How To Write a Business Plan for Robo-Advisor in 9 Steps: Checklist

By alex ryzhkov, resources on robo-advisor.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

Welcome to our blog post on how to write a business plan for a robo-advisor in 9 simple steps! If you're interested in joining the ever-growing industry of robo-advisory services, you've come to the right place. With the increasing demand for low-cost investment options and passive investing strategies, the robo-advisor market is booming. In fact, recent statistics show that the industry's assets under management reached a staggering $986 billion in 2020, and are projected to surpass $2.6 trillion by 2025 .

As you venture into this lucrative industry, it's crucial to have a well-thought-out business plan that not only outlines your strategy but also addresses crucial aspects such as market research, target audience, competition analysis, and financial projections. By following our 9-step checklist, you'll be able to develop a comprehensive business plan that sets you up for success .

First and foremost, conducting thorough market research is essential in understanding the current landscape of robo-advisory services. This step involves analyzing industry trends, identifying potential opportunities, and gauging the overall demand for your services.

Next, it's crucial to define your target audience and their specific needs. By understanding your potential clients' preferences, risk tolerance, and investment goals, you can tailor your services to meet their requirements .

Competition analysis is another critical step in developing your business plan. Evaluating your competitors' strengths and weaknesses can help you identify gaps in the market and position your robo-advisor as a unique and valuable offering .

Once you've completed the initial research, it's time to develop your value proposition and unique selling points. What sets your robo-advisor apart from the rest? Highlighting your competitive advantages will help attract clients and differentiate your business .

Of course, determining the right business model and revenue streams is crucial to sustaining your robo-advisory business. Whether you opt for a fee-based model or explore other innovative revenue streams, it's important to carefully consider the financial implications .

Speaking of finances, calculating financial projections and potential risks is a crucial step in any business plan. This involves estimating costs, forecasting revenue, and conducting a thorough risk analysis .

Identifying the necessary resources and potential partnerships is key to ensuring smooth operations. From technology infrastructure to regulatory requirements, outlining the resources you'll need will help you build a strong foundation for your robo-advisor business .

No business plan is complete without a well-developed marketing strategy and sales funnel. By defining your target marketing channels and outlining your customer acquisition process, you'll be able to effectively promote your services to potential clients .

Finally, outlining your operational processes and technology requirements is crucial in ensuring a seamless client experience. From onboarding to portfolio management, clearly defining these processes will help you deliver a top-notch service .

By following these 9 steps, you'll be equipped with a well-rounded business plan that addresses the key aspects of launching and running a successful robo-advisor. So why wait? Start crafting your plan today to take advantage of the booming robo-advisory industry !

Conduct Market Research

Conducting thorough market research is a critical step before starting a robo-advisor business. This step involves gathering and analyzing data to gain insights into the target market, industry trends, and customer preferences. Here are some important considerations for conducting market research:

- Identify your target market: Determine the specific group of investors you aim to serve with your robo-advisor platform. This could include millennials, high-net-worth individuals, or a particular niche market. Understanding their demographics, investment goals, and preferences will help shape your business strategy.

- Analyze market trends: Stay informed about the latest developments in the robo-advisor industry. This includes understanding regulatory changes, emerging technologies, and shifts in consumer behavior. Keep an eye on industry reports, news articles, and studies to stay ahead of the curve.

- Assess market size and potential: Determine the size of your target market and its growth potential. This information will help you assess the viability and potential scalability of your robo-advisor business. It is crucial to identify if there is enough demand for your services to support your growth objectives.

- Evaluate customer needs and pain points: Understand the pain points and challenges faced by potential customers in the investment industry. This could include high fees, lack of personalized advice, or difficulty in accessing professional investment management. Identifying these needs will allow you to tailor your services to address them effectively.

Tips for conducting market research:

- Utilize online surveys, customer interviews, and focus groups to gather valuable insights directly from potential clients.

- Study competitor offerings and their market positioning to identify gaps in the market that your robo-advisor could fill.

- Stay up to date with industry conferences, webinars, and networking events to make connections and gain industry knowledge.

- Consult with industry experts, financial advisors, and professionals who can provide valuable insights and guidance.

By conducting comprehensive market research, you'll be equipped with the necessary knowledge to develop a successful business plan for your robo-advisor platform. It will help you understand your target market, identify opportunities, and ensure that your services are aligned with customer needs.

Define Target Audience and Identify Their Needs

In order to effectively market and tailor your robo-advisor services, it is crucial to clearly define your target audience and identify their specific needs. This step will lay the foundation for developing a successful business plan.

Start by conducting thorough market research to understand the demographics, behaviors, and preferences of potential clients. This will allow you to gain insights on their financial goals, investment preferences, and risk tolerance. Analyze data on age, income level, investment experience, and other relevant factors to pinpoint your target audience.

Once you have defined your target audience, it is important to understand their needs and pain points. Identify what challenges they face when it comes to managing their investments and financial goals . Are they looking for convenient and affordable investment options? Are they seeking a personalized and user-friendly platform? Do they prioritize access to a wide range of investment options?

Understanding your target audience's needs will enable you to develop targeted marketing messages and create a product that resonates with them . By addressing their pain points and offering solutions, you will position your robo-advisor as a valuable tool that can meet their investment needs.

To further refine your target audience, segment them based on specific criteria. For example, you may have different offerings for younger investors compared to retirees. Tailor your marketing strategies and communication channels to effectively reach each segment, ensuring your message is relevant and appealing.

By dedicating time and effort to defining your target audience and understanding their needs, you will be able to develop a robo-advisor business plan that is tailored to your clients' preferences, ultimately increasing your chances of success in the competitive financial services industry.

Analyze Competitors And Evaluate Their Strengths And Weaknesses

When starting a robo-advisor business, it is essential to analyze competitors in the market and evaluate their strengths and weaknesses. This analysis will not only help you understand the competitive landscape but also identify areas where you can differentiate and provide unique value to your target audience.

First, identify your main competitors in the robo-advisor industry. Look for established players who have already gained market share and have a similar target audience. Take note of their offerings, pricing models, and marketing strategies.

- Consider the strengths of your competitors. Identify what they do well and how they differentiate themselves from others in the market. This could include factors like a user-friendly interface, a wide range of investment options, or personalized investment recommendations.

- Highlighting these strengths will help you understand what customers value in a robo-advisor and give you insights into areas where you can improve or provide a unique selling proposition.

Weaknesses:

- Next, evaluate the weaknesses of your competitors. Are there any gaps in their service offerings or areas where they falter? This could be high fees, a lack of transparency, or limited customer support.

- By identifying these weaknesses, you can position yourself to provide a solution or alternative that addresses customers' pain points and stands out in the market.

Tips for analyzing competitors:

- Conduct a thorough analysis of their website, social media presence, and customer reviews to gather valuable insights.

- Take note of any unique features or value-added services they offer to their clients.

- Consider reaching out to their current or past clients for feedback and understanding of their experience.

- Keep an eye on their marketing campaigns and strategies to understand how they attract and retain customers.

Remember, analyzing competitors is not about copying their strategies but rather understanding the market landscape and finding opportunities for differentiation. By carefully evaluating their strengths and weaknesses, you can shape your robo-advisor business to meet the needs of your target audience in a unique and compelling way.

Develop A Value Proposition And Unique Selling Points

Developing a strong value proposition and defining unique selling points is crucial for a successful robo-advisor business. These elements will differentiate your business from competitors and attract potential clients. Here are some key steps to consider:

- Understand client needs: Conduct thorough market research and gather insights about your target audience. Identify their pain points, financial goals, and preferences. This understanding will help you tailor your value proposition to meet their specific needs.

- Highlight benefits: Clearly communicate the benefits clients can expect from your robo-advisor service. This can include features such as cost-effectiveness, convenience, personalized advice, access to diverse investment options, and transparent reporting.

- Emphasize expertise: Showcase your team's expertise and qualifications in the financial industry. Highlight your experience, track record, and any certifications or accolades you have obtained. This will instill trust and confidence in potential clients.

- Offer customization: Differentiate your robo-advisor by offering customized investment portfolios based on clients' risk tolerance, objectives, and time horizon. Highlight your ability to provide personalized investment strategies that align with each individual's financial goals.

- Provide exceptional customer service: Stand out from the competition by emphasizing your commitment to excellent customer service. Offer multiple channels of communication, quick response times, and personalized support. This will foster strong client relationships and loyalty.

Tips for Developing a Compelling Value Proposition:

- Identify your unique selling points by conducting a thorough analysis of your competitors.

- Focus on what sets your robo-advisor apart and how it can address specific pain points in the market.

- Keep your value proposition concise, clear, and easy to understand.

- Use compelling language that resonates with your target audience.

- Continuously monitor the market and adapt your value proposition to remain relevant and competitive.

By developing a compelling value proposition and highlighting your unique selling points, you will attract the attention of potential clients and position your robo-advisor business as a strong player in the market.

Determine The Business Model And Revenue Streams

When establishing a robo-advisor business, it's crucial to determine the right business model and revenue streams. This will lay the foundation for your financial success and sustainability. Your chosen business model will define how you generate revenue and provide value to your clients.

1. Choose the right business model: Select a business model that aligns with your goals, target audience, and the services you plan to offer. The fee-based model, mentioned earlier, is a popular choice for robo-advisors. However, you may also consider a subscription model, where clients pay a fixed amount for access to your services, or a hybrid model that combines both.

2. Determine your revenue streams: Identify the various ways you can generate revenue within your chosen business model. For a fee-based model, your revenue will primarily come from charging a percentage of the assets under management. However, you can also explore additional revenue streams, such as offering premium services or partnerships with financial institutions.

Tips for determining your business model and revenue streams:

- Consider the preferences and financial capabilities of your target audience when choosing a business model.

- Research successful robo-advisors in the market to explore different revenue streams and learn from their strategies.

- Stay flexible and open to adjustments as you gain insights from market feedback and client needs.

- Ensure your revenue streams are aligned with your value proposition and the unique benefits you provide to your clients.

By carefully determining your business model and revenue streams, you will build a robust foundation for your robo-advisor business. This will not only ensure your financial success but also enable you to deliver valuable services to your target audience efficiently and effectively.

Calculate Financial Projections And Potential Risks

One of the crucial steps in writing a business plan for a robo-advisor is to calculate financial projections and assess potential risks. This process allows you to estimate your future earnings and identify possible challenges that may arise along the way. Here are the key aspects to consider:

- Revenue Projections: Begin by estimating your potential revenue streams and forecasting the growth of your client base. Consider factors such as the current market size, potential market share, and the scalability of your business model. Clearly outline the assumptions you have made to arrive at your revenue projections.

