- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Debt Assignment: How They Work, Considerations and Benefits

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Investopedia / Ryan Oakley

What Is Debt Assignment?

The term debt assignment refers to a transfer of debt , and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt. In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt.

Key Takeaways

- Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector).

- The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

- The debtor must be notified when a debt is assigned so they know who to make payments to and where to send them.

- Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA), a federal law overseen by the Federal Trade Commission (FTC).

How Debt Assignments Work

When a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract.

In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment.

The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default.

When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond.

The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment.

Special Considerations

Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors.

If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website .

Benefits of Debt Assignment

There are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party.

Criticism of Debt Assignment

The process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled.

Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021.

Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021.

:max_bytes(150000):strip_icc():format(webp)/148985994-5bfc2b8c46e0fb0083c07ba8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Help & Advice

- Debt help in Scotland

- What are the fees involved?

- How to avoid further debt

- How debt affects your benefits

- How debt affects your home

- How debt affects your credit score

- Joint and inherited debt

- Debt collection help and advice

- Sheriff Officer help and advice

Debt Solutions

- Administration Order

- Debt Arrangement Scheme

- Debt Consolidation Loans

- Debt Management Plan

- Debt Relief Order (DRO)

- Debt Settlement Offer

- Sequestration

- Process Map

Types of Debt

- Business Debt

- Council Tax Debt

- Credit Card Debt

- Festive Period

- Gambling Debt

- Income Tax Debt

- Logbook Loans

- Payday Loans

- Secured Loans

- Student loans

- Utility Bills

- Unsecured Debt

- Customer Stories

- Tips & Advice

Notice of Assignment: Debt Terms explained

Our team is responsible for verifying the accuracy of content as it’s created. Facts, figures, and eligibility requirements evolve over time, however, so there may be occasional oversights. We would always advise you to review the terms and conditions of any product before submitting an application.

A Notification of Assignment is employed to notify debtors that a third party has ‘acquired’ their debt. The new company (assignee) assumes responsibility for the collection processes, occasionally engaging a debt collection agency to retrieve the funds on their behalf.

2nd May 2019

A creditors’ main goal is to lend you money and to collect it, so they’re not the biggest fan of chasing those who fall into arrears. As such, sometimes they’ll pass arrears on to other companies.

Being in debt can get confusing as it is, but especially so if a situation arises where you owe money to your mortgage lender, then a letter comes through your door from a company you’ve never heard of asking you to make payments to them instead.

This is what’s known as a Notice of Assignment (NOA) . They are sent to inform you that a third party has bought a debt that you owe from the company you borrowed it from.

If your debt is assigned to a new owner, they will then take over the previous company’s responsibility for debt collection and will sometimes hire a collection agency to work on their behalf.

Write off up to 70% of your debt – Check if you qualify

What is a notice of assignment

A Notice of Assignment, in relation to debt, is a document used to inform debtors that their debt has been ‘purchased’ by a third party.

The notice serves to notify the debtor that a new company (known as the assignee) has taken over the responsibility of collecting the debt.

This means that the debtor should direct their future payments and communications regarding the debt to the assignee instead of the original creditor. T

he assignee may choose to handle the debt collection procedures themselves or may engage a debt collection agency to recover the outstanding amount on their behalf.

Types of assignment

There are two types of assignment that a creditor can make – Legal and equitable.

Both of them fall under the Law of Property Act 1925 and both require the creditor to notify you of the change in writing.

It also isn’t possible to assign only part of a debt to a third party. If a creditor is ‘selling’ your debt, they have to sell the debt as a whole, and that debt will become one of the purchasing company’s obligations.

We set out the differences between legal and equitable assignments below.

A legal assignment gives the purchasing party the power to enforce the debt. You will also then make payments to this company instead of the original creditor.

When a debt goes through an equitable assignment, it is only the amount owed that is transferred.

In these instances, the purchasing company cannot enforce the debt and the original creditor will still retain their original rights and responsibilities.

Why do creditors sell debts?

One of the most common questions asked when a notice of assignment is received is why? Why have they sold it and how can they?

The answer is that is it is actually perfectly legal for them to sell your debt to another company.

When you sign a credit agreement there will have been a clause within the fine print. This will have stated that they are able to assign their rights to a third party .

As you have signed for this, they do not need to ask your permission to ‘sell’ the debt and you are unfortunately unable to dispute it.

The only exception to this rule is if the lender pledges to the Standards of Lending Practice and you have given evidence of mental health issues previously.

In these instances, your debt should not have been sold and you should seek advice on this.

A massive thank you

“I’d like to say a massive thank you to Carrington Dean for helping me. It feels like I have control of my life again.”

What does a notice of assignment mean for you?

If a creditor passes one of your debts to a third party, they will notify the credit reference agencies that they are now responsible for the collection.

The previous company’s name will be removed from your credit file and that any defaults will also be registered in their name.

Many people often find that having a debt being passed to a third party is a blessing in disguise.

The new company might be easier to deal with or be more flexible. They may offer to freeze interest on your debts, for example, giving you more scope to repay what you owe more quickly.

Ultimately, getting your debt paid off is in both yours and the creditors best interests.

Agreeing to a manageable payment plan gives you some breathing space and it can often mean they won’t need to take any further action against you.

It’s also worth noting that this also does not reset the six-year period for the debt to become statute-barred and debts that are already in this category will remain as such.

Assignment and debt collection agencies

Sometimes, the purchasing company will employ a debt collection agency to act on their behalf or the debt will be purchased by an agency themselves

They will take over the full rights to the debt and attempt to collect it from you in full.

As such, they will contact you by letter, phone calls, texts or emails. It also means that they can take further action against you should you continue to default on the account.

However, unless it is stated otherwise, debt collection agencies only work on behalf of a company.

The purchasing company will still own the debt, although some collection agencies do deal in debt purchasing also.

It’s also important to remember that although they can contact you for payment, they still have to abide by creditor etiquette.

They cannot pretend to have certain legal powers or lie to you, break data protection laws or search for you on social media.

You’ll likely find that debt collection agencies are often open to negotiations, so it is always best to contact them as soon as possible when they contact you for payment.

Find out if you qualify to write off up to 70% of your unsecured debt!

Assignment and debt solutions.

If you are already in some form of debt solution such as an IVA , Trust Deed or a DMP that is run privately by a company, you must notify the company running your agreement.

