strategy

Variance analysis is a powerful tool that helps businesses identify strengths, weaknesses, and opportunities for improvement. It can help businesses make informed decisions, optimize financial performance, and plan for the future. With the use of Excel, it is much easier to conduct high-quality variance analysis and draw actionable insights from the data.

By incorporating variance analysis into your business strategy, you can gain a competitive advantage in your industry and drive better decision-making for future success.

By humans, for humans - Best rated articles:

Excel report templates: build better reports faster, top 9 power bi dashboard examples, excel waterfall charts: how to create one that doesn't suck, beyond ai - discover our handpicked bi resources.

Explore Zebra BI's expert-selected resources combining technology and insight for practical, in-depth BI strategies.

We’ve been experimenting with AI-generated content, and sometimes it gets carried away. Give us a feedback and help us learn and improve! 🤍

Note: This is an experimental AI-generated article. Your help is welcome. Share your feedback with us and help us improve.