- Cost Projections: Identify your fixed and variable costs, including marketing expenses, employee salaries, technology maintenance, and regulatory compliance costs. Ensure that your cost projections align with your revenue projections and allow for sufficient profitability.

- Break-Even Analysis: Determine the point at which your robo-advisor business will start generating enough revenue to cover its costs. This analysis helps you understand the timeframe required to reach profitability and allows for strategic planning.

- Risk Assessment: Assess potential risks that could impact your business, such as regulatory changes, market volatility, or cybersecurity threats. Develop strategies to mitigate these risks and outline contingency plans to address unforeseen challenges.

Tip #1: Seek Expert Advice

- Consider consulting with financial professionals, such as accountants or financial advisors, to ensure the accuracy and credibility of your financial projections.

Tip #2: Regularly Review and Update

- Financial projections are not set in stone and should be reviewed and updated regularly to reflect changing market conditions, business growth, and new opportunities.

By carefully calculating your financial projections and evaluating potential risks, you can strengthen the foundation of your robo-advisor business plan. This step enables you to make informed strategic decisions, attract potential investors, and navigate the dynamic landscape of the financial industry.

Identify Necessary Resources and Partnerships

Before launching a robo-advisor business, it is crucial to identify the necessary resources and partnerships that will drive its success. This step involves taking stock of the essential elements required to operate the business efficiently and effectively.

First and foremost, a reliable and secure technology infrastructure is a foundational resource for any robo-advisor. This includes a robust platform capable of handling client onboarding, investment monitoring, and rebalancing, as well as providing a user-friendly interface for clients to access their accounts. It is essential to assess the scalability and flexibility of the chosen technology to accommodate the growth and evolving needs of the business.

Additionally, access to accurate data and investment research is of utmost importance. This can be achieved through partnerships with reputable financial data providers and research firms. These partnerships can provide the necessary market intelligence and insights to develop and optimize investment strategies.

- A well-equipped and skilled team is also critical. This includes individuals with expertise in finance, compliance, and technology. Hiring professionals with a deep understanding of the regulatory landscape is crucial to ensure compliance with industry standards.

- Consider partnering with custodians and brokerage firms to facilitate the safekeeping and trading of client assets. These partnerships can provide the necessary infrastructure to hold client investments securely.

- Furthermore, maintaining relationships with legal professionals and compliance consultants can help navigate the complex regulatory environment and ensure adherence to applicable laws and regulations.

- Conduct thorough due diligence when selecting technology partners and data providers. Evaluate their track record, reliability, and scalability to ensure they can meet your business requirements.

- Establish clear communication channels and expectations with your partners. Regularly review and assess their performance to ensure alignment with your business goals.

- Seek expert guidance in legal and compliance matters to avoid regulatory pitfalls and maintain the integrity of your robo-advisor business.

By identifying the necessary resources and establishing strategic partnerships, you can position your robo-advisor business for success in an increasingly competitive marketplace. These essential elements will support the delivery of exceptional service, ensuring that your clients' needs are met consistently.

Create A Marketing Strategy And Sales Funnel

Creating a strong marketing strategy is essential for the success of your robo-advisor business. It helps you reach your target audience effectively and generate leads that can be converted into clients. A well-designed sales funnel complements your marketing efforts by guiding potential clients through the buying process.

1. Define your target audience: Before you can create an effective marketing strategy, you need to clearly define your target audience. Understand their demographics, financial goals, and investment preferences. This will help you tailor your marketing messages and campaigns to resonate with them.

2. Develop a compelling value proposition: Your value proposition should highlight the unique benefits and advantages that your robo-advisor offers. Differentiate yourself from competitors and clearly communicate why potential clients should choose your service.

3. Choose the right marketing channels: Identify the most effective marketing channels to reach your target audience. This may include digital advertising, content marketing, social media, email marketing, or strategic partnerships. Focus on channels that provide the highest return on investment for your business.

4. Craft persuasive marketing messages: Develop compelling and persuasive messages that communicate the value of your robo-advisor. Clearly articulate how your service can address the specific needs and pain points of your target audience. Use persuasive language and highlight the unique features of your offering.

5. Build a sales funnel: A sales funnel is a systematic approach to guide potential clients through the buying process. It typically includes stages such as awareness, interest, consideration, and conversion. Use various marketing tactics and tools to nurture leads and move them closer to becoming paying clients.

Tips for creating an effective marketing strategy and sales funnel:

- Use data analytics to monitor and optimize the performance of your marketing campaigns.

- Personalize your marketing messages to make them more relevant and engaging for your target audience.

- Utilize marketing automation tools to streamline and automate your marketing processes.

- Consistently evaluate and refine your marketing strategy based on the feedback and results you receive.

By creating a comprehensive marketing strategy and well-designed sales funnel, you can effectively promote your robo-advisor business and attract a steady stream of clients. Remember to regularly review and adapt your strategy to stay ahead in the dynamic financial services industry.

Outline Operational Processes And Technology Requirements

When it comes to running a successful robo-advisor business, having efficient operational processes and the right technology infrastructure are critical. Here are some key considerations for outlining your operational processes and technology requirements:

1. Client Onboarding: Develop an automated process for onboarding new clients. This should include gathering necessary client information, conducting risk assessments, and providing a seamless account setup process.

2. Portfolio Construction: Define the criteria and algorithms that will be used to construct client portfolios. This may involve determining asset allocation strategies, rebalancing criteria, and considering any investment restrictions or preferences.

3. Trade Execution: Consider how trades will be executed and how often rebalancing will occur. Evaluate whether you will partner with a brokerage firm or utilize an in-house trading platform.

4. Reporting and Communication: Determine how you will provide regular updates and performance reports to clients. This may involve offering online dashboards, personalized notifications, and periodic communication from the advisory team.

5. Compliance and Security: Ensure that your operations adhere to industry regulations and data security standards. Implement robust compliance monitoring processes and prioritize the protection of client data.

6. Scalability and Growth: Consider the scalability of your operational processes and technology infrastructure as your robo-advisor business grows. Assess whether your systems can handle increasing client volumes without compromising efficiency and quality.

- Regularly review and update your operational processes to adapt to changing market conditions and regulatory requirements.

- Invest in reliable and secure technology platforms that can support the growth and complexity of your business.

- Consider partnering with technology providers or outsourcing certain operational tasks to streamline your processes and enhance efficiency.

- Train your team on the proper utilization of technology tools and systems to maximize productivity and minimize errors.

By outlining your operational processes and technology requirements early on, you can ensure that your robo-advisor business runs smoothly and efficiently, providing a seamless experience for your clients. Investing in the right technology infrastructure and focusing on operational excellence will enable you to deliver outstanding financial services while differentiating yourself in the competitive robo-advisor market.

In conclusion, writing a business plan for a robo-advisor requires careful consideration of various factors and steps. By conducting market research, defining the target audience, analyzing competitors, and developing a value proposition, you can create a strong foundation for your business. Additionally, determining the business model, calculating financial projections, and identifying necessary resources and partnerships will help ensure your robo-advisor venture's success.

Creating a marketing strategy, outlining operational processes, and understanding the technology requirements are key elements in attracting and retaining clients. Ultimately, with a well-executed business plan, you can position your robo-advisor as a reliable and cost-effective option for investors looking for passive investment management and financial advice.

- Conduct market research

- Define target audience and identify their needs

- Analyze competitors and evaluate their strengths and weaknesses

- Develop a value proposition and unique selling points

- Determine the business model and revenue streams

- Calculate financial projections and potential risks

- Identify necessary resources and partnerships

- Create a marketing strategy and sales funnel

- Outline operational processes and technology requirements

By following this checklist and tailoring it to your specific robo-advisor, you can establish a solid foundation for your business and attract investors seeking a low-cost, passive investment option.

$169.00 $99.00 Get Template

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

- Get 7 Days Free

The Best Robo-Advisors of 2023

Understand the ins and outs of digital advice and see our top picks.

Digital investment advice is booming. As access to these services has increased, so have investors' questions about their suitability , cost , and range of offerings.

Digital investing platforms, or robo-advisors, offer financial advice and limited human interaction. This combination of services is becoming increasingly appealing, thanks to Generation Z 's ability and preference to handle its finances online, the pandemic-driven shift to virtual interactions with advisors , and increasing interest in novel assets like cryptocurrency.

In a report with my colleagues Alec Lucas, Dan Culloton, David Kathman, Drew Carter, Elizabeth Templeton, Gabriel Denis, and Lan Anh Tran, we took a closer look at what the top robo-advisors can (and can't) do and the type of investors who could benefit from using one. And if robo-advisors sound like a good fit, consider our list of top providers to better understand the options that could work for you.

You can also dive deeper into the details in the full research report .

IN THIS ARTICLE

What is a robo-advisor, are robo-advisors worth it for you, the drawbacks of robo-investing, who are the best robo-advisors, robo-advisor assessments, how we analyzed robo-advisors.

Robo-advisors occupy a middle ground between a wealth manager and a do-it-yourself trading platform.

For example, robo-advisors use computer algorithms to provide low-cost asset allocation and build automated investor portfolios. They offer more specificity than the straightforward trade execution of a brokerage platform but not as much as the personalization you'd get from a living, breathing wealth manager.

Robo-advisors also offer financial goal planning at a basic level. That means more customization than you'd see from a brokerage platform but not as much as from a live financial advisor.

This semitailored approach can be a good fit for early- to midcareer investors who want to further their investment strategy but don't have the means, need, or interest to engage a traditional financial advisor.

This group of investors would benefit from robo-advisors that offer :

- Lower fees . Perhaps the greatest appeal of robo-advisors is their substantially lower price tag for advice. Of the 20 providers we reviewed, the median advisory fee was 0.25%. Financial advisors tend to have advisory fees around 4 times that amount—about 1%—which is a greater burden on individuals investing less money.

- Lower account minimums. These substantially reduce barriers of entry to investing. Five of the 20 robo-advisor platforms we reviewed have no account minimum (or close to zero) for their most basic services, and nearly every other provider has a minimum of $5,000 or less. On the other hand, research from Cerulli Associates shows that only 7% of financial advisors focus on serving individuals who invest less than $100,000.

- Strategies to minimize taxes. Several robo-advisors we reviewed include the option to sell underperforming investments at a loss to offset taxes owed from other, higher-performing securities. This sophisticated strategy, known as tax-loss harvesting , speaks to the breadth of services and tax efficiency that these providers can offer at a lower price point.