They will make the necessary updates to their records and contact the company to arrange payment to the new company.

If you are managing your own debts, you will need to cancel any payment to the original company and set up a new one to the purchasing company or debt collection agency.

In this instance, you may be asked to show them an up to date state of affairs in case any changes need to be made.

If you’re receiving notices of assignment and struggling with debt collection, call us today. A qualified adviser will be on hand to give you free confidential advice and help you find the right solution for your debts.

KEY TAKEAWAYS

- Creditors often transfer arrears to other companies to handle debt collection.

- A Notice of Assignment (NOA) informs debtors that their debt has been purchased by a third party.

- The assignee, the new company, assumes responsibility for collecting the debt.

- Debtors should direct future payments and communication regarding the debt to the assignee.

- The assignee may handle debt collection internally or engage a debt collection agency.

Maxine is an experienced writer, specialising in personal insolvency. With a wealth of experience in the finance industry, she has written extensively on the subject of Individual Voluntary Arrangements, Protected Trust Deed's, and various other debt solutions.

How we reviewed this article:

Our debt experts continually monitor the personal finance and debt industry, and we update our articles when new information becomes available.

Current Version

Written by Maxine McCreadie

Edited by Ben McCormack

Edited by Maxine McCreadie

Latest Articles

Private renters urged to know their rights

Budget-friendly family fun: weekend activities that won’t break the bank

Valentine’s Day 2024: 5 low-cost date ideas

To find out more about managing your money and getting free advice, visit Money Helper, independent service set up to help people manage their money.

Customer Information

All calls are recorded for training and monitoring purposes. This website uses cookies. By using this website, you consent to cookies being placed on your computer or any device you are using to visit this site. To find out more about managing your money and getting free advice, visit Money Helper, independent service set up to help people manage their money.

Fees & Information

There are fees associated with our services. It is important these are fully explained before entering into a debt solution. You will always find us open about these fees and how they are charged.

© 2023 The Carrington Dean Group Limited. Authorised and regulated by the Financial Conduct Authority. FCA No: 674395. Registered in Scotland, Company Registration No SC 225672. Registered Address: Regent House, 5th Floor, 76 Renfield Street, Glasgow, G2 1NQ Samantha Warburton is authorised in the UK to act as Insolvency Practitioners by the Insolvency Practitioners Association IP Number: 12430

* A debt write off amount of between 25% and 70% is realistic, however, the debt write off amount for each customer differs depending upon their individual financial circumstances and is subject to the approval of their creditors. The example provided has been achieved by 15% of Trust Deed customers in the least 12 months. Carrington Dean: provides insolvency solutions to individuals, specialising in Trust Deeds, DAS ( Debt Arrangement Scheme) and Sequestration. We do not administer or provide advice relating to debt management products, such as Debt Management Plans. Advice and information on all options will be provided following an initial fact find where the individual(s) concerned meets the criteria for a Trust Deed, DAS(Debt Arrangement Scheme) or Sequestration and wishes to pursue it further. All advice given is based on formal options available in Scotland and is therefore provided in reasonable contemplation of an appointment.

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Search our site

What is an Assignment of Debt?

By Vanessa Swain Senior Lawyer

Updated on February 22, 2023 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

Perfecting Assignment

- Enforcing an Assigned Debt

Recovery of an Assigned Debt

- Other Considerations

Key Takeaways

Frequently asked questions.

I t is common for creditors, such as banks and other financiers, to assign their debt to a third party. Usually, an assig nment of debt is done in an effort to minimise the costs of recovery where a debtor has been delinquent for some time. This article looks at:

- what it means to ‘assign a debt’;

- the legal requirements to perfecting an assignment; and

- common problems with enforcing an assigned debt.

Whether you’re a small business owner or the Chief Financial Officer of an ASX-listed company, one fact remains: your customers need to pay you.

This manual aims to help business owners, financial controllers and credit managers best manage and recover their debt.

An assignment of debt, in simple terms, is an agreement that transfers a debt owed to one entity, to another. A creditor does not need the consent of the debtor to assign a debt.

Once a debt is properly assigned, all rights and responsibilities of the original creditor (the assignor ) transfer to the new owner (the assignee ). Once an assignment of debt has been perfected, the assignee can collect the full amount of the debt owed . This includes interest recoverable under the original contract, as if they were the original creditor. A debtor is still responsible for paying the outstanding debt after an assignment. However, now, the debt or must pay the debt to the assignee rather than the original creditor.

Purchasing debt can be a lucrative business. Creditors will generally sell debt at a loss, for example, 20c for each dollar owed. Although, the amount paid will vary depending on factors such as the age of the debt and the likelihood of recovery. This can be a tax write off for the assignor, while the assignee can take steps to recover 100% of the debt owed.

In New South Wales, the requirements for a legally binding assignment of debt are set out in the Conveyancing Act :

- the assignment must be in writing. You do this in the form of a deed (deed of assignment) and both the assignor and assignee sign it; and

- the assignor must provide notice to the debtor. The requirement for notice must be express and must be in writing. The assignor must notify the debtor advising them of the debt’ s assign ment and to who it has been assigned. The assignee will send a separate notice to the debtor, putting them on notice that the debt is due and payable. They will also provide them with the necessary information to make payment.

The assignor must send the notices to the debtor’s last known address.

Debtor as a Joined Party

In some circumstances, a debtor will be joined as a party to the deed of assignment . There can be a great benefit in this approach . This is because the debtor can provide warranties that the debt is owed and has clear notice of the assignment. However, it is not always practical to do so for a few reasons:

- a debtor may not be on speaking terms with the assignor;

- a debtor may not be prepared to co-operate or provide appropriate warranties; and

- the assignor or the assignee may not want the debtor to be made aware of the sale price . This occurs particularly where the sale price is at a significant discount.

If the debtor is not a party to the deed of assignment, proper notice of the assignment must be provided.

An assignment of debt that has not been properly perfected will not constitute a legal debt owing to the assignee. Rather, the legal right to recover the debt will remain with the assignor. Only an equitable interest in the debt will transfer to the assignee.

Enforcing an Assigned Debt

After validly assigning a debt (in writing and notice has been provided to the debtor’s last known place of residence), the assignee is entitled to take any legal steps available to them to recover the outstanding debt. These recovery options include:

- commencing court proceedings;

- obtaining a judgment; and

- enforcement of that judgment.