If you’re still learning the basics about investing and are intimidated by making decisions independently (and looking to invest a good amount), it might be smart to work with a human advisor who can take the lead and guide you through the ins and outs of their decision-making.

Investors with larger, more complex portfolios could also benefit from the support of a traditional financial advisor. That’s especially true for complex matters like insurance and risk management , estate planning , and retirement drawdown strategies .

Other factors could also complicate a portfolio. For instance, if you have a family member with a disability , you could likely benefit from one-on-one guidance around a special-needs trust or ABLE account.

Our assessment focused on the factors that most directly help investors reach their financial goals: fees, quality of portfolio construction and investment advice, and financial planning tools.

Read on to see our take on the leading robo-advisors.

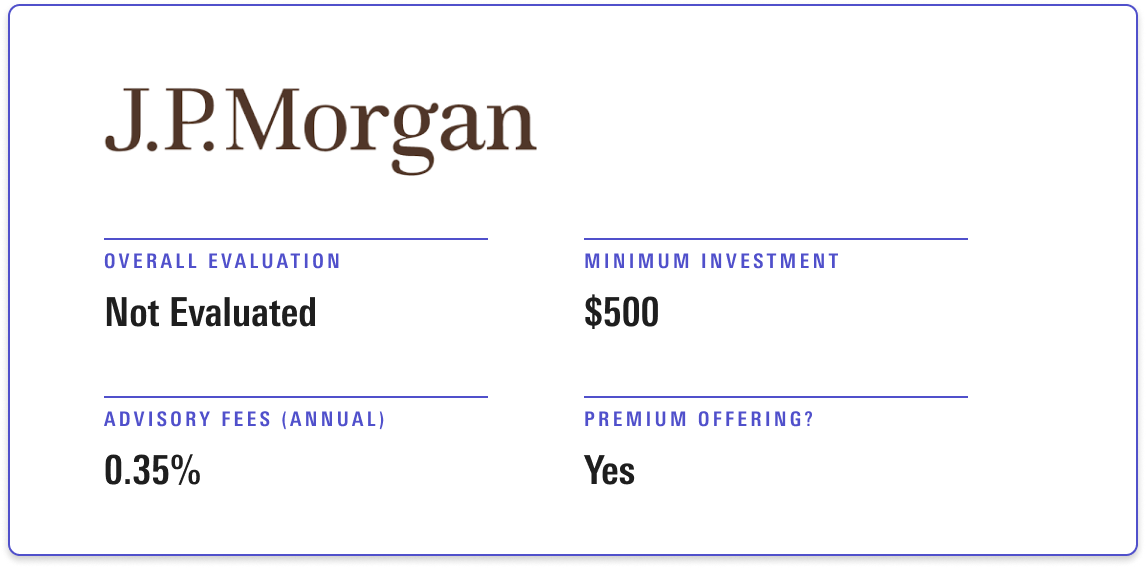

These are condensed versions of our assessments; you can explore the complete evaluations in our 2023 Robo-Advisor Landscape report . (We didn't evaluate Ellevest or J.P. Morgan Automated Investing because of potential conflicts of interest.)

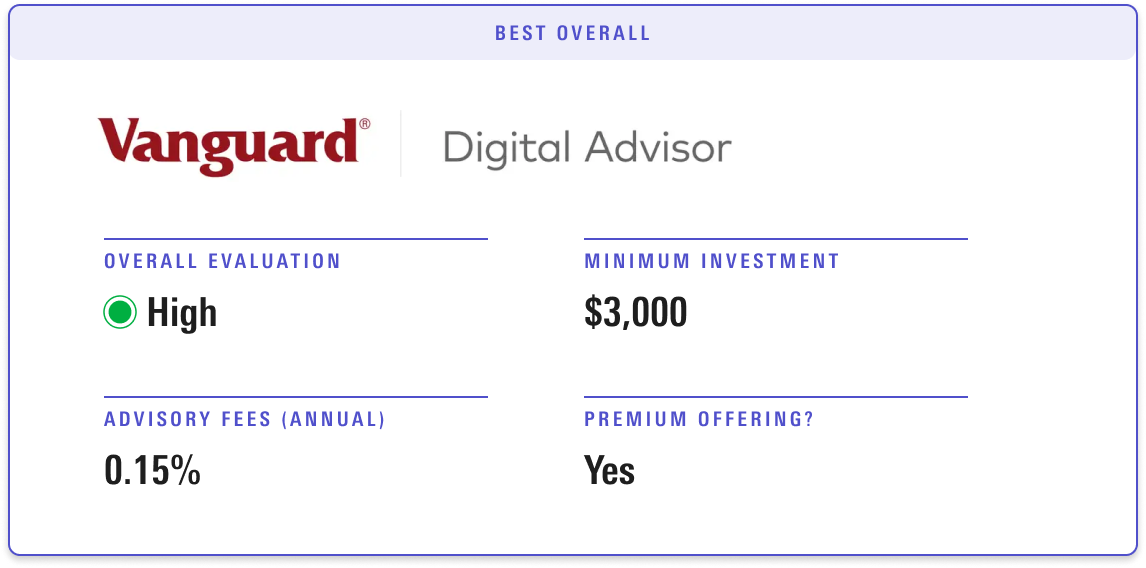

Vanguard Digital Advisor

Fee assumes a $15,000 account balance. Advisory Fee for Premium Customers: Starting at 0.30%. Data as of March 31, 2023.

Vanguard Digital Advisor and its hybrid sibling Vanguard Personal Advisor Services, which combines automation with human expertise, once again earn the top spot among the robo-advisors we surveyed. In fact, Vanguard has extended its lead through multiple enhancements.

In recent years, Vanguard has introduced environmental, social, and governance options, active equity and fixed-income funds, and a municipal-bond strategy. Tax-loss harvesting is now available to all advice clients, who also benefit from tax-efficient implementation, including a completion methodology that helps investors avoid realizing capital gains on existing holdings.

Vanguard's portfolio construction approach combines relative simplicity with customization. It offers more than 300 glide paths, based on an investor's needs, and updates the path annually as model inputs change.

Vanguard also offers an impressive array of planning tools, including outside account aggregation, custom goal planning, debt planning, a rainy-day tool, a healthcare estimator, and Medicare match. Clients with at least $50,000 can opt for the hybrid Personal Advisor Services offering for a 0.30% annual advisory fee (not including underlying fund fees) and have unlimited access to a pool of certified financial planners, who can further customize their portfolios around non-Vanguard fund holdings and individual stock ownership. Clients with higher asset levels are eligible for additional, more-customized planning services.

Vanguard isn't flawless. Some clients have complained about customer-service issues, and its "Invest for Amex by Vanguard" partnership has a higher pricing structure, which runs counter to Vanguard's generally rock-solid commitment to keeping pricing low and avoiding layered fees. This relatively minor issue aside, Vanguard continues to set the standard for low-cost digital financial advice.

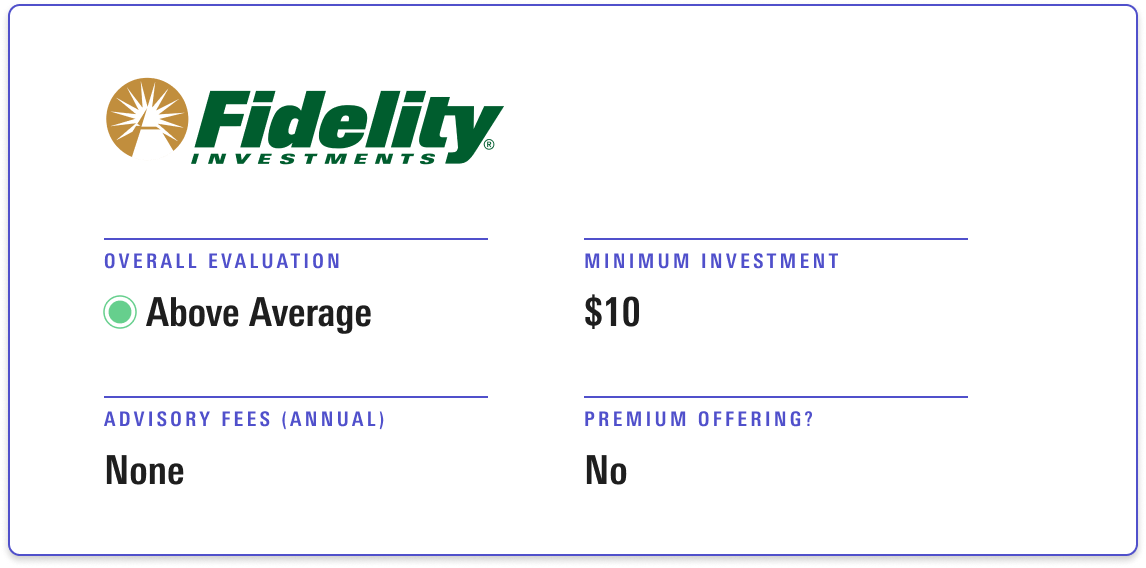

Fidelity Go

Fee assumes a $15,000 account balance.

Investors are automatically opted in to a 0.35% asset-based fee as soon as assets reach $25,000. Data as of May 31, 2023.

Fidelity Go stands out for its simple, straightforward approach that draws on Fidelity's strong global research and asset-allocation team.

Fidelity uses information from a relatively thorough risk-tolerance questionnaire to map investors to a taxable or retirement-focused portfolio, and each portfolio includes seven different risk levels. The portfolios all focus on a short list of core asset classes; esoteric asset classes or ESG-focused strategies aren't part of the offer.

The service also offers ongoing support. Text alerts and other communications let customers know how they are progressing with their goals, as well as provide behavioral nudges to encourage long-term investing. Fidelity Go does not currently offer tax-loss harvesting.

All Fidelity Go participants have access to tools for spending and debt management, while those with balances above $25,000 also get unlimited advice and planning calls. Users can choose from a menu of coaching solutions focused on different topics, including retirement planning and budgeting. In contrast to Betterment and Schwab, not all its financial advisors hold the CFP designation, though most do.

Schwab Intelligent Portfolios

Fee assumes a $15,000 account balance. Advisory Fee for Premium Customers: $300 one-time planning fee plus ongoing fees of $30 per month . Data as of May 31, 2023.

Schwab's robo-advisor program narrowly misses greatness.

The portfolio-construction process has several strengths. It uses an extensive risk-tolerance questionnaire to match investors with portfolios designed for one of 12 risk levels. Plus, the portfolios provide comprehensive asset-class exposure, including both U.S. and international large- and small-cap stocks, gold, Treasury Inflation-Protected Securities, REITs, corporate bonds, mortgages, Treasuries, high-yield bonds, muni bonds, world bonds, and emerging-markets debt. And the underlying investments are solid, while Schwab's approach to constructing portfolios, rebalancing to limit risk, and managing tax considerations is thoughtful.

Despite the portfolios' strengths, excessive cash allocations are an Achilles' heel. Cash allocations range from 6% to 30% of assets depending on the portfolio's risk level. This cash buffer was a positive in 2022's bear market, but has led to lower returns over longer periods .

Even with cash yields having reached above 5% as of early June 2023, above-average cash allocations will likely lead to lower returns over time.

Schwab Intelligent Portfolios Premium suffers from the same cash issue but otherwise has considerable merit. Investors with at least $25,000 have unlimited access to a financial planner holding the CFP designation. The service offers comprehensive financial planning, including advice on mortgages, college savings, retirement savings, retirement income, and budgeting.

Even with this flaw, Schwab still ranks among the best robo-advisoroptions, especially for investors with enough assets to benefit from itscomprehensive advice on financial planning and retirement income .

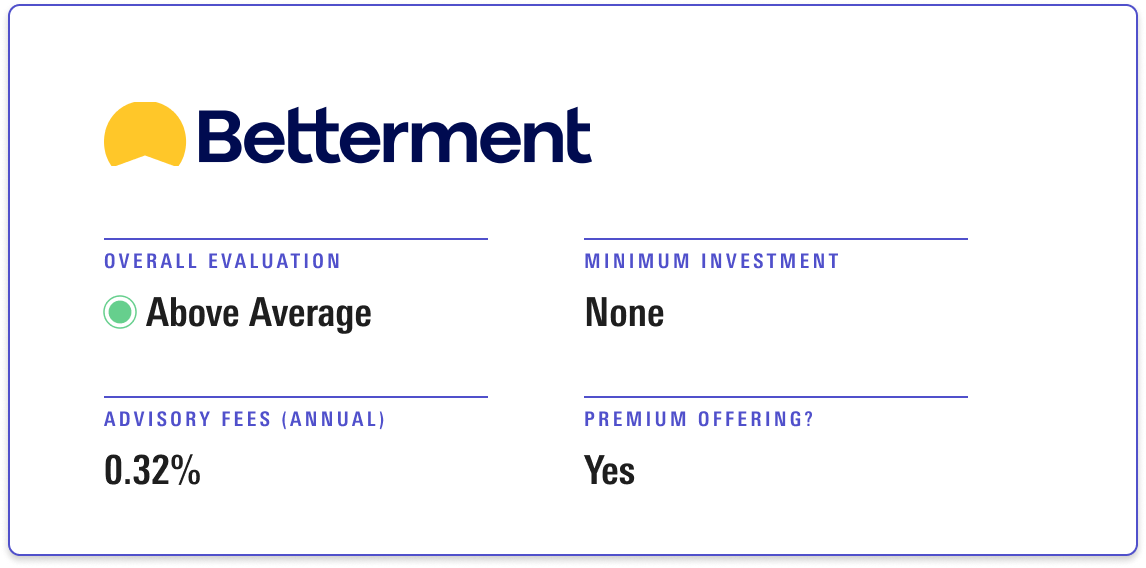

Betterment charges $4/month for accounts less than $20,000. However, that fee converts to 0.25% a number of ways, including with a $250/month automated deposit into a Betterment account at any balance. Advisory Fee for Premium Customers: 0.40%.

Data as of May 31, 2023.

Betterment's array of services and value set it apart, but investors would be better served sticking to its core offering and avoiding its gimmicky extras like cryptocurrency.

Betterment is one of the few robo-providers that employs a glide path, which gradually adjusts the portfolio's asset mix to become more conservative over time. Portfolio construction is sensible and well-thought-out: The main Core Portfolios series offers a mix of low-cost ETFs with exposure to several major asset classes. Betterment also offers a range of other portfolios beyond its core offering.

Betterment has a wide range of services, especially given its below-average price tag. Advice is part of the offer, too, and investors who use multiple banking and investment accounts can get holistic help with retirement investing, goal planning, and prioritizing various accounts. Although on-demand access to an investment advisor is reserved for Betterment Premium, clients can also pay hourly for advice on specific situations, such as retirement planning, general financial advice, college savings, marriage planning, and other topics.

Investors should be aware Betterment was fined $9 million in April 2023 after the SEC found the firm had not disclosed tax-loss-harvesting program changes and coding errors that cost about 25,000 clients a combined $4 million from 2016-19. A long-running error in a robo's algorithms is concerning, as is the lack of disclosure here.

Still, Betterment offers robust core investment and financial planning options at reasonable costs, and its website gives investors plenty to read before they invest. It's a strong competitor, especially for investors looking for a clean, easy-to-use interface.

Wealthfront

Fee assumes a $15,000 account balance. Data as of May 31, 2023.

Wealthfront has many strengths, but some strategic shifts and questionable allocations hold it back.

One strength is its low cost. The quality of the underlying funds is also generally strong; the majority of funds used in Wealthfront's portfolios receive Morningstar Medalist Ratings of Gold or Silver. The service includes a thorough questionnaire that incorporates behavioral economics research to evaluate both risk tolerance and risk capacity.

Wealthfront also has taken a thoughtful approach to tax-loss harvesting by incorporating direct indexing, which enables it to harvest losses at the individual stock level. It embraces a "play to learn" philosophy that allows investors to buy and sell individual stocks but still encourages them to build diversified portfolios.

Wealthfront slots investors into a portfolio matching one of 20 risk levels and spanning three account types: taxable, retirement, and socially responsible investing. Customers also have access to financial planning tools for spending, savings, income growth, inflation, Social Security, taxes, college planning, and home equity.

Still, some of Wealthfront's strategies seem driven by popular but not necessarily prudent investment trends. Many of its portfolios are on the aggressive side, and Wealthfront allows investors to put up to 10% of their assets in cryptocurrency funds.

Wealthfront had previously agreed to be acquired by Swiss banking giant UBS, but the two firms have now mutually agreed to terminate their merger agreement.

SigFig is a lean offering that doesn't sport the same scale of resources as some of its competitors, but it checks most of the right boxes for a robo-advisor.

SigFig's management fee is reasonable, and the program is free for accounts with less than $10,000. It uses a suite of low-cost ETFs for its portfolios but does not waive or return fees on these holdings.

SigFig's portfolio construction approach is simple but sensible. Allocations are strategic and updated periodically depending on the market environment and SigFig's capital markets assumptions. They are generally reasonable, with equity allocations for taxable portfolios ranging from 26% to 90% of assets, depending on the risk level, and 13% to 85% for retirement portfolios. However, all tax-deferred portfolios include allocations to riskier asset classes, such as emerging-markets debt and REITs. In addition, the portfolios only rely on one broad index for U.S. stock exposure.

The service has some weaknesses. It doesn't provide advice for multiple investment goals and lacks more-dedicated educational resources that could help clients make SigFig their "one-stop shop." The privately held firm's focus on partnering with larger corporations like UBS and Wells Fargo raises questions about whether it will remain independent. SigFig's small size and limited revenue base could make it a more likely acquisition target than some of its peers.

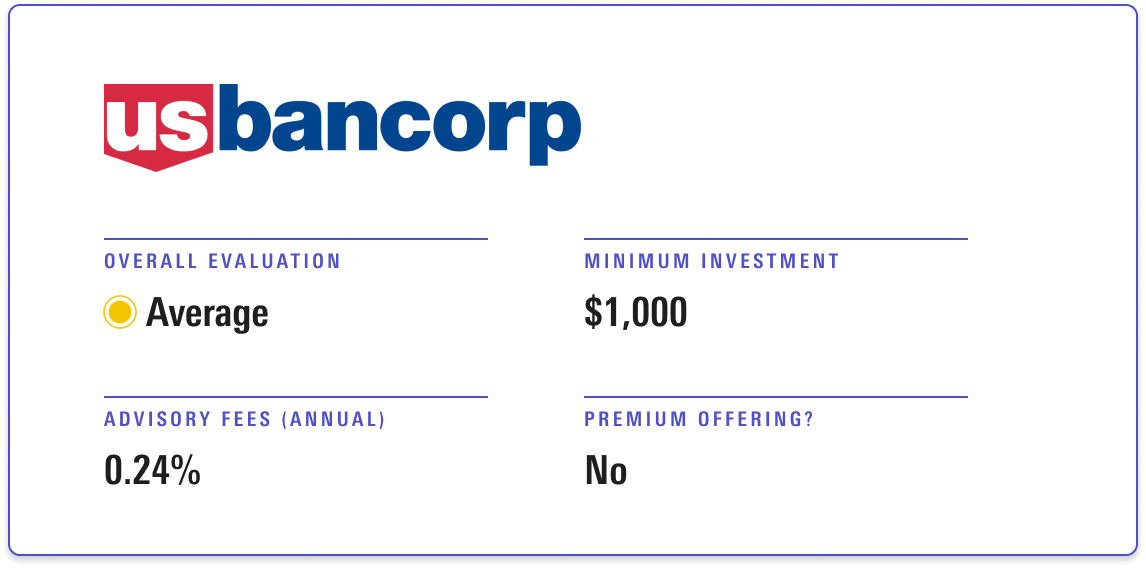

U.S. Bancorp Automated Investor

U.S. Bancorp Automated Investor is a straightforward offering that delivers on its simple promises .

Client portfolios are sorted into varying allocations of global equity and U.S. fixed-income ETFs according to goals and risk level, which is adequately granular.

Well-constructed portfolios stand out as the service's strong point. The service automatically applies glide paths for clients with a retirement or major purchase goal, a useful yet rare feature among most providers. This scales down the portfolio’s equity exposure as the end date approaches to limit risk and maximize capital preservation.

The portfolios' underlying funds consist of low-cost, third-party ETFs tracking sensible indexes, which provide access to a standard range of asset classes. Nontaxable and tax-efficient portfolios are well-diversified, and U.S. Bancorp does not put clients' assets in any gimmicky products or niche market areas.

U.S. Bancorp also provides automatic rebalancing and tax-loss harvesting. However, the service lacks some other core features such as retirement withdrawal advice or outside account aggregation that prevent it from being a one-stop shop for clients.