Suppose court proceedings have been commenced or judgment already entered in favour of the assignor. In that case, the assignee must take steps to have the proceedings or judgment formally changed into the assignee’s name.

In our experience, recovery of an assigned debt can be problematic because:

- debtors often do not understand the concept of debt assignment and may not be aware that their credit contract contains an assignment of debt clause;

- disputes can arise as to whether a lawful assignment of debt has arisen. A debtor may claim that the assignor did not provide them with the requisite notice of the assignment, or in some cases, a contract will specifically exclude the creditor from legally assigning a debt;

- proper records of the notice of assignment provided to the debtor must be maintained. If proper records have not been kept, it may be difficult to prove that notice has been properly given, which may invalidate the legal assignment; and

- the debtor has the right to make an offsetting claim in defence to any recovery action taken by the assignee. A debtor may raise an offsetting claim which has arisen out of a previous arrangement with the assignor (which the assignee may not be aware of). For example, the debtor may have entered into an agreement with the assignor whereby the assignor agreed to accept a lesser amount of the debt owed by way of settlement. Because the assignee acquires the same rights and obligations of the assignor, the terms of that previous settlement agreement will bind the assignee. The court may find that there is no debt owing by the debtor. In this case, the assignee will have been assigned nothing of value.

Other Considerations

When assigning a debt, it is essential that the assignee, in particular, considers relevant statutory limitation periods for commencing proceedings or enforcing a judgment debt . In New South Wales, the time limit:

- to file legal proceedings to recover debts is six years from the date of last payment or when the debtor admitted in writing that they owed the debt; and

- for enforcing a judgment debt is 12 years from the date of judgment.

An assignment of a debt does not extend these limitation periods.

While there can be benefits to both the assignor and the assignee, an assignment of debt will be unenforceable if done incorrectly. Therefore, if you are considering assigning or being assigned a debt, it is important to seek legal advice. If you need help with drafting or reviewing a deed of assignment or wish to recover a debt that has been assigned to you, contact LegalVision’s debt recovery lawyers on 1300 544 755 or fill out the form on this page.

An assignment of debt is an agreement that transfers a debt owed to one entity, to another. A creditor does not need the consent of the debtor to assign a debt.

Once the assignee has validly assigned a debt, they are entitled to take any legal steps available to them to recover the outstanding debt. This includes commencing court proceedings, obtaining a judgment and enforcement of that judgment.

We appreciate your feedback – your submission has been successfully received.

Register for our free webinars

Privacy law reform: how the proposed changes affect in-house counsel obligations, avoiding common legal and tax pitfalls for online businesses in australia, cyber attack how to prevent and manage a breach in your business, sealing the deal: in-house counsel’s guide to streamlining corporate transactions, contact us now.

Fill out the form and we will contact you within one business day

Related articles

Dealing With Proceedings in the Small Claims Division of the NSW Local Court

What Are the Pros and Cons of a Writ for Levy of Property?

I’m a Judgment Debtor. What are the Next Steps?

How Can I Enforce a Judgment Debt in New South Wales?

We’re an award-winning law firm

2023 Fast Firms - Australasian Lawyer

2022 Law Firm of the Year - Australasian Law Awards

2021 Law Firm of the Year - Australasian Law Awards

2020 Excellence in Technology & Innovation Finalist - Australasian Law Awards

2020 Employer of Choice Winner - Australasian Lawyer

Assignment Of Debt Agreement

Jump to section, what is an assignment of debt agreement.

An assignment of debt agreement is a legal document between a debtor and creditor that outlines the repayment terms. An assignment of debt agreement can be used as an alternative to bankruptcy, but several requirements must be met for it to work.

In addition, if obligations are not met under a debt agreement, it might still be necessary to file for bankruptcy later on. Therefore, consulting with an attorney specializing in debt agreements is always recommended before entering into one of these contracts.

Assignment Of Debt Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-10 5 exhibit1024f10qsbmay04.htm EXHIBIT 10.24 , Viewed December 20, 2021, View Source on SEC .

Who Helps With Assignment Of Debt Agreements?

Lawyers with backgrounds working on assignment of debt agreements work with clients to help. Do you need help with an assignment of debt agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignment of debt agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

Meet some of our Assignment Of Debt Agreement Lawyers

Legal services cost too much, and are often of low quality. I have devoted my law practice to providing the best work at the most affordable price—in everything from defending small businesses against patent trolls to advising multinational corporations on regulatory compliance to steering couples through a divorce.

Jo Ann has been practicing for over 20 years, working primarily with high growth companies from inception through exit and all points in between. She is skilled in Mergers & Acquisitions, Contractual Agreements (including founders agreements, voting agreements, licensing agreements, terms of service, privacy policies, stockholder agreements, operating agreements, equity incentive plans, employment agreements, vendor agreements and other commercial agreements), Corporate Governance and Due Diligence.

Jeremiah C.

Creative, results driven business & technology executive with 24 years of experience (15+ as a business/corporate lawyer). A problem solver with a passion for business, technology, and law. I bring a thorough understanding of the intersection of the law and business needs to any endeavor, having founded multiple startups myself with successful exits. I provide professional business and legal consulting. Throughout my career I've represented a number large corporations (including some of the top Fortune 500 companies) but the vast majority of my clients these days are startups and small businesses. Having represented hundreds of successful crowdfunded startups, I'm one of the most well known attorneys for startups seeking CF funds. I hold a Juris Doctor degree with a focus on Business/Corporate Law, a Master of Business Administration degree in Entrepreneurship, A Master of Education degree and dual Bachelor of Science degrees. I look forward to working with any parties that have a need for my skill sets.

Texas licensed attorney specializing for 22 years in Business and Contract law with a focus on construction law and business operations. My services include General Business Law Advisement; Contract Review and Drafting; Legal Research and Writing; Business Formation; Articles or Instructive Writing; and more. I am able to draft and review contracts, and have experience with, contract law and business formation in any state. For more insight into my skills and experience, please feel free to visit my LinkedIn profile or contact me with any questions.

I am a licensed attorney and a member of the California Bar. I graduated from the University of Dayton School of Law's Program in Law and Technology. I love IP, tech transfers, licensing, and how the internet and developing technology is changing the legal landscape. I've interned at both corporations and boutique firms, and I've taken extensive specialized classes in intellectual property and technology law.

Charlotte L.

I hold a B.S. in Accounting and a B.A. in Philosophy from Virginia Tech (2009). I received my J.D. from the University of Virginia School of Law in 2012. I am an associate member of the Virginia Bar and an active member of the DC bar. Currently, I am working as a self-employed legal consultant and attorney. Primarily my clients are start-up companies for which I perform various types of legal work, including negotiating and drafting settlement, preparing operating agreements and partnership agreements, assisting in moving companies to incorporate in new states and setting up companies to become registered in a state, assisting with employment matters, drafting non-disclosure agreements, assisting with private placement offerings, and researching issues on intellectual property, local regulations, privacy laws, corporate governance, and many other facets of the law, as the need arises. I have previously practiced as an attorney at a small DC securities law firm and worked at Deloitte Financial Advisory Services LLC. My work experience is dynamic and includes many short-term and long term experience that span across areas such as maintaining my own blog, freelance writing, and dog walking. My diverse background has provided me with a stong skill set that can be easily adapted for new areas of work and indicates my ability to quickly learn for a wide array of clients.

With over 25 years of experience in the technology sector, I am a strategic business counsel, outsourced general counsel, and a leader of high-performing legal teams aimed to help maximize the efficiency of all stakeholders. I recently joined the renewable energy space with the addition of a new client on its way to becoming the first Chinese battery company to build a battery manufacturing presence in the US beginning with a 1+ GWh cell and pack plant, and a domestic anode and cathode plant. In my most recent full-time role, I served as the Sr. Director and Assistant General Counsel at SMART Global Holdings, where I served as the general counsel for the HPC and AI division of this publicly traded holding company, comprised of four companies, before becoming the global head of the commercial legal function across all portfolio companies, including two multinational industry leaders. During much of my career, I provided outside legal services on a recurring basis for several years advising several high growth start-ups and venture firms as well as house hold names, and also led one of the country's fastest growing infrastructure resellers and managed services providers. My core competencies include contract review, commercial negotiation, legal operations, information security, privacy, supply chain and procurement, alliances and channel sales, HR, and general corporate. I am passionate about leveraging my legal skills to achieve business solutions, supporting innovation and growth in the technology sector, and helping maximize the commercial flow and efficiency at growing companies. I hold an undergraduate business degree, a JD, a MSBA Taxation, and certifications from the California Bar Association, Six Sigma, and ISM.

Find the best lawyer for your project

How it works.

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Debt Agreement lawyers by city

- Austin Assignment Of Debt Agreement Lawyers

- Boston Assignment Of Debt Agreement Lawyers

- Chicago Assignment Of Debt Agreement Lawyers

- Dallas Assignment Of Debt Agreement Lawyers

- Denver Assignment Of Debt Agreement Lawyers

- Houston Assignment Of Debt Agreement Lawyers

- Los Angeles Assignment Of Debt Agreement Lawyers

- New York Assignment Of Debt Agreement Lawyers

- Phoenix Assignment Of Debt Agreement Lawyers

- San Diego Assignment Of Debt Agreement Lawyers

- Tampa Assignment Of Debt Agreement Lawyers

related contracts

- Accredited Investor Questionnaire

- Adverse Action Notice

- Bridge Loan

- Bridge Loan Contract

- Collateral Assignment

- Commercial Loan

- Convertible Bonds

- Convertible Note

- Convertible Preferred Stock

- Cumulative Preferred Stock

other helpful articles

- How much does it cost to draft a contract?

- Do Contract Lawyers Use Templates?

- How do Contract Lawyers charge?

- Business Contract Lawyers: How Can They Help?

- What to look for when hiring a lawyer

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

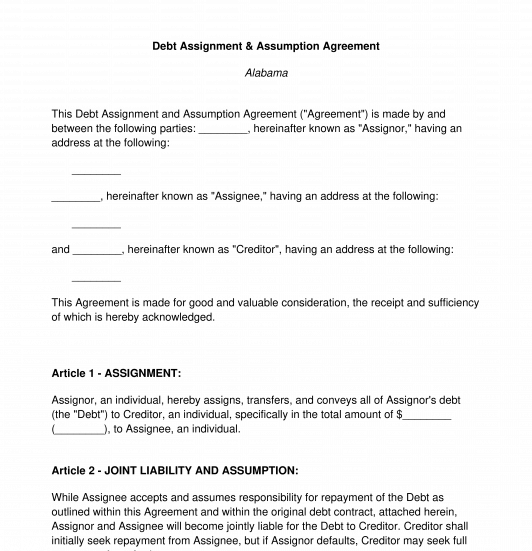

Debt Assignment and Assumption Agreement

Rating: 4.7 - 23 votes

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Agreement to Assign Debt, Agreement to Assume Debt, Assignment and Assumption of Debt, Assumption and Assignment of Debt Agreement, Debt Assignment Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

Assignments: why you need to serve a notice of assignment

It's the day of completion; security is taken, assignments are completed and funds move. Everyone breathes a sigh of relief. At this point, no-one wants to create unnecessary paperwork - not even the lawyers! Notices of assignment are, in some circumstances, optional. However, in other transactions they could be crucial to a lender's enforcement strategy. In the article below, we have given you the facts you need to consider when deciding whether or not you need to serve notice of assignment.

What issues are there with serving notice of assignment?

Assignments are useful tools for adding flexibility to banking transactions. They enable the transfer of one party's rights under a contract to a new party (for example, the right to receive an income stream or a debt) and allow security to be taken over intangible assets which might be unsuitable targets for a fixed charge. A lender's security net will often include assignments over contracts (such as insurance or material contracts), intellectual property rights, investments or receivables.

An assignment can be a legal assignment or an equitable assignment. If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the contract counterparty.

The main difference between legal and equitable assignments (other than the formalities required to create them) is that with a legal assignment, the assignee can usually bring an action against the contract counterparty in its own name following assignment. However, with an equitable assignment, the assignee will usually be required to join in proceedings with the assignor (unless the assignee has been granted specific powers to circumvent that). That may be problematic if the assignor is no longer available or interested in participating.

Why should we serve a notice of assignment?

The legal status of the assignment may affect the credit scoring that can be given to a particular class of assets. It may also affect a lender's ability to effect part of its exit strategy if that strategy requires the lender to be able to deal directly with the contract counterparty.