The service is currently only available to existing U.S. Bank customers, though the firm does plan to open the platform to nonbank customers in the near future.

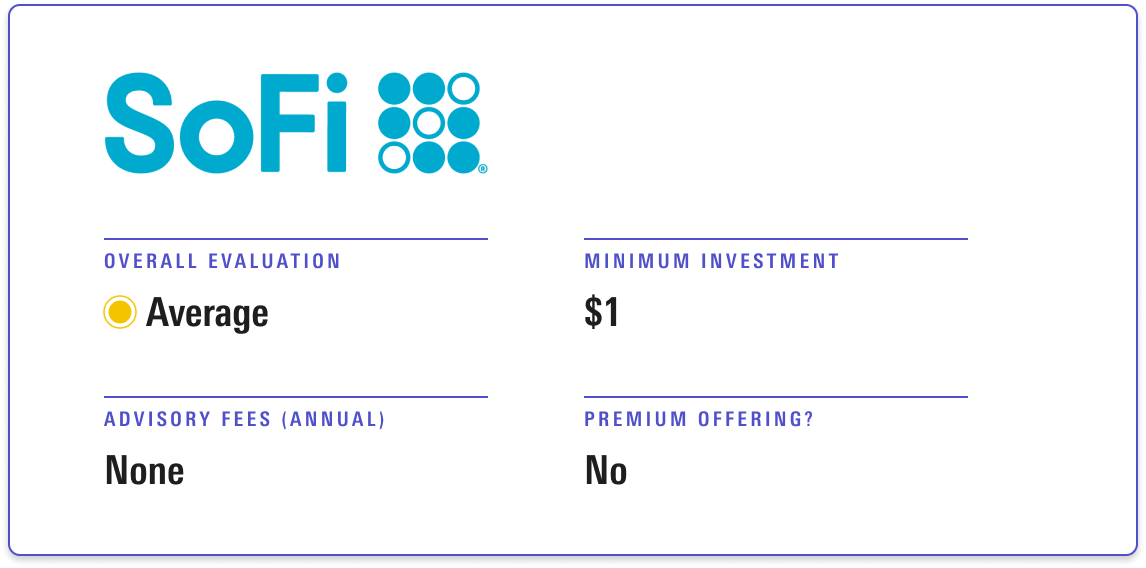

SoFi Wealth

While SoFi's access to financial planning and low cost of entry are attractive, the service has some questionable features that damp its appeal.

SoFi includes five different equity/fixed-income allocations according to a client's risk tolerance, but the firm's two proprietary ETFs are still used as the main equity exposure. SoFi has recently been waiving the annual fees for these ETFs, but if those waivers expire, their expense ratios would no longer be in line with SoFi's low-cost claims. In addition, these ETFs have an inherent growth bias that might not be suitable for a core equity allocation.

Originally a student loan refinancing service, SoFi has expanded into personal loans, mortgages, banking services, and insurance. As a result, the company's strategy for personal finance products seems focused on monetization through cross-selling as much as serving investment needs.

SoFi clients can access financial advisors by phone, virtual meetings, and electronic messages at no extra charge. SoFi also provides an online library of articles on a broad range of topics including goals, saving, investing, budgeting, debt repayment, home buying, and insurance. However, these articles also seem to double as marketing for its various personal finance services.

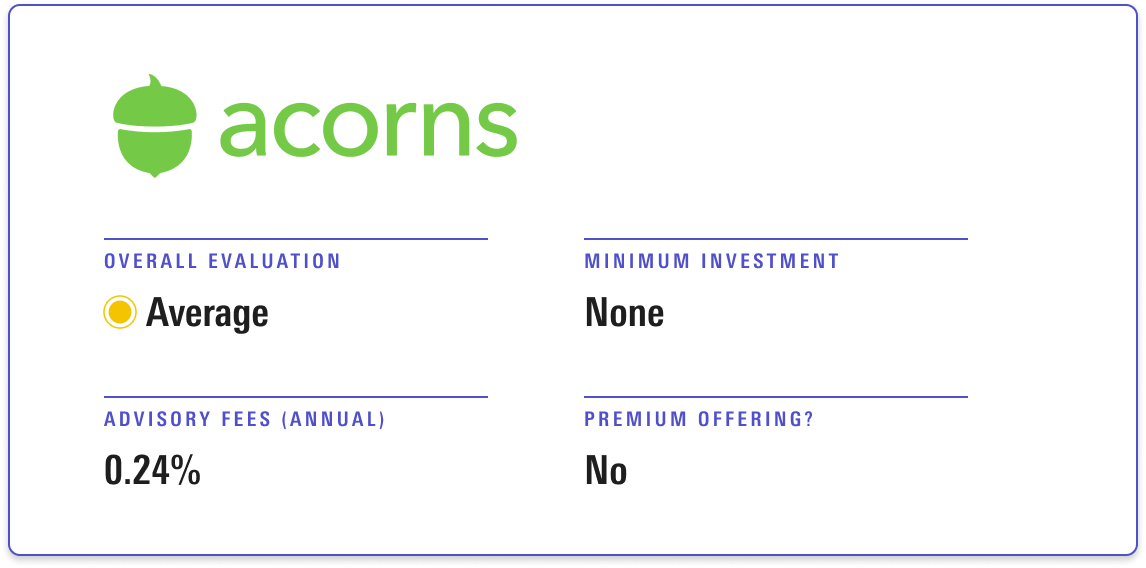

With no investment minimum and a straightforward investment approach, Acorns is easily accessible for beginning investors. But it doesn't quite live up to the hype.

It stands out for its focus on micro savings, with features that help investors round up spending on everyday purchases to build an investment balance. It also offers an "Earn Program" that provides rebates on purchases made through select companies. However, its subscription-based pricing model is relatively pricey given its target audience.

Acorns offers a small number of portfolios corresponding to different risk levels (five core portfolios and four SRI portfolios). Asset allocation is straightforward, and the quality of the underlying investments (mainly from iShares, Vanguard, J.P. Morgan, and Goldman Sachs) is above average. However, investors can now opt into a bitcoin ETF with up to 5% of portfolio assets or directly invest in stocks with up to 50% of their assets.

Acorns is also lacking in features. It offers automatic rebalancing but no tax-loss harvesting and few if any planning-related features. Some of the features it does have are suboptimal. For example, customers can set up an emergency fund, but it's a non-interest-bearing demand deposit. With other cash options now yielding 5% or more, this option is less appealing for cash savings .

Wells Fargo Intuitive Investor

Wells Fargo Intuitive Investor is a middle-of-the-road offering that has seen some improvements over the past year.

While not as robust as some competitors, it's not a bad choice for existing Wells Fargo clients. The program's asset-based fee is relatively high, though they've lowered the investment minimum considerably.

Wells Fargo uses the proprietary portfolio management algorithm from SigFig for ongoing monitoring, rebalancing, and tax-loss harvesting. Investors can choose from Wells Fargo's nine investment portfolios based on their answers to a risk-tolerance questionnaire.

The portfolios are intended to be well-diversified, cost-effective, and supportive of a long-term investment philosophy that shies away from niche products. Portfolio allocations are reasonable, with minimal cash allocations and adequate exposure to major asset classes.

Access to a financial advisor and tax-loss harvesting is a clear advantage. Goal-oriented resources are intended to help investors stay on track, and the platform has made some efforts to offer educational content for beginning investors, but it doesn't offer anything more extensive such as investment calculators or methodology whitepapers.

Ally Invest

Fee assumes a $15,000 account balance. Advisory Fee for Premium Customers: Between 0.75% and 0.85%. Data as of May 31, 2023.

Ally Invest still has some attractive features for Ally Financial banking customers, but it has otherwise lost ground to rivals owing to a lack of new features.

Ally's experienced investment team has put together 32 portfolios that rely on inexpensive Vanguard and iShares ETFs and come in two basic types: Market Focused (2% cash allocation), which has an annual advisory fee, and Cash Enhanced (30% cash allocation), which has no advisory fee. Each type has a core, tax-optimized, and ESG version. Allocations within each version vary based on one's risk profile.

In May 2022, Ally launched a wealth management service. It includes access to a dedicated human advisor alongside the digital advisor for a tiered fee: 0.85% for a household's first $250,000 in assets, 0.80% for its next $750,000, and 0.75% for assets exceeding $1 million. Those fees, however, are steep compared with the premium offers of best-in-class rivals Betterment, Fidelity, and Vanguard.

Ally has a few other weaknesses to address. Tax-loss harvesting isn't yet an option, and investors can't aggregate outside accounts or plan for multiple goals. Investors are also defaulted into the Cash Enhanced portfolios, whose 30% cash allocation may earn a competitive rate relative to other high-yield savings accounts but will struggle to keep up with inflation.

Merrill Guided Investing

Fee assumes a $15,000 account balance. Advisory Fee for Premium Customers: Between 0.70% and 0.85%. Data as of May 31, 2023.

Merrill Guided Investing and its premium cousin Merrill Guided Investing with Advisor lack feature advantages that justify their higher price tags relative to more comprehensive robo-advisor offerings.

Portfolio construction is fairly standard, but there are a few sticking points. The firm offers five levels of risk tolerance, with tax-aware and taxable options as well as an ESG suite for each of these risk levels. However, the firm's risk-tolerance questionnaire is less detailed than most. Merrill tilts its portfolios—composed almost exclusively of low-cost ETFs—toward certain asset classes, such as value stocks, and away from others based on firmwide capital market assumptions. These active asset-class decisions add uncertainty as they could help or hurt in any given year.

Merrill Guided Investing with Advisor offers the additional option of investing in hybrid active/passive portfolios of the three options listed above that supplement certain asset-class exposures with actively managed funds. However, it is difficult to recommend the active options used as Merrill no longer allows nonclients to access these composite portfolios.

What sinks this offering is its dearth of additional features, especially when considering its high fee and its lack of integration with Bank of America's more extensive, and impressive, research and educational offerings on its brokerage platform. Features like tax-loss harvesting or integration of external accounts, which differentiate more compelling offerings, are not present here. Merrill Guided Investing with Advisor, too, is somewhat misleading, as it provides access only to Series 6 and Series 7 certified "financial consultants" rather than CFP-certified advisors; clients who want access to those must unenroll from this program and reenroll in one of Merrill's managed account or advisory relationship offerings.

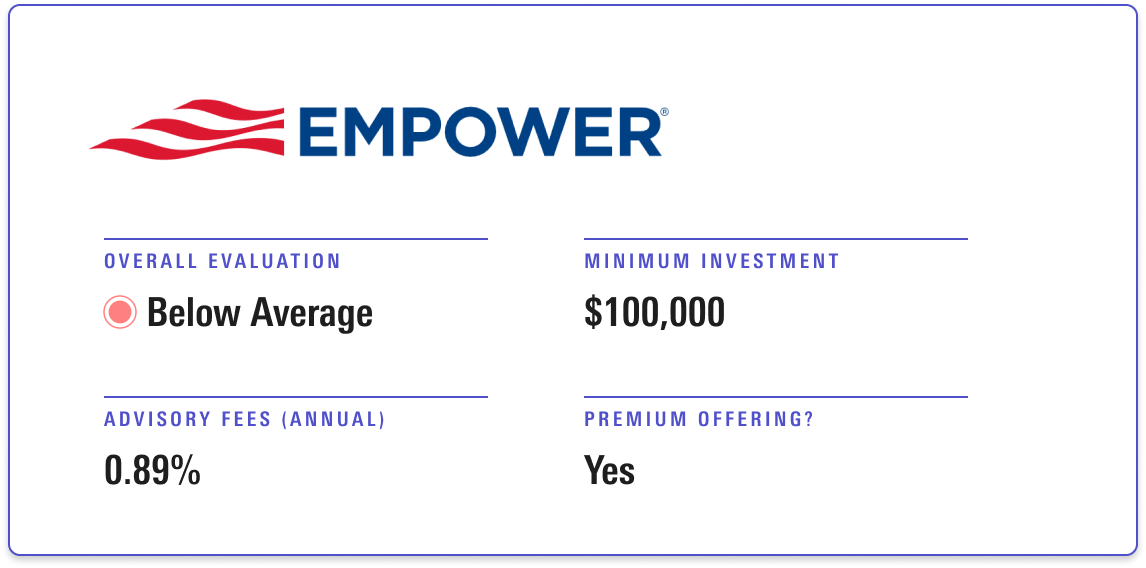

Empower Wealth/Personal Capital Investing

Fee assumes a $15,000 account balance. Advisory Fee for Premium Customers: Between 0.49% and 0.89%. Data as of May 31, 2023.

Formerly the financial technology upstart Personal Capital, Empower Personal Wealth is now ensconced in a North American insurance and asset-management conglomerate. Though it arguably helped create the category, Empower now does not consider itself a robo-advisor but rather a comprehensive wealth manager that uses digital tools to reach and serve the mass affluent. The digital component of its services, however, makes it a hybrid offering that falls within the scope of this report.

Empower opted out of our robo-advisor survey, which limits the information available to what can be gleaned from public disclosures. It is hard to gauge the relative attractiveness of Empower Personal Wealth's offering without its survey results or an interview. Based on publicly available information, however, it offers a comprehensive range of services, albeit for a steep fee.

Those with less than $250,000 in assets can expect more-basic options—essentially ETF portfolios based on client goals and risk tolerance. Those with $250,000 to $1 million get more comprehensive advice, including a dedicated certified financial planner and customized portfolios that include individual securities. At higher levels of assets, the firm layers in private banking and estate planning. Individuals and families with more than $5 million can invest in private equity.

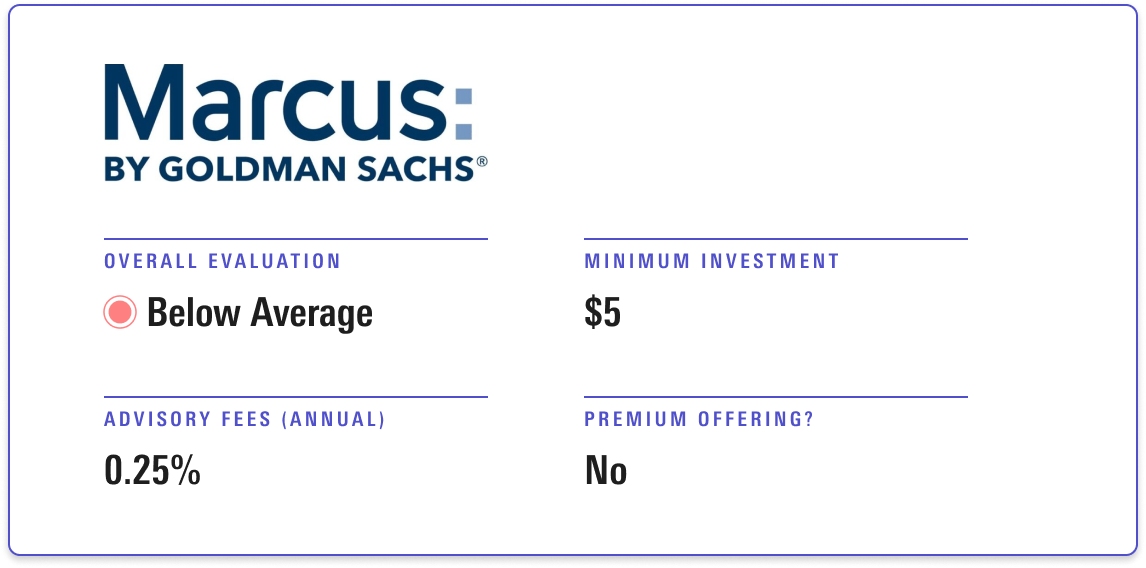

Marcus Invest

Lowering fees was a plus, but transparency is lacking, and Goldman Sachs' retreat from its Marcus consumer platform in early 2023 leaves this offering well behind its competitors.

Clients can choose from three investment styles: core, ESG, and smart beta. Each style has the same asset-class allocations but uses different ETFs to populate the portfolios. Established Goldman Sachs teams design and execute the portfolios, which are based on investors' stated time horizons and risk tolerances. Once investors receive a recommended portfolio, they have the option to go with that portfolio or seek out a new recommendation.

Marcus Invest lacks features like financial planning advice and tax-loss harvesting that come with top robo-advisors, but poor portfolio transparency and the offering's viability are larger concerns. Goldman doesn't share allocation information with nonclients, which leaves would-be investors in the dark on issues such as how much may be allocated to emerging markets in different portfolios. Further, when Goldman splintered its consumer business in October 2022, it announced a strategic pivot away from its Marcus platform. In February 2023, the firm said it would sell off part of its personal-loan book. Robo-advice appears safe for now, but the retreat from a consumer-focused business raises some uncertainty for investors here.

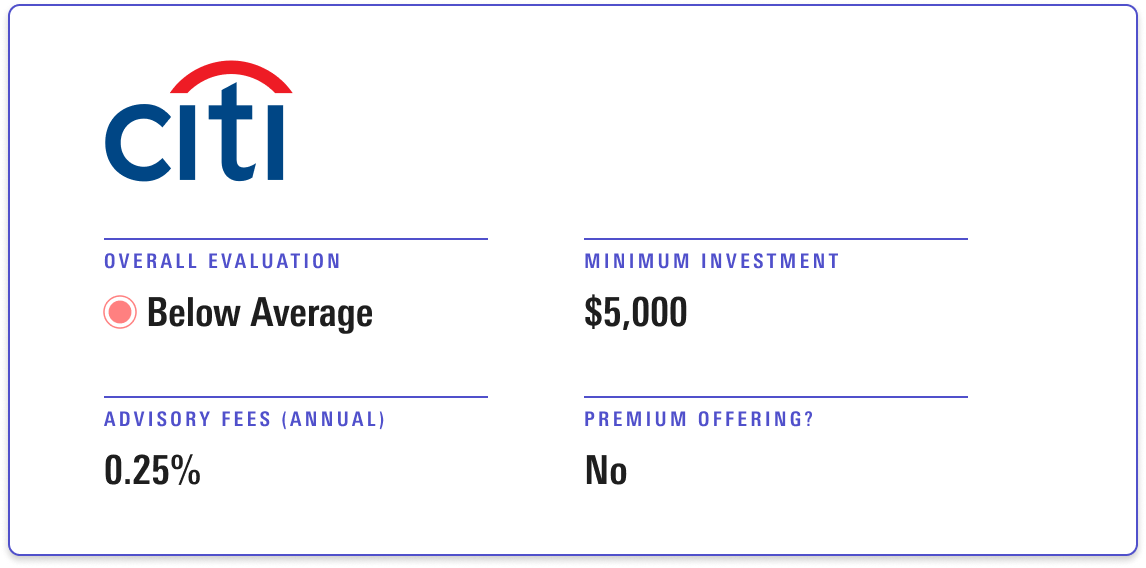

Citi Wealth Builder

Citi Wealth Builder's limited range of planning-related services and the uncertainty owing to a recent change in leadership make it a less competitive player in the robo-advisor space.

Portfolio construction at Citi does not reflect the same level of consideration as competing offerings. The digital platform offers three categories of portfolios, including index-tracking portfolios,

sustainability-focused portfolios, and actively managed portfolios. Specific risk profiles are not disclosed, but clients are placed into one of five portfolios based on their investment preferences. The portfolios invest in stocks, bonds, and short-term investments, and clients must have a Citibank checking account to open an account. Citi does not provide further insight into its asset-allocation process or underlying funds, leading to a basic service that lacks transparency.

On the positive side, fees for this service are comparatively low and have come down recently. However, the fee waiver on the underlying strategies was removed, which could increase the offering's overall cost.

Clients can contact a financial coach at any point, but the service does not advertise financial planning capabilities and seems more service- than advice-oriented. Additionally, tax-loss harvesting is not available. Like other robo-advisors offered by banks, this service appears to be a small part of the wealth management universe and potentially a way to get clients in the door for other services.