The case of General Nutrition Investment Company (GNIC) v Holland and Barrett International Ltd and another (H&B) provides an example of an equitable assignee being unable to deal directly with a contract counterparty as a result of a failure to provide a notice of assignment.

The case concerned the assignment of a trade mark licence to GNIC . The other party to the licence agreement was H&B. H&B had not received notice of the assignment. GNIC tried to terminate the licence agreement for breach by serving a notice of termination. H&B disputed the termination. By this point in time the original licensor had been dissolved and so was unable to assist.

At a hearing of preliminary issues, the High Court held that the notices of termination served by GNIC , as an equitable assignee, were invalid, because no notice of the assignment had been given to the licensee. Although only a High Court decision, this follows a Court of Appeal decision in the Warner Bros Records Inc v Rollgreen Ltd case, which was decided in the context of the attempt to exercise an option.

In both cases, an equitable assignee attempted to exercise a contractual right that would change the contractual relationship between the parties (i.e. by terminating the contractual relationship or exercising an option to extend the term of a licence). The judge in GNIC felt that "in each case, the counterparty (the recipient of the relevant notice) is entitled to see that the potential change in his contractual position is brought about by a person who is entitled, and whom he can see to be entitled, to bring about that change".

In a security context, this could hamper the ability of a lender to maximise the value of the secured assets but yet is a constraint that, in most transactions, could be easily avoided.

Why not serve notice?

Sometimes it's just not necessary or desirable. For example:

- If security is being taken over a large number of low value receivables or contracts, the time and cost involved in giving notice may be disproportionate to the additional value gained by obtaining a legal rather than an equitable assignment.

- If enforcement action were required, the equitable assignee typically has the option to join in the assignor to any proceedings (if it could not be waived by the court) and provision could be made in the assignment deed for the assignor to assist in such situations. Powers of attorney are also typically granted so that a lender can bring an action in the assignor's name.

- Enforcement is often not considered to be a significant issue given that the vast majority of assignees will never need to bring claims against the contract counterparty.

Care should however, be taken in all circumstances where the underlying contract contains a ban on assignment, as the contract counterparty would not have to recognise an assignment that is made in contravention of that ban. Furthermore, that contravention in itself may trigger termination and/or other rights in the assigned contract, that could affect the value of any underlying security.

What about acknowledgements of notices?

A simple acknowledgement of service of notice is simply evidence of the notice having been received. However, these documents often contain commitments or assurances by the contract counterparty which increase their value to the assignee.

Best practice for serving notice of assignment

Each transaction is different and the weighting given to each element of the security package will depend upon the nature of the debt and the borrower's business. The service of a notice of assignment may be a necessity or an optional extra. In each case, the question of whether to serve notice is best considered with your advisers at the start of a transaction to allow time for the lender's priorities to be highlighted to the borrowers and captured within the documents.

For further advice on serving notice of assignment please contact Kirsty Barnes or Catherine Phillips from our Banking & Finance team.

- [email protected]

- T: +44 (0)370 733 0605

- Download vCard for Catherine Phillips

Related Insights & Resources

Gowling WLG updates

Sign up to receive our updates on the latest legal trends and developments that matter most to you.

- Our partners

- Join the team

- Litigation & Dispute Resolution

- Commercial Law

- Employment Law

- Professional Negligence

- Data Breach & Cyber

- White Collar Crime

- Private Client

- Business owners

- High-net worth individuals

- Individuals impacted by professional negligence

- Group actions & professional negligence

- Individuals impacted by data breaches

- Case studies

- Testimonials

Deed of Assignment and the Notice of Assignment -What is the Difference?

In this article, Richard Gray barrister takes a brief look at the differences between a Deed of Assignment and a Notice of Assignment and the effect of the assignment on the contracting party

At the end of 2020, Elysium Law were instructed to act for a significant number of clients in relation to claims made by a company known as Felicitas Solutions Ltd (an Isle of Man Company) for recovery of loans which had been assigned out of various trust companies following loan planning entered into by various employees/contractors.

Following our detailed response, as to which please see the article on our website written by my colleague Ruby Keeler-Williams , the threatened litigation by way of debt claims seem to disappear. It is important to note that the original loans had been assigned by various Trustees to Felicitas, by reason of which, Felicitas stood in the shoes of the original creditor, which allowed the threatened action to be pursued.

After a period of inertia, Our Clients, as well as others, have been served with demand letters by a new assignee known as West 28 th Street Ltd . Accompanying the demand letters is a Notice of Assignment, by reason of which the Assignee has informed the alleged debtor of the Assignees right to enforce the debt.

Following two conferences we held last week and a number of phone call enquiries which we have received, we have been asked to comment upon the purport and effect of the Notice of Assignment, which the alleged debtors have received. Questions such as what does this mean (relating to the content) but more importantly is the ‘Notice’ valid?

Here I want to look briefly at the differences between the two documents.

There is no need for payment to make the assignment valid and therefore it is normally created by Deed.

The creation of a legal assignment is governed by Section 136 of the Law of Property Act 1925:

136 Legal assignments of things in action.

(1)Any absolute assignment by writing under the hand of the assignor (not purporting to be by way of charge only) of any debt or other legal thing in action, of which express notice in writing has been given to the debtor, trustee or other person from whom the assignor would have been entitled to claim such debt or thing in action, is effectual in law (subject to equities having priority over the right of the assignee) to pass and transfer from the date of such notice—

(a) the legal right to such debt or thing in action;

(b) all legal and other remedies for the same; and

(c) the power to give a good discharge for the same without the concurrence of the assignor:

Some of the basic requirements for a legal assignment are;

- The assignment must not be subject to conditions.

- The rights to be assigned must not relate to only part of a debt, or other legal chose in action.

- The assignment must be in writing and signed by the assignor.

- The other party or parties to the agreement must be given notice of the assignment.

Notice of assignment

To create a legal assignment, section 136 requires that express notice in writing of the assignment must be given to the other contracting party (the debtor).

Notice must be in writing

Section 136 of the LPA 1925 requires “express notice in writing” to be given to the other original contracting party (or parties).

Must the notice take any particular form?

The short answer is no. Other than the requirement that it is in writing, there is no prescribed form for the notice of assignment or its contents. However, common sense suggests that the notice must clearly identify the agreement concerned.

Can we challenge the Notice?