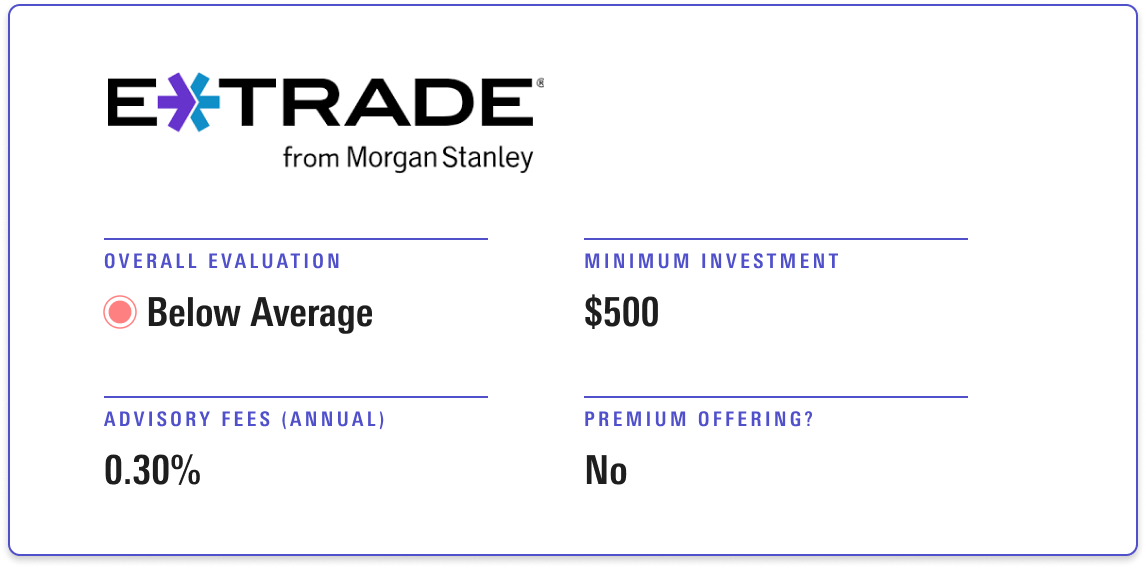

E-Trade Core Portfolios

E-Trade Core Portfolios meets industry standards in some respects, but it lacks transparency.

The service's advisory fee is in line with most competitors', but it does not include the underlying ETFs' expense ratios. Because the firm doesn't divulge which ones it uses or their relative weightings, it is impossible to calculate total costs.

This lack of transparency also makes it difficult to ascertain the effectiveness of the firm's portfolio-construction methodology. Though E-Trade now relies on Morgan Stanley's considerable macro research capabilities for capital market assumptions on key asset classes, the investment team that builds the firm's portfolios hasn't changed. Though the firm states it employs mostly cheap, beta-focused ETFs from third-party providers, it's hard for potential investors to verify the claim without a full list of holdings.

The portfolio assignment process is also a mixed bag. After going through a short risk questionnaire, E-Trade assigns clients to one of six target risk portfolios, ranging from aggressive to conservative. It does not consider risk capacity or adjust client portfolios based on time horizon or investing goals.

E-Trade plans to add features, such as tax-loss harvesting, but the service still lacks other compelling features such as integrated goal-planning across a variety of internal and external accounts and a way to seek more comprehensive counsel from financial advisors

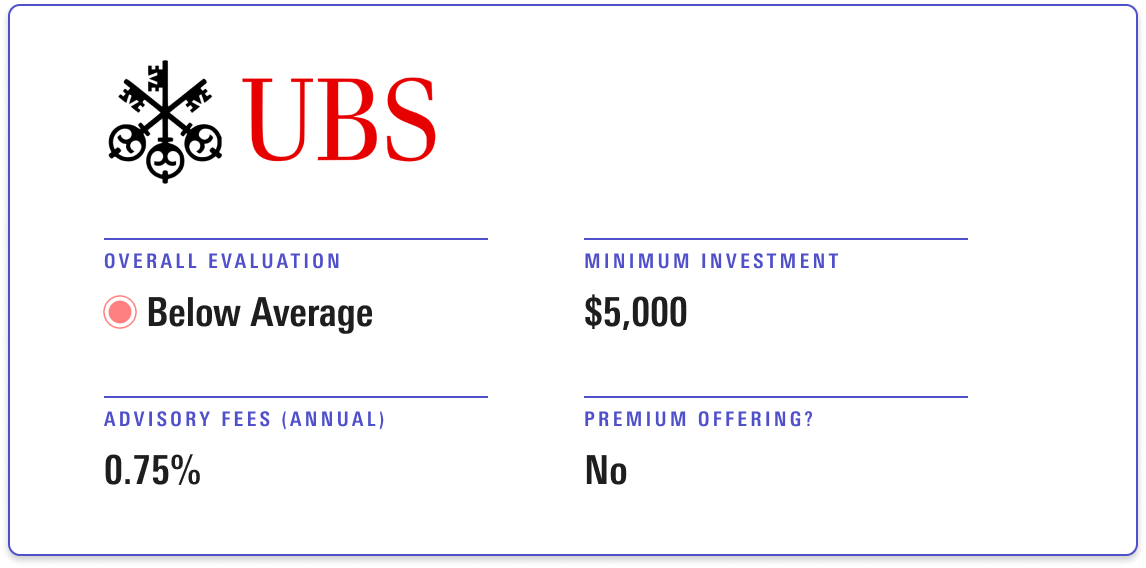

UBS Advice Advantage

UBS has been busy lately, but the Advice Advantage program remains an afterthought.

UBS' March 2023 acquisition of Credit Suisse poses a potential disruption to its global wealth management services, including this offering. A change in leadership at the top creates additional uncertainty, as UBS' new CEO has a different approach to the future of wealth management than his predecessor. And a failed acquisition of competing robo-advisor Wealthfront over the past year raises questions about how Advice Advantage fits into the larger UBS organization.

On top of this, hefty costs, steep account minimums, and poor transparency continue to be significant negatives for UBS Advice Advantage. The program's annual fee places this offering among the priciest robo-advisors we evaluated. Those fees are in addition to the expense ratios for the underlying funds used in the program, which are difficult to determine because UBS does not disclose which funds are used in the portfolios.

UBS Advice Advantage leverages SigFig's algorithm and offers investment advice, custody, trading/execution, and performance reporting. Investors can choose from five different portfolio risk levels based on a standard risk-tolerance questionnaire. Unfortunately, UBS does not publicly disclose which asset classes and underlying funds are used in the program.

On the positive side, UBS Advice Advantage includes access to financial advisors as well as portfolio diagnostics that incorporate outside holdings. However, it seems to play a secondary role within UBS' larger universe. With a disappointing amount of public information available, little credit can be given to this offering.

Fee assumes a $15,000 account balance and a blended account with active and passive investments. Data as of May 31, 2023.

Despite making several improvements, Titan remains the least attractive robo-advisor among those we evaluated because of its aggressive investment platform, narrow focus, and unproven management.

Though Titan has evolved its fee system for the better, its charges remain above average, and the underlying fees of some of the strategies in its client portfolios are very high. Titan styles itself as a lower-cost wealth manager for younger, tech-savvy up-and-coming investors who still cannot afford a private banker, but it is far from a low-cost option.

Increased diversification is laudable, but problematic inclusions in client portfolios remain. Available closed-end funds invest in esoteric asset classes, such as private credit and venture capital, that most investors do not need and would not miss. Titan's in-house strategies have mixed records, at best, and are concentrated and risky.

Titan plans to continue to develop its services, but it is not a holistic financial planner. It does not provide tax advice or manage its portfolios with regard for tax consequences, which means rebalancing portfolio allocations among its volatile equity and crypto strategies can result in big tax bills for clients investing in taxable accounts.

Titan uses client information to place them in aggressive, moderate, or conservative portfolios, distinguished by the percentage of assets each hedges. Titan uses technical signals to differentiate a hedge-worthy downturn from normal volatility, a notorious challenge even for investors who are not also trying to build and run a digital wealth management platform.

Fee assumes a $15,000 account balance and a Plus subscription plan. Advisory Fee for Premium Customers: Various coaching packages, which generally range from about $150 to $550 per session are available as a supplement to subscription-based packages . Data as of May 31, 2023.

Ellevest's platform caters primarily to women, using a gender-based investing approach that factors in issues like income level, earnings curve, and life expectancy. The platform also offers educational materials on a range of investing and career topics.

Its basic offering, Ellevest Essential, gives users an individual taxable account. Ellevest also offers two other service tiers that have additional features, including retirement accounts and planning. Ellevest portfolios are made up of a mix of mostly low-cost ETFs and mutual funds that cover 16 asset classes. Clients can also choose to invest in Ellevest's Impact Portfolios, which invest in ESG and impact funds.

Morningstar did not assess Ellevest because of Morningstar's ownership stake in the firm.

J.P. Morgan Automated Investing

Fee assumes a $15,000 account balance. Advisory Fee for Premium Customers: 0.60% . Data as of May 31, 2023.

J.P. Morgan Automated Investing uses a questionnaire to assess users' risk tolerance, goals, and time horizon. Its portfolios are composed of JPMorgan ETFs that cover eight asset classes. Despite charging account management fees on the higher end of the robo-advisor spectrum, J.P. Morgan Automated Investing doesn't offer additional services like tax-loss harvesting or financial planning tools.

The platform's integrated app may appeal to Chase users. It allows customers to access their bank, credit card, and investment information in one place.

Morningstar did not assess J.P. Morgan Automated Investing because some funds in which it invests track Morningstar indexes.

The Robo-Advisor Landscape report was designed to provide useful information to consumers before they sign up for a robo-advisor.

In the assessments, Morningstar's analysts prioritized low, transparent fees; a robust risk-tolerance questionnaire; logical mapping to portfolios; sound portfolio diversification that steers clear of questionable asset classes and investment tactics; and a broad range of planning-related features.

Morningstar scored robo-advisors on a five-point scale (High, Above Average, Average, Below Average, and Low) along with four dimensions: total price (30% weighting); the process used to select investments, construct portfolios, and match portfolios with investors (30%); the organization behind the digital platform (20%); and the breadth of services (20%). Morningstar weighted each category score and then summed it to arrive at an overall score, which was then used to rank the robo-advisors.

In our evaluation of each provider, we assumed a $15,000 account balance for ease of comparison and have noted providers whose fees decrease for higher investment amounts.

Get the Report For more information on the methodology, download the full report .

About the Author

Amy C. Arnott, CFA is a portfolio strategist for Morningstar.

Contributors

Research authors: Drew Carter, Dan Culloton, Gabriel Denis, David Kathman, Alec Lucas, Elizabeth Templeton, Lan Anh Tran Design editor: Nura Husseini-Yoon Editors: Emelia Fredlick, Margaret Giles Project manager: Connor Gallagher

These research authors and research contributors are employees of Morningstar Research Services LLC.

This content is not intended to be individualized investment advice, but rather to illustrate possible factors that can impact financial decisions. Investors should consider this information in the full context of their own financial decisions.

Read our editorial policy to learn more about our process.

Sponsor Center

How Robo Platforms Transform Traditional Advisory Business

Planners and asset managers can serve smaller clients and spend more time on big-picture topics.

Robo Platforms Transform Advisory Firms

Getty Images

Robo platforms free up traditional advisors to provide more service.