No. You can challenge the validity of the assignment assignment by ‘attacking the Deed, which must conform with Section 136. In this specific case, the Notice sent by West 28 th Street in itself is valid. Clearly, any claims made must be effected by a compliant Deed and it is that which will require detailed consideration before any right to claim under the alleged debt is considered.

Can I demand sight of the assignment agreement

On receiving a notice of assignment, you may seek to satisfy yourself that the assignment has in fact taken place. The Court of Appeal has confirmed that this is a valid concern, but that does not give an automatic right to require sight of the assignment agreement.

In Van Lynn Developments Limited v Pelias Construction Co [1969]1QB 607 Lord Denning said:

“After receiving the notice, the debtor will be entitled, of course, to require a sight of the assignment so as to be satisfied that it is valid…”

The Court of Appeal subsequently confirmed this stating the contracting party is entitled to satisfy itself that a valid absolute assignment has taken place, so that it can be confident the assignee can give it a good discharge of its obligations

The important document is the Deed of Assignment, which sets out the rights assigned by the Assignor. The Notice of Assignment is simply a communication that there has been an assignment. The deed is governed by Section 136 of the LP 1925. It should be possible to obtain a copy of the Deed prior to any action taken in respect of it.

For more information on the claims by West 28 th Street or if advice is needed on the drafting of a Deed, then please call us on 0151-328-1968 or visit www.elysium-law.com .

Related news

Get in touch.

Assignment of debts - take care with cross-referencing

- Using your device

In the recent High Court decision in Nicoll -v- Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the validity of an assignment of debts and the notice requirements is considered.

The High Court in this case considered whether a notice of assignment in relation to a debt, which mentioned an unverifiable date of assignment, was still valid and enforceable against the debtor.

The debt in question originally arose between the debtor and the Co-operative Bank (Bank) and was evidenced in various facility letters between September 2010 and May 2013. A sum of over £10 million was advanced by the Bank to the debtor, and security was taken by the Bank in the form of charges over certain property. The overall balance was repayable by May 2015, but the debtor defaulted on the payment terms.

On 29 July 2016, the Bank assigned (or purported to assign) its debt and security to Promontoria. Both the Bank and Promontoria provided joint notice of the assignment in a single document to the debtor on 2 August 2016, with wording that the debt had been assigned ‘on and with effect from 29 July 2016’. There was no express reference to the date of the assignment or the assignment effective date, but rather this was defined by reference to the completion date in a related but unreferenced loan sale deed, so a more complicated analysis of a series of documents was required to reach the actual date of the assignment.

Promontoria proceeded to pursue the debtor for the debt by serving a statutory demand, dated 27 January 2017, and referred to the deed of assignment within its contents for payment of the outstanding debt.

The debtor’s attempt to have the statutory demand set aside was dismissed at the initial hearing, but the debtor received leave to appeal to the High Court on one issue. The debtor sought to challenge the effectiveness of the assignment of the debt based on an inability to work out from the notice of assignment whether the completion date for assignment had actually occurred. The debtor argued that:

- the case of WF Harrison -v- Burke [1956] 1 W.L.R. 419 is authority that a notice of assignment that gets the date of assignment wrong is invalid and, as a result, the assignment is not good against any debtor; and

- the date of assignment stated in the notice given to him was unverifiable, and therefore potentially wrong, rendering the notice invalid

The High Court agreed that the documentation disclosed by Promontoria to the debtor after the notice of assignment was insufficient to verify the date on which assignment had occurred, due to cross-referencing to other documents and there being conditions for completion. However, the High Court distinguished this case from WF Harrison -v- Burke case as the joint notice of assignment did not specify the date of the deed of assignment. It specified the date on which the assignment took effect, which is different. In WF Harrison -v- Burke , the notice of the assignment (given by the assignee only) specified the date of the assignment document (as opposed to the assignment itself) and got it wrong. In the present case, the notice of assignment was from both Promontoria and the Bank, i.e. assignor and assignee and made clear that the parties considered the assignment to be complete. In the circumstances, the debtor was not entitled to challenge Promontoria’s title to the debt.

The High Court accepted that while Promontoria had not produced evidence which in terms showed what the effective date of the assignment was, the joint notice clearly showed that both the Bank and Promontoria agreed and accepted that the assignment had taken place, and was sufficient evidence for the present purposes to be valid. The judge said: ‘The question is not whether Promontoria have provided a chain of proof through the wording of the documents. If that were the question then Promontoria would fail. The question is whether Promontoria has demonstrated that there is a completed assignment. I consider that it has. The crucial matter is the notice of assignment, against the background of the assignment document. The assignment documentation demonstrates a clear intention to assign even if the documents do not match up as they ought to. The notice of assignment provides clear evidence that the assignment has taken place.’ Accordingly, the High Court concluded that there was no arguable case that the assignment’s effective date had not occurred and considered that the assignment had been sufficiently demonstrated to be effective as against the debtor.

The High Court clearly held that a notice of assignment of a debt given to a debtor was valid, even though the assignment effective date, referred to in the notice, could not be verified by the debtor. The judgment provides strong support for the proposition that it is not open to debtors to seek to find alleged defects in any assignment, as long as they have been properly notified of the assignment and most importantly that the assignor and assignee both agree that the assignment is valid. This is a welcome decision for all creditors.

Dispute resolution

Related insights, is an arbitration tribunal’s decision on illegality in conflict with public policy.

08 February 2024

Under the Arbitration Ordinance (Cap. 609) of Hong Kong (“AO”), unless the relevant arbitration agreement expressly provides for application of the opt-in provisions in sections 5-7 of Schedule 2...

The Mainland Judgments in Civil and Commercial Matters (Reciprocal Enforcement) Ordinance came into effect on 29 January 2024

31 January 2024

The newly-implemented and much-anticipated Mainland Judgments in Civil and Commercial Matters (Reciprocal Enforcement) Ordinance (Cap. 645) ('Ordinance') is one of the cornerstones of the mutual legal

Fair trials, proving your case and uncontroverted expert evidence

18 December 2023

This was a relatively low-value personal injury claim which would not in normal circumstances have gone as far as the Supreme Court. However, it raised a point of general importance, with regard to th

Focus on Cybersecurity: Claims against unknown hackers

20 November 2023

Next in our series of articles looking at cyber issues we consider recent developments around hacking and ransomware. Ransomware cyberattacks (typically involving use of malicious software designed...