Financial advisors are increasingly turning to robo advisors , technology platforms that not so long ago were viewed as fierce competition.

At their most basic, robo advisors provide digital, algorithm-based investment platforms. The first company that offered this service was Betterment, which launched in 2008 and began opening client accounts two years later.

Initially, robo advisors operated with little, if any, human interaction. They would gather data from clients using online surveys. Based on those results, the robo advisor would assign the client to an inexpensive portfolio of index exchange-traded funds that would be rebalanced at specified intervals, determined by an algorithm.

That basic model still exists, but robo advisor firms now offer a greater range of services. Some added mutual funds as part of their offerings, some can hold single stocks and others include financial planning software or even sessions with a human financial planner.

Several companies now operate robo advisors. In addition to Betterment, the roster includes Personal Capital, SoFi, Ellevest, SigFig, Vanguard, TD Ameritrade and Charles Schwab, among others.

Robo Platforms Free Up Advisors

In response to the growth of robo advisors, traditional advisors ramped up their planning capabilities and emphasized their personal touch and ability to address any complex situation a client may have.

While those remain key points of differentiation, it turns out that robo platforms actually free up traditional advisors to provide more service. The robo firms offer special platforms just for financial advisors to hold client accounts. The robos handle rebalancing, as well as performance reporting and billing, allowing advisors and planners to focus on big-picture planning topics with clients.

Because robo platforms are inexpensive, financial advisors often use them for smaller accounts or clients with fewer investable assets . That's a shift from the traditional focus on high net worth clients.

"To continue to grow, the financial planning industry will need to evolve and serve clients who may have traditionally felt left out of the conversation," says Kevin Smith, vice president of Wealthspire Advisors, based in New York.

Smith's firm launched Wealthspire Pathways, a digital advisor platform that combines low-cost automated investing with a tailored financial plan and a dedicated advisor. These services have historically been available to higher net worth clients, but Smith says the firm's robo offering is a way to engage a greater range of clients, especially younger investors.

New Platform Disrupts the Industry

Smith acknowledges that the emergence of digital advisor platforms disrupted the financial services industry, leaving many advisors wondering if their relationship structure would become obsolete.

He says Wealthspire Pathways was designed to use digital technologies while preserving the personal relationship that clients typically expect.

"It reflects the future of financial advice, which lies in embracing new technology in a way that not only enhances the client experience but makes our expertise more accessible," he says.

"As a firm, we felt that there is an unfulfilled niche for people that could greatly benefit from financial planning but believe it is a service only for the wealthy or that they would be better off doing it themselves to save money," Smith adds. "The fact is that those with lower assets or without industry knowledge often stand to gain the most through professional planning."

Gwen Garrison, president and financial advisor at LifePlan Financial Advisors in Newnan, Georgia, uses a robo platform called $ymbil, developed by her firm's broker-dealer , Ladenburg Thalmann, and designed so clients with fewer assets can begin investing.

When the platform launched, Garrison says, she was delighted. "It's kind of like an incubator. I still use it for small accounts for whom a more traditional portfolio manager account is too expensive relative to the size of the account."

Garrison appreciates that $ymbil includes her contact information on a client's log-in page. "So if they need help, they can call me. I also can monitor the accounts and see how they are doing. We set an alert for when the account reaches the goal that we set for the incubation period," she says.

Most of Garrison's clients are middle income and don't fall into the high net worth category.

"They do not know a lot about investments and want someone watching over their investments, even in a robo advisor," she says. "They are vulnerable in that if they have major losses, it can seriously impact their ability to be financially secure now and in retirement."

Robo Advisors Offer Efficiency

Andrew Komarow, founder of Tenpath Financial Group in Farmington, Connecticut, also uses a robo platform for clients with smaller accounts. Because the robo advisor charges low fees, it's an efficient way to serve these clients. He uses a service offered by his custodian, LPL Financial.

"For smaller accounts to scale effectively, you can't be bogged down with trading," he says. "If someone is interested in working with me and they fit my model, then I will absolutely mention it. At the end of the day, the clients are working with me for the value add I provide."

He found that the robo platform is also useful for existing clients who may be making small contributions to a qualified retirement account, such as a Roth individual retirement account. "Instead of charging more for smaller accounts, I charge the same, and the robo might charge slightly more," he says.

Taxable, or nonqualified, accounts pose a challenge for advisors using a robo platform. Moving an account to a robo platform usually entails selling existing positions and reinvesting in an ETF or mutual fund model. Because many of these taxable accounts have large capital gains, a move to a robo platform could result in a large tax bill for the client. That's something most advisors want to avoid.

David Hicks is an investment advisor at Oakmont Advisory Group in Albuquerque, New Mexico, and founder of Smpl Wealth, a robo-based advisory platform. Hicks says his firm now handles taxable accounts both inside and outside of robo advisors.

But all accounts are reviewed before transitioning to a robo strategy. "If an account is simply moved to a new strategy and no due diligence has been performed, then a transition could potentially cause unnecessary capital gains," he says. "On the other hand, passive strategies are often best for taxable accounts, and an automated option will be more efficient over the life of the investment."

Wealthspire's Smith also acknowledges concerns when it comes to capital gains taxes and reallocating into a robo platform.

"It absolutely is a problem to just dump a taxable account into a robo without first reviewing the potential tax consequences," he says. "We always review the embedded gains in a taxable account before it is transferred to the robo and have a conversation with the client about the tax consequences."

Clients Need to Understand

Smith says the biggest concern for advisors using a robo offering is to be sure clients understand how it works. "Communication is key here. Making sure the client knows any positions transferred into the robo account will be liquidated and the model will be purchased," he says.

He adds that it's important clients understand they can't make direct trades in a robo-advised account, as all securities are part of a model. "This also means a robo account should always be used as a long-term investment account. It is not ideal to use a robo if you have a need to constantly withdraw funds and need instant access to those funds," Smith says.

Hicks also has a suggestion for financial planners and asset managers considering a robo offering.

"There are more options available now, so my advice is to pick the one that makes the most sense for your tech stack, so it can be more easily integrated," he says. "It's really easy to be sold on a certain robo offering. It might look great on paper, but later you find out that it doesn't communicate well or perform well on the service side. It can take some trial and error to find the right robo offering, and clients are often at the mercy of that practice."

Tags: investing , stock market , financial advisors , Financial Advisor Advice

The Most Important Ages for Retirement Planning

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

You May Also Like

9 of the best reits to buy for 2024.

Wayne Duggan April 2, 2024

5 Sectors Disrupted by AI as a Service

Marc Guberti April 2, 2024

6 Best Cryptocurrencies to Buy

John Divine April 2, 2024

Growth Funds to Buy and Hold

Tony Dong April 2, 2024

Will the Stock Market Crash

Brian O'Connell April 1, 2024

10 of the Best-Performing 401(k) Funds

Coryanne Hicks April 1, 2024

Bridge Collapse Disrupts Coal Trade

Matt Whittaker April 1, 2024

2024's 10 Best-Performing Stocks

Wayne Duggan April 1, 2024

Best REIT ETFs to Buy and Hold for 2024

Glenn Fydenkevez March 29, 2024

9 Highest Dividend Stocks in the S&P 500

Jeff Reeves March 29, 2024

5 of the Best Stocks to Buy Now

Ian Bezek March 29, 2024

7 Best Copper Stocks to Buy

Glenn Fydenkevez March 28, 2024

11 New Spot Bitcoin ETFs to Buy in 2024

Tony Dong March 28, 2024

Is M&A Activity Set to Spike in 2024?

Scott Ward March 28, 2024

7 Oversold Tech Stocks to Buy

Wayne Duggan March 28, 2024

7 Top Gene-Editing Stocks to Buy

Wayne Duggan March 27, 2024

7 Best Preferred Stock ETFs to Buy Now

Tony Dong March 27, 2024

9 Growth Stocks for the Next 10 Years

Jeff Reeves March 27, 2024

5 Best Short-Term Investments for Income

Tony Dong March 26, 2024

10 Best Health Care Stocks to Buy

Wayne Duggan March 26, 2024

ccecosystems.news

Der Blog für Finanzinstitute

Robo-Advisors – Business Models and Strategies

Online asset management has been experiencing a rapid rise in Germany for several years. Since 2017, the number of users has grown by a factor of 7 from around 291,000 in 2017 to around 2.01 million in 2020 (cf. o.V. 2020), while the investment volume has increased more than tenfold from around 756 million euros to 8.068 billion euros (cf. o.V. 2020). Two factors in particular are key to this trend: firstly, the loss of trust in personal banking advisory services caused by the financial crisis in 2007, and secondly, the increasing demand for digital offerings by digital natives. The new generation of customers who have grown up with smartphones and tablets, also known as “Generation Y,” is much more attuned to electronic communication, which means that personal contact such as with customer advisors at banks is losing relevance (cf. Alt/Puschmann 2016, 29). In the course of the shift from a personal, individual customer experience at a bank to the desire for standardized and digitized processes, “robo-advisors”, which replace personal, human advice with the offer of algorithm-based investment proposals, are becoming increasingly important (cf. Dapp 2016, 1). For this reason, in this series of articles, I would like to provide an overview of what a robo-advisor is, what business models and strategies robo-advisors are pursuing, and how the traditional customer advisory process is changing through the use of robo-advisors. The articles are based on my bachelor thesis “An Analysis of the Impact of Robo-Advisors on the Customer Advisory Process in the Investment Sector”, which I wrote at the Information Systems Institute of the Faculty of Economics at Leipzig University.

Last week’s post was about how robo advisory services are defined and how they came into being, whether they are serious competition for banks, and what stage of development robo-advisors are at now . Today I present the prevailing business models and strategies of robo-advisors.

Business Models

As mentioned in the last article, it is not possible to define exactly what a robo-advisor is, as the individual providers offer a range of services of varying breadth. In fact, robo-advisors have long since ceased to offer mere recommendations or advice, and most providers are steadily expanding their services into a fully integrated solution. Accordingly, people now associate a robo-advisor with a platform that can also be used to make an investment directly (see [Bloch/Vins 2017, 114]). However, this service, for example, is linked to certain regulatory requirements, which are presented below. It should be noted here that this is the regulatory framework in Germany. In terms of regulation, four business models can be distinguished in the area of robo advisory services:

- investment brokerage (german: Anlagenvermittlung ),

- investment advice ( Anlagenberatung ),

- acquisition brokerage ( Abschlussvermittlung ), as well as

- financial portfolio management ( Finanzportfolioverwaltung ), also known as asset management.