Disclosure in Public Inquiries – Wide Powers

It appears at the moment that there are an unusually large number of Public Inquiries underway or being called for, these include the Covid-19 Inquiry, the Grenfell Tower Inquiry...

Part 36 and its Application to Probate Claims – Clarification provided

“Although Part 36 primarily functions in money claims it is capable of operating in other claims and it would be wrong to give its terms a narrow reading that limit its effect when the CPR...

We can help you resolve business disputes through negotiation, mediation, arbitration or litigation. Our aim is to achieve resolution quickly and efficiently and to minimise the impact of a dispute on your day-to-day operations.

Where possible, we try to settle disputes without recourse to legal proceedings. However, when this is unavoidable, our very experienced and tenacious team will vigorously pursue a strategy set to achieve a successful outcome for you.

Clients in manufacturing, service industries, retail plcs, owner-managed businesses, accountants and other professionals rely on our clear, pragmatic advice, expert technical analysis and sound understanding of their business problems and commercial objectives.

Bankruptcy & Insolvency News SLF Lawyers News Is Your Notice Assignment of Debt Valid? May 25, 2020

A creditor (assignor) can transfer their rights to receive and seek payment of a debt to a third party (assignee). Once the transfer of their rights has occurred, the assignor can then seek payment of that debt from the debtor. Once assigned, the assignee has the legal right to such debt and has the power to give a good discharge of it without the concurrence of the assignor. [1]

There are two factors that an assignee must consider before attempting to recover a debt from a debtor:

SERVICE OF THE NOTICE

The assignee must issue a notice of assignment of debt (“ Notice ”) to the debtor at the debtors last known residential address. This is where the confusion and issues around the service of the Notice can occur by the debtor. Generally, a bank will assign the debt to a collection company after years of attempting collection/locating debtor. It is at this stage that the debtor may have moved residential addresses and may not receive the Notice. The assignee is required to comply with section 347 of the Property Law Act 1974 (Qld), whereby service of any notices must be made to the person’s last known place of abode.

STATUTE OF LIMITATIONS

An assignee must ensure that they are within the statue of limitations to legally commence recovery of the debt. The purpose of a statute of limitations is to limit the delay for creditors to take action against a debtor for outstanding monies. The limitation period for a contract debt is six (6) years, calculated from the point of breach. Where an assignee has been assigned a debt, the point of breach will commence from the date the debt was assigned to the assignee. However, in some circumstances, where a debtor acknowledges the debt or makes a payment in respect of the debt, the point of breach starts from the date of acknowledgement or the last payment made by the debtor.

SLF Lawyers specialises in legal recoveries and various enforcement options and can assist in providing advice with respect to ensuring the Notice has been issued correctly.

If you have any questions, please contact Partner – Mark Smith of SLF Lawyers Brisbane on (07) 3839 8011.

PRACTICE AREAS

- Building & Construction

- Commercial Litigation

- Alternative Dispute Resolution

- Estate Planning & Disputes

- Commercial Law

- Italian Law

- Franchising & Licencing

- Immigration

- Bankruptcy & Insolvency

- Insurance Law

- Property Law

- Workplace Relations & Safety

- Banking & Finance

© 2022 SLF LAWYERS | ALL RIGHTS RESERVED | LIABILITY LIMITED BY A SCHEME APPROVED UNDER PROFESSIONAL STANDARDS LEGISLATION | DESIGN AND BUILT BY NO STANDING

Integrity. Experience. Results.

(813) 685-8600

FLORIDA RULES OF CIVIL PROCEDURE

Contact information.

Cox Law Office 156 East Bloomingdale Ave., Brandon, 33511 Phone: (813) 685 8600

CONNECT WITH COX LAW

Legal resources.

FLORIDA BAR HILLSBOROUGH COUNTY BAR FLORIDA COURTS WEBSITE FLORIDA STATUTES ONLINE FL RULES OF CIVIL PROCEDURE US FEDERAL COURTS FEDERAL COURTS MAP FEDERAL COURT LOCATOR FED RULES OF CIVIL PROCEDURE

LIKE US ON FACEBOOK

Providing notice of assignment of a debt is not a condition precedent pursuant to fla. statute § 559.715.

A. H olding

The failure to provide written notice under section Fla. Stat. § 559.715 did not bar the Mortgagee’s foreclosure suit, nor did it create a condition precedent to the institution of the foreclosure suit.

B. Procedural Posture & Facts

U.S. Bank foreclosed on a mortgage and note held by the Brindises. At the conclusion of a nonjury trial, the Court entered a final foreclosure judgment in favor of the Bank. The Brindises as mortgagors appealed claiming that that the trial court erroneously entered final judgment because, prior to filing suit, U.S. Bank failed to give written notice of assignment pursuant as required by Fla. Stat. § 559.715.

The Brindises, Appellants/Mortgators, appealed to the Second District Court whether trial court erroneously entered final judgment because, prior to filing suit, the Appellee/Mortgagee, U.S. Bank, failed to provide written notice of the assignment of their mortgage loan as required by Fla. Stat. § 559.715.

C. Rationale

Fla. Stat. § 559.715 provides in part:

Assignment of consumer debts. —This part does not prohibit the assignment, by a creditor, of the right to bill and collect a consumer debt. However, the assignee must give the debtor written notice of such assignment as soon as practical after the assignment is made, but at least 30 days before any action to collect the debt. The assignee is a real party in interest and may bring an action to collect a debt that has been assigned to the assignee and is in default….

The DCA failed to rule whether an effort to collect on a defaulted mortgage is or is not an attempt to collect a consumer debt. Appellant contended that foreclosure is an enforcement of a security instrument and not a debt while the Appellee argued that it is a collection of a consumer debt. Rather, the DCA noted that the Legislature failed to provide precise language specifying that the notice as a “condition precedent,” and the language of the statute was open ended meaning that the assignee alone was not the only real party in interest.

The statue prohibited specified debt collection practices, however, the Appellants failed to allege any specific wrongful conduct by the Appellee, and the Court was unwilling to apply the statute to “immunize” an alleged violator. The mere filing of a foreclosure suit, even one seeking money damages, alone did not trigger an egregious debt collection activity. The note at issue specifically provided that the lender could transfer the note without prior notice to them, and as a matter of simple contract, the statue was inapplicable.

Based on the “innumerable foreclosure cases” pending in the trial and district courts where defendants have raised the statute as a defense, the Second District certified the following question to the Florida Supreme Court:

IS THE PROVISION OF WRITTEN NOTICE OF ASSIGNMENT UNDER SECTION 559.715 A CONDITION PRECEDENT TO THE INSTITUTION OF A FORECLOSURE LAWSUIT BY THE HOLDER OF THE NOTE?

VIEW THE RULES OF CIVIL PROCEDURE

Browse legal topics.

English law assignments of part of a debt: Practical considerations

United Kingdom | Publication | December 2019

Enforcing partially assigned debts against the debtor

The increase of supply chain finance has driven an increased interest in parties considering the sale and purchase of parts of debts (as opposed to purchasing debts in their entirety).

While under English law part of a debt can be assigned, there is a general requirement that the relevant assignee joins the assignor to any proceedings against the debtor, which potentially impedes the assignee’s ability to enforce against the debtor efficiently.

This note considers whether this requirement may be dispensed with in certain circumstances.

Can you assign part of a debt?

Under English law, the beneficial ownership of part of a debt can be assigned, although the legal ownership cannot. 1 This means that an assignment of part of a debt will take effect as an equitable assignment instead of a legal assignment.

Joining the assignor to proceedings against the debtor

While both equitable and legal assignments are capable of removing the assigned asset from the insolvency estate of the assignor, failure to obtain a legal assignment and relying solely on an equitable assignment may require the assignee to join the relevant assignor as a party to any enforcement action against the debtor.

An assignee of part of a debt will want to be able to sue a debtor in its own name and, if it is required to join the assignor to proceedings against the debtor, this could add additional costs and delays if the assignor was unwilling to cooperate. 2

Kapoor v National Westminster Bank plc

English courts have, in recent years, been pragmatic in allowing an assignee of part of a debt to sue the debtor in its own name without the cooperation of the assignor.

In Charnesh Kapoor v National Westminster Bank plc, Kian Seng Tan 3 the court held that an equitable assignee of part of a debt is entitled in its own right and name to bring proceedings for the assigned debt. The equitable assignee will usually be required to join the assignor to the proceedings in order to ensure that the debtor is not exposed to double recovery, but the requirement is a procedural one that can be dispensed with by the court.

The reason for the requirement that an equitable assignee joins the assignor to proceedings against the debtor is not that the assignee has no right which it can assert independently, but that the debtor ought to be protected from the possibility of any further claim by the assignor who should therefore be bound by the judgment.

Application of Kapoor

It is a common feature of supply chain finance transactions that the assigned debt (or part of the debt) is supported by an independent payment undertaking. Such independent payment undertaking makes it clear that the debtor cannot raise defences and that it is required to pay the relevant debt (or part of a debt) without set-off or counterclaim. In respect of an assignee of part of an independent payment undertaking which is not disputed and has itself been equitably assigned to the assignee, we believe that there are good grounds that an English court would accept that the assignee is allowed to pursue an action directly against the debtor without needing the assignor to be joined, as this is likely to be a matter of procedure only, not substance.

This analysis is limited to English law and does not consider the laws of any other jurisdiction.

Notwithstanding the helpful clarifications summarised in Kapoor, as many receivables financing transactions involve a number of cross-border elements, assignees should continue to consider the effect of the laws (and, potentially court procedures) of any other relevant jurisdictions on the assignment of part of a debt even where the sale of such partial debt is completed under English law.

Legal title cannot be assigned in respect of part of a debt. A partial assignment would not satisfy the requirements for a legal assignment of section 136 of the Law of Property Act 1925.

If an assignor does not consent to being joined as a plaintiff in proceedings against the debtor it would be necessary to join the assignor as a co-defendant. However, where an assignor has gone into administration or liquidation, there may be a statutory prohibition on joining such assignor as a co-defendant (without the leave of the court or in certain circumstances the consent of the administrator).

[2011] EWCA Civ 1083

- Financial institutions

Recent publications

Publication

Belgium, the brand-new EU leader in the fight against ecocides

On 22 February 2024, Belgium became the EU frontrunner in the fight against ecocides by being the first EU member state to criminalise ecocide, in the new Belgian Criminal Code.

Global | March 22, 2024

Antitrust enforcers' views on info exchanges are evolving

Antitrust and competition enforcers in the US, the European Union and the UK have recently turned their attention to information exchanges.

United States | March 21, 2024

The rise of dawn raids: What should businesses do to prepare?

Dawn raids are on the rise; the first three months of the new SFO’s director’s tenure saw two dawn raids and the FCA’s dawn raid activity during 2023 was significantly increased compared with 2022.

Global | March 21, 2024

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023

- Canada (English)

- Canada (Français)

- United States

- Deutschland (Deutsch)

- Germany (English)

- The Netherlands

- Türkiye

- United Kingdom

- South Africa

- Hong Kong SAR

- Marshall Islands

- Nordic region

Assignment Involves Transfer of Rights to Collect Outstanding Debts

Can a person who is owed money transfer the right to collect to another person, the law allows a creditor to whom a debtor owes money to transfer the right to collect the outstanding monies to another person who then becomes the assignee creditor., understanding what constitutes as a legally binding assignment of creditor rights to collect a debt.

Right to Collect on Debts

Within the decision of Clark v. Werden , 2011 ONCA 619 the Court of Appeal confirmed the existence of the right to transfer debts as an assignment in accordance to the Conveyancing and Law of Property Act , R.S.O. 1990, c. C.34 , which prescribes the various requirements when a creditor transfers ownership of rights involving monies owed, among other things. Specifically, the Court of Appeal stated:

Clark v. Werden , 2011 ONCA 619 at paragraph 13

[13] The ability to assign a debt or legal chose in action is codified in s. 53 of the Conveyancing and Law of Property Act , which provides that a debt is assignable subject to the equities between the original debtor and creditor and reads as follows:

53 (1) Any absolute assignment made on or after the 31st day of December, 1897, by writing under the hand of the assignor, not purporting to be by way of charge only, of any debt or other legal chose in action of which express notice in writing has been given to the debtor, trustee or other person from whom the assignor would have been entitled to receive or claim such debt or chose in action is effectual in law, subject to all equities that would have been entitled to priority over the right of the assignee if this section had not been enacted, to pass and transfer the legal right to such debt or chose in action from the date of such notice, and all legal and other remedies for the same, and the power to give a good discharge for the same without the concurrence of the assignor.

Partially Assigned